A Case Study on the Particularities and Sustainability of the Concepts of TQM, Quality Control, and Risk Management in the Corporate Insurance Industry: Loss and the Incidence of Catastrophic Risks †

Abstract

1. Introduction

- Business disruption as a result of natural disasters (flood, earthquake, fire etc.).

- Business disruption because of terrorist acts. Products sold in the insurance industry also include policies that cover losses caused by acts of terrorism.

- Business disruption because of cyberattacks, as products sold in the insurance industry also include policies that cover losses caused by cyberattacks.

- Environmental liability insurance and losses from industrial accidents, which affect the environment [6].

- Third party liability insurance for nuclear, oil, and gas operations [6], with Romania yet to develop this sector as its experience/expertise in the area is limited.

- Business interruption (discontinuation of business because of various causes), 37% down from 2018 (42%)

- Cyber incidents, 37% down from 2018 (40%)

- Catastrophes attributable to natural causes, 28% down from 2018 (30%)

- Changes in laws and regulations, 27% up from 2018 (21%)

- Market development, 23% slightly up from 2018 (22%)

- Fires and explosion, 19% very similar to 2018 (20%)

- New technologies, 19% up from 2018 (15%)

- Climate changes/increasing volatility of weather, 13% up from 2018 (10%)

- Loss of reputation or brand value, 13% as high as in 2018

- Lack of a skilled labor force, 9% highlighted by AGCS as a new risk cause in insurance in 2019 as compared to previous years.

2. International Trends in Occurrence of Catastrophic Risks–Statistics and Facts

3. Particularities and Applications of the Corporate Insurance Industry: Total Quality Management (TQM) and Quality Control Globally and in Romania

- Quality and productivity policies are less clear than in the production sector.

- Service and financial companies are often shielded against international competitors under regulations, protection legislation, and cultural barriers.

- Financial institutions, particularly insurance companies, make promises that often are made good on only after a significant amount of time.

4. Conclusions

- Implementation of the following elements for a company’s quality control policies, which guarantees for professional liability and general liability: alpha and beta testing, formal client acceptance procedure, prototype development, statistic quality control, supplier check process, TQM, writing and documenting quality control program, and a client’s consent to each individual stage of the project.

- Meeting one or more widely accepted industry standards: UL/CSA, ISO 9000, CE MARK, ANSI etc.

- Performing pre-launch/pre-dissemination tests to protect clients against malicious codes and/or other security vulnerabilities in the company’s services.

- Availability of a plan to maintain documents/agreements for no less than 7 years.

- Firms must create business continuity plans to manage this risk [26].

Author Contributions

Funding

Conflicts of Interest

References

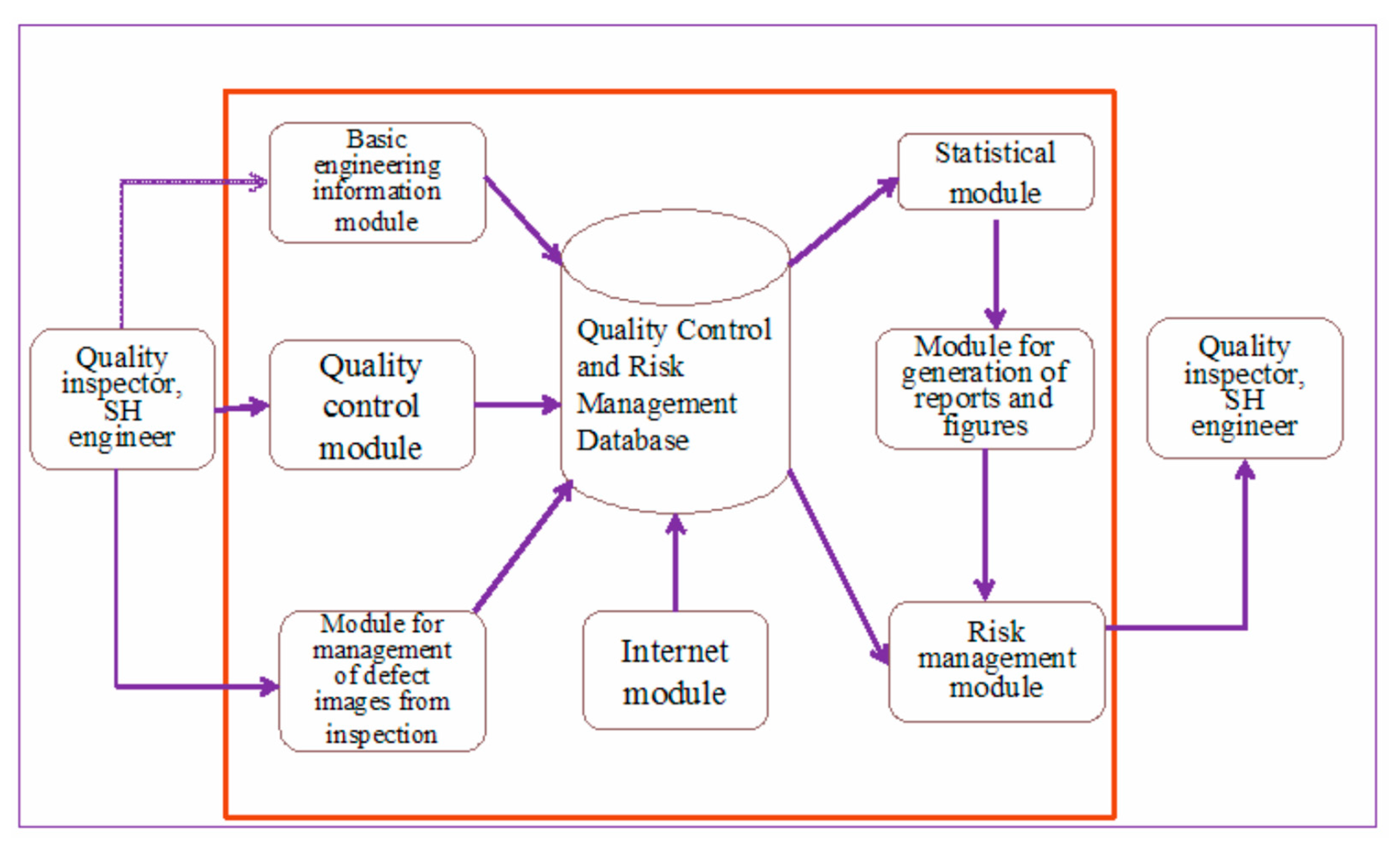

- Chen, J.; Chen, J.-H. Research in Establishment of Quality Control and Risk Management Systems. In Proceedings of the 28th International Symposium on Automation and Robotics in Construction (ISARC), Seoul, Korea, 29 June–2 July 2011; Available online: http://www.iaarc.org/publications/fulltext/S09-4.pdf (accessed on 20 August 2019). [CrossRef]

- Allianz Global Corporate and Specialty. Global Claims Review 2018—The Top Causes of Corporate Insurance Losses. 2018. Available online: https://www.agcs.allianz.com/news-and-insights/reports/claims-in-focus.html (accessed on 20 August 2019).

- Allianz Global Corporate and Specialty. Global Claims Review 2014—Loss Trend and Emerging Risk for Global Business. 2014. Available online: https://www.agcs.allianz.com/content/dam/onemarketing/agcs/agcs/reports/AGCS-Global-Claims-Review-2014.pdf (accessed on 20 August 2019).

- Thomas, D. Risk management in NDT. Insight 1998, 40, 352. [Google Scholar]

- Insurance Europe. European Insurance—Key Facts. 2018. Available online: https://www.insuranceeurope.eu/sites/default/files/attachments/European%20insurance%20-%20Key%20facts%20-%20October%202018.pdf (accessed on 20 August 2019).

- UNSAR—Uniunea Națională a Societăților de Asigurare și Reasigurare din România. Gradul de Penetrare Pentru Asigurările de Catastrofă. 2013. Available online: https://ec.europa.eu/finance/consultations/2013/disasters-insurance/docs/contributions/non-registered-organisations/unsar_ro.pdf (accessed on 22 August 2019).

- Allianz Global Corporate and Specialty. Allianz Risk Barometer—Top Business Risk for 2019. 2019. Available online: https://www.agcs.allianz.com/content/dam/onemarketing/agcs/agcs/reports/Allianz-Risk-Barometer-2019.pdf (accessed on 22 August 2019).

- Insurance Information Institute. Available online: https://www.iii.org/article/insurance-options-for-green-businesses (accessed on 22 August 2019).

- Insurance Information Institute. Available online: https://www.iii.org/article.infographic-business-interruption-insurance (accessed on 22 August 2019).

- Allianz Global Corporate and Specialty. Press Release—Fires and Explosions Cause Largest Losses for Business: Allianz Global Claims Analysis. 2018. Available online: https://www.agcs.allianz.com/news-and-insights/news/global-claims-review-2018.html (accessed on 22 August 2019).

- Radu, N.; Naghi, L.E. Evoluția internațională a Incidenței Riscurilor Catastrofale. Rev. Stud. Fin. 2019, IV, 68–82. Available online: https://revista.isfin.ro/wp-content/uploads/2019/05/5.4_Nicoleta-Radu_RO.pdf (accessed on 2 September 2019).

- Bawab, F.A.; Abbassi, G.Y. An application of Total Quality Management for the Insurance Companies Sector—A Case Study. Am. Soc. Eng. Manag. J. 1996, 207–214. Available online: http://www2.ju.edu.jo/sites/Academic/abbasi/Lists/Published%20Research/DispForm.aspx?ID=26 (accessed on 2 September 2019).

- Surange, V.G. Implementation of Six Sigma to Reduce Cost of Quality: A Case Study of Automobile Sector. J. Fail. Anal. Prev. 2015, 15, 282–294. [Google Scholar] [CrossRef]

- Jozsef, B.; Blaga, P. A more efficient production using quality tools and human resources management. Procedia Econ. Financ. 2012, 3, 681–689. [Google Scholar]

- Heckman, P.E. Total Quality Management in Property/Causality Insurance: An Actuarial Respective. Discussion Papers—The Actuary as Business Manager. 1993. Available online: https://www.casact.org/pubs/dpp/dpp93/93dpp073.pdf (accessed on 2 September 2019).

- Fataftah, S.K. The implementation of Total Quality Management (TQM) for the Insurance Companies in Palestine. Centre International de Hautes Etudes Agronomiques Mediterraneennes, Chania (Greece), Institut Agronomique Mediterranean. 2012. Available online: http://agris.fao.org/agris-search/search.do?recordID=QC2013200828 (accessed on 6 September 2019).

- CMA (Capital Market Authority). Guiding Manual for the Minimum Standards of Quality Assurance for the Services Provided to the Customers of Insurance Companies and Brokers. Available online: https://www.cma.gov.om/Home/InsurancePublicationFileDownlad/1019 (accessed on 6 September 2019).

- Terry, D. How Do Insurance Companies Track “Quality” Claim Handling? 2018. Available online: https://www.badfaithinsider.com/2018/02/insurance-companies-track-quality-claim-handling/ (accessed on 6 September 2019).

- Sandquist, E.J. Kaizen and TQM also Have Roles to Play in Insurance Marketing. 2019. Available online: https://insuranceblog.accenture.com/kaizen-and-tqm-also-have-roles-to-play-in-insurance-marketing (accessed on 6 September 2019).

- Crawford and Company. Crawford Netherlands Receives ISO Renewal again. 2019. Available online: https://www.claimsjournal.com/news/international/2005/09/16/59717.htm (accessed on 6 September 2019).

- Crawford and Company. Press Release: Crawford and Company® Australia achieves ISO 27001 Certification. 2018. Available online: https://au.crawfordandcompany.com/media/2369287/013218-crawford-australia-achieves-iso27001-certification-final.pdf (accessed on 6 September 2019).

- Monetary Authority of Singapore. Guidelines on Risk Management Practices for Insurance Business—Core Activities. 2013. Available online: https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulatory-and-Supervisory-Framework/Risk-Management/Risk-Management-Guidelines_Insurance-Core-Activities.pdf (accessed on 6 September 2019).

- KPMG International. Our Relentless Focus on Quality—2016 Transparency Report. 2016. Available online: www.kpmg.com/transparency (accessed on 6 September 2019).

- Ferguson, J. 4 Quality Control Tips That Can Reduce Claims. Available online: https://www.sadlerco.com/quality-control/ (accessed on 16 September 2019).

- Alexander, P. Best Practices Quality Management—Part I. 2011. Available online: https://www.insurancejournal.com/blogs/patalexander/2011/06/01/200428.htm (accessed on 6 September 2019).

- Zsidisin, G.A.; Melnyk, S.A.; Ragatz, G.L. An institutional theory perspective of business continuity planning for purchasing and supply management. Int. J. Prod. Res. 2005, 43, 3401–3420. [Google Scholar] [CrossRef]

- Pryor, J. Why Risk Management and Quality Management Must Converge. 2014. Available online: https://www.irmi.com/articles/expert-commentary/risk-and-quality-management-convergence (accessed on 16 September 2019).

| Top Causes of Loss by Total Value of Claims (2013–2018) (a) | Top Causes of Loss by Total Value (2009–2013) (b) | |||

|---|---|---|---|---|

| 1 | Fire/explosion | 24% | 1 | Grounding |

| 2 | Aviation collision/crash | 14% | 2 | Fire |

| 3 | Faulty workmanship/maintenance | 8% | 3 | Aviation crash |

| 4 | Storm | 7% | 4 | Earthquake |

| 5 | Defective products | 6% | 5 | Storm |

| 6 | Damaged goods (including handlings/storage) | 5% | 6 | Bodily injury (including fatalities) |

| 7 | Machinery breakdown (including engine failure) | 5% | 7 | Flood |

| 8 | Water damage | 3% | 8 | Professional indemnity |

| 9 | Ship sinking/collision | 2% | 9 | Product defects |

| 10 | Professional indemnity (e.g., negligence/bad advice) | 2% | 10 | Machinery breakdown |

| 1950–1959 | 1960–1969 | 1970–1979 | 1980–1989 | 1990–1999 | 2000–2009 | 2010–2018 | |

|---|---|---|---|---|---|---|---|

| Number of events | 292 | 547 | 839 | 1653 | 2577 | 3861 | 2988 |

| Economic losses | 6058 | 18,445 | 17,181 | 53,845 | 746,015 | 892,312 | 1,354,014 |

| Insured losses | 0.033 | 0.066 | 0.113 | 0.239 | 98.8 | 479 | 739 |

| Damage rate of economic losses | 0.54 | 0.36 | 0.66 | 0.44 | 13.24 | 53.68 | 54.58 |

| Average damage on the event | 0.020747 | 0.0337203 | 0.0204779 | 0.0325741 | 0.28949 | 0.231109 | 0.453151 |

| Average insured damage on the event | 0.000113 | 0.0001207 | 0.0001347 | 0.0001446 | 0.038339 | 0.124061 | 0.247323 |

| Sum of Squares | df | Mean Square | F | Sig. | ||

|---|---|---|---|---|---|---|

| Number of events | Between Groups | 9,141,660.964 | 1 | 9,141,660.964 | 23,971 | 0.004 |

| Within Groups | 1,906,814.750 | 5 | 381,362.950 | |||

| Total | 1.105 × 107 | 6 | ||||

| Economic losses | Between Groups | 1.625 × 1012 | 1 | 1.625 × 1012 | 40,080 | 0.001 |

| Within Groups | 2.027 × 1011 | 5 | 4.054 × 1010 | |||

| Total | 1.828 × 1012 | 6 | ||||

| Insured losses | Between Groups | 330,108.865 | 1 | 330,108.865 | 7961 | 0.037 |

| Within Groups | 207,336.051 | 5 | 41,467.210 | |||

| Total | 537,444.916 | 6 | ||||

| Coverage rate for economic losses | Between Groups | 2742.857 | 1 | 2742.857 | 12,299 | 0.017 |

| Within Groups | 1115.117 | 5 | 223.023 | |||

| Total | 3857.974 | 6 | ||||

| Average damage per event | Between Groups | 0.152 | 1 | 0.152 | 28,498 | 0.003 |

| Within Groups | 0.027 | 5 | 0.005 | |||

| Total | 0.179 | 6 | ||||

| Average damage insured per event | Between Groups | 0.032 | 1 | 0.032 | 7230 | 0.043 |

| Within Groups | 0.022 | 5 | 0.004 | |||

| Total | 0.054 | 6 |

| Sum of Squares | df | Mean Square | F | Sig. | ||

|---|---|---|---|---|---|---|

| Number of events | Between Groups | 7,186,572.014 | 1 | 7,186,572.014 | 9.304 | 0.028 |

| Within Groups | 3,861,903.700 | 5 | 772,380.740 | |||

| Total | 1.105 × 107 | 6 | ||||

| Economic losses | Between Groups | 1.302 × 1012 | 1 | 1.302 × 1012 | 12.403 | 0.017 |

| Within Groups | 5.251 × 1011 | 5 | 1.050 × 1011 | |||

| Total | 1.828 × 1012 | 6 | ||||

| Insured losses | Between Groups | 495,853.553 | 1 | 495,853.553 | 59.610 | 0.001 |

| Within Groups | 41,591.363 | 5 | 8318.273 | |||

| Total | 537,444.916 | 6 | ||||

| Coverage rate for economic losses | Between Groups | 3727.672 | 1 | 3727.672 | 143.040 | 0.000 |

| Within Groups | 130.301 | 5 | 26.060 | |||

| Total | 3857.974 | 6 | ||||

| Average damage per event | Between Groups | 0.099 | 1 | 0.099 | 6.165 | 0.056 |

| Within Groups | 0.080 | 5 | 0.016 | |||

| Total | 0.179 | 6 | ||||

| Average damage insured per event | Between Groups | 0.045 | 1 | 0.045 | 25.798 | 0.004 |

| Within Groups | 0.009 | 5 | 0.002 | |||

| Total | 0.054 | 6 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Păvălașcu, N.S.; Gabor, M.R. A Case Study on the Particularities and Sustainability of the Concepts of TQM, Quality Control, and Risk Management in the Corporate Insurance Industry: Loss and the Incidence of Catastrophic Risks. Proceedings 2020, 63, 3. https://doi.org/10.3390/proceedings2020063003

Păvălașcu NS, Gabor MR. A Case Study on the Particularities and Sustainability of the Concepts of TQM, Quality Control, and Risk Management in the Corporate Insurance Industry: Loss and the Incidence of Catastrophic Risks. Proceedings. 2020; 63(1):3. https://doi.org/10.3390/proceedings2020063003

Chicago/Turabian StylePăvălașcu, Narcis Sebastian, and Manuela Rozalia Gabor. 2020. "A Case Study on the Particularities and Sustainability of the Concepts of TQM, Quality Control, and Risk Management in the Corporate Insurance Industry: Loss and the Incidence of Catastrophic Risks" Proceedings 63, no. 1: 3. https://doi.org/10.3390/proceedings2020063003

APA StylePăvălașcu, N. S., & Gabor, M. R. (2020). A Case Study on the Particularities and Sustainability of the Concepts of TQM, Quality Control, and Risk Management in the Corporate Insurance Industry: Loss and the Incidence of Catastrophic Risks. Proceedings, 63(1), 3. https://doi.org/10.3390/proceedings2020063003