A Sustainable Advance Payment Scheme for Deteriorating Items with Preservation Technology

Abstract

:1. Introduction

- 1.

- This study discusses how preservation technology can play an important role in preserving products.

- 2.

- This allows the retailer to enjoy an optimum advance payment scheme when he cannot invest huge amounts in business and seek offers from the suppliers.

- 3.

- This study frames some ordering and investment decisions that can allow the profitable preservation of products so that the retailer does not have to make continuous investments, supporting knowledge of how to manage a harmonic relation between the simultaneous investment in preservation and the offer enjoyed from the supplier.

2. Literature Review

2.1. Traditional Inventory System

2.2. Inventory Model with Preservation Technology (PT)

2.3. Inventory Model with Advance Payments and Shortages

3. Problem Description, Assumptions, and Notations

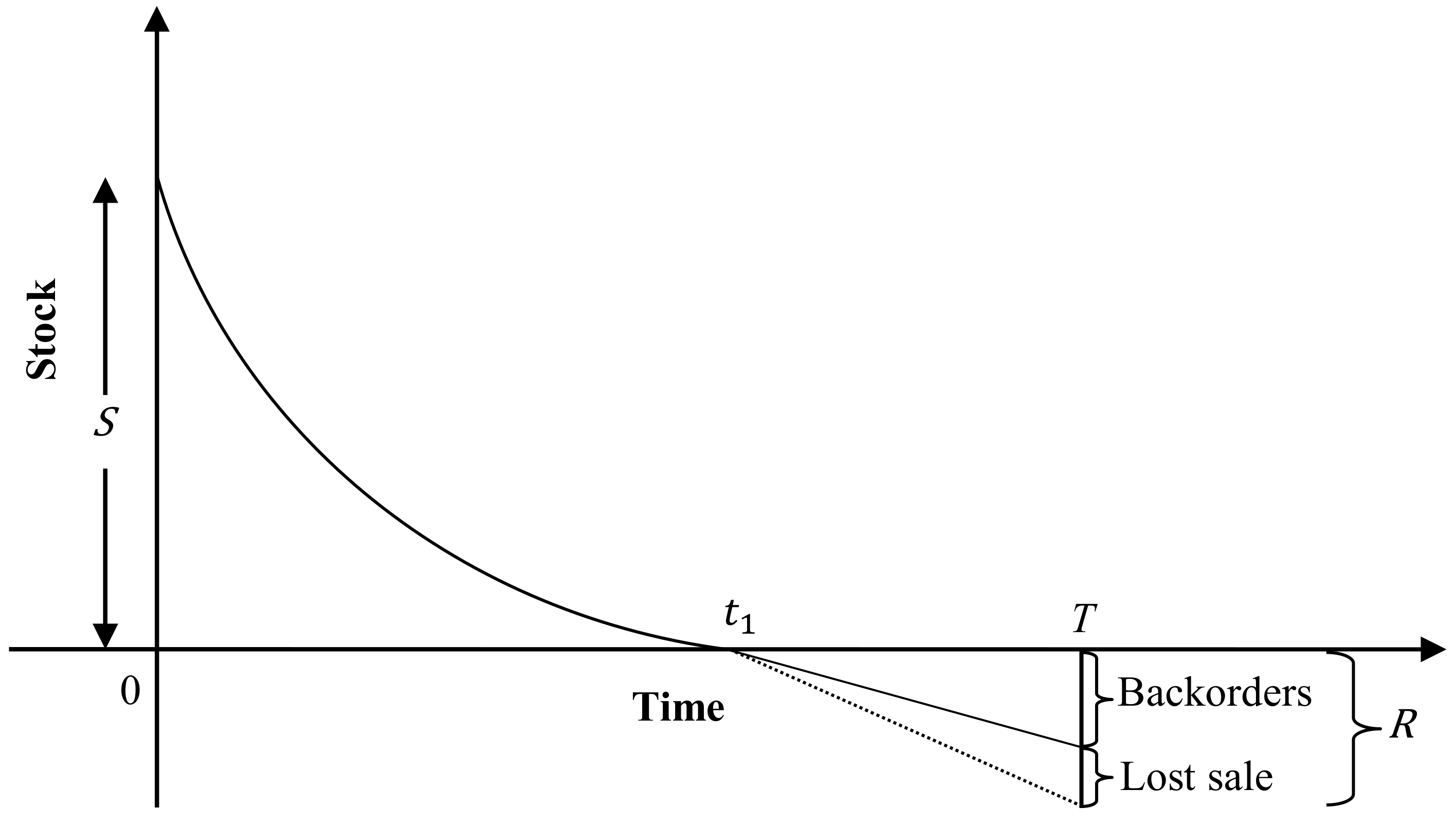

3.1. Problem Description

3.2. Assumptions

- The demand for the product follows a constant pattern;

- Due to impatient customers, the demand during stockout is partially lost;

- The backlogged demand is satisfied with the arrival of the next lot;

- The products are deteriorating in nature;

- There is no replacement of deteriorated items;

4. Model Formulation

4.1. Case I (Without Advance Payment)

4.2. Case II (With Advance Payment)

5. Numerical Illustrations

5.1. Algorithm (For Case I)

- Step 1:

- Plug in all the associated values of the parameters.

- Step 2:

- When the situationholds, there existsfor each cycle; if this form satisfies, proceed to Step 3; otherwise, proceed to Step 7.

- Step 3:

- Check with the help of Equation (17).

- Step 4:

- When accomplishes the sufficient condition for the optimum result indicated in Equation (19), then is the optimal outcome which minimizes Equation (15); if not, proceed to Step 7.

- Step 5:

- The order quantity can be determined from .

- Step 6:

- The total cost is calculated from Equation (15), and is premeditated from Equation (17).

- Step 7:

- End.

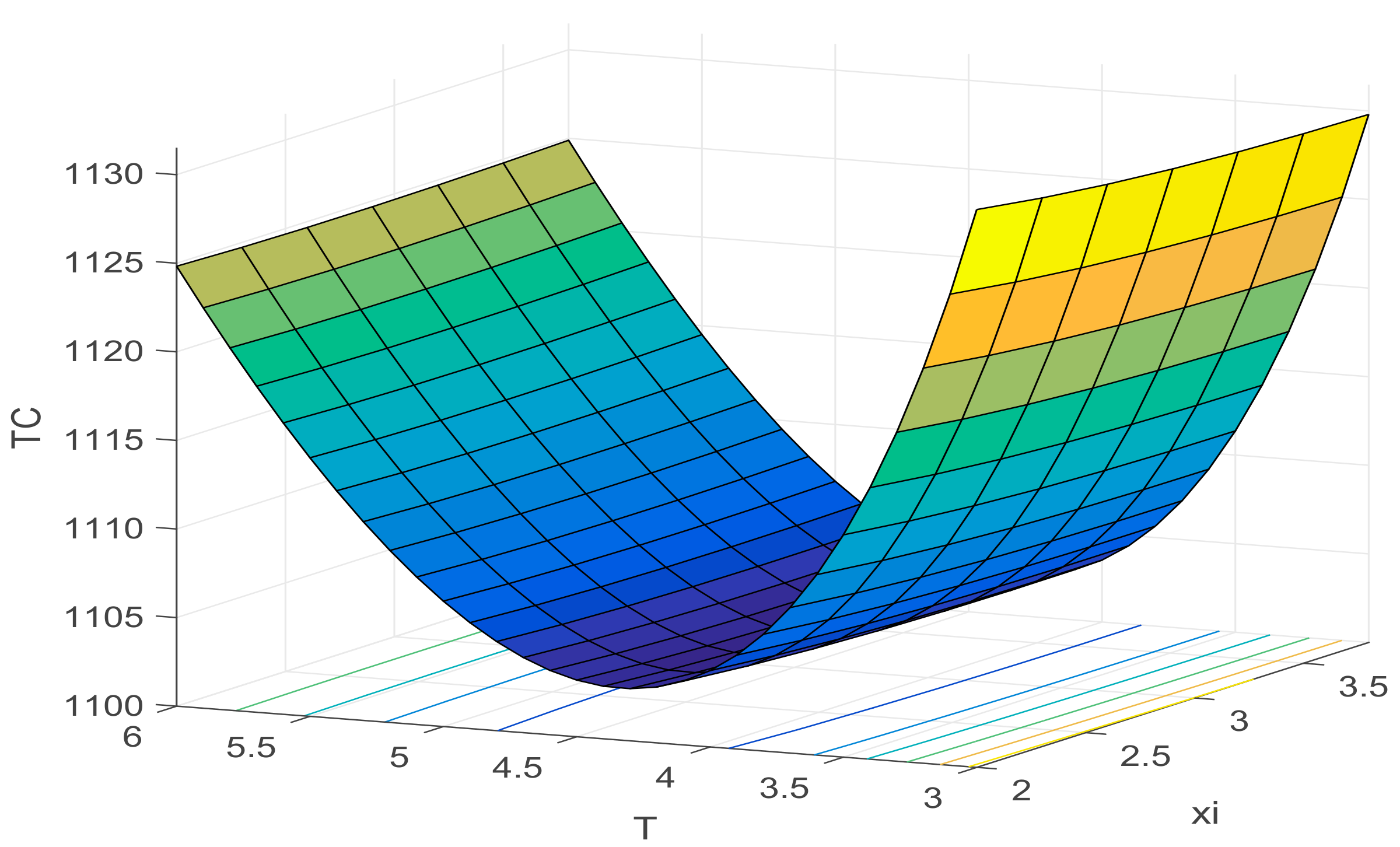

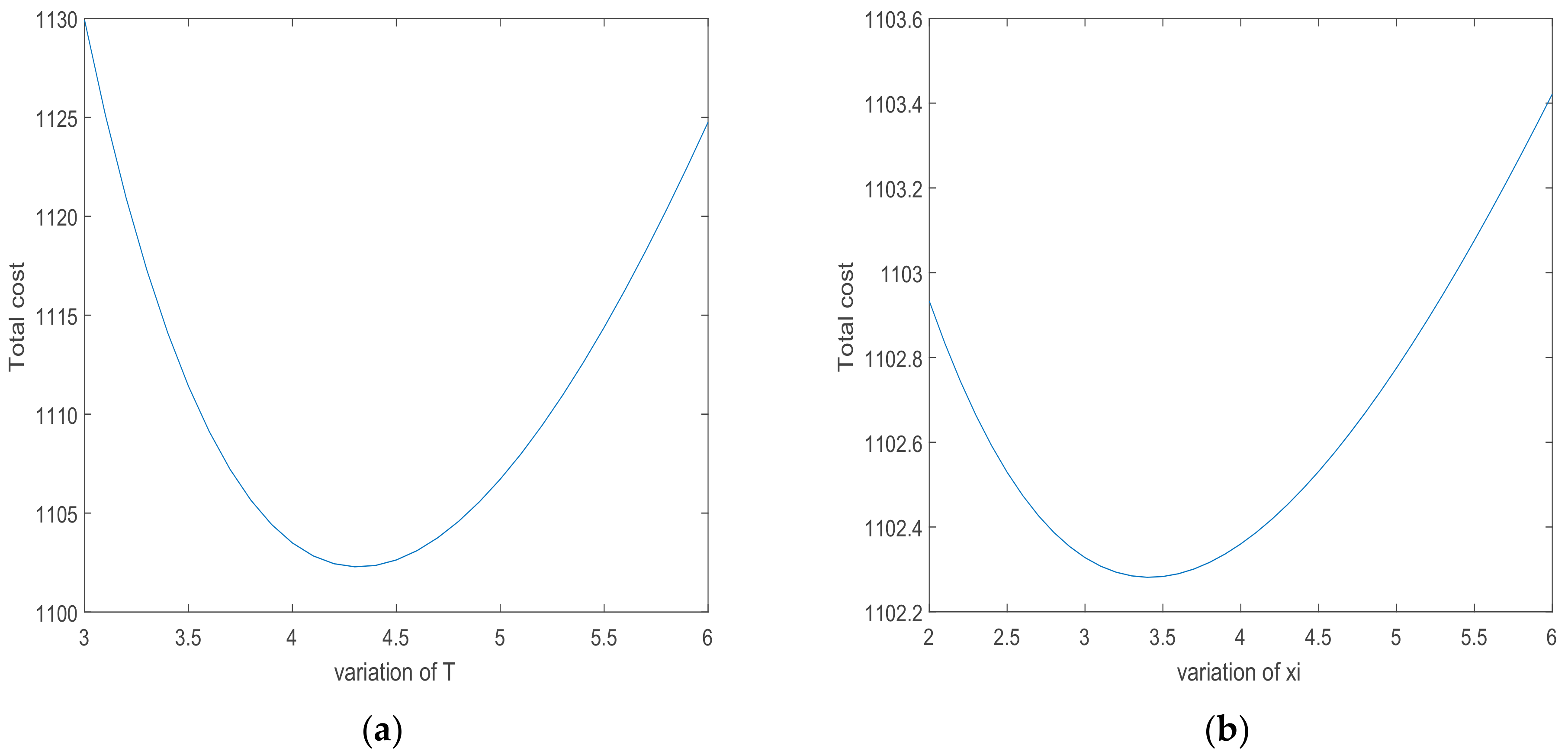

5.2. Case I (Without Advance Payment)

5.3. Case II (With Advance Payment)

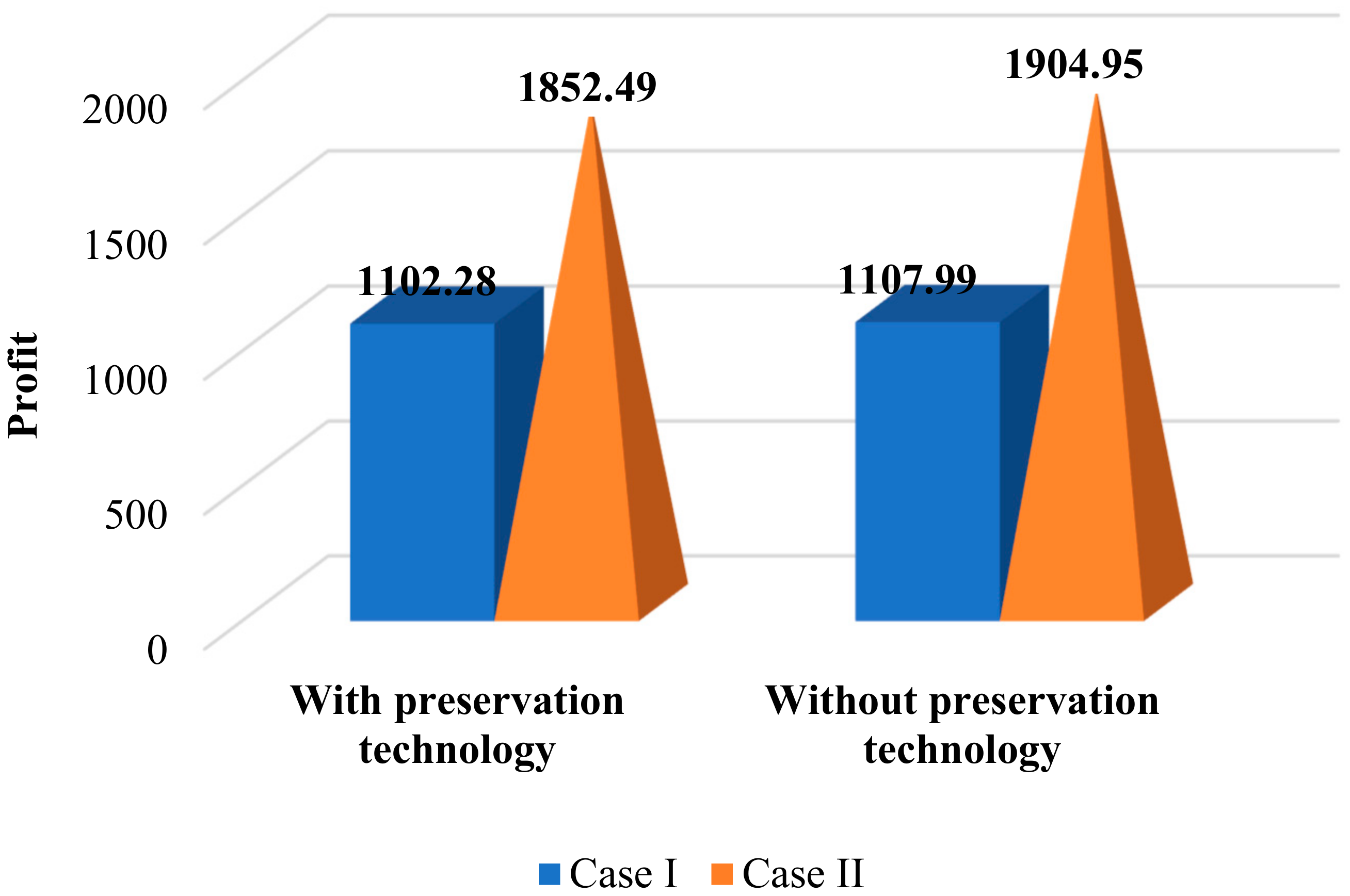

5.4. Comparative Study

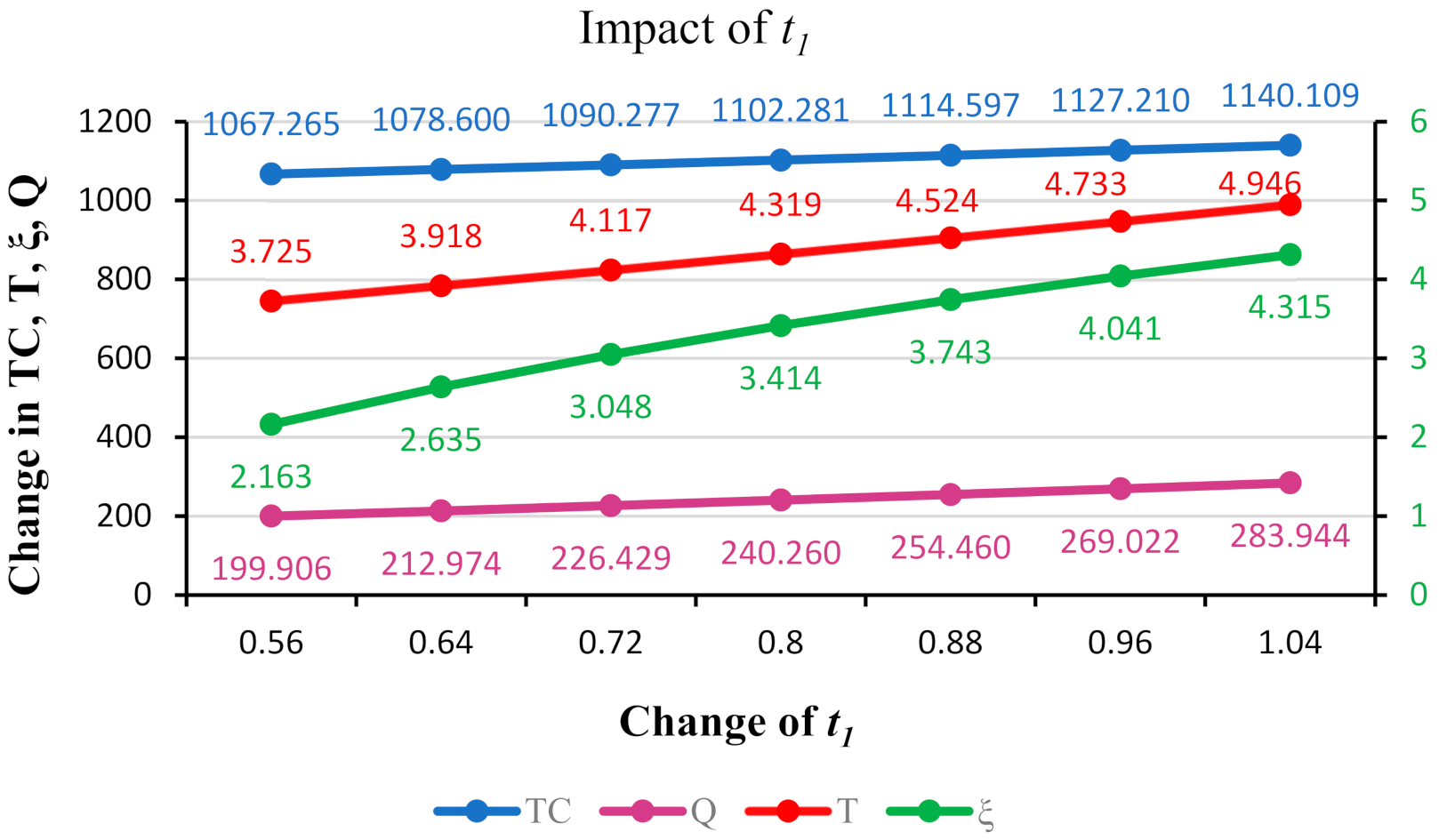

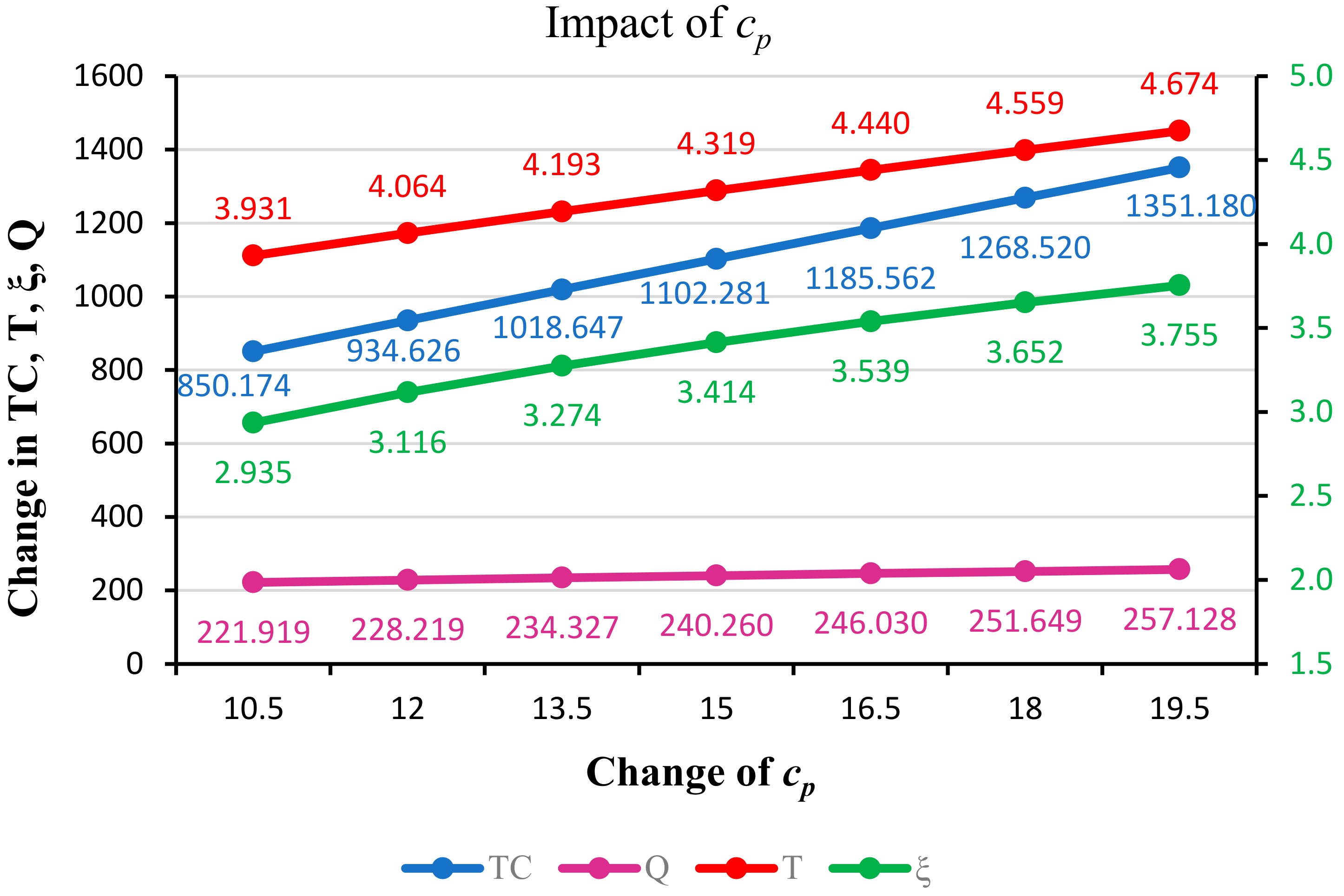

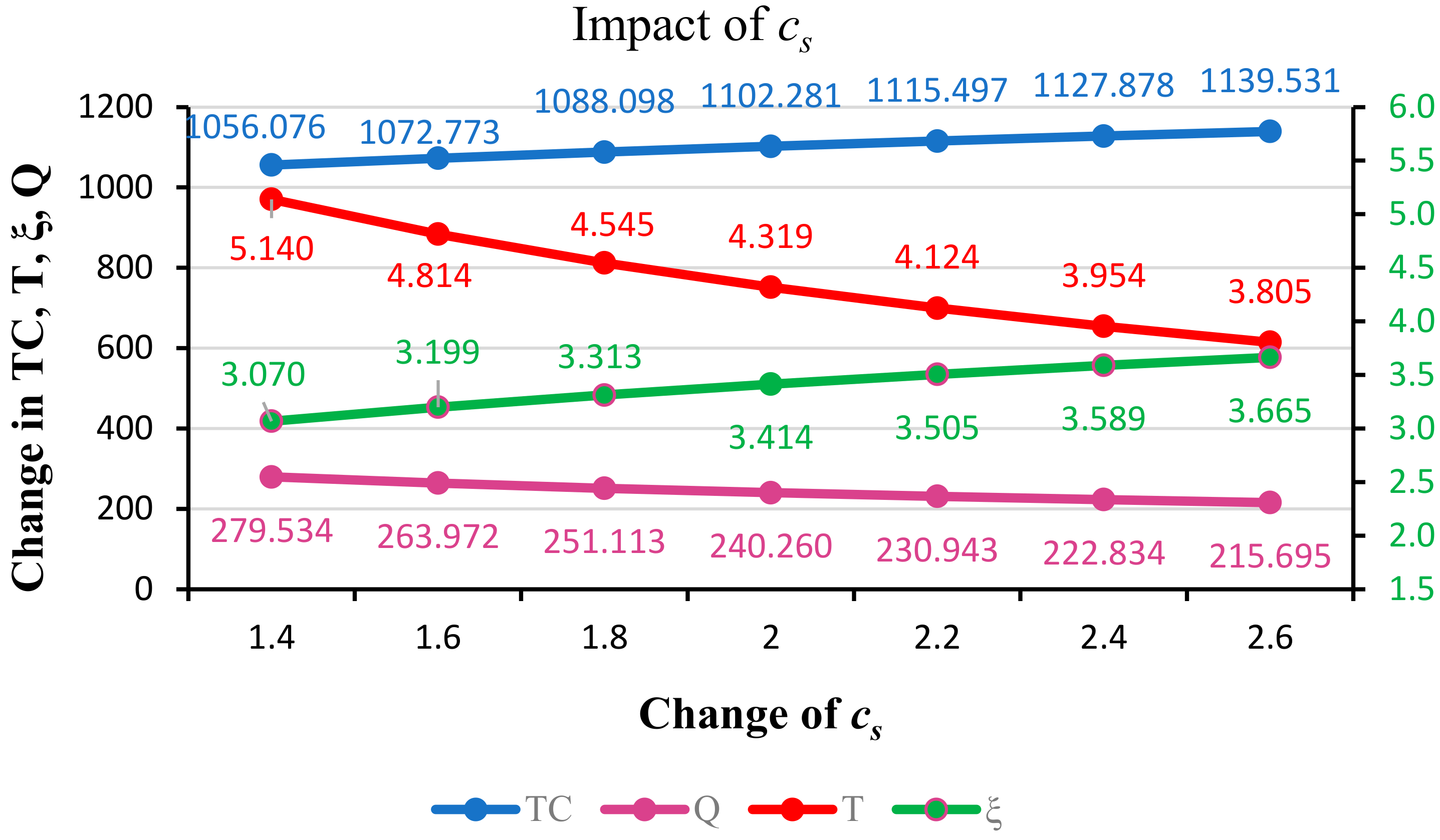

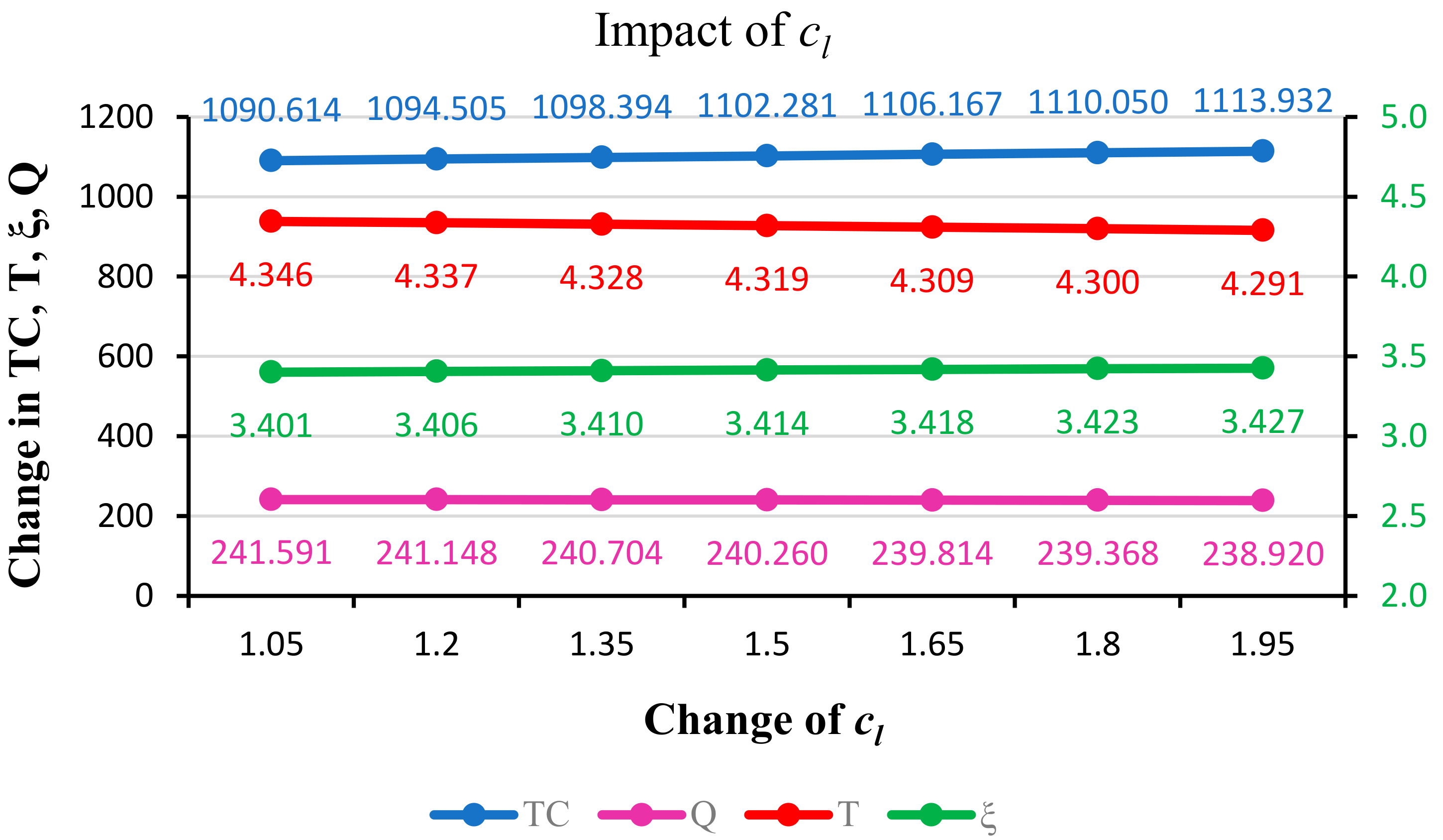

6. Sensitivity Analysis

7. Managerial Insights

- (i)

- One can quickly know how much and for how long one will have to invest in preservation technology to reduce product deterioration.

- (ii)

- An advance payment system creates flexibility for the retailer to deal with customers efficiently, although the capital is slightly lower compared to the general case. Moreover, advance payment always requires the retailer to complete the purchase in time, as some parts of the purchase cost have already been deposited in the supplier’s account. Thus, it sometimes helps to make a rigid decision in purchasing items from suppliers.

8. Conclusions and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Notations

| Notations | Description |

| Demand rate | |

| Reduced deterioration rate | |

| Highest reducible rate of deterioration | |

| Efficiency of preservation technology | |

| Deterioration rate, | |

| Amount of shortage | |

| Initial stock | |

| Total ordered quantity per cycle | |

| Order cost per cycle | |

| Purchasing cost per unit | |

| Holding cost per unit time | |

| Shortage cost per unit | |

| Lost sale cost per unit | |

| Backlogging parameter | |

| Time at which inventory level becomes zero | |

| Part of the purchase cost must be paid before delivery | |

| Lead time | |

| Interest rate of the capital cost | |

| Number of instalments that need to be prepaid | |

| Decision Variables | |

| Replenishment cycle | |

| Preservation technology cost per unit time | |

References

- Harris, F.W. How many parts to make at once. Fact. Mag. Manag. 1913, 10, 135–136. [Google Scholar] [CrossRef]

- Mishra, U.; Tijerina-Aguilera, J.; Tiwari, S.; Cárdenas-Barrón, L.E. Retailer’s Joint Ordering, Pricing, and Preservation Technology Investment Policies for a Deteriorating Item under Permissible Delay in Payments. Math. Probl. Eng. 2018, 2018, 1–14. [Google Scholar] [CrossRef]

- Lashgari, M.; Taleizadeh, A.A.; Sana, S.S. An inventory control problem for deteriorating items with back-ordering and financial considerations under two levels of trade credit linked to order quantity. J. Ind. Manag. Optim. 2015, 12, 1091–1119. [Google Scholar] [CrossRef] [Green Version]

- Sethi, V.; Sethi, S. Processing of Fruits and Vegetables for Value Addition; Indus Publishing: New Delhi, India, 2006; ISBN 8173871809. [Google Scholar]

- Dye, C.-Y. The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega 2013, 41, 872–880. [Google Scholar] [CrossRef]

- Soni, H.N. Optimal replenishment policies for non-instantaneous deteriorating items with price and stock sensitive demand under permissible delay in payment. Int. J. Prod. Econ. 2013, 146, 259–268. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Roy, D.; Daryanto, Y.; Ali, M.H. A Sustainable Inventory Model with Imperfect Products, Deterioration, and Controllable Emissions. Mathematics 2020, 8, 2049. [Google Scholar] [CrossRef]

- Li, G.; He, X.; Zhou, J.; Wu, H. Pricing, replenishment and preservation technology investment decisions for non-instantaneous deteriorating items. Omega 2019, 84, 114–126. [Google Scholar] [CrossRef]

- Dye, C.-Y.; Hsieh, T.-P. An optimal replenishment policy for deteriorating items with effective investment in preservation technology. Eur. J. Oper. Res. 2012, 218, 106–112. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Pourmohammad-Zia, N.; Konstantaras, I. Partial linked-to-order delayed payment and life time effects on decaying items ordering. Oper. Res. 2021, 21, 2077–2099. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Tavakoli, S.; San-José, L.A. A lot sizing model with advance payment and planned backordering. Ann. Oper. Res. 2018, 271, 1001–1022. [Google Scholar] [CrossRef]

- Shi, Y.; Zhang, Z.; Chen, S.-C.; Cárdenas-Barrón, L.E.; Skouri, K. Optimal replenishment decisions for perishable products under cash, advance, and credit payments considering carbon tax regulations. Int. J. Prod. Econ. 2020, 223, 107514. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Wee, H.-M.; Sarkar, B.; Chiang Li, Y.-H. A sustainable inventory system with the advanced payment policy and trade-credit strategy for a two-warehouse inventory system. Kybernetes 2021, 50, 1321–1348. [Google Scholar] [CrossRef]

- Cambini, A.; Martein, L. Generalized Convexity and Optimization; Lecture Notes in Economics and Mathematical Systems; Springer: Berlin/Heidelberg, Germany, 2009; Volume 616, ISBN 978-3-540-70875-9. [Google Scholar]

- Harris, F.W. What Quantity to Make at Once. Libr. Fact. Manag. Oper. Costs 1915, 5, 47–52. [Google Scholar]

- Ghare, P.M.; Schrader, G.F. A model for an exponentially decaying inventory. J. Ind. Eng. 1963, 14, 238–243. [Google Scholar]

- Skouri, K.; Papachristos, S. A continuous review inventory model, with deteriorating items, time-varying demand, linear replenishment cost, partially time-varying backlogging. Appl. Math. Model. 2002, 26, 603–617. [Google Scholar] [CrossRef]

- Li, R.; Teng, J.-T.; Zheng, Y. Optimal credit term, order quantity and selling price for perishable products when demand depends on selling price, expiration date, and credit period. Ann. Oper. Res. 2019, 280, 377–405. [Google Scholar] [CrossRef]

- Tiwari, S.; Cárdenas-Barrón, L.E.; Goh, M.; Shaikh, A.A. Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits in supply chain. Int. J. Prod. Econ. 2018, 200, 16–36. [Google Scholar] [CrossRef]

- Mashud, A.H.M. An EOQ deteriorating inventory model with different types of demand and fully backlogged shortages. Int. J. Logist. Syst. Manag. 2020, 36, 16. [Google Scholar] [CrossRef]

- Udayakumar, R.; Geetha, K.V.; Sana, S.S. Economic ordering policy for non-instantaneous deteriorating items with price and advertisement dependent demand and permissible delay in payment under inflation. Math. Methods Appl. Sci. 2021, 44, 7697–7721. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Wee, H.-M.; Huang, C.-V.; Wu, J.-Z. Optimal Replenishment Policy for Deteriorating Products in a Newsboy Problem with Multiple Just-in-Time Deliveries. Mathematics 2020, 8, 1981. [Google Scholar] [CrossRef]

- Mashud, A.M.; Hasan, R. An Economic Order Quantity model for Decaying Products with the Frequency of Advertisement, Selling Price and Continuous Time Dependent Demand under Partially Backlogged Shortage. Int. J. Supply Oper. Manag. 2019, 6, 296–314. [Google Scholar] [CrossRef]

- Das, S.C.; Zidan, A.; Manna, A.K.; Shaikh, A.A.; Bhunia, A.K. An application of preservation technology in inventory control system with price dependent demand and partial backlogging. Alexandria Eng. J. 2020, 59, 1359–1369. [Google Scholar] [CrossRef]

- Teng, J.-T.; Cárdenas-Barrón, L.E.; Chang, H.-J.; Wu, J.; Hu, Y. Inventory lot-size policies for deteriorating items with expiration dates and advance payments. Appl. Math. Model. 2016, 40, 8605–8616. [Google Scholar] [CrossRef]

- Lashgari, M.; Taleizadeh, A.A.; Sadjadi, S.J. Ordering policies for non-instantaneous deteriorating items under hybrid partial prepayment, partial trade credit and partial backordering. J. Oper. Res. Soc. 2018, 69, 1167–1196. [Google Scholar] [CrossRef]

- Taleizadeh, A.A. Lot-sizing model with advance payment pricing and disruption in supply under planned partial backordering. Int. Trans. Oper. Res. 2017, 24, 783–800. [Google Scholar] [CrossRef]

- Lashgari, M.; Taleizadeh, A.A.; Ahmadi, A. Partial up-stream advanced payment and partial down-stream delayed payment in a three-level supply chain. Ann. Oper. Res. 2016, 238, 329–354. [Google Scholar] [CrossRef]

- Maiti, A.K.; Maiti, M.K.; Maiti, M. Inventory model with stochastic lead-time and price dependent demand incorporating advance payment. Appl. Math. Model. 2009, 33, 2433–2443. [Google Scholar] [CrossRef]

- Chen, S.-C.; Teng, J.-T. Retailer’s optimal ordering policy for deteriorating items with maximum lifetime under supplier’s trade credit financing. Appl. Math. Model. 2014, 38, 4049–4061. [Google Scholar] [CrossRef]

- Taleizadeh, A.A. An economic order quantity model for deteriorating item in a purchasing system with multiple prepayments. Appl. Math. Model. 2014, 38, 5357–5366. [Google Scholar] [CrossRef]

- Khedlekar, U.K.; Shukla, D.; Namdeo, A. Pricing policy for declining demand using item preservation technology. Springerplus 2016, 5, 1957. [Google Scholar] [CrossRef] [Green Version]

- Shah, N.H.; Vaghela, C.R. Economic order quantity for deteriorating items under inflation with time and advertisement dependent demand. Opsearch 2017, 54, 168–180. [Google Scholar] [CrossRef]

- Tavakoli, S.; Taleizadeh, A.A. An EOQ model for decaying item with full advanced payment and conditional discount. Ann. Oper. Res. 2017, 259, 415–436. [Google Scholar] [CrossRef]

- Mashud, A.; Khan, M.; Uddin, M.; Islam, M. A non-instantaneous inventory model having different deterioration rates with stock and price dependent demand under partially backlogged shortages. Uncertain Supply Chain Manag. 2018, 6, 49–64. [Google Scholar] [CrossRef]

- Noori-daryan, M.; Taleizadeh, A.A.; Govindan, K. Joint replenishment and pricing decisions with different freight modes considerations for a supply chain under a composite incentive contract. J. Oper. Res. Soc. 2018, 69, 876–894. [Google Scholar] [CrossRef]

- Soni, H.N.; Suthar, D.N. Pricing and inventory decisions for non-instantaneous deteriorating items with price and promotional effort stochastic demand. J. Control Decis. 2019, 6, 191–215. [Google Scholar] [CrossRef]

- Li, R.; Liu, Y.; Teng, J.-T.; Tsao, Y.-C. Optimal pricing, lot-sizing and backordering decisions when a seller demands an advance-cash-credit payment scheme. Eur. J. Oper. Res. 2019, 278, 283–295. [Google Scholar] [CrossRef]

- Das, S.; Khan, M.A.A.; Mahmoud, E.E.; Abdel-Aty, A.H.; Abualnaja, K.M.; Shaikh, A.A. A production inventory model with partial trade credit policy and reliability. Alexandria Eng. J. 2021, 60, 1325–1338. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Lashgari, M.; Akram, R.; Heydari, J. Imperfect economic production quantity model with upstream trade credit periods linked to raw material order quantity and downstream trade credit periods. Appl. Math. Model. 2016, 40, 8777–8793. [Google Scholar] [CrossRef]

- Pervin, M.; Roy, S.K.; Weber, G.-W. Analysis of inventory control model with shortage under time-dependent demand and time-varying holding cost including stochastic deterioration. Ann. Oper. Res. 2018, 260, 437–460. [Google Scholar] [CrossRef]

- Pervin, M.; Kumar Roy, S.; Wilhelm Weber, G. Multi-item deteriorating two-echelon inventory model with price- and stock-dependent demand: A trade-credit policy. J. Ind. Manag. Optim. 2017, 13, 1–29. [Google Scholar] [CrossRef]

| Authors | Shortage | Deterioration | Preservation Technology | Advance Payment |

|---|---|---|---|---|

| Mashud et al. [13] | + | + | − | + |

| Tiwari et al. [19] | + | + | − | − |

| G. Li et al. [8] | + | + | − | − |

| Teng et al. [25] | + | + | − | + |

| Lashgari et al. [26] | + | + | − | + |

| Maiti et al. [29] | + | − | − | + |

| Chen and Teng [30] | − | + | − | − |

| Taleizadeh [31] | + | + | − | + |

| Khedlekar et al. [32] | − | + | + | − |

| Shah and Vaghela [33] | − | + | − | − |

| Tavakoli and Taleizadeh [34] | + | + | − | + |

| Taleizadeh [27] | + | + | − | + |

| Mishra et al. [2] | − | + | + | − |

| Mashud et al. [35] | + | + | − | − |

| Noori-daryan et al. [36] | − | − | − | − |

| Soni and Suthar [37] | + | + | − | − |

| R. Li et al. [38] | + | + | + | + |

| Das et al. [39] | − | + | − | − |

| This study | + | + | + | + |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roy, D.; Hasan, S.M.M.; Rashid, M.M.; Hezam, I.M.; Al-Amin, M.; Chandra Roy, T.; Alrasheedi, A.F.; Mashud, A.H.M. A Sustainable Advance Payment Scheme for Deteriorating Items with Preservation Technology. Processes 2022, 10, 546. https://doi.org/10.3390/pr10030546

Roy D, Hasan SMM, Rashid MM, Hezam IM, Al-Amin M, Chandra Roy T, Alrasheedi AF, Mashud AHM. A Sustainable Advance Payment Scheme for Deteriorating Items with Preservation Technology. Processes. 2022; 10(3):546. https://doi.org/10.3390/pr10030546

Chicago/Turabian StyleRoy, Dipa, S. M. Mahmudul Hasan, Md Mamunur Rashid, Ibrahim M. Hezam, Md Al-Amin, Tutul Chandra Roy, Adel Fahad Alrasheedi, and Abu Hashan Md Mashud. 2022. "A Sustainable Advance Payment Scheme for Deteriorating Items with Preservation Technology" Processes 10, no. 3: 546. https://doi.org/10.3390/pr10030546

APA StyleRoy, D., Hasan, S. M. M., Rashid, M. M., Hezam, I. M., Al-Amin, M., Chandra Roy, T., Alrasheedi, A. F., & Mashud, A. H. M. (2022). A Sustainable Advance Payment Scheme for Deteriorating Items with Preservation Technology. Processes, 10(3), 546. https://doi.org/10.3390/pr10030546