3.1. Theoretical Justification

The neoclassical framework established by Solow [

7,

8] and its extensions by Mankiw, Romer, and Weil [

18] distinguish between physical and human capital as fundamental drivers of growth. However, subsequent empirical research has demonstrated that productivity is also shaped by the quality of infrastructure, connectivity, and trade facilitation mechanisms [

20,

21,

22]. Logistics systems —hereafter conceptualised as logistics capital (Q), a stock of infrastructural and institutional assets that accumulate over time—reduce transaction cost, enable participation in global value chains, and improve the marginal productivity of both physical and human capital.

Certain regressors—physical capital, human capital, and the disaggregated LPI components—were treated as endogenous because reverse causality with income growth is plausible: higher income can itself stimulate infrastructure investment and logistics improvements. Institutional variables and population growth were treated as exogenous on the grounds that their short-term feedback from income growth is limited, a distinction consistent with standard dynamic panel specifications in the convergence literature [

14,

30]. This approach ensures that the estimation properly accounts for potential endogeneity biases while maintaining theoretical coherence with established growth and convergence frameworks.

In this sense, logistics can be conceptualised as a distinct form of productive capital: like physical capital, it requires continuous investment in ports, airports, and information technologies; like human capital, it enhances efficiency by coordinating supply chains and enabling knowledge diffusion; unlike either, logistics capital is inherently relational, creating network externalities that extend beyond national borders.

Recent studies have adopted similar approaches, treating infrastructure or logistics performance as a capital-like input with cumulative effects on growth. For example, ref. [

22] identified port logistics as a mediating factor between investment and GDP growth, while [

23] demonstrated that logistics performance moderates the productivity of capital in developing countries. Building on this literature, logistics capital (Q) is defined as the stock of logistical assets and capabilities that accumulate through both tangible investments and institutional improvements.

The σ and β convergence framework is incorporated into the logistics-augmented model so that the effect of improvements in logistics capital on income convergence can be tested.

3.3. Linking Logistics Dimensions to Output

To better capture the dynamics of economic growth that include logistical factors, an endogenous growth model is proposed and expressed in per-worker terms as the following dynamic equation:

where

is the growth rate of GDP per worker for country i in period t,

captures convergence dynamics

and are, respectively, physical and human capital per worker

are the components of logistics capital as derived from the LPI (see

Section 4.2 for definitions)

is the error term

By modelling as a composite of these dimensions, we capture the multifaceted ways in which logistics performance interacts with other growth determinants. Importantly, this disaggregation also enables us to test whether specific bottlenecks (e.g., customs inefficiency, shipment delays) exert negative effects even when other logistics components are strong. Each of these variables can influence economic growth differently, and their inclusion in the model allows for a more detailed and nuanced analysis of the impact of logistics on growth.

To evaluate the impact of logistical and infrastructure factors on economic growth, panel data models are employed. These models allow control over unobserved variables that vary between individuals but not over time, providing consistent estimates even in the presence of unobserved heterogeneity.

Equation (5) needs to be dynamized to provide a growth equation incorporating the various logistical components, suitable for estimation using panel data, as follows:

Equation (6) will be estimated using a fixed effects model. This model assumes that unobserved individual differences are correlated with the explanatory variables, allowing control over these constant individual effects over time. Subsequently, it will be estimated with a random effects model, which assumes that individual differences are random and not correlated with the explanatory variables, enabling the generalisation of results beyond the studied sample. The Hausman test will then be performed to select between the models. Finally, the estimation strategy will employ the Generalised Method of Moments (GMM) to address issues of endogeneity and heteroskedasticity in panel data. This method provides robust estimates by using appropriate instruments and is particularly useful when the explanatory variables are correlated with the error term, which could bias the estimators of fixed and random effects models.

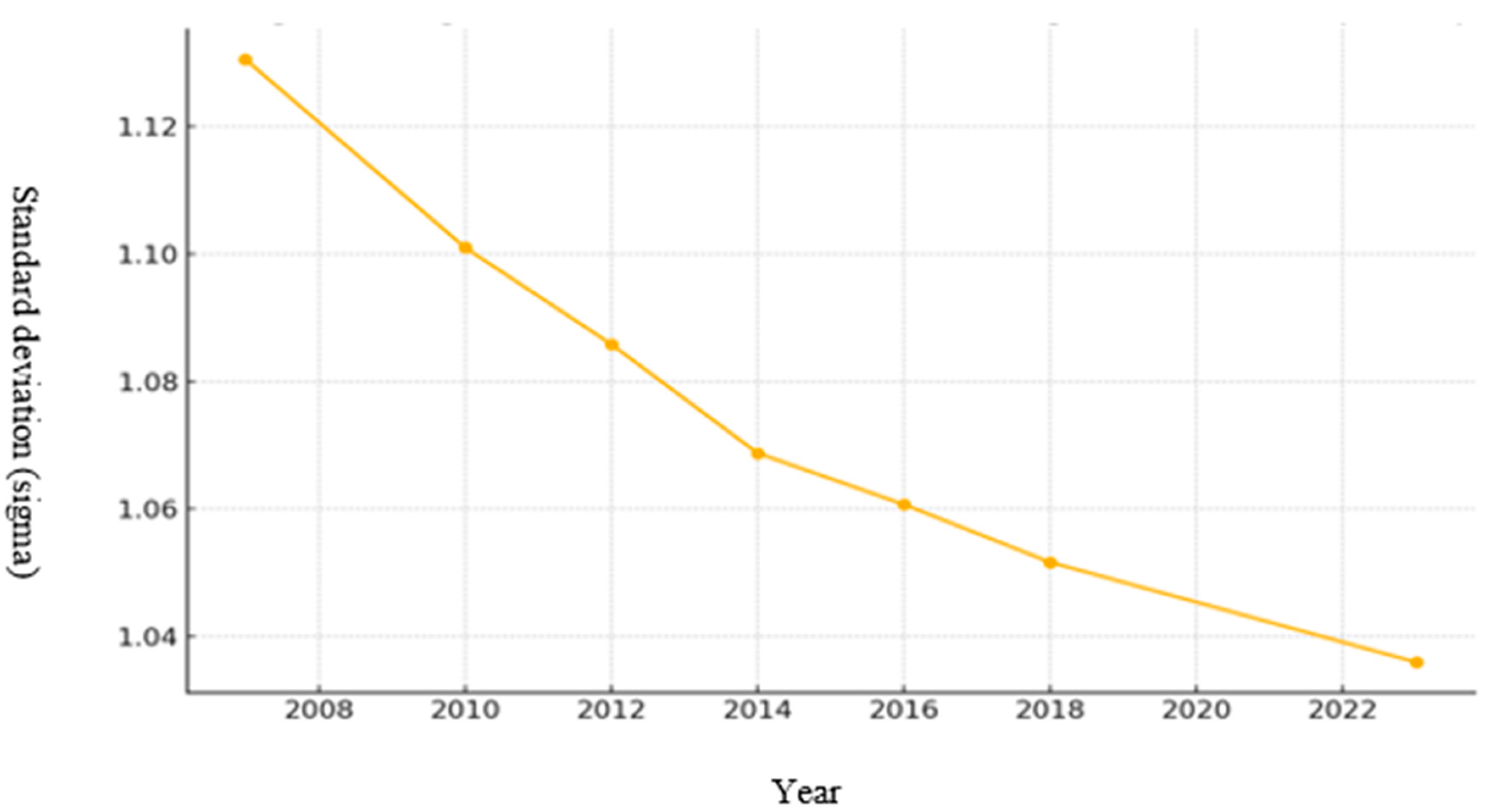

Convergence σ refers to the reduction in the dispersion of per capita GDP among countries over time. It is measured by observing the standard deviation of the logarithm of per capita GDP in a group of countries. If the standard deviation decreases over time, sigma convergence is said to occur, indicating that income level differences among countries are diminishing.

Mathematically, σ convergence can be expressed as:

where

is the logarithm of the per capita GDP of country i in year

,

is the average logarithm of per capita GDP of all countries in year

, and N is the number of countries.

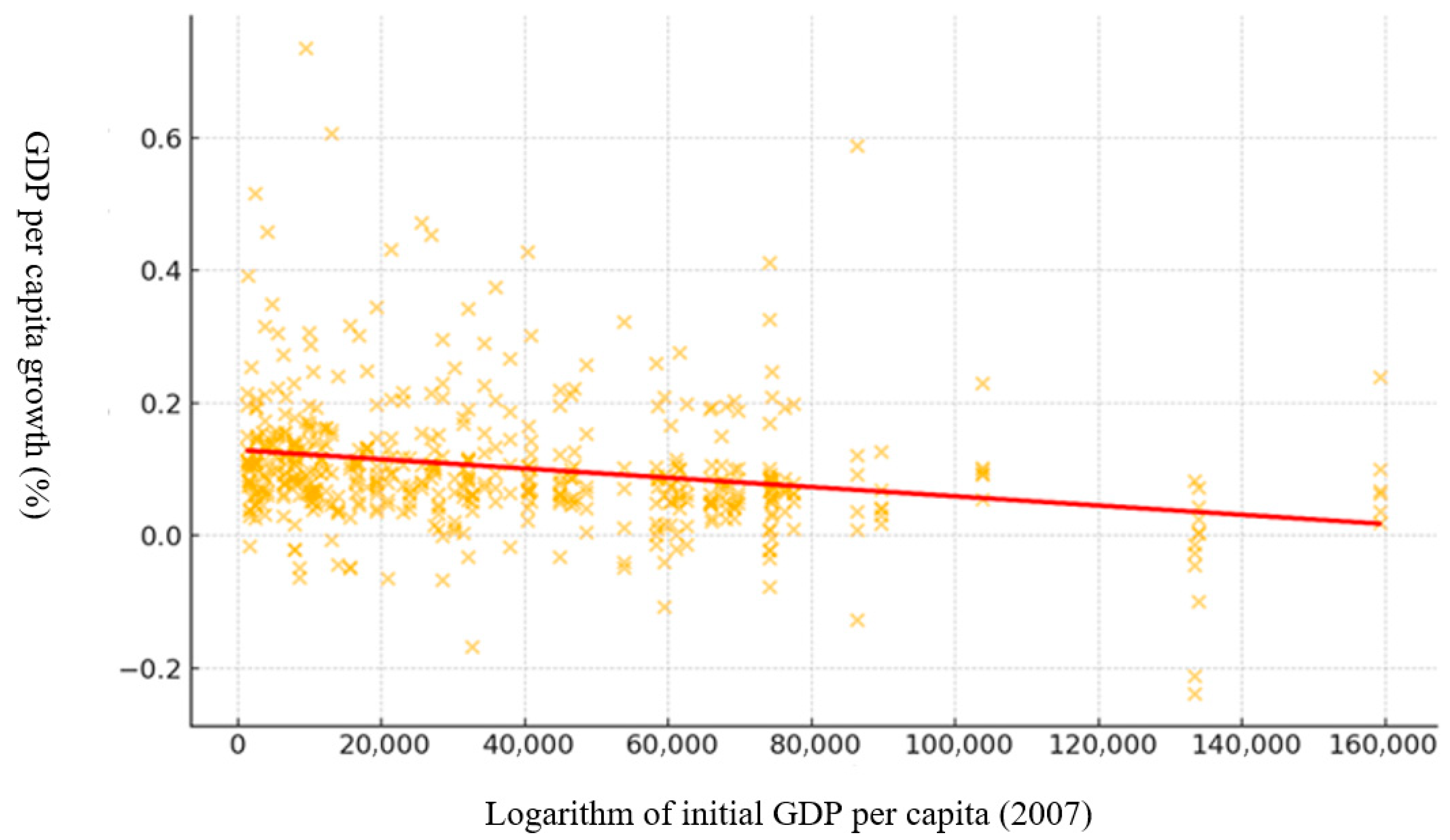

Convergence β refers to the tendency of poorer countries to grow more rapidly than richer countries, suggesting that countries with lower initial levels of per capita GDP are catching up to those with higher levels. β convergence is estimated by regressing the growth of per capita GDP on the initial level of per capita GDP. If the coefficient of the initial variable is negative and significant, it provides evidence of β convergence.

The typical regression equation for

β convergence is:

where

is the growth of the logarithm of the per capita GDP of country

i over period

t,

is the initial logarithm of the per capita GDP of country

i, and,

is the error term. A negative

β coefficient indicates

β convergence.

The theoretical framework established in this section provides a solid foundation for the empirical analysis of the impact of infrastructure and logistics on economic growth. By integrating the concepts of sigma and beta convergence with both traditional and endogenous economic growth models and incorporating logistical factors, this study aims to offer a deeper and more nuanced understanding of global economic growth dynamics.