European Option Pricing under Sub-Fractional Brownian Motion Regime in Discrete Time

Abstract

:1. Introduction

2. Approximate Stationarity of the Second Moment Increments of sfBm

3. European Option Pricing under the Sub-Fractional Geometric Brownian Motion (sfgBm) Model

3.1. Pricing Formula for European Call Option in Discrete Time under Delta Hedging Strategy

3.2. Pricing Formula for European Call Option in Discrete Time under Mixed Hedging Strategy

4. Numerical Analysis

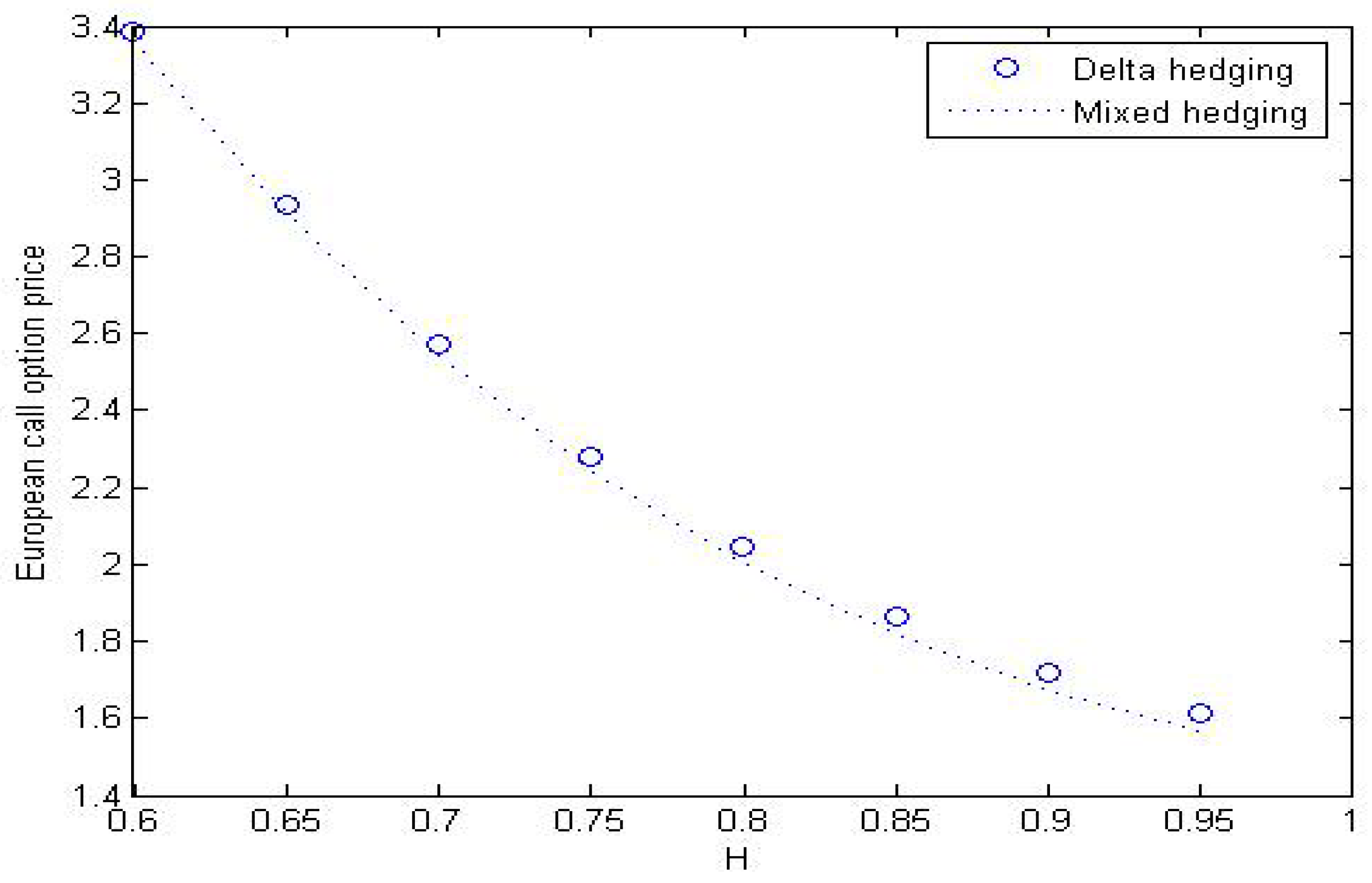

4.1. Price of European Call Option in Discrete Time under sfBm Model

4.2. Comparison of Delta Hedging Method and Mixed Hedging Method in sfBm Model

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Black, F.; Scholes, M.S. The pricing of options and corporate liabilities. J. Polit. Econ. 1973, 81, 637–659. [Google Scholar] [CrossRef]

- Necula, C. Option pricing in a fractional Brownian motion environment. Math. Rep. 2002, 2, 259–273. [Google Scholar] [CrossRef]

- Xiao, W.L.; Zhang, W.G.; Zhang, X.L.; Wang, Y.L. Pricing currency options in a fractional Brownian motion with jumps. Econ. Model. 2010, 27, 935–942. [Google Scholar] [CrossRef]

- Manley, B. How does real option value compare with Faustmann value when log prices follow fractional Brownian motion? Forest Policy Econ. 2017, 85, 76–84. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, R.; Yang, L.; Su, Y.; Ma, F. Pricing geometric Asian rainbow options under fractional Brownian motion. Physica A 2018, 494, 8–16. [Google Scholar] [CrossRef]

- Yang, P.; Xu, Z.L. Numerical Valuation of European and American Options under Fractional Black-Scholes Model. Fractal Fract. 2022, 6, 143. [Google Scholar] [CrossRef]

- Dufera, T.T. Fractional Brownian motion in option pricing and dynamic delta hedging: Experimental simulations. N. Am. J. Econ. Financ. 2024, 69, 102017. [Google Scholar] [CrossRef]

- Nouty, C.E. The fractional mixed fractional Brownian motion. Stat. Probabil. Lett. 2003, 65, 111–120. [Google Scholar] [CrossRef]

- Sun, L. Pricing currency options in the mixed fractional Brownian motion. Physica A 2013, 392, 3441–3458. [Google Scholar] [CrossRef]

- Kim, K.H.; Yun, S.; Kim, N.U.; Ri, J.H. Pricing formula for European currency option and exchange option in a generalized jump mixed fractional Brownian motion with time-varying coefficients. Physica A 2019, 522, 215–231. [Google Scholar] [CrossRef]

- Chen, Q.S.; Zhang, Q.; Liu, C. The pricing and numerical analysis of lookback options for mixed fractional Brownian motion. Chaos Solitons Fractals 2019, 128, 123–128. [Google Scholar] [CrossRef]

- Xu, F.; Yang, X.J. Pricing European Options under a Fuzzy Mixed Weighted Fractional Brownian Motion Model with Jumps. Fractal Fract. 2023, 7, 859. [Google Scholar] [CrossRef]

- Magdziarz, M. Black scholes formula in subdiffusive regime. J. Stat. Phys. 2009, 136, 553–564. [Google Scholar] [CrossRef]

- Gu, H.; Liang, J.R.; Zhang, Y.X. Time-changed geometric fractional Brownian motion and option pricing with transaction costs. Physica A 2012, 391, 3971–3977. [Google Scholar] [CrossRef]

- Guo, Z.D. Option pricing under the Merton model of the short rate in subdiffusive Brownian motion regime. J. Stat. Comput. Sim. 2017, 87, 519–529. [Google Scholar] [CrossRef]

- Shokrollahi, F. The evaluation of geometric Asian power options under time changed mixed fractional Brownian motion. J. Comput. Appl. Math. 2018, 344, 716–724. [Google Scholar] [CrossRef]

- Corns, T.R.A.; Satchell, S.E. Skew Brownian Motion and Pricing European Options. Eur. J. Financ. 2007, 13, 523–544. [Google Scholar] [CrossRef]

- Zhu, S.P.; He, X.J. A new closed-form formula for pricing European options under a skew Brownian motion. Eur. J. Financ. 2018, 24, 1063–1074. [Google Scholar] [CrossRef]

- Pasricha, P.; He, X.J. Skew-Brownian motion and pricing European exchange options. Int. Rev. Financ. Anal. 2022, 82, 102120. [Google Scholar] [CrossRef]

- Hussain, S.; Arif, H.; Noorullah, M.; Pantelous, A. Pricing American Options under Azzalini Ito-McKean Skew Brownian Motions. Appl. Math. Comput. 2023, 451, 128040. [Google Scholar] [CrossRef]

- Song, S.Y.; Wang, X.C.; Zhang, X.W. Valuation of spread options under correlated skew Brownian motions. Eur. J. Financ. 2023, 2023, 2202821. [Google Scholar] [CrossRef]

- Bojdecki, T.; Gorostiza, L.G.; Talarczyk, A. Sub-fractional Brownian motion and its relation to occupation times. Stat. Probabil. Lett. 2004, 69, 405–419. [Google Scholar] [CrossRef]

- Tudor, C. Some properties of the sub-fractional Brownian motion. Stoch. Int. J. Probab. Stoch. Process. 2007, 79, 431–448. [Google Scholar] [CrossRef]

- Shen, G.J.; Chen, C. Stochastic integration with respect to the sub-fractional Brownian motion with H ∈ . Stat. Probabil. Lett. 2012, 82, 240–251. [Google Scholar] [CrossRef]

- Yan, L.; Shen, G.J.; He, K. Itô’s formula for a sub-fractional Brownian motion. Comm. Stoch. Anal. 2011, 5, 9. [Google Scholar]

- Nouty, C.E.; Zili, M. On the sub-mixed fractional Brownian motion. Appl. Math. Ser. B 2015, 30, 27–43. [Google Scholar]

- Rao, B.L.S.P. More on maximal inequalities for sub-fractional Brownian motion. Stoch. Anal. Appl. 2019, 38, 1686395. [Google Scholar]

- Araneda, A.A.; Bertschinger, N. The sub-fractional CEV model. Physica A 2021, 573, 125974. [Google Scholar] [CrossRef]

- Wang, W.; Cai, G.H.; Tao, X.X. Pricing geometric asian power options in the sub-fractional brownian motion environment. Chaos Solitons Fractals 2021, 145, 110754. [Google Scholar] [CrossRef]

- Wang, X.T.; Yang, Z.J.; Cao, P.Y.; Wang, S.L. The closed-form option pricing formulas under the sub-fractional Poisson volatility models. Chaos Solitons Fractals 2021, 148, 111012. [Google Scholar] [CrossRef]

- Bian, L.; Li, Z. Fuzzy simulation of European option pricing using sub-fractional Brownian motion. Chaos Solitons Fractals 2021, 153, 111442. [Google Scholar] [CrossRef]

- Xu, F.; Li, R.Z. The pricing formulas of compound option based on the sub-fractional Brownian motion model. J. Phys. Conf. Ser. 2018, 1053, 012027. [Google Scholar] [CrossRef]

- Wang, X.T.; Zhao, Z.F.; Fang, X.F. Option pricing and portfolio hedging under the mixed hedging strategy. Physica A 2015, 424, 194–206. [Google Scholar] [CrossRef]

- Kim, K.H.; Kim, S.H.; Jo, H.B. Option pricing under mixed hedging strategy in time-changed mixed fractional Brownian model. J. Comput. Appl. Math. 2022, 416, 114496. [Google Scholar] [CrossRef]

- Guo, Z.D.; Yuan, H.J. Pricing European option under the time-changed mixed. Physica A 2014, 406, 73–79. [Google Scholar] [CrossRef]

| Strike Price | Delta Hedging | Mixed Hedging | |

|---|---|---|---|

| 42 | 9.0487 | 9.0486 | 0.0001 |

| 44 | 7.1507 | 7.1493 | 0.0014 |

| 46 | 5.2813 | 5.2741 | 0.0073 |

| 48 | 3.5256 | 3.5042 | 0.0215 |

| 50 | 2.0459 | 2.0077 | 0.0382 |

| 52 | 0.9967 | 0.9533 | 0.0434 |

| 54 | 0.3981 | 0.3650 | 0.0331 |

| 56 | 0.1290 | 0.1113 | 0.0177 |

| Week | Stock Price | Delta | Shares Purchased | Cost of Shares Purchased | Cumulative Cost Including Interest | Interest Cost | Option Price |

|---|---|---|---|---|---|---|---|

| 0 | 49 | 0.497333403 | 49,733.34 | 2,436,933.674 | 2,436,933.674 | 2343.205 | 0.717787102 |

| 1 | 49.45 | 0.584555406 | 8722.20 | 431,312.805 | 2,870,589.684 | 2760.182 | 0.917621068 |

| 2 | 50.32 | 0.750678897 | 16,612.35 | 835,933.407 | 3,709,283.273 | 3566.619 | 1.451814242 |

| 3 | 49.81 | 0.646630253 | −10,404.864 | −518,266.296 | 3,194,583.596 | 3071.715 | 1.044419038 |

| 4 | 50.86 | 0.834883451 | 18,825.320 | 957,455.765 | 4,155,111.076 | 3995.299 | 1.776745538 |

| 5 | 50.43 | 0.763181323 | −7170.213 | −361,593.832 | 3,797,512.543 | 3651.454 | 1.379749073 |

| 6 | 50.32 | 0.739377591 | −2380.373 | −119,780.379 | 3,681,383.618 | 3539.792 | 1.244182892 |

| 7 | 51.39 | 0.906823739 | 16,744.615 | 860,505.755 | 4,545,429.165 | 4370.605 | 2.080285620 |

| 8 | 51.54 | 0.925164351 | 1834.061 | 94,527.514 | 4,644,327.284 | 4465.699 | 2.164909300 |

| 9 | 50.65 | 0.802252336 | −12,291.202 | −622,549.356 | 4,026,243.627 | 3871.388 | 1.334854428 |

| 10 | 51.71 | 0.948091617 | 14,583.928 | 754,134.922 | 4,784,249.937 | 4600.240 | 2.219020546 |

| 11 | 52.04 | 0.972919347 | 2482.773 | 129,203.507 | 4,918,053.684 | 4728.898 | 2.484633325 |

| 12 | 52.60 | 0.992800929 | 1988.158 | 104,577.121 | 5,027,359.703 | 4834.000 | 2.986135035 |

| 13 | 53.83 | 0.999842305 | 704.138 | 37,903.727 | 5,070,097.43 | 4875.094 | 4.165455437 |

| 14 | 52.81 | 0.998258641 | −158.366 | −8363.330 | 5,066,609.194 | 4871.740 | 3.098185470 |

| 15 | 51.12 | 0.923907629 | −7435.1012 | −380,082.373 | 4,691,398.561 | 4510.960 | 1.393168349 |

| 16 | 50.71 | 0.857023251 | −6688.438 | −339,170.681 | 4,356,738.84 | 4189.172 | 0.9653540488 |

| 17 | 50.33 | 0.742755222 | −11,426.803 | −575,110.99 | 3,785,817.022 | 3640.209 | 0.5893340681 |

| 18 | 50.81 | 0.934088036 | 19,133.281 | 972,162.028 | 4,761,619.259 | 4578.480 | 0.9237137816 |

| 19 | 51.14 | 0.997258440 | 6317.0404 | 323,053.446 | 5,089,251.185 | 4893.511 | 1.188410772 |

| 20 | 52.07 | 1.000 | 274.156 | 14,275.303 | 5,108,419.999 | 4911.942 | 2.070000000 |

| Week | Stock Price | Shares Purchased | Cost of Shares Purchased | Cumulative Cost Including Interest | Interest Cost | Option Price | |

|---|---|---|---|---|---|---|---|

| 0 | 49 | 0.519720461 | 51,972.046 | 2,546,630.254 | 2,546,630.254 | 2448.683 | 0.691416840 |

| 1 | 49.45 | 0.610171453 | 9045.0992 | 447,280.155 | 2,996,359.092 | 2881.115 | 0.892284217 |

| 2 | 50.32 | 0.777127706 | 16,695.625 | 840,123.865 | 3,839,364.072 | 3691.696 | 1.43154169 |

| 3 | 49.81 | 0.674473194 | −10,265.451 | −511,322.124 | 3,331,733.644 | 3203.590 | 1.02144752 |

| 4 | 50.86 | 0.858844664 | 18,437.147 | 937,713.296 | 4,272,650.530 | 4108.318 | 1.76175939 |

| 5 | 50.43 | 0.791102994 | −6774.167 | −341,621.242 | 3,935,137.606 | 3783.786 | 1.36173009 |

| 6 | 50.32 | 0.768722934 | −2238.006 | −112,616.462 | 3,826,304.930 | 3679.139 | 1.22587031 |

| 7 | 51.39 | 0.925707400 | 15,698.447 | 806,743.171 | 4,636,727.240 | 4458.392 | 2.07125983 |

| 8 | 51.54 | 0.942012829 | 1630.543 | 84,038.181 | 4,725,223.813 | 4543.484 | 2.15757677 |

| 9 | 50.65 | 0.831665364 | −11,034.747 | −558,909.910 | 4,170,857.387 | 4010.440 | 1.32094420 |

| 10 | 51.71 | 0.961938784 | 13,027.342 | 673,643.855 | 4,848,511.682 | 4662.030 | 2.21402296 |

| 11 | 52.04 | 0.981702680 | 1976.390 | 102,851.315 | 4,956,025.027 | 4765.409 | 2.48188050 |

| 12 | 52.60 | 0.995862606 | 1415.993 | 74,481.211 | 5,035,271.647 | 4841.607 | 2.98532983 |

| 13 | 53.83 | 0.999942406 | 407.98 | 21,961.563 | 5,062,704.817 | 4867.380 | 4.16543469 |

| 14 | 52.81 | 0.999200206 | −74.22 | −3919.558 | 5,063,652.639 | 4868.897 | 3.09799812 |

| 15 | 51.12 | 0.946413643 | −5278.656 | −269,844.910 | 4,798,676.626 | 4614.112 | 1.38841294 |

| 16 | 50.71 | 0.893540210 | −5287.343 | −268,121.179 | 4,535,169.559 | 4360.740 | 0.958587694 |

| 17 | 50.33 | 0.797629707 | −9591.050 | −482,717.562 | 4,056,812.737 | 3900.781 | 0.580916083 |

| 18 | 50.81 | 0.962372528 | 16,474.282 | 837,058.274 | 4,897,771.792 | 4709.396 | 0.921047903 |

| 19 | 51.14 | 0.999639073 | 3726.655 | 190,581.111 | 5,093,062.299 | 4897.175 | 1.18829746 |

| 20 | 52.07 | 1.000 | 36.093 | 1879.347 | 5,099,838.821 | 4903.691 | 2.070000000 |

| H | Delta Hedging | Mixed Hedging | ||

|---|---|---|---|---|

| Hedging Cost | Hedging Error Ratio | Hedging Cost | Hedging Error Ratio | |

| 0.65 | 122,108.260 | 0.66878962 | 116,423.210 | 0.65177851 |

| 0.7 | 118,896.608 | 0.62489765 | 112,041.758 | 0.58961575 |

| 0.75 | 113,917.756 | 0.55685429 | 106,155.329 | 0.50610081 |

| 0.8 | 108,419.999 | 0.48171932 | 99,838.821 | 0.41648404 |

| 0.85 | 103,072.969 | 0.40864427 | 90,728.643 | 0.28723150 |

| 0.9 | 94,729.545 | 0.29461906 | 79,601.134 | 0.12935765 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, Z.; Liu, Y.; Dai, L. European Option Pricing under Sub-Fractional Brownian Motion Regime in Discrete Time. Fractal Fract. 2024, 8, 13. https://doi.org/10.3390/fractalfract8010013

Guo Z, Liu Y, Dai L. European Option Pricing under Sub-Fractional Brownian Motion Regime in Discrete Time. Fractal and Fractional. 2024; 8(1):13. https://doi.org/10.3390/fractalfract8010013

Chicago/Turabian StyleGuo, Zhidong, Yang Liu, and Linsong Dai. 2024. "European Option Pricing under Sub-Fractional Brownian Motion Regime in Discrete Time" Fractal and Fractional 8, no. 1: 13. https://doi.org/10.3390/fractalfract8010013

APA StyleGuo, Z., Liu, Y., & Dai, L. (2024). European Option Pricing under Sub-Fractional Brownian Motion Regime in Discrete Time. Fractal and Fractional, 8(1), 13. https://doi.org/10.3390/fractalfract8010013