Technical, Economic, and Environmental Optimization of the Renewable Hydrogen Production Chain for Use in Ammonia Production: A Case Study

Abstract

1. Introduction

2. Materials and Methods

2.1. Optimization—MILP

2.1.1. Objective Function

2.1.2. Constraints

2.1.3. Decision Variables

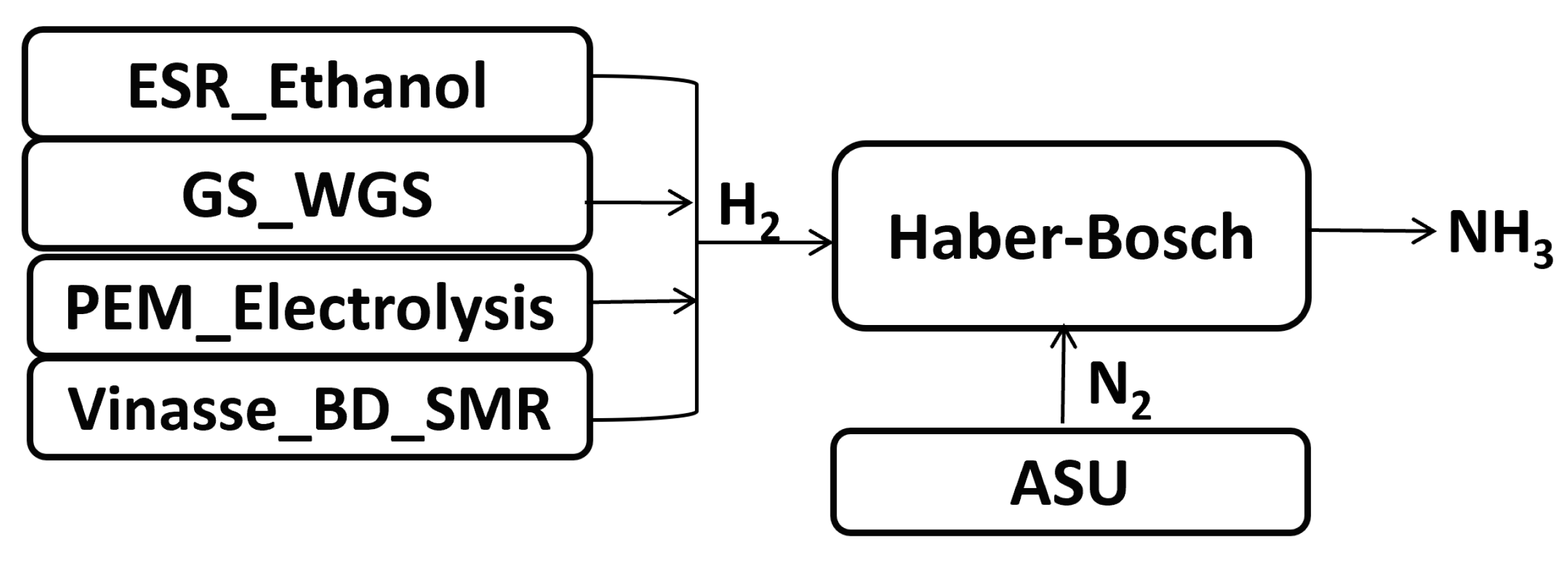

2.2. Physical Models

- Ethanol reforming (Ethanol_ESR);

- Biomass gasification (GS_WGS);

- PEM water electrolyzer (PEM_electrolysis);

- Anaerobic digestion of vinasse and steam reforming of biomethane (Vinasse_BD_SMR).

2.2.1. Physical Model of Ethanol_ESR Technology

2.2.2. Physical Model of GS_WGS Technology

2.2.3. Physical Model of PEM Technology

2.2.4. Physical Model of the Vinasse Technology_BD_SMR

2.2.5. Physical Model of the Air Separation Unit

2.2.6. Physical Model of the Ammonia Synthesis Unit

2.3. Economic and Environmental Model

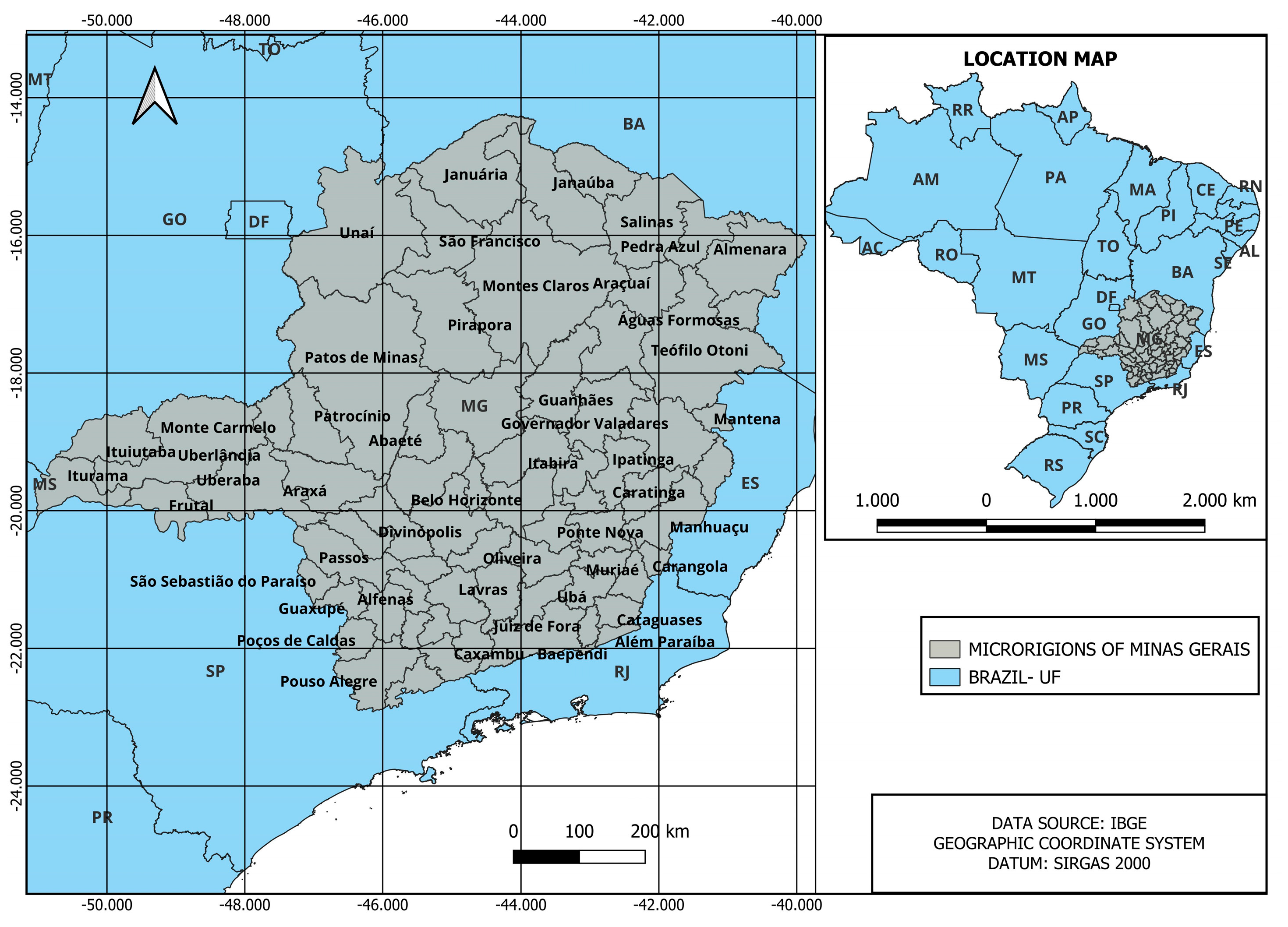

2.4. Regional Logistics Model

Demand and Availability of Resources

- Water resources—It was assumed that all regions had enough water available for the hydrogen production process and in turn ammonia.

- Electricity resources—The electricity needed for the processes would be supplied by the available electricity grid. This choice was justified by its practicality and the infrastructure already in place, avoiding the need for additional investment in on-site power generation systems.

- Wood biomass resources—For the amount of wood that would be used in the gasifier, it was estimated that 25% of the wood biomass planted in each micro-region would be available for hydrogen production. The amount of wood produced by each micro-region (total roundwood, firewood, and charcoal) was taken from [35].

- Ethanol—The amount of ethanol available was estimated based on the capacities of ethanol production plants located in Minas Gerais [36].

- Vinasse—The estimate of vinasse was performed considering that the production of 1 L of ethanol generated, on average, 12 L of vinasse [37].

2.5. Economic Indicators

2.6. Sensitivity Analysis

3. Results and Discussion

3.1. Results of the Case Study-Optimized Ammonia Production Routes

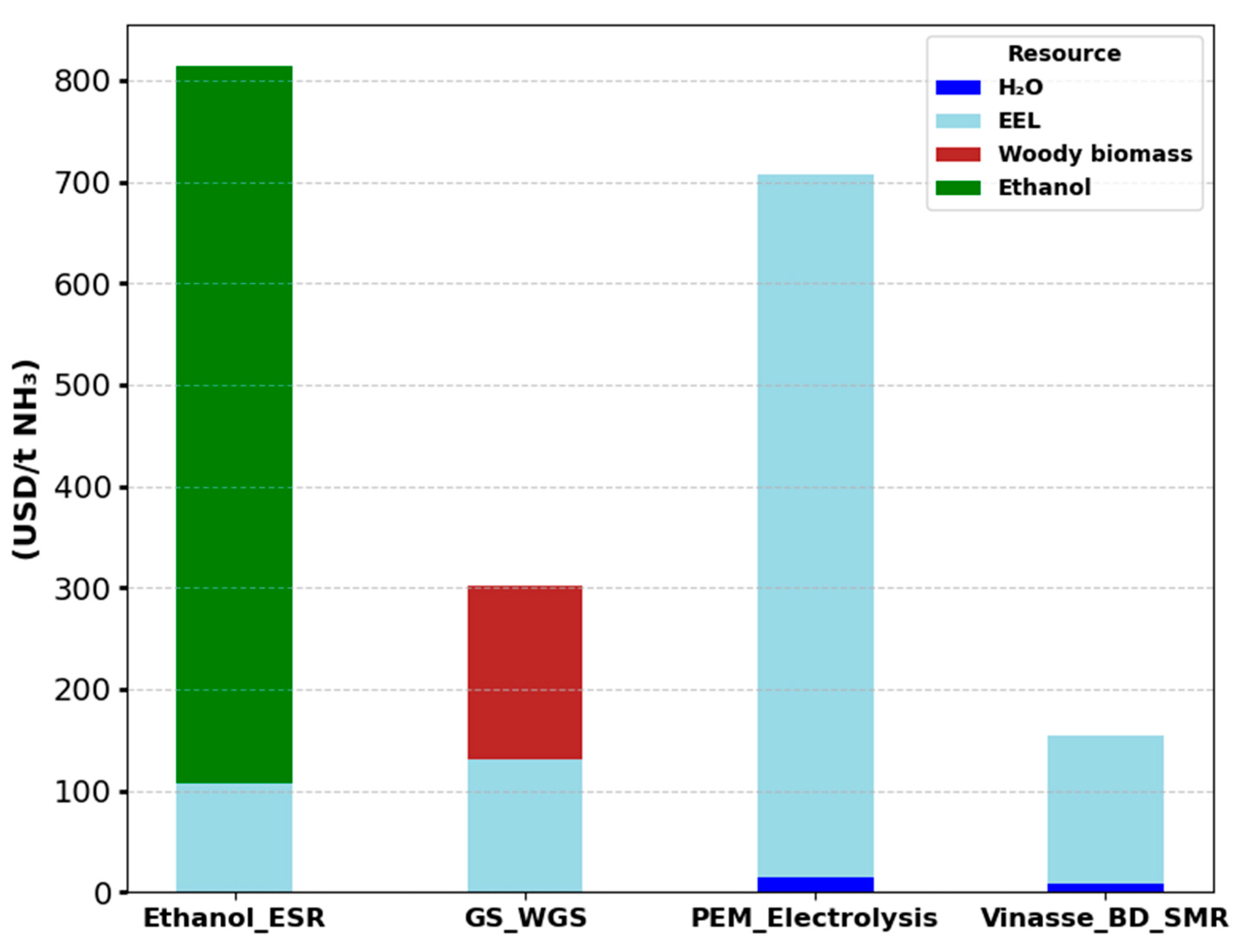

Economic Analysis

3.2. Economic Indicators and Minimum Ammonia Sales Price

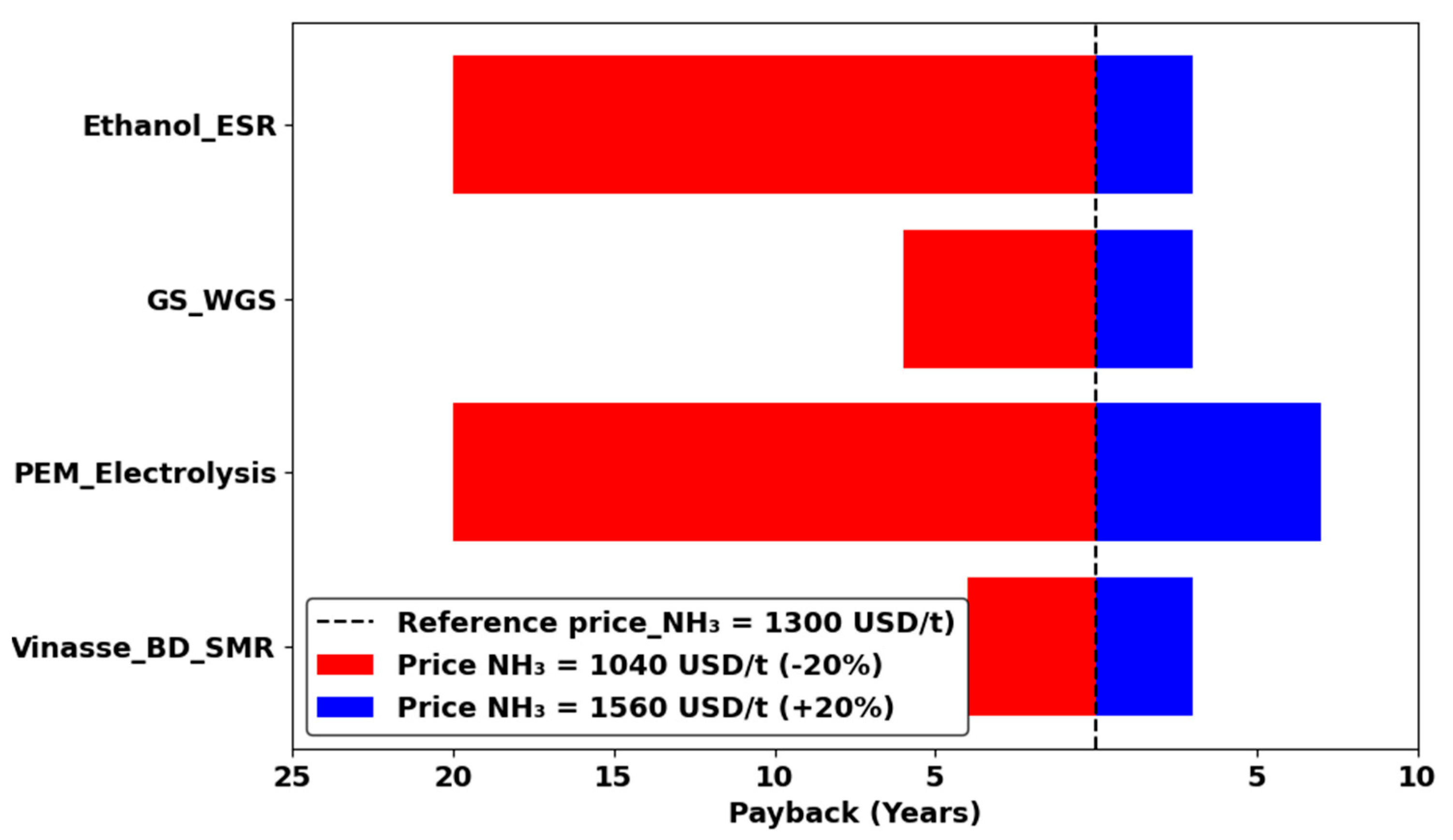

3.3. Results of Sensitivity Analysis

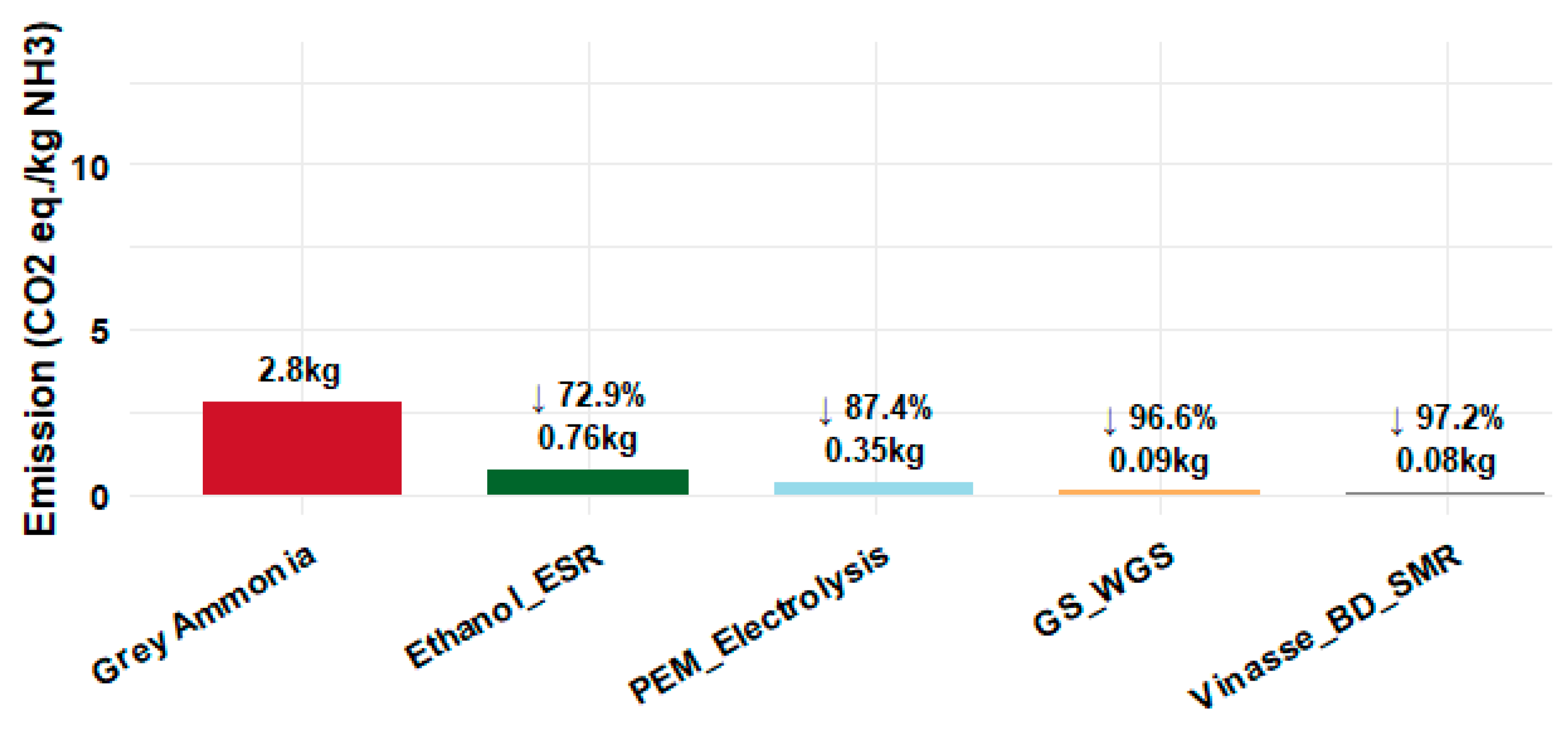

3.4. Environmental Analysis

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BD | Biodigestion |

| WGS | Water–gas shift reaction |

| MILP | Mixed-integer linear programming |

| T | Metric ton |

| NPV | Net present value |

| DFB | Dual fluidized bed |

| PSA | Pressure swing adsorption |

| IRR | Internal rate of return |

| SMR | Steam methane reforming |

| CEPCI | Chemical engineering plant cost index |

| ASU | Air separation unit |

| LCOH | Levelized cost of hydrogen |

References

- Chehade, G.; Dincer, I. Progress in Green Ammonia Production as Potential Carbon-Free Fuel. Fuel 2021, 299, 120845. [Google Scholar] [CrossRef]

- Lima, L.C.; Patrício, R.A.; Silva, C.D.N.; Batista, E.N.; De Oliveira, E.E.S.; Morais, F.H.B.D.L. Hidrogênio Solar-Eólico Para A Produção de Fertilizantes Nitrogenadosno Estado do Ceará. In Proceedings of the Congresso Brasileiro de Energia Solar, Fortaleza, Brazil, 1–5 June 2020. [Google Scholar]

- Liu, X.; Elgowainy, A.; Wang, M. Life Cycle Energy Use and Greenhouse Gas Emissions of Ammonia Production from Renewable Resources and Industrial By-Products. Green Chemistry 2020, 22, 5751–5761. [Google Scholar] [CrossRef]

- Ye, D.; Tsang, S.C.E. Prospects and Challenges of Green Ammonia Synthesis. Nat. Synth. 2023, 2, 612–623. [Google Scholar] [CrossRef]

- Matthew, C.; Spataru, C. What Drives the Viability of Waste-to-Energy? Modelling Techno-Economic Scenarios of Anaerobic Digestion and Energy Generation for the Scottish Islands. J. Clean. Prod. 2023, 410, 137306. [Google Scholar] [CrossRef]

- Kargbo, H.O.; Ng, K.S.; Phan, A.N. Evaluation of the Economic Feasibility of a Two-Stage Gasification System for Hydrogen, Liquid Fuels and Energy Production from Residues. Energy Convers. Manag. 2022, 253, 115126. [Google Scholar] [CrossRef]

- Riera, J.A.; Lima, R.M.; Knio, O.M. A Review of Hydrogen Production and Supply Chain Modeling and Optimization. Int. J. Hydrogen Energy 2023, 48, 13731–13755. [Google Scholar] [CrossRef]

- Gholizadeh-Roshanagh, R.; Zare, K.; Marzband, M. An A-Posteriori Multi-Objective Optimization Method for MILP-Based Distribution Expansion Planning. IEEE Access 2020, 8, 60279–60292. [Google Scholar] [CrossRef]

- Mohammed, A.; Ghaithan, A.M.; Al-Hanbali, A.; Attia, A.M. A Multi-Objective Optimization Model Based on Mixed Integer Linear Programming for Sizing a Hybrid PV-Hydrogen Storage System. Int. J. Hydrogen Energy 2023, 48, 9748–9761. [Google Scholar] [CrossRef]

- Garcia, V.F.; Palacios, R.; Ensinas, A. Optimisation of Ammonia Production and Supply Chain from Sugarcane Ethanol and Biomethane: A Robust Mixed-Integer Linear Programming Approach. Processes 2024, 12, 2204. [Google Scholar] [CrossRef]

- Compagnoni, M.; Mostafavi, E.; Tripodi, A.; Mahinpey, N.; Rossetti, I. Techno-Economic Analysis of a Bioethanol to Hydrogen Centralized Plant. Energy Fuels 2017, 31, 12988–12996. [Google Scholar] [CrossRef]

- Silva, M.E. Experimental Analysis of Ethanol Steam Reforming: Technical, Economic and Ecological Aspects. Ph.D. Thesis, Sao Paulo State University, São Paulo, Brazil, 2010. [Google Scholar] [CrossRef]

- Salkuyeh, Y.K.; Saville, B.A.; MacLean, H.L. Techno-Economic Analysis and Life Cycle Assessment of Hydrogen Production from Different Biomass Gasification Processes. Int. J. Hydrogen Energy 2018, 43, 9514–9528. [Google Scholar] [CrossRef]

- Jain, M.; Muthalathu, R.; Wu, X.Y. Electrified Ammonia Production as a Commodity and Energy Storage Medium to Connect the Food, Energy, and Trade Sectors. iScience 2022, 25, 104724. [Google Scholar] [CrossRef] [PubMed]

- Fuess, L.T.; de Araújo Júnior, M.M.; Garcia, M.L.; Zaiat, M. Designing Full-Scale Biodigestion Plants for the Treatment of Vinasse in Sugarcane Biorefineries: How Phase Separation and Alkalinization Impact Biogas and Electricity Production Costs? Chem. Eng. Res. Des. 2017, 119, 209–220. [Google Scholar] [CrossRef]

- Lewis, E.; McNaul, S.; Jamieson, M.; Henriksen, M.S.; Matthews, H.S.; Walsh, L.; Grove, J.; Shultz, T.; Skone, T.J.; Stevens, R. Comparison of Commercial, State-of-the-Art, Fossil-Based Hydrogen Production Technologies; Technical Report for USDOE Office of Fossil Energy: Washington, DC, USA, 2022. [CrossRef]

- ANTT Freight Calculator from the National Land Transport Agency-ANTT. Available online: https://calculadorafrete.antt.gov.br/?Length=4 (accessed on 16 September 2024).

- Howitt, C.; Ghaffariyan, M.R. Truck Configurations for Efficient Transportation of Forest Biomass: A Short Literature Review. Silva Balc. 2025, 26, 19–27. [Google Scholar] [CrossRef]

- Hunt, J.D.; Salgado, B. Aspectos Sobre o Armazenamento e Transporte de Hidrogênio; GIZ: Bonn and Eschborn, Germany, 2023. [Google Scholar]

- Gestran What Is a Tanker Truck and How Is It Regulated? Available online: https://www.gestran.com.br/blog/o-que-e-caminhao-tanque-e-como-e-sua-legislacao (accessed on 29 September 2024).

- Gasprom CNG Truck 2024: Maximum Capacity and Efficiency! Available online: https://gasprom.com.br/equipamentos-/carreta-de-gnc/ (accessed on 14 October 2024).

- Pimenta, É. Quanto Custa Encher o Tanque de Um Caminhão No Brasil? Available online: https://autopapo.com.br/noticia/quanto-custa-encher-o-tanque-de-um-caminhao-brasil/ (accessed on 16 September 2024).

- ECCC Fatores de Emissão e Valores de Referência-Canada.Ca. Available online: https://www.canada.ca/en/environment-climate-change/services/climate-change/pricing-pollution-how-it-will-work/output-based-pricing-system/federal-greenhouse-gas-offset-system/emission-factors-reference-values.html (accessed on 15 May 2025).

- DMAE Taxas-Tabela de Preço-DMAE. Available online: http://dmaepc.mg.gov.br/taxas-tabela-de-preco/ (accessed on 17 December 2024).

- Sinvespar Sinvespar. Available online: https://www.sinvespar.com.br/noticia/21/quanto-custa-a-energia-eletrica-para-as-industrias-do-brasil (accessed on 18 December 2024).

- SIRENE. Available online: https://www.gov.br/mcti/pt-br/acompanhe-o-mcti/sirene (accessed on 19 August 2024).

- Mfrural Cavaco de Madeira Biomassa Em Linhares ES à Venda. Compre Direto 756914. Available online: https://www.mfrural.com.br/detalhe/756914/cavaco-de-madeira-biomassa (accessed on 18 December 2024).

- ecoinvent Ecoinvent. Available online: https://ecoinvent.org/ (accessed on 19 August 2024).

- CEPEA Centro de Estudos Avançados Em Economia Aplicada. Available online: https://www.cepea.esalq.usp.br/br/indicador/etanol.aspx (accessed on 11 December 2024).

- Mekonnen, M.M.; Romanelli, T.L.; Ray, C.; Hoekstra, A.Y.; Liska, A.J.; Neale, C.M.U. Water, Energy, and Carbon Footprints of Bioethanol from the U.S. and Brazil. Environ. Sci. Technol. 2018, 52, 14508–14518. [Google Scholar] [CrossRef]

- Mayer, P.; Ramirez, A.; Pezzella, G.; Winter, B.; Sarathy, S.M.; Gascon, J.; Bardow, A. Blue and Green Ammonia Production: A Techno-Economic and Life Cycle Assessment Perspective. iScience 2023, 26, 107389. [Google Scholar] [CrossRef]

- d’Amore-Domenech, R.; Meca, V.L.; Pollet, B.G.; Leo, T.J. On the Bulk Transport of Green Hydrogen at Sea: Comparison between Submarine Pipeline and Compressed and Liquefied Transport by Ship. Energy 2023, 267, 126621. [Google Scholar] [CrossRef]

- Yara Grupo Yara Passa a Produzir Amônia Renovável Em Cubatão|BE News. Available online: https://portalbenews.com.br/grupo-yara-passa-a-produzir-amonia-renovavel-em-cubatao/ (accessed on 18 March 2025).

- Petrobras Petrobras Alcança Menor Taxa de Emissões de Gases de Efeito Estufa No Refino. Available online: https://agencia.petrobras.com.br/w/negocio/petrobras-alcanca-menor-taxa-de-emissoes-de-gases-de-efeito-estufa-no-refino (accessed on 20 April 2025).

- Produção Da Extração Vegetal e Da Silvicultura|IBGE. Available online: https://www.ibge.gov.br/estatisticas/economicas/agricultura-e-pecuaria/9105-producao-da-extracao-vegetal-e-da-silvicultura.html?=&t=resultados (accessed on 18 December 2024).

- ANP Dynamic Ethanol Producers Panel. Available online: https://app.powerbi.com/view?r=eyJrIjoiMmRhZWU2NDUtZWE2Yi00NzI5LWJjMGQtNjIwNjE0MjM0MjEzIiwidCI6IjQ0OTlmNGZmLTI0YTYtNGI0Mi1iN2VmLTEyNGFmY2FkYzkxMyJ9 (accessed on 11 December 2024).

- SERGOMEL Sugarcane Vinasse: What It Is and How It Can Be Used. Available online: https://www.sergomel.com.br/vinhaca-de-cana-de-acucar-o-que-e-e-qual-sua-aplicacao- (accessed on 11 December 2024).

- Liu, M. Research on Investment Project Evaluation: Comparative Analysis Based on NPV and IRR. Highlights Bus. Econ. Manag. 2024, 24, 1133–1138. [Google Scholar] [CrossRef]

- Guimarães, T.; de Carvalho Bittencourt, R.; Carvalho, A.M.M.L.; Valverde, S.R.; da Costa, M.M. Technical-Economic Assessment of 5-Hydroxymethylfurfural Production via Catalytic Hydrothermal Synthesis from Lignocellulosic Forest Residues. Food Bioprod. Process. 2024, 148, 341–352. [Google Scholar] [CrossRef]

- Neumann, N.C.; Baumstark, D.; López Martínez, P.; Monnerie, N.; Roeb, M. Exploiting Synergies between Sustainable Ammonia and Nitric Acid Production: A Techno-Economic Assessment. J. Clean. Prod. 2024, 438, 140740. [Google Scholar] [CrossRef]

- BCB Banco Central Do Brasil (BCB)-Taxa Selic. Available online: https://www.bcb.gov.br/controleinflacao/taxaselic (accessed on 3 February 2025).

- Cormos, C.C. Green Hydrogen Production from Decarbonized Biomass Gasification: An Integrated Techno-Economic and Environmental Analysis. Energy 2023, 270, 126926. [Google Scholar] [CrossRef]

- Wang, Y.; Li, G.; Liu, Z.; Cui, P.; Zhu, Z.; Yang, S. Techno-Economic Analysis of Biomass-to-Hydrogen Process in Comparison with Coal-to-Hydrogen Process. Energy 2019, 185, 1063–1075. [Google Scholar] [CrossRef]

- Etzold, H.; Röder, L.; Oehmichen, K.; Nitzsche, R. Technical Design, Economic and Environmental Assessment of a Biorefinery Concept for the Integration of Biomethane and Hydrogen into the Transport Sector. Bioresour. Technol. Rep. 2023, 22, 101476. [Google Scholar] [CrossRef]

- Khamhaeng, P.; Laosiripojana, N.; Assabumrungrat, S.; Kim-Lohsoontorn, P. Techno-Economic Analysis of Hydrogen Production from Dehydrogenation and Steam Reforming of Ethanol for Carbon Dioxide Conversion to Methanol. Int. J. Hydrogen Energy 2021, 46, 30891–30902. [Google Scholar] [CrossRef]

- María Villarreal Vives, A.; Wang, R.; Roy, S.; Smallbone, A. Techno-Economic Analysis of Large-Scale Green Hydrogen Production and Storage. Appl. Energy 2023, 346, 121333. [Google Scholar] [CrossRef]

- Yoshida, A.; Nakazawa, H.; Kenmotsu, N.; Amano, Y. Economic Analysis of a Proton Exchange Membrane Electrolyser Cell for Hydrogen Supply Scenarios in Japan. Energy 2022, 251, 123943. [Google Scholar] [CrossRef]

- de Meira, A.M.; Nolasco, A.M.; de Souza, E.C.; de Souza, M.P.; Pereira, A.K.S.; Ucella-Filho, J.G.M.; Dias Júnior, A.F. Integrated Municipal Management of Waste from Tree Pruning and Removal. Urban For. Urban Green. 2024, 94, 128238. [Google Scholar] [CrossRef]

- Fúnez Guerra, C.; Reyes-Bozo, L.; Vyhmeister, E.; Jaén Caparrós, M.; Salazar, J.L.; Clemente-Jul, C. Technical-Economic Analysis for a Green Ammonia Production Plant in Chile and Its Subsequent Transport to Japan. Renew. Energy 2020, 157, 404–414. [Google Scholar] [CrossRef]

- Cardoso, J.S.; Silva, V.; Chavando, J.A.M.; Eusébio, D.; Hall, M.J.; Costa, M. Small-Scale Biomass Gasification for Green Ammonia Production in Portugal: A Techno-Economic Study. Energy Fuels 2021, 35, 13847–13862. [Google Scholar] [CrossRef]

- Hein, H. Amônia Verde Já é Tão Competitiva Quanto Combustíveis Fósseis. Available online: https://canalsolar.com.br/producao-de-amonia-verde-ja-e-tao-competitiva-quanto-de-combustiveis-fosseis/ (accessed on 14 October 2024).

- SEEG SEEG-Sistema de Estimativa de Emissão de Gases. Available online: https://plataforma.seeg.eco.br/ (accessed on 4 May 2025).

| Resource | Cost (USD/t 100 km) | Emissions (t CO2/t. 100 km) |

|---|---|---|

| Hydrogen | 480.7 | 0.134 |

| Ammonia | 23.8 | 0.0065 |

| Biomass Woody | 32.9 | 0.011 |

| Biomethane | 55 | 0.015 |

| Vinasse | 5.3 | 0.0018 |

| Ethanol | 6.7 | 0.0022 |

| Resource | Price (2024) | Reference | Specific Emission | Reference |

|---|---|---|---|---|

| Water | 2.84 USD/t | [24] | - | - |

| Electric energy | 75.45 USD/MWh | [25] | 0.0385 t CO2 eq /MWh | [26] |

| Woody biomass | 59.77 USD/t | [27] | 0.00669 t CO2 eq/t | [28] |

| Ethanol | 612 USD/t | [29] | 0.61 t CO2 eq/t | [30] |

| Resource | Specific Emission | Reference |

|---|---|---|

| Ammonia | 2.9 t CO2 eq/t | [31] |

| Equipment | Reference Capacity | Reference Investment (Co) Million USD (2024) | Scaling Factor (α) | Reference |

|---|---|---|---|---|

| PEM | 1.88 t. H2/h | 186.65 | 0.7 | [14] |

| ASU | 29.63 t. N2/h | 29.78 | 0.6 | |

| Haber-Bosch | 36 t. NH3/h | 129.80 | 0.5 | |

| GS_WGS | 18.9 t H2/h | 810.44 | 0.7 | [13] |

| Ethanol_ESR | 0.0625 t H2/h | 5.78 | 0.7 | [11,12] |

| Vinasse_BD_SMR | 20.126 t H2/h | 355.69 | 0.7 | [16] |

| Production Technology | Ethanol_ESR | GS_WGS | PEM_Electrolysis | Vinasse_BD_SMR |

|---|---|---|---|---|

| Total investment (million USD) | 286 | 496 | 645 | 445 |

| NPV (million USD) | 534 | 906 | 262 | 1159 |

| IRR (%) | 46 | 45 | 22 | 58 |

| Discounted payback (years) | 3 | 3 | 8 | 2 |

| Production cost (USD/t.NH3) | 938 | 541 | 985 | 363 |

| Minimum selling price (USD/t.NH3) | 1278 | 1129 | 1749 | 891 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khalid, H.; Garcia, V.F.; Infante Cuan, J.E.; Zavala, E.H.; Ribeiro, T.M.; Rua Orozco, D.J.; Ensinas, A.V. Technical, Economic, and Environmental Optimization of the Renewable Hydrogen Production Chain for Use in Ammonia Production: A Case Study. Processes 2025, 13, 2211. https://doi.org/10.3390/pr13072211

Khalid H, Garcia VF, Infante Cuan JE, Zavala EH, Ribeiro TM, Rua Orozco DJ, Ensinas AV. Technical, Economic, and Environmental Optimization of the Renewable Hydrogen Production Chain for Use in Ammonia Production: A Case Study. Processes. 2025; 13(7):2211. https://doi.org/10.3390/pr13072211

Chicago/Turabian StyleKhalid, Halima, Victor Fernandes Garcia, Jorge Eduardo Infante Cuan, Elias Horácio Zavala, Tainara Mendes Ribeiro, Dimas José Rua Orozco, and Adriano Viana Ensinas. 2025. "Technical, Economic, and Environmental Optimization of the Renewable Hydrogen Production Chain for Use in Ammonia Production: A Case Study" Processes 13, no. 7: 2211. https://doi.org/10.3390/pr13072211

APA StyleKhalid, H., Garcia, V. F., Infante Cuan, J. E., Zavala, E. H., Ribeiro, T. M., Rua Orozco, D. J., & Ensinas, A. V. (2025). Technical, Economic, and Environmental Optimization of the Renewable Hydrogen Production Chain for Use in Ammonia Production: A Case Study. Processes, 13(7), 2211. https://doi.org/10.3390/pr13072211