Abstract

Background: literature on last mile logistic electrification has primarily focused either on the stakeholder interactions defining urban rules and policies for urban freight or on the technical aspects of the logistic EVs. Methods: the article incorporates energy sourcing, vehicles, logistics operation, and digital cloud environment, aiming at economic and functional viability. Using a combination of engineering and business modeling combined with the unique opportunity of the actual insights from Europe’s largest tender in the automotive aftermarket electrification. Results: the Last Mile Logistics (LML) electrification is possible and profitable without jeopardizing the high-tempo deliveries. Critical asset identification for a viable transition to EVs leads to open new lines of research for future logistic dynamics rendered possible by the digital dimensions of the logistic ecosystem. Conclusions: beyond the unquestionable benefits for the environment, the electrification of the LML constitutes an opportunity to enhance revenue and diversify income.

1. Introduction

Paraphrasing John Kasarda [1], “…..logistics is about capturing competitive advantage and creating customer value, …….. effectively monitoring and responding to changing market behavior efficiently connecting enterprises with innovative solutions”. The simultaneous gain of environmental consciousness in society and the increasing maturity levels of Electric Vehicles (EV) create business challenges and open opportunity windows to electrify part of the value chain logistics. The convergence of economic pressure and environmental agendas explicitly focusing on Last-Mile-Logistics (LML) has become a new reality supported by robust e-commerce platforms [2]. Different logistic operators, both in the Business to Customer (B2C) and Business to Business (B2B) fields are launching initiatives to make their operations more environmentally sustainable. Inner city and sub-urban logistics have been mainly focused on these greening initiatives [3].

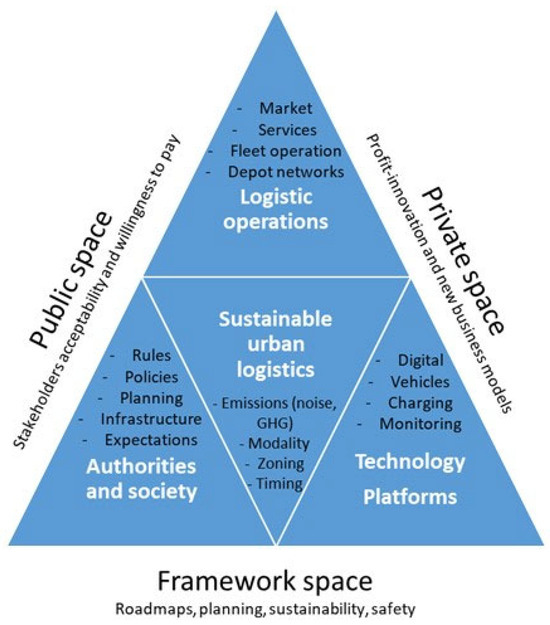

The LML is primarily an urban and suburban activity with various stakeholders. As cities become prominent economic actors and the living location for most of any country’s population, the planning and regulation of the logistic/freight/mobility activities require a multitude of alignments between different participants. The impact of the logistic operations in these densely populated areas is natural, as economic growth and wealth cannot be decoupled from the logistic value chain supporting them. Figure 1 represents how the literature has treated these interactions to achieve harmonious development. A significant body of literature [4,5,6,7,8,9,10,11,12,13] and research aims at better understanding and modeling the interactions between the city authorities and its citizens vis a vis of the logistic operations. The public-business interaction lies in the “Public Space” in Figure 1. These interactions aim to deploy policies and rules setting the boundary conditions within which logistics and freight activities could take place in urban space.

Figure 1.

Main spaces and interactions defining urban sustainable logistics.

It is crucial to recognize that there is no universal solution for integrating sustainable logistics into smart cities. Even cultural differences, as evidenced in Scandinavian vs. Anglo-Saxon [12] and Latin cities [3,7,13], significantly shape unique solutions. These cities have developed distinct approaches despite facing similar challenges. Some authors [8] argue that intelligent, sustainable logistics address the inherent dynamics of moving goods and significantly enhance the city’s quality of life.

The ¨framework space¨ in Figure 1, is driven by the technology-enabled paradigm shift offered by EVs, automation, sensing, and digital platforms, holds immense potential. It mobilizes national, regional, and international resources, continually pushing the boundaries of technical possibility and deployment feasibility. The extensive literature from scholars and technologists reflects the progressive deployment of new means to ensure smart and sustainable logistics within urban boundaries [14,15,16,17,18,19,20].

While there is a wealth of literature on sustainable logistics, there is a noticeable gap regarding the ¨private space¨, particularly the Last Mile Distribution (as shown in Figure 1). This specific topic of the private space is a critical area that demands attention. As [21] points out, the focus is on ‘profit’ as the LML freight market operates along free market principles and within the boundaries defined by legislation and societal expectations. However, once rules, zoning, and policies are in place, the private space will continue its technology experimentation and integration, primarily focusing on financial profitability and maintaining or improving customer service. The free-market approach determines the effective deployment of solutions to customers and underscores the importance of the current research.

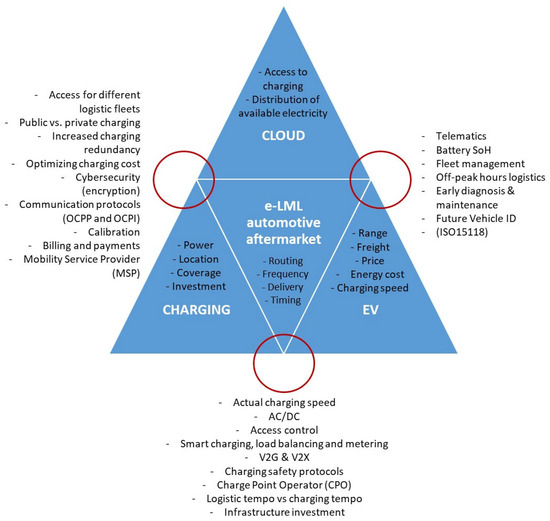

When analyzing the private space of Figure 1 in more detail, it becomes clear that the electrification of the LML is a complex, multivariable endeavor that goes well beyond substituting Internal Combustion Engine Vehicles (ICEV) with their electric counterparts (see Figure 2). It incorporates electric charging groundwork, digital (cloud-based) infrastructure, new business model options, and operational paradigm shifts. Ensuring the transition while preserving (or improving) the quality expectations of the receivers in a robust, reliably profitable approach requires choices and trade-offs that are entirely new compared to previous logistic operations. A successful transition necessitates integrating the different physical (hardware and location), digital, and business elements. It also provides an opportunity to review the current operations with the different logistic network actors to achieve a long-lasting, leaner structure designed for growth [22,23].

Figure 2.

Main features and interoperability interfaces in the electrified LML for the automotive aftermarket. Red circles indicating the interfaces between the different domains.

Figure 2 shows some of the inherent features of the different components of a modern electrified Last Mile Logistics (LML). The interfaces of the different domains create additional elements critical for the economic viability and functional qualification of the electrification endeavor.

Recent literature reviews [24,25,26] on the subject show a global trend towards the electrification of the LML combined with robust e-commerce platforms to alleviate some of the inefficiencies and negative environmental impact of this step of the value chain. The factors in previous articles specific to logistic operations cover operational aspects, organization, vehicle considerations, and social preferences. The focus is mainly on general Courier, Express Parcel (CEP) distribution rather than on the B2B logistics of a specific industry.

While sustainable routing of the parcel is to be optimized to reduce time, cost, and environmental impact, in the case of a B2B logistic chain within an industry, additional issues emerged to ensure multiple coverage of a given route with minimum disruption due to charging. Eliminating the randomness of the collecting/delivering points and, therefore, the routing optimization is a gap in the literature focusing on operations. Another operational aspect relates to charging infrastructures and their capacity to deliver energy where, when and in the amount needed. The details of how the charging infrastructure, the vehicles, and the grid interact and protect each other influence the recharging rate at which the vehicles are re-energized. The actual electric power rate has significant consequences on the definition of the charging capacity, its redundancy and, ultimately, on the ability of the logistic fleet to deliver as per customer expectations in a very competitive market.

The organizational aspects [27,28] focus on horizontal and vertical collaboration between actors in the LML. The literature has approached the issues of different actors (carriers, e-commerce platforms, receivers). The literature needs an analysis of the transactional compensation of companies or actors active at the intersections of the critical functions indicated in Figure 2. The back-office (billing/invoicing, payments) elements need to be added to the market companies and the receivers. A parallel back-office circuit is necessary to run the electrified LML and relates to the electricity supply and its associated compensatory mechanisms. The logistic operator or the so-called Mobility Service Provider (MSP) assumes the required support or assistance to users facing a system malfunction. In the former case, there is a need to train and manage teams to proficiently advise the user, which entails financial and time costs.

The different Electric Vehicle (EV) platform studies follow two main approaches. One branch of publications [29,30,31] focuses on the technical and engineering aspects of the different drivetrains, power electronics, and architectural configurations. Another line of research [32,33,34] approaches the different elements hindering the volume introduction of EV. The critical topics are economic (price, subsidies), perception (range anxiety, maintainability, safety, battery life), and differentiated adoption patterns in developing and developed economies. Although all those elements are certainly relevant to the use of EVs for the LML, the specificities of high-tempo electric logistics need more research regarding what makes a specific commercial EV suitable for last-mile logistics. The last generation of vehicles is finally delivering the performance (range, charging flexibility, and price) to enhance the deployment of electric platforms in LML.

The fundamental decision-making issues for the logistic operator in a competitive free-market environment are a) a profitable transition and b) the ability to provide high-frequency deliveries under the current Service Level Agreements (SLA). Based on the above research gaps, business constraints and profiting from the unique opportunity of the electrification of the largest LML in the European automotive aftermarket, we propose the following two main research questions:

- RQ1: Is electrification of LML economically viable in a European context?

- RQ2: What is the rationale for using Mobility Service Provider (MSP) cloud software, and how does it impact the profitability of LML?

The main research questions require several sub-research questions that will contribute to their answering during this article. The research sub-questions are:

- RSQ1: Why is charging redundancy needed, and which options are the most economically and functionally compatible?

- RSQ2: Could the digital nature of EVs and their infrastructure open the way for new business models in automotive aftermarket logistics?

- RSQ3: Which learning processes could be derived for any other logistic operator planning or undergoing the electrification of their LML operations?

The authors will be progressively developing the different balances required at each of the interfaces (see Figure 2) with a consistent research scope: the right balance between interoperability requirements and the economic profitability of the endeavor. Before developing this research initiative, it is undoubtedly helpful to set the framework to understand that electrified LML is a different activity than conventional last-mile distribution from an economical-technical-infrastructure (physical and digital) and data perspective.

The root cause of many novelty levels for the electrified LML is the fundamental differences between the ICEV and EV delivery platforms. As shown in Table 1, the range from the vehicles is different but more importantly, the recharging time required for the two types is drastically diverse, imposing the need for some new route planning and, potentially, some recharging top-ups for the EV during a working day.

Table 1.

Compared average range for diesel and electric vans currently used in the LML fleet of this study.

For this article, and based on the actual logistic operation undergoing electrification, the LML is operated by light commercial vehicles or vans. The freight volumes and load capacity span range from micro vehicles to vans, as described by length and height (see note in Table 1).

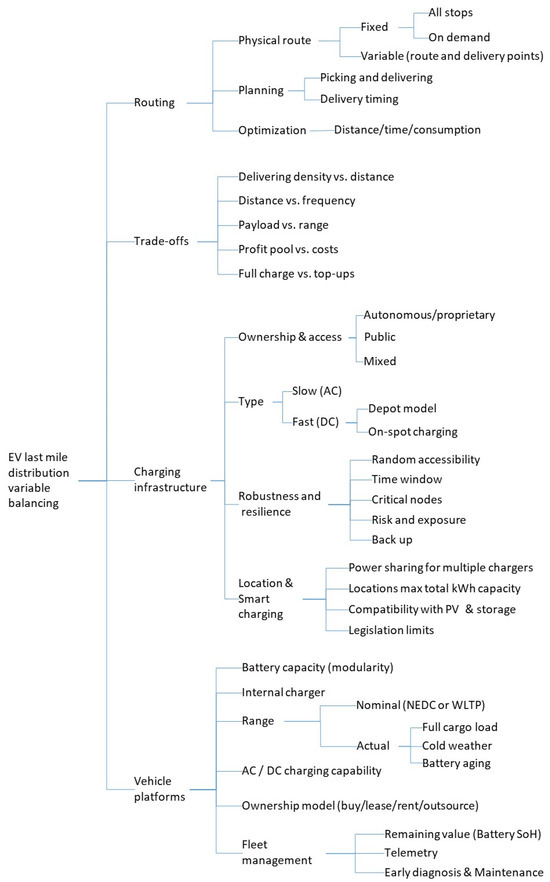

On the first-hand approach, Figure 3 describes some of the criteria and tradeoffs in the design of the newly electrified LML. While some elements, like the routing/scheduling, are expected for any LML (either electric or conventional); other criteria are directly derived from the initial differences in Table 1. They include aspects related to the EV platforms and the necessary tradeoff required for the different types of delivering routes and an adequate vehicle to serve customers on each of them. In addition to those elements, there are fleet-operating considerations regarding providing a supporting structure to the vehicles in their working environment to ensure that they will continue to fulfill the Service Level Agreement (SLA) that customers expect. The concepts of smart charging, load balancing, peak-shaving, and curtailment [36] are now embedded onboard some chargers and have a significant impact on the location and size of the charging facilities and, therefore, on the ability of the electric logistic fleet to accomplish its mission. These features respond to two main classes of boundary conditions to properly balance the grid and the recharging operations: implicit and explicit. Implicit limiting boundary conditions could include grid spare capacity optimization, time-based charging curtailment, and frequency balancing. Explicit boundaries are related to service demand and include constraints and congestion management. The type of last-mile logistics, either with fixed or variable routing, imposes boundaries on the location of charging locations, the number of chargers, and the recharging scheduling. The need for reverse logistics or variable collecting/delivering points equally influences the ability to craft routes compatible with EV autonomy while ensuring optimal vehicle utilization. In some Business-to-Business (B2B) supply chain logistics, the frequency of the deliveries or the time between placing an order and getting it delivered could impose severe boundary conditions on the EV deployment in a given LML route. The distance/time/energy-consumption balancing is more complex and broader on the operational consequences in EVs compared to their diesel equivalents.

Figure 3.

Key variables and trade-off for the electrification of the Last Mile Logistics (LML).

Urban spaces usually have a higher density of delivery points, leading to higher consumption in ICE vehicles. In contrast, thanks to regenerative braking, electric vehicles consume less energy in urban spaces than in long intercity drives. The distance vs. frequency is a general trade-off of any given LML route, but it might dictate the potential need for recharging top-ups in the cases of a high frequency of daily deliveries. It could lead to refining the routes to minimize the need for electric charging during service hours. The payload vs. range has different and more severe implications for EVs. The battery package is a heavy component with a large volume due to its much lower energy density than diesel fuel. In some new EVs specifically conceived for logistics, the battery is modular, leading to fewer battery modules for those vehicles aimed at shorter routes and complete battery modules for those aiming at more considerable distances. EVs (independent of battery configuration) tend to have a fixed maximum total weight. Therefore, vehicles with fewer battery modules have a higher payload capacity. Cost structure and the profitability of the EV operation is a balance between a cheaper energy cost, with a more expensive vehicle (either to purchase or lease), and a series of infrastructure costs supported by digital systems for their deployment and servicing. Finally, while refueling in ICEVs is a simple and fast operation that provides a very significant range, the equivalent for the EV is much slower, shorter range, and with a less developed charging network, potentially impacting the longevity of the battery packs [37].

The electric charging infrastructure goes beyond the chargers as it covers the location, the financial and operational impact of the charger’s ownership, and the EV charging speed capacity. There are fundamentally two types of chargers: either alternate current (AC) chargers or direct current (DC) chargers. The AC chargers cover power ranges up to 22 kW, while the DC chargers can reach 600 kW. Cost-wise, DC chargers are more expensive and usually are not in service by private logistic operators for their fleet. The DC chargers tend to be standard for highway charging stations for their obvious benefit of shorter recharging times. In order to have access to an external network of chargers, a logistics operator must have access, at a cost, to a cloud-based digital system provided by companies known as MSPs (Mobility Service Providers). In some countries, the logistic operator must request authorization to install EV chargers beyond a threshold power level. The physical space required to charge many EV platforms for several hours is another new and specific consideration for this type of vehicle. In the case of ICEV, refueling occurs outside the logistic operator’s premises.

In addition to the above, the electric vehicle determines the charging speed at which it can be re-energized. The power electronics in the vehicle and the connecting interfaces (plugs and cable) determine the maximum charging speed independently of the charger’s power. The system is a series-connected electric circuit where the slowest process dictates the speed of the whole charging system. In addition to the above, the range of the EV could be significantly reduced, up to more than 30%, by combinations of low temperature and high loads [38].

If a logistic operator utilizes its network of chargers on one site, the control algorithms will allow the usage maximization by the fleet seamlessly without the intervention of MSP software. Using chargers from another entity (or allowing other fleets to use your charging network) requires having the backing service of an MSP. It brings some uncertainty related to 1- availability at the time window of the recharge need and 2- the charging speed at which the charger can deliver the electricity to the EV.

The uncertainty about the electric power at which the chargers deliver electricity to the EVs might come from power-sharing schemes, also called smart charging, that obliges several chargers in parallel charging to share the limited available grid power.

An MSP provider will keep the different operators informed of the availability of the different chargers in different locations and signal those temporarily out of order. Scheduling functions are becoming common in MSP.

As the charging capacity of the vehicle, namely the State of Health (SoH) of the battery, will decay in time it is essential to have frequent or even continuous monitoring of it. SoH is affected by the type and frequency of charging and high-temperature excursions. Some cloud-based early diagnosis and maintenance monitor these novel vehicles’ battery SoH for proper long-term fleet management.

All of the above brings the necessity of building some intrinsic resilience in the operation of the new electric logistics structure and consolidating the distribution routing (including the location of the charging points), leading to delivery schemes that can be, ideally, sustained by a single full overnight charge wherever possible. The following article describes the actions, considerations, and tradeoffs to electrify one of the European automotive aftermarket sector’s most extensive B2B last-mile distribution networks. The approach has followed the well-known ASI (avoid, shift, improve) framework [39] in order to ensure the objectives of functional interoperability and economic viability of the logistic operations.

Based on the ASI methodology, the avoidance will be related to the reduction in the ICE fleet by its replacement with EVs, as well as the review of the routing to comply with the specific performance of the EV but not adding additional detour kilometers. The shift portion is related to the geographic location in different areas of the operational structure (sales outlets, depots). The improved part covers introducing micro EV vehicles to allow a punctual delivery of an order without covering the whole route.

A well-known leverage of the ASI approach related to the consolidation of the routes and reduction in the delivery frequencies is not an option due to the specific needs of this very competitive market. The current paper will, however, explore future paths that will allow even more relevant improvements in the LML. As described in the materials and methods section, this is not a hypothetical model but the actual numbers guiding the substitution of more than 7000 ICE vans in Europe in 4 years. The data sources include operations records, recent tenders, and internal validation. It is a unique set of the most up-to-date and complete parameters supporting the electrification of last-mile logistics.

2. Materials and Methods

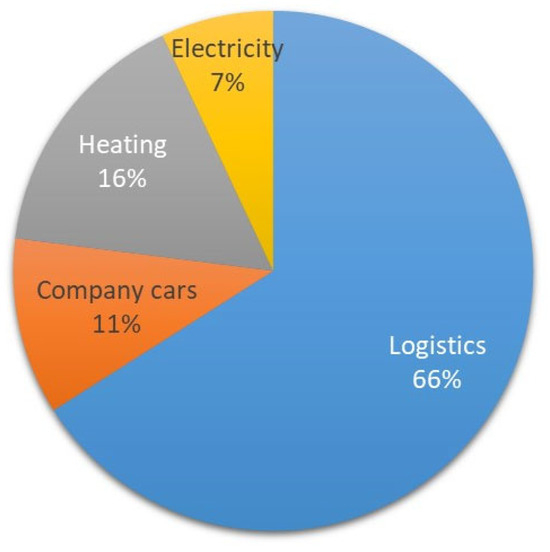

The focus of this article is the electrification of the last-mile logistics of the largest supply chain in the automotive aftermarket in Europe. The logistic operation expands, for this article, to France, the United Kingdom, Germany and the Benelux. The network in each country includes several large national and regional depots, complete with a dense network of sales outlets and local depots. The 3000 outlets and local depots serve and supply almost 40,000 workshops in the countries under study. The aftermarket operator assessed their CO2e footprint as reported in Figure 4 [40]. Their ambitious targets in terms of social and environmental responsibility highlighted the need to tackle the different emission sources but with an emphasis on the electrification of their logistics operations. Last-mile distribution logistics represents more than 80% of their logistic emissions.

Figure 4.

CO2e footprint of the automotive aftermarket operator.

The nature of the logistic operation for this specific B2B sector is peculiar as it combines different attributes from the scheduled and on-demand LML. The authors call it a hybrid LML, defining the routing for all platforms (EV or ICE) in advance, but the in-route delivery scheduling is order-based. The very nature of the aftermarket business leads to SLA (Service Level Agreements), including delivering goods and parts less than an hour from the electronic ordering. This tempo implies a non-negotiable condition of first-time-right bringing the right parts for the right vehicle. A very robust e-commerce and part identification digital platform ensure this business continuity. On the logistic side, this leads to marginal or nil levels of reverse logistics. The operations run under a fast tempo, with routes being served from a minimum of 6 times per day up to 10 times per day. The response time is fast, and the vehicle utilization is medium in terms of the usable payload. Table 2 presents the key attributes of the hybrid logistic network under study.

Table 2.

Last mile logistic (LML) logic prime attributes.

The preceding inclusion of micro-electric vehicles to the LML network has already added some elements of randomness to the scheduling and routing. It focuses on one-off deliveries that will hardly justify a partial route coverage. Delivery point is undoubtedly familiar and known, but heterodox scheduling is order-dependent. The receiving repair workshop working hours define the time window of delivery opportunities.

Besides any change in the vehicle platform used in the electrified LML, there is a practical consequence for the drivers associated with the vehicle type change. As in the past, it could be an accepted practice that drivers might return home using the delivery van; this practice will end with the arrival of the new EV as the logistic operator will not install chargers on premises other than its own. Any other external source of disruption, as cited by [41] is not relevant to the current transition to EV

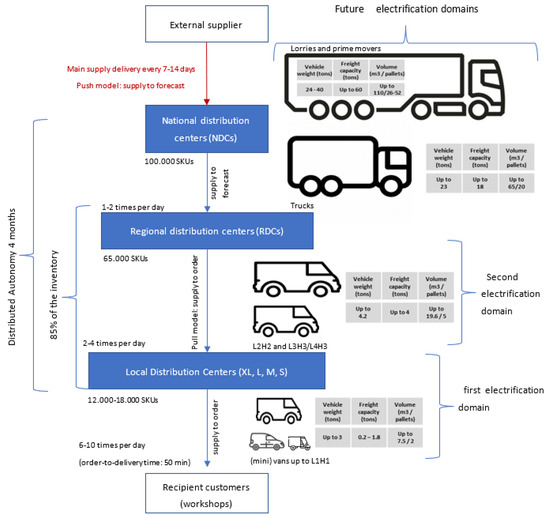

Figure 5 shows the organization of the value chain and the enhancing logistics that make it feasible. It shows the different distribution echelons and the vehicle types usually operated. The indicated frequencies are those exclusively related to the LML operator. It excludes some level of cross-boarding that varies from country to country. The authors have focused on the denominated first and second electrification domains. The selection of the specific domains resides in the actual technical and commercial availability of electric vehicles able to fulfill their delivery functions. Future domains, including electric trucks and prime movers, are in an advanced stage of development but their entire operational ecosystem still needs to meet the requirements of a high-intensity B2B LML operation.

Figure 5.

Supply Chain and the different electrification domains for its logistics.

It is a highly distributed and dynamic supply chain relying on a massive fleet of vehicles ranging from mini-sized to the largest non-truck dimensions. The challenge with this LML structure is that the electrification must ensure a transition without disturbing the business basis and the levels of service for the customers. The transition will imply a period of coexistence between ICEV and EV within the fleet and, therefore, proper planning for deploying the EV in specific routes. Prior to the launch of any electrified route, the charging infrastructure must be authorized, acquired, installed, and verified. Professional installation of the charging equipment and grid authorization is nowadays a time bottleneck for launching the newly electrified logistics. The situation will undoubtedly improve, but it still is a limiting factor.

Such complex logistics and its EV transitioning without jeopardizing the business lines require carefully analyzing the different interactions. In order to have a manageable analysis tool, there is a need to establish the different elements that will be included and excluded from the model and its calculations. Table 3 provides a brief overview of the variables in and those that have not, with a brief rationale. Table 4 includes the data sourcing information and some calculation methods used during the development of this article.

Table 3.

Inclusion and exclusion criteria.

Table 4.

Variables and equations.

A first and noticeable difference is the inclusion of the vehicle types and their performances. Meanwhile, for a conventional LML, the nature of the vehicle will only marginally influence the analysis. In the case of EV platforms, they determine the level of services and the supporting environment (charging and digital) to ensure seamless deployment. Current vehicle maturity, technical and commercial, makes the electrification of the LML possible. New platforms about to enter the market could bring the first commercial vehicles designed as purely EVs, not as a transformation of an existing ICE version of the exact vehicle. Performance envelope is, therefore, expanding rapidly, providing the reach for an increasing number of EV delivery routes.

As indicated in the introduction, the charging infrastructure and the digital access enablers (MSP) are also new elements that the logistic operator needs to include in the deployment plants to have a viable logistic proposition for the high-tempo supply chain of automotive after-market servicing. Part of that digital environment goes beyond the charging part as it relates to the understanding of EV performances and its evolution in time. It simplifies maintenance, allows vehicle retained-value estimations, and increases the availability of the EV for logistic duty.

The authors have only considered vehicles with the proper technological maturity. In this study, the authors have excluded some potential future means of delivery (drones, autonomous vehicles) or decentralized manufacturing of goods (fab shops). The above delivery-means belong to the Framework Space and Public Space described in Figure 1 with some punctual experimentation on the Private Space. The e-commerce platform considerations have also been left aside in this study as the authors believe that e-commerce building blocks will fit the electrified logistics. The same applies to the effects of the same reliable e-commerce platform in the absence of reverse logistics.

All energy prices (diesel or electricity) have been considered without local or temporary subsidies so that the analysis is more robust and not biased by incentives or consumer protection measures that are temporary by nature. Although currently considered and evaluated by the operator, energy storage and photovoltaic (PV) installations still need further assessment. They will undoubtedly improve the economics and potential speed of charging of any EV solution. However, insufficient operational returns to quantify their contribution to profitability makes the authors prefer a more conservative approach by excluding them from the analysis.

AC chargers with a maximum power of 22 kW, constitute the backbone of the electric charging infrastructure as the best trade-off between power, charger cost, and the possibility of installation. The operator chose vehicles that could also connect to DC chargers using the European AC/DC CCS-plug. This AC/DC charging option will leave open the hardware possibility of connecting to fast charger networks on highways but also increases the residual value of the vehicle by increasing the types of charging options.

The ownership model followed by the logistic operator is a leasing structure. Considering a pure leased fleet, the authors have sufficient information to incorporate the additional leasing costs for the EV platforms. It also allows the authors to avoid including models of battery decay in SoH. Even lessors need more accurate life data about the battery life of their vehicles, opting to lease contracts of around four years well within the Original Equipment Manufacturer (OEM) warranty of 8 years. The vans can then be sold in the second-hand market still under the constructor warranty.

Two aspects deserve a deeper description of the methods followed to optimize the analysis: the fleet selection criteria and the routing optimization. Electric vans have followed a different development path than EVs for private use. The latter has started from the beginning to be brand new fully electric designs. In contrast, the first two generations of electric vans for commercial use were the electrification of existing vehicles to complement the offer of ICE platforms. Table 5 shows a more detailed look into the different criteria that transformed those vehicles into platforms suitable for the intense logistic frequency of the last-mile distribution.

Table 5.

Electric platforms for the different distribution domains.

The first generation of commercial EVs were electric versions of the existing models in the market. That limited the size of the battery pack since they needed more floor clearance and space to install them. The initial mission profile was to bring a team of workers, with their tools from point A to point B and, after performing the work, bring them back to base. The small size of the battery pack leads to a short range. Table 5 reports the range using the most commonly used standard, the WLTP, for range [47], even though there are more sophisticated/accurate ways to assess the actual range of the EV [48]. As the vehicles were supposed to charge overnight, they were not equipped with fast internal chargers and charging could take up to 22 h. Those vehicles’ performance showed low utility for the logistic operations by their range and charging time combination.

The second generation of vehicles was still a conversion from an existing model. Batteries were left the same or marginally increased. The range remains the same. To make the second generation of commercial electric vans more adequate for logistic operations, the constructors increased the power of the internal charger to 11 kW and 22 kW in AC charging. More recent versions of the vehicles offer the possibility of both AC charging and DC charging via a CCS plug. The average maximum DC power usually is 80 kW.

The third generation of commercial electric vehicles is the first that is fully electric from the drawing board and is not an adaptation of an existing model. They tend to be modular in their battery pack design, allowing the operator to configure the trade-off between distance and payload for different logistic routes. The initial configuration can be upgraded/downgraded later on as per the needs of the distribution fleet operator. In general, large courier operators with large volumes and no significant cargo weight are the primary aims of this new generation of commercial EVs. Their introduction to the market starts with massive orders from very large couriers (also shareholders in the new ventures).

The authors consider a micro vehicle any delivery platform with a freight capacity inferior to 250 kg. They could be ICE or EV. For the latter, the authors consider a micro EV a platform with a battery capacity of less than 10 kWh. Those platforms, electric in the case of the logistic operator under consideration, are already added to complement the capacity for one-off deliveries where full route coverage will not be justified.

Although not considered in this electrification case, the EV platforms for trucks and prime movers show a lower Technology Readiness Level (TRL) but are moving closer to commercialization. Trucks aim for lower frequencies but longer routes that allow them to recharge overnight using AC chargers of 22 kW (5 to 8 h charging). Heavy prime movers focus on DC charging (even if they can charge with AC-compatible plugs). The focus on DC charging is related to the large capacity of the installed batteries. Fascinating ecosystems are developing either to create ventures of established OEM and electric truck startups [49,50] or to provide those future heavy e-Lorries with innovative, sometimes mobile, charging units using former batteries from EVs [51,52]. The authors maintain the core focus on the actionable electrification of the LML, and the paper will continue with the core emphasis on the first two electrification domains shown in Figure 5.

Routing is another crucial factor when electrifying last-mile logistics. This specific distribution network and the business sector of activity do not allow the building of proximity stations/hubs to deliver the goods and, in so doing, improve the efficiency of the LML. On the other hand, there is no customer presence uncertainty as goods are urgently needed.

This type is a single pickup point with multiple delivery points, with a heterogeneous fleet and a time window for delivery [53,54]. As the last mile logistics are considered the most expensive and ineffective part of the value chain [55,56], the authors looked at the initial operation with ICEV to reduce the impact (social, economic, and environmental) before transitioning into the vehicular electrification process.

General trends and specific boundary conditions for this last-mile logistic routing are worth discussing. Table 6 presents a summary of these points. The Vehicle Routing Problem (VRP) aims to improve the performance of the logistic operation. The term performance includes various elements like profitability, reliability, and consistency. Significant emphasis is on designing simple distribution routes with reduced navigation complexity and shorter, compact paths to minimize the need for top-up times during operation. There is a need to define the degree and location of potential overlapping points of the multiple routes to install redundancy charging capacity. The robustness of the electric VRP solutions depends on the vehicle availability and the functional accessibility of the charging infrastructure. The former is a general factor for any logistic operation. However, the latter adds a new layer of potential sources of hazards to the smooth running of the logistic distribution. Although contractual warranties of modern AC chargers assure up-times of 98%, the practical experience of operators leads to lower availability levels. The lower uptimes can be associated with the charger or other accessory factors (e.g., a faulty RFID reader that does not recognize the van and, therefore, does not authorize the start of the charging process). Faulty chargers could jeopardize the delivery route of an EV in the absence of some redundancy.

Table 6.

Vehicle Routing Problem (VRP) and charger location criteria and boundary conditions.

A more relevant factor than an individual failure of some chargers is present under the term “smart charging”. Initially, smart charging was a feature allowing users or the charger to choose the time of the day when to charge (usually the periods with lower electricity tariffs).

The time-choosing feature was a first step toward a future deployment where EVs will be distributed an electricity-storing capacity for the grid. As the demand for and the deployment of EVs have vastly exceeded the growth of electricity generation, smart charging now covers several other elements that directly impact the EV charging speed and, therefore, the overall electric logistic operation.

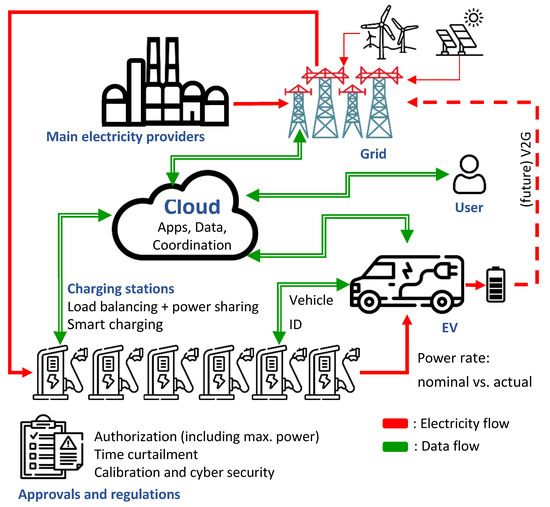

Figure 6 schematically shows some elements embedded under the term smart charging. One initial factor now included at the charger level is load balancing or power sharing. Suppose the grid only allows a given number of kWh assigned to a location (e.g., a logistics depot). In that case, the different active chargers will share that maximum load.

Figure 6.

Energy and data flows determining the actual power supplied to the EV under smart charging.

There are several ways to share the available electric energy: (a) a linear spreading of the available power among the active charger that leads to all chargers charging at the same speed or (b) an intelligent charging scheme where cars with lower battery levels receive priority to charge faster than those with a higher state of charge. Alternatively, some software allows allocating different power levels to specific vehicles (e.g., those with longer distribution routes). There could be a centralized controller that monitors and distributes the electric energy among the chargers or a ¨master-slave¨ configuration where only one charger (the master charger) interacts with the grid and then distributes the electricity to the other slave chargers. This solution tends to be cheaper but may induce the risk that if the master charger fails, all other connected chargers (the slave chargers) may either fail or fall to the slowest possible charging rate.

An additional factor is related to time curtailment, where charging of EVs is not allowed during some specific times of the day (where grid peak demand might occur). Time curtailment is mandatory in the UK, but other countries will likely replicate the time limitation. The above charging speed limitations are implicit at the charger level, and they imply that the effective rate of electricity supply to the EV might be lower than the nominal power of the charger. These new smart chargers are mandatory in the UK [53,54,55], the Netherlands [56,57,58], and Germany [59,60,61,62,63] and it is highly probable that they will be extended to Europe [64,65,66].

The impact of linking the location of the charging infrastructure to existing business locations is significant. The same reasoning allows for defining future new locations for depots and sales outlets based on the logistic operation. The average route length and the distance between the potential charging points directly affect the definition of the EV fleet (both sizing and composition). Consequently, the inventory locations ensure the right coverage within the shortest range.

The fact that the logistic operation is not starting from scratch but constructed on top of a large organization with an established footprint (in terms of logistic echelons, customers, and business expectations) imposes some specific boundary conditions to the specific electrification initiative.

Among some of the most relevant boundary conditions for the electrification of the last mile logistics, it is possible to indicate the need to have an exact starting and ending point to maintain the scheduling configuration for the customers. A minimum of one charger per vehicle will be augmented with additional chargers to cope with the potential failure of a given charger. The operations have intrinsic redundancy as the logistic operator owns more than five hundred EV maintenance workshops. Each of them has a minimum of one EV charger and up to six. Even though those chargers could be used to charge customers’ vehicles or carry out advanced diagnostics of the batteries, an intrinsic charging margin is embedded in the system.

The authors followed a Whale approach to define the number and location of the charging stations (either owned or publicly available via an MSP). The Whale algorithm [67,68,69] is easy to understand and supports the charger’s operational deployment under the specific location-solving framework of last-mile logistics. The Whale Algorithm is based on the hunting habits of humpback whales and has three distinct phases: (a) the surround prey hunting, (b) the bubble net attack, and (c) the random hunting (or search for prey). In the surrounding prey hunting, the best-placed whale (van) identifies the optimal distance for the prey (charger) and informs the other whales. In LML terms, this corresponds to the different vans serving a given route and the basic configuration of one charger per van. Should any malfunction occur, the leading van will inform others to find an alternative distance vector to a different charger/prey. The Bubble net attack is usually a three-dimensional algorithm, but it is a two-dimensional approach in this logistic case. Another difference is that instead of shrinking the circling component over time, we have an expanding circling that we minimize, locating the redundancy chargers in spots that could be reached by vans with a minimum detour and serving more than a distribution route. Suppose there are power limitations at the route’s start point (e.g., a depot). In that case, the alternative chargers will focus on other locations along the route to ensure that the EVs are charged at the nominal power of the chargers. Random hunting in nature is the search for potential prey. Our logistic approach covers both the installed chargers in the specialized EV workshops and the public chargers in the vicinity of the routes. As for the hunting whales, there is no guarantee that those chargers will be available instantly. Except for the public chargers, all other charging stations are rated AC 22 kW. Public charging is more expensive and may require longer detours, but the vans can also charge up to DC 80 kW, compensating for the detour time with a shorter charging time.

All the above coordination and communication between vans require robust MSP support. Some authors [70] define random hunting as exploration, the bubble net attack as exploitation, and surrounding prey hunting as convergence.

Maintaining a viable operation minimizes idle times (e.g., recharging during the day) and creates a charging infrastructure that minimizes the detour kilometers. The main objective is to maximize the number of routes (and EV platforms) only requiring one overnight charge.

The following tables in the result section progressively develop the energy transition’s financial cost at actual market prices and momentarily ignore the one-off investment costs of acquiring the AC chargers and their installation. Progressively, the authors considered additional layers of cost in order to find the right balance between the need-to-have and the nice-to-have components of an electrified LML. Among them are additional leasing costs. A detailed analysis of the MSP cost in terms of their price structuring and sensitivity allows the authors to determine their impact on the profitability of the logistic operation.

3. Results

Table 7 presents the main operational parameter of the logistic network based on actual annual figures for the ICE fleet as it currently operates. The authors have divided the small vans (up to L1H1) and the large vans (up to L3H3). The average L1H1 covers 40,000 km/y, while the average L3H3 covers 60,000 km/y. The fleet operates six days per week all year, making 312 active-duty journeys per year with an all-fleet average of more than a million kilometers per working day. On a global European basis, the 7000+ van performances are similar between the small and large categories. The same applies to the kilometers covered by the two classes among the four considered European countries.

Table 7.

Fleet main operational parameters.

This apparent homogeneity hides notable differences among countries regarding fleet composition and utilization. Comparing the fleets of France and Germany, two countries of roughly the same size, they seem balanced in opposite directions. France has a slight predominance of light vans, while three-quarters of Germany’s fleet comprises large vans. The kilometers covered by both categories are similar in France. Larger German vans take the bulk of the kilometers covered by the fleet. This more significant contribution of the larger vans is due to a non-homogeneous coverage of the territory, leading to the incorporation of longer distances. Recent M&A acquisition by the operator in southern Germany will lead to a more capillary distribution of the depots and outlets that should tip the balance for frequencies rather than distance.

Comparing the UK and Germany, two operational differences appear. Even though Germany is 1.5 times bigger than the UK, the number of distribution vehicles is almost inversely proportional to the country’s size difference. The composition of the fleets seems opposed as small vans dominate the UK compared to the fleet composition in Germany. The key operational difference is that the UK runs the logistic operation with the highest tempo, having most of its routes with ten daily rotations. The influence of frequency maximization in the UK is reflected in the average kilometers covered by vans in the UK, which is higher than in Germany despite having a smaller country and a more extensive fleet.

Although the Benelux appears as the same entity, the operations in Belgium and the Netherlands are vastly different due to the number and proximity of large depots in the Netherlands compared to Belgium. For some specific categories, the presence of large component manufacturers in the Netherlands allows a higher level of cross-boarding. The service frequency in the Netherlands is eight rotations per route for the whole country, making it Europe’s second most frequent delivery network.

The next step in the analysis (Table 8) consists of evaluating the cost structure of the ICE fleet operation and the CO2 emissions of the current LML. The assessment of the fuel costs is a function of the actual prices for transport/industrial diesel per country. Regarding emission, for each van category, the authors used the actual declared emission values for the different vehicles in the platform. The authors calculated a high and a low-end emission level using the emission levels of the most and least contaminating vehicles and then a weighted average of the high and low levels to provide fleet values.

Table 8.

ICE vs. electric fleet parameters, costs and profit-benefits.

The results in both areas, fuel cost and emissions, clearly confirmed what [24,71,72] stated in terms that the greening of the LML is an opportunity window to “foster financial returns and environmental sustainability”. Besides, and beyond the above, operators should be aware that the ICCT (International Council on Clean Transportation) [73,74] is discussing raising taxes in order to accelerate the date when the EV transport platform will equal the TCO (total cost of ownership) of diesel platforms. The current proposal ranges between 2 and 4 euros/day and per vehicle. Such a taxation would represent between 4.5 and 9 million euros/year for the fleet operator under consideration.

The route optimization incorporates the multiple boundary conditions of minimizing/avoiding detour kilometers, driver working duration while minimizing length, and driver idle periods (primarily due to recharging). The exercise allows an electric LML without adding kilometers and with minor adjustments in routing that compensate for each other. The fact that the operator directly owns or has uncompromised access to a vast array of potential charging locations simplifies this LML electrification. The authors understand that the same capillary flexibility might not exist in other LML networks.

The operation cost calculation using electricity (Table 8) as the energy source requires a brief description of the electricity market and its providers for charging EVs. The electric grid provides electricity to domestic, industrial, and business users at a specific price per kWh. The grid price of electricity is the one the operator using its chargers at its facilities will pay. Grid kWh is remarkably cheaper than a liter of diesel, but it also provides less range despite the much higher efficiencies of the electric motor compared to the ICE equivalent. As per Table 1, one kWh may propel a vehicle for 5–6 km, while a liter of diesel would provide 12 to 16 km. Even with that range difference, the grid kWh is more competitively priced than fossil fuel. Companies providing charging infrastructure to logistic and private users charge a premium on top of the grid price. The premium reflects the charger infrastructure, its installation, maintenance, connectivity, secure access, and a profit margin for the provider. Usually, the charging providers indicate the prices for the public charging in power brackets: AC (up to 22 kW), DC fast charging (up to 50 kW), and DC ultrafast charging (for power levels above 50 kW). The tariffs are country-specific, based on the differences in electricity grid prices and competitive considerations.

The selected EVs from Table 5 to operate in the newly electrified LML are all equipped to accept AC and DC charging. The AC charging capability is up to 22 kW (the highest commercially available), and the DC charging is around 80 kW (the standard offer for electric light commercial vehicles). The authors have, therefore, considered three options to evaluate the cost of the electric energy required to operate the LML: privately owned AC chargers (22 kW and paying the electricity at grid price), public AC chargers (always 22 kW and paying the electricity at the rate charged by the charging provider) and, finally, public DC chargers (up to 50 kW and at the rate charged by the provider). The authors recognize that there could be mixed solutions with different private vs. public charging ratios in different configurations. Table 8 shows the results of such calculations in two steps. The first is simply showing the cost of the electricity; the second step is subtracting the electricity cost from the diesel cost to verify the existence of a monetary margin resulting from the energy transition.

The straightforward calculation shows that public charging is significantly less attractive than private charging. There was a margin for most of the options when subtracting the electricity cost from the diesel cost. Margins clearly and rapidly decreased with public charging (especially DC charging). One interesting case appears for the Benelux when comparing the fossil fuel cost vs. the 100% public AC charging. The latter was more expensive than the diesel fueling. A justification for this exception finds that the Benelux has the lowest diesel price of the four zones considered and, simultaneously, the highest public rate for AC charging at 22 kW. From that moment onward, the DC calculations made little sense, if not for minimal fractions of the total charging.

This analysis has assumed, for simplicity’s sake, to have a fully leased fleet (which is the case in several of the considered countries) in order not to have to introduce calculations about the decay in time of the battery performance (known as the Battery State of Health, SoH). Assuming leasing periods are shorter than the OEM warranty, the vehicle will leave the logistic fleet to the lessor that will sell it (still under OEM warranty for the battery) in the second-hand market. Another advantage of such an approach is that routing does not require compensation factors to account for the decrease in the range of EVs. The leasing of electric vehicles is more expensive as the vehicles are more costly than their ICE counterparts.

The reduced and cheaper maintenance of the EVs attenuates the initial acquisition cost. Discussions with the lessors allow the authors to estimate the increase in the leasing rate of 120 euros/month for the small vans (up to L1H1) and 200 euros/month for the larger vans (up to L3H3). Adding these costs has a minor, marginal, effect on the viability of the electrification transition.

Charging EVs in chargers other than those of the vehicle operator is an engineering and business activity requiring three actors. There is the company that owns and operates the charging stations. It is known as a CPO (Charge Point Operator). The CPO could be public (a city) or private. There is the driver of the vehicle (or the company that operates the vehicle), and there is the E-MSP (e-Mobility Service Provider) that links the two to allow the drivers to find suitable/available charging stations and allow the CPO to charge the driver for the charging service. The E-MSP provides access to charging networks across countries [73,74,75,76,77,78].

There are two types of E-MSPs. One group of MSP vendors (the authors labeled them as integrators) univocally linked their cloud platform to some brands of chargers. Any CPO that wants to join them needs to operate the charger brands supported by the MSP: Any other brand will be either not connected (redirected as described in the MSP jargon) to them or will pay expensive, one-off, adaption costs are to be covered by the user. They operate an all-inclusive package where software and hardware come together with no other option. Other providers of MSP are the so-called “agnostics” as they redirect any charger as far as they use a communication protocol named OCPP (Open Charge Point Protocol) that all chargers use or OCPI (Open Charge Point Interface) that is becoming increasingly popular in Europe. Although the preference from the operator was for an MSP that will allow to keep future strategic independence in sourcing the future chargers of the logistic network, the analysis incorporates all vendors to evaluate the differences in their business models, financial impact, and ability to scale up the system. As a general backup, the MSP complements the charging infrastructure and opens the possibility for access in any available CPO. The only discarding criteria were any inflation-prone proposal (tied in with the kWh price or the total billing). Table 9 shows the diversity of proposals and the wide variety of variables called into formulating the pricing formula for a hypothetical fleet of 1000 EVs. Table 10 shows a transversal sensitivity analysis for the nine MSP proposals using low-normal-high scenarios for the key input variable variations and their impact on the output (price) variation.

Table 9.

Mobility Service Provider (MSP) annual cost calculation and impact for 1000 vehicles fleet.

Table 10.

Mobility Service Provider (MSP) sensitivity analysis for a 1000-vehicle fleet.

Both agnostics and integrated providers have a cost range between the most expensive proposal and the least expensive one, which is around 150,000 euros/year. The agnostic supplier’s offers were more expensive than those of the integrator. Based on the initial criteria of non-inflation, offers from vendors 3 and 8 are not acceptable for the logistic operator.

The cost of all the E-MSP proposals was higher than the potential savings from shifting to public electricity charging (even those derived from AC charging at 22 kW). The scenario with 100% owned AC chargers allows a large enough margin to cover the cost derived from the MSP. It is quite an expensive option as a first approach to a simple redundancy solution. The financial structure of the MSP proposals is based on other business categories different than logistics (Table 11). Three business categories need an e-MSP for their business:

Table 11.

Main differentiators between operations and supplying electricity to a logistic fleet versus third-party individual customers.

- (1)

- Companies (CPOs mainly) that focus exclusively on EV charging must maximize the utilization of their installed assets.

- (2)

- On the other extreme of the spectrum are companies whose core business has nothing to do with EV charging but use it to attract users to their core business (hotels, malls, supermarkets). They need the broadest possible access to the charging assets and various payment methods.

- (3)

- The third category includes the drivers/users. For private users, low-cost access IDs allow them to charge in a very vast charging network at the European level.

The MSP could provide extensive recharging portfolio access for business drivers (freight fleets, car sharing, e-taxis). The MSP’s contribution to the logistics business will be a subject in the following section of the paper.

The sensitivity analysis, a crucial tool in our evaluation, is presented in Table 10. It is based on normal-high-low scenarios for the input variable variation replicated for the nine proposals. As expected, the structure of the MSP proposals is entirely different, and different outcomes are logical. However, several elements are worth mentioning and valid across most MSP offer spectrums. The sensitivity to the kWh price is significant in absolute terms but even more so in the historical moment perspective. The electrification of the LML started at the beginning of 2022, and the events in Ukraine signal a significant increase in the kWh price (and even more significant for the diesel price).

The authors also used sensitivity analysis for the electricity and diesel price evaluation. Both diesel and kWh move in synchrony, but kWh is less prone to sudden price shocks as the electricity sources are diversified: oil/gas, renewables (wind, water, solar), nuclear, thermal, and others) [79]. Given the market volatility vis-à-vis the energy prices, the logistic operator decided to decouple the MSP price from the energy billing. These results are crucial for the logistic operator’s decision-making process, providing a clear understanding of the potential risks and benefits of electrifying the LML. A significant factor arises when the input variation relates to the number of charging events. Besides the potential economic impact, any increase in the number of charging events during a working day implies additional idle time charging and the potential risk of being unable to meet the established Service Level Agreements (SLA) with customers.

Ensuring deliveries within the SLA with the electrified LML is imperative for the logistic operator. There are two types of charging events daily: one long, fully-charged overnight session and the potential top-up of some vehicles in specific routes (or if carrying heavy freight in colder weather). Nominally, the average distance covered daily by vans in Europe is 143 km/day (see Table 7), and the WLTP range of light commercial e-vans ranges between 90 and 250 km. The battery range, weather, and freight loads leave the distinct possibility of having top-up charges during the day. The operator has accounted for this and nominally set the required chargers (at the proper locations) to ensure robust delivery according to the SLA. The reasons for the potential increase in charging events appeared during the initial pilots that the operator ran in France and the Benelux. To comply with the route rotation frequency, the top-up recharging was set in time (not based on any State of Charge, SoC). Even though all chargers and all vehicles were compatible with charging at 22 kW in AC, some vehicles showed SoC below the expected charge and were more compatible with an effective charging at 11 kW or less. Limits to the actual power available for charging could be due to two factors that may overlap: zone power limitations and location power sharing for several vehicles charging simultaneously. A lower SoC implies a shorter range and the possibility of additional top-ups either at the operator’s network or at public chargers (if time pressure forces the operator to do so in order to comply with the SLA). As indicated by Table 8, public charging significantly reduces the financial profitability of the logistic operation. Profitability is one of the essential conditions for the decision-making to electrify the LML

The logistic operator was already deploying PhotoVoltaic (PV) panels on all its main facilities (including its depots) roof. The PV and the grid will now constitute a multi-energy microgrid to support EV charging. This engineering endeavor requires careful regulation of the energy storage associated with the PV. The PV Battery Management System must ensure a charging operation that runs independently but alongside the grid. In the literature, this hybrid configuration is called a grid-connected PV microgrid. One main challenge is balancing the supply vs. load mismatches during different times of the day [80,81,82,83].

A practical approach to ensure charging at the power rate is to move the charging to time zones where the grid is less stressed on the demand side and higher power levels are available for charging. This focus on specific time windows is now mandatory in the UK but will be expanding to the rest of Europe as the grid capacity is struggling to cope with demand [84,85].

A final element emerges from the sensitivity analysis highlighting the differences in operations between an MSP used to support a logistic operation and one aimed at supporting independent users. The input variables that emerge as significant are fixed costs (subscription, roaming, 24/7 service, tokens, and others). Their nature, mostly subscription and roaming, needs to be more accurate as there are no actual meaningful costs associated with new chargers redirected to one specific MSP. Such fees only ensure the MSP has some cash flow while the CPO (Charge Point Operator) obtains sufficient new users as it grows the operation. The consequence is that during the initial stages (the first hundreds of chargers), the MSP becomes an expensive tool when the business still needs to generate cash. Some vendors will withdraw the subscription fee once a threshold (number of users/charging events, kWh) is reached. The situation is different for a logistic operator as the number of users equals the number of vehicle platforms, and it is well under control with a fast ramp-up to cover the number of vehicles in the LML. The other fixed cost is usually related to the 24/7 helpdesk. This type of service is the core activity of independent third-party companies that provide those services to any company. While a provider to a growing number of private users does need to have such a service with local access numbers and local language-speaking operators; the equivalent for a logistic operator, this type of support can be internalized by the same units that take care of managing the ICE fleet when on a vehicle or a fuel card does not work. The MSP offers are not specific to logistic operations, and therefore, logistic operators should analyze what parts of the MSP offer contribute to the operation of an electrified LML (see Table 11). All MSP providers supply (for a small fee) smart Radio Frequency Identifier (RFID) cards/tags or Near Field Communication (NFC) apps for mobile phones.

An additional factor to consider related to the electrification of the LML is the investment level required to acquire and install the chargers. Although this electrification endeavor is European, there is no such thing as a European technical specification for EV chargers. The technical specifications diverge among countries in significant matters. The required cybersecurity/encryption levels vary, as well as the nature of the kWh readers (and their remote calibration). The most comprehensive standards in Europe are the German requirements for chargers. Under the term ¨Einrecht¨, several requirements of the so-called Calibration Law apply to any device used to bill users. In the case of remote/digital operations, the norm requires a secured process chain to ensure faultless transmission of the reading in a transparent way. Both the meter and the transmission process need to be remotely testable by the authorities. Cost-wise, the German market chargers are the most expensive (with some providers declining to produce AC chargers for that market). The most recent UK requirements have moved closer to those in Germany. All the above shows that the charger’s prices for the same power range cover a range, with Germany on the top, followed by the UK and then the French and Benelux chargers. Authors could set a high-end (German level) and a low-end price (Benelux price) range for chargers and their installations for the total number of chargers included in the electrification of the operator’s last mile logistic. Table 12 shows the overall cost and payback times based on the profitability levels for internal charging indicated in Table 8.

Table 12.

Investment payback period for a wholly owned recharging network.

Public charging and the MSP price configuration will make the payback period longer. There is a significant, although non-quantifiable, time cost related to the authorization process in some countries, as well as the lack of enough qualified installers.

4. Discussion and Conclusions

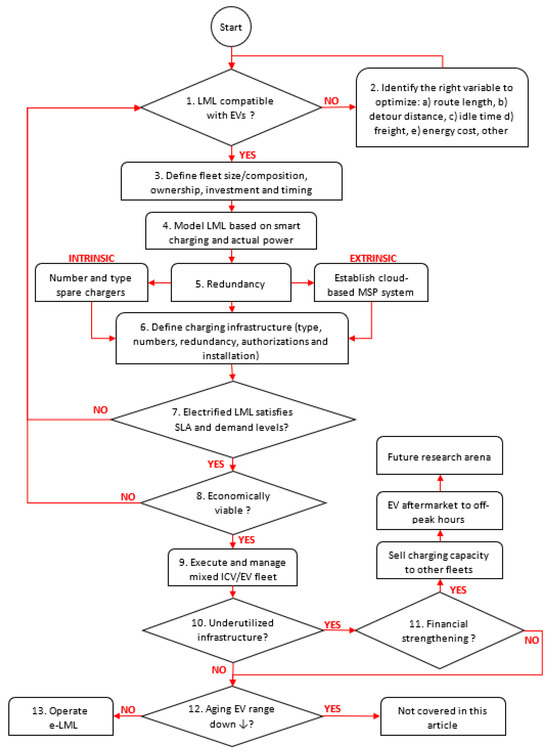

Figure 7 simplifies the thinking flow that the authors have followed during the electrification of the last mile logistics that this article is reporting to provide substantiated answers to the main research questions and sub-questions.

Figure 7.

Flow diagram of the analysis process to electrify the LML.

There are three decision levels to consider in defining a viable solution to the electrification of last-mile logistics. One level that the authors would qualify as operational is related to the routing optimization and charging process/levels to satisfy demand levels as anticipated.

Another level, defined as tactical, relates to the vehicle selection (fleet size/composition, investments, and timing). The final level, defined as strategic, is related to the ownership model of the charging infrastructure (public vs. operator-owned) and the technology choice (AC/DC, vehicle plugs) and charger location. The LML operator followed the strategic → tactical → operational path reflected in the flow diagram of Figure 7. The logistic operator decided to primarily support its electric distribution operation with AC chargers owned by the operator and located in specific locations (all belonging or associated with the operator). The strategic choice allows for the definition of the fleet composition and, from there, the routing definition and the associated charging time and charging levels.

The main research question focuses on the economic viability of the electrification of last-mile logistics. The results show that the electrification of the LML is feasible and a robust/resilient value proposition that maintains the expected quality levels from customers and ensures the operator a sustainably profitable activity. The need for the operator to provide its specific charging infrastructure differs from conventional (ICEV-based) logistic operations. The same applies to the charging times in between working hours. The one-off investments (mainly chargers and installation) reported in Table 11 are manageable and in line with [86,87,88] for the AC charging. A fundamental difference in the way the pay-back period is articulated for electrified LML is that the revenue actually is savings from the energy bill compared to ICE vehicles. Contrary to classic economic models [89], revenue is not generated by third parties using the charging infrastructure. The two business models are different but potentially complementary. It is worth noting that those investment costs did not account for the additional cost of the MPS, which, as shown in Table 9 and Table 10, could be significant. The analysis shows that profitability depends on fine-tuning between charging at the operator’s chargers (at grid electricity price) and the different options related to charging at other operators’ chargers with higher fees depending on the charging power. A significant time cost is associated with the deployment of the charging infrastructure. The time cost is associated with the required authorizations, the installation of the chargers, and the time required to have the internal teams adequately trained. The previous factors are all critical requirements needing attention from operators. Organizations tend to over-manage the investment side while undermanaging the timing factors.

The second main research question was related to the rationale for the MSP and its potential impact on the profitability of the transitioning to electric LML. The answer should embrace two research sub-questions focusing on the redundancy levels and the digital dimensions associated with EV. There are several levels of redundancy in the design: (a) there is a charger capacity at every single EV-specialized workshop (500+); (b) some vans are equipped with onboard mobile chargers that can connect to standard European 32 Amps sockets widely available in automotive workshops/retail-shops. An additional layer of redundant chargers consists of AC chargers where EVs of different routes could reach them with a minimum detour if one of the other chargers is out of order. The MSP provides final redundancy layers to access publicly available chargers (both AC and DC). The efficient coordination between these different levels of redundancy is only possible via a cloud-based software platform provided by the MSP.

Three main data/cloud dimensions distinguish between an electrified LML and simple legacy logistics: the EVs, the infrastructure, and a genuinely digital cloud application. At the vehicle level, besides re-energizing the batteries, there is another critical dimension related to using the charging infrastructure to perform diagnostics of the car (particularly the battery pack) combined with telematics. The infrastructure elements of the digital/data cloud relate to the local vs. cloud control of large, intelligent charging environments. This dimension connects different Charge Point Operators (CPO) to provide access to the logistic operator to a much more extensive charging network.

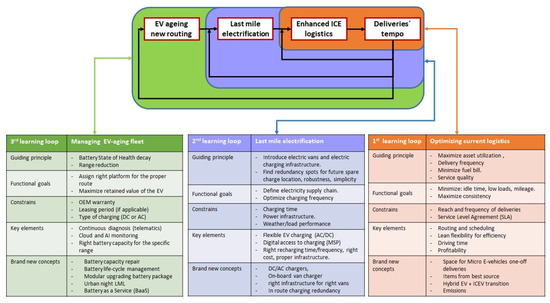

The research sub-question two brings a dimension specific to the EV and automotive aftermarket. This fundamental paradigm shifts in the fields of identification and diagnosis and, therefore, in the domain of the logistics supporting the business. The above is a new research and technology domain that did not exist some years ago. The potential strategic changes in the aftermarket business model (and its logistics) require a more detailed description. The next session will describe the operator’s actions and considerations to bring its LML operation to be future-ready.

The current technology [90,91] allows the use of the charging time, not only for its original purpose of re-energizing the vehicle but also to assess the State of Health (SoH) of the battery beyond the State of Charge (SoC). Massive communication between the charger and the Battery Management System (BMS) exists. If the charger can purposely alter the charging parameters (pulsing, transient load currents, voltages) and with adequately trained AI algorithms, a wealth of helpful information is available for collection. Not only can the SoH be monitored, but it can also be related to specific routing, weather/temperatures, loads, and charging patterns. Optimal charging patterns can reduce losses during the charging process for a specific SoC and minimize the impact on the electric grid of massively electrified logistic fleets. This type of insight also allows diversified charging schemes for a non-homogeneous fleet while preserving the customer’s SLA commitment. Some telematics solutions allow the fleet operator to continuously monitor the electric parameters (including battery SoH) by plugging a device (called a dongle in the automotive jargon) into the OBD (Onboard Diagnostics) port of the vehicle. The EVs are still a novelty for fleet managers in terms of their optimal operation and their residual value (both operational and financial). Including this digital dimension provides information to the operator’s logistics managers for fine-tuning the electrified logistic operations in a lean and efficient way.

A fundamental LML change is related to the technology brought by EVs in terms of the specificities of the automotive aftermarket. The changes are related to various operational aspects and present different readiness levels. The charging structure requires the driver’s identification with either the CPO or the MSP that coordinates the charging infrastructure. Access passes through one or multiple identifiers (radio frequency identifiers, RFID). The ISO-15118 standard [92,93] will allow, via double-key encryption, the vehicle to identify itself when connected to the charger. That will simplify logging in and tracking the charging activity. All the chargers acquired by the operator of the LML network under analysis are already ISO-15118 compatible. As per the EVs, currently, there are no commercially compatible vehicles with the ISO standard, but many European OEMs have agreed to have all new EVs be ISO15118-compatible by 2025.

The use of cloud-based control in a smart charging environment is a second pillar of the digital/cloud dimension of the electrification of the LML. As was described in the analysis of the use of MSP, only as a redundancy provider for the fleet could have been more cost-efficient. The backup view of the MSP is a somewhat limited approach to what a cloud-based control can do compared to the local control (provided by the CPO). The cloud-based MSP platforms provide flexible means of updating, upscaling, and reviewing. The MSP provides real-time, total system overview and data-rich analytics on the charging network and EVs’ performance. These two realities could balance each other. On the one hand, as shown in Table 9, the financial impact of the different and creative financial structuring of the MSP fees jeopardizes the savings from the energy transition. On the other hand, there is a sizeable unutilized charging capacity. The unused capacity could benefit a third party, most probably other logistic operators operating in the same urban–industrial zones. The scheduling challenge would fundamentally be related to the long daily full recharge. An ideal and complementary fleet will be one operating in off-peak hours.

Urban agglomerations in Europe (e.g., Paris, Stockholm) and in Canada (e.g., Toronto) are encouraging the off-peak hour B2C deliveries as a way to achieve several goals: (a) reduce the uncertainty of not finding the customer home (and associated extra kilometers) (b) driving in less rushed hours to help reduce traffic congestion [94,95,96,97,98]. Electric vehicles are ideally suited for these off-peak hours thanks to their reduced noise footprint. Such an off-peak fleet could recharge in the morning hours.

Another fundamental economic advantage for the logistic operator of using the MSP to allow other operators to charge at its charging infrastructure is that his fleet will benefit from charging at grid prices and selling extra capacity to another operator at the market price for public AC charging at 22 kW. The main benefit for the other party’s fleet would be fourfold:

- Not having to invest in its own charging infrastructure

- Using the available parking space available to the original logistic operator

- Benefiting from all the data statistics and dashboards generated by the MSP

- Immediately available infrastructure without the previously mentioned time-costs/delays.

Table 13 continues the model example of the 1000 vans to make a reverse calculation of the number of kilometers or kWh that would be required to break even for every 1000 vans in the original LML operation. The required kilometers to recover the MSP cost for a similar fleet to the one in consideration (7000 vans) would be less than ten days. Most MSPs have robust algorithms to handle this type of recharge queuing dynamics [99,100]. Besides the possibility of covering costs, the example shows the potential for logistic operators that would like to sell spare charging time to third parties profitably.

Table 13.

MSP cost breakeven for integrated vs. open providers for a 1000-vehicle fleet.