Climate Risks and Real Gold Returns over 750 Years

Abstract

1. Introduction

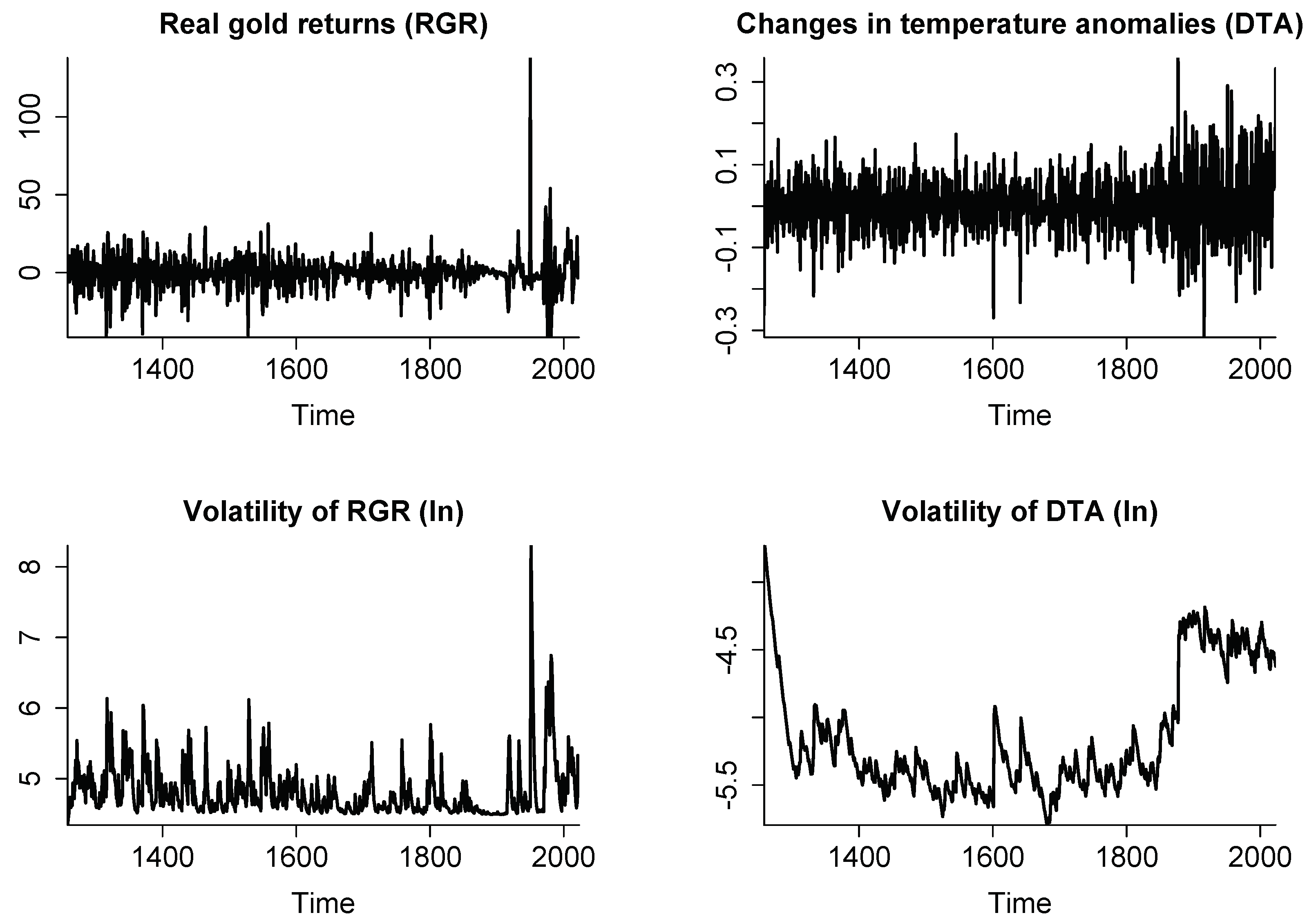

2. Data

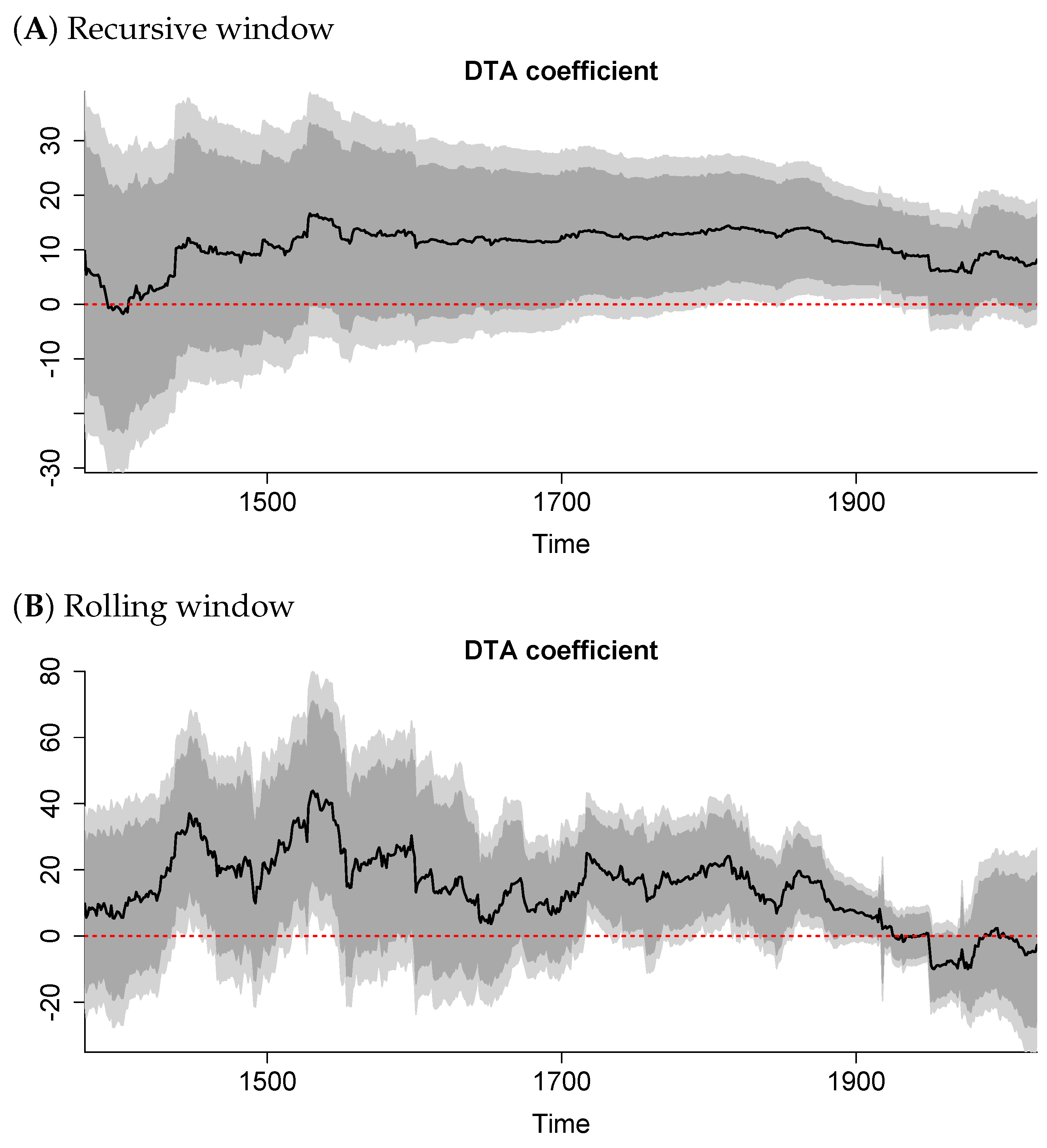

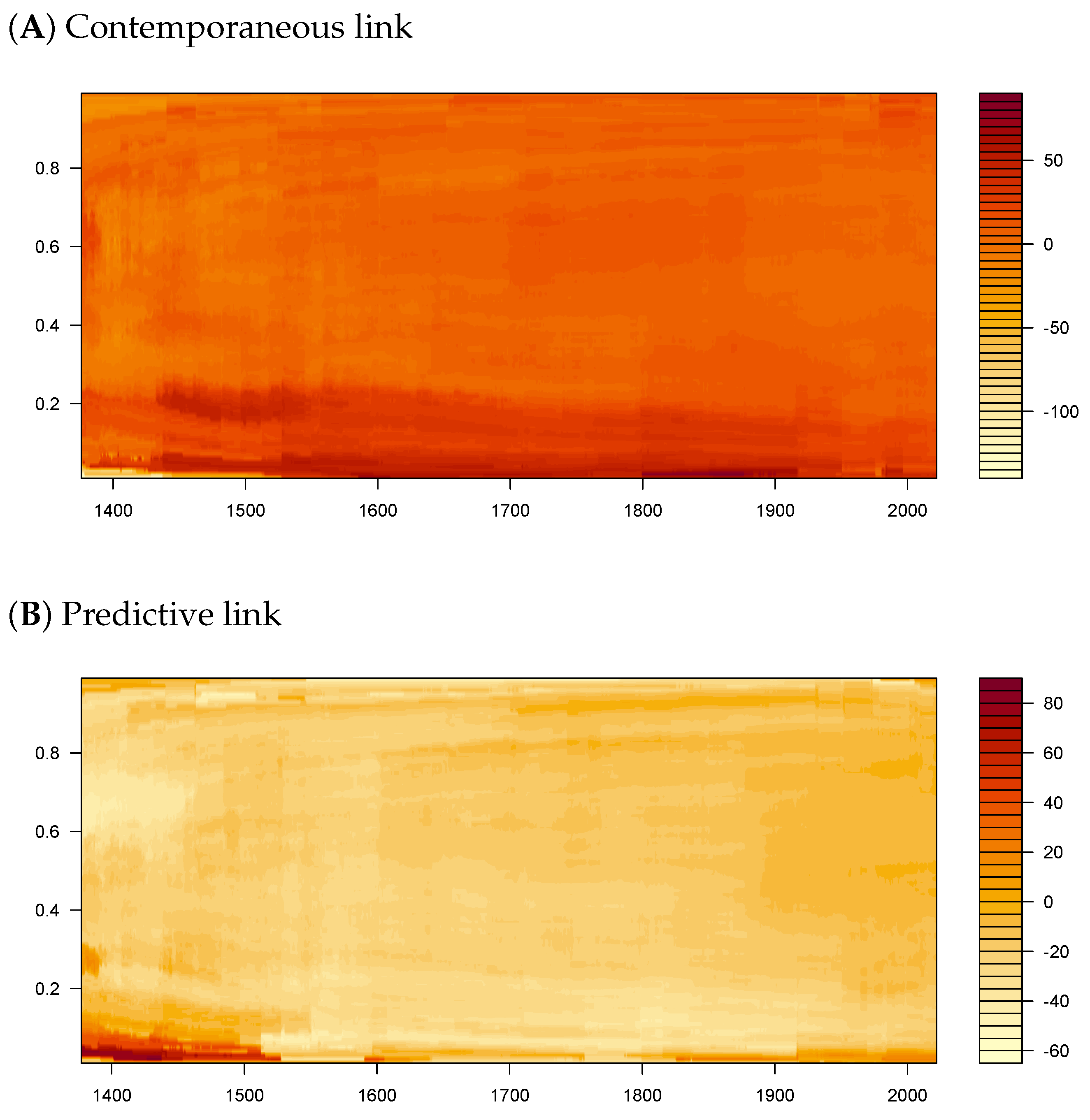

3. Empirical Models

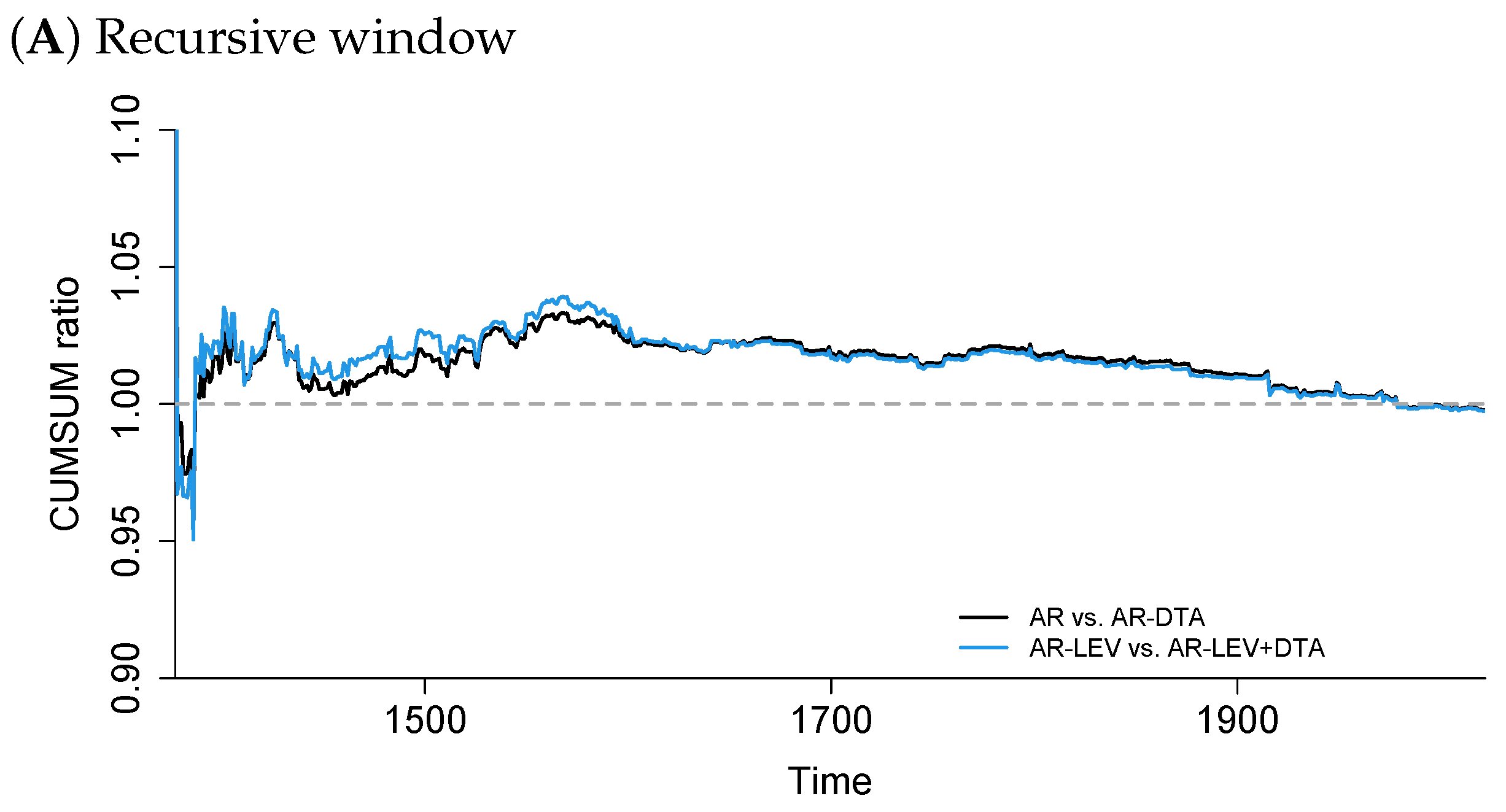

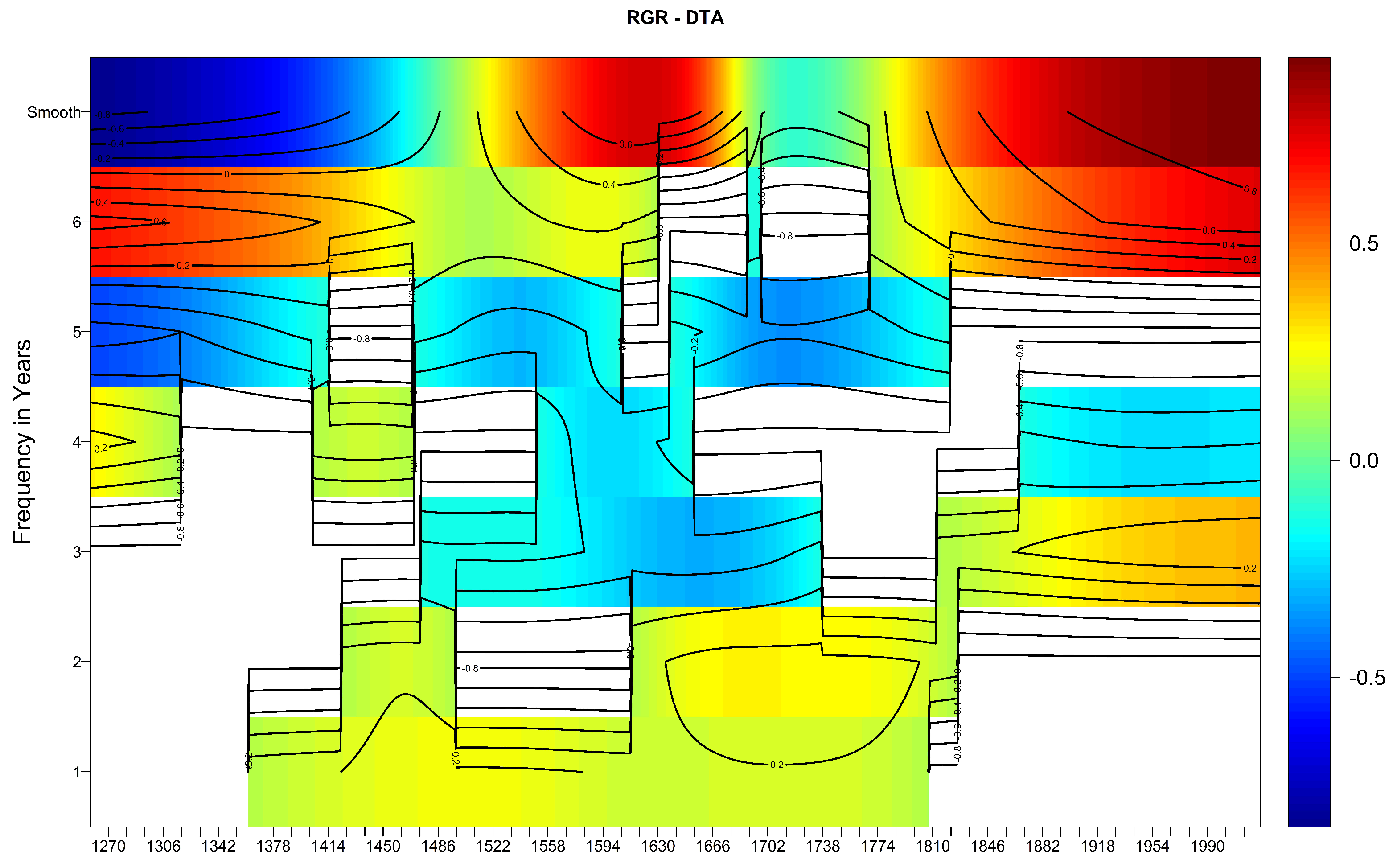

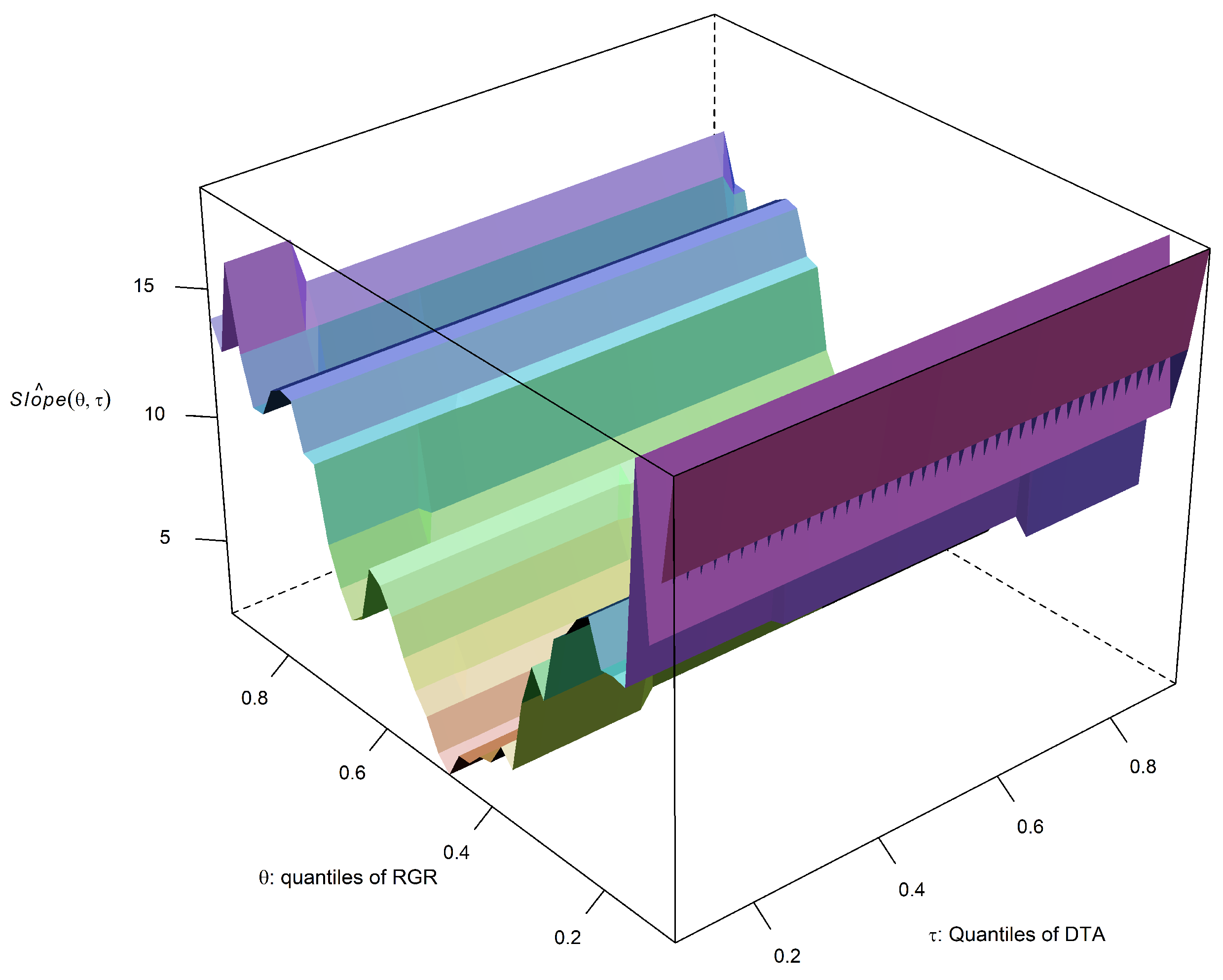

4. Empirical Results

5. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Predictor | Coefficient | t-Statistic | |

|---|---|---|---|

| Contemporaneous link | |||

| Intercept | |||

| *** | |||

| ** | |||

| Predictive link | |||

| Intercept | |||

| *** | |||

| ** | |||

| Benchmark vs. Extended Model | CW Test (p-Value) |

|---|---|

| Recursive window | |

| AR vs. AR-DTA | |

| AR vs. AR-DTA-VOLA | |

| AR vs. AR-DTA + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA | |

| AR-LEV vs. AR-LEV + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA | |

| AR-VOLA vs. AR-VOLA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA + DTA-VOLA | |

| Rolling window | |

| AR vs. AR-DTA | |

| AR vs. AR-DTA-VOLA | |

| AR vs. AR-DTA + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA | |

| AR-LEV vs. AR-LEV + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA | |

| AR-VOLA vs. AR-VOLA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA + DTA-VOLA |

References

- Battiston, S.; Dafermos, Y.; Monasterolo, I. Climate risks and financial stability. J. Financ. Stab. 2021, 54, 100867. [Google Scholar] [CrossRef]

- Flori, A.; Pammolli, F.; Spelta, A. Commodity prices co-movements and financial stability: A multidimensional visibility nexus with climate conditions. J. Financ. Stab. 2021, 54, 100876. [Google Scholar] [CrossRef]

- Diallo, M.N.; Bah, M.M.; Ndiaye, S.N. Climate risk and financial stress in ECOWAS. J. Clim. Financ. 2023, 5, 100025. [Google Scholar] [CrossRef]

- Del Fava, S.; Gupta, R.; Pierdzioch, C.; Rognone, L. Forecasting international financial stress: The role of climate risks. J. Int. Financ. Mark. Inst. Money 2024, 92, 101975. [Google Scholar] [CrossRef]

- Caporin, M.; Caraiani, P.; Cepni, O.; Gupta, R. Predicting the conditional distribution of US stock market systemic stress: The role of climate risks. J. Int. Financ. Mark. Inst. Money 2025, in press. [Google Scholar]

- Nordhaus, W. Climate change: The ultimate challenge for economics. Am. Econ. Rev. 2019, 109, 1991–2014. [Google Scholar] [CrossRef]

- Bansal, R.; Kiku, D.; Ochoa, M. Price of Long Run Temperature Shifts in Capital Markets; Working Paper No. 22529; National Bureau of Economic Research: Cambridge, MA, USA, 2021. [Google Scholar]

- Bansal, R.; Kiku, D.; Ochoa, M. Climate change and growth risks. In The Role of Uncertainty and Risk in Climate Change Economics; Chari, V.V., Litterman, R., Eds.; Wiley: Hoboken, NJ, USA, 2025; in press. [Google Scholar]

- Giglio, S.; Kelly, B.; Stroebel, J. Climate finance. Annu. Rev. Financ. Econ. 2021, 12, 15–36. [Google Scholar] [CrossRef]

- Rietz, T. The equity risk premium: A solution. J. Monet. Econ. 1988, 22, 117–131. [Google Scholar] [CrossRef]

- Barro, R.J. Rare disasters and asset markets in the twentieth century. Q. J. Econ. 2006, 121, 823–866. [Google Scholar] [CrossRef]

- Barro, R.J. Rare disasters, asset prices, and welfare costs. Am. Econ. Rev. 2009, 99, 243–264. [Google Scholar] [CrossRef]

- Balcilar, M.; Gabauer, D.; Gupta, R.; Pierdzioch, C. Climate risks and forecasting stock market returns in advanced economies over a century. Mathematics 2023, 11, 2077. [Google Scholar] [CrossRef]

- Bonato, M.; Cepni, O.; Gupta, R.; Pierdzioch, C. Climate risks and realized volatility of major commodity currency exchange rates. J. Financ. Mark. 2023, 62, 100760. [Google Scholar] [CrossRef]

- Bonato, M.; Cepni, O.; Gupta, R.; Pierdzioch, C. Climate risks and state-level stock market realized volatility. J. Financ. Mark. 2023, 66, 100854. [Google Scholar] [CrossRef]

- Cepni, O.; Demirer, R.; Pham, L.; Rognone, L. Climate uncertainty and information transmissions across the conventional and ESG assets. J. Int. Financ. Mark. Inst. Money 2023, 83, 101730. [Google Scholar] [CrossRef]

- Faccini, R.; Matin, R.; Skiadopoulos, G. Dissecting climate risks: Are they reflected in stock prices? J. Bank. Financ. 2023, 155, 106948. [Google Scholar] [CrossRef]

- Salisu, A.A.; Pierdzioch, C.; Gupta, R.; van Eyden, R. Climate risks and U.S. stock-market tail risks: A forecasting experiment using over a century of data. Int. Rev. Financ. 2023, 23, 228–244. [Google Scholar] [CrossRef]

- Polat, O.; Gupta, R.; Cepni, O.; Ji, Q. Can municipal bonds hedge US state-level climate risks? Financ. Res. Lett. 2024, 67, 105915. [Google Scholar] [CrossRef]

- Donadelli, M.; Jüppner, M.; Riedel, M.; Schlag, C. Temperature shocks and welfare costs. J. Econ. Dyn. Control 2017, 82, 331–355. [Google Scholar] [CrossRef]

- Donadelli, M.; Grüning, P.; Jxuxppner, M.; Kizys, R. Global temperature, R&D expenditure, and growth. Energy Econ. 2021, 104, 105608. [Google Scholar]

- Donadelli, M.; Jüppner, M.; Paradiso, A.; Schlag, C. Computing macro effects and welfare costs of temperature volatility: A structural approach. Comput. Econ. 2021, 58, 347–394. [Google Scholar] [CrossRef]

- Donadelli, M.; Jüppner, M.; Vergalli, S. Temperature variability and the macroeconomy: A world tour. Environ. Resour. Econ. 2022, 83, 221–259. [Google Scholar] [CrossRef]

- Kunene, D.M.; van Eyden, R.; Gupta, R.; Caraiani, P. The predictive impact of climate risk on total factor productivity growth: 1880–2020. World Dev. 2025, in press. [Google Scholar]

- Dai, Z.; Zhang, X. Climate policy uncertainty and risks taken by the bank: Evidence from China. Int. Rev. Financ. Anal. 2023, 87, 102579. [Google Scholar] [CrossRef]

- Baur, D.G.; Lucey, B.M. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ. Rev. 2010, 45, 217–229. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is gold a safe haven? International evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar]

- Boubaker, H.; Cunado, J.; Gil-Alana, L.; Gupta, R. Global Crises and Gold as a Safe Haven: Evidence from Over Seven and a Half Centuries of Data. Phys. A Stat. Mech. Its Appl. 2020, 540, 123093. [Google Scholar] [CrossRef]

- Salisu, A.A.; Gupta, R.; Ntyikwe, S.; Demirer, R. Gold and the global financial cycle. Quant. Financ. Econ. 2023, 7, 475–490. [Google Scholar] [CrossRef]

- Baur, D.G. Asymmetric volatility in the gold market. J. Altern. Invest. 2012, 14, 26–38. [Google Scholar] [CrossRef]

- Cepni, O.; Demirer, R.; Rognone, L. Hedging climate risks with green assets. Econ. Lett. 2022, 212, 110312. [Google Scholar] [CrossRef]

- Salisu, A.A.; Gupta, R.; Nel, J.; Bouri, E. The (asymmetric) effect of El Nino and La Nina on gold and silver prices in a GVAR Model. Resour. Policy 2022, 78, 102897. [Google Scholar] [CrossRef]

- Karmakar, S.; Gupta, R.; Cepni, O.; Rognone, L. Climate risks and predictability of the trading volume of gold: Evidence from an INGARCH model. Resour. Policy 2023, 82, 103438. [Google Scholar] [CrossRef]

- Nel, J.; Gupta, R.; Wohar, M.E.; Pierdzioch, C. Climate risks and predictability of commodity returns and volatility: Evidence from over 750 years of data. Clim. Change Econ. 2023. [Google Scholar] [CrossRef]

- Campbell, J.Y. Viewpoint: Estimating the equity premium. Can. J. Econ. 2008, 41, 1–21. [Google Scholar] [CrossRef]

- Barro, R.J.; Misra, S. Gold returns. Econ. J. 2026, 126, 1293–1317. [Google Scholar]

- Balcilar, M.; Gupta, R.; Nel, J. Rare disaster risks and gold over 700 years: Evidence from nonparametric quantile regressions. Resour. Policy 2022, 79, 103053. [Google Scholar] [CrossRef]

- Bouri, E.; Gupta, R.; Nel, J.; Shiba, S. Contagious diseases and gold: Over 700 years of evidence from quantile regressions. Financ. Res. Lett. 2022, 50, 103266. [Google Scholar] [CrossRef]

- Baur, D.G.; Smales, L.A. Hedging geopolitical risk with precious metals. J. Bank. Financ. 2020, 117, 105823. [Google Scholar] [CrossRef]

- Gupta, R.; Karmakar, S.; Pierdzioch, C. Safe Havens, Machine Learning, and the Sources of Geopolitical Risk: A Forecasting Analysis Using Over a Century of Data. Comput. Econ. 2024, 64, 487–513. [Google Scholar] [CrossRef]

- Gupta, R.; Nel, J.; Salisu, A.A.; Ji, Q. Predictability of economic slowdowns in advanced countries over eight centuries: The role of climate risks. Financ. Res. Lett. 2023, 54, 103795. [Google Scholar] [CrossRef]

- McDermott, A. News feature: Climate change hastens disease spread across the globe. Proc. Natl. Acad. Sci. USA 2022, 119, e2200481119. [Google Scholar] [CrossRef]

- Van de Vuurst, P.; Escobar, L.E. Climate change and infectious disease: A review of evidence and research trends. Infect. Dis. Poverty 2023, 12, 51. [Google Scholar] [CrossRef]

- Burke, M.; Hsiang, S.M.; Miguel, E. Climate and conflict. Annu. Rev. Econ. 2015, 7, 577–617. [Google Scholar] [CrossRef]

- Jin, Y.; Zhao, H.; Bu, L.; Zhang, D. Geopolitical risk, climate risk and energy markets: A dynamic spillover analysis. Int. Rev. Financ. Anal. 2023, 87, 102597. [Google Scholar] [CrossRef]

- Dichtl, H. Forecasting excess returns of the gold market: Can we learn from stock market predictions? J. Commod. Mark. 2020, 19, 100106. [Google Scholar] [CrossRef]

- Plakandaras, V.; Ji, Q. Intrinsic decompositions in gold forecasting. J. Commod. Mark. 2022, 28, 100245. [Google Scholar] [CrossRef]

- Gabauer, D.; Gupta, R.; Karmakar, S.; Nielsen, J. Stock Market Bubbles and the Forecastability of Gold Returns and Volatility. Appl. Stoch. Model. Bus. Ind. 2025, in press. [Google Scholar]

- Stock, J.H.; Watson, M.W. Forecasting output and inflation: The role of asset prices. J. Econ. Lit. 2023, 41, 788–829. [Google Scholar] [CrossRef]

- Salisu, A.A.; Gupta, R.; Karmakar, S.; Das, S. Forecasting output growth of advanced economies over eight centuries: The role of gold market volatility as a proxy of global uncertainty. Resour. Policy 2022, 75, 102527. [Google Scholar] [CrossRef]

- Officer, L.H.; Williamson, S.H. The Price of Gold, 1257—Present. MeasuringWorth. 2024. Available online: http://www.measuringworth.com/gold/ (accessed on 1 August 2024).

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Fernández-Macho, J. Time-localized wavelet multiple regression and correlation. Phys. A Stat. Mech. Its Appl. 2018, 492, 1226–1238. [Google Scholar] [CrossRef]

- Sim, N.; Zhou, H. Oil prices, US stock return, and the dependence between their quantiles. J. Bank. Financ. 2015, 55, 1–8. [Google Scholar] [CrossRef]

- Piffer, M.; Podstawski, M. Identifying uncertainty shocks using the price of gold. Econ. J. Financ. 2017, 128, 3266–3284. [Google Scholar] [CrossRef]

- Cepni, O.; Dul, W.; Gupta, R.; Wohar, M.E. The dynamics of U.S. REITs returns to uncertainty shocks: A proxy SVAR approach. Res. Int. Bus. Financ. 2021, 58, 101433. [Google Scholar] [CrossRef]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2024; Available online: https://www.R-project.org/ (accessed on 1 June 2024).

- Pesaran, M.H.; Timmermann, A. Predictability of stock returns: Robustness and economic significance. J. Financ. Financ. 1995, 50, 1201–1228. [Google Scholar] [CrossRef]

- Clark, T.D.; West, K.D. Approximately normal tests for equal predictive accuracy in nested models. J. Econom. 2007, 138, 291–311. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Computation and analysis of multiple structural change models. J. Appl. Econom. 2003, 18, 1–22. [Google Scholar] [CrossRef]

- Koenker, R. quantreg: Quantile Regression. R Package Version 5.95. 2023. Available online: https://CRAN.R-project.org/package=quantreg (accessed on 13 August 2024).

- Gupta, R.; Pierdzioch, C. Climate Risks and forecastability of the realized volatility of gold and other metal prices. Resour. Policy 2022, 77, 102681. [Google Scholar] [CrossRef]

- Salisu, A.A.; Olaniran, A.; Lasisi, L. Climate risk and gold. Resour. Policy 2023, 82, 103494. [Google Scholar] [CrossRef]

- Dai, Z.; Tong, W. The impact of oil shocks on systemic risk of the commodity markets. J. Syst. Sci. Complex. 2024. [Google Scholar] [CrossRef]

- Demirer, R.; Pierdzioch, C.; Zhang, H. On the short-term predictability of stock returns: A quantile boosting approach. Financ. Res. Lett. 2017, 22, 35–41. [Google Scholar] [CrossRef]

- Gupta, R.; Majumdar, A.; Pierdzioch, C.; Wohar, M.E. Do terror attacks predict gold Rreturns? Evidence from a quantile-predictive-regression approach. Q. Rev. Econ. Financ. 2017, 65, 276–284. [Google Scholar]

| Statistic | RGR | DTA | Volatility RGR | Volatility DTA |

|---|---|---|---|---|

| Mean | ||||

| Median | ||||

| Std. Dev. | ||||

| Max | ||||

| Min |

| Benchmark vs. Extended Model | CW Test (p-Value) |

|---|---|

| Recursive window | |

| AR vs. AR + DTA | |

| AR vs. AR + DTA-VOLA | |

| AR vs. AR + DTA + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA | |

| AR-LEV vs. AR-LEV + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA | |

| AR-VOLA vs. AR-VOLA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA + DTA-VOLA | |

| Rolling window | |

| AR vs. AR + DTA | |

| AR vs. AR + DTA-VOLA | |

| AR vs. AR + DTA + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA | |

| AR-LEV vs. AR-LEV + DTA-VOLA | |

| AR-LEV vs. AR-LEV + DTA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA | |

| AR-VOLA vs. AR-VOLA + DTA-VOLA | |

| AR-VOLA vs. AR-VOLA + DTA + DTA-VOLA |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gupta, R.; Majumdar, A.; Pierdzioch, C.; Polat, O. Climate Risks and Real Gold Returns over 750 Years. Forecasting 2024, 6, 952-967. https://doi.org/10.3390/forecast6040047

Gupta R, Majumdar A, Pierdzioch C, Polat O. Climate Risks and Real Gold Returns over 750 Years. Forecasting. 2024; 6(4):952-967. https://doi.org/10.3390/forecast6040047

Chicago/Turabian StyleGupta, Rangan, Anandamayee Majumdar, Christian Pierdzioch, and Onur Polat. 2024. "Climate Risks and Real Gold Returns over 750 Years" Forecasting 6, no. 4: 952-967. https://doi.org/10.3390/forecast6040047

APA StyleGupta, R., Majumdar, A., Pierdzioch, C., & Polat, O. (2024). Climate Risks and Real Gold Returns over 750 Years. Forecasting, 6(4), 952-967. https://doi.org/10.3390/forecast6040047