The Application of Fractional Calculus in Modeling Economic Growth in Serbia

Abstract

1. Introduction

2. Fractional Calculus

3. Integer and Fractional Model Description

- : land area (km2);

- : arable land (hectares);

- : population;

- : school attendance (years);

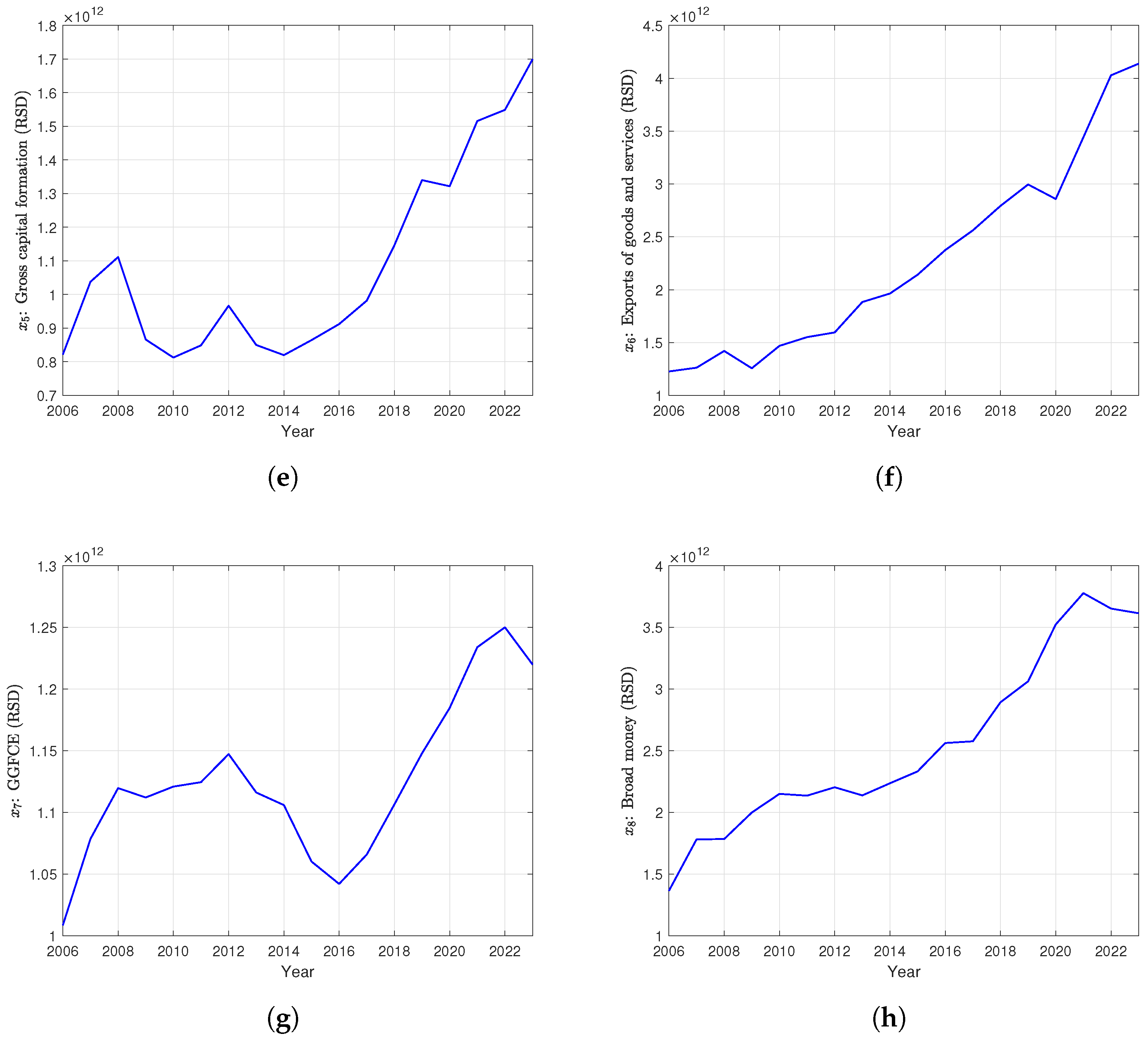

- : gross capital formation (GCF) (constant LCU, 2021 Serbian dinars);

- : exports of goods and services (constant LCU, 2021 Serbian dinars);

- : general government final consumption expenditure (GGFCE) (constant LCU, 2021 Serbian dinars);

- : broad money (constant LCU, 2021 Serbian dinars);

- : variation in gross capital formation (GCF).

- Land area, , is used as a measure of the available natural resources;

- Arable land, , is used as a measure of the quality of natural resources;

- Population, , is used as a measure of the available human resources;

- School attendance, , is used as a measure of the quality of human resources;

- Manufactured resources are represented by ;

- Exports, , are used as a measure of external impacts on the economy;

- GGFCE, , is used as a measure of budgetary impacts on the economy;

- is used as a measure of monetary impacts on the economy;

- is used as a measure of the impact of investment on the economy.

- (land area) and (arable land) are not only general measures of resources but are also important due to their relatively high share in gross value added and total employment of agriculture in the Serbian economy [25], especially in certain regions. Agriculture plays a critical role contributing to both domestic consumption and export capacity [26].

- (population) and (school attendance in years) represent the quantity and quality of the labor force. Indeed, workforce migration is an important constraint [27,28], influencing labor supply and domestic consumption. Investment in education and research and development [29] has often been recognized as essential for long-term GDP and productivity growth, although education as an indicator has limitations in the short term, as emphasized later on in this paper when discussing the results.

- (GCF) and (variation of GCF) record both the accumulation and dynamics of investments, crucial in the transition phase and after crises (e.g., 2008, 2020). Foreign direct investment still plays a crucial role in Serbia’s economic development, particularly in sectors like manufacturing and technology, as it facilitates not only technology transfer but general capital inflows that contribute to infrastructure development and unemployment rate decrease [20].

- (exports of goods and services) and (GGFCE) were chosen as representatives of external and fiscal impulses, which are significant in a small open economy like Serbia. Despite challenges in the EU accession process, Serbia’s efforts to integrate into regional and global markets put both the import and export of goods and services as a fundamental factor for GDP growth. In particular, in recent years, Serbia became recognized by its export of information and communication technology services [30].

- (broad money) was taken as a monetary indicator, taking into account the role of exchange rate stability and inflation in the transition period.

- IOM:

- GLFOM:

4. Optimization and Performance Evaluation

4.1. Economic Data for Serbia

4.2. Parameter Estimation

4.3. Model Evaluation

- The mean absolute deviation (MAD), given by

- The coefficient of determination (), given by

4.4. Fitting Results

4.5. Prediction Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| GDP | Gross domestic product |

| AIC | Akaike Information Criterion |

| EGM | Economic growth modeling |

| MSE | Mean squared error |

| MAD | Mean absolute deviation |

| GCF | Gross capital formation |

| GGFCE | General government final consumption expenditure |

| LCU | Local currency unit |

| IOM | Integer-order model |

| GLFOM | Grünwald–Letnikov fractional-order model |

| RSD | Republic of Serbia dinar |

| ARE | Absolute relative error |

Appendix A

- The values for variables , , , , , , and are taken from [34]. The values of land area () for 2023 were assumed to be the same as for the period of 2006–2022. Similarly, the values of arable land () for 2022 and 2023 were assumed to be equal to its 2021 values;

- The values for variable are taken from [35], with the values for 2023 assumed to be the same as in 2022.

| Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2006 | 4.7918 | 87 460 | 2 595 700 | 7 411 569 | 9.39 | 0.8215 | 1.2265 | 1.0085 | 1.3644 |

| 2007 | 5.1671 | 87 460 | 2 616 800 | 7 381 579 | 9.81 | 1.0378 | 1.2621 | 1.0786 | 1.7816 |

| 2008 | 5.4338 | 87 460 | 2 660 500 | 7 350 222 | 10.24 | 1.1113 | 1.4206 | 1.1197 | 1.7843 |

| 2009 | 5.2630 | 87460 | 2 613 700 | 7 320 807 | 10.31 | 0.8661 | 1.2567 | 1.1121 | 1.9995 |

| 2010 | 5.3478 | 87 460 | 2 654 300 | 7 291 436 | 10.37 | 0.8125 | 1.4686 | 1.1210 | 2.1504 |

| 2011 | 5.3507 | 87 460 | 2 639 500 | 7 236 519 | 10.57 | 0.8488 | 1.5513 | 1.1245 | 2.1361 |

| 2012 | 5.3270 | 87 460 | 2 562 100 | 7 201 497 | 10.57 | 0.9666 | 1.5956 | 1.1473 | 2.2042 |

| 2013 | 5.3510 | 87 460 | 2 590 300 | 7 166 553 | 10.57 | 0.8499 | 1.8835 | 1.1162 | 2.1382 |

| 2014 | 5.2545 | 87 460 | 2 605 700 | 7 131 787 | 10.72 | 0.8198 | 1.9639 | 1.1060 | 2.2366 |

| 2015 | 5.3226 | 87 460 | 2 591 000 | 7 095 383 | 11.02 | 0.8644 | 2.1414 | 1.0602 | 2.3328 |

| 2016 | 5.4809 | 87 460 | 2 598 000 | 7 058 322 | 11.13 | 0.9121 | 2.3746 | 1.0421 | 2.5628 |

| 2017 | 5.6105 | 87 460 | 2 595 000 | 7 020 858 | 11.16 | 0.9818 | 2.5613 | 1.0659 | 2.5770 |

| 2018 | 5.8713 | 87 460 | 2 583 000 | 6 982 604 | 11.27 | 1.1465 | 2.7929 | 1.1065 | 2.8933 |

| 2019 | 6.1502 | 87 460 | 2 579 000 | 6 945 235 | 11.37 | 1.3401 | 2.9954 | 1.1480 | 3.0631 |

| 2020 | 6.0918 | 84 090 | 2 604 000 | 6 899 126 | 11.51 | 1.3219 | 2.8581 | 1.1847 | 3.5243 |

| 2021 | 6.5760 | 84 090 | 2 615 000 | 6 834 326 | 11.51 | 1.5159 | 3.4419 | 1.2340 | 3.7781 |

| 2022 | 6.7490 | 84 090 | 2 615 000 | 6 664 449 | 11.51 | 1.5489 | 4.0281 | 1.2501 | 3.6530 |

| 2023 | 7.0087 | 84 090 | 2 615 000 | 6 623 183 | 11.51 | 1.6992 | 4.1380 | 1.22 | 3.6151 |

References

- Oldham, K.B.; Spanier, J. The Fractional Calculus; Academic Press: New York, NY, USA, 1974. [Google Scholar]

- Miller, K.S.; Ross, B. An Introduction to the Fractional Calculus and Fractional Differential Equations; John Wiley & Sons: New York, NY, USA, 1993. [Google Scholar]

- Samko, S.G.; Kilbas, A.A.; Marichev, O.I. Fractional Integrals and Derivatives; Gordon and Breach: Amsterdam, The Netherlands, 1993. [Google Scholar]

- Kilbas, A.A.; Srivastava, H.M.; Trujillo, J.I. Theory and Applications of Fractional Differential Equations; Elsevier: Amsterdam, The Netherlands, 2006. [Google Scholar]

- Atanackovic, T.M.; Kacapor, E.; Djekic, D.D.; Gilic, E. Non-local wave equation: Time delay with second order terms. Z. Angew. Math. Mech. 2025, 105, e202401241. [Google Scholar] [CrossRef]

- Atanackovic, T.M.; Djekic, D.D.; Gilic, E.; Kacapor, E. On a Generalized Wave Equation with Fractional Dissipation in Non-Local Elasticity. Mathematics 2023, 11, 3850. [Google Scholar] [CrossRef]

- Nonnenmacher, T.F.; Metzler, R. Applications of Fractional Calculus Ideas to Biology, in Applications of Fractional Calculus in Physics; World Scientific: Singapore, 1998. [Google Scholar]

- Scalas, E.; Gorenflo, R.; Mainardi, F. Fractional calculus and continuous-time finance. Phys. A Stat. Mech. Its Appl. 2000, 284, 376–384. [Google Scholar] [CrossRef]

- Laskin, N. Fractional market dynamics. Phys. A Stat. Mech. Its Appl. 2000, 287, 482–492. [Google Scholar] [CrossRef]

- Tenreiro Machado, J.A.; Silva, M.F.; Barbosa, R.S.; Jesus, I.S.; Reis, C.M.; Marcos, M.G.; Galhano, A.F. Some Applications of Fractional Calculus in Engineering. Math. Probl. Eng. 2010, 2010, 639801. [Google Scholar] [CrossRef]

- Podlubny, I. Fractional-Order Systems and Fractional-Order Controllers; Tech. Report UEF-03-94; Institute for Experimental Physics, Slovak Academy of Sciences: Kosice, Slovakia, 1994. [Google Scholar]

- Tejado, I.; Valério, D.; Pérez, E.; Valério, N. Fractional calculus in economic growth modelling: The Spanish and Portuguese cases. Int. J. Dyn. Control 2017, 5, 208–222. [Google Scholar] [CrossRef]

- Machado, J.A.T.; Mata, M.E. A fractional perspective to the bond graph modelling of world economies. Nonlinear Dyn. 2015, 80, 1839–1852. [Google Scholar] [CrossRef]

- Škovránek, T.; Podlubny, I.; Petráš, I. Modeling of the national economies in state-space: A fractional calculus approach. Econ. Model. 2012, 29, 1322–1327. [Google Scholar] [CrossRef]

- Ming, H.; Wang, J.; Fečkan, M. The Application of Fractional Calculus in Chinese Economic Growth Models. Mathematics 2019, 7, 665. [Google Scholar] [CrossRef]

- Tejado, I.; Hernández, E.; Valério, D. Economic growth in the European Union modelled with fractional derivatives: First results. Bull. Pol. Acad. Sci. Tech. Sci. 2018, 66, 455–465. [Google Scholar]

- Mitić, P.; Kojić, M.; Minović, J.; Stevanović, S.; Radulescu, M. An EKC-based modelling of CO2 emissions, economic growth, electricity consumption and trade openness in Serbia. Environ. Sci. Pollut. Res. 2024, 31, 5807–5825. [Google Scholar] [CrossRef] [PubMed]

- Obradovic, S.; Sapic, S.; Furtula, S.; Lojanica, N. Linkages between Inflation and Economic Growth in Serbia: An ARDL Bounds Testing Approach. Eng. Econ. 2017, 28, 401–410. [Google Scholar] [CrossRef]

- Uvalić, M.; Cerović, B.; Atanasijević, J. The Serbian economy ten years after the global economic crisis. Econ. Ann. 2020, 65, 33–71. [Google Scholar] [CrossRef]

- Vukmirović, V.; Kostić Stanković, M.; Pavlović, D.; Ateljević, J.; Bjelica, D.; Radonić, M.; Sekulić, D. Foreign Direct Investments’ Impact on Economic Growth in Serbia. J. Balk. Near East. Stud. 2021, 23, 122–143. [Google Scholar] [CrossRef]

- Podlubny, I. Fractional Differential Equations: An Introduction to Fractional Derivatives, Fractional Differential Equations, to Methods of Their Solution and Some of Their Applications, 1st ed.; Academic Press: San Diego, CA, USA, 1998. [Google Scholar]

- Ortigueira, M.D.; Coito, F. From differences to derivatives. Fract. Calc. Appl. Anal. 2004, 7, 459–471. [Google Scholar]

- Denison, E.F. Why Growth Rates Differ: Post-War Experience in Nine Western Countries; Brooking Institutions: Washington, DC, UDA, 1967. [Google Scholar]

- Lucas, R.E. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Mijatović, B.; Zavadjil, M. Serbia on the path to modern economic growth. Econ. Hist. Rev. 2023, 76, 199–220. [Google Scholar] [CrossRef]

- Stojanović, Ž. Agriculture in Serbia. In The Geography of Serbia: Nature, People, Economy; Manić, E., Nikitović, V., Djurović, P., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 199–206. [Google Scholar] [CrossRef]

- Drobnjaković, M.; Panić, M.; Kanazir, V.K.; Javor, V. Spatial aspects of labor force formation: The interrelation of cohort turnover and net migration in Serbia. Eurasian Geogr. Econ. 2022, 63, 543–559. [Google Scholar] [CrossRef]

- Lukić, V. Migration and mobility patterns in Serbia. In The Geography of Serbia: Nature, People, Economy; Manić, E., Nikitović, V., Djurović, P., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 157–167. [Google Scholar] [CrossRef]

- Kutlača, D.; Šestić, S.; Jelić, S.; Popović-Pantić, S. The impact of investment in research and development on the economic growth in Serbia. Industrija 2020, 48, 23–46. Available online: https://aseestant.ceon.rs/index.php/industrija/article/view/24949 (accessed on 12 June 2025).

- Domazet, I.; Marjanović, D.; Ahmetagić, D. The impact of high-tech products exports on economic growth—The case of Serbia, Bulgaria, Romania and Hungary. Ekon. Preduz. 2022, 70, 191–205. [Google Scholar] [CrossRef]

- Agasisti, T.; Bertoletti, A. Higher education and economic growth: A longitudinal study of European regions 2000–2017. Socio-Econ. Plan. Sci. 2022, 81, 100940. [Google Scholar] [CrossRef]

- Tejado, I.; Pérez, E.; Valério, D. Fractional Derivatives for Economic Growth Modelling of the Group of Twenty: Application to Prediction. Mathematics 2020, 8, 50. [Google Scholar] [CrossRef]

- Breton, T.R.; Siegel Breton, A. Education and Growth: Where All the Education Went; Working Papers, No. 16-02; Center for Research in Economics and Finance (CIEF): George Mason, VA, USA, 2016. [Google Scholar] [CrossRef]

- World Bank Group. File: API_SRB_DS2_en_excel_v2_17914.xls. Available online: https://data.worldbank.org/country/serbia?view=chart (accessed on 18 April 2025).

- Global Data Lab. File: GDL-Mean-Years-Schooling-Data.xlsx. Available online: https://globaldatalab.org/shdi/table/msch/SRB/?levels=1+4&interpolation=0&extrapolation=0 (accessed on 18 April 2025).

| IOM | GLFOM | |

|---|---|---|

| 18.22 × 106 | 92.94 × 106 | |

| 2.058 × 106 | 2.146 × 106 | |

| −7.413 × 105 | −68.22 × 104 | |

| −49.32 × 109 | −34.88 × 1010 | |

| −0.0326 | −297.3104 | |

| 0.5199 | 0.0551 | |

| 3.1923 | −2.5938 | |

| 0.2608 | 0.5737 | |

| 0.1984 | 298.7582 | |

| 0 | −0.0106 | |

| 0 | 0.0918 | |

| 0 | −0.0114 | |

| 0 | 0.0030 | |

| −1 | −0.7345 | |

| 0 | 0.0047 | |

| 0 | −0.0660 | |

| 1 | −0.5841 | |

| 1 | −0.7321 |

| Index | IOM | GLFOM |

|---|---|---|

| MSE () | 64.9737 | 2.8334 |

| MAD () | 5.6111 | 1.3498 |

| 0.9812 | 0.9992 | |

| AIC | 944.562 | 199.677 |

| Index | Variable | IOM | GLFOM |

|---|---|---|---|

| AIC without one variable | 936.26 | 1444.84 | |

| 938.97 | 1461.93 | ||

| 937.38 | 1430.01 | ||

| 936.13 | 1441.79 | ||

| 936.47 | 1479.16 | ||

| 941.18 | 1424.27 | ||

| 952.62 | 1454.12 | ||

| 938.15 | 1460.13 | ||

| 936.85 | 1479.22 | ||

| w found from AIC without one variable | |||

| Index | Variable | GLFOM |

|---|---|---|

| AIC | (order 0) | 201.03 |

| (order 0) | 236.51 | |

| (order 0) | 200.46 | |

| (order 0) | 199.75 | |

| (order −1) | 243.15 | |

| (order 0) | 199.67 | |

| (order 0) | 213.08 | |

| (order 1) | 230.34 | |

| (order 1) | 250.30 | |

| w found from AIC | (order 0) | |

| (order 0) | ||

| (order 0) | ||

| (order 0) | ||

| (order −1) | ||

| (order 0) | ||

| (order 0) | ||

| (order 1) | ||

| (order 1) |

| Index | IOM | GLFOM | ||

|---|---|---|---|---|

| MSE () | 64.9737 | 2.8334 | 2.8441 | 2.8319 |

| MAD () | 5.6111 | 1.3498 | 1.3528 | 1.3501 |

| 0.9812 | 0.9992 | 0.9992 | 0.9992 |

| Year | IOM | GLFOM | |||

|---|---|---|---|---|---|

| 2016 | 5.4809 | 5.3626 | 2.1593% | 5.4501 | 0.5630% |

| 2017 | 5.6105 | 5.4984 | 1.9969% | 5.5071 | 1.8429% |

| 2018 | 5.8713 | 6.2518 | 6.4800% | 5.8870 | 0.2680% |

| 2019 | 6.1502 | 6.0297 | 1.9593% | 6.2365 | 1.4035% |

| 2020 | 6.0918 | 6.9884 | 14.7184% | 6.1000 | 0.1349% |

| 2021 | 6.5760 | 7.1255 | 8.3564% | 6.7419 | 2.5231% |

| 2022 | 6.7490 | 6.7624 | 0.1981% | 6.6564 | 1.3726% |

| 2023 | 7.0087 | 6.7405 | 3.8263% | 6.7087 | 4.2807% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kacapor, E.; Valério, D.; Radonjic, L. The Application of Fractional Calculus in Modeling Economic Growth in Serbia. Fractal Fract. 2025, 9, 384. https://doi.org/10.3390/fractalfract9060384

Kacapor E, Valério D, Radonjic L. The Application of Fractional Calculus in Modeling Economic Growth in Serbia. Fractal and Fractional. 2025; 9(6):384. https://doi.org/10.3390/fractalfract9060384

Chicago/Turabian StyleKacapor, Enes, Duarte Valério, and Ljubivoje Radonjic. 2025. "The Application of Fractional Calculus in Modeling Economic Growth in Serbia" Fractal and Fractional 9, no. 6: 384. https://doi.org/10.3390/fractalfract9060384

APA StyleKacapor, E., Valério, D., & Radonjic, L. (2025). The Application of Fractional Calculus in Modeling Economic Growth in Serbia. Fractal and Fractional, 9(6), 384. https://doi.org/10.3390/fractalfract9060384