Assessing Purchase Patterns of Price Conscious Consumers

Abstract

1. Introduction

2. Materials and Methods

2.1. Hypotheses Development

2.2. Recruitment and Sampling

2.3. Price Consciousness Measures

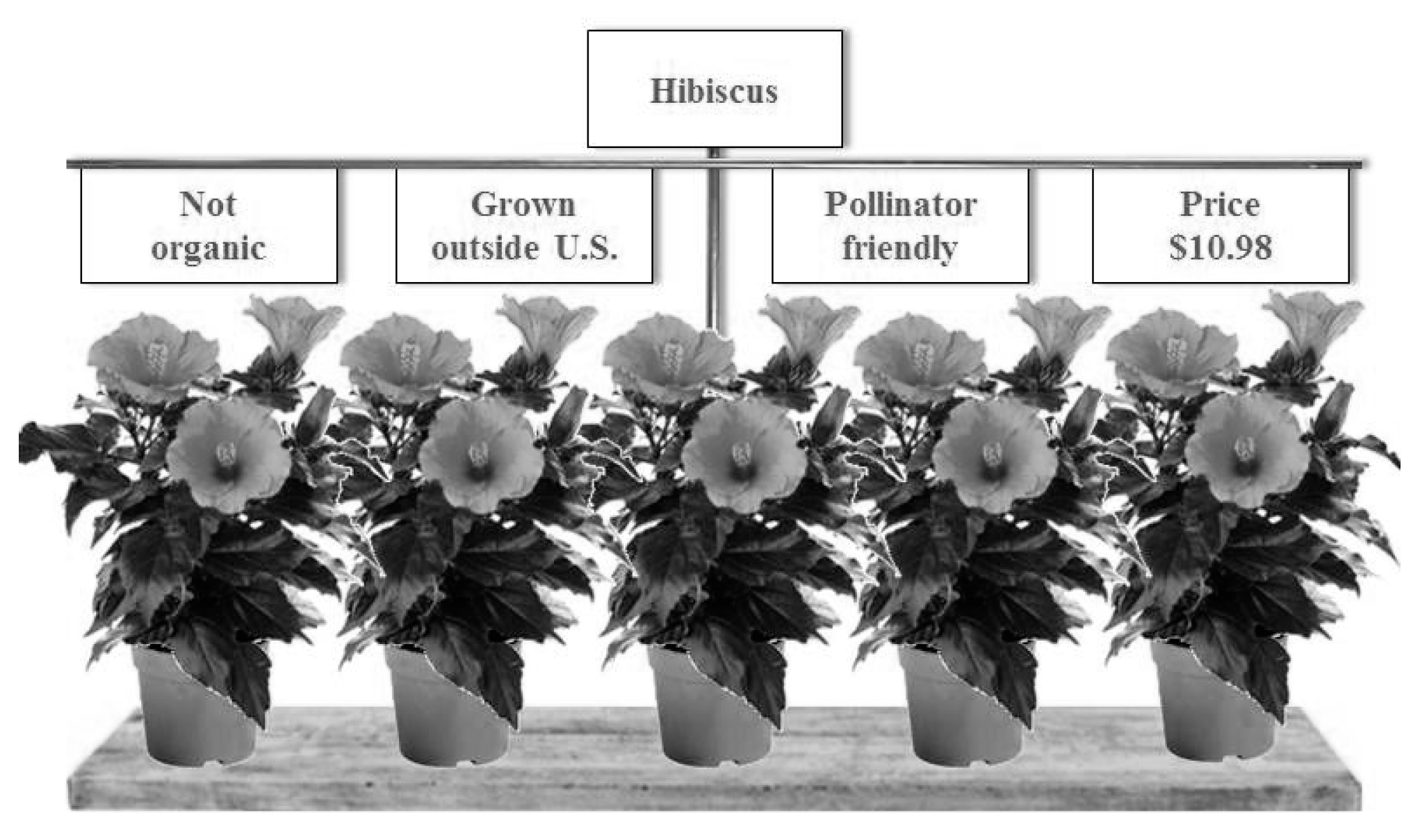

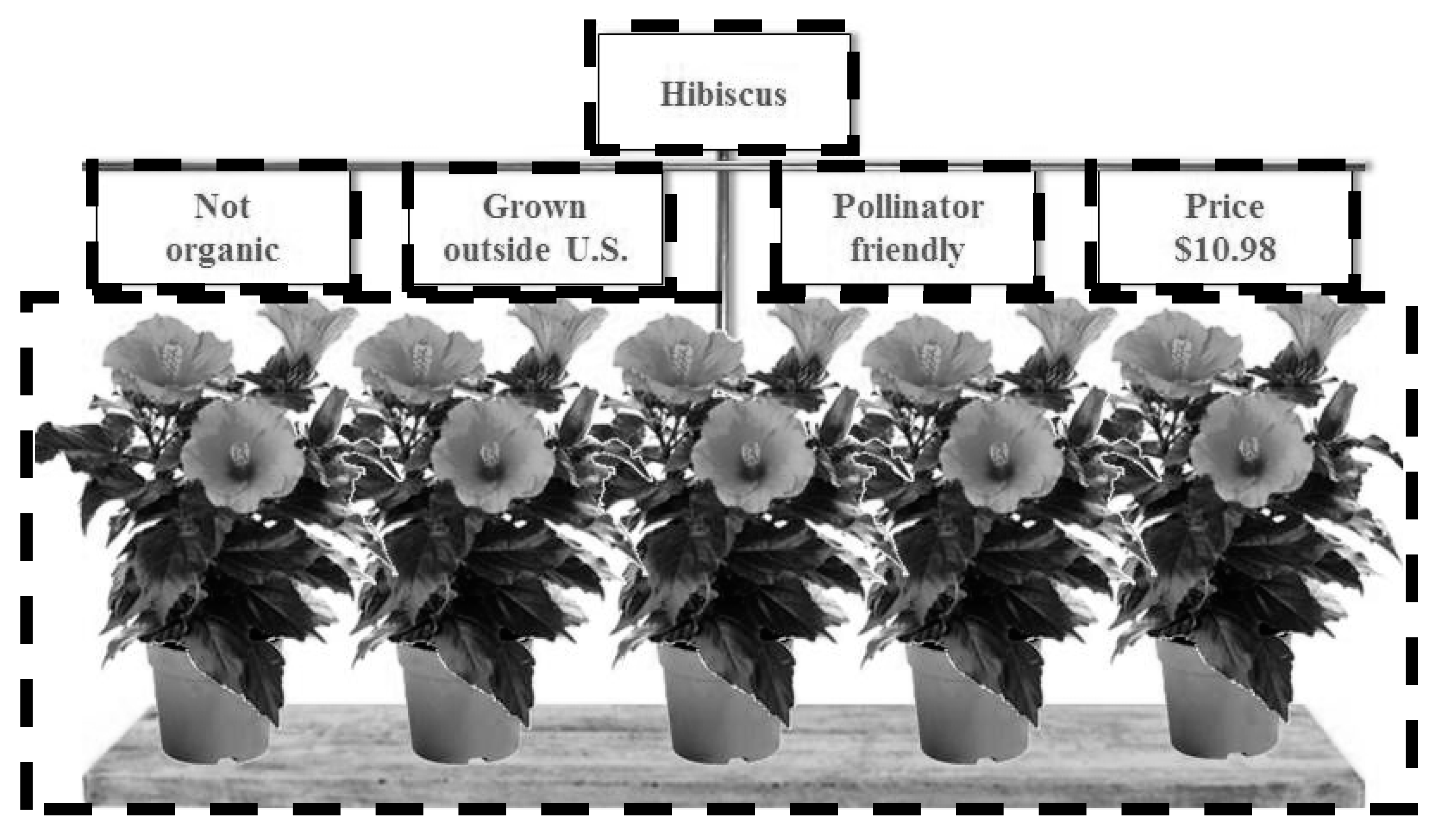

2.4. Conjoint Analysis Experiment Procedure

2.5. Eye Tracking Metrics and Procedures

2.6. Econometric Model

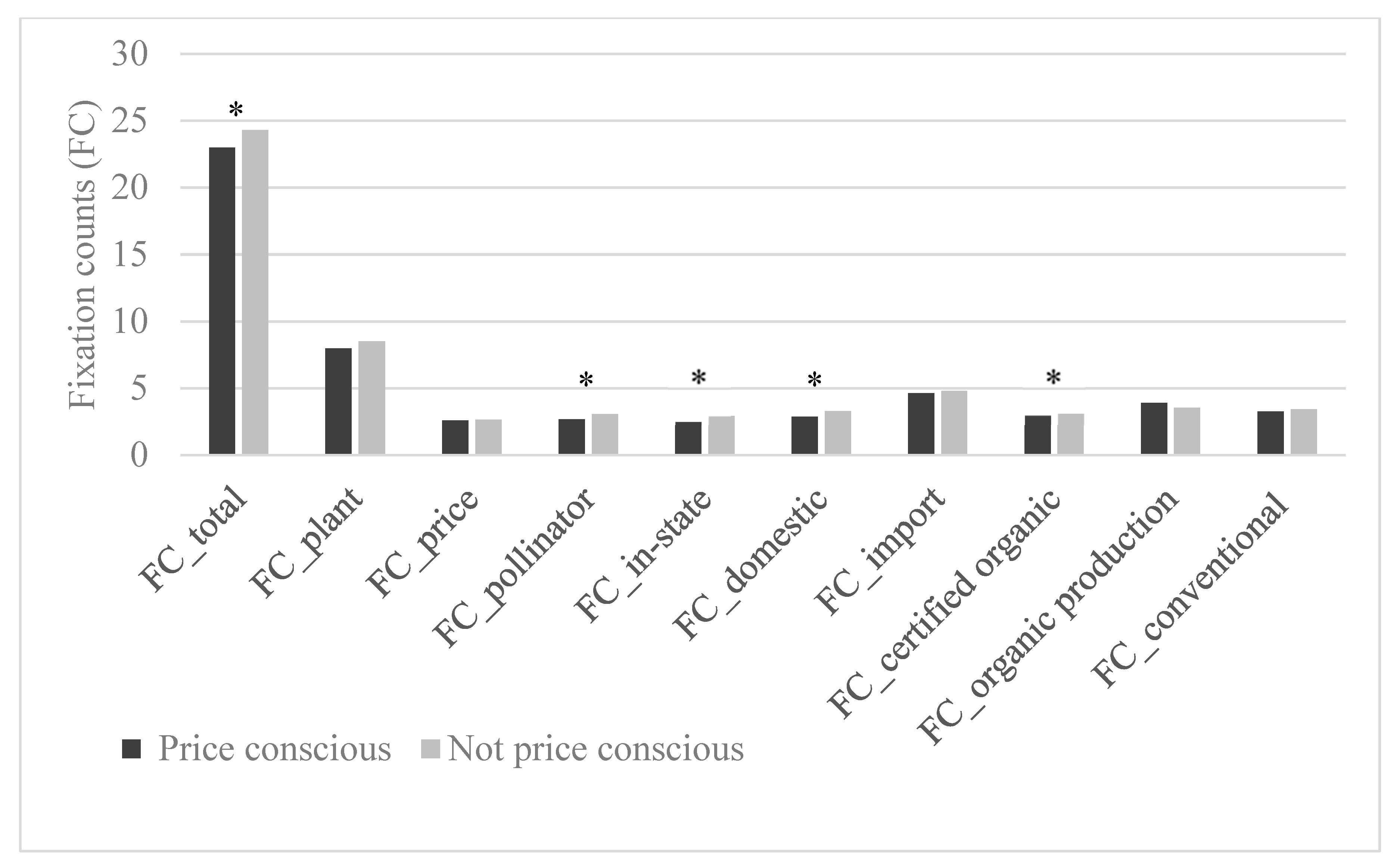

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Alford, B.L.; Biswas, A. The effects of discount level, price consciousness and sale proneness on consumers’ price perception and behavioral intention. J. Bus. Res. 2002, 55, 775–783. [Google Scholar] [CrossRef]

- Behe, B.K.; Campbell, B.; Khachatryan, H.; Hall, C.H.; Dennis, J.H.; Huddleston, P.T.; Fernandez, R.T. Incorporating eye tracking technology and conjoint analysis to better understand the green industry consumer. HortScience 2014, 49, 1550–1557. [Google Scholar]

- Han, S.; Gupta, S.; Lehmann, D.R. Consumer price sensitivity and price thresholds. J. Retail. 2001, 77, 435–456. [Google Scholar] [CrossRef]

- Lichtenstein, D.R.; Netemeyer, R.G.; Burton, S. Distinguishing coupon proneness from value consciousness: An acquisition-transaction utility theory perspective. J. Mark. 1990, 54, 54–67. [Google Scholar] [CrossRef]

- Lichtenstein, D.R.; Ridgway, N.M.; Netemeyer, R.G. Price perceptions and consumer shopping behavior: A field study. J. Mark. Res. 1993, 30, 234–245. [Google Scholar] [CrossRef]

- Sinha, I.; Batra, R. The effect of consumer price consciousness on private label purchase. Int. J. Res. Mark. 1999, 16, 237–251. [Google Scholar] [CrossRef]

- Sproles, G.B. From perfectionism to fadism: Measuring consumers’ decision-making styles. Proc. Am. Council Consum. Interests 1985, 31, 79–85. [Google Scholar]

- Hafstrom, J.L.; Jung, S.C.; Chung, Y.S. Consumer decision-making styles: Comparison between United States and Korean young consumers. J. Consum. Aff. 1992, 26, 146–158. [Google Scholar] [CrossRef]

- Kim, B.; Srinivasan, K.; Wilcox, R.T. Identifying price sensitive consumers: The relative merits of demographic vs. purchase pattern information. J. Retail. 1999, 75, 173–193. [Google Scholar] [CrossRef]

- Sproles, G.B.; Kendall, E.L. A short test of consumer decision-making styles. J. Consum. Aff. 1987, 5, 7–14. [Google Scholar]

- Hoch, S.J.; Kim, B.; Montgomery, A.L.; Rossi, P.E. Determinants of store-level price elasticity. J. Mark. Res. 1995, 32, 17–29. [Google Scholar] [CrossRef]

- Wakefield, K.L.; Inman, J.J. Situational price sensitivity: The role of consumption occasion, social context and income. J. Retail. 2003, 79, 199–212. [Google Scholar] [CrossRef]

- Martínez, E.; Montaner, T. The effect of consumer’s psychographic variables upon deal-proneness. J. Retail. Consum. Serv. 2006, 13, 157–168. [Google Scholar] [CrossRef]

- Inglehart, R. Culture Shift in Advanced Industrial Society; Princeton University Press: Princeton, NJ, USA, 1990. [Google Scholar]

- Ofir, C. Reexamining latitude of price acceptability and price thresholds: Predicting basic consumer reaction to price. J. Consum. Res. 2004, 30, 612–621. [Google Scholar] [CrossRef]

- Elitzak, H. Food Cost Review, 1950–1997; Report No. 780, USDA Agricultural Economic Report; Economic Research Service: Washington, DC, USA, 1999. [Google Scholar]

- Balcombe, K.; Bitzios, M.; Fraser, I.; Haddock-Fraser, J. Using attribute importance rankings within discrete choice experiments: An application to valuing bread attributes. J. Agric. Econ. 2014, 65, 446–462. [Google Scholar] [CrossRef]

- Bundesen, C. A Theory of visual attention. Psychol. Rev. 1990, 97, 523–547. [Google Scholar] [CrossRef] [PubMed]

- Reutskaja, E.; Nagel, R.; Camerer, C.F.; Rangel, A. Search dynamics in consumer choice under time pressure: An eye-tracking study. Am. Econ. Rev. 2011, 101, 900–926. [Google Scholar] [CrossRef]

- Arieli, A.; Ben-Ami, Y.; Rubinstein, A. Tracking decision makers under uncertainty. Am. Econ. J. Microecon. 2011, 3, 68–76. [Google Scholar] [CrossRef]

- Russo, J.E.; Leclerc, F. An eye-fixation analysis of choice processes for consumer nondurables. J. Consum. Res. 1994, 21, 274–290. [Google Scholar] [CrossRef]

- Van Loo, E.J.; Nayga, R.M.; Seo, H.S.; Verbeke, W. Visual Attribute Non-Attendance in a Food Choice Experiment: Results From an Eye-Tracking Study; Agricultural and Applied Economics Association Annual Meeting: Minneapolis, MN, USA, 2014. [Google Scholar]

- Van Loo, E.J.; Caputo, V.; Nayga, R.M.; Seo, H.S.; Zhang, B.; Verbeke, W. Sustainability labels on coffee: Consumer preferences, willingness-to-pay and visual attention to attributes. Ecol. Econ. 2015, 118, 215–225. [Google Scholar] [CrossRef]

- Orquin, J.L.; Loose, S.M. Attention and choice: A review on eye movements in decision making. Acta Psychol. 2013, 144, 190–206. [Google Scholar] [CrossRef] [PubMed]

- Chandon, P.; Wansink, B.; Laurent, G. A benefit conguency framework of sales promotion effectiveness. J. Mark. 2000, 64, 65–81. [Google Scholar] [CrossRef]

- Aschemann-Witzel, J.; Zielke, S. Can’t buy me green? A review of consumer perceptions of and behavior toward the price of organic food. J. Consum. Aff. 2017, 51, 211–251. [Google Scholar] [CrossRef]

- Magnusson, M.K.; Arvola, A.; Hursti, U.K.; Åberg, L.; Sjödén, P. Attitudes Towards Organic Foods Among Swedish Consumers. Br. Food J. 2001, 103, 209–226. [Google Scholar] [CrossRef]

- Grebitus, C.; Seitz, C. Relationship between attention and choice. In Proceedings of the European Association of Agricultural Economists 2014 Congress “Agri-Food and Rural Innovations for Healthier Societies”, Ljubljana, Slovenia, 26–29 August 2014. [Google Scholar]

- Chen, Y.; Caputo, V.; Nayga, R.M., Jr.; Scarpa, R.; Fazli, S. How visual attention affects choice outcomes: An eye tracking study. In Proceedings of the 3rd International Winter Conference on Brain-Computer Interface, Sabuk, Korea, 12–14 January 2015. [Google Scholar]

- Behe, B.K.; Bae, M.; Huddleston, P.T.; Sage, L. The effect of involvement on visual attention and product choice. J. Retail. Consum. Serv. 2015, 24, 10–21. [Google Scholar] [CrossRef]

- Huddleston, P.; Behe, B.K.; Minahan, S.; Fernandez, R.T. Seeking attention: An eye tracking study of in-store merchandise displays. Int. J. Ret. Dist. Manag. 2015, 43, 561–574. [Google Scholar] [CrossRef]

- Lichtenstein, D.R.; Bloch, P.H.; Black, W.C. Correlates of price acceptability. J. Consum. Res. 1988, 15, 243–252. [Google Scholar] [CrossRef]

- Schimmenti, E.; Galati, A.; Borsellino, V.; Ievoli, C.; Lupi, C.; Tinervia, S. Behaviour of consumers of conventional and organic flowers and ornamental plants in Italy. HortScience 2013, 41, 162–171. [Google Scholar]

- Reisen, N.; Hoffrage, U.; Mast, F.W. Identifying decision strategies in a consumer choice situation. Judgm. Decis. Mak. 2008, 3, 641–658. [Google Scholar]

- U.S. Census Bureau. State & County QuickFacts. 2014. Available online: http://quickfacts.census.gov/qfd/states/12000.html (accessed on 2 January 2018).

- National Gardening Association. The Impact of Home and Community Gardening in America; Butterfield, B., Ed.; National Gardening Association, Inc.: South Burlington, VT, USA, 2009; pp. 1–17. [Google Scholar]

- Kalyanaram, G.; Little, J.D.C. An empirical analysis of latitude of price Acceptance in consumer package goods. J. Consum. Res. 1994, 21, 408–418. [Google Scholar] [CrossRef]

- Low, W.; Lee, J.; Cheng, S. The link betweeen customer satisfaction and price sensitivity: An investigation of retailing industry in Taiwan. J. Retail. Consum. Serv. 2013, 20, 1–10. [Google Scholar] [CrossRef]

- Stock, R.M. Can customer satisfaction decrease price sensitivity in business-to-business markets? J. Bus.-to-Bus. Mark. 2005, 12, 59–87. [Google Scholar] [CrossRef]

- Hodges, A.W.; Khachatryan, H.; Hall, C.R.; Palma, M.A. Production and marketing practices and trade flows in the United States Green Industry in 2013. J. Environ. Hortic. 2015, 33, 125–136. [Google Scholar]

- Collart, A.J.; Palma, M.A.; Hall, C.R. Branding awareness and willingness-to-pay associated with the Texas Superstar™ and Earth-Kind™ Brands in Texas. HortScience 2010, 45, 1226–1231. [Google Scholar]

- Behe, B.K.; Zhao, J.; Sage, L.; Huddleston, P.T. Minahan, S. Display signs and involvement: The visual path to purchase intention. Int. Rev. Retail. Dist. Consum. Res. 2013, 23, 189–203. [Google Scholar]

- Behe, B.K.; Fernandez, R.T.; Huddleston, P.T.; Minahan, S.; Getter, K.L.; Sage, L.; Jones, A.M. Practical field use of eye-tracking devices for consumer research in the retail environment. HortTechnology 2013, 23, 517–524. [Google Scholar]

- Hall, C.R.; Dickson, M.W. Economic, environmental, and health/well-being benefits associated with green industry products and services: A review. J. Environ. Hortic. 2011, 29, 96–103. [Google Scholar]

- Long, J.S.; Freese, J. Regression Models for Categorical Dependent Variables Using STATA; A Stata Press Publication, StataCorp, LP: College Station, TX, USA, 2006. [Google Scholar]

- Schiffman, L.G.; Kanuk, L.L. Consumer Behavior, 9th ed.; Prentice-Hall, Inc.: Upper Saddle River, NJ, USA, 2007; pp. 177–178. [Google Scholar]

- Dagher, G.; Itani, O. Factors influencing green purchasing behaviour: Empirical evidence from the Lebanese consumers. J. Consum. Behav. 2014, 113, 188–195. [Google Scholar] [CrossRef]

- Khachatryan, H.; Rihn, A.L.; Campbell, B.; Yue, C.; Hall, C.; Behe, B.K. Visual attention to eco-labels predicts consumer preferences for pollinator friendly plants. Sustainability 2017, 9, 1743. [Google Scholar] [CrossRef]

- Miller, S.; Tait, P.; Saunders, C.; Dalziel, P.; Rutherford, P.; Abell, W. Estimation of consumer willingness-to-pay for social responsibility in fruit and vegetable products: A cross-country comparison using a choice experiment. J. Consum. Behav. 2017, 16, e13–e25. [Google Scholar] [CrossRef]

- Yue, C.; Campbell, B.; Hall, C.R.; Behe, B.K.; Dennis, J.; Khachatryan, H. Consumer preference for sustainable attributes in plants: Evidence from experimenal auctions. Agribusiness 2016, 32, 222–235. [Google Scholar] [CrossRef]

- Darby, K.; Batte, M.T.; Ernst, S.; Roe, B. Decomposing local: A conjoint analysis of locally produced foods. Am. J. Agric. Econ. 2008, 90, 476–486. [Google Scholar] [CrossRef]

- Onozaka, Y.; McFadden, D.T. Does local labeling complement or compete with other sustainable labels? A conjoint analysis of direct and joint values for fresh produce claims. Am. J. Agric. Econ. 2011, 93, 693–706. [Google Scholar] [CrossRef]

| Overall Mean | Price Conscious Mean | Non-Price Conscious Mean | p-Value a | |

|---|---|---|---|---|

| (n = 96) | (n = 30) | (n = 66) | ||

| Age (in years) | 52.5 | 47.267 | 54.879 | 0.00 |

| (16.678) | (10.554) | (16.642) | ||

| Male | 39.6% | 43.33% | 37.88% | 0.04 |

| (48.7) | (49.61) | (48.53) | ||

| Household size | 1.854 | 2.133 | 1.727 | 0.00 |

| (1.377) | (1.589) | (1.250) | ||

| High income (>$50,000) | 54.2% | 46.67% | 57.58% | 0.00 |

| (49.8) | (49.94) | (49.45) |

| Attributes | Attribute Levels | Definition/Description |

|---|---|---|

| Plant type a | Hibiscus Penta Petunia b | The type of plant in the scenario image shown to participants. |

| Price a | $10.98 $12.98 $14.98 | Price per plant. |

| Pollinator | Pollinator friendly | Indicates if the plant benefits pollinators. |

| No label b | ||

| Production method | Certified organic | Plants are certified as organically produced. |

| Organic production | Plants are produced in an organic manner, but are not certified organic. | |

| Not organic (conventional) b | Plants are grown using conventional production methods. | |

| Origin | In-state (Fresh from Florida) | Plants are produced in Florida |

| Domestic (Grown in the U.S.) | Plants are produced in the U.S. | |

| Imported (Grown outside the U.S.) b | Plants are imported from countries outside the U.S. |

| Variable | Dependent Variable: Purchase Likelihood | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Specification 1 | Specification 2 | Specification 3 | |||||||

| Coefficient | Standard Error | Coefficient | Standard Error | Coefficient | Standard Error | ||||

| Price-conscious indicator (PC) | −0.290 | (0.106) | *** | −0.251 | (0.108) | ** | −0.254 | (0.114) | ** |

| Plant attribute | |||||||||

| Hibiscus | 0.663 | (0.116) | *** | 0.716 | (0.120) | *** | 0.733 | (0.121) | *** |

| Penta | 0.414 | (0.110) | *** | 0.442 | (0.114) | *** | 0.468 | (0.112) | *** |

| Petunia | Base | Base | Base | ||||||

| Price | −0.175 | (0.029) | *** | −0.204 | (0.030) | *** | −0.208 | (0.030) | *** |

| Pollinator friendly | 0.319 | (0.094) | *** | 0.327 | (0.097) | *** | 0.333 | (0.095) | *** |

| Certified organic | 0.541 | (0.115) | *** | 0.514 | (0.118) | *** | 0.544 | (0.120) | *** |

| Organic production | 0.722 | (0.125) | *** | 0.699 | (0.128) | *** | 0.7333 | (0.128) | *** |

| Conventional | Base | Base | Base | ||||||

| In-state | 1.061 | (0.124) | *** | 1.156 | (0.131) | *** | 1.222 | (0.134) | *** |

| Domestic | 0.817 | (0.123) | *** | 0.922 | (0.128) | *** | 0.972 | (0.131) | *** |

| Import | Base | Base | Base | ||||||

| Visual Attention Variables | |||||||||

| FC_product image | 0.025 | (0.009) | *** | 0.053 | (0.011) | *** | |||

| FC_price | −0.049 | (0.006) | *** | −0.045 | (0.010) | *** | |||

| FC_pollinator friendly | 0.214 | (0.070) | *** | 0.322 | (0.086) | *** | |||

| FC_certified organic | 0.208 | (0.068) | *** | 0.367 | (0.093) | *** | |||

| FC_organic production | −0.064 | (0.033) | * | −0.030 | (0.047) | ||||

| FC_conventional | 0.159 | (0.038) | *** | 0.168 | (0.044) | *** | |||

| FC_in-state | −0.033 | (0.045) | −0.027 | (0.053) | |||||

| FC_domestic | 0.023 | (0.048) | −0.180 | (0.062) | *** | ||||

| FC_import | 0.199 | (0.034) | *** | 0.037 | (0.047) | ||||

| PC interacting with Visual Attention | |||||||||

| PC × FC_product image | −0.143 | (0.024) | *** | ||||||

| PC × FC_price | −0.411 | (0.216) | * | ||||||

| PC × FC_pollinator friendly | −0.780 | (0.163) | *** | ||||||

| PC × FC_certified organic | −0.042 | (0.157) | |||||||

| PC × FC_organic production | −0.041 | (0.082) | |||||||

| PC × FC_conventional | −0.135 | (0.114) | |||||||

| PC × FC_in-state | −0.007 | (0.127) | |||||||

| PC × FC_domestic | 0.576 | (0.107) | *** | ||||||

| PC × FC_import | 0.612 | (0.087) | *** | ||||||

| Social-demographics | |||||||||

| Age | 0.007 | (0.004) | ** | 0.001 | (0.004) | 0.010 | (0.004) | *** | |

| Gender | 0.243 | (0.095) | ** | 0.211 | (0.106) | ** | 0.205 | (0.117) | * |

| High income (>50 k) | 0.230 | (0.112) | ** | 0.300 | (0.116) | *** | 0.220 | (0.138) | |

| Household | −0.091 | (0.038) | ** | −0.164 | (0.041) | *** | −0.234 | ().047) | *** |

| Threshold Parameters a | |||||||||

| Cut 1 | −3.421 | (0.483) | −3.723 | (0.536) | −3.625 | (0.559) | |||

| Cut 2 | −2.233 | (0.474) | −2.444 | (0.521) | −2.265 | (0.542) | |||

| Cut 3 | −1.487 | (0.473) | −1.658 | (0.518) | −1.418 | (0.539) | |||

| Cut 4 | −1.117 | (0.472) | −1.259 | (0.516) | −0.992 | (0.538) | |||

| Cut 5 | −0.106 | (0.472) | −0.139 | (0.514) | 0.191 | (0.538) | |||

| Cut 6 | 1.024 | (0.473) | 1.085 | (0.514) | 1.468 | (0.541) | |||

| Number of Obs. | 1532 | 1472 | 1472 | ||||||

| Log likelihood | −2701.33 | −2504.89 | −2443.68 | ||||||

| BIC | 5542.01 | 5214.03 | 5157.26 | ||||||

| AIC | 5440.65 | 5065.78 | 4961.37 | ||||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rihn, A.; Khachatryan, H.; Wei, X. Assessing Purchase Patterns of Price Conscious Consumers. Horticulturae 2018, 4, 13. https://doi.org/10.3390/horticulturae4030013

Rihn A, Khachatryan H, Wei X. Assessing Purchase Patterns of Price Conscious Consumers. Horticulturae. 2018; 4(3):13. https://doi.org/10.3390/horticulturae4030013

Chicago/Turabian StyleRihn, Alicia, Hayk Khachatryan, and Xuan Wei. 2018. "Assessing Purchase Patterns of Price Conscious Consumers" Horticulturae 4, no. 3: 13. https://doi.org/10.3390/horticulturae4030013

APA StyleRihn, A., Khachatryan, H., & Wei, X. (2018). Assessing Purchase Patterns of Price Conscious Consumers. Horticulturae, 4(3), 13. https://doi.org/10.3390/horticulturae4030013