1. Transport Volume and Industrial Production in the Danube and Rhine Countries

Before discussing the actual transport logistics possibilities between the Central European countries and Ukraine, which have the potential to develop and support, respectively, the post-conflict recovery of industrial production, a basic comparison of transport parameters and volumes on the Rhine and the Danube is appropriate. This comparison will show us the possibilities and limitations of the current logistics on inland waterways. Therefore, the most up-to-date, available, and open-source statistical data were collected and analytically investigated between 2014 and 2022.

Freight traffic on the entire Rhine (from Basel to the North Sea) amounted to 262.3 million tonnes in 2023, compared to 292.3 million tonnes in 2022 (−10.2%). Regarding total freight volumes on the entire Rhine, mineral oils, chemicals, sand, stone, and gravel product segments accounted for the largest share in 2022 and 2023 [

1].

Freight traffic on the entire navigable Danube between Kelheim (Germany) and the Black Sea via the Danube–Black Sea Canal and the Sulina Canal ranges between 34 and 40 million tonnes per year. Transport capacity on the Danube (EU Danube countries plus Serbia) reached 23.9 billion tonne-kilometres (TKM) in 2022, a 20% decrease compared to 2021. Several factors have driven the Ukraine–Russia conflict, and the following have significantly affected Danube navigation: the energy crisis, the scarcity and rising prices of iron ore, restrictions on exporting grain and other foodstuffs, and rising fuel prices [

2].

The Rhine region is a significant industrial hub in Europe, primarily due to its role as a major transportation artery. The Rhine facilitates the movement of goods, historically supporting growth. One of the key industries along the Rhine is the chemical industry, with approximately one-fifth of the world’s chemical production in the region. The Ruhr region, located in North Rhine-Westphalia, is one of the largest industrial areas in the world and is traditionally renowned for its coal mining, steel production, and chemical manufacturing. The region boasts a dense network of railways and waterways, which enhances its industrial capabilities. Cities such as Duisburg, Essen, and Dortmund are at the heart of this industrial area. Overall, the region along the Rhine significantly contributes to the European economy through industrial production, especially in the abovementioned sectors. Its strategic location also facilitates trade and transport across Europe. The Ruhr area in Germany is historically known for its significant industrial activities, particularly coal mining and steel production [

3]. Steel production remains a key sector, with crude steel production in the region accounting for a substantial part of Germany’s output. Over time, the Ruhr region has diversified its industrial base towards chemical production and electronics. Emerging industries in the Ruhr include high-tech sectors as the region seeks to transform its economic structure and image due to the declining competitiveness of traditional heavy industries such as coal mining and metallurgy [

4].

Freight traffic on the entire navigable Danube between Kelheim (Germany) and the Black Sea ports (via the Sulina Canal or the Black Water Canal) ranges between 30 and 40 million tonnes annually. This is a historically stable figure. Whether by volume or the number of major ports (mainly racing ports, with the river ports divided into commercial and company ports), traffic is an order of magnitude lower than that of the Rhine (

Figure 1):

We would arrive at a higher figure by examining the individual countries and their declared volumes, based on statistical tracking, and summing up the individual volumes. However, goods in transit in individual countries’ volumes may be counted several times. At the expert level, there is always controversy about the “net” volume of goods transported annually on the Danube. The differences between the Danube and the Danube Waterway are mainly due to the volume of heavy and chemical industries built up primarily in the Benelux countries, close to or directly on the Rhine Waterway. Another reason is the vast network of canals and waterways, which allows a wide range of vessels to navigate and links with the most industrialised countries of the EU (France, Germany, Belgium, The Netherlands). The network of locks and canals also has a positive impact on navigability. There is a competitive advantage for countries in the upper part of the Danube. With more frequent periods of drought or, conversely, flooding, problems are increasing in those sections of the Danube that are not regulated. Climate change is causing significant problems for the navigability of the Danube. Therefore, investments in infrastructure are essential for the long-term sustainability of inland waterway transport on the Danube. The transport performance of the Rhine is 58 billion tonne km and decreased by 10% compared to 2019; that of the Rhine is 58 billion tonne km and decreased by 10% compared to 2019, that of the Seine is 3.1 billion tonnes km, and that of the Moselle is 1.6 billion tonnes km. The Danube transport performance was only 23 billion tonnes km in 2023 and decreased 18% compared to 2019 (

Figure 2):

Looking at the countries of the Danube region, the most significant volumes of goods are transported in Romania (24.40 million tonnes in 2020) and Bulgaria (22.18 million tonnes in 2020). The primary reason for this is that these two countries are situated just upstream of the mouth of the Danube into the Black Sea and the Black Sea-Constanța Canal, respectively, and most of the goods are transported to or from the largest Black Sea port, Constanța. Even with its size and importance, it does not reach the level of North Sea ports (Rotterdam, Antwerp) in terms of volumes. From this perspective, iron ore and grain are the most prominent commodities on the Danube waterway. The order of these two commodities often changes depending on the harvest. The volume of “complementary” commodities for the steel industry (coal, coke, slag, finished products) is also relatively high.

The reason for the high volume of iron ore is the location of three major steel companies directly on the Danube River. Regarding volume, the largest Austrian steelworks is Voestalpine, located in Linz. The second largest steelworks is the Liberty plant in the Romanian port of Galati (formerly known as ArcelorMittal Galati and historically as Sidex Galati). Moreover, the smallest, although recently a strong performer, is HBIS Smederevo (also previously long owned by U.S. Steel Corp.). The construction of the steelworks directly on the Danube River enabled the establishment of factory ports, through which the supply of iron ore, coal, and coke, as well as the subsequent production of plates, coils, construction steel, gates, and rails, could be routed directly along the Danube River. We are talking about millions of tonnes per year for each steelworks. Without these factories, the volume of goods transported along the Danube would be significantly reduced.

The second most common commodity or group of goods on the Danube is grain or agricultural production. However, this depends more on the weather and the harvest in a particular year. If the harvest is higher than average, producers and manufacturers must export their commodity. Moreover, inland water transport is advantageous since it is used for bulk commodities. Also, this type of goods is non-perishable and not sensitive to fast delivery. Romania, Serbia, and Hungary have traditionally been among the largest exporters of goods and services. The most common commodities are wheat, maise, and rapeseed. In a below-average harvest, many goods have been consumed domestically over the last decade. This consumes a large amount of local grain production.

Whether it is iron ore or grain, the location of a factory or plant near the Danube River is a basic requirement. Statistically, water transport has a competitive advantage if the distance between the port and the plant is less than 100 km. The advantage of water transport decreases directly with the number of transhipments.

The following paragraph analyses

Table 1. The table includes the absolute cargo volumes (in thousands of tonnes) for 2019 and 2020 and the relative share of each country’s port traffic as a percentage of total Danube throughput in a given year. Country-level performance analysis shows that Croatia has the strongest growth; Germany shows moderate growth; Austria shows slight growth; Bulgaria has stable performance; Romania shows a slight decline but remains dominant; Slovakia shows a moderate decline; Hungary has a noticeable drop; Moldova declined; Serbia had a significant decline; Ukraine produced the sharpest drop, obviously. Romania remains the largest contributor, increasing its share from 41.0% to 42.1%, and Germany and Austria gained market share despite modest volume increases; meanwhile, Ukraine and Serbia lost substantial shares, reflecting operational or geopolitical challenges. These could be due to post-COVID-19 impacts that disrupted supply chains and reduced demand. Geopolitical factors could also contribute, and Ukraine’s decline may reflect regional instability due to conflict.

While the end of 2021 and the first two months of 2022 showed positive signs for some growth in traffic volumes on the Danube, the conflict between Russia and Ukraine has led to several factors that have significantly affected navigation on the Danube: the energy crisis, the scarcity and rising prices of iron ore, the restriction of exports of grain and other food products, as well as increasing fuel prices.

As a result, traffic volumes for all freight segments decreased in 2022. This decline was particularly pronounced in the agri-commodity afterstream, which almost collapsed with an 80% reduction in the Middle Danube section. This can be partly explained by the fact that the Central Danube countries, especially Hungary and Serbia, introduced export restrictions for agriculture and foodstuffs to increase strategic stocks at the beginning of the Russian–Ukrainian conflict. Fears of future grain shortages and severe drought encouraged this phenomenon.

The Danube region is economically important due to its diverse industries and the river’s influence on economic activities. The Danube, which flows through ten countries including Germany, Austria, Slovakia, Hungary, Croatia, Serbia, Bulgaria, Romania, Moldova, and Ukraine, is a key trade artery. It supports freight transport, hydroelectric power generation, water supply for industrial use and the population’s needs, irrigation, and fisheries (especially in the Lower Danube). The large ports along the river, such as Vienna, Budapest, Bratislava, and Belgrade, facilitate freight transhipment mainly towards railways and vice versa, which is the most important economic use of the Danube. Hydropower is another key sector, with projects like the Iron Gate power plant on the border between Romania and Serbia and Gabcikovo in Slovakia. This not only generates electricity but also improves navigation on the river. Industrial activities dominate cities (or suburban areas) such as Vienna, Budapest, and Belgrade. The role of the Danube in economic activities also extends to tourism, especially in areas such as the Danube Delta, which attracts visitors interested in ecology and nature conservation. Despite pollution problems affecting irrigation and fisheries, the river remains a vital economic artery for the region. Agriculture in the Danube region benefits from the river’s extensive catchment area, whose diverse range of natural conditions is favourable to agriculture. The river’s catchment area is unevenly distributed, with the right-bank tributaries collecting water from the Alps and other mountainous regions and providing up to two-thirds of the river’s total runoff, making a significant contribution. The lower reaches of the Danube, which run essentially flat, offer fertile land suitable for agriculture. The river delta further extends seawards and includes cultivated land. The shallow water areas of the delta support the growth of reeds used in producing paper and textile fibres. Compared with the Rhine and the Danube, or the countries where the rivers flow, the Rhineland is more industrially developed than the Danube basin. The volume of industrial production is much higher and more varied. Agricultural production is stronger in countries in the Danube basin, especially in terms of the volume of goods transported via inland waterways. For industrial production, especially in the supply of raw materials, individual countries and their ports are often transit points for the supply of raw materials, and they are also transit points for final consumption. In this paper, the authors hypothesise that, based on the statistical performance data of inland navigation of the Danube River, the river not only plays a vital role in economics but could also play an indubitable role in the industrial recovery of Ukraine.

The Danube River has been extensively studied in numerous research and scientific articles in the context of inland navigation. Limited research exists on its role as a transport corridor during geopolitical crises and post-conflict recovery. Existing references compare the Danube River to the Rhine from the cargo or passenger transport perspective. Still, they rarely address the strategic potential of the Danube in supporting Ukraine’s industrial reconstruction. This article bridges that gap and demonstrates how Danube logistics can provide immediate security during disruption and a long-term foundation for Ukraine’s reintegration into the European supply chain.

2. Heavy and Oversized Pieces—A First Step for the Development of Industrial Production

Heavy and oversized goods have an inherent place on the Danube. River transport is characterised by its large loading capacity, low transportation costs, and minimal negative environmental impact, making it an ideal mode of transport for heavy and oversized goods. River transport is often the first choice, not just an alternative, for the special transportation of goods such as various oversized tanks, parts, or assemblies of wind power plants [

5].

A significant weakness and major risk of river transport is its dependence on nautical conditions. Especially in recent years, we have witnessed a lack of rainfall in the summer and autumn months, as well as low levels of snowfall during the winter, especially in the Alps region (an essential area for the upper Danube’s watershed). This lack of precipitation causes navigation problems. For the river transport of “heavy and oversized pieces”, the vessels are loaded at the lowest draft. Since even the heaviest items transported by the river generally weigh up to 400 t, this weight is negligible from a draft point of view, since the carrying capacity of most vessels is in the 800 to 2000 tonnes range. This fact creates a good prerequisite for moving heavy and oversized goods from the roads to the waterways as far as possible.

3. Advantages of Routing Heavy and Oversized Pieces to Inland Waterways

The most critical parameters affecting the usability of inland river transport in the logistics of heavy and oversized goods include the navigability of the waterways, accessibility, and the height of the bridges. The navigability of the waterways must be considered concerning seasonality in terms of:

high water,

low water,

ice.

Despite their name, heavy and oversized goods do not necessarily imply a high-draft vessel. Compared to the bulk substrate, they occupy only a small portion of the vessel, so vessels loaded with this type of cargo generally have a low draft, which is beneficial, especially during low-water periods.

Bridges and their clearance height can present a significant problem and pose a challenge during high-water periods, especially for oversized pieces. The correct choice for loading is part cargo loading, where part of the vessel, in a separate loading compartment, is loaded with heavier, bulk cargo, and the other part, in a separate loading compartment, is loaded with oversized cargo. The vessel can also be suitably ballasted before and at the actual bridge underpass, which can also help with the underpass of lower bridges.

Inland rivers are generally navigable 24/7. The locks on the Danube also operate on a 24-hour basis, 7 days a week. This is where the most significant contrast can be seen compared to road or rail. There are no weekend, holiday, or night restrictions. The state authorities issue an official ban on navigation on certain critical stretches during extremely high water and flooding, a rapid rise in water levels and extreme flow, or the event of ice, but this is the exception rather than the rule [

8].

The loading or final unloading point is often not located along the waterway. In such cases, the goods must be reloaded, sometimes several times. For heavy and oversized goods, there are two ways of loading:

A RoRo ramp with suitable parameters for loading and unloading points limits horizontal loading. Also, the transport must be carried out using specially wheeled equipment. The vessel’s carrying capacity or load per square meter must allow the passage of wheeled equipment. Of course, river transport is slow; therefore, the wheeled equipment is blocked for several days, and in exceptional cases, it is blocked for several weeks. There is also the question of the reverse unloading wheeled equipment intended to transport heavy and oversized goods. Therefore, vertical loading using special crane technology is much more common.

Transporting heavy goods by water also has a positive environmental aspect that cannot be overlooked. In addition to lower emissions when comparing inland waterway transport with road freight transport, it is also necessary to consider the substantial decrease in transport routes (fewer kilometres) that waterways enable. This further enhances the importance of this mode of transport.

Since the entire transport sector accounts for 21% of total emissions, road transport accounts for approximately 15% of total CO2 emissions. Rail travel and freight emit very little—only 1% of transport emissions. Other transport—mainly the movement of materials such as water, oil, and gas via pipelines—is responsible for 2.2%.

4. Oversized Transhipment in the Port of Bratislava

Slovakia has a unique location in terms of the possibility of transhipment of oversized and heavy goods directly in the port of Bratislava, which is also known as the “heavy location”. It is located in the new section of the Bratislava port. The tri-modal location can service river vessels, railway wagons, and motor vehicles. As a rule, only enthusiasts and experts in river transport and inland navigation know this position is unique on the entire Danube. Its uniqueness lies in the fact that it allows the transhipment of heavy loads weighing up to 560 tonnes [

9].

From the technical point of view, there are two electric gantry cranes with main and auxiliary hoist type KSB of 300/50 tonnes from the manufacturer Královopolská strojírna n.p., Brno, in the heavy position. They were manufactured in 1988 and subsequently assembled in the port of Bratislava. Each crane has a lift of up to 280 tonnes; in tandem, they have a total lift of 560 tonnes. The cranes are operated from the cab or remote control [

10].

In

Table 2, 11 years (2014–2024) of annual transhipment volumes of heavy and oversized goods (in tonnes) of the port of Bratislava are analysed. Minimum volume: 5806 tonnes (2021), maximum volume: 12,679 tonnes (2024), mean volume: 8648 tonnes, standard deviation: ≈ 1927 tonnes (indicating moderate variability). The data shows high volatility with alternating peaks and troughs: growth years were 2016, 2019, 2022, 2024 and decline years were 2015, 2017, 2020, 2021, 2023. A sharp drop could be noticed in 2017 (−36% from 2016); meanwhile, a strong recovery was seen in 2019 (+44% from 2018). The port’s transhipment activity appears highly sensitive to macroeconomic conditions, infrastructure projects, and possibly global trade disruptions (e.g., COVID-19 from 2020 to 2021). The strong rebound in 2022 and 2024 suggests renewed industrial activity or strategic investments in logistics. The data shows a possible 2–3-year cycle of decline followed by recovery, though more years would be needed to confirm this pattern. Port authorities should anticipate and buffer against cyclical downturns.

For the period 1–6/2025, the transhipment volume of heavy and oversized goods in the port of Bratislava is 10,187 tonnes, i.e., the assumption taking into account all aspects of the goods in question for 2025 is 18,000 tonnes (

Figure 3):

In addition to the technical parameters, which clearly demonstrate the uniqueness of this technology and its ability to handle even the heaviest loads on the European waterway network, the commercial indicators of the heavy location are also important. The total volume these cranes handle cannot be compared with handling bulk substrates, volumes, or weights. Regular goods flows include various transformers and generators. Large-volume tanks, whether for the food or petrochemical industries, are also regularly transhipped. Over the previous decade, the volume of transhipment of wind power plants, whether complete or in parts (wind power towers, blades), has increased significantly. Oversized vehicles for special, remarkable construction work, rails, or aeronautical equipment are also fairly regular goods flows. Among the more unique transhipments are various technological units for constructing large production plants in Central Europe. This was the case for the construction of the production halls of the KIA and Hyundai car manufacturers near Žilina and Nosovice in the Czech Republic, respectively, but also parts of the rides of amusement parks bound for North America, which were produced in Slovakia and transhipped at this location in the port of Bratislava. The average annual volume expressed in tonnes and handled on the cranes specified above has been 7000–8000 tonnes/year for the last 10 years. The transhipment volume is relatively stable, and many heavy equipment partners use the heavy position regularly. It is one of the few segments with the potential for volume growth even during deep industrial and economic recession (see heavy transhipment volume).

5. Danube—Its Power and Importance

The Danube is part of the Trans-European Transport Network (TEN-T), which connects Central Europe with the Balkans and the Black Sea. Through its Danube ports, Ukraine has direct access to EU member states (Romania, Bulgaria, Serbia, Hungary, Slovakia, Austria, and Germany). This strengthens Ukraine’s economic integration into the European Economic Area. Before the war, Black Sea ports (Odessa, Mykolaiv, Chornomorsk) accounted for more than 60% of Ukraine’s exports. The blockade or threat to these ports reduced the country’s export capacity, causing logistical bottlenecks. The Danube ports (Reni, Izmail) have become key, safer gateways to international markets. The war has demonstrated that dependence on a single transport route (the Black Sea) is risky. The Danube thereby reduces the country’s vulnerability to blockades or attacks. The strengthening of the Danube routes increases Ukraine’s cooperation with the Danube Commission and Central and Southeastern European countries. A strategic link between Ukraine and the EU is being created via the Danube, which supports its European integration. The Danube is a possible security alternative for Ukraine during the war and a potential driver of economic growth after the war, as it will enable faster trade recovery, facilitate connection to the EU, and promote infrastructure development.

6. The Impact of the War in Ukraine on Industrial Production and Transport on the Danube

The Russian invasion of Ukraine on 24 February 2022 represents a historical turning point that fundamentally reconfigured Europe’s geopolitical and security architecture. Its consequences extend far beyond security and foreign policy, affecting the energy sector and, more broadly, the economic stability of the European Union. Within this context, logistics has emerged as a decisive factor: although often overshadowed by political and military considerations, it plays a critical role in maintaining the functioning of national economies, industrial enterprises, and international supply chains.

Before 2022, transport volumes between Ukrainian Danube ports and European Danube states were declining rather than increasing. This trend was driven by complex administrative procedures in Ukrainian ports (notably Izmail and Reni), rising transhipment costs, extensive bureaucracy, and frequent penalties, which discouraged carriers from utilising these facilities. The war radically changed this position.

Following the break of transport links with Russia and Belarus and the occupation or blockade of most Ukrainian sea ports, Ukraine lost direct access to the Black Sea and the Sea of Azov. Simultaneously, the destruction of key railway nodes and bridges further disrupted the transportation of goods and raw materials. Consequently, logistical flows shifted predominantly toward Western Europe, generating new opportunities and significant structural bottlenecks.

7. Availability of Transport Routes and Capacity of Logistics Hubs

The first quarter of 2022 brought uncertainty to the European industry, particularly for the metallurgical and engineering sectors, which rely heavily on Ukrainian raw materials. Initial fears regarding supply continuity were quickly replaced by congestion at border crossings with Slovakia, Poland, and Romania. By March, thousands of wagons were waiting for transhipment at critical transhipment points such as Čierna nad Tisou and Maťovce (

Figure 4), where capacities proved insufficient to accommodate sudden surges in demand. This situation has persisted, highlighting the structural limitations of transhipment infrastructure.

The restricted throughput of railways and terminals significantly stimulated demand for inland waterway transport. Previously considered a secondary logistics route, the Danube rapidly assumed a central role in exports from Ukraine. It became essential for shipments directed to Izmail and Reni and cargo transiting through Constanța, the largest Black Sea port linking maritime and inland navigation. The embargo on Russian coal further amplified demand, compelling European industries to diversify supply sources [

11].

8. Escalation of Input Costs

The war-induced energy crisis substantially increased operating costs across the logistics sector. The average price of diesel fuel rose from EUR 0.45 per litre in 2021 to EUR 1.10 in the summer of 2022, with prices in Austrian and German ports reaching EUR 1.20–1.30 per litre. Since fuel typically accounts for approximately 40% of direct costs in inland navigation, this escalation imposed an unprecedented financial burden [

12].

The rise in electricity costs was even more dramatic, as it powered port cranes and transhipment equipment. Compared to 2020, prices increased four to five times, intensifying volatility and raising overall logistics costs. Consequently, freight rates in inland waterway transport recorded the steepest growth in over a decade.

9. Port Capacity and Operational Constraints

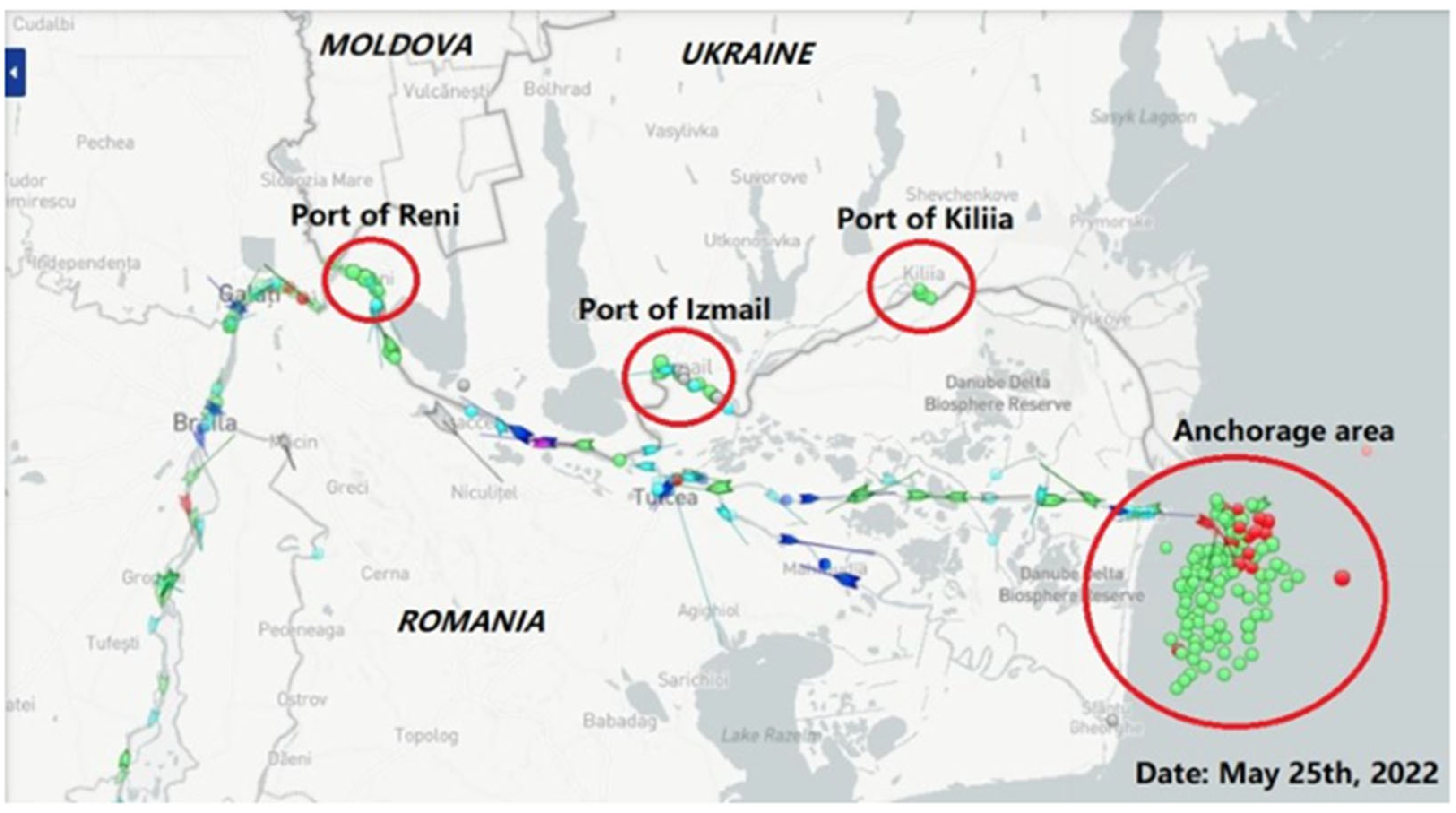

Port congestion became another critical challenge. Following the blockade of Ukrainian sea ports, Izmail and Reni emerged as key export hubs for grain, while Constanța absorbed most maritime cargo flows. This rapid concentration of volumes led to prolonged vessel waiting times (

Figure 5), extended turnaround cycles, and substantially increased transhipment and storage charges.

10. Ports of Bratislava and Komárno

In Slovakia, the ports of Bratislava and Komárno faced heightened demand, particularly from the steel industry. Owing to uncertainty regarding the continuity of Ukrainian supplies, enterprises shifted from lean inventory strategies to stockpiling, placing additional pressure on storage infrastructure. Ports responded by reorganising internal processes, expanding storage capacity, and investing in extra storage facilities [

14].

11. Availability of Crews

Human resources in inland waterway transport were equally affected. Ukraine traditionally provides the largest share of crew members in the Danube region, supported by its long-standing education system and extensive river and sea port infrastructure. By contrast, countries such as Slovakia have not trained new professional crews for nearly two decades.

The outbreak of war forced Ukrainian crew members into difficult choices: returning home with the risk of mobilisation or remaining abroad without seeing their families for extended periods. Border restrictions preventing the departure of men over 18 significantly hindered crew rotations, further complicating fleet operations. A partial alleviation came in mid-2022, when Ukraine permitted crew changes under the condition that vessels were engaged in grain transport from Ukrainian ports. Despite heightened risks and adverse insurance recommendations, this measure prompted many carriers, including Slovak operators, to redirect fleets to Izmail and Reni [

15].

The war in Ukraine has unequivocally demonstrated the irreplaceable role of the Danube within the European logistics network. Despite the “vis maior” situations—such as fluctuating water levels, seasonal flooding, or ice—the river continues to provide vital capacity for transport and port operations.

While the conflict has driven sharp increases in input costs and freight rates, cost is no longer the primary determinant of logistics decisions. Instead, the decisive factor has become the ability to ensure the execution of transport operations. This shift underscores the strategic importance of the Danube and highlights its potential for further development as a key artery of European inland waterway transport.

12. Post-Conflict Reconstruction of Ukraine, Possibilities of Using the Danube River

The conflict in Ukraine will one day come to an end, and then it will be rebuilt. Reconstruction will be a long-term affair involving the broad international community. In addition to structural, financial, and other reconstruction, industrial reconstruction will also be necessary. This is likely to involve various forms of heavy and extractive industry. Ukraine has a long tradition in mining and heavy industry, and during the conflict, it has rebuilt, directly or through its foreign partners, a relatively strong military production. These industries, of course, alongside massive construction activity and the rebuilding of the energy sector, will be the backbone of Ukraine’s reconstruction.

Ukraine is not a member of the EU and is therefore not subject to strict emission rules. This is a prerequisite for the interest of investors from EU countries to move their “more polluting production” to Ukraine or the Balkan region. We are still discussing heavy industry, which requires sophisticated logistics to establish, perhaps involving the movement of heavy and oversized machinery and equipment required to initiate production. This is an opportunity for the Central European countries bordering the Danube. It presents an opportunity to utilise the Danube waterway and its ports.

Of the Central European ports on the Danube waterway, the port of Bratislava, with its strategic location and the possibility of transhipping heavy and oversized goods up to a total weight of 560 tonnes, and the port of Linz, with the possibility of transhipping up to 600 tonnes, have great potential. Of course, other Danube ports also have the possibility of transshipping heavy and oversized goods, but their maximum capacity is not up to the level of Linz or Bratislava for the dismantling and assembly of various units, including the option for storage. This extends the logistical possibilities and critical point throughput, with the potential to utilise the Danube River and inland waterway transport.

The Danube will play a key role in the post-war reconstruction of Ukrainian industry. It is the most convenient route for transporting bulky industrial goods, such as steel, coal, building materials, and fertilisers, which will be essential for the country’s reconstruction. The Danube ports, especially Reni and Izmail, facilitate the export and import of industrial products, thereby reducing direct dependence on Black Sea ports, which remain vulnerable. Thanks to its connection to the European TEN-T, Ukraine is developing opportunities to integrate more quickly into the European industrial chain [

16]. The Danube will thus support the integration of Ukrainian producers into EU markets and reduce logistics costs. At the same time, the development of port and transport infrastructure in the southern regions will bring new investment and job opportunities. Navigation on the Danube will strengthen the stability of supply chains and enable more efficient exports of key raw materials. It will provide a reliable and safer channel for foreign trade for industrial companies. Ultimately, the Danube will become one of Ukraine’s industrial renewal pillars. This will contribute not only to economic growth but also to the long-term modernisation of the economy.

The catchment area for importing such heavy and oversized goods to the ports of Linz and Bratislava is quite wide. It includes production from:

From these countries (mainly), oversized production is already heading to Bratislava and Linz and then upstream or downstream along the Danube to final destinations in Europe or overseas (

Table 3). In terms of specific types of goods that could be directed to Ukraine from a post-conflict reconstruction perspective, combined with the difficult locations in Slovakia and Austria, one can include:

substations, generators, and turbines,

presses, production machinery, and equipment,

power plant components,

mining machinery and equipment.

Ukraine has two relatively large river ports on the Danube, which have been frequently used with large volumes in recent years for inland river navigation towards the EU Danube countries: the port of Izmail and the river-sea port of Reni, located on the border with Romania. Although these ports are mainly used for bulk commodities such as iron ore, coal, and coke, they are also of great importance for the transhipment of grain (at the time of the massive shelling of Odessa, this was the only export route for Ukrainian grain). They also served to tranship liquid goods (Reni). Relatively good logistics in the form of road and rail connections and, in the case of the port of Reni, the possibility of docking and servicing smaller naval vessels predestined these ports as a transhipment point for heavy and oversized items (also) from Central European countries as part of the post-conflict reconstruction of Ukraine and its industry (

Table 4):

Inland navigation on the Danube presents Ukraine with a strategic pathway for post-conflict industrial recovery, facilitating the movement of heavy goods, supporting EU integration, and advancing sustainability goals through greener transportation. Fragmented data and the high geopolitical and climate risk uncertainty constrain the analysis. Nevertheless, strengthening Danube infrastructure and logistics can make it a cornerstone of Ukraine’s economic renewal and long-term European integration.