1. Introduction

Shipping is a service industry that generates revenues from domestic cargo transport and transport services among different countries. It is estimated that the shipping market deals with approximately 90% of the worldwide trade volume (

Stopford 2008). Global shipping routes have connected the most distant nations, countries, and continents through trade and economic relations (

Tulyakova et al. 2019). In other words, an export of goods produced in Korea competes with shipping companies globally because there are no borders in the shipping market.

The shipping industry is a highly volatile industry affected by global economic aspects. Due to the global economic downturn in the late 2000s, the nosedive of demand for the shipping market due to the derived demand of the global economy has negatively affected the shipping industry (

Kim 2018). Fluctuations of freight rates due to the depression of the global economy have the potential to decrease sales of shipping companies. Due to the high fixed costs, the long-term stagnation of freight rates may deteriorate profitability, and, thus, less competitive shipping companies will likely face bankruptcy. The shipping industry is more sensitive to fluctuations in the global economy compared to other industries.

In particular, the Korean shipping industry faced a crisis in the 1980s during the global depression induced by the oil shock, experienced significant difficulties in the 1990s during the International Monetary Fund (IMF) bailout era, and was severely hit during the global financial crisis of 2008. In May 1984, in the aftermath of the oil shock, the Korean government implemented an action plan for the shipping industry rationalization, in which 63 out of 66 national shipping companies participated. As a result, six shipping companies merged, and 14 were integrated and assumed to merge within two years.

Post-Asian financial crisis of 1997, most shipping companies experienced negative growth (even under the IMF program), and the government’s regulation of the debt-to-income ratio forced ocean-going shipping companies to reduce their fleets. As ships ordered before the global financial crisis entered the market, the shipping market business began to feel pressure due to oversupply. Many shipping companies went bankrupt after 2008, and several became vulnerable to credit risk. For instance, Hanjin Shipping went bankrupt, and Hyundai Merchant Marine went through restructuring, after which Korea Development Bank became its largest shareholder.

The lack of ability to forecast shipping market fluctuations and manage shipping companies’ risks has been indicated as the primary reason appropriate measures were not taken until recently despite repeated crises. The crisis of the Korean shipping industry and the default of companies depend on unique features of both the Korean market and the global economy, which must all be considered to achieve reliable default predictions.

The shipping industry is capital-intensive and largely depends on borrowed capital as a means of financing ships. Most revenue comes from the freight rates paid by shippers. The profit structure of the shipping industry is peculiar; further, the financial structure of shipping companies is weaker than that of firms operating in the manufacturing industry.

The risk assessment of shipping companies should reflect the unique characteristics of the shipping industry (

Grammenos 2013). The business activities of shipping companies can be divided into two revenues: one from maritime transport (or shipping), which companies secure by managing their ships, and a second from the sale and the purchase of ships (S&P, henceforth). The demand for maritime transport largely depends on the demand for global trade and the trade volume, thus reflecting the procyclical feature of the shipping industry. Increasing and decreasing assets through the S&P of ships have a significant impact on the financial structure of shipping companies depending on when and how ships are acquired. The shipping industry as a whole is influenced by the shipping business cycle and is significantly affected by both the risks associated with individual companies and the systemic risks common to all companies. Therefore, diagnosing the default of shipping companies at an early stage and developing appropriate risk management tools are challenging tasks.

Thus, this study proposes a new approach to diagnose and predict the default crisis of Korean shipping companies utilizing the logit model. Financial ratios play an important role in revealing corporate financial soundness, a role which helps to maintain the competitive position of an enterprise, alongside the achievement of stable development contributing to the elimination of potential financial risks (

Kliestik et al. 2020). In order to predict the financial reliability of companies, it is necessary to follow the development of significant financial ratios (

Valaskova et al. 2020). Additionally, identification of key financial indicators enables modeling of the probability of default and prediction of financial problems to a specific level of accuracy (

Kovacova et al. 2019;

Kliestik et al. 2020). Thus, we propose two different models: the first approach is based on financial indicators (indicators proposed in the Financial Statement Analysis issued by the Bank of Korea), and the other relies on the unique characteristics of shipping companies. Expressly, the default prediction model of shipping companies is estimated using financial indicators such as the sales activities (through ships) and the variation of assets (through acquiring and selling ships), which are unique characteristics of the financial structure of shipping companies.

The remainder of this paper is organized as follows.

Section 2 outlines previous research related to default prediction analysis. In

Section 3, research methodology is addressed. Data description and the empirical results are presented in

Section 4. Finally,

Section 5 concludes the article.

2. Literature Review

It is significantly important to predict the default risk of companies as they become more global and more complex (

Kliestik et al. 2018). Default prediction models are used to identify companies that are likely to face issues in future soundness and to discover key factors in the early stage that may cause risks. The purpose of default prediction is to control insolvency and minimize social costs by prompting market participants to adopt adequate preemptive measures and by improving the standards of supervisory institutions.

Studies on quantitative corporate default prediction using financial ratios began with the two-way ANOVA introduced by

Beaver (

1966) and developed into discrete probability models, such as the multivariate discriminant analysis by

Altman (

1968), the logit model by

Ohlson (

1980), and the probit model by

Zmijewski (

1984). Recently, some studies used artificial neural network (ANN) and survival analysis.

The discriminant analysis proposed by

Altman (

1968) is a multivariate default model that analyzes the differences between two or more groups by simultaneously considering multiple financial ratios. Samples are randomly extracted from two populations of solvent and insolvent companies, through which the classification standard is estimated. Then, a procedure is followed for determining the group to which new samples belong by using the estimated classification standard. Discriminant analysis is widely used in default prediction and is extensively studied in the fields of credit rating, valuation of stocks, and bond rating.

However, discriminant analysis can only represent a ranking with simple discrimination scores and is subject to unrealistic constraints, such as the assumption of the normal distribution of independent variables and the variance homogeneity among groups. Moreover, this methodology cannot be applied when independent variables are of nominal scale, and testing the significance of each coefficient is not feasible.

Ohlson (

1980) stressed the problems of this approach and proposed the logit model for default prediction. The logit model is used when the dependent variables are binary (such as whether a company is bankrupt or not). Expressly, this model is applied when the dependent variables are qualitative and assume the values of zero or one, and the choice probability between zero and one exists and follows the logistic function. For instance, this approach allows perceiving a company’s insolvency or solvency as well as its probability of indebtedness.

Grammenos et al. (

2008) estimated the default prediction of high-yield bonds issued by shipping companies using the logit model. Considering the characteristics of the shipping industry, such as high volatility and high capital intensity, the study classified the possible determinants of default by bond characteristics, corporate financial characteristics, and industrial characteristics. A total of 50 high-yield bonds issued by shipping companies from 1992 to 2004 were analyzed, and several variables affecting the probability of bond default were addressed, such as bond characteristics, companies’ financial situations, and the soundness of the shipping business, as explanatory variables. The results show that the primary indicators of the default on bonds issued by shipping companies are financial variables, such as the working capital to total assets and the retained income to total assets. Further, the shipping business index was found to have significant explanatory power.

Mitroussi et al. (

2016) estimated the primary determinants of default of shipping companies and argued that credit risks are caused by both financial sector and non-financial sector factors. The study classified the variables affecting the default of shipping companies into financial sector, non-financial sector, and economic factors and subsequently analyzed the loans of 30 shipping companies in Greece from 2005 to 2009. The interest rate spread, the maintenance requirement rate of collateral, the company’s asset value to debt, and the total debt to ship value were used as the explanatory variables in the financial sector. The deadweight tonnage, the age of the vessel, and the fleet size were proposed as non-financial variables affecting credit risk. The results show that a shorter history and less regular chartering lead to a higher probability of default.

Kavussanos and Tsouknidis (

2016) argued that the long-term recession of the shipping industry following the global financial crisis of 2008 was caused by financial institutions denying loans to shipping companies. The study investigated the main causes and determinants of non-performing loans of shipping companies and used the logit model to analyze the probability of non-performing loans using financial data from 1997 to 2011 of 63 shipping companies. The estimation approach is based on the “Six C’s of credit”, which adds “company” to the “Five C’s of credit” proposed by

Smith (

1964): capacity, capital, collateral, condition, and character. The results show that the primary determinants of the default of shipping companies are the shipping market conditions and the ship value. The study highlights the need to address the prospects and the market conditions aside from financial indicators for a more detailed investigation of the shipping industry, which is characterized by high volatility and procyclical behavior.

Lozinskaia et al. (

2017) used a sample of 192 listed shipping companies from 2001 to 2016 and employed a logit model to investigate the determinants of the probability of default. As with prior studies, they also argued that both financial and non-financial factors should be considered in the study of shipping companies’ default predictions.

Meanwhile, a number of default prediction studies were conducted on Korean companies (

Nam and Jinn 2000;

Kim et al. 2011;

Park and Kang 2009).

Nam and Jinn (

2000) used the logit model to construct a bankruptcy prediction model for listed Korean companies that went bankrupt between 1997 and 1998, the time of the IMF crisis.

Kim et al. (

2011) built a logit model for default prediction of Korean companies from 2006 to 2008, the global financial crisis period.

Park and Kang (

2009) established a logit model for forecasting insolvency of KOSDAQ-listed companies through the logit model. These studies focused on predicting insolvency of Korean listed companies or Korean companies in general.

As mentioned above, it is important to build a model that reflects the financial characteristics of a shipping company to predict insolvency of the company. However, there are few default prediction studies on Korean shipping companies because it is difficult to secure long-term financial information for all relevant companies. In particular, most Korean shipping companies are unlisted companies, thus it is necessary to select a suitable model to predict insolvency. Accordingly, we collected long-term detailed financial information from the Korea Shipowners Association. Further, in this study, a logit model is proposed for predicting the default probability of shipping companies instead of Altman’s model. The logit model determines the causes of default by analyzing the financial standing of insolvent companies preceding default and enables the prediction of future default (

Kim et al. 2011). Default is often identified with delistings or workouts in a broader sense than with legal bankruptcies (

Kim et al. 2011;

Park and Kang 2009). However, this study determines default based on the cancelation of registration from the Korea Shipowners’ Association between 2001 and 2019. Companies are considered insolvent when their registration is canceled or when a company is under court receivership. In other words, this study classifies the bankruptcy of individual companies or equivalent situations as default and thus is considered a default prediction model in a strict sense.

3. Methodology

Our research constructs a default prediction model for Korean shipping firms using logit models. In developing corporate default prediction models, we examine factors which affect shipping companies’ financial risks. We then calculate commonly applied performance rates, namely accuracy rate, total error rate, type I errors, type II errors, and area under the curve (AUC), to compare the prediction accuracy of each model.

A logit model, which has been widely used in recent literature, is applied to capture corporate defaults (or insolvencies). The framework employs binary variables. A dependent variable yields a value of one if a company is insolvent and a value of zero if a company is solvent.

The logit model overcomes the limitations of the discriminant analysis as it does not assume normal distribution of independent variables nor homogeneity among groups (

Klieštik et al. 2015). Furthermore, the logit model allows for testing the significance of the independent variables’ coefficients and estimating the correlation between each independent variable and the probability of default. In addition, unlike AI (artificial intelligence) models such as ANN, it is easy to economically interpret results within the logit model. AI models in particular are simply specialized in predictive power, while logit models statistically explain causal relationships between variables, thus enabling conditional forecasting of insolvency alongside changes in other variables.

Since the model fails to satisfy the basic assumptions of an ordinary least squares (OLS), the approach is less accurate and reliable when a general linear regression model is applied in the case of a binary dependent variable (

Lee et al. 2005). When a dependent variable, y, represents binary values, either one (insolvent) or zero (solvent), with a nonlinear relationship to an independent explanatory variable,

, a logit function has the following Equation (1):

where, ①

indicates the probability of corporate default (or insolvency); ②

is a characteristic variable, such as an observable financial variable, of the

i-th company; ③

represents the cumulative distribution function of the logistic function.

The likelihood function for N companies can be expressed as follows:

When the dependent variable is discrete, the logit model cannot be estimated as a linear regression because it violates the assumptions about the error required for general linear regression. In particular, the estimated probability may be smaller than zero or greater than one (

Hill et al. 2018). Thus, the logit model can be estimated using maximum likelihood estimation (MLE).

The estimation procedures of the default prediction model are as follows:

① Select the candidate variable that might affect the dependent variable (insolvency). ② Select the variable that passes the significance test level for the candidate variable. The insolvency indicator is used, and the candidate variable to estimate the multivariate logistic regression model is chosen through Kendall’s Tau correlation coefficient and univariate logistic regression analysis. ③ Estimate the model using maximum likelihood and create a group of significant variables using the stepwise selection option. ④ Select the optimum regression equation using the group of variables that passed the standard for divergence consistency and parameter significance and determine the optimum threshold for the insolvency decision. The optimum threshold is the probability value that minimizes the sum of type I and type II errors of the prediction results for insolvency and solvency. ⑤ The probability of default of each firm can be obtained by substituting both the estimated coefficient of the selected model and the value of the financial variables of each firm into Equation (1). If the predicted probability exceeds a certain threshold, the company is likely to be insolvent.

4. Results of the Empirical Analysis

4.1. Data Description

4.1.1. Insolvency Standard

Corporate defaults or insolvencies can be very complicated depending on the company’s state and national standards and, thus, are difficult to clearly define. Legally, a court’s official declaration of bankruptcy may be regarded as a default, but, economically, corporate defaults are defined in various ways.

Beaver (

1966) defined a default as the state in which liabilities that must be paid at maturity are insolvent.

Altman (

1968),

Ohlson (

1980), and

Zmijewski (

1984) all defined a bankrupt company as an insolvent company in the legal sense.

Altman (

1971) considered risk compensation and defined insolvency as the case in which the realized compound yield of invested capital is severely and consistently lower than the general earnings rate of a similar investment plan. Moreover,

Lev (

1974) defined a default as financial or sales difficulties due to insolvency or bankruptcy.

Studies of Korean data using the logit model determine defaults by considering delistings and court receivership as the standard for insolvency, a broader sense than legal bankruptcy (

Kim et al. 2011;

Park and Kang 2009). Based on the aforementioned discussion, this study defines the bankruptcies of individual companies or equivalent situations as defaults.

Specifically, this study determines defaults based on cancelations of registrations with the Korea Shipowners’ Association, and companies are considered insolvent when their registration is canceled or they are placed under court receivership. The analyses focus on the period from 2001 to 2019.

Because, in most cases, a company’s financial data are unavailable the year a registration is canceled, the previous year and two years prior to bankruptcy are used as the year of default in this study. Thus, in this study, the estimated probability of an individual firm’s default is defined as the probability that it will become insolvent after two years. The data used in the analysis are the financial data of Korean shipping companies from 2001 to 2019 provided by the Korea Shipowners’ Association.

Table 1 shows the annual default rates of the sample.

4.1.2. Principal Financial Indicators

The data were extracted from Korea Shipowners’ Association Yearbook. The principal explanatory variables for predicting shipping company defaults are the financial indicators of the annual average of 74 companies registered as members of the Korea Shipowners’ Association between 2001 and 2019. The sample includes the annual average of nine cases of insolvency among the companies. As mentioned, the standard for insolvency is whether a company’s membership registration with the Korea Shipowners’ Association is canceled or whether the company filed for court receivership.

As shown in

Table 2, numerous financial indicators were collected and tested to determine whether the ratios have explanatory power on the failure of shipping firms. These indicators are classified into three groups: profitability, stability, and activity. We follow the classifications and the computations of ratios from the Bank of Korea’s Financial Statement Analysis.

1 In addition to these, we allow for eight industry specific indicators—“ratio of freight income to sales”, “ratio of ship rental income to sales”, “ratio of fuel cost to sales”, “ratio of shipping cost to sales”, “ratio of voyage cost to sales”, “ratio of chartering cost to sales”, “ratio of freight income to chartering cost”, and “ratio of ship value to total assets”—to reflect the unique financial characteristics of the shipping industry. As noted, the industry is capital intensive, faces highly volatile freight rates and ship prices, and exhibits strong cyclicality and seasonality (

Haider et al. 2019).

Freight income, ship rental income, fuel cost, and chartering costs are used as financial indicators related to profitability, and the ratio of ship value to total assets is used as the stability indicator to build a model that considers the distinct characteristics of the shipping industry. These indicators are described in

Table 3.

Among the explanatory variables, the ratio of ship value to total assets is expected to have a paradoxical effect on defaults. The ratio of ship value to total assets describes ship value as a percentage of a company’s assets, thus it is vulnerable to ship price fluctuations. This ratio can also be interpreted as the tendency to concentrate assets, and, thus, a positive correlation with the probability of default is expected.

4.2. Summary Statistics of Explanatory Variables

Table 4 and

Table 5 show the summary statistics of solvent and insolvent companies. As shown in the tables, many insolvent companies suffer deficits and face pressure from high interest expenses compared to solvent companies.

4.3. Results of Testing the Suitability of Explanatory Variables

To test the suitability of the explanatory variables, candidate indicators are selected by considering the expected signs of the coefficients and the statistical significance levels when estimating Kendall’s

and univariate logistic regressions (

Kwak 2013). The suitability test results are shown in

Table 6.

As a result of these tests, 15 candidate profitability indicators (e.g., the ratio of income before income taxes to total assets, the ratio of net income to total assets, or the ratio of net income to business taxes) and five indicators of stability (e.g., the debt ratio, the current ratio, or the ratio of ship value to total assets) are selected. This result means that an increase in indicators due to improved profitability or stability will reduce the probability of insolvency of shipping companies and an increase in cost indicators will reduce the probability of insolvency of shipping companies. Therefore, the selected indicators are suitable for the composition of the default prediction model of this study.

The characteristics of the variables selected for the model show that profitability appears to be more suitable for predicting defaults than stability. This result may be due to the attributes of the shipping industry, which is more highly dependent on borrowed capital than other industries, meaning that stability plays only a small role in determining the insolvency rate.

The profitability indicator has explanatory power for shipping company defaults; thus, a default prediction model with multiple variables describing the profits and the characteristics of the shipping industry seems suitable. Moreover, among the stability indicators, debt ratio, current ratio, and ratio of ship value to total assets are selected as candidates, demonstrating that liabilities and ship value (main asset) may be the principal explanatory variables for shipping companies’ default probabilities. The default factors may vary depending on the period and the economic situation; thus, in addition to the variables already used, variables not used in this study must be considered as candidate variables for future default predictions.

4.4. Results of the Logit Model Estimation

We chose the predictive variables based on univariate logit models and Kendall’s

. The seven variables are “ratio of net income to total assets (

)”, “ratio of operating income to sales (

)”, “ratio of interest expenses to liabilities

”, “current ratio

”, “debt ratio

”, “ratio of freight income to chartering cost

”, and “ratio of chartering cost to sales

.” Assuming the financial indicators’ ability to predict a firm’s failure one year prior, we use lagged variables of the ratios (i.e.,

). We estimate the following regressions:

where,

(1 −

is the log of the odds ratio;

is time fixed effects;

ratio of income to total assets;

ratio of operating income to sales;

ratio of interest expenses to liabilities;

current ratio;

debt ratio;

ratio of freight income to chartering cost; and

ratio of chartering cost to sales.

One potential problem with a logit regression is the presence of multicollinearity.

Grammenos et al. (

2008) suggested that multicollinearity may exist if correlation coefficients between explanatory variables are greater than 0.8. We conducted the bivariate correlation test among explanatory variables and found that, in all cases, correlation coefficients were less than 0.8 (see the

Supplementary Materials for the detailed results).

2Table 7 reports the results of the pooled logit models. The coefficients of the logit model estimation results can be used to estimate the probability of default by substituting the maximum likelihood values estimated for Equation (2) into Equation (1).

The resulting ratio of operating income to sales has a statistically significant effect, such that an increase in freight income, which is the main source of income for the shipping industry, leads to a lower probability of default. Increases in ratio of chartering cost to sales lead to a higher probability of default, demonstrating that the cost structure of the shipping industry is a principal factor in defaults. This structure is used to determine the solvency of a company or its credit capability, which is the most important variable in terms of credit analysis, which lowers the probability of default. In contrast, the ratio of interest expenses to liabilities and debt ratio increases the probability of default, indicating the burden of interest expenses and debt is closely related to shipping company defaults. If interest expenses increase or liabilities decrease, the ratio of interest expenses to liabilities increases. Considering the high debt dependency of shipping companies, the ratio of interest expenses to liabilities is more helpful in increasing the explanatory power of the default predictions than the ratio of interest expenses to sales.

4.5. Predictive Ability of the Models

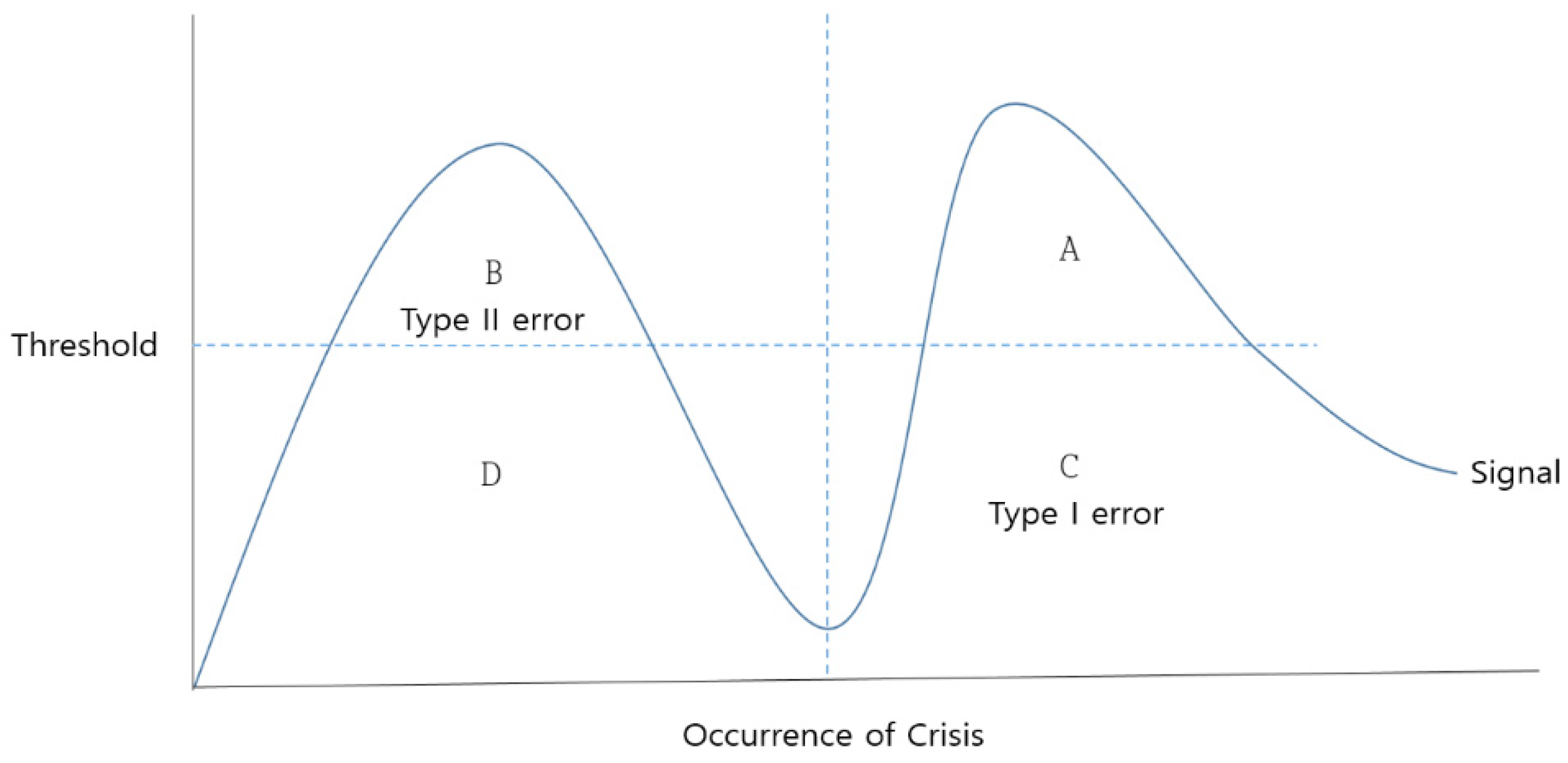

To predict financial defaults of shipping companies, it is important to select models with adequate fractions of type I and type II errors to test their predictive ability. Type I error refers to the case in which a signal does not occur in the case of an actual default (C), and type II error refers to the case in which a signal occurs, but a default does not occur (B).

To optimize predictive ability, both type I and type II errors must be zero, which is impossible in practice. The noise/signal ratio described in

Table 8 can be expressed as follows:

In Equation (7), the numerator represents the percentage of times a signal is given but no crisis occurs (type II error), and the denominator represents the percentage of times there is no crisis and a signal does not occur. Because a type I error is the percentage that a signal does not occur even in a crisis

), the signal-to-noise ratio in Equation (7) is equivalent to type II error/(1-type I error). Thus, if the signal-to-noise ratio is greater than one, the threshold set by the default prediction model may be sending excessive false signals, making it an unsuitable threshold (

Korean Ministry of Oceans and Fisheries 2015). The number of cases for the crisis signal threshold is shown in

Figure 1.

The optimal threshold must be set by reducing noise and increasing signals (

Bussiere and Fratzscher 2002). Thus, the threshold must be the value that minimizes the sum of type I and type II errors.

Table 9 shows accuracy rate, total error rate, type I and type II errors, and AUC for each threshold in the default prediction model.

The models’ predictive abilities for probability of default are shown in

Table 9.

Grammenos et al. (

2008) suggested that, since the accuracy rate does not contain information on types of error, comparing the models’ predictive ability based on accuracy rate could render a misperception. To rank the models’ predictive abilities, an accuracy rate allowing trade-off between type I errors and type II errors is necessary to avoid misperceptions of the overall prediction rates. For instance, while there is barely any difference between the accuracy rates of Model 1 and Model 2, Model 1 has a higher rate of type II errors (34.29%) than Model 2.

Regarding accuracy rates, Model 1, Model 2, and Model 3 have lower predictive abilities (between 73.31 and 75.63) than Model 4 (81.98%). Model 4 returns the lowest rate of type I errors (14.16), while it has the highest rate of type II errors (39.05%).

A widely used method comparing the predictive capacity of different models is the comparison of the area under the receiver operator characteristic (ROC). In the area under ROC, a larger AUC means better binary classification ability of the model (

Cesa-Bianchi et al. 2019).

Figure 2 shows the base of the ROC for all four models. The ROC curve is a curve that plots each prediction by stating the false positive rate predicted by the X-axis when no insolvency occurs and defining the Y-axis as sensitivity, which means the prediction matches the actual event occurrence. It is shown that Model 4 forms the largest AUC (77.81%), indicating that the model is the best predictor overall. Following this are Model 3 (77.41%), Model 2 (76.67%), and Model 1 (73.27%).

Overall, Model 4, which involves financial ratios and industry specific indicators, has greater predictive ability than the others according to its accuracy rate and trade-off between type I errors and type II errors, which suggests that including industry specific indicators in a model may improve the predictive ability of a default prediction.

5. Conclusions

This study developed prediction models to diagnosis default probability of Korean shipping companies. To this end, this study determined the financial characteristics of the shipping industry and proposed a method for predicting crises by estimating a prediction model that reflects the financial characteristics of the shipping industry.

Specifically, the logit model was used to predict shipping company defaults. Defaults were identified as canceling membership in the Korea Shipowners’ Association or being placed under court receivership. The important explanatory variables for distinguishing between solvent and insolvent companies included seven financial variables: ratio of net income to total assets, ratio of operating income to sales, ratio of interest expenses to liabilities, current ratio, debt ratio, ratio of freight income to chartering cost, and ratio of chartering cost to sales.

Because the financial characteristics of shipping companies have not been thoroughly identified, this study analyzed the financial indicators of shipping companies including characteristics of the shipping industry and traditional default predictors among the factors considered in the default prediction model. Accordingly, this study’s significance lies in providing useful information for risk assessment in the shipping industry by presenting models that reflect the industry’s characteristics.

The following matters must be considered to more efficiently predict shipping company defaults. First, it is necessary to obtain data reflecting the characteristics of shipping companies. Default probabilities could not be determined with a traditional financial approach because dependence on borrowing is higher in the shipping industry than in other industries. As this study found, financial indicators that take the characteristics of the shipping industry into account along with the traditional financial indicators used in previous studies are helpful in predicting shipping company defaults. Second, a clear standard for shipping company defaults must be defined. In this study, defaults were determined based on insolvencies or court receiverships, but this definition has limitations in identifying defaults at an early stage because it hinges on actual crises. Thus, it is necessary to discuss standards that are clearer than the method used in this study. In addition, this study attempted to test the robustness of the model through an in-sample forecasting analysis and did not perform an out-of-sample forecasting analysis because the estimated time series is only 19 years long. Thus, the model should be revised yearly to predict shipping company defaults and establish an optimal model.

The purpose of default predictions is to anticipate corporate risks and, thus, to minimize the damage from these risks through preemptive measures. Considering the significance of the shipping industry to Korea’s economy and the social costs that accompany defaults, it is necessary to warn companies of the risks identified by the default prediction system. Moreover, the government and financial institutions may provide support for companies to implement effective measures.

Author Contributions

Conceptualization, S.P. and H.K.; methodology, S.P. and J.K.; software, S.P. and J.K.; validation, H.K. and T.K.; formal analysis, S.P. and J.K.; investigation, S.P. and J.K.; resources, S.P. and T.K.; data curation, S.P. and J.K.; writing—original draft preparation, S.P., J.K. and T.K.; writing—review and editing, S.P., H.K., J.K. and T.K.; visualization, S.P. and J.K.; supervision, H.K. and T.K.; project administration, S.P. and H.K.; funding acquisition, S.P. and T.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Korea Maritime Institute, grant number GP2020-07.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing not applicable.

Acknowledgments

The authors fully acknowledge Korea Maritime Institute (KMI) for the approved funds as this research was supported by Grant Vote: GP2020-07, which makes this important research viable and effective.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | |

| 2 | In the Online Supplementary Materials, we also present a correlation matrix and Wald test statictics for the seven variables. We thank the refree for the useful suggestion. |

References

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I. 1971. Railroad bankruptcy propensity. The Journal of Finance 26: 333–45. [Google Scholar] [CrossRef]

- Altman, Edward I. 1983. Why businesses fail. Journal of Business Strategy 32: 307–17. [Google Scholar] [CrossRef]

- Altman, Edward I., and Gabriele Sabato. 2007. Modelling credit risk for SMEs: Evidence from the US market. Abacus 43: 332–57. [Google Scholar] [CrossRef]

- Altman, Edward I., Robert G. Haldeman, and Paul Narayanan. 1977. ZETATM analysis A new model to identify bankruptcy risk of corporations. Journal of Banking & Finance 1: 29–54. [Google Scholar] [CrossRef]

- Barboza, Flavio, Herbert Kimura, and Edward Altman. 2017. Machine learning models and bankruptcy prediction. Expert Systems with Applications 83: 405–17. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial ratios as predictors of failure. Journal of Accounting Research, 71–111. [Google Scholar] [CrossRef]

- Bonfim, Diana. 2009. Credit risk drivers: Evaluating the contribution of firm level information and of macroeconomic dynamics. Journal of Banking & Finance 33: 281–99. [Google Scholar] [CrossRef]

- Bussiere, Matthieu, and Marcel Fratzscher. 2002. Towards a New Early Warning System of Financial Crises. ECB Working Paper No. 145. Frankfurt am Main: European Central Bank. [Google Scholar]

- Cesa-Bianchi, Ambrogio, Fernando Eguren Martin, and Gregory Thwaites. 2019. Foreign booms, domestic busts: The global dimension of banking crises. Journal of Financial Intermediation 37: 58–74. [Google Scholar] [CrossRef]

- Grammenos, Costas, ed. 2013. The Handbook of Maritime Economics and Business. Abingdon: Taylor & Francis. [Google Scholar]

- Grammenos, C. Th, Nikos K. Nomikos, and Nikos C. Papapostolou. 2008. Estimating the probability of default for shipping high yield bond issues. Transportation Research Part E: Logistics and Transportation Review 44: 1123–38. [Google Scholar] [CrossRef]

- Haider, Jane, Zhirong Ou, and Stephen Pettit. 2019. Predicting corporate failure for listed shipping companies. Maritime Economics & Logistics 21: 415–38. [Google Scholar] [CrossRef]

- Hill, R. Carter, William E. Griffiths, and Guay C. Lim. 2018. Principles of Econometrics. Hoboken: John Wiley & Sons. [Google Scholar]

- Jacobson, Tor, Jesper Lindé, and Kasper Roszbach. 2005. Credit risk versus capital requirements under Basel II: Are SME loans and retail credit really different? Journal of Financial Services Research 28: 43–75. [Google Scholar] [CrossRef][Green Version]

- Kavussanos, Manolis G., and Dimitris A. Tsouknidis. 2016. Default risk drivers in shipping bank loans. Transportation Research Part E: Logistics and Transportation Review 94: 71–94. [Google Scholar] [CrossRef]

- Kim, Jin-Hwan. 2018. Studies on Better Management Skills in Korean Shipping. The Journal of Distribution Science 16: 5–13. [Google Scholar] [CrossRef]

- Kim, Sang Bong, Phillip Ji, and Kyung June Jo. 2011. The analysis on the causes of corporate bankruptcy with the bankruptcy prediction model. Journal of Market Economy 40: 85–106. [Google Scholar]

- Klieštik, Tomáš, Katarína Kočišová, and Mária Mišanková. 2015. Logit and probit model used for prediction of financial health of company. Procedia Economics and Finance 23: 850–55. [Google Scholar] [CrossRef]

- Kliestik, Tomas, Maria Misankova, Katarina Valaskova, and Lucia Svabova. 2018. Bankruptcy prevention: New effort to reflect on legal and social changes. Science and Engineering Ethics 24: 791–803. [Google Scholar] [CrossRef] [PubMed]

- Kliestik, Tomas, Katarina Valaskova, George Lazaroiu, Maria Kovacova, and Jaromir Vrbka. 2020. Remaining Financially Healthy and Competitive: The Role of Financial Predictors. Journal of Competitiveness 12: 74–92. [Google Scholar] [CrossRef]

- Korean Ministry of Oceans and Fisheries. 2015. Early warning system building project for the shipping market. unpulished manuscript. [Google Scholar]

- Kovacova, Maria, Tomas Kliestik, Katarina Valaskova, Pavol Durana, and Zuzana Juhaszova. 2019. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oeconomia Copernicana 10: 743–72. [Google Scholar] [CrossRef]

- Kwak, Dong Chul. 2013. An empirical research on risk evaluation model and forecasting of SMEs. Journal of Small Business Innovation 35: 1–23. [Google Scholar]

- Lee, Sungwoo, Sunghee Min, Jiyoung Park, and Sungdo Yoon. 2005. The Practice on Logit and Probit Model. Seoul: Pakyoungsa. [Google Scholar]

- Lev, B. 1974. Financial Statement Analysis. A New Approach. London: Prentice-Hall Inc. [Google Scholar]

- Lozinskaia, Agata, Andreas Merikas, Anna Merika, and Henry Penikas. 2017. Determinants of the probability of default: The case of the internationally listed shipping corporations. Maritime Policy & Management 44: 837–58. [Google Scholar] [CrossRef]

- Mitroussi, Kiriaki, W. Abouarghoub, Jane J. Haider, Stephen J. Pettit, and Niki Tigka. 2016. Performance drivers of shipping loans: An empirical investigation. International Journal of Production Economics 171: 438–52. [Google Scholar] [CrossRef]

- Nam, Joo-Ha, and Taehong Jinn. 2000. Bankruptcy prediction: Evidence from Korean listed companies during the IMF crisis. Journal of International Financial Management & Accounting 11: 178–97. [Google Scholar] [CrossRef]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 109–31. [Google Scholar] [CrossRef]

- Park, Hee Jung, and Ho Jung Kang. 2009. Failing Prediction Models of KOSDADQ Firms by using of Logistic Regression. The Journal of the Korea Contents Association 9: 305–11. [Google Scholar] [CrossRef]

- Saurina, Jesús, and Carlos Trucharte. 2004. The impact of Basel II on lending to small-and medium-sized firms: A regulatory policy assessment based on Spanish credit register data. Journal of Financial Services Research 26: 121–44. [Google Scholar] [CrossRef]

- Smith, Paul F. 1964. Measuring risk on consumer instalment credit. Management Science 11: 327–40. [Google Scholar] [CrossRef]

- Stopford, Martin. 2008. Maritime Economics, 3rd ed. New York: Routledge. [Google Scholar]

- Tinoco, Mario Hernandez, and Nick Wilson. 2013. Financial distress and bankruptcy prediction among listed companies using accounting, market and macroeconomic variables. International Review of Financial Analysis 30: 394–419. [Google Scholar] [CrossRef]

- Tulyakova, Irina R., Victor V. Dengov, and Elena Gregova. 2019. The positions of Russia and Croatia shipbuilding products on world markets and prospects of co-operation (analytical overview). NAŠE MORE: Znanstveni Časopis za More i Pomorstvo 66: 13–21. [Google Scholar] [CrossRef]

- Valaskova, Katarina, Pavol Durana, Peter Adamko, and Jaroslav Jaros. 2020. Financial Compass for Slovak Enterprises: Modeling Economic Stability of Agricultural Entities. Journal of Risk and Financial Management 13: 92. [Google Scholar] [CrossRef]

- Zmijewski, Mark E. 1984. Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research, 59–82. [Google Scholar] [CrossRef]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).