REA, Triple-Entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems

Abstract

:1. Introduction

2. Concepts

2.1. Triple-Entry Bookkeeping

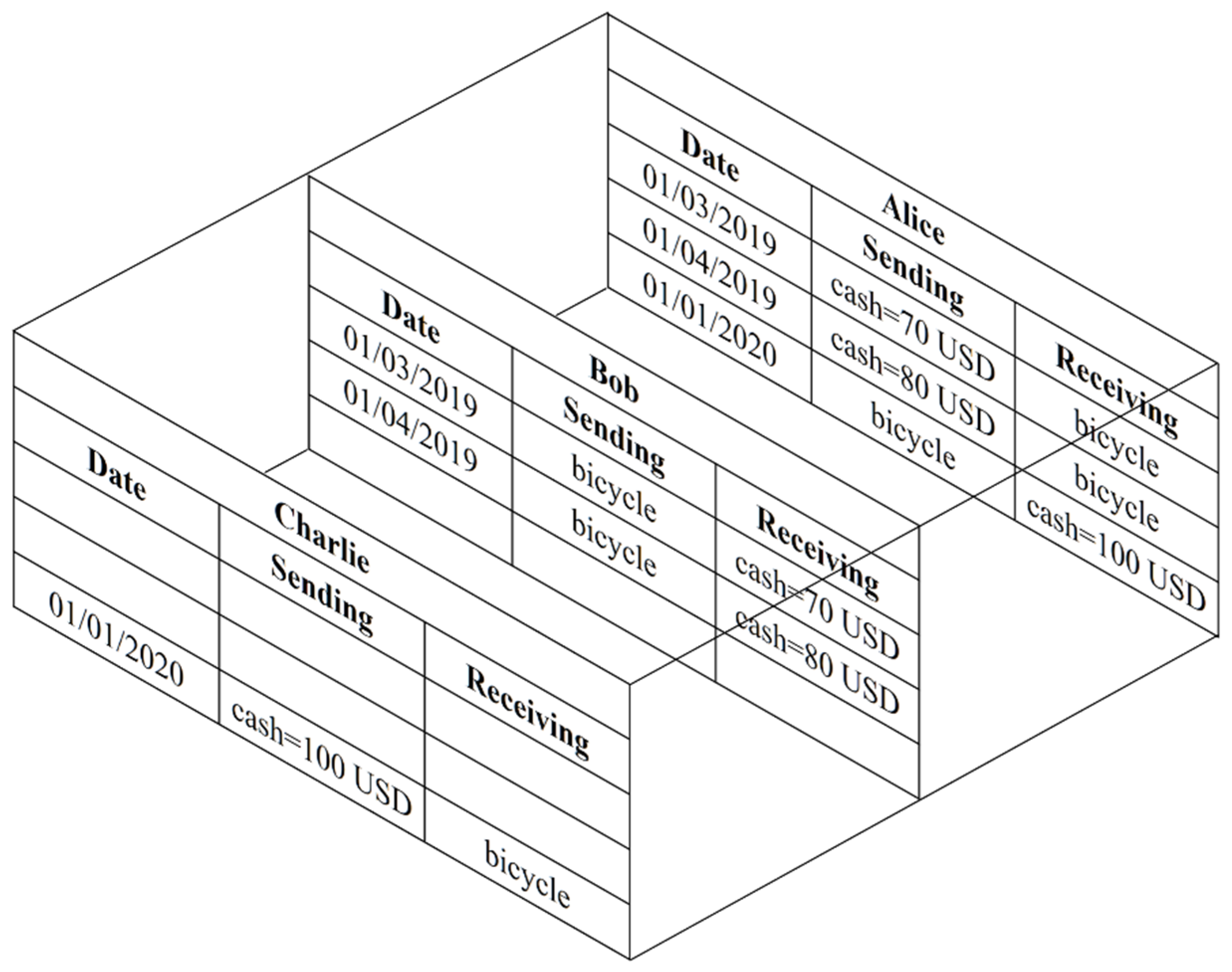

2.2. Triple-Entry Accounting

2.3. The REA Framework

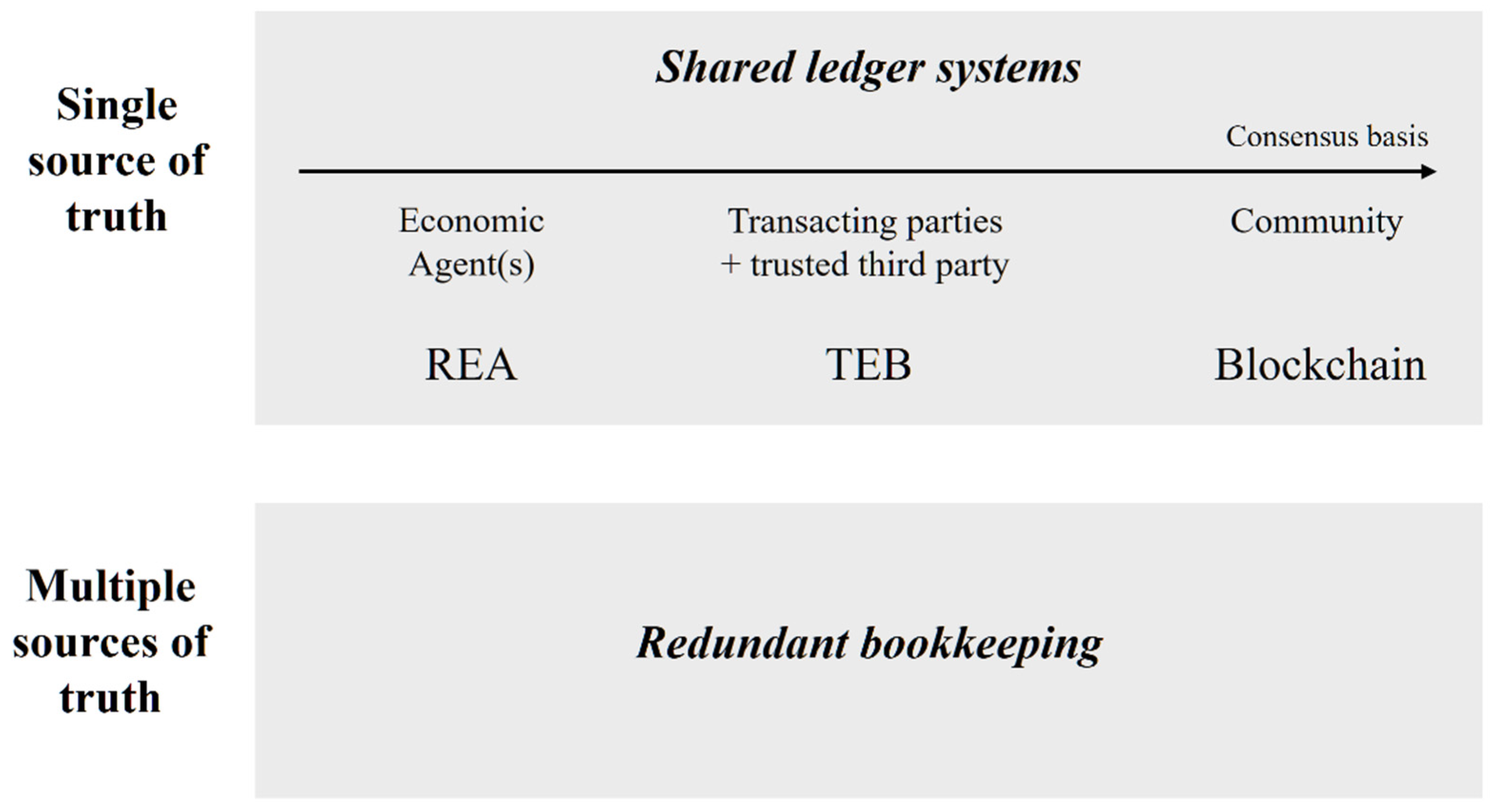

2.4. Differences and Similarities between REA, Triple-Entry Systems and Blockchain

3. Methodology

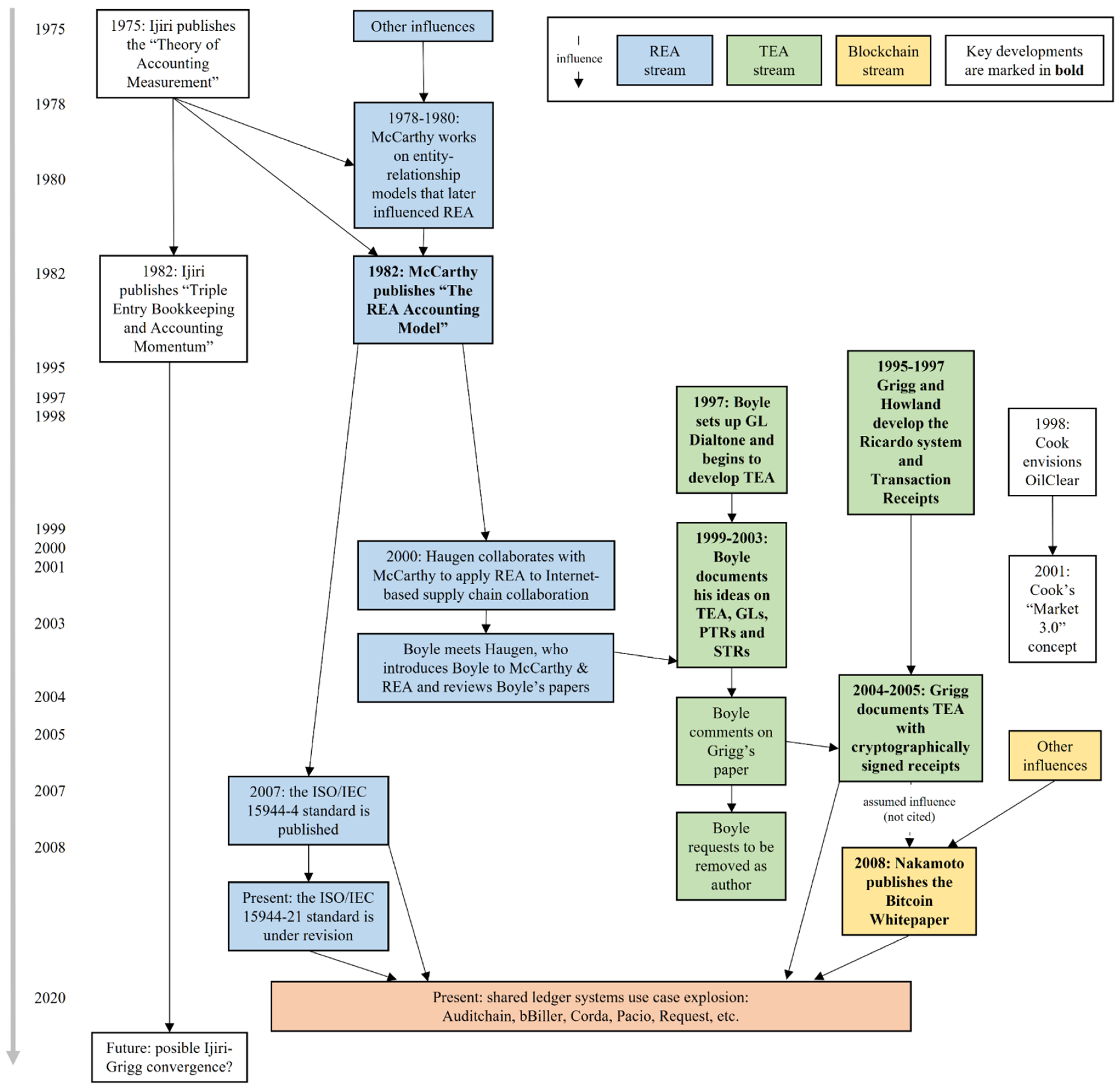

4. Results: A Genealogy of Shared Ledger Systems

4.1. Early Antecedents to Triple-Entry Accounting: Momentum Accounting and the Resource-Event-Agent Model

4.2. The Single Truth ‘Revolution’

4.3. The Single Truth Convergence

5. Discussion

6. Conclusions

7. Limitations and Future Research

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| ANSI/X3 | American National Standards Committee on Computers and Information Processing |

| AVCO | Average Cost |

| B2B | Business-to-business |

| DLT | Distributed Ledger Technology |

| FIFO | First-in, First Out |

| G2G | Government to Government |

| GAAP | Generally Accepted Accounting Principles |

| GL | General Ledgers |

| IEC | International Electrotechnical Commission |

| ISO | International Organization for Standardization |

| LIFO | Last-in, First-Out |

| OeBTO | Open-edi business transaction ontology |

| OeDBTR | Open-edi Distributed Business Transaction Repository |

| PTR | Public Transaction Repository |

| REA | Resource-Event-Agent |

| SPARC | Standards Planning and Requirements Committee |

| STR | Shared Transaction Repository |

| TEA | Triple-entry accounting |

| TEB | Triple-entry bookkeeping |

| 1 | In the remainder we refer to blockchain or blockchain technology in order to encompass all the possible architectural configurations and, for the sake of simplicity, also the larger family of distributed ledger technologies, i.e., community consensus-based distributed ledgers where the storage of data is not based on chains of blocks. For further understanding of the family of the distributed ledger technologies see Tasca and Tessone (2019). |

| 2 | |

| 3 | For a discussion of the different views on the specificity of double-entry bookkeeping, see Goldberg (1965, pp. 215–19). |

| 4 | General Ledger for Reporting (Boyle 2001b). |

| 5 | Multi-user accounting suite. |

| 6 | In earlier versions, it was defined as a “generalized accounting framework” or “accounting model” (McCarthy 1982, p. 554; McCarthy 2001). |

| 7 | See, for instance, Haugen and McCarthy (2000), extending the REA model to conceive a single source of truth for an event-driven generalized representation of material flows throughout supply chains and demand chains. |

| 8 | |

| 9 | Among others, such as Pacioli not inventing double-entry accounting but merely documenting it. |

| 10 | Also note that, while Pacioli (1494) did popularize double-entry accounting, Benedetto Cotrugli (1573) and Marino de Raphaeli (1475 in Sangster 2015) had preceded him in beginning to introduce and develop the concept (Postma and van der Helm 2000; Sangster 2015; Sangster and Rossi 2018). Furthermore, comparable double-entry systems had been developed separately by the Italians, Koreans, and the second Muslim Caliphate at different times for the same purpose (Byeongju 2018; El-Halaby and Hussainey 2016; Zaid 2004). |

| 11 | Setting aside changes in equity for the sake of simplicity (Ijiri 1986, p. 747). |

| 12 | Which becomes “income” when multiplied by duration (Ijiri 1986, p. 747). |

| 13 | And becomes “impulse” when multiplied by duration (Ijiri 1986, pp. 747–48a). |

| 14 | Ijiri also advocated cryptosystem solutions involving public encryption keys and private decryption keys to protect business confidentiality (Ijiri and Kelly 1980, pp. 118–20). |

| 15 | While McCarthy (1982, p. 56) states that “the REA framework (…) is explained using the ideas of a number of accounting theorists, principally Yuji Ijiri,” quotes concepts, uses ideas and expresses accounting principles following Ijiri (1975) on several occasions, Holman (personal communication, 21 February 2020) makes clear that “only a few vocabulary terms were adopted in the interest of consistent terminology, and nothing more.” Ijiri (1993) defended the “beauty of double-entry bookkeeping,” which McCarthy radically opposed. Thus, connections between the two authors can only be properly drawn if adequately contextualized, so as not to present them as allied researchers. |

| 16 | Boyle also criticized REA for being mislabeled as an accounting system (when, in his view, it was really a very generalized business information system). He moreover believed that the circumstances that REA had originally come to solve in the 1980s did not exist anymore (Boyle 2000c). For a response, see Haugen (2001) and McCarthy (2001). |

| 17 | |

| 18 | Grigg, Ian (personal communication, 15 April 2020). |

| 19 | For example, it is possible to calculate Bob’s balance by reading and calculating the net sum of all the receipts mentioning Bob. |

| 20 | |

| 21 | Boyle was a part of the same cypherpunk mailing lists in which cited influences in the Bitcoin whitepaper like Adam Back and Wei Dai participated (see Nakamoto 2008; Venona Cypherpunks Archives 2004) |

| 22 | Some believe Grigg is Satoshi Nakamoto himself, based on, inter alia, stylometric studies (Bits n Coins 2019; Helsel 2018), a claim we are unable to verify. Grigg (2016c) has denied being a member of the Satoshi Nakamoto team. However, Grigg (2016b) has also claimed direct knowledge of its internal workings. |

| 23 |

References

- Alawadhi, Abdullah, Brad Ames, Maciel de Aquino, Carlos Elder, María Arthúrsdóttir, Gerard M. Brennan, Helen L. Brown-Liburd, Nancy Bumgarner, Paul Byrnes, Thomas R. Criste, and et al. 2015. Audit Analytics and Continuous Audit: Looking Toward the Future. New York: American Institute of Certified Public Accountants (AICPA). [Google Scholar]

- Auditchain. 2018. Auditchain: Decentralized Continuous Audit & Reporting Protocol Ecosystem. Auditchain Whitepaper. Available online: https://auditchain.com/Auditchain-Whitepaper.pdf (accessed on 28 January 2020).

- Bits n Coins. 2019. The Many Facts Pointing to Ian Grigg Being Satoshi. Bits n Coins. Available online: https://www.bitscoins.net/the-many-facts-pointing-to-ian-griggbeing-satoshi/ (accessed on 12 February 2020).

- Boyle, Todd. 2000a. CDEA General Ledger Schema. Ledgerism. Available online: https://web.archive.org/web/20071001201740/http://www.ledgerism.net/GLSchema1.txt (accessed on 17 January 2020).

- Boyle, Todd. 2000b. Draft Schema for General Ledger. Ledgerism. Available online: http://web.archive.org/web/20051003224536/http://ledgerism.net/GLSchemaDraft1.txt (accessed on 8 February 2020).

- Boyle, Todd. 2000c. Re: Company Centric View Ends. Data Goes to the Net. Available online: http://linas.org/mirrors/www.gldialtone.com/2001.07.14/ToddREAPost.htm (accessed on 8 February 2020).

- Boyle, Todd. 2000d. The Public Transaction Repository (PTR) Project. GL Dialtone. Available online: http://web.archive.org/web/20000622133330/http://www.gldialtone.com/PTR.htm (accessed on 17 January 2020).

- Boyle, Todd. 2000e. Webledger. GL Dialtone. Available online: http://web.archive.org/web/20000610172851/GLDialtone.com/webledger.htm (accessed on 17 January 2020).

- Boyle, Todd. 2000f. WebLedger Architectures; Ending Data Duplication. GL Dialtone. Available online: http://web.archive.org/web/20000829141221/http://www.gldialtone.com/endredundancy.htm (accessed on 17 January 2020).

- Boyle, Todd. 2001a. End Data Duplication. GL Dialtone. Available online: https://linas.org/mirrors/www.gldialtone.com/2001.07.14/endredundancy.htm (accessed on 17 January 2020).

- Boyle, Todd. 2001b. GLT and GLR: Component Architecture for General Ledgers. GL Dialtone. Available online: https://linas.org/mirrors/www.gldialtone.com/2001.07.14/GLT-GLR.htm (accessed on 17 January 2020).

- Boyle, Todd. 2001c. RE: Initial Draft of CPP-CPA Specification. Available online: http://lists.ebxml.org/archives/ebxml-bp/200101/msg00089.html (accessed on 17 January 2020).

- Boyle, Todd. 2001d. Resume. GL Dialtone. Available online: http://web.archive.org/web/20010120224200fw_/http://www.gldialtone.com/resume.htm (accessed on 12 February 2020).

- Boyle, Todd. 2001e. Services. GL Dialtone. Available online: http://web.archive.org/web/20010120224200fw_/http://www.gldialtone.com/services.htm (accessed on 12 February 2020).

- Boyle, Todd. 2001f. The Shared Transaction Repository (STR) ver. 0.60 Spec. GL Dialtone. Available online: http://linas.org/mirrors/www.gldialtone.com/2001.07.14/STR.htm (accessed on 11 February 2020).

- Boyle, Todd. 2002. Inter-ledger Semantics and Methods: Requirements. GL Dialtone. Available online: http://web.archive.org/web/20021128152948/http://www.gldialtone.com/ (accessed on 11 February 2020).

- Boyle, Todd. 2003a. Accounting Hypercubes on the Internet. Ledgerism. Available online: http://web.archive.org/web/20060102014117/http://www.ledgerism.net/hypercub.htm (accessed on 11 February 2020).

- Boyle, Todd. 2003b. File-Based Commerce (FBC) Architecture ver. 0.31 spec. Business Requirements Viewpoint. Ledgerism. Available online: http://web.archive.org/web/20050211111755/http://ledgerism.net/fbc.htm (accessed on 8 February 2020).

- Boyle, Todd. 2003c. General Ledgerism. Ledgerism. Available online: http://web.archive.org/web/20060425114848/http://ledgerism.net/ (accessed on 8 February 2020).

- Boyle, Todd. 2003d. Ledger Ontology. Ledgerism. Available online: http://web.archive.org/web/20080209023044/http://ledgerism.net:80/LedgerOntology.htm (accessed on 11 February 2020).

- Boyle, Todd. 2003e. Shared Transaction Repository (STR) a High Level Software Specification. Ledgerism. Available online: http://web.archive.org/web/20060102052824/http://www.ledgerism.net/STR.htm (accessed on 17 January 2020).

- Boyle, Todd. 2003f. The Argument to Abolish Double-Entry Accounting and Abolish the Assets = Liabilities + Owner’s Equity Equation. Ledgerism. Available online: http://web.archive.org/web/20031208235246/http://ledgerism.net/GLSchema2.txt (accessed on 8 February 2020).

- Brown, Richard Gendall. 2015. How to Explain the Value of Replicated, Shared Ledgers from First Principles. Richard Gendal Brown: Thoughts on the Future of Finance. Available online: https://gendal.me/2015/04/27/how-to-explain-the-value-of-replicated-shared-ledgers-from-first-principles/ (accessed on 12 February 2020).

- Brown, Richard Gendall. 2020. Blockchain’s ‘Troughs of Disillusionment’ Are Really the ‘Trenches of Deployment.’ Forbes. Available online: https://www.forbes.com/sites/richardgendalbrown/2020/01/09/blockchains-troughs-of-disillusionment-are-really-the-trenches-of-deployment/ (accessed on 12 February 2020).

- Byeongju, H. 2018. An Introduction on Traditional Double Entry Bookkeeping of Korea. Paper presented at 8th World Congress of Korean Studies, Philadelphia, PA, USA, October 5–7. [Google Scholar]

- Cai, Cinthia Weiyi. 2019. Triple-Entry Accounting with Blockchain: How far Have we Come? Accounting & Finance. Melbourne: Accounting and Finance Association of Australia and New Zealand. [Google Scholar]

- Chandler, Alfred D. 1977. The Visible Hand: Managerial Revolution in American Business. Harvard: Harvard University Press. [Google Scholar]

- Cook, Chris. 2002. Market 3.0: The Final Version. Mondovisione. Available online: https://mondovisione.com/exchanges/handbook-articles/market-30-the-final-version/ (accessed on 17 January 2020).

- Cook, Chris. 2016. Fintech 2.0. P2P Foundation. Available online: https://blog.p2pfoundation.net/fintech-2-0/2016/10/06 (accessed on 6 January 2020).

- Cotrugli, Benedetto. 1573. Della Mercatura et del Mercante Perfetto. Libri Quattro. Available online: https://archive.org/details/bub_gb_Ohloe05v0-oC (accessed on 6 January 2020).

- Dai, Jun. 2017. Three Essays on Audit Technology: Audit 4.0, Blockchain and Audit App. Ph.D. dissertation, The State University of New Jersey, New Brunswick, NJ, USA. [Google Scholar]

- Dai, Jun, and Miklos A. Vasarhelyi. 2017. Toward Blockchain-Based Accounting and Assurance. Journal of Information Systems 31: 5–21. [Google Scholar] [CrossRef]

- Dunn, Cheryl, Gregory J. Gerard, and Severin V. Grabski. 2016. Resources-Events-Agents Design Theory: A Revolutionary Approach to Enterprise System Design. Communications for the Association for Information Systems 38: 554–95. [Google Scholar] [CrossRef]

- Edwards, James Don. 1960. Early Bookkeeping and its Development into Accounting. Business History Review 34: 446–58. [Google Scholar] [CrossRef]

- El-Halaby, Sherif, and Khaled Hussainey. 2016. Contributions of Early Muslim Scholars to Originality of Bookkeeping-system. Corporate Ownership and Control 13: 543–60. [Google Scholar]

- Faccia, Alessio, and Dominick Mosco. 2019. Understanding the Nature of Accounts Using Comprehensive Tools to Understand Financial Statements. Financial Markets Institutions and Risks 3: 18–27. [Google Scholar] [CrossRef]

- Faccia, Alessio, and Narcisa Roxana Mostenau. 2019. Accounting and blockchain technology: From double-entry to triple-entry. The Business and Management Review 10: 108–16. [Google Scholar]

- Fullana, Olga, and Javier Ruiz. 2020. Accounting Information Systems in the Blockchain Era. Social Science Research Network (SSRN). Available online: https://ssrn.com/abstract=3517142 (accessed on 17 February 2020).

- Gal, Graham, and William E. McCarthy. 1986. Operation of a Relational Accounting System. Advances in Accounting 3: 83–112. [Google Scholar]

- Ge, Jun. 2005. Accounting English. Available online: http://abook.cn/pdf/H-0535.0101.pdf (accessed on 18 February 2020).

- Geerts, Guido L., and William E. McCarthy. 2006. Policy-Level Specifications in REA Enterprise Information Systems. Journal of Information Systems 20: 37–63. [Google Scholar] [CrossRef]

- Ginigoada Foundation. 2017. Introduction to Bookkeeping: A Flexible Learning Course. Available online: http://oasis.col.org/bitstream/handle/11599/2749/2017_Ginigoada-Bisnis-Foundation_Introduction-to-Bookkeeping_pdf (accessed on 18 February 2020).

- Goldberg, Louis. 1965. An Inquiry into the Nature of Accounting. American Accounting Association. Menasha: George Banta Company. [Google Scholar]

- Gomaa, Ahmed, Mohammed Gomaa, Salem Boumediene, and Magdy Farag. 2023. The Creation of One Truth: Single-Ledger Entries for Multiple Stakeholders Using Blockchain Technology to Address the Reconciliation Problem. Journal of Emerging Technologies in Accounting 20: 59–75. [Google Scholar]

- Grigg, Ian. 2000. Financial Cryptography in 7 Layers. In Financial Cryptography: 4th International Conference, FC 2000 Anguilla, British West Indies, February 20–24, 2000 Proceedings 4. Berlin and Heidelberg: Springer, pp. 332–48. [Google Scholar]

- Grigg, Ian. 2004. The Ricardian Contract. Systemics Inc. Available online: https://iang.org/papers/ricardian_contract.html (accessed on 19 December 2019).

- Grigg, Ian. 2005a. Ian Grigg—Triple Entry Accounting. Financial Cryptography. Available online: https://www.financialcryptography.com/mt/archives/000501.html (accessed on 19 December 2019).

- Grigg, Ian. 2005b. Triple Entry Accounting. Systemics Inc. Available online: https://iang.org/papers/triple_entry.html (accessed on 19 December 2019).

- Grigg, Ian. 2014. Who Invented the Shared Repository Idea: Bitcoin, Boyle and History. Financial Cryptography. Available online: http://financialcryptography.com/mt/archives/001469.html (accessed on 17 January 2020).

- Grigg, Ian. 2016a. In a Nutshell: Ian Grigg’s Ricardian Contracts and Digital Assets Prehistory (B. F. Crain, M. Roy, interviewers). Bits on Blocks: Thoughts on Blockchain Technology. Available online: https://bitsonblocks.net/2016/11/22/in-a-nutshell-ian-griggs-ricardian-contracts-and-digital-assets-prehistory/ (accessed on 22 January 2020).

- Grigg, Ian. 2016b. Satoshi is Dead—Long Live Satoshi—Team Leader Comes Out. Financial Cryptography. Available online: http://financialcryptography.com/mt/archives/001593.html (accessed on 12 February 2020).

- Grigg, Ian. 2016c. @tomerkantor Nope—I Am Not a Member of the Team. Twitter Post. Available online: https://twitter.com/iang_fc/status/727068366129655810 (accessed on 12 February 2020).

- Grigg, Ian. 2017a. My thanks to Todd Boyle, Originator of the Concept of Triple Entry, for Pointing Out This Video by Bill McCarthy. Twitter Post. Available online: https://twitter.com/iang_fc/status/939258799654924288 (accessed on 12 February 2020).

- Grigg, Ian. 2017b. “But It’s Not Modelled There, It’s Only Modelled Up in the Cloud”. HOLYSMOKINMUDDERODUKS! That’s Triple Entry Accounting at the Triple A. Twitter Post. Available online: https://twitter.com/iang_fc/status/939243253060329475 (accessed on 26 January 2020).

- Grigg, Ian. 2017c. Wildest dream: REA (Triple entry Accounting) is the Golden Spike that Brings the Conventional Industry Together with Wild-Eyed Blockchain… Twitter Post. Available online: https://twitter.com/iang_fc/status/939256814314622976 (accessed on 25 January 2020).

- Grigg, Ian. 2018. Independently, @cjenscook Invented Something to STR Similar for Oil Trading. Also Someone (Eric Hughes?) Postulated the “We All Share a Common Ledger” Idea on Cypherpunks, but Couldn’t Make It Work Technically. Twitter Post. Available online: https://twitter.com/iang_fc/status/1035845304556417025 (accessed on 12 February 2020).

- Grigg, Ian. 2019a. It’s tricky—Term Was Coined 20 Years Ago by Todd Boyle. My Paper Was 2004 or so. Oddly—Paper Is “3E Accounting” but Techniques Are Really Bookkeeping. Yuri Ijiri’s Work Was Originally Labelled “Triple Entry Bookkeeping” but Is Really Accounting… Confusion Abounds… Twitter Post. Available online: https://twitter.com/iang_fc/status/1182660123245928449 (accessed on 25 January 2020).

- Grigg, Ian. 2019b. Triple Entry Accounting Was about Creating Facts. Nominally for Accounting, Also Useful for Cash. Bitcoin Showed a Way to Do 3E without a Single Center. Corda Showed a Way to do 3E with Selected Notaries. I’m Working with 3E by Communities. The Future is Triple entry. Twitter Post. Available online: https://twitter.com/iang_fc/status/1103046077954097158 (accessed on 25 January 2020).

- Grigg, Ian. 2019c. Triple Entry Accounting Was Theorised Originally by Todd Boyle, Who Wrote of Its Application & Implementation in the 1990s. My Team Implemented It Independently. In 2004 I Wrote the Paper, Thinking We’d Discovered It De Novo. An Example of Science Moving in Parallel, in Mass. Twitter Post. Available online: https://twitter.com/iang_fc/status/1103047183287418885 (accessed on 25 January 2020).

- Grigg, Ian. 2020a. REA—Some Thoughts on Relationship to TEA and Computer Science. Financial Cryptography. Available online: http://financialcryptography.com/mt/archives/001661.html (accessed on 25 May 2020).

- Grigg, Ian. 2020b. Thoughts on Momentum Accounting. Financial Cryptography. Available online: http://financialcryptography.com/mt/archives/001655.html#more (accessed on 22 January 2020).

- Gröblacher, Marlene, and Vule Mizdraković. 2019. Triple-entry Bookkeeping: History and Benefits of the Concept. Digitization and Smart Financial Reporting, 58–61. [Google Scholar] [CrossRef]

- Haugen, Robert. 2001. Re: Company Centric View Ends. Data Goes to the Net. Available online: http://linas.org/mirrors/www.gldialtone.com/2001.07.14/BobHaugenPost.htm (accessed on 20 January 2020).

- Haugen, Robert, and William E. McCarthy. 2000. REA, a semantic model for Internet supply chain collaboration. In OOPSLA Workshop on Business Object Components: Enterprise Application Integration. Minneapolis: OOPSLA. [Google Scholar]

- Helsel, B. 2018. The Uncovering of Satoshi Nakamoto Through Literary Habits? CryptoCoin Mastery. Available online: https://cryptocoinmastery.com/the-uncoveringof-satoshi-through-literary-habits/ (accessed on 12 February 2020).

- Holman, G. Ken. 2019. Blockchain and eBusiness. LinkedIn. Available online: https://www.linkedin.com/pulse/blockchain-ebusiness-ken-holman/ (accessed on 12 February 2020).

- Howland, Gary. 1996. Development of an Open and Flexible Payment System. Systemics Ltd. Available online: http://www.systemics.com/docs/sox/overview.html (accessed on 19 April 2020).

- Hsieh, Pei-Gin. 2018. The Intellectual Development of Yuji Ijiri. Accounting History 23: 541–54. [Google Scholar] [CrossRef]

- Hughes, Eric. 1993a. PROTOCOL: Encrypted Open Books. Cypherpunks Mailing List. Available online: https://marc.info/?l=cypherpunks&m=85281390301301&w=3 (accessed on 12 February 2020).

- Hughes, Eric. 1993b. PROTOCOL: Encrypted Open Books. Cypherpunks Mailing List. Available online: https://marc.info/?l=cypherpunks&m=85281390300988&w=3 (accessed on 12 February 2020).

- Ibañez, Juan Ignacio. 2022. Triple-Entry Accounting with Blockchain. In Blockchain Technology: Advances in Research and Applications. Edited by Eva Porras. Madrid: Nova. [Google Scholar]

- Ibañez, Juan Ignacio, Chris N. Bayer, Paolo Tasca, and Jiahua Xu. 2021. The Efficiency of Single Truth: Triple Entry Accounting. Social Science Research Network. Available online: https://www.researchgate.net/publication/349474210_The_Efficiency_of_Single_Truth_Triple-entry_Accounting (accessed on 10 July 2023).

- Ibañez, Juan Ignacio, Chris N. Bayer, Paolo Tasca, and Jiahua Xu. 2023. Triple-entry accounting, blockchain and next of kin: Towards a standardization of ledger terminology. In Digital Assets: Pricing, Allocation and Regulation. Edited by R. Aggarwal and P. Tasca. Cambridge: Cambridge University Press. [Google Scholar]

- ICAEW. 2018. Blockchain and the Future of Accountancy. Institute of Chartered Accountants in England and Wales. Available online: https://www.icaew.com/technical/technology/blockchain/blockchain-articles/blockchain-and-the-accounting-perspective (accessed on 10 July 2023).

- Ijiri, Yuji. 1975. Theory of Accounting Measurement. Sarasota: American Accounting Association. [Google Scholar]

- Ijiri, Yuji. 1982. Triple-Entry Bookkeeping and Income Momentum. Sarasota: American Accounting Association. [Google Scholar]

- Ijiri, Yuji. 1986. A Framework for Triple-Entry Bookkeeping. The Accounting Review 61: 745–59. [Google Scholar]

- Ijiri, Yuji. 1989. Momentum Accounting and Triple-Entry Bookkeeping: Exploring the Dynamic Structure of Accounting Measurements. Sarasota: American Accounting Association. [Google Scholar]

- Ijiri, Yuji. 1993. The Beauty of Double-entry Bookkeeping and its Impact on the Nature of Accounting Information. Economic Notes: Economic Review of Banca Monte dei Paschi di Siena 22: 265–85. [Google Scholar]

- Ijiri, Yuji, and Edward C. Kelly. 1980. Multidimensional Accounting and Distributed Databases: Their Implications for Organizations and Society. Accounting, Organizations and Society 5: 115–23. [Google Scholar] [CrossRef]

- Inghirami, Iacopo Ennio. 2019. Accounting Information Systems: The Scope of Blockchain Accounting. Paper presented at ITAIS and MCIS 2019: 13th Mediterranean Conference on Information Systems and 16th Conference of the Italian Chapter of AIS (Pavia), Naples, Italy, September 27–28. [Google Scholar]

- IRS. 2015. Publication 583 (01/2015), Starting a Business and Keeping Records. Internal Revenue Service. Available online: https://www.irs.gov/publications/p583#en_US_201408_publink1000253188 (accessed on 26 January 2020).

- ISO. 2019. ISO/IEC CD 15944-21 [ISO/IEC CD 15944-21]. ISO. Available online: https://www.iso.org/standard/78924.html (accessed on 12 February 2020).

- ISO/IEC. 2015. ISO/IEC 15944-4. Information Technology—Business Operational View—Part 4: Business Transaction Scenarios—Accounting and Economic Ontology. Second edition 2015-04-01. Geneva: International Organisation for Standardisation. [Google Scholar]

- Jeffries, Daniel. 2020. Why Everyone Missed the Most Important Invention in the Last 500 Years. Hackernoon. Available online: https://hackernoon.com/why-everyone-missed-the-most-important-invention-in-the-last-500-years-c90b0151c169 (accessed on 22 January 2020).

- Kuhn, Thomas S. 1996. The Structure of Scientific Revolutions. Chicago: The University of Chicago Press. [Google Scholar]

- Liu, Manlu, Kean Wu, and Jennifer Jie Xu. 2019. How Will Blockchain Technology Impact Auditing and Accounting: Permissionless versus Permissioned Blockchain. Current Issues in Auditing 13: A19–A29. [Google Scholar] [CrossRef]

- Lomax, Paul S. 1918. Significant Results of Missouri and New Mexico Commercial Education Studies. The School Review: A Journal of Secondary Education 26: 73–84. [Google Scholar] [CrossRef]

- McCarthy, William E. 1979. An Entity-Relationship View of Accounting Models. The Accounting Review 54: 667–86. [Google Scholar]

- McCarthy, William E. 1980. Construction and Use of Integrated Accounting Systems with Entity-Relationship Modeling. Proceedings of the 1st International Conference on the Entity-Relationship Approach to Systems Analysis and Design. In Entity-Relationship Approach to Systems Analysis and Design. Edited by P. Chen. Amsterdam: North Holland Publishing Company, pp. 625–37. [Google Scholar]

- McCarthy, William E. 1982. The REA Accounting Model: A Generalized Framework for Accounting Systems in a Shared Data Environment. The Accounting Review 57: 554–78. [Google Scholar]

- McCarthy, William E. 2001. Re: Company Centric View Ends. Data goes to the Net. Available online: http://linas.org/mirrors/www.gldialtone.com/2001.07.14/McCarthyPost.htm (accessed on 11 January 2020).

- McCarthy, William E. 2016. Accounting Is Big Data: How Research Becomes Reality. Accounting is Big Data Conference. American Accounting Association. Video. Available online: https://aaahq.org/Meetings/2016/Accounting-Is-Big-Data-Conference/Video-Gallery/AIBD-Video-10-Public (accessed on 12 February 2020).

- McCarthy, William E., and Graham Gal. 1981. Declarative and Procedural Features of a CODASYL Accounting System. Entity-Relationship Approach to Information Modeling and Analysis. Washington, DC: ER Institute, pp. 197–13. [Google Scholar]

- McCarthy, William E., and G. Ken Holman. 2019. Blockchain and eBusiness. In The Open-edi Distributed Business Transaction Repository. ISO/IEC 15944-21 OeDBTR. Singapore: E-Invoicing Exchange Summit Singapore. [Google Scholar]

- Mohanty, Debajani. 2018. Blockchain from Concept to Execution: BitCoin, Ethereum, Quorum, Ripple, R3 Corda, Hyperledger Fabric/SawTooth/Indy, MultiChain, IOTA, CoCo. New Delhi: BPB Publications. [Google Scholar]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 9 January 2020).

- Odom, Chris. 2013. Triple-Signed Receipts. Open-Transactions. Available online: https://opentransactions.org/wiki/Triple-Signed_Receipts (accessed on 28 January 2020).

- Odom, Chris. 2015. Open-Transactions: Secure Contracts Between Untrusted Parties. Open-Transactions White Paper. Available online: http://www.opentransactions.org/open-transactions.pdf (accessed on 19 December 2019).

- Pacio. 2018a. Pacio Technology. Pacio Whitepaper Extract. Available online: https://www.pacio.io/docs/Pacio_Technology.pdf (accessed on 9 January 2020).

- Pacio. 2018b. Semantic Blockchain for Business Data: Competition. Pacio. Available online: https://www.pacio.io/docs/PacioCompetition.pdf (accessed on 9 January 2020).

- Pacio. 2020. Pacio White Paper. Pacio. Available online: https://pacio.io/docs/PacioWhitePaper.pdf (accessed on 6 January 2020).

- Pacioli, Luca. 1494. Particularis de Computis et Scripturis. In Summa de Arithmetica Geometria Proportioni et Proportionalita. Translated by Luca Pacioli. Seattle: Pacioli Society. [Google Scholar]

- Peters-Richardson, Jacqueline. 2011. Introduction to Accounting. Ministry of Education, Trinidad and Tobago Commonwealth of Learning. Available online: http://oasis.col.org/bitstream/handle/11599/2463/2011_VUSSC_Intro-Accounting.pdf (accessed on 18 February 2020).

- Postma, Johannes, and Anne J. van der Helm. 2000. La Riegola de Libro: Bookkeeping Instructions from the Mid-fifteenth Century. Accounting and History: A Selection of Papers Presented at the 8th World Congress of Accounting Historians, Madrid, Spain, July 9–21; Watson: Asociación Española de Contabilidad y Administración de Empresas (AECA), pp. 147–78. [Google Scholar]

- Rao, Vinayakrao. 2020. Blockchain Accounting in A Triple Entry System—Its Implications on the Firm. Our Heritage 68: 10499–512. [Google Scholar]

- Request. 2018a. The Concept of Smart Financial Audits on the Blockchain. Request Yellow Paper. Available online: https://request.network/assets/pdf/request_yellowpaper_smart_audits.pdf (accessed on 29 January 2020).

- Request. 2018b. The Future of Commerce: A Decentralized Network for Payment Requests. Request Whitepaper. Available online: https://request.network/assets/pdf/request_whitepaper.pdf (accessed on 24 August 2023).

- Rukhiran, Meennapa, and Paniti Netinant. 2018. The House Bookkeeping Conceptual Framework for Supporting Adaptability Using Three Dimensions Layering. Advanced Science Letters 24: 5234–38. [Google Scholar] [CrossRef]

- Sangster, Alan. 2015. The Earliest Known Treatise on Double Entry Bookkeeping by Marino de Raphaeli. Accounting Historians Journal 42: 1–34. [Google Scholar] [CrossRef]

- Sangster, Alan, and Franco Rossi. 2018. Benedetto Cotrugli on Double Entry Bookkeeping. De Computis, Revista Española de Historia de la Contabilidad 15: 22–38. [Google Scholar] [CrossRef]

- Sleeter, Doug. 2014. Bitcoin Is Based on This Writing from Todd Boyle in 2003. We collaborated during his development. #roundtable14. Twitter Post. Available online: https://twitter.com/DougSleeter/status/428612589795704832 (accessed on 12 February 2020).

- Swanson, Tim. 2015. A Blockchain with Emphasis on the “A”. Great Wall of Numbers: Business Opportunities and Challenges in Emerging Markets. Available online: https://www.ofnumbers.com/2015/07/09/a-blockchain-with-emphasis-on-the-a/ (accessed on 12 February 2020).

- Tasca, Paolo, and Claudio Tessone. 2019. Taxonomy of Blockchain Technologies: Principles of Identification and Classification. Pittsburgh: Ledger, p. 4. [Google Scholar]

- Tsichritzis, Dennis, and Anthony Klug. 1978. The ANSI/X3/SPARC DBMS Framework Report of the Study Group on Database Management Systems. Information Systems 3: 173–91. [Google Scholar] [CrossRef]

- Venona Cypherpunks Archives. 2004. Cypherpunks Date Index for 1998 11. Cypherpunks Archives. Available online: http://cypherpunks.venona.com/date/1998/11/ (accessed on 20 May 2020).

- Vijai, C., M. Elayaraja, S. M. Suriyalakshimi, and D. Joyce. 2019. The Blockchain Technology and Modern Ledgers Through Blockchain Accounting. Adalya Journal 8: 545–57. [Google Scholar]

- Vollmer, Hendrik. 2003. Bookkeeping, Accounting, Calculative Practice: The Sociological Suspense of Calculation. Critical Perspectives on Accounting 14: 353–81. [Google Scholar]

- Wang, Yunsen, and Alexander Kogan. 2018. Designing Confidentiality-preserving Blockchain-based Transaction Processing Systems. International Journal of Accounting Information Systems 30: 1–18. [Google Scholar]

- Wild, John, Ken Shaw, and Barbara Chiappetta. 2011. Fundamental Accounting Principles. New York: McGraw-Hill/Irwin. [Google Scholar]

- Zaid, Omar Abdullah. 2004. Accounting Systems and Recording Procedures in the Early Islamic State. The Accounting Historians Journal 31: 149–70. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ibañez, J.I.; Bayer, C.N.; Tasca, P.; Xu, J. REA, Triple-Entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems. J. Risk Financial Manag. 2023, 16, 382. https://doi.org/10.3390/jrfm16090382

Ibañez JI, Bayer CN, Tasca P, Xu J. REA, Triple-Entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems. Journal of Risk and Financial Management. 2023; 16(9):382. https://doi.org/10.3390/jrfm16090382

Chicago/Turabian StyleIbañez, Juan Ignacio, Chris N. Bayer, Paolo Tasca, and Jiahua Xu. 2023. "REA, Triple-Entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems" Journal of Risk and Financial Management 16, no. 9: 382. https://doi.org/10.3390/jrfm16090382

APA StyleIbañez, J. I., Bayer, C. N., Tasca, P., & Xu, J. (2023). REA, Triple-Entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems. Journal of Risk and Financial Management, 16(9), 382. https://doi.org/10.3390/jrfm16090382