Abstract

To reach Carbon Peak in 2030 and Carbon Neutrality in 2060, China is developing renewable energy at a fast pace. Renewable energy enterprises will participate in the power market in an all-round way as China gradually improves its electricity market. Signing the Power Purchase Agreement (PPA) helps renewable energy companies to avoid market risk and achieve sustainable development. Therefore, a novel PPA pricing model is proposed in our research. Based on the theory of the Levelized Cost of Energy (LCOE), our model considers system operating costs in China’s dual-track electric power sector, which is both government-guided and market-oriented. First of all, key influencing factors of the PPA agreement are analyzed in view of the developments of the renewable energy and electricity markets in China. Next, the design of pricing strategies for renewable energy power plants to cope with market challenges is presented through a photovoltaic project case study. The results show that when the operating costs of the system are considered and other conditions remain unchanged, the investment payback period of the new energy power station will change from 10.8 years to 13.6 years. Furthermore, correlation degree and sensitivity coefficient (SAF) were introduced to conduct correlation analysis and sensitivity analysis of key elements that affect the pricing of the PPA. Finally, it is concluded that the utilization hours of power generation have the most significant effect on the PPA price, while the system’s operating cost is the least sensitive factor. The study expands the application of LCOE, and provides a decision-making solution for the PPA pricing of renewable energy power enterprises. It is expected to help promote power transactions by renewable energy companies.

1. Introduction

Last year, China released its strategic goal to reach “carbon peak by 2030 and carbon neutralization by 2060”, and the plan to increase its installed capacity of wind and solar power to more than 1.2 billion kilowatts in 2030 [1]. In March 2021, President Xi Jinping proposed an important work deployment for building a new power system, with renewable energy as the main source [2]. There have been calls to vigorously develop the renewable energy sector [3,4]. However, China’s present policy of awarding subsidies for renewable energy generation is facing great pressure due to a widening financial gap: the renewable energy subsidy is gradually declining [5]. In June 2021, the National Development and Reform Commission (“NDRC”) issued a new policy that the government will no longer grant central financial subsidies for newly approved renewable energy projects from 2021, including centralized photovoltaic power plants, distributed photovoltaic projects for industrial and commercial use, as well as onshore wind power projects. These projects are offered the same local benchmark price that is set for coal-fired power generation. Newly built projects can also form their own sales prices through voluntary market-oriented transactions to better reflect the value of green electricity from photovoltaic and wind power and promote the healthy and sustainable development of the renewable energy industry [6].

Since China launched the latest round of electricity reform in 2015, it has gradually deepened the marketization of its power sector, and formed a medium- and long-term trading-oriented pattern supplemented by spot trading. Currently, the first batch of spot trading pilot projects has completed a trial operation of settlement; most provinces vigorously promote the development of spot and ancillary services markets [7,8]. However, the mechanism of renewable energy trading is not clear, so supporting policies for renewable power and its trading mechanisms have become research topics [9]. At present, due to the contradiction between the high proportion of new energy targets and the imperfect market mechanism, new energy enterprises are facing severe challenges. Meanwhile, unstable wind and solar power output due to random weather conditions increases the risk of market transactions. Finding a solution to guarantee power sales income and avoid the risk of spot price fluctuation is the key to the sustainable development of renewable energy enterprises and an important condition for the healthy development of China’s renewable energy sector.

Many scholars have conducted in-depth research on the development of renewable energy. On the issue of securing the benefits of renewable power generation, most EU countries and Japan implemented fixed subsidies [10]. With the development of renewable energy, Germany has replaced the fixed feed-in tariff mechanism with a premium mechanism and a tendering and bidding mechanism [11]. In the United Kingdom, reasonable benefits for renewable energy producers are ensured through CFDs between the government and power producers [12]. In addition, countries such as the United Kingdom, the United States [13], and Australia use the PPA to enable buyers and sellers to share risks and protect mutual interests [14]. The PPA has become a popular pricing approach for renewable energy companies [15,16,17]. Long-term PPA [18,19] is a crucial pathway towards sustainable development for renewable power generation enterprises when selling electricity at market prices without government subsidies.

Depending on the different delivery methods used in the electricity trade, PPAs can be divided into physical agreements and financial agreements [20]. Physical PPAs define all of the commercial terms for the sale of renewable electricity between the seller and buyer, including schedules for the delivery of electricity, penalties for under-delivery, payment terms, etc. For renewable energy generators, signing physical PPAs is subject to serious deviations due to intermittent and unstable solar or wind power generation, which also affect the stable operation of the power market. Unlike physical PPAs, financial PPAs are a hedged arrangement that offers power generation companies long-term contracts with predictable revenues. Therefore, the financial PPA is a rational choice for renewable energy enterprises. As price is the key factor in the effect of the PPA contract [21], many scholars and institutions have performed a large amount of research on PPA prices. Lawrence Berkeley Laboratory has systematically analyzed PV technologies, costs and PPA prices over the years in the United States, tracking PPA trends in a timely manner and providing empirical evidence [13,22]. Some scholars have proposed a PPA pricing and risk management model based on the relationship between renewable energy generation and spot market price [23]. Heijden NCVD [24] has designed the best PPA for communities with photovoltaic power generation facilities, in an attempt to minimize the total cost of electricity. Some researchers estimate the cost of power generation technology [13,22] as the price of the contractual transaction COE for the purchase of energy For example, Yan Qingyou [25] introduced the Levelized Cost of Energy (LCOE), which made the net present value of revenue equal to the net present value of cost, and analyzed the key content of the agreement, including agreement price and contract period. Bruck et al. proposed an LCOE calculation model for wind farm PPAs, focusing on the upper and lower limits of traded electricity [14,26]. Mendicino et al. provided suggestions as to the length and price of CPPA (Corporate Power Purchase Agreement) based on the LCOE model [18]. Some of these scholars have specifically evaluated the relationship between PPA and LCOE [27], and emphasized the important influence of LCOE components on pricing strategies. However, PPA negotiations require accurate LCOE estimates to ensure profitability [27]. Therefore, a systematic analysis of the main components of renewable energy LCOE in the Chinese market is not only important for evaluating renewable energy enterprise projects [28], but can also provide the basis for renewable energy companies to formulate PPA strategies in the online parity market environment.

In applying the LCOE model to renewable energy power generation enterprises, Wang Yu [29] considered the whole process of wind power projects, including construction, operation, transmission and connection to the grid, and obtained the LCOE model of wind power. Chen Rongrong [30] estimated the LCOE level of grid-connected photovoltaic power generation projects in different capacities. Some other scholars tried to improve the classic LCOE model. Wang Yongli [31] considered the cost of environmental externalities, Sun Jianmei [32] measured the income per CER unit, and Chang Dunhu [33] introduced policy factors into the LCOE model to analyze the economic sustainability of photovoltaic power generation projects. Many of these scholars have analyzed related issues on long-term PPAs and LCOEs, but their studies lack a systematic analysis of the key elements of PPA pricing adapted to the Chinese electricity market, which is expanding to become wider and greener. Previous researchers ignored the change of system operation cost, as renewable energy is called to account for an increasing proportion of China’s electricity market.

To fill this gap, we performed a comprehensive analysis of China’s electricity market and renewable energy enterprises’ participation in it. Key factors influencing PPA were selected after our analysis. Furthermore, a market-based PPA pricing model for renewable energy based on LCOE was built. Taking a practical photovoltaic project in a certain region of China as an example, this paper presents an empirical analysis. In order to provide strategic support for signing the PPA, a sensitivity analysis was performed on the factors that may affect the PPA price of renewable energy enterprises, such as investment cost and estimated payback period. The main contributions of this paper are as follows:

- This paper systematically analyzes key elements of the PPA signed by renewable energy enterprises in the context of China’s two-track electricity market. Besides technical and system operation costs, the time value of capital is also identified as a key factor affecting the agreement price.

- Based on improved LCOE, a PPA pricing model considering system operation costs and the time value of capital in the electricity market is proposed, expanding the application of LCOE.

- The model was verified as effective through empirical analysis, which was carried out at a photovoltaic power station in a specific region of China. The empirical analysis covered relevant factors affecting PPA prices, including investment payback period, investment cost, system operation costs, contract length, discount rate, annual output loss rate, etc.

- In order to further analyze the impact of changing factors on the price of renewable energy PPA, sensitivity coefficient (SAF) was introduced [14]. A varying trend of contract prices was observed when changing indexes, including annual utilization hours, investment cost, and payback period.

The structure of this paper is as follows: Section 2 introduces the basic concepts and key elements of PPA. In Section 3, the general structure of the LCOE model is introduced, and then a renewable energy PPA pricing model considering system operation costs is constructed. In Section 4, a photovoltaic power plant in a specific region of China is selected as an example to carry out a series of empirical analyses. Further, Section 5 analyzes the sensitive factors affecting PPA prices based on the empirical analyses, and obtains key factors that affect the PPA price. Finally, Section 6 summarizes the conclusions of the paper and offers recommendations on PPA pricing.

2. Power Purchase Agreement

Interventionary studies involving animals or humans, and other studies that require ethical approval, must list the authority that provided approval and the corresponding ethical approval code. The term “Power Purchase Agreement” refers to a legally binding agreement concluded between an independent power generation enterprise and a power sales company, power grid or government for the purpose of obtaining the value of power products and clarifying the rights and obligations of each party [34]. According to trading rules in the electricity market, PPAs can be divided into physical PPAs and financial PPAs [20]. Physical PPAs require the construction of dedicated power transmission lines between the two sides of the transaction, which is costly and may cause excessive investment in the construction of electricity distribution lines. In addition, renewable power generation companies still have to pay market operators to maintain the stability of the power system. The cost of physical PPAs is higher compared with that of financial agreements. Therefore, financial PPA is a more economical option for renewable energy enterprises looking to trade in the electricity market.

2.1. Overview of the Financial PPA

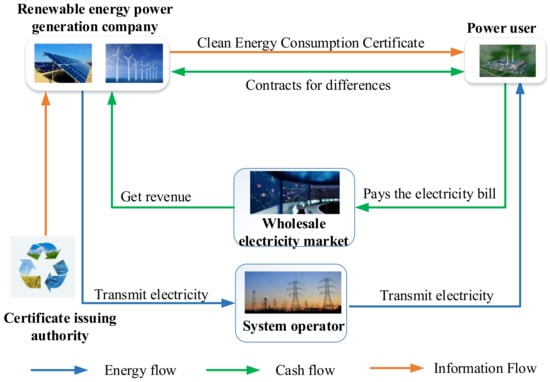

Renewable energy enterprises and electricity consumers are required to sign power supply and consumption contracts for a certain period at a fixed price. After signing a financial PPA, users purchase electricity from the market instead of directly from renewable energy enterprises, while power generators sell electricity to the market instead of directly delivering power to users. Financial PPAs fall under “Contract for Differences (CFDs)”. When settling accounts, power generation enterprises are expected to compensate the buyer if the user’s electricity purchase cost exceeds the agreed price. Similarly, the user is expected to compensate the loss of revenue for the power generation company if the market price is lower than the agreed price [35].

In addition, users who sign the PPA can obtain a “clean energy consumption voucher” provided by the renewable energy enterprises. The energy flow is shown in Figure 1.

Figure 1.

Financial PPA for Renewable Energy.

2.2. Analysis of Key Elements of Financial PPA

A typical financial PPA includes the following parameters: the duration of the agreement, the contract price [36], minimum/maximum power delivery volume, penalties for default, etc., [37]. Among them, the contract price is a key factor affecting the profitability of renewable energy power generation companies. Therefore, it is necessary to analyze the impact of various factors on the contract price during the implementation of the power purchase agreement, so as to accurately calculate the investment payback period of the project.

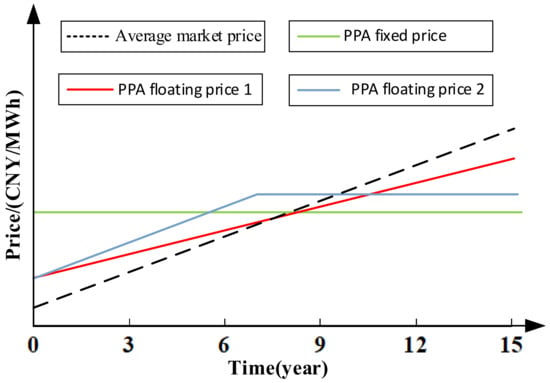

In terms of contract prices, renewable energy projects, such as solar and wind energy, generally use one-step pricing PPA, which only calculates the electricity tariff without the capacity tariff [21]. The current PPA prices include fixed electricity prices and floating electricity prices. A fixed electricity price means that both parties must always provide the contracted electricity at the same price during the contract period. The average market transaction price increases over time due to inflation and fuel price increases. Therefore, the fixed contract price may be higher than the average market price when the contract is first signed, while the fixed price may be lower than the average market price during the later period of the contract’s duration, as shown in Figure 2 by the black dashed line and the green solid line. Users who sign a fixed electricity price agreement can hedge against the risk of a sharp increase in market-based transaction prices. A floating electricity price means that the contract price changes over time. There are different types of floating electricity price. As shown in Figure 2, the red line means that the price will increase in a certain proportion during the contract period (for example, an annual increase of 2%). The blue line means that the contract price will increase by a certain percentage every year in the early period of the contract’s duration, while the price will be fixed during the middle and latter stages of the contract. The contract’s signatories can also divide the agreement duration into multiple periods and re-negotiate the price before the start of each period. They can also discuss other types of negotiated prices, according to their own conditions, research, and judgment about the future.

Figure 2.

Schematic diagram of PPA contract price.

In terms of contract duration, power generation companies generally sign long-term contracts with customers for a period of 10–15 years to reduce variable risks. Power generation enterprises can set specific contract terms based on such factors as investment costs and expected payback periods. However, policy keeps changing for the renewable energy sector as China’s electricity market is restructuring. Due to uncertain future policies, power consumers may refuse to sign long-term contracts in order to maximize their own interests. Therefore, domestic renewable energy enterprises can divide the life cycle of their power plants into several short time spans to cater to electricity users. Signing several short-term agreements is beneficial for enterprises looking to gradually recover their investment costs.

In terms of power delivery, enterprises may allocate the proportion of contracted power volume according to market conditions. When market risk hikes, enterprises can increase the proportion of electricity volume for the contract signed with users. Conversely, when enterprises see opportunities to benefit from the market, they can increase their share of traded electricity.

3. Identification of Key Elements of PPA and a Novel Pricing Model Based on LCOE

3.1. Overview of the LCOE

LCOE (Levelized Cost of Energy), refers to the energy cost consumed by the system to produce a unit of the total electric power output. It can be used to evaluate the cost or the comprehensive economic benefits of different power generation technologies in different regions, at different scales, and at different investment amounts [29]. The basic definition of levelized cost is expressed by the following Equation [26]:

In Equation (1), t represents the t-th year, n is the contract period, r is the discount rate, is the total cost of the t-th year, including construction costs, operation and maintenance costs, capital costs, etc., and is the total power generation in the t-th year.

The traditional LCOE calculation method only considers plant-level costs [38], including capital costs (CAPEX) and operation and maintenance costs (OPEX) [39]. Systemic costs, or cost changes in system evolution are ignored [40,41,42]. In the application process, different LCOE-based calculations vary according to different research goals.

3.2. Cost Analysis of Renewable Energy Power Plants

When applying the LCOE model to determine the PPA price, some scholars consider factors affecting the cost of renewable energy companies, such as a project’s residual value or tax reductions and exemptions, but ignore the full cost of companies participating in market transactions, especially in China’s dual-track electricity market. Management assessment and ancillary service allocation costs are also not considered. However, the dual assessment policies [43] involved in China’s market-government dual-track electricity market have a profound impact on the operation of renewable energy companies. Therefore, it is necessary to systematically analyze the detailed cost of renewable energy companies participating in the electricity market and propose a PPA pricing model for China’s renewable energy plants.

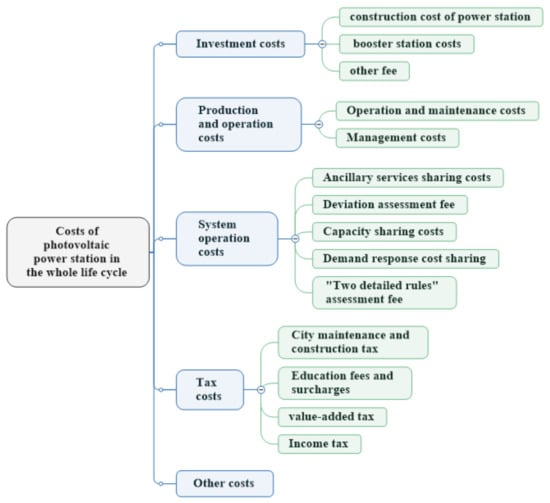

The total cost of renewable energy power plants participating in the electricity market mainly includes five parts, as shown in Figure 3:

Figure 3.

Cost composition of renewable energy power plants participating in the electricity market.

- Investment cost

Investment cost mainly refers to the construction cost. The investment cost of the photovoltaic power generation system consists of the cost of the photovoltaic field power generation system, the engineering cost of the booster station, and other expenses. Among them, the cost of the power generation system includes photovoltaic modules, brackets, combiner boxes, inverters, box transformers, collection lines, and related installation and construction costs. The engineering cost includes the costs of booster station equipment and installation works, construction works, roads, and other works. Taking a typical photovoltaic power station in 2019 as an example, photovoltaic modules were the largest investment, accounting for about 38% of the total investment; construction and installation engineering costs, support and basic costs, and cable costs together accounted for more than 10%. In addition, there are land costs, grid connection fees, combiner boxes and other major electrical equipment, inverters, and other costs.

- 2.

- Production and operation costs

Production and operation costs are used to manage, operate and maintain renewable energy power stations. Management costs consist of the loan interest, depreciation, employee wages and benefits, and insurance premiums. The operation and maintenance cost is determined by the aging of the generator set. Generally, the maintenance cost increases as the operating period expands.

- 3.

- System operation costs

The system operation cost is used to maintain the stability of the whole power system. Power generation enterprises are required to bear the system operation cost, or they can choose to provide ancillary services to help maintain the stability of the system. Due to unstable output, renewable energy companies usually cannot provide ancillary services, so they have to bear part of the cost. At present, market rules vary across different provinces, and the system operation costs are also different. Overall, the system operation costs borne by the renewable energy enterprises include the apportionment cost of auxiliary services, the cost of deviation assessment, the “Two Detailed rules” [43] assessment cost, the capacity apportionment cost, and the cost of demand response apportionment.

The cost-sharing of ancillary services refers to the cost to power plants of providing basic auxiliary services to the grid. Renewable energy enterprises are required to accept assessment when they fail to meet the schedule and standards of auxiliary services. Costs are determined during the appraisal. According to the rules in different provinces, renewable power plants are mainly subject to the government’s assessment of power prediction, automatic voltage control (AVC), automatic generation control (AGC), primary frequency modulation assessment, equipment automation access, and reactive power compensation device assessment. Among them, power prediction is assessed through the upload rate, short-term prediction accuracy, and ultra-short-term prediction accuracy. The AVC system checks the rate of operation and the qualified rate of regulation. The AGC system checks the operation rate and the implementation of the power generation plan. The equipment automation is examined by checking the access to information of each device. The “Two Detailed Rules” fees are incurred during the scoring and assessment of the power plants by the Energy Regulatory Administration, which uses an evaluation criteria to optimize the allocation of electricity resources and ensure the safe, stable, and efficient operation of the power system. The deviation assessment cost occurs when generation companies’ actual electricity transactions with the power grid are different from the agreed volume in the contract. Unstable renewable energy power output due to weather conditions is considered a deviation; a deviation within ±10% from the contract volume is allowed in some provinces, while some other provinces ignore positive deviation from the agreement so that renewable energy enterprises do not discard surplus wind and photovoltaic power. Capacity allocation fees mean that each renewable energy unit should pay compensation to other generating units that help guarantee reliable generating capacity in the power system to supply the peak load. The sharing of the demand response cost refers to user subsidies provided by new energy enterprises to encourage demand.

According to the market conditions in different provinces, specific cost calculation methods are divided into two types. In provinces where the electric power sector is government-planed rather than market-oriented, non-market means are used to reduce the deviation in the power system; while in provinces where the power sector is market-oriented, some deviations are adjusted through market means.

- 4.

- Tax cost

The taxes paid by renewable energy power companies mainly include value-added tax, business tax and surcharges, and corporate income tax. A total of 50% of the value-added tax levied on renewable energy enterprises is refunded immediately as an incentive. Renewable energy power companies are exempted from income tax for three years, and then pay half the standard rate of income tax for the subsequent three years. Business taxes and surcharges mainly include urban construction and maintenance fees, education surcharges and local education surcharges, with tariff rates differing among the regions where the energy companies are located [8].

3.3. Modified LCOE Pricing Model for Renewable Energy with PPA

Considering the above factors comprehensively, the following LCOE calculation models are proposed for renewable energy projects to participate in the electricity market:

In Equation (2), t is the t-th production year, r is the discount rate, I is the investment cost of the renewable energy power station, is the power station production and operation cost, is the system operation cost, is the tax cost, is the tax-free cost, is the residual value of the power station, and is the annual power generation.

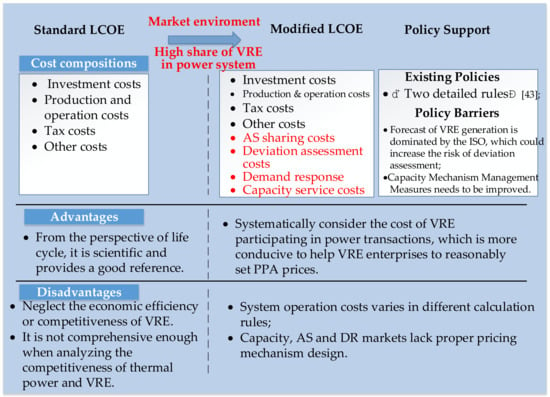

Compared with the standard LCOE model, the modified LCOE model systematically considers the lifecycle costs of variable renewable energy (VRE) in the market environment and high share of VRE in power system, especially the system operation cost, as shown in Figure 4. However, the system operation cost varies due to different market rules. Furthermore, a capacity market has not been built in China, and the relative mechanism needs to be improved. Moreover, the deviation assessment is based on the deviation between the ISO forecast results and the actual generation of the RE power plant. Given that RE power plants trade based on their own forecast results, this increases the risk of deviation deficit for RE plants to a certain extent.

Figure 4.

Comparisons of the standard LCOE and the modified LCOE model.

4. Case Study

4.1. Basic Assumptions

A photovoltaic power station with an installed capacity of 20MW is newly built in a certain area of Northwest China, and the investment payback period and the optimal price of the PPA of the PV power station are calculated. Make the following assumptions:

- The power station is located in a province in Northern China (azimuth angle: 0°, inclination angle: 30°). The estimated maximum annual utilization hours of the power station is 1200 h. Considering that the electricity output of the station will decrease by 0.3% per year due to equipment aging, the lifetime of the power plant is 25 years, with a unit investment cost of 2600 CNY/kW.

- The cost of a photovoltaic power plant throughout its life cycle includes construction costs, operation and maintenance costs, system operation costs, tax costs, etc. Among them, fixed assets are depreciated using the average life method, with a depreciation period of 25 years, and the residual value rate is 5%. According to statistics, the operation and maintenance costs are expected to rise slightly in the near future, and then remain generally stable in the long term, and the management costs will be almost constant after construction [44]. The deviation assessment costs, ancillary service allocation costs, and demand response allocation costs are calculated by referring to the data from a similar renewable energy power station in Gansu Province in 2020. China has not yet opened a capacity market, so capacity allocation costs are currently not considered. Considering that new energy companies enjoy multiple tax deductions and preferential policies in China [44], the tax cost accounts for a small proportion, so it is temporarily not considered in the calculation.

- The electricity output of the PV power station is sold into two halves. One half is purchased by the government, according to indemnity plans, while the other 50% is signed in the PPA in order to sell it on to power purchase companies and other power purchasers. The setting of the sales price refers to the government-guided price for renewable photovoltaic power and wind power projects in some provinces (autonomous regions and municipalities) in 2021. The electricity price for government-guaranteed purchase is set at 350 CNY/MWh, while power sold in the PPA is set at 327.4 CNY/MWh, with a discount rate set to 8% [45].

4.2. Case Analysis

According to the above basic assumptions, the total cost and total revenue can be calculated, as shown in Table 1.

Table 1.

Cost analysis.

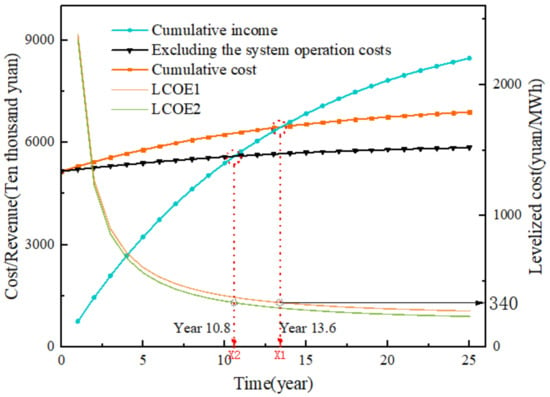

The investment payback period of the photovoltaic power station is analyzed by calculating its total cost, income, and net present value. The data shows that the total investment can be recovered at the end of the 13th year under the above assumptions, and the LCOE at this time is 340 CNY/MWh if calculated by the proposed method, as shown by the orange line in Figure 5 (LCOE 1). As shown by the dotted orange and blue lines in Figure 5, the total cost of the PV power station for the first 13.6 years is always greater than the revenue. After 13.6 years, the cumulative revenue is greater than the cumulative cost, which indicates that the power station starts to make profits. In order to assess the impact of system operation costs on the power station, the LCOE that does not consider the system operation costs is shown by the green line in the Figure 5 (LCOE2). While keeping the basic assumptions unchanged, a cumulative cost curve that does not include the system operation costs is added, as shown by the black dotted line in Figure 5. At this point, the intersection of the cumulative cost curve and the cumulative yield curve moves to the end of the 10.8th year, on the left, shortening the payback period by 3 years. It can be seen that system operation costs have a significant impact on the payback period for renewable energy companies.

Figure 5.

Investment payback period and LCOE curve.

5. Discussion

5.1. Correlation Analysis of Price and Other Factors in PPA

From the case study, we can see that construction costs, system operation costs, the contract length, the contract price, discount rates, the annual output loss rate and other factors can all influence the operating income of renewable energy enterprises. In order to identify the key factors for renewable energy companies to determine whether they should launch their investments, a correlation analysis between the contract price and other factors was conducted based on equation (2) for the 20MW PV plants. The basic assumptions remained the same as the case study in Section 4.

Correlation Analysis 1: Investment Cost and PPA Price

According to the conditions in and prospects of China’s photovoltaic industry, the average cost of constructing a photovoltaic power plant was between 2100–3100 CNY/kW in 2020, and it is expected to fall to 2100 CNY/kW by 2025. Therefore, the correlation between the construction cost (2100–3100 CNY/kW), the payback period (9–25 years), and the PPA price was analyzed, based on equation (2), as shown in Table 2. Assuming that the state-owned power grid enterprise purchases 50% of the electricity generated by the photovoltaic power station at a government-guided price for the photovoltaic resource area II in 2021 (the guiding prices vary from different areas divided by the government), the remaining 50% of the electricity volume is under a PPA.

Table 2.

Correlation analysis of unit kilowatt construction cost, investment payback period and PPA price (the result is PPA price).

As shown in Table 2, if the plant plans to enter into a fixed-term contract, the price of the PPA contract can be determined with certain construction costs, assuring the enterprise of a certain amount of profits.

For example, if the construction cost of the plant is 2500 CNY/kW, the total investment is expected to be recovered within 15 years. The PPA price must be higher than 279 CNY/MWh, so that the funds can be recovered within the expected time. We can also analyze the trend of the payback period under the given PPA price and construction cost. For example, at a construction cost of 3000 CNY/kW and a PPA price of 313 CNY/MWh, the payback period for the plant is 23 years. With PPA prices remaining unchanged, the payback period falls to 13 years when construction costs fall to 2500 CNY/kW.

Correlation Analysis 2: System Operation Costs, Payback Period, and PPA Price

To generate and consume more clean power in accordance with China’s move towards “carbon peak and carbon neutrality”, the flexible operation of power systems is critical in transmitting renewable electricity. Therefore, in addition to the investment and maintenance costs, the system operation costs for renewable energy enterprises must be considered in the future. Moreover, renewable energy companies may be expected to bear a larger share of the system costs in the future. The system operation cost of a 20MW photovoltaic power station in Gansu province was 980,000 CNY in 2020, accounting for 1.88% of the investment cost. Using this data as a reference, and considering a fluctuation of 50%, the ratio of market participation cost to investment cost was assumed to be between 0.94% and 2.82% (500,000 CNY to 1.5 million CNY per year). Next, the correlation degree between the system operation costs, the investment payback period, and the PPA price was analyzed, as shown in Table 3.

Table 3.

Analysis of the Correlation between System Operation Costs, Investment Payback Period and PPA Price.

As can be seen from Table 3, a 50% fluctuation in the system operation costs leads to a 9.2% fluctuation in the same direction in the PPA price when the expected payback period remains unchanged. Assuming no change occurs in the system operation costs, the PPA price can be expected to increase by about 15% for every two years of reduced payback period. It can be seen that in the current electricity market conditions, the system operation costs have a significant impact on renewable energy enterprises. With further the improvement of new energy permeability in the future, it is possible that the proportion of this cost to the investment cost will increase further. At that time, new energy companies should take more care to consider the impact of the cost on the payback period and PPA contract price.

Correlation Analysis 3: Annual Utilization Hours, Payback Period and PPA Price

Annual power generation hours directly impact the income of renewable energy enterprises. In most regions in China, the average annual utilization hours of photovoltaic power stations surpasses 900 h, while some specific areas see this time reach 1500 h. Therefore, the correlation analysis of annual utilization hours (900–1500 h), investment payback period, and PPA price was conducted, as shown in Table 4.

Table 4.

Correlation Analysis of Utilization Hours, Payback Period and PPA Price.

As can be seen in Table 4, with the expected payback period unchanged, a 6% reduction in annual utilization of hours leads to an 8%–12% increase in PPA prices. Moreover, the longer the payback period, the larger the influence of annual utilization hours on the agreement price. Therefore, the annual utilization hours, the enterprise’s investment payback period, and PPA prices are all closely associated. The PPA price of new energy power plants in different regions should be reasonably designed according to the variation in annual utilization hours due to regional solar resources.

Correlation Analysis 4: Discount Rate, Payback Period, and PPA Price

The discount rate, which reflects the cash flow of enterprises, is a key factor affecting the survival of enterprises. Assuming that the discount rate ranges from 5.5% to 10.5%, a correlation analysis was performed.

As shown in Table 5, the impact of the discount rate on the enterprise’s income is larger than its influence on the cost to the renewable energy companies. It is possible that the greatest proportion of the total cost takes the form of an initial one-time investment, which is less affected by the discount rate. However the renewable energy enterprise’s annual income remains stable, so it is more vulnerable to the effects of the discount rate. In addition, a 0.5% increase in the discount rate led to a 4% and 12% growth in the PPA price, respectively, when the payback period was expected to be 9 and 25 years. It can be concluded that the longer the payback period, the greater the influence of discount rate on the agreement price. Therefore, the enterprise should recover as much as possible in the early stage of the project, as the discount rate will bring greater financial pressure over time.

Table 5.

Correlation Analysis of Discount Rate, Payback Period, and PPA Price.

Correlation Analysis 5: Proportion of PPA Power, Payback Period, and PPA Price

China’s renewable energy enterprises are still at the initial stages of signing the PPA. Choosing a proper proportion from the total power generation output to be signed in PPAs is a significant issue. Different proportions of contracted volume to companies’ total output were analyzed, assuming that electricity volume not covered in the PPA is purchased by state-owned grid companies at 350 CNY/MWh.

The results are shown in Table 6. When the price of the PPA is higher than the state-guaranteed purchase price, the larger the proportion of electricity output signed in the PPA, the shorter the payback period. Therefore, if power generation enterprises predict that the market electricity price will fall below the potential price agreed in the PPA, they should allocate a large proportion of electricity volume to be signed in the agreement, so as to protect their revenue. Conversely, if power companies expect market prices to rise, they should allocate more of their electricity generation to the real-time market to obtain higher yields.

Table 6.

Analysis of the Relationship between Contract Signing Proportion, Investment Payback Period and PPA.

Based on these correlation analyses, we suggest that renewable energy enterprises should inquire about the minimum contract price in the above forms when the investment cost is known and the investment payback period is fixed. They can also judge whether the project is economically feasible through the above analysis of the discounted rate, the proportion of PPA electricity, and other factors.

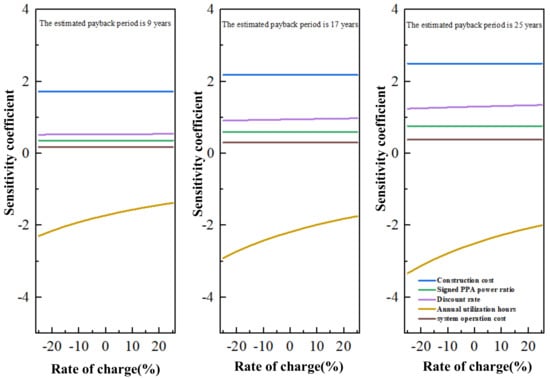

5.2. Power Purchase and Sale Contract Price-Sensitivity Analysis of Investment Payback Period

The above analysis is focused on the correlation between the PPA price and the payback period, but it fails to show the changing trend of influence when the values of different factors vary. In order to further analyze the impact of changes to various factors under different contract prices, a sensitivity coefficient (SAF) analysis was introduced [46]. SAF > 0 means that the evaluation object and the uncertainty factor change are in the same direction. If SAF < 0, then the evaluation object and the uncertainty factor change are in the opposite direction. The larger the |SAF|, the more sensitive the evaluation object will be to the uncertainty factor. The SAF analysis of factors including annual utilization hours, investment cost, and system operation costs are shown in the figure below.

As shown in Figure 6, as the expected investment payback period increases, the sensitivity of PPA prices to various parameters grows. For the different expected investment payback periods, the sensitivity coefficient of the investment cost, the system operation costs, discount rate, and the proportion of electricity volume signed in the PPA is larger than 0, which means that these factors are positively correlated with the price of the PPA, while the number of annual utilization hours is negatively correlated with the PPA price. Among these factors, investment costs and annual utilization hours have the strongest impact on the PPA price, while changes in the system operation costs have the weakest impact on the price. The reason for this may be that the system operation cost accounts for only 1.88% of the construction cost under current market conditions, which leads to a much smaller impact on the negotiated price than that of other factors. In addition, there is a linear relationship between the construction cost, the proportion of electricity agreed when signing the PPA, the discount rate, the system operation costs, and the price of the PPA; while the annual utilization hours and the PPA price have a non-linear relationship, and as the annual utilization hours decrease, the PPA price becomes more sensitive to this factor.

Figure 6.

Sensitivity analysis of investment payback periods for different contract electricity prices.

6. Conclusions

PPA is of great significance to the participation of renewable energy companies in the power market. The price of the PPA directly affects the operating efficiency of an enterprise. Therefore, this paper first summarized the typical characteristics and key elements of the PPA, then analyzed the cost structure for renewable energy power plants participating in China’s electricity market. Based on the above, a novel LCOE pricing model that considered the system operation cost in China’s market-government dual-track environment for renewable energy power plants was constructed. Next, a PV power plant in Northwest China was selected as a case study. Furthermore, the factors affecting the price of PPA contracts were analyzed for correlation and sensitivity. The conclusions drawn were as follows:

- Against the background of large-scale renewable energy participation in the electricity market, renewable energy power plants can no longer rely on government subsidies. By signing the PPA, companies and large users can avoid market risks and create stable profits to companies;

- Renewable energy enterprises should consider not only the CAPEX, general OPEX and tax, but also the allocation of system operation costs in the current dual-track power market environment in China, such as the cost allocation of management and auxiliary services;

- After considering the allocation of system operating costs, the payback period for the PV power plant changes from 10.8 years to 13.6 years if the other assumptions are maintained;

- Affected by factors such as technological progress and policy changes in the renewable energy industry, the price of renewable energy components is expected to drop significantly in the future, and the initial investment and operation and maintenance costs will be further reduced, which will help to promote the further reduction of the cost of renewable energy leveling;

- The results of the correlation analysis and sensitivity analysis show that the investment cost and annual utilization hours of renewable energy power plants have a significant impact on companies’ investment payback period, suggesting that against the background of the current technical level and development of the electricity market, renewable energy companies still need to prioritize investment costs and geographic location when building renewable energy power stations.

Author Contributions

Conceptualization, J.D., D.L. and Y.Z.; methodology, D.L. and Y.Z.; validation, D.L. and Y.Z.; formal analysis, Y.Z. and Y.W.; investigation, Y.W.; resources, X.D.; data curation, J.D. and Y.Z.; writing—original draft preparation, Y.Z.; writing—review and editing, D.L. and Y.W.; visualization, Y.Z.; supervision, J.D.; project administration, J.D. and D.L.; funding acquisition, J.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received Higher Education Discipline Innovation and Talent Plan-China Green Power Development Research Discipline Innovation and Talent Base (B18021) funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- China Wind News. China’s Wind Power Photovoltaic Installed Capacity Will Exceed 1.2 Billion Kw in 2030. Available online: http://www.chinawindnews.com/16827.html (accessed on 15 August 2021).

- International Power. Xi Jinping: Building a New Power System with New Energy as the Main Body. Available online: https://power.in-en.com/html/power-2384936.shtml (accessed on 15 August 2021).

- Zheng, H.; Song, M.; Shen, Z. The Evolution of Renewable Energy and Its Impact on Carbon Reduction in China. Energy 2021, 237, 121639. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Jiang, H.; Zeng, X. CO2 Emissions, Economic Growth, and the Environmental Kuznets Curve in China: What Roles Can Nuclear Energy and Renewable Energy Play? J. Clean. Prod. 2018, 196, 51–63. [Google Scholar] [CrossRef]

- Auffhammer, M.; Wang, M.; Xie, L.; Xu, J. Renewable Electricity Development in China: Policies, Performance, and Challenges. Rev. Environ. Econ. Policy 2021, 15, 323–339. [Google Scholar] [CrossRef]

- National Development and Reform Commission. NDRC Notice on Issues Related to New Energy Feed in Tariff Policy in 2021. Available online: http://www.gov.cn/zhengce/zhengceku/2021-06/11/content_5617297.htm (accessed on 7 June 2021).

- Qian, M.; Chen, B.; Huang, D.; Huang, C.; Jing, Z.; Zhu, J.; Song, Y. The Fifth Anniversary of China’s New Electricity Market Reform: An Overview and Enlightenment of Subsidy Mechanism for High-Cost Units. IOP Conf. Ser. Earth Environ. Sci. 2021, 675, 012126. [Google Scholar]

- Zhang, S.; Jing, Z.; Xiao, D. Cross-Provincial/Regional Transmission Pricing Mechanism to Facilitate Regional Integration Development in China: Analyses and Suggestions. In Proceedings of the 2021 5th International Conference on Smart Grid and Smart Cities (ICSGSC), Tokyo, Japan, 18–20 June 2021; pp. 134–140. [Google Scholar]

- Chen, S.; Li, Z.; Li, W. Integrating High Share of Renewable Energy into Power System Using Customer-Sited Energy Storage. Renew. Sustain. Energy Rev. 2021, 143, 110893. [Google Scholar] [CrossRef]

- Joint Research Centre, European Commission. Renewables in the EU: An Overview of Support Schemes and Measures; Joint Research Centre Publications Office: Ispra, Italy, 2017. [Google Scholar]

- Huang, J. Analysis on Auction Scheme of International Renewable Energy Generation Projects. Electr. Power Surv. Des. 2020, 12, 72–78. [Google Scholar]

- Department for Business, Energy & Industrial Strategy. Electricity Market Reform: Contracts for Difference; Department for Business, Energy & Industrial Strategy: London, UK, 2015. [Google Scholar]

- Bolinger, M.; Seel, J.; Robson, D. Utility-Scale Solar: Empirical Trends in Project Technology, Cost, Performance, and PPA Pricing in the United States—2019 Edition; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2019. [Google Scholar]

- Bruck, M.; Sandborn, P.; Goudarzi, N. A Levelized Cost of Energy (LCOE) Model for Wind Farms That Include Power Purchase Agreements (PPAs). Renew. Energy 2018, 122, 131–139. [Google Scholar] [CrossRef]

- Kobus, J.; Nasrallah, A.; Guidera, J. The Role of Corporate Renewable Power Purchase Agreements in Supporting Wind and Solar Deployment; Center on Global Energy Policy, Columbia University: New York, NY, USA, 2021. [Google Scholar]

- Viswamohanan, A. Power Purchase Agreements as Instruments of Risk Allocation and Alleviation for Renewable Energy in Asia. In Renewable Energy Transition in Asia; Janardhanan, N., Chaturvedi, V., Eds.; Springer: Singapore, 2021; pp. 187–207. [Google Scholar]

- IRENA. Power Purchase Agreements for Variable Renewable Energy; IRENA: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Mendicino, L.; Menniti, D.; Pinnarelli, A.; Sorrentino, N. Corporate Power Purchase Agreement: Formulation of the Related Levelized Cost of Energy and Its Application to a Real Life Case Study. Appl. Energy 2019, 253, 113577. [Google Scholar] [CrossRef]

- BloombergNEF. Global Corporate PPA Market Progress and Outlook; BloombergNEF: New York, NY, USA, 2020. [Google Scholar]

- Tang, C.; Zhang, F. Classification, Principle and Pricing Manner of Renewable Power Purchase Agreement. IOP Conf. Ser. Earth Environ. Sci. 2019, 295, 052054. [Google Scholar] [CrossRef]

- Sun, X.L. Discussion on Power Purchase Agreement in Overseas IPP Investment Projects. Mod. Commer. 2019, 35, 66–68. [Google Scholar]

- Bolinger, M.; Weaver, S. Utility-Scale Solar 2013: An Empirical Analysis of Project Cost, Performance, and Pricing Trends in the United States; Electricity Markets and Policy Group: Berkeley, CA, USA, 2014. [Google Scholar]

- Tranberg, B.; Thrane Hansen, R.; Catania, L. Managing Volumetric Risk of Long-Term Power Purchase Agreements. Energy Econ. 2020, 85, 104567. [Google Scholar] [CrossRef]

- van der Heijden, N.C.; Alpcan, T.; Martinez-Cesena, E.A.; Suits, F. Optimal Power Purchase Agreements in PV-Rich Communities. In Proceedings of the 2017 Australasian Universities Power Engineering Conference (AUPEC), Melbourne, Australia, 19–22 November 2017; pp. 1–6. [Google Scholar]

- Bruck, M.; Sandborn, P. Pricing Bundled Renewable Energy Credits Using a Modified LCOE for Power Purchase Agreements. Renew. Energy 2021, 170, 224–235. [Google Scholar] [CrossRef]

- Miller, L.; Carriveau, R.; Harper, S.; Singh, S. Evaluating the Link between LCOE and PPA Elements and Structure for Wind Energy. Energy Strateg. Rev. 2017, 16, 33–42. [Google Scholar] [CrossRef]

- Yan, Q.Y.; Zhu, M.L. An Empirical Study on the Economics of Wind Power Integration Based on the LCOE Method. Technol. Econ. Manag. Res. 2017, 11, 21–25. [Google Scholar]

- Bruck, M.; Goudarzi, N.; Sandborn, P. A Levelized Cost of Energy (LCOE) Model for Wind Farms That Includes Power Purchase Agreement (PPA) Energy Delivery Limits. In Proceedings of the ASME 2016 Power Conference collocated with the ASME 2016 10th International Conference on Energy Sustainability and the ASME 2016 14th International Conference on Fuel Cell Science, Engineering and Technology, Charlotte, NC, USA, 26–30 June 2016. [Google Scholar]

- Wu, H.; Yuan, Y.; Jiang, T. LCOE Calculation Model and Application Analysis of Wind Power Investment Project. Northwest Hydropower 2020, 05, 107–110. [Google Scholar]

- Wang, Y. Research on China’s Wind Power Cost Based on The LCOE Method. Master’s Thesis, North China Electric Power University, Beijing, China, 2017. [Google Scholar]

- Chen, R.R.; Sun, Y.L.; Chen, S.M.; Shen, H. LCOE analysis of grid-connected photovoltaic power generation projects. Renew. Energy 2015, 33, 731–735. [Google Scholar]

- Wang, Y.L.; Gao, M., C.; Tao, S.Y.; Zhou, M.H.; Han, X.; Yao, S.H. Research on the lifetime cost accounting method of energy internet photovoltaic system. Coal Econ. Res. 2020, 40, 25–32. [Google Scholar]

- Sun, J.M.; Chen, L. Analysis of Benefits of Grid-connected Distributed Photovoltaic Power Generation Based on LCOE. Electr. Power 2018, 51, 88–93. [Google Scholar]

- Chang, D.H.; Tian, C.; Zhang, Z.Y.; Miu, Q.; Kuang, Y.J.; Huo, L.M. Analysis of the economic benefits of photovoltaic power generation based on the LCOE model: Taking the photovoltaic poverty alleviation power station project in rural Yichang as an example. Environ. Sci. Res. 2020, 33, 2412–2420. [Google Scholar]

- Jenkins, G.; Lim, H. An Integrated Analysis of a Power Purchase Agreement. JDI Executive Programs. 1999. Available online: https://ideas.repec.org/p/qed/dpaper/138.html (accessed on 15 August 2021).

- Huneke, F.; Göß, S.; Österreicher, J.; Dahroug, O. Power Purchase Agreements: Financial Model for Renewable Energies; Energy Brainpool: Berlin, Germany, 2018. [Google Scholar]

- Wallace, P. Long-term power purchase agreements: The factors that influence contract design. In Research Handbook on International and Comparative Sale of Goods Law; Edward Elgar Publishing: Cheltenham, UK, 2019; pp. 305–333. [Google Scholar]

- The World Bank. Power Purchase Agreements (PPAs) and Energy Purchase Agreements (EPAs); The World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Adaramola, M.S.; Paul, S.S.; Oyedepo, S.O. Assessment of Electricity Generation and Energy Cost of Wind Energy Conversion Systems in North-Central Nigeria. Energy Convers. Manag. 2011, 52, 3363–3368. [Google Scholar] [CrossRef]

- Aldersey-Williams, J.; Rubert, T. Levelised Cost of Energy—A Theoretical Justification and Critical Assessment. Energy Policy 2019, 124, 169–179. [Google Scholar] [CrossRef]

- Joskow, P.L. Comparing the Costs of Intermittent and Dispatchable Electricity Generating Technologies. Am. Econ. Rev. 2011, 101, 238–241. [Google Scholar] [CrossRef] [Green Version]

- Varro, L. LCOE Is a Less and Less Relevant Metric for Renewables. Available online: https://www.rechargenews.com/transition/-lcoe-is-a-less-and-less-relevant-metric-for-renewables (accessed on 12 August 2021).

- Northwest Regulatory Bureau of National Energy Administration. Notice of Northwest Regulatory Bureau of National Energy Administration on the Implementation Rules for Grid Connected Operation Management of Power Plants in Northwest China and the Implementation Rules for Auxiliary Service Management of Grid Connected Power Plants in Northwest China. Available online: http://guangfu.bjx.com.cn/news/20181227/952418.shtml (accessed on 21 December 2018).

- CN Energy News. China Power Calculation and Analysis of Photovoltaic Cost per KW-h. Available online: http://www.cnenergynews.cn/guangfu/2021/02/19/detail_2021021991142.html (accessed on 29 September 2021).

- Qi, X.Y. Tax-related risks of preferential tax policies for new energy power generation companies. Taxpay 2021, 15, 19–20. [Google Scholar]

- eDF GROUP. What’s the Escalation Rate on Your PPA? Available online: https://blog.dalkiasolutions.com/whats-the-escalation-rate-on-your-ppa (accessed on 18 August 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).