1. Introduction

Factory logistics encompasses the planning, implementation, and control of the efficient flow and storage of raw materials, work-in-progress inventories, finished goods, and related information within a manufacturing facility. It plays a crucial role in optimizing production processes, reducing costs, and enhancing overall operational efficiency [

1,

2].

This field has garnered significant attention in recent years due to its profound impact on operational efficiency, cost reduction, and overall competitiveness in the manufacturing sector [

3]. The importance of effective factory logistics is multifaceted, contributing to streamlined production processes, reduced waste, improved quality control, and enhanced flexibility in responding to market demands. Recent trends in factory logistics reflect the broader shift towards Industry 4.0, with the increasing integration of smart technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning

. These emerging technologies are revolutionizing factory logistics in several ways: IoT enables the real-time tracking and monitoring of inventories and equipment, enhancing visibility and control [

4]. AI and machine learning algorithms optimize routing, predict maintenance needs, and improve demand forecasting accuracy [

5]. In material handling, automated guided vehicles (AGVs) and robotic process automation (RPA) are increasingly deployed, significantly improving efficiency and reducing errors [

6]. The adoption of automation technologies, including automated guided vehicles (AGVs) and robotic process automation (RPA), is revolutionizing material handling and inventory management [

7]. Additionally, there is a growing emphasis on real-time visibility and data analytics, enabling more informed decision-making and predictive maintenance strategies. However, the implementation of advanced logistics systems is not without challenges, including substantial initial investments, complexity in management, space constraints within facilities, and the need for specialized skills [

8,

9].

While Industry 4.0 offers significant opportunities for improving factory logistics, it also introduces potential trade-offs between different priorities that manufacturers must carefully balance. Tensions exist between cost reduction, quality control, and flexibility in responding to market demands [

9]. For example, implementing advanced automation systems can reduce labor costs but may require substantial upfront investment and potentially reduce flexibility to adapt to changing product specifications. Real-time quality monitoring enabled by Industry 4.0 technologies can improve product quality but may impact production speeds [

10]. Manufacturers must therefore strategically evaluate these trade-offs and determine the optimal balance for their specific context and priorities. As Industry 4.0 continues to evolve, finding ways to simultaneously optimize multiple performance dimensions remains an important area for further research and practical innovation in factory logistics [

11]. Understanding these trade-offs is crucial for implementing effective automation strategies that improve overall performance while maintaining adaptability in the dynamic logistics landscape [

12].

Recent research has identified gaps in performance metrics that manufacturers need to leverage for effective predictive maintenance strategies, with significant consequences for factory logistics. While many studies focus on data analytics and machine learning methods for predictive maintenance, there is a lack of standardized metrics to evaluate the impact on overall production efficiency. This gap makes it challenging for manufacturers to quantify the benefits of predictive maintenance implementations [

13].

Additionally, current performance metrics often fail to capture the complex interplay between maintenance activities and logistics operations. New metrics need to be developed to measure not just equipment uptime, but also the ripple effects on inventory management, production scheduling, and supply chain responsiveness. For example, traditional metrics like Overall Equipment Effectiveness (OEE) may not fully reflect how predictive maintenance influences just-in-time delivery capabilities or reduces rush orders for spare parts [

14].

These gaps in performance measurement have important implications for factory logistics. Without comprehensive metrics, manufacturers may struggle to optimize their maintenance strategies in ways that truly enhance logistical efficiency. Future research should focus on developing holistic performance frameworks that integrate maintenance, production, and logistics metrics to provide a more accurate picture of predictive maintenance’s value in the Industry 4.0 context [

15].

As manufacturing continues to evolve in response to global competition and technological advancements, the role of factory logistics becomes increasingly critical in determining organizational success [

16]. By addressing existing limitations and leveraging emerging trends, factories can enhance their competitiveness, improve productivity, and meet the changing demands of the market [

17].

The case study presented herein is emblematic of the broader challenges faced within the Thai industrial ecosystem, particularly in the realm of logistics management. This scenario reflects the complex landscape in which Thai enterprises operate, where significant hurdles in logistics optimization and strategic management persist [

18]. To ensure survival and maintain competitiveness, Thai businesses are increasingly compelled to embrace new knowledge paradigms and leverage external expertise [

19]. By utilizing external knowledge sources and specialized expertise, these enterprises aim to transcend their inherent limitations, whether they be in technological capabilities, managerial practices, or logistics efficiencies [

20]. This strategy of knowledge acquisition and expert consultation is particularly crucial in the context of Thailand’s efforts to enhance its industrial competitiveness and move up the global value chain. The case thus underscores the critical role of knowledge integration and external collaboration in overcoming the multifaceted challenges faced by Thai industries, particularly in the domain of logistics management, which is fundamental to operational efficiency and market responsiveness [

21].

This paper analyzes the results of factory logistics improvement projects implemented in 30 factories across Northern Thailand from 2022 to 2024. These projects are part of a long-running initiative funded by the Ministry of Industry, which has been active for decades. To date, over 500 factories in Thailand have undergone logistics enhancements, achieving performance improvements, cost savings, and numerous other benefits through consultancy, reskilling, and technology transfer processes. The urgency of this research is underscored by the significant economic impact of logistics inefficiencies. According to Thailand’s Logistics Report 2021, logistics costs in Thailand amount to 13.7% of GDP, substantially higher than the global average of 10.8% [

22]. This gap represents a potential for annual savings of up to THB 500 billion if Thailand could align its logistics costs with global standards. Such improvements could significantly enhance the competitiveness of Thai industries in the global market. This study builds upon and updates the findings presented in an initial paper published in 2015 [

23], offering fresh insights into the program’s ongoing impact and effectiveness in the Northern Thailand region.

This study builds upon previous research on supply chain and logistics management in Thai SMEs [

18] that has highlighted the importance of internal linkages and the key roles of production planning, control, and inventory management [

24]. However, while past studies have explored the implementation of supply chain concepts in various sectors, there remains a gap in understanding how these principles are applied specifically in factory logistics improvement projects across different industries in Northern Thailand. This research aims to bridge this gap by providing a comprehensive analysis of recent logistics improvement initiatives in the region.

2. Background

2.1. Industries in Thailand

Thailand’s economic landscape, as reported by the Office of the National Economic and Social Development Council in 2022, shows a gross domestic product (GDP) of THB 17,378,017 million, positioning the country as the world’s 23rd-largest economy. The GDP composition reveals agriculture contributing 8.7%, industry 32.6%, and services 58.7% [

25]. Key industrial sectors include the electronics, automotive, and food industries [

26].

Thailand faces the middle-income trap due to the relatively low technological learning of firms, perpetuated ineffective science, technology, and innovation policies, and a lack of critical mass of innovative firms [

27]. Challenges in Thai industry include managing cultural diversity, mitigating the impact of natural disasters on the global supply chain, and addressing the need for technological upgrading and input growth [

28]. The lack of systematic planning and control of the production process in SMEs poses barriers to lean automation transformation and industrial technological advancement [

29].

2.2. Logistics in Thailand

Thailand’s logistics sector has seen significant changes in recent years. Thailand’s total logistics costs increased from THB 2085.1 billion in 2017 to an estimated THB 2238.8 billion in 2021. Transport costs consistently represent the largest portion of these costs, followed by inventory holding costs and administration costs.

Logistics costs as a percentage of GDP have fluctuated, reaching 13.8% in 2021. This figure remains high compared to the global average of 10.8% in 2020, indicating room for improvement in Thailand’s logistics efficiency [

22].

Thailand’s logistics performance on the global stage, as measured by the World Bank’s International Logistics Performance Index (LPI), has shown some improvement but remains challenging. As seen in Image 2, Thailand’s overall LPI score improved from 3.26 in 2016 to 3.41 in 2018, with its global rank moving from 45th to 32nd. However, specific areas such as customs procedures and infrastructure still present opportunities for enhancement [

30].

These challenges have prompted the Thai government to prioritize logistics performance improvement as a key mission. Initiatives include infrastructure development, the enhancement of laws and standards, and industrial logistics management [

31]. Factory logistics improvement projects represent one of these strategic initiatives, specifically targeting internal logistics improvement within industries.

2.3. Industries in Northern Thailand

Northern Thailand represents a significant portion of the country’s demographic and economic landscape. The region is home to 16.1% of Thailand’s total population and contributes 7.6% to the nation’s GPP. According to the Ministry of Industry’s database, Northern Thailand hosts 100,647 industrial establishments, constituting 15.7% of the country’s factories. The National Statistical Office census reveals that the region’s industrial sector is dominated by food product manufacturing (27.1%), followed by wood and wood products (18.1%), wearing apparel (14.4%), and textiles (8.1%). Furthermore, the region employs 9.1% of Thailand’s total labor force.

3. Methodology

The Department of Industrial Promotion, under the Ministry of Industry, is tasked with promoting and enhancing logistics performance in Thai industries. This initiative employs a triple-helix model, fostering strong collaboration among the government, industry, and academic sectors [

32]. While the department provides funding and a consultation framework, university consultants and experts work directly with industries to improve logistics performance. Typically, these projects span 5–6 months, with a minimum of 10 man-days dedicated to consultancy.

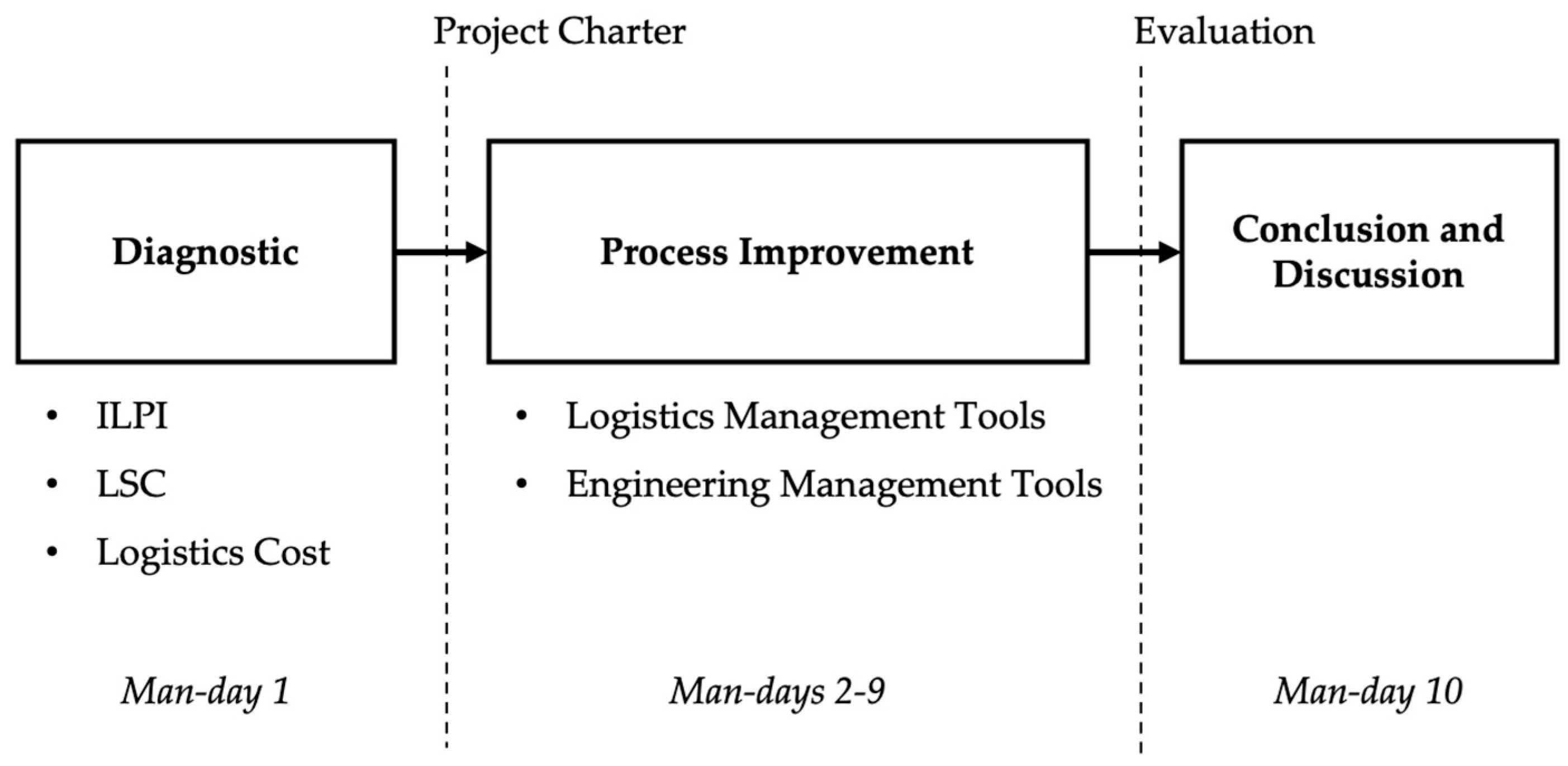

The project’s methodology (see

Figure 1) begins with problem identification using preliminary diagnostic tools, including the Logistics/Supply Chain Scorecard (LSC Scorecard) [

33], the Industrial Logistics Performance Indicator (ILPI) [

34], and logistics cost analysis.

The Logistics/Supply Chain Scorecard (LSC) offers a quantitative evaluation of a factory’s awareness and implementation of logistics and supply chain principles. As detailed in

Table 1, the LSC assessment is based on 23 specific criteria, grouped into five key areas: corporate strategy and inter-organization alignment, planning and execution capability, logistics performance, IT methods and implementation, and external collaboration [

33]. This comprehensive approach provides a detailed picture of a company’s logistics sophistication and strategic alignment.

The Industrial Logistics Performance Indicator (ILPI) (see

Table 2) is a constructive indicator that evaluates the performance of 9 logistics activities across three critical dimensions, i.e., cost, time, and reliability [

34]. This multidimensional approach ensures a holistic view of logistics efficiency, encompassing activities from demand forecasting to reversed logistics.

The project utilized several key performance indicators to assess logistics efficiency. To give some examples, Forecast Accuracy Rate (FAR) measures the precision of demand forecasting by comparing predicted versus actual order quantities. Transportation Cost per Sale (TCPS) evaluates transportation efficiency by considering various costs such as personnel, fuel, maintenance, and depreciation relative to total sales. Inventory Accuracy (IA) assesses the correctness of inventory records by comparing recorded stock levels against physical counts. Warehousing Cost per Sale (WCPS) measures warehousing efficiency by factoring in costs like depreciation, insurance, labor, and equipment relative to sales. Lastly, the Transportation DIFOT (Delivery In Full On Time) Rate gauges delivery performance by analyzing the proportion of orders delivered completely and punctually. These indicators provide a comprehensive view of a company’s logistics performance across forecasting, transportation, inventory management, warehousing, and delivery reliability.

In addition to these standardized metrics, logistics cost analysis plays a crucial role in performance evaluation. This analysis delves deeply into the actual logistics costs incurred by manufacturers, offering a granular view of expenditures across various logistics activities. Such detailed cost breakdowns are essential for identifying inefficiencies and potential areas for cost optimization.

The true power of these assessment tools lies in their comparative capabilities. After conducting diagnostics using ILPI, LSC, and logistics cost analysis, a company’s performance can be benchmarked against a national database comprising more than 1200 factories. This comparative analysis enables the identification of specific weaknesses or areas with significant room for improvement in a company’s logistics operations. By leveraging this extensive dataset, manufacturers can gain valuable insights into their relative performance within the industry and pinpoint targeted areas for enhancement.

Once key issues are identified, improvement projects are designed using various management tools. These may include lean concepts, logistics design, simulations, operations research, and Information Technology implementation, tailored to meet the specific requirements of each project.

The selection of 30 factories across various sectors in Northern Thailand was based on a rigorous multi-stage process aligned with the project’s objectives and constraints. Initially, a call for applications was issued following the project’s approval. Applicants were required to meet basic eligibility criteria, including location within the northern region, Thai majority ownership (at least 51% Thai-owned), registration with either the Ministry of Industry or Ministry of Commerce, and the ability to provide financial documentation. Subsequently, a comprehensive selection process was conducted collaboratively by the consulting team and representatives from the Ministry of Industry. This process evaluated applicants based on four key criteria: (1) the significance of their logistics-related challenges and the feasibility of addressing these within the project’s timeframe and budget constraints, (2) market potential, (3) readiness for project participation, as assessed through self-evaluation, and (4) understanding of the project’s objectives and requirements. This methodical approach ensured that the selected sample not only represented diverse sectors within Northern Thailand’s industrial landscape, but also comprised companies with both the need and capacity to benefit from logistics improvements. The final selection of 30 factories was thus a balanced representation of the region’s industrial diversity, while also meeting the practical considerations of the research project.

4. Results and Case Study

The involvement of 30 diverse factories revealed a varied industrial landscape, with the food and beverage sector emerging as the most prominent, comprising approximately 26.7% of the sample. This sector encompasses a wide range of enterprises, from egg and dried fruit production to frozen foods and dairy processing. The logistics industry follows, representing 20% of the sample, highlighting the critical role of infrastructure and supply chain management in the region’s economy. Retail and wholesale businesses, along with manufacturing operations, each account for about 16.7% of the sample. The retail and wholesale segment primarily focuses on consumer goods and construction materials, while manufacturing activities span a diverse range from plastic products to concrete and asphalt production. The remaining portion of the sample is composed of agriculture-related enterprises and miscellaneous businesses, including specialized sectors such as medical equipment sales and waste management.

The projects predominantly focus on warehouse and inventory management (38.8%) and transportation optimization (27.8%) with a strong emphasis on core logistics functions. The remaining projects address other logistics administration management elements, e.g., information systems and data management, market expansion and customer service, demand forecasting and planning, and sustainability initiatives.

The collective implementation of these initiatives has resulted in substantial cost savings, exceeding USD 1.8 million. This figure underscores the considerable financial benefits that can be achieved through targeted logistics optimization strategies. Concurrently, the projects have led to a marked enhancement in overall logistics performance, with an average improvement of 22.3% (see

Table 3).

The following sections present exemplary case studies from the factory logistics improvement projects conducted between 2022 and 2024. These cases illustrate the practical applications and outcomes of logistics enhancement initiatives across various industries in Northern Thailand.

Thus, the selected case studies presented in this paper are categorized into three main logistics components, i.e., transportation management, warehouse and inventory management, and logistics administration management.

4.1. Transportation Management

Transportation management is a critical component of logistics and supply chain operations, playing a pivotal role in the efficient movement of goods from origin to destination. The scope of transportation management encompasses a wide range of activities, including mode selection, carrier management, route optimization, freight consolidation, and delivery scheduling. Its significance in logistics is multifaceted and profound. Effective transportation management can lead to substantial cost savings, improved customer service levels, and enhanced supply chain responsiveness.

The following case studies exemplify the interventions and improvements implemented during the course of the projects.

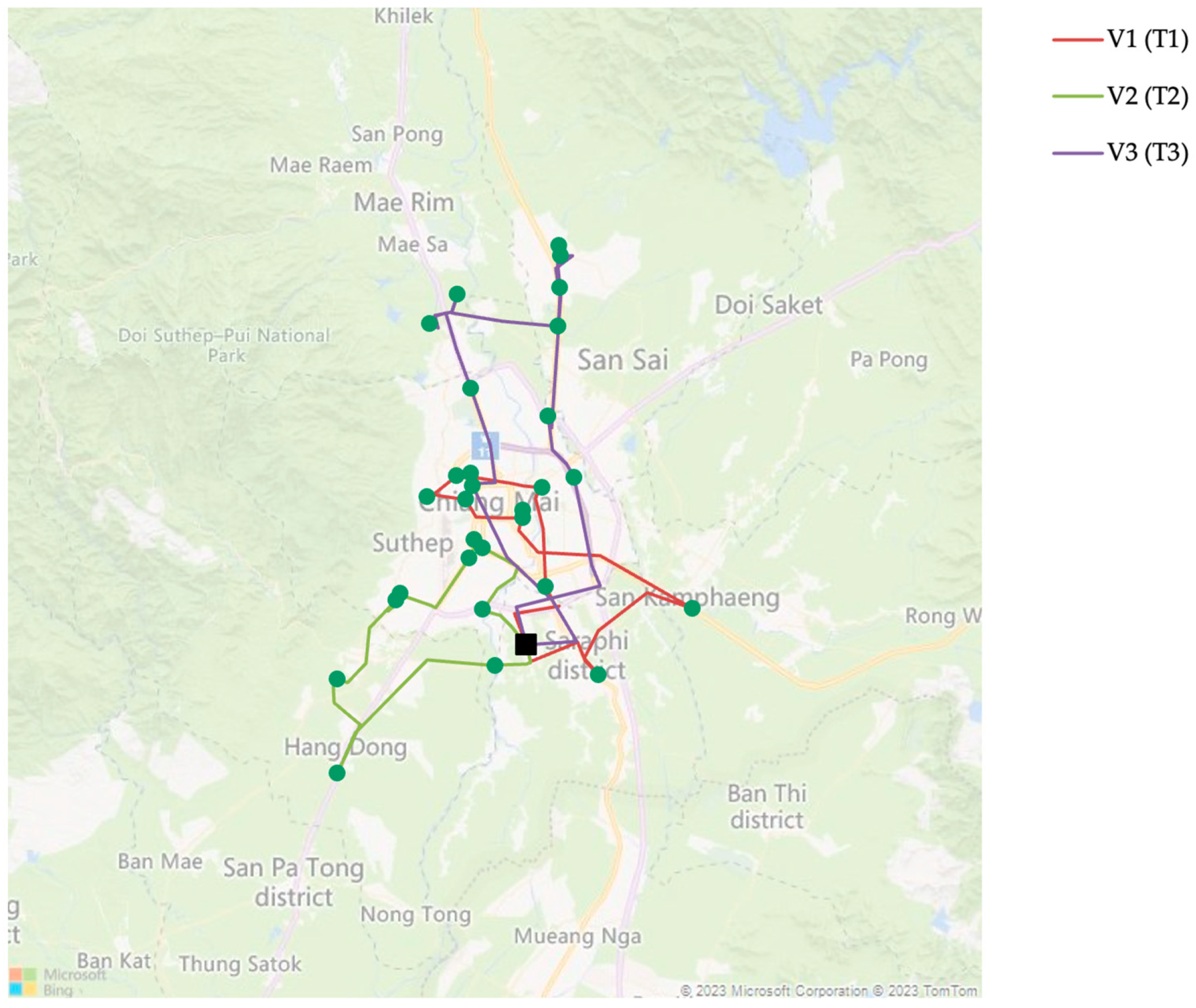

4.1.1. Vehicle Routing Solution

This case study focuses on a large-scale milk production factory serving over 500 customers in Northern Thailand. The company’s current delivery system, which operates on a two-day cycle, relies on manually designed routes based on planner experience. This approach has proven costly and inefficient, with transportation costs accounting for 9.5% of sales and a delivery-in-full-on-time (DIFOT) rate of 80%.

To address these issues, a Vehicle Routing Problem (VRP) optimizer was implemented. The problem was classified as a Capacitated Time-Window Vehicle Routing Problem [

35]. A VRP Spreadsheet Solver was employed to develop the solution [

36]. After collecting customer location data and requirements, a distance matrix was constructed, enabling the design of more efficient routes (as illustrated in

Figure 2).

The implementation of the optimized routes resulted in significant improvements. Cost savings of 23.7% were achieved through reduced fuel consumption, lower labor costs, and improved fleet utilization. Additionally, the service level saw a marked increase, with the DIFOT rate rising to 95%.

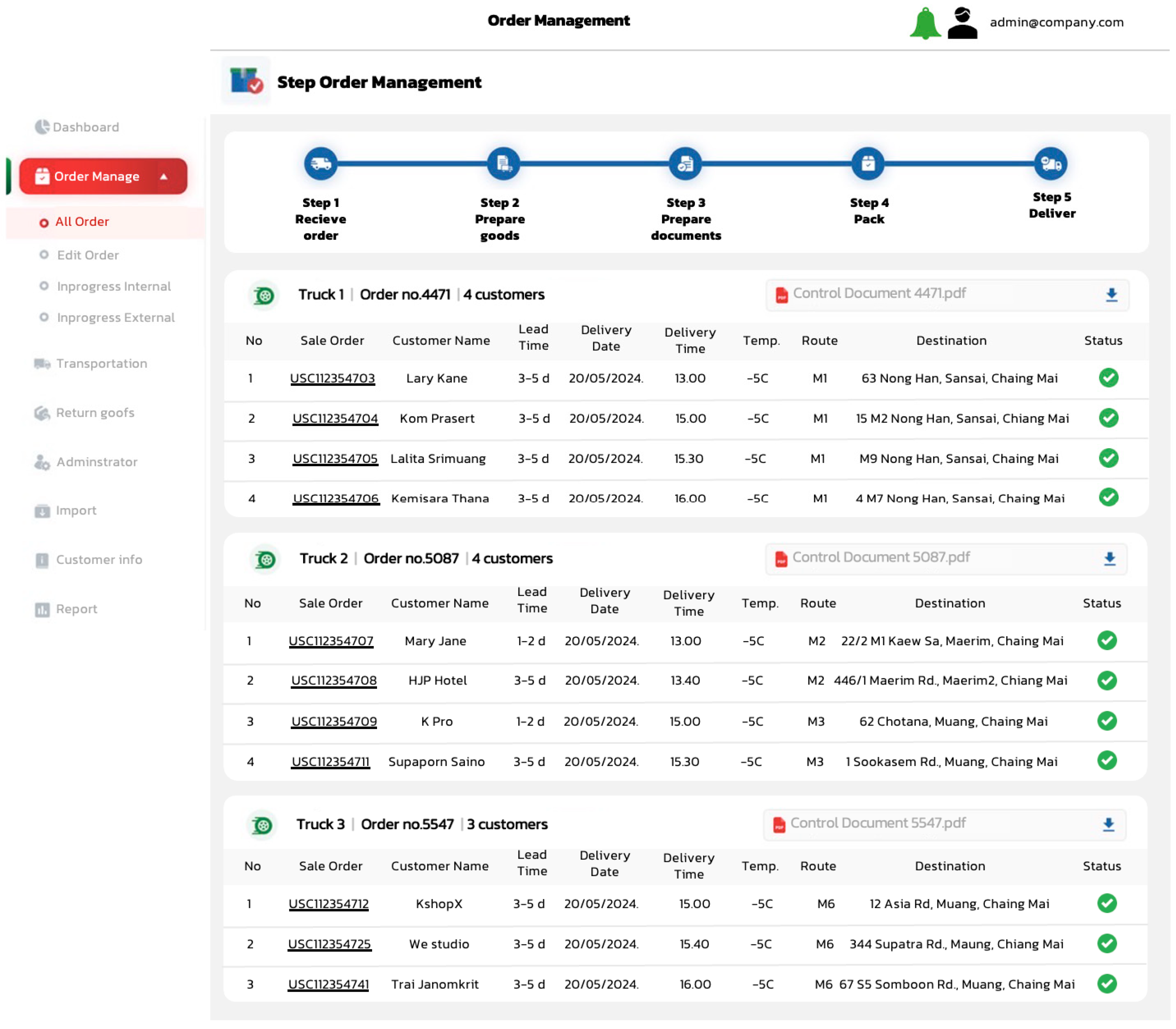

4.1.2. Transportation Management System (TMS)

This case study examines a medium-sized medical device and equipment trader based in Chiang Mai. The company manages approximately 1000 SKUs and serves 450 customers, handling 1300 orders per month across Northern Thailand. While the company uses in-house fleets and personnel for deliveries, their distribution management relies on manual, experience-based assignment and paper-based processes. This approach has resulted in costly, time-consuming operations prone to errors, with a delivery-in-full-on-time (DIFOT) rate of 85%.

To address these inefficiencies, a Transportation Management System (TMS) was developed and implemented. The TMS design process included system analysis, logical design, and physical design (as illustrated in

Figure 3). The system incorporates various functions, including sales order management, pick–pack–ship job assignment, fleet and personnel management, stock cutting, GPS-based delivery tracking, return management, and monitoring and reporting.

The implementation of the TMS yielded significant improvements, e.g., an 80% reduction in transportation management time, 25% cost savings, 100% error elimination, an increase in DIFOT to 97%, and 100% traceability of deliveries.

Notably, the project achieved a rapid return on investment, with a payback period of just 5 months.

The case studies of transportation management demonstrate significant improvements in efficiency and cost reduction. It is important to note the interdependencies between transportation and other key supply chain functions. Optimized transportation routes and schedules, as seen in the VRP case, directly impact inventory management by enabling more frequent, smaller deliveries, potentially reducing overall inventory levels. The implementation of TMS, as illustrated in the second case, not only improves transportation efficiency, but also enhances warehouse operations through the better coordination of pick–pack–ship processes. Furthermore, these transportation improvements can influence procurement strategies, allowing for more responsive and cost-effective sourcing decisions. These interconnections underscore the systemic nature of logistics improvements, where enhancements in one area often yield benefits across multiple supply chain functions.

4.2. Warehouse and Inventory Management

Warehouse and inventory management also play significant roles in logistics operations. The scope of these functions encompasses a wide range of activities, including storage allocation, inventory control, order fulfillment, and material handling. Proper inventory management ensures optimal stock levels, reducing both stockouts and excess inventories, thereby balancing the trade-off between service level and holding costs. Warehouse management, on the other hand, focuses on maximizing space utilization, improving picking efficiency, and reducing material handling costs. These cases collectively showcase the diverse range of challenges addressed and the corresponding benefits realized, offering valuable insights into the effectiveness of different approaches to logistics improvement.

4.2.1. Inventory Model Application

This case study focuses on a small-sized beverage container manufacturing factory with a nationwide customer base, owing to its customization capabilities. Despite handling a large variety and volume of raw materials, the factory’s warehouse management was inadequate. The absence of a Warehouse Management System (WMS) and reliance on paper-based stock recording led to high stock levels and low stock accuracy.

To address these issues, the following steps were taken:

The implementation of these strategies resulted in a significant improvement for A-level materials, with inventory holding and carrying costs reduced by 55%. This outcome demonstrates the effectiveness of applying structured inventory management techniques in small-scale manufacturing environments.

4.2.2. Warehouse Layout Design

This case study examines a medium-sized beverage production factory serving over 100 OEM customers. The product range varies significantly in size, shape, material, and packaging to meet diverse customer requirements. High stock levels, particularly of raw materials like empty bottles, are maintained due to the nature of beverage OEM operations and economies of scale. However, the warehouse lacked proper management, with no Standard Operating Procedures (SOP) or Warehouse Management System (WMS) in place. Consequently, stocks were disorganized, leading to high inventory holding costs, low inventory accuracy, and significant dead stock.

To address these issues, the following solutions were implemented:

These interventions resulted in a 16.74% reduction in inventory holding and carrying costs.

4.2.3. Warehouse Management System (WMS)

This case study focuses on a large food-processing factory specializing in frozen vegetables for 100% export. Despite using a legacy ERP system, the company faced complications in warehouse operations. The challenges stemmed from the simultaneous production of various products, both made-to-order and made-to-stock. The warehouse had a large and diverse volume of finished goods, with known volumes but unpredictable sequences. This resulted in inefficient put-away processes, often requiring product relocation.

To resolve these issues, an add-on sequencing solution was developed and integrated with the existing ERP system. This enhancement led to a 21% reduction in warehouse operation costs.

4.2.4. Automation in Material Handing

This case study examines a large beverage company with a daily production capacity of 1 million water bottles, employing an automated production process encompassing water sourcing, purification, bottle preparation, filling, capping and sealing, labeling, and packaging. Despite the high level of automation in production, the quality control process remains manual. The current procedure involves human operators collecting sample bottles from the production line at 30 min intervals and transporting them to a laboratory located 100 m away. At the laboratory, tests are conducted for pH, conductivity, and turbidity, along with microbiological analysis, chemical analysis, and physical tests. This manual sampling and delivery process necessitates a dedicated employee to perform these tasks consistently. Recognizing the potential for improvement, the company is exploring automation options for this quality control process. A proposed solution involves the implementation of an Autonomous Mobile Robot (AMR) equipped with a robotic arm, capable of replicating the human operator’s functions in sample collection and delivery. Financial analysis indicates a breakeven point of one year for this automation investment, based on a 24 h production schedule.

4.3. Logistics Administrative Management

The diverse elements of logistics, including customer accommodation, forecasting, demand planning, order processing, logistics communication, and logistics outsourcing, are collectively categorized as logistics administrative management. While their direct financial impact may be less pronounced compared to the more tangible aspects of logistics, their significance lies in their ability to optimize data and information flows throughout the supply chain.

The case studies presented herein serve as empirical evidence of the transformative potential of improving these aspects of logistics management. They demonstrate how targeted interventions in these areas can yield substantial improvements in overall logistics performance.

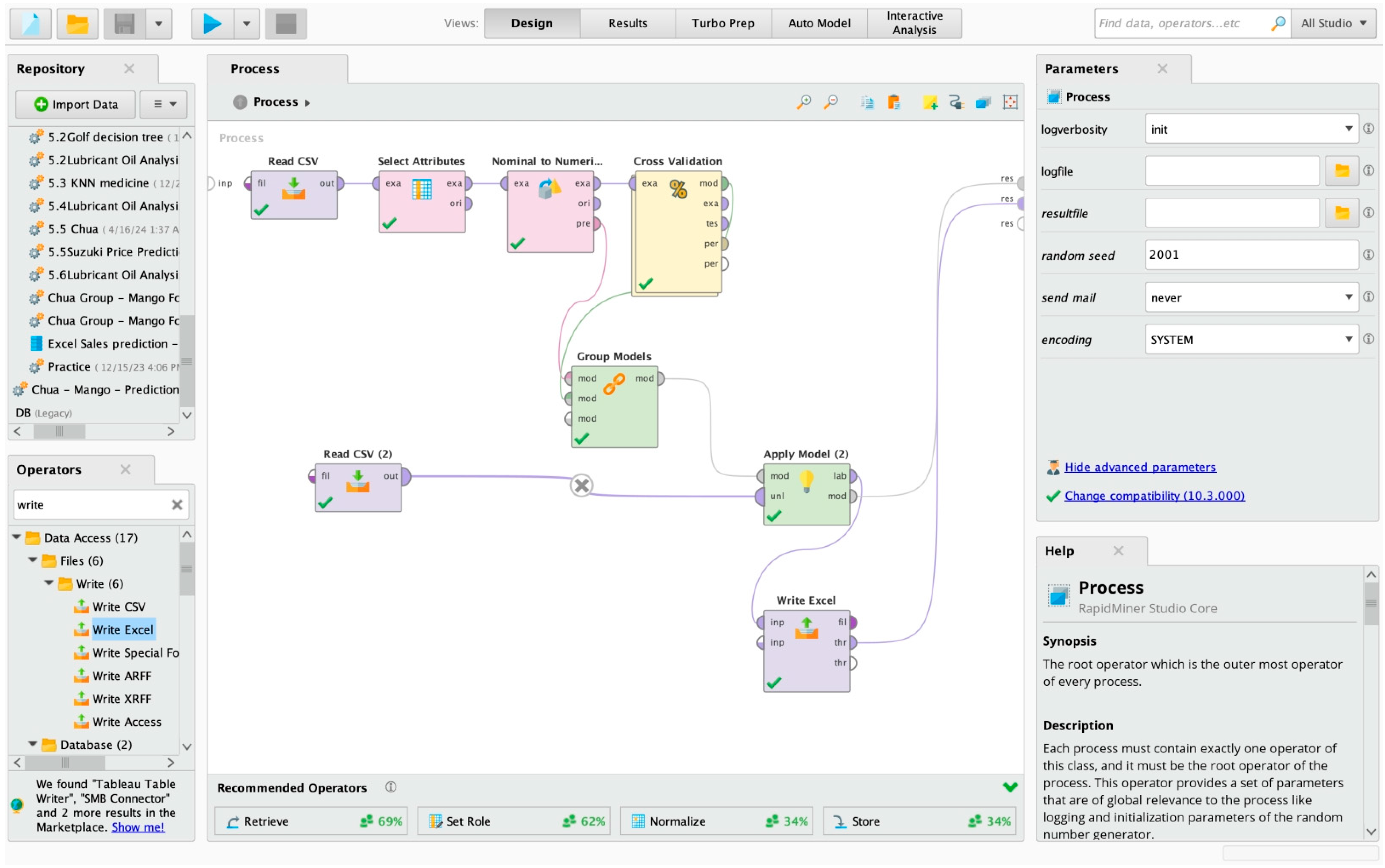

4.3.1. Forecasting and Demand Planning

This case study involves a small-sized processed food factory producing freeze-dried snacks from local fruits and vegetables. The company sells through online channels and modern trade outlets. Previously, the factory did not forecast demand, resulting in stockouts, expired inventories, and product returns from retailers.

Basic forecasting models were initially introduced [

39], but accuracy was unsatisfactory with Root Mean Square Error (RMSE) values under 60%. Subsequently, advanced forecasting tools using data mining techniques (RapidMiner and Python) were implemented (see

Figure 5). Using two years of historical sales data as a training set, the new model achieved 80% accuracy (RMSE).

This improved forecasting accuracy enabled better planning, sourcing, and communication, resulting in a 16.3% cost saving.

4.3.2. Logistics Communication

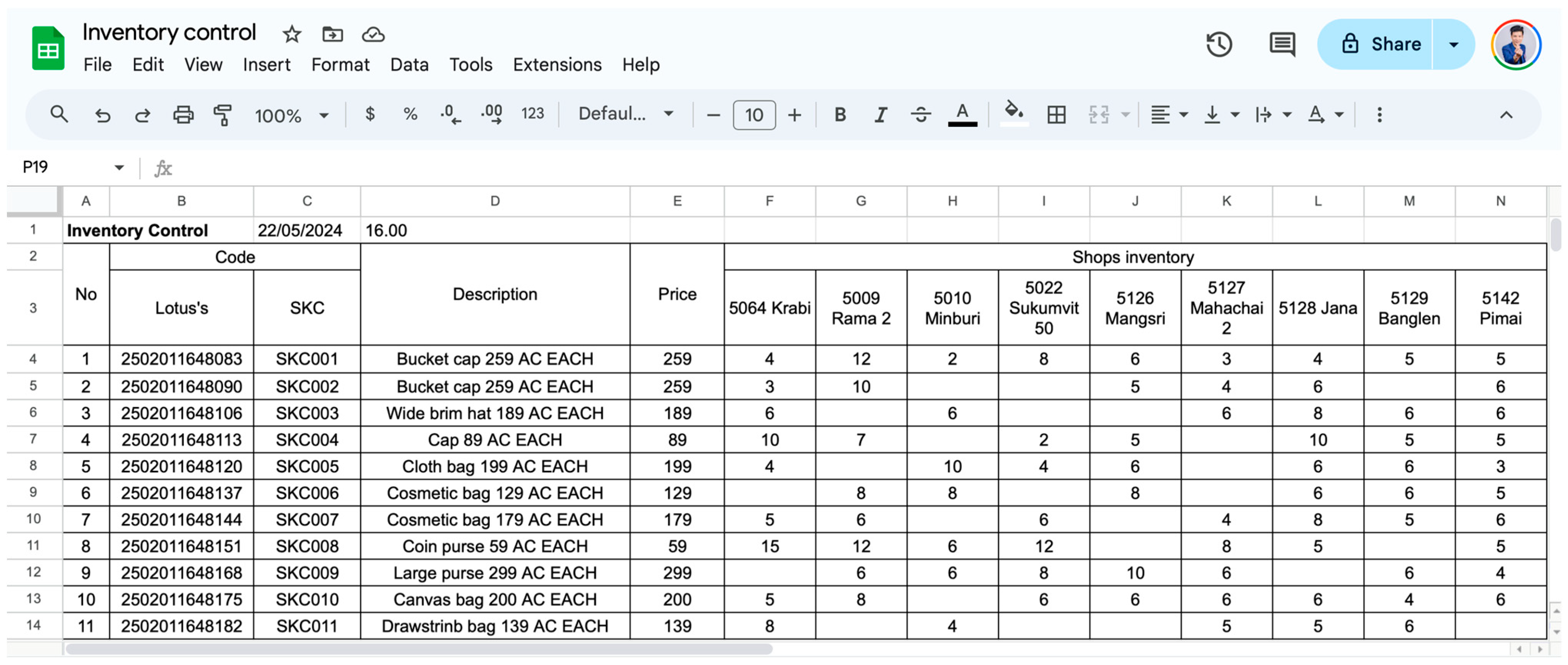

The subject of this case study is a medium-sized clothing factory producing 183 SKUs of uniquely designed local garments. The company distributes through 35 small shops in modern trade outlets across Thailand. The main challenge was the lack of real-time inventory visibility after product delivery to shops due to the absence of a Point-of-Sale (POS) system and reliance on offline, weekly inventory reporting.

A simple, yet effective solution was implemented: an online spreadsheet-based inventory database (see

Figure 6). The new procedure requires each shop to update stock levels daily, enabling more accurate production planning.

This intervention reduced inventory holding costs at fabrication sites by 16.25% and significantly improved inventory visibility and production planning efficiency.

4.3.3. Outsourcing

The strategic adoption of logistics outsourcing has emerged as a pivotal approach for enhancing operational efficiency among Thai manufacturers. A comprehensive multi-company case study, encompassing eight firms, provided compelling evidence of the benefits derived from leveraging Logistics Service Providers (LSPs) across various logistical activities [

40].

The study’s findings revealed multifaceted advantages of outsourcing, particularly in cost reduction and service improvement. Notably, firms that engaged in service volume commitment agreements with LSPs were able to secure significant discounts, optimizing their cost structures through economies of scale. A striking outcome was observed in transportation logistics, where the transition from in-house fleets to LSP-managed transportation services yielded substantial benefits. This shift resulted in total cost reductions ranging from 10% to 20%, alongside lead time reductions of 15% to 25% in certain cases, underscoring the efficiency gains achievable through specialized logistics management.

Furthermore, the integration of e-fulfillment services provided by LSPs led to marked improvements in service levels, with increases exceeding 15% in some instances, highlighting the potential for enhanced customer satisfaction through outsourcing. Beyond operational efficiency, the adoption of outsourcing strategies addressed a critical challenge facing the Thai manufacturing sector: the shortage of skilled labor [

41,

42]. By delegating complex logistics operations to specialized providers, manufacturers could mitigate the impacts of labor scarcity while simultaneously accessing a pool of experts with advanced technological capabilities. This multifaceted approach to outsourcing not only streamlined operations, but also positioned Thai manufacturers to better navigate the complexities of global supply chains, enhance their competitive stance, and adapt more flexibly to market fluctuations. The study’s findings suggest that the strategic utilization of LSPs represents a significant opportunity for Thai manufacturers to optimize their logistics performance, reduce operational costs, and address systemic challenges in the labor market, thereby fostering long-term sustainability and growth in an increasingly competitive global landscape.

5. Discussion and Conclusions

The factory logistics improvement projects in Northern Thailand from 2022 to 2024 have demonstrated significant potential for enhancing logistics performance across various industries. The projects’ success, evidenced by cost savings of up to 25% in transportation management, inventory cost reductions of up to 55%, and improved planning capabilities leading to cost savings of up to 20%, underscores the effectiveness of the triple-helix model in fostering collaboration between the government, industry, and academia.

These achievements highlight that, with proper guidance and knowledge transfer, substantial improvements in logistics performance are attainable. The project has not only resulted in tangible benefits for participating factories, but has also contributed to the broader goal of enhancing Thailand’s logistics competitiveness.

From a theoretical perspective, this study contributes to the understanding of how organizations strive for seamless integration and optimization across interconnected logistics domains. The case studies reveal that improvements in one area, such as transportation management, often yield benefits in related functions, like inventory management and procurement. This interdependence underscores the need for a holistic approach to logistics optimization, where changes in one domain are considered in light of their impacts on others.

However, the study also reveals implementation challenges, including time constraints, varying levels of business readiness, and limitations in technology adoption or investment capabilities. These factors can restrict the extent of improvements realized and must be addressed in future initiatives. The complexity of integrating various logistics functions while optimizing overall performance remains a significant challenge, particularly for smaller businesses with limited resources.

These limitations point to several avenues for future research:

Developing more adaptive and scalable logistics improvement methodologies that can accommodate businesses of varying sizes and technological readiness levels.

Investigating the long-term sustainability of logistics improvements, particularly in the face of changing market conditions and technological advancements.

Exploring the potential of emerging technologies, such as artificial intelligence and blockchain, in facilitating more seamless integration across logistics functions.

Examining the role of organizational culture and change management in the successful implementation of logistics improvements.

The implications of this study extend to various stakeholders:

For policymakers, the results underscore the importance of continued support for logistics improvement initiatives, particularly in developing economies. The triple-helix model demonstrated here could serve as a blueprint for similar programs in other regions or countries.

Industry practitioners can benefit from the practical insights and methodologies presented, adapting them to their specific contexts to achieve logistics optimization.

Academic researchers can build upon this work to further explore the interconnections between various logistics functions and develop more integrated theoretical models of logistics performance.

Technology providers may find opportunities to develop more tailored solutions that address the specific challenges faced by businesses in implementing logistics improvements.

In conclusion, while these factory logistics improvement projects have shown promising results, they also highlight the ongoing challenges in achieving truly integrated and optimized logistics operations. Future efforts should focus on developing more holistic, adaptable approaches that can accommodate the diverse needs of businesses while leveraging emerging technologies to drive continued improvements in logistics performance.