1. Introduction

In today’s society, almost all human activities are inseparable from the help of technology, including the financial sector. Financial technology seeks to make it easier for humans to meet increasing needs, faster human mobilization, and ever-increasing human activity. Financial technology, often abbreviated as fintech, is an innovation from the financial services industry that utilizes technology. Fintech companies provide services that combine financial services with technology that can make it easier for consumers to access various financial services efficiently and financially. This is because fintech services only require internet. Various financial activities, such as fund transfers and payments to borrowing funds, can be undertaken more easily because of the existence of fintech. The business model offered by fintech is prospective with the value of flexibility, security, and efficiency. Of course, not many people believe in this technology because there are still many people who are unfamiliar with financial literacy and doubt the security of fintech. However, in 2015 an association called the Indonesian Fintech Association (AFI) was established. The emergence of AFI had a good impact on the development of fintech in Indonesia. This is evidenced by the number of fintech companies in Indonesia, which has increased by 78% during the period 2006–2017. Public doubts about this financial service have started to decrease since the financial services authority (OJK) requires all financial service institutions to register their companies in order to obtain permits. Fintech companies must also follow the applicable regulations and provisions from the OJK. If there is a violation, the OJK has the authority to revoke operational licenses and impose sanctions in accordance with OJK regulations.

After gaining the trust of customers, a company must then prepare a strategy so that customers remain loyal and satisfied. The role the customer plays in a company is vital. By having customer loyalty, the level of customer retention will tend to be higher. Customer loyalty and customer relationships will survive if the company provides the best service without compromising the quality of the services or products offered. With customer service, companies can interact directly with customers to make it easier for customers to obtain information about the problems they are experiencing or submit complaints for future company evaluations. For this reason, one of the things to focus on in future business development is how the company can further empower the customer service aspect.

The quality of good customer service is based on services that meet customer needs and can provide information quickly and accurately. Providing friendly service is also a parameter of quality service. Problems that often become obstacles in customer service are repeated questions from customers and the inability to serve customers at any time due to time constraints. Inconsistent provision of information and feedback across various customer service channels can have an impact on the quality of online customer service and on customer relationships. As a result, these problems can affect customer satisfaction which may then have an impact on customer loyalty.

The solution to this problem is the use of artificial intelligence. Artificial intelligence itself is information that is processed in a computer system that can understand, correct, and have the power of thinking like humans. Artificial intelligence that can often be found in all lines of business in customer service is a chatbot. Almost all business industries have created their own chatbots to communicate with customers. Chatbots are used in enterprise customer service because they can answer repeated customer questions to reduce customer service time and increase customer satisfaction, because the service is available 24 h and can respond to customers with consistent answers. Chatbots can also help companies cut human resource costs, as they can handle several customers at the same time. By using natural language processing (NLP) techniques, chatbots can understand or interpret user input. NLP collects information about the behavior of humans. NLP generally requires a machine learning approach to build models that contain language understanding.

PT. FinAccel Finance Indonesia use AI chatbots to optimize services. This company is one of the big players in the financing industry sector and they are the parent of Kredivo. Kredivo offers instant credit solution services for the people of Indonesia. As a company engaged in the financial sector, of course, customer requests can occur at indefinite times. Kredivo itself is noted to have various forms of customer service that can be utilized by its users, such as social media sites including Facebook, Instagram, and Twitter, email, live chat, and telephone. However, this service only operates according to operating hours; if users have problems or questions outside of the operating hours, it will be difficult to obtain information from customer service agents. Submission of information is generally a conversation between users and customer service agents; however, the delivery of information becomes less effective for users who want to obtain information quickly without waiting in line. Due to a high number of incoming calls or messages and the limitations of customer service agents, this can become an obstacle for users and customer service agents. As Kredivo users increase from year to year, Kredivo decided to use artificial intelligence in the form of a chatbot called “Dina Kredivo”. The existence of chatbots has helped support customer service that is no less relevant and much faster than humans. The aim of this study is to determine how chatbots are implemented at PT. FinAccel Finance Indonesia to optimize customer service, and to uncover customer service procedures at PT. FinAccel Finance Indonesia.

2. Literature Review

2.1. Definition of Artificial Intelligence

Artificial intelligence is a computer system that can perform tasks normally performed by humans. This technology can make decisions through analysis and use of data from a system. This process is similar to the process that humans go through before making a decision. More broadly, artificial intelligence has several definitions according to experts, including: artificial intelligence is creating a tool or machine that can think like humans [

1]; artificial intelligence (AI) is the embodiment of a machine that shows aspects of human intelligence and continues to be used in services and is a source of today’s innovation [

2].

2.2. Definition of a Chatbot

A chatbot is a form of artificial intelligence with natural language processing abilities, which makes it an intelligent computer program that can answer questions given by humans. Chatbots can convey information according to the knowledge that has been given previously. Chatbots are built to help humans in the field of customer service using data that is already available. In a chatbot, a knowledge model is implanted to answer questions according to the keywords that have been compiled. Chatbots are computer programs that simulate human conversations through artificial intelligence. It allows machines to interact with humans in a closed domain through written text or voice interaction, with or without the help of other humans [

3].

2.3. Definition of Nature Language Processing

Natural language processing is a branch of science from artificial intelligence that is able to study communication between humans and computers through natural language. The processing stage is to identify the intent, process the input, and display the results according to the input.

2.4. Understanding Customer Service

Customer service is a variety of activities in all business areas that seek to combine ordering, processing, to providing service results through communication to strengthen cooperation with consumers [

4].

2.5. Definition of Excellent Service

Excellent service, or service excellence, is based on the efforts of businesspeople to provide the best service as a form of the company’s concern for customers/consumers. In other words, excellent service is a service that meets predetermined quality standards [

5].

Based on the explanation above, it can be concluded that service excellence is the best service provided by the organization/company to meet the expectations and needs of customers to create satisfaction and loyalty to the company.

2.6. History of PT. FinAccel Finance Indonesia

PT. FinAccel Finance Indonesia was originally founded in 2016 by Akshay Garg, CEO and co-founder of Kredivo and founder of the advertising technology company Komli, former McKinsey consultant Umang Rustagi, and Alie Tan, who has previously overseen a number of start-ups. This company is engaged in financing or other services. Previously, this company was named PT Swarna Niaga Finance, but it changed its name on 22 September 2020 to PT. FinAccel Finance Indonesia through a decree of the Board of Commissioners of the Financial Services Authority with the number KEP-257/NB.11/2020. The Board of Commissioners of the Financial Services Authority granted the enforcement of business licenses in the field of financing companies in connection with the change in name from PT Swarna Niaga Finance to PT. FinAccel Finance Indonesia. The enactment of this business license is effective as of the date of the issuance mentioned above. The following is

Figure 1 which describe the appearance of Kredivo logo.

PT. FinAccel Finance Indonesia, in carrying out its business activities, must implement healthy business practices and always refer to the applicable laws and regulations. PT. FinAccel Finance Indonesia has collaborated with leading investors, such as Square Peg, Mirae Asset, NAVER, Jungle Ventures, GMO Internet, Singtel Innov8, Telkomsel Indonesia (TMI), Cathay Innovation, and Kejora-InterVest.

Kredivo users can ‘buy now and pay later’ with one of the lowest interest rates among digital credit providers in Indonesia. Kredivo’s trading partners benefit from instant point-of-sale financing, backed by unique two-click payments. With nearly four million current users, and collaborations with eight of the 10 leading e-commerce platforms in Indonesia, Kredivo is the largest and fastest growing buy now, pay later (BNPL) platform in Indonesia to date, with plans to expand into regional markets such as Vietnam and Thailand in the near future. Kredivo caters to the fast-growing middle class in Indonesia and the credit application and approval process can be completed in just two minutes. In January 2021, FinAccel announced an overhaul of its management structure which will be effective in January 4th. Umang Rustagi, who previously served as Deputy Chief Executive Officer (CEO) of FinAccel, has assumed the position of CEO of Kredivo. At the C-level, Umang will collaborate with Valery Crottaz as Chief Operating Officer (COO) and Paramananda Setyawan as Chief Data Officer (CDO). In addition, Alie Tan as Chief Technology Officer (CTO) of the FinAccel group will serve as CEO of KrediFazz, a new business unit operating as a P2P lending fintech company under FinAccel. Akshay Garg, who currently serves as CEO of Kredivo, will take on new responsibilities as Group CEO of FinAccel, which will oversee its two business units, Kredivo and KrediFazz. Kredivo and KrediFazz focus on expanding the business scale while the FinAccel group can continue to move and explore various innovations in other areas.

2.7. Products PT. FinAccel Finance Indonesia

Kredivo

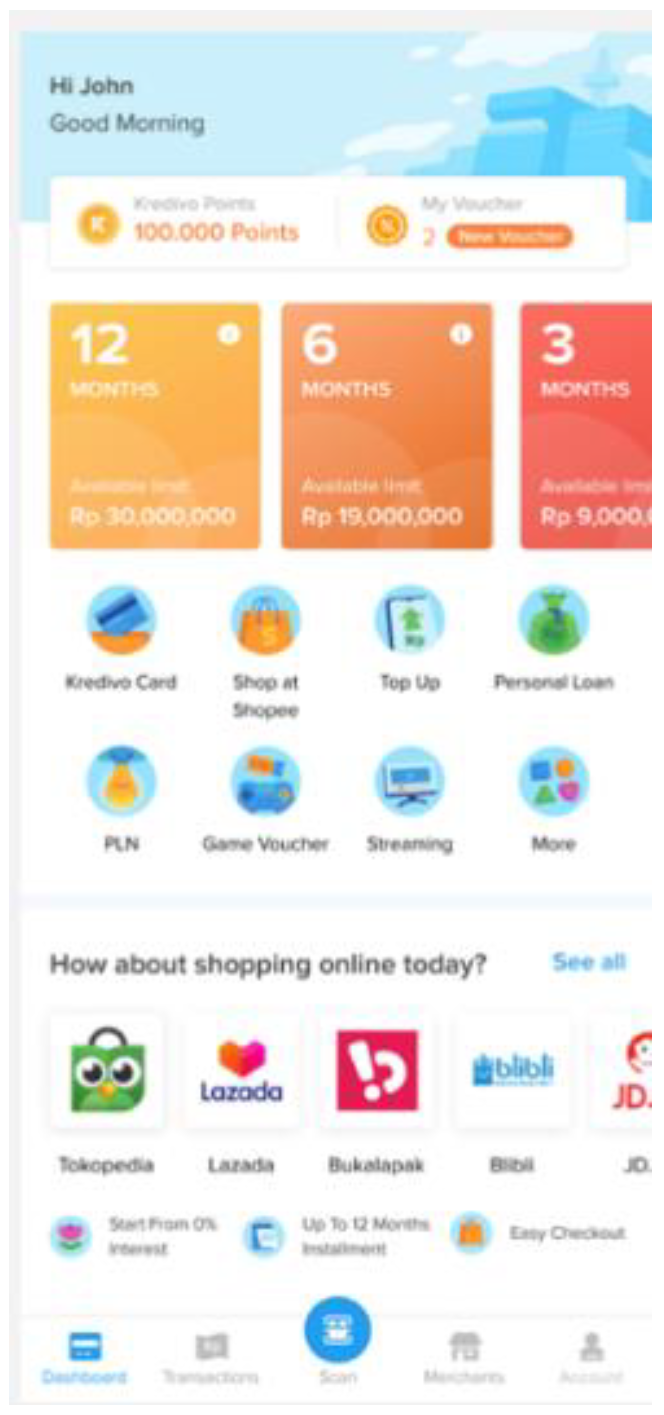

The following is

Figure 2 which describe the appearance of Kredivo products on website.

Kredivo provides customers with instant credit financing for ecommerce purchases and personal loans based on real-time decisions. They offer customers the opportunity to buy now and pay later, or to borrow at the lowest interest rates among all digital lenders in the country. For ecommerce merchants, Kredivo enables instant point of sale (PoS) financing with a unique and simple two-click purchase option that makes purchasing easy. The following is

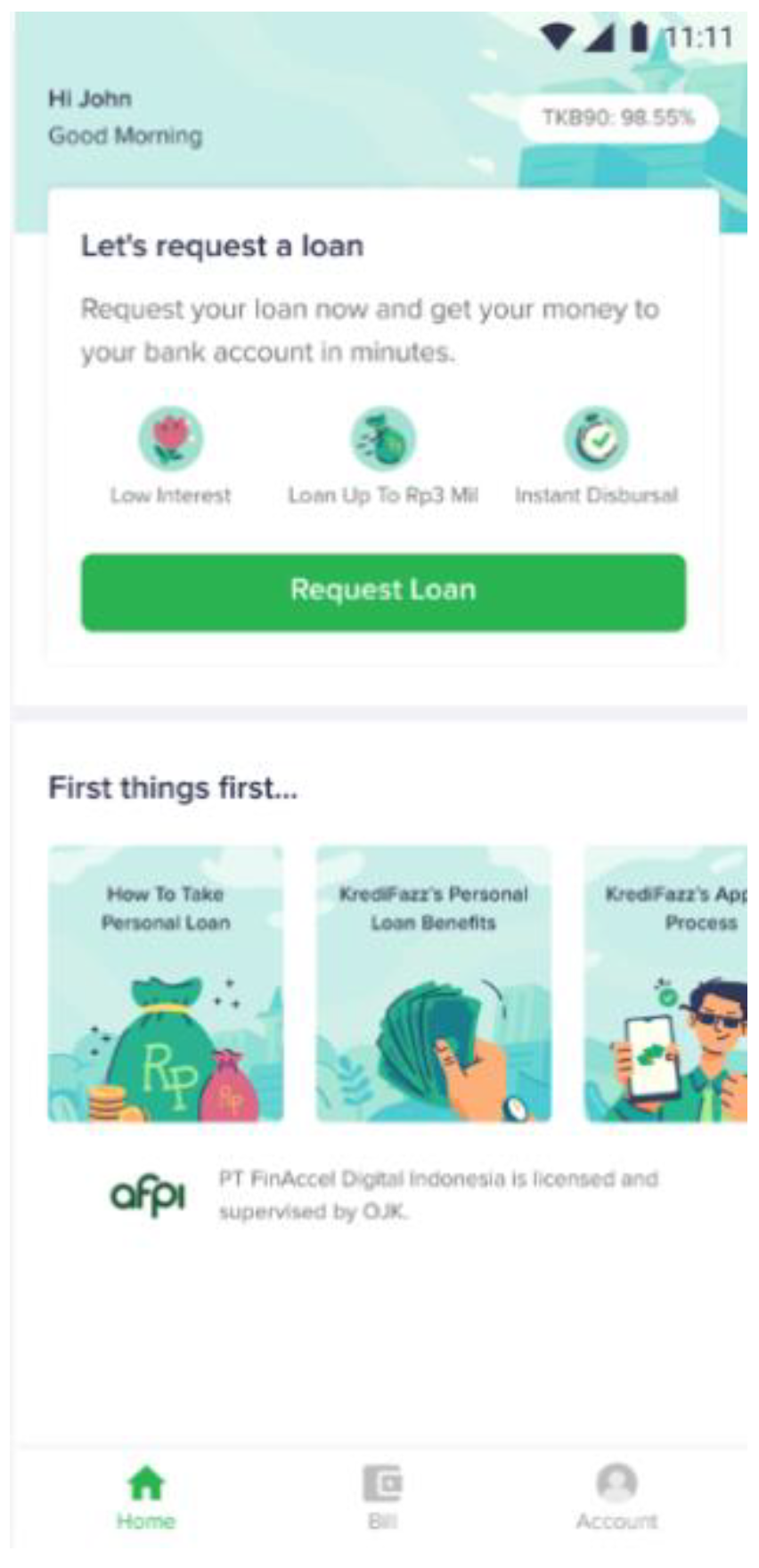

Figure 3 which describes the appearance of KrediFazz on website.

KrediFazz

With lower interest rates than other similar service providers, KrediFazz offers customers the benefit of instant cash loans in a fast and easy way.

2.8. Process Flow of Consumer Complaint Handling and Resolution

The department responsible for receiving complaints is customer services (CS), including providing information about products or services provided by PT. FinAccel Finance Indonesia or Kredivo (the “company”).

- ➢

Complaint media (phone, email, chat, and social media)

The following is a list of official Kredivo websites, social media accounts, and customer service numbers:

- ➢

Complaint handling

- ➢

Complaint handling time

Verbal complaints will be resolved within five working days, but in the event that the company requires supporting documents for the complaints submitted by the consumers and/or consumer representatives verbally, the company may request the consumers and/or consumer representatives to submit a written complaint and necessary supporting documents. Written complaints will be completed within 20 working days and can be extended by 20 working days under certain conditions.

- ➢

Complaints completed

Service operation time

Day: every day including Saturday, Sunday, and national holidays. Operating hours: 08.00–20.00 WIB.

2.9. Implementation of AI chatbot in PT. FinAccel Finance Indonesia Customer Service

In 2020, Kredivo created a chatbot, also known as AR (auto responder). The chatbot created was given a nickname, Dina Kredivo, who was present to respond to questions and complaints from Kredivo customers. This chatbot was created after a thorough consideration process carried out by the data science team as part of the chatbot development team. They researched several products from other vendors before deciding to create their own chatbot, as the data science team is optimistic that they can create a better and more flexible chatbot.

Initially, the bot created by Kredivo’s internal team was channeled to the email service first. Then, a year later in 2021, the Kredivo internal team decided to use a chatbot (or auto responder) for live chat services after believing that the chatbot created by Kredivo’s internal team was satisfactory. The use of an auto responder as AI is currently available in various customer service lines, including email, live chat, and Google play.

The existence of this chatbot is the answer to the problems that often occur in conventional customer service. These problems include traffic or long queues of customers on social media, slow response times, limited number of participating agents, and operational expenditures. In addition, the type of information that customers want to know is often general and repetitive. As a result, the data science and customer service teams had the idea to automate responses to these problems into a service that can make it easier for customers [

6].

The effectiveness of chatbots to help optimize customer service is very satisfying both in terms of quantity and quality. A total of 30% of the chats that enter the system are successfully completed by the chatbot. This is a fairly large number, as the live chat service is dynamic and users can ask questions several times directly to the agent. If the user is not satisfied with the answer from the bot, then they will directly connect with an agent.

3. Method

The method used is a quantitative method in the form of a SWOT Analysis.

3.1. Strength

- 1

The application of chatbots in customer service facilitates the complaint process where the chatbot can provide services at any time, 24/7 (auto response). Service at any time can increase customer satisfaction.

- 2

Customer service chatbots have the ability to respond to customer inquiries more quickly. Customers can also receive answers to their questions faster without having to wait for a reply during operating hours.

- 3

Companies can save the cost of human resources (HR). Chatbots help reduce business costs. Chatbots serve more customers at a reduced cost.

- 4

Customers can access the business at any time using a chatbot connected to a chat service. It also extends the reach to customers by interacting with multiple consumers at once, anytime, anywhere.

- 5

Easier interactions with consumers which can foster good attachments. This is one of the advantages of chatbots. Interaction with consumers is also easier. Consumers will be more comfortable shopping because their questions about the product will be answered quickly. It can feel like buying directly at an offline store or like talking to the shop owner directly.

- 6

Minimize errors caused by humans.

3.2. Weaknesses

- 1

Reducing the customer service role

Jobs in this field, which are usually performed by humans, would inevitably become redundant as this technique developed, and humans gradually become replaced by robots.

- 2

Cannot answer all complaints

In running a business, there are problems that befall consumers that demand accountability. Unfortunately, chatbots may not be able to meet all consumer demands, and therefore may not result in customer satisfaction.

- 3

Not yet known to the wider community

Not all Kredivo users understand how chatbots work, so customers often ask questions in an inappropriate format (typo, non-standard language, abbreviated language) so that the answers given by chatbots are often inappropriate. This is because some users are still unfamiliar with chatbot performance.

3.3. Opportunity

- (1)

Trends in the use of digital conversations that continue to develop along with technological developments

- (2)

Investment in the company’s operations in the long term

- (3)

Can accelerate customer satisfaction

- (4)

Increase chatbot usage

- (5)

The existence of service personalization

- (6)

Increasing the standard of living of the urban community

- (7)

The needs of society demand everything to be faster and more sophisticated

3.4. Threats

- 1

The level of technology acceptance of artificial intelligence is still low. Technology acceptance in developing countries has not been evenly distributed. There are still many people who are skeptical of technological assistance [

7].

- 2

Many other developers are developing chatbots, which may result in more sophisticated technology in the future.

- 3

System crash.

Although the chatbot has been designed using sophisticated technology, it does not rule out system disturbances where the chatbot cannot operate smoothly (depends on the system).

4. Obstacle

The obstacles in implementing chatbots are as follows:

- 1

When a new product is launched, there are often long queues, meaning the chatbot will not be able to provide an appropriate answer due to the lack of sample data.

- 2

The process of collecting data samples takes quite a long time, and this must occur before chatbots can understand the intent of the customer’s question.

Solution

- 1

Prior to the launch of a new product, the development team can prepare a template for questions that customers are likely to ask, so that when a new product runs, the chatbot already has a template and can answer customer questions [

8].

- 2

Can develop and train AI using natural language program (NLP) or natural language understanding (NLU), to further enrich AI understanding in equivalent words addressed to customers [

9].

5. Conclusions

This research is based on the previously described discussion regarding the application of artificial intelligence chatbots to optimize customer service at PT. FinAccel Finance Indonesia, and it can be concluded as follows:

- 1

Implementation of artificial intelligence chatbot in optimizing customer service at the financial technology company PT. FinAccel Finance Indonesia has seen favorable results.

- 2

There are two types of customer service utilized within the company PT. FinAccel Finance Indonesia, namely, assisted and automated. The assisted form of customer service is characterized in terms of services performed by agents or people. The difference from automated forms of customer service is the absence of agents or people.

- 3

In its implementation, AI is still assisted by human resources to be able to answer customer questions or complaints.

- 4

PT. FinAccel Finance Indonesia created a chatbot in 2020 called Dina Kredivo as a virtual representative of Kredivo agents.

- 5

The chatbot used by PT. FinAccel Finance Indonesia uses a modeling process and a natural language processing (NLP) approach, which is a technology that makes it easier for AI to understand natural language according to the user’s intent.

5.1. Advantages

- 1

Facilitates the complaint process where the chatbot can provide services at any time

- 2

Has the ability to respond to customer inquiries more quickly

- 3

Helps to reduce company costs

- 4

Helps to reduce the burden on customer services

- 5

Avoids human error

- 6

Interaction with customers is easier

5.2. Deficiency

- 1

Not yet known to the general public

- 2

Marketing has not been maximized

- 3

In the process of implementation, problems can occur in the system, where bugs or errors can occur.

5.3. Suggestion

After the discussion on the implementation of artificial intelligence chatbots in optimizing customer service at the financial technology company PT. FinAccel Finance Indonesia, the suggestions given by the author are:

- 1

Socialization or promotion of chatbots to customers, such as providing broadcast messages or tutorials on how to ask questions properly and correctly through the official customer service website.

- 2

Continue to innovate continuously to develop chatbot technology so as not to lose competitiveness with competitors.

- 3

Periodic performance evaluation is still carried out properly and correctly.

Author Contributions

Conceptualization, M.R. and K.H.M.; methodology, M.R.; software, M.R.; validation, M.R. and K.H.M.; formal analysis, M.R.; investigation, K.H.M.; resources, K.H.M.; data curation, M.R.; writing-original draft preparation, M.R.; writing-review and editing, M.R.; visualization, M.R. and K.H.M.; supervision, M.R.; project administration, M.R.; funding acquisition, M.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable for studies not involving humans or animals.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Goralski, M.A.; Tan, T.K. Artificial Intelligence and Sustainable Development. Int. J. Manag. Educ. 2020, 18, 100330. [Google Scholar] [CrossRef]

- Huang, M.; Rust, R.T. Artificial Intelligence in Service. J. Serv. Res. 2018, 21, 155–172. [Google Scholar] [CrossRef]

- Simon, J.P. Artificial Intelligence: Scope, Players, Markets and Geography. Digit. Policy Regul. Gov. 2019, 21, 208–237. [Google Scholar] [CrossRef]

- Lupiyoadi, H. Manajemen Pemasaran Jasa, 2nd ed.; Penerbit Salemba Empat: Jakarta, Indonesia, 2006. [Google Scholar]

- Rangkuti, F. Customer Care Excellence; Gramedia Pustaka Utama: Jakarta, Indonesia, 2017. [Google Scholar]

- Kusumadewi, S. Artificial Intelligence (Teknik dan Aplikasinya), 1st ed.; Cetakan Pertama; Graha Ilmu: Yogyakarta, Indonesia, 2003. [Google Scholar]

- Piccoli, G.; Lui, T.W.; Grün, B. The Impact of IT-enabled Customer Service Systems on Service Personalization, Customer Service Perceptions, and Hotel Performance. Tour. Manag. 2017, 59, 349–362. [Google Scholar] [CrossRef]

- Prentice, C.; Nguyen, M. Engaging and Retaining Customers with AI and Employee Service. J. Retail. Consum. Serv. 2020, 56, 102186. [Google Scholar] [CrossRef]

- Russel, S.; Norvig, P. Artificial Intelligence: A Modern Approach; CreateSpace Independent Publishing Platform: Scotts Valleyt, CA, USA, 2010. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).