Modeling and Forecasting Somali Economic Growth Using ARIMA Models

Abstract

1. Introduction

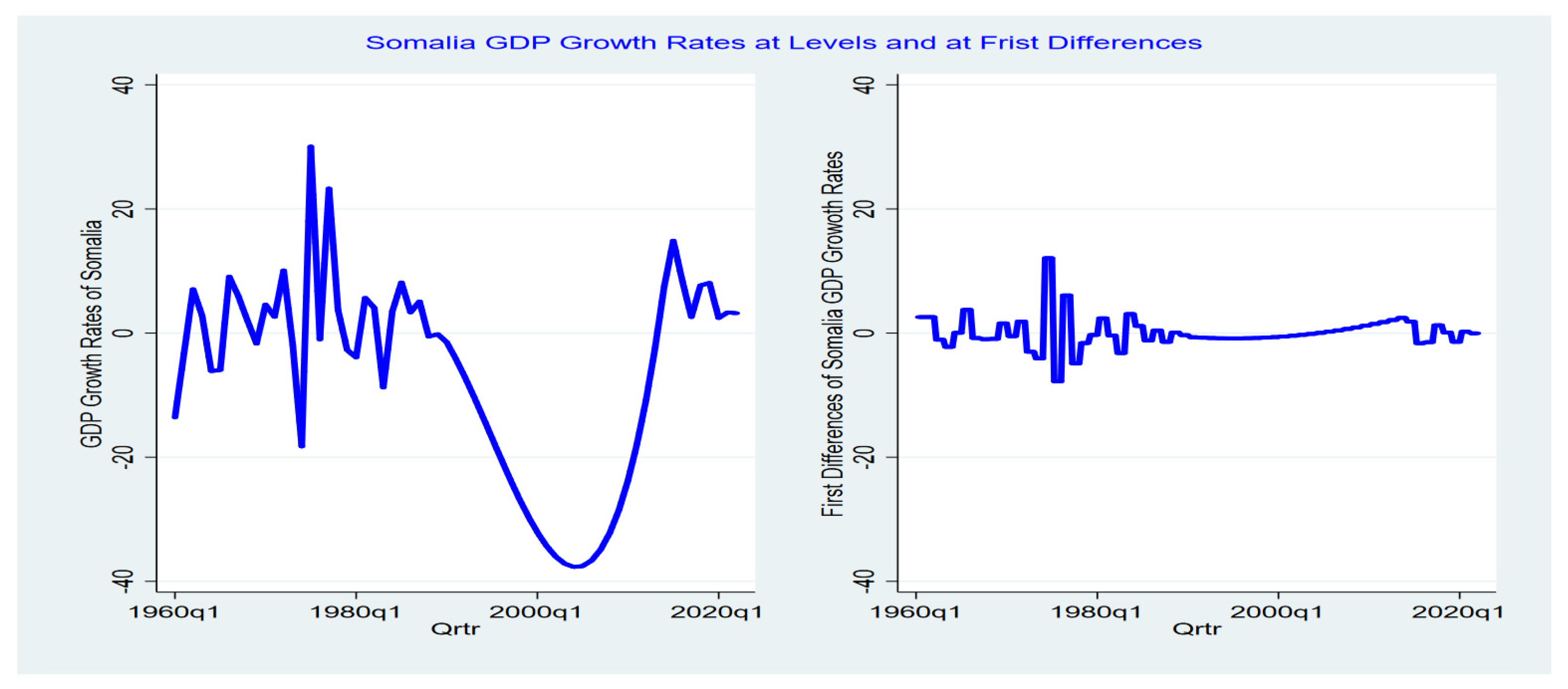

2. Materials and Methods

2.1. Theoretical Foundation of ARIMA Modelling

2.2. Model Specification

2.3. Model Identification

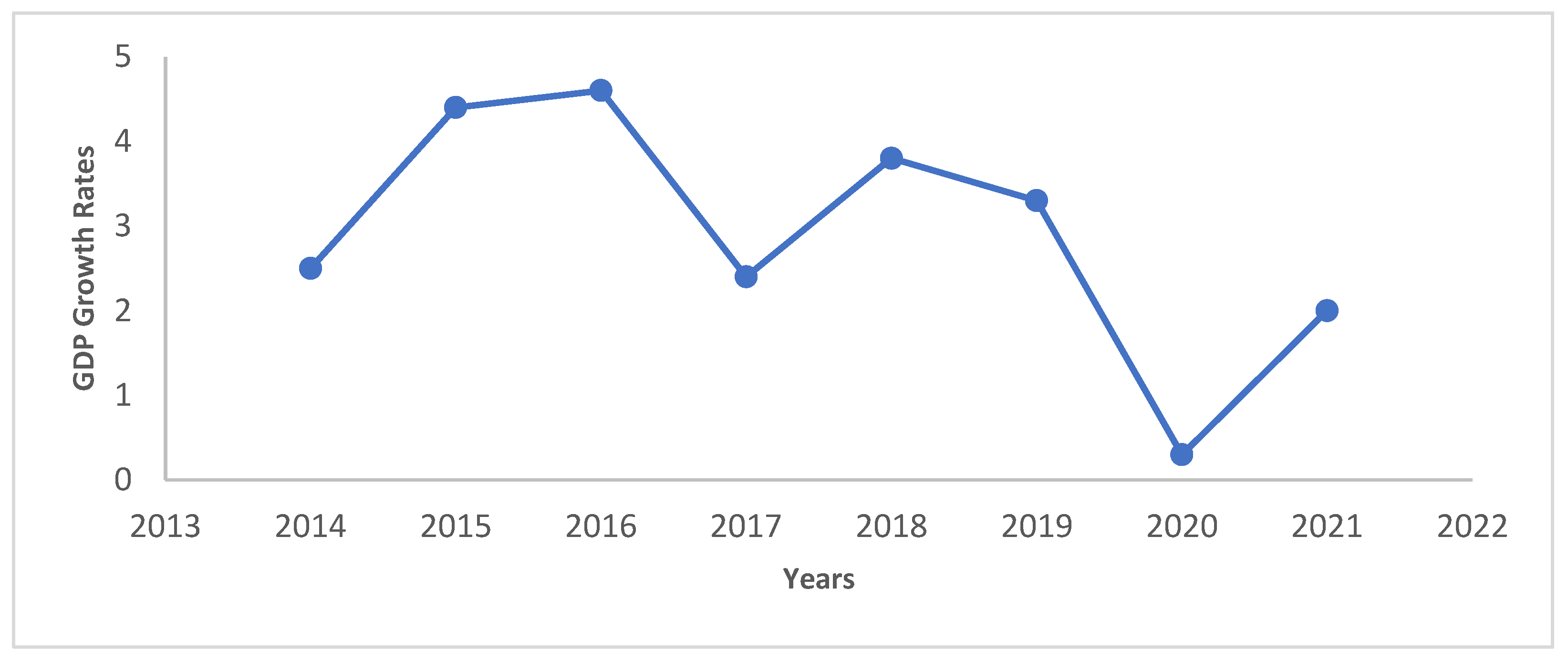

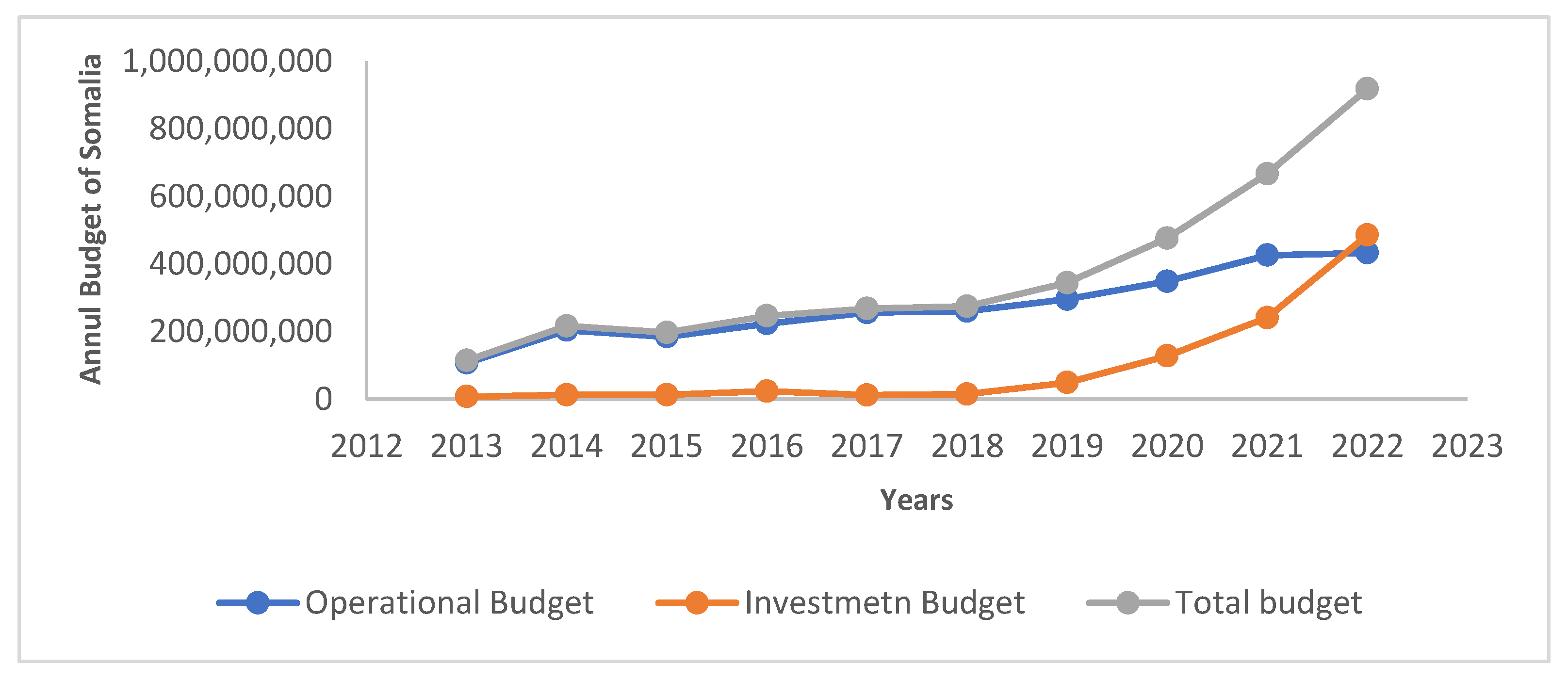

3. Results

3.1. Model Estimation

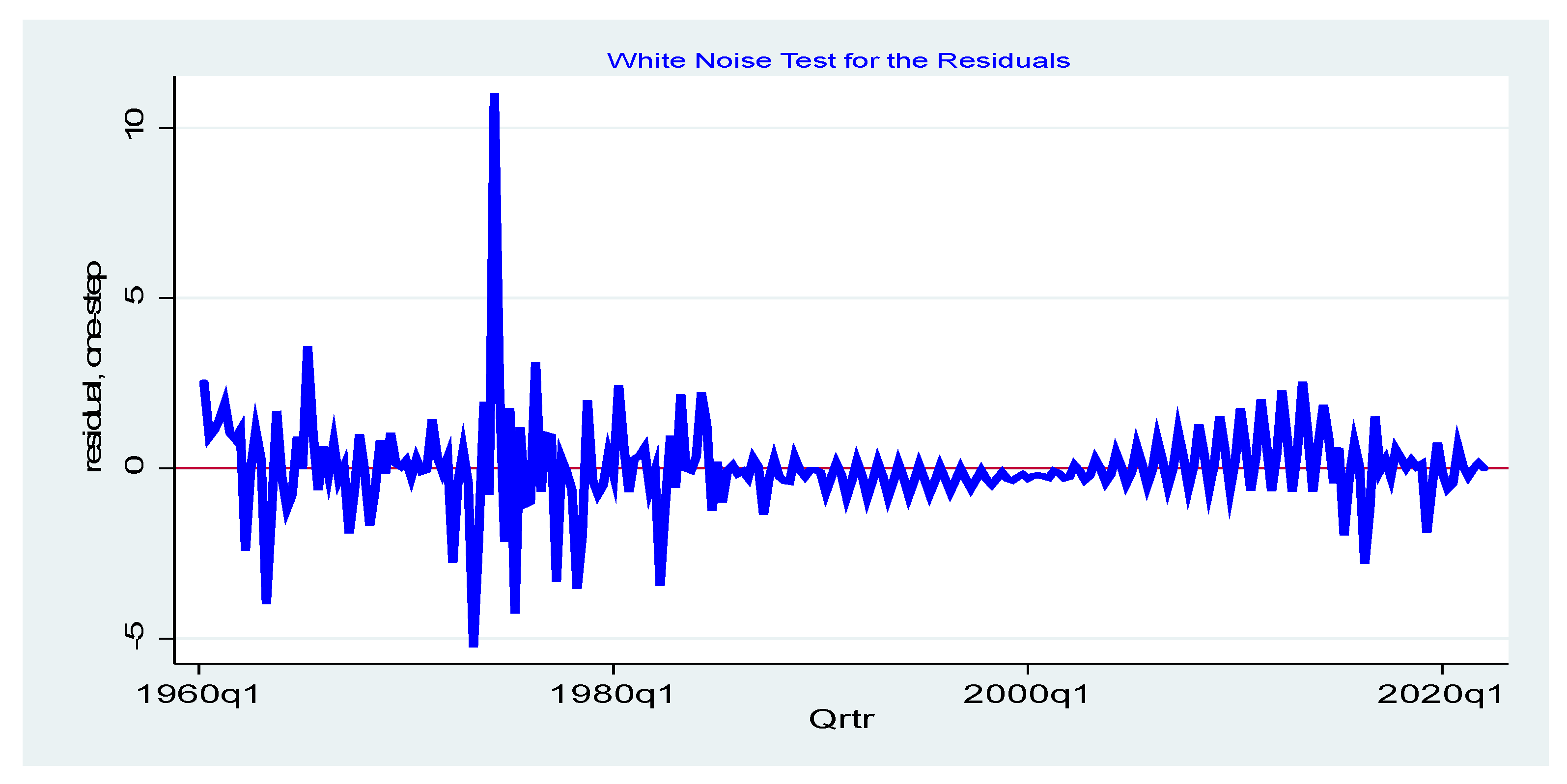

3.2. Model Diagnostics

3.3. Model Forecasting

3.4. Robustness Checks

4. Discussion

5. Conclusions and Policy Recommendations

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, T. Forecast of Economic Growth by Time Series and Scenario Planning Method—A Case Study of Shenzhen. Mod. Econ. 2016, 07, 212–222. [Google Scholar] [CrossRef]

- Sheehey, E.J. The growing gap between rich and poor countries: A proposed explanation. World Dev. 1996, 24, 1379–1384. [Google Scholar] [CrossRef]

- Pieterse, J.N. Global inequality: Bringing politics back in. Third World Q. 2002, 23, 1023–1046. [Google Scholar] [CrossRef]

- Dabla-Norris, M.E.; Kochhar, M.K.; Suphaphiphat, M.N.; Ricka, M.F.; Tsounta, M.E. Causes and consequences of income inequality: A global perspective. Int. Monet. Fund 2015, 13, 1–39. [Google Scholar] [CrossRef]

- Hicks, N.; Streeten, P. Indicators of development: The search for a basic needs yardstick. World Dev. 1979, 7, 567–580. [Google Scholar] [CrossRef]

- Van den Berg, H. Economic Growth and Development, 3rd ed.; World Scientific Publishing Company: Singapore, 2016. [Google Scholar]

- Nuraini, I.; Hariyani, H.F. Quality Economic Growth as an Indicator of Economic Development. J. Èkon. Pembang. Kaji. Masal. Èkon. Pembang. 2019, 20, 80–86. [Google Scholar] [CrossRef]

- Kuznets, S. The American Economic Review; American Economic Association: Nashville, TN, USA, 1955; Volume 1, pp. 3–28. Available online: https://www.jstor.org/stable/1811581 (accessed on 12 March 2022).

- Wabomba, M.S.; Mutwiri, M.P.; Fredrick, M. Modeling and Forecasting Kenyan GDP Using Autoregressive Integrated Moving Average (ARIMA) Models. Sci. J. Appl. Math. Stat. 2016, 4, 64. [Google Scholar] [CrossRef]

- Dritsaki, C. Forecasting Real GDP Rate through Econometric Models: An Empirical Study from Greece. J. Int. Bus. Econ. 2015, 3, 13–19. [Google Scholar] [CrossRef][Green Version]

- World Bank. Somalia Economic Update: Investing in Health to Anchor Growth; World Bank: Washington, DC, USA, 2021; Available online: https://openknowledge.worldbank.org/handle/10986/36312 (accessed on 3 April 2022).

- International Monetary Fund. World Economic Outlook: War Sets Back the Global Recovery. 2022. Available online: https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022 (accessed on 24 March 2022).

- Raddatz, C. Liquidity needs and vulnerability to financial underdevelopment. J. Financ. Econ. 2006, 80, 677–722. [Google Scholar] [CrossRef]

- Addison, T. Underdevelopment, transition and reconstruction in sub-Saharan Africa. AgEcon SEARCH 1998, 45, 72. [Google Scholar] [CrossRef]

- Korf, B.; Silva, K.T. Poverty, ethnicity and conflict in Sri Lanka. Retrieved Novemb. 2003, 6, 2014. [Google Scholar]

- Servén, L. Real-Exchange-Rate Uncertainty and Private Investment in LDCS. Rev. Econ. Stat. 2003, 85, 212–218. [Google Scholar] [CrossRef]

- Wang, S.; Lin, X.; Xiao, H.; Bu, N.; Li, Y. Empirical Study on Human Capital, Economic Growth and Sustainable Development: Taking Shandong Province as an Example. Sustainability 2022, 14, 7221. [Google Scholar] [CrossRef]

- Umaru, A.; Pate, H.A.; Haruna, A.D. The impact of insecurity and poverty on sustainable economic development in Nigeria. Int. J. Humanit. Soc. Sci. Educ. 2015, 2, 32–48. [Google Scholar]

- Sahinoz, S.; Cosar, E.E. Economic policy uncertainty and economic activity in Turkey. Appl. Econ. Lett. 2018, 25, 1517–1520. [Google Scholar] [CrossRef]

- Krol, R. Economic Policy Uncertainty and Exchange Rate Volatility. Int. Financ. 2014, 17, 241–256. [Google Scholar] [CrossRef]

- Cepni, O.; Guney, I.E.; Swanson, N.R. Forecasting and nowcasting emerging market GDP growth rates: The role of latent global economic policy uncertainty and macroeconomic data surprise factors. J. Forecast. 2019, 39, 18–36. [Google Scholar] [CrossRef]

- Segnon, M.; Gupta, R.; Bekiros, S.; Wohar, M.E. Forecasting US GNP growth: The role of uncertainty. J. Forecast. 2018, 37, 541–559. [Google Scholar] [CrossRef]

- Pao, H.-T.; Fu, H.-C.; Tseng, C.-L. Forecasting of CO2 emissions, energy consumption and economic growth in China using an improved grey model. Energy 2012, 40, 400–409. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. Modeling and forecasting the CO2 emissions, energy consumption, and economic growth in Brazil. Energy 2011, 36, 2450–2458. [Google Scholar] [CrossRef]

- Mourougane, A.; Roma, M. Can confidence indicators be useful to predict short term real GDP growth? Appl. Econ. Lett. 2003, 10, 519–522. [Google Scholar] [CrossRef]

- Chuku, C.; Simpasa, A.; Oduor, J. Intelligent forecasting of economic growth for developing economies. Int. Econ. 2019, 159, 74–93. [Google Scholar] [CrossRef]

- Chuku, C.; Oduor, J.; Simpasa, A. Intelligent forecasting of economic growth for African economies: Artificial neural networks versus time series and structural econometric models. Wash. Res. Program Forecast. 2017, 1, 28. [Google Scholar]

- Zakai, M. A time series modeling on GDP of Pakistan. J. Contemp. Issues Bus. Res. 2014, 3, 200–210. [Google Scholar]

- Abonazel, M.; Abd-Elftah, A.I. Forecasting Egyptian GDP using ARIMA modes. Rep. Econ. Financ. 2019, 5, 35–47. [Google Scholar] [CrossRef]

- Box, G.E.P.; Jenkins, G.M. Time Series Analysis: Forecasting and Control; revised edition; Holden Day: San Francisco, CA, USA, 1976. [Google Scholar]

- Zolfaghari, M.; Gholami, S. A hybrid approach of adaptive wavelet transform, long short-term memory and ARIMA-GARCH family models for the stock index prediction. Expert Syst. Appl. 2021, 182, 115149. [Google Scholar] [CrossRef]

- Girish, G. Spot electricity price forecasting in Indian electricity market using autoregressive-GARCH models. Energy Strat. Rev. 2016, 11–12, 52–57. [Google Scholar] [CrossRef]

- Vo, N.; Ślepaczuk, R. Applying Hybrid ARIMA-SGARCH in Algorithmic Investment Strategies on S&P500 Index. Entropy 2022, 24, 158. [Google Scholar] [CrossRef]

| Augmented Dickey–Fuller Test (ADF) | Phillips-Perron Test (PP) | |||||||

|---|---|---|---|---|---|---|---|---|

| Levels | MacKinnon p-Value | Frist Diff | MacKinnon p-Value | Levels | MacKinnon p-Value | Frist Diff | MacKinnon p-Value | |

| L.GDP Growth | −0.02358 | 0.2038 | −0.44976 | 0.0000 | 0.98617 | 0.7694 | 0.63321 | 0.0000 |

| D.GDP Growth | 0.64593 | 0.2038 | 0.22353 | 0.0000 | ||||

| Trend | −0.00146 | 0.2038 | −0.00071 | 0.7694 | ||||

| Constant | 0.03337 | 0.2038 | −0.03944 | 0.0000 | 0.06072 | 0.7694 | −0.03098 | 0.0000 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

|---|---|---|---|---|---|---|---|---|---|---|

| VARIABLES | ARIMA (1,1,1) | ARIMA (1,1,2) | ARIMA (2,1,1) | ARIMA (2,1,2) | ARIMA (3,1,1) | ARIMA (3,1,2) | ARIMA (4,1,1) | ARIMA (4,1,2) | ARIMA (5,1,1) | ARIMA (5,1,2) |

| L.ar | 0.485 *** | 0.493 *** | 1.346 *** | 0.669 *** | 0.991 *** | 0.637 *** | 0.0140 | 0.587 *** | 0.680 *** | 0.704 *** |

| (0.0420) | (0.0230) | (0.0584) | (0.0370) | (0.109) | (0.0331) | (0.297) | (0.0383) | (0.205) | (0.0527) | |

| L.ma | 0.259 *** | 0.00546 | −0.604 *** | −0.00705 | −0.333 *** | −0.00711 | 1.044 *** | 0.00540 | 0.179 | 0.0109 |

| (0.0803) | (0.0406) | (0.0822) | (0.0433) | (0.106) | (0.0371) | (0.0245) | (0.720) | (0.256) | (0.0480) | |

| L2.ma | 1.000 | 1.000 | 1.000 | 1.000 | 0.936 *** | |||||

| (0.000) | (0.000) | (0.000) | (271.6) | (0.0225) | ||||||

| L2.ar | −0.628 *** | −0.340 *** | −0.192 | −0.276 *** | 0.405 *** | −0.377 *** | 0.0757 | −0.394 *** | ||

| (0.0532) | (0.0357) | (0.131) | (0.0349) | (0.0276) | (0.0491) | (0.167) | (0.0576) | |||

| L3.ar | −0.266 *** | −0.0942 *** | 0.0121 | 0.164 *** | 3.71 × 10−5 | 0.259 *** | ||||

| (0.0715) | (0.0244) | (0.306) | (0.0490) | (0.0824) | (0.0653) | |||||

| L4.ar | −0.587 *** | −0.409 *** | −0.710 *** | −0.597 *** | ||||||

| (0.0273) | (0.0498) | (0.0553) | (0.0652) | |||||||

| L5.ar | 0.468 *** | 0.305 *** | ||||||||

| (0.0852) | (0.0650) | |||||||||

| Constant | 0.0788614 | 0.0675238 | 0.0565055 | 0.0675167 | 0.0587675 | 0.0649755 | 0.0558976 | 0.0552598 | 0.0768576 | 0.0621376 |

| Observations | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 |

| Model Section Process | ||||||

|---|---|---|---|---|---|---|

| Models | Significance | Sigma | Loglikelihood | AIC | BIC | Best Model |

| ARIMA (1,1,1) | 2/3 | 1.945216 | −517.1954 | 1042.391 | 1056.444 | |

| ARIMA (1,1,2) | 1/4 | 1.565433 | −468.2262 | 944.4523 | 958.5061 | |

| ARIMA (2,1,1) | 3/4 | 1.845577 | −504.2956 | 1018.591 | 1036.158 | |

| ARIMA (2,1,2) | 2/5 | 1.475717 | −453.367 | 916.734 | 934.3012 | |

| ARIMA (3,1,1) | 3/5 | 1.803765 | −498.6927 | 1009.385 | 1030.466 | |

| ARIMA (3,1,2) | 3/6 | 1.468036 | −452.2701 | 916.5402 | 937.6208 | |

| ARIMA (4,1,2) | 3/6 | 1.362904 | −441.5866 | 897.1732 | 921.7672 | |

| ARIMA (4,1,2) | 4/7 | 1.33876 | −429.9177 | 875.8355 | 903.9429 | |

| ARIMA (5,1,1) | 3/8 | 1.422986 | −440.9773 | 897.9546 | 926.062 | |

| ARIMA (5,1,2) | 6/8 | 1.292778 | −419.1822 | 856.3644 | 887.9852 | |

| Model choice | ARIMA (5,1,2) | ARIMA (5,1,2) | ARIMA (5,1,2) | ARIMA (5,1,2) | ARIMA (5,1,2) | ARIMA (5,1,2) |

| Quarter | Forecasted GDP Growth Rates |

|---|---|

| 2022q3 | 3.706963 |

| 2022q4 | 3.826241 |

| 2023q1 | 3.933865 |

| 2023q2 | 3.90751 |

| 2023q3 | 3.85275 |

| 2023q4 | 3.901956 |

| 2024q1 | 3.968435 |

| 2024q2 | 4.075136 |

| 2024q3 | 4.206374 |

| 2024q4 | 4.27282 |

| 2025q1 | 4.315757 |

| 2025q2 | 4.355294 |

| 2025q3 | 4.382552 |

| 2025q4 | 4.442555 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohamed, A.O. Modeling and Forecasting Somali Economic Growth Using ARIMA Models. Forecasting 2022, 4, 1038-1050. https://doi.org/10.3390/forecast4040056

Mohamed AO. Modeling and Forecasting Somali Economic Growth Using ARIMA Models. Forecasting. 2022; 4(4):1038-1050. https://doi.org/10.3390/forecast4040056

Chicago/Turabian StyleMohamed, Abas Omar. 2022. "Modeling and Forecasting Somali Economic Growth Using ARIMA Models" Forecasting 4, no. 4: 1038-1050. https://doi.org/10.3390/forecast4040056

APA StyleMohamed, A. O. (2022). Modeling and Forecasting Somali Economic Growth Using ARIMA Models. Forecasting, 4(4), 1038-1050. https://doi.org/10.3390/forecast4040056