Investigating the Factors Which Determine the Adoption of Mobile Banking Apps by Youth: The Case of Kuwait and Serbia †

Abstract

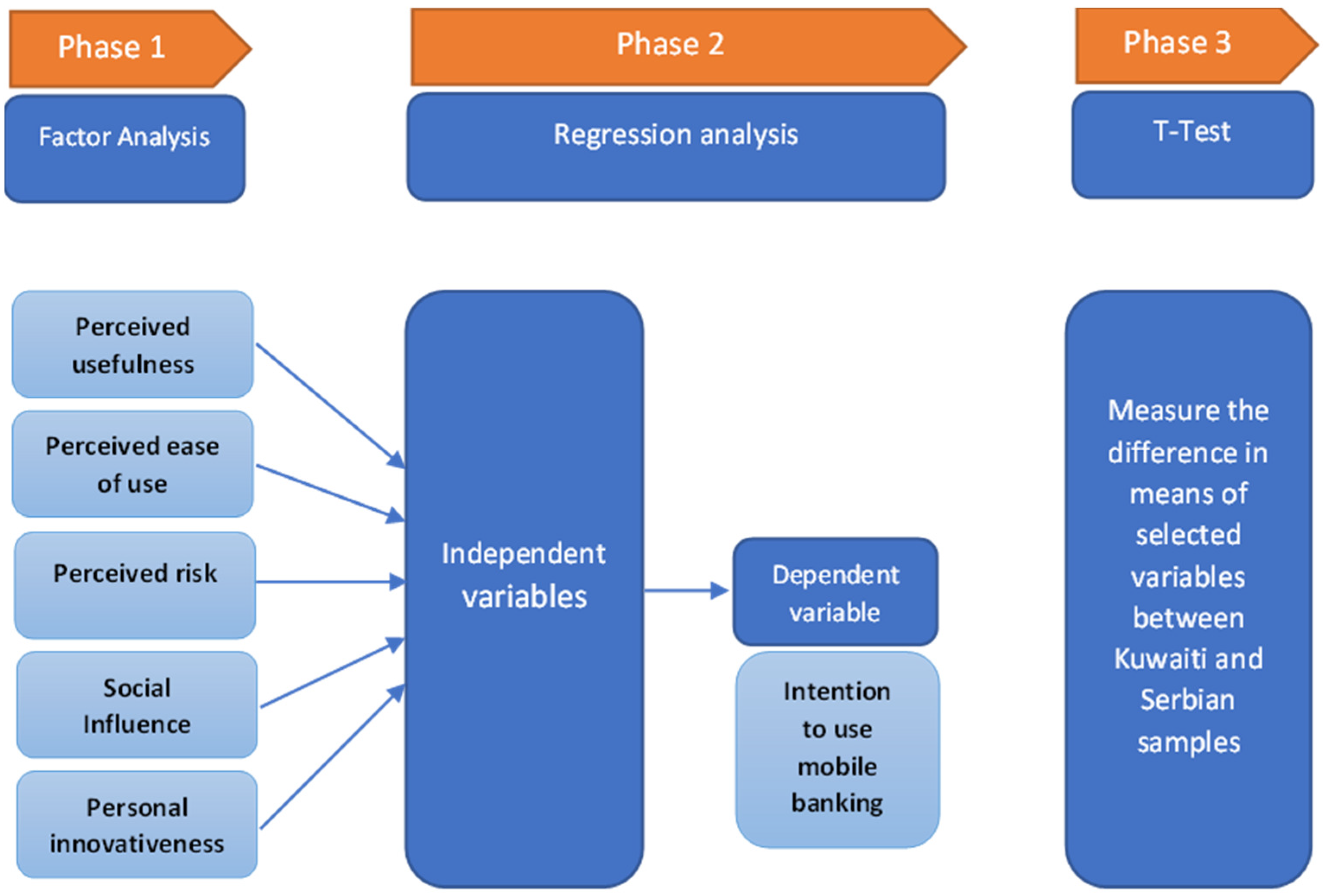

1. Objectives

- To determine which of the proposed adoption factors by the literature represent, and to what extent, are the main predictors of the intention to use mobile banking applications by the youth. These factors are: the perceived ease of use, the perceived usefulness, the personal innovativeness, the perceived risk, and social influence [1,2,3,4,5,6,7,8].

- To compare the key predictors of the adoption of mobile banking by the youth in Kuwait and Serbia.

2. Methodology

3. Results

4. Implications

5. Originality-Value

6. Contribution

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lukić, V.; Čolić, L.; Prica, I. Perspectives and adoption of mobile banking in Serbia: The case of young adults. Ekon. Preduzeća 2019, 67, 334–344. [Google Scholar] [CrossRef]

- Goh, T.T.; Sun, S. Exploring gender differences in Islamic mobile banking acceptance. Electron. Commer. Res. 2014, 14, 435–458. [Google Scholar] [CrossRef]

- Saprikis, V.; Markos, A.; Zarmpou, T.; Vlachopoulou, M. Mobile shopping consumers’ behavior: An exploratory study and review. J. Theor. Appl. Electron. Commer. Res. 2018, 13, 71–90. [Google Scholar] [CrossRef]

- Avornyo, P.; Fang, J.; Odai, R.O.; Vondee, J.B.; Nartey, M.N. Factors Affecting Continuous Usage Intention of Mobile Banking in Tema and Kumasi. Int. J. Bus. Soc. Sci. 2019, 10, 114–130. [Google Scholar] [CrossRef]

- Antonijević, M.; Ivanović, Đ.; Simović, V. Adoption of mobile banking in the Republic of Serbia. In International Monograph “New Models, Structures and Markets in Finance, Innovation and Technology”; Institute of Economics: Skopje, North Macedonia, 2021; pp. 76–96. ISBN 978-608-4519-23-2. [Google Scholar]

- Lai, P. The literature review of technology adoption models and theories for the novelty technology. J. Inf. Syst. Technol. Manag. 2017, 14, 21–38. [Google Scholar] [CrossRef]

- Al-Jabri, I.M. The intention to use mobile banking: Further evidence from Saudi Arabia. S. Afr. J. Bus. Manag. 2015, 46, 23–34. [Google Scholar] [CrossRef]

- Farah, M.F.; Hasni, M.J.S.; Abbas, A.K. Mobile-banking adoption: Empirical evidence from the banking sector in Pakistan. Int. J. Bank Mark. 2018, 36, 1386–1413. [Google Scholar] [CrossRef]

- Rabaa’i, A.; AlMaati, S. Exploring the determinants of users’ continuance intention to use mobile banking services in Kuwait: Extending the expectation-confirmation model. Asia Pac. J. Inf. Syst. 2021, 31, 141–184. [Google Scholar] [CrossRef]

| Kuwait | Serbia | Independent Samples T-Test | |

|---|---|---|---|

| Heard about M-Banking | Yes = 88.2% No = 7.8% | Yes = 100% No = 0% | |

| Use M-Banking | Yes = 78.4% No = 21.6% | Yes = 74.2% No =25.8% | |

| Perceived Usefulness (5 = Agree, 1 = Disagree) | M = 3.95 SD = 0.44 | M = 3.90 SD = 0.54 | t(17) = 0.212, p = 0.835 |

| Ease of Use (5 = Agree, 1 = Disagree) | M = 3.75 SD = 0.79 | M = 3.95 SD = 0.76 | t(17) = −0.554, p = 0.587 |

| Risk (5 = High risk, 1 = Low Risk) | M = 3.49 SD = 0.88 | M = 2.85 SD = 1.42 | t(17) = 1.212, p = 0.242 |

| Social Influence (5 = High, 1 = Low) | M = 2.93 SD = 0.76 | M = 3.12 SD = 1.30 | t(17) = −0.407, p = 0.689 |

| Personal Innovativeness (5 = High, 1 = Low) | M = 3.34 SD = 0.77 | M = 3.56 SD = 1.41 | t(17) = −0.441, p = 0.665 |

| Environmental Awareness (5 = High, 1 = Low) | M = 3.91 SD = 1.07 | M = 4.25 SD = 0.97 | t(17) = −0.707, p = 0.489 |

| Attitudes towards M-Banking (5 = Positive, 1 = Negative) | M = 3.50 SD = 0.79 | M = 4.09 SD = 1.02 | t(17) = −1.421, p = 0.173 |

| Intention to use M-Banking (5 = High, 1 = Low) | M = 3.61 SD = 0.77 | M = 4.09 SD = 1.18 | t(17) = −1.068, p = 0.300 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Theofanidis, F.; Rahat, M. Investigating the Factors Which Determine the Adoption of Mobile Banking Apps by Youth: The Case of Kuwait and Serbia. Proceedings 2023, 85, 31. https://doi.org/10.3390/proceedings2023085031

Theofanidis F, Rahat M. Investigating the Factors Which Determine the Adoption of Mobile Banking Apps by Youth: The Case of Kuwait and Serbia. Proceedings. 2023; 85(1):31. https://doi.org/10.3390/proceedings2023085031

Chicago/Turabian StyleTheofanidis, Faidon, and Massouma Rahat. 2023. "Investigating the Factors Which Determine the Adoption of Mobile Banking Apps by Youth: The Case of Kuwait and Serbia" Proceedings 85, no. 1: 31. https://doi.org/10.3390/proceedings2023085031

APA StyleTheofanidis, F., & Rahat, M. (2023). Investigating the Factors Which Determine the Adoption of Mobile Banking Apps by Youth: The Case of Kuwait and Serbia. Proceedings, 85(1), 31. https://doi.org/10.3390/proceedings2023085031