Show Me the Money! Process Modeling in Pharma from the Investor’s Point of View

Abstract

1. Introduction

- (i)

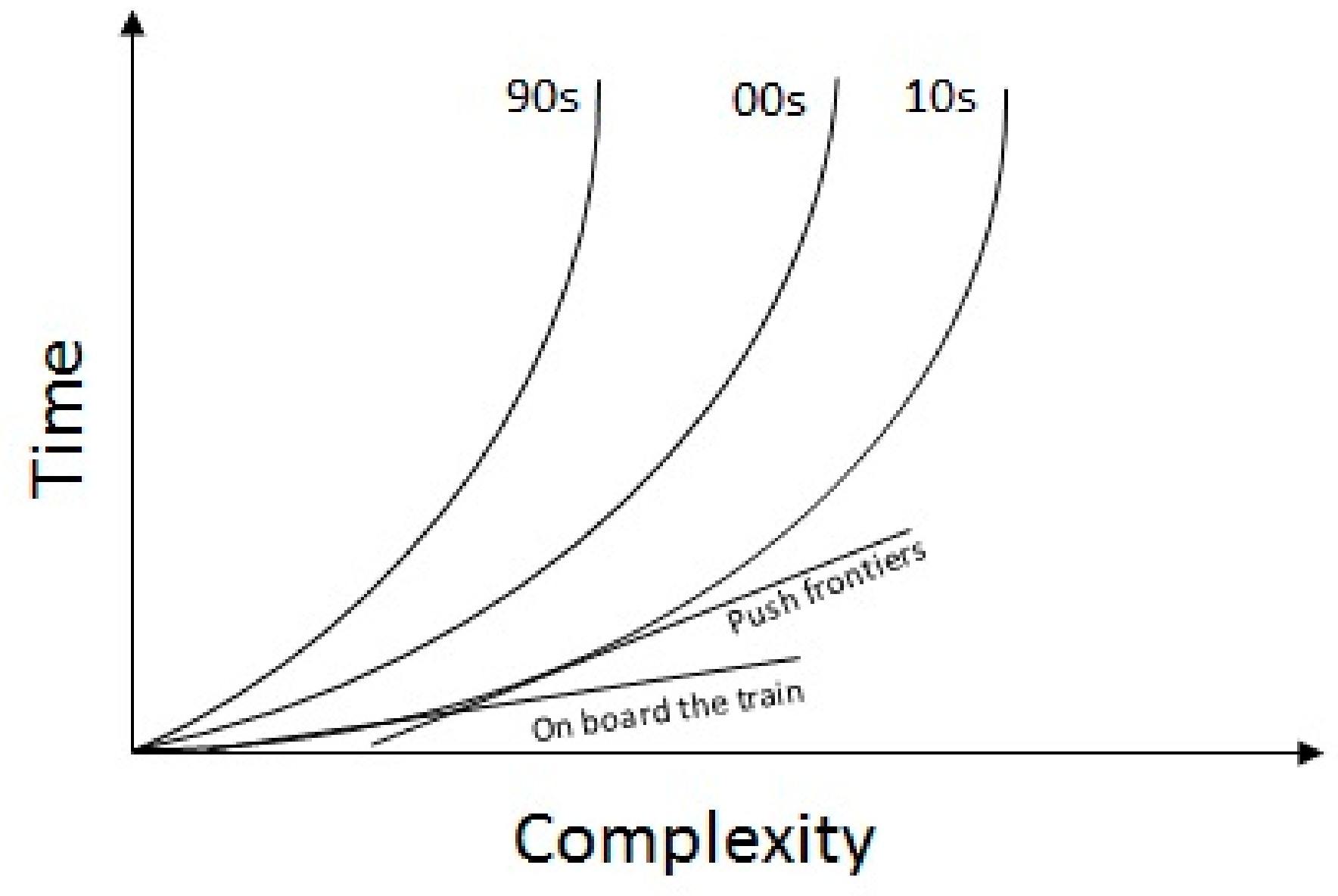

- Keeping science out of processing. This manifests itself through the continuous and oftentimes erroneous belief that (a) the complexity of the processes is too high and (b) the maturity of M&S is too low for the production of fruitful results. This line of thought has been perpetuating though some recent efforts that hint that blending science-based solutions with engineering approaches is growing momentum [7]. Moreover, and perhaps more importantly, there is a growing volume of research efforts (i) corroborating both the pertinence and the efficacy of M&S on both upstream and downstream [8,9,10], (ii) offering holistic and industrial-friendly frameworks [11] and (iii) focusing on even the most novel processing techniques [12].

- (ii)

- Lack of regulatory frameworks. M&S has been notably absent from regulatory frameworks. However, recent publications [13], betoken that such ideas are cultivating.

- (iii)

- Domination of empirical/statistical modeling. Processing in pharma has partnered very well with statistics. Progressively, statistical modeling has been integrated in the core of R&D methodologies. Proposing alternative methodologies will undoubtedly be subject to “appeal-to-tradition” reactions.

- (iv)

- Emphasis on drug discovery: From an investment-risk portfolio management point of view, investments in drug/vaccine discovery are more promising than those in process development/understanding. Consequently, only the bare minimum has been done to get the processes economically viable. Even so, investment-related decision making has been relevant; rationally choosing, for example, between batch and continuous processing has attracted considerable attention [14].

- (v)

- Shortage of in-house M&S expertise. Accommodation of M&S components that are relatively new and evolving requires dedicated FTEs (Full Time Equivalent) and building up competencies. In the absence of an interest towards M&S, such internal expertise is cumbersome to be built and updated. Consequently, new concepts or breakthroughs, are difficult to detect, digest and eventually implement.

2. State of the Art in Decision Making

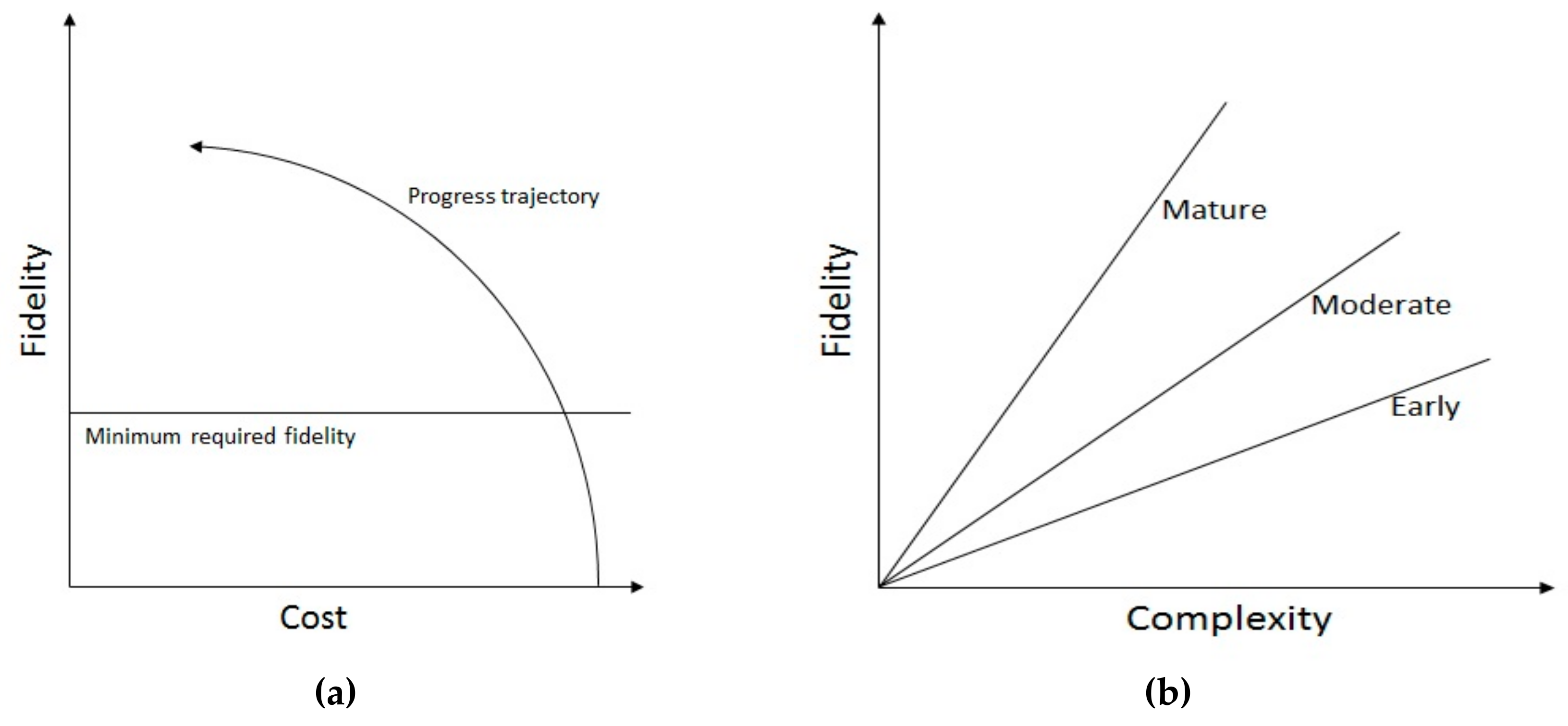

2.1. Tradeoffs

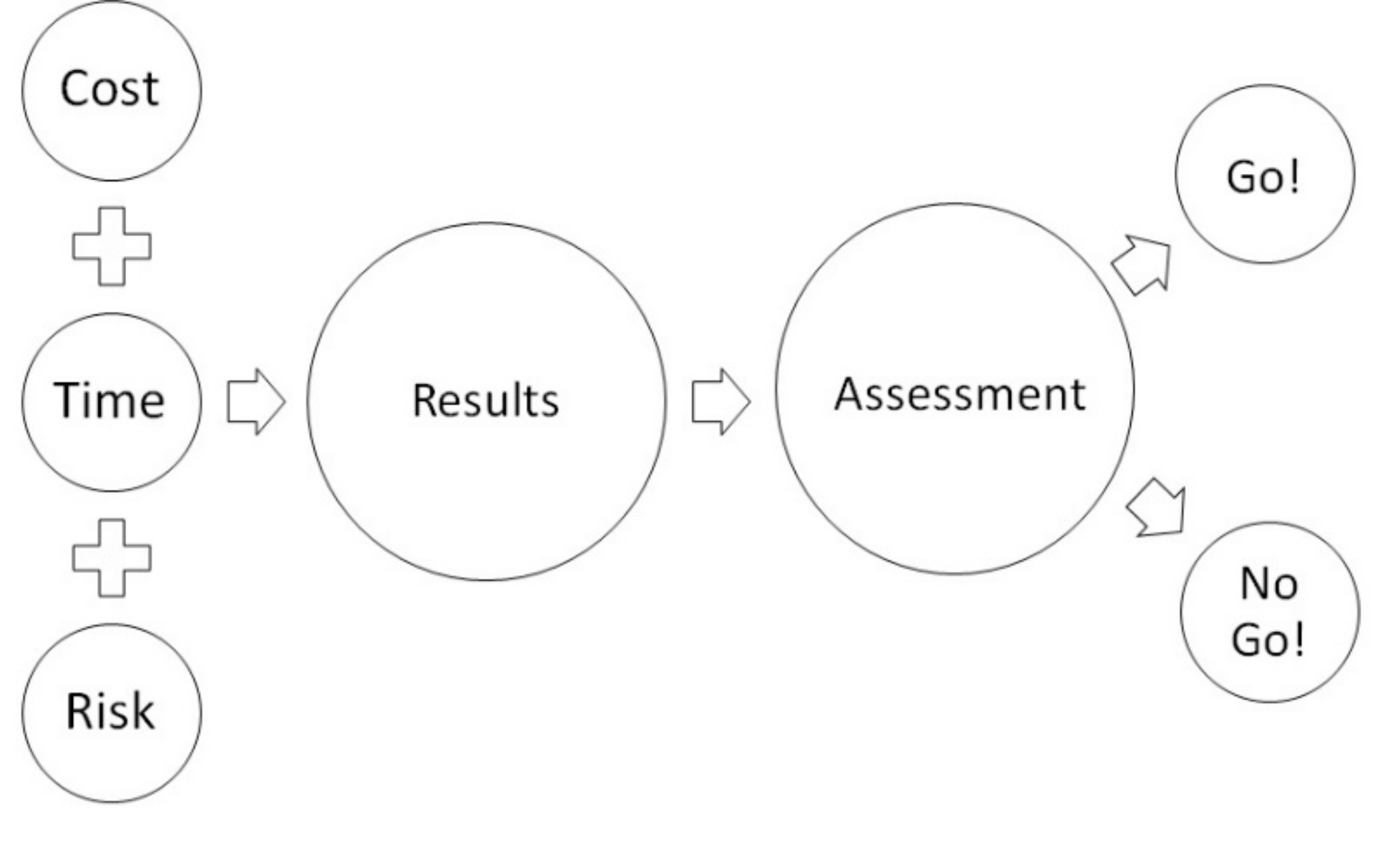

2.2. Decision Flow-Chart

- Accuracy is defined as the degree to which the predictions are correct (formally, accuracy is defined with respect to a particular norm.).

- Descriptive realism refers to the degree that a model predicates upon “true” principles [28].

- Uncertainty refers to the confidence on outputs, given that some aspects are unknown.

- Applicability accounting for the potential that the exploitation of the model for the envisioned purpose falls short, because the investigated/modeled phenomena do not govern the system in the a priori expected manner.

3. An Investor’s Approach to M&S

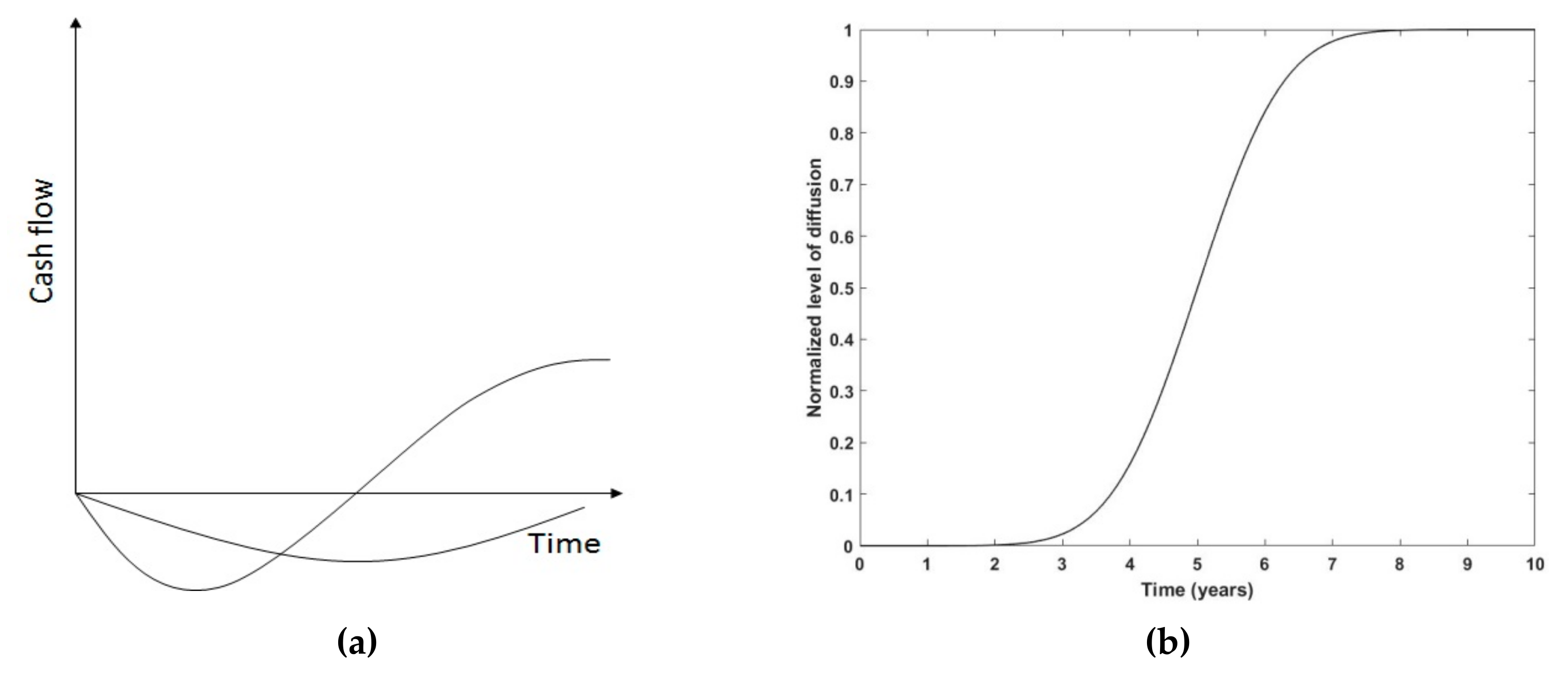

3.1. Monetary Metrics

- Cost savings = Cost with M&S—Cost without M&S

- Cost avoidance = Cost of unnecessary/harmful decision.

- Increased revenues = profit due to changes in margins or production capacity.

3.2. Diffusion-of-Innovation Metrics

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Petrides, D.P.; Koulouris, A.; Lagonikos, P.T. The Role of Process Simulation in Pharmaceutical Process Development and Product Commercialization. Pharm. Eng. 2002, 22, 56–65. [Google Scholar]

- García-Muñoz, S.; Luciani, C.V.; Vaidyaraman, S.; Seibert, K.D. Definition of Design Spaces Using Mechanistic Models and Geometric Projections of Probability Maps. Org. Process Res. Dev. 2015, 19, 1012–1023. [Google Scholar] [CrossRef]

- Aboud, L.; Henry, S. New Prescription for Drug Makers: Update the Plants. Leila Aboud & Scott Henry. The Wall Street Journal. 3 September 2003. Available online: https://www.wsj.com/articles/SB10625358403931000 (accessed on 4 September 2019).

- Rogers, A.; Ierapetritou, M. Challenges and opportunities in modeling pharmaceutical manufacturing processes. Comput. Chem. Eng. 2015, 81, 32–39. [Google Scholar] [CrossRef]

- Muzzio, F.J.; Shinbrot, T.; Glasser, B.J. Powder technology in the pharmaceutical industry: The need to catch up fast. Powder Technol. 2002, 124, 1–7. [Google Scholar] [CrossRef]

- McKenzie, P.; Kiang, S.; Tom, J.; Rubin, A.; Futran, M. Can pharmaceutical process development become high tech? AIChE J. 2006, 52, 3990–3994. [Google Scholar] [CrossRef]

- Reklaitis, G.V.; Khinast, J.; Muzzio, F. Pharmaceutical engineering science—New approaches to pharmaceutical development and manufacturing. Chem. Eng. Sci. 2010, 65, 4–8. [Google Scholar] [CrossRef]

- Eberle, L.G.; Sugiyama, H.; Papadokonstantakis, S.; Graser, A.; Schmidt, R.; Hungerbühler, K. Data-driven Tiered Procedure for Enhancing Yield in Drug Product Manufacturing. Comput. Chem. Eng. 2016, 87, 82–94. [Google Scholar] [CrossRef]

- Casola, G.; Siegmund, C.; Mattern, M.; Sugiyama, H. Uncertainty-conscious methodology for process performance assessment in biopharmaceutical drug product manufacturing. AIChE J. 2018, 64, 1272–1284. [Google Scholar] [CrossRef]

- Van Bockstal, P.J.; Mortier, S.; De Meyer, L.; Corver, J.; Vervaet, C.; Nopens, I.; De Beer, T. Mechanistic modelling of infrared mediated energy transfer during the primary drying step of a continuous freeze-drying process. Eur. J. Pharm. Biopharm. 2017, 114, 11–21. [Google Scholar] [CrossRef]

- Kornecki, M.; Strube, J. Accelerating Biologics Manufacturing by Upstream Process Modelling. Processes 2019, 7, 166. [Google Scholar] [CrossRef]

- Metta, N.; Ghijs, M.; Schäfer, E.; Kumar, A.; Cappuyns, P.; Van Assche, I.; Singh, R.; Ramachandran, R.; De Beer, T.; Ierapetritou, M.; et al. Dynamic Flowsheet Model Development and Sensitivity Analysis of a Continuous Pharmaceutical Tablet Manufacturing Process Using the Wet Granulation Route. Processes 2019, 7, 234. [Google Scholar] [CrossRef]

- Chatterjee, S.; Moore, C.; Nasr, M. An Overview of the Role of Mathematical Models in Implementation of Quality by Design Paradigm for Drug Development and Manufacture. Food Drug Adm. Papers 2017, 23. [Google Scholar]

- Matsunami, K.; Miyano, T.; Arai, H.; Nakagawa, H.; Hirao, M.; Sugiyama, H. Decision support method for the choice between batch and continuous technologies in solid drug product manufacturing. Ind. Eng. Chem. Res. 2018, 57, 9798–9809. [Google Scholar] [CrossRef]

- Rantanen, J.; Khinast, J. The Future of Pharmaceutical Manufacturing Sciences. J. Pharm. Sci. 2005, 104, 3612–3638. [Google Scholar] [CrossRef]

- Gernaey, K.V.; Woodley, J.; Sin, S. Introducing mechanistic models in Process Analytical Technology education (Research Highlight). Biotechnol. J. 2009, 4, 593–599. [Google Scholar] [CrossRef]

- Deloitte Center for Health Solutions. A New Future for R&D? Measuring the Return from Pharmaceutical Innovation; Deloitte Centre for Health Solutions: Deloitte, UK, 2017. [Google Scholar]

- DiMasi, J.A.; Hansen, R.W.; Grabowski, H.G. The price of innovation: New estimates of drug development costs. J. Health Econ. 2003, 22, 151–185. [Google Scholar] [CrossRef]

- Grabowski, H.; Vernon, J.J. A new look at the returns and risks to pharmaceutical R&D. Manag. Sci. 1990, 36, 804–821. [Google Scholar]

- David, E.; Tramontin, T.; Zemmel, R. Pharmaceutical R&D: The road to positive returns. Nat. Rev. Drug Discov. 2009, 8, 609–610. [Google Scholar]

- Carter, J., III. A Business Case for Modeling and Simulation; SPECIAL REPORT-RD-AS-01-02; Aviation and Missile Research, Development, and Engineering Center: Redstone Arsenal, AL, USA, 2001. [Google Scholar]

- Oswalt, I.; Cooley, T.; Waite, W.; Waite, E.; Gordon, S.; Severinghaus, R.; Feinberg, J.; Lightner, G. Calculating Return on Investment for U.S. Department of Defense Modeling and Simulation; Defense Acquisition Univ. ft. Belvoir VA: Fort Belvoir, VA, USA, 2011. [Google Scholar]

- Brown, D.; Grant, G.; Kotchman, D.; Reyenga, R.; Szanto, T. Building a business case for modeling and simulation. Acquis. Rev. Q. 2000, 24, 312–315. [Google Scholar]

- Smith, J.M. A Business Case for Using Modeling and Simulation in Developmental Testing; Thesis Naval Postgraduate School; Storming Media: Washington, DC, USA, 2001. [Google Scholar]

- Gordon, S.; Oswald, I.; Cooley, T. Why Spend One More Dollar for M&S? Observations on the Return of Investment: Discipline, Ethics, Education, Vocation, Societies, and Economics. In The Profession of Modeling and Simulation; Chapter 14; John Wiley & Sons: Hoboken, NJ, USA, 2017. [Google Scholar]

- Glass, H.E.; Kolassa, E.M.; Muniz, E. Drug development through modeling and simulation-The business case. Applied Clinical Trials. 25 July 2016. Available online: http://www.appliedclinicaltrialsonline.com/drug-development-through-modeling-and-simulation-business-case (accessed on 4 September 2019).

- Rogers, E. Diffusion of Innovations, 5th ed.; Simon and Schuster: New York, NY, USA, 2003. [Google Scholar]

- Meyer, W.J. Concepts of Mathematical Modeling; McGraw-Hill Book Company: New York, NY, USA, 1984. [Google Scholar]

- Mathews, S.H.; Datar, V.T.; Johnson, B. A practical method for valuing real options. J. Appl. Corp. Financ. 2007, 19, 95–104. [Google Scholar] [CrossRef]

- Babcock, B.A.; Choi, E.K.; Feinerman, E. Risk and probability premiums for CARA utility functions. J. Agric. Resour. Econ. 1993, 18, 17–24. [Google Scholar]

- Back, K.E. Asset Pricing and Portfolio Choice Theory; Oxford Univeristy Press: Oxford, UK, 2017. [Google Scholar]

- AEgis Technologies Group. Metrics for Modeling and Simulation (M&S) Investments; Naval Air Systems Command Prime Contract No. N61339-05-C-0088; The Aegis Technologies Group, Inc.: Huntsville, AL, USA, 2008. [Google Scholar]

| Upfront Costs | Recurring Costs | |

|---|---|---|

| Descriptive | Design, Implementation, Verification, Validation, Accreditation, Training, Procurement | Employment, Upgrades |

| Prescriptive | Design, Implementation, Verification, Validation, Training, Procurement | Employment, Design, Temptation |

| Time Required | ||||

|---|---|---|---|---|

| ~DAYS | Reuse | Reuse | Low & medium complexity | No post-processing required |

| ~WEEKS | Reuse/discover | Digitize existing system | Detailed CFD | Meticulous post-processing/big data |

| ~MONTHS | Develop | Design & digitize system | Industrial scale CFD | N/A |

| Name of Metric | Numerical Value (s) |

|---|---|

| Awareness | Relative frequency of different projects utilizing M&S |

| Coordination | Relative frequency of M&S duplicate activities avoided |

| Congruity | Relative frequency of M&S clients correctly interpreting/understanding the results |

| Guidance | Relative frequency of M&S users conforming to existing standards |

| Proactivity | Relative frequency of (early) decisions made by M&S |

| Empowerment | Relative frequency of M&S decision makers attending key meetings |

| Foundation | Relative frequency of foundational competencies covered |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Varsakelis, C.; Dessoy, S.; von Stosch, M.; Pysik, A. Show Me the Money! Process Modeling in Pharma from the Investor’s Point of View. Processes 2019, 7, 596. https://doi.org/10.3390/pr7090596

Varsakelis C, Dessoy S, von Stosch M, Pysik A. Show Me the Money! Process Modeling in Pharma from the Investor’s Point of View. Processes. 2019; 7(9):596. https://doi.org/10.3390/pr7090596

Chicago/Turabian StyleVarsakelis, Christos, Sandrine Dessoy, Moritz von Stosch, and Alexander Pysik. 2019. "Show Me the Money! Process Modeling in Pharma from the Investor’s Point of View" Processes 7, no. 9: 596. https://doi.org/10.3390/pr7090596

APA StyleVarsakelis, C., Dessoy, S., von Stosch, M., & Pysik, A. (2019). Show Me the Money! Process Modeling in Pharma from the Investor’s Point of View. Processes, 7(9), 596. https://doi.org/10.3390/pr7090596