A Mean-Risk Multi-Period Optimization Model for Cooperative Risk in the Shipbuilding Supply Chain

Abstract

1. Introduction

- This paper makes a quantitative study of the cooperative risk of shipbuilding enterprises. At present, risk management is mainly analyzed in three steps: risk identification, risk evaluation, and risk control. There is little literature on cooperative risk management of shipbuilding enterprises, and most of the risk assessment models are in the active scoring stage, lacking objectivity and pertinency. The multi-period linear programming decision model and the nonlinear programming decision model established in this paper are both quantitative research models.

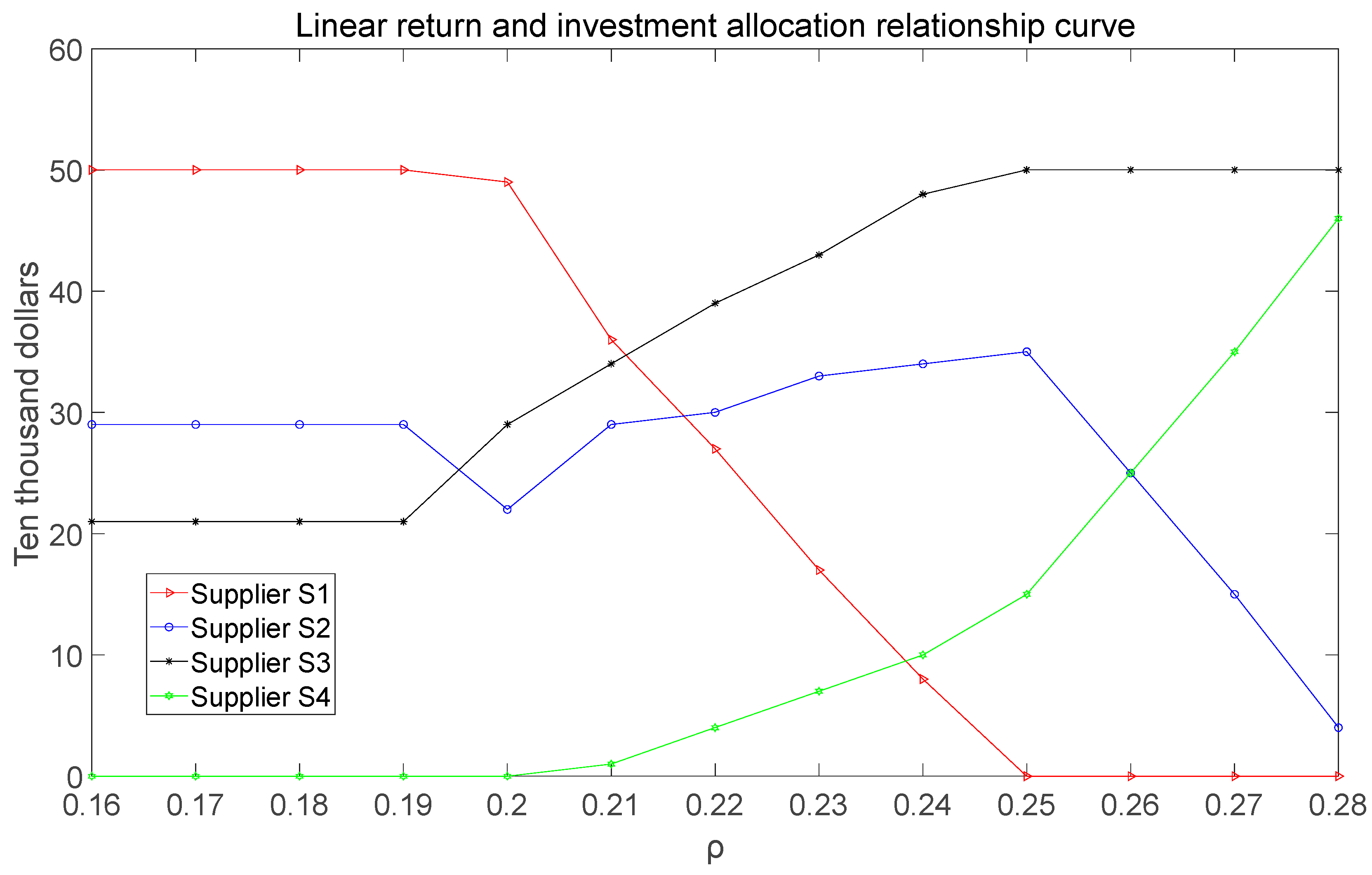

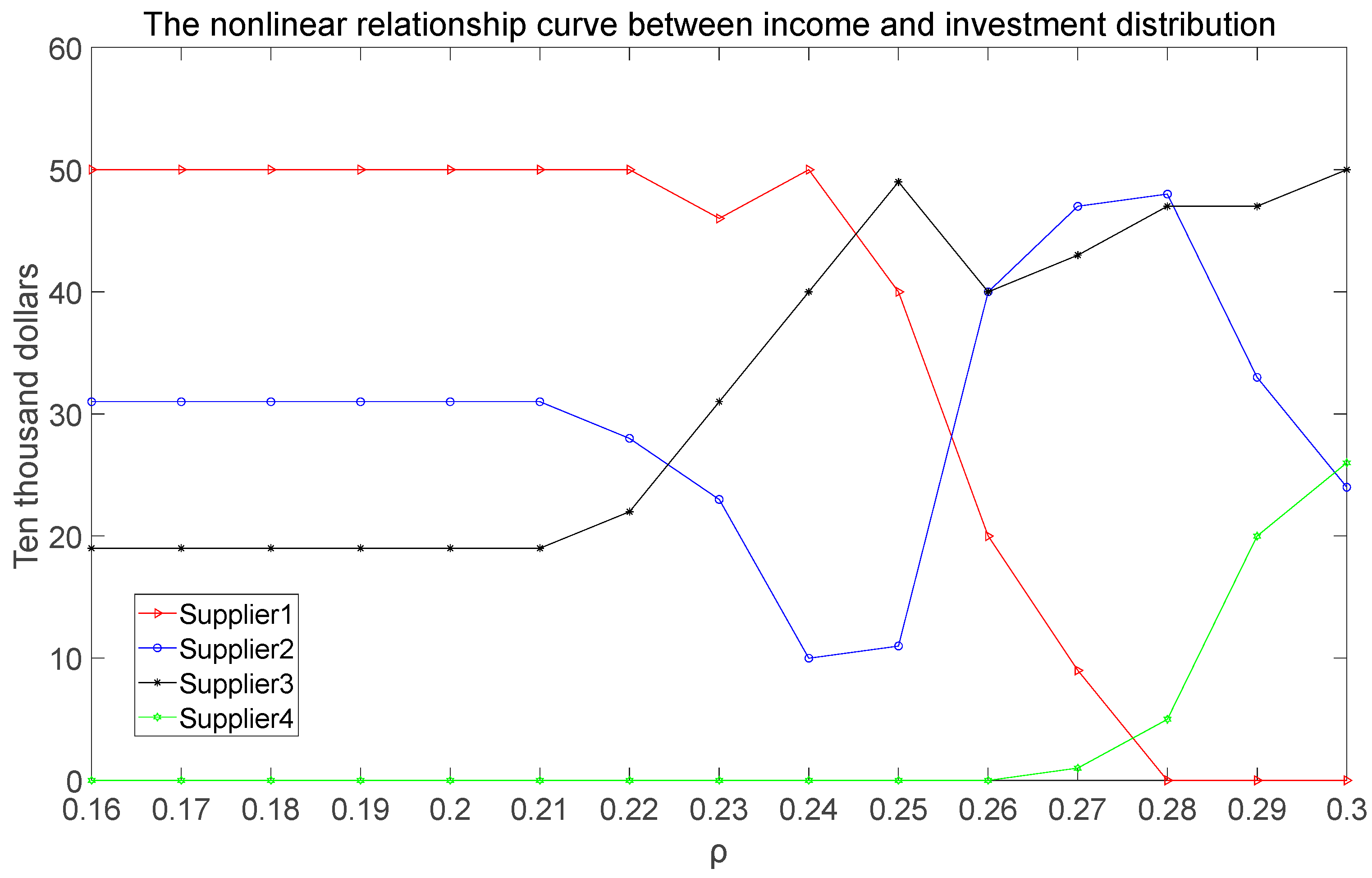

- A multi-period nonlinear programming decision model based on mean risk is established to study the risk of shipbuilding supply chain cooperation. This paper constructs a multi-period planning decision model in which the expected return and the investment amount have a nonlinear relationship, which is more in line with the actual situation, and is compared with the results of the linear decision model. The calculation results show that the nonlinear decision model can reduce the risk at the same level of return.

- Enriched the research on cooperative risk in the shipbuilding supply chain. Aiming at the cooperative development work between shipbuilding enterprises and suppliers under supply risk, the mean-risk model was improved, and the mean-risk multi-period linear programming decision model and nonlinear programming decision model were constructed and applied to the research on cooperative risk in the shipbuilding supply chain for the first time.

2. Literature Review

2.1. Overview of Shipbuilding Supply Chain Cooperation Risks

2.2. Risk Characteristics of Shipbuilding Supply Chain Cooperation

- Globally. Compared with the supply chains of other manufacturing industries, the shipbuilding supply chain involves a larger number of cooperative enterprises, and the number of foreign cooperative node enterprises is also larger, with a particularly wide geographical span. There are both domestic suppliers and overseas suppliers. Suppliers are geographically diverse and more susceptible to exchange rates and energy price fluctuations, cultural and language differences, trade regulations, and political and economic stability. Shipbuilding is a complex project involving a large number of different types of parts. Many domestic and foreign suppliers are involved in inbound logistics, and different parts have different logistics requirements. If a supplier fails to deliver on time, it may cause a chain reaction. Therefore, the cooperation risk of the shipbuilding supply chain has global characteristics.

- Uncertainty. Based on the characteristics of the shipbuilding industry and the production logistics of the shipbuilding industry, it is known that the process of manufacturing ships is extremely arduous and complex, and the architecture of the shipbuilding supply chain is also particularly cumbersome. In the shipbuilding supply chain, there is not only cooperation between node enterprises but also a lot of collaboration between sub-chains. This extremely cumbersome collaboration has many uncontrollable or uncertain elements and is, therefore, more prone to uncertain cooperation risks.

- Uncertainty. From the perspective of the cooperative node enterprises in the supply chain, there is always some sudden unpredictability in terms of cooperation risks, and it is quite obvious. In the shipbuilding supply chain, whether it is the production and transportation of parts and the assistance of cooperative manufacturers, or the step-by-step assembly of shipbuilding enterprises, there are many links and steps involved in the middle, which are particularly complicated. These links and steps will interfere with the attention of the cooperative node enterprises in the supply chain to a certain extent. Shipbuilding enterprises cannot accurately predict and calculate these unpredictable cooperation risks, so they will not perceive the cooperation risks until they occur, which will catch the node enterprises off guard and make them feel the suddenness of the cooperation risks.

- Dynamicity. The cooperation risk of the shipbuilding supply chain is not always constant but is in a dynamic development process. Sometimes, the cooperation risk becomes weaker and weaker due to the implementation of risk model management. Sometimes, the cooperation risk becomes worse due to the disruption of internal and external factors of the supply chain.

2.3. Shipbuilding Supply Chain Cooperation Risk Assessment Model

- Probabilistic decision model. The international engineering standard ISO 14971 defines risk as R, the product of the probability and harmfulness of a risk source event: , where represents the probability of the risk event, and represents the loss of cost, quality, and time caused by the risk event. The main purpose of supply chain risk assessment is to estimate the adverse impact of the probability of the risk event on the entire supply chain. It is often difficult to quantify the probability and harmfulness of risk events because it is almost impossible to accurately assess the possibility of occurrence and its impact; however, as a qualitative method, it is desirable to evaluate the identified risks. The probability decision matrix is a qualitative risk assessment tool with two dimensions: “probability” (from low to high) and “impact” (from weak to severe) based on the scale. In the risk assessment of the supply chain, the probability decision matrix is a widely used risk assessment model.

- Fuzzy comprehensive evaluation model. Many factors affect supply chain risks, some of which can be obtained, while others cannot be obtained, which is a kind of gray information. Therefore, it is impossible to accurately describe the risk level in the risk assessment process. At the same time, given that the supply chain is a dynamic network alliance created around core enterprises, the risk-based inference lacks original data in many cases, and the corresponding probability distribution cannot be determined. In many cases, it relies on personal subjective inference, which is relatively vague. Therefore, for the overall evaluation of supply chain risks, fuzzy comprehensive evaluation methods are widely used [19,20].

- Bayesian network model. The Bayesian network model takes into account the advantages of probability theory and graph theory. It combines the two organically and can handle uncertainty problems very clearly. It has been widely used in decision support, machine learning, and data mining.

- Mean-risk model. Also called Markowitz model, or mean-risk (risk) analysis, also known as modern portfolio theory (MPT), it was established by economist Harry Markowitz in the 1950s. The author was later awarded the Nobel Prize in Economics. In the initial version of the mean-risk theory model, investment return is defined as the expected value of the rate of return, that is, the average return of the asset, and investment risk is defined as the volatility of the rate of return, that is, the risk of the asset return [21,22]. In the existing literature, it is assumed that the return and investment amount are in a linear relationship, and nonlinear situations are not considered. Based on the existing literature, the main risk assessment models and their related characteristics are listed in Table 1.

Synthesis and Identified Research Gap

3. Risk Model of Shipbuilding Supply Chain Cooperation

3.1. Markowitz Model Theory

3.2. Analysis of Cooperation Process in Shipbuilding Supply Chain

3.2.1. Collaborative Process of Shipbuilding Supply Chain

3.2.2. Lean Control of Cooperative Risk Based on the Whole Life Cycle Theory

- Establishment stage and control of cooperative relationship

- 2.

- Operation stage and control of cooperative relationships

- 3.

- Maintenance and optimization stages and control of cooperative relationships

3.3. Multi-Period Linear Programming Decision Model Based on Mean-Risk

3.3.1. Problem Description and Model Assumptions

- The total budget amount for each period includes not only procurement costs but also other related costs.

- The data of the historical cycles are reliable and there are no major market fluctuations. The returns and risks of this period are estimated based on the data of the historical cycles.

- The return on investment in each supplier is linearly related to the investment amount, and the returns are all positive.

- This model considers the case of a single product and multiple cycles.

- After fitting, the historical period data of each supplier obeys a certain probability distribution of mathematical statistics.

- The investment amount allocated by the shipbuilding enterprise to the supplier is an integer.

3.3.2. Linear Decision Model Construction

- : It indicates the total budget amount invested by the shipbuilding enterprise in suppliers.

- : Indicates the investment amount allocated to the supplier .

- : Indicates the number of suppliers.

- : Represents the overall expected minimum rate of return required by the shipbuilding enterprise.

- : Indicates the minimum amount allocated to the supplier .

- : Indicates the maximum amount allocated to the supplier .

- : Represents the rate of return of shipbuilding enterprises’ investment in supplier .

- : Indicates the total number of time cycles.

- : The actual rate of return of the supplier in the period .

- : Represents the expected rate of .

- : The covariance between the expected rates of return and for any two suppliers, i.e., .

3.4. Multi-Period Nonlinear Programming Decision Model Based on Mean Risk

3.4.1. Problem Description and Model Assumptions

- The total budget amount for each period includes not only procurement costs but also other related costs.

- The data of the historical cycles are reliable and there are no major market fluctuations. The returns and risks of this period are estimated based on the data of the historical cycles.

- The return on investment in each supplier is nonlinearly related to the investment amount. The higher the investment amount, the higher the rate of return, and the rate of return is always positive.

- This model considers the case of a single product and multiple cycles.

- After fitting, the historical period data of each supplier obeys a certain probability distribution of mathematical statistics.

- The investment amount allocated by the shipbuilding enterprise to the supplier is an integer.

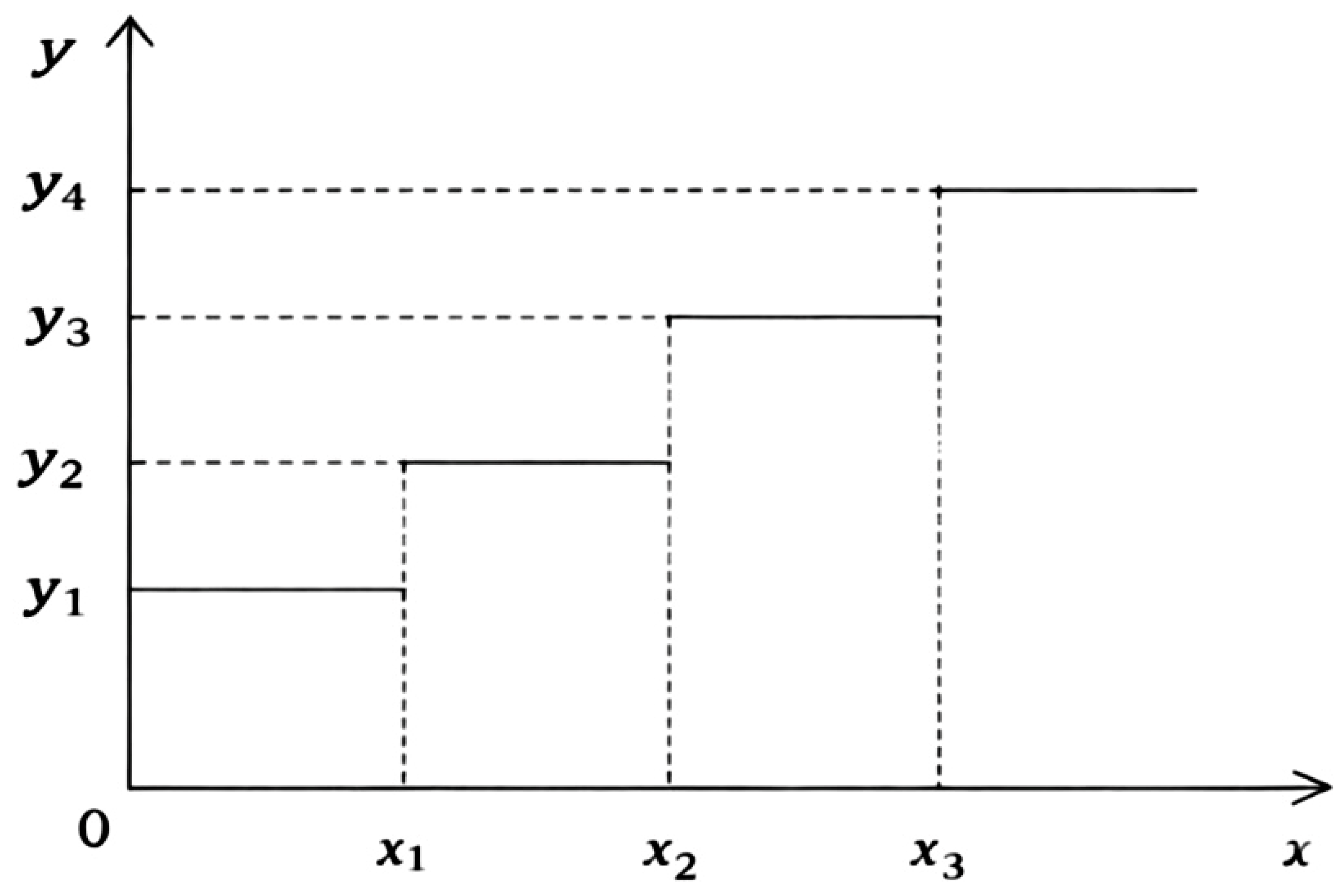

3.4.2. Construction of a Nonlinear Decision Model

- : It indicates the total budget amount invested by the shipbuilding enterprise in suppliers.

- : Indicates the investment amount allocated to the supplier .

- : Indicate the highest investment level of the supplier .

- : Indicate the investment amount of the supplier at level , where .

- : If the investment amount of the supplier is at level , it is 1; otherwise, it is 0.

- : Indicates the total number of suppliers.

- : Represents the overall expected minimum rate of return required by the shipbuilding enterprise.

- : Indicate the minimum investment amount for the supplier .

- : Indicate the maximum investment amount for the supplier .

- : The minimum investment amount of the supplier at the first level .

- : The maximum investment amount of the supplier at the first level .

- : Represents the rate of return of shipbuilding enterprises’ investment in supplier .

- : Indicates the total number of time cycles.

- : Indicates the actual rate of return of the Supplier at the -th level during the -th cycle.

- : Indicate the expected return rate at level .

- : The covariance between the expected rates of return and for any two suppliers, i.e., .

4. Empirical Research and Results Analysis

5. Conclusions

Research Prospects

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Alfnes, E.; Strandhagen, J.O.; Dreyer, H.C. Supply chain risk assessment in engineer-to-order shipbuilding. Int. J. Prod. Econ. 2021, 240, 108243. [Google Scholar] [CrossRef]

- Hattis, D.; Burmaster, D.E. Assessment of variability and uncertainty distributions for practical risk analyses. Risk Anal. 1994, 14, 713–730. [Google Scholar] [CrossRef]

- Choi, T.M.; Chiu, C.H.; Chan, H.K. Risk management of logistics systems. Transp. Res. Part E Logist. Transp. Rev. 2016, 90, 1–6. [Google Scholar] [CrossRef]

- Beasley, M.; Bradford, M.; Pagach, D. Outsourcing at your own risk. Strateg. Financ. 2004, 86, 22. [Google Scholar]

- Klein, J.H.; Cork, R.B. An approach to technical risk assessment. Int. J. Proj. Manag. 1998, 16, 345–351. [Google Scholar] [CrossRef]

- Haimes, Y.Y.; Kaplan, S.; Lambert, J.H. Risk filtering, ranking, and management framework using hierarchical holographic modeling. Risk Anal. 2002, 22, 383–397. [Google Scholar] [CrossRef]

- Schank, R.C. A Theory of Reminding and Learning in Computers and People; Cambridge University Press: Cambridge, UK, 1982. [Google Scholar]

- Giaglis, G.M.; Minis, I.; Tatarakis, A. Minimizing logistics risk through real-time vehicle routing and mobile technologies. Int. J. Phys. Distrib. Logist. Manag. 2004, 34, 749–764. [Google Scholar] [CrossRef]

- Tao, Q. Study on Risk Management of China’s Shipbuilding Supply Chain Complex Network Based on Cooperative Symbiosis Mode. Shanghai Manag. Sci. 2017, 39, 64–72. [Google Scholar]

- He, Z. Supply Chain Finance in the Shipbuilding Industry Application and Research on Credit Risk Management. Master’s Thesis, Shanghai Jiao Tong University, Shanghai, China, 2015. [Google Scholar]

- Zhou, Y. Research on Supply Chain Management of Cooperation Risks of Shipbuilding Enterprises. Logist. Eng. Manag. 2014, 36, 75–76+78. [Google Scholar]

- Jeong, J.; Hong, P.; Park, Y. Collaborative risk management in global shipbuilding. Sustainability 2020, 12, 7725. [Google Scholar] [CrossRef]

- Ramirez-Peña, M.; Abad Fraga, F.J.; Sánchez Sotano, A.J.; Batista, M. Shipbuilding 4.0 Index Approaching Supply Chain. Materials 2019, 12, 4129. [Google Scholar] [CrossRef]

- Baroroh, D.K.; Chu, C.-H.; Wang, L. Modular construction risks in shipbuilding. IOP Conf. Ser. Mater. Sci. Eng. 2020, 793, 012002. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, S.; Yao, J. Bayesian networks for delay prediction. Int. J. Prod. Econ. 2023, 255, 108712. [Google Scholar] [CrossRef]

- Guo, Y.; Liu, F.; Song, J.S.; Wang, S. Supply chain resilience: A review from the inventory management perspective. Fundam. Res. 2025, 5, 450–463. [Google Scholar] [CrossRef] [PubMed]

- Fatouh, A.; Rego, C. AI limitations in engineer-to-order supply chains. Procedia Comput. Sci. 2023, 217, 1563–1572. [Google Scholar] [CrossRef]

- Kuiti, M.R.; Ghosh, D.; Basu, P. Cap-and-trade for circular supply chains. Int. J. Prod. Econ. 2020, 227, 107667. [Google Scholar] [CrossRef]

- Ghadimi, P.; Azadnia, A.H.; Yusof, N.M.; Saman, M.Z.M. A weighted fuzzy approach for product sustainability assessment: A case study in automotive industry. J. Clean. Prod. 2012, 33, 10–21. [Google Scholar] [CrossRef]

- Zimmer, K.; Fröhling, M.; Breun, P.; Schultmann, F. Assessing social risks of global supply chains: A quantitative analytical approach and its application to supplier selection in the German automotive industry. J. Clean. Prod. 2017, 149, 96–109. [Google Scholar] [CrossRef]

- Rubinstein, M. Markowitz’s” portfolio selection”: A fifty-year retrospective. J. Financ. 2002, 57, 1041–1045. [Google Scholar] [CrossRef]

- Talluri, S.; Narasimhan, R.; Chung, W. Manufacturer cooperation in supplier development under risk. Eur. J. Oper. Res. 2010, 207, 165–173. [Google Scholar] [CrossRef]

- Li, J.; Wu, W.; Jin, Y.; Zhao, R.; Bian, W. Research on environmental comfort and cognitive performance based on EEG+VR+LEC evaluation method in underground space. Build. Environ. 2021, 198, 107886. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, S.; Zio, E.; Zhang, C.; Dui, H.; Chen, R. Model-guided system operational reliability assessment based on gradient boosting decision trees and dynamic Bayesian networks. Reliab. Eng. Syst. Saf. 2025, 259, 110949. [Google Scholar] [CrossRef]

- Munoz, E.G.A.; Yilan, G. Second-hand clothing and sustainability in the fashion sector: Analysing visions on circular strategies through SWOT/ANP method. J. Clean. Prod. 2025, 493, 144909. [Google Scholar] [CrossRef]

- Juan, S.R.J.M.; Rodríguez, D.M.J.; Martín, P.C.; Pérez-Mulas, A.; Cayuela, C.S.; Ciscar, J.V.; Vera, M.L.R.; Hernández, E.F.; Albiach, C.F.; Masferrer, J.P.; et al. MARRTA: Risk matrix in advanced radiotherapy. Physica Medica 2024, 127, 104846. [Google Scholar] [CrossRef]

- Giri, B.C.; Masanta, M. Developing a closed-loop supply chain model with price and quality dependent demand under uncertainty. J. Ind. Manag. Optim. 2020, 16, 1385–1412. [Google Scholar]

- Bai, L.; Zhang, H. Dynamic mean-variance problem with constrained risk control for the insurers. Math. Methods Oper. Res. 2008, 68, 181–205. [Google Scholar] [CrossRef]

- Singh, H.; Saxena, S.; Sharma, H.; Kamboj, V.K.; Arora, K.; Joshi, G.P.; Cho, W. An integrative TLBO-driven hybrid Grey Wolf optimizer for the efficient resolution of multi-dimensional, nonlinear engineering problems. Sci. Rep. 2025, 15, 11205. [Google Scholar] [CrossRef]

- Wu, W.; Yang, X. A branch and bound algorithm for continuous multiobjective optimization problems using general ordering cones. Eur. J. Oper. Res. 2025, 326, 28–41. [Google Scholar] [CrossRef]

| Evaluation Model | Characteristic | References |

|---|---|---|

| LEC evaluation model | Easy to understand and operate, but strong subjectivity, limited ability to assess complex risks. | [23] |

| Mean-risk model | Can quantify risk, concise and intuitive, but accurate data acquisition is difficult. | [21,22] |

| Bayesian network model | The model is simple and interpretable, but it needs to collect a lot of data. | [24] |

| Network analysis model (ANP) | It is presented graphically, but the modeling of the relationship between each factor requires a lot of data support. | [25] |

| Risk matrix model | The graphical presentation is intuitive and easy to understand, but ignoring some potential risks makes the assessment incomprehensive and subjective. | [26] |

| Supplier | P1 | P2 | P3 | P4 | P5 | P6 | P7 | P8 | |

|---|---|---|---|---|---|---|---|---|---|

| S1 | 0.17 | 0.18 | 0.16 | 0.15 | 0.17 | 0.13 | 0.17 | 0.14 | 0.16 |

| S2 | 0.22 | 0.24 | 0.25 | 0.16 | 0.20 | 0.17 | 0.19 | 0.22 | 0.21 |

| S3 | 0.25 | 0.32 | 0.22 | 0.19 | 0.21 | 0.32 | 0.26 | 0.25 | 0.26 |

| S4 | 0.41 | 0.37 | 0.42 | 0.21 | 0.26 | 0.25 | 0.38 | 0.28 | 0.31 |

| Investment Amount (Unit: Ten Thousand US Dollars) | Investment Amount Level | Multiple Rates of Return |

|---|---|---|

| 0–19 | 1 | 1.0 |

| 20–39 | 2 | 1.1 |

| 40–50 | 3 | 1.2 |

| Supplier | Investment Amount | Investment Amount Level |

|---|---|---|

| S1 | 50 | 3 |

| S2 | 31 | 2 |

| S3 | 19 | 1 |

| S4 | 0 | 1 |

| Yield | Linear Model Value at Risk | Nonlinear Model Value at Risk | Risk Reduction Percentage |

|---|---|---|---|

| 0.16–0.19 | 3.0225 | 3.7364 (−0.7139) | |

| 0.20 | 3.2221 | 3.7363 (−0.5142) | |

| 0.21 | 4.1694 | 3.7363 (0.4331) | 10.39% |

| 0.22 | 5.3569 | 3.8692 (1.4877) | 22.77% |

| 0.23 | 6.7660 | 4.3163 (2.4497) | 36.20% |

| 0.24 | 8.3956 | 5.5237 (2.8719) | 34.21% |

| 0.25 | 10.2778 | 6.7284 (3.5494) | 34.53% |

| 0.26 | 12.7578 | 7.7543 (5.0035) | 39.22% |

| 0.27 | 15.9403 | 9.4019 (6.8384) | 42.90% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiang, Z.; Naseem, M.H.; Pan, X.; Ahmad, F.S. A Mean-Risk Multi-Period Optimization Model for Cooperative Risk in the Shipbuilding Supply Chain. Math. Comput. Appl. 2025, 30, 125. https://doi.org/10.3390/mca30060125

Xiang Z, Naseem MH, Pan X, Ahmad FS. A Mean-Risk Multi-Period Optimization Model for Cooperative Risk in the Shipbuilding Supply Chain. Mathematical and Computational Applications. 2025; 30(6):125. https://doi.org/10.3390/mca30060125

Chicago/Turabian StyleXiang, Ziquan, Muhammad Hamza Naseem, Xiuqian Pan, and Fatima Sayeeda Ahmad. 2025. "A Mean-Risk Multi-Period Optimization Model for Cooperative Risk in the Shipbuilding Supply Chain" Mathematical and Computational Applications 30, no. 6: 125. https://doi.org/10.3390/mca30060125

APA StyleXiang, Z., Naseem, M. H., Pan, X., & Ahmad, F. S. (2025). A Mean-Risk Multi-Period Optimization Model for Cooperative Risk in the Shipbuilding Supply Chain. Mathematical and Computational Applications, 30(6), 125. https://doi.org/10.3390/mca30060125