A Data-Driven Framework for Agri-Food Supply Chains: A Case Study on Inventory Optimization in Colombian Potatoes Management

Abstract

1. Introduction

2. Related Literature

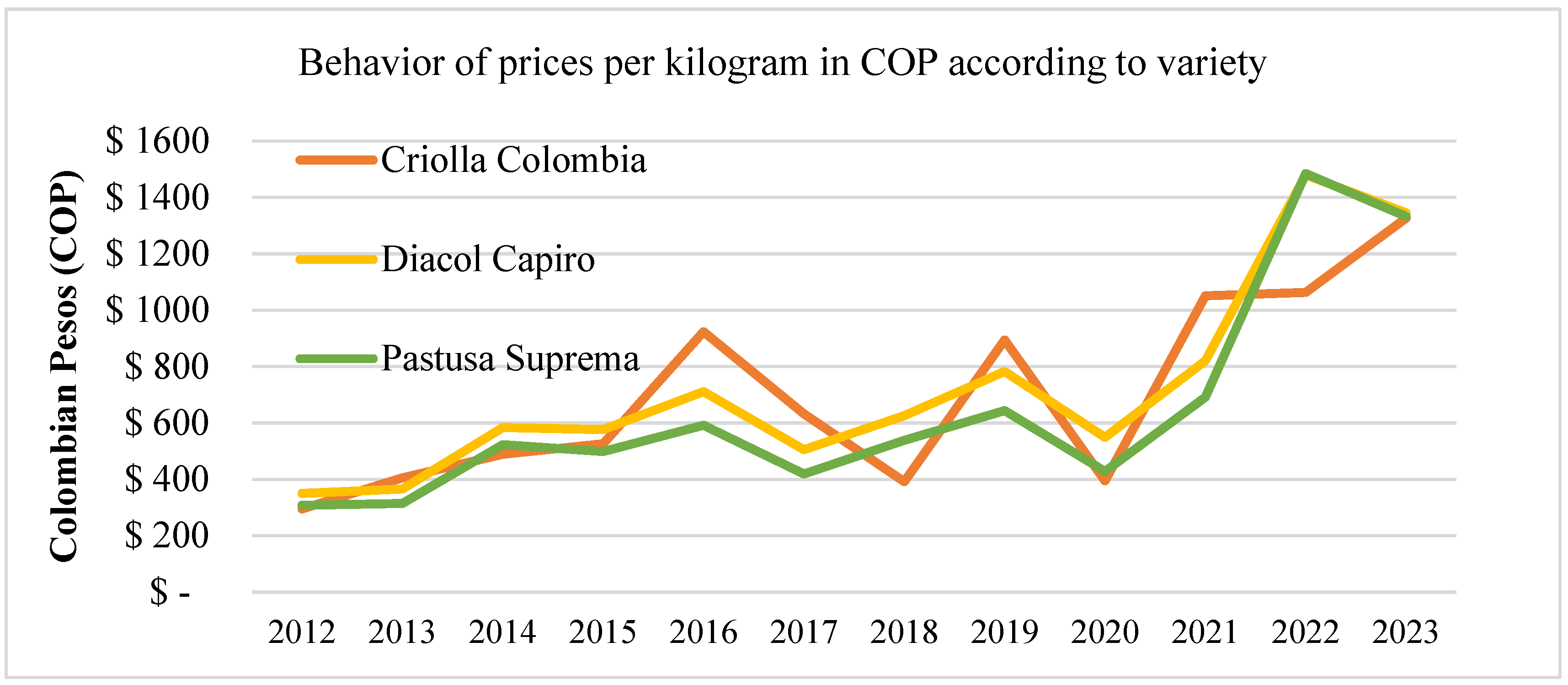

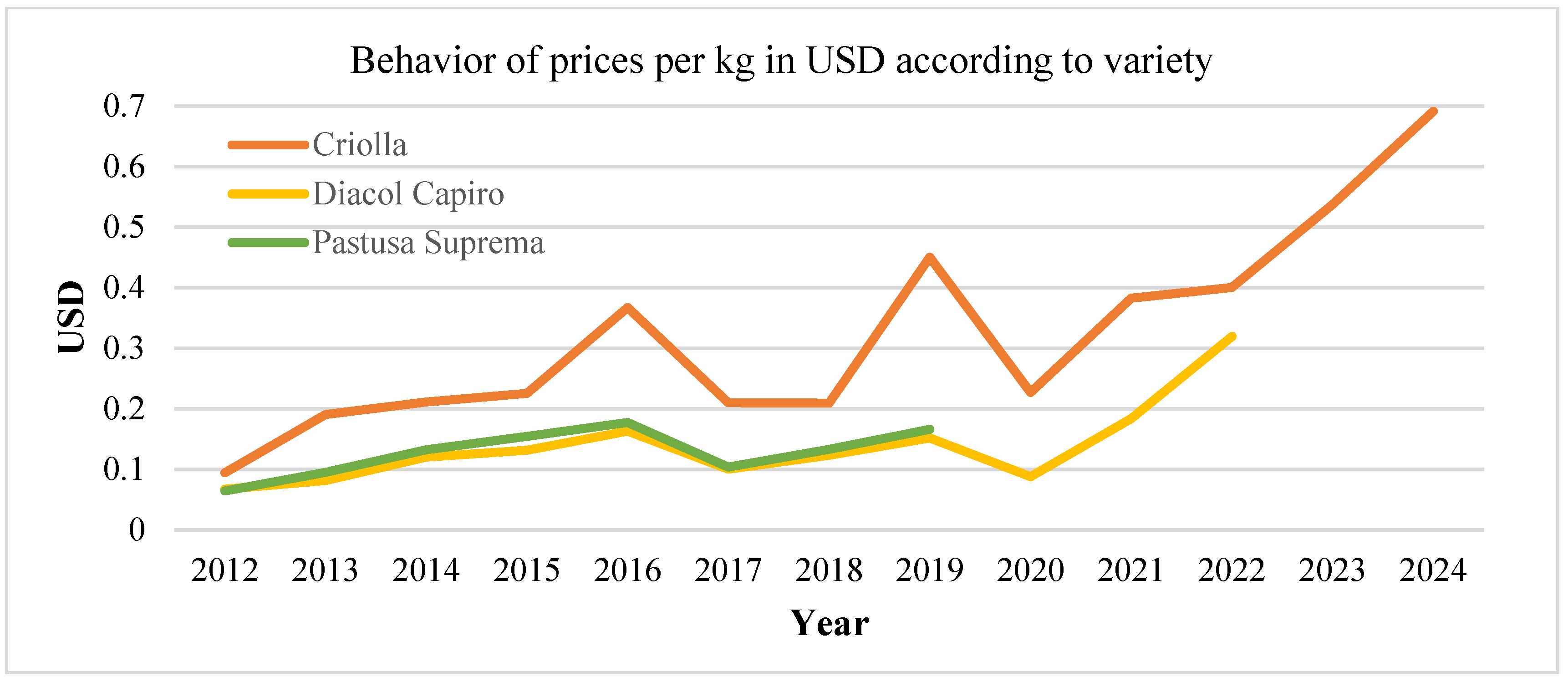

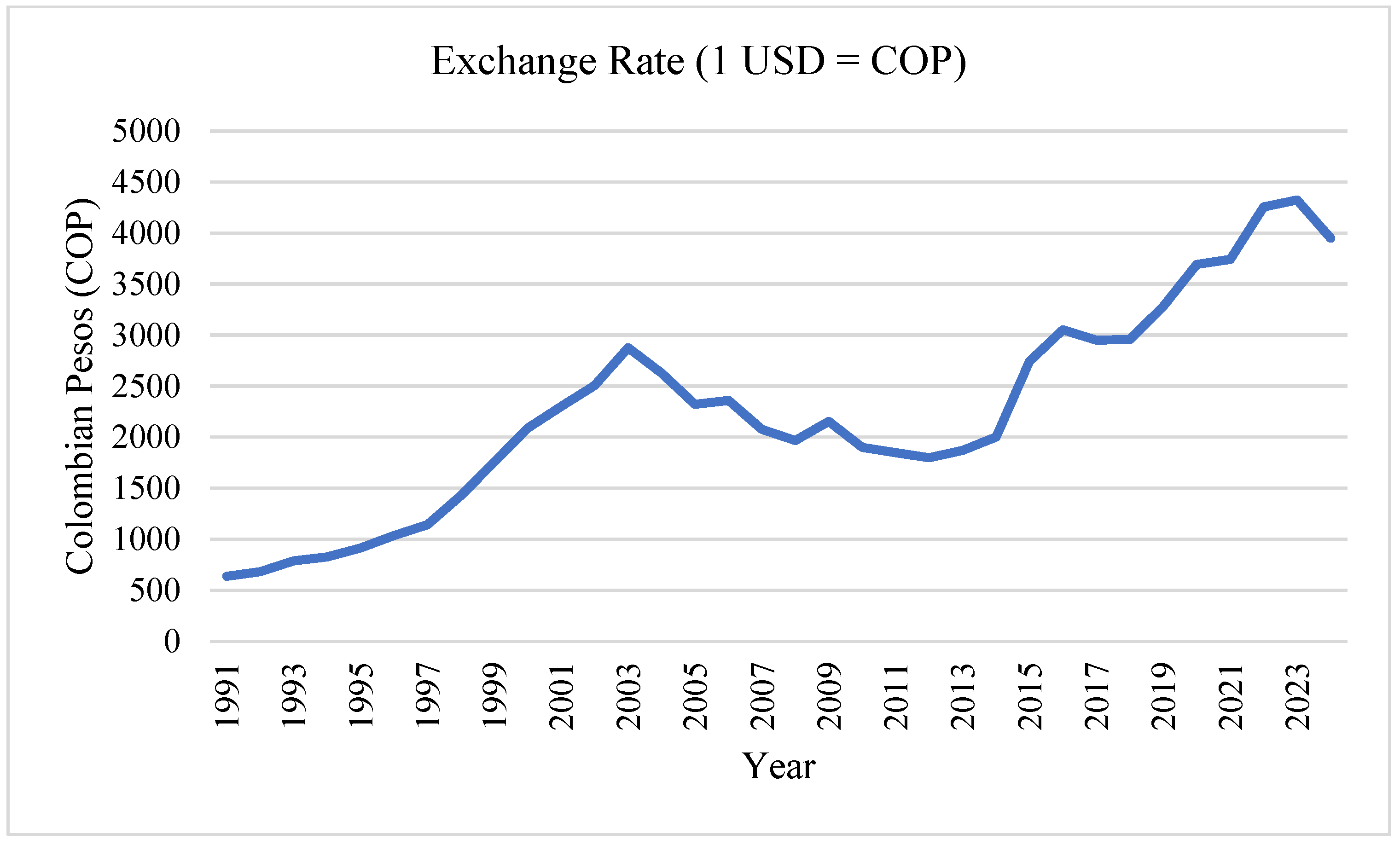

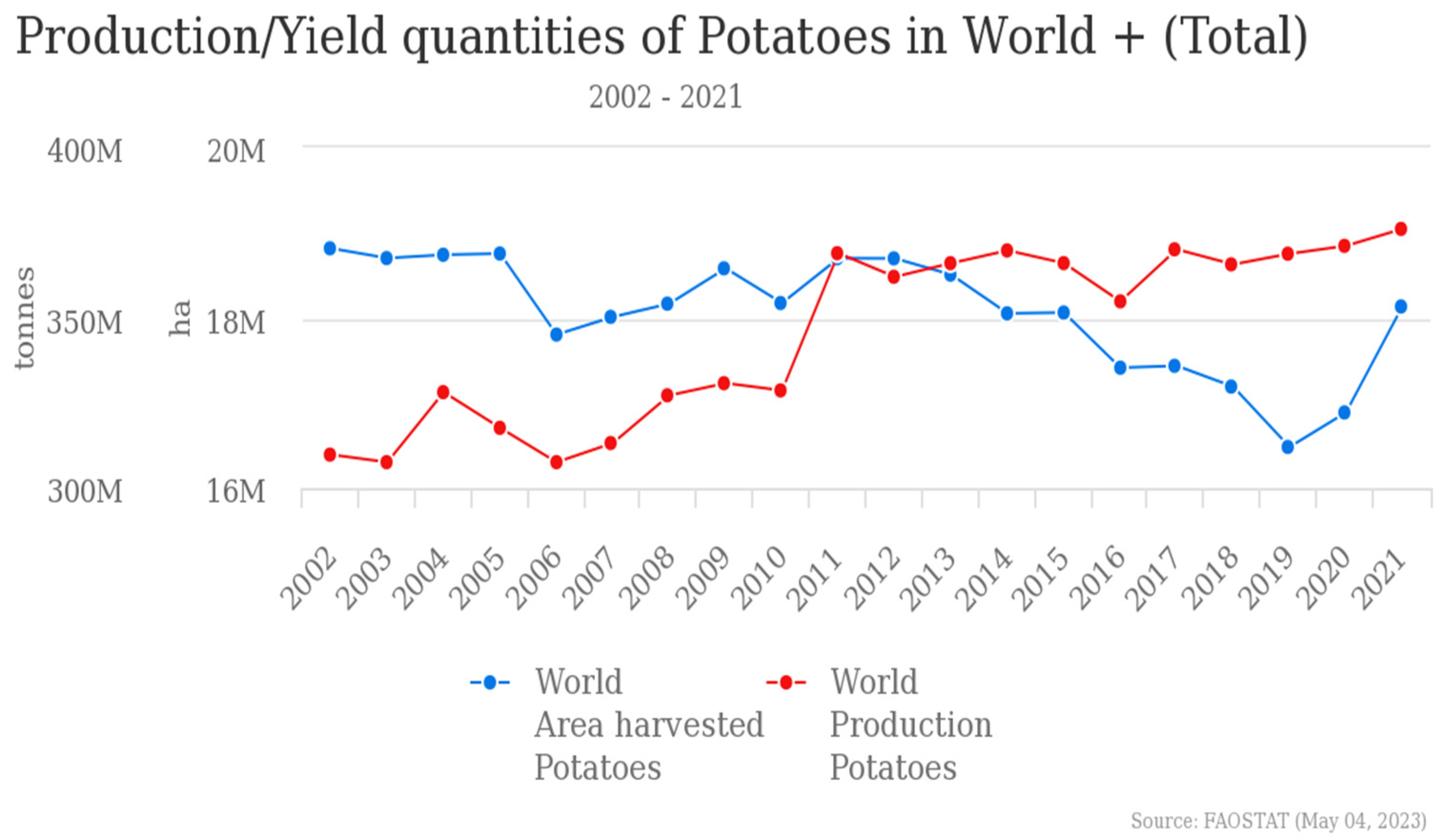

3. Case Study: The Potato Supply Chain

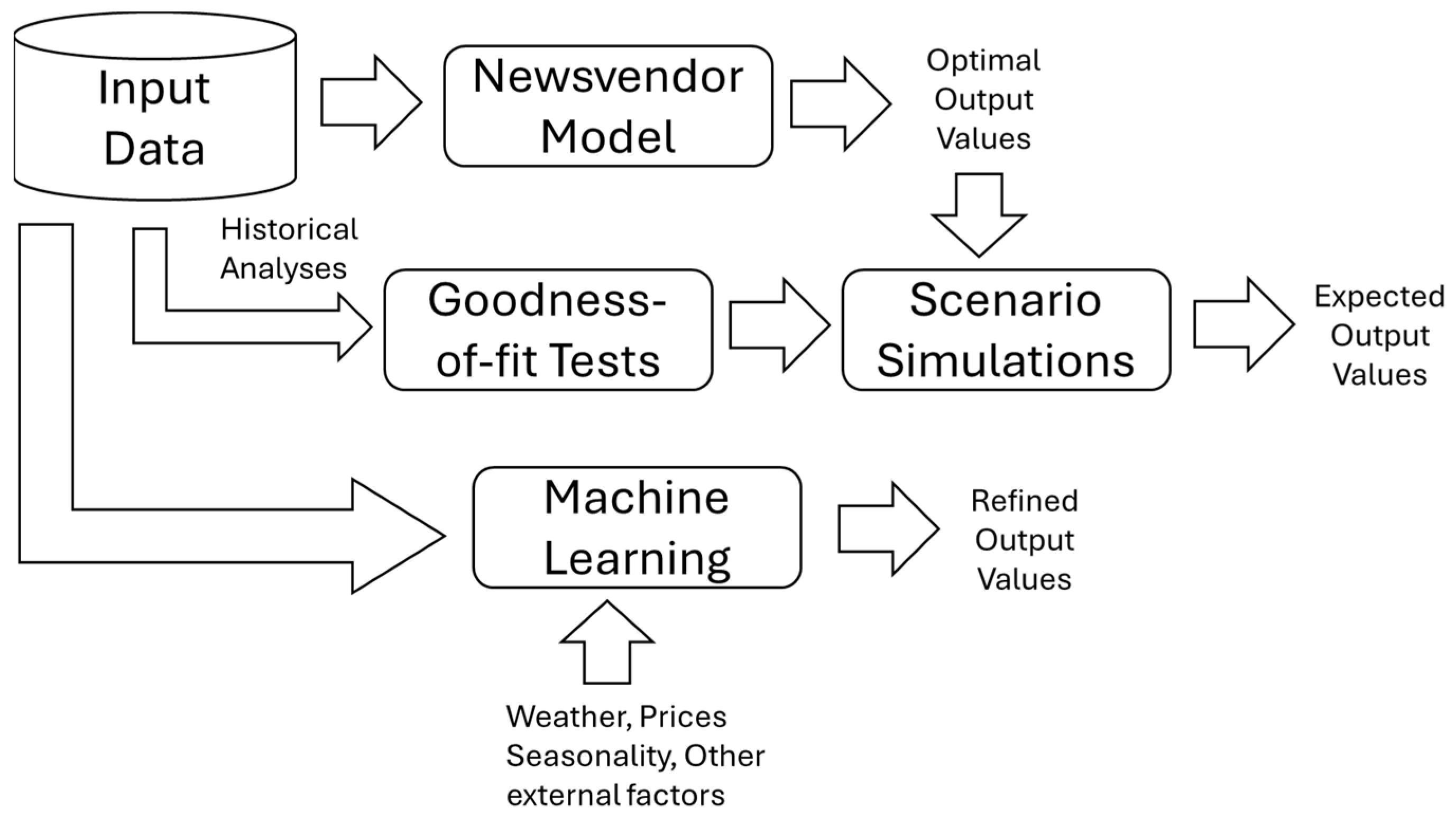

4. Materials and Methods

5. Results

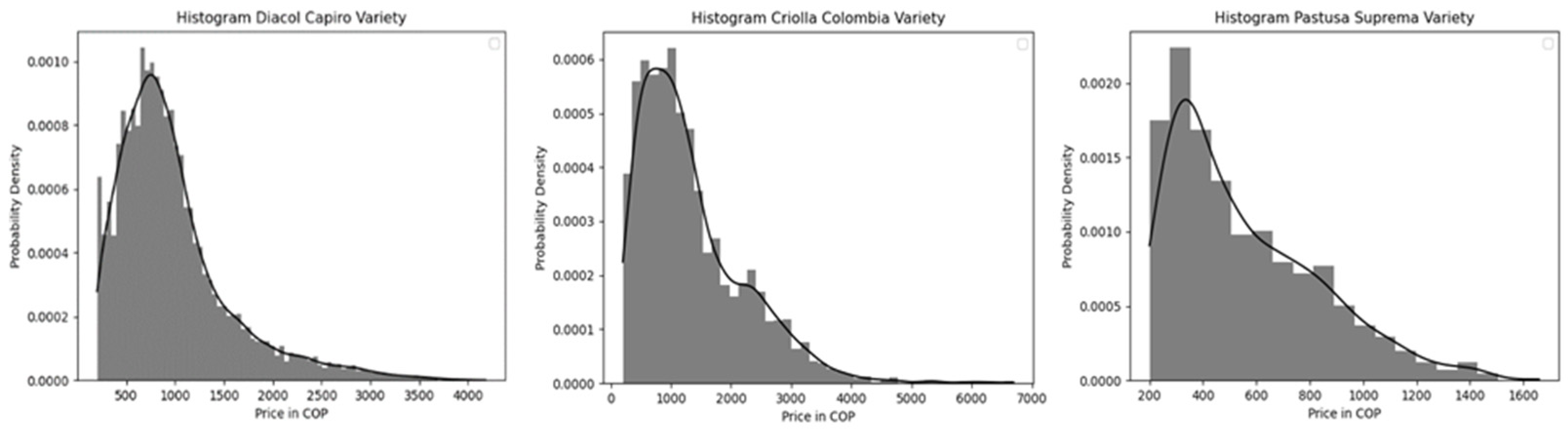

5.1. Data Fit

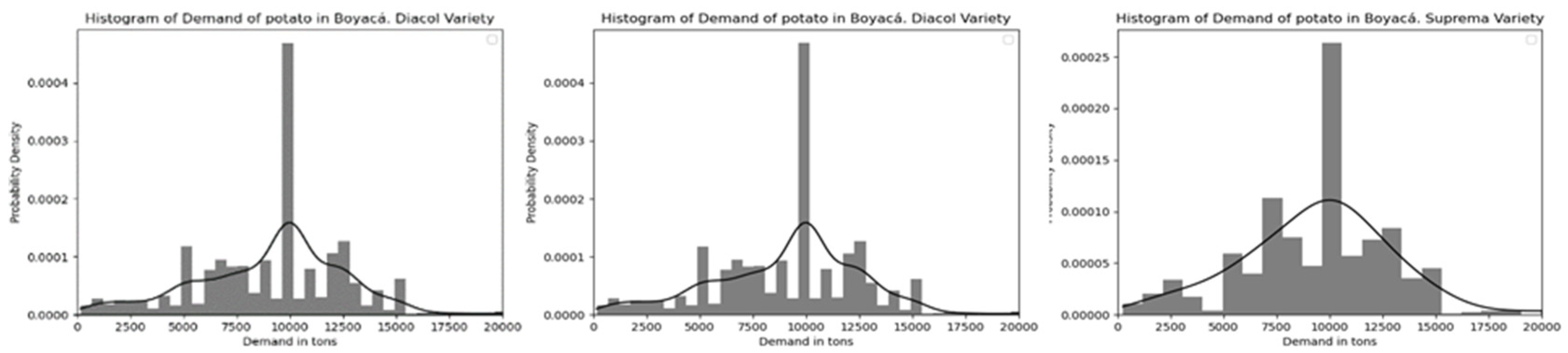

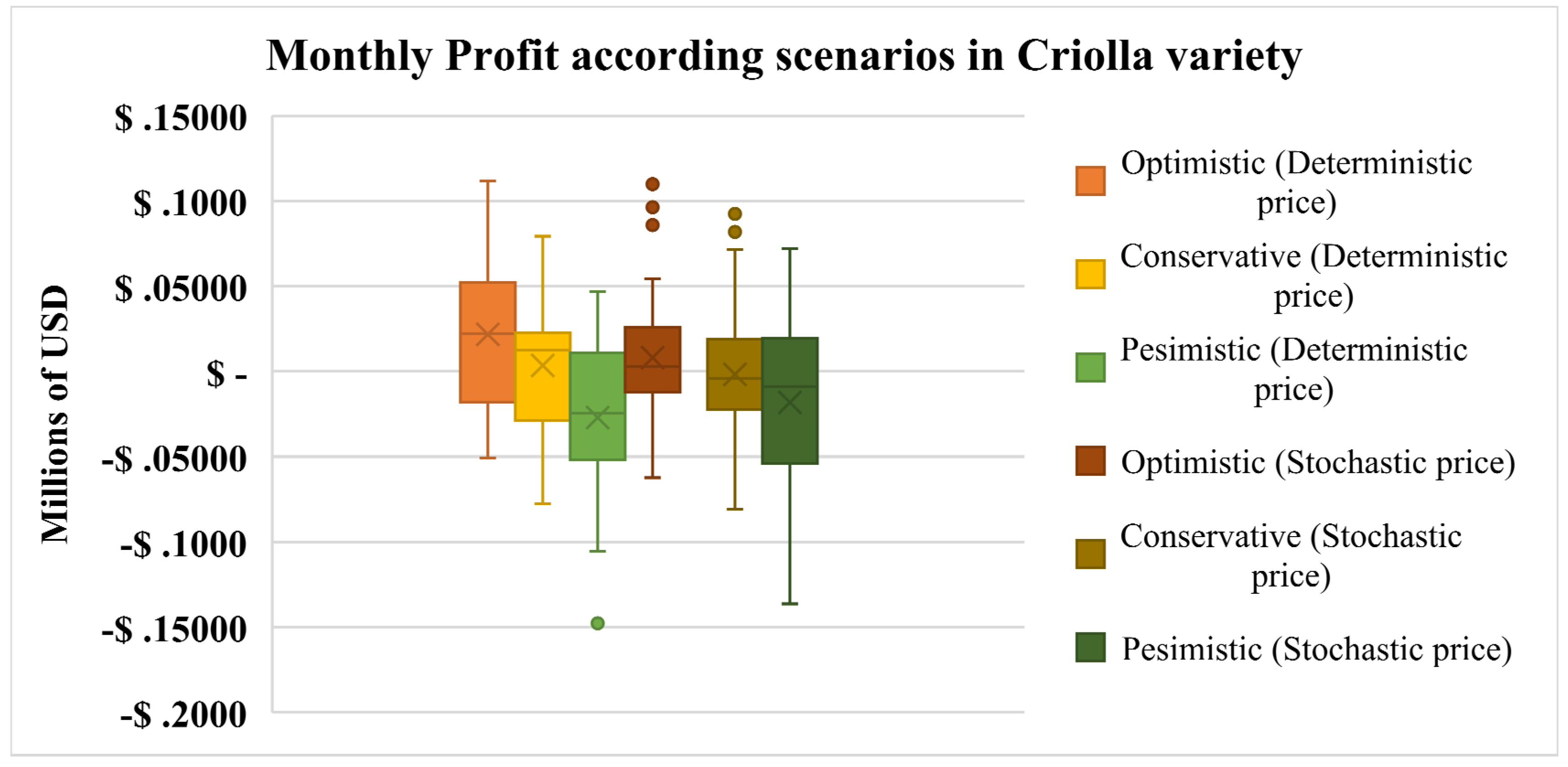

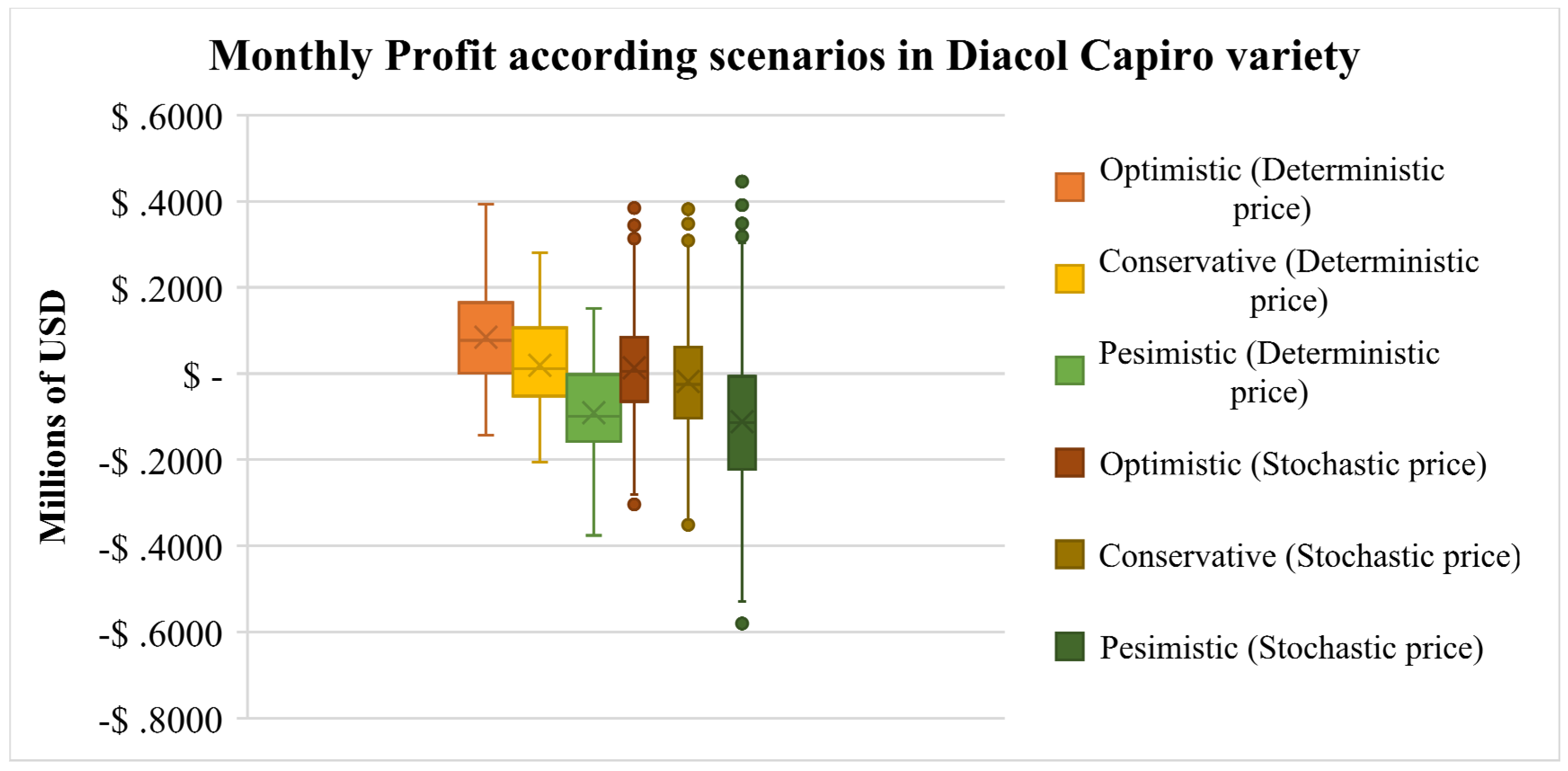

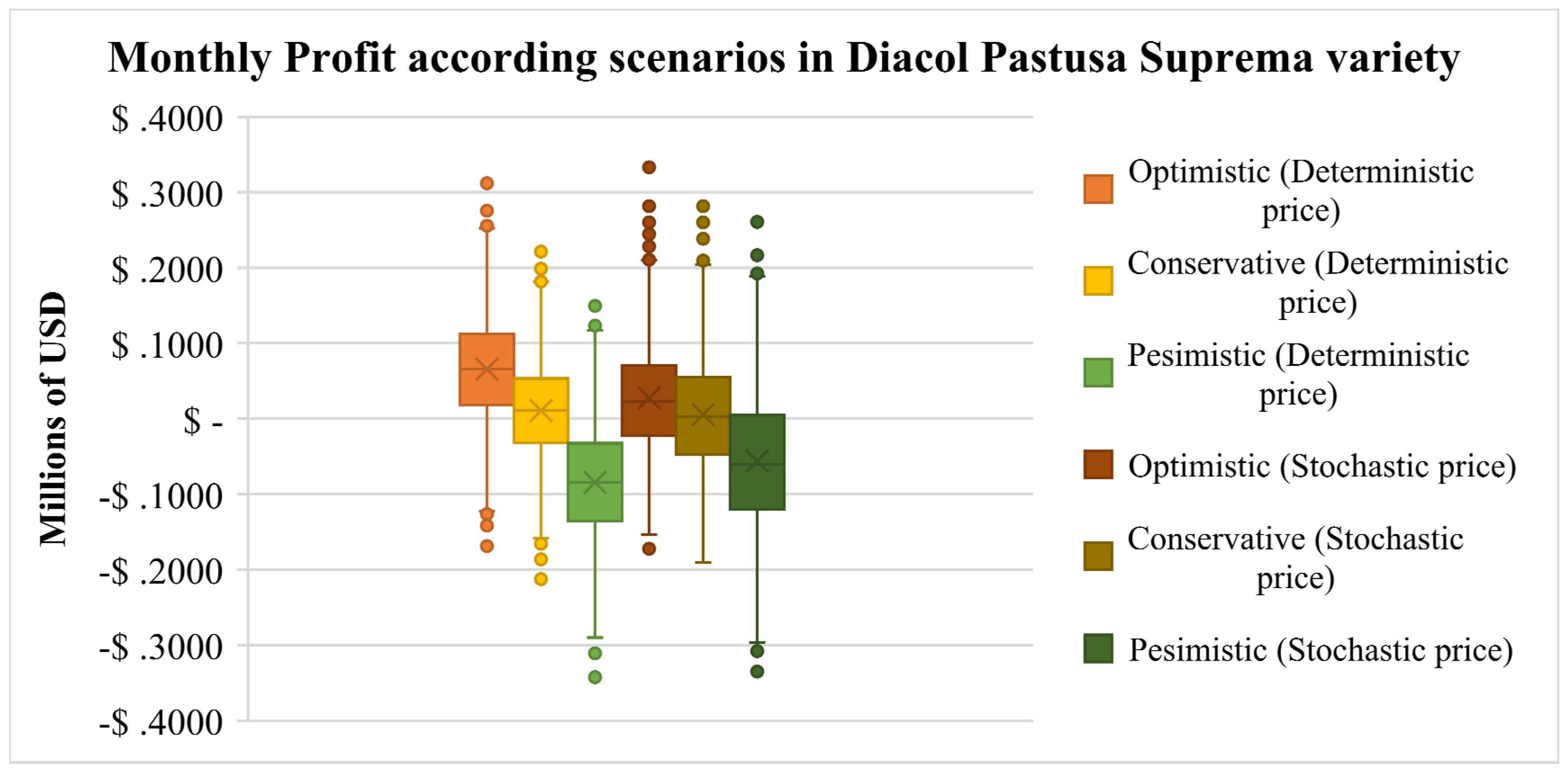

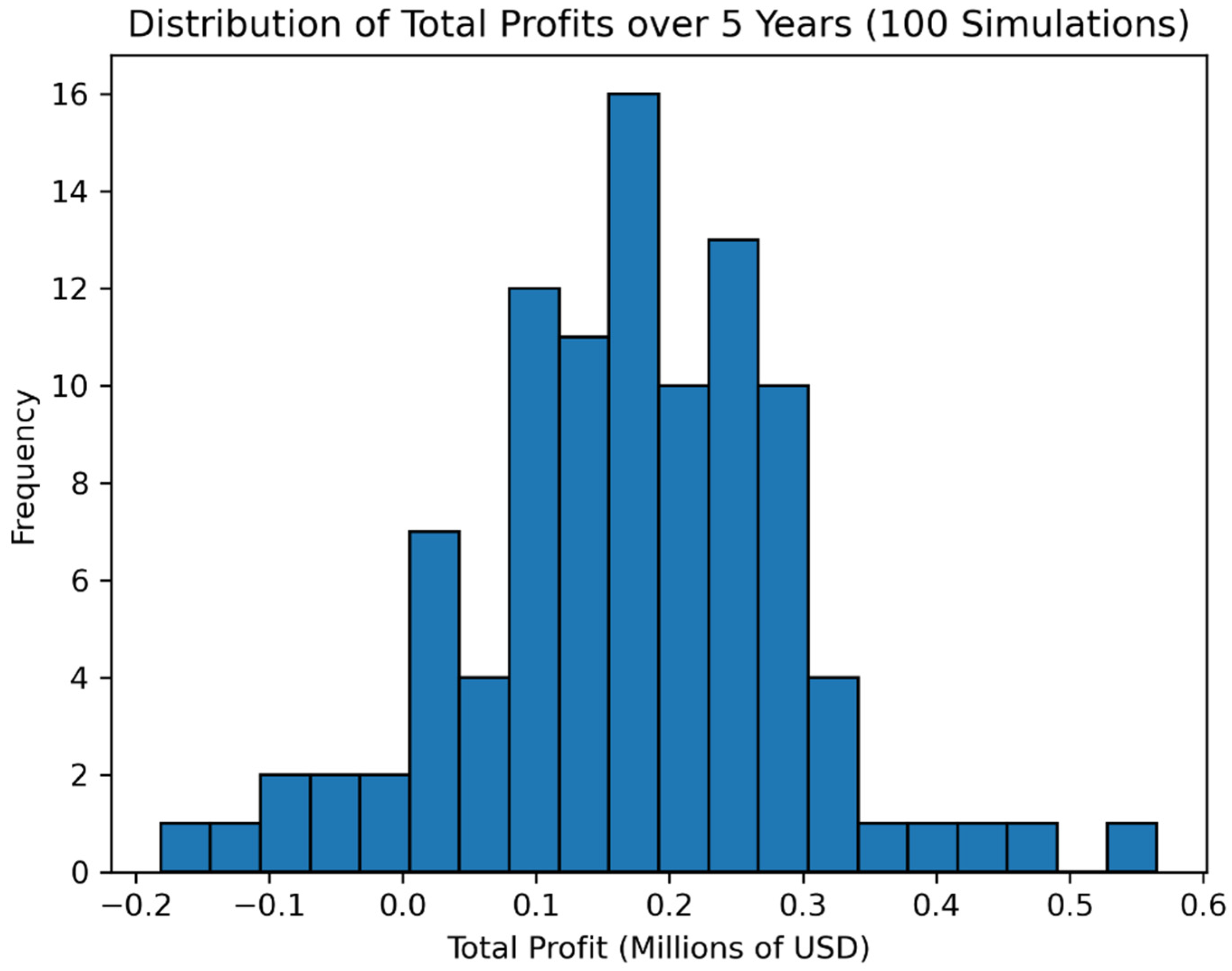

5.2. Numerical Analysis and Monte Carlo Simulation Process

5.3. Machine Learning Model

5.4. Validation and Reliability

6. Discussion and Insights on Policy-Making

7. Conclusions and Perspectives

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Larson, P.D.; Rogers, D.S. Supply Chain Management: Definition, Growth and Approaches. J. Mark. Theory Pract. 1998, 6, 1–5. [Google Scholar] [CrossRef]

- Gibson, B.J.; Hanna, J.B.; Defee, C.C.; Chen, H. The Definitive Guide to Integrated Supply Chain Management: Optimize the Interaction between Supply Chain Processes, Tools, and Technologies; Part of the Council of Supply Chain Management Professionals Series; Pearson FT Press: Saddle River, NJ, USA, 2013. [Google Scholar]

- Richey, R.G.; Roath, A.S.; Adams, F.G.; Wieland, A. A Responsiveness View of Logistics and Supply Chain Management. J. Bus. Logist. 2022, 43, 62–91. [Google Scholar] [CrossRef]

- Ribeiro, J.; Barbosa-Povoa, A. Supply Chain Resilience: Definitions and Quantitative Modelling Approaches—a literature review. Comput. Ind. Eng. 2018, 115, 109–122. [Google Scholar] [CrossRef]

- Barbosa-Póvoa, A.P.; da Silva, C.; Carvalho, A. Opportunities and challenges in sustainable supply chain: An operations research perspective. Eur. J. Oper. Res. 2018, 268, 399–431. [Google Scholar] [CrossRef]

- Moreno-Camacho, C.A.; Montoya-Torres, J.R.; Jaegler, A.; Gondran, N. Sustainability metrics for real case applications of the supply chain network design problem: A systematic literature review. J. Clean. Prod. 2019, 231, 600–618. [Google Scholar] [CrossRef]

- Niggli, U.; Schmid, H.; Fliessbach, A. Organic Farming and Climate Change. International Trade Centre (ITC), Geneva, Switzerland. 2008. Available online: https://www.intracen.org (accessed on 11 August 2025).

- Mijena, G.M.; Gedebo, A.; Beshir, H.M.; Haile, A. Ensuring food security of smallholder farmers through improving productivity and nutrition of potato. J. Agric. Food Res. 2022, 10, 100400. [Google Scholar] [CrossRef]

- EPA. Global Greenhouse Gas Emissions Data, United States Environmental Protection Agency. 2022. Available online: https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data (accessed on 11 August 2025).

- FAO. The State of Agricultural Commodity Markets 2020. Agricultural Markets and Sustainable Development: Global Value Chains, Smallholder Farmers and Digital Innovations; FAO: Rome, Italy, 2020. [Google Scholar] [CrossRef]

- FAO. Brief to The State of Food Security and Nutrition in the World 2020. In Transforming Food Systems for Affordable Healthy Diets; Food and Agriculture Organization of the United Nations: Rome, Italy, 2020. [Google Scholar] [CrossRef]

- FAO. Economic Dimensions of Agriculture. In Statistical Yearbook 2021; Food and Agriculture Organization of the United Nations, FAO Statistics: Rome, Italy, 2021; pp. 2–7. [Google Scholar]

- Gharye Mirzaei, M.; Gholami, S.; Rahmani, D. A mathematical model for the optimization of agricultural supply chain under uncertain environmental and financial conditions: The case study of fresh date fruit. Environ. Dev. Sustain. 2024, 26, 20807–20840. [Google Scholar] [CrossRef]

- Cozzolino, D. The contribution of digital and sensing technologies and big data towards sustainable food supply and value chains. Sustain. Food Technol. 2025, 3, 181–187. [Google Scholar] [CrossRef]

- Kazaz, B.; Webster, S. Technical Note—Price-Setting Newsvendor Problems with Uncertain Supply and Risk Aversion. Oper. Res. 2015, 63, 751–978. [Google Scholar] [CrossRef]

- Violi, A.; Laganá, D.; Paradiso, R. The inventory routing problem under uncertainty with perishable products: An application in the agri-food supply chain. Soft Comput. 2019, 24, 13725–13740. [Google Scholar] [CrossRef]

- Oroojlooy, A.; Snyder, L.; Takác, M. Applying Deep Learning to the Newsvendor Problem; COR@L Technical Report 17T-004; Department of Industrial and Systems Engineering, Lehigh University: Bethlehem, PA, USA. Available online: https://engineering.lehigh.edu/sites/engineering.lehigh.edu/files/_DEPARTMENTS/ise/pdf/tech-papers/17/17T_004_0.pdf (accessed on 11 August 2025).

- Allal, L.G.; Bennekrouf, M.; Bettayeb, B.; Sahnoun, M. Improving the Potato Supply Chain in Western Algeria: An Optimization Model. In Proceedings of the 2024 International Conference of the African Federation of Operational Research Societies, Université de Tlemcen, Tlemcen, Algeria, 3–5 November 2024; Available online: https://hal.science/hal-04982106/document (accessed on 11 August 2025).

- Allal, L.G.; Bennekrouf, M.; Bettayeb, B.; Sahnoun, M. Technologies and strategies for optimizing the potato supply chain: A systematic literature review and some ideas for application in the Algerian context. Comput. Electron. Agric. 2025, 234, 110171. [Google Scholar] [CrossRef]

- Kalimuthu, T.; Kalpana, P.; Kuppusamy, S.; Sreedharan, V.R. Intelligent decision-making framework for agriculture supply chain in emerging economies: Research opportunities and challenges. Comput. Electron. Agric. 2024, 219, 108766. [Google Scholar] [CrossRef]

- Edgeworth, F. The mathematical theory of banking. J. R. Stat. Soc. 1888, 51, 113–127. [Google Scholar]

- Whitin, T.M. Inventory Control and Price Theory. Manag. Sci. 1955, 2, 61–68. [Google Scholar] [CrossRef]

- Mills, E.S. Uncertainty and price theory. Q. J. Econ. 1959, 73, 116–130. [Google Scholar] [CrossRef]

- Mills, E.S. Price, Output and Inventory Policy; John Wiley: New York, NY, USA, 1962. [Google Scholar]

- Petruzzi, N.C.; Dada, M. Pricing and the Newsvendor Problem: A Review with Extensions. Oper. Res. 1999, 47, 183–194. [Google Scholar] [CrossRef]

- Dolgui, A.; Proth, J.-M. Supply Chain Engineering: Useful Methods and Techniques; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Porteus, E.L. The Newsvendor Problem. In Building Intuition; Chhajed, D., Lowe, T.J., Eds.; International Series in Operations Research & Management Science; Springer: Boston, MA, USA, 2008; Volume 115. [Google Scholar]

- Muñoz Rojas, D.; Montoya-Torres, J.R. Multimodal logistics systems for agricultural development, a systematic review identifying the Latin American case. In Proceedings of the IISE Annual Conference and Expo 2024, Montreal, QC, Canada, 18–21 May 2024; Brown Greer, A., Contardo, C., Frayret, J.-M., Eds.; Institute of Industrial and Systems Engineers: Arlington, TX, USA, 2024; pp. 1–7. [Google Scholar] [CrossRef]

- Erlebacher, S.J. Optimal and heuristic solutions for the multi-item newsvendor problem with a single capacity constraint. Prod. Oper. Manag. 2000, 9, 303–318. [Google Scholar] [CrossRef]

- Jammernegg, W.; Kischka, P. The price-setting newsvendor with service and loss constraints. Omega 2013, 41, 326–335. [Google Scholar] [CrossRef]

- Wu, X.; Niederhoff, J.A. Fairness in Selling to the Newsvendor. Prod. Oper. Manag. 2014, 23, 2002–2022. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, M.; Zhang, Z.C. Technical Note—A Risk-Averse Newsvendor Model Under the CVaR Criterion. Oper. Res. 2009, 57, 1040–1044. [Google Scholar] [CrossRef]

- Ma, L.; Zhao, Y.; Xue, W.; Cheng, T.C.E.; Yan, H. Loss-averse newsvendor model with two ordering opportunities and market information updating. Int. J. Prod. Econ. 2012, 140, 912–921. [Google Scholar] [CrossRef]

- Petruzzi, N.C.; Wee, K.E.; Dada, M. The Newsvendor Model with Consumer Search Costs. Prod. Oper. Manag. 2009, 18, 693–704. [Google Scholar] [CrossRef]

- Peng, L.; Lu, G.; Pang, K.; Yao, Q. Optimal farmer’s income from farm products sales on live streaming with random rewards: Case from China’s rural revitalisation strategy. Comput. Electron. Agric. 2021, 189, 106403. [Google Scholar] [CrossRef]

- Dutta, N.; Kaur, A. A socially responsible decision-making model for firms contracting with constrained farmers. Int. Trans. Oper. Res. 2023, 30, 2094–2121. [Google Scholar] [CrossRef]

- Fu, Z.; Sun, H.; Xu, C.; Yue, M. Downstream Information Sharing in Agricultural Supply Chains with Investment Spillovers. Decis. Anal. 2025, 22, 147–168. [Google Scholar] [CrossRef]

- Sharma, I.; Kaur, G.; Dey, B.K.; Majumder, A. Leveraging Blockchain and Consignment Contracts to Optimize Food Supply Chains Under Uncertainty. Appl. Sci. 2024, 14, 11735. [Google Scholar] [CrossRef]

- Pinçe, Ç.; Yücesan, E.; Bhaskara, P.G. Accurate response in agricultural supply chains. Omega 2021, 100, 102214. [Google Scholar] [CrossRef]

- Amaruchkul, K. Value of Image-based Yield Prediction: Multi-location Newsvendor Analysis. In Operations Research and Enterprise Systems; Parlier, G., Liberatore, F., Demange, M., Eds.; ICORES 2019; Communications in Computer and Information Science; Springer: Cham, Switzerland, 2020; Volume 1162. [Google Scholar] [CrossRef]

- Castañeda, J.A.; Brennan, M.; Goentzel, J. A behavioral investigation of supply chain contracts for a newsvendor problem in a developing economy. Int. J. Prod. Econ. 2019, 210, 72–83. [Google Scholar] [CrossRef]

- Wu, X.; Nie, L.; Xu, M.; Yan, F. A perishable food supply chain problem considering demand uncertainty and time deadline constraints: Modeling and application to a high-speed railway catering service. Transp. Res. Part E Logist. Transp. Rev. 2018, 111, 186–209. [Google Scholar] [CrossRef]

- Shaltayev, D.; Deniz, B.; Hasbrouck, R. Factors affecting a perishable supply chain’s transaction costs and service. Int. J. Appl. Manag. Sci. 2016, 8, 114–131. [Google Scholar] [CrossRef]

- Papier, F. Supply Allocation Under Sequential Advance Demand Information. Oper. Res. 2016, 64, 341–361. [Google Scholar] [CrossRef]

- Xu, F.; Baker, R.; Whitaker, T.; Luo, H.; Zhao, Y.; Stevenson, A.; Boesch, C.; Zhang, G. Review of good agricultural practices for smallholder maize farmers to minimise aflatoxin contamination. World Mycotoxin J. 2022, 15, 171–186. [Google Scholar] [CrossRef]

- Reader, J. Potato; Yale University Press: New Haven, CT, USA, 2009; ISBN 978-0300141092. [Google Scholar]

- Rodríguez, L.E. Origen y evolución de la papa cultivada—una revisión. Agron. Colomb. 2010, 28, 9–17. [Google Scholar]

- FAOSTAT. Crops and Livestock Products. Production Quantity and Yield of Potato. 2023. Available online: https://www.fao.org/faostat/en/#data/QCL (accessed on 11 August 2025).

- FEDEPAPA & FNFP. El Cultivo de la papa: Factores Que Influyen en la Productividad; Federación Colombiana de Productores de Papa—Fondo Nacional de Fomento de la papa: Bogotá, Colombia, 2023; Available online: https://repositorio.fedepapa.com/items/4a10c78c-4849-4aa7-a9d3-c9f9675fca69 (accessed on 11 August 2025).

- Ahmad, U.; Sharma, L. A review of Best Management Practices for potato crop using Precision Agricultural Technologies. Smart Agric. Technol. 2023, 4, 100220. [Google Scholar] [CrossRef]

- Ñústez López, C.E. Variedades Colombianas de Papa; Universidad Nacional de Colombia: Bogotá, Colombia, 2011. [Google Scholar]

- Bonilla Correa, C.R.; Pérez Gil, Y.M. Papa Criolla; Universidad Nacional de Colombia: Bogotá, Colombia, 2010. [Google Scholar]

- Guerrero-Guio, J.C.; Cabezas Gutiérrez, M.; Galvis Quintero, J.H. Efecto de dos sistemas de riego sobre la producción y uso eficiente del agua en el cultivo de papa variedad diacol capiro. Rev. De Investig. Agrar. Y Ambient. 2019, 11, 41–52. [Google Scholar] [CrossRef]

- FNFP. Observatorio del Consejo Nacional de la Papa. Cálculos de Sistemas de Información y Estudios Económicos Fedepapa-FNFP. 2023. Available online: https://fedepapa.com/home/wp-content/uploads/2024/09/INFORME-DE-GESTION-VIGENCIA-2023.pdf (accessed on 11 August 2025).

- Palacio, G. Desafíos y oportunidades para el subsector de la papa en 2023. In Proceedings of the XXIX Congreso de la Asociación Latinoamericana de la Papa, Puerto Varas, Chile, 28–31 March 2023. [Google Scholar]

- Ñústez López, C.E. Grupo de Investigación en papa. Universidad Nacional de Colombia. Obtenido de Facultad de Ciencias Agrarias. 2023. Available online: https://www.papaunc.com/catalogo/pastusa-suprema (accessed on 11 August 2025).

- FEDEPAPA. Fondo Nacional del fomento de la papa. In Boletín Regional Departamento de Boyacá: Volumen 6; Federación Colombiana de Productores de Papa: Bogotá, Colombia, 2022. [Google Scholar]

- Beaverstock, M.; Greenwood, A.; Nordgren, W. Applied Simulation: Modeling and Analysis Using FlexSim, 5th ed.; FlexSim Software Products, Inc.: Orem, UT, USA, 2017. [Google Scholar]

- Ross, S. Chapter 4—Generating Discrete Random Variables. In Simulation, 5th ed.; Ross, S., Ed.; Marquette University: Milwaukee, WI, USA, 2013; pp. 47–68. [Google Scholar] [CrossRef]

- Peña, A.; Alvarez, E.L.; Ayala Valderrama, D.M.; Palacio, C.; Bermudez, Y.; Paredes-Madrid, L. Usage of Machine Learning Techniques to Classify and Predict the Performance of Force Sensing Resistors. Sensors 2024, 24, 6592. [Google Scholar] [CrossRef]

- Devaux, A.; Goffart, J.P.; Kromann, P.; Andrade-Piedra, J.; Polar, V.; Hareau, G. The Potato of the Future: Opportunities and Challenges in Sustainable Agri-food Systems. Potato Res. 2021, 64, 681–720. [Google Scholar] [CrossRef] [PubMed]

- Jagtap, S.; Raut, R.; Dani, S. Advancing the digital frontier in agri-food supply chains. Int. J. Food Sci. Technol. 2024, 59, 3433–3435. [Google Scholar] [CrossRef]

- NPC. National Potato Council Releases Groundbreaking Report on U.S. Potato Industry’s Contribution to America’s Economy. 2023. Available online: https://www.nationalpotatocouncil.org/economic-impact-report/ (accessed on 21 March 2025).

- Europatat. The EU Potato Sector in 2022 & 2023. 2023. Available online: https://europatat.eu/activities/the-eu-potato-sector/ (accessed on 21 March 2025).

- Eurostat. The EU Potato Sector—Statistics on Production, Prices and Trade. 2024. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?_prices_and_trade&oldid=646772 (accessed on 21 March 2025).

- PotatoPro. Colombia, Potato Market Statistics. 2025. Available online: https://www.potatopro.com/potato-markets/colombia (accessed on 21 March 2025).

- Lu, L.; Nguyen, R.; Rahman, M.M.; Winfree, J. Demand Shocks and Supply Chain Resilience: An Agent-Based Modelling Approach and Application to the Potato Supply Chain; NBER Working Paper Series Working Paper 29166; National Bureau of Economic Research: Cambridge, MA, USA, 2021; Available online: http://www.nber.org/papers/w29166 (accessed on 11 August 2025).

- Yakovleva, N.; Flynn, A. The Food Supply Chain and Innovation: A Case Study of Potatoes; Working Paper Series No. 15; Centre for Business Relationships, Accountability, Sustainability & Society: Cardiff, UK, 2004. [Google Scholar]

- Kufa, T.K. Potato Value Chain Analysis in the Case of Dugda Woreda, East shoazone, Oromia National Regional State of Ethiopia. Master’s Thesis, Addis Ababa University School of Commerce, Addis Ababa, Ethiopia, 2019. [Google Scholar]

- Mukami Kimathi, S.; Ingasia Ayuya, O.; Mutai, B. Adoption of climate-resilient potato varieties under partial population exposure and its determinants: Case of smallholder farmers in Meru County, Kenya. Cogent Food Agric. 2021, 7, 1860185. [Google Scholar] [CrossRef]

- Galvis-Tarazona, D.Y.; Ojeda-Pérez, Z.Z.; Arias-Moreno, D.M. Cultural and ethnobotanical legacy of native potatoes in Colombia. J. Ethnobiol. Ethnomed. 2022, 18, 59. [Google Scholar] [CrossRef] [PubMed]

- Muthoni Thuo, C.; Wambugu Maina, S. Strengthening smallholder farmers resiliency for improved sustainable productivity of Irish Potatoes in Kenya. World J. Adv. Res. Rev. 2024, 22, 512–520. [Google Scholar] [CrossRef]

- Bayiyana, I.; Juma Okello, J.; Lubega Mayanja, S.; Nakitto, M.; Namazzi, S.; Osaru, F.; Ojwang, S.; Mashisia Shikuku, K.; Lagerkvist, C.-J. Barriers and enablers of crop varietal replacement and adoption among smallholder farmers as influenced by gender: The case of sweetpotato in Katakwi district, Uganda. Front. Sustain. Food Syst. 2024, 8, 1333056. [Google Scholar] [CrossRef]

| Protocol | Description |

|---|---|

| Database | Scopus, Web-of-Science (WOS) |

| Search Field | Title, Keywords, and Abstract, Especially Title |

| Query and results | Scopus: TITLE-ABS-KEY ((“newsvendor model” OR “newsvendor problem” OR “news-vendor model”) AND (“agrifood supply chain” OR “agri-food supply chain” OR “agricultural supply chain” OR “food supply chain” OR “perishable supply chain”)). Eight documents found from 2010 to 2025 Web-of-Science: TS = ((“newsvendor model” OR “newsvendor problem” OR “news-vendor model”) AND (“agrifood supply chain” OR “agri-food supply chain” OR “agricultural supply chain” OR “food supply chain” OR “perishable supply chain”)). Three documents found from 2016 to 2025. |

| Inclusion Criteria | Document Type: Article OR Review; Language: English OR Spanish; Area of Knowledge: Engineering, Business, Management and Accounting, Decision Sciences, Agricultural and Biological Sciences |

| Exclusion Criteria | Not aligned with key words or research questions, written in a language distinct from English or Spanish, duplicates (the same articles found in different databases) |

| Reference | Methodology | Topic Focus and Remarks |

|---|---|---|

| [37] | Game-theoretic modeling and equilibrium analysis | Coordination between distributors and farming cooperatives in agribusiness supply chain management, focusing on the incentives and mechanisms for sharing information about consumer preferences in the presence of quality improvement investment opportunities, with applications in perennial crops where demand forecasting and preference prediction are uncertain. |

| [38] | Newsvendor-based mathematical model. | Food supply chain management in perishable goods using blockchain technologies, examining the impact of blockchain implementation on the profitability of retailers and the overall food supply chain, managing uncertain demand and high perishability. The study investigates whether blockchain adoption and consignment contracts can together improve profitability and consumer trust. Applied to blockchain for traceability, reducing costs and fraud risks, guiding contract design and risk sharing between manufacturers and retailers. |

| [39] | Multi-ordering news vendor model with Martingale Model of Forecast Evolution | Agribusiness and operations research models (newsvendor, MMFE) for production and forecasting decisions. The article explains how to exploit evolving forecasts to improve production decisions and profitability in agricultural supply chains with long lead times and high uncertainty. All for decision frameworks for seed manufacturers and broader agribusiness contexts, using MMFE-based multi-ordering strategies, clustering, and a quadrant matrix to guide production timing and resource allocation. |

| [40] | Multi-location newsvendor model integrating machine learning | Agricultural supply chain optimization, combining machine-learning-based image prediction with news vendor analysis. Quantifying the economic value of image-based yield predictions in reducing uncertainty and mismatches in agricultural supply chains. Its applications include improving yield forecasting accuracy, optimizing inventory and harvest allocation decisions, supporting farmers and cooperatives in strategic planning, and encouraging the adoption of precision agriculture technologies that leverage AI-driven remote sensing. |

| [41] | Mixed-methods: qualitative field interviews and behavioral experiments (lab-based newsvendor tasks). | This study explores behavioral operations in agricultural supply chains of developing economies, focusing on whether risk-sharing contracts (buyback, salvage) can reduce production and ordering risks under uncertainty. It shows how biases like anchoring and loss aversion shape decisions, with applications in African storage systems, guidance for NGOs and policy-makers, and extensions of behavioral contract theory to low-resource contexts. |

| [42] | Variational inequality model that integrates a newsvendor framework | Study of perishable food supply chains and railway catering logistics, focusing on the optimization of meal distribution under uncertain demand, perishability, and strict delivery deadlines. Applies to high-speed rail catering operations. The authors design an Euler algorithm combined with an augmented Lagrangian dual approach, validated through sensitivity analyses. |

| [43] | Newsvendor problem and simulation-based analysis | Traditional models often overlook search and finding costs beyond basic ordering costs, despite their significant impact when supply is uncertain. The study investigates how transaction costs and service levels are affected in a perishable supply chain with multiple suppliers and retailers, managing agricultural and seafood supply chains, guiding sourcing strategies, and reducing procurement inefficiencies. |

| [44] | Finite-horizon Markov Decision Process with a Martingale Model of Forecast Evolution (MMFE) | How to allocate limited supply to sequentially opening markets under uncertainty using advance demand information (ADI) forecast updates received over time to improve allocation, reduce misallocation risks, and maximize profit. Its applications include the European seed industry, pharmaceuticals, or consumer products, showing how forecast updating can guide resource allocation and boost profitability. |

| [13] | MILP optimization model with stochastic scenarios | The study is situated in agribusiness supply chain management and procurement planning, addressing the challenge of sourcing perishable products under uncertain supply and demand conditions. It employs a Mixed-Integer Linear Programming (MILP) model to optimize procurement decisions, incorporating stochastic demand scenarios and yield variability to capture uncertainty. |

| This article | Newsvendor problem using machine learning and Monte Carlo simulation-based analysis | Agri-food supply chain management and sustainable agriculture, focusing on the optimization of potato inventory decisions in Boyacá, Colombia, under demand and price uncertainty. The core issue is how to reduce waste, stabilize farmer income, and improve profitability through a data-driven decision-making process. Its applications include providing decision-support for smallholder farmers and supply chain managers, identifying profitable potato varieties, and informing agricultural policy with potential scalability to other crops and regions. |

| Aspect | S. tuberosum L. Diacol Capiro Variety PAP-68-02 | S. phureja Juz &Buk Criolla Colombia Variety PAP-05-39 | S. tuberosum L. Pastusa Suprema Variety PAP-02-37 |

|---|---|---|---|

| Morphological features | Medium plant size, dark green foliage, medium flowering, and very little fruit formation. | Diploid, medium plant size, slightly light green foliage, abundant flowering, and rare fruit formation. | Large plant size, slightly light green foliage, moderate flowering, rare fruit formation, and high male sterility. |

| Agronomic characteristics | Highly adaptable since it is cultivated between 1800 and 3200 m above sea level (masl) and has a relatively late ripening (165 days at 2600 masl). Its yield potential under optimum growing conditions is over 40 tons per hectare (t/ha), and its resting period is 3 months at 15 °C and 75% relative humidity (RH). | It is cultivated between 2400 and 3200 masl, with a cycle length of 120 days at 2600 masl, the yield potential under optimum growing conditions is between 15 and 25 t/ha, and there is no resting period. | It is cultivated between 2500 and 3200 masl, with a cycle length of 165 days at 2600 masl, the yield potential under optimum growing conditions is over 45 tons per hectare (t/ha), and its resting period is 2 months at 15 °C and 75% relative humidity (RH). |

| Quality | Dry matter values between 20 and 23%, light cream flesh color and good response to fracture. | Dry matter values between 21 and 23%, suitability for processing as precooked frozen and canned, excellent culinary quality for fresh consumption. | Dry matter values between 21 and 23%, suitability for processing as precooked frozen and canned, excellent culinary quality for fresh consumption. |

| Susceptibility | Potato blight (Phytophthora infestans) Wallroth (Spongospora subterranean) Potato yellow vein virus (PYVV) | Potato blight (Phytophthora infestans) Wallroth (Spongospora subterranean) Potato yellow vein virus (PYVV) | Potato blight (Phytophthora infestans) Wallroth (Spongospora subterranean) Potato yellow vein virus (PYVV) |

| Water requirement | 400–700 mm [53]. | Average annual rainfall of 900 mm, of which 500 mm is required during the vegetative period. | 400–700 mm [53] |

| Factor | Influence |

|---|---|

| Photosynthesis | More than 90% of the dry weight accumulated by the potato plant is derived from the fixation and assimilation of CO2 and the process of photosynthesis through the canopy structure. |

| Leaf structure | Stomata are present on both sides of the leaf surface. Some varieties have low photosynthetic rates in the early stages of development; however, after tuberization, the CO2 assimilated by the leaves increases two to three times. |

| Light intensity and temperature | Maximum photosynthetic rates are found in the range of 15 to 25 °C, stomatal conductance peaks at 24 °C, and maximum photosynthetic values in potato are recorded between 9:00 am and 2:00 pm under Colombian conditions. Temperatures between 15 °C and 19 °C are optimal for tuber growth. |

| Tuber growth | The tuber functions as a dumping ground: the rate of net assimilation (photosynthesis) is controlled by the demand and the size of the tuber, having a maximum period at the flowering stage. Tuber growth is related to increases in the photosynthetic capacity of plant leaves. |

| Day length | This is one of the main factors regulating tuberization because the photoperiod influences tuber protein and starch synthesis. Andigena subspecies from the Andes of South America require short days for tuberization, while tuberosum subspecies varieties require long days. |

| Symbol | Explanation News Vendor Model | Case Study | Type in Case Study |

|---|---|---|---|

| y | Crop yield. | Crop yield in tons per hectare (t/ha). | Deterministic |

| a | Cultivated area. | Cultivated area in hectares (ha). | Deterministic |

| c | Production cost (or purchasing cost) per item used to replenish the stock. | Production cost in USD/ha. | Deterministic |

| v | Salvage value per item (price at which one item can be sold after a given death line). | Salvage value in USD/t. This is the price at which each ton is sold when oversupplied. | Deterministic |

| p | Selling price of one item. | Selling price of the grower in dollars per tons (USD/t). | Stochastic |

| Distribution Fit and Data Summary of Price in COP/Kg According to Variety | |||

|---|---|---|---|

| Variety | Diacol Capiro | Criolla Colombia | Pastusa Suprema |

| Normal Distribution Fit | Normal | Normal | Normal |

| Expression | NORM (1760, 702) | NORM (2220, 906) | NORM (1530, 583) |

| Best Distribution Fit | Erlang | Erlang | Triangular |

| Expression | 439 + ERLANG (439.3) | 421 + ERLANG (450.4) | TRIA (384,952,3260) |

| Square Error | 0.016365 | 0.004851 | 0.002500 |

| Number of Data Points | 2949 | 4569 | 689 |

| Sample Mean | 1760 | 2220 | 1530 |

| Sample Std Dev | 702 | 906 | 583 |

| Test | Chi Square Test | ||

| Number of Intervals | 37 | 18 | 22 |

| Degrees of Freedom | 34 | 15 | 20 |

| Test Statistic | 3730 | 12,200 | 50.6 |

| Corresponding p-value | <0.005 | <0.005 | <0.005 |

| Test | Kolmogorov–Smirnov Test | ||

| Test Statistic | 0.353 | 0.145 | 0.0417 |

| Corresponding p-value | <0.01 | <0.01 | >0.15 |

| Distribution Fit and Data Summary of Demand in Kg According to Variety | |||

|---|---|---|---|

| Variety | Diacol Capiro | Criolla Colombia | Pastusa Suprema |

| Best Distribution Fit | Normal | Normal | Normal |

| Expression | NORM (9460, 4510) | NORM (1620, 1860) | NORM (8390, 3430) |

| Square Error | 0.044258 | 0.100365 | 0.022695 |

| Number of Data Points | 4950 | 24,040 | 42,496 |

| Sample Mean | 9460 | 1620 | 8390 |

| Sample Std Dev | 4510 | 1860 | 3430 |

| Test | Chi Square Test | ||

| Number of Intervals | 25 | 9 | 24 |

| Degrees of Freedom | 22 | 6 | 21 |

| Test Statistic | 3410 | 2650 | 1490 |

| Corresponding p-value | <0.005 | <0.005 | <0.005 |

| Variable | Criolla Colombia Variety | Diacol Capiro Variety | Pastusa Suprema Variety | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Scenario: optimistic (O), conservative (C), or pessimistic (P) | O | C | P | O | C | P | O | C | P |

| Yield (t/ha) | 15 | 12 | 7.5 | 25 | 20 | 12.5 | 25 | 20 | 12.5 |

| Selling price (p) in USD/t | 732 | 520 | 308 | 577 | 412 | 248 | 495 | 358 | 222 |

| Production cost in USD/t | 436 | 545 | 871 | 332 | 415 | 664 | 323 | 404 | 647 |

| Results | Criolla Variety | Diacol Capiro Variety | Pastusa Suprema Variety |

|---|---|---|---|

| Total profit or loss over 5 years (million USD) | 0.17 | −1.05 | −1.55 |

| Optimal monthly inventory quantity (tons) | 49.56 | 283.23 | 250.68 |

| 95% confidence interval for optimal monthly inventory (tons) | [49.1; 50.1] | [282.1; 284.4] | [249.8; 251.6] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muñoz Rojas, D.; Montoya-Torres, J.R.; Ayala Valderrama, D.M. A Data-Driven Framework for Agri-Food Supply Chains: A Case Study on Inventory Optimization in Colombian Potatoes Management. Logistics 2025, 9, 164. https://doi.org/10.3390/logistics9040164

Muñoz Rojas D, Montoya-Torres JR, Ayala Valderrama DM. A Data-Driven Framework for Agri-Food Supply Chains: A Case Study on Inventory Optimization in Colombian Potatoes Management. Logistics. 2025; 9(4):164. https://doi.org/10.3390/logistics9040164

Chicago/Turabian StyleMuñoz Rojas, Daniel, Jairo R. Montoya-Torres, and Diana M. Ayala Valderrama. 2025. "A Data-Driven Framework for Agri-Food Supply Chains: A Case Study on Inventory Optimization in Colombian Potatoes Management" Logistics 9, no. 4: 164. https://doi.org/10.3390/logistics9040164

APA StyleMuñoz Rojas, D., Montoya-Torres, J. R., & Ayala Valderrama, D. M. (2025). A Data-Driven Framework for Agri-Food Supply Chains: A Case Study on Inventory Optimization in Colombian Potatoes Management. Logistics, 9(4), 164. https://doi.org/10.3390/logistics9040164