1. Introduction

Financial planning [

1,

2] is an indispensable part of modern life. Whether it is an individual planning their monthly expenses or a family juggling with combined finances, effective budgeting is crucial for achieving long-term financial security and prosperity. However, with the proliferation of expenses and the intricate nature of contemporary economic systems, the endeavor of financial planning often feels overwhelming to many. Traditional methods, while systematic, sometimes fall short in accommodating the dynamic nature of financial needs, and often lack the ability to personalize recommendations to cater to individual or household-specific priorities.

We are now entering the age of artificial intelligence (AI) [

3], a transformative force that has already revolutionized numerous sectors, from healthcare to entertainment. The vast inferential and predictive capabilities of AI, especially models like the large language model (LLM) [

4], offer a unique advantage in the realm of financial planning. By processing vast amounts of financial data and patterns [

5], such models can provide tailored recommendations that not only adhere to general financial best practices, which are widely accepted principles or guidelines in financial planning that are considered effective for managing personal finances, but are also congruent with specific user inputs.

In this paper, we set out to bridge the traditional econometric methods of financial planning with the power of AI-driven recommendations. By considering the LLM’s suggestions as a foundation, we refine and optimize budget allocations for both individuals and households. Our approach strives to achieve a balance between mathematical optimization and real-world practicality, ensuring that the solutions are not just economically sound but also feasible and user-friendly.

In practical terms, when artificial neural networks (ANNs), including DL and LLMs, are trained through supervised learning, they employ a learning rule that iteratively converges toward an equilibrium, finely balancing the dilemma of underfitting versus overfitting. Despite their ability to discern nonlinear continuous transformations, their operational mechanics do not inherently encapsulate an internal representation of the nonlinear relationships between training exemplars [

6]. The consequence of this limitation is twofold: firstly, when ANNs process data with inter-relations confined within Euclidean boundaries, they excel; secondly, when confronted with data existing beyond these confines, the results may not only be suboptimal but also unpredictably aberrant. This limitation is similar, in many respects, to the constraints encountered in traditional statistical regression methods.

In the subsequent sections, we will delve into the methodologies that we have developed for individual and cooperative financial planning, elucidate on the integration of LLMs in these methods, and present the results of our preliminary tests. Through this exploration, we hope to usher in a new paradigm in financial planning, one that is more accessible, efficient, and in tune with the unique needs of today’s diverse society. That being said, it is also necessary to recognize the potential limitations and inherent risks of AI, such as errors and hallucinations, and the strategies that can be implemented to mitigate these issues, such as rigorous validation processes, the constant monitoring of AI outputs, and the incorporation of fail-safes and human oversight.

The essence of this study lies in addressing a critical challenge: the democratization of financial planning in a landscape riddled with complexity and unpredictability. Our work is driven by the imperative to equip individuals and households with the tools to navigate the economic maze toward sustainable financial health. The problem statement is twofold—firstly, the need to simplify the intricacies of financial decision making for the non-expert and, secondly, to create an adaptive system that is resilient to the volatile nature of economic dynamics.

Our motivation is rooted in the recognition that financial security and literacy are cornerstones of individual autonomy and societal well-being. We propose an innovative solution that intersects the predictive acuity of LLMs with the foundational constructs of econometrics. The mathematical core of our approach is to optimize a utility function

U that encapsulates the financial health of an entity, of the form:

where

I is income,

S is savings,

E represents expenses across

n categories,

are the personalized preference weights, and

,

are parameters calibrating the trade-off between savings and expenditures. Through this formulation, we seek to craft a system that not only provides bespoke financial advice but also evolves with the user’s changing economic scenario, embodying the fluidity required for real-world financial planning.

The problem at the heart of our research is the incremental complexity of personal financial management in a rapidly evolving economic landscape. In an age where financial instruments and markets are increasingly intricate, the average individual is at a significant disadvantage when attempting to plan for financial security. This challenge is not merely academic but a pressing real-world issue that affects the quality of life and long-term well-being of individuals and families. The need for accessible financial planning is further highlighted by the widening gap in financial literacy, which can lead to poor financial decisions and increased economic inequality.

Our work is motivated by the imperative to render financial planning not only more approachable but also more aligned with the diverse and dynamic financial goals of individuals. We aim to address this by leveraging the computational prowess of LLMs to distill complex financial data into actionable insights. The mathematical underpinning of our approach is an optimization framework, tailored to the nuances of personal finance, which can be represented as:

Here, symbolizes the financial decision variables, U is the utility function that quantifies financial health, defines the feasible set based on financial constraints, represents inequality constraints (such as budget limits), and captures equality constraints (such as income–expense balance). Our motivation is to implement a system that empowers users with personalized, intelligent recommendations, thus equipping them to make informed financial choices in pursuit of economic resilience and prosperity.

The remainder of this paper is structured as follows:

Section 2 provides related work.

Section 3 focuses on the materials and methodology adopted, presenting the foundational aspects and research methodology pertinent to the optimization models. In

Section 4, we explore the significance of LLMs in individual budgeting, emphasizing their recommendation-driven approach to financial planning.

Section 5 offers an in-depth look into cooperative financial planning for households, showcasing the synergistic view between LLM recommendations and household members’ financial priorities. The subsequent

Section 6 presents the intricacies of cooperative budgeting within an established extended coevolutionary (EC) framework, elucidating its innovative facets. Moving forward,

Section 7 describes our simulation framework, detailing how LLM-informed decisions can be simulated and analyzed, while also highlighting in

Section 7.3 the importance of long-term planning dependencies to further develop the simulated framework. Finally, in

Section 8, we draw our conclusions, recapitulating the primary findings and looking ahead at promising directions for future work in this domain.

2. Related Work

The landscape of financial planning and optimization has been deeply enriched by the intersection of computational intelligence and economic theories. In this section, we contextualize our contributions within the spectrum of existing literature, delineating the evolution of financial planning methodologies from traditional models to AI-augmented frameworks.

Traditional financial planning has been heavily influenced by seminal works such as those of Markowitz [

7] on portfolio optimization and Ando and Modigliani’s life-cycle hypothesis [

8]. The optimization of financial assets has been extensively studied, with methods ranging from linear programming [

9] to more sophisticated stochastic models [

10].

The infusion of behavioral economics into financial optimization models has provided a more thorough understanding of human financial behavior, as evidenced by the works of Thaler and others [

11]. This has led to models that account for irrational decision making and heuristics used by individuals, adding complexity to the optimization problems [

12].

The advent of AI [

13,

14] in financial planning has opened new avenues for personalized and adaptive financial advice. Early systems utilized rule-based expert systems [

15], while recent advancements have leveraged machine learning for predictive analytics in finance [

16].

The integration of LLMs [

4] into financial planning is a relatively new and emerging field. Recent studies have begun to explore the capabilities of models like OpenAI’s GPT series and explainable AI techniques in generating financial narratives [

17,

18]. Our work extends this line of research by embedding LLM insights into the optimization framework, a novel approach that has not been extensively covered in the existing literature.

Comparative studies have highlighted the strengths and weaknesses of AI-driven financial tools compared to traditional methods [

19,

20,

21]. However, there remains a gap in the literature regarding the efficacy of LLM recommendations within the cooperative budgeting context, an area our research directly addresses.

While existing works provide a foundational understanding of the financial optimization landscape, there remains a lacuna when it comes to the integration of real-time, AI-driven, personalized recommendations into these models. Our research fills this gap by not only integrating but also critically examining and refining the role of LLMs within financial planning and optimization frameworks.

In summary, our research builds upon the rich heritage of financial optimization while branching into the relatively uncharted territory of LLM-augmented financial planning. By doing so, we aim to contribute a significant advancement in the domain, tailored for the dynamic economic world of the 21st century.

3. Materials and Methodology

This research proposes an optimization model for individual and cooperative financial planning, both enhanced by the integration of large language model (LLM) recommendations. The two primary facets of this approach are: (1) foundational mathematical models that describe budgeting optimization problems, and (2) computational algorithms that incorporate the LLM’s recommendations into financial decision-making processes.

The objective of maximizing savings by allocating monthly income across various expense categories is grounded in core principles of theory in household finance. This approach aligns with the life-cycle hypothesis of Ando and Modigliani (1963) [

8], which posits that individuals plan their consumption and savings behavior over their lifetime to achieve financial stability. Furthermore, it reflects the principles of optimal portfolio selection from the theory of modern portfolio of Markowitz (1952) [

7], adapted to the context of household budgeting, where the portfolio is a mix of expenses and savings.

Our model also incorporates the behavioral aspects of financial decision making as discussed by Xiao (2008) [

22], acknowledging that individuals have varying preferences and subjective weights on different expense categories. Additionally, Browning and Lusardi’s (1996) research on micro theories and micro facts of household saving [

23] provides empirical support for the relevance of optimizing savings behavior at the household level.

For the cooperative financial recommendation model, we draw on these individual financial behaviors and extend them to a household context, considering the collective utility maximization and shared financial responsibilities, resonating with the cooperative game theory in household economics [

24].

Individual Financial Recommendation Model

Objective: Our primary goal is to find the best allocation of an individual’s monthly income across various expense categories while maximizing their potential savings [

7,

8,

22,

23].

Variables:

I: Monthly income.

: Expense for category z (e.g., rent, groceries, utility bills, entertainment).

S: Savings for the month.

Objective Function: This function emphasizes maximizing savings after covering all necessary expenses.

Constraints: The constraints ensure non-negative expenses, savings, and that total expenses do not surpass the monthly income.

Cooperative Financial Recommendation Model (Household)

Objective:

In a household setting, our aim is to optimize combined budget allocation for all members. We ensure that each member’s preferences and necessities are accommodated, aiming for an overall maximization of household savings.

Variables:

: Monthly income of member o.

: Expense for category z by member o.

: Savings for the month by member o.

: Total combined savings of the household.

Objective Function:

This function prioritizes the overall savings of the household, given each member’s income and expenses.

Constraints:

The constraints are extensions of the individual model but factor in multiple members.

Preferences/Weights:

To personalize the model, we introduce weights

representing the importance of an expense category

z for member

o. This ensures that individual preferences are not lost in the collective model.

Collaborative Constraint:

Factoring in shared expenses, such as rent, can lead to substantial savings. Therefore, we introduce a combined expense constraint.

Incorporating LLM Recommendations

The true innovation of our approach lies in blending traditional optimization techniques with AI-driven insights [

25,

26]. The LLM’s vast knowledge base and advanced language processing capabilities can provide nuanced, context-aware recommendations for individuals and households.

Given a recommendation

from the LLM for an expense category

z, we can adjust our initial financial allocations.

With these LLM-generated insights serving as a foundation, the optimization model can be fine-tuned at a later stage to suit specific needs, balancing mathematical accuracy with real-world financial insights.

3.1. Prospective Validation Framework for AI-Driven LLM Financial Recommendations

This framework can be designed to uphold the integrity and applicability of AI-driven insights, ensuring that they are not only relevant but also conform to the highest standards of financial prudence.

A multi-tiered verification process that scrutinizes the LLM output for reliability and truthfulness can be proposed. This process would involve:

Expert Review: Each LLM-generated recommendation is evaluated by financial experts to ensure that it is consistent with established economic principles and real-world conditions. Experts may modify LLM suggestions to correct any inaccuracies or to better align with conservative financial practices.

Contextual Analysis: The model contextualizes LLM responses by examining them against current financial trends, regulatory guidelines, and economic indicators. This ensures that the advice is not only mathematically sound but also practical, taking into account the socio-economic environment of the users.

Risk Assessment: Risk analysis is conducted to evaluate the potential harm that could arise from following the LLM’s advice. This includes stress testing the recommendations against various economic scenarios to gauge their resilience and adaptability.

Ethical Considerations: An ethical review is performed to ensure that the LLM’s advice does not inadvertently lead to financial decisions that could be detrimental to the user’s long-term well-being or that could perpetuate biases.

The objective function within the optimization framework would be then defined as follows:

where

is the utility function dependent on savings

S, a vector of expenses

, and a context vector

C that includes both economic conditions and user-specific circumstances. The function

quantifies the utility derived from savings, emphasizing the goal of maximization, while

is a penalty function that increases when expenses are either economically unsound or potentially harmful.

To integrate LLM insights effectively, a constraint adaptation strategy can be employed where LLM recommendations adjust the boundaries of the feasible solution space rather than dictating fixed allocations. This would allows us to maintain a flexible yet controlled optimization environment where LLM inputs serve as informed guidelines rather than rigid directives. The optimization problem would then become:

where

and

are vectors of minimum and LLM-recommended expenses, respectively.

Through this meticulous approach, we can ensure that the financial planning methodologies proposed in this study are not only innovative and AI-enhanced but are also reliable, ethically responsible, and practically applicable in a variety of financial contexts. This methodology, with the proposal of a thorough validation mechanism, sets a precedent for the responsible integration of AI in the sensitive realm of personal finance.

3.2. RAG Approach with LLM Recommendations

Additionally, to address the potential for LLM hallucination, the methodology could integrate a retrieval augmented generation (RAG) approach into the recommendation generation process. This sophisticated mechanism can enhance the robustness of the LLM’s outputs by anchoring its responses in verifiable data, thereby significantly reducing the likelihood of generating spurious or misleading financial advice.

The RAG process can operate by first querying a large-scale dataset of financial information, regulatory guidelines, and historical economic data. The LLM then synthesizes this retrieved information with its pre-trained knowledge to generate recommendations that are not only contextually rich but also data-grounded. Here is how the RAG methodology could be incorporated:

Data Retrieval: Prior to recommendation generation, the LLM queries a curated dataset to retrieve relevant financial data and historical trends that mirror the user’s query context.

Augmented Generation: The model combines its own language-understanding capabilities with the retrieved data to generate a draft recommendation. This step ensures that each piece of advice is informed by empirical data, thereby enhancing its accuracy and relevance.

Validation and Refinement: The draft recommendation is then passed through a validation filter, which includes a comparison against up-to-date financial models and a check for compliance with current economic conditions.

Expert Oversight: The final stage can involve human oversight, where financial experts review the LLM-generated advice to ensure that it adheres to professional standards and reflects sound financial judgment.

The incorporation of RAG into our recommendation generation process can be mathematically represented in the optimization model as an additional set of constraints that the LLM’s responses must satisfy:

where

represents the RAG process with expenses

and retrieved data

, mapping to the LLM’s recommended expenses

.

Incorporating the RAG methodology into the LLM framework could significantly mitigate the risk of hallucinations by ensuring that the model’s recommendations are continuously grounded in empirical evidence. It can also provide an additional layer of confidence in the model’s outputs, reinforcing their reliability for end-users seeking sound financial planning advice.

4. LLM-Informed Budgeting

In the modern era of data-driven solutions, using an LLM to provide financial advice offers an innovative approach to household budgeting. Given the intricate nature of individual spending habits and the myriad of ways in which funds can be allocated, using the power of AI can significantly enhance personalized financial recommendations.

The value addition of our research to the field of financial planning lies in the novel synthesis of econometric modeling and state-of-the-art AI. By integrating the insights from LLMs into traditional financial planning frameworks, we provide a multi-faceted approach that aligns with the contemporary demand for personalized financial advice. This integration heralds a significant shift from one-size-fits-all financial advisories to solutions that respect individual financial narratives and the unique economic contexts that they exist in.

Our models offer significant improvements over existing methodologies by incorporating behavioral economic factors and real-time data analysis, thereby delivering a more granular and responsive financial planning tool. The mathematical model that encapsulates our approach can be represented as:

Here, denotes the vector of decision variables for financial planning, U is the utility function enhanced by LLM insights , represents the feasible region influenced by external data , and , are the sets of constraints parameterized by and , respectively, signifying economic conditions and user preferences. The LLM’s capability to digest and interpret large volumes of data transcends the capabilities of traditional methods, thus enabling our model to adaptively recalibrate recommendations in accordance with the fluctuating economic indicators and personal financial goals.

Moreover, the transformative potential of our methodology becomes particularly salient when considering the adaptability of LLMs to a changing information landscape, a feature that conventional financial planning tools lack. By continually learning from new data, our model remains at the forefront of financial planning innovation, marking a decisive step toward a more intelligent, adaptable, and personalized financial planning paradigm.

The approach leverages the capabilities of OpenAI’s GPT-4 model to analyze a user’s financial data and provide a bespoke recommendation based on that data. The process involves:

Data Input: Users provide a breakdown of their monthly income and primary expenses.

LLM Analysis: The model evaluates the data in the context of sound financial planning.

Recommendation Generation: The LLM then offers a detailed recommendation on how the user might best allocate their remaining funds.

The Python script, get_financial_recommendation, takes a string representation of the user’s financial data and attempts to retrieve or generate a recommendation.

Key features of the script include:

Caching Mechanism: To enhance efficiency, the script maintains a

recommendation_cache. If the user’s financial data match a previous entry, a stored recommendation is returned without invoking the LLM, thereby saving computational resources and time.

Robust Error Handling: Recognizing the potential for API errors or timeouts, the script employs a retry mechanism with exponential backoff. This ensures that transient issues do not lead to immediate failures and offers a resilient approach.

User-Friendly Output: The LLM’s response is parsed to retrieve a clear, concise recommendation that is then returned to the user.

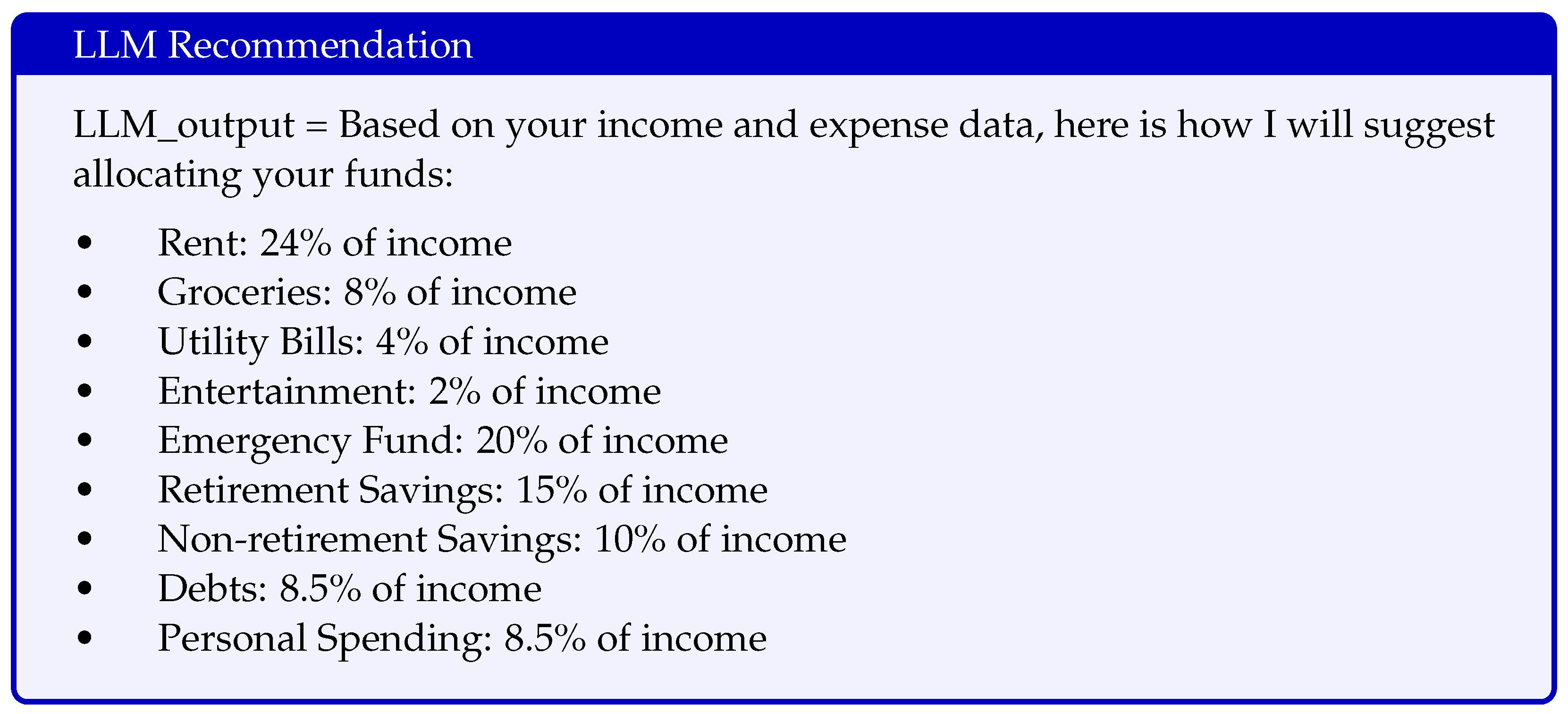

Here, we describe an example for clarity. Consider a user with a monthly income of USD 5000 and major expenses that include USD 1200 for rent, USD 400 for groceries, USD 200 for utilities, and USD 100 for entertainment. When they input these data, the LLM could provide a recommendation like:

“Based on your financial data for the month, after accounting for your major expenses, you have $2100 remaining. I recommend allocating $500 towards an emergency fund, $300 towards investments, $200 for miscellaneous expenses, and saving the remaining $1100.”

Advantages of the LLM Approach:

Personalization: Unlike generic financial advice, the LLM approach tailors recommendations to the individual’s unique financial situation.

Scalability: The approach can cater to a vast number of users simultaneously, making it suitable for integration into financial planning apps or platforms.

Learning Over Time: As LLMs evolve and receive more training, the quality and depth of their recommendations can only improve.

While the current implementation provides robust financial recommendations, future versions could:

Integrate real-time data sources to provide up-to-the-minute advice.

Consider longer-term financial goals, such as buying a home or retirement planning, in its recommendations.

Incorporate user feedback to continually refine and enhance recommendations.

In conclusion, using LLMs for household financial recommendations represents a significant step forward in the marriage of AI and financial planning. By offering personalized, scalable, and increasingly sophisticated advice, this approach promises to revolutionize the way individuals manage their finances.

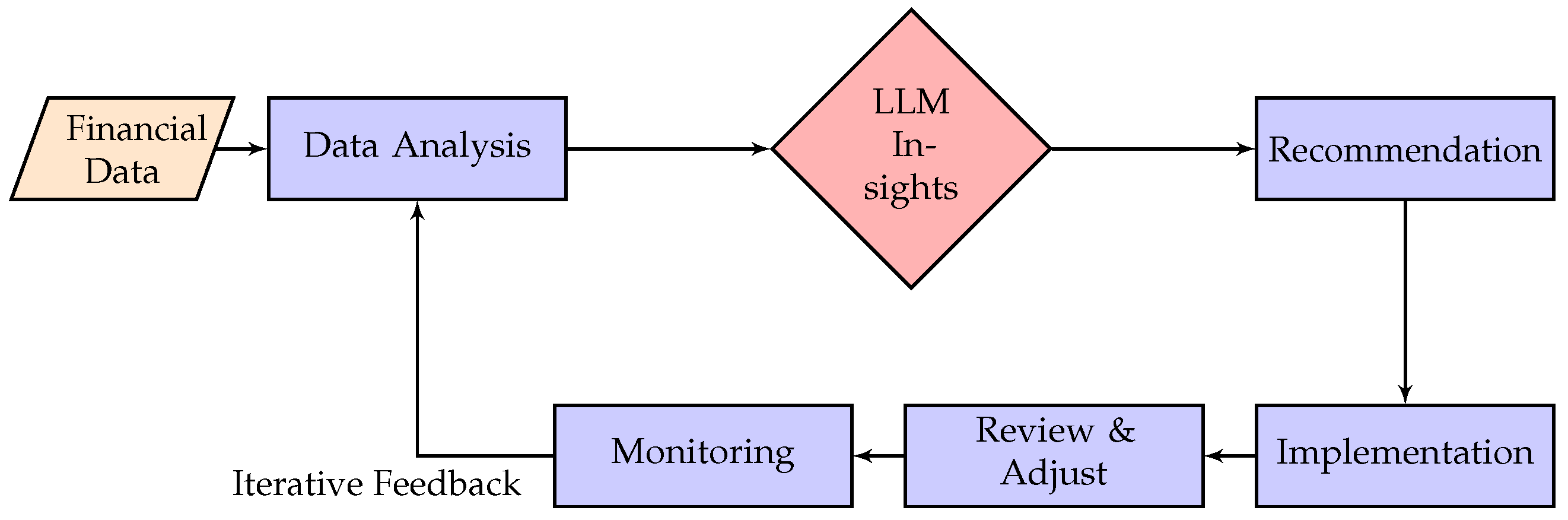

Figure 1 delineates the proposed financial planning methodology that makes use of the capabilities of LLMs to enhance data analysis and supports the formulation of robust recommendations. This schematic presents a sequence of interconnected stages starting with the aggregation of financial data, proceeding to an in-depth analysis phase, which converge into the application of LLM insights for the generation of tailored financial recommendations. The iterative cycle is fundamental for maintaining the relevancy and efficacy of the financial plan, adapting dynamically to the evolving economic landscape and individual and cooperative financial objectives.

4.1. Verification Mechanism for LLM-Generated Financial Advice

In our approach, we could ensure the alignment of the LLM-generated recommendations with established financial truths by implementing a verification mechanism within the Python script: get_financial_recommendation. This mechanism can cross-reference the recommendations against a comprehensive financial database that includes a wide array of economic indicators, historical financial data, and regulatory compliance requirements. Here, we describe the process in detail:

Recommendation Generation: The script first invokes the LLM to generate a preliminary financial recommendation based on the user’s input data.

Database Cross-Reference: Upon obtaining the LLM’s output, the script automatically queries a financial database, seeking corroboration for the proposed financial strategies. This database is consistently updated to reflect the latest financial truths, including market trends, tax laws, and industry standards.

Truth Alignment Check: The script compares the LLM’s recommendation against the database entries to verify the accuracy and relevance of the advice. Recommendations that significantly diverge from the financial truths are flagged for further review.

Feedback Loop for Adjustment: In cases where discrepancies arise, the script adjusts the recommendations by applying a set of heuristic rules derived from the financial truths. This iterative process ensures that the final advice provided to the user is both data-driven and aligned with financial realities.

Human Expert Review: The last step involves a financial expert who reviews and, if necessary, refines the script’s output to ensure full compliance with financial best practices.

Mathematically, this verification mechanism can be represented as a constraint satisfaction problem, where the generated recommendations

R must satisfy a set of conditions

C based on the truths

T from the financial database

D:

Incorporating this truth-checking protocol could enhance the reliability of our LLM-informed budgeting system, ensuring that users receive recommendations that are not only personalized but also pragmatically sound and financially valid.

4.2. Prompt Engineering for Improved LLM Financial Recommendations

To empower users in optimizing their interactions with the LLM, we can also introduce a guided prompt optimization feature within our LLM-informed budgeting system. This enhancement can educate users on constructing effective prompts, thereby improving the quality of the financial recommendations that they receive. Here is how we can incorporate this guidance into the user experience:

Prompt Templates: We provide users with a collection of prompt templates that are designed based on successful financial inquiry patterns. These templates serve as starting points for users to articulate their financial data and questions.

Prompt Feedback Mechanism: After users submit their prompts, our system analyzes the prompt structure and provides instant feedback on how to refine it for clearer communication and better-aligned financial recommendations.

Adaptive Learning from User Interaction: As users interact with the system, it can employ ML algorithms to learn from the quality of recommendations generated from past prompts. The system then suggests modifications to the prompts for future queries, aiming to maximize the relevance and precision of the recommendations.

Informative Tutorials and Tips: Alongside direct feedback, users have access to educational materials that explain the principles of effective prompt construction, including clarity, specificity, and the inclusion of relevant financial context.

Expert System Insights: A built-in expert system analyzes user prompts and compares them with a database of optimized prompts and their outcomes. By highlighting key differences, the system offers actionable insights for users to improve their queries.

Mathematically, this process can be viewed as an optimization problem where the aim is to maximize the utility

U of a prompt

P with respect to the quality

Q of the recommendation

R as follows:

The function denotes the utility of the prompt, which is a function of its effectiveness in generating high-quality recommendations . By iteratively refining P based on system feedback and learning, we can ensure a continuous improvement in the prompt’s utility.

4.3. EC Theory for Household Finance: Beyond Euclidean Domains

The extended coevolutionary (EC) theory provides a sophisticated framework that allows us to navigate beyond the intrinsic limitations of ANNs. While these models might struggle with capturing the intricacies of non-Euclidean spaces due to their reliance on linear transformations within a Euclidean framework, EC theory embraces a more holistic view.

EC theory, through its foundational principles of coadaptation and coevolution, inherently accounts for the complex and dynamic inter-relationships characteristic of real-world scenarios, which often extend beyond linearly definable spaces. This adaptability is made possible by EC theory’s capacity to model interactions within a multi-dimensional space that can effectively represent the high-level abstractions and nonlinear interdependencies of financial data.

Here, represents the change in the strategy vector at time , and F encapsulates a nonlinear function of the strategy vectors at all previous time steps, capturing the essence of iterative learning and strategic adaptation over time. This function F is not restricted to the confines of a Euclidean space, enabling the EC model to explore a more diverse solution space and offering a robust mechanism for identifying equilibria in complex systems.

Furthermore, the EC theory facilitates the integration of external insights, such as those derived from LLMs, into its evolutionary process. By considering the LLM outputs as auxiliary data points, the EC model can refine its strategic outlook, effectively bridging the gap between the traditional optimization techniques and the high-dimensional space of AI-driven recommendations.

In the equation above, represents the rate of integration of LLM recommendations denoted by into the current strategy . The term , as previously defined, ensures that the EC model dynamically evolves, reflecting both the insights from LLMs and the iterative learning process.

By leveraging the flexibility and multidimensional approach of EC theory, we can transcend the traditional limitations posed by ANNs. This progressive modeling approach not only aligns with the complex nature of financial ecosystems but also offers a robust platform for developing advanced financial planning tools that are both comprehensive and capable of evolving in tandem with the changing economic landscape.

5. LLM Cooperative Budgeting and Financial Planning for Households

Cooperative budgeting emerges as an imperative when multiple individuals, such as partners or roommates, decide to combine their financial resources and manage expenses collectively. By jointly analyzing incomes and costs, households can better allocate resources, set shared financial goals, and plan for both short-term needs and long- term objectives.

The provided Python script, get_cooperative_financial_recommendation, seeks to tap into the potential of LLMs to generate budgeting advice tailored for households that are pooling their resources.

Key Script Features:

Caching Mechanism: Repetitive queries are bypassed by maintaining a recommendation_cache. If data from a household match a prior request, the cached recommendation is returned, thereby conserving computational effort.

Retry with Exponential Backoff: The script is robust against potential API timeouts or other exceptions. By employing a retry mechanism that increases the waiting time after each attempt, it provides resilience against transient issues.

Tailored Recommendations: The response from the LLM is parsed to yield a succinct and actionable cooperative financial recommendation for the household.

Sample Use Case

Consider a household comprising two members:

Member 1 with an income of USD 5000, paying rent of USD 800 and spending USD 300 on groceries.

Member 2 earning USD 4000, having a rent of USD 700 and grocery expenses amounting to USD 350.

Upon feeding these combined data to the LLM, a recommendation could emerge as:

“Given the combined income and individual expenses, the household has a remaining amount of $7850 after rent and groceries. It is advised to allocate $1500 for joint savings, $1000 for utilities and shared amenities, $500 towards entertainment and leisure, and set aside $1000 as an emergency fund. The residual amount can be directed towards individual savings or other shared financial goals.”

Benefits of Collaborative Budgeting:

Shared Responsibility: Distributing financial responsibilities can alleviate individual burdens and promote mutual accountability.

Strategic Decision Making: With pooled resources, households can make more informed choices about investments, large purchases, and savings.

Achievement of Common Goals: Be it buying a new home, planning a vacation, or preparing for family expansions, cooperative budgeting can expedite the realization of shared aspirations.

Enhancements for the Future:

The script, while effective, can be augmented further by:

Incorporating feedback mechanisms where household members can adjust recommendations based on changing financial scenarios.

Integrating data from financial institutions in real-time for more current and accurate recommendations.

Introducing functionalities to handle more complex financial situations, such as investments, loans, and mortgages.

In essence, cooperative budgeting facilitated by AI-driven models can revolutionize the way households manage their finances, promoting a culture of transparency, mutual trust, and shared financial growth.

6. Cooperative Budgeting within the EC Framework

Cooperative budgeting for households represents a tangible instantiation of the extended coevolutionary (EC) framework’s principles first introduced in [

27]. By analyzing this in the context of the EC theory, we illuminate the synergistic confluence of game-theoretic models, LLMs, and adaptive learning in practical MAS scenarios.

Let us consider a household

H consisting of

n members, where each member

o is an agent. Each agent has a financial profile characterized by its income

and expenses

. The collective budget of the household can be expressed as:

The goal is to cooperatively allocate a common budget across members to optimize some household-wide utility function . This utility can be a measure of financial stability, savings, or any other metric significant to the household.

Incorporating the adaptive learning mechanism from the EC framework, each agent

o iteratively adjusts its expenses

based on a derived utility

that takes into account the household’s collective goal and individual preferences. The adjustment can be mathematically represented analogous to the previous equation as:

Here, remains the learning rate, and signifies the gradient of utility with respect to agent o’s expenses, considering other agents’ expenses as .

The strategy of agent

o, specifically its expense

, can be influenced by recommendations from an LLM. Representing the LLM’s recommendation for agent

o at time

t as

, and similar to the equation presented before, the new expense can be modeled as:

Here, designates the influence rate of the LLM on the agent’s expense strategy.

Given that LLM recommendations, like budget suggestions, come with inherent uncertainties, a confidence measure

associated with each recommendation

should be considered. This is analogous to the previous equation, and the updated expense can be modeled as:

Each household member may have distinct financial priorities and constraints, echoing the EC theory’s emphasis on heterogeneous agents. The utility for each agent would thus encapsulate individual preferences, like risk aversion or future financial goals.

The cooperative budgeting scenario for households aptly demonstrates the applicability of the EC theory in real-world contexts. This intersection of theoretical constructs with tangible applications showcases the robustness and versatility of the EC framework. The use of mathematical representations deepens our understanding, offering a quantitative lens to perceive the dynamics of the household as a multi-agent system influenced by adaptive learning and LLMs.

Linear Optimization Model for Financial Planning with LLM Constraints

Another instance of the same financial planning scenario is the following, where we propose to use the LLM recommendation as bounds of the optimization model. We construct a linear optimization model to distribute the monthly income I across various expense categories while maximizing potential savings. The model is formulated as follows:

Let I represent the monthly income of a household, and represent the expenses in category z, where z can be rent, groceries, utility bills, or entertainment. Let S denote the savings for the month. The goal is to maximize S subject to the constraints imposed by the financial data and recommendations from the LLM.

The objective function and constraints are presented as follows:

Additional constraints are derived from the LLM recommendations, which suggest percentages of income to be allocated toward each category. Let

be the percentage of income recommended for category

z, and

be the recommended expenses calculated as

. We can introduce bounds based on these recommendations to guide the optimization:

where

is a lower bound to ensure that each category meets essential spending requirements. The upper bound

is influenced by the LLM’s advice and represents an ideal spending target as suggested by the model.

7. Simulation Framework: LLM-Informed Decisions

To comprehend the LLM’s effectiveness in financial advice, it is essential to assess its recommendations. Let us delve into its suggestions for individual and cooperative financial management:

7.1. User Financial Recommendation

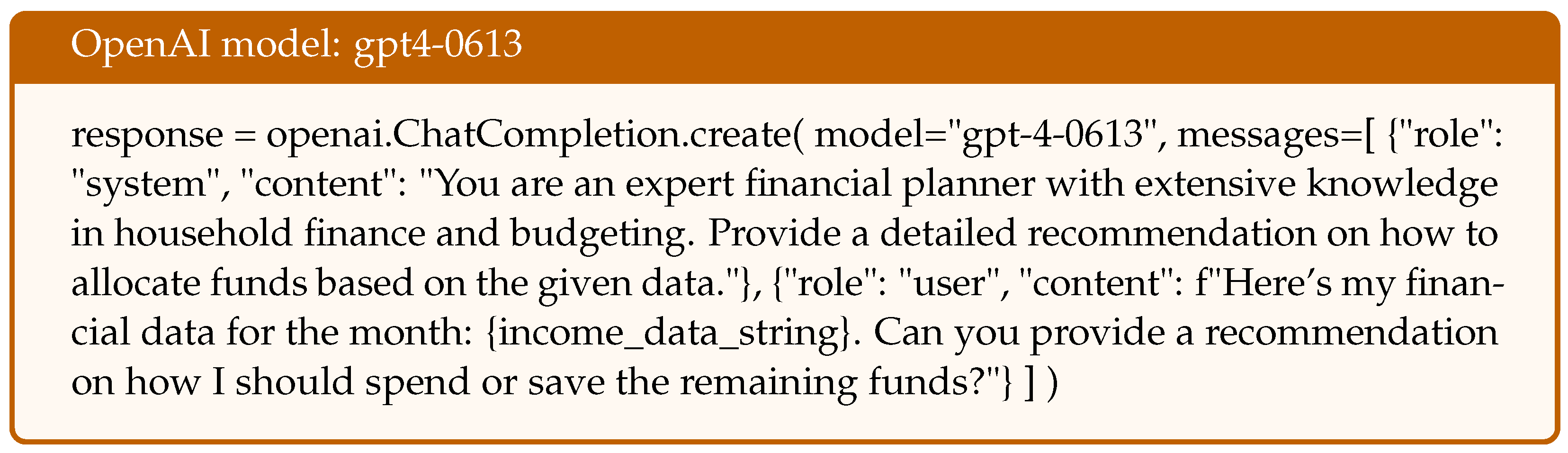

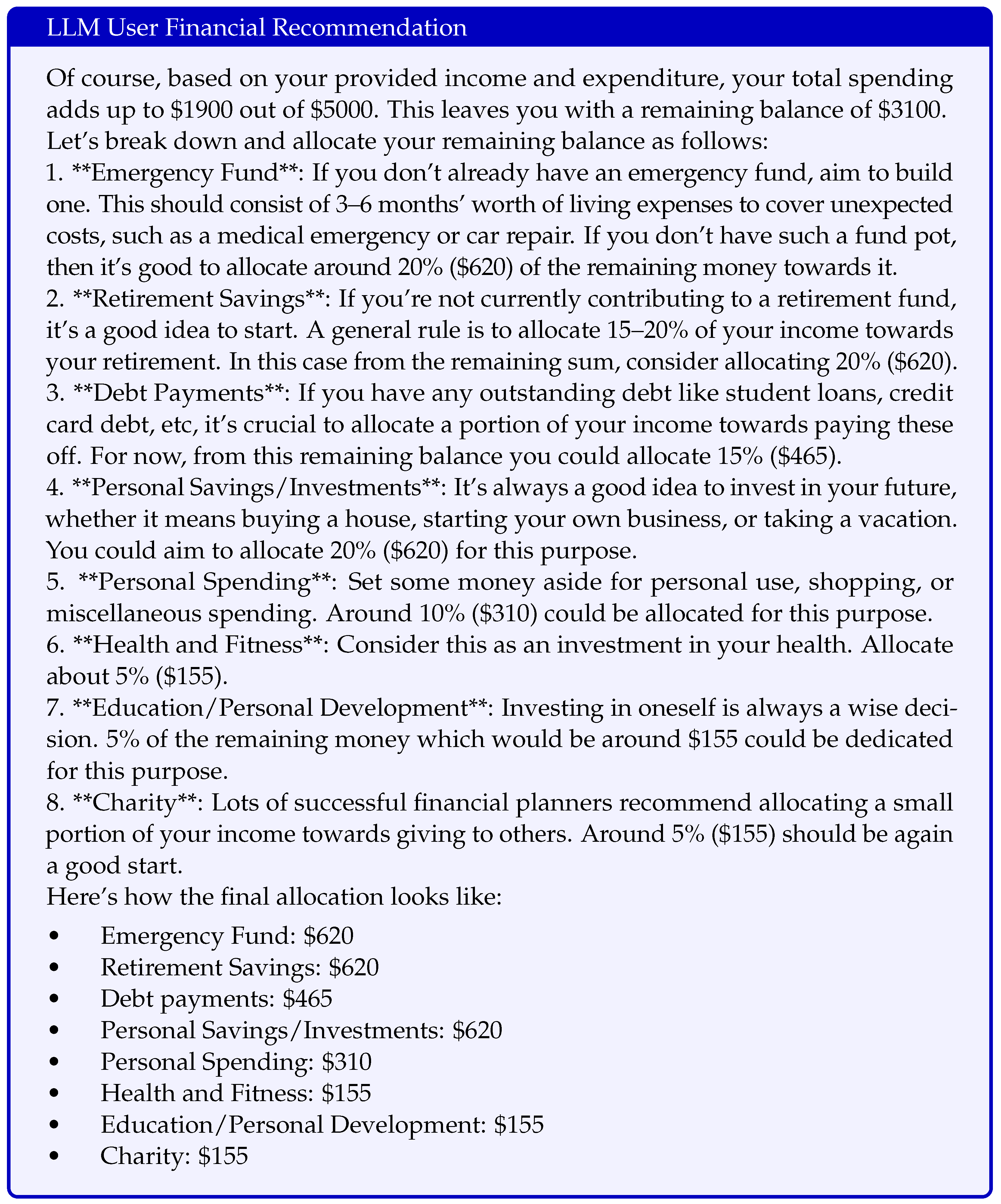

![Ai 05 00006 i001]()

The instruction given to the model focused on its expertise as a financial planner. This query is indicative of how the LLM would process individual financial data and provide a comprehensive recommendation.

![Ai 05 00006 i002]()

Analysis: The recommendation begins by acknowledging the user’s financial state, ensuring transparency in the LLM’s calculations. The model then meticulously divides the leftover funds into eight categories. These categories represent the fundamental areas that most individuals need to consider in their financial planning. The proportional allocation seems balanced and encourages both saving and investing while also emphasizing personal well-being and community giving.

This framework aligns well with traditional financial planning advice, indicating the model’s efficacy in this domain. Moreover, the clarity and structure provided by the model can greatly assist users in understanding their financial standing and planning their future expenditures.

7.2. Cooperative Financial Recommendation

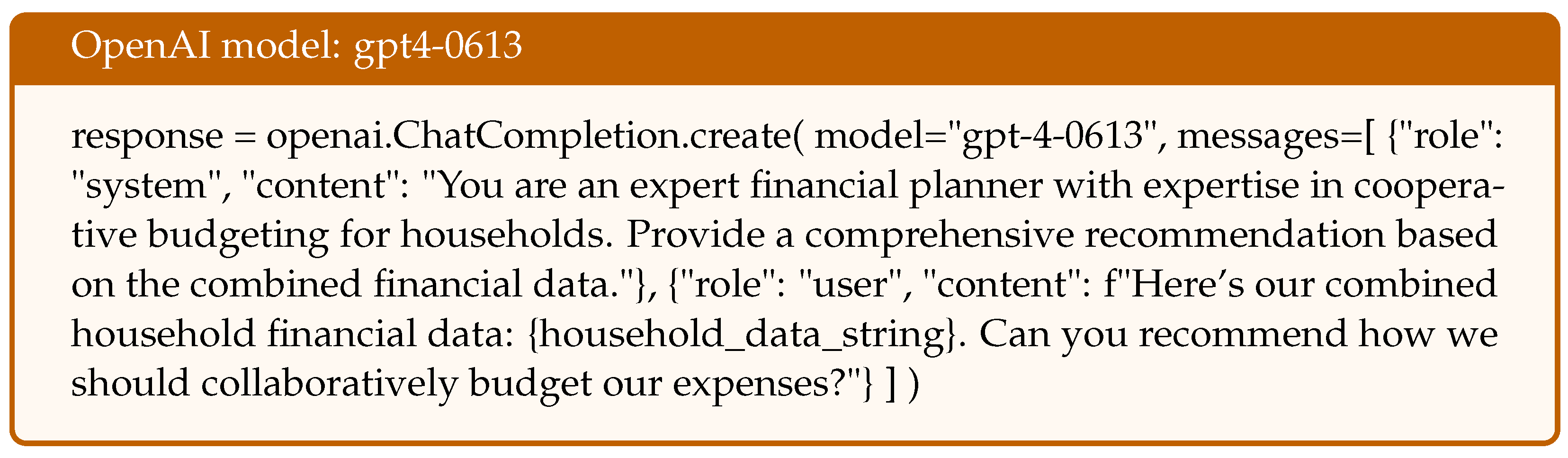

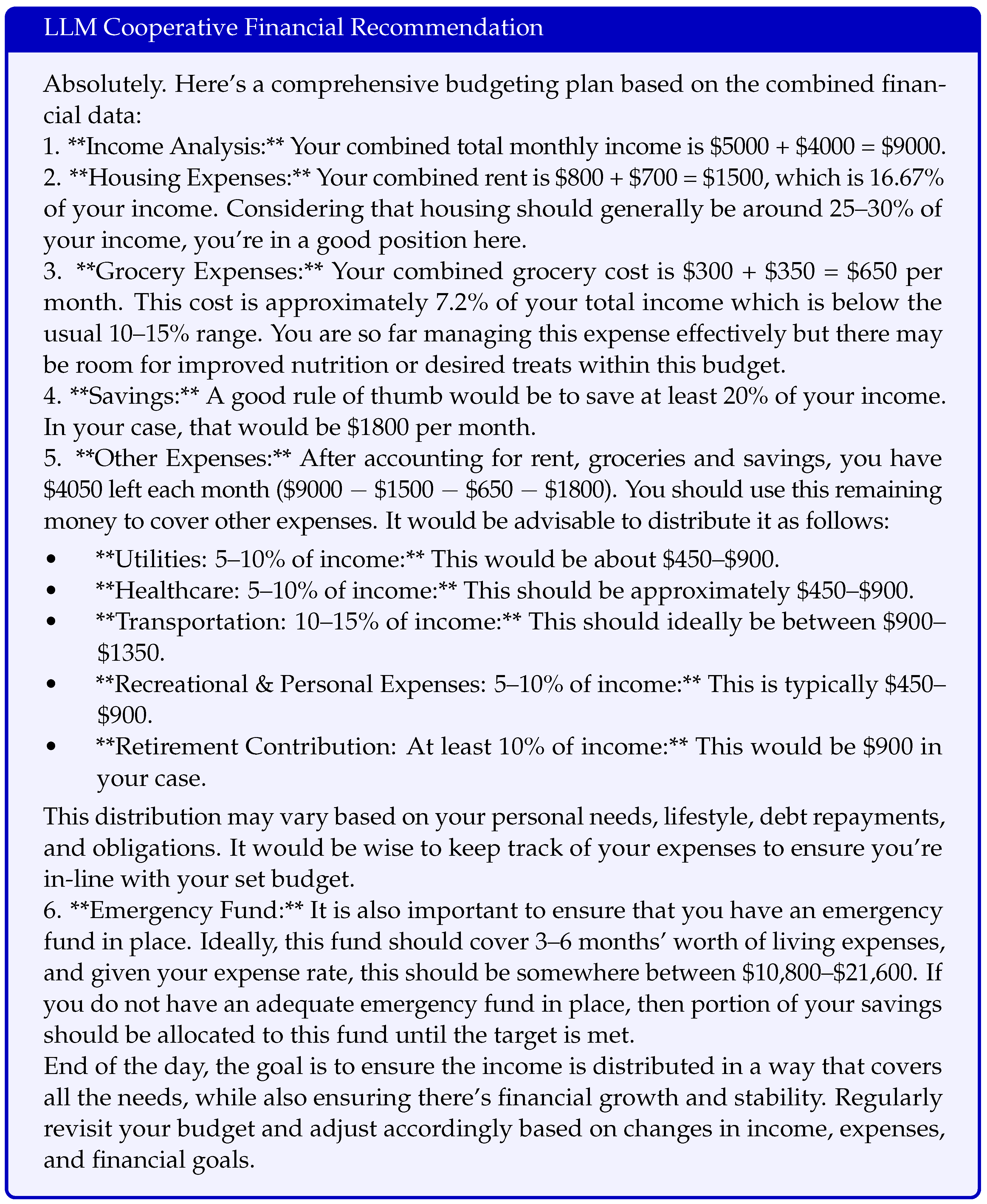

![Ai 05 00006 i003]()

In this inquiry, the model was tasked with providing a comprehensive recommendation based on combined financial data, embodying the complexities of cooperative budgeting for households.

![Ai 05 00006 i004]()

Analysis: The model adopts a detailed approach to cooperative financial planning, starting with a clear breakdown of combined income and essential expenses like housing and groceries. The percentages used to allocate various expenses, such as housing taking up 25–30% of the income, align with widely accepted financial guidelines.

A particularly noteworthy aspect of this recommendation is the inclusion of an emergency fund, highlighting the LLM’s capacity to foresee potential financial pitfalls and its alignment with prudent financial practices.

The cooperative recommendation, much like the individual one, is comprehensive, detailed, and aligns with standard financial planning guidelines. This reinforces the model’s reliability in producing accurate and actionable financial advice.

7.3. The Significance of Long-Term Models in Financial Planning

Financial planning [

28,

29], at its core, is not just about budgeting for the next month or year: it is about laying a foundation for the entire life-cycle [

30,

31]. Decisions made today will inevitably impact financial security, flexibility, and wealth accumulation in the distant future. With this understanding, there arises an imperative need for long-term models in the domain of financial planning.

Long-term models bring foresight to financial decision making. By analyzing long-term implications of current financial data, these models offer recommendations that are not just about immediate benefit but also cater to future financial health. The importance of long-term models becomes even more pronounced in situations that involve uncertainties like changing job markets, economic fluctuations, or personal life events.

Here is a glimpse into the key benefits and functionalities of long-term models in the financial domain:

Consumption Smoothing: Long-term models assist in balancing consumption patterns over time, ensuring that individuals do not overspend during prosperous periods or face hardship during lean times. By forecasting future income streams and financial obligations, long-term models promote consistent living standards throughout an individual’s life.

Life-cycle Modeling: These models simulate various stages of an individual’s life, from early career stages, potential family planning, and mid-life crises, to retirement. By doing so, they help in preparing for financial needs and challenges typical to each phase.

Risk Management: LLMs highlight potential risks by analyzing economic trends, inflation rates, and personal financial data. They help to devise strategies to mitigate these risks, be it through investments, insurance, or savings.

Investment Guidance: Based on long-term financial goals and market predictions, LLMs provide guidance on where and how much to invest. This includes suggestions on diversifying portfolios, adjusting asset allocations, and more.

Future Projections: One of the standout features of LLMs is their ability to project financial futures based on current data and decisions. They offer a roadmap of where one’s finances could be in 5, 10, or even 30 years from now.

7.4. Long-Term Cooperative Financial Recommendation

![Ai 05 00006 i005]()

Here is an example usage with more comprehensive data taking into account long-term dependencies:

![Ai 05 00006 i006]()

As seen from our simulation framework, when LLMs like gpt-4-0613 are given a long-term perspective, they provide advice that aligns with the core tenets of financial planning. Whether it is individual or cooperative budgeting, the model’s recommendations reflect an understanding of the intricate dance between current spending, future needs, and long-term financial growth.

Analysis: The long-term cooperative financial recommendation exemplifies the model’s capacity to engage with complex financial scenarios that span across an individual’s lifetime. Notably:

Consumption Smoothing: The model emphasizes consumption smoothing by suggesting a consistent standard of living. Its advice on adjusting income to accommodate a projected pay cut is particularly salient, as it showcases the model’s ability to suggest proactive measures against potential financial setbacks.

Emergency and Specific Funds: The inclusion of both an emergency fund and a child fund showcases the model’s comprehensive approach. It highlights an understanding of immediate needs (like emergencies) and future events (like planning for a child), thus promoting financial preparedness.

Retirement Planning: The model’s advice to prioritize retirement savings for Member 2, who plans to retire in 20 years, underscores its alignment with a long-term vision. It demonstrates an acute awareness of the time-sensitive nature of retirement planning.

Overall, the model’s long-term cooperative financial recommendation reflects a good understanding of the life-cycle model’s principles. It meticulously integrates immediate financial needs with long-term goals, showcasing its potential to serve as a valuable tool in the domain of financial planning.

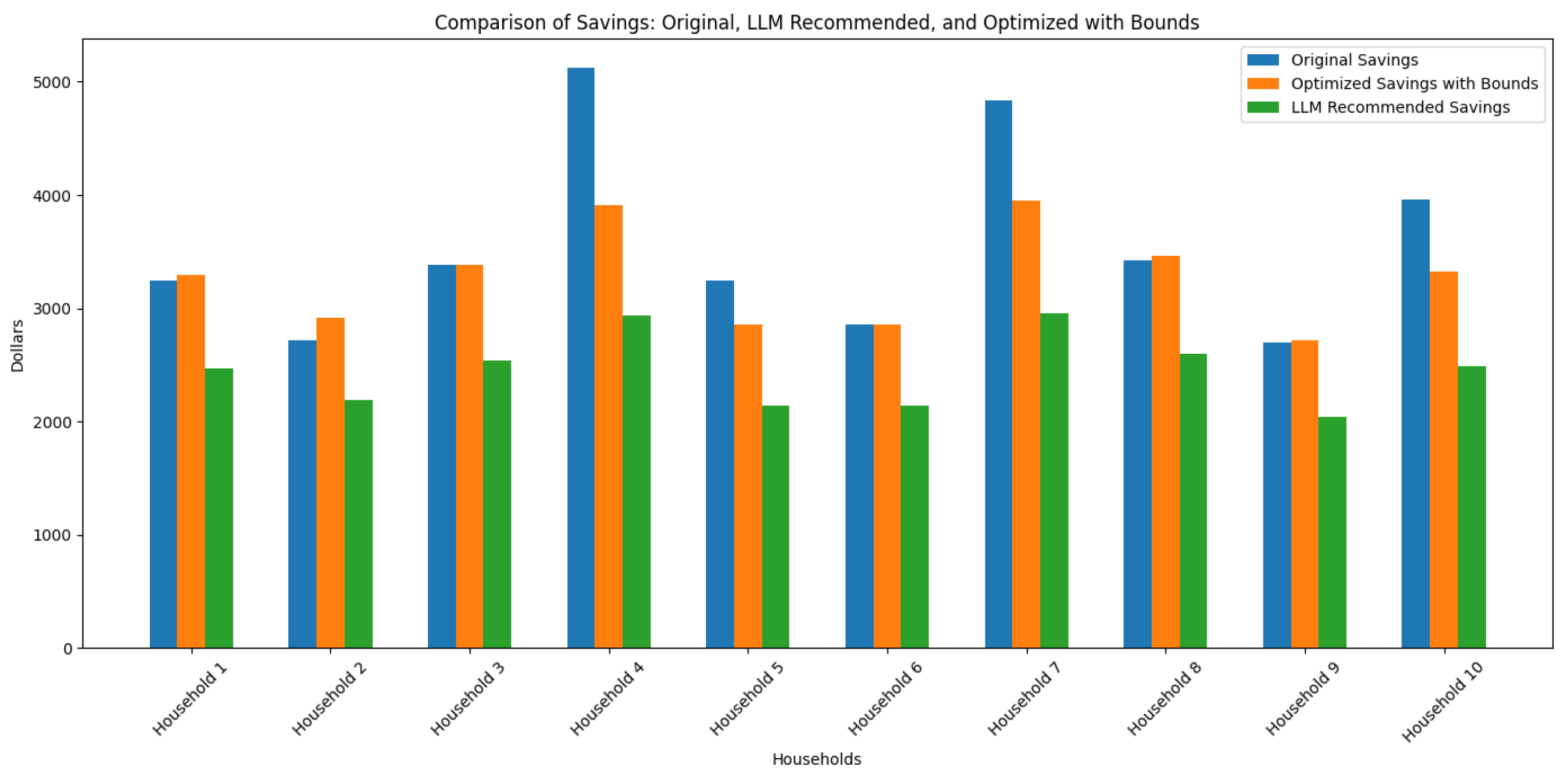

7.5. Simulation of Financial Planning with LLM Recommendations

Going beyond, we present a simulation that integrates financial recommendations from an LLM into the financial planning process of synthetic household datasets. Our approach involves generating synthetic financial profiles for ten households, encompassing monthly income and expenses across four categories: rent, groceries, utility bills, and entertainment. The monthly incomes are normally distributed around a mean of USD 5000 with a standard deviation of USD 1000. Expenses in each category are also generated following a normal distribution with category-specific means and variances.

Once the synthetic dataset is established, we employ an LLM to provide financial planning advice for each household. The LLM is prompted to analyze the financial data and recommend allocations as percentages of the household’s monthly income. The advice is structured to include essential expenditures, savings, and discretionary spending, following sound financial planning principles.

The LLM’s textual recommendations are parsed using regular expressions to extract the suggested allocation percentages for each financial category. These extracted values are then translated into monetary amounts based on the respective household’s income and stored alongside the original data.

Subsequently, we apply a linear programming optimization model to each household’s financial data, aiming to maximize savings while adhering to realistic constraints. This model takes into account minimum spending requirements for each expense category, ensuring that the optimized plan remains practical and sustainable.

Finally, we visualize the simulation results, comparing the original savings, LLM-recommended savings, and optimized savings with bounds. This comparison highlights the potential impact of AI-driven financial advice when combined with traditional optimization techniques.

The instance of a financial planning scenario in

Figure 2 not only showcases the feasibility of utilizing AI in personal financial planning but also serves as a benchmark for evaluating the LLM’s performance against traditional optimization models. The findings suggest that LLMs can effectively contribute to financial decision making, offering insights that align with recognized financial best practices.

![Ai 05 00006 i007]()

The simulation involves several stages:

Generation of synthetic financial data for each household, with random distributions for income and expenses.

Retrieval of financial recommendations from an LLM, which analyzes the synthetic data and provides allocation percentages for various expense categories.

Parsing of the LLM output to translate percentage-based recommendations into monetary allocations.

Application of a linear optimization model to determine an optimized savings strategy for each household, independent of LLM recommendations, using fixed minimum spending bounds for each expense category.

Visual comparison of the households’ original savings, the savings as recommended by the LLM, and the savings post-optimization, highlighting the potential of LLM guidance in enhancing financial decision making.

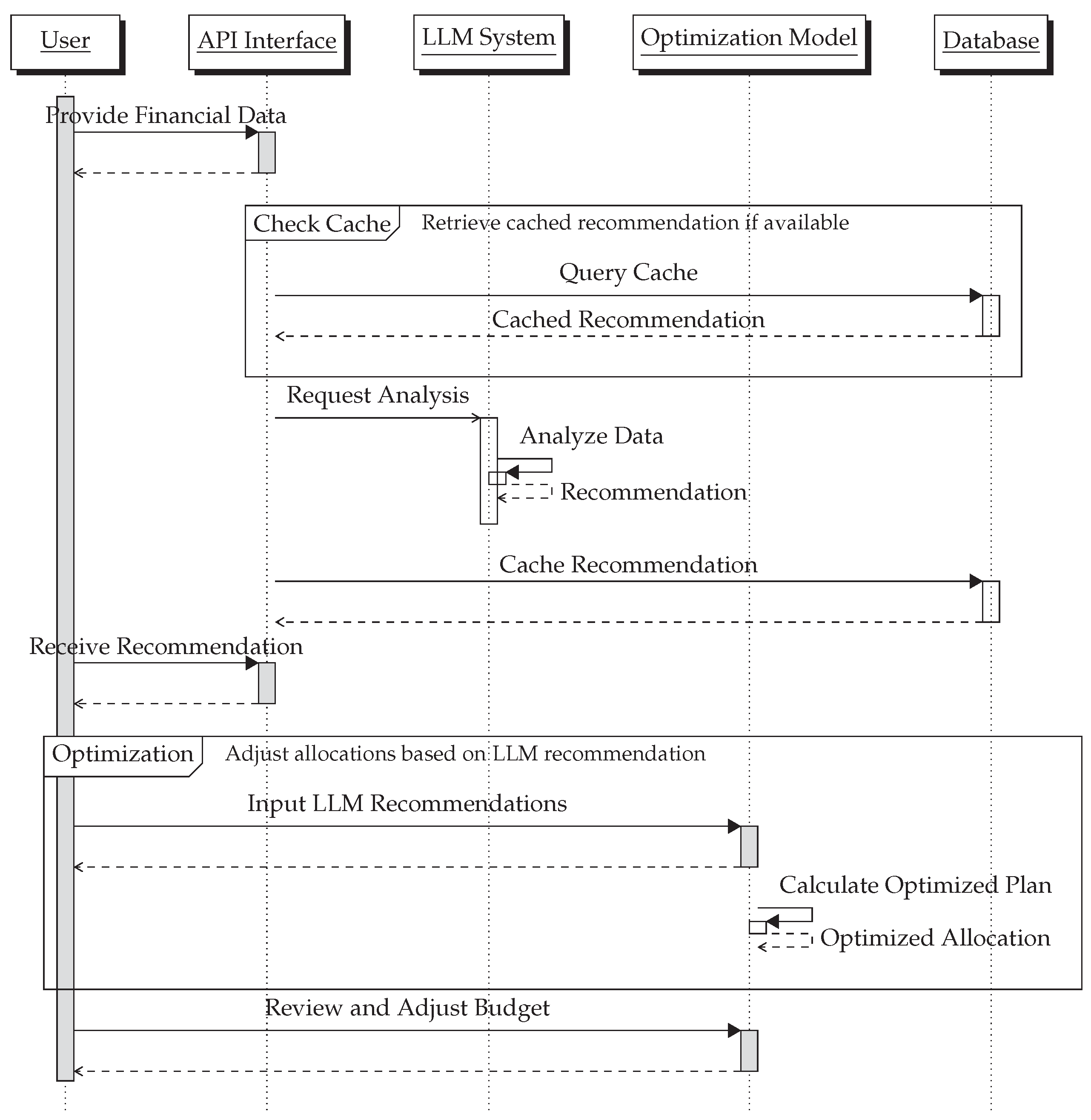

In the process of developing our LLM financial recommender system, we mapped the interactions between various components to ensure a seamless user experience and robust performance.

Figure 3 illustrates the sequence of events from the moment a user inputs their financial data to the receipt of personalized recommendations and subsequent budget optimization. This diagram delineates the system’s workflow, highlighting the role of the LLM in analyzing financial data and generating tailored advice. The sequence further demonstrates the integration of an optimization model that fine-tunes the initial recommendations to accommodate user-specific financial goals and constraints. The interaction between the user, LLM, and optimization model encapsulates the synergy of AI-driven insights with algorithmic precision, which is central to the innovative approach of our financial planning system.

The qualitative analysis in

Table 1 distinctly showcases the advantages of our proposed models over traditional financial planning methodologies. Key enhancements include the capacity for high personalization, where the LLM’s inferential abilities tailor recommendations to specific user scenarios. Unlike traditional models, our approach dynamically adapts to market changes, leveraging the LLM’s capacity to analyze current data trends. Scalability is another significant improvement: the AI-driven model can simultaneously cater to a vast array of users, a feat challenging for traditional methods. In terms of user accessibility, the proposed system simplifies complex financial concepts, making financial planning more approachable for the general public. The integration of real-time data ensures that the advice is always relevant and timely, a critical aspect often lacking in conventional models. Finally, the proposed methodology excels in long-term financial planning, with the ability to project and adapt to future financial scenarios, providing users with a comprehensive view of their financial trajectory.

8. Conclusions and Future Work

The transition from traditional optimization approaches to the use of the extended coevolutionary (EC) theory presents an innovative direction for the domain of financial planning. By analyzing cooperative budgeting within households, this paper illuminates the compatibility of game-theoretic models, adaptive learning, and the influential role of large language models (LLMs) in shaping financial recommendations.

The provided pipeline exemplifies practical applications of the EC theory [

27], demonstrating a marriage between adaptive learning mechanisms and LLMs to generate financial advisories, as an instantiation of a new economic theory where human decisions can be greatly influenced by AI agents. Through iterative refinements influenced by LLM recommendations, the system iteratively approaches optimal financial allocations. The clear distinction between individualized financial recommendations and cooperative household budgeting reinforces the versatility of this approach, which could be seamlessly integrated into household members by the use of a smartphone, smartwatch, or personal computer.

Future work may involve:

Expansion of Utility Functions: Future studies could delve deeper into constructing more comprehensive utility functions, encompassing factors like changing financial landscapes, inflation rates, and socio-economic considerations.

Model Robustness: Analyzing the robustness of LLM recommendations in diverse financial scenarios, especially under market volatility, would be beneficial. This ensures the system’s resilience and adaptability to external shocks.

Integration with Real-time Data: By interfacing the proposed methodology with real-time financial databases, the recommendations can be rendered even more timely and relevant.

Human-in-the-loop Mechanism: While LLMs are proficient, human expertise remains indispensable. Incorporating a human-in-the-loop mechanism, where financial experts refine or validate LLM recommendations, could elevate the system’s reliability.

Ethical Considerations: As with any AI-driven system, ethical considerations, especially in a domain as crucial as finance, are paramount. Future work must ensure that the recommendations are unbiased, transparent, and in the best interest of the users.

Scalability to Larger Cooperative Entities: While households were the primary focus, scaling the model to address cooperative budgeting for larger entities, like community groups or small businesses, could be a natural progression.

In essence, the integration of the EC framework into financial planning is but the tip of the iceberg. The potential applications and refinements are vast, opening avenues for research and practical implementations that can significantly enhance the quality of financial advisories and decision-making processes.