1. Introduction

Digitalization and disruptive technologies are changing innovative international business tendencies from conventional businesses to digitally transformed businesses. Such technologies are vastly influencing Supply Chain Finance (SCF) and its global application. SCF is an emerging research field and an important source of competitive advantage. SCF provides a complete solution for financial management matters in the supply chain as it assists buyers and suppliers in managing their working capital. Suppliers also benefit from using trade credits as it permits them to schedule the payments on their favorable dates without disturbing the firm’s cash flow [

1].

Additionally, buyers who utilize SCF may obtain numerous advantages, such as extending the due dates for payment, as it allows faster cash access to suppliers to manage the working capital. SCF is important in expanding vendors’ liquid assets and working capital to increase business effectiveness, where buyers benefit from delayed payouts [

1]. Therefore, SCF is believed to offer efficient cash flow management solutions to maintain the relationship between different suppliers and financial institutions in the supply chain. For instance, SCF works as a “factoring reversal”, allowing buyers to make early payments of their trade credits to the suppliers. However, the buyer or supplier must assess their relationship with financial institutions, whether they are high or low-risk customers [

2,

3].

Traditional supply chain financing models, such as factoring, reverse factoring, and trade credit, have long served as essential mechanisms for enhancing liquidity and optimizing working capital across supply chains. These conventional practices rely heavily on manual processes, paper-based documentation, and third-party financial institutions that assess creditworthiness through historical financial data and static risk models [

4]. While effective to a degree, these models often suffer from issues of limited transparency, time-consuming approval processes, and asymmetric information that can disadvantage smaller suppliers with weaker bargaining power.

In contrast, AI-blockchain-based SCF models leverage distributed ledger technologies and intelligent analytics that enhance visibility, traceability, and trust across supply chain stakeholders. Artificial Intelligence (AI) enables real-time credit evaluation based on alternative data sources, predictive modeling, and risk profiling, allowing more inclusive financing decisions. Moreover, blockchain guarantees data immutability, auditability, and shared access to transactions, therefore reducing the necessity for intermediaries and potential fraud [

5].

Despite the growing body of research exploring the impact of firm capabilities, resources, AI, and blockchain technology on supply chain financing, the role of trust remains unexplored in the Jordanian context. Previous studies have focused primarily on the individual effects of these elements rather than their combined impact on supply chain financing, with blockchain technology and trust serving as moderators, leaving room for further investigation. By addressing this research gap, the study aims to expand the understanding of how firm capabilities, resources, and AI influence supply chain finance decision-making and explore these relationships, thereby contributing to the existing literature and offering valuable insights for practitioners seeking to optimize their supply chain financing operations. Considering the gaps, this study aims to answer the following research question:

RQ1 “How do firm capabilities/resources and artificial intelligence affect supply chain finance through the mediation of blockchain technology and trust as moderator?”

While this study provides valuable insights into supply chain dynamics within the Jordanian context, it is important to acknowledge that the findings are shaped by the country’s specific socio-economic conditions. Jordan’s limited resources, import dependence, and distinctive regulatory and labor market structures present characteristics that differ significantly from those of larger or more industrialized economies. These factors may influence the applicability of some conclusions to other regions, particularly in global supply chains that span more diverse economic environments. Therefore, the study’s scope is context-specific, and readers should interpret the results with this in mind.

2. Literature Review

Supply chain finance refers to the use of financial instruments, practices, and technologies to optimize the management of working capital and liquidity in supply chain processes for collaborating business partners [

6]. It aims to integrate the flows of information, logistics, and funds within the supply chain, transforming the risks of individual enterprises into controllable risks for the entire chain [

7]. This finance service mode focuses on the trading process rather than bank credit, providing comprehensive finance services with minimal risk, especially for companies that face difficulties in accessing traditional finance institutions [

8,

9]. Supply chain finance can help eliminate obstacles of information asymmetry between banks and enterprises, can improve the core competitiveness of commercial banks, and is able to bring new profit growth for both banks and third-party organization enterprises [

10]. SCF expands the traditional scope of supply chain management by incorporating the flow of financial resources, aiming for efficient capital flow and availability where needed [

11].

SCF faces challenges such as information imbalances, restricted capital flow, and operational inefficiencies that hinder flexibility and competitiveness within supply chains. As the number of participants in the supply chain increases, a trust gap emerges among enterprises, especially between core enterprises and lower-tier suppliers, leading to a breakdown of trust. Overcoming these challenges necessitates a strategic approach, effective communication, technical innovation, and collaboration among all stakeholders involved in supply chain finance. Furthermore, effective communication is essential for nurturing trust in supply chain financing through fostering open channels of communication and sharing information in real-time through AI-powered platforms, stakeholders can build stronger relationships based on transparency and accountability [

12].

Blockchain is a cutting-edge, decentralized, and distributive technology that guarantees all transactions and data privacy, availability, and integrity [

13]. It may bring improvement to the existing practices of firms, such as enhancing the security, trust, and transparency of various business procedures [

14]; AI and blockchain technologies are both complementary to each other by their design and to unlock their true potential, these two must be integrated [

15].

In supply-chain finance, blockchain builds trust between the concerned partners responsible for managing the rolling stocks. Regardless of the known importance of blockchain technology from a financial perspective, it still requires novel contributions to advance the field. Blockchain technology comprises of few key attributes: it is secure, indelible, coordinated, distributed, and sustainable; consensus-based, transactional, and transparent, among other attributes [

16], as blockchain technology works with a distributed set of databases that are controlled by persons who manage the relevant information. Blockchain technology is divided into three forms: private, public, and consortium blockchains; these categorizations are based on several factors like transaction, speed, ownership, security, and access rights [

17]. Therefore, existing studies [

16,

18] assert that blockchain technology instigates trust in financial transactions and allows one to make decentralized decisions.

The study of AI focuses on developing or programming computers to mimic human intelligence [

19]. When applying AI, it connects SCF networks and fosters digitalization in various supply chain practices such as digital material management, technology-enabled cash flows, and automatic networking among stakeholders to meet customer expectations [

20]. Incorporating innovations in the supply chain management domain provides the basis for AI implementation and the advantages of advanced data analytic instruments comprising intelligent networking systems [

21]. AI has been available for decades, although not fully utilized, particularly in the supply chain management context worldwide [

22]. Therefore, AI has large potential in the financial sector as it may provide enhanced customer experience, reduce operating and business costs, and allow firms to exploit new markets.

Moreover, it is vital to integrate evolving technology such as green cloud multimedia networking and AI, as these provide reflective implications for enhancing organization, trust, and capabilities through blockchain integration [

23]. Green cloud multimedia encourages energy-efficient resource allocation by eliminating hardware dependencies and enabling dynamic infrastructures, which is essential for an organization to maintain sustainability [

24]. AI enables ideal traffic management and real-time decision-making, which are significant for resource optimization and planning coordination in complex supply networks [

25]. These innovations collectively strengthen firm-level capabilities and inter-organizational trust, unleashing the transformative potential of AI and blockchain in supply chain financing.

Emerging technologies are reshaping the context of SCF and logistics. The Internet of Things (IoT) assists real-time data exchange and system visibility across stakeholders, allowing automation of inventory management, order tracking, and financial settlements. These capabilities permit firms to make informed, data-driven financial decisions, improving liquidity and mitigating transaction risk [

26].

Building on the IoT, the Software-Defined Internet of Things (SD-IoT) introduces a network architecture where control logic is decoupled from data transmission, allowing for agile reconfiguration and centralized orchestration. This flexibility is important in dynamic supply chains where financial conditions or logistical demands change rapidly. In tandem, QoS-aware SD-IoT frameworks are being developed to ensure performance metrics such as latency, throughput, and reliability guaranteeing that time-sensitive financial data are transmitted and processed with minimal disruption [

27].

Moreover, the Software-Defined Internet of Multimedia Things (SD-IMT) extends these capabilities to include real-time multimedia communication within supply chains. Multimedia monitoring tools such as warehouse surveillance, cargo condition monitoring, or vehicle dashcams contribute to enhanced transparency, security, and compliance assurance, all of which are critical aspects in SCF environments where creditworthiness and operational visibility are intertwined [

28]. Additionally, smart transportation systems are also evolving through the Software-Defined Internet of Vehicles (SD-IoV), which enables Vehicle-to-Network (V2N) streaming for location tracking, environmental sensing, and vehicle diagnostics. Streaming capabilities facilitate live decision-making for fleet rerouting, load balancing, and just-in-time delivery, thus influencing financing decisions tied to delivery timelines and cargo integrity [

29].

Furthermore, Fog-IoT systems are supporting data processing, reducing response times and bandwidth demands. By integrating Artificial Optimization (AO) techniques and the Whale Optimization Algorithm (WOA), Fog-IoT systems support dynamic scheduling, load balancing, and resource allocation. These optimizations are valuable for decentralized financial tasks such as localized credit scoring or vendor performance evaluation [

30].

At the same time, it is necessary to take into consideration the potential biases in AI models and data privacy concerns arising from large datasets. Although AI systems are capable of detecting biases if trained on unreliable or skewed data, it may lead to unfair decision-making processes in SCF applications [

31]. In addition, data privacy is critical, particularly in financial transactions, where sensitive information must be protected in compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) [

32]. Therefore, employing approaches such as bias detection, correction techniques, and robust security measures, including encryption and access controls is crucial to mitigate these risks and maintain trust across the blockchain-enabled SCF ecosystem [

33].

Moreover, AI and blockchain may also encounter critical regulatory and legal challenges. The nature of Blockchain disputes regulations such as the EU’s GDPR, which mandates data elimination that is incompatible with blockchain’s immutability [

34]. Additionally, compliance with Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations remains challenging on decentralized platforms, especially in cross-border SCF operations [

35]. Addressing these legal complexities is essential for scaling blockchain-based SCF solutions effectively and securely.

Trust consists of cognitive processes and communication patterns among supply-chain members. It is the dyadic relationship between trustee and trustor, where the trustor evaluates whether to trust or not. Trust affects the nature of relationships, such as privacy levels, security concerns, and purchase intentions [

36]. Also, the adoption of disruptive technologies like blockchain in the supply chain may derive trust from the image and reputation of their intermediary network [

37].

Trust plays an essential role in supply chain financing; it serves as a foundational element that underpins successful collaborations and transactions among various stakeholders. According to some scholars [

38], trust is essential for fostering cooperation, reducing transaction costs, and mitigating risks in supply chain financing. Establishing trust is crucial for enabling efficient financial flows and ensuring the smooth functioning of supply chains. Therefore, building and maintaining trust in the context of AI and blockchain technology involves several key strategies. Firstly, transparency plays a vital role in enhancing trust within supply chain financing processes. By leveraging blockchain technology, stakeholders can access real-time, immutable records of transactions, thereby increasing transparency and reducing the likelihood of fraud or errors [

39]. Additionally, the use of AI algorithms can help analyze vast amounts of data to identify patterns and anomalies, further bolstering trust by enhancing decision-making processes based on accurate insights [

40]. These technological advancements not only streamline operations but also contribute to building trust among participants in the supply chain ecosystem.

Furthermore, continuous communication and collaboration are essential for nurturing trust in supply chain financing. By fostering open channels of communication and sharing information in real time through AI-powered platforms, stakeholders can build stronger relationships based on transparency and accountability. Maintaining trust requires a proactive approach to addressing issues promptly and effectively, thereby demonstrating reliability and commitment to ethical business practices [

41]. By integrating firm capabilities, resources, AI, blockchain technology, and trust into supply chain financing practices, organizations can unlock new opportunities for growth, innovation, and sustainable partnerships in an increasingly interconnected global marketplace.

Building and maintaining trust among stakeholders in supply chain finance faces several common challenges. One challenge is the lack of shared trust, which can hinder the implementation of precise data and smart business operations [

42]. This lack of trust can lead to difficulties in data sharing and impact management choices [

43]. Another challenge is the need for transparency in the flow of goods, which requires accurate and timely information accessible to all stakeholders [

44]. Additionally, the use of traditional consensus algorithms in blockchain technology has limitations on the nodes’ ability to agree, posing a challenge to trust. Trust is both a challenge and a prerequisite, as it is necessary to build confidence and enable seamless and secure data sharing. Therefore, decision-makers need to employ various strategies for enhancing trust in supply chain finance including the use of blockchain technology [

12]. Blockchain-based solutions provide a secure and transparent platform for sharing information and conducting transactions, which helps to build trust among supply chain partners [

45]. Moreover, the implementation of smart contracts can help solidify payment paths and control risks, further enhancing trust in the supply chain [

41].

5. Methodology

The researchers strategically selected targeted participants according to purposive criteria, ensuring relevant and adequate insights aligned with the study objectives. Purposive sampling involves selecting participants based on specific characteristics or criteria relevant to the research objectives [

106]. Specifically, participants were mandated to hold pertinent industry expertise in domains such as supply chain management, finance, technology, or intricately linked sectors. The purpose of this criterion was to guarantee that participants were able to provide well-informed viewpoints and valuable insights into the subject of study. Furthermore, the study placed significant importance on the selection of participants who were actively engaged with or possessed expertise in emerging technologies, including artificial intelligence and blockchain. These technologies were considered essential elements of the investigation conducted in the study. Moreover, persons currently working in Jordanian startups or research institutions actively involved in the creation or application of innovative technologies in several domains were given priority. The inclusion of this contextual criterion was considered crucial to attain significant insights and views that are pertinent to the research subject. Therefore, to foster a thorough comprehension of the study setting, the inclusion criteria placed emphasis on a wide array of professional backgrounds. The study sought to obtain a comprehensive understanding of the intricate dynamics involved in the integration of supply chain finance and technology by involving specialists from diverse sectors such as technology, finance, and supply chain management.

Furthermore, this study used a combination of snowball sampling and purposive sampling methods because there was no specific sample frame for the intended respondents. Snowball sampling is a method that entails the initial identification of a select group of participants who satisfy the study’s inclusion criteria [

106]. Subsequently, these individuals are requested to provide referrals for more potential participants who also satisfy the same criteria. This approach enables the discovery of supplementary responders by means of referrals from current participants, thus augmenting the sample size. The study sought to recruit respondents who fit the specified criteria by combining these two sampling procedures, even though there was no pre-defined sample frame. This methodology assisted the process of identifying and incorporating people who possess pertinent expertise, experience, and viewpoints that are essential for effectively addressing research inquiries.

Accordingly, the survey link, created using Google Forms, was disseminated to the target participants through email and various social media platforms, such as LinkedIn and Facebook. This multi-channel strategy was employed to broaden the survey’s reach and enhance its accessibility to potential respondents (see

Appendix A). Each participant was required to provide prior consent before completing the questionnaire, ensuring compliance with ethical standards and data privacy regulations. As a result, a total of 362 completed questionnaires were received from respondents. After excluding 13 questionnaires due to missing data, the remaining 349 validated responses were utilized to analyze the proposed model and draw conclusions from the study. The necessary sample size was determined using G-Power software 3.1.9.7, with parameters set to 0.95 power, 0.05 alpha level, 0.15 effect size, and four predictors, resulting in a minimum requirement of 129 participants. In this study, the actual sample size (349) exceeded this minimum requirement of 129, alleviating concerns about sample size appropriateness.

This research adopts the questionnaire of firm capabilities and resources from the study of Carmeli and Tishler encompassing managerial capabilities, human capital—two items, auditing abilities—two items, organizational culture—four items, communication—two items, and firm reputation—two items [

107]. For blockchain technology, from [

84] were taken 14 items covering six of its important characteristics, namely transparency, tracing, authentication, security, unchangeability, and decentralization [

83,

108,

109,

110]. This study adopted the questionnaire developed by [

111] as it explained the importance of artificial intelligence in the supply chain finance context to investigate the scope of AI in supply chain finance. The four-item scale for measuring supply chain finance was adopted from [

112]. Trust is understood as a matter of honesty and benevolence of members and lies in a firm’s belief in its partners’ benevolence and honesty [

113]. The study adopts a ten-item scale. The first five items evaluate the partner’s honesty, truthfulness, and reliability level, and the next five consider the firm’s interest or welfare. Ten experts validated the scale while the scale’s Cronbach’s alpha was 0.782.

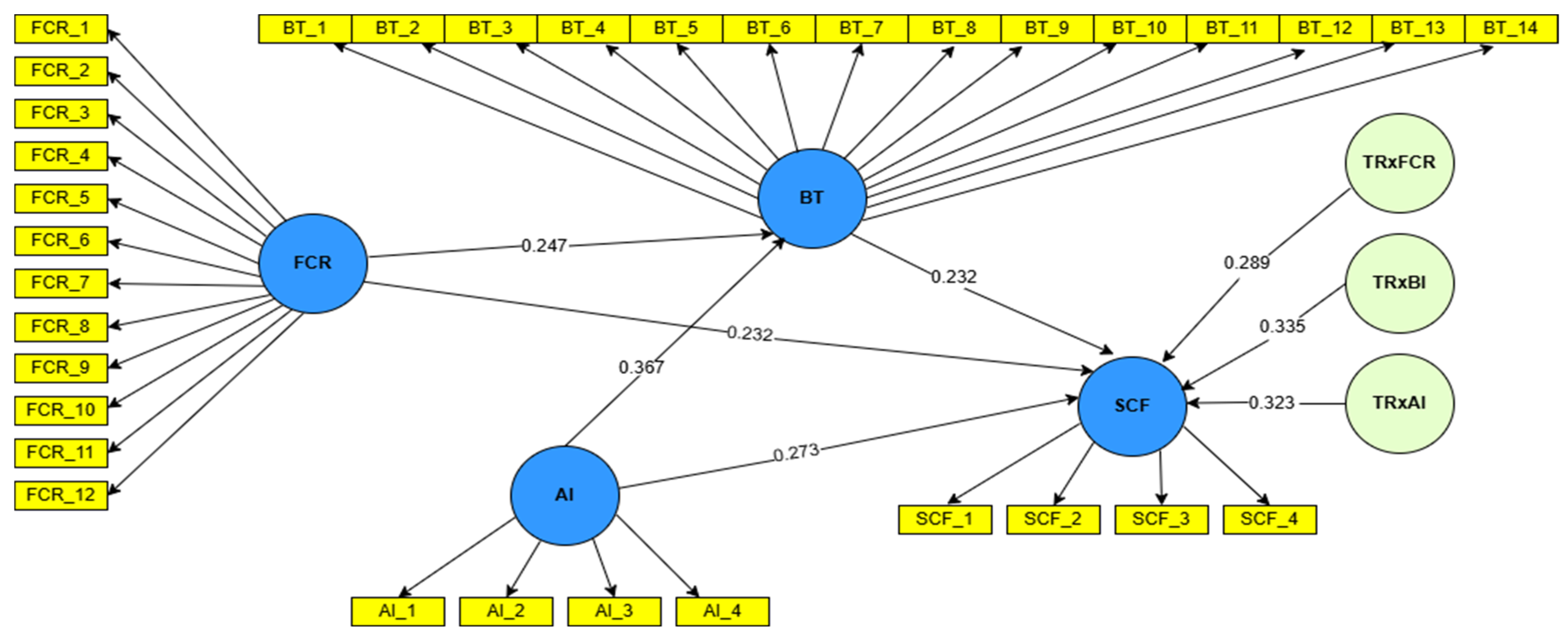

Figure 1 presents the study’s structural model.

Data Analysis Approach

As highlighted by [

114], verifying data distribution is crucial, as certain analytical methods may be incompatible with non-normally distributed data. Utilizing Mardia’s multivariate normality test to assess multivariate data normality, the analysis indicated that both multivariate skewness (22.32) and kurtosis (175.18) exceeded the standard cut-off, confirming non-normality. Consequently, Partial Least Square-Structural Equation Modelling (PLS-SEM) proved ideal for evaluating data in this study due to superior reliability and robustness with small samples versus Covariance-Based SEM (CB-SEM), offering comparable statistical power [

114]. This advantage is considered significant, particularly given the nascent nature of the AI, blockchain, and supply chain finance fields, which, in the context of the study, have received limited research and have a small pool of familiar users. However, despite these challenges, diligent efforts were undertaken to meet the requirements of PLS-SEM. However, researchers should still adhere to sample size recommendations provided by guidelines such as those outlined [

115]. PLS-SEM also does not require the assumption of normally distributed data and is resilient to skewness (which is the case with this study) [

116]. Additionally, PLS-SEM is capable of handling complex models with numerous observed variables, often avoiding convergence issues and maintaining robustness. For this study, SmartPLS software [

117] was utilized to conduct the two phases of Structural Equation Modeling (SEM) analysis, encompassing measurement model and structural model assessments.

8. Discussion

This research extended evidence on supply chain finance using a sample of Jordanian firms. The study discussed the effect of firm capabilities and resources and artificial intelligence on supply chain finance through blockchain technology, assuming the substantial potential for improving supply chain financial practices in Jordanian firms. The findings confirm the positive impact of artificial intelligence and firm capabilities and resources and blockchain technology on supply chain finance (H1, 2, 3, 4, 5) are found consistent with existing studies, e.g., [

21,

127,

128,

129]. Supply chain finance is a capital approach that eases the financing terms between all members and lowers their financial risks. The firm’s capabilities and resources supporting the implementation of blockchain technology might be useful prerequisites for making supply chain finance decisions.

This implies that companies with stronger capabilities, resources, and utilization of AI tend to have better performance in managing their supply chain finances. Furthermore, utilizing blockchain technology can positively influence the efficiency and effectiveness of financial transactions within supply chains in Jordan.

The results also confirm the partial mediation between the proposed relationship (H6 and H7). This is consistent with prior research [

72,

84]. The mediation of blockchain technology confirms the authenticity, security, and accuracy of supply chain finance information, thus adding robustness and richness in managing supply chain relationships, particularly with financial partners. The study offers a model for Jordanian firms to overcome the problems in the traditional supply chain finance system. For example, there is ample evidence the supply chain finance sector is facing problems like redundancy delays, ineffective communication among supply chain members, and lack of trust between member firms. However, the model proposed in this research has the potential to address these supply chain finance problems in Jordanian firms. Therefore, the mediation indicates that leveraging blockchain technology in supply chain finance processes serves as a mechanism through which the effects of firm capabilities/resources and AI are transmitted. Blockchain enhances transparency, traceability, and security in supply chain transactions, potentially amplifying the positive impacts of firm capabilities/resources and AI on supply chain finance efficiency and effectiveness. Consequently, firms with stronger capabilities/resources and AI utilization can further optimize their financial processes by adopting blockchain solutions, leading to enhanced trust, reduced transaction costs, and improved overall performance.

Moreover, trust was found to be a moderator in the study, H8 (a, b, c), which is consistent with previous studies [

130]. Therefore, the study believes that degrees of trust in the supply chain context have a greater improvement potential for the supply chain financing opportunities between partner firms and financial institutions. This implies that the level of trust among supply chain partners influences how firm capabilities/resources and technology adoption (blockchain and AI) impact supply-chain finance outcomes. Furthermore, trust acts as a facilitator that strengthens the linkages between firm capabilities/resources, technology adoption, and supply chain finance. Higher levels of trust enhance collaboration, information sharing, and risk-sharing among supply chain partners, thereby amplifying the positive impacts of firm capabilities/resources and technology adoption on supply chain finance performance. The study suggests that the firm’s capabilities and resources in integration with blockchain technology instigate mutual trust in the supply chain finance network and allow it to make secure and timely transactions that facilitate decentralization in the Jordanian firm’s context.

Blockchain technology provides a great opportunity for transforming SCF. Nevertheless, its scalability and performance characteristics should be censoriously addressed. Transaction speed in public blockchains may lead to slower transaction processing times especially proof of work compared to traditional financial systems [

131]. In addition, the high energy consumption associated with certain blockchain protocols may raise concerns about environmental sustainability in its adoption in SCF [

132]. Security is another hurdle where blockchain may experience vulnerabilities to cyberattacks when handling massive transactions [

133].

Accordingly, the study highlights the interconnectedness of firm capabilities/resources, AI, blockchain technology, trust, and supply chain finance within the context of Jordan. These findings underscore the significance of technology adoption and trust-building initiatives in optimizing supply chain finance processes and driving business performance.

10. Limitations

Given the research aims and scope, this study has limitations that offer opportunities for future research. This study examined the role of firm capabilities, resources, and AI in SCF considering blockchain technology and trust. However, it does not address other perspectives, such as political strategies and firm policies. Similarly, the sample during the data collection process targeted startup firms in Jordan, future researchers are suggested to examine the model in other contexts. Also, the number of respondents (362) may not have been a proper representation of the target population.

Although the study provides empirical evidence from Jordan’s supply chain context, caution should be taken in generalizing the findings. Jordan’s unique socioeconomic indicators may affect the broader applicability of some results particularly those related to hypotheses that firm capabilities/resources positively influence blockchain technology (H3), blockchain technology positively influences supply chain finance (H5), and trust in supply chain networks affect how firm capabilities, blockchain technology, and other factors influence supply chain finance (H8), which are more sensitive to national-level development factors, market scale, or infrastructure capacity. These results may differ in countries with contrasting economic profiles, and further cross-country validation is recommended.

Similarly, as all the quantitative research data were collected online, there was an inevitable lack of environmental control and consistency for the respondents as they were completing the surveys. Additionally, due to the limited outcomes of this type of research, in-depth research is needed to address the gaps that this research was unable to address thoroughly. Moreover, this study did not consider the financial impact of implementing AI technologies, which presents an interesting area for future research.