The Importance of Informational Components of Sparkling Wine Labels Varies with Key Consumer Characteristics

Abstract

:1. Introduction

1.1. Wine Labels and Consumer Behaviour

Wine Label Information

1.2. Sparkling Wine

1.3. The Current Study

2. Materials and Methods

2.1. Demographics, Knowledge, and Wine Involvement

2.2. Mock Label Information Manipulation

2.3. Self-Rated Importance of Label Information

2.4. Data Treatment and Analysis

3. Results

3.1. Self-Reported Importance of Label Information

3.2. Mock Labels

3.2.1. Manipulation of Label Information

Willingness to Buy (WTB)

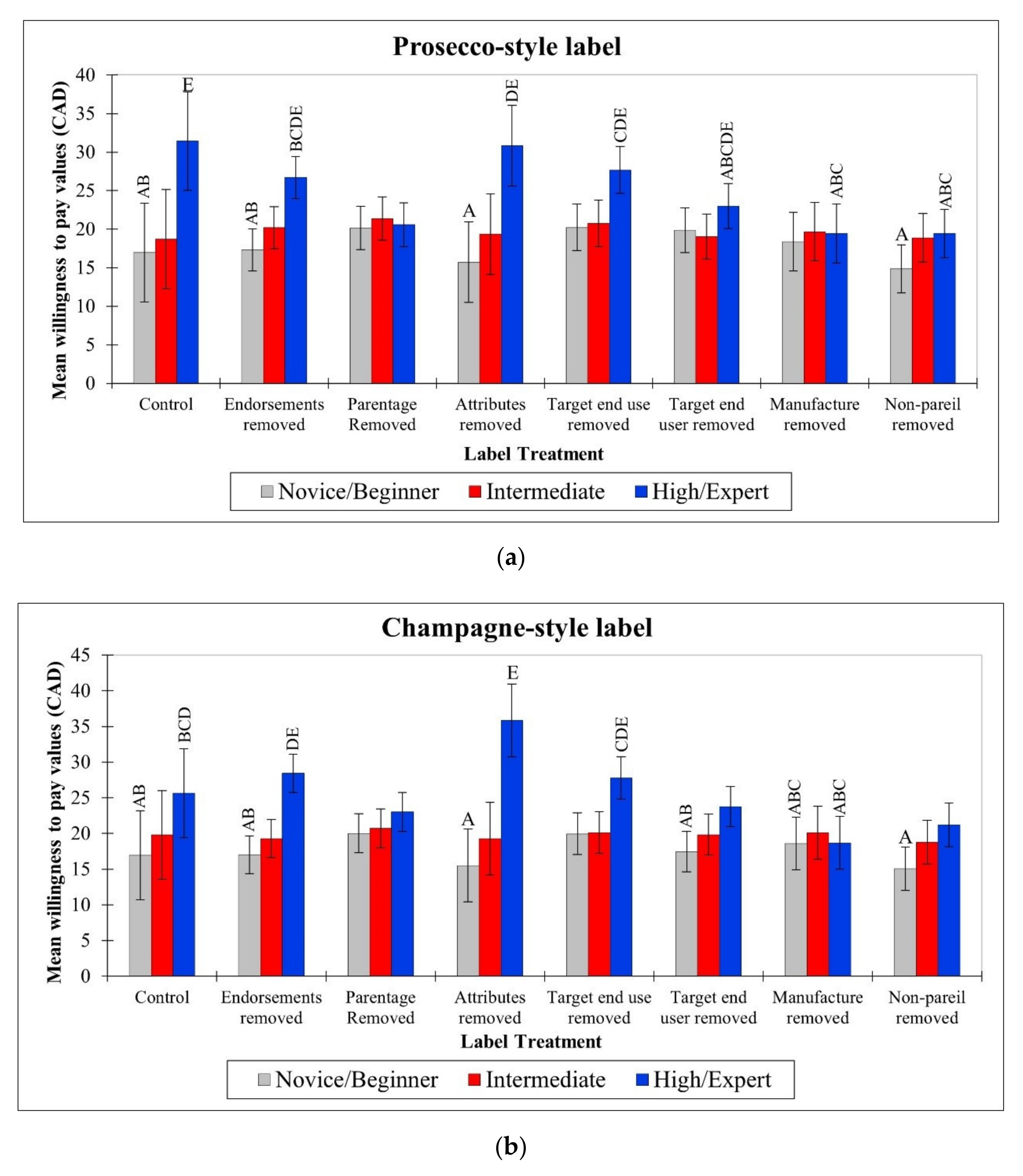

Willingness to Pay (WTP)

Perception of Quality (POQ)

4. Discussion

4.1. Self-Rated Importance of Label Information Elements

4.2. Mock Labels

Influence of Specific Information Types

4.3. Managerial Implications

4.4. Comparison of Methods and Study Limitations

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Measure | Question Wording | Categories |

|---|---|---|

| Yearly alcohol intake | How frequently do you consume alcohol? |

|

| Yearly sparkling wine intake | How frequently do you consume sparkling wine? |

|

| Preferred sparkling wine style | Which of the following sparkling wine styles do you prefer? |

|

| Money typically spent per bottle of sparkling wine | When buying sparkling wine, how much do you typically spend per bottle? (CAD) |

|

Appendix B

| Variables | Information Elements | ||||||

|---|---|---|---|---|---|---|---|

| Wine Region History | Wine-Maker History | Brand Name | Wine Company | How the Wine Is Made | Wine’s Attributes | How to Use the Wine | |

| Gender of consumer | * | * | |||||

| Female | ns | ns | ns | 3.28 a | ns | 3.88 a | ns |

| Male | ns | ns | ns | 3.09 b | ns | 3.68 b | ns |

| Age | ** | ||||||

| 18–25 | ns | ns | ns | ns | ns | ns | 3.42 b |

| 26–35 | ns | ns | ns | ns | ns | ns | 3.29 ab |

| 36–45 | ns | ns | ns | ns | ns | ns | 3.39 b |

| 46–55 | ns | ns | ns | ns | ns | ns | 3.14 ab |

| 56+ | ns | ns | ns | ns | ns | ns | 2.89 a |

| Subjective knowledge | *** | *** | *** | *** | *** | ** | |

| Novice/beginner | 2.88 a | 2.67 a | 2.92 a | 2.94 a | 2.85 a | ns | 2.95 a |

| Intermediate | 3.31 b | 3.06 b | 3.22 b | 3.22 b | 3.26 b | ns | 3.17 a |

| High | 3.76 c | 3.61 c | 3.56 c | 3.70 c | 3.74 c | ns | 3.50 b |

| Objective knowledge | *** | *** | *** | *** | *** | *** | *** |

| Beginner | 2.87 a | 2.66 a | 2.85 a | 2.88 a | 2.72 a | 3.52 a | 2.88 a |

| Intermediate | 3.41 b | 3.21 b | 3.30 b | 3.32 b | 3.37 b | 3.87 b | 3.26 b |

| High | 3.45 b | 3.15 b | 3.47 b | 3.52 b | 3.67 b | 4.13 b | 3.38 b |

| Wine involvement | *** | *** | *** | *** | *** | *** | *** |

| Low | 2.53 a | 2.28 a | 2.62 a | 2.61 a | 2.62 a | 3.29 a | 2.59 a |

| Medium | 3.19 b | 2.98 b | 3.11 b | 3.12 b | 3.11 b | 3.73 b | 3.13 b |

| High | 3.59 c | 3.37 c | 3.51 c | 3.59 c | 3.57 c | 4.12 c | 3.39 c |

| Sparkling wine involvement | *** | *** | *** | *** | *** | *** | *** |

| Low | 2.82 a | 2.58 a | 2.76 a | 2.77 a | 2.74 a | 3.46 a | 2.86 a |

| Medium | 3.26 b | 3.05 b | 3.21 b | 3.22 b | 3.22 b | 3.82 b | 3.12 b |

| High | 3.78 c | 3.58 c | 3.72 c | 3.84 c | 3.81 c | 4.23 c | 3.67 c |

| Yearly sparkling wine intake | *** | *** | *** | *** | *** | ** | ** |

| Once a year | 2.72 a | 2.51 a | 2.66 a | 2.70 a | 2.67 a | 3.40 a | 2.75 a |

| 2–4 times per year | 3.06 ab | 2.88 ab | 3.08 b | 3.03 ab | 3.07 ab | 3.72 ab | 3.05 ab |

| 5–10 times per year | 3.22 bc | 2.99 bc | 3.11 b | 3.22 bc | 3.09 ab | 3.76 abc | 3.10 abc |

| Once a month | 3.42 bc | 3.18 bc | 3.35 bc | 3.44 c | 3.52 bc | 4.10 c | 3.27 bc |

| 2–3 times a month | 3.53 c | 3.26 bc | 3.37 bc | 3.40 bc | 3.39 bc | 3.93 bc | 3.33 bc |

| One or more times per week | 3.73 c | 3.52 c | 3.71 c | 3.71 c | 3.60 c | 3.90 abc | 3.58 c |

| Variables | Information Elements | ||||||

| What Occasion the Wine Is for | Who the Wine would Appeal to | Expert Endorsements | Unique or Unrivalled | Alcohol Content | Grape Variety/ Blend | Vintage/ Year | |

| Age | * | *** | ** | ** | ** | ||

| 18–25 | 3.55 a | 3.58 b | 3.36 b | 3.10 b | 3.61 b | ns | ns |

| 26–35 | 3.25 a | 3.12 ab | 3.11 b | 2.87 b | 3.33 ab | ns | ns |

| 36–45 | 3.39 a | 3.30 b | 2.94 ab | 2.94 b | 3.49 ab | ns | ns |

| 46–55 | 2.98 a | 2.80 a | 2.78 ab | 2.71 ab | 3.21 a | ns | ns |

| 56+ | 3.11 a | 2.84 a | 2.70 a | 2.44 a | 3.08 a | ns | ns |

| Income (CAD) | ** | ||||||

| Under 25 k | ns | ns | ns | ns | 3.68 b | ns | ns |

| 25–45 k | ns | ns | ns | ns | 3.36 ab | ns | ns |

| 46–65 k | ns | ns | ns | ns | 3.42 ab | ns | ns |

| 66–85 k | ns | ns | ns | ns | 3.31 ab | ns | ns |

| 86–100 k | ns | ns | ns | ns | 3.29 ab | ns | ns |

| 101–140 k | ns | ns | ns | ns | 3.04 a | ns | ns |

| 141–200 k | ns | ns | ns | ns | 3.00 a | ns | ns |

| 200 k+ | ns | ns | ns | ns | 3.03 a | ns | ns |

| Subjective knowledge | * | * | *** | *** | * | *** | *** |

| Novice/beginner | 3.03 a | 2.88 a | 2.64 a | 2.43 a | 3.08 a | 3.11 a | 2.88 a |

| Intermediate | 3.23 ab | 3.00 a | 2.90 b | 2.73 b | 3.27 ab | 3.51 b | 3.21 b |

| High | 3.45 b | 3.36 b | 3.35 c | 3.28 c | 3.52 b | 3.88 c | 3.73 c |

| Objective knowledge | * | * | *** | *** | *** | *** | *** |

| Beginner | 2.98 a | 2.82 a | 2.61 a | 2.43 a | 2.97 a | 3.01 a | 2.77 a |

| Intermediate | 3.30 b | 3.14 b | 3.03 b | 2.90 b | 3.41 b | 3.62 b | 3.36 b |

| High | 3.33 b | 3.04 ab | 2.99 b | 2.72 ab | 3.33 b | 3.77 b | 3.48 b |

| Wine involvement | *** | *** | *** | *** | *** | *** | *** |

| Low | 2.71 a | 2.54 a | 2.30 a | 2.24 a | 2.90 a | 2.68 a | 2.36 a |

| Medium | 3.17 b | 3.01 b | 2.83 b | 2.60 b | 3.18 a | 3.35 b | 3.16 b |

| High | 3.45 c | 3.23 b | 3.22 c | 3.12 c | 3.51 b | 3.89 c | 3.55 c |

| Sparkling wine involvement | *** | *** | *** | *** | *** | *** | *** |

| Low | 2.90 a | 2.68 a | 2.44 a | 2.25 a | 2.83 a | 2.94 a | 2.73 a |

| Medium | 3.23 b | 3.05 b | 2.94 b | 2.72 b | 3.29 b | 3.48 b | 3.24 b |

| High | 3.58 c | 3.47 c | 3.42 c | 3.43 c | 3.81 c | 4.08 c | 3.72 c |

| Yearly sparkling wine intake | ** | *** | *** | *** | *** | *** | |

| Once a year | ns | 2.66 a | 2.35 a | 2.19 a | 2.81 a | 2.84 a | 2.51 a |

| 2–4 times per year | ns | 2.90 a | 2.73 ab | 2.55 ab | 3.13 ab | 3.38 b | 3.16 b |

| 5–10 times per year | ns | 3.06 ab | 2.99 bc | 2.68 b | 3.21 abc | 3.40 b | 3.23 b |

| Once a month | ns | 3.14 ab | 3.02 bc | 2.92 bc | 3.29 bc | 3.70 b | 3.32 b |

| 2–3 times a month | ns | 3.14 ab | 3.08 bc | 2.93 bc | 3.55 cd | 3.65 b | 3.40 b |

| One or more times per week | ns | 3.48 b | 3.46 c | 3.42 c | 3.81 d | 3.77 b | 3.65 b |

| Preferred style | ** | * | |||||

| Fruity, sweeter, sparkling wine | ns | ns | ns | ns | 3.36 b | ns | 3.13 a |

| Creamy, bready, drier, sparkling wine | ns | ns | ns | ns | 3.09 a | ns | 3.32 b |

Appendix C

| Variables | Means and Statistical Significance | |||||

|---|---|---|---|---|---|---|

| WTB | WTP | POQ | ||||

| Prosecco Style Label | Champagne Style Label | Prosecco Style Label | Champagne Style Label | Prosecco Style Label | Champagne Style Label | |

| Age | ** | * | *** | *** | ||

| 18–25 | 5.13 a | 4.97 a | 29.61 a | 28.26 a | ns | ns |

| 26–35 | 4.96 abc | 4.87 ab | 19.80 bc | 19.89 bc | ns | ns |

| 36–45 | 5.08 ab | 4.95 a | 21.07 b | 21.09 b | ns | ns |

| 46–55 | 4.66 bc | 4.54 ab | 20.89 b | 20.51 b | ns | ns |

| 56+ | 4.53 c | 4.49 b | 18.08 c | 18.23 c | ns | ns |

| Gender of consumer | ** | *** | *** | |||

| Female | 4.95 a | ns | ns | ns | 3.98 a | 3.99 a |

| Male | 4.59 b | ns | ns | ns | 3.75 b | 3.79 b |

| Income (CAD) | ** | * | ||||

| Under 45 k | ns | ns | 17.55 a | 18.20 a | ns | ns |

| 46–65 k | ns | ns | 18.40 ab | 18.32 a | ns | ns |

| 66–85 k | ns | ns | 20.89 bc | 19.78 ab | ns | ns |

| 86–100 k | ns | ns | 18.93 ab | 19.42 a | ns | ns |

| 101–140 k | ns | ns | 20.22 bc | 19.96 ab | ns | ns |

| 140 k+ | ns | ns | 21.74 c | 22.00 b | ns | ns |

| Subjective knowledge | *** | *** | *** | *** | * | ** |

| Novice/beginner | 4.44 a | 4.29 a | 17.78 a | 17.51 a | 3.86 a | 3.86 a |

| Intermediate | 4.90 b | 4.79 b | 20.08 b | 19.87 b | 3.82 ab | 3.85 a |

| High | 5.21 b | 5.31 c | 26.32 c | 27.22 c | 4.04 b | 4.09 b |

| Objective knowledge | *** | *** | *** | *** | * | * |

| Beginner | 4.43 a | 4.39 a | 17.81 a | 17.51 a | 3.80 a | 3.81 a |

| Intermediate | 4.98 b | 4.79 b | 21.18 b | 20.87 b | 3.87 ab | 3.89 a |

| High | 4.94 b | 5.06 b | 22.61 b | 23.78 c | 4.02 b | 4.07 b |

| Wine involvement | *** | *** | *** | *** | *** | *** |

| Low | 4.30 a | 4.25 a | 17.01 a | 17.14 a | 3.74 a | 3.75 a |

| Medium | 4.84 b | 4.72 b | 20.62 b | 20.07 b | 3.86 a | 3.86 a |

| High | 5.36 c | 5.32 c | 24.18 c | 25.18 c | 4.12 b | 4.21 b |

| Sparkling wine involvement | *** | *** | *** | *** | *** | *** |

| Low | 4.06 a | 4.11 a | 16.74 a | 16.88 a | 3.70 a | 3.74 a |

| Medium | 4.89 b | 4.75 b | 20.50 b | 20.18 b | 3.85 b | 3.86 a |

| High | 5.67 c | 5.50 c | 25.28 c | 25.54 c | 4.22 c | 4.26 b |

| Yearly sparkling wine intake | *** | *** | *** | *** | * | |

| Once a year | 3.74 a | 3.85 a | 15.71 a | 15.92 a | 3.72 a | |

| 2–4 times per year | 4.69 b | 4.55 b | 19.36 b | 19.43 b | 3.80 ab | |

| 5–10 times per year | 4.88 bc | 4.62 b | 19.83 b | 19.77 b | 3.90 abc | |

| Once a month | 5.02 bc | 4.99 c | 21.01 b | 20.77 b | 3.90 abc | |

| 2–3 times a month | 5.13 c | 5.06 c | 21.41 b | 21.05 b | 3.94 bc | |

| One or more times per week | 5.73 d | 5.48 c | 28.17 c | 27.92 c | 4.13 c | ns |

| Amount spent per bottle of sparkling wine (CAD) | ** | ** | *** | *** | ||

| 8–14.99 | 4.24 a | 4.28 a | 13.08 a | 13.29 a | ns | ns |

| 15–19.99 | 4.70 ab | 4.51 ab | 16.91 b | 16.59 b | ns | ns |

| 20–24.99 | 4.99 b | 4.81 abc | 21.21 c | 21.42 c | ns | ns |

| 25–29.99 | 5.00 b | 5.00 abc | 23.74 d | 24.25 d | ns | ns |

| 30–39.99 | 4.97 b | 5.25 c | 33.82 e | 32.89 e | ns | ns |

| 40–49.99 | 5.20 b | 5.20 bc | 37.90 e | 35.80 e | ns | ns |

| 50+ | 4.71 ab | 4.88 abc | 33.06 e | 32.71 e | ns | ns |

| Preferred style | ** | * | *** | |||

| Fruity, sweeter, sparkling wine | 4.97 a | ns | 19.79 a | 19.53 a | ns | ns |

| Creamy, bready, drier, sparkling wine | 4.60 b | ns | 21.45 b | 21.75 b | ns | ns |

References

- Olson, J.C. Cue Utilization in the Quality Perception Process: A Cognitive Model and an Empirical Test. Ph.D. Thesis, Purdue University, West Lafayette, IN, USA, 1972. [Google Scholar]

- Cox, D. Predicting consumption, wine involvement and perceived quality of Australian red wine. J. Wine Res. 2009, 20, 209–229. [Google Scholar] [CrossRef]

- Dodd, T.H.; Laverie, D.A.; Wilcox, J.F.; Duhan, D.F. Differential effects of experience, subjective knowledge, and objective knowledge on sources of information used in consumer wine purchasing. J. Hosp. Tour. Res. 2005, 29, 3–19. [Google Scholar] [CrossRef]

- Frøst, M.B.; Noble, A.C. Preliminary study of the effect of knowledge and sensory expertise on liking for red wines. Am. J. Enol. Vitic. 2002, 53, 275–284. [Google Scholar]

- Mueller, S.; Francis, L.; Lockshin, L. The Relationship between Wine Liking, Subjective and Objective Wine Knowledge: Does It Matter Who Is Your ‘Consumer’ Sample? Ph.D. Thesis, AWBR Academy of Wine Business Research, Dijon, France, 2008. [Google Scholar]

- Elliot, S.; Barth, J.E. Wine label design and personality preferences of millennials. J. Prod. Brand. Manag. 2012, 21, 183–191. [Google Scholar] [CrossRef]

- Lerro, M.; Vecchio, R.; Nazzaro, C.; Pomarici, E. The growing (good) bubbles: Insights into US consumers of sparkling wine. Br. Food J. 2020, 122, 2371–2384. [Google Scholar] [CrossRef]

- Thomas, A.; Pickering, G. The importance of wine label information. Int. J. Wine Mark. 2003, 15, 58–74. [Google Scholar] [CrossRef]

- Charters, S.; Lockshin, L.; Unwin, T. Consumer responses to wine bottle back labels. J. Wine Res. 1999, 10, 183–195. [Google Scholar] [CrossRef]

- Barber, N.; Almanza, B.A. Influence of wine packaging on consumers’ decision to purchase. J. Foodserv. Bus. Res. 2007, 9, 83–98. [Google Scholar] [CrossRef]

- Kelley, K.; Hyde, J.; Bruwer, J. US wine consumer preferences for bottle characteristics, back label extrinsic cues and wine composition: A conjoint analysis. Asia Pac. J. Mark. Logis. 2015, 27, 516–534. [Google Scholar] [CrossRef]

- Boudreaux, C.A.; Palmer, S.E. A charming little Cabernet: Effects of wine label design on purchase intent and brand personality. Int. J. Wine Bus. Res. 2007, 19, 170–186. [Google Scholar] [CrossRef]

- Sherman, S.; Tuten, T. Message on a bottle: The wine label’s influence. Int. J. Wine Bus. Res. 2011, 23, 221–234. [Google Scholar] [CrossRef]

- Barber, N.; Ismail, J.; Taylor, D.C. Label fluency and consumer self-confidence. J. Wine Res. 2007, 18, 73–85. [Google Scholar] [CrossRef]

- Sáenz-Navajas, M.-P.; Campo, E.; Sutan, A.; Ballester, J.; Valentin, D. Perception of wine quality according to extrinsic cues: The case of Burgundy wine consumers. Food Qual. Prefer. 2013, 27, 44–53. [Google Scholar] [CrossRef]

- Mueller, S.; Lockshin, L.; Saltman, Y.; Blanford, J. Message on a bottle: The relative influence of wine back label information on wine choice. Food Qual. Prefer. 2010, 21, 22–32. [Google Scholar] [CrossRef]

- Shaw, M.; Keeghan, P.; Hall, J. Consumers judge wine by its label, study shows. Aust. N.Z. Wine Ind. J. 1999, 14, 84–87. [Google Scholar]

- Allied Market Research (AMR). Global Sparkling Wines Market, Opportunities and Forecast, 2021–2027. Available online: https://www.alliedmarketresearch.com/sparkling-wines-market-A08370 (accessed on 28 March 2022).

- Morton, A.L.; Rivers, C.; Healy, M. Beyond the bubbles: Identifying other purchase decision variables beyond country of origin effect that make Australians buy Champagne. In Proceedings of the ANZIBA Conference 2004: Dynamism and Challenges in Internationalisation, Canberra, Australia, 5–6 November 2004; pp. 1–20. [Google Scholar]

- Cerjak, M.; Tomić, M.; Fočić, N.; Brkić, R. The importance of intrinsic and extrinsic sparkling wine characteristics and behavior of sparkling wine consumers in Croatia. J. Int. Food Agribus. 2016, 28, 191–201. [Google Scholar] [CrossRef]

- Verdonk, N.; Wilkinson, J.; Culbert, J.; Ristic, R.; Pearce, K.; Wilkinson, K. Toward a model of sparkling wine purchasing preferences. Int. J. Wine Bus. Res. 2017, 29, 58–73. [Google Scholar] [CrossRef]

- Charters, S.; Velikova, N.; Ritchie, C.; Fountain, J.; Thach, L.; Dodd, T.H.; Fish, N.; Herbst, F.; Terblanche, N. Generation Y and sparkling wines: A cross-cultural perspective. Int. J. Wine Bus. Res. 2011, 23, 161–175. [Google Scholar] [CrossRef]

- Vecchio, R.; Lisanti, M.T.; Caracciolo, F.; Cembalo, L.; Gambuti, A.; Moio, L.; Siani, T.; Marotta, G.; Nazzaro, C.; Piombino, P. The role of production process and information on quality expectations and perceptions of sparkling wines. J. Sci. Food Agric. 2019, 99, 124–135. [Google Scholar] [CrossRef] [Green Version]

- Vintners Quality Alliance Ontario 2015 Annual Report. Available online: https://www.vqaontario.ca/Library/AnnualReports/vqa_annual_report_15.pdf (accessed on 1 August 2019).

- Vintners Quality Alliance (VQA). Our Mandate. Available online: https://www.vqaontario.ca/AboutVQA (accessed on 30 August 2020).

- Pickering, G.; Kemp, B. Focus the Fizz: Using Consumer Insights to Inform Branding, Labelling and Development of Ontario Sparkling Wine; Ontario Grape and Wine Research Inc.: St. Catharines, ON, Canada; p. 43. Available online: https://ontariograpeandwineresearch.com/file/download/hGCtL5whAd4irTcVwaHUvQ2020 (accessed on 25 April 2022).

- Qualtrics Version May 2020. Copyright © 2020 Qualtrics. Qualtrics and All Other Qualtrics Product or Service Names Are Registered Trademarks or Trademarks of Qualtrics, Provo, UT, USA. Available online: https://www.qualtrics.com (accessed on 25 April 2022).

- Quester, P.G.; Smart, J. The influence of consumption situation and product involvement over consumers’ use of product attribute. J. Consum. Mark. 1998, 3, 220–238. [Google Scholar] [CrossRef]

- Culbert, J.; Verdonk, N.; Ristic, R.; Olarte Mantilla, S.; Lane, M.; Pearce, K.; Cozzolino, D.; Wilkinson, K. Understanding consumer preferences for Australian sparkling wine vs. French Champagne. Beverages 2016, 2, 19. [Google Scholar] [CrossRef]

- VQA Ontario. Quick Reference Labelling Guide. Available online: https://www.vqaontario.ca/Library/Documents/VQAQuickReferenceLabellingGuide.pdf (accessed on 30 August 2020).

| Information Types | Informational Statements |

|---|---|

| Endorsements | Expert endorsements (e.g., awards, expert opinions) |

| Parentage | Wine region history |

| Winemaker history | |

| Brand name | |

| Wine company | |

| Attributes | Wine attributes (e.g., taste and flavour descriptors) |

| Target end use | How to use the wine (e.g., food pairings) |

| What occasion the wine is for | |

| Target end user | Who the wine would appeal to |

| Manufacture | How the wine is made (production process) |

| Nonpareil | A statement that the wine is unrivalled or unique |

| Additional information | Alcohol content |

| Grape variety/blend | |

| Vintage/year |

| Frequency | Proportion (%) | ||

|---|---|---|---|

| Gender | Male | 282 | 49 |

| Female | 294 | 51 | |

| Age | 18–25 | 31 | 5.4 |

| 26–35 | 106 | 18.4 | |

| 36–45 | 107 | 18.6 | |

| 46–55 | 116 | 20.1 | |

| 56+ | 216 | 37.5 | |

| Income (CAD) | Under 25 k | 34 | 5.9 |

| 25–45 k | 55 | 9.6 | |

| 46–65 k | 78 | 13.6 | |

| 66–85 k | 96 | 16.8 | |

| 86–100 k | 94 | 16.4 | |

| 101–140 k | 121 | 21.1 | |

| 141–200 k | 69 | 12 | |

| 200 k+ | 26 | 4.5 | |

| Subjective knowledge | Novice/beginner | 214 | 37.2 |

| Intermediate | 275 | 47.7 | |

| High | 76 | 13.2 | |

| Expert/very high | 11 | 1.9 | |

| Objective knowledge | Beginner | 209 | 36.3 |

| Intermediate | 281 | 48.8 | |

| High | 86 | 14.9 | |

| Wine involvement | Low | 76 | 13.2 |

| Medium | 334 | 58 | |

| High | 166 | 28.8 | |

| Sparkling wine involvement | Low | 174 | 30.2 |

| Medium | 303 | 52.6 | |

| High | 99 | 17.2 | |

| Yearly alcohol intake | Less than once a month | 30 | 5.2 |

| Once a month | 26 | 4.5 | |

| 2–4 times per month | 148 | 25.7 | |

| 2–4 times per week | 258 | 44.8 | |

| More than 4 times per week | 114 | 19.8 | |

| Yearly sparkling wine intake | Once a year | 97 | 16.8 |

| 2–4 times per year | 152 | 26.4 | |

| 5–10 times per year | 88 | 15.3 | |

| Once a month | 96 | 16.7 | |

| 2–3 times a month | 95 | 16.5 | |

| One or more times per week | 48 | 8.3 | |

| Preferred sparkling wine style | Fruity, sweeter, sparkling wine (e.g., Prosecco) | 351 | 60.9 |

| Creamy, bready, drier, sparkling wine (e.g., Champagne) | |||

| Unsure | 205 | 35.6 | |

| 20 | 3.5 | ||

| Money typically spent per bottle of sparkling wine (CAD) | 8–14.99 | 76 | 13.2 |

| 15–19.99 | 221 | 38.4 | |

| 20–24.99 | 149 | 25.9 | |

| 25–29.99 | 66 | 11.5 | |

| 30–39.99 | 37 | 6.4 | |

| 40–49.99 | 10 | 1.7 | |

| 50+ | 17 | 3 |

| Information Statement | Mean | SE | Information Type | Groups | |||||

|---|---|---|---|---|---|---|---|---|---|

| Wine’s attributes | 3.81 | 0.042 | Attributes | A | |||||

| Grape variety/blend | 3.46 | 0.044 | - | B | C | ||||

| Wine region history | 3.26 | 0.046 | Parentage | B | C | ||||

| Alcohol content | 3.26 | 0.044 | - | C | D | ||||

| Wine company | 3.22 | 0.044 | Parentage | C | D | ||||

| Occasion wine is for | 3.21 | 0.050 | Target end use | C | D | ||||

| How wine is made | 3.21 | 0.046 | Manufacture | C | D | ||||

| Vintage/year | 3.20 | 0.047 | - | C | D | ||||

| Brand name | 3.19 | 0.042 | Parentage | C | D | ||||

| How to use the wine | 3.15 | 0.046 | Target end user | C | D | ||||

| Who wine appeals to | 3.03 | 0.050 | Target end use | D | E | ||||

| Winemaker history | 3.02 | 0.045 | Parentage | D | E | ||||

| Expert endorsements | 2.90 | 0.047 | Endorsements | E | F | ||||

| Unique or unrivalled | 2.74 | 0.049 | Nonpareil | F | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pickering, G.J.; Duben, M.; Kemp, B. The Importance of Informational Components of Sparkling Wine Labels Varies with Key Consumer Characteristics. Beverages 2022, 8, 27. https://doi.org/10.3390/beverages8020027

Pickering GJ, Duben M, Kemp B. The Importance of Informational Components of Sparkling Wine Labels Varies with Key Consumer Characteristics. Beverages. 2022; 8(2):27. https://doi.org/10.3390/beverages8020027

Chicago/Turabian StylePickering, Gary J., Marcus Duben, and Belinda Kemp. 2022. "The Importance of Informational Components of Sparkling Wine Labels Varies with Key Consumer Characteristics" Beverages 8, no. 2: 27. https://doi.org/10.3390/beverages8020027

APA StylePickering, G. J., Duben, M., & Kemp, B. (2022). The Importance of Informational Components of Sparkling Wine Labels Varies with Key Consumer Characteristics. Beverages, 8(2), 27. https://doi.org/10.3390/beverages8020027