Cryptocurrency Price Prediction Algorithms: A Survey and Future Directions

Abstract

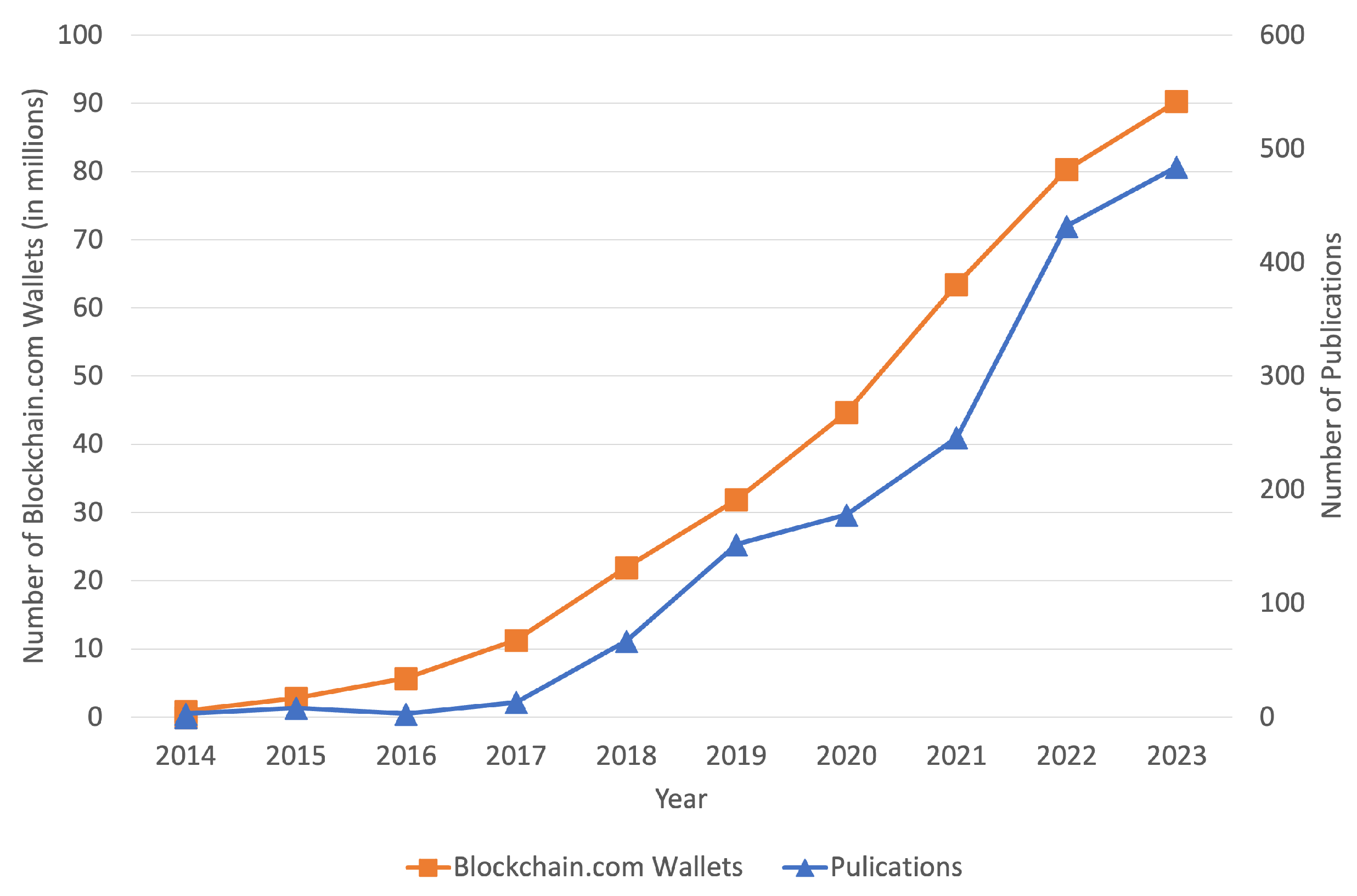

1. Introduction

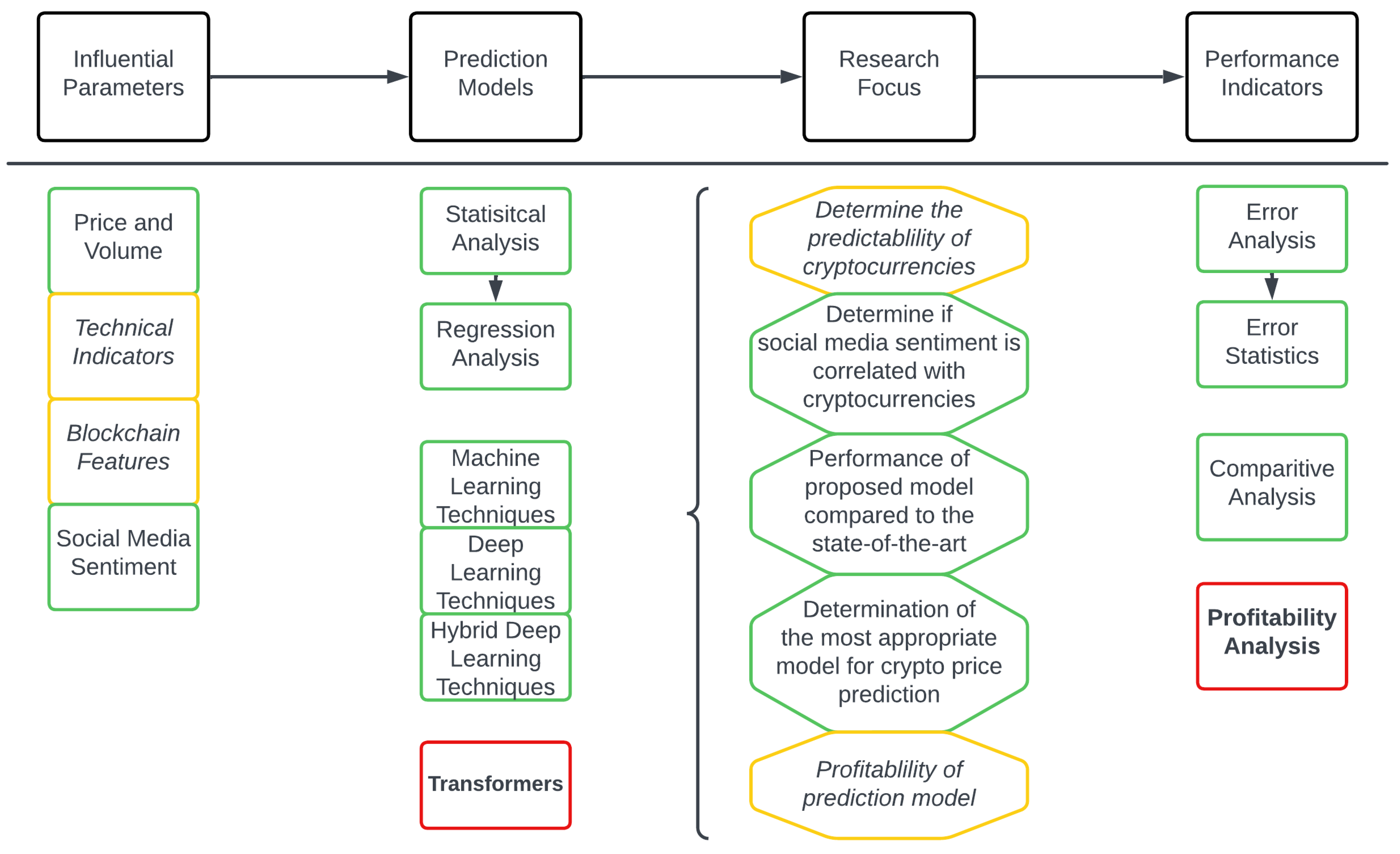

Scope and Objectives

- Comprehensive Parameter Analysis: Beyond simply identifying common parameters key influential parameters that have been considered for algorithmic methods used in cryptocurrency price prediction, this review includes an exploration of less-studied parameters, offering insights into their underutilised potential.

- Methodological Innovation: By examining state-of-the-art methodologies, this review highlights the evolution of predictive models from basic statistical approaches to sophisticated machine learning and deep learning techniques. It critically assesses the applicability of these models in real-world market scenarios, and a novel evaluation on how they utilise the various data sources available; and

- Future Research Directions: Based on the identified shortcomings, research challenges and gaps in the literature, this review proposes research avenues to help guide future research directions.

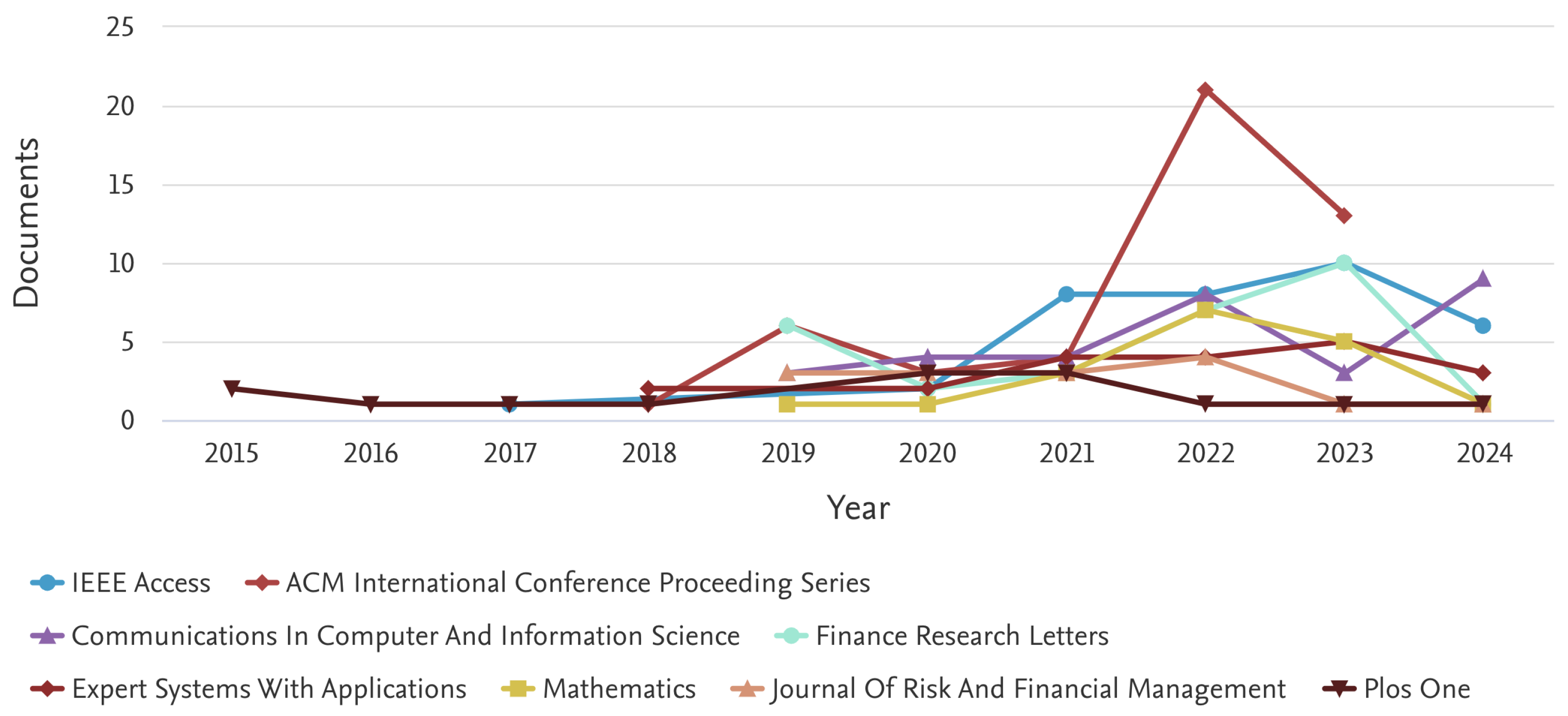

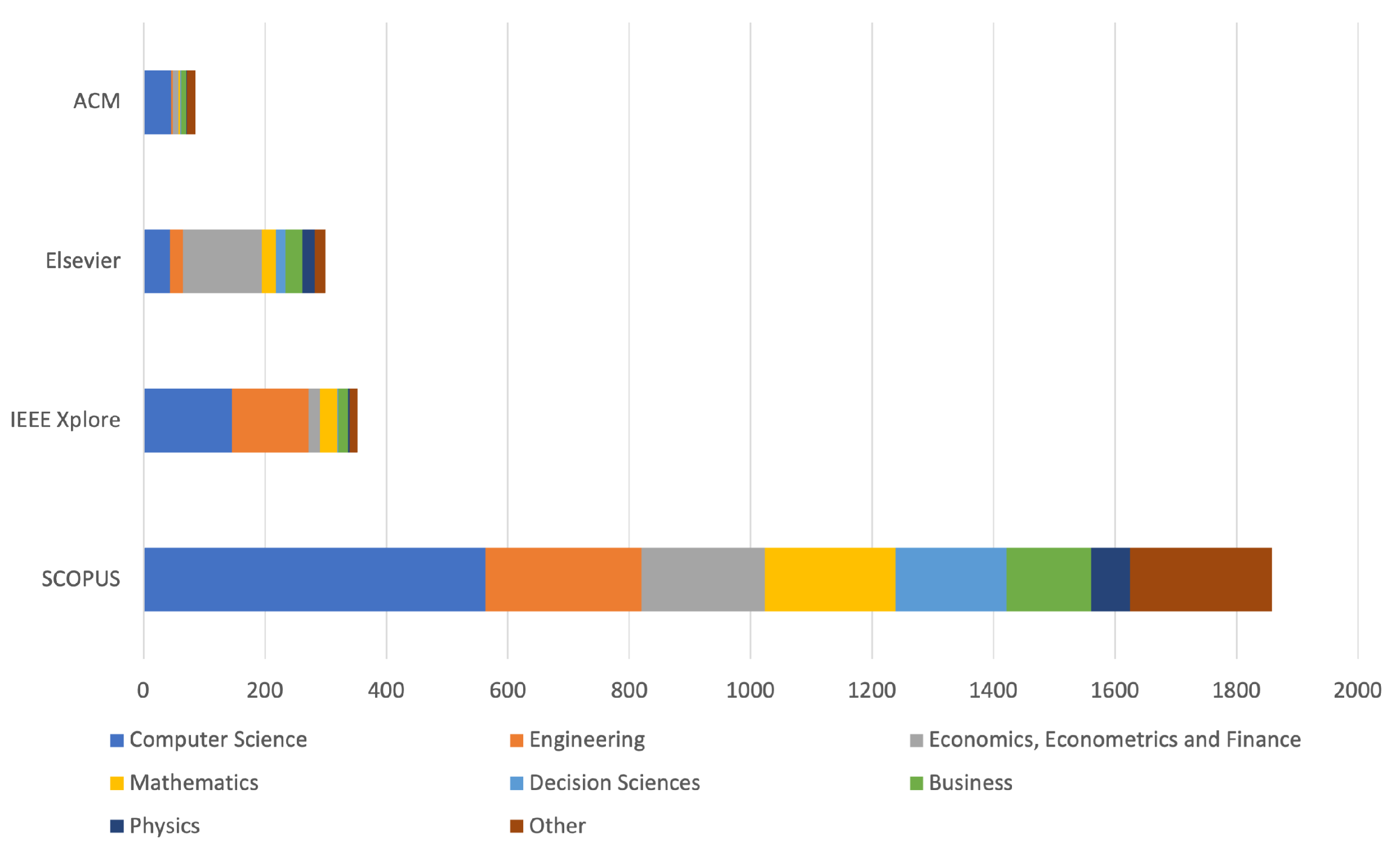

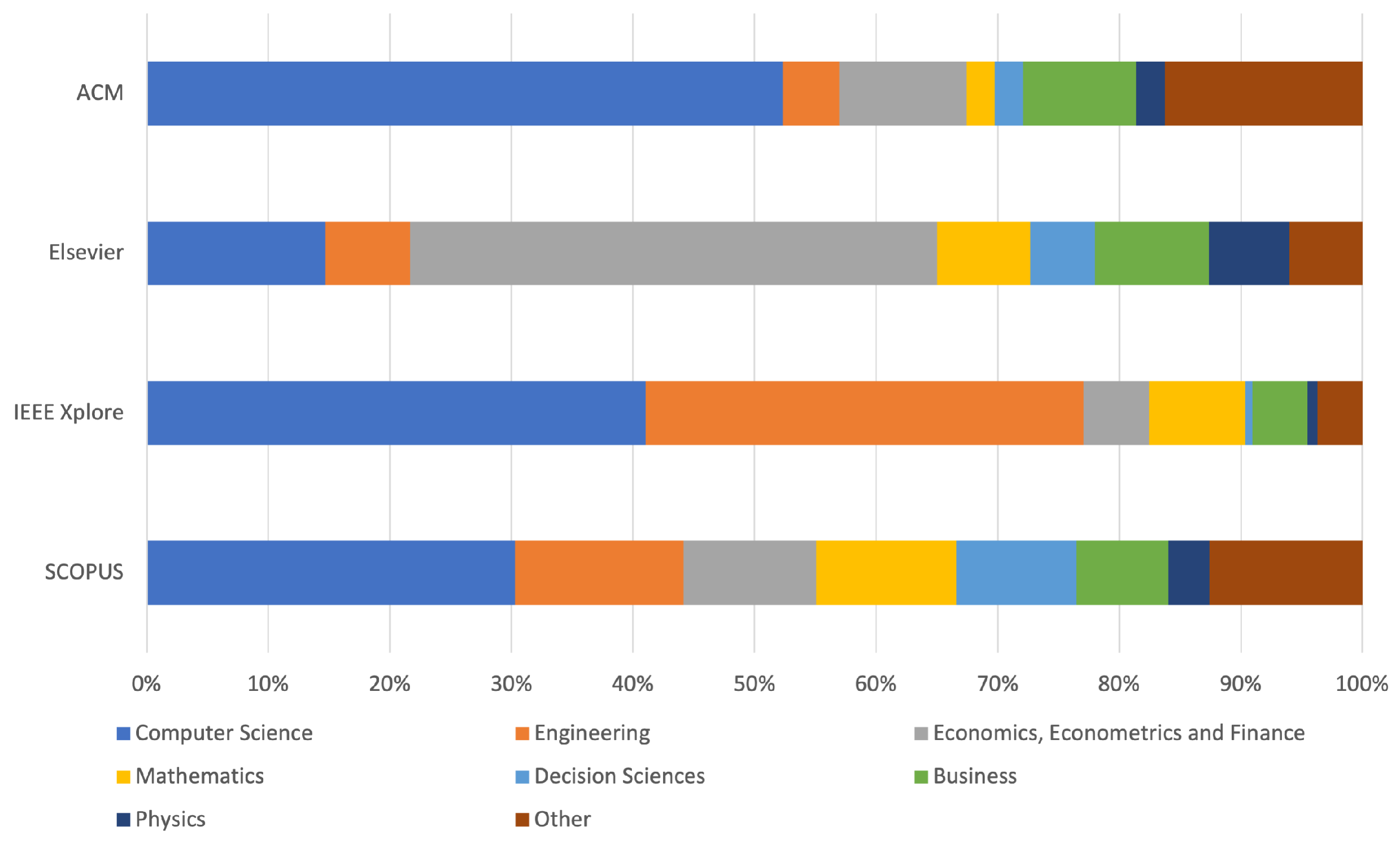

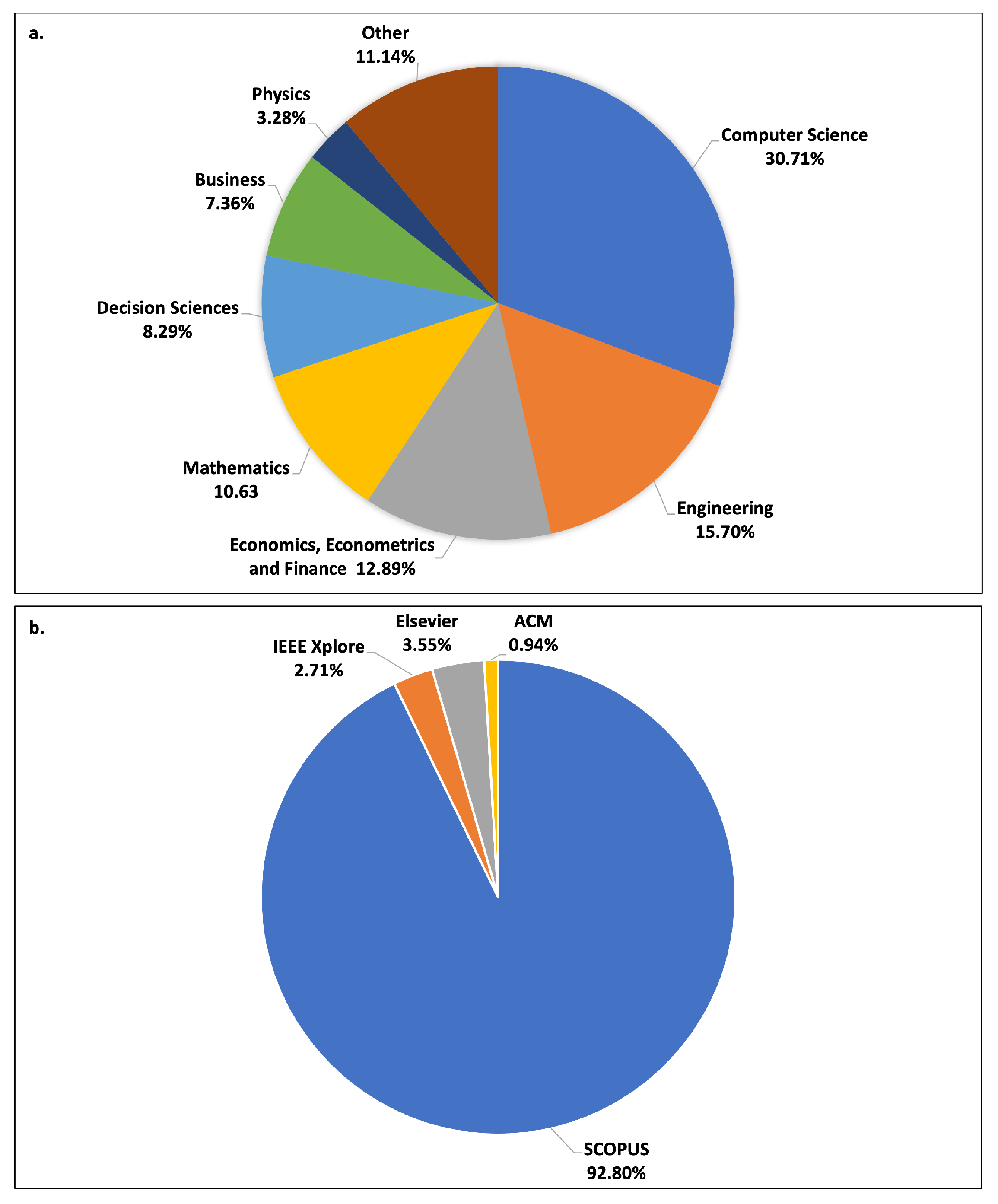

2. Methodology

2.1. Paper Selection

2.2. Duplicate Removal

2.3. Results Filtering

- Language and Scope: This review specifically targets studies that utilise algorithmic methodologies such as state-of-the-art computational techniques (including machine learning, deep learning, etc.), and other advanced statistical techniques capable of handling large dataset and extracting predictive insights from complex market dynamics. Studies not written in English, or primarily employing traditional economic or financial models without integration of these advanced state-of-the-art techniques were excluded.

- Relevance to Cryptocurrency Price Prediction: Studies were also excluded that did not directly aim to predict cryptocurrency prices through quantitative models. For instance, papers primarily using traditional or theoretical economic analysis or financial forecasting models, without empirical testing or incorporating advanced computational techniques, were not considered.

- Methodological Rigor: Studies lacking in rigorous mathematical analysis evident from either the absence of rigorous statistical analysis or failure to report essential performance metrics like accuracy, precision, recall, or mean squared error were excluded. Additionally, studies that do not provide proper validation methods for their predictive models or fail to describe their methodologies transparently were also excluded. It was crucial that included studies demonstrated substantial mathematical outcomes with sufficient validation or justifications of there methods used, that contribute directly to the field of cryptocurrency price prediction.

2.4. Initial Review

3. Influential Parameters for Cryptocurrency Price Prediction

3.1. Price and Volume

3.2. Technical Indicators

3.3. Blockchain Features

3.4. Social Media Sentiment

- Examples of data extraction include:

- Twitter: Tweets containing specific keywords or hashtags, tweets posted by certain influential users or institutions, and tweets posted by users with a specific minimum or maximum number of followers. Some previous works have also extracted data by using keywords and hashtags relating to specific equities or equity markets, for example, Kilimci [22] used “BitcoinDollar”, “BitcoinUSD”, “BTCDollar”, “BTCUSD” for the extraction of Bitcoin related tweets. Others have used posts that contain explicit statements of the user’s mood states, for example, Bollen et al. [27] used posts with the expressions “I feel”, “I am feeling”, “I don’t feel”, “I’m”. These data points can be leveraged to gauge market sentiment and predict potential price movements based on the emotional tone and public reactions to market events or news [21,22,23,24,26,27,28,29,35,36,42,50,61,103,106,107,109,110,111,112,113].

- Reddit: Analysis of comments and posts in both general and specific cryptocurrency-related subreddits. This involves tracking the frequency and sentiment of posts about specific cryptocurrencies or the overall cryptocurrency market as a whole, and examining the community engagement that follows specific and general market-related events. For instance, the subreddit r/Bitcoin frequently features discussions that reflect user sentiments ranging from bullish to bearish, which correlate with market movements [114]. During specific events like regulatory announcements or technological advancements (e.g., Bitcoin halving), the increase in posting frequency and shift in sentiment can be significant indicators of market. Additionally subreddits such as r/CryptoCurrency and r/Bitcoin are pivotal in gathering collective investor sentiment, such as threads discussing new ICOs or tokens may serve as early indicators of market interest or skepticism [114,115,116,117].

- Methodological Considerations for Social Media Sentiment Data:

3.5. Summary of Influential Parameters Used

4. Recent Methodologies Employed

4.1. Machine Learning Based Prediction

4.2. Deep Learning Based Prediction

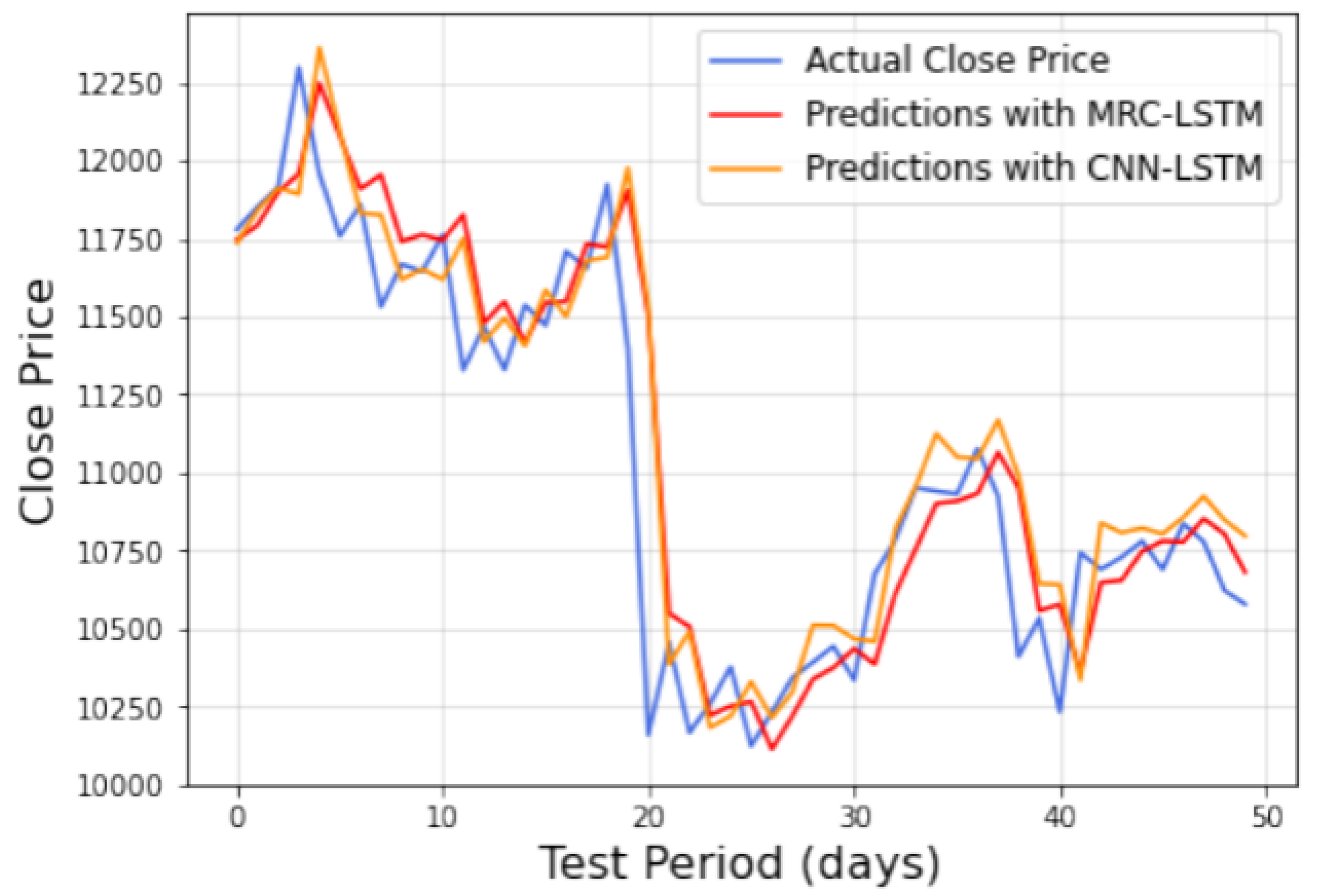

4.3. Hybrid Deep Learning Based Prediction

4.4. Open-Source Contributions in Cryptocurrency Price Prediction Research

4.5. Comparative Summary of Methodological Aspects

5. Discussion

5.1. Influential Parameters

5.2. Prediction Models

Evaluation of Model Accuracy and Reliability

5.3. Research Focus

5.4. Performance Indicators

6. Future Directions in Cryptocurrency Price Prediction

6.1. Enhancing Predictive Models with Advanced Technologies

6.1.1. Exploring Transformer Capabilities

6.1.2. Hybrid Model Innovations

6.2. Strengthening Feature Analysis

6.2.1. Deepening Technical Indicator and Blockchain Feature Analysis

6.2.2. Enhancing the Incorporation of Market Sentiment and Social Media Data

6.3. Enhancing Real-World Application and Profitability of Prediction Models

6.3.1. Integrating Practical Profitability Metrics and Usability

6.3.2. Regulatory Compliance and Ethical Considerations

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Evans, C.W. Bitcoin in Islamic banking and finance. J. Islam. Bank. Financ. 2015, 3, 1–11. [Google Scholar] [CrossRef]

- Bulíř, A. Income inequality: Does inflation matter? IMF Staff Pap. 2001, 48, 139–159. [Google Scholar] [CrossRef]

- Patel, M.M.; Tanwar, S.; Gupta, R.; Kumar, N. A deep learning-based cryptocurrency price prediction scheme for financial institutions. J. Inf. Secur. Appl. 2020, 55, 102583. [Google Scholar] [CrossRef]

- Tanwar, S.; Patel, N.P.; Patel, S.N.; Patel, J.R.; Sharma, G.; Davidson, I.E. Deep learning-based cryptocurrency price prediction scheme with inter-dependent relations. IEEE Access 2021, 9, 138633–138646. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system. Decent. Bus. Rev. 2008, 1, 1–9. [Google Scholar]

- Ahamad, S.; Nair, M.; Varghese, B. A survey on crypto currencies. In Proceedings of the 4th International Conference on Advances in Computer Science, Delhi, India, 13–14 December 2013; pp. 42–48. [Google Scholar]

- Xie, Z.; Dang, S.; Zhang, Z. On Convergence Probability of Direct Acyclic Graph-Based Ledgers in Forking Blockchain Systems. IEEE Syst. J. 2023, 17, 1121–1124. [Google Scholar] [CrossRef]

- Lin, C.; He, D.; Huang, X.; Xie, X.; Choo, K.K.R. PPChain: A Privacy-Preserving Permissioned Blockchain Architecture for Cryptocurrency and Other Regulated Applications. IEEE Syst. J. 2021, 15, 4367–4378. [Google Scholar] [CrossRef]

- Narayanan, A.; Bonneau, J.; Felten, E.; Miller, A.; Goldfeder, S. Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

- Bouri, E.; Gupta, R. Predicting Bitcoin returns: Comparing the roles of newspaper-and internet search-based measures of uncertainty. Financ. Res. Lett. 2021, 38, 101398. [Google Scholar] [CrossRef]

- Adamczyk, A. What’s Behind Dogecoin’s Price Surge—And Why Seemingly Unrelated Brands Are Capitalizing on Its Popularity. 2021. Available online: https://www.cnbc.com/2021/05/12/dogecoin-price-surge-elon-musk-slim-jim.html (accessed on 1 May 2024).

- Bouri, E.; Saeed, T.; Vo, X.V.; Roubaud, D. Quantile connectedness in the cryptocurrency market. J. Int. Financ. Mark. Inst. Money 2021, 71, 101302. [Google Scholar] [CrossRef]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where Is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef]

- Giudici, G.; Milne, A.; Vinogradov, D. Cryptocurrencies: Market analysis and perspectives. J. Ind. Bus. Econ. 2020, 47, 1–18. [Google Scholar] [CrossRef]

- Fang, F.; Ventre, C.; Basios, M.; Kanthan, L.; Martinez-Rego, D.; Wu, F.; Li, L. Cryptocurrency trading: A comprehensive survey. Financ. Innov. 2022, 8, 1–59. [Google Scholar]

- Kyriazis, N.A. A survey on efficiency and profitable trading opportunities in cryptocurrency markets. J. Risk Financ. Manag. 2019, 12, 67. [Google Scholar] [CrossRef]

- Price manipulation in the Bitcoin ecosystem. J. Monet. Econ. 2018, 95, 86–96. [CrossRef]

- Thakkar, A.; Chaudhari, K. Fusion in stock market prediction: A decade survey on the necessity, recent developments, and potential future directions. Inf. Fusion 2021, 65, 95–107. [Google Scholar] [CrossRef] [PubMed]

- Wątorek, M.; Drożdż, S.; Kwapień, J.; Minati, L.; Oświęcimka, P.; Stanuszek, M. Multiscale characteristics of the emerging global cryptocurrency market. Phys. Rep. 2021, 901, 1–82. [Google Scholar] [CrossRef]

- Patel, N.P.; Parekh, R.; Thakkar, N.; Gupta, R.; Tanwar, S.; Sharma, G.; Davidson, I.E.; Sharma, R. Fusion in Cryptocurrency Price Prediction: A Decade Survey on Recent Advancements, Architecture, and Potential Future Directions. IEEE Access 2022, 10, 34511–34538. [Google Scholar] [CrossRef]

- Colianni, S.; Rosales, S.; Signorotti, M. Algorithmic trading of cryptocurrency based on Twitter sentiment analysis. CS229 Proj. 2015, 1, 1–4. [Google Scholar]

- Kilimci, Z.H. Sentiment analysis based direction prediction in bitcoin using deep learning algorithms and word embedding models. Int. J. Intell. Syst. Appl. Eng. 2020, 8, 60–65. [Google Scholar] [CrossRef]

- Stenqvist, E.; Lönnö, J. Predicting Bitcoin Price Fluctuation with Twitter Sentiment Analysis. 2017, p. 31. Available online: https://www.diva-portal.org/smash/get/diva2:1110776/FULLTEXT01.pdf (accessed on 1 May 2024).

- Rahman, S.; Hemel, J.N.; Anta, S.J.A.; Al Muhee, H.; Uddin, J. Sentiment analysis using R: An approach to correlate cryptocurrency price fluctuations with change in user sentiment using machine learning. In Proceedings of the 2018 Joint 7th International Conference on Informatics, Electronics & Vision (ICIEV) and 2018 2nd International Conference on Imaging, Vision & Pattern Recognition (icIVPR), Kitakyushu, Japan, 25–29 June 2018; pp. 492–497. [Google Scholar]

- Shah, D.; Zhang, K. Bayesian regression and Bitcoin. In Proceedings of the 2014 52nd Annual Allerton Conference on Communication, Control, and Computing (Allerton), Monticello, IL, USA, 30 September–3 October 2014; pp. 409–414. [Google Scholar]

- Serafini, G.; Yi, P.; Zhang, Q.; Brambilla, M.; Wang, J.; Hu, Y.; Li, B. Sentiment-driven price prediction of the bitcoin based on statistical and deep learning approaches. In Proceedings of the 2020 International Joint Conference on Neural Networks (IJCNN), Glasgow, UK, 19–24 July 2020; pp. 1–8. [Google Scholar]

- Bollen, J.; Mao, H.; Zeng, X. Twitter mood predicts the stock market. J. Comput. Sci. 2011, 2, 1–8. [Google Scholar] [CrossRef]

- John, D.L.; Stantic, B. Forecasting Cryptocurrency Price Fluctuations with Granger Causality Analysis. In Proceedings of the Asian Conference on Intelligent Information and Database Systems, Ho Chi Minh City, Vietnam, 28–30 November 2022; Springer: Singapore, 2022; pp. 201–213. [Google Scholar]

- John, D.L.; Stantic, B. Machine Learning or Lexicon Based Sentiment Analysis Techniques on Social Media Posts. In Proceedings of the Asian Conference on Intelligent Information and Database Systems, Ho Chi Minh City, Vietnam, 28–30 November 2022; Springer: Singapore, 2022; pp. 3–12. [Google Scholar]

- Pirgaip, B.; Dinçergök, B.; Haşlak, Ş. Bitcoin market price analysis and an empirical comparison with main currencies, commodities, securities and altcoins. In Blockchain Economics and Financial Market Innovation; Springer: Cham, Switzerland, 2019; pp. 141–166. [Google Scholar]

- Politis, A.; Doka, K.; Koziris, N. Ether price prediction using advanced deep learning models. In Proceedings of the 2021 IEEE International Conference on Blockchain and Cryptocurrency (ICBC), Sydney, Australia, 3–6 May 2021; pp. 1–3. [Google Scholar]

- Jang, H.; Lee, J. An Empirical Study on Modeling and Prediction of Bitcoin Prices With Bayesian Neural Networks Based on Blockchain Information. IEEE Access 2018, 6, 5427–5437. [Google Scholar] [CrossRef]

- Aggarwal, A.; Gupta, I.; Garg, N.; Goel, A. Deep learning approach to determine the impact of socio economic factors on bitcoin price prediction. In Proceedings of the 2019 12th International Conference on Contemporary Computing (IC3), Noida, India, 8–10 August 2019; pp. 1–5. [Google Scholar]

- Zhang, C.; Li, Y.; Chen, X.; Jin, Y.; Tang, P.; Li, J. DoubleEnsemble: A new ensemble method based on sample reweighting and feature selection for financial data analysis. In Proceedings of the 2020 IEEE International Conference on Data Mining (ICDM), Sorrento, Italy, 17–20 November 2020; pp. 781–790. [Google Scholar]

- Ghahramani, M.; Najafabadi, H.E. Compatible deep neural network framework with financial time series data, including data preprocessor, neural network model and trading strategy. arXiv 2022, arXiv:2205.08382. [Google Scholar]

- Fleischer, J.; Von Laszewski, G.; Theran, C.; Bautista, Y.J.P. Time series analysis of blockchain-based cryptocurrency price changes. arXiv 2022, arXiv:2202.13874. [Google Scholar]

- Kilimci, H.; Yıldırım, M.; Kilimci, Z.H. The Prediction of Short-Term Bitcoin Dollar Rate (BTC/USDT) using Deep and Hybrid Deep Learning Techniques. In Proceedings of the 2021 5th International Symposium on Multidisciplinary Studies and Innovative Technologies (ISMSIT), Ankara, Turkey, 21–23 October 2021; pp. 633–637. [Google Scholar] [CrossRef]

- Guo, Q.; Lei, S.; Ye, Q.; Fang, Z. MRC-LSTM: A Hybrid Approach of Multi-scale Residual CNN and LSTM to Predict Bitcoin Price. arXiv 2021, arXiv:2105.00707. [Google Scholar]

- Ji, S.; Kim, J.; Im, H. A comparative study of bitcoin price prediction using deep learning. Mathematics 2019, 7, 898. [Google Scholar] [CrossRef]

- Madan, I.; Saluja, S.; Zhao, A. Automated Bitcoin Trading via Machine Learning Algorithms. 2015. Available online: https://www.smallake.kr/wp-content/uploads/2017/10/Isaac-Madan-Shaurya-Saluja-Aojia-ZhaoAutomated-Bitcoin-Trading-via-Machine-Learning-Algorithms.pdf (accessed on 1 May 2024).

- Tan, X.; Kashef, R. Predicting the closing price of cryptocurrencies: A comparative study. In Proceedings of the Second International Conference on Data Science, E-Learning and Information Systems, Dubai, United Arab Emirates, 2–5 December 2019; pp. 1–5. [Google Scholar]

- Lamon, C.; Nielsen, E.; Redondo, E. Cryptocurrency price prediction using news and social media sentiment. SMU Data Sci. Rev 2017, 1, 1–22. [Google Scholar]

- Chen, M.; Narwal, N.; Schultz, M. Predicting price changes in Ethereum. Int. J. Comput. Sci. Eng. (IJCSE) 2019. Available online: https://cs229.stanford.edu/proj2017/final-reports/5244039.pdf (accessed on 1 May 2024).

- Velankar, S.; Valecha, S.; Maji, S. Bitcoin price prediction using machine learning. In Proceedings of the 2018 20th International Conference on Advanced Communication Technology (ICACT), Chuncheon, Republic of Korea, 11–14 February 2018; pp. 144–147. [Google Scholar]

- Wu, C.H.; Lu, C.C.; Ma, Y.F.; Lu, R.S. A new forecasting framework for bitcoin price with LSTM. In Proceedings of the 2018 IEEE International Conference on Data Mining Workshops (ICDMW), Singapore, 17–20 November 2018; pp. 168–175. [Google Scholar]

- Tandon, S.; Tripathi, S.; Saraswat, P.; Dabas, C. Bitcoin price forecasting using LSTM and 10-fold cross validation. In Proceedings of the 2019 International Conference on Signal Processing and Communication (ICSC), Noida, India, 7–9 March 2019; pp. 323–328. [Google Scholar]

- Kim, J.; Kim, S.; Wimmer, H.; Liu, H. A cryptocurrency prediction model using LSTM and GRU algorithms. In Proceedings of the 2021 IEEE/ACIS 6th International Conference on Big Data, Cloud Computing, and Data Science (BCD), Zhuhai, China, 13–15 September 2021; pp. 37–44. [Google Scholar]

- Nakano, M.; Takahashi, A.; Takahashi, S. Bitcoin technical trading with artificial neural network. Phys. A Stat. Mech. Its Appl. 2018, 510, 587–609. [Google Scholar] [CrossRef]

- Alonso-Monsalve, S.; Suárez-Cetrulo, A.L.; Cervantes, A.; Quintana, D. Convolution on neural networks for high-frequency trend prediction of cryptocurrency exchange rates using technical indicators. Expert Syst. Appl. 2020, 149, 113250. [Google Scholar] [CrossRef]

- Eom, C.; Kaizoji, T.; Kang, S.H.; Pichl, L. Bitcoin and investor sentiment: Statistical characteristics and predictability. Phys. A Stat. Mech. Its Appl. 2019, 514, 511–521. [Google Scholar] [CrossRef]

- Doumenis, Y.; Izadi, J.; Dhamdhere, P.; Katsikas, E.; Koufopoulos, D. A critical analysis of volatility surprise in bitcoin cryptocurrency and other financial assets. Risks 2021, 9, 207. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, L.; Zhou, Q.; Jin, X. A Novel Bitcoin and Gold Prices Prediction Method Using an LSTM-P Neural Network Model. Comput. Intell. Neurosci. 2022, 2022, 1643413. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Dai, W. Bitcoin price forecasting method based on cnn-lstm hybrid neural network model. J. Eng. 2020, 2020, 344–347. [Google Scholar] [CrossRef]

- Peng, Y.; Albuquerque, P.H.M.; de Sá, J.M.C.; Padula, A.J.A.; Montenegro, M.R. The best of two worlds: Forecasting high frequency volatility for cryptocurrencies and traditional currencies with Support Vector Regression. Expert Syst. Appl. 2018, 97, 177–192. [Google Scholar] [CrossRef]

- Yiying, W.; Yeze, Z. Cryptocurrency price analysis with artificial intelligence. In Proceedings of the 2019 5th International Conference on Information Management (ICIM), Cambridge, UK, 24–27 March 2019; pp. 97–101. [Google Scholar]

- McNally, S.; Roche, J.; Caton, S. Predicting the Price of Bitcoin Using Machine Learning. In Proceedings of the 2018 26th Euromicro International Conference on Parallel, Distributed and Network-based Processing (PDP), Cambridge, UK, 21–23 March 2018; pp. 339–343. [Google Scholar] [CrossRef]

- Jay, P.; Kalariya, V.; Parmar, P.; Tanwar, S.; Kumar, N.; Alazab, M. Stochastic Neural Networks for Cryptocurrency Price Prediction. IEEE Access 2020, 8, 82804–82818. [Google Scholar] [CrossRef]

- Phaladisailoed, T.; Numnonda, T. Machine Learning Models Comparison for Bitcoin Price Prediction. In Proceedings of the 2018 10th International Conference on Information Technology and Electrical Engineering (ICITEE), Bali, Indonesia, 24–26 July 2018; pp. 506–511. [Google Scholar] [CrossRef]

- Saad, M.; Choi, J.; Nyang, D.; Kim, J.; Mohaisen, A. Toward Characterizing Blockchain-Based Cryptocurrencies for Highly Accurate Predictions. IEEE Syst. J. 2020, 14, 321–332. [Google Scholar] [CrossRef]

- Akbiyik, M.E.; Erkul, M.; Kämpf, K.; Vasiliauskaite, V.; Antulov-Fantulin, N. Ask “Who”, Not “What”: Bitcoin Volatility Forecasting with Twitter Data. In Proceedings of the Sixteenth ACM International Conference on Web Search and Data Mining (WSDM’23), Singapore, 27 February–3 March 2023; p. 9. [Google Scholar] [CrossRef]

- Herremans, D.; Low, K.W. Forecasting Bitcoin Volatility Spikes from Whale Transactions and Cryptoquant Data Using Synthesizer Transformer Models. arXiv 2022, arXiv:2211.08281. [Google Scholar]

- Shou, M.H.; Wang, Z.X.; Li, D.D.; Zhou, Y.T. Forecasting the price trends of digital currency: A hybrid model integrating the stochastic index and grey Markov chain methods. Grey Syst. 2021, 11, 22–45. [Google Scholar] [CrossRef]

- Ren, X.; Jiang, Z.; Su, J. The Use of Features to Enhance the Capability of Deep Reinforcement Learning for Investment Portfolio Management. In Proceedings of the 2021 IEEE 6th International Conference on Big Data Analytics (ICBDA 2021), Xiamen, China, 5–8 March 2021; pp. 44–50. [Google Scholar] [CrossRef]

- Huang, H.; Ye, T. Asset Trading Strategies Based on LSTM—Bitcoin and Gold as an Example. In Proceedings of the CAIBDA 2022—2nd International Conference on Artificial Intelligence, Big Data and Algorithms, Nanjing, China, 17–19 June 2022; pp. 650–655. [Google Scholar]

- Zhang, Z.; Dai, H.N.; Zhou, J.; Mondal, S.K.; García, M.M.; Wang, H. Forecasting cryptocurrency price using convolutional neural networks with weighted and attentive memory channels. Expert Syst. Appl. 2021, 183, 115378. [Google Scholar] [CrossRef]

- Liu, F.; Li, Y.; Li, B.; Li, J.; Xie, H. Bitcoin transaction strategy construction based on deep reinforcement learning. Appl. Soft Comput. 2021, 113. [Google Scholar] [CrossRef]

- García-Medina, A.; Huynh, T.L.D. What drives bitcoin? An approach from continuous local transfer entropy and deep learning classification models. Entropy 2021, 23, 1582. [Google Scholar] [CrossRef]

- Bangroo, R.; Gupta, U.; Sah, R.; Kumar, A. Cryptocurrency Price Prediction using Machine Learning Algorithm. In Proceedings of the 2022 10th International Conference on Reliability, Infocom Technologies and Optimization (Trends and Future Directions) (ICRITO 2022), Noida, India, 13–14 October 2022. [Google Scholar] [CrossRef]

- Han, N.; Zhang, S.; Wang, H.; Chen, Z.; Hou, X.; Sun, Z. Quantitative investment decision model based on ARIMA and iterative neural network. In Proceedings of the 2022 IEEE Conference on Telecommunications, Optics and Computer Science (TOCS 2022), Dalian, China, 11–12 December 2022; pp. 1076–1081. [Google Scholar] [CrossRef]

- Guo, Y.; Zhao, R.; Ma, X.; Zhu, C.; Xie, X. A Reasonable Investment Method based on Multiple Factors Time Series. In Proceedings of the 2022 International Conference on Machine Learning, Cloud Computing and Intelligent Mining (MLCCIM 2022), Xiamen, China, 5–7 August 2022; pp. 179–187. [Google Scholar] [CrossRef]

- Zhou, W.; Guo, Y.; Li, S. Study on the Risk-Return Mathematical Model Based on LSTM Time-Series Model and Monte Carlo Simulations. In Proceedings of the 2022 International Conference on Data Analytics, Computing and Artificial Intelligence (ICDACAI 2022), Zakopane, Poland, 15–16 August 2022; pp. 354–367. [Google Scholar] [CrossRef]

- Wenhao, Q. Smart Portfolio Trading Strategy Based on Random Forest Model with Limited Information. In Proceedings of the 2022 IEEE 2nd International Conference on Data Science and Computer Application (ICDSCA 2022), Dalian, China, 28–30 October 2022; pp. 1437–1441. [Google Scholar] [CrossRef]

- De Rosa, P.; Schiavoni, V. Understanding Cryptocoins Trends Correlations. In Proceedings of the IFIP International Conference on Distributed Applications and Interoperable Systems, Lucca, Italy, 13–17 June 2022; Lecture Notes in Computer Science. Springer: Cham, Switzerland, 2022; Volume 13272, pp. 29–36. [Google Scholar] [CrossRef]

- Birim, ¸S.Ö.; Sönmez, F.E.; Liman, Y.S. Estimating Return Rate of Blockchain Financial Product by ANFIS-PSO Method. In Proceedings of the International Conference on Intelligent and Fuzzy Systems, Izmir, Turkey, 19–21 July 2022; Lecture Notes in Networks and Systems. Springer: Cham, Switzerland, 2022; Volume 504, pp. 802–809. [Google Scholar] [CrossRef]

- Ye, X.; Li, Y.; Feng, X.; Heng, C. A Crypto Market Forecasting Method Based on Catboost Model and Bigdata. In Proceedings of the 2022 7th International Conference on Intelligent Computing and Signal Processing (ICSP 2022), Xi’an, China, 15–17 April 2022; pp. 686–689. [Google Scholar] [CrossRef]

- Montenegro, C.; Armas, R. Can the Price of BTC Bitcoin Be Forecast Successfully with NARX Neural Networks? In Proceedings of the World Conference on Information Systems and Technologies, Budva, Montenegro, 12–14 April 2022; Lecture Notes in Networks and Systems. Springer: Cham, Switzerland, 2022; Volume 468, pp. 521–530. [Google Scholar] [CrossRef]

- Parvini, N.; Abdollahi, M.; Seifollahi, S.; Ahmadian, D. Forecasting Bitcoin returns with long short-term memory networks and wavelet decomposition: A comparison of several market determinants. Appl. Soft Comput. 2022, 121, 108707. [Google Scholar] [CrossRef]

- Shahbazi, Z.; Byun, Y.C. Knowledge Discovery on Cryptocurrency Exchange Rate Prediction Using Machine Learning Pipelines. Sensors 2022, 22, 1740. [Google Scholar] [CrossRef]

- Serrano, W. The random neural network in price predictions. Neural Comput. Appl. 2022, 34, 855–873. [Google Scholar] [CrossRef]

- Xie, C.; Wu, X.; Bai, X. Optimal Strategy: A Comprehensive Model for Predicting Price Trend and Algorithm Optimization. In Proceedings of the ICCSIE2022: 7th International Conference on Cyber Security and Information Engineering, Brisbane, QLD, Australia, 23–25 September 2022; pp. 457–460. [Google Scholar] [CrossRef]

- Saleh, G.; Arabiat, L.; Al-Badarneh, A. Testing Lasso Regression and XGBOOST on Crypto-Currency Volatility and Price Prediction. In Proceedings of the 2023 14th International Conference on Information and Communication Systems (ICICS 2023), Irbid, Jordan, 21–23 November 2023. [Google Scholar] [CrossRef]

- Shamshad, H.; Ullah, F.; Ullah, A.; Kebande, V.R.; Ullah, S.; Al-Dhaqm, A. Forecasting and Trading of the Stable Cryptocurrencies With Machine Learning and Deep Learning Algorithms for Market Conditions. IEEE Access 2023, 11, 122205–122220. [Google Scholar] [CrossRef]

- Ali, F.; Suryakant, R.; Nimbore, S. Ensemble Model Based on Deep Learning for Forecasting Crypto Asset Futures in Markets. In Proceedings of the 2023 3rd International Conference on Smart Generation Computing, Communication and Networking (SMART GENCON 2023), Bangalore, India, 29–31 December 2023. [Google Scholar] [CrossRef]

- Narang, H.K.; Shrirame, V.K.; Kurrey, B. Price Prediction of Ethereum Using Blockchain Historical and Exchange Data by Supervised Machine Learning Algorithms. In Proceedings of the 2023 4th International Conference on Industrial Engineering and Artificial Intelligence (IEAI 2023), Chiang Mai, Thailand, 27–29 April 2023; pp. 8–15. [Google Scholar] [CrossRef]

- Kumar, M.R.; Umar, S.; Venkatram, V. Short Term Memory Recurrent Neural Network-based Machine Learning Model for Predicting Bit-coin Market Prices. In Proceedings of the 14th International Conference on Advances in Computing, Control, and Telecommunication Technologies (ACT 2023), Hyderabad, India, 15–16 June 2023; pp. 1683–1689. [Google Scholar]

- Hawi, L.A.; Sharqawi, S.; Al-Haija, Q.A.; Qusef, A. Empirical Evaluation of Machine Learning Performance in Forecasting Cryptocurrencies. J. Adv. Inf. Technol. 2023, 14, 639–647. [Google Scholar] [CrossRef]

- Kanzari, D. Context-adaptive intelligent agents behaviors: Multivariate LSTM-based decision making on the cryptocurrency market. Int. J. Data Sci. Anal. 2023. [Google Scholar] [CrossRef]

- Xie, S.; Zhao, Z.; Li, L.; Wu, H. Gold and Bitcoin Trading Strategies: A Comprehensive Model for Optimal Investment Returns. In Proceedings of the International Conference on Images, Signals, and Computing (ICISC 2023), Chengdu, China, 27–29 May 2023; Volume 12783. [Google Scholar] [CrossRef]

- Milicevic, M.; Jovanovic, L.; Bacanin, N.; Zivkovic, M.; Jovanovic, D.; Antonijevic, M.; Savanovic, N.; Strumberger, I. Optimizing Long Short-Term Memory by Improved Teacher Learning-Based Optimization for Ethereum Price Forecasting. In Mobile Computing and Sustainable Informatics; Lecture Notes on Data Engineering and Communications Technologies; Springer: Singapore, 2023; Volume 166, pp. 125–139. [Google Scholar] [CrossRef]

- Srivastava, V.; Kumar Dwivedi, V.; Kumar Singh, A. Prediction of Bitcoin Price using Optimized Genetic ARIMA Model and Analysis in Post and Pre Covid Eras*. In Proceedings of the 2023 3rd International Conference on Smart Data Intelligence, (ICSMDI 2023), Trichy, India, 30–31 March 2023; pp. 143–148. [Google Scholar] [CrossRef]

- Aghashahi, M.; Bamdad, S. Analysis of different artificial neural networks for Bitcoin price prediction. Int. J. Manag. Sci. Eng. Manag. 2023, 18, 126–133. [Google Scholar] [CrossRef]

- Kalyani, K.; Parvathy, V.S.; Abdeljaber, H.A.; Satyanarayana Murthy, T.; Acharya, S.; Joshi, G.P.; Kim, S.W. Effective Return Rate Prediction of Blockchain Financial Products Using Machine Learning. Comput. Mater. Contin. 2023, 74, 2303–2316. [Google Scholar] [CrossRef]

- Mahfooz, A.; Phillips, J.L. Conditional Forecasting of Bitcoin Prices Using Exogenous Variables. IEEE Access 2024, 12, 44510–44526. [Google Scholar] [CrossRef]

- Ramesh, R.; Karthic, M.J. Optimizing Cryptocurrency Price Prediction: A Hybrid Approach with Resilient Stochastic Clustering and Gravitational Search Algorithm. Int. J. Intell. Syst. Appl. Eng. 2024, 12, 239–248. [Google Scholar]

- Giudici, P.; Raffinetti, E.; Riani, M. Robust machine learning models: Linear and nonlinear. Int. J. Data Sci. Anal. 2024. [Google Scholar] [CrossRef]

- Amiri, A.; Tavana, M.; Arman, H. An Integrated Fuzzy Analytic Network Process and Fuzzy Regression Method for Bitcoin Price Prediction. Internet Things 2024, 25, 101027. [Google Scholar] [CrossRef]

- Ladhari, A.; Boubaker, H. Deep Learning Models for Bitcoin Prediction Using Hybrid Approaches with Gradient-Specific Optimization. Forecasting 2024, 6, 279–295. [Google Scholar] [CrossRef]

- Peng, P.; Chen, Y.; Lin, W.; Wang, J.Z. Attention-based CNN–LSTM for high-frequency multiple cryptocurrency trend prediction. Expert Syst. Appl. 2024, 237, 121520. [Google Scholar] [CrossRef]

- Belcastro, L.; Carbone, D.; Cosentino, C.; Marozzo, F.; Trunfio, P. Enhancing Cryptocurrency Price Forecasting by Integrating Machine Learning with Social Media and Market Data. Algorithms 2023, 16, 542. [Google Scholar] [CrossRef]

- Jin, C.; Li, Y. Cryptocurrency Price Prediction Using Frequency Decomposition and Deep Learning. Fractal Fract. 2023, 7, 708. [Google Scholar] [CrossRef]

- Chen, J. Analysis of Bitcoin Price Prediction Using Machine Learning. J. Risk Financ. Manag. 2023, 16, 51. [Google Scholar] [CrossRef]

- Kelotra, A.; Pandey, P. Stock market prediction using optimized deep-convlstm model. Big Data 2020, 8, 5–24. [Google Scholar] [CrossRef]

- Buzcu, B.; Ozgun, M.; Yılmaz, D. Cryptocurrency Price Prediction Using News and Social Network Data. 2021. Available online: https://yilmazdoga.net/assets/cryptocurrency_price_prediction_using_news_and_social_network_data.pdf (accessed on 1 May 2024).

- Liu, L. Are Bitcon returns predictable?: Evidence from technical indicators. Phys. A Stat. Mech. Its Appl. 2019, 533, 121950. [Google Scholar] [CrossRef]

- Uras, N.; Ortu, M. Investigation of Blockchain Cryptocurrencies’ Price Movements through Deep Learning: A Comparative Analysis. In Proceedings of the 2021 IEEE International Conference on Software Analysis, Evolution and Reengineering (SANER 2021), Honolulu, HI, USA, 9–12 March 2021; pp. 715–722. [Google Scholar] [CrossRef]

- Cavalli, S.; Amoretti, M. CNN-based multivariate data analysis for bitcoin trend prediction. Appl. Soft Comput. 2021, 101, 107065. [Google Scholar] [CrossRef]

- Pellon Consunji, M. EvoTrader: Automated bitcoin trading using neuroevolutionary algorithms on technical analysis and social sentiment data. In Proceedings of the ACAI’21: Proceedings of the 2021 4th International Conference on Algorithms, Computing and Artificial Intelligence, Sanya, China, 22–24 December 2021. [Google Scholar] [CrossRef]

- El Badaoui, M.; Raouyane, B.; El Moumen, S.; Bellafkih, M. Impact Machine Learning Classification and Technical Indicators Forecast The Direction Of Bitcoin. In Proceedings of the SITA 2023: 2023 14th International Conference on Intelligent Systems: Theories and Applications, Casablanca, Morocco, 22–23 November 2023. [Google Scholar] [CrossRef]

- Abraham, J.; Higdon, D.; Nelson, J.; Ibarra, J. Cryptocurrency price prediction using tweet volumes and sentiment analysis. SMU Data Sci. Rev. 2018, 1, 1. [Google Scholar]

- Hasan, S.H.; Hasan, S.H.; Ahmed, M.S.; Hasan, S.H. A novel cryptocurrency prediction method using optimum cnn. Comput. Mater. Contin. 2022, 71, 1051–1063. [Google Scholar] [CrossRef]

- Sabeena, J.; Sagar, P. Enhancing Predictive Accuracy for Real Time Cryptocurrency Market Prices with Machine Learning Techniques. In Proceedings of the International Conference on Sustainable Communication Networks and Application (ICSCNA 2023), Theni, India, 15–17 November 2023; pp. 1288–1292. [Google Scholar] [CrossRef]

- Bute, H.; Singh, A.; Nandurbarkar, S.; Wagle, S.A.; Pareek, P. Bitcoin Price Prediction using Twitter Sentiment Analysis. Int. J. Intell. Syst. Appl. Eng. 2024, 12, 469–477. [Google Scholar]

- Gupta, A.; Pandey, G.; Gupta, R.; Das, S.; Prakash, A.; Garg, K.; Sarkar, S. Machine Learning-Based Approach for Predicting the Altcoins Price Direction Change from a High-Frequency Data of Seven Years Based on Socio-Economic Factors, Bitcoin Prices, Twitter and News Sentiments. Comput. Econ. 2024. [Google Scholar] [CrossRef]

- Phillips, R.C.; Gorse, D. Predicting cryptocurrency price bubbles using social media data and epidemic modelling. In Proceedings of the 2017 IEEE Symposium Series on Computational Intelligence (SSCI), Theni, India, 15–17 November 2017; pp. 394–400. [Google Scholar] [CrossRef]

- Kim, Y.B.; Kim, J.G.; Kim, W.; Im, J.H.; Kim, T.H.; Kang, S.J.; Kim, C.H. Predicting Fluctuations in Cryptocurrency Transactions Based on User Comments and Replies. PLoS ONE 2016, 11, e0161197. [Google Scholar] [CrossRef]

- Sagi, O.; Rokach, L. Ensemble learning of online discussion data for cryptocurrency trend prediction. Data Min. Knowl. Discov. 2018, 32, 1542–1575. [Google Scholar]

- Ante, L. The social influence of blockchain communities from Reddit data. J. Inf. Technol. Politics 2021, 18, 373–387. [Google Scholar]

- Dimitriadou, A.; Gregoriou, A. Predicting Bitcoin Prices Using Machine Learning. Entropy 2023, 25, 777. [Google Scholar] [CrossRef]

- Albariqi, R.; Winarko, E. Prediction of bitcoin price change using neural networks. In Proceedings of the 2020 international conference on smart technology and applications (ICoSTA), Surabaya, Indonesia, 20 February 2020; pp. 1–4. [Google Scholar]

- Mariappan, L.; Pandian, J.; Kumar, V.; Geman, O.; Chiuchisan, I.; Năstase, C. A Forecasting Approach to Cryptocurrency Price Index Using Reinforcement Learning. Appl. Sci. 2023, 13, 2692. [Google Scholar] [CrossRef]

- Khedr, A.M.; Arif, I.; El-Bannany, M.; Alhashmi, S.M.; Sreedharan, M. Cryptocurrency price prediction using traditional statistical and machine-learning techniques: A survey. Intell. Syst. Account. Financ. Manag. 2021, 28, 3–34. [Google Scholar] [CrossRef]

- Chu, J.; Nadarajah, S.; Chan, S. Statistical analysis of the exchange rate of bitcoin. PLoS ONE 2015, 10, e0133678. [Google Scholar] [CrossRef] [PubMed]

- Mizuno, H.; Kosaka, M.; Yajima, H.; Komoda, N. Application of neural network to technical analysis of stock market prediction. Stud. Inform. Control 1998, 7, 111–120. [Google Scholar]

- Lo, A.W.; Mamaysky, H.; Wang, J. Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. J. Financ. 2000, 55, 1705–1765. [Google Scholar] [CrossRef]

- Chen, J.; Hui, P.M.; Gerlach, R.; Algesheimer, R.; Garcia, D. The sentiment expressed on social media predicts the Bitcoin exchange rate. PLoS ONE 2018, 13, e0205823. [Google Scholar] [CrossRef]

- Lachanski, M.; Pav, S. Do Tweets precede trades? The relationships between Twitter sentiment, stock returns, and volatility. Mark. Lett. 2017, 28, 69–84. [Google Scholar]

- Feng, W.; Wang, Y.; Zhang, Z. Informed trading in the Bitcoin market. Financ. Res. Lett. 2018, 26, 63–70. [Google Scholar] [CrossRef]

- Lachanski, M.S.; Pav, S. Shy of the Character Limit: “Twitter Mood Predicts the Stock Market” Revisited. Econ J. Watch 2017, 14, 302–345. [Google Scholar]

- TechCrunch. Twitter to End Free Access to Its API in Elon Musk’s Latest Monetization Push. 2023. Available online: https://techcrunch.com/2023/02/01/twitter-to-end-free-access-to-its-api/ (accessed on 1 May 2024).

- Tech Policy Press. Comparing Platform Research API Requirements. 2023. Available online: https://www.techpolicy.press/comparing-platform-research-api-requirements/ (accessed on 1 May 2024).

- Roach, J. Why Everyone Is Freaking out about the Reddit API Right Now. Digital Trends. 2023. Available online: https://www.digitaltrends.com/computing/reddit-api-changes-explained/ (accessed on 1 May 2024).

- Help, R. Reddit Data API Wiki. 2024. Available online: https://support.reddithelp.com/hc/en-us/articles/16160319875092-Reddit-Data-API-Wiki (accessed on 1 May 2024).

- Reddit. Creating a Healthy Ecosystem for Reddit Data and Reddit Data API Access. 2023. Available online: https://www.redditinc.com/blog/2023apiupdates (accessed on 1 May 2024).

- Vaswani, A.; Shazeer, N.; Parmar, N.; Uszkoreit, J.; Jones, L.; Gomez, A.N.; Kaiser, Ł.; Polosukhin, I. Attention is all you need. In Proceedings of the NIPS 2017: 31st Annual Conference on Neural Information Processing Systems, Long Beach, CA, USA, 4–9 December 2017. [Google Scholar]

- Hutto, C.; Gilbert, E. VADER: A parsimonious rule-based model for sentiment analysis of social media text. In Proceedings of the International AAAI Conference on Web and Social Media, Ann Arbor, MI, USA, 1–4 June 2014; Volume 8. [Google Scholar]

- Sheth, K.; Patel, K.; Shah, H.; Tanwar, S.; Gupta, R.; Kumar, N. A taxonomy of AI techniques for 6G communication networks. Comput. Commun. 2020, 161, 279–303. [Google Scholar] [CrossRef]

- Singh, S.; Bhat, M. Transformer-based approach for Ethereum Price Prediction Using Crosscurrency correlation and Sentiment Analysis. arXiv 2024, arXiv:2401.08077. [Google Scholar]

- Penmetsa, S.; Vemula, M. Cryptocurrency Price Prediction with LSTM and Transformer Models Leveraging Momentum and Volatility Technical Indicators. In Proceedings of the 2023 IEEE 3rd International Conference on Data Science and Computer Application (ICDSCA), Dalian, China, 27–29 October 2023; pp. 411–416. [Google Scholar] [CrossRef]

- Sridhar, S.; Sanagavarapu, S. Multi-Head Self-Attention Transformer for Dogecoin Price Prediction. In Proceedings of the 2021 14th International Conference on Human System Interaction (HSI), Gdańsk, Poland, 8–10 July 2021; pp. 1–6. [Google Scholar] [CrossRef]

| Ref. | Year | Data Source | Methodology | Data Collection Period | Performance Indicators | Task Type |

|---|---|---|---|---|---|---|

| [25] | 2014 | Social Media Posts | Bayesian Regression | Every 2 s—over 200 million data points | Double the investment in less than 60 day period | Regression |

| [21] | 2015 | Social Media Posts | Naive Bayes, logistic regression, and SVM | 21 Days | Accuracy = 95% | Classification |

| [40] | 2015 | Price and 16 Blockchain Features | Random forests, SVM, GLM | 5 Days | Sign Prediction Accuracy = 98.5% | Classification |

| [23] | 2017 | Social Media Posts | Sentiment Analysis—VADER | 31 Days | Accuracy = 83% | Classification |

| [24] | 2018 | 500 tweets extracted every day | 5 regression algorithms and 11 classification algorithms | 3 Months | Regression accuracy = 70%, Naive Bayes accuracy = 89.65% Random Forest Classification accuracy = 85.78% | Classification & Regression |

| [39] | 2019 | 29 Blockchain features | DNN, LSTM, CNN, DNR | 2590 Days | Profitability Analysis | Classification |

| [41] | 2019 | Price and Volume | LSTM, ARIMA, Bayesian regression, SVM | 1839 days | LSTM RMSE = 33.7091 | Classification |

| [22] | 2020 | 17629 tweets | Sentiment analysis, various Deep learning algorithms, Word embeddings | 92 Days | Word Embedding accuracy = 89.13% | Classification |

| [102] | 2020 | 12 technical indicators and price | Deep-ConvLSTM | 729 days | MSE = 7.2487, RMSE = 2.6923 | Classification |

| [26] | 2020 | Price and Volume, Social Media Sentiment | VADER, ARIMAX, LSTM | 944 days | LSTM MSE = 0.000304 | Classification |

| [3] | 2020 | Price and Volume | LSTM-GRU | 1851 Days | 1, 3, 7 day MAPE of 4.0727, 6.2754, 19.3493 | Classification |

| [37] | 2021 | Price and Volume, 7 Technical indicators | Deep and hybrid Deep Learning | 74 days | MAPE= 2.4076 | Classification |

| [4] | 2021 | Price | LSTM-GRU | 1736 days | Litecoin MSE = 0.02038, Zcash MSE = 0.00461 | Classification |

| Influential Parameter | Benefits | Challenges |

|---|---|---|

| Price and Volume |

|

|

| Technical Indicators |

|

|

| Blockchain Features |

|

|

| Social Media Sentiment (Twitter & Reddit) |

|

|

| Ref. | Year | Data Sources | Methodology | Language | Code URL |

|---|---|---|---|---|---|

| [34] | 2020 | Financial Data | DoubleEnsemble, DNN, Gradient Boosting Decision Tree | Python | https://github.com/microsoft/qlib/tree/main/examples/benchmarks/DoubleEnsemble (accessed on 1 May 2024) |

| [36] | 2021 | Blockchain-Based Cryptocurrency Price Changes | LSTM | Python | https://github.com/cybertraining-dsc/su21-reu-361 (accessed on 1 May 2024) |

| [60] | 2022 | Public Twitter Data | Several Deep Learning Architectures | Python | https://github.com/meakbiyik/ask-who-not-what (accessed on 1 May 2024) |

| [35] | 2022 | Public Twitter Data | Different Convolutional Layers, LSTM | Python | https://github.com/mmghahramanibozandan/MyPaper_DL_ML_Fin (accessed on 1 May 2024) |

| [61] | 2022 | Historical Price, Public Twitter Data | Synthesiser Transformer models | Python | https://github.com/dorienh/bitcoin_synthesizer (accessed on 1 May 2024) |

| Data Source | Benefits | Challenges |

|---|---|---|

| Machine Learning |

|

|

| Deep Learning |

|

|

| Hybrid Deep Learning |

|

|

| Ref. | Year | ML Approach | Features | Performance Metrics |

|---|---|---|---|---|

| [25] | 2014 | Bayesian Regression | Historical Price and Volume | Investment Doubling in <60 days |

| [122] | 2015 | Statistical Analysis | Historical Price | Volatility Analysis, Risk Measures (VaR, ES) |

| [32] | 2017 | Bayesian Neural Networks (BNNs) | Historical price, Blockchain Features, macroeconomic indexes | RMSE: 0.0031, MAPE: 0.0325 |

| [56] | 2018 | Bayesian Optimised RNN and LSTM Networks | Historical price | Highest classification accuracy: 52%, RMSE: 8%; Outperformed ARIMA model; GPU implementation was 67.7% faster than CPU. |

| [54] | 2018 | GARCH Model, SVR | Historical Price, Volatility measures | RMSE: 0.0313, MAE: 0.01315 |

| [39] | 2019 | DNN, LSTM, CNN, ResNet, Ensemble, SVM | Bitcoin blockchain features | MAPE: DNN = 3.61, LSTM = 3.79, CNN = 4.27, ResNet = 4.95, Ensemble = 4.02, SVM = 4.75 |

| [45] | 2020 | LSTM with AR(2) Model | Historical Price | MSE: 4574.12, RMSE: 9.08, MAE: 9.75, MAPE: 0.15 |

| [49] | 2020 | CNN-LSTM, CNN, MLP, RFBNN | Historical Price | Accuracy CNN-LSTM: BTC = 0.6106, Dash = 0.7412, ETH = 0.5899, LTC = 0.6763, XMR = 0.7994, XRP = 0.6704 |

| [3] | 2020 | GRU and LSTM Hybrid Model | Historical Price | RMSE: 1-day: LTC = 2.2986, XMR = 3.2715, 3-days: LTC = 2.0327, XMR = 5.5005, 7 days: LTC = 4.5521, XMR = 20.2437 |

| [4] | 2021 | GRU and LSTM Hybrid Model | Historical Price, Inter-dependency of the parent coin | MSE: 1-day: LTC = 0.0203, Zcash = 0.0046, 3-days: LTC = 0.0266, Zcash = 0.0048, 7 days: LTC = 0.2337, Zcash = 0.0052 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

John, D.L.; Binnewies, S.; Stantic, B. Cryptocurrency Price Prediction Algorithms: A Survey and Future Directions. Forecasting 2024, 6, 637-671. https://doi.org/10.3390/forecast6030034

John DL, Binnewies S, Stantic B. Cryptocurrency Price Prediction Algorithms: A Survey and Future Directions. Forecasting. 2024; 6(3):637-671. https://doi.org/10.3390/forecast6030034

Chicago/Turabian StyleJohn, David L., Sebastian Binnewies, and Bela Stantic. 2024. "Cryptocurrency Price Prediction Algorithms: A Survey and Future Directions" Forecasting 6, no. 3: 637-671. https://doi.org/10.3390/forecast6030034

APA StyleJohn, D. L., Binnewies, S., & Stantic, B. (2024). Cryptocurrency Price Prediction Algorithms: A Survey and Future Directions. Forecasting, 6(3), 637-671. https://doi.org/10.3390/forecast6030034