Blockchain Disrupting Fintech and the Banking System †

Abstract

:1. Introduction

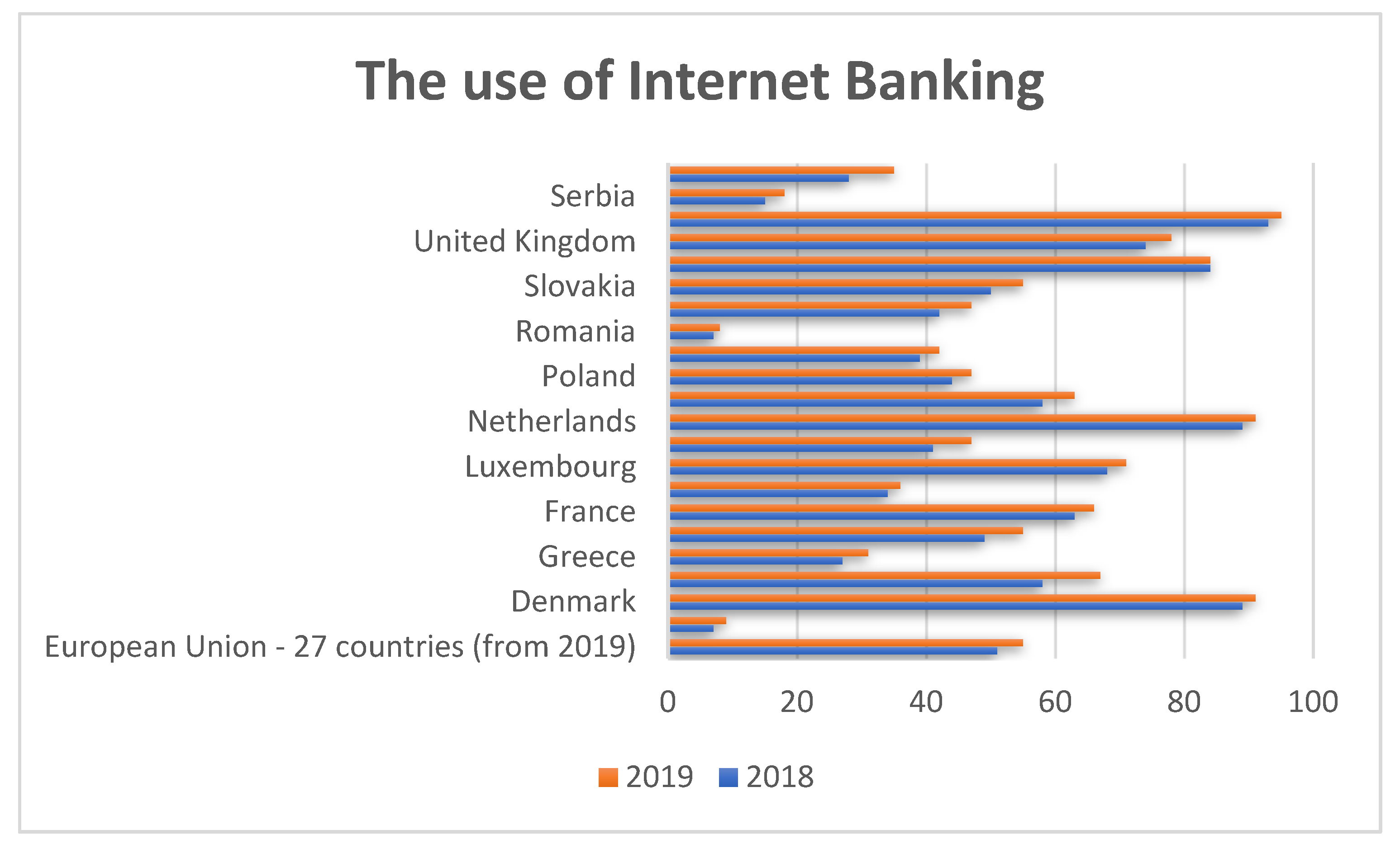

2. The Modern Approach of the Banking System

- -

- Video communication (or electronic meetings) between customers and back-office specialists is happening in real time, at a higher speed;

- -

- Online banking is customized according to the client’s needs;

- -

- ATMs can be located easier, not being influenced by poor internet connectivity [4].

3. Digital Products and Services of Fintech Companies

- -

- People to people,

- -

- People to machines,

- -

- Machines to machines.

4. Technological Competitive Innovations

4.1. Crowdfunding

4.2. Peer-to-Peer Lending

4.3. Digital Currencies—The Case of Elrond

- -

- Scalability: It should have a high scalability in order to enable the network to have a performance above that of other centralized counterparts, being measured in transactions per second (TPS). TPS is also known as throughput, thus the formula is:

- -

- Decentralization: There should be full decentralization, removing any third party;

- -

- Efficiency: Minimum energy should be involved in the process of performing all network services needed;

- -

- Security: There is a need to avoid any attack through a known attack vector. Hence, all transactions should be secure;

- -

- Cross-chain interoperability: Communication with external services should be unlimited;

- -

- Bootstrapping and storage enhancement: The storage of data and its synchronization should be at a competitive cost. [14]

- -

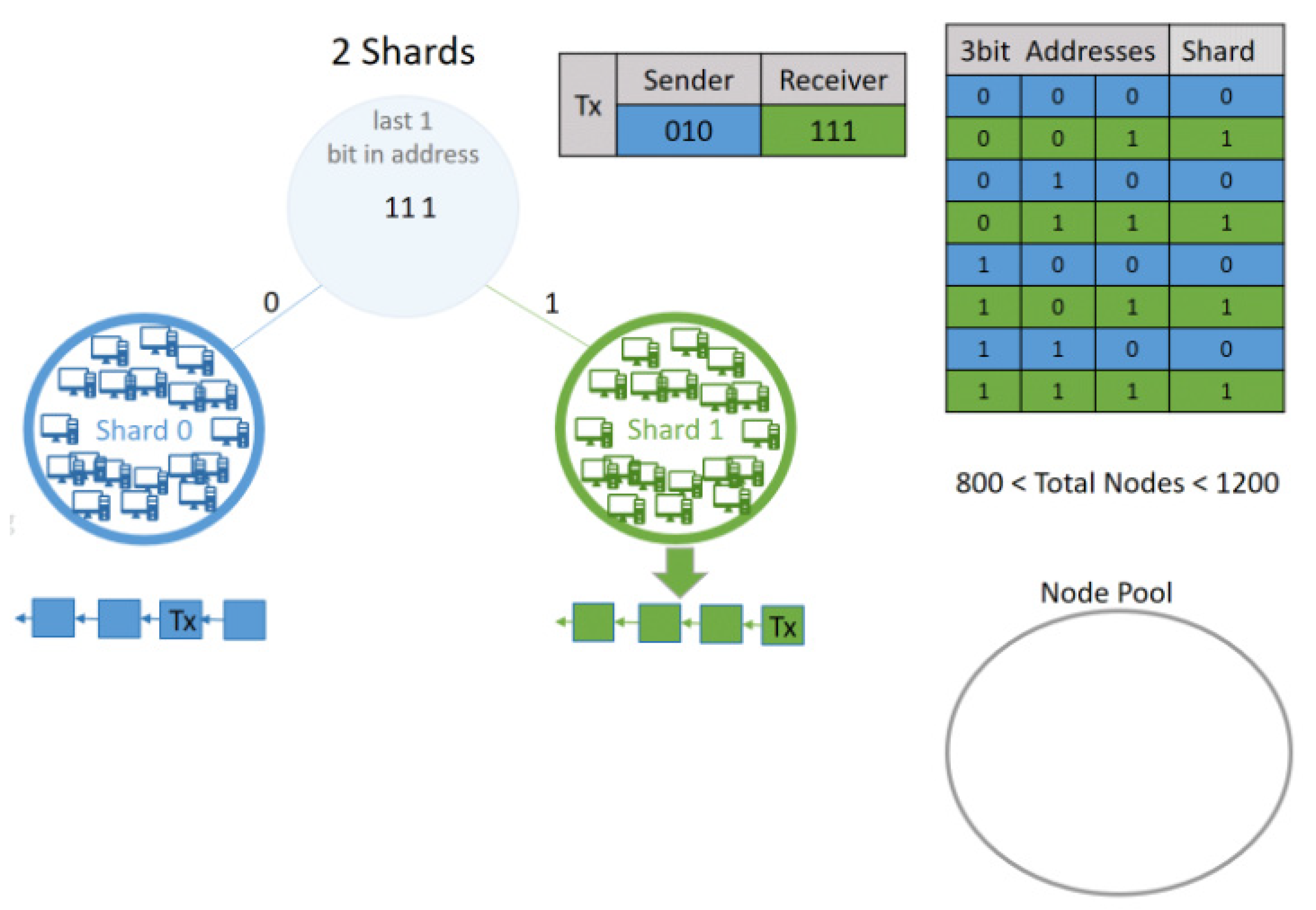

- The state sharding approach,

- -

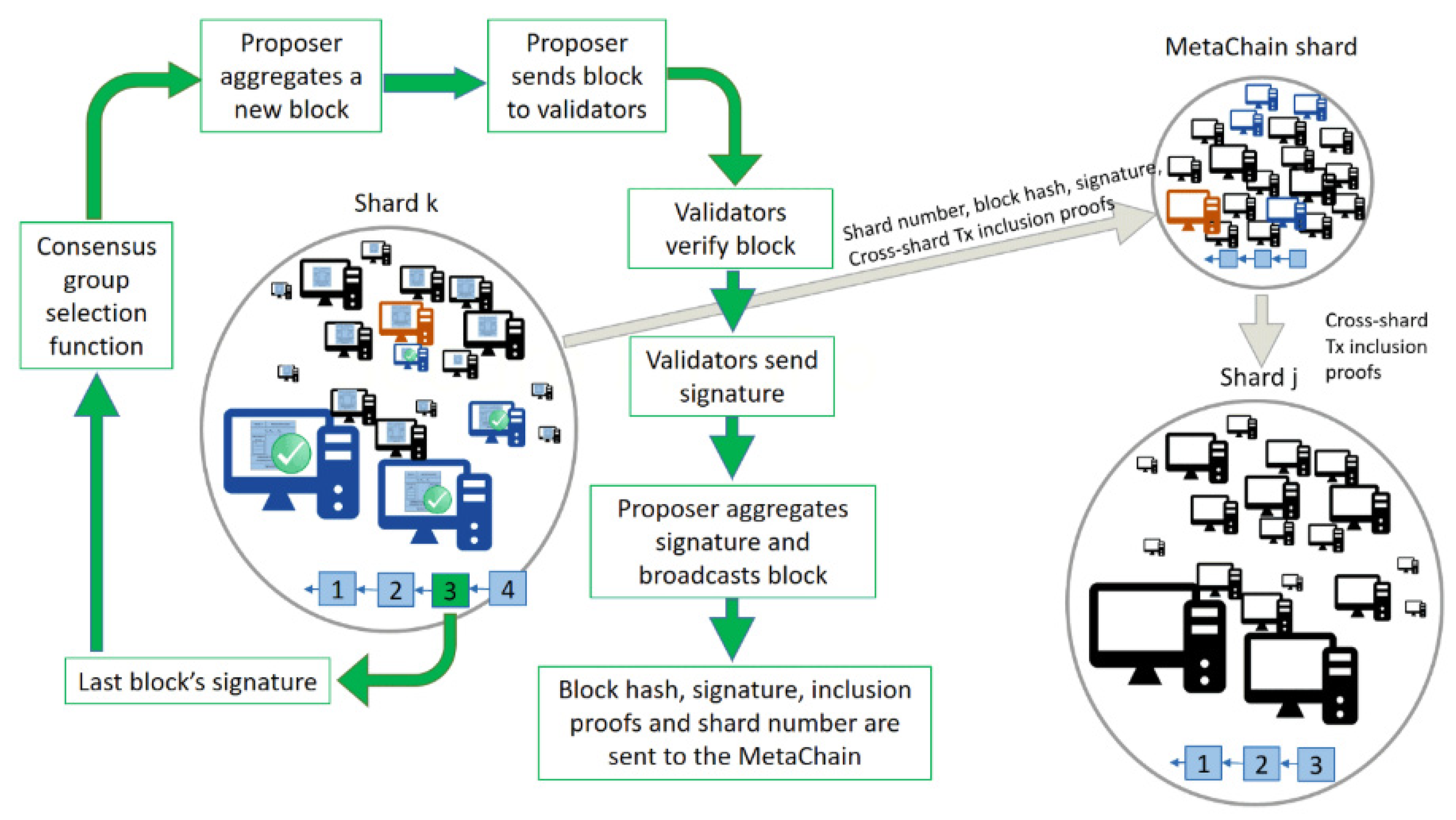

- The mechanism of the proof of stake (PoS).

- -

- Network sharding: This is used for optimizing the communication process, by handling how nodes are divided into shards. Accordingly, the message is easily transmitted through a shard, quicker than to the entire network. This is considered a weakness for attacks, because an attacker may be in control of a shard;

- -

- State sharding: The main important aspect is that each and every shard works with a portion of the state. Transactions that are in different shards have to transmit messages in separate shards. On the other hand, shards must be reorganized often in order to avoid attacks;

- -

- Transaction sharding: This type has to map the transactions to the shards before being processed [15].

- -

- Avoiding having effects on availability, because of scalability. This is due to the increasing and decreasing number of shards, but it should affect only small nodes, without any serious trouble;

- -

- Promptness and instant traceability;

- -

- It introduced an innovative element that helps with reducing abeyance. Nodes in the shard easily find the consensus group at the starting point of a specific round;

- -

- Usually, a random committee selection takes around 12 s, while for Elrond, the time is estimated to be under 100 milliseconds. Again, abeyance is reduced as well at this level;

- -

- Rating is introduced, a weight factor additionally added to a common consensus mechanism;

- -

- Formal verifications are taken into consideration regarding protocol implementation. All the algorithms used are intended to be correct and complete.

- -

- Keystore (drag and drop the keystore file and the password set when creating the Elrond wallet);

- -

- PEM (drag and drop the PEM file);

- -

- Ledger (this is not yet available, but it will be possible to connect through this means in the near future) [14].

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Vial, G. Understanding Digital Transformation: A Review and A Research Agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Thakkar, D. Authentication vs. Authorization and How Biometric Technology Makes Sense in Implementing Both, Bayometric. Available online: https://www.bayometric.com/authentication-vs-authorization-biometric-technology/ (accessed on 29 March 2020).

- Kaur, R.; Sandhu, R.S.; Gera, A.; Kaur, T.; Gera, P. Intelligent Voice Bots for Digital Banking. In Proceedings of the Smart Systems and IoT: Innovations in Computing, Jaipur, India, 18-20 January 2019; Volume 141, pp. 401–409. [Google Scholar]

- Aithal, S.; Karan, K.P. Massive Growth of Banking Technology with the Aid of 5G Technology. Int. J. Technol. Manag. 2015, 5, 617–626. [Google Scholar]

- ETSI, About ETSI, Internet. Available online: https://www.etsi.org/about (accessed on 8 February 2020).

- Xu, L.D.; He, W.; Li, S. Internet of Things in Industries: A Survey. Ieee Trans. Ind. Inform. 2014, 10, 2233–2243. [Google Scholar] [CrossRef]

- European Commission. Internet of Things—The Next Revolution, A Strategic Reflection About an European Approach to Internet of Things; CONNECT Advisory Forum (CAF): London, UK, 2014. [Google Scholar]

- Faroukhi, A.Z.; El Alaoui, I.; Gahi, Y. Big Data Monetization Throughout Big Data Value Chain: A Comprehensive Review. J. Big Data 2020, 7, 3. [Google Scholar] [CrossRef]

- Go Dogo, How It Works? Internet. Available online: https://go-dogo.com/how_it_works/ (accessed on 30 March 2020).

- Kickstarter, Go Dogo—Mental Workout for Dogs, Internet. Available online: https://www.kickstarter.com/projects/godogo/go-dogo-mental-workout-for-dogs?ref=discovery&term=Go%20Dogo (accessed on 12 April 2020).

- Ashta, A.; Assadi, D. An Analysis of European Online Micro-Lending Websites. In Proceedings of the EMN 6th Annual Conference, Milan, Italy, 1–4 July 2009. [Google Scholar]

- CoinMarketCap, Internet. Available online: https://coinmarketcap.com/ (accessed on 11 April 2020).

- Elrond, Internet. Available online: https://elrond.com/technology/ (accessed on 11 April 2020).

- Elrond. A Highly Scalable Public Blockchain via Adaptive State Sharding and Secure Proof of Stake; Technical Whitepaper; Publisher Elrond: Sibiu, Romania, 2019; pp. 1–5. [Google Scholar]

- Saino, L.; Psaras, I.; Pavlou, G. Understanding Sharded Caching Systems. In Proceedings of the IEEE INFOCOM 2016—The 35th Annual IEEE International Conference on Computer Communications, San Francisco, CA, USA, 10–15 April 2016; pp. 1–9. [Google Scholar]

- Nguyen, C.T.; Nguyen, D.N.; xNguyen, H.T.; Dutkiewicz, E. Proof-of-Stake Consensus Mechanisms for Future Blockchain Networks: Fundamentals, Applications and Opportunities. IEEE Access 2017, 7, 85727–85745. [Google Scholar] [CrossRef]

- The Elrond Wallet. Available online: https://wallet.elrond.com/ (accessed on 3 June 2020).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stoica, E.A.; Sitea, D.M. Blockchain Disrupting Fintech and the Banking System. Proceedings 2021, 74, 24. https://doi.org/10.3390/proceedings2021074024

Stoica EA, Sitea DM. Blockchain Disrupting Fintech and the Banking System. Proceedings. 2021; 74(1):24. https://doi.org/10.3390/proceedings2021074024

Chicago/Turabian StyleStoica, Eduard Alexandru, and Daria Maria Sitea. 2021. "Blockchain Disrupting Fintech and the Banking System" Proceedings 74, no. 1: 24. https://doi.org/10.3390/proceedings2021074024

APA StyleStoica, E. A., & Sitea, D. M. (2021). Blockchain Disrupting Fintech and the Banking System. Proceedings, 74(1), 24. https://doi.org/10.3390/proceedings2021074024