Inventory Turnover and Firm Profitability: A Saudi Arabian Investigation

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. The Shift from Oil-Based to Manufacturing-Based Economy in Saudi Arabia

2.2. Inventory Turnover and Corporate Profitability

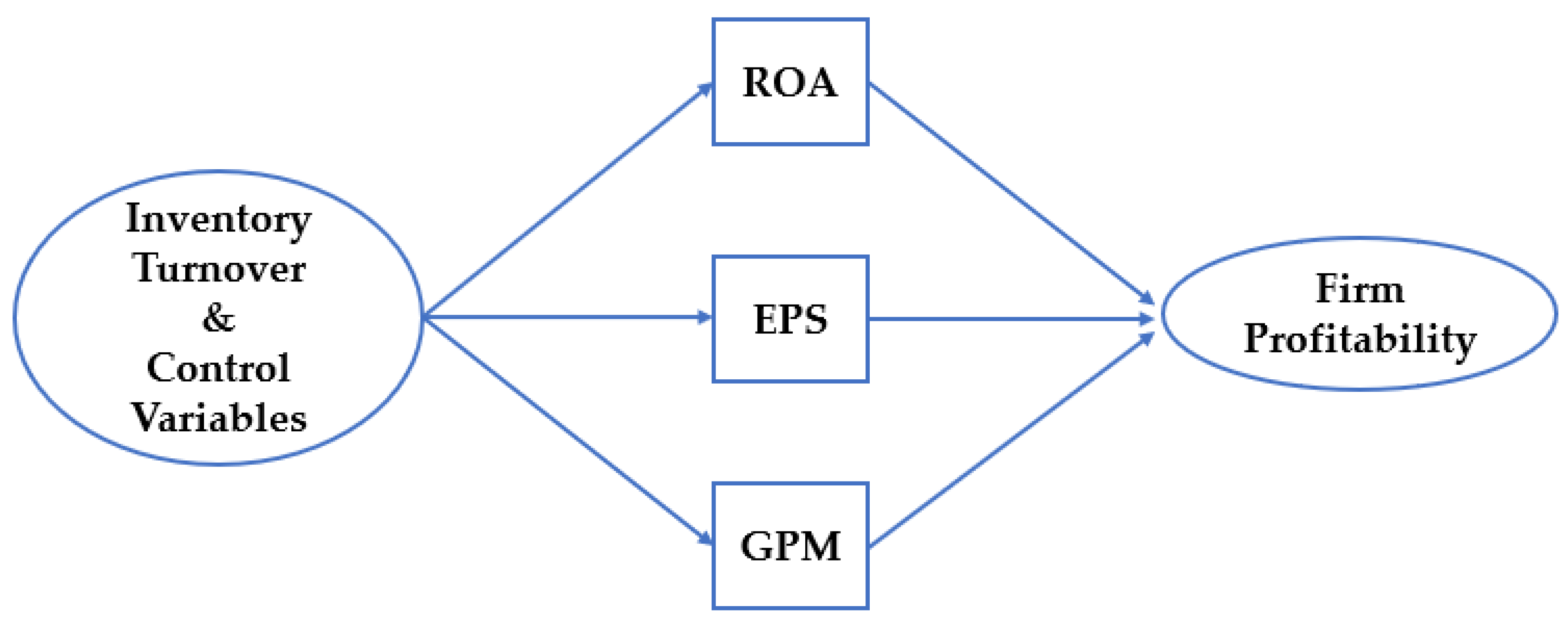

3. Research Design and Methodology

3.1. Sample Selection and Model Specifications

3.2. Variables Measurement

3.2.1. Sustainable Firm Profitability Measure

3.2.2. Inventory Turnover Measure

3.2.3. Control Variables

4. Analysis Results and Discussion

4.1. Summary Statistics

4.2. Multicollinearity Tests

4.3. Hypothesis Testing Results

4.4. Further Robustness Checks

5. Conclusions and Contributions

6. Managerial Implications and Research Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Variables’ Measurement

| Variable | Symbol | Measure | Data Source |

| Return on assets | ROA | Book value of net profit after tax/total assets | Database |

| Earnings per share | EPS | Net income/average number of outstanding common shares | Database |

| Gross profit margin | GPM | Gross profit/net sales | Database |

| Inventory turnover | ITR | Cost of goods sold/average inventory | Database |

| Accounts receivable collection period | ARCP | (Average receivables/sales) × 365 | Annual reports |

| Days payable outstanding | DPO | (Average payables/cost of goods sold) × 365 | Annual reports |

| Firm size | FSIZE | Natural logarithm of total assets | Annual reports |

| Leverage ratio | LEV | Long-term liabilities/lagged total assets | Annual reports |

| Market to book ratio | MTB | Market capitalization/book value | Database |

| Sales Growth | SGROW | (Current year net sales –prior year net sale)/prior year net sales | Annual reports |

| Board size | BSIZE | Number of members in the board of directors | Database |

| Coronavirus pandemic | COVID | Indicator that takes a value of 1 for the firm-year observations that falls in the coronavirus pandemic (2020–2021), and 0 otherwise. | Authors calculation |

| Big4 auditor | BIG | Indicator that takes the value of 1 if the company is audited by at least one of the Big4 audit firm; 0 otherwise. | Annual reports |

References

- Wangari, K.L. Influence of inventory management practices on organizational competitiveness: A case of Safaricom Kenya LTD. Int. Acad. J. Procure. Supply Chain Manag. 2015, 1, 72–98. [Google Scholar]

- Karim, N.; Nawawi, A.; Salin, A.S.A.P. Inventory management effectiveness of a manufacturing Company–Malaysian evidence. Int. J. Law Manag. 2018, 60, 1163–1178. [Google Scholar] [CrossRef]

- Eroglu, C.; Hofer, C. Lean, leaner, too lean? The inventory–performance link revisited. J. Oper. Manag. 2011, 29, 356–369. [Google Scholar] [CrossRef]

- Syeda, R. Impact of working capital management on profitability: A case study of trading companies. Account. Financ. Innov. 2021. [Google Scholar] [CrossRef]

- Lyngstadaas, H.; Berg, T. Working capital management: Evidence from Norway. Int. J. Manag. Financ. 2016, 12, 295–313. [Google Scholar] [CrossRef]

- Singhania, M.; Mehta, P. Working capital management and firms’ profitability: Evidence from emerging Asian countries. South Asian J. Bus. Stud. 2017, 6, 80–97. [Google Scholar] [CrossRef]

- Kwak, J.K. Analysis of inventory turnover as a performance measure in manufacturing industry. Processes 2019, 7, 760. [Google Scholar] [CrossRef]

- Ali, K.; Showkat, N.; Chisti, K.A. Impact of inventory management on operating profits: Evidence from India. J. Financ. Econ. 2022, 10, 47–50. [Google Scholar] [CrossRef]

- Rehman, M.Z.; Khan, M.N.; Khokhar, I. Select financial ratios as a determinant of profitability evidence from petrochemical industry in Saudi Arabia. Eur. J. Bus. Manag. 2014, 6, 187–196. [Google Scholar]

- Khan, M.N.; Khokhar, I. The effect of selected financial ratios on profitability: An empirical analysis of listed firms of cement sector in Saudi Arabia. Q. J. Econom. Res. 2015, 1, 1–12. [Google Scholar] [CrossRef]

- Hashed, A.W.A.; Shaik, A.R. The nexus between inventory management and firm performance: A Saudi Arabian perspective. J. Asian Financ. Econ. Bus. 2022, 9, 297–302. [Google Scholar] [CrossRef]

- Simon, H.A. On the application of servomechanism theory in the study of production control. Economitra 1952, 20, 247–268. [Google Scholar] [CrossRef]

- Atieh, A.M.; Kaylani, H.; Al-abdallat, Y.; Qaderi, A.; Ghoul, L.; Jaradat, L.; Hdairis, I. Performance improvement of inventory management system processes by an automated warehouse management system. Procedia CIRP 2016, 41, 568–572. [Google Scholar] [CrossRef]

- Becerra, P.; Mula, J.; Sanchis, R. Sustainable inventory management in supply chains: Trends and further research. Sustainability 2022, 14, 2613. [Google Scholar] [CrossRef]

- Axsater, S. Control theory concepts in production and inventory control. Int. J. Syst. Sci. 1985, 16, 161–169. [Google Scholar] [CrossRef]

- Wiendahl, H.P.; Breithaupt, J.W. Automatic production control applying control theory. Int. J. Prod. Econ. 2000, 63, 33–46. [Google Scholar] [CrossRef]

- Hoberg, K.; Bradley, J.R.; Thonemann, U.W. Analyzing the effect of the inventory policy on order and inventory variability with linear control theory. Eur. J. Oper. Res. 2007, 176, 1620–1642. [Google Scholar] [CrossRef]

- Aharon, B.T.; Boaz, G.; Shimrit, S. Robust multi-echelon multi-period inventory control. Eur. J. Oper. Res. 2009, 199, 922–935. [Google Scholar] [CrossRef]

- Ignaciuk, P.; Bartoszewic, A. Linear-quadratic optimal control strategy for periodic-review inventory systems. Automatica 2010, 46, 1982–1993. [Google Scholar] [CrossRef]

- Pan, J.; Chiu, C.-Y.; Wu, K.-S.; Yen, H.-F.; Wang, Y.-W. Sustainable production–inventory model in technical cooperation on investment to reduce carbon emissions. Processes 2020, 8, 1438. [Google Scholar] [CrossRef]

- Antic, S.; Djordjevic Milutinovic, L.; Lisec, A. Dynamic discrete inventory control model with deterministic and stochastic demand in pharmaceutical distribution. Appl. Sci. 2022, 12, 1536. [Google Scholar] [CrossRef]

- Massaro, A. Advanced control systems in industry 5.0 enabling process mining. Sensors 2022, 22, 8677. [Google Scholar] [CrossRef]

- Panayides, P.M.; Andreou, P.C.; Louca, C. The impact of vertical integration on inventory turnover and operating performance. Int. J. Logist. Res. Appl. 2015, 19, 218–238. [Google Scholar] [CrossRef]

- Huson, M.; Nanda, D. The impact of just-in-time manufacturing on firm performance in the US. J. Oper. Manag. 1995, 12, 297–310. [Google Scholar] [CrossRef]

- Balakrishnan, R.; Linsmeier, T.J.; Venkatachalam, M. Financial benefits from JIT adoption: Effects of customer concentration and cost structure. Account. Rev. 1996, 71, 183–205. Available online: http://www.jstor.org/stable/248445 (accessed on 21 September 2022).

- Kinney, M.R.; Wempe, W.F. Further evidence on the extent and origins of JIT’s profitability effects. Account. Rev. 2002, 77, 203–225. Available online: http://www.jstor.org/stable/3068862 (accessed on 8 October 2022). [CrossRef]

- Chen, H.; Frank, M.Z.; Wu, O.Q. What actually happened to the inventories of American companies between 1981 and 2000? Manag. Sci. 2005, 51, 1015–1164. [Google Scholar] [CrossRef]

- Koumanakos, D.P. The effect of inventory management on firm performance. Int. J. Product. Perform. Manag. 2008, 57, 355–369. [Google Scholar] [CrossRef]

- Muchaendepi, W.; Mbohwa, C.; Hamandishe, T.; Kanyepe, J. Inventory management and performance of SMEs in the Manufacturing sector of Harare. Procedia Manuf. 2019, 23, 454–461. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Sarkar, B. Optimum sustainable inventory management with backorder and deterioration under controllable carbon emissions. J. Clean. Prod. 2021, 279. [Google Scholar] [CrossRef]

- Gitman, L.J. Principles of Managerial Finance; Pearson Education International: Boston, MA, USA, 2015. [Google Scholar]

- Rodrigo, W.L.M.P.U.; Rathnayake, R.M.S.S.; Pathirawasam, C. Effect of inventory management on financial performance of listed manufacturing companies in Sri Lanka. IAR J. Bus. Manag. 2020, 1, 383–389. [Google Scholar]

- Shaik, A.R. COVID-19 pandemic and the reaction of Asian stock markets: Empirical evidence from Saudi Arabia. J. Asian Financ. Econ. Bus. 2021, 8, 1–7. [Google Scholar] [CrossRef]

- Kouaib, A. Corporate sustainability disclosure and investment efficiency: The Saudi Arabian context. Sustainability 2022, 14, 13984. [Google Scholar] [CrossRef]

- Kouaib, A.; Amara, I. Corporate social responsibility disclosure and investment decisions: Evidence from Saudi indexed companies. J. Risk Financ. Manag. 2022, 15, 495. [Google Scholar] [CrossRef]

- Louw, E.; Hall, J.H.; Pradhan, R.P. The relationship between working capital management and profitability: Evidence from South African retail and construction firms. Glob. Bus. Rev. 2022, 23, 313–333. [Google Scholar] [CrossRef]

- Weston, J.F.; Thomas, E.C. Managerial Finance; The Dryden Press International Edition: Amazon, USA, 1992. [Google Scholar]

- Innocent, E.C.; Mary, O.I.; Matthew, O.M. Financial ratio analysis as a determinant of profitability in Nigerian pharmaceutical industry. Int. J. Bus. Manag. 2013, 8, 107–117. [Google Scholar]

- White, R.E.; Pearson, J.N.; Wilson, J.R. JIT manufacturing survey of implementations in small and large U.S. manufacturers. Manag. Sci. 1999, 45, 1–55. Available online: https://www.jstor.org/stable/2634918 (accessed on 25 September 2022). [CrossRef]

- Gaur, V.; Fisher, M.L.; Raman, A. An econometric analysis of inventory turnover performance in retail services. Manag. Sci. 2005, 51, 181–194. [Google Scholar] [CrossRef]

- Schonberger, R.J. Japanese production management: An evolution–with mixed success. J. Oper. Manag. 2007, 25, 403–419. [Google Scholar] [CrossRef]

- Shah, R.; Shin, H. Relationships among information technology, inventory, and profitability: An investigation of level invariance using sector level data. J. Oper. Manag. 2007, 25, 768–784. [Google Scholar] [CrossRef]

- King, A.A.; Lenox, M.J. Lean and green? An Empirical examination of the relationship between lean production and environmental performance. Prod. Oper. Manag. 2011, 10, 244–256. [Google Scholar] [CrossRef]

- Brigham, E.F. Fundamentals of Financial Management; The Dryden Press: Fort Worth, TX, USA, 1995. [Google Scholar]

- Deloof, M. Does working capital management affect profitability of Belgian firms? J. Bus. Financ. Account. 2003, 30, 573–588. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Size and book-to-market factors in earnings and returns. J. Financ. 1995, 50, 131–155. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G. The External Control of Organizations: A Resource Dependence Perspective; Harper and Row: New York, NY, USA, 1978. [Google Scholar]

- Beiner, S.; Drobetz, W.; Schmid, F.; Zimmermann, H. Is board size an independent corporate governance mechanism? Kyklos 2004, 57, 327–356. [Google Scholar] [CrossRef]

- Alves, S.M.G. The effect of the board structure on earnings management: Evidence from Portugal. J. Financ. Report. Account. 2011, 9, 141–160. [Google Scholar] [CrossRef]

- Iliemena, R.O.; Aniefor, S.J.; Odukoya, O.O. Inventory management and control systems in Covid-19 pandemic era: An exploratory study of selected health institutions in Anambra State, Nigeria. Glob. J. Manag. Bus. Res. A Adm. Manag. 2022, 22, 43–55. [Google Scholar]

- Ke, J.Y.F.; Otto, J.; Han, C. Customer-Country diversification and inventory efficiency: Comparative evidence from the manufacturing sector during the pre-pandemic and the COVID-19 pandemic periods. J. Bus. Res. 2022, 148, 292–303. [Google Scholar] [CrossRef]

- Afrifa, G.A.; Alshehabi, A.; Tingbani, I.; Halabi, H. Abnormal inventory and performance in manufacturing companies: Evidence from the trade credit channel. Rev. Quant. Financ. Account. Vol. 2021, 56, 581–617. [Google Scholar] [CrossRef]

- Bhattacharya, D.K. On multi-item inventory. Eur. J. Oper. Res. 2005, 162, 786–791. [Google Scholar] [CrossRef]

- Gujarati, D.N. Basic Econometrics, 4th ed.; McGraw Hill: New York, NY, USA, 2003. [Google Scholar]

| Sector | Industry Group | Firms | Obs. | % | |

|---|---|---|---|---|---|

| 1 | Energy | Energy | 2 | 10 | 3 |

| 2 | Materials | Materials Industry Group | 41 | 205 | 53 |

| 3 | Industrials | Capital Goods | 10 | 50 | 13 |

| 4 | Consumer Discretionary | Consumer Durables and Apparel | 6 | 30 | 8 |

| 5 | Consumer Staples | Food and Beverages | 13 | 65 | 17 |

| 6 | Health Care | Pharma, Biotech and Life Science | 1 | 5 | 1 |

| 7 | Utilities | Utilities | 5 | 25 | 6 |

| Total | 78 | 390 | 100 |

| Mean | Median | St. Dev. | Kurtosis | Skewness | Minimum | Maximum | |

|---|---|---|---|---|---|---|---|

| Panel A. Summary statistics | |||||||

| Total Assets | 61,184,715 | 4,767,888 | 120,358,734 | 3 | 2 | 542,858 | 406,391,118 |

| Total Inventories | 3,075,648 | 394,955 | 7,409,813 | 7 | 3 | 3502 | 28,274,921 |

| Total Cost of Goods Sold | 11,529,290 | 1,916,849 | 25,559,565 | 6 | 3 | 9930 | 97,751,803 |

| Total Sales | 13,921,728 | 3,580,205 | 20,406,841 | 6 | 2 | 67,210 | 102,589,000 |

| Average Accounts Receivable | 3,051,529 | 290,678 | 12,412,566 | 57 | 7 | 3810 | 138,657,500 |

| Average Accounts Payable | 8,221,192 | 655,377 | 16,964,661 | 4 | 2 | 0 | 62,837,131 |

| ROA | 9.4745 | 9.1658 | 6.4163 | 2.9393 | 1.3718 | 0.0500 | 33.7124 |

| EPS | 2.5510 | 1.2950 | 2.4602 | 37.4209 | 5.4057 | 0.09 | 19.8741 |

| GPM | 34.1705 | 32.200 | 18.9046 | −0.6023 | 0.4641 | 3.6300 | 84.2000 |

| ITR | 7.9907 | 6.4900 | 3.3171 | 1.6577 | 0.3361 | 3.9718 | 15.7100 |

| ARCP | 81.0069 | 35.1963 | 21.0878 | 82.9970 | 8.4962 | 29.0526 | 150.9347 |

| DPO | 59.1641 | 60 | 26.8383 | 1.9355 | −0.0524 | 10 | 104 |

| FSIZE | 16.009 | 15.3774 | 1.9687 | −0.7058 | 0.6488 | 13.2046 | 19.8228 |

| LEV | 1.1722 | 0.3906 | 2.8225 | 18.0328 | 4.1928 | 0.0052 | 18.7467 |

| MTB | 2.7930 | 2.2950 | 1.8160 | 9.6643 | 2.0843 | 0.7092 | 13.0860 |

| SGROW | 10.5288 | 4.5027 | 63.1338 | 159.3817 | 11.8110 | −81.1050 | 945.1838 |

| BSIZE | 9.7769 | 9 | 2.1074 | 11.8833 | 2.0473 | 3 | 25 |

| Panel B. Frequencies statistics | Obs. | Freq (1) | % | Freq (0) | % | ||

| COVID | 390 | 156 | 40 | 234 | 60 | ||

| BIG | 390 | 285 | 73 | 105 | 27 | ||

| ROA | EPS | GPM | ITR | ARCP | DPO | FSIZE | LEV | MTB | SGROW | BSIZE | VIF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 1.0000 | 0.1946 *** | 0.0636 | 0.0984 ** | 0.0687 | 0.0709 | 0.0980 * | −0.0132 * | 0.3806 *** | 0.0376 * | 0.0542 | - |

| EPS | 0.0951 * | 1.0000 | 0.0781 | 0.1002 ** | 0.1271 ** | 0.0438 | 0.4021 *** | −0.1351 *** | −0.0940 * | 0.0596 | 0.3000 *** | - |

| GPM | 0.0009 | 0.0134 | 1.0000 | 0.0327 *** | 0.2835 *** | 0.0120 | 0.0917 * | −0.0251 * | −0.0111 | 0.0249 ** | 0.1061 ** | - |

| ITR | 0.0131 ** | 0.0818 * | 0.0327 * | 1.0000 | −0.0314 | −0.0929 * | −0.1512 *** | −0.0973 * | −0.1603 *** | 0.1100 ** | −0.0614 | 1.25 |

| ARCP | 0.0084 | 0.0307 | 0.2835 *** | −0.0314 | 1.0000 | 0.0267 | 0.3050 *** | −0.0427 | 0.0182 | −0.0249 | 0.0913 * | 1.20 |

| DPO | 0.0813 | 0.0242 | 0.0120 | −0.0929 * | 0.0267 | 1.0000 | −0.0761 | 0.2778 *** | 0.1140 ** | −0.0251 | −0.0435 | 1.13 |

| FSIZE | 0.0727 * | 0.2926 ** | 0.0917 * | −0.1512 *** | 0.3050 *** | −0.0761 | 1.0000 | −0.2196 *** | 0.0226 | −0.0130 | 0.3901 *** | 1.43 |

| LEV | −0.0194 * | −0.0934 * | −0.0251 * | −0.0973 * | −0.0427 | 0.2778 *** | −0.2196 *** | 1.0000 | 0.1701 *** | −0.0129 | −0.2637 *** | 1.23 |

| MTB | 0.3691 *** | −0.0829 | −0.0111 | −0.1603 *** | 0.0182 | 0.1140 ** | 0.0226 | 0.1701 *** | 1.0000 | 0.0003 | −0.0101 | 1.07 |

| SGROW | 0.0063 * | 0.0231 * | 0.0249 * | 0.1100 ** | −0.0249 | −0.0251 | −0.0130 | −0.0129 | 0.0003 | 1.0000 | −0.0278 | 1.02 |

| BSIZE | 0.0281 * | 0.3002 *** | 0.1061 ** | 0.061 | 0.0913 * | −0.0435 | 0.3901 *** | −0.2637 *** | −0.0101 | 0.0278 | 1.0000 | 1.34 |

| Panel A Y = ROA | Panel B Y = EPS | Panel C Y = GPM | ||||

|---|---|---|---|---|---|---|

| Coef. | t | Coef. | t | Coef. | t | |

| Constant | 3.6050 ** | 1.97 | 3.4416 * | 1.69 | 6.3031 *** | 2.69 |

| ITR | 0.3426 * | 1.66 | 0.4328 ** | 2.32 | 1.0416 ** | 2.04 |

| ARCP | 0.0000 | 1.50 | 0.0000 | 1.41 | 0.0000 ** | 1.95 |

| DPO | −0.0032 | −0.24 | −0.0012 | −033 | 0.0326 | 0.73 |

| FSIZE | 0.5395 | 1.41 | 0.2764 ** | 2.44 | 1.8386 * | 1.95 |

| LEV | −0.3800 * | −1.67 | −0.0200 * | −1.70 | −0.274 * | −1.69 |

| MTB | 0.5969 *** | 3.81 | −0.0188 | −0.40 | −0.0804 | −0.21 |

| SGROW | 0.0045 | 1.31 | 0.0002 | 0.27 | −0.0026 | −0.30 |

| BSIZE | 0.0491 | 0.30 | 0.0274 | 0.57 | 0.7936 ** | 1.98 |

| COVID | 0.1769 | 0.28 | 0.3793 ** | 2.04 | 0.7029 | 0.45 |

| BIG | 0.1652 | 1.61 | 0.1307 | 0.91 | 0.1162 | 1.15 |

| Adjusted R-sq | 8.6 | 8.1 | 12.9 | |||

| F-stat | 7.88 *** | 15.37 *** | 13.88 *** | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alnaim, M.; Kouaib, A. Inventory Turnover and Firm Profitability: A Saudi Arabian Investigation. Processes 2023, 11, 716. https://doi.org/10.3390/pr11030716

Alnaim M, Kouaib A. Inventory Turnover and Firm Profitability: A Saudi Arabian Investigation. Processes. 2023; 11(3):716. https://doi.org/10.3390/pr11030716

Chicago/Turabian StyleAlnaim, Musaab, and Amel Kouaib. 2023. "Inventory Turnover and Firm Profitability: A Saudi Arabian Investigation" Processes 11, no. 3: 716. https://doi.org/10.3390/pr11030716

APA StyleAlnaim, M., & Kouaib, A. (2023). Inventory Turnover and Firm Profitability: A Saudi Arabian Investigation. Processes, 11(3), 716. https://doi.org/10.3390/pr11030716