COVID-19 Disruption Strategy for Redesigning Global Supply Chain Network across TPP Countries

Abstract

:1. Introduction

2. Literature Review

- RQ1: Which suppliers and their countries should be switched and selected depending on the different scales of disruption?

- RQ2: Where are factories relocated to when suppliers are switched?

- RQ3: What is the effect on TPP and non-TPP member countries?

- RQ4: What are managerial insights from the results?

3. Model and Formulation

3.1. Model

- O: Set of suppliers, o ∈ O

- : Set of suppliers on county n, O

- G: Set of suppliers in countries forming the TPP, g ∈ G

- D: Set of disrupted supplier cities in supplier set O, d ∈ O

- J: Set of parts, j ∈ J

- P: Set of factories, p ∈ P

- Q: Set of markets, q ∈ Q

- : Number of parts j transported from supplier o to factory p

- : Number of products transported from factory p to market q

- : Number of products manufactured in factory p

- : Binary value: 1 if the route between factory p and market q is opened, and 0 otherwise

- : Binary value: 1 if factory p is opened, and 0 otherwise

- TC: Total cost [USD]

- : Logistics cost per unit part for transporting from supplier o to factory p

- : Logistics cost per unit product for transporting from factory p to market q

- : Procurement cost of procuring per unit part j by supplier o

- : Customs duty per unit on transportation from supplier o to factory p

- : Customs duty per unit on transportation from factory p to market q

- : Manufacturing cost per product at factory p

- : Fixed cost for opening route between factory p and market q

- : Fixed cost of opening factory p

- : Total number of parts j, consisting of one product

- : Demand for products in market q

- M: Very large number (Big M)

- : Production capacity at factory p

- : Binary value: 1 if part j is supplied by supplier o, and 0 otherwise

3.2. Formulation

4. Disruption Scenarios

4.1. Global Supply Chain and Product Example

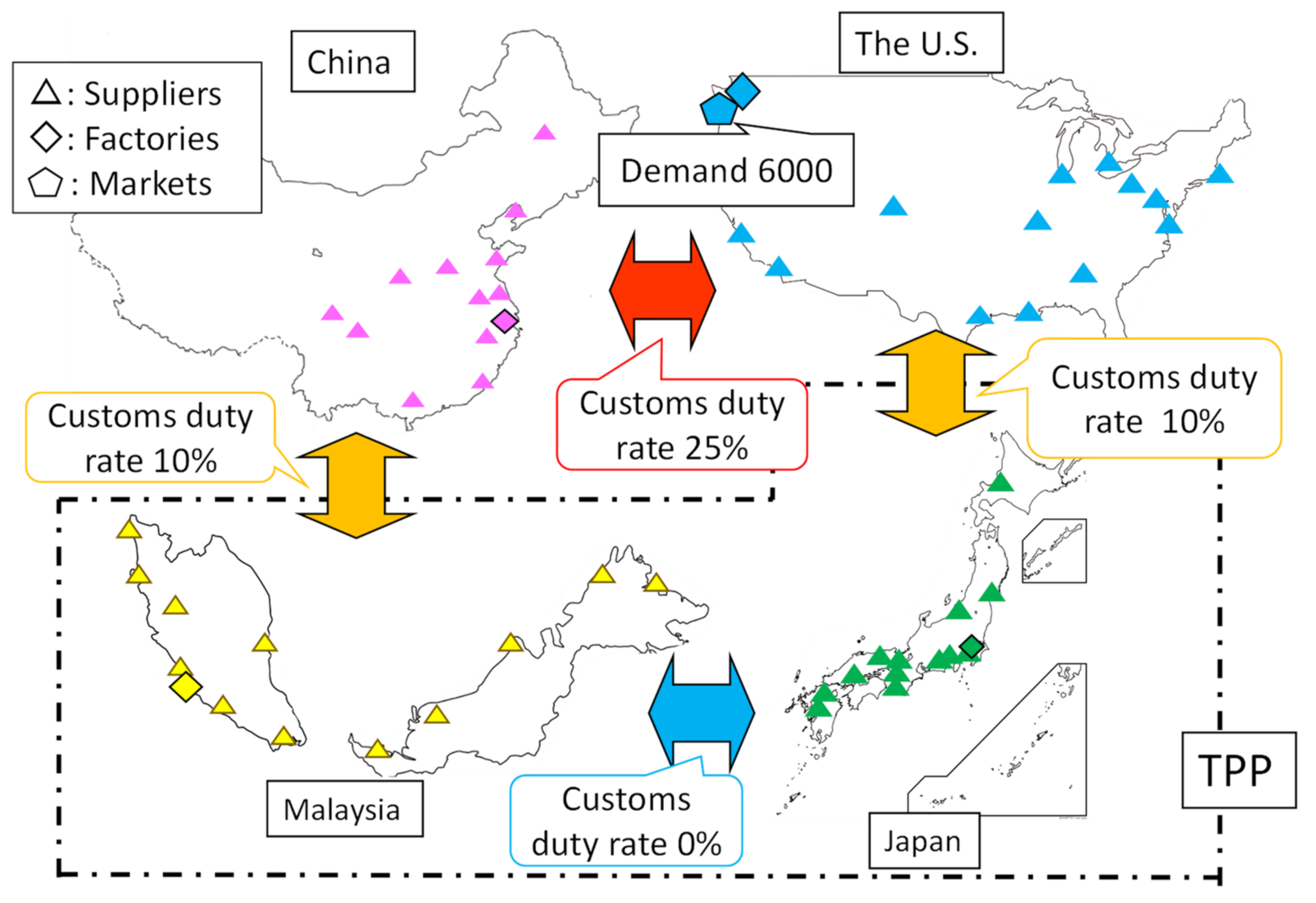

- A total of 52 cities (13 cities in four countries, the U.S., China, Japan, and Malaysia) are selected as suppliers. Transportation costs of parts between cities are provided based on the distances as shown in Table A1 in Appendix A.

- Four cities (Shanghai, Kuala Lumpur, Seattle, and Tokyo) are identified as candidate locations for factories. The production capacity of a factory is 3000 units. The market is set in Seattle in the U.S., and the demand is 6000 units of product. Transportation costs of product between factory cities and market cities are provided based on the distances as shown in Table A2 in Appendix A.

- Japan and Malaysia are CPTPP member countries; in contrast, the U.S. and China are non-CPTPP member countries in the experiments. The customs duty between the U.S. and China is set at 25%. Between a CPTPP country and a non-CPTPP country, a duty of 10% is imposed. For instance, the customs duty between Malaysia and China, and between Japan and the U.S., is 10%. Meanwhile, customs duty is not imposed between CPTPP countries such as Malaysia and Japan.

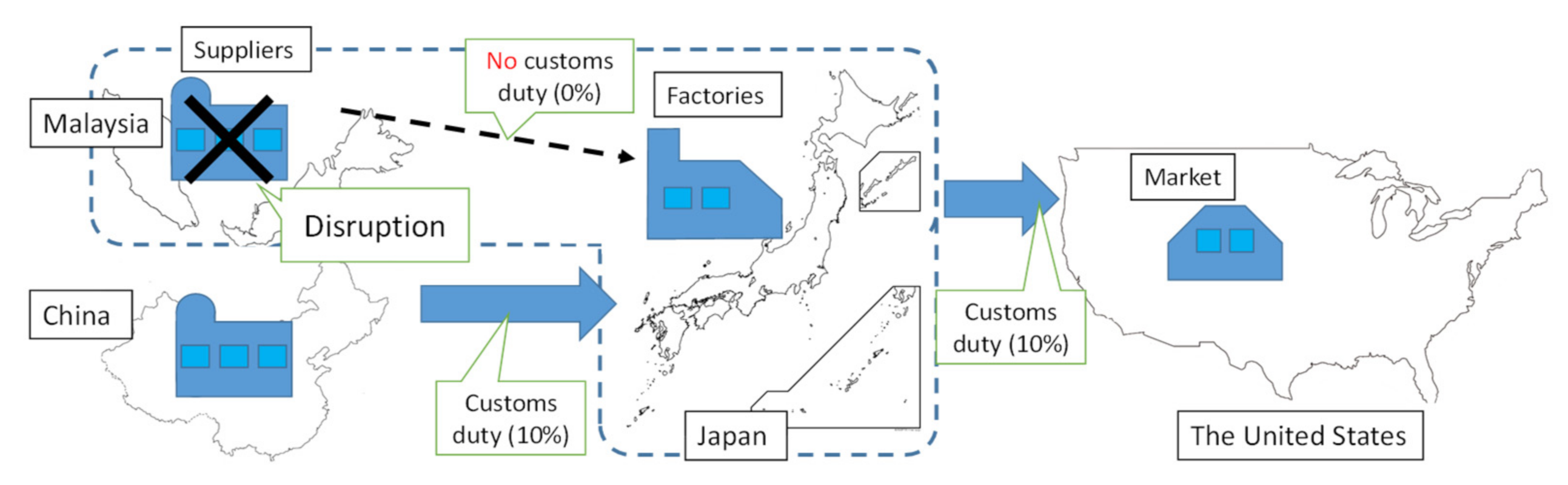

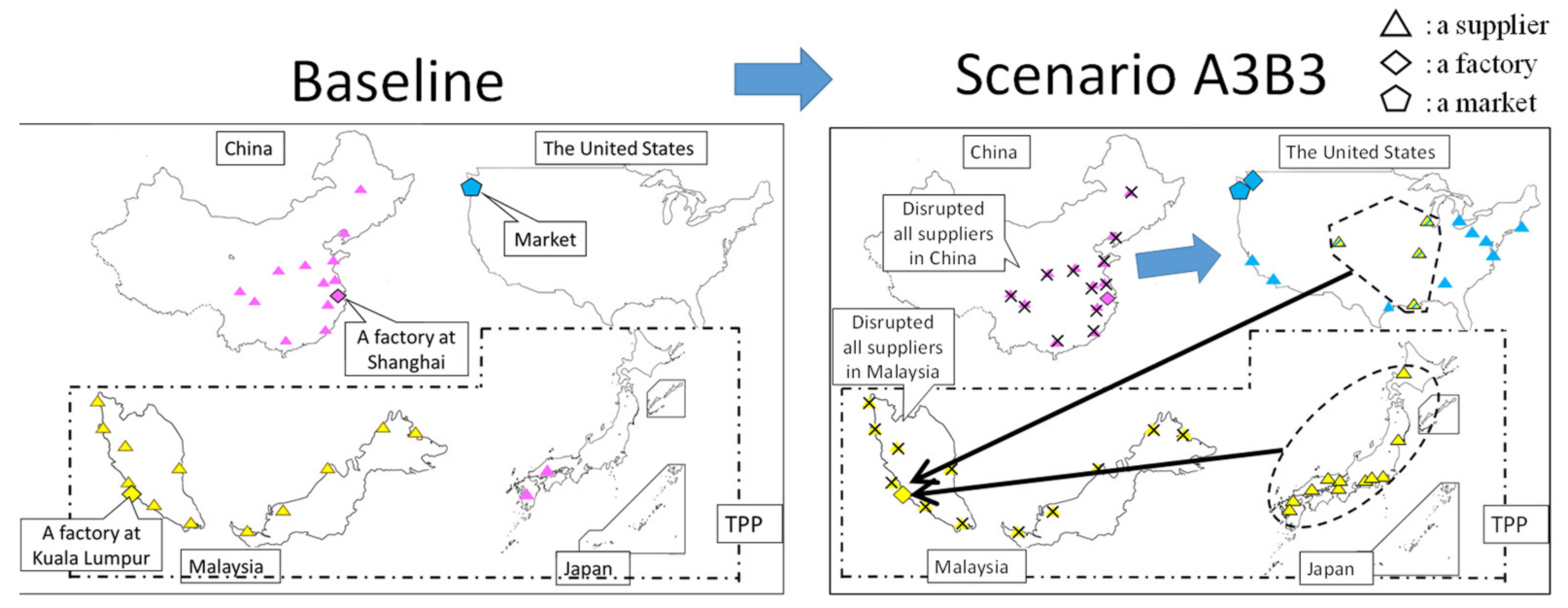

4.2. Example of a Disruption Scenario

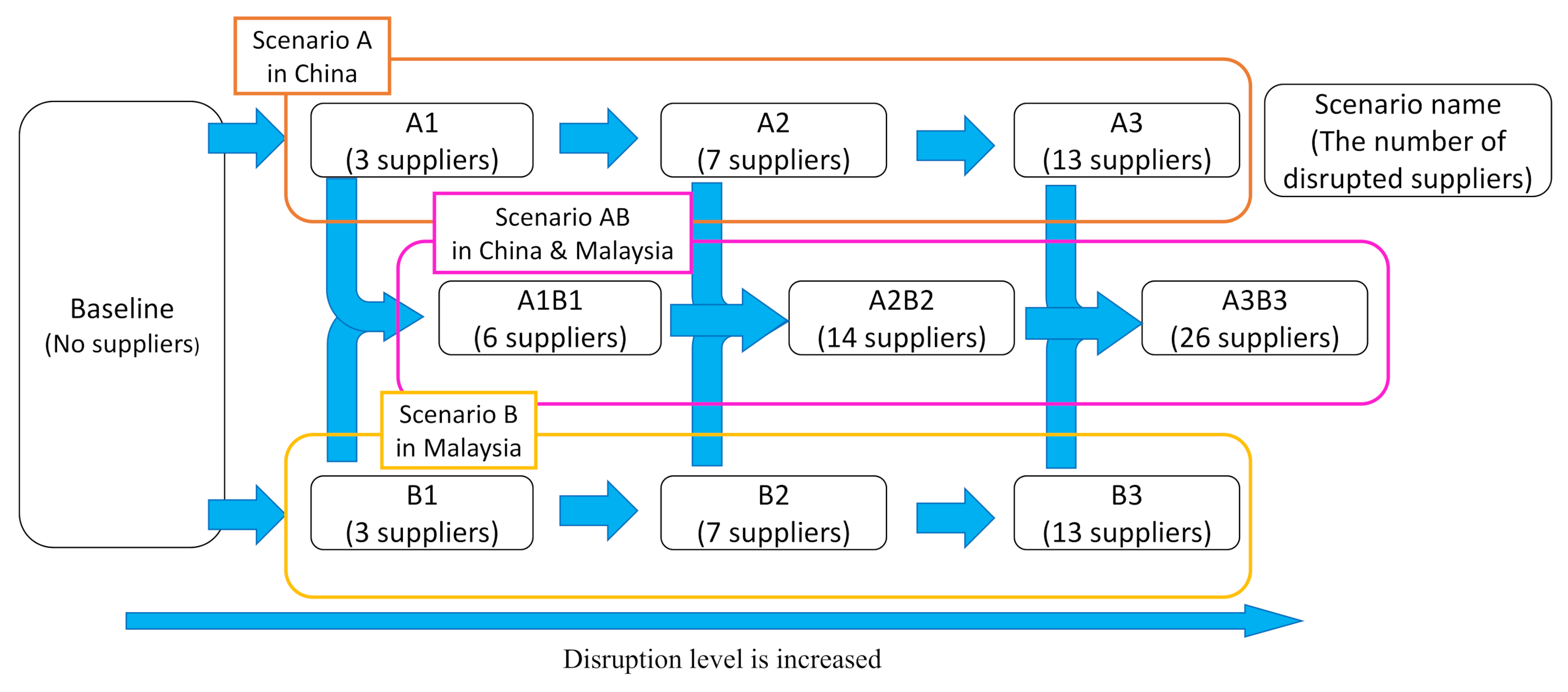

- Baseline: No disruption

- Scenario A: Supplier disruption in China, a non-TPP country.

- A1: Disruption in three cities (Xi’an, Chengdu, and Chongqing)

- A2: Disruption in seven cities (three cities in A1 + Nanjing, Hangzhou, Jinan, and Suzhou)

- A3: Disruption of all Chinese suppliers

- Scenario B: Supplier disruption in Malaysia, a TPP country.

- B1: Disruption in three cities (Miri, Kota Kinabalu, and Sandakan)

- B2: Disruption in seven cities (three cities in B1 + Kuantan, Johor Bahru, Kuching, and Sibu)

- B3: Disruption of all Malaysian suppliers

- Scenario AB: the combination of scenarios A and B.

- A1B1: The combination of scenarios A1 and B1.

- A2B2: The combination of scenarios A2 and B2.

- A3B3: The combination of scenarios A3 and B3.

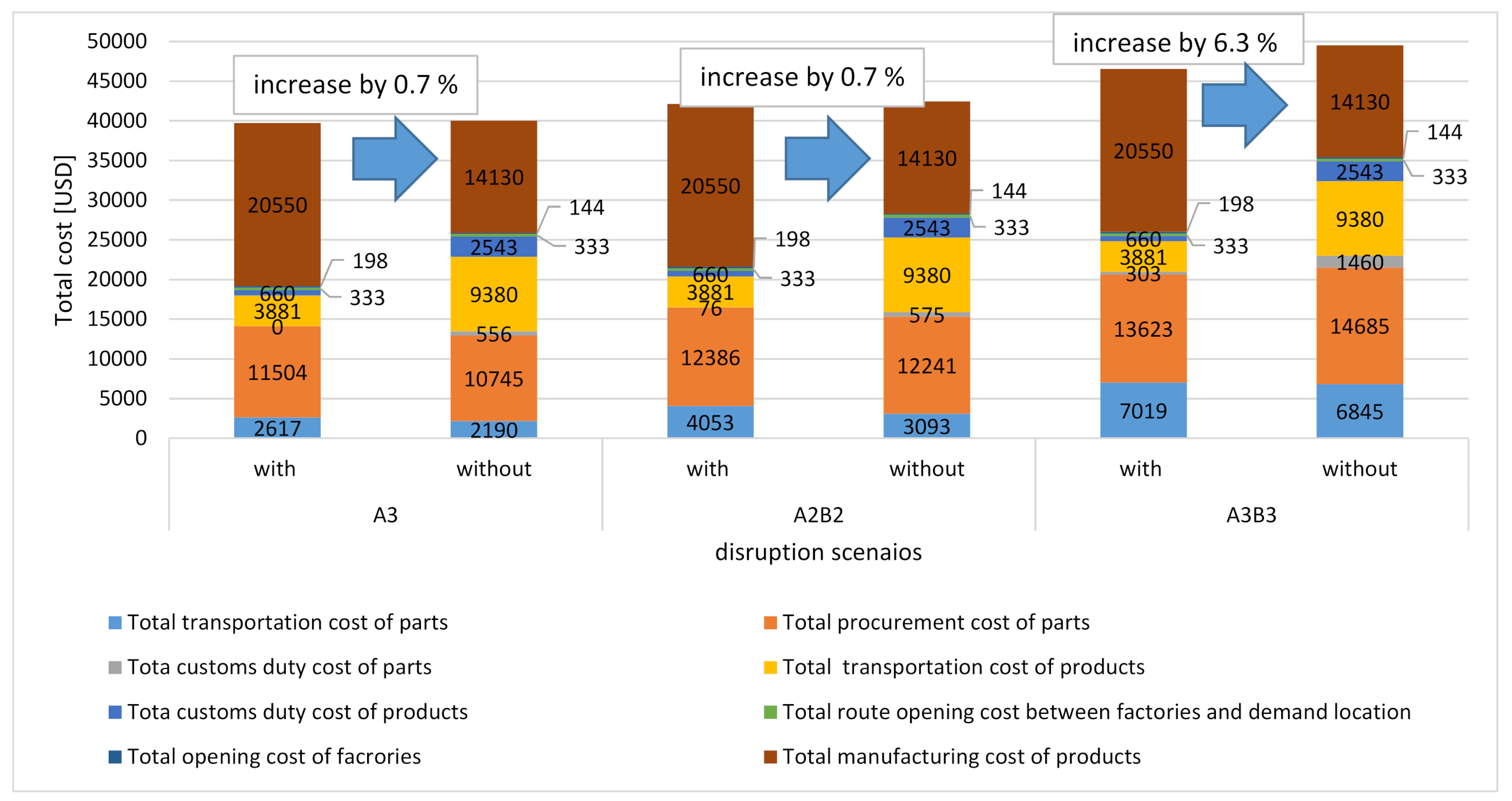

5. Results: Impact on Combined Disruption Scenarios with and without TPP Countries

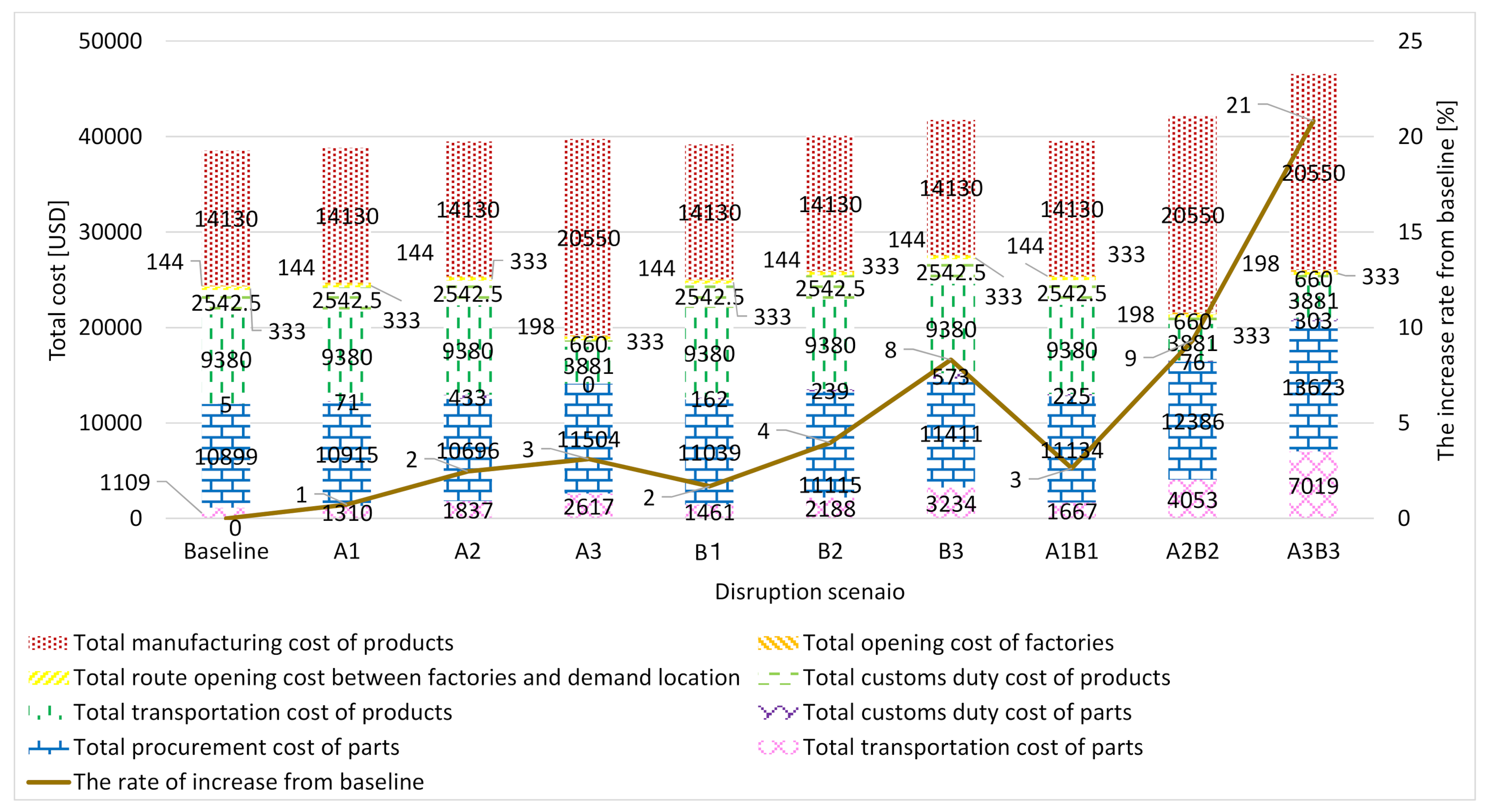

5.1. Results of Total Cost in Nine Scenarios

5.2. The Degree of Disruptions and the Countermeasure

5.3. Impact of Disruption on Supplier Selection without Factory Relocation

6. Analysis of Disruption Impact: Non-TPP vs. TPP Countries

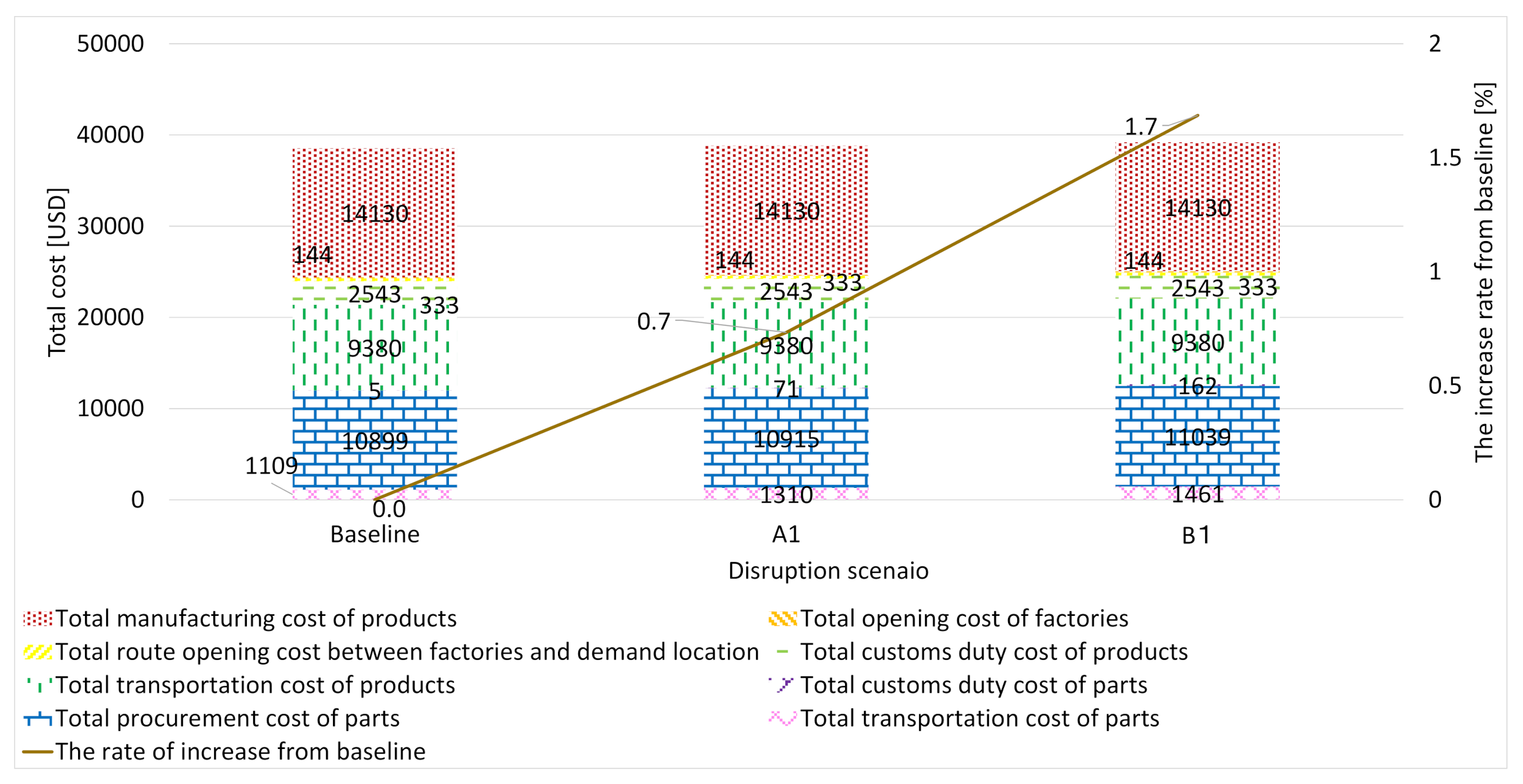

6.1. Comparison of Results of the Disruption Scenarios A1 on a Non-TPP Country and B1 on a TPP One

6.2. The Impact of Non-TPP Country Disruption

6.2.1. The Impact on Total Cost and the Breakdown

6.2.2. The Impact on Supplier Selection under Supply Disruption

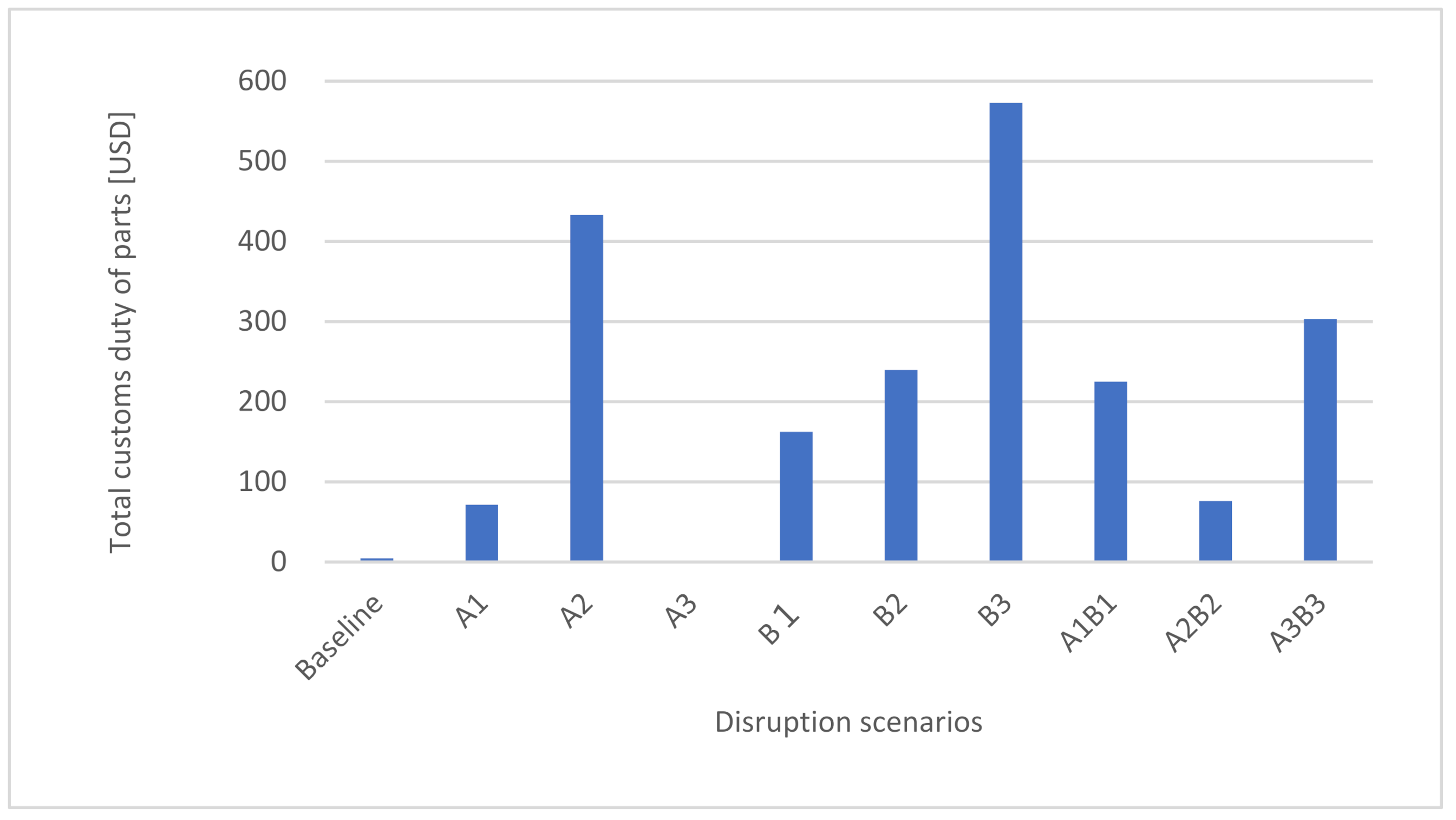

7. The Effect of the Customs Duty Rate Changes

7.1. Total Customs Duty Cost by Each Scenario

7.2. Impact of Customs Duty Rate Changes on Factory and Supplier Selection under Malaysian Disruption Scenarios B

7.3. Sensitivity Analysis by Customs Duty Rate in Scenario B

8. Discussion

- Size: The disruption scale affects the total cost increment and the factory relocation from one of the selected factories at baseline, which is in China, to the market country, which is in the US.

- Duration: The duration is not directly considered in the numerical experiment. However, by assuming the sequences of different locations and sizes of disruption, as shown in Figure 5 and Figure 8, the disruption duration can be considered through the numerical experiment. Thus, some practical recommendations emerge from the results. First, if the duration of Chinese supplier disruption is brief, such as a few months, the factory in China should not be relocated because of the relocation cost. Second, if the duration of Chinese supplier disruption is long, such as a few years, the factory in China should be relocated to the market location, Seattle.

- Impact: The disruption impact differs by country. The large disruption including Chinese suppliers in scenarios A3, A2B2, and A3B3 causes factory relocation. Moreover, the relocation increases the manufacturing cost for the product because the price ratio and labor cost differ across countries. However, for Malaysian supplier disruptions, such as scenarios B1 to B3, the effect of disruption on factory relocation is not observed as suppliers are switched from the Malaysian suppliers to those from other countries.

- Aftermath: Once a factory is relocated to avoid the disruption, the factory must be maintained even when the disruption ends. Therefore, decision makers should carefully consider whether facilities such as factories are should indeed be relocated. The duration of the disruption is an important factor in determining this as production can be stopped in brief disruptions. In contrast, the way of maintaining production by switching to alternative suppliers and relocating a factory should be undertaken in lengthier disruptions, such as that caused by COVID-19.

9. Conclusions and Future Research

- The results of the nine disruption scenarios show that once the Chinese supplier is restored, the factory placement returns to Shanghai after the Chinese supplier disruption brings the factory to Seattle. Then, assuming the recovery speed of disrupted suppliers, strategic factory selection after the recovery of disruptions is proposed.

- The behaviors of total and breakdown costs under different scales of disruptions are analyzed through the disruption scenarios in China. Regarding supplier selection, there are two patterns: directly changed by supplier disruption, and indirectly changed due to factory relocation. Depending on the scale of disruption and the locations of occurrence, the impact on total cost changes regardless of the number of disrupted suppliers.

- Some potential scenarios are found where companies may or may not change their supply chain design due to fluctuations in duties and tariffs. Regarding the TPP effect, there is a case in which the TPP has a positive impact on maintaining costs despite disruption. Moreover, when the supplier disruption and the increment in the customs duty rate occurs simultaneously, there is a case in which suppliers in TPP countries are chosen to avoid an increase in customs duty costs.

- Alternative suppliers in the other country should be selected instead of disrupted ones. Then, the factory should be maintained at the existing location. However, when many suppliers are switched from far alternative suppliers to the existing country because of the disruption, the factory should be relocated to the country in which the suppliers are selected. Moreover, the results indicate that the TPP has a positive impact on maintaining costs despite disruption; it is the non-TPP countries which affect costs as customs duty costs increase. Therefore, non-TPP countries are gradually selected less under the customs duty-rate increment and disruption. Emerging one managerial insight is that in the maintained factory, regardless of the disruption, a capital investment such as automation should be carried out. Then, the operation can be continued under the disruption by switching to alternative suppliers while suppressing the total cost increases.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Shanghai | Kuala Lumpur | Seattle | Tokyo | |

|---|---|---|---|---|

| Atlanta | 0.122976000 | 0.158640000 | 0.035079800 | 0.110339000 |

| Alor Star | 0.035573720 | 0.003626180 | 0.127259000 | 0.051890640 |

| Guangzhou | 0.012132400 | 0.025510000 | 0.103888000 | 0.029056110 |

| Fukuoka | 0.008788560 | 0.045146750 | 0.084466000 | 0.008819450 |

| San Jose | 0.099463000 | 0.136560000 | 0.011183700 | 0.083314000 |

| Penang | 0.036278820 | 0.002715330 | 0.127960000 | 0.052476710 |

| Chongqing | 0.014436300 | 0.029860350 | 0.101353000 | 0.031651550 |

| Hiroshima | 0.010851200 | 0.047151850 | 0.082633000 | 0.006751860 |

| Detroit | 0.114595500 | 0.149360000 | 0.062113800 | 0.101157000 |

| Kuantan | 0.051490080 | 0.001972760 | 0.127875000 | 0.051490080 |

| Nanjing | 0.002699630 | 0.036833410 | 0.092730000 | 0.019689570 |

| Yokohama | 0.017503030 | 0.053083310 | 0.077094000 | 0.000277890 |

| Chicago | 0.113569500 | 0.149216000 | 0.028162300 | 0.113350000 |

| Malacca | 0.038106490 | 0.001216630 | 0.129929000 | 0.053625820 |

| Harbin | 0.016802060 | 0.053281160 | 0.076662000 | 0.015767770 |

| Osaka | 0.013644420 | 0.049536170 | 0.080111000 | 0.000396890 |

| Cleveland | 0.115844000 | 0.150390000 | 0.032688700 | 0.104493000 |

| Kuala Lumpur | 0.037533800 | 0.000010000 | 0.129359000 | 0.053276340 |

| Xian | 0.012220570 | 0.035538450 | 0.095434000 | 0.027962100 |

| Nagoya | 0.015013380 | 0.050886330 | 0.079133000 | 0.002588690 |

| Boston | 0.117328500 | 0.149030000 | 0.040052200 | 0.107891000 |

| Johor Bahru | 0.038023620 | 0.002961260 | 0.129694000 | 0.053162080 |

| Chengdu | 0.016625960 | 0.030641050 | 0.101700000 | 0.033508700 |

| Sapporo | 0.021920310 | 0.059928350 | 0.070269000 | 0.008330410 |

| Pittsburgh | 0.117439500 | 0.151650000 | 0.034296200 | 0.106259000 |

| Kuching | 0.036075300 | 0.009793970 | 0.125494000 | 0.048616730 |

| Changchun | 0.014413130 | 0.050915280 | 0.078704000 | 0.052302800 |

| Kumamoto | 0.008886780 | 0.044773390 | 0.084951000 | 0.008864890 |

| Los Angeles | 0.104306500 | 0.141360000 | 0.015451700 | 0.088101000 |

| Sibu | 0.033748960 | 0.011327220 | 0.123876000 | 0.046954700 |

| Dalian | 0.008554320 | 0.044651240 | 0.084855000 | 0.016375080 |

| Kobe | 0.013369700 | 0.049311650 | 0.080631000 | 0.004238580 |

| Houston | 0.121954500 | 0.159310000 | 0.030680500 | 0.107318000 |

| Miri | 0.030948910 | 0.013736200 | 0.120565000 | 0.043747360 |

| Hangzhou | 0.001650620 | 0.035924960 | 0.093425000 | 0.019173776 |

| Shizuoka | 0.016286970 | 0.051846520 | 0.078357000 | 0.001429900 |

| New Orleans | 0.124391000 | 0.161280000 | 0.033910800 | 0.110491000 |

| Kota Kinabalu | 0.028663010 | 0.016318100 | 0.117782000 | 0.040926890 |

| Jinan | 0.007248680 | 0.040530120 | 0.089383000 | 0.020265060 |

| Kyoto | 0.013960700 | 0.049944370 | 0.079857000 | 0.003641270 |

| Washington | 0.119828500 | 0.153370000 | 0.037249000 | 0.109014000 |

| Sandakan | 0.028482330 | 0.018413320 | 0.116546000 | 0.039917480 |

| Qingdao | 0.005478160 | 0.041386020 | 0.088210000 | 0.017392910 |

| Sendai | 0.019342960 | 0.055760450 | 0.074139000 | 0.003055610 |

| Saint Louis | 0.115819500 | 0.152130000 | 0.027653800 | 0.104495000 |

| Ipoh | 0.036490160 | 0.001758780 | 0.123818000 | 0.052512710 |

| Suzhou | 0.000848760 | 0.037088570 | 0.092352000 | 0.018364290 |

| Niigata | 0.017696580 | 0.542252800 | 0.075688000 | 0.002546620 |

| Denver | 0.107845500 | 0.145240000 | 0.016302200 | 0.093269000 |

| Penang | 0.036278820 | 0.002715330 | 0.127960000 | 0.052476710 |

| Fuzhou | 0.006120420 | 0.031712790 | 0.097695000 | 0.022165510 |

| Wakayama | 0.013242390 | 0.489808100 | 0.081014000 | 0.004432180 |

| Shanghai | Kuala Lumpur | Seattle | Tokyo | |

|---|---|---|---|---|

| Shanghai | 0.000100 | 0.375338 | 1.833208 | 0.176019 |

| Kuala Lumpur | 0.375338 | 0.000100 | 1.293590 | 0.532763 |

| Seattle | 1.833208 | 1.293590 | 0.000100 | 1.532334 |

| Tokyo | 0.176019 | 0.532763 | 1.532334 | 0.000100 |

| Part No. | Part Name | Required Number for a Product | Procurement Costs [USD] | |||

|---|---|---|---|---|---|---|

| The U.S. | Malaysia | China | Japan | |||

| 1 | Wheel of nozzle | 2 | 0.0153 | 0.0126 | 0.0138 | 0.0196 |

| 2 | Wheel stopper | 2 | 0.0037 | 0.0030 | 0.0033 | 0.0047 |

| 3 | Upper nozzle | 1 | 0.0545 | 0.0448 | 0.0492 | 0.0698 |

| 4 | Lower nozzle | 1 | 0.0447 | 0.0367 | 0.0403 | 0.0572 |

| 5 | Nozzle | 1 | 0.0374 | 0.0307 | 0.0337 | 0.0478 |

| 6 | Right handle | 1 | 0.0530 | 0.0435 | 0.0478 | 0.0678 |

| 7 | Switch | 1 | 0.0041 | 0.0034 | 0.0037 | 0.0058 |

| 8 | Left handle | 1 | 0.0560 | 0.0460 | 0.0505 | 0.0716 |

| 9 | Left body | 1 | 0.2028 | 0.1667 | 0.1829 | 0.2595 |

| 10 | Right body | 1 | 0.1948 | 0.1601 | 0.1757 | 0.2493 |

| 11 | Dust case cover | 1 | 0.0629 | 0.0517 | 0.0567 | 0.0964 |

| 12 | Mesh filter | 1 | 0.3209 | 0.2637 | 0.2894 | 0.5990 |

| 13 | Connection pipe | 1 | 0.0781 | 0.0642 | 0.0705 | 0.1012 |

| 14 | Dust case | 1 | 0.3022 | 0.2483 | 0.2725 | 0.4632 |

| 15 | Exhaust tube | 1 | 0.0286 | 0.0235 | 0.0258 | 0.0401 |

| 16 | Upper filter | 1 | 0.3085 | 0.2535 | 0.2782 | 0.5759 |

| 17 | Lower filter | 1 | 0.0318 | 0.0261 | 0.0286 | 0.0406 |

| 18 | Protection cap | 1 | 0.0341 | 0.0280 | 0.0307 | 0.0437 |

| 20 | Rubber of outer flame of fan | 1 | 0.0422 | 0.0347 | 0.0381 | 0.0556 |

| 21 | Outer flame of fan | 1 | 0.0913 | 0.0750 | 0.0823 | 0.1182 |

| 22 | Lower fan | 1 | 0.0163 | 0.0134 | 0.0147 | 0.0209 |

| 23 | Fan | 1 | 0.1029 | 0.0845 | 0.0928 | 0.1332 |

| Price Level Index | Equipment Residential Devices Maintenance |

|---|---|

| Japan | 1 |

| China | 0.57 |

| The United States | 0.64 |

| Malaysia | 0.52 |

References

- Kubo, M. Global supply chain optimization models. J. Jpn. Ind. Manag. Assoc. 2006, 16, 56–61. (In Japanese) [Google Scholar]

- JETRO. Jetro Trade Handbook 2017; Japan External Trade Organization: Tokyo, Japan, 2017. (In Japanese) [Google Scholar]

- JETRO. 40% of Japanese Companies in the U.S., Change Their Suppliers, from China to Japan, the U.S., Thailand, and Vietnam. Available online: https://www.jetro.go.jp/biz/areareports/special/2019/1201/a8e8e09a32969f71.html (accessed on 18 October 2021). (In Japanese).

- Ministry of Economy, Trade and Industry. Trans-Pacific Partnership (TPP). Available online: https://www.meti.go.jp/policy/external_economy/trade/tpp.html (accessed on 26 October 2020). (In Japanese)

- Institute for Government. Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Available online: https://www.instituteforgovernment.org.uk/explainers/trade-cptpp (accessed on 15 October 2021).

- Nagao, T.; Ijuin, H.; Yamada, T.; Nagasawa, K.; Zhou, L. The impact of COVID-19 disruption on designing a global supply chain network across the trans-pacific partnership agreement. In Proceedings of the Northeast Decision Sciences Institute 50th Anniversary Annual Conference (NEDSI2021), Online, 26–27 March 2021. [Google Scholar]

- World Health Organization. Coronavirus Disease (COVID-19). Available online: https://www.who.int/emergencies/diseases/novel-coronavirus-2019/question-and-answers-hub/q-a-detail/coronavirus-disease-covid-19 (accessed on 15 January 2021).

- Nikkei NewsPaper. Factory Shapes Layout and Stuff Shift—VW Maintains 1.5 meters. (In Japanese)

- The Plight of Front-Line Workers: Suffering from "Declining Orders" and Worrying about "Remote Operations" as Seen in a Free-Form Questionnaire Survey. In Nikkei Monodukuri; Nikkei Business Publications: Tokyo, Japan, 2020. (In Japanese)

- Kim, Y.; Chen, Y.; Linderman, K. Supply network disruption and resilience: A network structural perspective. J. Oper. Manag. 2015, 33–34, 43–59. [Google Scholar] [CrossRef] [Green Version]

- Ministry of Economy, Trade and Industry. Supplementary Budget Project Overview PR Support for Overseas Supply Chain Diversification 2020. Available online: https://www.meti.go.jp/main/yosan/yosan_fy2020/hosei/pdf/hosei_yosan_pr.pdf (accessed on 26 October 2020). (In Japanese)

- NHK World-Japan. Toyota to Cut Global Output by 40% in September. Available online: https://www3.nhk.or.jp/nhkworld/en/news/20210820_02/ (accessed on 31 August 2021).

- Ministry of Economy. The State of Economic and Industrial Policy in Light of the Impact of the New Coronavirus. Available online: https://www.meti.go.jp/shingikai/sankoshin/sokai/pdf/026_02_00.pdf (accessed on 15 February 2021). (In Japanese)

- Salvendy, G. (Ed.) Handbook of Industrial Engineering; John Wiley and Sons Inc.: New York, NY, USA, 1982. [Google Scholar]

- Araz, O.M.; Choi, T.M.; Olson, D.L.; Salman, F.S. Data analytics for operational risk management. Decis. Sci. 2020, 51, 1316–1319. [Google Scholar] [CrossRef]

- Govindan, K.; Fattahi, M.; Keyvanshokooh, E. Supply chain network design under uncertainty: A comprehensive review and future research directions. Eur. J. Oper. Res. 2017, 263, 108–141. [Google Scholar] [CrossRef]

- Tang, C.S. Perspectives in supply chain risk management. Int. J. Prod. Econ. 2006, 103, 451–488. [Google Scholar] [CrossRef]

- Heckmann, I.; Comes, T.; Nickel, S. A critical review on supply chain risk–Definition, measure and modeling. Omega 2015, 52, 119–132. [Google Scholar] [CrossRef] [Green Version]

- Snyder, L.V.; Atan, Z.; Peng, P.; Rong, Y.; Schmitt, A.J.; Sinsoysal, B. OR/MS models for supply chain disruptions: A review. IIE Trans. 2016, 48, 89–109. [Google Scholar] [CrossRef]

- Nakamura, K.; Yamada, T.; Kim, H.T. The impact of Brexit on designing a material-based global supply chain network for Asian manufacturers. Manag. Environ. Qual. Int. J. 2019, 30, 980–1000. [Google Scholar] [CrossRef]

- Hayashi, K.; Matsumoto, R.; Yamada, T.; Nagasawa, K.; Kinoshita, Y. Designing a global supply chain network considering carbon tax and trans-pacific partnership agreement. In Proceedings of the 2020 the society of Plant Engineering Japan Spring Conference, Tokyo, Japan, 4 June 2020; pp. 97–100. (In Japanese). [Google Scholar]

- Amin, S.H.; Baki, F. A facility location model for global closed-loop supply chain network design. Appl. Math. Model. 2017, 41, 316–330. [Google Scholar] [CrossRef]

- Kovács, G.; Kot, S. New logistics and production trends as the effect of global economy changes. Pol. J. Manag. Stud. 2016, 14, 115–126. [Google Scholar] [CrossRef]

- Kot, S.; Haque, U.A.; Baloch, A. Supply chain management in smes: Global perspective. Montenegrin J. Econ. 2020, 16, 87–104. [Google Scholar] [CrossRef]

- Lahkani, M.J.; Wang, S.; Urbański, M.; Egorova, M. Sustainable B2B E-commerce and blockchain-based supply chain finance. Sustainability 2020, 12, 3968. [Google Scholar] [CrossRef]

- Jabbarzadeh, A.; Haughton, M.; Khosrojerdi, A. Closed-loop supply chain network design under disruption risks: A robust approach with real world application. Comput. Ind. Eng. 2018, 116, 178–191. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. Viability of intertwined supply networks: Extending the supply chain resilience angles towards survivability. A position paper motivated by COVID-19 outbreak. Int. J. Prod. Res. 2020, 58, 2904–2915. [Google Scholar] [CrossRef] [Green Version]

- Govindan, K.; Mina, H.; Alavi, B. A decision support system for demand management in healthcare supply chains considering the epidemic outbreaks: A case study of coronavirus disease 2019 (COVID-19). Transp. Res. E Logist. Transp. Rev. 2020, 138, 101967. [Google Scholar] [CrossRef] [PubMed]

- Ivanov, D. Viable supply chain model: Integrating agility, resilience and sustainability perspectives. Lessons from and thinking beyond the COVID-19 pandemic. Ann. Oper. Res. 2020, 288, 1–21. [Google Scholar] [CrossRef] [PubMed]

- Min, S.; Zhang, X.; Li, G. A snapshot of food supply chain in Wuhan under the COVID-19 pandemic. China Agric. Econ. Rev. 2020, 12, 689–704. [Google Scholar] [CrossRef]

- Johns Hopkins Coronavirus Resource Center. COVID-19 Map. Available online: https://coronavirus.jhu.edu/map.html (accessed on 15 October 2021).

- BBC News. Covid Map: Coronavirus Cases, Deaths, Vaccinations by Country. Available online: https://www.bbc.com/news/world-51235105 (accessed on 22 October 2021).

- Urata, T.; Yamada, T.; Itsubo, N.; Inoue, M. Global supply chain network design and Asian analysis with material-based carbon emissions and tax. Comput. Ind. Eng. 2017, 113, 779–792. [Google Scholar] [CrossRef]

- Hiller, F.S.; Lieberman, G.J. Introduction to Operations Research, 8th ed.; McGraw Hill Higher Education: New York, NY, USA, 2005. [Google Scholar]

- Inoue, M.; Yamada, T.; Ishikawa, H. Life cycle design support system based on 3D-CAD for satisficing product performances and reduction of environmental loads at the early phase of design. Des. Eng. 2014, 49, 543–549. (In Japanese) [Google Scholar]

- Horiguchi, K.; Tsujimoto, M.; Yamaguchi, H.; Itsubo, N. Development of greenhouse gases emission intensity in eastern Asia using Asian international input-output table. In Proceedings of the 7th Meeting of the Institute of Life Cycle Assessment, Chiba, Japan, 7–9 March 2012; pp. 236–239. (In Japanese). [Google Scholar]

- Ministry of Internal Affairs and Communication. New International Comparisons of GDP and Consumption Based on Purchasing Power Parities for the Year 2011. Available online: https://www.soumu.go.jp/main_content/000296486.pdf (accessed on 15 October 2021). (In Japanese)

- Numerical Optimizer. Available online: http://www.msi.co.jp/nuopt/ (accessed on 26 October 2020). (In Japanese).

- Levalle, R.R. Resilience by Teaming in Supply Chains and Networks; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Kondo, R.; Kinoshita, Y.; Yamada, T. Green Procurement Decisions of Carbon Leakage by Global Suppliers and Order Quantities under Different Carbon Tax. Sustainability 2019, 11, 3710. [Google Scholar] [CrossRef] [Green Version]

- Arimura, T.H.; Matsumoto, S. (Eds.) Carbon Pricing in Japan; Springer: Singapore, 2021; ISBN 978-981-15-6963-0. [Google Scholar]

| Literature | Type of Paper | Cost/Profit | Disruption | Global Supply Chain | Network Decision | Method | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Case Study | Review | Modeling | Consideration | Scale | Customs Duty | FTA | Region/Country | Type | BOM | Supplier Location | Factory Location | ||||

| TPP | Non-TPP | ||||||||||||||

| Nakamura et al. [20] | ✓ | ✓ | ✓ | TPP | England | Forward | ✓ | ✓ | ✓ | Integer programming | |||||

| Hayashi et al. [21] | ✓ | ✓ | ✓ | TPP | Japan, Malaysia | China, The U.S. | Forward | ✓ | ✓ | ✓ | Integer programming | ||||

| Amin and Baki [22] | ✓ | ✓ | ✓ | NAFTA | Forward | ✓ | ✓ | Mixed integer programming | |||||||

| Kovács and Kot. [23] | ✓ | ||||||||||||||

| Kot et al. [24] | ✓ | Canada | Iran, Turkey | Survey | |||||||||||

| Lahkani et al. [25] | ✓ | China | Blockchain | ||||||||||||

| Jabbarzadeh et al. [26] | ✓ | ✓ | ✓ | Random | Iran | Closed-loop | ✓ | ✓ | Lagrangian relaxation | ||||||

| Ivanov and Dolgui [27] | ✓ | ✓ | ✓ | Intertwined supply networks | Dynamic game-theoretic modelling on ecosystem | ||||||||||

| Govindan et al. [28] | ✓ | ✓ | 5 scales | Healthcare | Fuzzy inference | ||||||||||

| Ivanov [29] | ✓ | ✓ | Forward | ✓ | Dynamic systems theory | ||||||||||

| Min et al. [30] | ✓ | ✓ | ✓ | China | China | Telephone survey | |||||||||

| This paper | ✓ | ✓ | ✓ | China, Malaysia | ✓ | ✓ | Japan, Malaysia | China, The U.S. | Forward | ✓ | ✓ | ✓ | Integer programming | ||

| Country | The Average Procurement Cost of the Parts [USD] | The Manufacturing Cost of the Product [USD] |

|---|---|---|

| Japan | 0.143 | 6.29 |

| The U.S. | 0.095 | 4.65 |

| Malaysia | 0.086 | 2.51 |

| China | 0.078 | 2.20 |

| Scenario | Baseline | A3 | A2B2 | A3B3 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| With | Without | With | Without | With | Without | ||||||||||

| Factory | Shanghai | Kuala Lumpur | Seattle | Kuala Lumpur | Shanghai | Kuala Lumpur | Seattle | Kuala Lumpur | Shanghai | Kuala Lumpur | Seattle | Kuala Lumpur | Shanghai | Kuala Lumpur | |

| #1 | Wheel of nozzle | Guangzhou | Alor Star | Atlanta | Alor Star | Fukuoka | Alor Star | Atlanta | Alor Star | Guangzhou | Alor Star | Atlanta | Fukuoka | Fukuoka | Fukuoka |

| #2 | Wheel stopper | Hiroshima | Penang | San Jose | Penang | Hiroshima | Penang | San Jose | Penang | Hiroshima | Penang | San Jose | Hiroshima | Hiroshima | Hiroshima |

| #3 | Upper nozzle | Nanjing | Kuantan | Detroit | Kuantan | Yokohama | Kuantan | Detroit | Yokohama | Yokohama | Yokohama | Detroit | Yokohama | Yokohama | Yokohama |

| #4 | Lower nozzle | Harbin | Malacca | Chicago | Malacca | Osaka | Malacca | Chicago | Malacca | Harbin | Malacca | Chicago | Osaka | Osaka | Osaka |

| #5 | Nozzle | Xian | Kuala Lumpur | Cleveland | Kuala Lumpur | Nagoya | Kuala Lumpur | Cleveland | Kuala Lumpur | Nagoya | Kuala Lumpur | Cleveland | Nagoya | Nagoya | Nagoya |

| #6 | Right handle | Chengdu | Johor Bahru | Boston | Johor Bahru | Johor Bahru | Johor Bahru | Boston | Sapporo | Sapporo | Sapporo | Boston | Sapporo | Sapporo | Sapporo |

| #7 | Switch | Kumamoto | Kuching | Pittsburgh | Kuching | Kumamoto | Kuching | Pittsburgh | Kumamoto | Kumamoto | Kumamoto | Pittsburgh | Kumamoto | Kumamoto | Kumamoto |

| #8 | Left handle | Dalian | Sibu | Los Angeles | Sibu | Sibu | Sibu | Los Angeles | Dalian | Dalian | Dalian | Los Angeles | Kobe | Kobe | Kobe |

| #9 | Left body | Hangzhou | Miri | Houston | Miri | Miri | Miri | Houston | Shizuoka | Shizuoka | Shizuoka | Houston | Shizuoka | Shizuoka | Shizuoka |

| #10 | Right body | Jinan | Kota Kinabalu | New Orleans | Kota Kinabalu | Kota Kinabalu | Kota Kinabalu | New Orleans | Kyoto | Kyoto | Kyoto | New Orleans | Kyoto | Kyoto | Kyoto |

| #11 | Dust case cover | Qingdao | Sandakan | Washington | Sandakan | Sandakan | Sandakan | Washington | Qingdao | Qingdao | Qingdao | Washington | Sendai | Sendai | Sendai |

| #12 | Mesh filter | Suzhou | Ipoh | Saint Louis | Ipoh | Ipoh | Ipoh | Saint Louis | Ipoh | Ipoh | Ipoh | Saint Louis | Saint Louis | Saint Louis | Saint Louis |

| #13 | Connection pipe | Fuzhou | Penang | Denver | Penang | Penang | Penang | Denver | Penang | Fuzhou | Penang | Denver | Denver | Kumamoto | Denver |

| #14 | Dust case | Nanjing | Penang | New Orleans | Penang | Penang | Penang | New Orleans | Penang | Penang | Penang | New Orleans | New Orleans | New Orleans | New Orleans |

| #15 | Exhaust tube | Guangzhou | Kuching | Los Angeles | Kuching | Kumamoto | Kuching | Los Angeles | Guangzhou | Guangzhou | Guangzhou | Los Angeles | Kumamoto | Kumamoto | Kumamoto |

| #16 | Upper filter | Hangzhou | Ipoh | Chicago | Ipoh | Ipoh | Ipoh | Chicago | Ipoh | Ipoh | Ipoh | Chicago | Chicago | Chicago | Chicago |

| #17 | Lower filter | Xian | Miri | Detroit | Miri | Miri | Miri | Detroit | Shizuoka | Shizuoka | Shizuoka | Detroit | Shizuoka | Shizuoka | Shizuoka |

| #18 | Protection cap | Jinan | Sibu | San Jose | Sibu | Kobe | Sibu | San Jose | Kobe | Kobe | Kobe | San Jose | Kobe | Kobe | Kobe |

| #20 | Rubber of outerflame of fan | Qingdao | Johor Bahru | Houston | Johor Bahru | Johor Bahru | Johor Bahru | Houston | Qingdao | Qingdao | Qingdao | Houston | Sapporo | Sapporo | Sapporo |

| #21 | Outer flame of fan | Dalian | Sandakan | Denver | Sandakan | Sandakan | Sandakan | Denver | Dalian | Dalian | Dalian | Denver | Sendai | Sendai | Sendai |

| #22 | Lower fan | Chongqing | Kuantan | Cleveland | Kuantan | Yokohama | Kuantan | Cleveland | Yokohama | Yokohama | Yokohama | Cleveland | Yokohama | Yokohama | Yokohama |

| #23 | Fan | Chengdu | Kuala Lumpur | Atlanta | Kuala Lumpur | Kuala Lumpur | Kuala Lumpur | Atlanta | Kuala Lumpur | Kuala Lumpur | Kuala Lumpur | Atlanta | Nagoya | Nagoya | Nagoya |

| Baseline | Disruption Scenarios | |||||

|---|---|---|---|---|---|---|

| Scenario A1 in China, without TPP | Scenario B1 in Malaysia, with TPP | |||||

| Factory | Shanghai | Kuala Lumpur | Shanghai | Kuala Lumpur | Shanghai | Kuala Lumpur |

| Supplier | 12 in China 2 in Japan | 13 in Malaysia | 9 in China 3 in Malaysia 4 in Japan | 13 in Malaysia | 12 in China 2 in Japan | 4 in China 9 in Malaysia |

| Scenario | Selected factories | Selected Suppliers |

|---|---|---|

| Baseline | Shanghai | 12 suppliers in China 2 suppliers in Japan |

| Kuala Lumpur | 13 suppliers in Malaysia | |

| Scenario A1 3 suppliers disruption | Shanghai | 9 suppliers in China 3 suppliers in Malaysia 4 suppliers in Japan |

| Kuala Lumpur | 13 suppliers in Malaysia | |

| Scenario A2 7 suppliers disruption | Shanghai | 5 suppliers in China 6 suppliers in Malaysia 5 suppliers in Japan |

| Kuala Lumpur | 13 suppliers in Malaysia | |

| Scenario A3 All suppliers disruption in China | Kuala Lumpur | 13 suppliers in Malaysia |

| Seattle | 13 suppliers in the United States |

| Disruption scenario B in Malaysia | Customs Duty Rate on Both of the Parts and Products [%] | |||

|---|---|---|---|---|

| 0 | 25 | 50 | 100 | |

| Baseline | Shanghai Kuala Lumpur | Shanghai Kuala Lumpur | Shanghai Seattle | Shanghai Seattle |

| 11 in China 1 in Japan | 11 in China 1 in Japan | – | – | |

| B1: 3 suppliers | Shanghai Kuala Lumpur | Shanghai Kuala Lumpur | Kuala Lumpur Seattle | Kuala Lumpur Seattle |

| 9 in China 1 in Japan | 9 in China 1 in Japan | 9 in China 2 in Japan | 2 in China 7 in Japan | |

| B2: 7 suppliers | Shanghai Kuala Lumpur | Shanghai Kuala Lumpur | Kuala Lumpur Seattle | Kuala Lumpur Seattle |

| 5 in China | 5 in China | 4 in China 1 in Japan | 3 in Japan | |

| B3: all suppliers | Shanghai Kuala Lumpur | Shanghai Kuala Lumpur | Kuala Lumpur Seattle | Kuala Lumpur Seattle |

| (Only Malaysia) | (Only Malaysia) | (Only Malaysia) | (Only Malaysia) | |

| The Customs Duty Rate [%] | |||||||

|---|---|---|---|---|---|---|---|

| 41% | 48% | 51% | 58% | 96% | 100% | 41→100% | |

| Total transportation cost of parts [USD] | 2969.01 | 2997.26 | 3045.02 | 3078.35 | 3121.47 | 3170.39 | 6.78% |

| Total procurement cost of parts [USD] | 11,644.20 | 11,864.90 | 12,094.80 | 12,202.50 | 12,321.60 | 12,357.80 | 6.13% |

| Total customs duty of parts [USD] | 647.23 | 504.72 | 256.43 | 148.42 | 82.37 | 0.00 | −100.00% |

| Total transportation cost of products [USD] | 3881.07 | 3881.07 | 3881.07 | 3881.07 | 3881.07 | 3881.07 | 0.00% |

| Total customs duty of products [USD] | 2706.00 | 3168.00 | 3366.00 | 3828.00 | 6336.00 | 6600.00 | 143.90% |

| Total fixed opening route cost between factory and market [USD] | 333.40 | 333.40 | 333.40 | 333.40 | 333.40 | 333.40 | 0.00% |

| Total opening cost of factories [USD] | 198.01 | 198.01 | 198.01 | 198.01 | 198.01 | 198.01 | 0.00% |

| Total manufacturing cost [USD] | 20,550.00 | 20,550.00 | 20,550.00 | 20,550.00 | 20,550.00 | 20,550.00 | 0.00% |

| Total cost [USD] | 42,928.91 | 43,497.36 | 43,724.73 | 44,219.75 | 46,823.92 | 47,090.67 | 9.69% |

| Parts | The Customs Duty Rate [%] | ||||||

|---|---|---|---|---|---|---|---|

| Number | Name | 41–47% | 48–50% | 51–57% | 58–95% | 96–99% | 100% |

| 9 | Left body | Hangzhou | Hangzhou | Shizuoka | Shizuoka | Shizuoka | Shizuoka |

| 10 | Right body | Jinan | Kyoto | Kyoto | Kyoto | Kyoto | Kyoto |

| 11 | Dust case cover | Qingdao | Qingdao | Qingdao | Qingdao | Sendai | Sendai |

| 17 | Lower filter | Xian | Xian | Xian | Xian | Xian | Shizuoka |

| 21 | Rubber of outer flame of fan | Dalian | Dalian | Dalian | Sendai | Sendai | Sendai |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nagao, T.; Ijuin, H.; Yamada, T.; Nagasawa, K.; Zhou, L. COVID-19 Disruption Strategy for Redesigning Global Supply Chain Network across TPP Countries. Logistics 2022, 6, 2. https://doi.org/10.3390/logistics6010002

Nagao T, Ijuin H, Yamada T, Nagasawa K, Zhou L. COVID-19 Disruption Strategy for Redesigning Global Supply Chain Network across TPP Countries. Logistics. 2022; 6(1):2. https://doi.org/10.3390/logistics6010002

Chicago/Turabian StyleNagao, Takaki, Hiromasa Ijuin, Tetsuo Yamada, Keisuke Nagasawa, and Lei Zhou. 2022. "COVID-19 Disruption Strategy for Redesigning Global Supply Chain Network across TPP Countries" Logistics 6, no. 1: 2. https://doi.org/10.3390/logistics6010002

APA StyleNagao, T., Ijuin, H., Yamada, T., Nagasawa, K., & Zhou, L. (2022). COVID-19 Disruption Strategy for Redesigning Global Supply Chain Network across TPP Countries. Logistics, 6(1), 2. https://doi.org/10.3390/logistics6010002