1. Introduction

1.1. Preface

State finances are all rights and obligations of the state that can be valued in currency and everything that can be used as state property in connection with the implementation of these rights and obligations. A state’s finance includes monetary authority and fiscal authority. Fiscal authority includes, among others, the management of state revenues and the management of state expenditures. The management of state finances is directed to achieve the goals of the state. To carry out government functions to achieve state goals, a state budget is prepared. A state budget is the state’s annual financial plan that is approved by the parliament.

The management of state finances is authorized by the Minister of Finance as the fiscal manager. As the fiscal manager, the Minister of Finance prepares the draft of the state budget. In the context of preparing the draft of the state budget, the line ministries compile budget documents that comprise annual financial plan documents. The process of preparing the budget documents is coordinated by the Directorate General of Budget at the Ministry of Finance. Thus, the Directorate General of Budget has authority over the function of state budgeting. Budgeting can be interpreted as a process for preparing government financial plans that are prepared based on applicable rules to achieve state goals.

The management of state finances is directed at achieving the goals of the state, among others, in the form of the general welfare. To achieve the goals of the state, national development is needed. National development is a series of continuous (development) activities to realize national goals. A planning process is needed to achieve this form of sustainability with respect to short-term, medium-term, and long-term periods. The development planning process involves line ministries, local governments, and community participation. The resulting planning documents are the annual planning document, the five-year planning document, and the twenty-year planning document. The development of planning processes at the line ministries is coordinated by the National Development Planning Agency (Bappenas). Thus, Bappenas has authority over the function of development planning, which is realized by project planning to support the achievement of national development.

If line ministries propose a new project during development planning, the mechanism is carried out through the Proposed New Initiative. A New Initiative is a proposed additional performance plan in the form of a program, activity, or output (or project). The Proposed New Initiative proposed to Bappenas and to the Directorate General of Budget. Concerning the proposed new project, Bappenas conducts a review of the results (projects) from the aspect of performance targets and conformity to policy directions and national development priorities. The Directorate General of Budget examines the efficiency and effectiveness of state spending (Regulation of the Head of Bappenas Number 1/2021 concerning Procedures for Compiling, Reviewing, and Amending Work Plans of the Line Ministries).

In Indonesia, the relationship between the planning function and the budgeting function fluctuates. Before 2003, the planning function was very dominant compared to the budgeting function. After the enactment of Law Number 17 of 2003 concerning State Finances, the budgeting function became relatively more dominant than the planning function. After the enactment of Government Regulation 17/2017 concerning the Synchronization of National Development Planning and Budgeting Processes, to maintain consistency between the planning documents and the budgeting documents, Bappenas was further involved in budget preparation processes. The budget planning process in Indonesia is a unique model because two units with different functions (planning and budgeting functions) synchronize to work together in almost all annual budget preparation processes [

1].

1.2. Research Gap

The research objectives achieved are as follows: (i). We analyze and assess whether the current planning process (in Bappenas) conflicts with the authority of the Minister of Finance as the Chief Financial Officer in the preparation of the state budget; (ii). we provide alternative policies so that the relationship between the planning function (at Bappenas) and the budgeting function (at the Ministry of Finance) becomes more constructive in the preparation of the state’s budget.

The Synchronization of the Planning and Budgeting Process is a process of harmonizing and strengthening the planning and budgeting process for controlling the achievement of development goals (Government Regulation 17/2017). There were several weaknesses before the enactment of Government Regulation 17/2017 [

1]: (i). a weak integration between planning documents and budgeting documents was observed; (ii). the role of Bappenas is limited to the planning aspects for priority programs, while the real budget available to the Ministry of Finance can be diverted from the original plan; (iii). changes in the budgeting document side are not accommodated in the planning document. The implication is that there is a potential for funding changes for priority projects that are not monitored on the planning side. However, there are several weaknesses with the enactment of Government Regulation 17/2017: (i). There is a potential struggle for influence between Bappenas and the Ministry of Finance in the budgeting process; (ii). the function of the Chief Financial Officer is not fully under the authority of the Ministry of Finance, as stipulated in Law Number 17 of 2003; (iii). there is a duplication of planning functions in the budgeting function, which causes inefficiency in organizational functions.

It can be said that Indonesia has experienced three patterns of change (fluctuation) in the relationship between the planning function and the budgeting function. The pattern of changes in the relationship is a form of repositioning in order to respond to the dynamics of existing policies. However, there is no guarantee that the current pattern of relationships will not change in the future. Alternative solutions that are more permanent for the long term are required. Alternative solutions that can be considered include repositioning, which not only comprises a synchronization between the two planning and budgeting entities but also comprises a repositioning in planning and budgeting functions in the perspective of a single entity. With respect to these conditions, for the sake of efficiency, World Bank Indonesia provides options or discourses to combine the two functions so that planning, budget allocation, budget distribution, review, analysis, monitoring, and evaluation processes are in one entity [

1].

From the explanation above, there is a practical gap in which the planning function and the budgeting function are two different entities, and Bappenas (to some extent) is included in the area of the budgeting function. In addition to the practical gap, there is an academic gap in which, in some OECD (Organisation for Economic Co-operation and Development) countries, the planning and budgeting functions are in one entity.

1.3. Literature Review

After the 1997/1998 economic crisis, Indonesia reformed its budgeting system, which was marked by the issuance of Law Number 17 of 2003 concerning State Finance. Several points of concern from the law are as follows [

2] (p. 7): (i). There is a consensus from the parliament with respect to what a major achievement is after the crisis; (ii). the law regulates in great detail and specifically regarding budgetary control in the context of increasing fiscal responsibility and the precautionary principle of state finances; and (iii). Separation of laws related to budgeting and planning. The Explanation Sheet for Law Number 17 of 2003 somewhat ignores the planning function.

Apart from the legal framework, budget transformation is achieved by integrating the regular budget with the development budget (investment expenditure) and including the non-budget in the statutory budget. Initially, the regular budget was the responsibility of the Ministry of Finance, and the development budget was the responsibility of Bappenas. Double budgets should be avoided by integrating regular and development budgets. A feature of Indonesian budgeting is the national planning function. Regarding the national planning function, which is within territory of Bappenas, there are some issues related to the budgeting process. First, achieving economic growth since independence has been inseparable from the success of development plans. Second, this plan has become an important tool for organizing donor development assistance to Indonesia. Third, the five-year plan runs in parallel with the presidential term and can reflect the political agenda of the presidential term. It can be said that the planning function of the Budget Bureau is outside the Indonesian Budget Bureau, that is, in Bappenas. In OECD countries, this planning function is integrated into a single budget office rather than individually as in Indonesia. In Indonesia, planning and budgeting are inefficient due to their separate structures, but this separation is addressed as part of performance-based budgeting reform [

2] (p. 12).

The following is a budget preparation cycle in Indonesia.

Preparation of Budget Availability: Budget availability preparations are carried out by the Fiscal Policy Agency and the Directorate General of Budget and usually begin in February to guide the budget preparation process. After the macroeconomic framework is established, the Directorate General of Budget will fund the availability of existing budgets for regular spending (non-discretionary spending) and new programs/activities/projects (discretionary spending).

Prioritization of new programs: After the Ministry of Finance prepares the Availability of Budget for development expenditure, Bappenas then distributes the budget into priority projects. This priority project refers to the five-year planning document, which is further elaborated in the annual planning document and becomes the basis for line ministries to prepare budget documents. Furthermore, the Ministry of Finance and Bappenas issued a Joint Letter on the Indicative Ceiling containing the estimated funding for each program at the line ministries.

Preliminary Talks with the parliament: The government submits to Parliament a document on the macroeconomic framework and the basics of fiscal policy. This document is basically a pre-budget report that includes a macroeconomic framework, fiscal policy and priorities, deficit targets, and revenue forecasts. The government also submits a plan document to parliament for discussion.

Finalization of budget proposals: After the government reaches an agreement with Parliament on budget policies and priorities in mid-June, the Ministry of Finance issues a Finance Ministers’ Decree on Budget Caps for line ministries’ programs. The line ministry then creates a budget document with a different structure and format than the planning document. As part of the performance-based budgeting reform, synchronization efforts are underway to reconcile the two. Line ministries must submit a budget by July. Bappenas reviews budget documents to ensure consistency with planning documents, and DG Budget reviews budget documents to ensure they comply with budget caps, unit prices, and spending classifications.

In the United States, planning and budgeting processes are carried out by the Office of Management and Budget (OMB). The OMB is the central budgeting office that is part of the Executive Office of the President. The OMB director is equivalent to a minister and is a member of the cabinet. The OMB oversees the implementation of coordination and management of all executive agencies. OMB serves as the central clearing house for all communications between the executive and Congress. All legislation and other submissions to Congress must be reviewed by the OMB [

3] (p. 12). In South Korea, the planning and budgeting process is carried out by the Ministry of Economy and Finance. Initially, the Ministry of Economy and Finance were two separate entities, namely the Ministry of Finance and the Ministry of Economic Planning Board. The Ministry of Finance was responsible for the management of financial resources, the development of financial, monetary, and currency exchange policy policies. Meanwhile, the Ministry of Economic Planning Board was responsible for budget planning and economic development [

4] (p. 309). In Singapore, the planning and budgeting process is carried out by the Development Planning Committee consisting of the Minister of Finance, Minister for Trade and Industry, and ministers who have sectoral projects. The committee is responsible for all capital expenditures or development expenditures [

5] (p. 59). In the United Kingdom, the planning and budgeting functions are performed by the HM Treasury. The HM Treasury comprises the Ministry of Economy and Finance, which compiles public spending, sets the direction of economic policy, and determines strong and sustainable economic growth [

4].

2. Research Methodology

In this study, the data collection method was carried out through a Focus Group Discussion (FGD) and literature study. The FGD was conducted by involving experts from the Directorate General of Budget, Bappenas, representatives from the line ministries, and consultants from the World Bank Indonesia: (i). Eko Roestanto, Head of Sub-Directorate of Budget for Public Works, Agrarian, and Spatial Planning (Ministry of Finance); (ii). Anantyo Wahyu Nugroho, Coordinator of Development Planning System (Bappenas); (iii). M. Taufik Kurniawan, Head of Planning and Performance Accountability (Financial Transaction Reporting and Analysis Center); (iv). Agus Haryanto, Sub-Coordinator of Work Plan Alignment, Planning Bureau (Ministry of Marine Affairs and Fisheries); (v). Sudes Nazarudin, Representative of the Association of Budget Analysts (Ministry of Finance); (vi). Hari Purnomo, Senior Public Finance Management Specialist (World Bank Indonesia).

The literature study was conducted by examining articles and books. The FGD was held online on 18 January 2022. The data analysis method used is the NVivo application. NVivo is an application that is used to assist in the processing and analysis of qualitative data. Furthermore, to maintain validity, the triangulation method was carried out. In this study, triangulation was carried out based on the data sources. In particular, the analysis was not only carried out on the results of interview transcripts, the Focus Group Discussions, and the observations but was supplemented with data sourced from the various documents, such as annual reports, regulations, and journal articles.

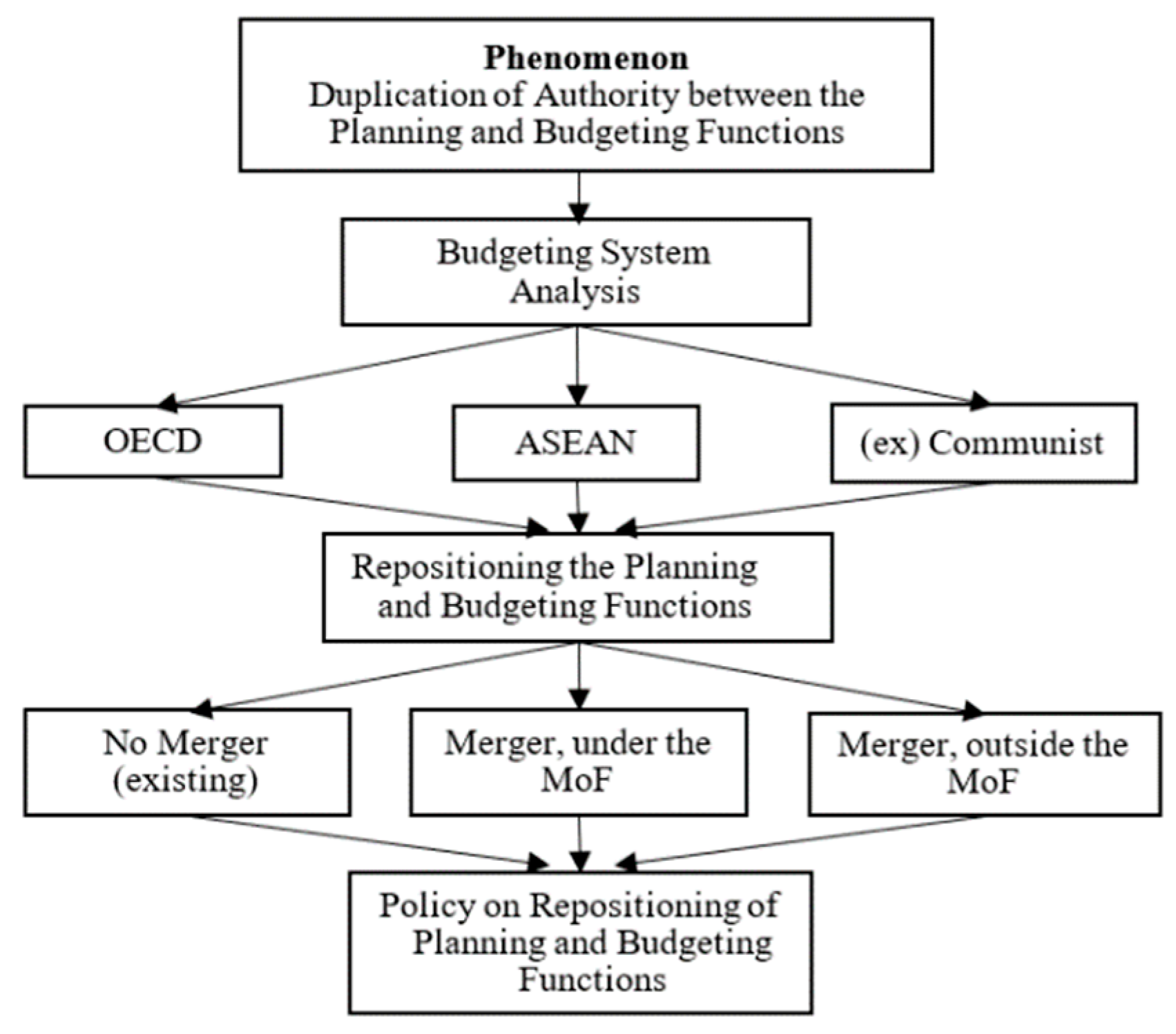

Furthermore, the framework of this research is described in the diagram, as shown in

Figure 1 below. Government Regulation Number 17 of 2017 concerning the Synchronization of the National Development Planning and Budgeting Process implies the existence of a phenomenon in the form of a duplication of authority between the planning function and the budgeting function, which ultimately leads to inefficiency in organizational functions. To minimize these implications, it is necessary to reposition functions in the planning and budgeting domains.

The design of this research study is as follows. The results of the FGD are recorded in the form of a transcript for each expert (informant) involved. Furthermore, based on the prepared transcript, a systematic coding process was carried out. In this case, coding is intended for drawing the themes contained in the perspective of the sources in the form of coding nodes and cases. In the coding and analysis process, the NVivo application is used. The analysis carried out comprises hierarchical analysis, comparison diagram, matrix code, and concept map.

3. Research Result and Discussion

3.1. Focus Group Discussion Results

In the Focus Group Discussion (FGD), the experts (informants) were given two questions:

Does the current planning process not conflict with the authority of the Minister of Finance as the Chief Financial Officer in the preparation of the state budget?

What policies need to be taken to make the relationship between planning and budgeting more constructive in the preparation of the state budget? Do the planning and budgeting functions remain separate (model 1)? Do we merge Bappenas with the Ministry of Finance (model 2) or do we merge Bappenas with the Directorate General of Budget (model 3)?

In the first question, based on the results of the FGD, it can be concluded that the current planning process conflicts with the authority of the Minister of Finance as the Chief Financial Officer. The conflict of authority is a form of collaboration and synergy. The current planning process (synchronization of planning with budgeting) is aimed at aligning planning documents with budgeting documents. To synchronize planning documents with budgeting documents, the planning function is included in (part of) the budgeting process. Thus, the conflict of authority is intended to further build synergies. Regarding the second point question, based on the results of the FGD, it can be concluded that the relationship between the planning and budgeting processes leads to model 1 (current conditions, without merging) by perfecting the synchronization process through a Memorandum of Understanding.

Regarding the conflict of interest, viewed from the theory of public policy, the policy of synchronizing planning and budgeting (which causes a conflict of authority) reflects public policy with a combination model of the institutional theory and the group theory. The policy of synchronizing planning and budgeting comprises decision making based on internal bureaucratic actors attached to the organizational structure of the government. On the other hand, the policy of synchronizing planning and budgeting is the result of an alignment of interests between two groups, namely Bappenas and the Ministry of Finance. In group theory, there can be changes in the balance of group interests. In this case, the group’s interest is in the form of the inclusion of the planning function in (part of) the budgeting area. The balance in question is in the form of increasing the authority of the entity that carries out the planning function.

Here are some statements from FDG respondents.

“Regarding the results of the evaluation of the synchronization of planning and budgeting, there are several challenges, namely synchronizing the five-year planning with fiscal capacity, a potential deviation, and an inefficient process. Therefore, the solution is to improve regulations, improve data synchronization…”.

“This synergy is quite difficult to challenge, it is easier to say, for example, who leads the (meeting) is a sensitive issue. (In the past) in a meeting when the Bappenas was invited, the Ministry of Finance did not necessarily want to attend in full. On the other hand, if the Ministry of Finance invites it as if the lead is (from) the Minister of Finance…”.

“… what we are doing now (making the Memorandum of Understanding) is something important, so that the planning and budgeting process is really integrated in a real way…”.

3.2. NVivo Analysis Results

The results of the Focus Group Discussion were processed by using the NVivo application. The final output of the NVivo application is Concept Mapping, which describes interrelationships of various issues/discussion topics. Some of the issues/discussion topics (on the Concept Mapping) reflect the solutions desired by the experts involved. Some of the other issues/topics reflect the obstacles faced in realizing the intended solution. Obstacles that arise in Concept Mapping are then used as a reference to provide recommendations so that the relationship between the planning function and the budgeting function becomes more constructive.

The Concept Mapping shown in

Figure 2 below can be interpreted as follows. To improve the quality of planning and budgeting results, the relationship between planning and budgeting functions needs to be more synchronized. In the synchronization process, based on the results of the NVivo application analysis, several interrelated topics/problems require attention, namely Data Integration, Asymmetric Information, Technology Integration, Information Transparency, Institutional Coordinators, Institutional Pride, Institutional Asynchronous, Planning and Budgeting Asynchronous, Institutional Competition, and Supreme Regulation. From the relationship between these problems, the following analysis was obtained:

To build a constructive relationship between the planning function and the budgeting function, Synchronization is necessary. We realize Synchronization is not easy. Some obstacles arise in the form of Asymmetric Information, Institutional Pride, Institutional Asynchronous, Planning, and Budgeting Asynchronous, and Institutional Competition.

Institutional Competition and Institutional Pride are causes of Institutional Asynchronous and also has an impact on Planning and Budgeting Asynchronous.

To overcome this problem (Institutional Pride and Institutional Competition), it is necessary to return it to the Supreme Regulation or through the coordinator of the two institutions, for example, the President or Vice President or possibly another independent institution.

4. Conclusions and Recommendations

4.1. Conclusions

From the results of the discussion in the previous chapter, the following conclusions can be drawn:

The current planning process (to some extent) conflicts with the authority of the Minister of Finance as the Chief Financial Officer in the preparation of the state’s budget.

The relationship between the planning function and the budgeting function leads to model 1 (current conditions, without merger) by perfecting the synchronization process through the Memorandum of Understanding.

4.2. Recommendation

4.2.1. Short-Term Recommendations

To increase synergy and minimize the impact of Institutional Pride, it is necessary to create an employee exchange program so that Bappenas employees serve for some time at the Directorate General of Budget and vice versa. In addition, a task force can be formed between the Ministry of Finance and Bappenas to discuss or handle strategic issues (for example) in the planning or evaluation of national priority activities.

To improve Data Integration, Technology Integration, Information Transparency, and overcome Asymmetric Information, it is necessary to perform data integration that is not only limited to reference data but also requires is expanded to output achievements and budget realization data. Thus far, the output achievement data and the budget realization data in the Bappenas eMonev application have been filled in manually by spending units at the line ministries, even though the data are already available at the Ministry of Finance.

To improve Synchronization/Coordination, there is a need for an additional Memorandum of Understanding outside the Memorandum of Understanding related to the information system’s integration.

There is a need for further research on the relationship between the planning function and the budgeting function with respondents from members of parliament as partners of the government in the preparation of the state budget.

4.2.2. Medium-Term Recommendations

To support Data Integration, the features in the Bappenas eMonev application need to be integrated with the monitoring and evaluation application at the Directorate General of Budget so that the spending units at the line ministries do not need to use two different applications with the same or similar functions [

9]. In addition, it is necessary to distinguish between the information needs of the budgeting unit and the spending unit so that evaluation results are more useful in the budgeting process [

10] (p. 29). Furthermore, it is necessary to have a mechanism that allows executive leadership to track the progress of achieving strategic targets (outcomes at the line ministries level) to pursue their strategic goals [

11] (p. 18).

To improve the efficiency of business processes, it is necessary to consider the simplification of business processes so that meetings or discussions regarding planning and budgeting are not carried out repeatedly (bilateral meetings, first-stage trilateral meetings, second-stage trilateral meetings, first-stage budget document reviews, and second-stage budget document reviews).

To improve synchronization, we should consider strengthening the Ministry of Finance ‘s role in the process of medium-term planning and budgeting. Thus far, the Ministry of Finance’s role has been more focused on the annual budget. In this case, it is necessary to conduct research that examines the integration of medium-term planning (at the Ministry of Finance) and five-year planning (at Bappenas).

The annual planning document has revised targets and funding needs, but the five-year planning document has not been revised (Presidential Regulation Number 18 of 2020 concerning the 2020–2024 National Medium-Term Development Plan); thus, it needs to be considered so that the revised target and indication of funding needs can be implemented in the five-year planning document. Regarding the 2020–2024 medium-term planning document, Bappenas can make program adjustments and overhaul all programs and targets set based on various assumptions and new developments after COVID-19 and the economic crisis that accompanied it. In this case, all programs that have been set out in the 2020–2024 medium-term planning document are reviewed, the strategy is reformulated, and the implementation period is rescheduled [

12] (p. 250).

To some extent, it is necessary to consider synchronization between the five-year planning document (at Bappenas) and the medium-term expenditure framework documents (at the Ministry of Finance). The expenditure figures in the medium-term expenditure framework document can be used as a reference for the preparation or adjustment of the planning document. In addition, in the preparation of the five-year planning document, it is necessary to review real conditions by involving the independent institution [

13] (p. 12). Furthermore, the budget documents containing medium-term information and performance achievements need to be presented to the parliament [

14] (p. 58).

4.2.3. Long-Term Recommendations

Since the implementation of Law Number 17 of 2003 regarding the State Finances does not pay attention to planning aspects, the synchronization of planning and budgeting is not only carried out at the government regulation level but also at the legislation level; in this case, it involves Law Number 17 of 2003 and Law Number 25 of 2004 concerning the National Development Planning System. Further research is needed on the synchronization of Law Number 25 of 2004 and Law Number 17 of 2003:

In Law Number 25 of 2004, it is necessary to consider the chapter on the preparation of the Macroeconomic Framework, Principles of Fiscal Policy, and Budget Availability. In addition, it is necessary to consider synchronization between the development targets in the twenty-year planning document and the development targets in the five-year planning document and the annual planning documents.

In Law Number 17 of 2003, it is necessary to consider the subject of monitoring and evaluation of the implementation of programs and activities, the subject of consistency between planning and budgeting, and the subject of medium-term budgeting. The medium-term budgeting concept includes the Medium-Term Fiscal Framework, the Medium-Term Budget Framework, and the Medium-Term Expenditure Framework.

Author Contributions

Conceptualization, I.S.; methodology, I.S. and M.Z.H.; software, I.S.; validation, I.S., B.S. and M.Z.H.; formal analysis, I.S.; investigation, I.S.; resources, M.Z.H.; data curation, I.S.; writing—original draft preparation, I.S.; writing—review and editing, B.S. and M.Z.H.; visualization, I.S.; supervision, B.S. and M.Z.H.; project administration, I.S.; funding acquisition, I.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

In this study, the data-collection method was carried out through the Focus Group Discussion. Therefore, the authors would like to thank the Focus Group Discussion’s participants, namely, Eko Roestanto and Kiswanto (Directorate General of Budget), Anantyo Wahyu Nugroho (Bappenas), M. Taufik Kurniawan (line ministry), Agus Haryanto (line ministry), Sudes Nazarudin (the budget analyst), and Hari Purnomo (the World Bank Indonesia Governance Global Practice Team). In addition, we thank Eleonora Sofilda (Trisakti University), the World Bank, the International Monetary Fund, and the OECD for sharing journals/papers/reports/e-books on related websites.

Conflicts of Interest

The authors declare no conflict of interest.

References

- World Bank Indonesia Governance Global Practice Team. Synchronization for the Process of National Development Planning and Budgeting.pptx; World Bank Indonesia Governance Global Practice Team: Jakarta, Indonesia, 2017. [Google Scholar]

- Blöndal, J.R.; Hawkesworth, I.; Choi, H. Budgeting in Indonesia. OECD J. Budg. 2009, 2, 1–30. [Google Scholar] [CrossRef]

- Blöndal, J.R.; Kraan, D.; Ruffner, M. Budgeting in the United States. OECD J. Budg. 2003, 3, 7–48. [Google Scholar] [CrossRef]

- Lienert, I.; Jung, M. The Legal Framework for Budget Systems—An International Comparison; OECD Publishing: Paris, France, 2004; p. 309. [Google Scholar]

- Blöndal, J.R. Budgeting in Singapore. OECD J. Budg. 2006, 6, 45–84. [Google Scholar] [CrossRef]

- Roestanto, E. Integrasi Sistem Perencanaan dan Penganggaran; FGD Reposition of Planning and Budgeting Functions in the Financial Chief Officer: Jakarta, Indonesia, 2022. [Google Scholar]

- Purnomo, H. Indonesia—Synchronization of the Process of National Development Annual Planning and Budgeting; FGD Reposition of Planning and Budgeting Functions in the Financial Chief Officer: Jakarta, Indonesia, 2022. [Google Scholar]

- Nazarudin, S. Perencanaan dan Penganggaran; FGD Reposition of Planning and Budgeting Functions in the Financial Chief Officer: Jakarta, Indonesia, 2022. [Google Scholar]

- Suliantoro, I. Duplikasi Sistem Monitoring dan Evaluasi Belanja Kementerian/Lembaga. J. Publ. Fina. Mana. 2020, 4, 16–30. [Google Scholar] [CrossRef]

- Robinson, M. Connecting Evaluation and Budgeting; World Bank: Washington, DC, USA, 2014; p. 29. [Google Scholar]

- Beazley, I. Incentivising Performance in Public Investment Policies Delivered at National and Subnational Levels: Managing across Temporal and Institutional Horizons; OECD-European Commission: Paris, France, 2017; p. 18. [Google Scholar]

- Muhyiddin, M. COVID-19, New Normal dan Perencanaan Pembangunan di Indonesia. Indones. J. Dev. Plan. 2020, 4, 240–252. [Google Scholar]

- Setiawan, L.; Prasojo, W.; Parulian, A. Refleksi Penerapan Kerangka Fiskal Jangka Menengah di Indonesia. J. Indones. Stat. Budg. Fina. 2020, 2, 163–174. [Google Scholar]

- Allen, R.; Eckardt, S.; Jacobs, D.; Kristensen, J.; Lienert, I.; Schiavo-Campo, S. Indonesia: Budget Reform Strategy Priorities; International Monetary Fund & World Bank: Washington, DC, USA, 2007; p. 58. [Google Scholar]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).