Dynamic Optimal Decision Making of Innovative Products’ Remanufacturing Supply Chain

Abstract

1. Introduction

- In the growing market of innovative products such as mobile phones, computers, automobiles, and other smart devices, scholars only consider the goodwill model and the classical demand model. Few scholars have studied the supply chain of innovative products, and the research on the supply chain of innovative products needs to be deepened.

- The existing research on the remanufacturing supply chain mainly focuses on the static supply chain, without considering the game between manufacturers and retailers in continuous time. The static model cannot adapt to the continuous and real-time modeling requirements, so it is urgent to increase research on the dynamic supply chain.

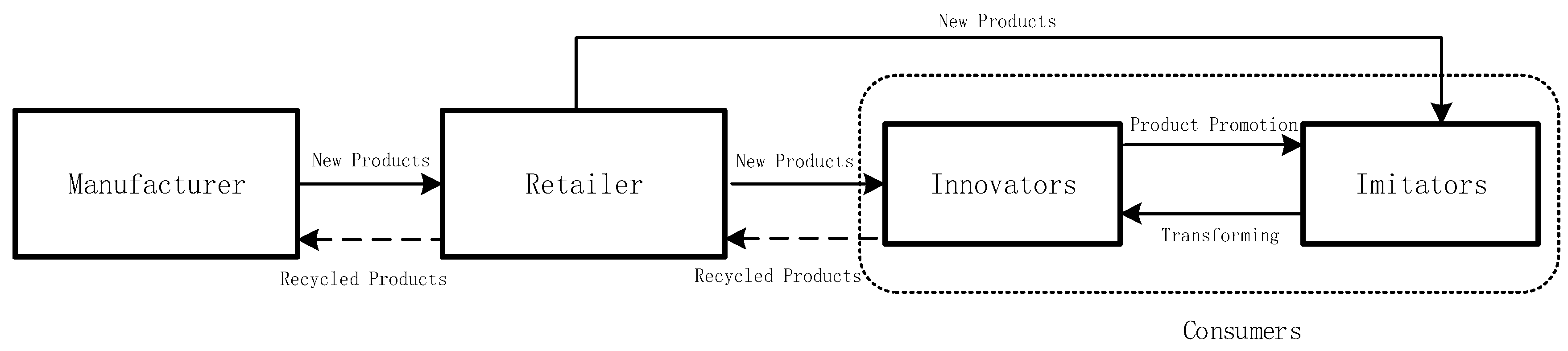

2. Model Background Description

2.1. Introduction to the Bass Model

2.2. Symbol Description

- (1)

- Main parameters and their meanings

- (2)

- Variables (including objective function) and their meanings

2.3. Optimal Control Theory

2.4. Model Function

- (1)

- Consumer market

- (2)

- Manufacturer

- (3)

- Retailer

3. Model Building and Solving

- (1)

- The manufacturer’s optimal pricing path strategy is

- (2)

- The retailer’s optimal pricing path strategy and recycling effort decision are

4. Optimal Decision Analysis

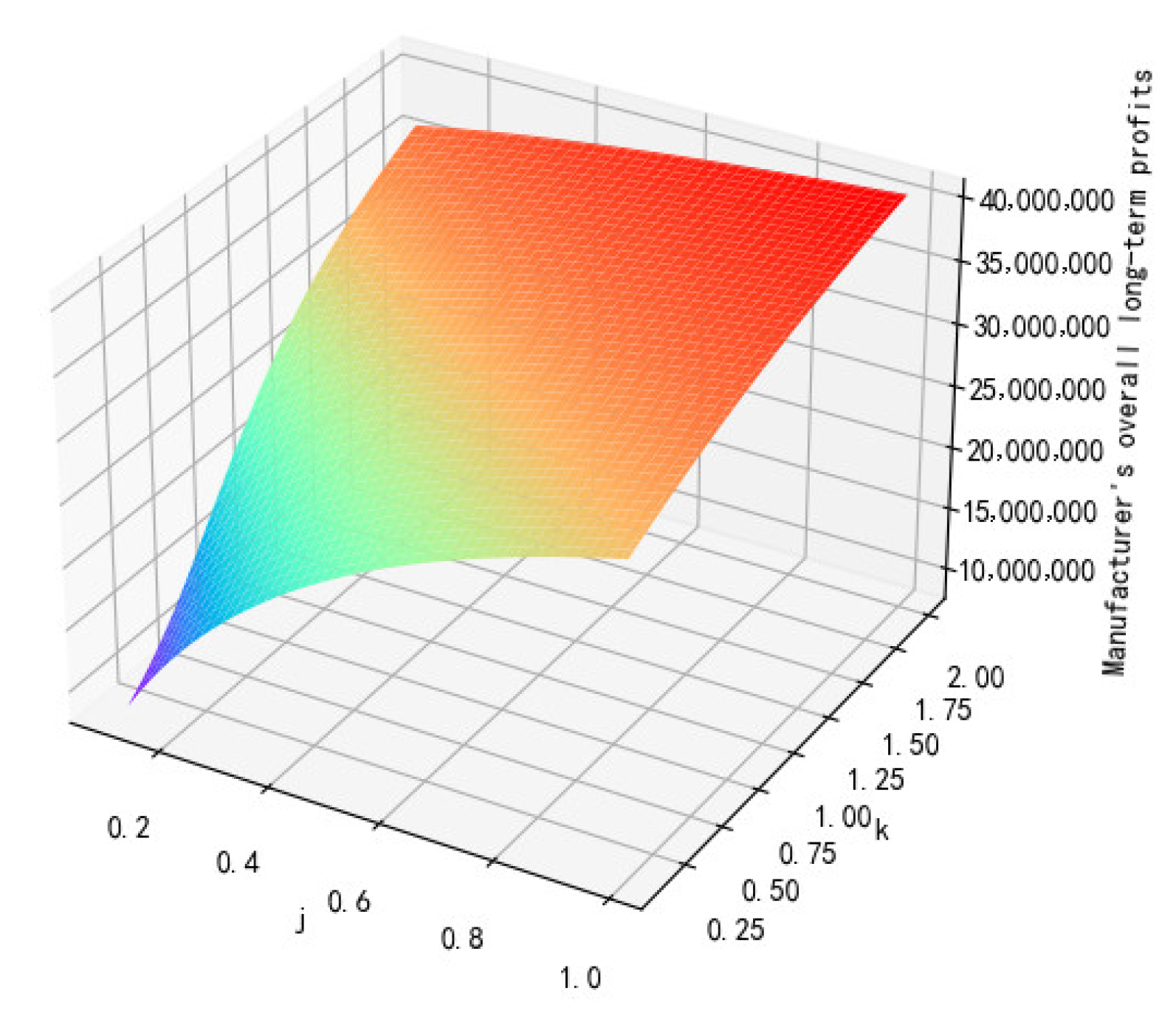

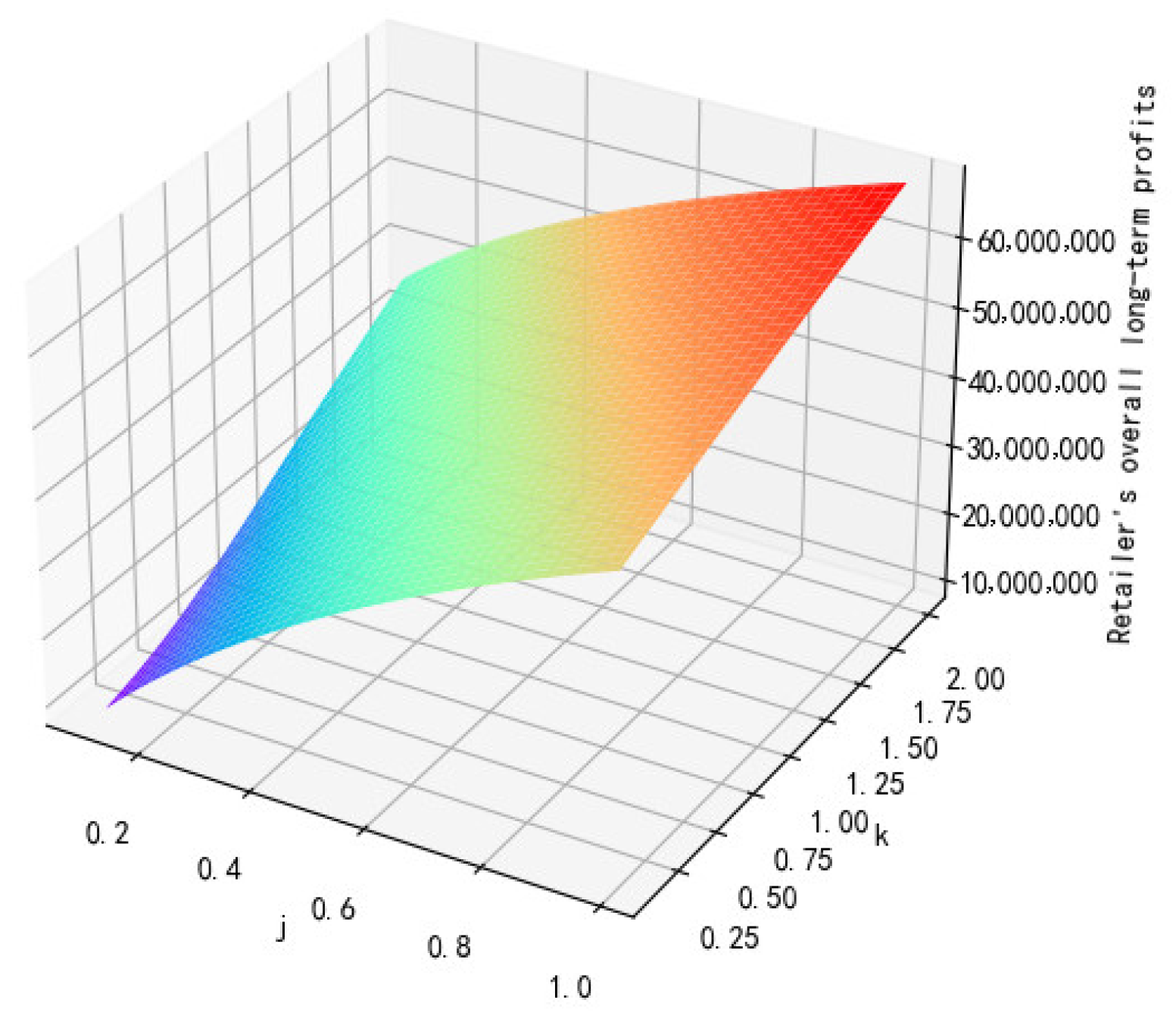

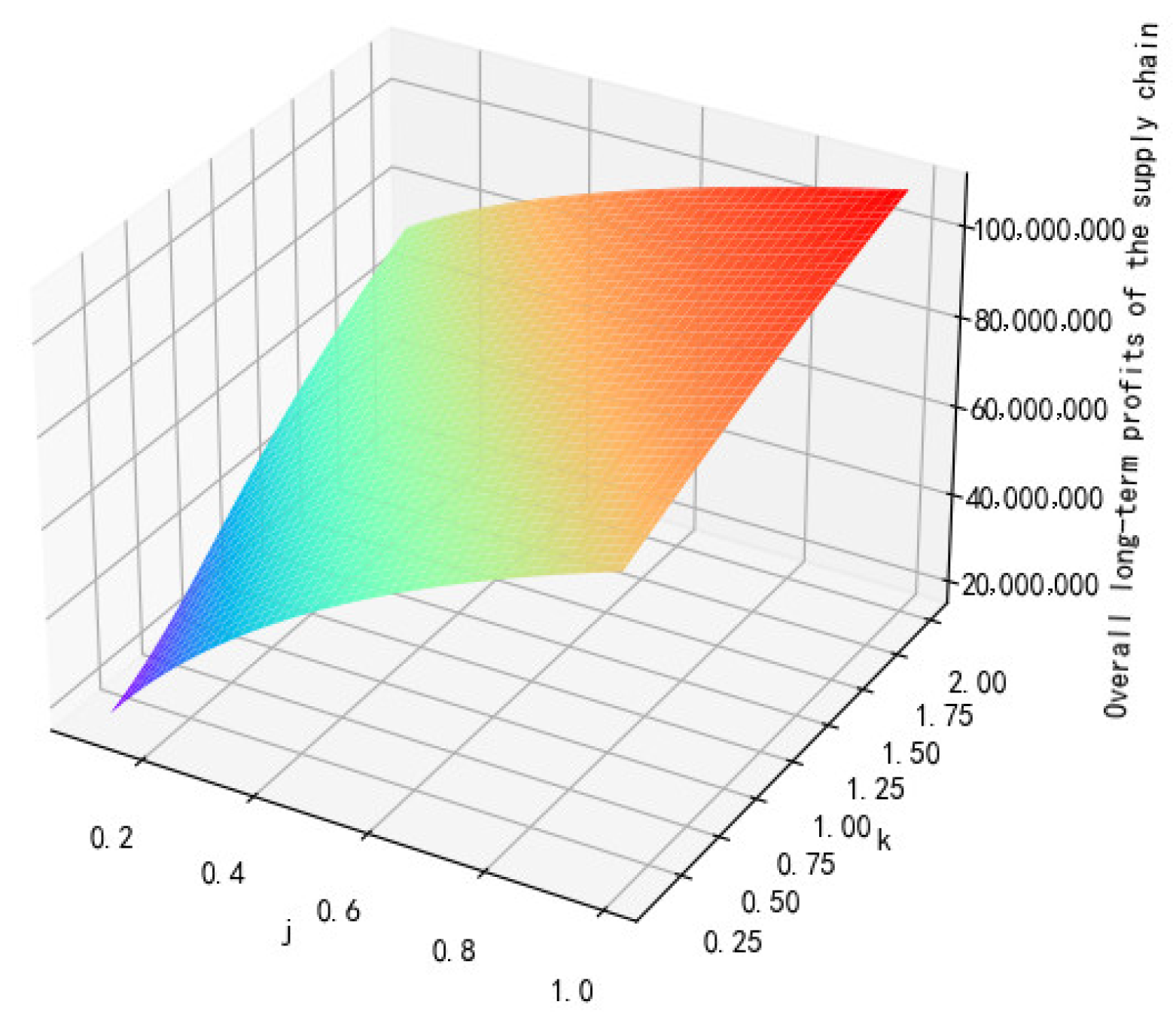

5. Numerical Example

6. Conclusions

- To maximize profits, the manufacturer’s optimal pricing strategy is to maintain a fixed value of marginal profit for each product, and in the early stage, the innovation factor is increased through advertising and other sales efforts to speed up the product diffusion, which can increase the final sales of the product.

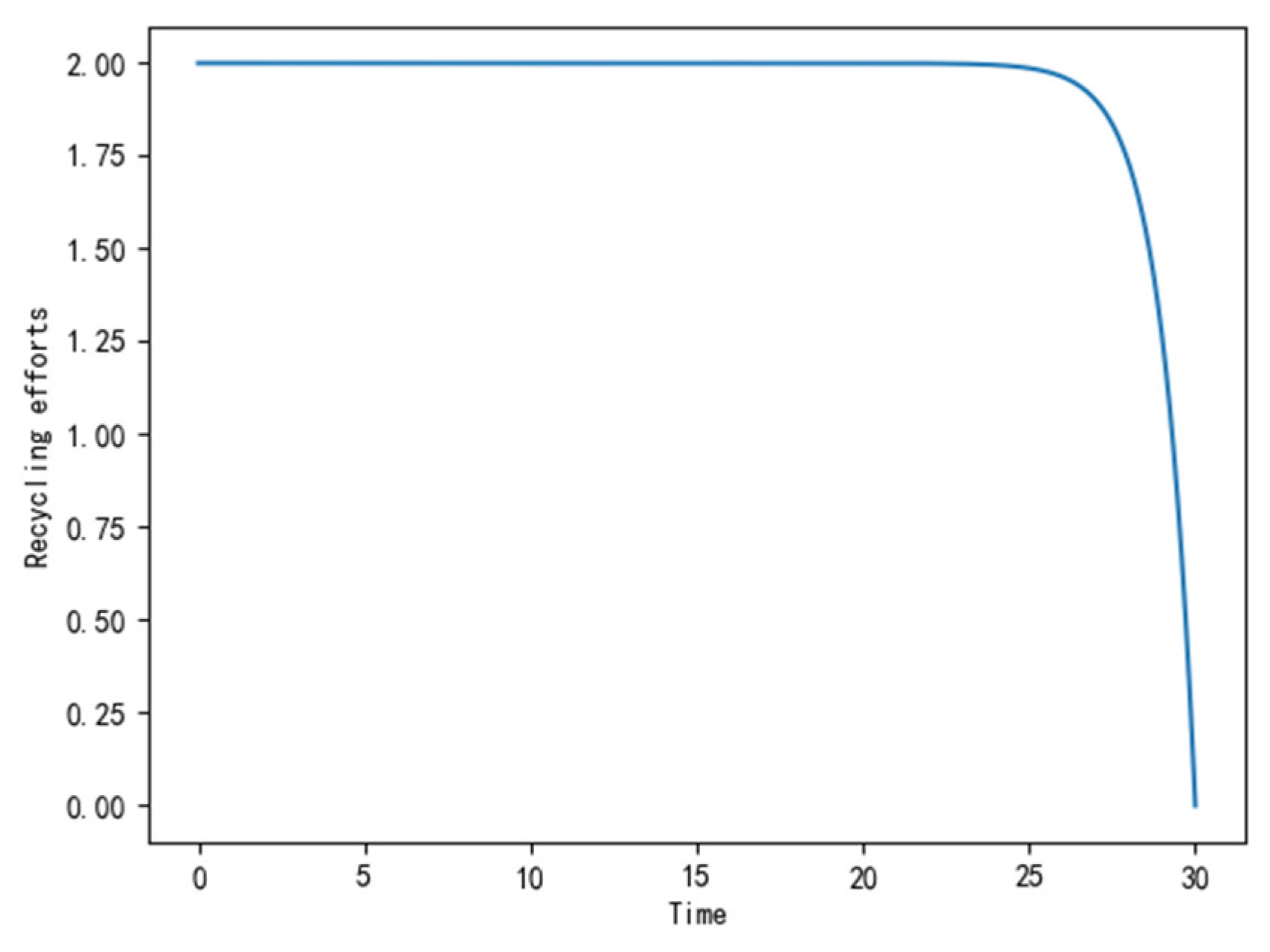

- The specific pricing strategy of the retailer should be determined according to different markets, and the recycling strategy of the retailer should be to make a lot of recycling publicity and preparation in the early stage to raise consumers’ recycling awareness as soon as possible, so that the recycling rate of innovative products can quickly reach a high level, and then the retailer can maintain this high recycling rate with lower recycling costs.

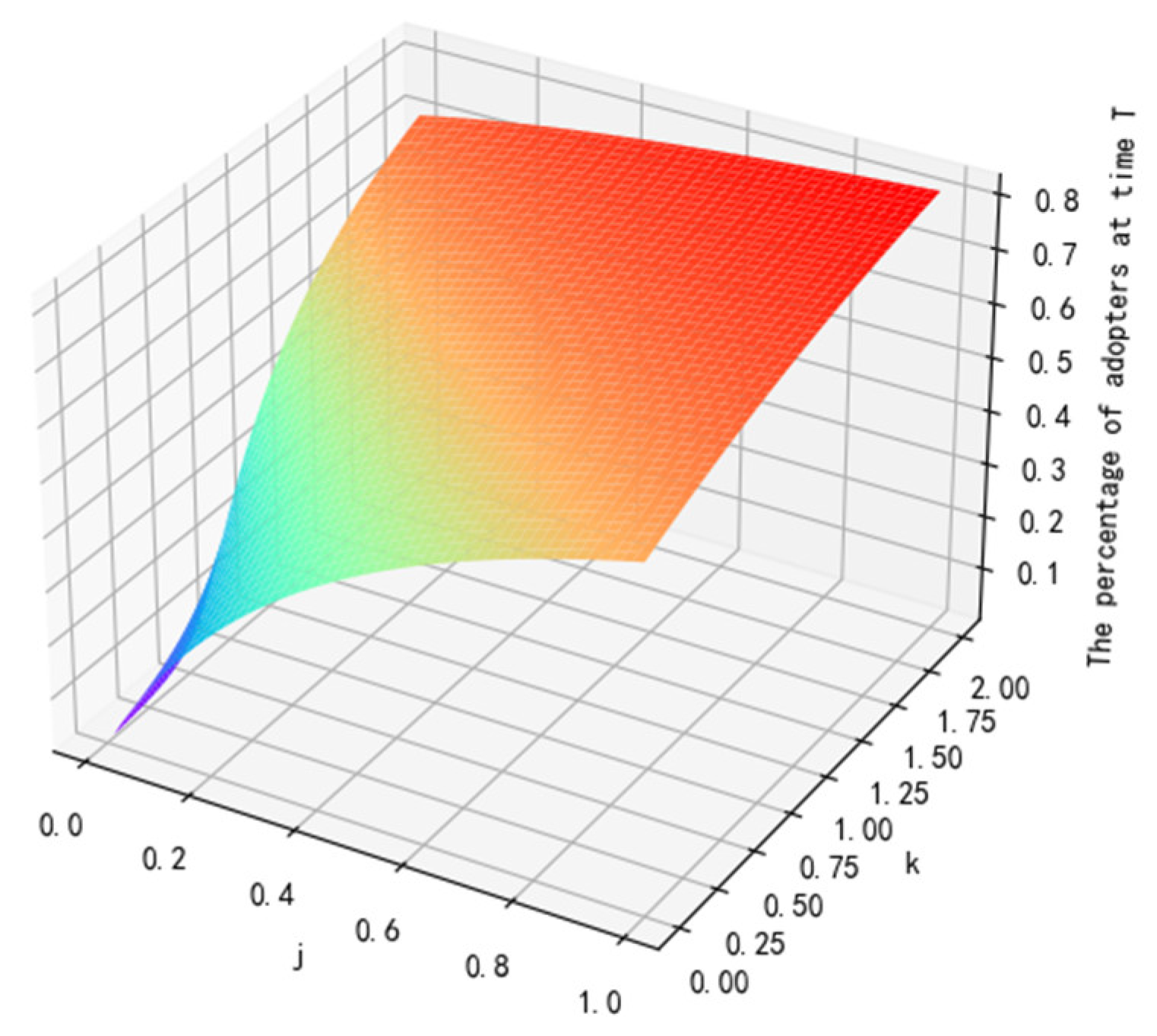

- In markets with higher innovation and imitation coefficients, the sales of the innovative product are higher and the profits of the closed-loop supply chain are higher, so manufacturers and retailers should choose to put the innovative product into markets with higher innovation and imitation coefficients, while in markets with lower innovation and imitation coefficients, manufacturers and retailers should consider sales efforts such as advertising and better customer services to improve consumer satisfaction and increase the speed of product diffusion, thus increasing the profits of manufacturers and retailers.

- The closed-loop innovative product supply chain is much more complex than the open-loop one. In the closed-loop innovative product supply chain, the dynamic demand changes in the market become more complex, and thus the optimal decisions of manufacturers and retailers are also more complex, so the members of the closed-loop supply chain need to have stronger market information acquisition ability and faster response to market changes.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Deng, D.S.; Long, W.; Li, Y.Y.; Shi, X.Q. Building Robust Closed-Loop Supply Networks against Malicious Attacks. Processes 2021, 9, 39. [Google Scholar] [CrossRef]

- Guo, Y.; Shi, Q.; Guo, C. A Fuzzy Robust Programming Model for Sustainable Closed-Loop Supply Chain Network Design with Efficiency-Oriented Multi-Objective Optimization. Processes 2022, 10, 1963. [Google Scholar] [CrossRef]

- Institute of Internet Industry; Tsinghua University. White Paper 2018 on Intelligent Remanufacturing; Institute of Internet Industry: Beijing, China, 2018. [Google Scholar]

- Ding, Y. Game Analysis and Decision Research of Remanufacturing Supply Chain System for Information and Communication Equipment. Master’s Thesis, Zhejiang University of Technology, Hangzhou, China, 2020. [Google Scholar]

- Mota, B.; Gomes, M.I.; Carvalho, A.; Barbosa-Povoa, A.P. Sustainable supply chains: An integrated modeling approach under uncertainty. Omega 2017, 77, 32–57. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Wassenhove, L. Closed-Loop Supply Chain Models with Product Remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Wassenhove, L. Reverse channel design: The case of competing retailers. Oper. Res. 2006, 46, 621–624. [Google Scholar] [CrossRef]

- Ferguson, M.E.; Toktay, L.B. The effect of competition on recovery strategies. Prod. Oper. Manag. 2006, 15, 351–368. [Google Scholar] [CrossRef]

- Jian, J.; Li, B.; Zhang, N.; Su, J. Decision-making and coordination of green closed-loop supply chain with fairness concern. J. Clean. Prod. 2021, 298, 126779. [Google Scholar] [CrossRef]

- Masoudipour, E.; Amirian, H.; Sahraeian, R. A novel closed-loop supply chain based on the quality of returned products. J. Clean. Prod. 2017, 151, 344–355. [Google Scholar] [CrossRef]

- Diaz, R.; Marsillac, E. Evaluating strategic remanufacturing supply chain decisions. Int. J. Prod. Res. 2016, 55, 2522–2539. [Google Scholar] [CrossRef]

- Jena, S.K.; Sarmah, S.P.; Sarin, S.C. Joint-advertising for collection of returned products in a closed-loop supply chain under uncertain environment. Comput. Ind. Eng. 2017, 113, 305–322. [Google Scholar] [CrossRef]

- Tsao, Y.C.; Linh, V.T.; Lu, J.C. Closed-loop supply chain network designs considering RFID adoption. Comput. Ind. Eng. 2016, 113, 716–726. [Google Scholar] [CrossRef]

- Bhattacharya, R.; Kaur, A.; Amit, R.K. Price optimization of multi-stage remanufacturing in a closed loop supply chain. J. Clean. Prod. 2018, 186, 943–962. [Google Scholar] [CrossRef]

- Ma, Z.J.; Zhang, N.; Dai, Y.; Hu, S. Managing channel profits of different cooperative models in closed-loop supply chains. Omega 2016, 59, 251–262. [Google Scholar]

- Xiong, Y.; Zhao, Q.; Zhou, Y. Manufacturer-remanufacturing vs. supplier-remanufacturing in a closed-loop supply chain. Int. J. Prod. Econ. 2016, 176, 21–28. [Google Scholar] [CrossRef]

- Xie, J.P.; Liang, L.; Liu, L.H.; Ieromonachou, P. Coordination contracts of dual-channel with cooperation advertising in closed-loop supply chains. Int. J. Prod. Econ. 2016, 183, 528–538. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, Z.; Hong, X.; Zhong, Q. Fuzzy closed-loop supply chain models with quality and marketing effort-dependent demand. Expert Syst. Appl. 2022, 207, 118081. [Google Scholar] [CrossRef]

- He, Q.; Wang, N.; Browning, T.R.; Jiang, B. Competitive collection with convenience-perceived customers. Eur. J. Oper. Res. 2022, 303, 239–254. [Google Scholar] [CrossRef]

- Lee, C.; Realff, M.; Ammons, J. Integration of channel decisions in a decentralized reverse production system with retailer collection under deterministic non-stationary demands. Adv. Eng. Inform. 2011, 25, 88–102. [Google Scholar] [CrossRef]

- Giovanni, P.D. Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Ann. Oper. Res. 2014, 220, 135–157. [Google Scholar] [CrossRef]

- Xiang, Z.; Xu, M. Dynamic cooperation strategies of the closed-loop supply chain involving the Internet service platform. J. Clean. Prod. 2019, 220, 1180–1193. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Shi, C.V.; Xu, H.; Zhou, L. Cost-sharing contract design in a low-carbon service supply chain. Comput. Ind. Eng. 2019, 139, 106160. [Google Scholar] [CrossRef]

- Song, J.; Bian, Y.; Liu, G. Decisions of Closed-Loop Supply Chain Based on Recycling Effort and Differential Game. Discret. Dyn. Nat. Soc. 2020, 2020, 7493942. [Google Scholar] [CrossRef]

- Yang, Y.; Xu, X. A differential game model for closed-loop supply chain participants under carbon emission permits. Comput. Ind. Eng. 2019, 135, 1077–1090. [Google Scholar] [CrossRef]

- China Household Electric Appliance Research Institute. White Paper on WEEE Recycling Industry in China (2021); China Household Electric Appliance Research Institute: Beijing, China, 2022. [Google Scholar]

- Bass, F.M. A New Product Growth Model for Consumer Durables. Manag. Sci. 1976, 15, 215–227. [Google Scholar] [CrossRef]

- Bass, F.M.; Krishnamoorthy, A.; Sethi, P. Generic and Brand Advertising Strategies in a Dynamic Duopoly. Mark. Sci. 2005, 24, 556–568. [Google Scholar] [CrossRef]

- Quan, X.; Tu, F.; Wei, J. A Manufacturer-Retailer Stackelberg Game of Innovation Pricing. J. Syst. Eng.—Theory Pract. 2007, 8, 111–117. [Google Scholar]

- White, M.; Braczyk, J.; Ghobadian, A.; Niebuhr, J. Small Firms’ Innovation: Why Regions Differ; Policy Studies Institute: Addis Ababa, Ethiopia, 1988. [Google Scholar]

- Chiang, A.C. Elements of Dynamic Optimization; McGraw-Hill: New York, NY, USA, 2000. [Google Scholar]

- Apple Inc. Environmental Progress Report; Apple Inc.: Cupertino, CA, USA, 2022. [Google Scholar]

| k = 0.1 | k = 0.3 | k = 0.5 | k = 0.7 | k = 0.9 | |

|---|---|---|---|---|---|

| j = 0.1 | x(T) = 16.77% πm = 8,169,477 πr = 8,653,421 πh = 16,822,898 | x(T) = 22.39% πm = 10,978,126 πr = 10,149,939 πh = 21,128,065 | x(T) = 30.24% πm = 14,903,680 πr = 12,203,997 πh = 27,103,677 | x(T) = 39.29% πm = 19,428,616 πr = 14,857,422 πh = 34,286,038 | x(T) = 47.76% πm = 23,665,577 πr = 17,959,185 πh = 41,624,762 |

| j = 0.3 | x(T) = 36.75% πm = 18,160,691 πr = 21,972,993 πh = 40,133,684 | x(T) = 42.44% πm = 21,005,584 πr = 24,194,929 πh = 45,200,513 | x(T) = 48.31% πm = 23,937,359 πr = 26,665,438 πh = 50,602,797 | x(T) = 53.89% πm = 26,727,890 πr = 29,315,981 πh = 56,043,871 | x(T) = 58.89% πm = 29,226,630 πr = 32,065,608 πh = 61,292,238 |

| j = 0.5 | x(T) = 48.63% πm = 24,099,991 πr = 32,304,674 πh = 56,404,665 | x(T) = 53.24% πm = 26,402,195 πr = 34,592,296 πh = 60,994,491 | x(T) = 57.63% πm = 28,597,894 πr = 36,981,292 πh = 65,579,186 | x(T) = 61.65% πm = 30,608,553 πr = 39,425,744 πh = 70,034,297 | x(T) = 65.23% πm = 32,397,806 πr = 41,884,117 πh = 74,281,923 |

| j = 0.7 | x(T) = 56.63% πm = 28,098,253 πr = 40,789,355 πh = 68,889,608 | x(T) = 60.32% πm = 29,944,437 πr = 429,90,543 πh = 72,934,980 | x(T) = 63.74% πm = 31,654,302 πr = 45,225,646 πh = 76,879,948 | x(T) = 66.84% πm = 33,201,773 πr = 47,466,725 πh = 80,668,498 | x(T) = 69.59% πm = 34,580,783 πr = 49,690,895 πh = 84,271,678 |

| j = 0.9 | x(T) = 62.42% πm = 30,992,496 πr = 48,004,289 πh = 78,996,785 | x(T) = 65.42% πm = 32,493,335 πr = 50,080,667 πh = 82,574,002 | x(T) = 68.17% πm = 33,866,554 πr = 52,158,179 πh = 86,024,733 | x(T) = 70.64% πm = 35,105,751 πr = 54,219,755 πh = 89,325,506 | x(T) = 72.86% πm = 36,214,147 πr = 56,252,149 πh = 92,466,296 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, L.; Liu, Z.; Pu, Y.; Wang, N. Dynamic Optimal Decision Making of Innovative Products’ Remanufacturing Supply Chain. Processes 2023, 11, 295. https://doi.org/10.3390/pr11010295

Liu L, Liu Z, Pu Y, Wang N. Dynamic Optimal Decision Making of Innovative Products’ Remanufacturing Supply Chain. Processes. 2023; 11(1):295. https://doi.org/10.3390/pr11010295

Chicago/Turabian StyleLiu, Lang, Zhenwei Liu, Yutao Pu, and Nan Wang. 2023. "Dynamic Optimal Decision Making of Innovative Products’ Remanufacturing Supply Chain" Processes 11, no. 1: 295. https://doi.org/10.3390/pr11010295

APA StyleLiu, L., Liu, Z., Pu, Y., & Wang, N. (2023). Dynamic Optimal Decision Making of Innovative Products’ Remanufacturing Supply Chain. Processes, 11(1), 295. https://doi.org/10.3390/pr11010295