Abstract

The objective of this research was to demonstrate the (nonlinear) risks of sovereign insolvency and explore the applicability of stochastic modeling in public debt management, given a structural economic model of stochastic government debt dynamics. A stochastic optimal control model was developed to model public debt dynamics based on the debt accounting identity, where the interest-growth differential obeys a continuous random process. This stochasticity represents both the interest rate risk of public debt and the variability of the growth rate of the nominal Gross Domestic Product combined. The optimal fiscal policy was analyzed in terms of the model parameters. The model was simulated, and results were visualized. The insolvency risk was demonstrated by examining the variance of the optimal process. The model was amended with hidden credit risk premia and fiscal multipliers, which forces the debt dynamics to be nonlinear in the debt ratio. The results, on the other hand, confirm that the volatility of the interest-growth differential is crucial in terms of sovereign solvency and in addition, it demonstrates the large risks stemming from the multiplier effect, which underlines the need for prudent debt management and fiscal policy.

1. Introduction

Public debt sustainability has become an increasingly important macroeconomic question for investors and sovereigns alike. Fiscal sustainability and debt sustainability are now especially important policy questions due to the global COVID-19 pandemic as governments have implemented various large fiscal backstops and support programs for households and firms. Moreover, automatic stabilizers and fiscal stimulus have caused the public debt ratios to increase. Fiscal crises stemming from unsustainable public debt can lead to an abrupt rise in taxes and deep cuts in welfare spending. Some authors have stressed the relationship of austere fiscal policy and the rise of populism and nationalism (see e.g., Dovis et al. 2016). If government spending is consistently unsustainable, debt to GDP ratios can spiral out of control. For example, if government spending does not contribute to productivity growth and employment, but is used for import consumption spending, there is a risk that the policy stance is not sustainable. Persistent current account deficits financed by government borrowing are examples of such risky policies. Public finances need to be sustainable so that interest servicing costs stay contained and market access is retained. In general, it is very difficult to assess when public debt is sustainable.

In classical debt dynamics models, the evolution of debt is usually deterministic. In practical terms, nevertheless, in terms of interest rate risk, debt managers usually face a trade-off between the expected interest rate costs and variability of interest rate costs. Moreover, debt dynamics and the coordination of fiscal and monetary policies have an evident and important link with each other as monetary policy can be used to ensure, at least for some time, that the interest rates on government debt are contained. In practice, the central banks can utilize yield curve control (YCC), where short-term rates as well as long-term interest rates are contained and controlled effectively by utilizing quantitative easing (QE). In QE, central banks use central bank money to buy government bonds from banks in order to drive down the yields across the yield curve. From the perspective of the present model, such policies can directly affect the interest-growth differentials for sovereigns. In fact, before the COVID-19 pandemic, the interest-growth differential was negative for many European countries, as was shown in Checherita-Westphal and Domingues Semeano (2020). As QE is now a common and canonized policy tool for central banks around the world, it is important to especially analyze the effects of interest-growth differentials on government debt dynamics using stochastic dynamic modeling.

This research aims to demonstrate and show that particularly with fiscal multipliers and credit risk premiums, bad fiscal policy can cause the debt ratio to have very large volatility. In order to demonstrate the use of stochastic modeling in government debt dynamics more concretely, an index of insolvency was derived from the optimal process and an extended nonlinear stochastic model is presented to model debt dynamics. The aim of the paper was not to claim any exact model to be used as a concrete tool in debt management, but rather, the aim was to illustrate and demonstrate the effects of randomness and nonlinearity stemming from credit risk premiums and fiscal multipliers together in terms of the evolution of government debt.

The rest of this paper is organized as follows. In Section 2, a literature review is presented; in Section 3, the basic stochastic model for debt dynamics is developed; in Section 4, the optimal control problem is formulated and solved; and in Section 5, sensitivity analysis is conducted for the optimal policy. Finally, in Section 6, the model is amended with hidden fiscal multipliers and credit risk premiums and in Section 7, the results are analyzed and conclusions are drawn.

2. Literature Review

2.1. Interest-Growth Differentials and Debt Sustainability

The debt dynamics of the sovereign depend largely on the fiscal policy stance, the rate of nominal GDP growth, and the interest rate of the debt stock. The random nature of interest-growth differentials is a key question for sovereign debt managers and fiscal policy-makers as these variables determine the debt dynamics. According to Warmedinger et al. (2017), debt to GDP ratio and annual gross financing needs are important when it comes to evaluating debt sustainability. In this research article, it is assumed that the main indicator for public debt sustainability is the debt to GDP ratio. In recent years, the topic of interest-growth differentials has become more and more prominent. For a more broad discussion on negative interest-growth differentials, see Escolano et al. (2017). The differential can be negative even in the long run, as demonstrated in Barret (2018). There is, however, no guarantee that the differential will stay negative in the long run (see Blanchard 2019; Rogoff 2020). Escolano (2010) discussed how a ‘modified golden rule’ could be argued, that is, the reason why the differential should be positive (see also Abel et al. 1989). From a technical point of view, a negative interest-growth differential usually makes it impossible to have a well-defined infinite-horizon budgetary constraint for the government (integrals do not converge necessarily) (see van Wijnbergen et al. 2020).

The other very important and interesting factor of the interest-growth differential in terms of debt sustainability is the volatility of the differential (see Aizenman and Pasricha 2010; Lian et al. 2020). The volatility of the interest-growth differential can cause the risk of the debt burden to grow substantially and bring the sovereign to the brink of default and insolvency. Such a volatility could be especially relevant for small Member States in the Euro area as the general level of interest rates is not necessarily strongly correlated with the nominal GDP growth of the given small Member State.

Modern fiscal policy and debt management literature can be traced back to Diamond (1965), in which an overlapping generations model is presented. For Ricardian equivalence, see Barro (1974). Barro’s tax-smoothing model Barro (1979) sees a benevolent government and shows that tax volatility is to be avoided, where a random walk model for taxes is suggested. The results in Lucas and Stokey (1983) and Aiyagari et al. (2002) conclude that budgetary balance must be respected in a present values sense, but no case can be made for budgetary balance on a continual basis. For a continuous-time model with debt, see, for example, Ihori’s (1988) work, where an infinite-horizon model is presented.

The solvency of a sovereign can be understood from one perspective through the intertemporal budget constraint. In this interpretation, the sovereign is solvent, if the current level of debt equals the net present value of future primary balances. This approach is the basis of debt sustainability considerations in the EU, and the European Commission has developed specific indicators for this purpose called the S1 and S2 indicators. The International Monetary Fund has published a cookbook on fiscal sustainability issues based on accounting identities of debt dynamics (see Tanner 2013). Public debt management using stochastic optimal control is a rather new direction of macroeconomic research and the literature is not too abundant, but see, for example, the recent papers by Cadenillas and Huamán-Aguilar on government debt ceilings (Cadenillas and Huamán-Aguilar 2016, 2018; Huamán-Aguilar and Cadenillas 2015; Ferrari 2018).

Finally, on sovereign defaults and debt restructuring and the problems therein, see Sturzenegger and Zettelmeyer (2006); Buchheit and Gulati (2018); Bucheit et al. (2019); and Canuto et al. (2014).

2.2. Political Economy of Public Debt and Fiscal Multipliers

Electoral business cycles have been discussed in the theoretical context, for example, Rogoff and Sibert (1986). For empirical results, see Brender and Drazen (2008) and Levitt and Snyder (1997). A broad collection of issues around the political economy of public debt is discussed in Alesina and Passalacqua (2015). The empirical evidence suggests that it might indeed be tempting to use fiscal policy proactively in order to affect the outcome of general elections.

Depending on behavioral and structural factors and the nature of government spending or tax policies, fiscal multipliers can vary substantially; see Auerbach and Gorodnichenko (2011) and DeLong and Summers (2012). Moreover, the multiplier appears to be different when there is free capacity and slack in the economy versus economic booms, see Auerbach and Gorodnichenko (2013, 2017) and Alesina et al. (2015). Usually, the practical challenge with proactive countercyclical fiscal policies is the issue of timing and the asymmetric nature of such proactive countercyclical fiscal stances. When governments implement expansionary fiscal policies, they can do so without compensating actions (i.e., fiscal policy is not contractionary) when the economy is booming and operating above the natural growth rate. This can lead to a chronic and excessive fiscal deficit and thus unsustainable public finances, which in turn could lead to fiscal dominance of monetary policy, loss of monetary policy independence, and even to hyperinflation.

3. A Model for Stochastic Public Debt Dynamics

In order to demonstrate and explore the use of stochastic modeling in debt dynamics, an optimal fiscal policy rule was constructed in order to bring down the ratio of public debt in finite time, without utilizing too large primary imbalances that may hurt the economy, increase credit spreads, or cause domestic political support to vanish. The basic dynamic model for the dynamic evolution of government debt is aligned with the continuous-time models presented in van Wijnbergen et al. (2020) and in Ihori (1988).

Assume that the nominal gross domestic product (GDP) evolves according to the ordinary differential equation (ODE):

where is the nominal GDP and is the annual growth rate of nominal GDP. The dot above the function means the time derivative, , where is the time variable. The stock of gross debt evolves according to the following accounting identity:

where is the effective interest rate of the government debt stock. Effective interest rate in this paper means the interest rate expense, when different maturities of government bonds and specifics of the debt management strategy are aggregated to express the overall interest cost including possible interest rate swaps. The variable is the primary balance variable, that is, the budgetary balance excluding interest expenses on the debt. Total tax revenue is and public spending is . If is positive, the budget is in primary surplus and vice versa. Note that the interest expenses are capitalized in the debt stock.

We are interested in the nominal debt to nominal GDP variable , whose time derivative is given by: . Substituting the derivatives from Equations (1) and (2) gives the basic deterministic debt dynamics equation in continuous time:

The primary balance to GDP—variable is . Note that the debt to GDP ratio is stabilized, if the following holds: . Stabilizing the debt ratio is important as it keeps the interest costs to tax income of the government contained. Note that even a primary deficit can stabilize the debt ratio, if the interest-growth differential is negative with a positive gross debt ratio.

The Stochastic Evolution Model of the Debt to GDP Ratio

As can be seen from Equation (3), the evolution of the debt to GDP ratio depends crucially on the interest-growth differential . As the interest-growth differential determines largely debt sustainability in this debt dynamics accounting model, it is very important to consider what is to be expected in terms of the differential. For example, and as is the case in many countries now, it may well be that the nominal growth rate is higher than the effective nominal interest rate on the debt stock. In particular, quantitative easing is pushing down the effective interest rate on public debt. On the other hand, in the Euro area for small Member States, the differential can be large in terms of the downside risk so that the general interest rate level is high compared to the growth-rate of the economy. Such a negative scenario would hamper debt sustainability to a large extent.

As future growth rates and interest rates are essentially random, we modeled the stochastic evolution of the debt ratio by assuming that the interest-growth differential is some constant plus white noise. By random, it is meant that debt managers and policymakers responsible for managing the interest rate risk of sovereign debt should aim to contain the future interest rate costs relative to the future GDP, which is not known ex ante.

Formally, we may then write:

where is some constant; is some constant; is standard Brownian motion; and is white noise. The white noise part can be understood as representing essentially the combined interest rate risk of the debt stock and the variability of the nominal GDP. In particular, the parameter represents the risk that interest rate deviates largely from the nominal growth rate of the economy for some reason. We are stating this only formally, as it is well known that Brownian motion is nowhere differentiable. It is, however, useful to think in this way, as we can build a reasonable stochastic model in such a way. Note that the volatility can stem also from the volatility of the growth rate of the nominal GDP.

Many combinations of and are realistic and feasible, depending partly on the risk preferences of sovereign debt managers and their political masters. In practical terms, the interest rate risk of the sovereign can be in principle fully adjusted by using, for example, interest rate swaps. With such a debt management strategy, the sovereign can adjust the interest rate risk profile of the debt by committing to pay floating interest rates through the swaps, even though the bonds themselves carry a fixed coupon. Such debt management strategies allow the finance ministries and debt managers to pick various combinations of expected interest rate costs and interest rate risks thereto. For example, one such strategy could be to issue very long-term bonds to minimize the refinancing risk, and at the same time, enter into interest rate swaps in order to achieve exposure into short-term floating market rates. On top of interest rate swaps, the risk profile can be adjusted by issuing GDP linked bonds or the like.

Using the specification above, the evolution of the government debt ratio becomes the following stochastic differential equation (SDE) or Ito process:

subject to some initial condition describing the initial debt ratio of gross public debt to GDP. This stochastic model for the government debt dynamics therefore describes the evolution of the debt to GDP ratio of public debt when the interest-growth differential is a stochastic process.

4. The Stochastic Optimal Control Model

In order to demonstrate the risks related to the evolution of the debt ratio, an operational assumption, or decision model, is needed for the evolution of the primary balance variable as it is a policy variable chosen at each instant by the government. In order to have a reasonable model, it is assumed that the government wants to implement a fiscal policy, which tries to control the evolution of the debt ratio in such a way that it brings the debt ratio down to zero by some terminal time . This time-horizon could be relatively long or short. Such an objective might come from political considerations or from strict obligations to drive down the debt ratio.

A rational government should implement a fiscal policy that maximizes the welfare of the potential voters and citizens over this time-horizon. This behavior can lead to the political support of potential voters in order to retain political power (e.g., Rogoff and Sibert 1986; Alesina and Passalacqua 2015). This means, in practical terms, that the government would generally like to avoid excess saving/primary surplus, if the alternative is to distribute monetary resources to voters in the form of transfers or tax cuts. On the other hand, in terms of fiscal policy, one of the key constraints for this kind of politically selfish fiscal policy is the sustainability of public finances. Whereas more public spending by the government usually implies more consumption welfare for voters in the short-term, governments need to consider issues related to long-term debt sustainability. Therefore, persistent primary deficits are also a cost for policy-makers and politicians.

Such a medium-term control objective for the debt ratio would require an active steering of the debt ratio by controlling it using the primary balance ratio as a control variable. As described, we assumed that the government is such that it would prefer to keep the primary balance ratio close to zero at all times. This assumption can be argued to hold approximately, as large primary surpluses would most likely be costly from a political economy point of view and on the other hand, large primary deficits could cause, for example, the credit rating to deteriorate and the credit spreads (interest rate on debt above the safe rate) to increase. Primary deficits are also sometimes capped by fiscal rules, as is the case in the EU.

With these assumptions, we may establish the following stochastic optimal control problem for the government:

subject to:

The minimization is taken over the primary balance paths and with conditional expectation with respect to the initial condition . The running cost is quadratic in the control variable; it is the simplest, smooth and symmetric penalty for primary imbalances. Moreover, as a quadratic approximation of a differentiable function holds locally, it is a good approximation even for more complicated penalty functions for primary imbalances. We did not apply discounting for tractability of the model, moreover, it can be argued that for reasonable time-horizons (electoral cycles) of a few years, the running cost and the penalty function are not to be discounted from a political point of view. Discounting is mathematically necessary in infinite-horizon models, as otherwise the objective functional is not bounded.

The function is a penalty function for the government in terms of the level of terminal debt; it represents the cost related to remaining debt at final time . The penalty function in this model was also chosen to be quadratic and of the functional form:

where is some constant depending on the level of penalty, which is needed to deter the government from taking too much debt.

The Solution to the Stochastic Optimal Control Model

The dynamic programming equation for the value function or the Hamilton–Jacobi–Bellman partial differential equation (PDE) can be determined by first maximizing the Hamiltonian of the stochastic optimal control problem with respect to the control. For technical details, see Fleming and Soner (2006).

The Hamiltonian for the present stochastic optimal control problem is given by:

As the Hamiltonian is concave in control, the necessary and sufficient condition for a global maximum is that the control should be . The subscript refers to partial differentiation.

Using the optimal policy, the Hamilton–Jacobi–Bellman (HJB) equation is given by:

The present HJB equation is a nonlinear PDE, but we can solve it in this case explicitly using separation of variables.

Consider the ansatz: , where is some differentiable function depending only on time. Substituting the ansatz into the HJB PDE, we obtain a Riccati/Bernoulli differential equation for :

This Riccati equation has a well-known solution, which is in this case:

where is a constant of integration, to be determined from the terminal condition. The value function is given by:

The optimal fiscal policy function is given by the derivative of the value function with respect to the debt ratio, so:

The essential feature of the model is that the optimal fiscal policy depends linearly on the level of the current debt ratio and that it depends, in particular, on the expected interest-growth differential and the volatility in the interest-growth differential. The integration constant can be recovered by solving .

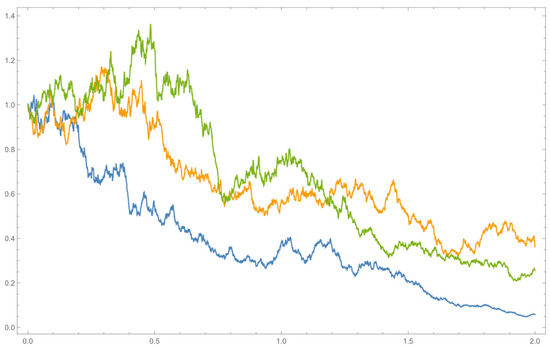

We now simulate the model using some example parameters (see Figure 1). The simulation was done using the Mathematica software (the routine ItoProcess, Wolfram, Champaign, IL, USA). We started with an initial debt ratio of 100%. Let , , and .

Figure 1.

Three sample paths for the optimal debt ratio.

From Figure 1, it can be clearly seen that the debt to GDP ratio is on a downward path on average, due to the optimal control policy. Nevertheless, sometimes the debt ratio increases locally due to the Brownian dynamics. As the optimal feedback control drives down the debt to GDP ratio and as the volatility of the process depends on the debt to GDP ratio, the volatility of the optimal process also goes down when terminal time is approached. Figure 1 illustrates that such an optimal policy drives down the level of debt quite consistently.

5. Economic Analysis and Risk Analysis Based on the Optimal Path of Debt

The dynamically optimal primary balance depends linearly on the debt ratio, so that a large ratio of debt warrants a large primary surplus.

Effects of the key parameters on the policy stance can be analyzed using sensitivity analysis. For tractability and without loss of generality, we fixed the length of the time-horizon and the penalty parameter in such a way that c = 0. It should also be noted that the Hamilton–Jacobi–Bellman equation, technically speaking, develops a finite-time singularity for the value function, when . For this reason, as we considered only time period , we demand that that the terminal time must be constrained to .

The primary balance optimal control variable is then:

We considered the effect of the consolidated interest-growth parameter on the optimal policy. Take the partial derivative,

Assuming that , and assuming positive amount of debt, the fiscal policy reacts to an increase in the consolidated interest-growth parameter by increasing the primary surplus. This can be interpreted as a prudent fiscal stance in the sense that higher perceived interest rate or lower growth and interest rate risk is at least partly offset by more prudent fiscal policy.

From the perspectives of investors or debt managers, and in terms of risk management, a reasonable way to evaluate the risk of sovereign insolvency can be done by considering the variance of the debt ratio. This means that we compute the variance of the Ito process. The optimal debt ratio evolves according to:

The process above is a geometric Brownian motion with a time-dependent drift. Using standard Ito calculus (variance of geometric Brownian motion with a deterministic time-dependent drift), the variance of the Ito process in the present model is given by:

One way to measure the insolvency risk of the sovereign is to consider what is the variance of the Ito process at time . The intuition is that the larger the variance of the debt ratio, the larger the probability that the debt ratio is too large to sustain a reasonable base of investors and reasonable credit spreads. This gives us an index of insolvency risk as a function of the parameters , , and :

where is the debt ratio initially.

6. The Effect of Hidden Fiscal Multipliers and Hidden Credit Risk Premiums

So far in the present study, it has been assumed that there are no fiscal multipliers in the sense that the local nominal growth rate of GDP would depend locally on the current fiscal policy and current level of debt . However, in reality, the effect of fiscal policy and debt on growth can be substantial (see Auerbach and Gorodnichenko (2011, 2013, 2017); DeLong and Summers (2012); Alesina and Passalacqua (2015); and Reinhart and Rogoff (2010)). In fact, and especially due to COVID-19, one major debate on macroeconomic policy is whether there is too much or too little macroeconomic stimulus. The effect of fiscal stimulus depends on the fiscal multiplier effect.

In order to assess the effects of local fiscal multipliers in the present model, it is assumed that the primary balance policy variable has direct effects on the instantaneous nominal GDP growth-rate. This is reasonable, if government spending induces a multiplier effect through fiscal stimulus. By the same argument, it is expected that austerity or fiscal consolidation shrinks locally in time with the nominal GDP growth rate. To also take into account the possibility that a high debt to GDP-ratio could hamper growth (see e.g., Reinhart and Rogoff 2010), the nominal growth rate should be coupled to the debt to GDP ratio. This possible effect of excessive debt to hamper growth can be understood as debt overhang, where the excessive interest cost bill to foreign creditors suppresses productivity enhancing investment. For debt overhang, see Sachs (1989). Moreover, according to Reinhart and Rogoff (2010), there could be a nonlinear effect of “debt intolerance” presumably related to a nonlinear response of market interest rates. According to Reinhart and Rogoff (2010), sharply rising interest rates, in turn, could cause fiscal adjustment in the form of tax hikes and spending cuts, or, in some cases, outright default, which would hamper growth. It is therefore assumed in this model that the nominal growth rate of GDP depends linearly on both the primary balance and the debt to GDP ratio. The fiscal multiplier effect then comes from two sources: the current budgetary policy of the government affects growth through spending and taxing decisions and on the other hand, large debt ratios may hamper growth, as explained above. The first order approximation is a linear relationship for these effects.

To make the model even more realistic, one can model the price of risk of the possibility of a sovereign default and sovereign insolvency. This possibility can be taken into account by introducing a credit risk premium into the model. A simple model for credit risk can be incorporated into the model by assuming that the interest rate depends linearly on the (primary balance and) debt to GDP ratio. If a sovereign has a high debt to GDP ratio, it is assumed that the probability of default (PD) is higher.

For reference, in bank capital regulations (Basel II & Basel III), the probability of default for sovereigns in terms of the standardized approach depends on credit ratings, and in turn, credit ratings depend partly on debt to GDP ratios. Even in the Advanced Internal Ratings Approach (A-IRB), banks internally determine the probability of default of their credit exposures by partly considering the indebtness of the counterparty. In bank capital regulation, probability of default and loss given default (LGD) relate directly to the risk-weight function, which determines the capital requirement in Basel III. Therefore, a large credit risk and large capital requirement for banks could lead to higher credit risk premiums to compensate the possible decrease in return of equity for banks. Insurance companies typically have regulations in line with the Basel regime, so a similar reasoning applies to them as investors.

If the investors are close to risk neutral, the financial market demands the total return, taking into account expected losses (EL, and LGD refers to loss given default) , for the risky bond of face value yields the risk free rate :

so that the credit spread is proportional to the probability of default For the purposes of the present study, we may assume that the probability of default depends both on the primary balance and the debt to GDP ratio in a linear manner . The true functional relationship between primary balances, debt ratios, and probability of default could be a more complicated function, but we may use a linear approximation as a first order approximation. The economic assumptions are based, in particular, on the reasoning that higher debt ratios may increase the probability of default for a sovereign, ceteris paribus. A primary surplus might compress the credit risk premium because in the eyes of the capital market, a prudent policy stance of the government could increase the overall credibility of fiscal policy in general.

The fiscal multipliers and credit risk premiums are assumed to be hidden in the sense that the policy-maker does not observe them directly and does not consider them when solving the stochastic optimal control problem. This assumption is done in order to keep the model tractable. Taking these assumptions of fiscal multipliers and credit risk premiums together, the stochastic model can be amended so that the interest-growth differential rate has the following linear structure:

where and are some constants representing the effects of the combined effect of the fiscal multipliers and the credit risk premia. As said, in order to retain the model as tractable, it is assumed that the policy-maker does not directly observe these linear effects of fiscal policy and debt on the interest-growth differential. Therefore, the optimal primary balance is identical with the above formulation without fiscal multipliers and credit risk premia. The interest-growth differential then has feedback from the capital markets and from the fiscal multipliers. If the debt ratio, for example, becomes too large, the interest rate may go up due to the perceived increased credit risk and nominal growth might go down at the same time due to debt overhang. In terms of primary balance, a positive primary balance might compress the perceived credit risk in the markets, but it may simultaneously shrink growth due to the fiscal multiplier effect. Numerous combinations are possible.

The optimal debt to GDP ratio then follows:

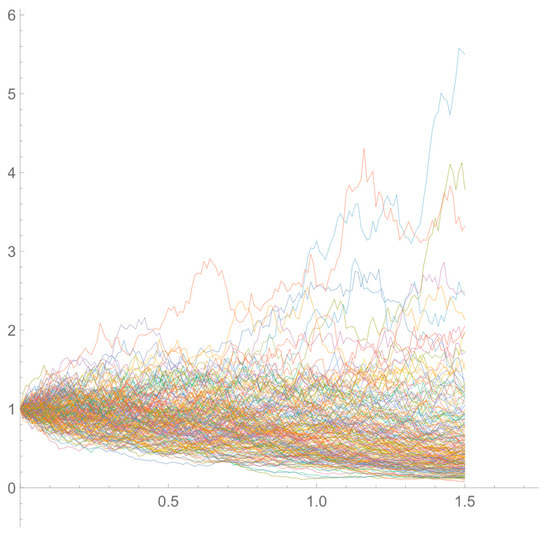

The stochastic differential equation above is now nonlinear (i.e., there is the quadratic nonlinearity in the debt to GDP ratio) as the optimal primary balance is a linear function of the debt to GDP ratio as before. Unfortunately, we cannot solve the nonlinear stochastic differential equation analytically, but we can still simulate its sample paths for the debt ratio. Simulating the model, see Figure 2, we obtain the following 200 sample paths ():

Figure 2.

The sample paths for the optimal debt ratio with hidden fiscal multipliers and hidden credit risk premia.

As can be seen from Figure 2. above, the nonlinear model with hidden fiscal multipliers and hidden credit risk premia sometimes causes the debt ratio to diverge drastically. This feature can be understood through the quadratic nonlinearity in the debt to GDP ratio: the drift of the process is quadratic in the debt ratio and there can be very strong positive feedback for debt ratios greater than 100%, which can cause the dynamics to inherit a self-reinforcing, vicious loop, albeit most of the trajectories are controlled toward zero.

7. Results and Conclusions

The present study demonstrates and explores how, in particular, the volatility of the interest-growth differential affects government debt dynamics with hidden fiscal multipliers and hidden credit risk premiums. The results demonstrate that, in particular, the risks stemming from the multipliers and the volatility can cause the debt ratio to vary and to diverge quite rapidly, to possibly unsustainable levels. The results of the present model could be relevant in particular for Member States of the Eurozone, as monetary policy in the Eurozone is driven mainly by the aggregate inflation expectations of the Eurozone as a whole, rather than the nominal growth rate of some smaller Member States of the Eurozone. This in turn makes the possible variation of interest-growth differentials a key risk factor. Therefore, further stochastic modeling of the risks in terms of government debt is encouraged.

7.1. Discussion

When the risk is understood in terms of the volatility of the debt ratio stemming from the interest-growth differentials, the model automatically has some features of asset liability management for the government, as the largest asset for a government is usually the future stream of tax income, which correlates to future nominal growth, given a level of overall taxation. Debt management strategies, where the interest rate risk is analyzed without taking into account the total balance sheet of the government, can lead to suboptimal solutions. One way to reduce the volatility of interest-growth differentials would be to issue bonds, where the coupon rate depends on the nominal GDP growth (i.e., floating interest rate bonds).

From the point of view of the fiscal policy-maker, the results suggest that when driving down the public debt ratio, with reasonable assumptions, governments should follow a fiscal policy adjustment path, where budgetary adjustment is proportional to the current debt ratio. Moreover, any perceived increase in interest rate risk or anticipated variability in future nominal growth should result in a more prudent fiscal stance. Finally, the budgetary adjustment should become more ambitious when the time-horizon gets shorter. The results are rather intuitive.

Given that the present model gives an indication that with hidden fiscal multipliers, reducing debt using fiscal consolidation might be hazardous, it might be tempting for (monetary) policy-makers to reduce debt by keeping the interest-growth differential negative for an extended period. The evolution of the interest-growth differential is arguably one of the key questions in macroeconomic policy, given that developed economies are facing fiscal sustainability challenges from an aging population and enjoying ultra-low yield curves at the same time. It might well be that monetary policy is forced to keep the yield curve contained for an extended period of time due to the large amounts of public debt in many developed economies, especially after COVID-19. One may even ask if we are facing the risk of fiscal dominance of monetary policy (see the seminal paper by Sargent and Wallace (1981)) where fiscal policy forces the monetary policy authorities to keep interest rates low in spite of perhaps high inflation. Indeed, if central bankers would opt to choose a symmetric inflation-targeting regime, cumulative past deviations from the inflation target might justify symmetric overshooting of the inflation target in the future. This type of monetary policy targeting rule resembles PID-control methods in control theory (see the review paper by Hawkins et al. (2015)).

Comparing the obtained nonlinear stochastic dynamic model for government debt in terms of earlier results, there has been a strand of literature, where indeed empirical evidence of nonlinear debt dynamics has been found (see for example the papers by Sarno (2001) and a structural model by Tamborini (2014)). These results indicate that there is a real possibility that the dynamics of government debt are inherently nonlinear. For reference (e.g., in Piergallini 2019), the primary surplus variable is coupled to the debt in a nonlinear fashion. The possibility of nonlinear debt dynamics should encourage fiscal policy-makers to be very vigilant in terms of high debt to GDP ratios, that is, over 100 per cent of GDP, as the nonlinear model is quadratic in debt ratios.

Moreover, as the model seems to imply that there is an inclination for the government to spend in an unsustainable fashion, proper and orderly sovereign debt restructuring should be enabled by creating legal tools and mechanisms to foster orderly sovereign debt restructuring. These tools could include, for example, single-limb aggregation collective action clauses and other such contractual instruments. The current monetary policy stance in the Euro area, for example, makes sovereign debt restructuring difficult due to the fact that the Eurosystem holds so much of its sovereign debt on its balance sheet. Only a small group of vulture creditors is needed to block sovereign restructuring as it is generally assumed that the Eurosystem is forced to vote against any restructuring due to the prohibition of monetary financing. Furthermore, orderly sovereign debt restructuring could be supported by ensuring that the domestic banking system holds sufficient capital in order to sustain a significant haircut on the face value of the bond holdings. As, for example, in the Euro area, there are virtually no capital requirements for sovereign bonds and home-bias and concentration risk is evident, so better prudential regulation is needed acutely.

7.2. Limitations and Future Line of Research

The model in this study relies on the key assumption that the effect of the primary balance and debt stock on the instantaneous nominal GDP growth can be measured and estimated. Therefore, more research should be done on fiscal multipliers. The clear limitations of this study relate to the focus on theoretical considerations. Unfortunately, it is not foreseeable that complete high-frequency data on variables like growth, debt, or primary balance will be available even in the foreseeable future. The debt dynamics in the present model was modeled in a continuous-time setting and therefore, in order to estimate, for example, the risk index properly, one should theoretically have the data sampled at very high frequency. Currently, nominal GDP growth rates are reported on a quarterly basis. The present model is therefore not meant so much as a concrete tool for policy-makers or debt managers, but merely to illustrate and demonstrate how stochastic modeling can be utilized to model government debt dynamics.

In terms of the nonlinearities, further analytical work could be done on perhaps identifying a more complex functional relationship than the linear one between the interest-growth differentials as well as the probability of default and fiscal multipliers. This functional relationship could even be itself nonlinear.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing is not applicable to this article.

Conflicts of Interest

The author declares no conflict of interests.

References

- Abel, Andrew. B., Nicholas. G. Mankiw, Lawrence. H. Summers, and Richard. J. Zeckhauser. 1989. Assessing dynamic efficiency: Theory and evidence. The Review of Economic Studies 56: 1–19. [Google Scholar] [CrossRef]

- Aiyagari, S. Rao, Albert Marcet, Thomas J. Sargent, and Juha Seppälä. 2002. Optimal taxation without state-contingent debt. Journal of Political Economy 110: 1220–54. [Google Scholar] [CrossRef]

- Aizenman, Joshua, and Gurnain K. Pasricha. 2010. Fiscal Fragility: What the Past May Say about the Future. NBER Working Paper. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Alesina, Alberto, and Andrea Passalacqua. 2015. The Political Economy of Government Debt. Working Paper 21821. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Alesina, Alberto, Carlo Favero, and Francesco Giavazzi. 2015. The output effect of fiscal consolidation plans. Journal of International Economics 96: S19–S42. [Google Scholar] [CrossRef]

- Auerbach, Alan J., and Yuriy Gorodnichenko. 2011. Fiscal Multipliers in Recession and Expansion. Working Paper 17447. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Auerbach, Alan J., and Yuriy Gorodnichenko. 2013. Measuring the output responses to fiscal policy. American Economic Journal: Economic Policy 4: 1–27. [Google Scholar]

- Auerbach, Alan J., and Yuriy Gorodnichenko. 2017. Fiscal Stimulus and Fiscal Sustainability. Working Paper 23789. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Barret, Philip. 2018. Interest-Growth Differentials and Debt Limits in Advanced Economies. IMF Working Paper 18/82. Washington, DC: International Monetary Fund. [Google Scholar]

- Barro, Robert J. 1974. Are government bonds net wealth? Journal of Political Economy 82: 1095–117. [Google Scholar] [CrossRef]

- Barro, Robert J. 1979. On the determination of the public debt. Journal of Political Economy 87, Pt 1: 940–71. [Google Scholar] [CrossRef]

- Blanchard, Olivier. 2019. Public debt and low interest rates. American Economic Review 109: 1197–229. [Google Scholar] [CrossRef]

- Brender, Adi, and Allan Drazen. 2008. How do budget deficits and economic growth affect re-election prospects? Evidence from a large panel of countries. American Economic Review 98: 2203–20. [Google Scholar] [CrossRef]

- Bucheit, Lee, Guillaume Chabert, Chanda DeLong, and Jeromin Zettelmeyer. 2019. How to Restructure Sovereign Debt: Lessons from Four Decades. Working Paper19-8. Washington, DC: Peterson Institute for International Economics. [Google Scholar]

- Buchheit, Lee C., and Mitu. G. Gulati. 2018. Sovereign debt restructuring in Europe. Global Policy 9: 65–69. [Google Scholar] [CrossRef]

- Cadenillas, Abel, and Ricardo Huamán-Aguilar. 2016. Explicit formula for the optimal government debt ceiling. Annals of Operations Research 247: 415–49. [Google Scholar] [CrossRef]

- Cadenillas, Abel, and Ricardo Huamán-Aguilar. 2018. On the Failure to Reach the Optimal Government Debt Ceiling. Risks 6: 138. [Google Scholar] [CrossRef]

- Canuto, Otaviano, Brian Pinto, and Mona Prasad. 2014. Orderly sovereign debt re-structuring: Missing in action! (And likely to remain so). The World Bank Research Observer 29: 109–35. [Google Scholar] [CrossRef]

- Checherita-Westphal, Cristina, and João Domingues Semeano. 2020. Interest Rate-Growth Differentials on Government Debt: An Empirical Investigation for the Euro Area. Working Paper Series; Frankfurt am Main: European Central Bank. [Google Scholar]

- DeLong, J. Bradford, and Lawrence Summers. 2012. Fiscal Policy in a Depressed Economy. Brookings Papers on Economic Activity. Washington, DC: The Brookings Institution, vol. 43, pp. 233–97. [Google Scholar]

- Diamond, Peter A. 1965. National debt in a neoclassical growth model. The American Economic Review 55: 1126–50. [Google Scholar]

- Dovis, Alessandro, Mikhail Golosov, and Ali Shourideh. 2016. Political Economy of Sovereign Debt: A Theory of Cycles of Populism and Austerity. Working Paper 21948. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Escolano, Julio. 2010. A Practical Guide to Public Debt Dynamics, Fiscal Sustainability, and Cyclical Adjustment of Budgetary Aggregates. IMF Technical Notes and Manuals. Washington, DC: International Monetary Fund. [Google Scholar]

- Escolano, Julio, Anna Shabunina, and Jaejoon Woo. 2017. The Puzzle of Persistently Negative Interest-Rate–Growth Differentials: Financial Repression or Income Catch-Up? Fiscal Studies 38: 179–217. [Google Scholar] [CrossRef]

- Ferrari, Giorgio. 2018. On the Optimal Management of Public Debt: A Singular Stochastic Control Problem. SIAM Journal on Control and Optimization 56: 2036–73. [Google Scholar] [CrossRef]

- Fleming, Wendell H., and Halil M. Soner. 2006. Controlled Markov Processes and Viscosity Solutions. New York: Springer Science + Business Media. [Google Scholar]

- Hawkins, Raymond J., Jeffrey K. Speakes, and Dan E. Hamilton. 2015. Monetary policy and PID control. Journal of Economic Interaction and Coordination 10: 183–97. [Google Scholar] [CrossRef]

- Huamán-Aguilar, Ricardo, and Abel Cadenillas. 2015. Government Debt Control: Optimal Currency Portfolio and Payments. Operations Research 63: 1044–57. [Google Scholar] [CrossRef]

- Ihori, Toshihiro. 1988. Optimal deficits in a growing economy. Journal of the Japanese and International Economies 2: 526–42. [Google Scholar] [CrossRef]

- Levitt, Steven D., and James M. Snyder. 1997. The impact of federal spending on house election outcomes. Journal of Political Economy 105: 30–53. [Google Scholar] [CrossRef]

- Lian, Weicheng, Andrea F. Presbitero, and Ursula Wiriadinata. 2020. Public Debt and r − g at Risk. IMF Working Paper 20/137. Washington, DC: International Monetary Fund. [Google Scholar]

- Lucas, Robert E., and Nancy L. Stokey. 1983. Optimal fiscal and monetary policy in an economy without capital. Journal of Monetary Economics 12: 55–93. [Google Scholar] [CrossRef]

- Piergallini, Alessandro. 2019. Nonlinear policy behavior, multiple equilibria and debt-deflation attractors. Journal of Evolutionary Economics 29: 563–80. [Google Scholar] [CrossRef]

- Reinhart, Carmen M., and Kenneth S. Rogoff. 2010. Growth in a time of debt. American Economic Review 100: 573–78. [Google Scholar] [CrossRef]

- Rogoff, Kenneth S. 2020. Falling real interest rates, rising debt: A free lunch? Journal of Policy Modeling 42: 778–90. [Google Scholar] [CrossRef]

- Rogoff, Kenneth, and Anne Sibert. 1986. Elections and Macroeconomic Policy Cycles. NBER Working Papers 1838. Washington, DC: National Bureau of Economic Research. [Google Scholar]

- Sachs, Jeffrey. D. 1989. The debt overhang of developing countries. In Debt, Stabilization and Development: Essays in Memory of Carlos Diaz-Alejandro. Edited by Guillermo Calvo, Ronald Findlay, Pentti Kouri and Jorge B. de Macedo. Oxford: Basil Blackwell. [Google Scholar]

- Sargent, Thomas J., and Neil Wallace. 1981. Some unpleasant monetarist arithmetic. Quarterly Review 5: 1–17. [Google Scholar] [CrossRef]

- Sarno, Lucio. 2001. The Behavior of US Public Debt: A Nonlinear Perspective. Economics Letters 74: 119–25. [Google Scholar] [CrossRef]

- Sturzenegger, Federico, and Jeromin Zettelmeyer. 2006. Debt Defaults and Lessons from a Decade of Crises. Cambridge, MA: MIT Press. [Google Scholar]

- Tamborini, Roberto. 2014. Interest-Rate Spread and Public-Debt Dynamics in a Two-Country Monetary-Union Portfolio Model. Open Economies Review 25: 243–61. [Google Scholar] [CrossRef]

- Tanner, Evan C. 2013. Fiscal Sustainability: A 21st Century Guide for the Perplexed. IMF working paper no. 13/89. Washington, DC: International Monetary Fund. [Google Scholar]

- Van Wijnbergen, Sweder, Stan Olijslagers, and Nander de Vette. 2020. Debt Sustainability When r − g < 0: No Free Lunch after All, TI 2020-079/VI Tinbergen Institute Discussion Paper. London: CEPR Centre for Economic Policy Research. [Google Scholar]

- Warmedinger, Thomas, Cristina Checherita-Westphal, Francesco Drudi, Ralph Setzer, Roberta De Stefani, Othman Bouabdallah, and Andreas Westphal. 2017. Debt Sustainability Analysis for Euro Area Sovereigns: A Methodological Framework. Occasional Paper Series 185; Frankfurt am Main: European Central Bank. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).