Abstract

This study investigates the convergence of blockchain, artificial intelligence (AI), near-field communication (NFC), and mobile technologies in electronic payment (e-payment) systems, proposing an innovative integrative framework to deconstruct the systemic innovations and transformative impacts driven by such technological synergy. Unlike prior research, which often focuses on single-technology adoption, this study uniquely adopts a cross-technology convergence perspective. To our knowledge, this is the first study to empirically map the multi-technology convergence landscape in e-payment using scientometric techniques. By employing bibliometric and thematic network analysis methods, the research maps the intellectual evolution and key research themes of technology convergence in e-payment systems. Findings reveal that while the integration of these technologies holds significant promise, improving transparency, scalability, and responsiveness, it also presents challenges, including interoperability barriers, privacy concerns, and regulatory complexity. Furthermore, this study highlights the potential for convergent technologies to unintentionally deepen the digital divide if not inclusively designed. The novelty of this study is threefold: (1) theoretical contribution—this study expands existing frameworks of technology adoption and digital governance by introducing an integrated perspective on cross-technology adoption and regulatory responsiveness; (2) practical relevance—it offers actionable, stakeholder-specific recommendations for policymakers, financial institutions, developers, and end-users; (3) methodological innovation—it leverages scientometric and topic modeling techniques to capture the macro-level trajectory of technology convergence, complementing traditional qualitative insights. In conclusion, this study advances the theoretical foundations of digital finance and provides forward-looking policy and managerial implications, paving the way for a more secure, inclusive, and innovation-driven digital payment ecosystem.

1. Introduction

In the era of rapid digital transformation, electronic payment (e-payment) technology has emerged as a cornerstone of modern financial infrastructure. The convergence of key digital technologies—including mobile communication, blockchain, artificial intelligence (AI), and near-field communication (NFC)—has led to the evolution of e-payment systems that are more secure, efficient, and user-centric [1,2], reflecting a paradigm shift in digital finance driven by growing expectations for speed, transparency, convenience, and trust [2,3]. As e-payment systems increasingly support not only daily financial transactions but also broader economic inclusion goals, understanding their convergent evolution is vital.

For instance, integrating blockchain technology into e-payment systems offers a paradigm shift toward decentralized, transparent, and secure transaction mechanisms that challenge conventional banking models [1]. Likewise, the integration of AI and machine learning enhances fraud detection and customer interaction through real-time, predictive analytics [2]. NFC technology, which enables contactless transactions, gained even greater relevance during the COVID-19 pandemic [3,4].

Despite these advantages, technological convergence in e-payments introduces significant challenges. Interoperability barriers, data privacy concerns, and inconsistencies in regulatory frameworks across regions hinder the standardized deployment of converged systems [5]. Moreover, the rapid pace of technological innovation often surpasses the readiness of existing institutional structures to adapt.

This convergence also poses risks related to digital inequality and financial exclusion. Although convergent technologies have the potential to expand financial access, they may exacerbate the digital divide if issues of affordability, infrastructure, or user literacy are not adequately addressed [6,7]. These multifaceted concerns call for a systematic, theory-driven investigation of convergence phenomena within the e-payment landscape.

To address this, the present study investigates how technological convergence shapes the development, adoption, and performance of e-payment systems, particularly in relation to key stakeholders such as consumers, financial institutions, and regulators. A bibliometric approach is employed to uncover emerging themes and structural patterns in the literature, offering a data-driven perspective on the evolution of the e-payment domain.

This study differs from prior works focusing on singular technologies—such as blockchain [1], mobile payments [8], or AI [2]—by adopting a comprehensive perspective that reveals the synergies and challenges arising from their convergence.

This research is guided by two primary questions:

RQ1: Which technologies (e.g., AI, blockchain, NFC) most frequently co-occur and form dominant convergence patterns in e-payment literature (2000–2023)?

RQ2: How does technological convergence impact security, system interoperability, and financial inclusion in diverse institutional and geographic contexts?

By uncovering interrelations among technological trends, user behaviors, and policy contexts, this study aims to bridge a critical knowledge gap and offer strategic insights for advancing inclusive, secure, and future-ready digital financial ecosystems.

2. Theoretical Underpinnings: Evolution of E-Payment Technology and Converging Domains

In the rapidly evolving digital landscape, e-payment technology has emerged as a pivotal component of the global economy, reshaping how financial transactions are executed. The advent of the Internet and the proliferation of mobile technology have catalyzed the growth of e-payment systems, making them indispensable in today’s digital age. The genesis of e-payment systems can be traced back to the 1970s with the introduction of Electronic Funds Transfer (EFT), which marked the initial step towards electronic transactions. The development of Automated Teller Machines (ATMs) in 1967 revolutionized banking, offering a precursor to the convenience of e-payments [9]. The 1990s witnessed a significant leap with the advent of online banking, propelled by the Internet’s commercialization. This era set the stage for the emergence of PayPal in 1998, a ground-breaking platform that simplified online transactions and heralded a new era for e-commerce [10]. These developments underscored a shift towards more accessible and efficient financial transactions, laying the groundwork for modern e-payment systems. In the early 2000s, technological advancements and increased internet accessibility led to the proliferation of digital wallets and mobile payment solutions. Companies like Apple, Google, and Samsung introduced digital wallets, further embedding e-payments into daily commerce [11,12]. These innovations highlighted a growing trend towards seamless, user-friendly payment methods. Introducing blockchain technology and cryptocurrencies in 2009 with Bitcoin presented a novel approach to e-payments, emphasizing decentralization, security, and transparency. This period marked the diversification of e-payment methods, reflecting a dynamic landscape of technological innovation and adoption. These digital currencies offer a decentralized alternative to traditional financial systems, minimizing transaction costs and enhancing cross-border transaction efficiency. Integrating Near Field Communication (NFC) technology in smartphones enabled contactless payments, enhancing the convenience and speed of transactions. The COVID-19 pandemic further accelerated the adoption of contactless payments as consumers and retailers sought safer payment alternatives [4,13]. The timeline of the e-payment evolution research is shown in Table 1 below.

Table 1.

Timeline of e-payment technology development.

The primary focus of recent research is the development of advanced security measures to protect against fraud and cyberattacks. Techniques leveraging artificial intelligence (AI) and machine learning (ML) are at the forefront, with studies exploring how these technologies can be applied to detect fraudulent activities in real time and prevent security breaches [14,15]. Blockchain technology is also a significant area of interest, providing a decentralized and tamper-proof framework for conducting transactions securely. Studies [6,16,17] have examined ways to make e-payments more intuitive, seamless, and inclusive, catering to a diverse user base. Current research in e-payment technology has significantly contributed to advancing security, usability, and accessibility. However, gaps remain in understanding and addressing the challenges of cross-border payments, interoperability, privacy, and adoption barriers, particularly in emerging markets. Legacy systems like SWIFT (Society for Worldwide Interbank Financial Telecommunications) remain crucial for ensuring secure cross-border messaging and financial interoperability, complementing newer blockchain-based systems in the evolving global payment infrastructure. Addressing these gaps presents an opportunity for future research to innovate further and refine e-payment technologies, making them more secure, efficient, and accessible to a global audience.

Technology convergence refers to the integration of distinct digital technologies—such as AI, blockchain, and NFC—into cohesive, interoperable platforms that enable new systemic functionalities, going beyond mere parallel adoption or sequential use (The Technological Convergence Innovation [18,19,20]). The era of unprecedented technological convergence within the e-payment domain mirrors advancements in related technological fields, creating innovative solutions that redefine traditional paradigms. This convergence has led to the seamless integration of digital payments into daily life and business operations, reflecting a broader trend towards a seamless, integrated digital ecosystem. The synergy between mobile technology and NFC, along with the incorporation of AI and ML, has streamlined payment processes and enhanced the security and reliability of e-payment platforms. Research highlights the transformative role of blockchain, the potential of AI and ML in fraud detection and customer service, and the need for cohesive standards to support widespread adoption. While individual technologies like blockchain and AI have been explored [1,2], there is a call for more research on understanding the convergence phenomenon and its collective impact on system performance, security, and user experience, emphasizing the dynamic and rapidly evolving field of e-payment technology.

This study adopts a bibliometric analysis approach—a quantitative method widely used for systematically reviewing and mapping the structure and evolution of large-scale academic literature. Bibliometric techniques enable researchers to analyze publication trends, citation patterns, keyword co-occurrence networks, topic evolution, co-authorship structures, and institutional collaborations across time and disciplines [16,17,21,22,23].

Bibliometrics provides a robust framework for tracing the chronological development of a scientific domain from a multi-disciplinary perspective, helping to uncover the underlying intellectual structure of a field [23]. This is achieved through widely adopted techniques such as co-citation clustering, bibliographic coupling, and centrality analysis of keywords—each offering objective insights into research influence and thematic convergence.

In recent years, bibliometric studies have played an increasingly prominent role in shaping theory and evaluation within fields such as digital finance, e-commerce, and information systems. For example, Ngai and Wat [24] conducted a comprehensive classification and literature review of e-commerce research, applying citation-based mapping to track the development of knowledge in decision support systems. Similarly, Daim, Rueda, Martin and Gerdsri [21] combined co-word analysis and patent citation analysis to forecast emerging technology trajectories.

In the context of mobile and digital payments, Motwani¹, et al. [25] conducted a bibliometric analysis highlighting how mobile payment systems have matured through cross-domain innovation, as revealed by keyword clustering and citation evolution. Meanwhile, in the broader fintech landscape, Gomber et al. Gomber, et al. [26] provided a conceptual review of innovation and disruption mechanisms in financial services, while Haddad and Hornuf Haddad and Hornuf [5] applied bibliometric techniques to assess the global expansion of fintech research, identifying key geographic and thematic clusters. Riggins and Wamba Riggins and Wamba [27] further examined the convergence of IoT and Big Data analytics by applying thematic evolution mapping to digital adoption trends in information systems.

Despite the growing volume of bibliometric research in finance and technology, few studies have applied an integrative lens that concurrently investigates both technological convergence (e.g., blockchain, AI, NFC) and theoretical constructs of user acceptance (e.g., trust, security, perceived usefulness). This study addresses that gap by combining traditional bibliometric mapping with evolutionary scientometric analysis, offering a comprehensive overview of how previously isolated technologies are converging into a unified, interoperable e-payment ecosystem.

By doing so, this study not only contributes to the expanding bibliometric literature but also offers novel insights into the evolution of digital finance, the sociotechnical mechanisms of adoption, and the institutional patterns of scholarly collaboration shaping the future of e-payment technologies.

3. Research Methodology

A bibliometric analysis is a well-established quantitative evaluative methodology used to systematically review scholarly literature. It examines citation structures, thematic relationships, authorship patterns, and institutional or geographical distributions across research outputs. This approach enables researchers to trace the chronological development and intellectual structure of a given domain from a multi-disciplinary perspective [23].

In this study, bibliometric analysis was selected for its dual strength: (1) its ability to conduct a large-scale quantitative overview of the field and (2) its thematic capability to uncover both emerging and established research areas. Metrics such as total citations, publication frequency, and network centrality (e.g., betweenness, closeness) are employed to identify influential themes and knowledge clusters.

This study adopts a three-phase bibliometric analysis framework(in Figure 1) to examine the convergence of digital technologies in e-payment systems: (1) data retrieval; (2) pre-processing; and (3) quantitative and network-based analysis. The objective is to map the thematic evolution, intellectual structure, and influential contributors to the domain of technology convergence in e-payments.

Figure 1.

Research process.

To formulate the search strategy, we identified and verified various keywords from existing literature shown in Table 2.

Table 2.

Search strategy.

3.1. Phase 1: Data Retrieval

The data had been taken from the Web of Science (WoS) database, as it offered the strongest publication coverage. The ISI only indexes quality sources within the scope of the WoS database. WoS further offers the most pertinent metadata for scientometrics analysis and reliably presents detailed, formatted, full citation record information [21].

Research Limitation

While the search strategy retrieved 6153 peer-reviewed publications from the Web of Science Core Collection (SCI-Expanded, SSCI, A&HCI), it is important to acknowledge certain limitations. Notably, critical infrastructures such as SWIFT (Society for Worldwide Interbank Financial Telecommunications)—despite their centrality in global e-payment systems—are largely absent from the retrieved dataset. This is because SWIFT is more commonly discussed in industry white papers, government reports, technical manuals, and geopolitical policy documents, rather than in academic journal articles indexed by WoS. Moreover, terms like “SWIFT” or “interbank settlement” rarely co-occur with the search strings used (e.g., “digital payment,” “blockchain,” “AI”). This limitation reflects a broader challenge in bibliometric studies: the underrepresentation of practical infrastructure and regulatory content that falls outside traditional academic publishing.

3.2. Phase 2: Pre-Processing

We limit our search results to English-language publications, including journal articles (including early access), proceeding articles, and book chapters. The reason to include proceedings and book chapters is that sometimes, book chapters provide theoretical underpinnings of the technology domain, and the proceeding papers are considered the starting point for new research when authors sometimes publish the beginning of their research in novel technologies in conferences to secure the idea. After obtaining the results, we performed the scientometrics analysis using Biblimetrix R package(v4.2.1).

Our search query resulted in 6153 unique documents from 1742 sources, and the brief information of the data obtained is provided in Table 2. The WoS database has an export limitation of 500 records at one time. Therefore, we export our results from the WoS web interface in various export queries in plain text format and with full citation records. After obtaining the plain text files of our search result records, we merged them for import in the Bibliometrix interface for analysis.

3.3. Phase 3: Bibliometric Analysis

We import the plain text record into the Biblimetrix R package web interface using the Biblioshiny package. The results thus obtained are analyzed and explained in further sections. After performing the network analysis, we also analyzed the top-cited papers for a systematic literature review.

3.3.1. Analytical Techniques and Tools

To systematically map the intellectual, thematic, and conceptual structure of e-payment technology convergence, we implemented a comprehensive bibliometric workflow using the Biblimetrix R package(v4.2.1) and complementary tools.

3.3.2. Keyword Co-Occurrence and Thematic Mapping

We first applied coWordAnalysis() and networkPlot() functions to construct a co-occurrence matrix based on author keywords. Keywords appearing at least 10 times were retained to ensure thematic significance. Clustering was conducted using the Louvain algorithm, which maximizes modularity and detects cohesive thematic communities within the keyword network.

Subsequently, the thematicMap() function was used to categorize topics into four strategic quadrants—Motor Themes, Basic Themes, Niche Themes, and Emerging or Declining Themes—using normalized axes of centrality (relevance) and density (development). Thresholds were as follows:

Motor Themes: centrality > 0.5, density > 0.5;

Basic Themes: centrality > 0.5, density ≤ 0.5;

Niche Themes: centrality ≤ 0.5, density > 0.5;

Emerging/Declining Themes: centrality ≤ 0.5, density ≤ 0.5.

3.3.3. Co-Citation Network Analysis

Using biblioNetwork() and networkPlot() functions, we created a co-citation matrix to identify foundational intellectual structures. Nodes represent cited references, with size being proportional to citation frequency, while edge weight denotes co-citation strength. Centrality metrics—degree, betweenness, and closeness—were calculated to interpret influence and network position of key publications.

3.3.4. Country–Affiliation–Keyword Linkage (Sankey Diagram)

The threeFieldsPlot() function visualized tripartite relationships among countries, institutions, and keywords via a Sankey diagram. This allowed for exploration of global research flows and keyword concentration by geography and institutional affiliation.

3.3.5. Systematic Review Article Selection

To complement quantitative network analysis with deeper conceptual insights, we conducted a systematic literature review of the top-cited works.

Fifty documents were selected based on Total Citations per Year (TC_per_Year) to minimize temporal bias and reflect consistent impact. Titles and abstracts were manually coded by two independent researchers using a structured protocol capturing;

Technological domain (AI, blockchain, NFC, etc.);

Theoretical framework (e.g., TAM, UTAUT, trust-based models);

Sectoral application (e.g., banking, retail, mobile platforms).

Inter-rater reliability was high, with Cohen’s Kappa = 0.84, and discrepancies were resolved through iterative discussion. This qualitative triangulation ensured robust alignment between bibliometric structures and conceptual content.

3.3.6. PSoftware Environment and Parameters

The following R packages were used: bibliometrix v4.2.1 for bibliometric processing, igraph v1.5.1 for network clustering, ggplot2, dplyr, stringr, and tm for visualization and text handling, and networkD3 for Sankey diagram generation.

By integrating structured bibliometric methods with transparent parameterization and rigorous validation, this study ensures methodological reproducibility and analytical robustness. The framework enables both macro-level mapping of scholarly discourse and micro-level insights into theoretical and practical developments within the evolving e-payment technology landscape.

4. Result Analysis

4.1. Descriptive Analysis

Table 3 summarizes bibliometric data from a search on e-payment topics, as retrieved from the Web of Science database, from 1990 to 2024. The search yielded 6153 documents from 1742 sources, such as journals and books. These documents are characterized by an annual growth rate of 8.69%, indicating a steady increase in publications on this subject over the years. The average age of these documents is roughly 11 years, and each document has been cited 31.8 times, which shows their relevance and impact on the academic community.

Table 3.

Data description.

A total of 184,433 references have been used across all documents, signifying extensive research and a rich network of related work. There are 4225 “Keywords Plus” and 12,967 “Author’s Keywords” listed, which are terms associated with e-payment and used to index and retrieve relevant documents.

Regarding authorship, there are 12,971 authors involved, with 881 of them having written single-authored documents. The data also indicate that, on average, there are about 2.88 co-authors per document, suggesting a moderate level of collaboration. Notably, 24.15% of the documents feature international co-authorships, which highlights the global collaboration in the field of e-payment research.

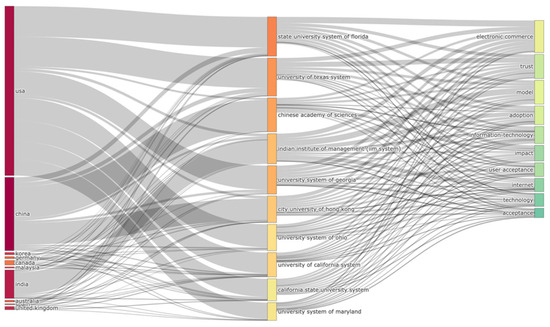

Figure 2 and Table 4 show the flow of research efforts from different countries to their respective academic institutions and subsequently to the key topics or keywords that are prevalent in their research papers. Identifying key players in the e-payment technological landscape, such as potential collaborators or emerging research trends, is essential. On the leftmost side, countries are ranked vertically, with the thickness of the horizontal bands representing the volume of e-payment research associated with each country. The United States (USA) has the thickest band, suggesting it contributes the largest volume of research in e-payment technology. Other countries like China, India, Korea, Germany, Canada, Malaysia, Australia, and the United Kingdom contribute, but to a lesser extent, as indicated by the thinner bands. The middle section lists the institutions, such as the State University System of Florida, the University of Texas System, the Chinese Academy of Sciences, the Indian Institute of Management, and others. Each institution has bands originating from one or multiple countries, illustrating the global collaboration or the distribution of research work across geographical boundaries. The width of these bands suggests the quantity of research output from each institution. For example, a broad band connecting the USA to the State University System of Florida implies that a significant amount of the USA’s research in e-payment technology is concentrated in that system.

Figure 2.

Sankey diagram correlations with country, affiliation, and keywords.

Table 4.

Sankey diagram correlations with country, affiliation, and keywords.

On the rightmost side, keywords are displayed, highlighting the research papers’ focus areas. The size of the boxes and the connecting bands to the institutions reveal the prominence and frequency of each keyword in the institution’s research. For instance, “electronic commerce” may have multiple thick bands connecting to it from different institutions, indicating that it is a major area of focus within e-payment research across these institutions. Other keywords like “trust,” “model,” “adoption,” “information technology,” “impact,” “user acceptance,” “internet,” “technology,” and “acceptance” represent specific themes or topics that are being actively explored in the e-payment technology research.

The flow of the diagram indicates the research volume and the connections between the place of research and the content. This shows trends, such as if a particular country’s institutions focus heavily on a certain aspect of e-payment or if a topic is of global interest, signified by multiple countries’ institutions connecting to the same keyword.

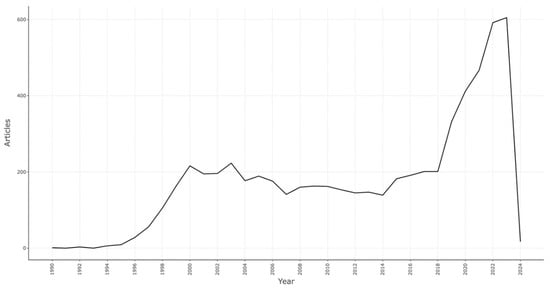

Figure 3 shows the annual scientific production, specifically the number of research papers related to e-payment technology, over more than three decades from 1990 to 2024. The periods can be divided into four stages. From the early 1990s to the late 2000s, the number of e-payment research articles was quite low, starting close to a few articles and gradually increasing. This suggests that e-payment was either a nascent field or not a focus of significant research at the time. A modest rise in articles from the late 2000s to the early 2010s indicates a growing interest in e-payment technology research. This could correspond with the broader adoption of the Internet and the beginning of online commerce during this period. There is a slight dip in the research articles in early 2010, whereas the period from the mid-2010s to early 2020s shows a sharp increase in research papers, which indicates a booming interest and possibly advancements in the field of e-payment technology. This period might align with the introduction of new technologies, increased e-commerce, and a shift towards mobile payments and digital wallets. Further, there is a very steep rise, reaching the chart’s peak around 2022 and 2023. This reflects a surge in e-payment solutions and research due to factors like the COVID-19 pandemic, which accelerated the move towards contactless payments and heightened interest in digital financial solutions.

Figure 3.

Annual scientific production of research articles focused on e-payment technology.

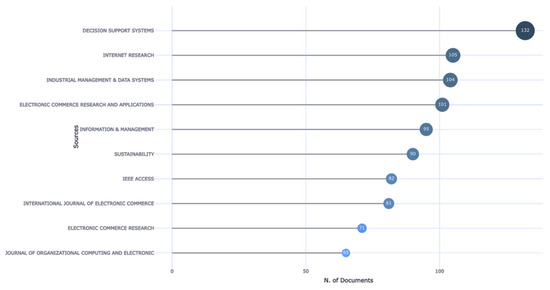

Figure 4 represents various academic journals and their respective contributions to the field of e-payment technology, as measured by the number of documents or papers published. The vertical axis lists the names of the journals, which range from specialized publications like Electronic Commerce Research and Applications to broader journals like Sustainability and IEEE Access. The horizontal axis represents the number of documents published, providing a quantitative measure of each journal’s output in the area of e-payment. The size of the bubble for each journal correlates with the number of documents published—the larger the bubble, the greater the number of publications. Decision Support Systems appears to be the leading source, with the highest number of documents, followed by Internet Research and Industrial Management and Data Systems. These journals strongly focus on the technological and managerial aspects of e-payment systems. Electronic Commerce Research and the Journal of Organizational Computing and Electronic Commerce are more specialized. Still, they also make notable contributions to the field, as indicated by the size of their publications.

Figure 4.

Most relevant sources.

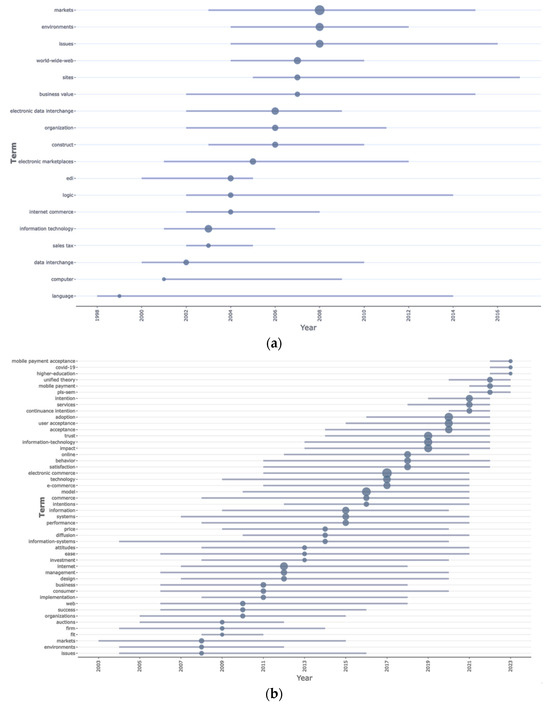

Figure 5a,b depict the prevalence and intensity of various research topics in e-payment technology from 1990 to 2008. It illustrates the topics of interest and how these interests have changed over time, reflecting the technological advancements and shifts in the digital economy. Here is a detailed interpretation with relevance to the periods:

Figure 5.

(a) Trend topics: 1990–2008. (b) Trend topics: 2008–2024.

Early 1990s: Topics such as “computer” and “language” appear early on, which likely correlates with the foundational research in computer science and programming languages necessary to develop the first digital payment systems.

Mid to Late 1990s: The emergence of the “World-Wide Web” as a research topic is in line with the public adoption of the internet during this period. The internet’s rapid expansion provided a platform for online transactions and thus became a focus for e-payment research. “EDI” (Electronic Data Interchange) had a spike in research interest, which fits the timeline wherein businesses were adopting this technology for B2B transactions before the advent of modern internet-based e-payment systems. “Sales tax” research peaked, likely in response to the emergence of e-commerce and the resulting legal and economic discussions about how to apply traditional taxation to online sales.

Early 2000s: “Electronic marketplaces” see a rise, corresponding with the dot-com bubble where numerous online marketplaces emerged and significant interest was in understanding and optimizing e-commerce platforms. “Internet commerce” peaks in research interest, aligning with the growth of e-commerce and the need for secure, efficient online payment methods. “Information technology” remains a steady area of focus, supporting the backbone of e-payment solutions as they become more sophisticated.

Mid 2000s: “Business value” becomes a significant topic. As e-payment technologies matured and their adoption increased, there was a growing need to assess their impact on business performance and consumer behavior. “Sites” and “issues” related to e-commerce and e-payments gain attention, possibly due to the increasing complexity of online transactions and the challenges faced such as fraud, security, and privacy.

Late 2000s: “Organizations” and “constructs” suggest a shift towards understanding the strategic and structural aspects of e-payments within organizations, indicating a move from technical to more organizational and managerial aspects of e-payment systems. The term “environments” suggests broadening research to include the ecosystems in which e-payments operate, including regulatory, economic, and technological environments.

Throughout the timeline in Figure 5a, the fluctuating size of the topics suggests the changing intensity of research activity. This analysis captures the evolution of e-payment technology research as it transitions from foundational technological issues to more complex socioeconomic and organizational concerns. The size and timing of the bubbles reflect the historical context of e-payment evolution, such as the internet becoming mainstream, the establishment of online businesses, and the development of legal frameworks for online transactions.

2008–2010 (Early Years): “Mobile payment” starts to appear, which likely corresponds with the advent of smartphones and the beginning of mobile payment solutions.

“E-commerce” and “Consumer web use” reflect the ongoing growth of online shopping and the need for secure payment methods.

2011–2013 (Expansion Period): “Social media” and “Information systems performance” suggest an exploration of social platforms as marketplaces and the efficiency of information systems supporting e-payments. “Internet management” becomes more prominent, possibly due to the increasing complexity and scale of online transactions.

2014–2016 (Consolidation and Growth): “User acceptance” and “Trust” gain focus, indicating a concern with the adoption of e-payment systems and the need for building trust in digital transactions. “Online behavior” and “Service innovation” trends suggest a shift toward understanding user interactions and the introduction of novel e-payment services.

2017–2019 (Technological Advancements): “Fintech” emerges, reflecting the rise of technology-driven financial services and a shift in how consumers and businesses interact with finances. “Blockchain” research increases, aligning with the interest in cryptocurrencies and secure, decentralized ledger systems.

2020–2022 (Pandemic and Beyond): A significant spike in “COVID-19”-related research shows the pandemic’s impact on e-payments, likely due to the increased need for contactless payments and digital financial solutions. “Higher education” possibly indicates a focus on e-payments in the context of online education platforms, which saw a surge due to remote learning.

2023–2024 (Latest Trends): “Mobile payment acceptance” and “Continuance intention” suggest a research focus on the long-term use and integration of mobile payments in daily transactions.

“P2P (peer-to-peer) systems” indicates a sustained interest in decentralized financial transactions.

Throughout the timeline in the current trends in Figure 5b, we see an evolution from basic e-commerce and web usage topics to more sophisticated concepts such as blockchain and fintech. This shift mirrors the broader digital transformation in society, with a move towards integrated, user-focused, and secure e-payment solutions. The timeline also reflects the impact of global events (like the COVID-19 pandemic) on research directions and the increasing importance of mobile platforms in financial transactions.

In summary, this analysis encapsulates the dynamic nature of e-payment research, highlighting how global events, technological advancements, and shifts in consumer behavior shape academic focus. The progression from foundational technologies to complex systems and the recent emphasis on mobile and P2P systems underscores the rapid innovation and adaptation within the field, signaling a future where e-payments could become even more seamless and integrated into everyday life.

4.2. Network Analysis

4.2.1. Co-Occurrence Network

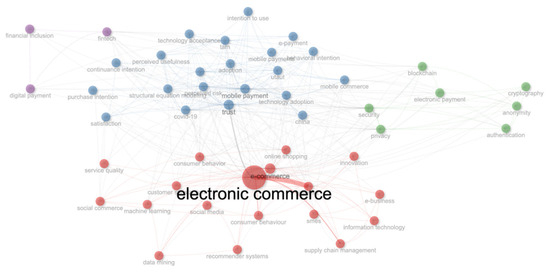

The keyword co-occurrence network in Figure 6 and Table 5 depicts the interconnected nature of various research themes in the evolution of e-payment technology. This section delves into each cluster and highlights their significance in the context of e-payment technology convergence.

Figure 6.

Co-occurrence network.

Table 5.

Co-occurrence network.

- Adoption and Behavioral Intentions (Blue cluster):

This cluster captures the essence of technological acceptance models (TAM), which are crucial for understanding how users accept and use e-payment systems. Terms like “perceived usefulness,” “continuance intention,” and “adoption” reflect the psychological and social factors that drive or hinder the adoption of e-payments. “Mobile payment” and “e-payment” highlight a shift towards mobile-driven transactions, a significant trend in e-payment evolution, accommodating the rise of smartphones. The inclusion of “COVID-19” signifies a pivotal moment in e-payment history, where the pandemic forced a swift move towards contactless and mobile payments, bypassing traditional cash transactions for health and safety reasons.

- E-Commerce and Market Dynamics (Red Cluster):

The focus on “e-commerce” and “online shopping” indicates the environment in which e-payment technology has flourished. As consumers increasingly turned to online platforms for purchasing, e-payment systems had to evolve to meet these demands efficiently and conveniently. “Consumer behavior” reflects the central role that user preferences and habits play in shaping e-payment technologies. Understanding these behaviors is essential for designing user-friendly payment systems. “Social commerce” and “social media” point to the recent trend of purchases being made directly through social platforms, necessitating integrated e-payment solutions working seamlessly within these networks.

- Security, Trust, and Technology (Green Cluster):

Security is paramount in the evolution of e-payment technologies. Terms like “security,” “privacy,” “trust,” “blockchain,” and “cryptography” underscore the ongoing arms race between payment security measures and the sophistication of cyber threats. “Blockchain” technology has been a game-changer in this evolution, offering decentralized and transparent transaction mechanisms that could potentially revolutionize how e-payments are conducted and recorded. “Trust” is both a result of and a prerequisite for effective security measures. As e-payment technologies become more secure, they earn greater trust from users, which, in turn, drives wider adoption.

- Data

- Analytics and Personalization (Orange Cluster):

The emergence of “data mining,” “machine learning,” and “recommender systems” speaks to the increasingly personalized nature of e-commerce, where e-payment systems must integrate with back-end analytics to provide tailored purchasing experiences. This trend has significant implications for the evolution of e-payments. As systems become more data-driven, the ability to offer personalized discounts, loyalty rewards, and targeted marketing can increase e-commerce conversion rates. “Information technology” remains the backbone of this evolution, supporting the complex data architectures required for modern e-payment systems and the infrastructure needed to handle vast amounts of transaction data.

Together, the co-occurrence network illustrates the broad spectrum of factors influencing the development of e-payment technologies. From the early days of simple online transactions to the current landscape featuring mobile payments, sophisticated security protocols, and data-driven personalization, the evolution of e-payment technology has been both rapid and responsive to changes in consumer behavior, security threats, and technological advancements. This network thus encapsulates the historical and predicted future trajectories of e-payment systems as they adapt to an increasingly digital and interconnected global marketplace.

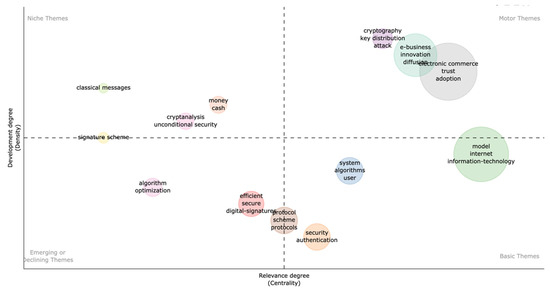

4.2.2. Thematic Analysis

The thematic map shown in Figure 7 and Table 6 is divided into four quadrants, each representing a different status of research themes within the context of e-payment technology evolution.

Figure 7.

Thematic map—four quadrants (Basic Themes, Motor Themes, Niche Themes, Emerging/Declining Themes).

Table 6.

Thematic map—four quadrants (Basic Themes, Motor Themes, Niche Themes, Emerging/Declining Themes).

- Upper Left Quadrant—“Niche Themes”:

These are topics that have a high development degree but low centrality. They are well-developed and mature in their research lifecycle but are currently specialized and not central to the field of e-payment. Examples might include advanced or highly specialized topics like “cryptanalysis” or “classical messages” that are important within their own subfields but do not currently influence the core of e-payment research.

- Upper Right Quadrant—“Motor Themes”:

These themes are well-developed and have high centrality, meaning they are mature and influential within the field. They drive the research agenda and are fundamental to the current understanding and advancement of e-payment technologies. Here, we find topics like “cryptography,” “trust,” “e-business,” and “electronic commerce,” which are key areas of focus that push the field forward.

- Lower Right Quadrant—“Basic Themes”:

These themes have low developmental degree but high centrality. They are central to the field and form the foundational concepts of e-payment research, even though they may not be at the forefront of current research development. Fundamental concepts such as “security,” “authentication,” and “digital signature” protocols are located here. These are the building blocks upon which more complex systems and ideas are developed.

- Lower Left Quadrant—“Emerging or Declining Themes”:

These topics have low centrality and are at the early or declining stages of their development degree. They might be areas that are just beginning to be explored within e-payment research or once were of interest but are now losing relevance due to technological advancement or shifts in research focus. Topics such as “algorithm optimization” might be emerging, reflecting new methods to enhance e-payment processing, while “signature schemes” might decline as newer verification and validation forms are developed.

In terms of the evolution of e-payment technology, this map provides a snapshot of how different concepts have evolved and their current standing in the research landscape. “Motor Themes” like “cryptography” have evolved to become essential, driving the security aspect of e-payment systems. “Basic Themes” like “security” represent the fundamental concerns that have always been central to the field. “Niche Themes” could represent areas like “cryptanalysis” which are critical to understanding and developing secure e-payment systems but are highly specialized. Lastly, “Emerging or Declining Themes” are those that represent the dynamic and changing nature of e-payment technology research, with new ideas coming to the fore and older ones becoming less relevant.

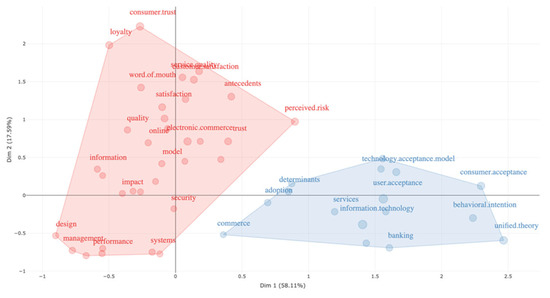

Figure 8 provides the factorial analysis to identify clusters of closely related variables in e-payment technology convergence. This analysis can reduce the dimensionality of data by identifying the underlying relationships between different themes. In the context of the evolution of e-payment technology, each cluster represents a group of interrelated topics that can be interpreted in terms of their dimensional value, which indicates their influence or importance in the analysis.

Figure 8.

Factorial analysis.

Cluster 1 (Red Cluster): This cluster is characterized by terms that are related to the customer experience and service quality aspects of e-payment technology, such as “consumer trust,” “loyalty,” “satisfaction,” “quality,” and “service quality.” The dimensional values, represented by Dimensions 1 and 2 on the axes, show the degree of variance each dimension explains in the dataset. For instance, the value of 58.11% for Dimension 1 indicates that this dimension accounts for most of the variance in the data for this cluster. The significance of this cluster lies in its focus on the subjective experience of the consumer using e-payment technology. Factors such as trust, satisfaction, and quality are crucial for adopting and continuing the use of e-payment systems. The high percentage in Dimension 1 suggests that these aspects are highly influential in e-payment research and development.

Cluster 2 (Blue Cluster): On the right side, we have a cluster that focuses on the adoption and theoretical framework of e-payment systems, with terms like “technology acceptance model,” “user acceptance,” “information technology,” “banking,” and “behavioral intention.” The placement of these terms along the two dimensions indicates their relative importance in explaining the data variance. These terms are more related to the theoretical and practical understanding of how and why consumers and businesses adopt e-payment technologies.

The significance here is in understanding the factors that drive the adoption of e-payment technology. Models such as the Technology Acceptance Model (TAM) and the Unified Theory of Acceptance and Use of Technology (UTAUT) are foundational to this understanding. These factors are essential for guiding the design, implementation, and improvement of e-payment systems to enhance user acceptance and usage.

Together, these clusters and their dimensional values highlight two critical aspects of e-payment technology evolution: the user experience and the theoretical understanding of technology adoption. The user experience is key for customer retention and loyalty, while understanding the factors that drive adoption is essential for the initial acceptance of e-payment technologies. The factorial analysis demonstrates the interplay between these aspects and their combined influence on the direction and focus of e-payment technology development and research.

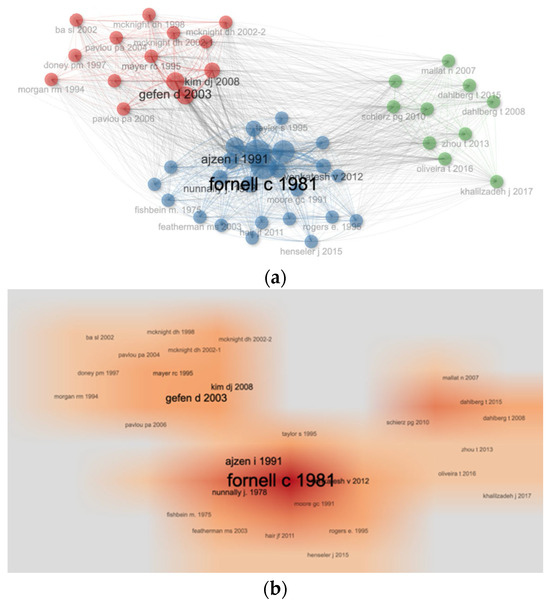

4.2.3. Citation Network

Figure 9 shows the co-citation network of the obtained results (Figure 9a) and citation network density (Figure 9b). The co-citation network obtained is divided into three prominent clusters described further in this section.

Figure 9.

(a) Co-citation network plot. (b) Co-citation density plot. [28,29,30,32,35,36,37,38,39,40,41,42,43,44,45,46,47].

- Cluster 1: Trust, Technology Acceptance, and Risk Perception in E-Commerce

The research conducted in this cluster emphasizes the intricate balance between technological ease of use, perceived usefulness, and the relational dynamics between buyers and sellers, mediated by trust and perceived risks. This theme is dissected through various lenses, including the Technology Acceptance Model (TAM), trust theories, and the perceived risk associated with online transactions. These papers collectively illustrate that trust significantly influences consumer willingness to engage in online shopping and electronic commerce, their perceptions of the technology’s usefulness and ease of use, and their assessment of the risks involved in online transactions. Methodologically, these studies employ a variety of approaches, including empirical research, structural equation modeling, surveys, and data analysis, to validate their hypotheses and models. These methods allow for a rigorous examination of the relationships between trust, perceived usefulness, perceived ease of use, and perceived risk. The findings underscore the complexity of online consumer behavior, revealing that trust and perceived risk are as crucial as the “perceived usefulness” and the ease of use of e-commerce platforms. Integrating the TAM with constructs of trust and perceived risk addresses a significant research gap, highlighting the need for a holistic understanding of the factors influencing e-commerce acceptance and participation. The synthesis of these papers offers a comprehensive exploration of the dynamics at play in e-commerce settings. It emphasizes the necessity of a multi-dimensional approach that considers technological, psychological, and relational factors to understand and foster online consumer engagement fully.

- Cluster 2: Integrating Technology Acceptance and User Behavior

The central theme revolves around the Technology Acceptance Model (TAM), perceived risk, user trust, and their impact on the adoption of technologies and services, especially in the context of e-commerce and online transactions. These studies explore various dimensions of technology acceptance, integrating psychological and behavioral aspects such as trust, perceived ease of use, and perceived usefulness, alongside the risk perceptions associated with adopting new technologies. The methodologies used across these studies range from empirical analyses and structural equation modelling (SEM) to surveys and data analysis, emphasizing the multifaceted nature of technology acceptance and the need to consider both the positive and negative utilities that influence user behavior. The research collectively addresses gaps in our understanding of the complex interplay between user perceptions, trust mechanisms, and their implications for technology adoption, offering insights into how perceived risks can be mitigated and trust can be enhanced to promote the greater acceptance and usage of technological innovations. The research underscores the importance of trust and perceived risk in the technology acceptance process, advocating for a comprehensive approach that integrates these factors with traditional TAM constructs.

- Cluster 3: Trust, Security, and Sociocultural Perspectives

The collection of papers on mobile payment technologies presents a comprehensive examination of the multifaceted factors influencing consumer adoption, usage, and the evolution of mobile payment systems. At the core, these studies navigate the interplay of technological, psychological, and sociocultural dimensions that shape user perceptions and behaviors toward mobile payments. A common methodological approach across these papers is structural equation modeling (SEM), a powerful statistical technique that analyzes complex relationships between observed and latent variables. This approach is instrumental in unpacking the nuanced influences on consumer adoption and use of mobile payment services. Through SEM, researchers have validated theoretical models incorporating various factors, including perceived ease of use, usefulness, trust, security perceptions, and the impact of social influence. Trust and security emerge as central themes, underscoring their pivotal role in accepting and adopting mobile payment technologies. These papers collectively argue that trust in the technology and the provider is paramount for users to feel comfortable engaging in mobile transactions. Security concerns, particularly related to personal and financial data, significantly affect user willingness to adopt mobile payments. Addressing these concerns through robust security measures and clear communication about privacy protections is essential for fostering trust and encouraging wider adoption. Cultural and social factors also play a critical role, as highlighted by the studies’ findings on the impact of social influence and cultural values on technology adoption. The research indicates that individual decisions about mobile payment usage are not made in isolation but are influenced by the behaviors and attitudes of peers, the perceived norm within one’s social circle, and broader cultural attitudes towards technology and financial transactions. This suggests that mobile payment providers consider these social dynamics in their strategies, potentially leveraging social networks to enhance adoption and acceptance. Furthermore, the papers point to the importance of user experience, including ease of use and the compatibility of mobile payment systems with users’ lifestyles and existing payment habits. Mobile payments’ convenience and added value, such as reducing transaction times or providing integration with other services, are significant factors in user adoption decisions. The literature presents a detailed landscape of mobile payment adoption, underpinned by a complex web of factors that include trust, security, social influence, cultural values, and technological attributes. The methodological rigor of these studies, particularly SEM, provides a solid foundation for understanding the intricate dynamics at play. As mobile payment technologies continue to evolve, this body of work offers valuable insights for academics and practitioners in designing user-centric payment solutions that address potential users’ multifaceted needs and concerns. Future research directions include exploring emerging technologies, deeper dives into cultural and social influences across different regions, and the long-term impacts of mobile payment adoption on consumer behavior and financial systems.

4.2.4. Most-Posted Papers

The most-cited research in the domain of e-payment is observed to examine the key factors influencing consumer decisions to adopt e-payment systems, such as perceived ease of use, usefulness, trust, and security concerns. The studies also delve into the technological aspects of e-payment systems, discussing the innovations that have made them more secure, user-friendly, and widely accessible. Additionally, the research highlights the importance of understanding consumer behavior and preferences in developing and implementing e-payment solutions. Table 7 presents the top-contributing journals in the field of e-payment technology research, based on the total number of peer-reviewed journal articles.

Table 7.

Top 10 cited publications.

One significant contribution of the research is developing and testing theoretical models that explain adopting e-payment systems. These models integrate constructs from established theories, such as the Technology Acceptance Model (TAM) and the Theory of Planned Behavior (TPB), with factors specific to e-payments, such as mobile payment knowledge and system characteristics like mobility and reachability. These research findings advance academic knowledge and offer practical implications for businesses and policymakers. The implications of these studies suggest strategies for enhancing the adoption of e-payment systems, improving consumer trust and satisfaction, and addressing the technological challenges associated with these systems. Overall, the research presented in these papers is crucial for understanding the dynamics of e-payment systems, driving their evolution, and ensuring their alignment with user needs and technological advancements.

5. Discussion and Conclusions

This chapter synthesizes and interprets the analytical findings from Chapter 4 to provide insights into how the e-payment research domain has evolved, which conceptual and technological elements have converged over time, and what this implies for the theoretical and practical understanding of digital transaction systems.

5.1. Convergence of Technologies as Reflected in Thematic Evolution

The bibliometric evidence reveals a clear convergence of technologies such as mobile payment systems, blockchain, artificial intelligence (AI), and cybersecurity within the e-payment research landscape. Rather than developing in isolation, these technologies frequently co-occur in keyword networks and thematic clusters (Figure 6 and Figure 7), illustrating a co-evolutionary trajectory.

This convergence is particularly evident in the rise of themes like “trust,” “security,” “blockchain,” and “mobile payment,” which have transitioned from peripheral to central positions in the thematic map over time. These now-core “motor themes”—including cryptography, trust, and e-business—demonstrate not only technical sophistication but also a deep embedding within broader social and behavioral contexts. This shift reflects a transition from technology-push models to sociotechnical integration, consistent with contemporary theories of innovation convergence.

The longitudinal evolution of research topics—from foundational keywords such as “EDI” and “language” in the 1990s to more recent terms like “Fintech,” “P2P systems,” and “COVID-19” in the 2020s (Figure 5a,b)—further highlights the transformation of e-payment from a simple transaction mechanism to a complex digital infrastructure encompassing security, user behavior, and business innovation.

The integration of blockchain, AI, NFC, and mobile technologies in modern e-payment systems signals a paradigm shift in the fintech landscape and offers fertile ground for theoretical advancement. This study contributes to the theoretical foundations of digital finance and innovation by showing how technological convergence can resolve long-standing challenges in e-payments—particularly in security, privacy, and operational efficiency.

By combining decentralized ledgers, intelligent fraud detection algorithms, and seamless contactless interfaces, convergent technologies not only enhance technical functionality but also improve user experience. Furthermore, the research addresses critical theoretical dimensions of interoperability—an essential condition for achieving universal access to digital financial services—and considers the tension between regulatory compliance and innovation, especially in contexts demanding consumer protection.

This study advances interdisciplinary understanding by integrating perspectives from information systems, cybersecurity, and behavioral finance, offering a robust theoretical lens for exploring how converging technologies shape the future of financial services. In doing so, it also opens new avenues for investigating broader societal impacts—such as the digital divide and financial inclusion—in an increasingly interconnected world.

Ultimately, this research enriches existing knowledge and sets the stage for future theoretical inquiries into the dynamic interplay between technological convergence and societal transformation in the digital economy.

5.2. Theoretical Integration: From Technology Adoption to Trust in a Converging Ecosystem

The co-citation and factorial analyses (Figure 9) reveal that traditional Technology Acceptance Models (TAM, UTAUT) have evolved into more expansive frameworks that integrate trust, risk perception, and security—particularly in the context of mobile and decentralized platforms. These findings support and extend prior works (e.g., [28,29]), highlighting the increasing importance of multi-dimensional trust and contextual security in influencing user adoption.

The factorial analysis further distinguishes two interrelated drivers of e-payment adoption:

- (1)

- User perception—trust, satisfaction, loyalty;

- (2)

- System acceptance—ease of use, intention, and infrastructural readiness.

This dual-path structure suggests that technology adoption is no longer a purely cognitive evaluation but is increasingly shaped by affective, behavioral, and contextual factors. These findings align with post-TAM perspectives and underscore the blurring boundaries between technical design and user psychology, particularly in a globally interconnected financial environment.

5.3. Theoretical Contributions and Conceptual Integration

This study makes several key contributions to the theory of digital finance and bibliometric analysis: it demonstrates how topic evolution analysis can track not only emerging technologies but also the integration of once-separate research streams (e.g., TAM × trust × security); it reveals how macro-level trends (e.g., publication growth, institutional expansion) intersect with micro-level conceptual shifts, particularly around user experience and system design; and it confirms the interdisciplinary convergence of behavioral theories and technological innovations, offering a more integrated lens for understanding the complexities of digital transaction systems.

This study contributes to the theory of digital finance by proposing the Convergent Adoption–Trust–Security (CATS) Framework, which synthesizes key findings from the bibliometric and thematic analyses to explain how technological convergence shapes user adoption, trust, and platform security in e-payment ecosystems.

The CATS framework builds upon and extends established adoption theories such as TAM and UTAUT by introducing multi-technology integration, trust mechanisms, and layered security architectures as central constructs. This integrated model helps explain how digital trust (e.g., blockchain transparency), AI-driven personalization, and secure mobile/NFC systems jointly influence user perceptions and technological acceptance. It also recognizes regulatory responsiveness and governance mechanisms as external systemic enablers of sustained adoption.

This framework is directly grounded in empirical findings from Section 4:

Convergent Adoption: Keyword co-occurrence (Table 5, Figure 8) and country–affiliation–keyword linkages (Figure 2) reveal high-frequency and centrality connections among blockchain, AI, NFC, and mobile technologies, highlighting convergence as a structural theme in the research domain.

Adoption Models Enhanced: The top-cited literature (Table 7) shows how traditional models such as TAM and UTAUT are increasingly applied in convergent contexts, emphasizing interoperability, real-time service, and system-level coordination.

Trust Mechanisms: Cluster 2 in Table 5 and centrality measures in Figure 5a,b underscore the importance of trust, privacy, and usability, confirming their role as conceptual bridges in multi-technology systems.

Security Architecture: Co-word networks (Figure 9a,b) and the motor theme quadrant in the thematic map emphasize the integration of security, authentication, biometrics, and blockchain, validating the security pillar of the CATS model.

By embedding these components within a unified theoretical framework, this study offers a novel lens to understand both the evolutionary trajectory of digital finance research and the practical architecture of converged e-payment platforms. The CATS model provides a foundation for future empirical testing and cross-national comparison in fintech ecosystems.

5.4. Practical Implications and Strategic Recommendations

This research offers a practical roadmap for key stakeholders across the fintech ecosystem.

For financial institutions and developers, the integration of blockchain, AI, NFC, and mobile technologies can enhance transaction security, fraud detection, and user experience. Systems emphasizing intuitive design, personalization, and decentralization are more likely to achieve widespread adoption and long-term engagement.

For policymakers and regulators, findings emphasize the need to craft supportive yet protective regulatory frameworks that balance innovation with privacy, security, and consumer protection. Special attention should be given to interoperability standards and digital financial inclusion, especially in underserved populations.

For consumers and educators, the convergence of advanced technologies in finance necessitates greater digital literacy, including awareness of privacy risks, secure usage practices, and the potential of new financial tools. Education and awareness campaigns are essential to bridging the digital divide.

For global strategy planners, understanding institutional research focus (e.g., blockchain in China, e-commerce trust in the U.S.) can inform strategic alliances, regulatory alignment, or market entry planning in different regions. In this context, it is important to recognize that while blockchain and decentralized systems are gaining traction, legacy infrastructures like SWIFT (Society for Worldwide Interbank Financial Telecommunications) continue to serve as the global backbone for secure cross-border messaging. Since the 1970s, SWIFT has connected over 11,000 financial institutions across more than 200 countries, playing a foundational role in international payment interoperability. As geopolitical events and digital innovation reshape financial networks, SWIFT’s coexistence with emerging blockchain-based solutions reflects the hybrid nature of the evolving global e-payment landscape. Notably, the exclusion of certain Russian banks from SWIFT following the Ukraine conflict highlights the geopolitical leverage of such centralized systems, underscoring the need for resilience, redundancy, and interoperable alternatives in future digital payment architectures. Although next-generation systems, such as RippleNet, central bank digital currencies (CBDCs), and blockchain-based settlement layers, are designed to enable decentralized cross-border transactions, most current infrastructures operate in parallel with, or as complementary frameworks to, SWIFT. This evolving hybridization represents a pragmatic transition, wherein SWIFT remains a trusted, globally adopted messaging layer, while newer technologies enhance flexibility, speed, and inclusiveness within modern e-payment ecosystems.

5.5. Limitations and Future Research

While this study provides a comprehensive scientometric overview, several limitations must be acknowledged: (1) Data source limitations: The analysis is based solely on Web of Science data, which may omit important regional or industry research (e.g., patents, internal white papers). (2) Methodological constraints: Static co-citation and co-occurrence analyses do not fully capture temporal topic dynamics. Future studies could incorporate dynamic topic modeling (DTM) or temporal BERTopic for greater granularity. (3) Cultural and contextual variability: Cross-regional differences in adoption behavior, regulatory culture, and infrastructure were not explicitly modeled but are critical for nuanced understanding. Future work should compare regional evolution trajectories in Asia, Europe, and the Global South.

5.6. Conclusions

This study explores the convergence of blockchain, AI, NFC, and mobile technologies in e-payment systems through a robust combination of descriptive, network, and evolutionary scientometric analyses. It identifies the conceptual transition from isolated technological innovations to an integrated, sociotechnical ecosystem—with trust, security, and usability as core pillars.

The findings reveal that blockchain, artificial intelligence (AI), mobile platforms, and contactless interfaces (e.g., NFC) have emerged as dominant, interlinked themes within the e-payment literature. Thematic evolution maps and keyword co-occurrence networks show that these technologies increasingly co-appear and form core “motor themes,” underscoring their centrality in driving the digital transformation of payment systems.

This study highlights several opportunities: improved transaction security through decentralized systems, predictive fraud detection via AI, and enhanced user convenience through seamless mobile interfaces. However, these benefits are accompanied by critical challenges—such as the lack of interoperability across systems, data privacy risks, regulatory misalignment, and the potential widening of the digital divide. These insights are supported by the convergence of theoretical models emphasizing trust, security, and risk perception in e-payment adoption.

By integrating both macro-level patterns and micro-level conceptual linkages, this study contributes to theoretical development, practical design strategies, and policy formulation in the digital finance domain. It also highlights challenges such as interoperability, regulatory harmonization, and digital exclusion, calling for multi-disciplinary collaboration among technologists, economists, and institutional actors to co-create an inclusive, secure, and user-centered digital finance future.

Author Contributions

Conceptualization, K.-K.L. and P.C.B.; methodology, P.C.B.; software, P.C.B.; validation, K.-K.L., Y.-C.H., and V.A.D.; formal analysis, P.C.B.; data curation, P.C.B. and V.A.D.; writing—original draft preparation, P.C.B.; writ-ing—review and editing, Y.-C.H.; visualization, P.C.B. and V.A.D.; supervision, K.-K.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The bibliographic data used in this study were retrieved from the Web of Science (WoS) database, which is a sub-scription-based and not publicly available source. Data analysis was conducted using the Bibliometrix R package (version 4.2.1). This study did not generate any new data. Due to license restrictions, the raw dataset cannot be shared publicly.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Dogan, O.; Karacan, H. A Blockchain-Based E-Commerce Reputation System Built With Verifiable Credentials. IEEE Access 2023, 11, 47080–47097. [Google Scholar] [CrossRef]

- Roh, T.; Park, B.I.; Xiao, S. Adoption of AI-Enabled robo-advisors In Fintech: Simultaneous employment of UTAUT and the theory of reasoned action. J. Electron. Commer. Res. 2023, 24, 29–47. [Google Scholar]

- Sleiman, K.A.A.; Lan, J.; Lei, H.Z.; Rong, W.; Wang, B.; Li, S.; Cheng, J.; Amin, F. Factors that impacted mobile-payment adoption in China during the COVID-19 pandemic. Heliyon 2023, 9, e16197. [Google Scholar] [CrossRef] [PubMed]

- Al-Qudah, A.A.; Al-Okaily, M.; Alqudah, G.; Ghazlat, A. Mobile payment adoption in the time of the COVID-19 pandemic. Electron. Commer. Res. 2022, 24, 427–451. [Google Scholar] [CrossRef]

- Haddad, C.; Hornuf, L. The emergence of the global fintech market: Economic and technological determinants. Small Bus. Econ. 2019, 53, 81–105. [Google Scholar] [CrossRef]

- Neelam, S.; Bhattacharya, S. The Role of Mobile Payment Apps in Inclusive Financial Growth. Australas. Account. Bus. Financ. J. 2023, 17, 9–31. [Google Scholar] [CrossRef]

- Omarini, A.E. Fintech and the future of the payment landscape: The mobile wallet ecosystem. A challenge for retail banks? Int. J. Financ. Res. 2018, 9, 97–116. [Google Scholar] [CrossRef]

- Jocevski, M.; Ghezzi, A.; Arvidsson, N. Exploring the growth challenge of mobile payment platforms: A business model perspective. Electron. Commer. Res. Appl. 2020, 40, 100908. [Google Scholar] [CrossRef]

- Liu, J.; Kauffman, R.J.; Ma, D. Competition, cooperation, and regulation: Understanding the evolution of the mobile payments technology ecosystem. Electron. Commer. Res. Appl. 2015, 14, 372–391. [Google Scholar] [CrossRef]

- Hillberry, R.; Mahlstein, K.; Schropp, S. The geography of payment activity on PayPal. Rev. Int. Econ. 2023, 31, 1688–1718. [Google Scholar] [CrossRef]

- Weiss, K. Mobile payments, digital wallets and tunnel vision. Biom. Technol. Today 2011, 2011, 8–9. [Google Scholar] [CrossRef]

- Ilieva, G.; Yankova, T.; Dzhabarova, Y.; Ruseva, M.; Angelov, D.; Klisarova-Belcheva, S. Customer Attitude Toward Digital Wallet Services. Systems 2023, 11, 185. [Google Scholar] [CrossRef]

- Jegerson, D.; Hussain, M. A framework for measuring the adoption factors in digital mobile payments in the COVID-19 era. Int. J. Pervasive Comput. Commun. 2023, 19, 596–623. [Google Scholar] [CrossRef]

- Ou, C.M.; Ou, C.R. Non-Repudiation Mechanism of Agent-Based Mobile Payment Systems: Perspectives on Wireless PKI; Springer: Berlin/Heidelberg, Germany, 2007; pp. 298–307. [Google Scholar]

- Das, D.N.; Chattopadhyay, S. Academic performance indicators: Straitjacketing higher education. Econ. Political Wkly. 2014, 49, 68–71. [Google Scholar]

- Harb, H.; Farahat, H.; Ezz, M. SecureSMSPay: Secure SMS mobile payment model. In Proceedings of the 2008 2nd International Conference on Anti-Counterfeiting, Security and Identification, Guiyang, China, 20–23 August 2008; pp. 11–17. [Google Scholar]

- Masamila, B.; Mtenzi, F.; Said, J.; Tinabo, R. A Secured Mobile Payment Model for Developing Markets; Springer: Berlin/Heidelberg, Germany, 2010; pp. 175–182. [Google Scholar]

- Adams, T.L.; Taricani, E.; Pitasi, A. The technological convergence innovation. Int. Rev. Sociol. 2018, 28, 403–418. [Google Scholar] [CrossRef]

- Lei, D.T. Industry evolution and competence development: The imperatives of technological convergence. Int. J. Technol. Manag. 2000, 19, 699–738. [Google Scholar] [CrossRef]

- Baldwin, C.Y.; Clark, K.B. Design Rules, Volume 1: The Power of Modularity; MIT Press: Cambridge, MA, USA, 2000. [Google Scholar]

- Daim, T.U.; Rueda, G.; Martin, H.; Gerdsri, P. Forecasting emerging technologies: Use of bibliometrics and patent analysis. Technol. Forecast. Soc. Change 2006, 73, 981–1012. [Google Scholar] [CrossRef]

- Al-Dala’in, T.; Luo, S.; Summons, P.; Colyvas, K. Evaluating the utilisation of mobile devices in online payments from the consumer perspective. J. Converg. Inf. Technol. 2010, 5, 7–16. [Google Scholar]

- Ioannidis, J.P.A.; Boyack, K.W.; Small, H.; Sorensen, A.A.; Klavans, R. Bibliometrics: Is your most cited work your best? Nature 2014, 514, 561–562. [Google Scholar] [CrossRef]

- Ngai, E.W.; Wat, F. A literature review and classification of electronic commerce research. Inf. Manag. 2002, 39, 415–429. [Google Scholar] [CrossRef]

- Motwani¹, K.; Choubey, S.; Saxena, A.; Patni, I. Understanding Mobile Payment Continuance: A Bibliometric Analysis and Systematic Review. J. Syst. Manag. Sci. 2024, 14, 22–42. [Google Scholar]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Riggins, F.J.; Wamba, S.F. Research directions on the adoption, usage, and impact of the internet of things through the use of big data analytics. In Proceedings of the 2015 48th Hawaii International Conference on System Sciences, Kauai, HI, USA, 5–8 January 2015; pp. 1531–1540. [Google Scholar]

- Pavlou, P.A. Consumer acceptance of electronic commerce: Integrating trust and risk with the technology acceptance model. Int. J. Electron. Commer. 2003, 7, 101–134. [Google Scholar]

- Gefen, D.; Karahanna, E.; Straub, D.W. Trust and TAM in online shopping: An integrated model. MIS Q. 2003, 27, 51–90. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of continuance intention of mobile payment services. Decis. Support Syst. 2013, 54, 1085–1091. [Google Scholar] [CrossRef]

- Belanger, F.; Hiller, J.S.; Smith, W.J. Trustworthiness in electronic commerce: The role of privacy, security, and site attributes. J. Strateg. Inf. Syst. 2002, 11, 245–270. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Stallings, W. Network Security Essentials: Applications and Standards; Pearson: London, UK, 2016. [Google Scholar]

- Gans, J.S. Some Simple Economics of the Blockchain; NBER Working Paper No. 22952; National Bureau of Economic Research: Cambridge, MA, USA, 2016; Available online: https://www.nber.org/papers/w22952 (accessed on 27 June 2025).

- Ajzen, I. The theory of planned behavior. Organizational Behavior and Human Decision Processes 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory: 2d Ed. McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- McKnight, D.H.; Chervany, N.L. What trust means in e-commerce customer relationships: An interdisciplinary conceptual typology. Int. J. Electron. Commer. 2001, 6, 35–59. [Google Scholar] [CrossRef]

- Mayer, R. An Integrative Model of Organizational Trust. Acad. Manag. Rev. 1995.

- Taylor, S.; Todd, P.A. Understanding information technology usage: A test of competing models. Inf. Syst. Res. 1995, 6, 144–176. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. A Bayesian analysis of attribution processes. Psychol. Bull. 1975, 82, 261. [Google Scholar] [CrossRef]

- Rogers, E.M. Lessons for guidelines from the diffusion of innovations. Jt. Comm. J. Qual. Improv. 1995, 21, 324–328. [Google Scholar] [CrossRef] [PubMed]

- Hair, J.F., Jr.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate data analysis. Multivar. Data Anal. 2010, 785. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. In New challenges to international marketing; Emerald Group Publishing Limited: Bradford, UK, 2009; pp. 277–319. [Google Scholar]

- Dahlberg, T.; Mallat, N.; Ondrus, J.; Zmijewska, A. Past, present and future of mobile payments research: A literature review. Electron. Commer. Res. Appl. 2008, 7, 165–181. [Google Scholar] [CrossRef]

- Khalilzadeh, J.; Ozturk, A.B.; Bilgihan, A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 2017, 70, 460–474. [Google Scholar] [CrossRef]

- Iacovou, C.L.; Benbasat, I.; Dexter, A.S. Electronic Data Interchange and Small Organizations: Adoption and Impact of Technology. MIS Q. 1995, 19, 465. [Google Scholar] [CrossRef]

- Kim, C.; Mirusmonov, M.; Lee, I. An empirical examination of factors influencing the intention to use mobile payment. Comput. Hum. Behav. 2010, 26, 310–322. [Google Scholar] [CrossRef]

- Schierz, P.G.; Schilke, O.; Wirtz, B.W. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electron. Commer. Res. Appl. 2010, 9, 209–216. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Grandon, E.E.; Pearson, J.M. Electronic Commerce Adoption: An Empirical Study of Small and Medium US Businesses. Inf. Manag. 2004, 42, 197–216. [Google Scholar] [CrossRef]

- Mallat, N. Exploring consumer adoption of mobile payments: A qualitative study. J. Strateg. Inf. Syst. 2007, 16, 413–432. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the International Institute of Knowledge Innovation and Invention. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).