Abstract

The objective of this work is to analyze the economic viability of a replacement to the energy supplied by the grid during costly periods by infrastructure owned by the consumer. The study takes into account the costs to purchase, manage and operate the structure to set which option an affordable option. A statistical approach based on the Monte Carlo Method distributes the costs through a 25 lifecycle period, establishing the cash flow and the economic parameters for each energy source combination scenario. The scenarios are evaluated for a Brazilian consumer, and the current regulatory parameters and market values are deployed to study the viability for a Diesel Generator, and two different types of batteries as replacements during the most energy-costly periods. As a result, the work establishes the most affordable scenarios from a technical and economic approach. Batteries are still costly for the consumer, and a 48.3% reduction in the costs may enable the deployment of batteries as an alternative in the country. The results establish that multi-source energy set with a Diesel Generator is an economically viable possibility during peak hours.

1. Introduction

Greenhouse gas emissions may reach a 59% level by 2030 if the limiting actions are not put into action in the next few years [1]. As climate change accelerates, the energy sector’s endeavor must be addressed to reduce the sector’s carbon footprint: the sector itself is responsible for two-thirds of global greenhouse gases emissions and is a key industry for slowing down the effects of climate change [1].

The sector focus on energy matrix renewal and energy efficiency techniques. the current focus is on renewable energy sources enhancement, leading to a faster pace in reducing carbon footprint.It is expected that the sector must reduce 25% of carbon emissions during the energy generation to reach environmental agreement’s goals [1]. The advances in the energy matrix must be sped up to mitigate the climate changes effects. Different technologies evolve to increase the energy conversion efficiency, and the mix of Battery Energy Storage Systems (BESS) and renewable energy sources may reduce the dependency on fossil fuels and establish a new strategy for the sector.

BESS is set to play a key role in the energy transition in further years. The system is considered a key enabling technology that may reduce costs and increase the deployment of renewable and efficient solutions [2]. Despite the positive evolution of BESS in the sector, its deployment requires practices and investments to set long-term solutions [2]. The energy transition requires a new set of services focused on technology improvements, as well as energy policies focused on cheaper and affordable energy services [2].

Energy policies focused on technological access establishes new opportunities and multiple paths for the transition scenario [2,3]. Currently, the energy transition requires a path-building perspective that allows policymakers and stakeholders to set rules to increase the access and the affordability of new generators and prosumers [2]. Economic and technical viability evaluations assist in the path definition. The analysis explores different economic perspectives and enables the definition of a road map to guide demands and local markets’ perspectives.

Viability studies encompass conclusions that may guide analytical framework and guideline policymakers. Besides this, the study may enable the path definition for a technological deployment in countries that have more complex access to technologies. For emerging economies, studies that evaluate the deployment of new systems guide the tracking of barriers and development opportunities.

The Global South countries have a key role in the energy transition, due to their access to renewable energy sources and potential to reduce inequalities and increase social inclusion [3]. The present work aims to evaluate the economic viability for BESS deployment focused on Global South countries. The analysis considers the technical perspective, economic parameters, and energy sector definitions to set a model for the BESS viability. Energy sources affordability, inflation and tariffs increase, initial investments, and access invisible costs are employed to evaluate the energy transition from an emerging country perspective.

A viability study for Diesel Generator replacement in Brazil is proposed. As an emerging economy, Brazil must cope with the BESS implementation as well. In 2022, the country accounts for 832,328 distributed power plants, with 9,231,633.55 kW of installed capacity [4]. Almost 30% of the total distributed power plants are implemented in commercial-class consumers [4], stating the growth in resilient energy sources. The viability analysis focuses on BESS implementation for a real-life consumer, taking advantage of Time-of-Use rate variation. As a result, it is expected that the analysis points out economic barriers and affordability of large-scale system implementation.

The work is organized in the following sections. Section 2 presents previous works that set the conditions for an economic viability analysis for different consumers’ profiles and markets. Section 3 shows the method employed in this work and details parameters referred through the study. Section 4 presents the four scenarios and the results obtained by the statistical method proposed in this work and analyzes the obtained results and the economic viability for each scenario. Section 5 presents the learned lessons for this work and the next steps of this research.

2. Energy Storage Deployment

Advances have been made to reduce the cost of energy storage technologies. The technology development emerges at a time when the energy demand is looking for supply flexibility and differentiation in serving consumers [5,6]. One strategy to encourage new distributed generators is the BESS implementation into microgrids, combining a controllable point system with renewable sources of power generation [5]. Microgrids are defined as an electrical system that contains different electrical loads and distributed electrical sources, and that can be controlled and monitored autonomously, as an island, or interconnected to the electrical grid. The microgrid must be able to operate for a controlled time independently from the main grid, although the definition does not establish the minimum period of operation [7]. These networks are classified according to the type of energy storage employed, generating sources and types of electrical loads [7].

BESS may fulfill various functions at the end-user level, meeting requirements of energy and power demand and services provisioning reliability [8]. The BESS may replace Diesel Generators and be employed as a backup for end-users, extending the benefits of operating micro-grids. Although the benefit of the systems integration is apparent, dimension and allocating the BESS is a challenge to end-users due to the BESS lifecycle [8].

The BESS lifetime is dependable on the energy sources and the cycling conditions: the intermittent behavior of renewable energy sources may lead to a more frequent charge and discharge cycles of the BESS [8]. Unpredictable shortage and deployment conditions may lead to a frequent cycling and reduced lifecycle of the BESS. The lifecycle has a direct impact on costs, which implies an economic justification of the BESS according to the size and the control strategy for the system [9].

Although the possibility to reduce costs and profitable operation of the BESS, costs regarding losses, initial investment, and operating exceed the profit expectation [8]. One of the possibilities for this type of system is the search for a balance between costs and operators’ expectations, along with operating conditions and efficiency applications that may reduce the impact of initial investments and losses [8]. This balance depends on a substantial number of factors, besides the technologies, including the structure of the energy sector, geographical location, and energy policies.

The economic aspect, therefore, is the one that may dictate the technical and operational conditions for the implementation of a BESS. Technical aspects of the resources, energy sources, installation conditions, initial investments, replacement and maintenance costs, and fixed operating costs are factors that demand critical analysis so that the balance between costs and gains can be visualized by end-users [6].

Through this analysis, social and environmental gains should be accounted for, allowing the evaluation of factors that may encourage inexperienced users. The reduction of carbon emissions in comparison to other sources, especially those that employ fossil fuels, are countable, and they may lead to subsidies and other encouragement actions regarding BESS implementation [6]. The analysis of environmental and social aspects also presents a strategy for the BESS implementation through the reduction of current energy sources.

Environmental factors are currently accounted as economic, but they also have an impact on the choice of the physical infrastructure of the microgrid, since efficient and more reliable equipment can be chosen by end consumers. The capacity, charge and discharge cycles, battery aging and chemical materials, and the location are aspects that should be considered during the viability study [6]. Despite the analysis of technical and economic viability can be done separately and individually [6], the multipurpose aspects of the BESS and the grid operation require that the evaluation of the referred aspects should be done as a set.

The system capacity is a significant factor during the technical selection of the BESS. Besides, the referred factors are related to the lifecycle enlargement, stability, reliability, and the expected performance of the microgrid [6]. The technological maturity of lithium batteries proves that they are more beneficial for microgrid operation, despite their excessive costs [6]. This analysis also considers the islanded operation and the maintenance costs [5].

Access to modern energy services is not uniform worldwide. Economic development establishes barriers to emerging economies, stating that these countries require access to the technology, but also energy policies and changes in consumer’s role to fulfill decarbonization goals [3,10]. The association of these parameters may lead to the development of a new model for the local energy sector that enables the entry and universal access to modern services, leading to a technology input that leads to economic and social development [3]. As an initial step for the local market establishment and fairer rules, the analysis of economic statements and implementation scenarios helps to set a path for these countries.

The economic viability analysis establishes paths for infrastructure implementation and maintenance costs, establishing strategies to supply the consumers’ demands. Despite critics about technology input from an economic perspective, focusing on financial gains, this work focuses on mapping and addressing barriers from a viability point of view. The analysis points out parameters to a BESS deployment for emerging economies, helping stakeholders to cope with economic factors, operation and management of the infrastructure, regulation, market factors and business models, and consumers’ expectations [11,12], setting how initial predictions state accurate planning and policies on BESS implementation.

There is not a common indicator and scenario for BESS implementation: currency, technological alternatives, services provisioning, and local rules are some approaches that should be considered during decision making [13]. As the conditions change, the economic indicators also differ according to deployment terms. Money value, discount rate, investments, levelized costs, operation and maintenance costs, and fuel costs are variables for the viability analysis [13].

Although there are variables that allow for a feasibility study, the initial cost of the BESS and its costs during the operating cycle are fundamental to an analysis of the feasibility of implementation. The combination of these indicators may show the financial viability for a BESS, determining a path for the electric sector to enable access for consumers. However, this approach focuses on market indicators, and the costs and benefits of a BESS implementation are focused on selling energy and enhancing individual gains [13].

The technical indicators allow the analysis of the BESS from an optimization perspective, and the measurement of the requirements focusing on a specific goal, such as the dynamic state of the system [13]. Besides this, the technical perspective allows the selection of the system through the expected role of the BESS in the microgrid. This perspective comprises capacity and sizing of the system, performance, loads accountability, battery supply conditions, utility role, and the sources that form the microgrid [13].

The sizing is a result of both the technical and economic analyses, and it can set the application and scalability of the system, how it can fulfill the demand or integrate with other energy sources, establish the functions of the BESS and, set the system’s characteristics, encompassing battery type, cost, and operation constraints [13]. As goals for consumers, the reduction of energy costs and generating and managing the energy supply are factors that encourage the entry of new prosumers in the sector [14]. The possibility to reduce carbon emissions is a third interest for consumers [14].

Reducing the usage of fossil fuels is a focus for the energy sector, and the implementation of BESS is encouraged to diversify the energy matrix and enhance the renewables integration. Decarbonization may be an aspect that encourages subsidies and financial support to new prosumers, enhancing renewable sources and meeting the demand. From an economic perspective, the expected profitability of BESS implementation is one encouragement aspect for consumers interested in reducing energy costs; for these groups, the batteries’ aging aspect may reduce the expected return of initial investments and reduce its gains [15].

The reduction of solar photovoltaic panels prices and subsidies for its broader usage may encourage the entry of new end-users in the sector. Besides this, the combination of a BESS and photovoltaic source is one aspect that may have a significant impact on the costs, reducing the aging and degradation of the infrastructure when balanced with investments and costs for end-users [15,16]. These costs are not usually accounted for: the energy conversion through photovoltaic panels may disturb the cycle for BESS operation and have consequences on its maintenance and operation costs [15].

For consumers that may not take advantage of feed-in tariffs and prices variation, the storage system does not present significant benefits. Despite the possible benefit of photovoltaic generation and costs reduction, the generation potential and the dispatch cycle for a BESS do not reduce the impact of a price-fixed market. Although a credit system and tariffs changes may benefit BESS owners, the initial costs are still a significant barrier [16].

Consumers may take advantage of a combination of renewable sources and reduced costs for energy generation, but the balance between the degradation and tariffs is a disadvantage for consumers [15,16]. The aging process of the infrastructure and a viable dimension of the storage system emphasizes the financial disadvantages for consumers, contributing to a zero or negligible return on the initial investment for end users [15,16].

Barzegkar-Ntvom et al. [17] set a cost of use parameter to analyze the economic viability for self-supplied consumers. The Levelized Cost of Electricity (LCOE) is a known economic indicator, focused on the costs for a BESS system, in contrast to the focus on the consumption levels through a period. Levelized Cost of Use (LCOU), a solution provided by the authors, is used to analyze the viability of photovoltaic panels and BESS microgrids. The LCOU takes advantage of the self-consumed energy instead of surplus energy to calculate the viability for a hybrid system [17].

The energy generated by the panels changes the costs and profits dynamic, which sets a manageable consumption pattern to take advantage of this particularity. The indicator is not independent of other factors, such as the energy retail prices and initial investments, but it establishes if the balance between self-supply’s costs and purchased energy make such a combination of sources feasible for end users [17].

For highly regulated markets, the retail prices are set by the government or agencies associated with the government. If the reduction of carbon emissions is a social interest for the government, subsidies and a new energy price mechanism may encourage BESS implementation [18]. The difference between peak and off-peak periods must be high to create a gap that minimizes the initial investments impact [18].

This scenario requires that regulatory agencies, utilities, and consumers be aligned to build a new framework for the local sector, to build policies focused on social welfare and sustainable energy prices’ policies [18]. The balance between costs and initial investments are analyzed by Net Present Value (NPV) and the Internal Rate of Return (IRR) indicators. Similarly, the Brazilian scenario is highly regulated, and the peak and off-peak periods tariffs may encourage consumers to replace more pollutant sources in favor of storage systems [19].

Despite the renewable profile of the matrix, usually, Diesel Generators employment is a cost-reduction strategy by commercial and industrial consumers in Brazil. Martinez-Bolanos et al. [19] study the viability of a combined BESS and Diesel Generator Set system as a replacement to the grid during the costliest periods. The works apply economic parameters on the costs and tariffs to discuss the viability of the projects. For this work, the analysis also employs distinct economic indicators, such as the Net Present Value (NPV) and the Internal Rate of Return (IRR). Both indicators and their variation through the lifecycle of the battery allow the comparison of different scenarios and different resources as replacements to the energy grid.

NPV and the IRR are economic parameters that enable the analysis of scenarios as replacements to the grid according to the variation of different inputs. Thomé [20] analyzes the deployment of batteries as a time-shift strategy through economic parameters such as the NPV and the IRR. The author studies the values of tariffs and the expected demand for consumers connected to the medium-voltage network to evaluate the deployment of batteries. The author establishes the costs to buy the infrastructure and its expected lifetime to analyze the viability of a consumer located in three different areas. As a result, the proposed system does not generate results for two distribution companies, and a third scenario points out the payback on the implementation in an affordable lifecycle.

The combination of energy sources is employed to increase the reliability of the BESS and to reduce the costs through the lifecycle, regardless of the country. For emerging economies, the combination of BESS and other sources may be an affordable way to allow the implementation of technologies, alongside increasing the deployment of other renewable sources and the growth of distributed generators. The information gathered enables the analysis of scenarios and conditions of BESS implementation, for different energy profiles and demands.

Santos [21] studies the possibility to deploy photovoltaic infrastructure to supply a building with and without the usage of a BESS. The author studies the viability of a bank of batteries charged by the photovoltaic produced locally and discharged during peak hours. The author states the regular demand for the building and measures a bank of batteries that could supply it. As a result, the author states that the adoption of a bank of batteries may be worthwhile if the system discharges during peak hours and that the tariff increase encourages consumers to deploy batteries to reduce costs. Besides this, the author points out that if the cost to buy batteries decreases, it may increase the advantages of technology adoption.

3. Materials and Methods

The economic viability is analyzed from a distributed generator perspective and the main goal is to evaluate a strategy to reduce energy costs for consumers able to manage and operate a microgrid for a BESS lifecycle.The proposed microgrid consists of a BESS and an alternative energy source; the microgrid does not operate fully isolated from the grid and depends on its energy supply to ensure that consumer demand is met. In order to achieve this goal, total costs regarding energy services supply—energy supplied from the grid—are balanced with initial investments for alternative energy sources, and operation and maintenance costs of the microgrid.

The most common strategy is to operate the microgrid to take advantage of rates and demand variation throughout the day. The Time-of-Use is a rate structure that regulates the energy costs according to the time of the day. Thus, the tariff regulation establishes the period of charge and discharge of the storage system and periods of grid supply or alternative energy sources’ supply. Meeting this condition dictates which storage-based services are provided.

Operational aspects of the BESS is applied to take advantage of the Time-of-Use rate variation. Time-shifting comprises market transactions with economic merits based on the difference between the cost of buying, storing, and discharging the electricity and the benefits derived from this application to the grid. The service is dependent on market variation, which has only significant impacts on BESS investments and operational costs if the market parameter exceeds the initial values for the prescribed period. Two performance characteristics that have a significant impact on the discharge cost of BESS are the overall system efficiency and the system degradation rate.

Other services that can be provided by BESS are power supply and backup. The provision of multiple services can make BESS more attractive to consumers; the type of service also allows limiting the location of the system in the network and the potential consumer profiles that can be served. The analysis focuses on commercial or industrial type consumers connected to the medium-voltage network. This choice was made to delimit the size and capacity of the micro-grid and storage system. In this case, this choice also delineates the regulation and pricing rules for a consumer profile—since these rules are not the same for all consumer profiles—and microgrid management.

This work considers a microgrid supplied by the grid, a Diesel Generator, and a BESS. The BESS and the Diesel Generator have nominal power equal to or greater than the maximum demand of the local and do not operate in parallel with the utility’s network. Besides this, the BESS must supply the local for three hours, no faults, or function as a backup during power outages that last less than three hours.

For the proposed evaluation, the variation of three parameters is considered, namely: the tariffs, the price of diesel fuel, and the cost of the BESS. These values are inputs for the model. The base year for the model is 2008, which indicates the beginning of the analysis of the variation of these values. The base year does not indicate the start of the battery life cycle, but the start of capturing the values applied in the evaluation.

The costs for the acquisition of the BESS are initial investments. The investment encompasses the costs to transport the infrastructure from its origin, importation taxes, local taxes, and physical site adjustments for system implementation (masonry). The analysis also considers the values to operate and manage the system during the period.

For the case of imported equipment along with the battery, duties and taxes are also due for these structures. All the required infrastructure is imported, and the cost of the currency (dollar) employed during the negotiation of the asset must be considered. The Diesel generator’s costs are evaluated similarly, except for import costs—most of the time, this type of generator has a known supply chain and does not need to be imported.

The energy tariffs vary according to the hours of the day and taxes rate. The average tariff for the group of consumers analyzed is ranked from the base year chosen, and its cumulative increase is a function of the kWh established. These values allow the cumulative increase for the period to be determined and the comparison with inflation and other economic price control parameters in the country. The value of the tariff for a given distribution company, whose data varies according to the location of the consumer unit, establishes the maximum, minimum, and average value of the tariff.

Using the values of the cumulative increase in the tariff for the period, the method establishes the maximum, minimum, and average values for this parameter. The cumulative increase takes into account the tax-free fares for the established period. Taxes are grouped as those that depend on legislative changes for readjustment and those that are readjusted periodically, according to regulatory agency rules. For the first, the same value is applied for the entire period analyzed, in the second case, the maximum, minimum, and average values are applied to the values of the purchase of energy from the grid and tariffs.

If an alternative energy source generation is deployed for the economic viability evaluation, initial investment for the purchase of the generation infrastructure, and operation and maintenance costs must be valued in the model. As no off-grid power generation sources are considered in this study except for Diesel Generator, the BESS is charged at times when power is more affordable and discharged during the costliest periods.

The purchase of the Diesel generator is considered as an initial investment, like the purchase of the BESS when its use is evaluated. All taxes for the purchase of the generator are applied in the proposed model, except for import taxes that do not fit in this case. The cost per liter is calculated as the average value of the fuel for the final consumer, with taxes and other fees applied.

The accumulated increase for Diesel fuel since the base year is applied to the analyzed period. In this way, the fuel increase is limited by the average fuel increase for the period studied from the base year to the end of the life cycle of the proposed micro-grid.

From the source of the input data, classification methods are applied. The method depends on the type of economic input parameter. The normal distribution, sometimes called the Gaussian distribution, is one of the most used distributions for modeling natural phenomena. The usual justification for using the normal distribution for modeling is the Central Limit Theorem, which states that, as the sample size increases, the sampling distribution of its mean gets closer and closer to a normal distribution.

The Probabilistic Distribution Function (PDF) classifies the outcomes according to their incidence, allowing the estimation of average values, minimum and maximum values, and the standard deviation. PDF enables dealing with the uncertainties of economic inputs through two different distribution models: normal distribution and triangular distribution. The normal distribution—or Gaussian distribution—enables dealing with natural phenomena. The normal distribution is a function described through average value () and standard deviation (), and triangular distribution enables the description of a population with limited data available. The results were obtained using MATLAB [22].

The triangular distribution is useful for describing a population for which limited sample data are available. It is a simple representation of the probability distribution of data and common applications of this PDF include stochastic simulations aimed at the area of project or business planning and management and economic analysis. It is set according to the minimum value (a), the maximum value (c), and mode value (b), which explains its triangular shape: the distribution begins with the minimum value, increases linearly, and decreases slowly until the maximum value.

Due to the amount of data required, the proposed analysis applies a probabilistic method. This method allows the analysis of uncertainties on entry parameters, such as tariffs and maintenance costs. The technical parameters are set up through a deterministic method, which includes the costs to buy the required infrastructure. The Monte Carlo Method (MCM) deals with the diversity and complexity of data, establishing different results and scenarios for a broader analysis.

NPV and IRR are economic indicators used to evaluate cash flow and to assess return on investment. The first indicator points out the variation of the financial values through time, based on the Differential Cash Flow—the variation between a reference case and a case under evaluation. The second indicator analyses the rate of return on initial investments. The study establishes NPV and the IRR associated with the Cash Flow set for different scenarios: for each scenario, random variations of the parameters that may affect the Cash Flow are generated.

The combination of the two indicators indicates whether there is an expected return on the initial investment. In the case of the present analysis, the return will be the reduction in electricity-related expenses.

4. Storage System Economy Availability

The BESS economic viability focuses on replacing the Diesel Generator as a source during the most costly periods or as a backup source. The study takes into account a service station located in Jundiaí, a city near São Paulo, and the station includes a gas station, an electric vehicle charging station, and a restaurant in the location, both working 24 h a day.

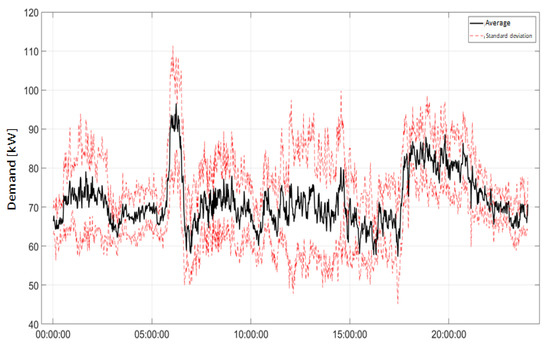

Figure 1 displays the average values and standard deviation of the daily demand curve for the installation site, with one-minute resolution. The greatest variability of the curve is located outside peak hours, with a standard deviation in the range of ±18 kW. During peak hours, between 6 p.m. and 9 p.m., the standard deviation drops to approximately ±7 kW.

Figure 1.

Average curve and standard deviation of the daily demand.

According to normative resolutions, the tariff for commercial consumers classified as A4 subgroup tension required from 2.3 kV until 25 kV is divided into peak three-hour interval that starts at 6 p.m. and ends at 9 p.m. daily, excluding weekends and holidays and off-peak periods, and is complemented by a single tariff for its contracted demand.

This group may enjoy the binomial tariff, as classified by ANEEL (Agência Nacional de Energia Elétrica, Brasilia,Brazil), that establishes two values for the tariff: the peak (period with the cheapest fare), and off peak (period with the most expensive fare) periods, complemented by a single tariff for its contracted demand. Thus, BESS is charged during the off-peak period and is discharged during the peak period.

The tariff is stated into a three-part determination that refers to the amount of energy generated, the transport of the energy until the consumers—including transmission and distribution costs, and taxes for the sector, non-manageable costs, and transferred to consumers. The tariff is split into TUSD (Tariff for the Distribution System Usage), a single value that concerns the usage of the distribution infrastructure and TE (Energy Tariff), that refers to the value of the energy consumed and employed to set the monthly income. The taxes for the consumers are determined by the local government and state: local taxes on the circulation of products and social taxes are parts of the tariff for a Brazilian consumer. The rise in rates and taxes depends on economic parameters that change through time.

Federal, state, and municipal taxes are included in the energy bill, as well as the work listed in the local tax ICMS (Imposto sobre circulação de Mercadorias e Serviços), PIS (Programa de Integração Social), PASEP (Programa de Formação do Patrimônio do Servidor Público), and COFINS (Contribuição para Financiamento da Seguridade Social). The ICMS is a non-cumulative tax levied on transactions involving the purchase and sale of goods and services on a state and municipal level. ICMS in the state of São Paulo is calculated as 18%. Its adjustment depends on changes in the legislation of the state where the final consumer is located. PIS/PASEP and COFINS are levied on the electric power distributor’s revenues and billing, non-cumulative taxes. The values of these taxes vary monthly and must be described in the energy bill for the final consumer.

The IPCA (National Consumer Price Index Plan) measures the impact of inflation on a given set of goods and services produced in the country, and is determined from the comparison of the current purchase values of the good and previous values. The index allows to verify the impact of price variation for the final consumer, and allows the government to evaluate if the inflation target is in line with what is expected.

Taking 2008 as the base year and the values for the industrial tariff analyzed for the period allows the evaluation of the ICPA evolution and the industrial tariff for the distributor corresponding to the installation site, and the accumulated increase for the period. The evaluation of the accumulated values of the IPCA and the industrial tariff shows that the tariff was readjusted, in the period, above the accumulated index.

The Real Interest Rates are the parameter applied to purge the effect of inflation for the lifecycle. The parameter is established through the variation of the average value for inflation (3.66%) and it enables to set the Cash Flow for the period. Thus, all the costs are real costs, constant for the analyzed period, except for the value of the electricity tariff, which is adjusted yearly.

Equation (1) establishes the values for the use case.

Since one of the most widely employed sources of power generation in the country is the Diesel generator, the study employs it as a comparison with energy storage. Diesel Generators are used as replacement for the grid during peak periods or backup. These systems benefit from a broad chain of suppliers and skilled labor, but also from knowledge about their use and variety of applications. For this fuel, there are taxes charged by each state—ICMS and federal taxes PIS/PASEP, COFINS and CIDE (Contribuições de Intervenção no Domínio Econômico). The taxes make up a significant part of the final Diesel price for the consumer: the ICMS corresponds to 16% of the total final price, while CIDE, PIS/PASEP and COFINS correspond to 10% of the total Diesel price [23]. The historical series of prices for the fuel and the taxes values for the period set the base value for the fuel.

The operation, maintenance, and installation costs were calculated for a Diesel generator up to 500 kW. To calculate the base value, the resale value for the period was used (in BRL/L), with the respective deviation per month (also determined in BRL/L); the deviation is defined by the variations for the fuel sales and distribution. For the analyzed period, the Diesel was readjusted annually by determination of PETROBRAS (Petróleo Brasileiro Sociedade Anônima) from the inflation variation for the period. From these values, and applying the similar method for tariffs, the study established the expected values of the fuel for the 25 period.

Based on the site characteristics and project requirements, BESS was sized for 200 kW/390 kWh as the optimal size to meet the site demand. For the Diesel generator, a system of up to 500 kW was considered to meet the demands of the project. In this case, there are no subsidies for the purchase and maintenance of this system. The minimum, maximum, and average values for installation, in BRL/kW, are 650, 800, and 750, respectively USD 158.54, 195.12, and 182.93, approximately. The minimum, maximum, and average values for operation and maintenance are 35, 50, and 45, respectively, in BRL/L. The dollar values are 8.54, 12.20, and 10.98, approximately [24].

Table 1 contains the input parameters for the model, and the parameter setting of the PDF associated. The values are inputs for the grid, Diesel generator, and the BESS. The inputs refer to values of the tariffs (TUSD and TE) of the energy purchased from the grid, and the exceeding peak and off-peak demands are also considered for the source. The triangular distribution is the method chosen to deal with most of the data, except for the normal distribution employed to deal with the data regarding the Diesel Generator.

Table 1.

Inputs for the economic viability study.*

The work evaluates four scenarios as following: grid and Diesel Generator; grid and LFP (Lithium Iron Phosphate) BESS; grid and NCA (Lithium Nickel Cobalt Aluminium Oxides) BESS; and grid, BESS, and Diesel generator. NCA is a technology engineered to comply with high energy density, minimized weight and volume, and moderate lifetime with low maintenance. LFP is inherently non-combustible, which makes it safer. It also has many advantages over other lithium systems, particularly for high power applications. Compared to NCA technology, LFP batteries have a higher price and lower specific energy due to the lower nominal cell voltage, but in return have a longer lifetime especially at deep discharge cycles [25].

It is noteworthy that both technologies meet the requirements proposed, and their replacement over the 25 years of the project is not considered. Scenarios for the BESS analyze the implementation with and without subsidies; subsidies are the withdrawal of taxes to buy batteries as a possible encouragement to consumers purchase the technologies. Subsidies regarding Diesel Generators or the energy supplied by the grid are not considered.

4.1. Scenario A: Grid and Diesel Generator

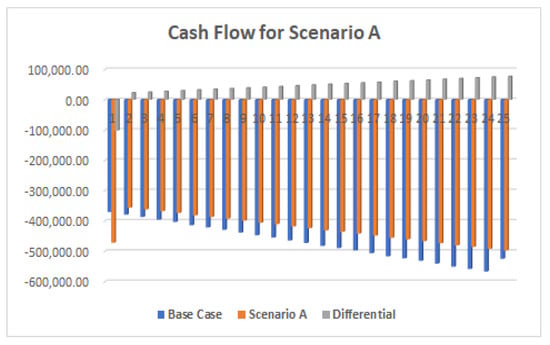

The grid supplies the demand during off-peak periods and the Diesel generator attends during peak periods; the employment of the BESS as a source is not considered in this scenario. Figure 2 shows the cash flow for the proposed scenario, and the values refer to the annual average flow. For the first year, the differential cash flow is negative due to the recent investment to purchase and adjust the Diesel Generator infrastructure. After the second year, the differential parameter is positive, since the Diesel Generator is not replaced during the lifecycle stated and the values also show savings in the tariff.

Figure 2.

Cash Flow for Scenario A.

The tariff for the period is expected to increase 2.31% under the historical readjustment index. The differential cash flow is expected to be equal to BRL 23,091.72, the average value for the second year of the combined sources employment, and to reach the average value of BRL 76,956,93 at the end of the period. The positive values for the differential cash flow define that the consumer may reduce the costs, and decrease the value of the energy bill for the period. The savings are caused by the expectation of higher costs to buy the energy supplied by the grid during peak hours about the costs to operate and manage the Diesel Generator.

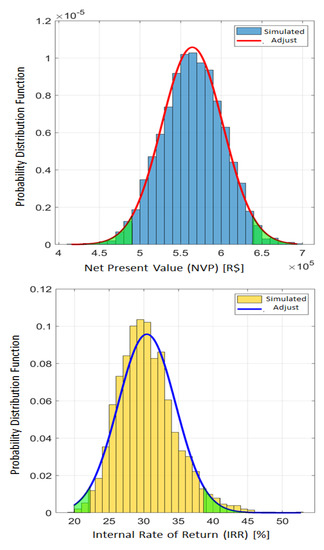

Figure 3 shows the histogram and the referred normal distribution curve adjusted to the histogram. The normal distribution graph displays a green region that represents a 95% confidence interval, i.e., 95% of all results are located out of the green-marked area. The average value of the NPV is equal to BRL 564,470 (USD 137,675.61), with a standard deviation of BRL 37,730 (USD 9202.44), and its confidence interval (95%) ranging from BRL 490,500 (USD 119,634.15) to BRL 638,400 (USD 155,707.32). The average value of the IRR is equal to 30.45%, its standard deviation of 4.16%, and its confidence interval (95%) varies from 22.28% to 38.62%.

Figure 3.

NPV and IRR for Scenario A.

The confidence interval shows that the NPV is positive for this scenario, which states the economic viability of the Diesel Generator as a replacement of the Grid during peak hours; these data are strengthened by the average value of the IRR. Despite the positive values regarding the economic viability of this scenario, it is important to state that the analysis does not take into account social and environmental viability. It is probable, due to the known negative impacts of Diesel Generator employment, that a broader study under the three perspectives may reduce the viability for this scenario.

4.2. Scenario B: Grid and LFP Battery Scenario

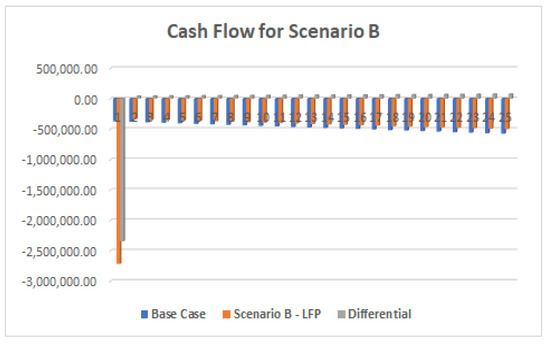

The consumer is supplied by the grid during off-peak periods and the BESS based in LFP-batteries attends the demand during peak hours. This initial study does not consider subsidies as an encouragement to consumers to import and maintain a BESS in Brazil. Due to tariff variation during the day, the BESS is charged only during off-peak periods. Figure 4 shows the Cash Flow for the grid and BESS combination for 25 years. The average value of the differential cash flow is negative for the first year, due to the costs to purchase and adjust the system. After the second year of operation, the average values regarding the differential cash flow are positive because the infrastructure is not replaced during the referred period.

Figure 4.

Cash Flow for Scenario B.

The positive differential cash flow points out that the combination of the sources may be economically viable for the consumer as a replacement of the grid during peak hours. The cash flow points out reductions in the energy bill: the costs to charge the BESS in off-peak periods are lower in comparison to the costs to maintain and operate the system. Besides this, the increasing and positive values for the differential cash flow are due to the expected readjustment of the energy tariff for the period from the 2nd year until the 25th year.

The cash flow for the first year has an average value of BRL 2,344,014.37 (USD 571,710.82), higher in comparison to the Diesel Generator scenario (Scenario A). The average cash flow for the first year is 80.75% higher in comparison to the scenario for a Diesel Generator implementation, but the differential cash flow is 3.43% lower at the end of the lifecycle due to capacity loss and efficiency of the BESS.

Figure 5 shows the histogram for this scenario. The average value of the NPV is negative: the parameter is accounted as −BRL 1,530,800 (USD 373,365.85) and its standard deviation is BRL 114,340 (USD 27,887.80). The confidence interval (95%) ranges from −BRL 1,755,000 (USD 428,028.78) to −BRL 1,307,000 (USD 318,780.48) for the NPV. The IRR is −3.53%, the standard deviation is 0.41, and the confidence interval (95%) ranges from −4.32% to −2.73%. The histogram shows that the probability of the NPV as always negative is high (95%). The data proves that the BESS is not an affordable alternative as the replacement of the grid during peak hours.

Figure 5.

NPV and IRR for Scenario B without subsidies.

The break-even point states where the balance between costs and revenues occurs, and it enables to analyze where all the costs have been paid, and the investment is profitable. Sensitivity analysis allows to set the parameter and to set the variation of variables that may cause changes in the whole scenario. The variation of costs to purchase the BESS enables to study of the sensibility of the NPV and IRR regarding particular aspects. The sensitivity analysis establishes that the parameters of the triangular probability distribution regarding the investments to purchase, operate, and maintain the BESS must decrease by 56.5% to achieve the break-even point for this scenario. The standard deviation for the NPV is equal to BRL 59,837. The average value for the IRR is 4.34%, the standard deviation is equal to 0.56% and the 95% confidence interval ranges from 3.27% to 5.44%.

For a scenario with subsidies, the results regarding the cash flow are similar to the scenario without subsidies. This similarity is due to the technical equality of both scenarios. The average value of the differential cash flow for the first year is lower in comparison with a non-subsidies scenario, and the average value of the parameter is equal to BRL 1,688,747.38 (USD 411,889.60), 27.96% lower compared with the scenario without subsidies. This datum reduces the values of the NPV and IRR.

The NPV is equal to −BRL 854,000 (USD 208,292.68), the standard deviation is BRL 87,410.00 (USD 21,319.51), and the 95% confidence interval ranges from −BRL 1,046,000 (USD 255,121.95) to −BRL 703,800 (USD 171,658.54). The IRR for this scenario is equal to −1.36%, the standard deviation is 0.44%, and the confidence interval (95%) ranges from −2.23% to −0.49%. Although the cost to purchase the BESS decreases by almost 30%, the cost reduction is insufficient, and the economic viability of the BESS as a replacement for the grid for peak hours is endorsed.

Likewise, in the scenario without subsidies, the sensitivity analysis enables to study of the feasibility of the BESS regarding economic parameters. The analysis establishes that the costs to purchase, maintain, and operate the BESS must decrease by 42.5% to achieve the break-even point for this scenario.

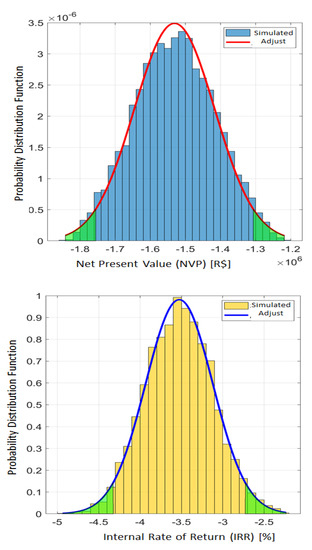

4.3. Scenario C: Grid and NCA Battery Scenario

The first part of the analysis describes the economic viability of an NCA-battery scenario combined with the grid without subsidies. Figure 6 shows the cash flow for the referred scenario. The cash flow is similar to the one obtained previously from the second year until the end of the cycle, due to similarities of performance for both batteries. For the first year, the average value of the differential cash flow is equal to BRL 1,655,467.16 (USD 403,772.48), almost 30% lower compared to the LFP scenario. The average values regarding the differential cash flow increases for the further years, raging from BRL 41,873.88 (USD 10,213.14), at the second year of the project, to BRL 74,339.49 (USD 18,131.58), at the end of the period.

Figure 6.

Cash Flow for Scenario C.

Figure 7 represents the histogram for this scenario. The average value of NPV for the solution is equal to −BRL 843,680.00 (USD 205,775.61), with an standard deviation of BRL 87,330.00 (USD 21,300) and confidence interval (95%) that starts at −BRL 1,015,000.00 (USD 247,560.98) and ends at −BRL 672,000.00 (USD 163,902.44). The average value of IRR is equal to −1.24%, standard deviation is 0.45%, and confidence interval (95%) ranges from −2.12% to −0.35%.

Figure 7.

NPV and IRR for Scenario C without subsidies.

The NPV for this scenario is negative for the period, which states that the replacement of the grid during peak hours is not viable for an NCA–battery solution. This analysis is endorsed by the high probability (97.5%) of negatives values for the IRR, due to the sum of the further cash flows inferiority in comparison to the initial investment to purchase the system.

Likewise, in the LFP scenario, sensitivity analysis allows studying the variation of the NPV and IRR regarding cost variations for the BESS. The analysis establishes that it is required that the values for the probability distribution function must decrease 41.6% to achieve the break-even point for this scenario. The standard deviation for the NPV is equal to BRL 58,724 (USD 14,322.93), and its average value is null. The average value for the IRR is 4.34%, the standard deviation is equal to 0.57%, and the confidence interval (95%) ranges from 3.24% to 5.47%.

For a scenario with subsidies, there are no significant changes for the average yearly values regarding the differential cash flow after the second year. For the first year, the scenario requires BRL 1,214,323.93 (USD 296,176.57) to implement the BESS, a reduction of 26.65% compared to the non-subsidized scenario. The NPV average value is equal to −BRL 401,840 (USD 98,009.76), with a standard deviation of BRL 68,500.00 (USD 16,707.32), and the confidence interval (95%) ranges from −BRL 536,000 (USD 130,731.71) to −BRL 267,000 (USD 65,121.95). The average value for IRR is 1.03%, with 0.50% of standard deviation, and its confidence interval (95%) ranges from 0.05% to 2%.

The histogram shows that the probability of positive values for the IRR is high (95%), but the probability of negative values for the NPV is high as well. The values define that even with subsidies the BESS is not an affordable replacement for the energy supplied by the grid for peak hours. The sensitivity analysis establishes that it is required a 25.3% reduction in the BESS costs, with a 50% probability, to reach the break-even point for these conditions.

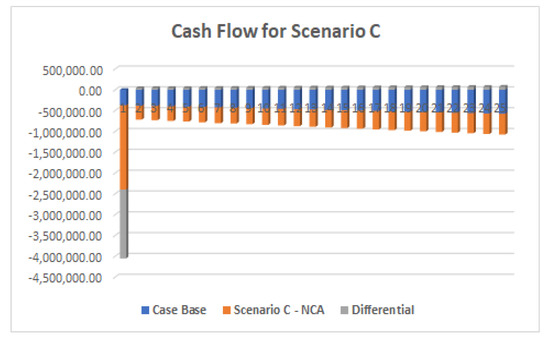

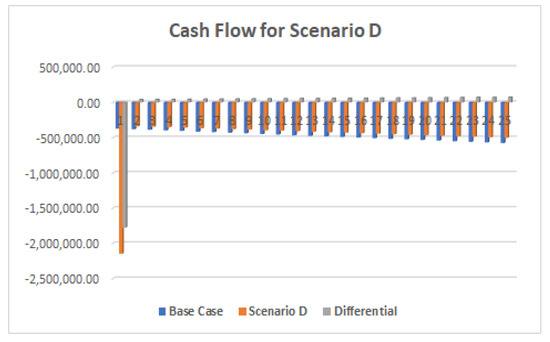

4.4. Scenario D: Grid, Battery, and Diesel Generator Scenario

The analysis of the previous scenarios establishes that the Diesel Generator is an affordable replacement of the grid during peak hours, in contrast to scenarios based on BESS. The last scenario takes into account the combination of the three referred sources: the grid, the BESS–NCA battery—without subsidies, and the Diesel Generator. During off-peak periods, the grid supplies the consumer and the BESS is charged, and during peak hours, the BESS supplies the consumer. The Diesel Generator is employed in case of unavailability by the BESS.

Figure 8 shows the cash flow for the three sources scenario. The average value of the differential cash flow is negative for the first year, due to the recent investment in the infrastructure, and its value is BRL 1,775,640.13 (USD 433,082.96). The required investment is lower compared with the LFP battery unit without subsidies, due to the lower costs to purchase the Diesel Generator compared to the costs to acquire the batteries analyzed in this work.

Figure 8.

Cash Flow for Scenario D.

After the second year of the period, the average value of the differential cash flow is positive, due to the impacts of the grid replacement during peak hours and the savings in the energy bill. The positive results are lower compared to the BESS scenarios, because of the maintenance costs of the Diesel Generator. The average differential cash flow increases, from BRL 41,288.02, for year two, to BRL 73,610.93 (USD 17,953.88) at the end of the lifecycle.

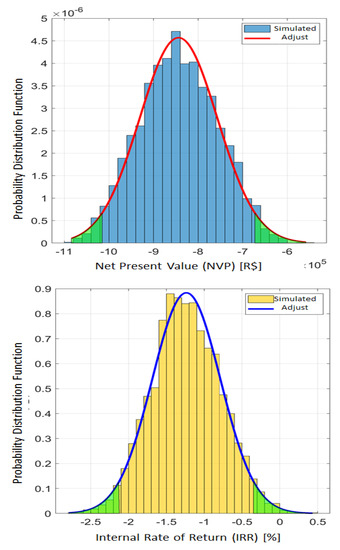

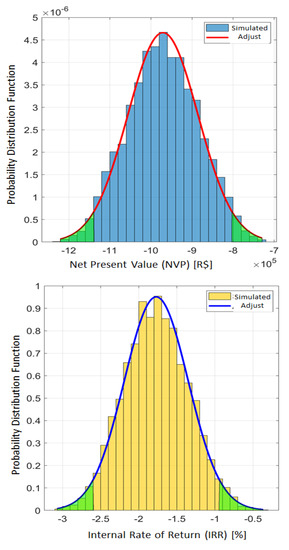

The average value for NPV is −BRL 970,670 (USD 236,748.78), the standard deviation is equal to BRL 85,600 (USD 20,878.05), and the confidence interval (95%) ranges from −BRL 1,138,000 (USD277,560.98) to −BRL 802,900 (USD 195,829.27). The average value for IRR is equal to −1.77%, the standard deviation is 0.42%, and the confidence interval (95%) ranges from −2.60% to −0.95%. Figure 9 shows the histogram of the solution.

Figure 9.

NPV and IRR for Scenario D.

Figure 9 shows that the probability of negative values for NPV and IRR are high. These results explain the lower value of the average differential cash flows compared to the initial investments in the infrastructure. The break-even point analysis states that costs to purchase the BESS must decrease by 48.3% to reach the break-even point, with a 50% probability.

5. Conclusions

The work focuses on evaluating the BESS viability in emerging economies. The work takes into account the replacement of the grid or Diesel Generator for the costly periods to meet the demand of consumers that takes advantage of Time-of-Use rate plans. In order to evaluate the BESS entry scenario, the work employs the costs variation through the lifecycle regarding different economic and technical parameters.

Four different scenarios with different energy sources combination are analyzed. Despite efforts to increase the BESS implementation, the access to the technology is still not affordable for a large share of consumers. A large-scale system, such as the one analyzed, is expensive for consumers located in emerging economies, and this reality is aggravated by a currency that is devalued against others and import costs. The advantage of Time-of-Use rate through the day does not establish an affordable perspective, even for a high variation of tariffs and fuel costs.

This paper balances the costs for buying energy from other sources with the costs for purchasing and maintaining a BESS. Although the tariffs and fuel costs grow above the inflation rate for the period, the initial investments regarding a BESS is not affordable for the proposed scenarios. From the scenarios, the deployment of BESS requires subsidies and new rules for the energy sector in order to enable the affordability of storage systems. For scenarios that deploy subsidies as an encouragement to buy batteries as an alternative source, the results establish that it is required 42.5% and 25.3% reduction, respectively, to buy the LFP and NCA battery unities to reach the break-even point of the solution.

The Diesel Generator as a replacement during peak hours is still an affordable option in the country. Costs to attend to the demand during peak hours are lower in comparison to the other scenarios, and the differential cash flow presents the average IRR equal to 30.45%. These values may change from an economic and social viability study, which allows establishing parameters and the definition of a model focused on renewable energy sources deployment and improvement of the services quality.

The evaluation of methods that encourage the adoption of the BESS as an affordable technology for consumers through a business model, and a governance method that facilitates the entry of consumers in the energy sector, are the next steps for this research. The viability must deal with economic analysis for a demand-side solution with a BESS to allow business continuity. The analysis of the viability for a real-life BESS implementation in Brazil and local business models are further next steps for this research.

Author Contributions

Conceptualization, J.R.M.-B. and V.T.N.; methodology, J.R.M.-B.; investigation, V.T.N. and J.R.M.-B.; data curation, J.R.M.-B. and V.T.N.; writing—original draft preparation, V.T.N.; writing—review and editing, M.E.M.U. and V.B.R.; visualization, A.L.V.G.; supervision, A.L.V.G. and M.E.M.U.; project administration, A.L.V.G., V.B.R. and T.J.; funding acquisition, A.L.V.G. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded by CPFL—Companhia Paulista de Força e Luz Energia (Campinas,Brazil).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

This study was financed in part by the Conselho Nacional de Desenvolvimento Científico e Tecnológico—Brazil (CNPq). The authors would like to thank CPFL Energia and Fundação para o Desenvolvimento Tecnológico da Engenharia-FDTE for funding the R&D strategic project ANEEL 00063-3025/2016 “Sistemas de Armazenamento Integrados a mais de uma fonte energética: Gestão híbrida de Sistemas energéticos Multi-fontes”, enabling the idealization and development of this work.

Conflicts of Interest

The authors declare no conflict of interest.

References

- International Renewable Energy Agency. IRENA’s Energy Transition Support to Strengthen Climate Action—Insight to Impact; Technical Report; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021. [Google Scholar]

- Blazquez, J.; Fuentes-Bracamontes, R.; Manzano, B. A Road Map to Navigate the Energy Transition; Technical Report; The Oxford Institute for Energy Studies: Oxford, UK, 2019. [Google Scholar]

- Cantarero, M.M.V. Of renewable energy, energy democracy, and sustainable development: A roadmap to accelerate the energy transition in developing countries. Energy Res. Soc. Sci. 2020, 70, 101716. [Google Scholar] [CrossRef]

- Agência Nacional de Energia Elétrica ANEEL. Geração Distribuída—Unidades Consumidoras Com Geração Distribuída; Agência Nacional de Energia Elétrica ANEEL: Brasília, Brazil, 2022. [Google Scholar]

- Faisal, M.; Hannan, M.A.; Ker, P.J.; Hussain, A.; Mansor, M.B.; Blaabjerg, F. Review of energy storage system technologies in microgrid applications: Issues and challenges. IEEE Access 2018, 6, 35143–35164. [Google Scholar] [CrossRef]

- Hannan, M.; Wali, S.; Ker, P.; Abd Rahman, M.; Mansor, M.; Ramachandaramurthy, V.; Muttaqi, K.; Mahlia, T.; Dong, Z. Battery energy-storage system: A review of technologies, optimization objectives, constraints, approaches, and outstanding issues. J. Energy Storage 2021, 42, 103023. [Google Scholar] [CrossRef]

- Chris, M.; Chatzivasileiadis, S.; Abbey, C.; Iravani, R.; Joos, G.; Lombardi, P.; Mancarella, P.; von Appen, J. Microgrid Evolution Roadmap. In Proceedings of the 2015 International Symposium on Smart Electric Distribution Systems and Technologies (EDST), Vienna, Austria, 7–11 September 2015. [Google Scholar]

- Wong, L.A.; Ramachandaramurthy, V.K.; Taylor, P.; Ekanayake, J.; Walker, S.L.; Padmanaban, S. Review on the optimal placement, sizing and control of an energy storage system in the distribution network. J. Energy Storage 2019, 21, 489–504. [Google Scholar] [CrossRef]

- Teleke, S.; Baran, M.E.; Huang, A.Q.; Bhattacharya, S.; Anderson, L. Control strategies for battery energy storage for wind farm dispatching. IEEE Trans. Energy Convers. 2009, 24, 725–732. [Google Scholar] [CrossRef]

- Lott, M.C. Technology Roadmap Energy Storage; Technical Report; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Usera, I.; Rodilla, P.; Burger, S.; Herrero, I.; Batlle, C. The Regulatory Debate About Energy Storage Systems: State of the Art and Open Issues. IEEE Power Energy Mag. 2017, 15, 42–50. [Google Scholar] [CrossRef]

- Eller, A.; Gauntlett, D. Energy Storage Trends and Opportunities in Emerging Markets; Navigant Consulting Inc.: Boulder, CO, USA, 2017. [Google Scholar]

- Yang, Y.; Bremner, S.; Menictas, C.; Kay, M. Battery energy storage system size determination in renewable energy systems: A review. Renew. Sustain. Energy Rev. 2018, 91, 109–125. [Google Scholar] [CrossRef]

- Parra, D.; Swierczynski, M.; Stroe, D.I.; Norman, S.A.; Abdon, A.; Worlitschek, J.; O’Doherty, T.; Rodrigues, L.; Gillott, M.; Zhang, X.; et al. An interdisciplinary review of energy storage for communities: Challenges and perspectives. Renew. Sustain. Energy Rev. 2017, 79, 730–749. [Google Scholar] [CrossRef]

- Uddin, K.; Gough, R.; Radcliffe, J.; Marco, J.; Jennings, P. Techno-economic analysis of the viability of residential photovoltaic systems using lithium-ion batteries for energy storage in the United Kingdom. Appl. Energy 2017, 206, 12–21. [Google Scholar] [CrossRef]

- Tervo, E.; Agbim, K.; DeAngelis, F.; Hernandez, J.; Kim, H.K.; Odukomaiya, A. An economic analysis of residential photovoltaic systems with lithium ion battery storage in the United States. Renew. Sustain. Energy Rev. 2018, 94, 1057–1066. [Google Scholar] [CrossRef]

- Barzegkar-Ntovom, G.A.; Chatzigeorgiou, N.G.; Nousdilis, A.I.; Vomva, S.A.; Kryonidis, G.C.; Kontis, E.O.; Georghiou, G.E.; Christoforidis, G.C.; Papagiannis, G.K. Assessing the viability of battery energy storage systems coupled with photovoltaics under a pure self-consumption scheme. Renew. Energy 2020, 152, 1302–1309. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Wu, W. Economic viability of battery energy storage and grid strategy: A special case of China electricity market. Energy 2017, 124, 423–434. [Google Scholar] [CrossRef]

- Martinez-Bolanos, J.R.; Udaeta, M.E.M.; Gimenes, A.L.V.; da Silva, V.O. Economic feasibility of battery energy storage systems for replacing peak power plants for commercial consumers under energy time of use tariffs. J. Energy Storage 2020, 29, 101373. [Google Scholar] [CrossRef]

- Thomé, M.H.C. AnáLise De Viabilidade EconôMica Da ImplantaçãO De Sistemas De Baterias De LíTio-íOn Em Unidades Consumidoras Conectadas Na MéDia TensãO. Ph.D. Thesis, Universidade Federal do Rio de Janeiro, Rio de Janeiro, Brazil, 2017. [Google Scholar]

- dos Santos, L.G.M. Estratégias de Armazenamento de Energia Elétrica e uma Análise de Viabilidade Econômica da Adoção de Baterias Para Gerenciamento Pelo Lado da Demanda; Fórum de Energias Renováveis: Boa Vista, Brazil, 2018. [Google Scholar]

- Statistics and Machine Learning Toolbox. Available online: https://www.mathworks.com/products/statistics.html (accessed on 28 January 2022).

- Petrobras—Petroleo Brasileiro S.A. Preço de Venda de Combustíveis. Available online: https://petrobras.com.br/pt/nossas-atividades/precos-de-venda-de-combustiveis/ (accessed on 28 January 2022).

- Motores e Geradores. Diesel ou GáS Natural? Available online: https://www.joseclaudio.eng.br/geradores/Diesel_versus_gas (accessed on 28 January 2022).

- Saldaña, G.; San Martín, J.I.; Zamora, I.; Asensio, F.J.; Oñederra, O. Analysis of the current electric battery models for electric vehicle simulation. Energies 2019, 12, 2750. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).