Abstract

We study whether gold acts as a hedge or a safe haven in U.S. and the Indian stock markets. These two stock markets have been chosen as representatives of the developed markets and the emerging markets, respectively, and are of significant interest to long-term investors. We apply a linear regression and a GARCH technique to monthly return series data on the S&P500, the BSE Sensex, and gold prices. We find that, for the period of our study, 1980–2020, gold has not served as a hedge or a safe haven for long-term investors in the U.S. or Indian stock markets. This holds true even across multiple sub-periods in our study period. Gold returns do not exhibit a significant negative relationship with stock returns in any of the chosen stock market scenarios, i.e., in times of extremely low returns as well as in the periods of high or low volatility. Equity investors in U.S. and Indian markets can use the findings of this study for optimising their portfolios. Additionally, central bankers and policy makers can use the findings for better outcomes with respect to their policies on holding of gold.

1. Introduction

Long-term investors in stocks look for optimising their portfolios to achieve the best risk-adjusted returns. They like to include such assets in their stock portfolios as would provide them with the benefit of diversification. Some investors choose to protect their portfolios from extreme market downturns, while others may look for hedging their portfolios, even in ordinary times.

Gold is one asset that has long been considered by both individuals, institutions, and governments as a safe asset and a store of value, especially in times of distress. The utility of gold, as an investment asset, has been widely believed as a hedge during periods of uncertainty or extreme market conditions.

We observe that there have been several studies on the developed markets, but few in the context of emerging markets such as India. We examine, in this paper, the relationship of gold with stocks and the benefit of including gold in a predominantly stock portfolio in a large emerging market. This study specifically examines the relationship between gold prices and the stock prices in the U.S. and Indian markets. These two stock markets are of significant interest to investors in the advanced and emerging markets categories, respectively.

The U.S. stock market is the largest in the world, and the S&P500 index represents a widely followed index for benchmarking of performance by institutional investors. Long-term investors such as pension funds and trusts are interested in diversifying their portfolios. These investors want to maximise the risk-adjusted return or minimise the portfolio volatility. Toward this objective, international stocks, bonds, and gold have often been suggested to be included in their portfolios. Such long-term investors would like to know if gold really does provide benefits of reducing the risk in their equity portfolios.

Indian stock and gold markets are among the largest in the emerging markets. In 2019, India was the second largest consumer of gold1 and had the seventh largest stock market2 capitalisation in the world. Hence, the relationship between the returns from gold and Indian stocks would be of interest to both international as well as domestic Indian investors.

Secondly, this study should inform policy makers interested in Indian and U.S. markets on the value of considering gold for hedging against equity market risk. Policy makers in India consider the large retail holding as well as import of gold as unproductive and a drain on foreign exchange reserves. They have been trying to de-incentivise the holding, by individuals and households, of physical gold through periodic offerings of gold bonds. They have also, at times, imposed restrictions on the import of gold3. This study should help the policy makers better understand if there is a merit in allowing individual and institutional investors to hold gold for hedging stock market risk.

We test whether, for a long-term investor, gold acts as a safe haven asset or a hedge asset. We use the terms “safe haven” and “hedge asset” in a definitive manner. We refer to previous studies (Baur and Lucey 2010; Baur and McDermott 2010, 2016) to define a “safe haven asset” and a “hedge asset”.

A safe haven asset is defined in terms of its behaviour during periods of crisis or during extreme movements in prices. A safe haven asset’s returns are uncorrelated with those from other risky assets in the periods of financial market distress. The behaviour of the asset in normal times, i.e., of being correlated or otherwise with other assets, does not impact its classification as a safe haven asset. “A safe haven asset is safe (and needs to be safe only) during times of crisis or turmoil” (Baur and McDermott 2016). The classification of a corollary is that the asset as a safe haven would not automatically and necessarily losing its safe haven asset would not impact the status if its price fell along with the prices of other assets in the periods of normal markets, i.e., non-crisis periods.

On the other hand, a hedge asset is one whose returns do not move in the same direction as those of other assets such as stocks or bonds, across all time periods. The extent of decoupling the returns determines the degree of effectiveness of the hedge asset. If the hedge asset prices move in opposite direction to the underlying asset, the former is said to be a strong or highly effective hedge.

It should be noted that a risk-free asset is not the same as a safe haven asset. The former indicates merely the low-risk characteristic of the asset. Bonds issued by governments in their home currencies, i.e., gilts, are said to be risk free, as they have a low risk of default. They are, of course, prone to market risk. Gilts may be risk free but do not qualify as a safe haven as they do not move in the opposite direction as stocks in times of distress. In that case, the risk-free assets such as gilts would not qualify to be called safe haven assets with regard to risky assets such as stocks.

The study focuses on long-term investors and uses data on monthly returns on assets. Most previous studies have used daily or weekly returns on the assets. A few authors such as Baur and Lucey (2010) and Baur and McDermott (2010) have demonstrated, using daily and monthly return series, that the safe haven effect of gold lasts only for a few days. We believe that the choice of frequency of returns should be based on the need of long-term investors. The use of monthly returns is more appropriate for long-term investors, as it matches well with the frequency of portfolio review conducted by them. Long-term investors would not be too concerned with daily or weekly returns, as they would not be taking actions based on variations in such short-term returns. Bredin (2015) do consider long-term investment horizon but assume one-year investment horizon as a long-term period and use daily returns. Baur and McDermott (2010) and Beckmann et al. (2015b) had also used monthly returns for their studies on several developed and emerging markets, including India. We have, however, extended their periods of study beyond 2009 and 2012, respectively, till 2020. This is important as the period beyond 2009 till 2020 has especially witnessed several large variations in the prices of stocks as well as gold.

This study contributes to the existing literature in the following manner.

- (a)

- This extends the few significant studies, known to the authors, on the relationship between gold and stock in the U.S. as well as a large and emerging market such as India over a fairly long period of 1980–2020. This period is sufficiently long to cover multiple financial market crises such as the 1987 crash, the 2000 dot com boom and crash, the 2008 global financial crisis, and, more recently, the COVID-19-led crash in 2020.

- (b)

- We study the hedge and safe haven behaviour of gold in multiple sub-periods within the overall time period of study. While studying the co-variance between gold and the risky assets, the previous studies have not evaluated any regime shift over time. Mei and McNown (2019) had concluded that the behaviour of gold was a strong hedge for the U.S. stocks changed between before and after the 2008 global financial crisis. It was shown to be a strong hedge before the crisis and a weak hedge afterward. However, they did not study if there was any transition across multiple time periods.

- (c)

- We evaluate the relationship between gold and stock returns in the periods of low volatility, i.e., in calm markets. To the best of our understanding, the previous studies have focussed only on the periods of low returns and/or high volatility to understand whether gold acts as a safe haven. It is important to also understand the behaviour in less volatile market conditions.

The remainder of this paper is organised as follows: Section 2 reviews the previous studies on the relationship between gold returns and other assets in various markets. Section 3 presents the data and methodology used for this study. Section 4 presents and discusses the results, and Section 5 presents the conclusions from the study.

2. Literature Review

The studies till the early 2000s mostly focussed on the relationship between macro-economic variables such as inflation or interest rate and gold prices. This was mainly in the backdrop of the Bretton Woods collapse and the oil price shocks in 1973. Recently, Beckmann and Czudaj (2013) studied whether gold was a good hedge against inflation. They found that the hedge behaviour of gold against inflation was regime dependent.

A later set of studies focussed on investigating whether gold could act as a diversifier in a portfolio or as a hedge against risky assets such as stocks, bonds, and currencies. These were primarily motivated by the idea of improving the return-to-risk ratio of stock portfolios, through the Markowitz style of diversification. These included Jaffe (1989), Upper (2000); Ciner et al. (2013); Michaud et al. (2011); McCown and Zimmerman (2006); Baur and Lucey (2010); Hoang et al. (2015); Mei and McNown (2019); Ghazali et al. (2020); and Hood and Malik (2013). These studies found varying results, with the majority suggesting that the correlation between the two was minimal or negative.

We present a summary of the significant studies, over the last 50 years, on the relationship between gold and stock prices. These are broadly segregated as those that found a relationship between gold and stock prices, those that did not find the same, those that specifically included emerging markets in their studies, and a few other related studies.

- (A)

- One set of studies found a negative relationship between gold and stock prices. McDonald and Solnick (1977) studied the correlation between gold, inflation, and security returns. They found that gold mining stocks provided the benefit of diversification to European stock portfolios. Similarly, Chua et al. (1990) found that a 25% proportion of gold in a stock portfolio improved the return to risk ratio of the latter. However, they also found the correlation between gold and stocks to be increasing over time, which would imply a decreasing benefit of diversification. On the other hand, Hillier et al. (2006) found weak, and at times, negative correlations between precious metals (gold, silver, platinum, etc.) and S&P 500. They found it useful to include precious metals in the portfolio of stocks.Baur and Lucey (2010) checked the relationship between gold, stock, and bond prices together. The authors were amongst the first ones to explicitly introduce and test the safe haven characteristic of gold. This meant that gold prices had no relationship with the prices of other risky assets, in situations of extreme price movement of the latter. They found that for the stocks traded in the United Kingdom, Germany, and the United States, gold acted as a safe haven. In addition, gold had a negative relationship with stock prices under non-extreme scenarios in the United States and the United Kingdom. In other words, gold was also a hedge for stocks in these countries. However, it was not a safe haven for bonds in any of these countries.

- (B)

- There were also a few studies which did not find a significant relationship between gold and stock prices. McCown and Zimmerman (2006) tested the relationship between the returns on gold and the MSCI stock indices (U.S. as well as world), using the capital asset pricing model (CAPM). He found that gold was a zero-beta asset, i.e., it did not move with the stock indices over long periods of time.

- (C)

- Another dimension of the past studies has been on the relationship between gold and stocks in the developed versus emerging markets.Baur and McDermott (2010) analysed a sample spanning a 30 year period from 1979 to 2009 and showed that gold was both a hedge and a safe haven for major European stock markets and the US when returns were analysed at daily frequency. However, it was not the case for Australia, Canada, or Japan. Gold, however, ceased to be a hedge nor a safe haven against the U.S. stocks, when the returns were measured on a weekly or monthly basis. The latter is an important reference for our study as we have tested the relationship for returns at monthly intervals only.They found that for large, emerging markets such as the BRIC countries (Brazil, Russia, India, and China) it was neither a hedge nor a safe haven when the tests were conducted on daily, weekly, or monthly returns. Curiously, in the case of India, when the tests were performed on weekly returns, gold was found to be a safe haven, in the period when the returns were in the range of the bottom 5% or 10% of historical returns. However, it ceased to be a safe haven when returns fell to the bottom 1% of the historical range. Gold was not a hedge for the Indian stock market in any case.Baur and McDermott (2016) examined the relationship between assets across asset classes. They tested the MSCI world stock market index, the S&P 500 index, the US 10-year Treasury bonds, gold, silver and the CRB commodity index (all denominated in US dollars). During periods of stress, gold, US Treasury bonds, the US dollar, and the Swiss Franc were found to behave as “safe haven” assets. They posited that the variation of gold price posed a risk for investors, unlike the gilt, which assured a risk-free rate even in times of a crisis. They posed the question as to why investors were yet attracted to gold. Their explanation was that psychological and emotional factors affect the decisions of investors during periods of market turmoil. For example, when investors are faced with choices in uncertain times, they encounter cognitive limitations. They suggested that the results of safe haven behaviour of assets should be understood through the lens of investor behaviour.Jaffe (1989); Baur and McDermott (2010); Mensi et al. (2014); Beckmann et al. (2015b); El Hedi Arouri et al. (2015); Mei and McNown (2019); and Ghazali et al. (2020) studied the relationship of gold with emerging market stocks. At a more specific level, Baur and McDermott (2010); Beckmann et al. (2015b); Shalini and Prasanna (2016); and Ghazali et al. (2020); and Bouri et al. (2017) studied the stocks traded on the Indian stock market.Jain and Ghosh (2013) examined, in the Indian context, the relationship among global oil prices, precious metal (gold, platinum and silver) prices, and Indian Rupee–US Dollar exchange. The study, however, did not include the impact on stock prices.Gürgün and Ünalmış (2014) studied the daily returns of gold and stocks of 28 emerging market countries, in their local currencies as well as in USD. They found that gold was a hedge and/or a safe haven for the domestic investors of several emerging markets. Secondly, the safe haven property of gold was stronger during extreme losses in equity markets both for domestic and foreign investors. For India, gold was found to be a strong hedge, though not as strong as a safe haven for USD investors. Furthermore, for the Indian domestic investors, gold did not behave as a hedge or a safe haven.Mensi et al. (2014) studied the relationship between gold and the stock prices of BRICS countries. Using daily prices from 1997–2013, they found that gold acts as neither a hedge nor a safe haven in these countries.El Hedi Arouri et al. (2015) studied the impact of gold prices on Chinese stock prices for the period from March 2004 to March 2011. They found a significant relationship between the returns and volatilities of gold and stock prices in China. They observed that the inclusion of gold in a portfolio comprising of Chinese stocks boosted its risk-adjusted return. Gold also effectively hedged against stock risk over time. They found that a gold asset served as a safe haven for Chinese stocks in the period of crisis as well.Beckmann et al. (2015b) performed a broad study that included data from 18 individual economies and 5 regional indices on a monthly frequency. They went beyond the Baur and McDermott (2010) model and introduced a transition variable in their estimation model. They found that gold varyingly served as a hedge or a safe haven, and this depended on the markets and their conditions. In the case of Indian stocks, gold acted as a strong safe haven but not a hedge.Shalini and Prasanna (2016) studied the relationship between a wide range of commodities and the stock markets. They found that metals had an inverse relationship with stock prices at all times. In addition, the volatility of the metal prices suffered a regime shift in times of a crisis and returned fast to the normal level of volatility.Soja (2019) developed an optimal portfolio that included the Eurozone bond index with investment grade rating, the Eurostoxx50 (a stock index), and gold, using the Markowitz methodology. The author concluded that an optimal portfolio should include gold between 1% and 9%, depending upon the level of risk acceptable to an investor.Mei and McNown (2019) studied the relationship between returns and volatility across stock markets in the U.S., and China, against gold. The study was for the period of 1996–2018. They showed that the hedging ability of gold varied over time. It was a strong hedge for the U.S. stocks before the 2008 financial crisis but turned into a weak hedge after the crisis. For China, gold was a weak hedge throughout the period of study.Ghazali et al. (2020) investigated and confirmed the role of gold as a hedge against stock market collapse in five countries. They also found gold to be a prominent asset for investment in US, UK, China, and India but not in Malaysia.

- (D)

- There have been studies to test the relationship of gold prices with exchange rates, either in themselves or as a factor behind equity portfolios. Capie et al. (2005) analysed the role of gold as a hedge against the U.S. dollar. They found a negative relationship between the two but shifting over time. Beckmann et al. (2015a) found in the context of multiple currency-linked gold prices that the volatility of dollar exchange rates resulted in strong hedging function of the gold prices.Hood and Malik (2013) examined the relationship between gold and other precious metals and the U.S. stock market volatility index (VIX) to check whether the former were a hedge or a safe haven. They found that gold, unlike other precious metals, served as a hedge and a weak safe haven for US stock market. However, in periods of extremely low or high volatility, gold did not have a negative correlation with the US stock market, and VIX was found to be a superior hedging tool and served as a better safe haven than gold.Chkili (2016) looked at the dynamic relationship between gold and stock prices in the BRIC countries. He used the weekly prices and found that the dynamic conditional correlation (DCC) between the two variables switched between positive and negative over the period of 2000–2014. The gold price exhibited a low to negative correlation with stock prices during periods of major financial crises, leading to the conclusion that gold could act as a safe haven in times of such crises.Interestingly, Bouri et al. (2017) studied the impact of the internal gold and oil price volatility on the Indian stock price volatility during the period 2009–2016. They found that the implied volatility of the former affected the volatility of the latter. They also found that there was an inverse and two-way relationship between the volatilities of gold and oil prices.

- (E)

- A few recent studies have focussed on the impact of COVID-19 on the behaviour of gold as a hedge against stock price risk.Salisu et al. (2021a) compared the safe haven property of gold during the COVID-19 period with the behaviour immediately before the COVID-19. They found that gold did act as a safe haven but to a lesser extent during the COVID-19 than before the COVID-19 period. Yousaf et al. (2021) have studied the safe haven behaviour of gold across thirteen Asian stock markets during the COVID-19 period. They found that gold acted as a strong safe haven in China, Indonesia, Singapore, and Vietnam, and a weak safe haven in Pakistan and Thailand. Gold did not exhibit safe haven property for the stock markets in Hong Kong, India, Malaysia, or Philippines.Salisu et al. (2021b) have, in another paper, studied the hedging relationship between the U.S. stocks and gold. They found a significant hedging relationship, though it was weaker during the COVID-19 pandemic, compared to the prior period.

The previous findings have thus been mixed across countries and time periods.

3. Data and Methodology

The data includes the month-end prices of S&P BSE 30 index (Sensex), the S&P 500 index, gold, and USD/INR exchange rate from January 1980 till September 2020. The Sensex is a market capitalisation weighted index of the prices of 30 large capitalisation stocks traded on the Bombay Stock Exchange in India. The Sensex was launched in March 1979, and hence the data series used here begins from 1980. The data used for the study has been shown in Table 1.

Table 1.

Data.

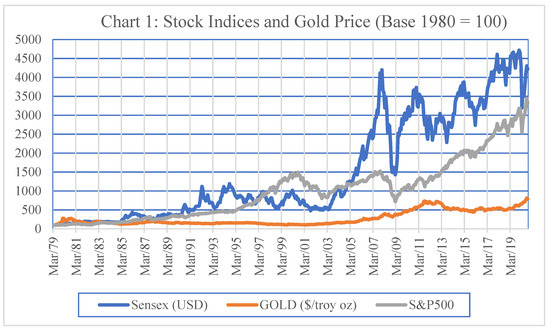

The trend of the prices of the S&P500, Sensex, and gold, all in USD, on a base of 100 in as of January 31, 1980, is shown in Chart 1.

Chart 1.

Stock indices and gold prices. Sources: BSE-India, World Bank, Yahoo.com (accessed on 20 November 2020).

We use monthly returns for the stock indices, S&P500 and Sensex (Rstock,t) and for gold (Rgold,t), which are computed as follows:

where Pstock,t and Pgold,t are the prices of the stock indices and of gold, respectively, in the ith month.

Rstock,t = ln (Pstock,t/Pstock,t−1) for t = every month since February 1980

Rgold,t = ln (Pgold,t/Pgold,t−1) for t = every month since February 1980

The returns on gold are computed, based on its prices in USD as well as in INR, using the USD/INR exchange rate data. The two series of gold returns, in USD and INR, are separately used in the analysis.

The summary statistics for the return series are shown in Table 2. We are interested in studying the relationship between gold returns and stock returns over multiple time periods. The time periods have been selected as 1980–2020, 1980–1989, 1990–1999, 2000–2009, and 2010–2020. Thus, we have a long time horizon of 40 years and four intermediate time horizons of 10 years each.

Table 2.

Summary statistics of monthly (not annualised) returns.

The statistics for each time period are presented in Table 2.

The data set on monthly returns for Sensex and S&P500 have 488 observations for each asset, i.e., gold, S&P500, and Sensex. We are interested in observing the relationship over the entire period as well as in the periods of low return. We have chosen the low return periods as the bottom 1%, 5%, and 10% of the return distribution. The available number of observations for these periods is presented in Table 3.

Table 3.

Number of observations within the bottom percentiles of return (1980–2020).

The number of observations against any given percentile of returns is a function of the number of overall observations in the study period. The number of observations in the bottom percentile is quite low and not quite amenable to a proper statistical test. However, we do perform our tests for this sub-set of data as well and present the results.

Our objective is to determine if the gold returns are affected by stock price returns. We use the ordinary least square (OLS) regression model proposed by Baur and McDermott (2010) and used in other studies such as Hood and Malik (2013). It may be mentioned here that the OLS model does have its limitation of not capturing the non-normal behaviour of extreme observations. Alternate models such as dynamic conditional model (Chkili 2016), time-varying dynamic model (Beckmann and Czudaj 2013), and quantile regression model (Shahzad et al. 2019) were also used in other studies. We believe that the limitation is mitigated to a large extent for a long-term investor, who is interested in the average relationship between gold and stocks over a long time-horizon.

Our model is given as:

Rgold,t = a + bt Rstock,t + εt

bt = c0 + c1D(Rstockq10) + c2D(Rstockq5) + c3D(Rstockq1)

ht = ω + αε2t−1 + βht−1

Equation (1) models the relationship between the returns on gold and the stock returns with parameters a and bt and the error term εt. The regression is run separately for S&P500 and Sensex. The gold returns in USD are regressed on the S&P 500 returns, and the gold returns in INR are regressed on the Sensex (INR) returns.

We are interested in finding out the relationship between gold and stock prices over a long period of time as well as in extreme market scenarios. Hence, we model the parameters for both conditions.

The parameter bt is modelled as shown by Equation (2) with c0, c1, c2, and c3 as the parameters to be estimated in various scenarios. D(…) is the dummy variable to capture any sharp decline in the stock market. It is equal to 1, if the stock price exhibits extreme returns. Based on the return percentiles, D is 1, if the return is beyond +/−1%, and c1 is then estimated. Similarly, D is 1, if the return is beyond +/−5% or +/−10% while estimating c2 or c3. The parameters c1, c2, and c3 are tested for being significantly different from zero as evidence of a relationship between gold and the stock prices. Equation (3) is a GARCH(1,1) model to account for the possibility of heteroscedasticity in the given time-series data. All the equations are simultaneously estimated, following the methods of maximum likelihood.

The null hypothesis that is tested is that the returns on the stock indices do not have a significant impact on gold returns. The alternate hypothesis is that the stock returns do have a causal impact on the gold returns.

- H0: bt = 0

- H1: bt <> 0

The hypotheses are tested for both the Sensex and the S&P500 indices.

The parameters in Equation (2) determine whether gold acts as a weak or strong safe haven for the market under study. If they are simply non-positive (including c0), then it is a weak safe haven. However, if the parameters are negative with a statistically significant difference from zero, gold would be a strong safe haven. The parameter c0 determines whether gold is a hedge for the market under study, provided that the sum of the parameters c1–c3 is not jointly positive and is greater than the c0. Gold would be a weak or a strong hedge, depending on whether the parameter c0 is zero or negative, respectively.

Based on the results from the regression models, the null hypothesis that stock returns have a significant impact on gold returns would be accepted or rejected in the various test scenarios.

The tests are conducted in two stages:

- (a)

- For the entire data set from 1980–2020. This helps understand the long-term relationship between gold and stock prices.

- (b)

- For four sub-sets of the data for 10 years each. The sub-sets are for the periods 1980–1989, 1990–1999, 2000–2009, and 2010–2020. The tests on these data sets help us understand if there is a shift in the observed relationships over time.

The regressions as per Equations (1) and (2) were run, for each time period, for the entire data, and for:

- (a)

- the observations pertaining to the top 10%, 5%, and 1% of the volatility during the period. The results for these regressions are presented in Table 4.

Table 4. Regression of gold returns on Sensex returns.

Table 4. Regression of gold returns on Sensex returns. - (b)

- the observations pertaining to the bottom 10%, 5%, and 1% of the volatility during the period. The results for these regressions are presented in Table 5.

Table 5. Regression of gold returns on Sensex returns for periods of high volatility using GARCH.

Table 5. Regression of gold returns on Sensex returns for periods of high volatility using GARCH.

The study of the results under (b) above goes beyond the tests in previous studies. The earlier studies have been restricted to (a), i.e., the relationship between gold and stock returns under periods of high volatility of the latter. However, we felt that it would be useful to study the relationship under periods of low volatility as well. This provides useful information on deciding whether gold should be maintained as a diversifier in the stock portfolio during periods of low volatility.

Robustness Test

The regression model adopted by us assumes that there is no heteroscedasticity. There is, however, a possibility that the variance of the error term might not be constant and be affected by some other variables missed in our model. For example, the gold returns could possibly become more volatile in the presence of political uncertainty. To be sure, the returns from the broad stock market indices such as the S&P500 or the Sensex are affected by all macro factors and should therefore already capture the impact of a wide range of variables such as the one mentioned above.

However, in order to establish the robustness of the model, the assumption of heteroscedasticity was tested, using the Breusch–Pagan test. For the models (1), (2), and (3), the Breusch–Pagan test of heteroscedasticity was conducted to check the strength of the results of the regression equations.

4. Results

4.1. Regressions for Data Stratified by Returns

The results for the tests of regressing the gold returns over stock returns, as per equations (1) and (2) are shown in Table 4A,B. The first set of figures in the table shows the regression coefficients of the Sensex returns over gold returns, both denominated in INR. The second set of figures presents the results of the regression of gold monthly returns (USD) over S&P500 monthly returns (USD).

The columns in the table present the test results for multiple time periods over which the tests were conducted. The rows contain the results based on tests for the entire data sample and the data for the bottom 10%, 5%, and 1% of the returns during the respective time periods.

As noted above, there is a limited number of observations within the bottom 1% return scenarios. As a result, the tests for the individual 10-year periods could not be conducted. Further, the limited observations, even in the entire time frame of 1980–2020, may be constraining the null hypothesis test result from being accepted. Thus, there is scope for further investigation in the extreme risk scenario.

The coefficients are not significant in most cases. There is a mix of positive and negative signs.

Thus, gold does not act as a significant hedge or a safe haven in any scenario, except one. This is true for both the U.S. and the Indian stock markets. It acts as a hedge against the Indian stocks only in the 10-year period of 2010–2020.

It is notable that gold has consistently failed to serve as a hedge or a safe haven in most scenarios. This finding re-confirms the findings of several previous studies, such as Baur and McDermott (2010) and McCown and Zimmerman (2006), and Mensi et al. (2014).

4.2. Regressions for Periods Stratified by Volatility Using GARCH

As per Equation (3), the volatilities were computed using GARCH model. The sample data for each period were then sorted in ascending order of volatility.

The regressions as per Equations (1) and (2) were run, for each time period, for the entire data, and for:

- (c)

- the observations pertaining to the top 10%, 5%, and 1% of the volatility during the sample period. The results for these regressions are presented in Table 5A,B.

- (d)

- the observations pertaining to the bottom 10%, 5%, and 1% of the volatility during the period. The results for these regressions are presented in Table 6A,B.

Table 6. Regression of gold returns on Sensex returns for periods of low volatility using GARCH.

Table 6. Regression of gold returns on Sensex returns for periods of low volatility using GARCH.

The Breusch–Pagan tests on the data sets indicated no evidence of heteroscedasticity. The null hypothesis of homoscedasticity could not be rejected at the 95% significance level in almost all the scenarios under which the models have been run.

The results (Table 5A,B) for the observations corresponding to highly volatile periods indicate that gold is neither a hedge nor a safe haven in the Indian or U.S. markets. However, these values are not significant at even a 10% level. Hence, we do not consider gold to be a hedge in these periods. Interestingly, in the period 2010–2020, the coefficient is actually marginally positive in the case of U.S. stocks, in the periods of very high volatility.

For the periods corresponding to low volatility, the results (Table 6A,B) indicate that gold does not act as a hedge or a safe haven against S&P500 or Sensex. The results in the periods of low volatility are useful because many investors may not be, ex ante, predicting the degree of volatility. Such investors would be interested in hedging against equity risk in all phases of volatility. The results, of course, indicate that gold is not an effective hedge even in times of low volatility in the stock market.

There are a few cases, where the regression coefficient is negative but not significant at even a 10% level. For example, the top 10% volatility observations, for the periods 1980–1989, 1990–1999, and 2010–1020 for Sensex (Table 5A), and the periods 1980–1989, 1990–1999, and 2000–2009 for S&P500 (Table 5B), are amongst such cases. However, since these values are not significant at any of our considered levels, we do not consider gold to be a hedge in any of these cases.

5. Conclusions

It has been a matter of debate for long whether gold acted as a hedge or a safe haven against the risks in a stock portfolio. We have tested the hedge and safe haven characteristics of gold in normal periods, periods of low return, periods of very high volatility, and periods of very low volatility.

We have found that gold has, since 1980 onwards, failed to act as a hedge or a strong haven against Indian as well as U.S. stocks. In fact, it showed a positive co-movement with the S&P500 in extreme market movements. This can be explained by the possibility that in extreme periods, investors may be selling off all financial assets and moving into cash.

The long-term investors including the central banks, institutional investors, and retail savers have, for long, considered gold as an instrument for the preservation of value. Several U.S. investors manage their aggregate portfolios with a narrowly targeted level of risk. The pension funds, for instance, are interested in maintaining a low volatility of returns over a long time horizon. Diversification across assets is the most efficient way of reducing risk. The institutional investors have the opportunity to diversify across international stocks as well as non-stock assets such as gold. With the availability of exchange-traded funds (ETFs) in gold, it is now relatively easy for investors to take positions in gold. The Federal Reserve of the U.S.A. would, similarly, be interested, for reasons of macro-prudential and financial stability, in maintaining an optimum level of gold in its reserves.

For all such investors, the hedging property, or the lack of it, of gold against other assets, including stocks, would be of significant value. This, of course, would be one of the input factors, amongst many required to build an optimal portfolio. This study is based on the S&P500 index and hence is especially useful to passive investors, who are now a significant proportion of the U.S. market investors.

The retail savers in India have especially been highly favourable towards keeping their savings in gold. The Indian government does not provide any direct and guaranteed social security to the residents. Hence, the Indian consumers as well as investors have, on their own, resorted to hedging against the potential loss of wealth or income. Now, as they are increasingly investing in listed stocks, they would be well advised to diversify their portfolios with hedging instruments. In this context, it is clear that gold is unlikely to serve the purpose of a hedge.

The results of the study can provide support to policy makers, especially in India. India is the largest importer of gold in the world, amounting to US$ 25 billion4 in the financial year ending in March 2020, i.e., 1% of its national gross domestic product. Even though gold is an unproductive asset, its import consumes a huge amount of foreign exchange reserves. Lately, the government has been issuing, to retail savers, sovereign gold bonds, as an attractive alternative to physical gold. The government is trying to dissuade the savers from investing in physical gold and thus save on imports as well as productive capital. In parallel, an increasing number of Indian retail savers are now investing in the stock market. As the government works further on its social security plans as well as its trade rules, it should consider the implications of gold not being a strong hedge for stocks. There is scope for further research and deliberations on this subject to help in policy making.

There is potential for further research into the optimal level of gold that should be held by individual and institutional investors in a diversified portfolio of equities, bonds, and commodities. Further study may also be performed in the context of building a portfolio of equities and bonds across multiple countries to check if gold can be a hedge in such cases. There is also further scope to study the behavioural dimension of the affinity for gold in India, with the finding from our study that gold does not serve as a hedge against stocks. Similarly, the impact of the gold-related policies in India, considering the absence of any hedging benefit for investors, is also worth studying further.

Funding

This research received no external funding.

Data Availability Statement

The links for all data used in this article have been cited. Apart from those, no new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The author declares no conflict of interest.

Notes

| 1 | https://www.providentmetals.com/knowledge-center/precious-metals-resources/world-gold-production-consumption.html (accessed on 15 November 2020). |

| 2 | World Bank data. https://data.worldbank.org/indicator/CM.MKT.LCAP.CD?most_recent_value_desc=true (accessed on 20 November 2020). |

| 3 | Sovereign Gold Bond Scheme, Reserve Bank of India https://m.rbi.org.in/Scripts/FAQView.aspx?Id=109 (accessed on 17 November 2020). |

| 4 | Value of gold imported into India, Statista.com, https://www.statista.com/statistics/625818/import-value-of-gold-india/ (accessed on 17 November 2020). |

References

- Baur, Dirk G., and Brian M. Lucey. 2010. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas K. J. McDermott. 2010. Is gold a safe haven? International evidence. Journal of Banking and Finance 34: 1886–98. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas K. J. McDermott. 2016. Why is gold a safe haven? Journal of Behavioral and Experimental Finance 10: 63–71. [Google Scholar] [CrossRef]

- Beckmann, Joscha, and Robert Czudaj. 2013. Gold as an inflation hedge in a time-varying coefficient framework. The North American Journal of Economics and Finance 24: 208–22. [Google Scholar] [CrossRef] [Green Version]

- Beckmann, Joscha, Robert Czudaj, and Keith Pilbeam. 2015a. Causality and volatility patterns between gold prices and exchange rates. The North American Journal of Economics and Finance 34: 292–300. [Google Scholar] [CrossRef] [Green Version]

- Beckmann, Joscha, Theo Berger, and Robert Czudaj. 2015b. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Economic Modelling 48: 16–24. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Anshul Jain, Pratap Chandra Biswal, and David Roubaud. 2017. Cointegration and nonlinear causality amongst gold, oil, and the Indian stock market: Evidence from implied volatility indices. Resources Policy 52: 201–6. [Google Scholar] [CrossRef]

- Bredin, Don. 2015. Does gold glitter in the long-run? Gold as a hedge and safe haven across time and investment horizon. International Review of Financial Analysis 41: 320–28. [Google Scholar] [CrossRef]

- Capie, Forrest, Terence C. Mills, and Geoffrey Wood. 2005. Gold as a hedge against the dollar. Journal of International Financial Markets, Institutions and Money 15: 343–52. [Google Scholar] [CrossRef]

- Chkili, Walid. 2016. Dynamic correlations and hedging effectiveness between gold and stock markets: Evidence for BRICS countries. Research in International Business and Finance 38: 22–34. [Google Scholar] [CrossRef]

- Chua, Jess H., Gordon Sick, and Richard S. Woodward. 1990. Diversifying with Gold Stocks. Financial Analysts Journal 46: 76–79. [Google Scholar] [CrossRef]

- Ciner, Cetin, Constantin Gurdgiev, and Brian M. Lucey. 2013. Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. International Review of Financial Analysis 29: 202–11. [Google Scholar] [CrossRef]

- El Hedi Arouri, Mohamed, Amine Lahiani, and Duc Khuong Nguyen. 2015. World gold prices and stock returns in China: Insights for hedging and diversification strategies. Economic Modelling 44: 273–82. [Google Scholar] [CrossRef] [Green Version]

- Ghazali, Mohd Fahmi, Hooi Hooi Lean, and Zakaria Bahari. 2020. Does Gold Investment offer protection against stock market losses? evidence from five countries. Singapore Economic Review 65: 275–301. [Google Scholar] [CrossRef] [Green Version]

- Gürgün, Gözde, and İbrahim Ünalmış. 2014. Is gold a safe haven against equity market investment in emerging and developing countries? Finance Research Letters 11: 341–48. [Google Scholar] [CrossRef]

- Hillier, David, Paul Draper, and Robert Faff. 2006. Do Precious Metals Shine? An Investment Perspective. Financial Analysts Journal 62: 98–106. [Google Scholar] [CrossRef]

- Hoang, Thi-Hong-Van, Hooi Hooi Lean, and Wing-Keung Wong. 2015. Is gold good for portfolio diversification? A stochastic dominance analysis of the Paris stock exchange. International Review of Financial Analysis 42: 98–108. [Google Scholar] [CrossRef]

- Hood, Matthew, and Farooq Malik. 2013. Is gold the best hedge and a safe haven under changing stock market volatility? Review of Financial Economics 22: 47–52. [Google Scholar] [CrossRef]

- Jaffe, Jeffrey F. 1989. Gold and Gold Stocks as Investments for Institutional Portfolios. Financial Analysts Journal 45: 53–59. [Google Scholar] [CrossRef]

- Jain, Anshul, and Sajal Ghosh. 2013. Dynamics of global oil prices, exchange rate and precious metal prices in India. Resources Policy 38: 88–93. [Google Scholar] [CrossRef]

- McCown, James Ross, and John R. Zimmerman. 2006. Is Gold a Zero-Beta Asset? Analysis of the Investment Potential of Precious Metals (SSRN Scholarly Paper ID 920496). Social Science Research Network. Available online: https://susy.mdpi.com/user/manuscripts/proof/file/7b7e1636988b5e754b8ba49372e1e47f (accessed on 31 August 2020). [CrossRef]

- McDonald, John G., and Bruno H. Solnick. 1977. Valuation and strategy for gold stocks. Journal of Portfolio Management 3: 29–33. [Google Scholar] [CrossRef]

- Mei, Ganghua, and Robert McNown. 2019. Dynamic causality between the U.S. stock market, the Chinese stock market and the global gold market: Implications for individual investors’ diversification strategies. Applied Economics 51: 4742–56. [Google Scholar] [CrossRef]

- Mensi, Walid, Shawkat Hammoudeh, Juan Carlos Reboredo, and Duc Khuong Nguyen. 2014. Do global factors impact BRICS stock markets? A quantile regression approach. Emerging Markets Review 19: 1–17. [Google Scholar] [CrossRef]

- Michaud, Richard O., Robert Michaud, and Katharine Pulvermacher. 2011. Gold as a Strategic Asset (SSRN Scholarly Paper ID 2402862). Social Science Research Network. Available online: https://papers.ssrn.com/abstract=2402862 (accessed on 24 September 2020).

- Salisu, Afees A., Ibrahim D. Raheem, and Xuan Vinh Vo. 2021a. Assessing the Safe Haven Property of the Gold Market during COVID−19 Pandemic. International Review of Financial Analysis 74: 101666. [Google Scholar] [CrossRef]

- Salisu, Afees A., Xuan Vinh Vo, and Brian Lucey. 2021b. Gold and US Sectoral Stocks during COVID-19 Pandemic. Research in International Business and Finance 57: 101424. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Walid Mensi, Shawkat Hammoudeh, Asiya Sohail, and Khamis Hamed Al-Yahyaee. 2019. Does gold act as a hedge against different nuances of inflation? Evidence from Quantile-on-Quantile and causality-in-quantiles approaches. Resources Policy 62: 602–15. [Google Scholar] [CrossRef]

- Shalini, Velappan, and Krishna Prasanna. 2016. Impact of the financial crisis on Indian commodity markets: Structural breaks and volatility dynamics. Energy Economics 53: 40–57. [Google Scholar] [CrossRef]

- Soja, Tijana. 2019. Gold in investment portfolio from perspective of european investor. Zlato U PORTFOLIO INVESTICIJAMA IZ UGLA EVROPSKOG ULAGAČA 16: 41–58. [Google Scholar]

- Upper, Christian. 2000. How Safe Was the “Safe Haven”? Financial Market Liquidity During the 1998 Turbulences. (SSRN Scholarly Paper ID 219132). Social Science Research Network. Available online: https://papers.ssrn.com/abstract=219132 (accessed on 24 September 2020). [CrossRef] [Green Version]

- Yousaf, Imran, Elie Bouri, Shoaib Ali, and Nehme Azoury. 2021. Gold against Asian Stock Markets during the COVID-19 Outbreak. Journal of Risk and Financial Management 14: 186. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).