Implementation of the Digital Sales Channel in the Coatings Industry

Abstract

:1. Introduction

2. Research Procedure

- Review of theoretical bases;

- Conducting a survey (identification of sales channels and determining their importance);

- Conducting structured interviews (modeling—As-Is sales processes);

- Business process analysis;

- A proposal to improve the process with the help of a common technical enabler and digital transformation of the sales channel process (modeling—To-Be sales process);

- Verification of the efficiency of the To-Be sales process.

3. Results

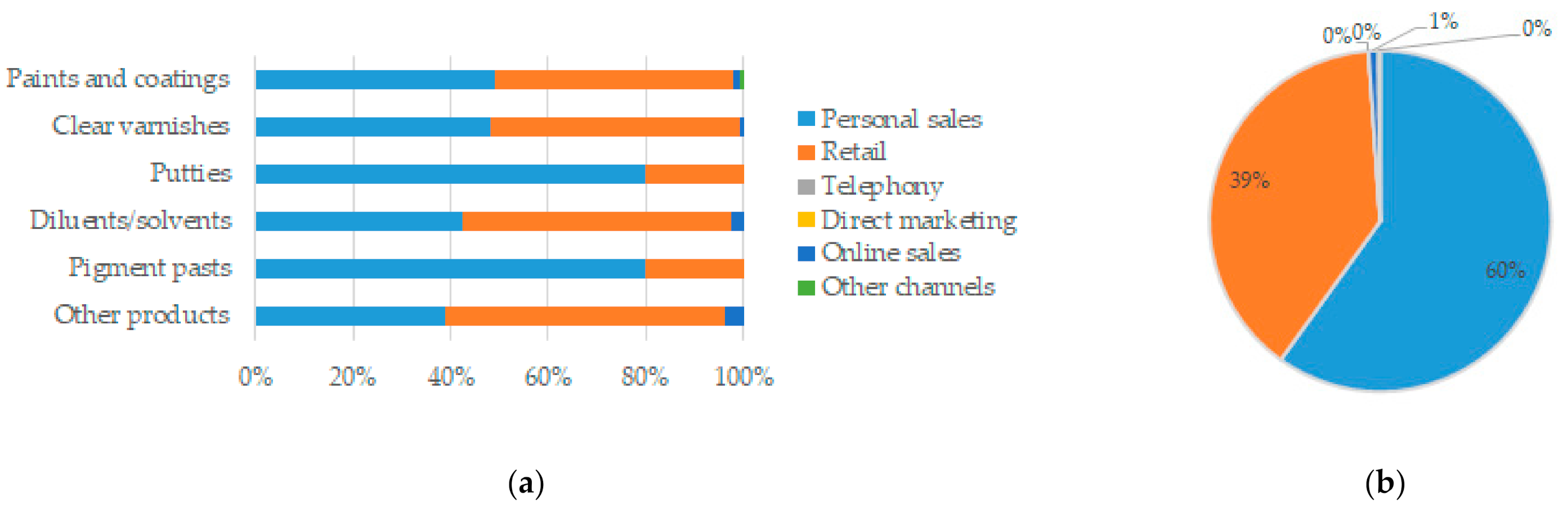

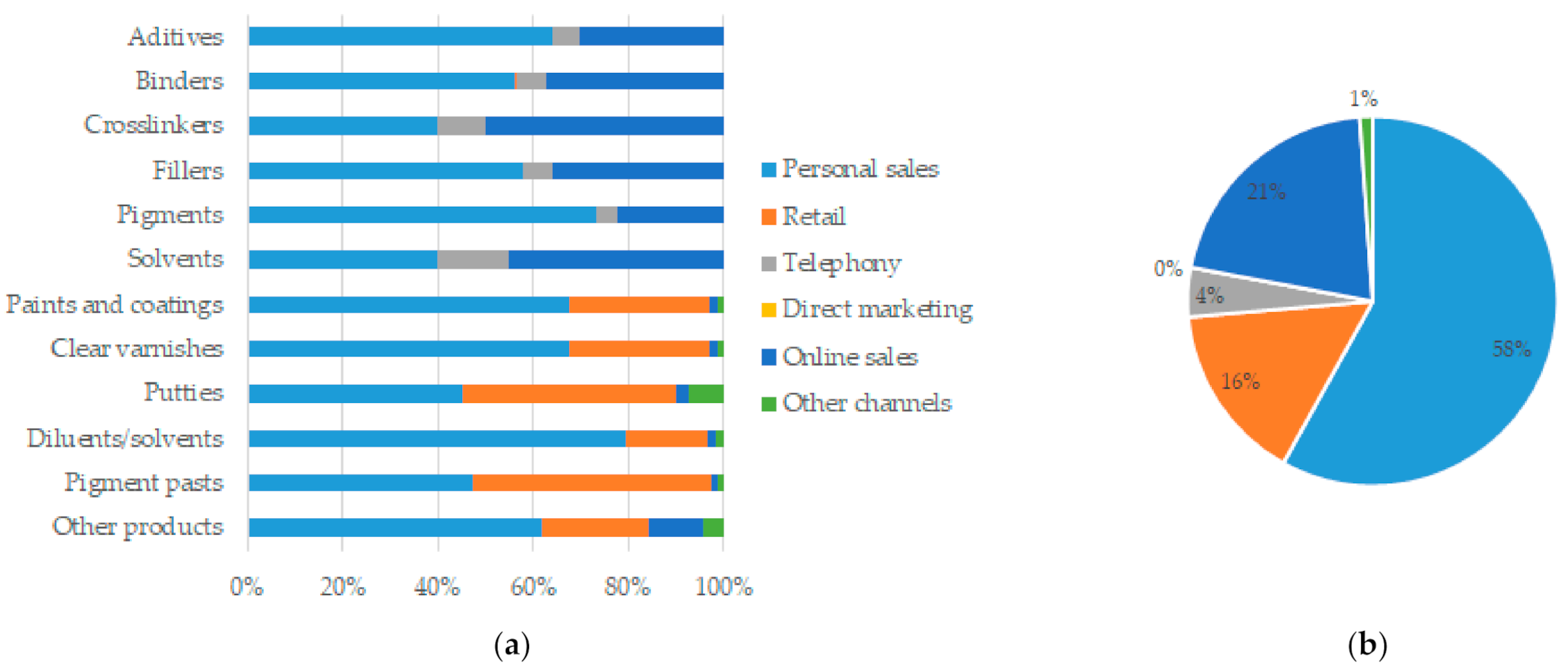

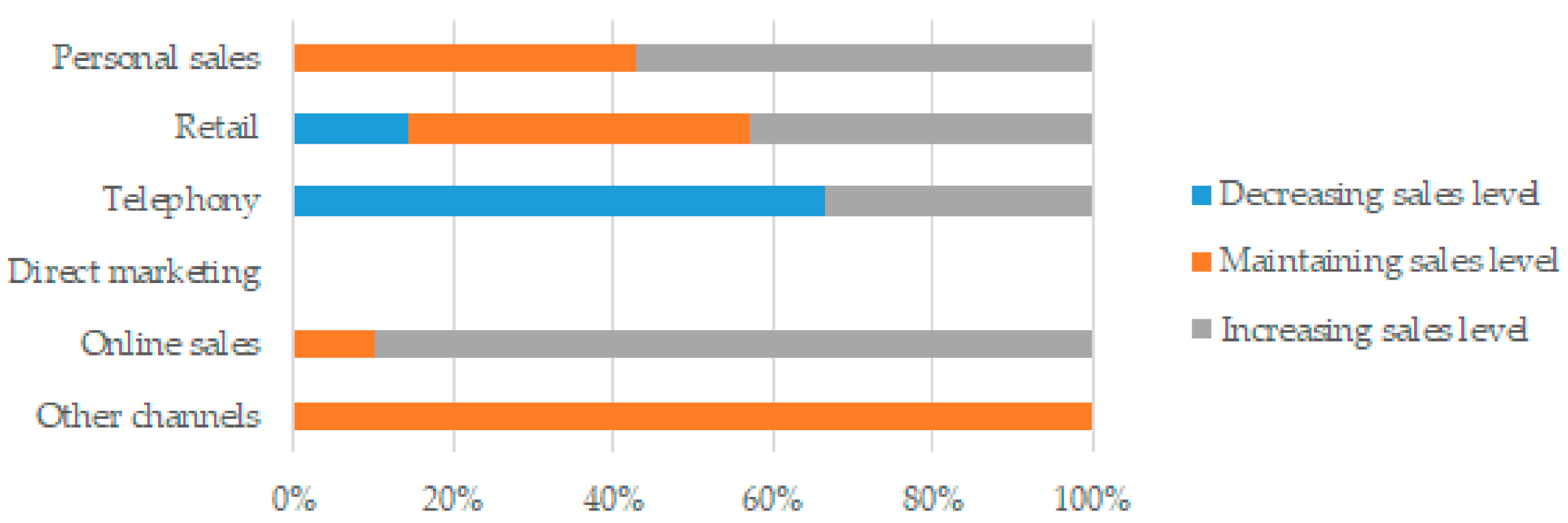

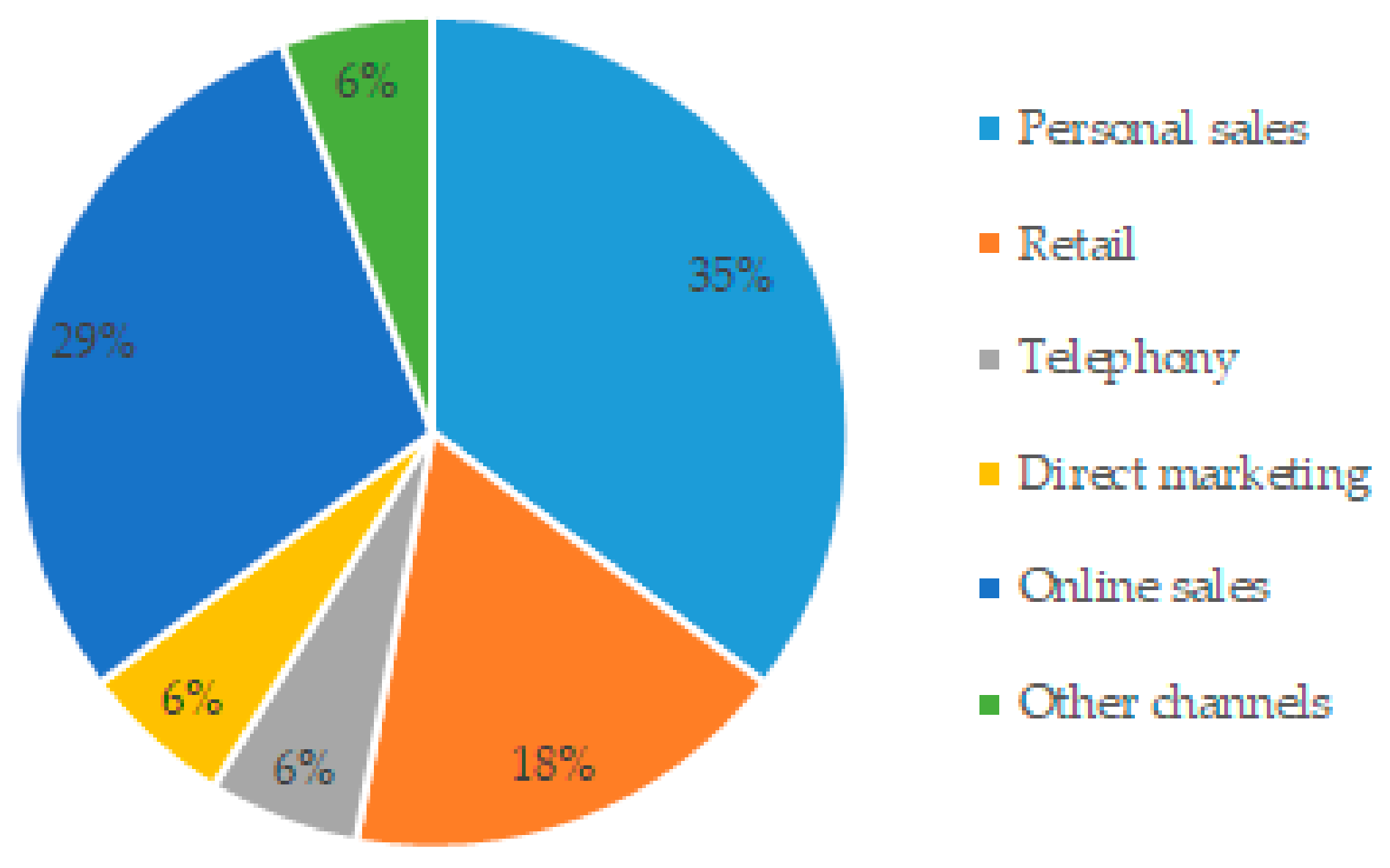

3.1. Sales Channels in the Coatings Industry

- Personal sales;

- Retail;

- Online sales.

- Personal sales;

- Online sales;

- Retail.

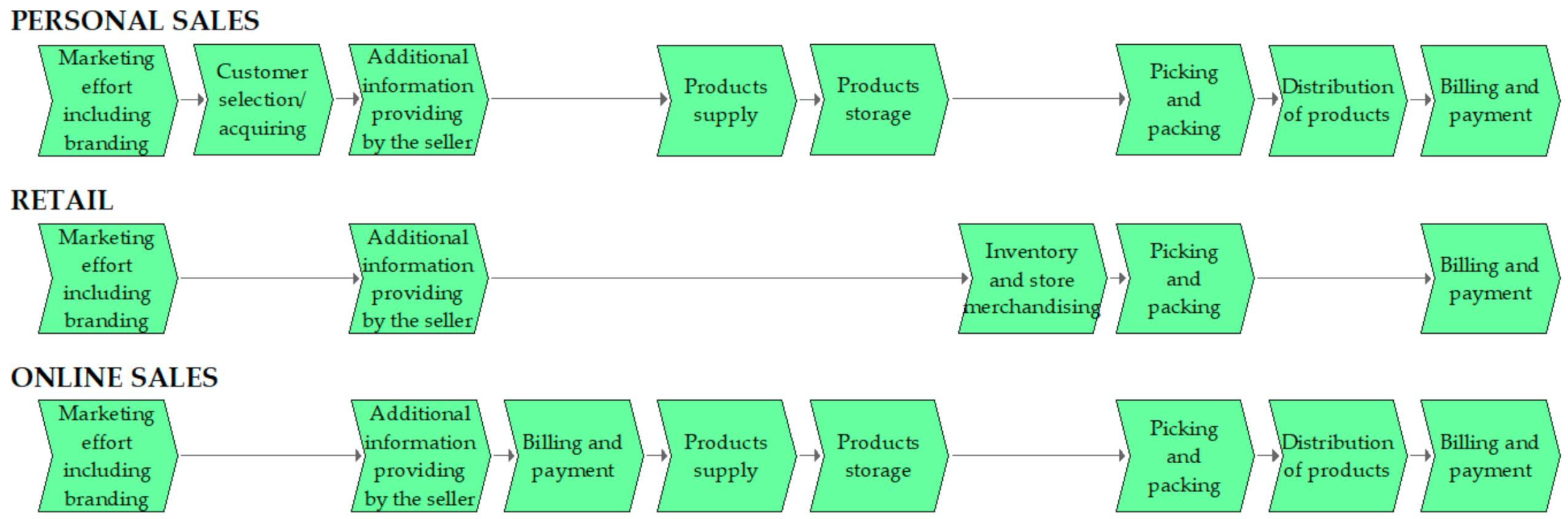

3.2. As-Is Sales Processes

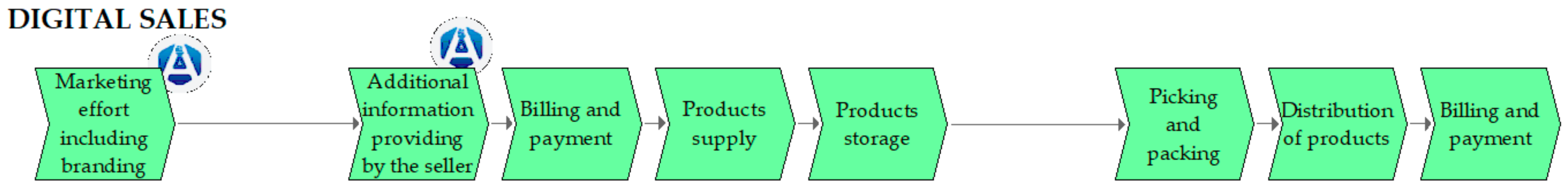

3.3. To-Be Process of a Digital Sales Channel

3.4. Verification of Digital Sales Channel Advantages

4. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Kern, T.; Krhač, E.; Senegačnik, M.; Urh, B. Digitalizing the Paints and Coatings Development Process. Processes 2019, 7, 539–561. [Google Scholar] [CrossRef] [Green Version]

- Urh, B.; Senegačnik, M.; Kern, T.; Krhač, E. Reducing waste of laboratory tests in the coating development process. Pol. J. Environ. Stud. 2020, 29, 3841–3851. [Google Scholar] [CrossRef]

- Kern, T.; Krhač Andrašec, E.; Urh, B.; Senegačnik, M. Digital transformation reduces costs of the paints and coatings development process. Coatings 2020, 10, 1–15. [Google Scholar] [CrossRef]

- Dumas, M.; La Rosa, M.; Mendling, J.; Reijers, H.A. Fundamentals of Business Process Management, 2nd ed.; Springer: Berlin/Heidelberg, Germany, 2018; p. 2. [Google Scholar]

- ALLCHEMIST®. Digital Platform for Experts Working in the Paint Coatings Industry Who Want to Work Directly with Data Instead of Datasheets 2018. Available online: https://www.allchemist.net/ (accessed on 28 March 2021).

- Bai, C.; Sarkis, J. A grey-based DEMATEL model for evaluating business process management critical success factors. Int. J. Prod. Econ. 2013, 146, 281–292. [Google Scholar] [CrossRef]

- Guha, S.; Kettinger, W.J.; Teng, J.T.C. Business process reengineering: Building a Comprehensive Methodology. Inf. Syst. Manag. 1993, 10, 13–22. [Google Scholar] [CrossRef]

- Trkman, P. The critical success factors of business process management. Int. J. Inf. Manag. 2010, 30, 125–134. [Google Scholar] [CrossRef]

- Hilbert, M.; Cerrato, J. Utilize Digital Adoption Solutions to Assist with Process Transformation and Employee Experience—ID G00738480 [Gartner, Inc.]. Published 11 December 2020. Available online: www.gartner.com (accessed on 12 March 2021).

- Andersson, B.; Bider, I.; Johannesson, P.; Perjons, E. Towards a formal definition of goal-oriented business process patterns. Bus. Process Manag. J. 2005, 11, 650–662. [Google Scholar] [CrossRef]

- Aguilar, E.R.; Garcia, F.; Ruiz, F.; Piattini, M.; Visaggio, C.A.; Canfora, G. Evaluation of BPMN Models Quality—A Family of Experiments. In ENASE 2008, Proceedings of the 3rd International Conference on Evaluation of Novel Approaches to Software Engineering, Funchal, Madeira, Portugal, 4–7 May 2008; Gonzalez-Perez, C., Jablonski, S., Eds.; INSTICC: Madeira, Portugal, 2008; pp. 56–63. [Google Scholar]

- Succi, G.; Predonzani, P.; Vernazza, T. Business Process Modeling with Objects, Costs and Human Resources. In Systems Modeling for Business Process Improvement; Bustard, D., Kawalek, P., Norris, M., Eds.; Artech House: Boston, MA, USA; London, UK, 2000; pp. 47–60. [Google Scholar]

- Likar, B.; Trček, D. Orde ab Chao Method for Disruptive Innovations Creation (With COVID-19 Pandemic Case Application). Front. Psychol. 2021, 11, 581968. [Google Scholar] [CrossRef]

- Reijers, H.A.; Mendling, J. A study into the factors that influence the understandability of business process models. IEEE Trans. Syst. Man Cybern. Part A Syst. Hum. 2011, 41, 449–462. [Google Scholar] [CrossRef]

- Mendling, J. Managing Structural and Textual Quality of Business Process Models. In Data-Driven Process Discovery and Analysis; Springer: Berlin/Heidelberg, Germany, 2013; pp. 100–111. [Google Scholar]

- Vanderfeesten, I.; Cardoso, J.; Mendling, J.; Reijers, H.A.; van der Aalst, W. Quality Metrics for Business Process Models. In 2007 BPM and Workflow Handbook, 1st ed.; Fischer, L., Ed.; Future Strategies Inc.: Lighthouse Point, FL, USA, 2007; Volume 144, pp. 179–190. [Google Scholar]

- Cardoso, J. Business Process Control-Flow Complexity: Metric, Evaluation and Validation. Int. J. Web Serv. Res. 2008, 5, 49–76. [Google Scholar] [CrossRef] [Green Version]

- Rolón, E.; Ruiz, F.; Garcia, F.; Piattini, M. Applying Software Metrics to evaluate Business Process Models. CLEI Electron. J. 2006, 9. [Google Scholar] [CrossRef]

- van der Aalst, W.M.P. Business process management: A comprehensive survey. ISRN Softw. Eng. 2013, 2013, 1–37. [Google Scholar] [CrossRef] [Green Version]

- Urh, B. Predicting the Effectiveness of a Business System from the Point of View of Managing Business Process Efficiency. Ph.D. Thesis, University of Maribor, Maribor, Slovenia, 2011. [Google Scholar]

- Mendling, J.; Moser, M.; Neumann, G.; Verbeek, H.M.W.; Van Dongen, B.F.; van der Aalst, W.M.P. A Quantitative Analysis of Faulty EPCs in the SAP Reference Model; BPM Center Report BPM-06-08; BPM Center: Eindhoven, The Netherlands, 2006. [Google Scholar]

- Sarnikar, S.; Deokar, A.V. A design approach for process-based knowledge management systems. J. Knowl. Manag. 2017, 21, 693–717. [Google Scholar] [CrossRef]

- Urh, B.; Kokalj, S.; Zajec, M. The Importance of Structural Indicators in Assessing the Efficiency of Business Process Performance. In People and Sustainable Organization; Kern, T., Rajkovic, V., Eds.; Peter Lang GmbH: Frankfurt am Main, Germany, 2011; pp. 248–270. [Google Scholar]

- Cardoso, J. Complexity analysis of BPEL web processes. Softw. Process Improv. Pract. 2007, 12, 35–49. [Google Scholar] [CrossRef]

- Mendling, J.; Sánchez-González, L.; García, F.; La Rosa, M. Thresholds for error probability measures of business process models. J. Syst. Softw. 2012, 85, 1188–1197. [Google Scholar] [CrossRef] [Green Version]

- Figl, K. Comprehension of procedural visual business process models. Bus. Inf. Syst. Eng. 2017, 59, 41–67. [Google Scholar] [CrossRef] [Green Version]

- Cardoso, J.; Mendling, J.; Neumann, G.; Reijers, H.A. A Discourse on Complexity of Process Models. In Business Process Management Workshops, Proceedings of the International Conference on Business Process Management, Vienna, Austria, 4–7 September 2006; Eder, J., Dustdar, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2006; pp. 117–128. [Google Scholar]

- Gruhn, V.; Laue, R. Adopting the cognitive complexity measure for business process models. In Cognitive Informatics, Proceedings of the 2006 5th IEEE International Conference on Cognitive Informatics, Beijing, China, 17–19 July 2006; Yao, Y., Shi, Z., Wang, Y., Kinsner, W., Eds.; IEEE: New York, NY, USA, 2006; pp. 236–241. [Google Scholar]

- Irani, Z.; Hlupic, V.; Giaglis, G.M. Business process reengineering: An analysis perspective. Int. J. Flex. Manuf. Syst. 2002, 14, 5–10. [Google Scholar] [CrossRef]

- Meglič, J.; Kern, T.; Urh, B.; Balkovec, J.; Roblek, M. Influence of Polyvalence Professionals on Product Development Process Efficiency. Strojarstvo 2009, 51, 105–121. [Google Scholar]

- Alba, J.; Lynch, J.; Weitz, B.; Janiszewski, C.; Lutz, R.; Sawyer, A.; Wood, S. Interactive home shopping: Consumer, retailer, and manufacturer incentives to participate in electronic marketplaces. J. Mark. 1997, 61, 38–53. [Google Scholar] [CrossRef] [Green Version]

- Payne, A.; Frow, P. The role of multichannel integration in customer relationship management. Ind. Mark. Manag. 2004, 33, 527–538. [Google Scholar] [CrossRef]

- Neslin, S.A.; Grewal, D.; Leghorn, R.; Shankar, V.; Teerling, M.L.; Thomas, J.S.; Verhoef, P.C. Challenges and opportunities in multichannel customer management. J. Serv. Res. 2006, 9, 95–112. [Google Scholar] [CrossRef]

- Neslin, S.A.; Shankar, V. Key issues in multichannel customer management: Current knowledge and future directions. J. Interact. Mark. 2009, 23, 70–81. [Google Scholar] [CrossRef]

- Avery, J.; Steenburgh, T.J.; Deighton, J.; Caravella, M. Adding bricks to clicks: Predicting the patterns of cross-channel elasticities over time. J. Mark. 2012, 76, 96–111. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Kannan, P.K.; Inman, J.J. From multi-channel retailing to omni-channel retailing: Introduction to the special issue on multi-channel retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Kannan, P.K.; Reinartz, W.; Verhoef, P.C. The path to purchase and attribution modeling: Introduction to special section. Int. J. Res. Mark. 2016, 33, 449–456. [Google Scholar] [CrossRef]

- Kannan, P.K. Digital marketing: A framework, review and research agenda. Int. J. Res. Mark. 2017, 34, 22–45. [Google Scholar] [CrossRef]

- Van Heerde, H.J.; Dinner, I.; Neslin, S.A. Engaging the unengaged customer: The value of a retailer mobile up. Int. J. Res. Mark. 2019, 36, 420–438. [Google Scholar] [CrossRef]

- Liu, H.; Lobschat, L.; Verhoef, P.C. Multichannel retailing: A review and research agenda. Found. Trends Mark. 2018, 12, 1–79. [Google Scholar] [CrossRef]

- Liu, H.; Lobschat, L.; Verhoef, P.C.; Zhao, H. App adoption: The effect on purchasing of customers who have used a mobile website previously. J. Interact. Mark. 2019, 47, 16–34. [Google Scholar] [CrossRef]

- Nibusiness Info.co.uk. The Sales Process. Available online: https://www.nibusinessinfo.co.uk/content/sales-process (accessed on 26 March 2021).

- Burt, S.; Sparks, L. E-commerce and the retail process: A review. J. Retail. Consum. Serv. 2003, 10, 275–286. [Google Scholar] [CrossRef]

- Melacini, M.; Tappia, E. A critical comparison of alternative distribution configurations in Omni-channel retailing in terms of cost and greenhouse gas emissions. Sustainability 2018, 10, 1–15. [Google Scholar] [CrossRef] [Green Version]

- 1ka Enklik Anketa. Orodje za Anketiranje (Survey Tool). Available online: https://www.1ka.si/ (accessed on 27 March 2021).

- Scheer, A.W. ARIS—Business Process: Framework, 2nd ed.; Springer: Berlin/Heidelberg, Germany, 1998. [Google Scholar]

- Pavlović, I.; Kern, T.; Miklavčič, D. Comparison of paper-based and electronic data collection process in clinical trials: Costs simulation study. Contemp. Clin. Trials 2009, 30, 300–316. [Google Scholar] [CrossRef] [PubMed]

- Sánchez González, L.; García Rubio, F.; Ruiz González, F.; Piattini Velthuis, M. Measurement in business processes: A systematic review. Bus. Process Manag. J. 2010, 16, 114–134. [Google Scholar] [CrossRef]

- Davis, R. Aris Design Platform: Advanced Process Modelling and Administration, 1st ed.; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Valiris, G.; Glykas, M. Business analysis metrics for business process redesign. Bus. Process Manag. J. 2004, 10, 445–480. [Google Scholar] [CrossRef]

- Gartner. The 2019 CIO Agenda: Securing a New Foundation for Digital Business. Available online: https://www.gartner.com/doc/3891665/cio-agenda-securing-new-foundation (accessed on 28 March 2021).

- Deutsche Kommission Elektrotechnik (DKE). Elektronik Informationstechnik in DIN und VDE, German Standardization Roadmap, Industrie 4.0. Available online: https://www.din.de/blob/65354/57218767bd6da1927b181b9f2a0d5b39/roadmap-i4-0-e-data.pdf (accessed on 28 March 2021).

- Challener, C. The paint and coatings industry in the age of digitalization. Available online: https://www.paint.org/coatingstech-magazine/articles/paint-coatings-industry-age-digitalization/ (accessed on 5 July 2021).

- Nisar, T.M.; Yeung, M. Attribution Modeling In Digital Advertising—An Empirical Investigation Of the Impact of Digital Sales Channels. J. Advert. Res. 2018, 58, 399–413. [Google Scholar] [CrossRef]

- Bongers, F.M.; Schumann, J.H.; Schmitz, C. How the introduction of digital sales channels affects salespeople in business-to-business contexts: A qualitative inquiry. J. Pers. Sell. Sales Manag. 2021, 41, 150–166. [Google Scholar] [CrossRef]

- Yan, Y.; Zhao, R.; Liu, Z. Strategic introduction of the marketplace channel under spillovers from online to ofline sales. Eur. J. Oper. Res. 2018, 267, 65–77. [Google Scholar] [CrossRef]

- Urh, B.; Zajec, M.; Kern, T.; Krhač, E. Structural Indicators for Business Process Redesign Efficiency Assessment. In Advances in Manufacturing II—Volume 3: Quality Engineering and Management, Proceedings of the International Scientific-Technical Conference Manufacturing, Poznań, Poland, 19–22 May 2019; Hamrol, A., Grabowska, M., Maletič, D., Woll, R., Eds.; Springer: Cham, Switzerland, 2019; pp. 16–32. [Google Scholar]

- Cheng, C. Complexity and Usability Models for Business Process Analysis. Ph.D. Thesis, The Graduate School College of Engineering, Pennsylvania State University, State College, PA, USA, 21 August 2008. [Google Scholar]

- Cottrell, W.D. Simplified Program Evaluation and Review Technique (PERT). J. Constr. Eng. Manag. 1999, 125, 16–22. [Google Scholar] [CrossRef]

- Ljubič, T. Operational Management of Production, 1st ed.; Modern Organization: Kranj, Slovenia, 2006; p. 25. [Google Scholar]

| References | Sales Channels |

|---|---|

| Alba et al. [31] | Supermarket, department store, category, catalog, internet retail, and interactive home shopping. |

| Payne and Frow [32] | 1. Sales force (field account management, service, personal representation); 2. Outlets (retail branches, stores, depots, and kiosks); 3. Telephony (traditional telephone, facsimile, telex, call center contact); 4. Direct marketing (direct mail, radio, traditional TV); 5. E-commerce (e-mail, the Internet, interactive digital TV); 6. M-commerce (mobile telephony, SMS and text messaging, WAP, and 3G mobile services). |

| Neslin et al. [33] | Internet, ATM, call centers, retail, catalog, internet, direct e-mail, store, telemarketing, direct selling. |

| Neslin and Shankar [34] | Channels typically include the store, the Web, catalog, sales force, third party agency, call center and the like. |

| Avery et al. [35] | Catalog channel, internet channel (websites), retail store. |

| Verhoef et al. [36] | Retail channels (store), online website, direct marketing, mobile channels (i.e., smart phones, tablets, apps), social media customer touchpoints (mass communication channels: TV, Radio, Print, C2C). |

| Kannan et al. [37] | Online, mobile and offline media and channels: search engines, display advertisement, social media, e-mail, print ads, radio, TV ads, website, mobile apps or sites, stores. |

| Kannan [38] | Online and mobile channels (apps), social channels, search engines, e-mail, print catalog, TV. Individual marketing channels, such as search, display, e-mail, referral, and direct site. |

| van Heerde et al. [39] | Online channel, physical store, mobile channel (app). |

| Liu et al. [40] | 1. Offline channels (mainly physical stores and catalogs); 2. Online channels (e-mail and websites); 3. Mobile channels (mobile websites and apps); 4. Other touchpoints (social media, word of mouth advertising, promotions, and thank-you cards). |

| Liu et al. [41] | Physical stores, online website, mobile website, apps. |

| References | Sales Channel Activities |

|---|---|

| Nibusinessinfo.co.uk [42] | 1. Generating sales leads; 2. Make the right sales contacts; 3. Get sales appointments; 4. Sales meeting; 5. Negotiate and close the sale; 6. Sales follow-up and relationship building. |

| Burt and Sparks [43] | 1. Comprising the sourcing of products; 2. Stockholding, inventory, and store merchandising; 3. Marketing effort, including branding; 4. Customer selection, picking, and payment; 5. Distribution of goods by or to the consumer. |

| Melacini and Tappia [44] | 1. Transport from supplier to DC; 2. Warehousing (receiving and storing, inventory, picking, packing and consolidation); 3. Transport from DC to store; 4. Store activities (handling, inventory); 5. Home delivery. |

| Company | Area of Business | Size | Years in the Industry | Responding Person |

|---|---|---|---|---|

| Company A | Production of coatings, lacquers, pigment pastes, and chemicals. | Small-sized enterprise | Since 1980 | Director and Head of Development |

| Company B | Production of abrasives, putties—body fillers, primers, masking products, clear coats and paints, uniMix paints, hardeners, polishing system, bonding and sealing products, body shop, consumables tools and accessories, health and safety products, car cleaning products, technical aerosols, promotional articles. | Medium-sized enterprise | More than 20 years | Head of Development |

| Company C | Production of titanium dioxide, sulphuric acid, zinc wire, zinc alloys, zinc bars, zinc anodes, recycled zinc, printing inks, powder coating, anti-corrosion coatings, copper fungicides, sulfur fungicides, fertilizers, phytopharmaceuticals, rubber coating. | Large-sized enterprise | Since 1873 | Sales Manager |

| Company D | Sales, marketing, and logistics of specialty chemicals and ingredients. | Large-sized enterprise | Since 1995 | Marketing Manager |

| Company E | Production of decorative coatings, industrial paints for wood and metals, car refinish program, road paints, resins, powder coatings. | Medium-sized enterprise | Since 1844 | Head of Coating Resins Sales |

| Company F | Coatings for wood and metals, wall paints, plasters. | Small-sized enterprise | Since 1995 | Sales Manager |

| Company G | Distributor and agent for raw materials and chemicals—they are concerned with products used in construction, coatings, detergent, cosmetics, rubber and plastic, food and feed. | Micro-sized enterprise | Since 1993 | Director |

| Company H | Distributor for coatings, lacquers, and chemicals. | Small-sized enterprise | Since 1997 | Sales Manager |

| Company I | Production of coatings for impregnation and protection of wood, stone, and other building materials, grouts, waterproofing coatings, cleaners. | Micro-sized enterprise | Since 2014 | Sales Manager |

| Company J | Distribution and selling of various chemicals. | Micro-sized enterprise | Since 2011 | Business Development Manager |

| Company K | Production of paints and coatings, performance applications, and composites. | Large-sized enterprise | Since 1961 | Business Developer and Innovation Leader |

| Company L | Specialty chemicals for paints, coatings, adhesives, plastics, building materials: defoamers, powder additives, wetting and dispersion agents, mineral flame retardants, thickeners and rheology, additives, pigments and fillers. | Small-sized enterprise | Since 1947 | Managing Director |

| Company M | Production of complex inorganic color pigments. | Medium-sized enterprise | Since 1920 | Regional Sales Manager |

| Company N | The company operates in the chemical industry in several segments: coatings, adhesives, resins, pigments, and other specialty chemicals. | Micro-sized enterprise | Missing answer | CSO |

| Company O | Provider of digital system solutions for measurement methods in the paints and coatings industry. | Small-sized enterprise | Since 2014 | Key Account Manager |

| Company P | Missing answer. | Large-sized enterprise | Missing answer | Head of Sales |

| Company R | Production of decorative coatings, industrial paints for wood and metals, car refinish program, road paints, resins, powder coatings. | Large-sized enterprise | Since 1988 | Assistant in the Sales Department |

| Company S | Production and sales: paints and coatings, chemicals. | Large-sized enterprise | Since 2007 | Sales Manager |

| No. 1 | Phases of the Sales Process | Sales Channels | ||

|---|---|---|---|---|

| Personal Sales | Retail | Online Sales | ||

| 10 | Marketing effort including branding | √ | √ | √ |

| 20 | Customer selection/acquiring | √ | ||

| 30 | Additional information provided by the seller | √ | √ | √ |

| 40 | Billing and payment | √ 2 | ||

| 50 | Product supply | √ | √ | |

| 60 | Product storage | √ | √ | |

| 70 | Inventory and store merchandising | √ | ||

| 80 | Picking and packing | √ | √ | √ |

| 90 | Distribution of products | √ | √ | |

| 100 | Billing and payment | √ | √ | √ |

| Process Complexity Data | Sales Channels | ||

|---|---|---|---|

| Personal Sales | Online Sales | Digital Sales | |

| The number of activities | 37 | 26 | 29 |

| The number of possible transitions between activities | 30 | 20 | 21 |

| The number of positions (employees) | 11 | 9 | 8 |

| The number of connections between positions and activities | 43 | 26 | 33 |

| The number of used documents | 9 | 9 | 5 |

| The number of documents created within a process | 6 | 7 | 3 |

| The number of decisions made by employees | 3 | 2 | 3 |

| The number of used information technology (ICT) | 5 | 3 | 4 |

| The number of activities supported by the information technology (ICT) | 18 | 14 | 16 |

| Indicators of Process Structure | Sales Channels | ||

|---|---|---|---|

| Personal Sales | Online Sales | Digital Sales | |

| Process activities | 97 | 96 | 97 |

| Number of transitions between activities | 19 | 23 | 28 |

| Process positions | 9 | 11 | 13 |

| Level of inclusion of the positions | 11 | 11 | 14 |

| Percentage of created documents | 33 | 22 | 40 |

| Percentage of created documents and activities | 84 | 73 | 90 |

| Process decisions | 92 | 92 | 90 |

| Process information technologies | 80 | 67 | 75 |

| Percentage of activities supported by the ICT | 49 | 54 | 55 |

| No. | Process Phase | Time Estimates (in Hours, h) | Optimistic | Most Probable | Pessimistic | Expected | Phase Throughput |

|---|---|---|---|---|---|---|---|

| 10 | Marketing effort, including branding | Waiting | 2.00 | 4.00 | 8.00 | 4.33 | 175.38 1 |

| Orientation | 0.30 | 1.00 | 2.00 | 1.05 | |||

| Processing | 80.00 | 160.00 | 300.00 | 170.00 | |||

| 20 | Customer selection/acquisition | Waiting | 0.00 | 0.00 | 0.01 | 0.00 | 0.28 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.13 | 0.25 | 0.50 | 0.27 | |||

| 30 | Additional information provided by the seller | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.61 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 50 | Product supply | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.32 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.05 | 0.20 | 0.50 | 0.23 | |||

| 60 | Product storage | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 1.61 |

| Orientation | 0.30 | 1.00 | 2.00 | 1.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 80 | Picking and packing | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.61 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 90 | Distribution of products | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 2 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 100 | Billing and payment | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.32 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.05 | 0.20 | 0.50 | 0.23 |

| No. | Process Phase | Time Estimates (in Hours, h) | Optimistic | Most Probable | Pessimistic | Expected | Phase Throughput |

|---|---|---|---|---|---|---|---|

| 10 | Marketing effort, including branding | Waiting | 2.00 | 4.00 | 8.00 | 4.33 | 175.38 1 |

| Orientation | 0.30 | 1.00 | 2.00 | 1.05 | |||

| Processing | 80.00 | 160.00 | 300.00 | 170.00 | |||

| 30 | Additional information provided by the seller | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.61 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 40 | Billing and payment | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 3 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 50 | Product supply | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.32 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.05 | 0.20 | 0.50 | 0.23 | |||

| 60 | Product storage | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 1.61 |

| Orientation | 0.30 | 1.00 | 2.00 | 1.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 80 | Picking and packing | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.61 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 90 | Distribution of products | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 2 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 100 | Billing and payment | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 3 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 |

| No. | Process Phase | Time Estimates (in Hours, h) | Optimistic | Most Probable | Pessimistic | Expected | Phase Throughput |

|---|---|---|---|---|---|---|---|

| 10 | Marketing effort, including branding | Waiting | 2.00 | 4.00 | 8.00 | 4.33 | 175.38 1 |

| Orientation | 0.30 | 1.00 | 2.00 | 1.05 | |||

| Processing | 80.00 | 160.00 | 300.00 | 170.00 | |||

| 30 | Additional information provided by the seller | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 4 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 40 | Billing and payment | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 3 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 50 | Product supply | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.32 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.05 | 0.20 | 0.50 | 0.23 | |||

| 60 | Product storage | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 1.61 |

| Orientation | 0.30 | 1.00 | 2.00 | 1.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 80 | Picking and packing | Waiting | 0.02 | 0.04 | 0.10 | 0.05 | 0.61 |

| Orientation | 0.02 | 0.04 | 0.10 | 0.05 | |||

| Processing | 0.10 | 0.50 | 1.00 | 0.52 | |||

| 90 | Distribution of products | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 2 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 100 | Billing and payment | Waiting | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 3 |

| Orientation | 0.00 | 0.00 | 0.00 | 0.00 | |||

| Processing | 0.00 | 0.00 | 0.00 | 0.00 |

| No. | Phases of the Sales Process | Phase Throughput Time (h) | ||

|---|---|---|---|---|

| Personal Sales | Online Sales | Digital Sales | ||

| 10 | Marketing effort, including branding | 175.38 1 | 175.38 1 | 175.38 1 |

| 20 | Customer selection/acquisition | 2.28 | 0.00 2 | 0.00 2 |

| 30 | Additional information provided by the seller | 0.61 | 0.61 | 0.00 3 |

| 40 | Billing and payment | 0.00 2 | 0.00 3 | 0.00 3 |

| 50 | Product supply | 0.32 | 0.32 | 0.32 |

| 60 | Product storage | 1.61 | 1.61 | 1.61 |

| 80 | Picking and packing | 0.61 | 0.61 | 0.61 |

| 90 | Distribution of products | 0.00 4 | 0.00 4 | 0.00 4 |

| 100 | Billing and payment | 0.32 | 0.00 3 | 0.00 3 |

| PROCESS THROUGHPUT TIME: | 3.75 | 3.15 | 2.54 | |

| THROUGHPUT TIME REDUCTION (in %): | 15.9% | 32.1% | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Krhač Andrašec, E.; Urh, B.; Senegačnik, M.; Kern, T. Implementation of the Digital Sales Channel in the Coatings Industry. Processes 2021, 9, 1168. https://doi.org/10.3390/pr9071168

Krhač Andrašec E, Urh B, Senegačnik M, Kern T. Implementation of the Digital Sales Channel in the Coatings Industry. Processes. 2021; 9(7):1168. https://doi.org/10.3390/pr9071168

Chicago/Turabian StyleKrhač Andrašec, Eva, Benjamin Urh, Marjan Senegačnik, and Tomaž Kern. 2021. "Implementation of the Digital Sales Channel in the Coatings Industry" Processes 9, no. 7: 1168. https://doi.org/10.3390/pr9071168

APA StyleKrhač Andrašec, E., Urh, B., Senegačnik, M., & Kern, T. (2021). Implementation of the Digital Sales Channel in the Coatings Industry. Processes, 9(7), 1168. https://doi.org/10.3390/pr9071168