Exchange Rate, Gold Price, and Stock Market Nexus: A Quantile Regression Approach

Abstract

1. Introduction

2. Literature Review

3. Research Design

3.1. Sample

3.2. Empirical Models

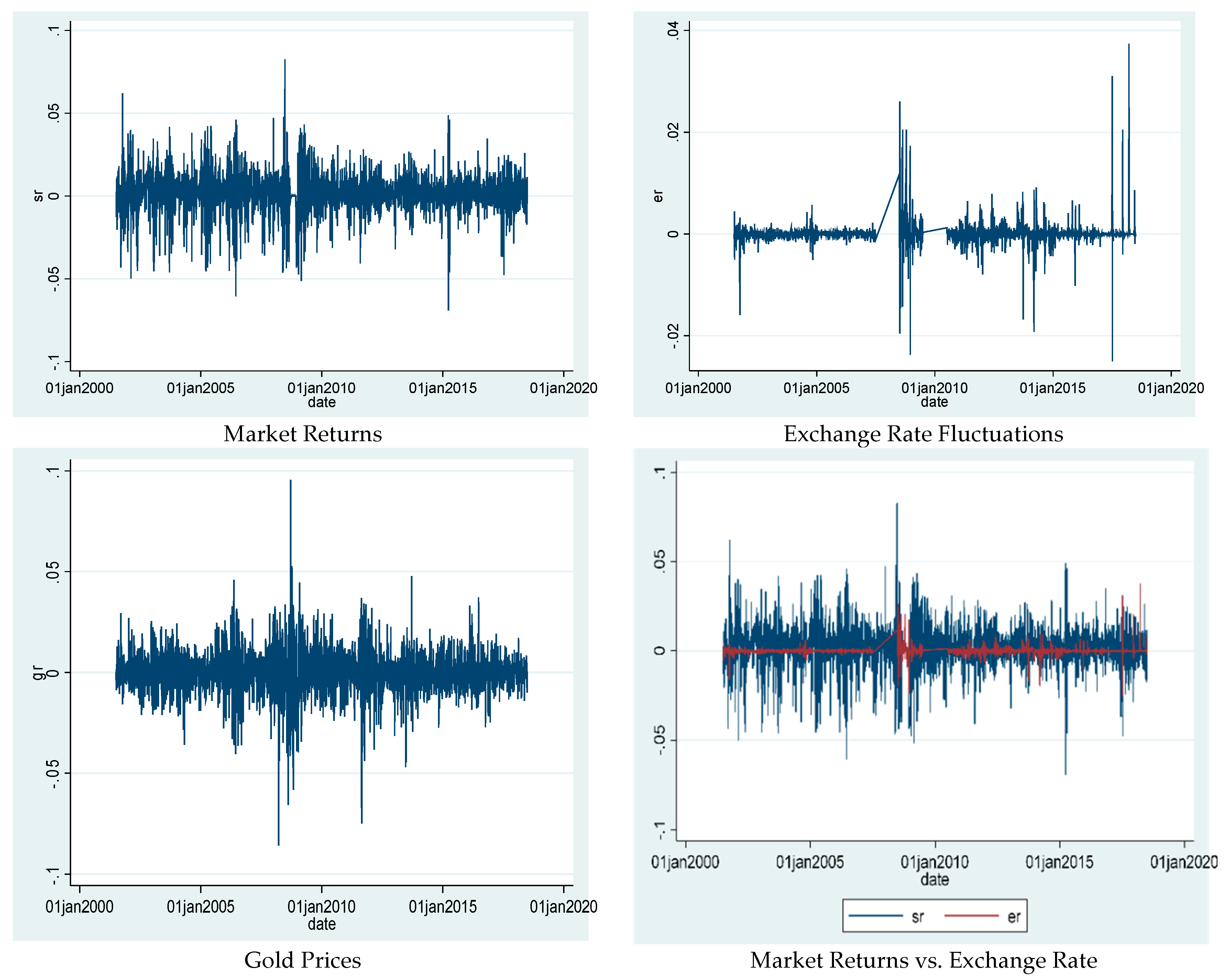

4. Descriptive Results

4.1. Multivariate-GARCH

4.2. Empirical Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Akkoc, Ugur, and Irfan Civcir. 2019. Dynamic linkages between strategic commodities and stock market in Turkey: Evidence from SVAR-DCC-GARCH model. Resource Policy 62: 231–39. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, Amine Lahiani, and Duc Khuong Nguyen. 2015. World gold prices and stock returns in China: Insights for hedging and diversification strategies. Economic Modelling 44: 273–82. [Google Scholar] [CrossRef]

- Aye, Goodness C., Hector Carcel, Luis A. Gil-Alana, and Rangan Gupta. 2017. Does gold act as a hedge against inflation in the UK? Evidence from a fractional cointegration approach over 1257 to 2016. Resources Policy 54: 53–57. [Google Scholar] [CrossRef]

- Bampinas, Georgios, and Theodore Panagiotidis. 2015. Are gold and silver a hedge against inflation? A two-century perspective. International Review of Financial Analysis 41: 267–76. [Google Scholar] [CrossRef]

- Baur, Dirk G. 2012. Asymmetric Volatility in the Gold Market. Journal of Alternative Investments 14: 26–38. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Brian M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas K. McDermott. 2010. Is gold a safe haven? International evidence. Journal of Banking Finance 34: 1886–98. [Google Scholar] [CrossRef]

- Beckmann, Joscha, Theo Berger, and Robert Czudaj. 2015. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Economic Modelling 48: 16–24. [Google Scholar] [CrossRef]

- Bouri, E., A. Jain, P. C. Biswal, and D. Roubaud. 2017. Cointegration and nonlinear causality amongst gold, oil, and the Indian stock market: Evidence from implied volatility indices. Resources Policy 52: 201–6. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, John Hunter, and Faek Menla Ali. 2014. On the linkages between stock prices and exchange rates: Evidence from the banking crisis of 2007–2010. International Review of Financial Analysis 33: 87–103. [Google Scholar] [CrossRef]

- CEIC Data. 2020. Available online: https://www.ceicdata.com/en (accessed on 11 May 2020).

- Chen, An-Sing, and James Wuh Lin. 2014. The relation between gold and stocks: An analysis of severe bear markets. Applied Economics Letters 21: 158–70. [Google Scholar] [CrossRef]

- Delgado, Nancy Areli Bermudez, Estefanía Bermudez Delgado, and Eduardo Saucedo. 2018. The relationship between oil prices, the stock market and the exchange rate: Evidence from Mexico. The North American Journal Economics Finance 45: 266–75. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 49: 1057–72. [Google Scholar] [CrossRef]

- Dornbusch, Rudiger, and Stanley Fischer. 1980. Exchange rates and the current account. American Economic Review 70: 960–71. [Google Scholar]

- Ebrahim, Zoheir, Oliver R. Inderwildi, and David A. King. 2014. Macroeconomic impacts of oil price volatility: Mitigation and resilience. Front Energy 8: 9–24. [Google Scholar] [CrossRef]

- Ewing, Bradley T., and Farooq Malik. 2016. Volatility spillovers between oil prices and the stock market under structural breaks. Global Finance Journal 29: 12–23. [Google Scholar] [CrossRef]

- Gokmenoglu, Korhan K., and Negar Fazlollahi. 2015. The interactions among gold, oil, and stock market: Evidence from S&P500. Procedia Economics and Finance 25: 478–88. [Google Scholar]

- Iqbal, Javed. 2017. Does gold hedge stock market, inflation and exchange rate risks? An econometric investigation. International Review of Economics & Finance 48: 1–17. [Google Scholar]

- Jain, Anshul, and P. C. Biswal. 2016. Dynamic linkages among oil price, gold price, exchange rate, and stock market in India. Resources Policy 49: 179–85. [Google Scholar] [CrossRef]

- Kanjilal, Kakali, and Sajal Ghosh. 2014. Income and price elasticity of gold import demand in India: Empirical evidence from threshold and ARDL bounds test cointegration. Resources Policy 41: 135–42. [Google Scholar] [CrossRef]

- Kumar, Satish. 2017. On the nonlinear relation between crude oil and gold. Resources Policy 51: 219–24. [Google Scholar] [CrossRef]

- Le, Thai-Ha, and Youngho Chang. 2016. Dynamics between strategic commodities and financial variables: Evidence from Japan. Resources Policy 50: 1–9. [Google Scholar] [CrossRef]

- Leung, Henry, Dirk Schiereck, and Florian Schroeder. 2017. Volatility spillovers and determinants of contagion: Exchange rate and equity markets during crisis. Economic Modelling 61: 169–80. [Google Scholar] [CrossRef]

- Masih, Rumi, Sanjay Peters, and Lurion De Mello. 2011. Oil price volatility and stock price fluctuations in an emerging market: Evidence from South Korea. Energy Economics 33: 975–86. [Google Scholar] [CrossRef]

- Mensi, W., M. Beljid, A. Boubaker, and S. Managi. 2013. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Modelling 32: 15–22. [Google Scholar] [CrossRef]

- Mun, Kyung-Chun. 2007. Volatility and correlation in international stock markets and the role of exchange rate fluctuations. Journal of International Financial Markets Institutions and Money 17: 25–41. [Google Scholar] [CrossRef]

- Ng, Serena, and Pieere Perron. 2001. Lag Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 69: 1519–54. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2015. Time Series and Panel Data Econometrics. Oxford: Oxford University Press. [Google Scholar]

- Phillips, Peter CB, and Pierre Perron. 1988. Testing for a unit root in a time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Raza, Naveed, Syed Jawad Hussain Shahzad, Aviral Kumar Tiwari, and Muhammad Shahbaz. 2016. Asymmetric impact of gold, oil prices and their volatilities on stock prices of emerging markets. Resources Policy 49: 290–91. [Google Scholar] [CrossRef]

- Reboredo, Juan C. 2013. Is gold a hedge or safe haven against oil price movements? Resources Policy 38: 130–37. [Google Scholar] [CrossRef]

- Rjoub, Husam, Irfan Civcir, and Nil Gunsel Resatoglu. 2017. Micro and macroeconomic determinants of stock prices: The case of Turkish banking sector. Romanian Journal of Economic Forecasting 20: 150–66. [Google Scholar]

- Schwert, G. William. 2002. Tests for unit roots: A Monte Carlo investigation. Journal of Business & Economic Statistics 20: 5–17. [Google Scholar]

- Sadorsky, Perry. 2014. Modeling volatility and correlations between emerging market stock prices and the prices of copper, oil and wheat. Energy Economics 43: 72–81. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Mohammad Iqbal Tahir, Imran Ali, and Ijaz Ur Rehmand. 2014. Is gold investment a hedge against inflation in Pakistan? A co-integration and causality analysis in the presence of structural breaks. The North American Journal of Economics and Finance 28: 190–05. [Google Scholar] [CrossRef]

- Singhal, Shelly, and Sajal Ghosh. 2016. Returns and volatility linkages between international crude oil price, metal and other stock indices in India: Evidence from VAR-DCC-GARCH models. Resources Policy 50: 276–88. [Google Scholar] [CrossRef]

- Sreekanth, D., and L. Krishna Veni. 2014. Causal relationship between gold price and nifty–an empirical study in Indian context. Asian Journal of Research in Banking and Finance 4: 253–65. [Google Scholar]

- Tsai, I-Chun. 2012. The relationship between stock price index and exchange rate in Asian markets: A quantile regression approach. Journal of International Financial Markets Institutions and Money 22: 609–21. [Google Scholar] [CrossRef]

- Tule, Moses Kpughur, Mela Yila Dogo, and Godfrey Chidozie Uzonwanne. 2018. Volatility of stock market returns and the Naira exchange rate. Global Finance Journal 35: 97–105. [Google Scholar] [CrossRef]

- Walid, Chkili, Aloui Chaker, Omar Masood, and John Fry. 2011. Stock market volatility and exchange rates in emerging countries: A Markov-state switching approach. Emerging Markets Review 12: 272–92. [Google Scholar] [CrossRef]

- Wong, Hock Tsen. 2019. Volatility spillovers between real exchange rate returns and real stock price returns in Malaysia. International Journal of Finance & Economics 24: 131–49. [Google Scholar]

| Variable | Obs | Mean | SD | Min | Max | Skew | Kurt |

|---|---|---|---|---|---|---|---|

| Full Sample 2001–2018 | |||||||

| Market Return | 3228 | 0.00135 | 0.01238 | −0.06684 | 0.08604 | −0.27351 | 6.60031 |

| Exchange Rate | 3228 | 0.00002 | 0.00227 | −0.02504 | 0.03734 | 2.51386 | 76.45716 |

| Gold Price | 3228 | −0.00004 | 0.01084 | −0.08571 | 0.09554 | −0.22967 | 9.10732 |

| Split Sample 2001–2007 | |||||||

| Market Return | 1040 | 0.00188 | 0.01488 | −0.05882 | 0.06403 | −0.39434 | 4.68177 |

| Exchange Rate | 1040 | −0.00006 | 0.00097 | −0.01592 | 0.00567 | −4.60093 | 75.95287 |

| Gold Price | 1040 | 0.00028 | 0.00999 | −0.04059 | 0.04591 | −0.09609 | 4.96092 |

| Split Sample 2008–2018 | |||||||

| Market Return | 2188 | 0.00110 | 0.010991 | −0.06684 | 0.08604 | −0.169474 | 8.27509 |

| Exchange Rate | 2188 | 0.00008 | 0.002760 | −0.02504 | 0.03734 | 2.29305 | 55.05006 |

| Gold Price | 2188 | −0.00019 | 0.011227 | −0.08571 | 0.09554 | −0.264639 | 10.21202 |

| Full Sample 2001–2018 | Split Sample 2001–2007 | Split Sample 2008–2018 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | MR | ER | GP | MR | ER | GP | MR | ER | GP |

| MR | 1.000 | 1.000 | 1.000 | ||||||

| ER | −0.065 | 1.000 | −0.026 | 1.000 | −0.072 * | 1.000 | |||

| GP | −0.001 | −0.033 | 1.000 | 0.034 | 0.011 | 1.000 | −0.017 | −0.046 * | 1.000 |

| Full Sample 2001–2018 | Split Sample 2001–2007 | Split Sample 2008–2018 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | ADF | PP | NGP | ADF | PP | NGP | ADF | PP | NGP |

| Level | Level | Level | Level | Level | Level | Level | Level | Level | |

| MR | −12.442 *** | −12.385 *** | −12.981 *** | −10.124 *** | −9.925 *** | −9.435 *** | −11.214 *** | −12.022 *** | −9.930 *** |

| ER | −11.413 *** | −11.504 *** | −14.973 *** | −10.265 *** | −10.105 *** | −12.980 *** | −10.853 *** | −11.045 *** | −14.937 *** |

| GP | −14.502 *** | −14.536 *** | −10.191 *** | −11.206 *** | −11.524 *** | −9.736 *** | −12.242 *** | −12.359 *** | −10.194 *** |

| Daily | Monthly | |||

|---|---|---|---|---|

| Variable | Market Return | Market Return | ||

| Exchange Rate | −0.627 ** (−3.24) | −1.06 (−1.20) | ||

| Gold Price | 0.0104 (0.58) | −0.05 (−0.61) | ||

| Constant | 0.00162 *** (9.73) | 0.00155 *** (9.70) | 0.02 *** (6.69) | 0.02 *** (7.03) |

| ARCH L1 | 0.245 *** (7.77) | 0.242 *** (8.21) | 0.030 * (1.67) | 0.01 (0.73) |

| GARCH L1 | 0.831 *** (7.19) | 0.818 *** (7.46) | −1.02 *** (−131.38) | 0.98 *** (34.31) |

| Constant | −0.0000 (−1.06) | −0.0000 (−0.90) | 0.004 *** (11.33) | 0.0000 (−0.14) |

| Obs | 3228 | 3228 | 204 | 204 |

| AIC | −18,109.3 | −20,212.6 | −682.04 | −680.50 |

| BIC | −18,079.7 | −20,182.4 | −665.45 | −663.91 |

| Market Return with Exchange Rate | |||||||||||||||

| Full Sample 2001–2018 | Split Sample 2001–2007 | Split Sample 2008–2018 | |||||||||||||

| OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | |

| Exchange Rate | −0.684 ** (−3.18) | 0.732 * (−2.55) | −0.654 ** (−3.10) | −0.826 ** (−2.71) | −1.098 * (−2.18) | −0.378 (−0.73) | −0.799 (−1.04) | −0.431 (−0.68) | −0.365 (−0.51) | −0.698 (−0.71) | −0.741 *** (−3.32) | −0.642 * (−2.14) | −0.610 ** (−2.97) | −0.926 ** (−2.77) | −0.777 ** (−1.43) |

| Constant | 0.001 *** (8.07) | −0.004 *** (−16.63) | 0.001 *** (7.09) | 0.007 *** (29.11) | 0.014 *** (34.08) | 0.002 *** (5.90) | −0.004 *** (−8.53) | 0.0024 *** (5.85) | 0.009 *** (20.31) | 0.017 *** (26.63) | 0.001 *** (4.81) | −0.003 *** (−13.99) | 0.0007 *** (3.72) | 0.00616 *** (19.44) | 0.0123 *** (23.84) |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 3228 | 3228 | 3228 | 3228 | 3228 | 1040 | 1040 | 1040 | 1040 | 1040 | 2188 | 2188 | 2188 | 2188 | 2188 |

| Market Return with Gold Price | |||||||||||||||

| Full Sample 2001–2018 | Split Sample 2001–2007 | Split Sample 2008–2018 | |||||||||||||

| OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | |

| Gold Price | 0.00584 (0.29) | −0.00641 (−0.24) | −0.0100 (−0.51) | −0.00399 (−0.13) | 0.0278 (0.62) | 0.0326 (0.78) | 0.0603 (1.02) | −0.00712 (−0.14) | −0.0235 (−0.41) | 0.0468 (0.59) | −0.0180 (−0.78) | −0.0368 * (−1.22) | −0.0203 (−0.97) | −0.0310 (−0.96) | −0.0151 (−0.27) |

| Constant | 0.001 *** (8.19) | −0.004 *** (−18.49) | 0.001 *** (7.03) | 0.007 *** (29.38) | 0.014 *** (37.50) | 0.002 *** (5.68) | −0.004 *** (−9.22) | 0.002 *** (5.49) | 0.009 *** (20.67) | 0.017 *** (26.59) | 0.001 *** (5.14) | −0.004 *** (−15.78) | 0.0006 *** (3.45) | 0.0064 *** (22.65) | 0.012 *** (25.43) |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 3228 | 3228 | 3228 | 3228 | 3228 | 1040 | 1040 | 1040 | 1040 | 1040 | 2188 | 2188 | 2188 | 2188 | 2188 |

| Market Return with Exchange Rate | |||||||||||||||

| Full Sample 2001–2018 | Split Sample 2001–2007 | Split Sample 2008–2018 | |||||||||||||

| OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | |

| Exchange Rate | −1.421 (−1.76) | −1.208 (−1.04) | −1.193 (−1.49) | −1.900 (−1.72) | −2.756 * (−2.00) | −1.604 (−0.75) | −0.162 (−0.06) | −0.867 (−0.30) | −4.279 (−1.24) | −6.911 (−1.28) | −1.207 (−1.51) | −1.631 (−1.27) | −0.857 (−1.00) | −0.507 (−0.51) | −0.933 (−0.68) |

| Constant | 0.023 *** (7.27) | 0.0003 (0.08) | 0.023 *** (7.33) | 0.047 *** (10.92) | 0.077 *** (14.40) | 0.032 *** (4.66) | −0.000 (−0.04) | 0.027 ** (2.94) | 0.070 *** (6.35) | 0.101 *** (5.85) | 0.018 *** (5.55) | −0.0006 (−0.12) | 0.019 *** (5.31) | 0.043 *** (10.31) | 0.066 *** (11.46) |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 204 | 204 | 204 | 204 | 204 | 66 | 66 | 66 | 66 | 66 | 138 | 138 | 138 | 138 | 138 |

| Market Return with Gold Price | |||||||||||||||

| Full Sample 2001–2018 | Split Sample 2001–2007 | Split Sample 2008–2018 | |||||||||||||

| OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | OLS | P25th | P50th | P75th | P90th | |

| Gold Price | −0.0961 (−0.95) | −0.187 (−1.35) | −0.0834 (−0.78) | −0.188 (−1.45) | −0.138 (−0.61) | −0.502 * (−2.07) | −0.815 * (−2.32) | −0.554 * (−2.04) | −0.444 (−1.09) | −0.130 (−0.19) | 0.007 (0.07) | −0.0003 (0.00) | 0.0350 (0.31) | −0.0469 (−0.35) | −0.0399 (−0.31) |

| Constant | 0.023 *** (7.27) | −0.0037 (−0.86) | 0.023 *** (7.01) | 0.049 *** (12.06) | 0.074 *** (10.27) | 0.034 *** (5.24) | 0.004 (0.46) | 0.033 *** (4.51) | 0.067 *** (5.99) | 0.104 *** (5.65) | 0.018 *** (5.45) | 0.00008 (0.01) | 0.0205 *** (5.43) | 0.0449 *** (9.95) | 0.0664 *** (15.41) |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 204 | 204 | 204 | 204 | 204 | 66 | 66 | 66 | 66 | 66 | 138 | 138 | 138 | 138 | 138 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, R.; Mangla, I.U.; Rehman, R.U.; Xue, W.; Naseem, M.A.; Ahmad, M.I. Exchange Rate, Gold Price, and Stock Market Nexus: A Quantile Regression Approach. Risks 2020, 8, 86. https://doi.org/10.3390/risks8030086

Ali R, Mangla IU, Rehman RU, Xue W, Naseem MA, Ahmad MI. Exchange Rate, Gold Price, and Stock Market Nexus: A Quantile Regression Approach. Risks. 2020; 8(3):86. https://doi.org/10.3390/risks8030086

Chicago/Turabian StyleAli, Rizwan, Inayat Ullah Mangla, Ramiz Ur Rehman, Wuzhao Xue, Muhammad Akram Naseem, and Muhammad Ishfaq Ahmad. 2020. "Exchange Rate, Gold Price, and Stock Market Nexus: A Quantile Regression Approach" Risks 8, no. 3: 86. https://doi.org/10.3390/risks8030086

APA StyleAli, R., Mangla, I. U., Rehman, R. U., Xue, W., Naseem, M. A., & Ahmad, M. I. (2020). Exchange Rate, Gold Price, and Stock Market Nexus: A Quantile Regression Approach. Risks, 8(3), 86. https://doi.org/10.3390/risks8030086