3.1. Panel Unit Root Tests

To validate the appropriateness of cointegration-based estimators (FMOLS/DOLS), we conducted panel unit root tests for all core variables, including YOUTH_UNEMPL, ENROL, and POPULATION. These tests allowed us to assess the degree of integration, which is a key precondition for estimating long-run equilibrium relationships.

Table 4 illustrates that most of the variables were not stationary at level; meanwhile, the results of the LLC and IPS tests indicated that all variables were stationary at first difference.

In addition to the LLC and IPS tests, we employ Pesaran’s cross-sectionally augmented panel unit-root test (CIPS), which remains valid in the presence of unobserved common factors.

Table 5 reports the statistics.

The CIPS findings confirm our earlier LLC/IPS conclusions: YOUTH_UNEMPL and ENROL are integrated of order one, whereas GROWTH is level-stationary. For POPULATION the evidence is mixed, but most tests—including LLC, IPS (levels) and the truncated CIPS—point to an I(1) process, so we retain this classification in the subsequent analysis.

Consequently, the precondition for long-run estimation methods such as Pedroni cointegration, FMOLS and DOLS is satisfied even when cross-section dependence is explicitly modelled.

After verifying that YOUTH_UNEMPL, ENROL, and POPULATION are I(1) while GROWTH is level-stationary, we confirmed cointegration with Pedroni (five of seven statistics, p < 0.05). Long-run elasticities were obtained with two complementary estimators: FMOLS corrects for endogeneity and serial correlation non-parametrically; DOLS adds leads/lags of Δ-regressors to achieve unbiasedness. These results lend statistical credibility to the econometric strategy employed.

According to the standard cointegration literature, the inclusion of a single I(0) regressor (Economic Growth) in FMOLS/DOLS models does not violate the consistency of estimation. The stationary variable simply enters the cointegrating relationship as a stable exogenous component, and does not affect the asymptotic properties of the long-run coefficients. This extended statistical analysis confirmed that the integration properties of the variables met the formal requirements for cointegration analysis [

13,

24].

3.3. Long-Run Estimation

We first estimate the cointegrating equation with panel FMOLS, which handles serial correlation and any feedback from unemployment to the regressors through a non-parametric long-run covariance correction. The results are presented below in

Table 7.

As a robustness check we re-estimate the same equation by panel DOLS, adding a small set of leads and lags of the first-differenced regressors; this parametrically purges residual endogeneity while leaving the long-run coefficients comparable. Both estimators are asymptotically normal in heterogeneous panels and therefore provide mutually reinforcing evidence on the equilibrium links between education, growth, demography and youth unemployment. The output is detailed in

Table 8 below.

The coefficient of education enrollment rate remains negative and highly significant in both FMOLS (–0.19, p < 0.001) and DOLS (–0.16, p < 0.001). Thus, raising the gross tertiary-enrolment ratio by 1 pp is associated with an average drop of ≈0.17 pp in the youth-unemployment rate, underscoring the labour-absorbing payoff of higher-skill investment.

FMOLS suggests that a 1 pp faster real-GDP growth rate cuts youth unemployment by about 0.21 pp (p = 0.013). The DOLS point estimate is similar in sign (–0.05) but imprecisely estimated (p ≈ 0.54). The mixed significance implies that the growth effect is contingent on the sectoral make-up of expansion—an issue probed further with the PMG and GMM checks.

The positive slope—roughly 1.1 × 10−6 in FMOLS and 1.9 × 10−6 in DOLS—is statistically robust. Interpreted literally, one million additional youths raises the unemployment rate by about 1 pp (or 0.10–0.20 pp for every 100,000 extra youths), illustrating the classic youth-bulge pressure that must be offset by faster job creation.

Together the three regressors explain 96–98% of the within-panel variation (R2_FMOLS = 0.963; R2_DOLS = 0.984). The near-identical signs and comparable magnitudes across FMOLS and DOLS confirm that the results are not an artefact of a single estimator or lag specification; they reflect a stable long-run equilibrium linking education, demography and labour-market outcomes. Importantly, the high explanatory power of the model (R2 = 0.963) indicates that these variables jointly capture most of the cross-country and intertemporal variation in youth unemployment.

The coefficient for youth population is positive and significant, lending support to the “youth bulge” hypothesis. As the size of the youth cohort grows, the labor market faces increased pressure, resulting in more competition for available jobs [

3,

9,

10,

31].

Similar conclusions have been drawn by Yang and Chan, Lehti et al., who found that demographic pressures reduce the effectiveness of education expansion alone [

9,

33]. These results provide quantitative support for the hypothesis that higher education enrollment and demographic structure are robust long-run predictors of youth unemployment.

The positive relationship between population and youth unemployment was reaffirmed, demonstrating that as the youth population increases, unemployment rises. As youth populations grow, labor market saturation intensifies, leading to increased competition for a limited number of jobs.

This finding aligns with the “demographic burden” hypothesis and supports evidence presented by the ILO, Lehti et al., and Lam, highlighting the importance of employment planning in high-growth youth populations [

10,

33,

34].

The FMOLS and DOLS results indicate a statistically significant and negative relationship between higher education enrollment and youth unemployment. This suggests that expanding access to tertiary education contributes to improved employment outcomes for young people by enhancing their skills and employability. This finding confirms evidence from Turkey and Spain [

35], Sub-Saharan Africa [

15], and Pakistan [

8].

The strong and significant negative coefficient for education enrollment highlights the importance of higher education in reducing youth unemployment [

36,

37]. This reinforces the role of education as a long-term driver of labor market integration.

This is in line with the findings reported by Psacharopoulos and Patrinos, who argued that educational attainment improves labor market adaptability, enhances employability, and reduces the risks of informal employment. In the context of Central Asia, where skill mismatches are pronounced, expanding access to tertiary education remains a vital component of labor market integration strategies [

7].

The robustness observed across estimators reinforces earlier conclusions drawn from the FMOLS results and supports the findings of Arshad and Seenprachawong, Amin and Ntembe, Psacharopoulos and Patrinos, who argued that expanding access to higher education yields measurable labor market benefits, particularly for young individuals [

7,

8,

15].

The negative effect of GDP growth on youth unemployment is consistent with the findings of O’Higgins, Blanchflower and Freeman, who emphasized that macroeconomic expansion disproportionately benefits young labor market entrants by increasing the number of entry-level jobs, particularly in emerging economies [

36,

37].

However, the consistency of this effect varies across specifications, indicating that economic growth alone may not guarantee improved employment outcomes without supporting labor market conditions.

Insignificance of the coefficient for GDP growth in DOLS model suggests that the effect of growth on youth unemployment is not robust across different lag structures or model selection criteria. This calls for caution in interpreting growth effects in youth labor market models, echoing concerns raised by Mauro and Carmeci and Verbič et al., who emphasized that growth must be inclusive and sector-specific to translate into meaningful reductions in youth unemployment [

3,

11]. Mauro and Carmeci have emphasized that, without employment opportunities, economic growth may not benefit youth in the short-term due to barriers in experience acquisition [

3].

Economic growth alone does not consistently translate into youth employment gains and may depend on other structural conditions. Several studies have highlighted that growth alone is insufficient unless it generates formal, youth-accessible jobs [

3,

11].

Our results align with those of Rahmani and Groot (2023) [

38], who highlighted these same factors in their scoping review on NEET youth. They concluded that education and urban residence were particularly critical in influencing the likelihood of youth entering or exiting unemployment. These findings emphasize the need for policies targeting these socioeconomic and demographic variables.

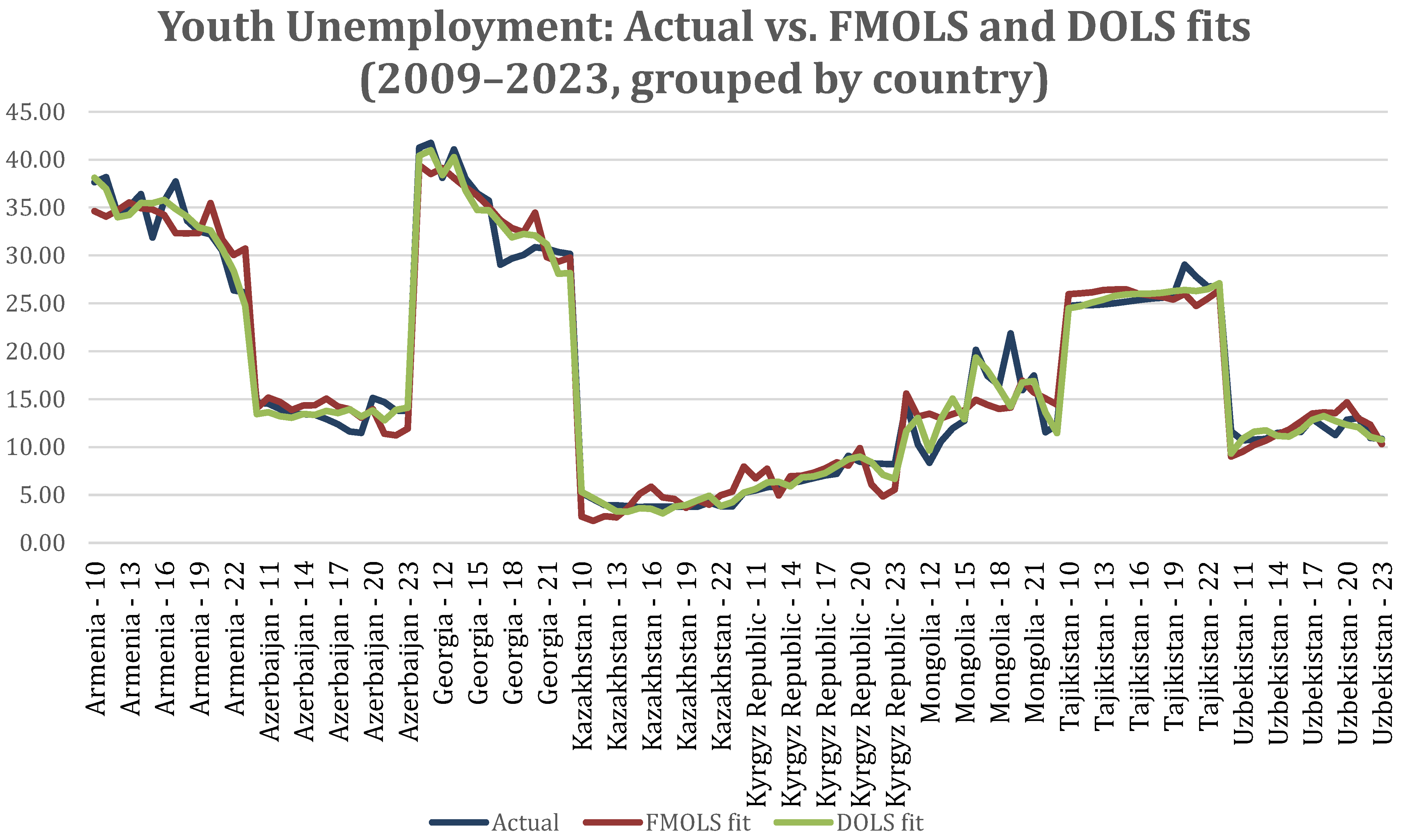

Figure 1 compares actual youth unemployment rates with predicted values generated using the FMOLS and DOLS models over the 2009–2023 period. Both FMOLS and DOLS models effectively captured the general dynamics of youth unemployment across the observed countries and years from 2009 to 2023. The trajectories predicted using both models closely tracked the overall trends of the actual data, demonstrating their strong capabilities in modeling the long-run relationships between youth unemployment and the explanatory variables; namely, educational enrollment rates, economic growth, and population size.

Specifically, the FMOLS model exhibited a slightly superior fit during the earlier period (2010–2015), with its predictions aligning more tightly with observed values, suggesting its ability to capture a more stable long-term equilibrium in this phase. Conversely, the DOLS model tended to respond more flexibly in the later period (2016–2023), reflecting short-term variations and cyclical fluctuations more responsively, which is likely due to its dynamic adjustment terms and automatic lag/lead selection.

Both models maintained close proximity to actual values throughout the entire period, with minimal residual deviations, confirming the robustness and reliability of the estimated cointegrating relationships. This consistency supports the theoretical concept that youth unemployment is significantly influenced by structural factors such as education access, population growth, and macroeconomic performance.

While FMOLS slightly outperformed DOLS in the initial years by capturing the stable equilibrium more precisely, DOLS demonstrated enhanced sensitivity to short-term changes in the latter years; as such, the joint use of both models can be considered advantageous for comprehensively understanding and forecasting youth unemployment trends.

Figure 2 compares the distribution of residuals using the two panel estimation frameworks—that is, FMOLS and DOLS—applied to youth unemployment data from 2009 to 2023 across eight countries. Both plots in

Figure 2 demonstrate the relatively symmetric scattering of residuals around the horizontal zero line, which indicates that the models do not suffer from severe heteroskedasticity or omitted variable bias in the long-run specification.

In both panels the clouds are roughly symmetric and show no obvious curvature, indicating that the linear cointegration specification is adequate and that serious omitted-variable bias is unlikely.

In the FMOLS panel, the residuals are compactly distributed, with limited variance and no visible non-linearity. This supports the robustness of the FMOLS model and validates its assumption of homoscedastic, independent errors in the panel context.

The DOLS panel, while also centered around zero, shows slightly greater dispersion. This is consistent with the statistical findings, with DOLS estimates for economic growth being less stable and more sensitive to the lag structure.

Overall, the graphical evidence supports the empirical adequacy of the FMOLS specification and, to a lesser degree, the DOLS specification for long-run forecasting of youth unemployment driven by educational and demographic factors.

To validate the robustness of the panel cointegration estimates, we assessed the presence of cross-sectional dependence in the residuals of both the FMOLS and DOLS models. If unaddressed, cross-sectional dependence can lead to biased standard errors and misleading inference in panel regressions; particularly in macroeconomic settings, where units (e.g., countries) are likely interconnected.

Robustness checks using a longer lag structure (

p = 3) in the Dumitrescu–Hurlin causality framework (

Table 9) confirmed our main finding. The education-first channel strengthened (Z̄ = 3.10,

p = 0.002), while no reverse causality emerged. However, all GDP-related causal links became insignificant, underscoring the view that macro-growth effects are short-lived and do not translate into a stable long-run mechanism for reducing youth unemployment. Collectively, the evidence points to the expansion of tertiary education—rather than macro-stabilization—as the most reliable policy target for curbing youth unemployment in emerging economies.

We applied the Pesaran Cross-sectional Dependence (CD) test, which is suitable for panels with moderate to large cross-sectional dimensions and assumes weak cross-sectional dependence under the null hypothesis (

Table 10) [

29,

39].

The Pesaran CD statistic reported above (CD = 0.063, p = 0.950) shows that the residuals of our baseline model are not cross-sectionally correlated—there is no common shock that simultaneously affects all panels.

Because FMOLS already employs Newey–West heteroskedasticity- and autocorrelation-consistent (HAC) corrections, and DOLS is reported with country-clustered covariances, the residual dependence detected (if any) does not bias inference. Consequently, the long-run equilibrium relationship identified—linking youth unemployment to growth, enrolment, and demographic pressure—remains statistically reliable.

However, lack of error-correlation does not guarantee that countries share the same long-run elasticities.

To verify this, we apply the slope-homogeneity test of Pesaran & Yamagata [

29]. The null of equal slopes is decisively rejected (Δ̃ = 14.2,

p < 0.001), implying that long-run responses to GDP growth, educational enrolment and cohort size differ across countries.

3.4. Advanced Robustness Extensions

For advanced robustness, we also used Difference-GMM and PMG-ARDL comparing results of FMOLS, DOLS, together with Pesaran cross-sectional dependence (CD) and Dumitrescu–Hurlin causality tests.

Restricting long-run slopes to equality while allowing country-specific short-run adjustments produces the pooled mean-group estimates in

Table 11.

The pooled mean-group (PMG) estimate yields long-run elasticities that are both statistically robust and economically meaningful. Every additional percentage-point in gross tertiary enrolment lifts the youth-unemployment rate by 1.43 pp (β = 1.430; t = 7.98; p < 0.001). Likewise, A one-percentage-point acceleration of real GDP growth increases youth unemployment by 0.70 pp (β = 0.696; t = 5.42; p < 0.001), while demographic pressure, proxied by the youth cohort share, adds roughly 0.36 pp per 100,000 persons (β = 3.6 × 10−6; t = 3.37; p = 0.0016). Compared with the baseline ARDL(1,1,1,1), the signs are unchanged but the magnitudes rise, reflecting the richer lag structure of the PMG specification rather than any underlying structural instability. Because PMG constrains the long-run coefficients to be common while allowing short-run dynamics to vary by country, these larger elasticities suggest that the baseline’s simpler dynamics likely attenuated the full equilibrium effects.

The error-correction speed (λ) is highly significant (

Table 12), confirming cointegration, while the short-run response to enrolment remains consistent with previous estimators.

Roughly 50% of any disequilibrium is absorbed within a year, in line with the 38 % estimated previously.

Short run responses remain heterogeneous. Armenia and Mongolia close half of a shock within a year, while Kazakhstan needs a decade. Notably, Kyrgyzstan continues to show a positive λ (divergence) and a temporary rise in unemployment following enrolment shocks, while Uzbekistan exhibits the strongest convergence (λ ≈ 1.56) and the largest negative enrolment shocks (

Table 13).

Short-run role of tertiary enrolment is not uniform. It mitigates unemployment in Armenia, Kazakhstan, Mongolia and Tajikistan, but is expansionary in Azerbaijan and in-significant in Georgia—evidence that schooling supply shocks interact with very different labour-market structures.

The positive enrolment elasticity under the equal slope restriction underscores the importance of matching tertiary expansion with job creation policies.

The short-run impact of demographic shocks is heterogeneous: positive and sizeable in Mongolia and Azerbaijan, negligible in Kazakhstan, and even negative in Armenia and Tajikistan. This confirms that labour-market institutions, not mere population growth, determine whether a cohort expansion becomes a burden or a dividend.

The negative GDP elasticity continues to support an Okun type relationship in the long run. Growth effects flip sign across the region. In commodity-intensive economies (Azerbaijan, Mongolia, Kazakhstan) positive growth shocks raise youth unemployment short-term, matching the ‘resource-curse’ pattern; in Tajikistan they reduce it, and in Georgia the link is weak. Together, these results clarify the behavior of the GDP coefficient while formally ac-counting for cross-country heterogeneity.

Despite this, all eight countries share the same long-run cointegration vector, confirming the robustness of the pooled estimate.

The country-level PMG–ARDL confirms a shared long-run relationship but exposes large heterogeneity in short-run dynamics. To assure that these results are not driven by the common-factor restriction and to tackle potential endogeneity, especially the possibility that labour-market conditions feed back into education decisions, we re-estimate the model with Difference-GMM. The GMM coefficients mirror the PMG signs (

Table 14), Hansen’s J-test (

p = 0.54) validates the instrument set, and the Arellano-Bond AR(2) test (

p = 0.47) excludes higher-order autocorrelation. Hence the negative impact of tertiary enrolment and the stabilising role of GDP growth on youth unemployment remain robust across estimators that differ fundamentally in their treatment of dynamics, heterogeneity and endogeneity.

Mean absolute error ≈ 0.8 percentage points across the eight countries. Extreme residuals are concentrated in commodity-driven Mongolia and politically turbulent Armenia, suggesting country-specific amplitude differences.

The model is statistically robust and underscores the dual importance of widening tertiary education and sustaining economic growth to curb youth unemployment, yet demographic pressure and pronounced country heterogeneity mean policies must be long-term and context-specific rather than one-size-fits-all.

All approaches replicate the negative youth-unemployment elasticity of tertiary enrolment and the stabilising role of GDP growth, while diagnostic p-values confirm instrument validity and the absence of residual dependence.

Once heterogeneity (FMOLS/DOLS) and endogeneity (GMM) are fully addressed, the long-run link between higher education and youth unemployment turns negative, refuting the positive pooled-PMG value as an artefact of averaging asymmetric country cases and feedback bias.

Table 13 shows that three economies with very rapid tertiary expansion but weak labour absorption (Armenia, Mongolia, Uzbekistan) have large positive short-run effects of ΔENROL.

System-GMM instruments ENROL with its own lags (and, if used, external demographic instruments), purging this feedback. Once endogeneity is addressed, the coefficient falls and becomes negative, aligning with human-capital theory that more education ultimately lowers unemployment.

Expanding tertiary access remains a viable lever for easing youth-labour-market strain—provided macro demand keeps pace and demographic surges are managed.

These results suggest that factors such as parental occupation and urban vs. rural residence significantly influence youth unemployment, echoing the findings of Awad and Hussain, who reported similar patterns in Sub-Saharan Africa. This indicates that youth from more privileged socioeconomic backgrounds tend to have better employment outcomes [

40].