Abstract

The world produces more than 20 billion pairs of shoes every year, and the greenhouse gas emissions of the shoe industry account for 1.4% of the world. This research, taking the knitted footwear industry as an example, combines the concepts of mathematical programming and carbon emissions to discuss the impact of a circular economy sustainable decision-making model (including four carbon tax functions) to achieve net zero emissions under Industry 4.0 on company profits and product structure. The findings suggest that using activity-based costing to measure the attribution of various costs during process improvement allows companies to more accurately capture the carbon cost of producing each pair of shoes. In addition, under the trend of global efforts to reduce carbon emissions, if the price of carbon taxes or carbon rights is not enough to affect companies’ profits, companies will not pay attention to the impact of carbon emissions. To ensure a sustainable production model, the shoe industry should work with brand customers to reduce the effects of products on the environment, coordinate with brand customers’ sustainable development milestones, and formulate a carbon reduction path to achieve zero carbon emission growth goals. Future research can apply these research models, incorporating the carbon tax and carbon rights proposed by this paper to the other industries. In addition, the research also can be extended to explore the consumer behavior for the newly developed knitted footwear.

1. Introduction

With rapid economic development, the accompanying greenhouse effect and environmental pollution have gradually become more and more serious. The circular eonomics is a new business model. It uses resources through the “manufacture-use-recycle” approach to retain the original value of products and materials as much as possible [1,2]. Resource recycling is a crucial strategy to guide enterprises to reduce carbon while improving profitability and moving towards net zero. With the advancement of science and technology and the maturity of the global industrial chain, the commodity production capacity between brands has become stronger and stronger [3]. In terms of shoemaking, the structure of sneakers can be divided into several categories, including the tongue, upper, midsole, outsole, etc. Traditional in terms of shoe materials, many of them include artificial leather, TPU, rubber, and other ingredients. The carbon dioxide emitted during the production process is a source of pollution.

According to data released by Adidas [4], the shoe industry produces an average of 700 million tons of carbon dioxide a year, which is equivalent to the annual emissions of 80,775,444 households. The average amount of carbon dioxide a pair of running shoes produces is about 11.3 to 16.7 kg. Nowadays, environmental awareness is on the rise [2]. In order to achieve the goal of carbon reduction, the footwear industry has comprehensively reviewed the production process, including production lines, product raw materials, and finished product transportation processes, so as to reduce the carbon dioxide generated during the shoemaking process [5]. And the industry continues to supply high-quality products on the premise of reducing carbon [6]. Therefore, combined with the concepts of smart manufacturing and circular economy (CE) under Industry 4.0, changing production methods and developing environmentally friendly products are the keys to maintaining a competitive advantage in the shoe industry [5,7,8,9]. This study could be of interest to scholars and practitioners alike because it integrates two widely used management theories of ABC and the TOC to offer possible solutions to contemporary environmental challenges [10].

In the process of process improvement, using activity-based costing (ABC) to measure the attribution of various costs enables enterprises to more accurately grasp the environmental cost of producing each pair of shoes [11,12,13,14]. ABC allocates resources based on activity costs, while the TOC focuses on overcoming bottlenecks [15]. Combining them enhances efficiency, cost reduction, and resource optimization. This integration likely utilizes ABC for detailed cost insights across activities and the TOC to pinpoint and address bottlenecks, improving resource utilization. In addition, the combination of ABC and the theory of constraints (TOC) can solve long-term management costs and short-term resource constraints and effectively reduce costs [3,11,16]. ABC identifies resource-intensive activities, and the TOC targets critical bottlenecks, enabling businesses to optimize processes and allocate resources more effectively [17].

Shoemaking and textiles are both important industries in Taiwan and have complete industrial chains. How to develop and introduce innovative materials and meet the green and sustainable requirements of various brand manufacturers for energy conservation and carbon reduction are important factors in promoting a circular economy. Functional water-repellent and waterproof treatment of various types of fabrics, automatic weaving of shoe uppers, and recycling of old shoes and waste raw materials are all important issues in the circular economy. In addition, the circular economy can be applied in various industries [18,19,20].

Taking the knitted shoe industry as an example, this study extends the Tsai and Jhong [14] research and combines the concepts of carbon emissions to explore the impact of different carbon tax pricing, carbon rights trading, and other related environmental costs on company profits and product mix. In summary, our study not only advances the theory but also provides practical value by assisting businesses in sustainable operations and supporting policy making for carbon reduction goals to achieve net-zero emissions. We believe it makes a substantial contribution to both scholarly understanding and practical applications, fostering the development of more environmentally friendly and sustainable business models in the rapidly evolving green industry.

2. Literature Review

2.1. Circular Economy and Net-Zero Transformation of the Shoe Industry

In 2018, a total of 24.2 billion pairs of shoes were manufactured worldwide, of which Asia accounted for 86.2%. The production of these footwear, although the fruit of economic growth, also produces a large amount of waste, sewage, and greenhouse gases, and the labor of the shoe is also exposed to toxic substances for a long time [21]. The circular economy is a new type of economic development model [22]. The main features include “reduction”, “reuse”, and “resource utilization”, all of which are based on improving the utilization efficiency of resources and promoting recycling [6]. The technological transformation of the industry has promoted the minimization of resource consumption and waste discharge [22], to reduce environmental costs and achieve sustainable economic and social development [23]. The ultimate goal is to promote the harmonious coexistence of socioeconomic systems and natural ecosystems.

Because of the global wave of net zero emissions and the trend of the EU carbon border adjustment mechanism [2], as well as the imminent imposition of the EU carbon tax and the Taiwan carbon fee, the practice of ESG in net zero transformation is indeed critical to the international competitiveness of the footwear industry. The net-zero transformation of the footwear industry adopts low-carbon first and then pursues zero-carbon [3]. Through the three significant aspects of process improvement, energy conversion, and circular economy, and using upstream, midstream, and downstream manufacturers to conduct a carbon inventory on cloud platforms and the application of product carbon footprints, manufacturing shoe companies have the ability to master the carbon emissions of their product lines, analyze the key factors affecting carbon emissions, and make decisions that comply with energy conservation and carbon reduction regulations. These are key elements for moving towards net zero carbon emissions.

2.2. Industry 4.0 Smart Manufacturing

“Smart manufacturing” is the key to maintaining the competitiveness of Taiwan’s footwear industry at this stage. The footwear industry has introduced vital technologies such as sensing, AIoT, and extensive data analysis to push shoe manufacturing from the original automation to digital transformation and intelligent manufacturing [24,25], in response to supply chain restructuring and small and diverse production needs. In Industry 4.0, machines can be equipped with various sensors to collect more accurate resource and job-driven data, thus improving the accuracy of ABC calculations and updating cost data in real-time [8]. A manufacturing execution system (MES) can be applied to actual production control. MES can immediately feed on actual production-related parameters and resource constraints to managers, allowing managers to adjust production in real time [7].

In addition, MES can detect the actual production, quality, and machine operation in real time and allow managers to successfully achieve production planning goals [7,9]. There are many pieces of equipment that use a lot of energy in the shoemaking process [8]. Suppose that equipment can be systematically improved and managed. In that case, the factory’s energy consumption can be greatly reduced, the efficiency of the equipment itself can be improved, and the cost of carbon emissions can be reduced. In addition, Industry 4.0 automated woven shoe upper technology is the most important innovative smart manufacturing technology in the footwear industry in recent years [5]. The upper weaving technology automates the production process, which can greatly reduce labor costs, and the one-piece woven upper can reduce the waste generated by tailoring [9]. The appearance, weaving texture, and yarn mix and match of the woven upper can be designed through computer software and then handed over to the knitting machine to make a one-piece seamless woven upper. Finally, the upper is attached to the sole to complete a pair of shoes.

The work of Stock and Seliger [26] offers an analysis of sustainable manufacturing from both broad and focused perspectives within the context of Industry 4.0. Their findings suggest that the technologies of Industry 4.0 are instrumental in fostering sustainability across its three primary dimensions. Several new prospects are emerging, such as business models based on intelligent data utilization, the development of closed-loop supply chain networks, the digital transformation of small and medium-sized enterprises (SMEs), enhancing the skills of workers in the realm of information and communication technologies (ICT), design strategies for sustainable products, and the decentralization of manufacturing processes.

Kamble, Gunasekaran, and Gawankar [27] have proposed a framework that integrates the principles of Industry 4.0 with sustainable practices, highlighting how these technologies can boost resource efficiency and overall productivity. Bag and Pretorius [28] have explored the ways in which the fusion of sustainable manufacturing practices with Industry 4.0 can lead to improvements in energy usage, waste reduction, and resource optimization. Their discussion is anchored in a conceptual framework that elucidates the interplay between Industry 4.0 and sustainable manufacturing. Additionally, Machado et al. [29] conducted a systematic literature review to identify emerging research trends within sustainable manufacturing and Industry 4.0, focusing particularly on supply chain dynamics and human–machine interactions, thereby identifying potential areas for future research.

2.3. Carbon Emission Cost Calculation and Allocation Basis

In recent years, due to environmental concerns, there has been an increased application and exploration of new green manufacturing technologies to improve operation technology [30]. The issue of global warming has garnered increasing attention, leading economists and international organizations to advocate for the introduction of carbon taxes as a cost-effective method to reduce greenhouse gas (GHG) emissions [31]. Furthermore, the implementation of carbon duty guidelines is believed to not only promote the growth and application of renewable power sources, but also assist in the development of the global economy [32]. This shift marks a significant change in addressing environmental challenges, emphasizing the integration of sustainability into economic and industrial practices. The carbon emission cost includes the cost of a carbon tax levied by the government and the cost of carbon rights generated by carbon trading [33]. Under the cap-and-trade system, a company’s carbon cap may be subject to the government’s emission allowances. And carbon trading is an effective way to solve the government’s limit on carbon emissions and helps companies buy carbon rights in the market to increase the amount of carbon emissions [1]. Carbon reduction is an important measure to reduce the greenhouse effect and global warming, and improving equipment efficiency and saving energy use are the most significant ways to reduce carbon emissions [16]. Internal Carbon Pricing (ICP) means that companies internalize the “external cost” of emitting greenhouse gases, set a carbon emission price within the company, and actually charge carbon emission fees to the relevant units of carbon emission [6]. In addition, the water-based PU adhesive does not contain volatile organic solvents, has no irritating odor, and will not affect human health and pollute the environment. In addition to being of great help for the working environment and air quality of the shoe factory workshop, it can also relatively improve employees’ work stability [23]. The product itself is a high solid content ingredient, so the amount of glue used can be reduced, and the water-based glue is non-flammable and safe, the cost and risk of transportation and storage are relatively reduced, and the overall cost-effectiveness is also improved [34].

3. Research Methods

This study uses ABC to estimate costs associated with shoemaking because ABC can help producers to allocate manufacturing overhead and related costs to products more accurately and to identify non-value-added costs [35]. Furthermore, using ABC and the theory of constraints allows producers to achieve the optimal product mix and effectively increase profits [3,36]. ABC is an essential theory in management accounting [11,37]. It was developed to allocate manufacturing expenses to more accurately estimate the manufacturing cost of products [35]. In the process of cost allocation, each product or service will be dismantled for the most basic operation activities of the year. Then, a reasonable cost will be calculated using accurate cost traceability and cost allocation methods [38]. Using the spirit of activity-based costing for production management and decision making is the so-called “job-based management” [3,12].

The theory of constraints is used to identify bottlenecks and then consider lifting these constraints. Kee [39] discusses the product mix when resources are elastic, that is, materials enjoy quantity discounts, and labor production capacity can be achieved through overtime or by renting equipment to cope with an insufficient production capacity. Gong and Hu [40] developed a product portfolio elasticity model, which considered artificial elasticity and machine elasticity. This model can help decision makers optimally configure product portfolios in uncertain environments [40].

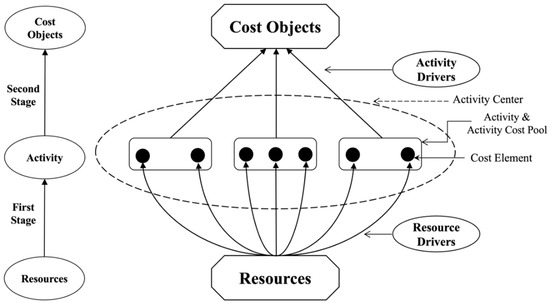

ABC uses a two-stage cost assignment method to calculate the accurate cost of cost objects as shown in Figure 1. In the first stage, the resource costs are assigned to activities by using resource drives, and then, the activity costs are assigned to cost objects such as parts, products, channels, selling areas, and so on. In this research, the costs of machine, personnel, buildings, and other manufacturing/selling resources are assigned to various activities and then assigned to products. ABC has been applied to manufacturing [41] and the service industry [42].

Figure 1.

ABC two-stage model.

Goldratt proposed the theory of constraints (TOC) to improve bottlenecks and increase profits gradually [43]. A considerable amount of research uses the theory of job-based costs and constraints for production decisions [11]. Contamination problems caused by shoe manufacturing can be improved through redesign of the footwear. Under TOC, when the “carbon emission allowance” is the main limitation in the shoe-making process, using the limitation theory to review the carbon emission allowance on a rolling basis and using the operation-based costing system to apportion the carbon emission cost generated in the process can more effectively inspect the production process carbon reduction effect and the product portfolio decision.

With the rise in consumers’ environmental awareness, environmentally friendly products can increase customers’ willingness to buy. Therefore, by redesigning shoes, such as using renewable resources, knitted fabrics as the upper layer of running shoes, or improvements in manufacturing processes, companies can reduce costs while complying with government regulations to achieve environmental protection.

This article uses mathematical programming methods to establish an analytical model based on the company’s production and sales. It considers factors including the carbon tax and carbon rights purchase [36], as well as various production and sales constrictions, to find the product mix that maximizes corporate profits.

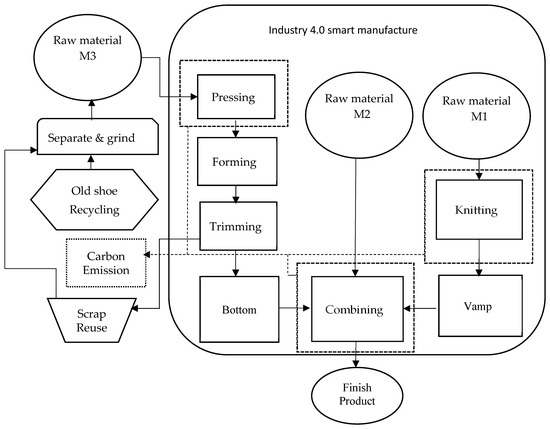

Taking the knitted shoe industry as an example, this study extends the research of Tsai and Jhong [14]. It combines the concepts of carbon emissions to explore the impact of different carbon tax pricing, carbon rights trading, and other related environmental costs on company profits and product mixes. A pair of knitted shoes can consist of an upper layer (vamp) and a lower layer (bottom). Due to the integration of textile and shoemaking technologies under Industry 4.0, the upper layer of knitted shoes has become a knitted layer formed by knitting a whole piece, which greatly simplifies the manufacturing process of knitted shoes and reduces the demand for manpower, thus reducing the cost of production [3]. The production process of knitted shoes in this paper is shown in Figure 2.

Figure 2.

Shoes production flow chart.

3.1. Objective Function

Maximum profit (π) is the general formula of the objective function of the four models. The complete objective function of the four models will be listed below.

- (1)

- Carbon tax cost function of continuous incremental tax rate with tax exemption (no carbon rights trading)—Model 1

Function (1) is the objective function for maximizing profit, and its related constraint formulas are Functions (7)–(15), (24), (30)–(45).

- (2)

- Carbon tax cost function of continuous incremental tax rate with tax exemption (with carbon rights trading)-Model 2

Function (2) is the objective function of profit maximization, and its related constraint formulas are Functions (7)–(15), (25)–(28), (30)–(45).

- (3)

- Carbon tax cost function of discontinuous full progressive tax rate with tax exemption (no carbon rights trading)—Model 3

Function (3) is the objective function of profit maximization, and its related constraint formulas are Functions (17)–(23), (24), (30)–(45).

- (4)

- Carbon tax cost function of discontinuous full progressive tax rate with tax exemption (with carbon rights trading)—Model 4

Function (4) is the objective function for maximizing profit, and its related constraint formulas are Functions (17)–(23), (25)–(28), (30)–(45).

3.2. Carbon Emission Cost

Carbon emissions include the cost of carbon taxes levied by the government and the cost of carbon rights generated by carbon trading [33]. Under the cap-and-trade system (cap-and-trade system), the government’s emission allowance may restrict the company’s carbon emission cap [44]. And carbon trading is an effective way to solve the government’s carbon emission constraints and help companies purchase carbon rights (Carbon Rights) in the market to increase the number of carbon emissions in the future. The continuous and discontinuous types of carbon tax are based on the following assumptions: (1) the “continuous incremental tax rate” is based on the excess part of the taxable income as the basis for progression. When the taxable income exceeds each bracket, the excess tax rate will be calculated separately. Some tax rates are applicable to the corresponding brackets; (2) the “discontinuous full progressive tax rate” is based on the full amount of taxable income. When the taxable income exceeds a certain level, the tax rate of the corresponding bracket is applied in full. Regarding carbon rights trading, countries such as those in the European Union and New Zealand have implemented a total domestic carbon emission control (Cap and Trade), regulate large carbon emitters in various industries, and set upper limits on their carbon emissions. Therefore, for enterprises, (1) there is an upper limit on the amount of carbon emissions of enterprises, and they cannot emit unlimited carbon; (2) if the enterprise strives to reduce carbon emissions and keeps carbon emissions below the upper limit, it will have excess “carbon rights” to sell it to obtain additional profits; (3) if a company’s carbon emissions exceed the upper limit, it needs to purchase the excess carbon rights of others to achieve its carbon reduction goals. Based on the above reasons, we set whether there is carbon rights trading to observe the final profit of the company. This article analyzes the impact of carbon emission costs on company profits through four models, and these four models are composed of two carbon tax cost equations and the presence or absence of carbon rights exchanges.

3.2.1. Carbon Emission Function

The raw materials and shoe-making process have a great relationship with the carbon emissions of shoe manufacturers and their products. The model in this article considers the impact of carbon emissions on the profits of knitted shoe manufacturers in the shoe-making process, and the government can collect carbon taxes to force related industries to focus on reducing carbon emissions and environmental protection [14,33,45]. Therefore, the model proposed in this paper can be used to evaluate the carbon emissions generated when making shoes. In the production process of knitted shoes, we assume that carbon emissions are generated by three processes, namely knitting (m = 1), pressurizing (m = 2), and combination (m = 5), and the manufacturer only produces three knitted shoes; the total carbon emission (q) can be expressed as Equation (5):

Among them, Xi is the production quantity of the i-th knitted shoe, CEim is the unit carbon emission of the i-th product in the m process, and Equation (5) is the total carbon emission of the knitted shoe manufacturer.

3.2.2. Carbon Tax Function

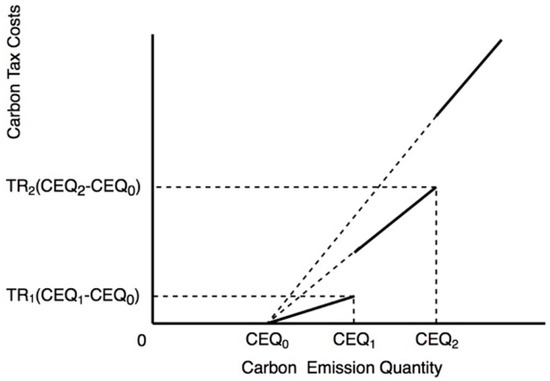

There are four carbon tax functions in this article: the carbon tax cost function of the continuous incremental tax rate, the carbon tax cost function of the continuous incremental tax rate with tax exemption, the carbon tax cost function of the discontinuous full incremental tax rate, and the carbon tax cost function of the discontinuous full progressive tax rate with tax exemption, as shown in Figure 3 and Figure 4.

Figure 3.

Carbon tax cost function of continuous incremental tax rate with tax exemption.

Figure 4.

Carbon tax cost function of discontinuous full progressive tax rate with tax exemption.

- (1)

- Carbon tax cost function of continuous incremental tax rate with tax exemption

Figure 3 is a carbon tax cost function using a continuous incremental tax rate with tax exemptions. This function takes into account the carbon emissions granted by the government that are not taxed. Therefore, the carbon emissions of enterprises are not subject to this carbon emission limit. After exceeding the tax-free carbon emissions granted by the government, different amounts of carbon emissions correspond to different carbon tax rates. In Figure 4, CEQ0 is the total amount of tax-free carbon emissions granted by the government. The upper limits of the first and second stages of carbon emissions are CEQ1 and CEQ2. Therefore, the carbon tax cost function in Figure 4 can be expressed as Function (6):

Functions (7)–(15) are constraint related to the cost of the carbon tax.

where

| CEim | is the carbon emission per unit of the m process for the i-th product (m = 1, 2, 5). |

| CT | is the corporate carbon tax costs. |

| CEQ0 | is the total amount of tax-free carbon emissions granted by the government. |

| CEQ3 | Since the third carbon tax system set by the government has no upper limit, a large amount of carbon emissions, if CEQ3 is not defined, in the mathematical programming model cannot be implemented. |

| CT3 | is the cost of a carbon tax at this point in CEQ3 |

| TRi | is carbon tax rate that the carbon emission falls on the i-segment. |

| are dummy variables (0,1), and only one of the three can be 1. | |

| are a non-negative variable, and at most, two adjacent variables are not 0. |

are dummy variables (0,1) and only one of the three can be 1. If is 1, then and in Function (13) are 0, and in Function (11) and Function (10) are all 0, in Function (9) and Function (8), and in Function (12).

- (2)

- Carbon tax cost function of discontinuous full progressive tax rate with tax exemption

Figure 4 is a carbon tax cost function using a discontinuous full progressive tax rate. It is assumed that the carbon tax cost function is composed of three discontinuous piecewise functions, and the three segments use different progressive tax rates. In addition, this function takes into account the carbon emissions granted by the government that are not taxable. Therefore, the company’s carbon emissions are not taxed within this carbon emission limit, and after exceeding the tax-free carbon emissions granted by the government, different carbon emissions are taxed. In Figure 4, CEQ0 is the total tax-free carbon emissions granted by the government. The upper limits of the first and second paragraphs of carbon emissions are CEQ1 and CEQ2, respectively, and in the first, second, and third paragraphs, the carbon tax rates function in Figure 5 can be expressed as Function (16):

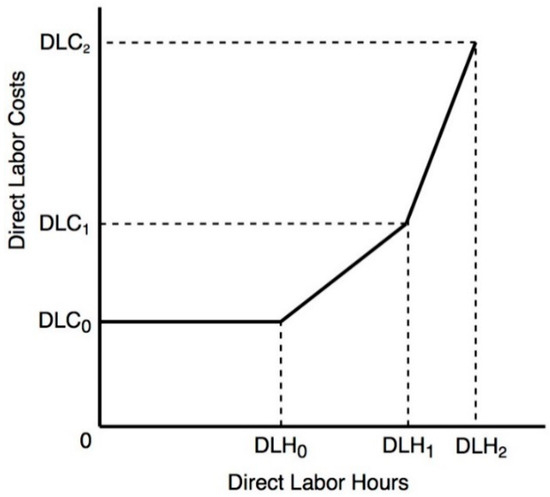

Figure 5.

Direct labor cost equation.

Functions (17)–(23) are constraint related to the cost of the carbon tax.

where:

| is the total amount of tax-free carbon emissions granted by the government. | |

| is the total carbon emissions falling in the i-th paragraph carbon emissions (i = 0, 1, 2, 3). | |

| CEim | is the unit carbon emissions of the i-th product in one of the m processes (m = 1, 2, 5). |

| TRi | is the carbon tax rate based on the carbon emissions falling on the i-th segment. |

| are dummy variables (0,1), and only one of the four can be 1. |

are dummy variables (0,1) and only one of the four can be 1. If is 1, then in Function (22) are 0. Therefore, Function (19) shows that the company’s total carbon emissions fall on (CEQ0, ), and the cost of the carbon tax shows that the cost is .

3.2.3. Carbon Rights Trading Function

Models 1 and 3 do not have carbon rights trading, and Models 2 and 4 add carbon rights trading. Therefore, in addition to the cost of the carbon tax, the cost or benefit of carbon rights needs to be considered. The following are the carbon tax costs used by each model and whether there is carbon trading:

- (1)

- Carbon tax cost function of continuous incremental tax rate with tax exemption (no carbon rights trading)-Model 1;

- (2)

- Carbon tax cost function of continuous incremental tax rate with tax exemption (with carbon rights trading)-Model 2;

- (3)

- Carbon tax cost function of discontinuous full progressive tax rate with tax exemption (no carbon rights trading)—Model 3;

- (4)

- Carbon tax cost function of discontinuous full progressive tax rate with tax exemption (with carbon rights trading)-Model 4.

Models 1 and 3 only need to consider the cost of the carbon tax, so their carbon emissions must not exceed the allowable upper limit set by the government, and this upper limit can be expressed by Function (24).

where

| is the quantity of the i-th product (i = 1, 2, 3). | |

| CEim | is the carbon emissions per unit of the m process for the i-th product (m = 1, 2, 5). |

| is the allowable upper limit of carbon emissions stipulated by the government. |

Models 2 and 4 also take into account the purchase cost or sale income of carbon rights trading in addition to the cost of the carbon tax. This article assumes that the company buys or sells carbon rights at a single carbon rights price (α). Carbon rights trading can be expressed by Function (25). MPCEQ is the upper limit of carbon emissions after purchasing carbon rights, and LPCEQ is the upper limit of carbon rights that can be purchased.

The complete carbon emission function includes a carbon tax function and a carbon trading function. The complete carbon emission function of Models 2 and 4 related constraint Formulas (26)–(29) are listed below:

- Model 2—Carbon tax cost function of continuous incremental tax rate with tax exemption (with carbon rights trading)

When is 1, the Function (29) knows that is 0, and Function (27) shows that the company’s total carbon emission q will fall at (0, MCEQ), which means that the company does not need to buy carbon rights and can also sell carbon rights. The carbon emission cost at this time is .

- Model 4—Carbon tax cost function of discontinuous full progressive tax rate with tax exemption (with carbon rights trading)

When is 1, Function (29) shows that is 0, and Function (27) shows that the company’s total carbon emission q will fall at (0, MCEQ), which means that the company does not need to buy carbon rights and can also sell carbon rights. The carbon emission cost at this time is .

3.3. Direct Labor Cost Function

The direct labor used in making knitted shoes includes normal working hours and overtime working hours. These hours are used to trim the lower layer and the combination of knitted shoes. In the short term, the cost of normal working hours is fixed, and workers must be paid regardless of whether there is a production demand. However, if there are urgent orders or orders that cannot be completed on schedule, it will result in overtime and increase direct labor costs.

In the production process of knitted shoes, because many processes that require manpower can be achieved through knitting machines, a large number of direct labor hours and direct labor costs are reduced. This article assumes that the processes that require manpower are pruning (m = 4) and combination (m = 5). The total direct labor cost equation is a continuous piecewise linear function, as shown in Figure 5.

The direct labor cost function constraint formula in Figure 5 can be expressed by Functions (30)–(37) in the mathematical programming model.

Direct labor cost function:

Relevant constraints:

| is the quantity of the i-th product (i = 1, 2, 3). | |

| are non-negative variable, and at most two adjacent variables are not 0. | |

| are dummy variables (0,1), and only one of them can be 1. | |

| is the number of man-hours required to complete a unit of i-th product in the pruning (m = 4) activity. | |

| is the highest number of man-hours falling in the first period of overtime, as shown in Figure 5. | |

| is the highest number of man-hours falling in the second period of overtime, as shown in Figure 5. |

If is 1, then in Equation (35) is 0, in Equation (33) is 0, and in Equations (31) and (32) fall on [0, 1] and the sum is 1.

3.4. Capacity Per Machine Hour

It is assumed that there are three kinds of automated equipment in the manufacturing process of knitted shoes in this study, which can replace traditional manual labor to improve work efficiency. The relevant constraint formulas for machine hours are given in Equations (38)–(40):

where

| Xi | is the quantity of the i-th product (i = 1, 2, 3). |

| is I machine hours required for the knitting machine to complete one unit of the i-th product. |

3.5. Setting and Material Handling Cost Function

This study assumes that there are three batch-level operations in the process of manufacturing knitted shoes: forming the lower sole (m = 3), setting (m = 6) to produce different uppers and soles, and material handling (m = 7). The total cost of batch-level operations must be deducted from the profit function, and the related constraint equations are (41) and (42).

The total cost of batch-level operations:

Relevant constraints:

Equation (41) is the limit on the number of products, and the quantity of each product cannot exceed the quantity produced in each batch. Equation (42) is the resource constraint formula for each batch of level jobs.

3.6. Product Level Activity–Product Design Cost Function

Assuming that there are three styles of knitted shoes produced by a knitted shoe company, namely walking shoes (product 1), jogging shoes (product 2), and high-top shoes (product 3), this article assumes that the product design cost of each footwear is the product. For hierarchical operations, the total cost of product-level operations must be deducted from the profit function, and the relevant constraint equation is (43) and (44).

Total cost of product-level activities:

Relevant constraints:

where

| is the quantity of the i-th product (i = 1, 2, 3). | |

| is the market demand for the i-th product. | |

| is a dummy variable (0,1), which determines whether the i-th product is produced. If is 1, the product is produced. If 0, it means there is no production. | |

| is the resources consumed by the product-level operations of the i-th product (i = 1, 2, 3). | |

| is the upper limit of available resources for product-level operations. |

3.7. Material Cost Function

This article assumes that the knitted shoe company mainly uses three kinds of raw materials in the process of producing knitted shoes, which are the thread used for knitting (m = 1), the polyurethane (PU) used for pressure (m = 2), and the combination (m = 5) that the glue used. The direct raw material cost must be deducted from the profit function, and its related constraint equation is (45).

Direct raw material cost function:

Relevant constraints:

where

| is the quantity of the i-th product (i = 1, 2, 3). | |

| is one unit of raw material cost (j = 1, 2, 3). | |

| is the number of raw materials consumed to complete a unit of product i (i = 1, 2, 3, j = 1, 2, 3). | |

| is the upper limit of the number of available raw materials for the j-th type. |

4. Research Results and Analysis

4.1. Assumption of Model Parameter Data

Taking the knitted shoe industry as an example, this study extends the research of Tsai and Jhong [14] and combines the concepts of carbon emissions to explore the impact of different carbon tax pricing, carbon rights trading, and other related environmental costs on company profits and product mixes. Regarding the data used in this research, some are real, and some are assumed based on the understanding of the industry due to the data confidentiality. Although the case company cannot provide all real data, the cost estimates used in the model, such as shoe sales, labor costs, overtime pay calculations, etc., are all based on the real data in Taiwan. In addition, the mathematical programming models are used to analyze whether the carbon tax and carbon right costs will greatly increase the production costs.

Assuming that the prices of product 1, product 2, and product 3 in this article are TWD 1705, TWD 1974, and TWD 2178, respectively, and the three-stage wage rates WR0, WR1, and WR2 of direct labor costs are, respectively, TWD 133, TWD 177, TWD 221 per hour. The three-stage carbon tax rates TR1, TR2, and TR3 are TWD 0.9, TWD 1.16, and TWD 1.417 per kilogram, respectively. Table 1 gives the basic example parameters, Table 2 gives the single-phase model, substituting the demonstration parameters into the four model target equations and the carbon emission restriction formula, and Table 3 gives the common restriction formula of each model in a single period model for demonstration.

Table 1.

Basic example parameters.

Table 2.

Labor cost data.

Table 3.

Carbon emission cost data.

4.2. Model Analysis

The model proposed in this study combines activity-based costing, constraint theory, and the concept of carbon emission cost and maximizes profits under the constraints of various resources. This paper uses the basic example parameters in Table 2 and analyzes the model results with the LINGO software. The optimal solutions of each model in Table 4 can be used to explore the impact of different models on profits and whether to purchase carbon rights. The following description is only for the single-phase model.

Table 4.

The optimal solution of the single-phase Model 1 to Model 4.

4.2.1. Model Description

- (1)

- Carbon tax cost function of continuous incremental tax rate with tax-exempt quota (without carbon trading)—Model 1

The optimal solution of the single-phase Model 1 is shown in Table 4, and it is concluded that the total revenue is TWD 152,326,482, the revenue of each product is TWD 59,364,690, TWD 28,532,196, and TWD 64,429,596. The production quantities of each product are 34,818 pairs, 14,454 pairs, and 29,582 pairs, with a total profit of TWD 45,730,174. The total direct labor cost is TWD 15,960,000, of which the normal working hours are 119,999.2 h, and there are no overtime hours. The total batch-level operation cost was TWD 16,426,915, of which the molding operation cost was TWD 1,208,990 (120,899 machine hours in total), the setup operation cost was TWD 3,154,160 (78,854 setup hours in total), and the handling operation cost was TWD 1,208,990 (a total of 120,899 machine hours). TWD 1,182,855 (78,857 handling hours in total). The cost of the carbon tax is TWD 134,999, and a total of 249,999 kg of carbon dioxide are emitted, of which the emissions of each product are 61,629 kg, 47,264 kg, and 141,106 kg, respectively.

- (2)

- Carbon tax cost function of continuous incremental tax rate with tax-exempt quota (with carbon rights trading)—Model 2

The optimal solution of single-phase Model 2 is shown in Table 4, and it is concluded that the total revenue is TWD 160,213,500, the revenue of each product is TWD 45,523,500, TWD 49,350,000, and TWD 65,340,000, and the production quantities of each product are 26,700 pairs, 25,000 pairs, and 30,000 pairs, with a total profit of TWD 49,923,842. The total direct labor cost was TWD 18,030,900, including 120,000 normal hours and 11,700 overtime hours. The total batch-level operation cost was TWD 16,583,580, of which the molding operation cost was TWD 1,209,000 (120,900 machine hours), the setup operation cost was TWD 3,268,080 (81,702 setup hours), and the handling operation cost was TWD 1,225,500 (81,700 handling hours in total). The cost of the carbon tax is TWD 160,646, and the cost of carbon rights is TWD 16,140. A total of 272,109 kg of carbon dioxide are emitted, of which the emissions of each product are 47,259 kg, 81,750 kg, and 143,100 kg, respectively.

- (3)

- Carbon tax cost function of discontinuous full progressive tax rate with tax-exempt quota (without carbon rights trading)—Model 3

The optimal solution of single-phase Model 3 is shown in Table 4, and the total revenue is TWD 152,326,482, the revenue of each product is TWD 59,364,690, TWD 28,532,196, and TWD 64,429,596, and the production quantities of each product are 34,818 pairs, 14,454 pairs, and 29,582 pairs, with a total profit of TWD 45,730,174. The total direct labor cost is TWD 15,960,000, of which the normal working hours are 119,999.2 h, and there are no overtime hours. The total batch-level operation cost was TWD 16,426,915, of which the molding operation cost was TWD 1,208,990 (120,899 machine hours in total), the setup operation cost was TWD 3,154,160 (78,854 setup hours in total), and the handling operation cost was TWD 1,208,990 (a total of 120,899 machine hours). The cost of the carbon tax is TWD 134,999, and a total of 249,999 kg of carbon dioxide are emitted, of which the emissions of each product are 61,629 kg, 47,264 kg, and 141,106 kg, respectively.

- (4)

- Carbon tax cost function of discontinuous full progressive tax rate with tax-exempt quota (with carbon rights trading)—Model 4

The optimal solution of single-period Model 4 is shown in Table 4, and the total revenue is TWD 160,213,500, the revenue of each product is TWD 45,523,500, TWD 49,350,000, and TWD 65,340,000, and the production quantities of each product are 26,700 pairs, 25,000 pairs, and 30,000 pairs, with a total profit of TWD 49,884,842. The total direct labor cost was TWD 18,030,900, including 120,000 normal hours and 11,700 overtime hours. The total batch-level operation cost was TWD 16,583,580, of which the molding operation cost was TWD 1,209,000 (120,900 machine hours), the setup operation cost was TWD 3,268,080 (81,702 setup hours), and the handling operation cost was TWD 1,225,500 (81,700 handling hours in total). The carbon tax cost is TWD 199,646, and the cost of carbon rights is TWD 16,140. A total of 272,109 kg of carbon dioxide are emitted, of which the emissions of each product are 47,259 kg, 81,750 kg, and 143,100 kg, respectively.

4.2.2. Model Comparison

This section discusses the comparison between single-period models individually, and the results can be seen in Table 4. From the comparison of single-phase models in Table 4, it is better to meet market demand in the models without carbon rights trading (Models 1 and 3) than in models with carbon rights trading (Models 2 and 4). Under certain conditions, more third products (X3) will be produced. Since the carbon-free trading model must comply with the carbon emission cap set by the government, companies will choose between the carbon tax, carbon emission cap, and profit. In addition, the continuous carbon tax (Model 2) in the single-period carbon rights trading model has higher earnings than the discontinuous carbon tax (Model 4). Still, the carbon emissions produced are the same, and the number of goods delivered is the same. It is also the same. It can be seen that the cost structure of carbon tax has little impact on corporate decision-making. Therefore, in the process of maximizing profits, the government can use the continuous carbon tax cost model to help companies. At the same time, it can also restrict corporate carbon emissions.

4.3. Sensitivity Analysis

In order to explore the future government policies of various carbon taxes and carbon rights, this study conducts the sensitivity analysis from two aspects, namely, the adjustment of carbon tax prices and the reduction of the carbon emission cap stipulated by the government. The first is to gradually increase the price of the carbon tax and see how its profits change. The second aspect is to reduce the total carbon emissions that companies can emit year by year and explore changes in their corporate profits, and the results are shown in Table 5 and Table 6.

Table 5.

Impact of carbon tax changes on the total profit of Model 1–Model 4.

Table 6.

Impact of carbon emission cap changes on the total profit of Model 1–Model4.

From the results in Table 5 to Table 6, it is evident that in the face of changes in the carbon tax and reduction of carbon emission caps, the increase in carbon tax has a limited influence on the production decision making of enterprises. Specifically, Table 5 shows that the increase in carbon tax rates has a relatively small impact on corporate profits. For example, in Model 1, when the carbon tax rate increases by 5%, profit decreases only by 0.0148%; even at a 25% increase, the decrease in profit remains the same at 0.0148%. Model 2 shows a similar trend, with profit changes due to tax rate increases staying within 0.02%. Models 3 and 4 also indicate similar patterns.

On the other hand, Table 6 reveals that when the government reduces the upper limit of carbon emissions, this policy has a more significant impact on the profit of the enterprise. In Model 1, a 5% reduction in the limit leads to a 6.8% decrease in profits, and a 10% reduction results in a 7.96% decrease. This pattern indicates that the larger the reduction in limits, the more significant the impact on profits. Model 2’s results reflect a similar pattern: a reduction in limits by 5% leads to a minor decrease in profits (0.02%), but a 15% reduction results in a 9.41% decrease in profits. Models 3 and 4’s results are highly consistent with those of Model 1. This analysis highlights the differing impacts of increasing carbon tax rates and reducing carbon emission caps on corporate profits, suggesting that the latter has a more profound effect on enterprise decision making.

From the results in Table 5 to Table 6, it can be seen that in the face of changes in the carbon tax and reduction of carbon emission caps, it is difficult for the increase in carbon tax to have an influence on the production decision making of enterprises. On the other hand, when the government reduces the upper limit of carbon emissions, it can be seen from the results that this policy has a greater impact on the profit of the enterprise.

5. Discussion

This paper considers four models involving the carbon tax rate and carbon rights: (1) a continuous incremental tax rate or a discontinuous full progressive tax rate, (2) without or with carbon rights trading. All four models have an amount of tax exemption. However, Tsai and Jhong [14] considered the model with a discontinuous full progressive tax rate and without tax exemption, which is different to the models discussed in this paper.

The four models presented in this paper use ABC to calculate the product costs. ABC calculates the accurate product costs by using the two-stage cost assignment model as shown in Figure 1. On the other hand, the theory of constraints (TOC) is used to form the constraints of mathematical programing models. The constraints in the decision models will be various constraints concerning machine hours, employee work hours, and other resources.

This study explores the existing research on sustainable development and circular economy principles in the footwear industry. This research focuses on mathematical models concerning carbon emissions and carbon right purchasing, differing from previous studies that primarily concentrated on general sustainability indicators or waste reduction. Additionally, this study employs activity-based cost accounting and constraint theory modeling, offering more detailed, operationally oriented manufacturing decision-making approaches. In the context of Industry 4.0, we apply technologies such as automation, the Internet of Things, and data analytics to the challenge of reducing carbon emissions. Regarding policy insights, this paper builds on research in footwear industry environmental regulations, exploring carbon tax and emission cap policies. Overall, this study contributes new carbon accounting models, optimized production methods, and policy insights to the field of sustainable development in the footwear industry.

This study provides practical recommendations for footwear manufacturers and policymakers to achieve sustainable production and reduce emissions. For manufacturers, suggestions include adopting automation technologies such as automatic weaving machines to improve efficiency and reduce waste, applying mathematical models to optimize product portfolios and profits under different carbon pricing schemes, conducting carbon footprint assessments to identify reduction hotspots, collaborating with suppliers to develop sustainable materials like bio-based polyurethane, and setting carbon reduction targets and pathways with brand partners. For policymakers, recommendations include implementing progressively stricter carbon taxes, collaborating with manufacturers to develop industry-specific carbon reduction roadmaps, supporting the development of circular economy practices, offering incentives for the adoption of clean technologies, and promoting energy audits and environmental management certifications. These measures aim to steer the footwear industry towards more eco-friendly and sustainable practices.

In this study, Taiwan is chosen as the research object of carbon tax policy as Taiwan is likely to implement such a policy in the coming years. This choice is pertinent since Taiwan’s significant knitted footwear industry aligns with our case study, and being based in Taiwan, we have a deeper insight into local policies. Taiwan’s situation also represents other regions when considering carbon pricing, and its unique policy environment and industrial structure provide valuable insights for our research.

The theoretical contributions of this study include integrating activity-based costing, theory of constraints, and carbon emission costs to enhance sustainable decision-making analysis. We developed a mathematical model considering carbon taxes and trading, offering a framework for future research. The study provides practical insights for footwear companies in achieving net-zero emissions and assists policymakers in comparing various carbon policies. Recognizing some simplifications in our model, future work could focus on more realistic models and extend the research to other industries. We also aim to validate our model with more data and consider comparative studies across different regions.

6. Conclusions and Recommendations

Traditional manufacturing industries have faced environmental regulations, a lack of labor, and shortened production times in recent years. Environmental issues have brought a lot of discussion all over the world. To reduce carbon emissions and ensure environmental sustainability, countries are gradually improving their production, using renewable energy, recycling and reusing waste, and various methods that can protect the environment we live in. In order to maintain a competitive advantage, many companies are transforming to Industry 4.0 and building smart factories to meet various challenges [24]. The production of knitted shoes reduces waste generation and environmental pollution [46] and reduces the demand for labor. Sports shoes with knitted uppers have proven popular with consumers—especially because of the comfort they provide. The knitted upper has a fit similar to that of a sock, but it also provides a high level of support for the foot. In addition, the knitted fabric structure is highly breathable and allows for extremely lightweight shoes. Traditional sports shoes typically include an upper made of multiple components and are manufactured using labor-intensive processes. In contrast, knitted uppers typically consist of single pieces of fabric joined by a single seam. As a result, shoes with knitted uppers are faster, easier, and cheaper to manufacture and require significantly less labor. In addition, the use of knitted uppers significantly reduces waste compared to traditional cut and sewn uppers. Knitted fabrics are also used in the form of spacer fabrics to make the linings of athletic shoes. Spacer fabrics facilitate a high degree of ventilation, and therefore, insoles made of this fabric are considered very comfortable.

Taking the knitted shoe industry as an example, this study combines the concepts of activity-based costing, restriction theory, and carbon emissions to explore the impact of the carbon tax and rights on company profits and product mixes. The mathematical programming model of activity-based costing combined with constraint theory can effectively control costs and increase profits [14], and the model in this paper considers the allocation of long-term resources and the increase in short-term labor hours. Among the models without carbon rights trading in this paper, the models with continuous progressive tax rates are more profitable than the modthoseon-continuous progressive tax rates. From the perspective of companies, the government’s constant progressive tax rate imposes a lower carbon tax burden on companies. For the government, adopting a continuous progressive tax rate in the early stage of implementing the carbon tax system has a milder impact on enterprises. In addition, affected by the government’s carbon cap, the company’s production capacity cannot be fully utilized, but by purchasing carbon rights, the company can achieve higher profits.

This study found that under the trend of global efforts to reduce carbon emissions, to effectively reduce carbon emissions, the reduction of the carbon emissions cap set by the government is more effective than increasing the carbon tax rate. Because the cost of a carbon tax or carbon rights is not enough to affect the profits of enterprises, enterprises will not pay attention to the impact of carbon emissions. Therefore, if the government wants to control carbon emissions quickly, it can formulate relevant policies for carbon emission caps. In addition, Industry 4.0 has gradually brought together information on people, machines, materials, and materials, but this is only limited to the data collection of manufacturers. If logistics, warehousing, retail, and even the recycling and reuse of products after use are added, it may be accurate. To ensure a sustainable production model, the shoe industry should work with brand customers to reduce the effects of products on the environment, coordinate with brand customers’ sustainable development milestones, and formulate a carbon reduction path to achieve zero carbon emission growth goals. This research involves issues related to carbon rights and carbon tax. With the global emphasis on net-zero carbon emissions, the models presented in this paper will help companies to analyze the effect on profit of the carbon tax and carbon rights. In addition, the shoe industry can work with brand customers for sustainable production to meet the consumer expectations and government environmental restrictions.

Author Contributions

Conceptualization, C.-L.H. and W.-H.T.; Methodology, C.-L.H.; Investigation, C.-L.H.; Writing—original draft, C.-L.H.; Writing—review & editing, W.-H.T.; Supervision, W.-H.T.; Funding acquisition, C.-L.H. and W.-H.T. All authors have read and agreed to the published version of the manuscript.

Funding

The authors would like to thank the National Science and Technology Council of Taiwan for financially supporting this research under Grant No. MOST111-2410-H-008-021, MOST112-2410-H-008-061, and NSTC 112-2410-H-025-046.

Data Availability Statement

The author confirms that the data supporting the findings of this study are available within the article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bonsu, N.O. Towards a circular and low-carbon economy: Insights from the transitioning to electric vehicles and net zero economy. J. Clean. Prod. 2020, 256, 120659. [Google Scholar] [CrossRef]

- Hailemariam, A.; Erdiaw Kwasie, M.O. Towards a circular economy: Implications for emission reduction and environmental sustainability. Bus. Strategy Environ. 2023, 32, 1951–1965. [Google Scholar] [CrossRef]

- Hansen, D.R.; Mowen, M.M.; Heitger, D.L. Cost management. Cengage Learning, 5th ed.; Cengage: Boston, MA, USA, 2021. [Google Scholar]

- Patras, V. Sustainability in the Shoe Market: Adidas on a Move to Sustainability. 2021. Available online: https://www.theseus.fi/bitstream/handle/10024/511091/Patras_Veena.pdf?sequence=3&isAllowed=y (accessed on 5 November 2023).

- Jimeno-Morenilla, A.; Azariadis, P.; Molina-Carmona, R.; Kyratzi, S.; Moulianitis, V. Technology enablers for the implementation of Industry 4.0 to traditional manufacturing sectors: A review. Comput. Ind. 2021, 125, 103390. [Google Scholar] [CrossRef]

- Cheah, L.; Ciceri, N.D.; Olivetti, E.; Matsumura, S.; Forterre, D.; Roth, R.; Kirchain, R. Manufacturing-focused emissions reductions in footwear production. J. Clean. Prod. 2013, 44, 18–29. [Google Scholar] [CrossRef]

- Bai, C.; Dallasega, P.; Orzes, G.; Sarkis, J. Industry 4.0 technologies assessment: A sustainability perspective. Int. J. Prod. Econ. 2020, 229, 107776. [Google Scholar] [CrossRef]

- Dwivedi, A.; Moktadir, M.A.; Jabbour, C.J.C.; de Carvalho, D.E. Integrating the circular economy and industry 4.0 for sustainable development: Implications for responsible footwear production in a big data-driven world. Technol. Forecast. Soc. Chang. 2021, 175, 121335. [Google Scholar] [CrossRef]

- Spahiu, T.; Almeida, H.; Manavis, A.; Kyratsis, P.; Jimeno-Morenilla, A. Industry 4.0 for Sustainable Production in Footwear Industry, International Conference on Water Energy Food and Sustainability; Springer: Berlin/Heidelberg, Germany, 2021; pp. 699–707. [Google Scholar]

- Tsai, W.-H.; Lai, S.Y. Green production planning and control model with ABC under industry 4.0 for the paper industry. Sustainability 2018, 10, 2932. [Google Scholar] [CrossRef]

- Al-Dhubaibi, A. Optimizing the value of activity based costing system: The role of successful implementation. Manag. Sci. Lett. 2021, 11, 179–186. [Google Scholar] [CrossRef]

- Alsayegh, M.F. Activity Based Costing around the World: Adoption, Implementation, Outcomes and Criticism. J. Account. Financ. Emerg. Econ. 2020, 6, 251–262. [Google Scholar]

- Mahal, I.; Hossain, A. Activity-based costing (ABC)–an effective tool for better management. Res. J. Financ. Account. 2015, 6, 66–74. [Google Scholar]

- Tsai, W.-H.; Jhong, S.-Y. Production decision model with carbon tax for the knitted footwear industry under activity-based costing. J. Clean. Prod. 2019, 207, 1150–1162. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Chen, H.C.; Leu, J.D.; Chang, Y.C.; Lin, T.W. A product-mix decision model using green manufacturing technologies under activity-based costing. J. Clean. Prod. 2013, 57, 178–187. [Google Scholar] [CrossRef]

- Jian, T.; Jiang, G.; Zuogong, W. Decision making of product quality and carbon emission reduction in footwear supply chain under production capacity constraint. Rev. Piel. Incaltaminte 2019, 19, 203. [Google Scholar]

- Eklund, F.J. Resource Constraints in Health Care-Case Studies on Technical, Allocative and Economic Efficiency. 2008. Available online: https://aaltodoc.aalto.fi/items/ab7ca857-2544-410f-805b-055865625400 (accessed on 5 November 2023).

- Arruda, E.H.; Melatto, R.A.P.; Levy, W.; Conti, D.M. Circular economy: A brief literature review (2015–2020). Sustain. Oper. Comput. 2021, 2, 79–86. [Google Scholar] [CrossRef]

- Fang, Y.; Chen, M.; Liang, W.; Zhou, Z.; Liu, X. Knowledge Graph Learning for Vehicle Additive Manufacturing of Recycled Metal Powder. World Electr. Veh. J. 2023, 14, 239. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Pieroni, M.P.; Pigosso, D.C.; Soufani, K. Circular business models: A review. J. Clean. Prod. 2020, 277, 123741. [Google Scholar] [CrossRef]

- Mahmud, Y.; Rashed-Ul-Islam, M.; Islam, M.; Moin, T.S.; Rahman, K.T. Assessment of the Carbon Footprint and VOCs Emissions Caused by the Manufacturing Process of the Footwear Industry in Bangladesh. Text. Leather Rev. 2021, 4, 23–29. [Google Scholar] [CrossRef]

- Ainalis, D.; Bardhan, R.; Bell, K.; Cebon, D.; Czerniak, M.; Farmer, J.D.; Fitzgerland, S.; Galkowski, K.; Grimshaw, S.; Harper, G. Net-Zero Solutions and Research Priorities in the 2020s. 2021. Available online: https://uucn.ac.uk/wp-content/uploads/2022/09/NetZero-Solutions-and-Research-Priorities-in-the-2020s.pdf (accessed on 5 November 2023).

- Arán-Ais, F.; Ruzafa-Silvestre, C.; Carbonell-Blasco, M.; Pérez-Limiñana, M.; Orgilés-Calpena, E. Sustainable adhesives and adhesion processes for the footwear industry. Proc. Inst. Mech. Eng. Part C J. Mech. Eng. Sci. 2021, 235, 585–596. [Google Scholar] [CrossRef]

- Majeed, A.A.; Rupasinghe, T.D. Internet of things (IoT) embedded future supply chains for industry 4.0: An assessment from an ERP-based fashion apparel and footwear industry. Int. J. Supply Chain Manag. 2017, 6, 25–40. [Google Scholar]

- Román-Ibáñez, V.; Jimeno-Morenilla, A.; Pujol-Lopez, F.A. Distributed monitoring of heterogeneous robotic cells. A proposal for the footwear industry 4.0. Int. J. Comput. Integr. Manuf. 2018, 31, 1205–1219. [Google Scholar] [CrossRef]

- Stock, T.; Seliger, G. Opportunities of Sustainable Manufacturing in Industry 4.0. In Procedia CIRP, Proceedings of the 13th Global Conference on Sustainable Manufacturing—Decoupling Growth from Resource Use, Binh Duong, Vietnam, 16–18 September 2016; Seliger, G., Malon, J., Kohl, H., Eds.; Elsevier B.V.: Amsterdam, The Netherlands, 2016; Volume 40, pp. 536–541. [Google Scholar]

- Kamble, S.S.; Gunasekaran, A.; Gawankar, S.A. Sustainable Industry 4.0 Framework: A Systematic Literature Review Identifying the Current Trends and Future Perspectives. Process. Saf. Environ. Prot. 2018, 117, 408–425. [Google Scholar] [CrossRef]

- Bag, S.; Pretorius, J.H.C. Relationships between Industry 4.0, Sustainable Manufacturing and Circular Economy: Proposal of a Research Framework. Int. J. Organ. Anal. 2022, 30, 864–898. Available online: https://www.emerald.com/insight/content/doi/10.1108/IJOA-04-2020-2120/full/html (accessed on 5 November 2023). [CrossRef]

- Machado, C.G.; Winroth, M.P.; Ribeiro da Silva, E.H.D. Sustainable Manufacturing in Industry 4.0: An Emerging Research Agenda. Int. J. Prod. Res. 2020, 58, 1462–1484. [Google Scholar] [CrossRef]

- Duez, B. Towards a Substantially Lower Fuel Consumption Freight Transport by the Development of an Innovative Low Rolling Resistance Truck Tyre Concept. Trans. Res. Procedia 2016, 14, 1051–1060. [Google Scholar] [CrossRef]

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emission. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- Conegrey, T.; Gerald, J.D.F.; Valeri, L.M.; Tol, R.S.J. The impact of a carbon tax on economic growth and carbon dioxide emissions in Ireland. J. Environ. Plan. Manag. 2013, 56, 934–952. [Google Scholar] [CrossRef]

- Metcalf, G.E.; Weisbach, D. The design of a carbon tax. Harv. Environ. Law Rev. 2009, 33, 499. [Google Scholar] [CrossRef]

- Staikos, T.; Rahimifard, S. A decision-making model for waste management in the footwear industry. Int. J. Prod. Res. 2007, 45, 4403–4422. [Google Scholar] [CrossRef]

- Kaplan, R.S. In defense of activity-based cost management. Strateg. Financ. 1992, 74, 58. [Google Scholar]

- Tsai, W.-H.; Lu, Y.-H.; Hsieh, C.-L. Comparison of Production Decision-making Models under Carbon Tax and Carbon Rights Trading. J. Clean. Prod. 2022, 379, 34462. [Google Scholar] [CrossRef]

- Turney, P.B. Activity Based Costing, Management Accounting Handbook; Butterworth-Heinemann: Oxford, UK; CIMA: London, UK, 1992. [Google Scholar]

- Ghani, N.; Zaini, S.; Abu, M. Assessment the unused capacity using time driven activity based costing in automotive manufacturing industry. J. Mod. Manuf. Syst. Technol. 2020, 4, 82–94. [Google Scholar] [CrossRef]

- Kee, R. The sufficiency of product and variable costs for production-related decisions when economies of scope are present. Int. J. Prod. Econ. 2008, 114, 682–696. [Google Scholar] [CrossRef]

- Gong, Z.; Hu, S. An economic evaluation model of product mix flexibility. Omega-Int. J. Manag. Sci. 2008, 36, 852–864. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Lai, S.-Y.; Hsieh, C.-L. Exploring the impact of different carbon emission cost models on corporate profitability. Ann. Oper. Res. 2023, 322, 41–74. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Kuo, L. Operating costs and capacity in the airline industry. J. Air Transp. Manag. 2004, 10, 269–275. [Google Scholar] [CrossRef] [PubMed]

- Goldratt, E.M. The Haystack Syndrome: Sifting Information from the Data Ocean? North River Press: Croton-on-Hudson, NY, USA, 1990. [Google Scholar]

- Fu, J.; Liu, S.; Chen, X.; Bai, X.; Guo, R.; Wang, W. Petrogenesis of taxitic dioritic–tonalitic gneisses and Neoarchean crustal growth in Eastern Hebei, North China Craton. Precambrian Res. 2016, 284, 64–87. [Google Scholar] [CrossRef]

- Liu, Z.; Zheng, X.-X.; Gong, B.-G.; Gui, Y.-M. Joint decision-making and the coordination of a sustainable supply chain in the context of carbon tax regulation and fairness concerns. Int. J. Environ. Res. Public Health 2017, 14, 1464. [Google Scholar] [CrossRef]

- Borchardt, M.; Wendt, M.H.; Pereira, G.M.; Sellitto, M.A. Redesign of a component based on ecodesign practices: Environmental impact and cost reduction achievements. J. Clean. Prod. 2011, 19, 49–57. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).