2.1. Measuring Systemic Risk in the Banking Sector

Let us consider a financial system composed by a set

V of

N banks:

. Let

A indicate the corresponding vector of net asset values:

. Net asset values can be calculated by subtracting intangibles and liabilities from banks’ balance-sheet assets and indicate the financial amounts owned by shareholders. For a bank

, the expected net asset value can be calculated as follows:

where

and

indicate, respectively, the probability of default and the recovery rate in case of default, for each bank

. From (

1), we can derive the expected losses of bank

n:

A Credit Default Swap (CDS) agreement allows the shareholders of bank

n to buy a protection against the default event of the bank: in the simplified case of a one-year contract, the premium paid by the buyer is the spread

, which can be obtained from the following equation:

If we substitute (

3) in (

2), we obtain:

which provides a straightforward formula to estimate the expected loss of each bank in the system.

We remark that Equation (

3) is rather simplistic with respect to the real pricing of CDS contracts: as argued in many studies, in fact, there are more sophisticated methods to calculate CDS spreads as a function of the

and the

of the underlying position (see, e.g.,

Zhu (

2006)). Given the different focus and objective of this study, we decided to adopt a simple approach for CDS spreads, and without loss of generality, we will consider

as an input to our model, regardless of how it has been derived.

The aim of our analysis is to extend (

4), which is based on a single CDS contract, into a formulation that takes contagion between banks into account. We remark that banks are connected in multiple ways through (even if not limited to) their balance-sheets. Besides interbank claims and liabilities, which have been studied in most network models (see, e.g.,

Battiston et al. (

2012), banks hold common investment exposures on the asset side, as well as common liabilities on the funding side.

One methodology to tackle multiple interconnections implements a correlation networks built on the market prices related to financial institutions, as in (

Ahelegbey et al. 2015;

Billio et al. 2012;

Giudici and Spelta 2016). In the current paper, we consider the correlation network between CDS spreads. To this aim, we extend Equation (

4) by defining a new variable, called Total Expected Loss (

), which takes contagion between CDS spreads into account, as follows:

where

, whereas

(with

) are coefficients to be estimated from the available CDS spread data. Please note that Equation (

5) (multivariate model) extends Equation (

2) (univariate model): when

, it follows that

, thus implying that the univariate expected loss is a particular solution of the multivariate Equation (

5).

From an economic viewpoint, we remark that without loss of generality, the total expected losses could be constrained as follows:

in order to prevent the expected losses from being negative or higher than the overall size assigned to each bank (which, in our case, is equal to the net asset value).

The estimation of the coefficients

from the available data could, in principle, be based on a linear regression model that explains the CDS spread of a bank as a function of all the other banks’ CDS spreads. Although feasible from a statistical and computational viewpoint, this model is not economically meaningful, as the direction of contagion is typically unknown and, often, reciprocal. We thus propose to estimate the coefficients in (

5) without assuming any causal relationships, but rather by exploiting an important correlation’s property that will now be described.

Let us assume that CDS spreads are correlated with each other so that, for each pair

of banks:

Let

R be an

positive definite matrix, containing all pairwise correlations. Let then

be the inverse of the correlation matrix, with elements

. The partial correlation coefficient

between variables

and

, conditional on the remaining variables in

V, can be obtained as:

It can be shown that the partial correlation between

and

, given all the other

spreads, is equal to the geometric average between the coefficients in (

5):

We would like to remark that in the case of only two components (

), Equation (

5) becomes:

from which the standard correlation coefficient

can be derived as the geometric average between the coefficients in (

10):

The result reported in (

8) allows the estimation of (

5) without assuming any dependency structure. Instead of “directed” regression coefficients obtained through endogenously-imposed causality constraints, we used “symmetric” partial correlations, able to identify the overall, comprehensive link between two variables once the effects due to the other variables have been removed. Our model for the total expected losses can thus be developed by substituting the coefficients

with their geometric averages

, as in (

9):

From a computational viewpoint, we remark that, consistent with (

11), the only unknown parameter is the correlation matrix between CDS spreads, which can be easily estimated with the sample correlation matrix

R. From an economic viewpoint, we can improve the interpretation of (

11) through an alternative definition of total expected losses analogous to its univariate definition (

4), as follows:

where the total spread

is defined as

. The following equation can thus be derived:

Equation (

13) shows that the total spread

adds a spillover effect to each bank’s CDS spreads, which derives from the propagation of the CDS spreads of the other banks through the network: in our framework, such propagation is conveyed through partial correlation coefficients and relative asset values.

What has been seen so far can be employed to understand banks’ propensity for a private intervention, in case a bank is detected as failing or likely to fail. To achieve this aim, each bank should evaluate the expected losses in a long-term perspective. We can think of a discrete timeline, made up of a number

K of subsequent points in time:

. Each bank can evaluate its expected losses across the whole time horizon, as follows:

As described in the introductory remarks, the objective of this paper is not limited to understanding which drivers might incentivize, or not, some banks to participate in the direct acquisition of a distressed bank; the analysis presented so far can be further extended to understand which policy action might limit the expected losses for the entire banking sector in case of an adverse scenario. Let us suppose a banking system is composed by

N institutions, each of them characterized by a CDS risk premium

. We can define the total expected losses of the system as the amount the entire banking system would lose in case all banks are simultaneously affected by a distress event. The total expected losses of the system can thus be derived as the product between the net asset value of the system as a whole and the probability of simultaneous defaults. For simplicity, we will consider the worst scenario, which consists of a null recovery rate for each financial institution. The total expected losses of the system described above can be formalized as:

Since default events are not independent but, on the contrary, can propagate to each other, the previous equation can be rewritten in terms of an ordered sequence of conditional probabilities, as follows:

Under the null recovery rate assumption (we remark that such an assumption makes our results more conservative), the conditional probabilities in Equation (

16) can be calculated as in (

13), with the conditioning set composed by, respectively, 1, 2, …, (

) institutions. Consistently, the sums in Equation (

13) will become, respectively,

,

, …,

. Since the product in (

16) depends on the choice of the order between institutions

2, let us introduce the following sets of indexes:

, and

, such that the following ordering conditions hold:

Consequently, we will obtain a set of

ordered couples of indexes:

. After some calculations, it can be shown that Equation (

16) becomes:

To rewrite the previous equation in a compact form, let us consider the following matrix of indexes:

where the highlighted part indicates that the coefficients are consistent with the conditions in (

17). Let us call

the lower triangular part of matrix

I,

the first column of matrix

I, and

the first row of matrix

I. We can thus define the following indexes:

It can be shown that (

18) can be rewritten as:

Equation (

20) defines the total expected losses of the entire banking system as the product between the sum of the net asset values of all the banks and a factor composed by two parts: the first one represents the product between the default probabilities of banks; the second one adds a further component deriving from the propagation of default probabilities through the system (and thus representing the contagion effects).

To improve the interpretation of the previous equation, we can develop the product in (

20), thus obtaining the following:

In Equation (

21),

calculates the total expected losses of the system in case of independent default probabilities.

adds a further component, which represents the expected losses of the system due to contagion effects. Consistently,

becomes equal to zero if all the partial correlation coefficients are null.

We also remark that is composed by a series of sums, where each term corresponds to a different order of propagation: the first element represents the propagation of a bank PD to its neighbors ; the second element represents the propagation of the PD from the elements to their neighbors, and so on, until all the possible propagation channels have been explored.

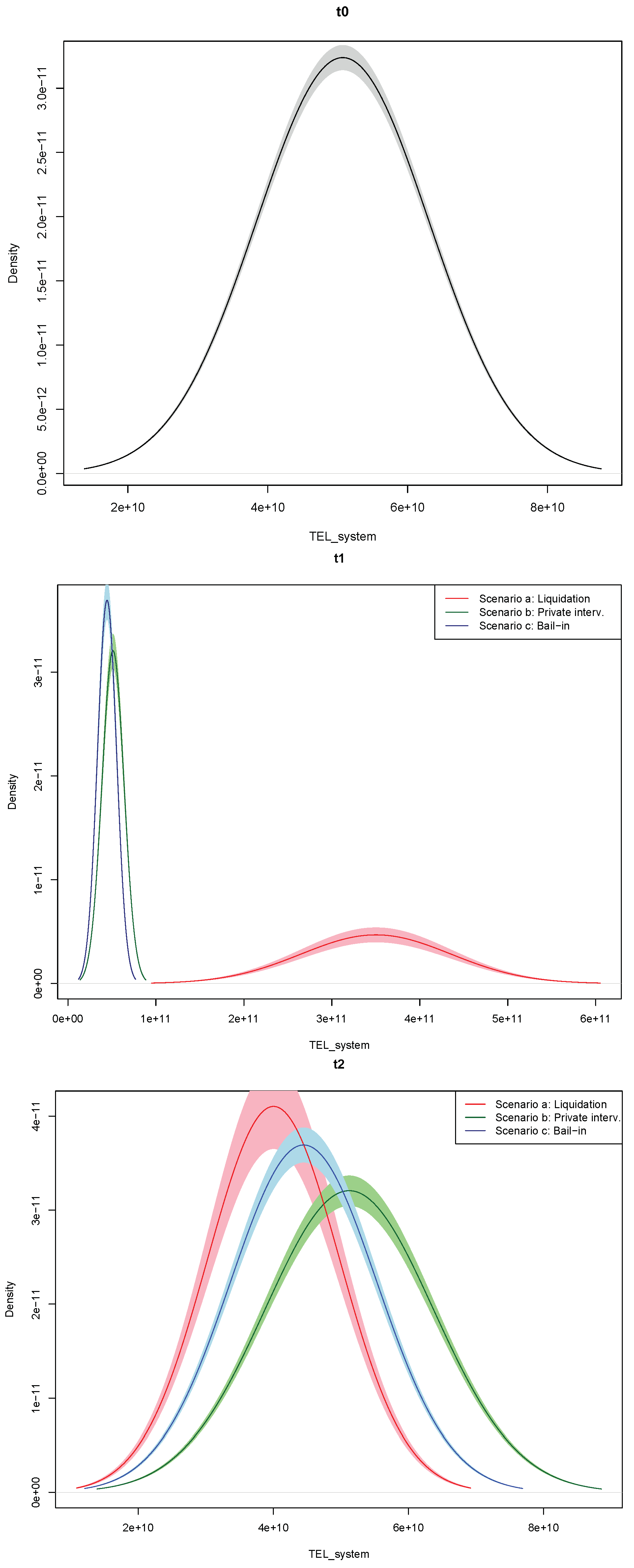

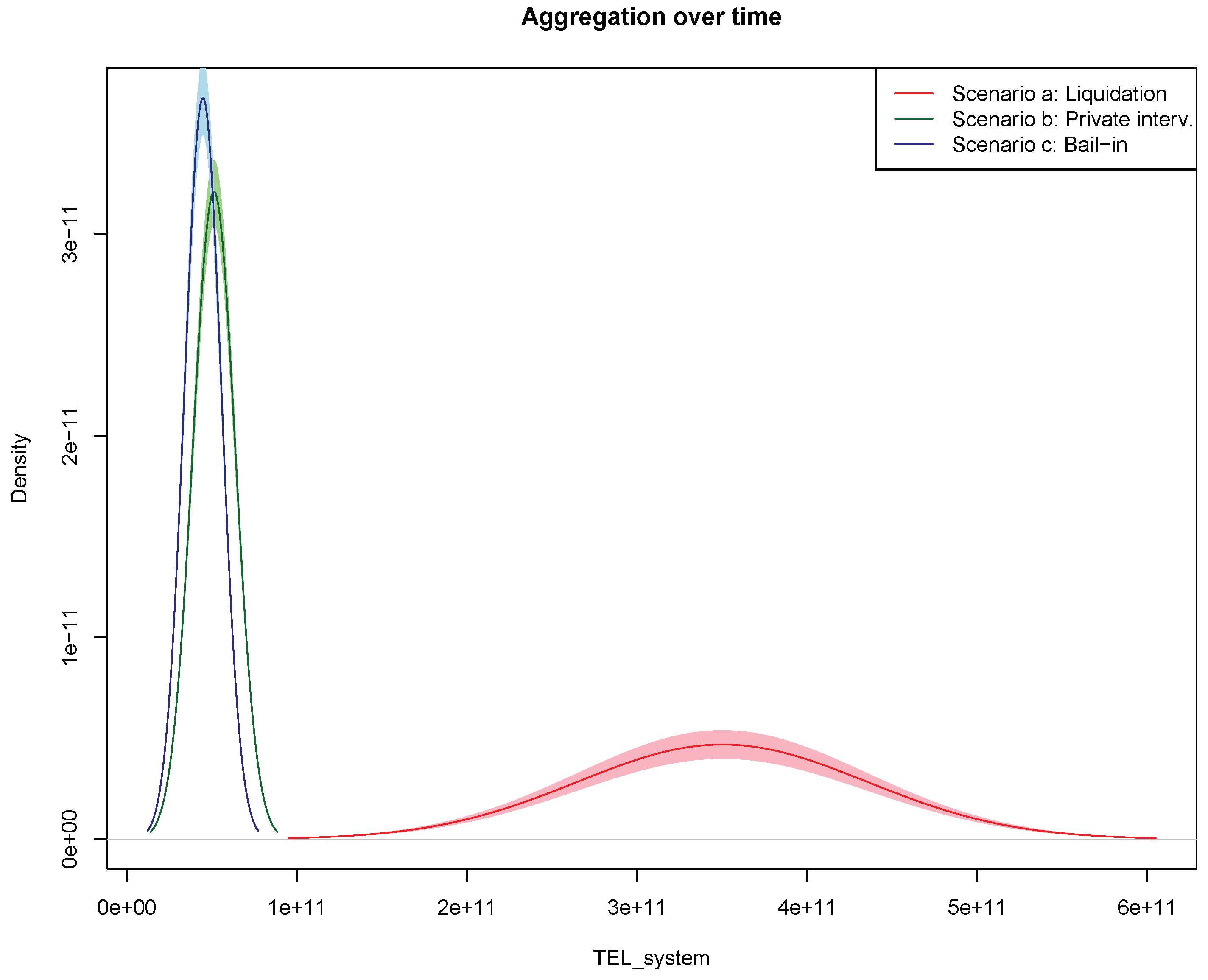

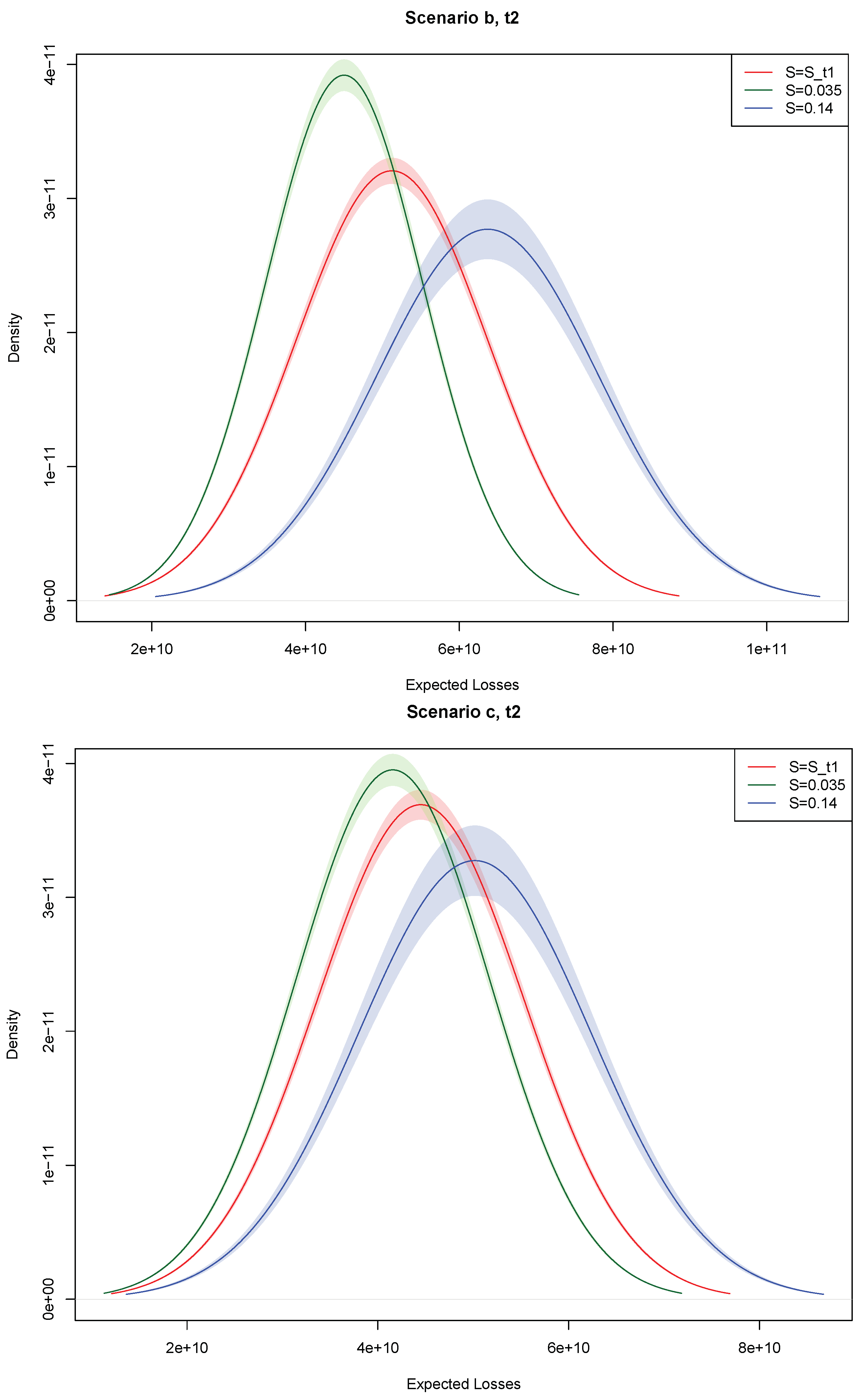

2.2. The Systemic Effects of Bank Resolution

We will measure the systemic effect of bank resolution under the three alternative scenarios previously specified: (a) a distressed bank in the system is liquidated; (b) a distressed bank avoids liquidation and resolution via bail-in through a private intervention action, aiming at recapitalizing the distressed bank through partial or total acquisitions by other actors in the market; (c) a distressed bank undergoes resolution through a bail-in process. For each bank, the “best” scenario in our framework will be the one able to minimize losses.

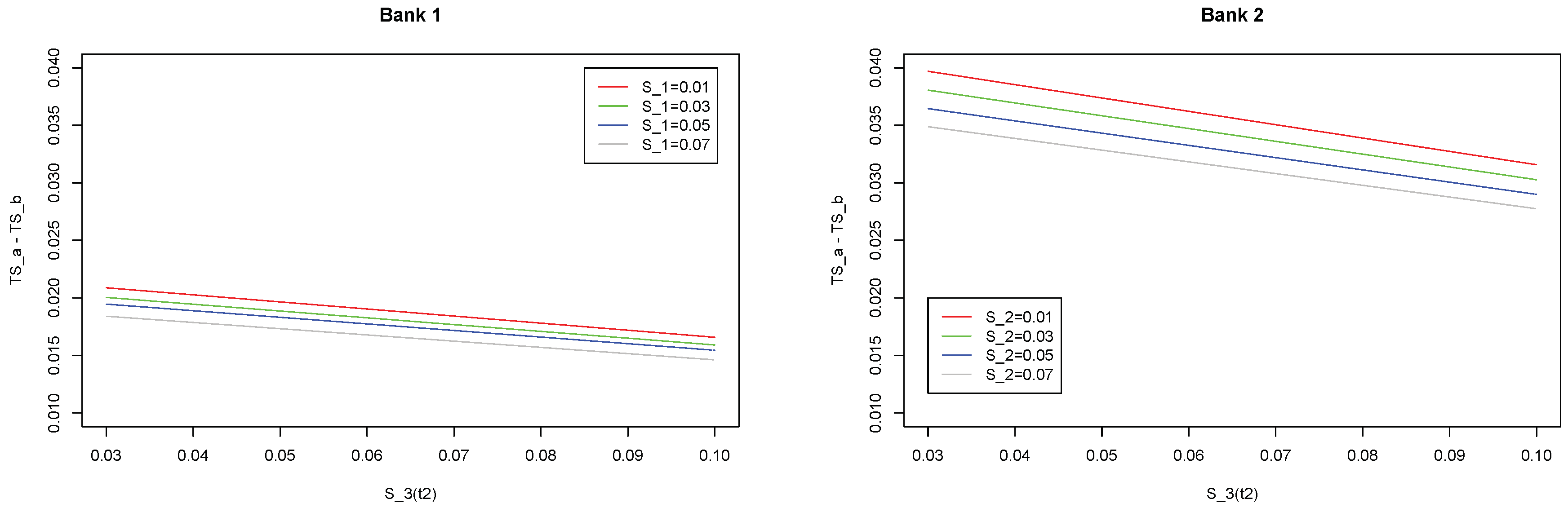

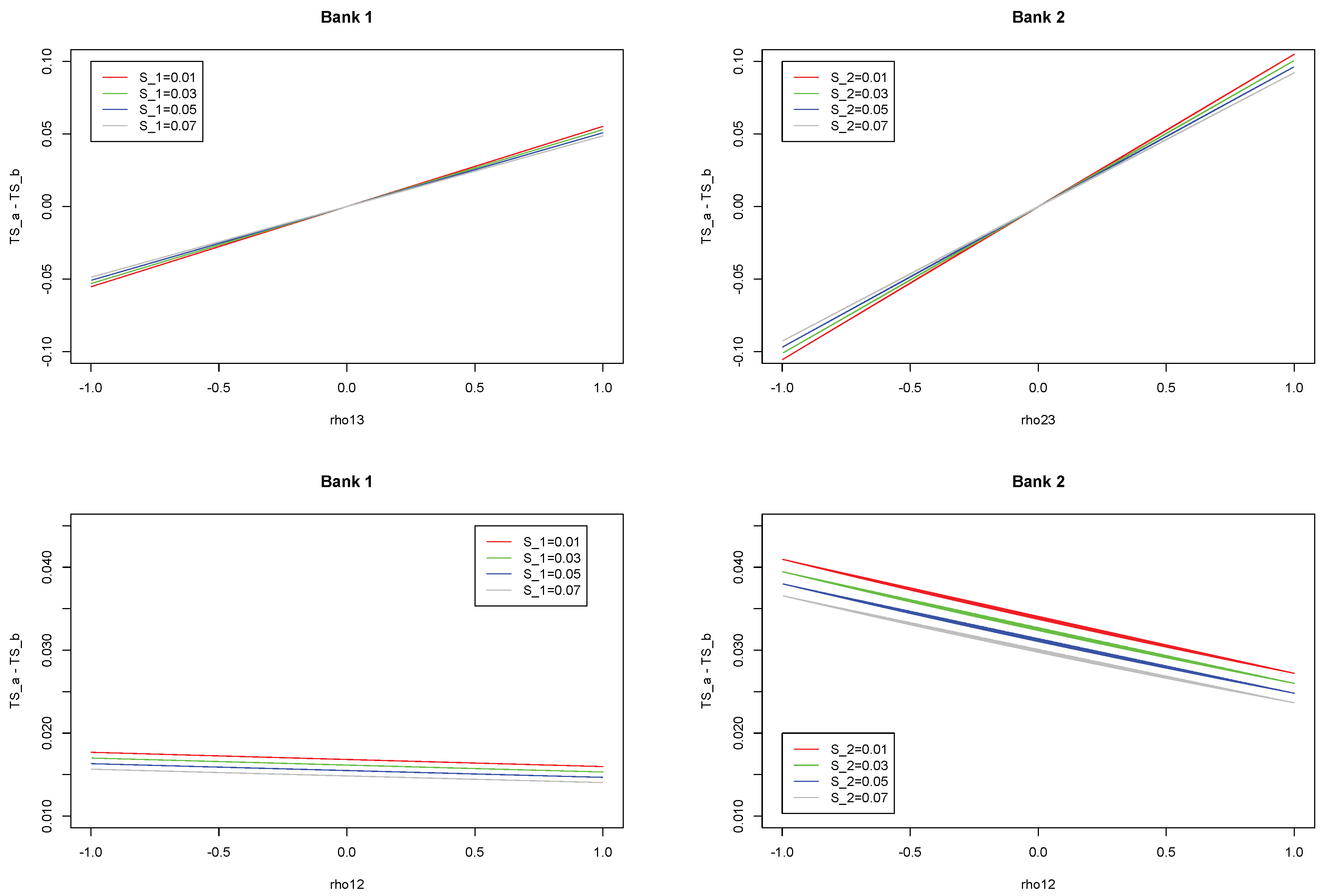

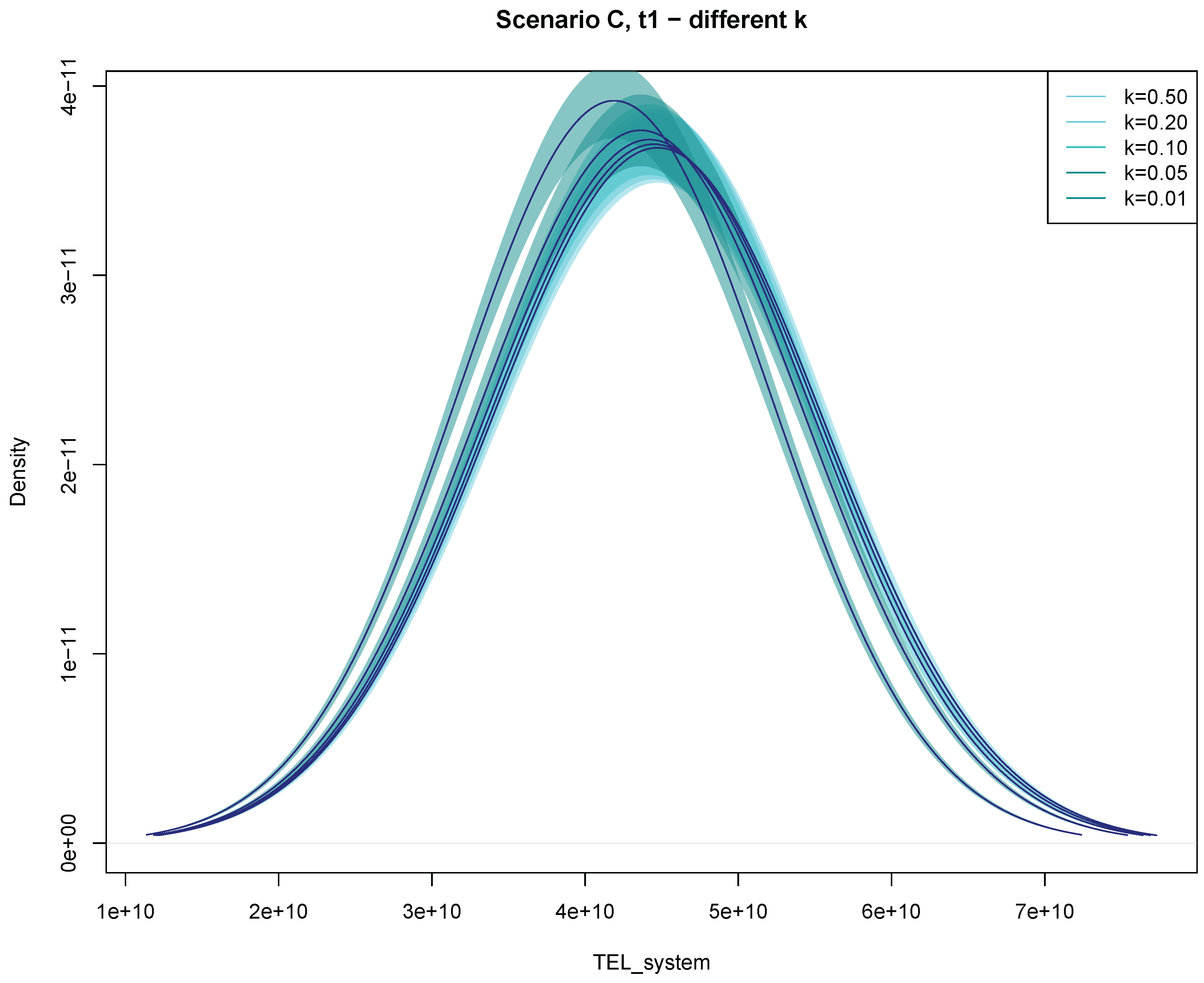

As discussed in the previous section, each total spread depends on a set of variables: the individual spread , the spreads of the other banks, the correlation structure between banks, and the relative asset sizes. To better understand the dependence of on all these variables, we now design an experimental setting in terms of a stylized model: the advantage of a reduced structure for the banking sector is the possibility to isolate the effects, measured in terms of banks’ losses, deriving from each single source of variability in the model.

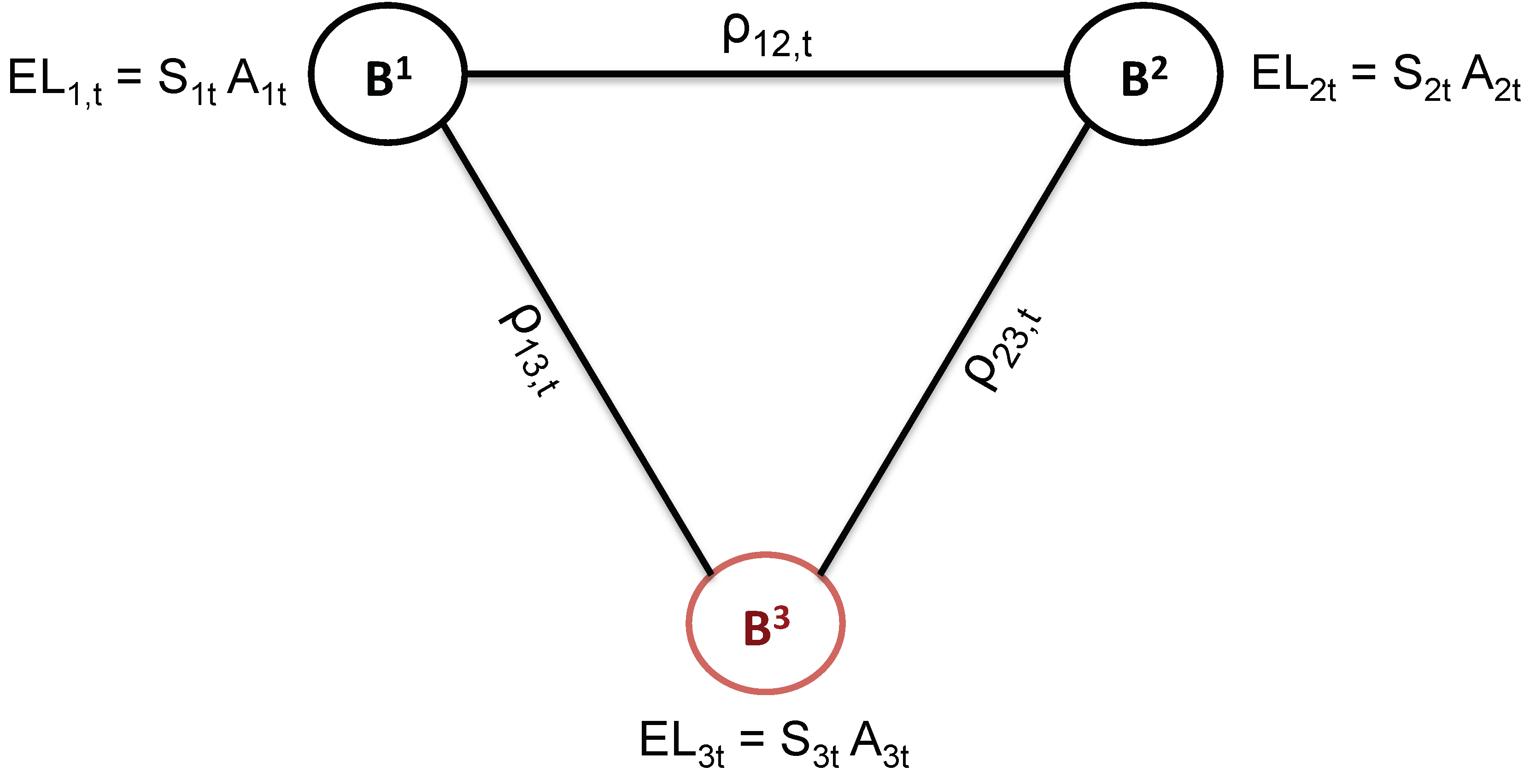

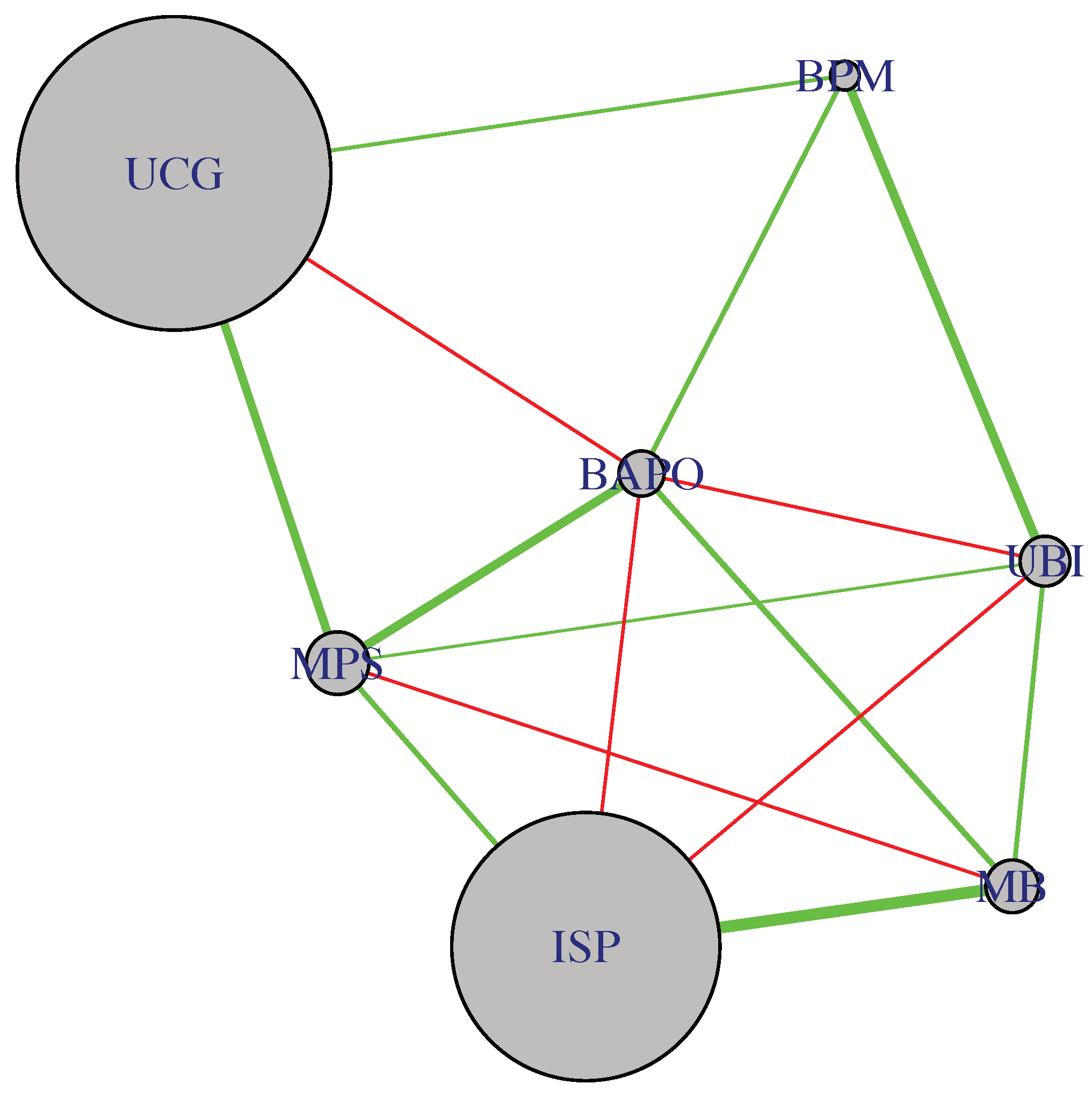

Consider a simplified system composed of three banks:

,

, and

, with the last one being in distress, as shown in

Figure 1.

At any time, the three banks have an expected loss (), calculated as the product between their net assets () and their expected loss probability (). In addition, they are all (directly) correlated with each other through partial correlation coefficients , which depend on the conditioning set.

To understand whether and will benefit more from the private intervention on , rather than its liquidation or bail-in, we derive the time evolution of the total balance-sheets and spreads under the three scenarios. For simplicity, we consider three reference discrete times: , and . At time , three events can occur: (a) is liquidated; (b) is recapitalized by and ; (c) is bailed in. At time , the banking system will reach a new equilibrium, without (Scenario (a)) or with (Scenarios (b) and (c)) .

2.2.1. Scenario (a): Liquidation

We assume that banks maintain their value in the considered time period: . Moreover, we assume that the two safe banks, and , maintain the same spread through time: . The distressed bank follows a different evolution: while its spread at time is , in the following time period and in the liquidation scenario that defaults, so that (assuming ). Finally, at time , the distressed bank exits the system.

From a balance-sheet perspective, we assume that

suffers severe losses at time

, which explain why that bank is considered to be in distress: at the same time, we suppose that the other two safe banks in the system have not been affected by losses. The rationale behind this setup is that we are not interested in understanding what may happen in case of an exogenous systemic crisis, but rather if systemic consequences might be triggered in case an endogenous distress event affects one bank. We then assume that at time

, the liquidation procedure is concluded, and thus,

is not part of the system anymore: from a balance-sheet perspective, this means that its liabilities have been written down to cover losses. We can reasonably suppose that a portion

k of such liabilities

3 consists of cross-bank exposures. This implies that the other two banks in the system have lost a fraction, respectively equal to

and

, of their balance-sheet. These fractions may be fixed by regulation authorities.

Partial correlation coefficients can be derived from the correlation matrix between the CDS spreads, along all the available time period. We suppose that the shock that

and

receive at time

, due to the liquidation of

, depends on the correlations between the two safe banks and the distressed bank

observed at time

. At time

, after the liquidation of

, the banking system is composed by only two banks,

and

, so that the correlation matrix becomes a

, rather than a

, matrix. A summary of the involved variables can be observed in

Table 1.

We can calculate the total spread of each bank, at each discrete point in time

, by jointly computing the variables in

Table 1 according to Equation (

13). The total spreads can be then aggregated over time according to Equation (

14): the results consist of an overall total spread for each bank,

, where “overall” indicates the aggregation of the total spread over time and

a refers to the liquidation scenario.

2.2.2. Scenario (b): Private Intervention

When

and

decide to participate in a private intervention in order to recapitalize

, we assume a proportional capital injection, meaning that the amount that the two safe banks have to use is proportional to their relative size. More precisely, we assume that the distressed bank

needs a net asset value equal to

X in order to absorb all losses while still meeting minimum regulatory requirements. The other two banks in the system should inject, respectively, a fraction

and

of their net asset values, as follows:

Consistent with (

22), at times

and

, the values of

and

are reduced by amounts

and

, while the value of

is increased by amount

X. As concerns the spreads, we suppose that, as in the liquidation scenario,

and

maintain their spread constant over time, and so does

until time

. However, differently from what happens under the liquidation hypothesis,

does not default so that, at time

,

. After a bank has been recapitalized, its spread at time

is very likely to be smaller than before, as it is reasonable to imagine that a highly capitalized bank has gained market confidence; since we prefer being conservative, we assume that the worst scenario applies, so that

.

Partial correlations can be derived as in the liquidation scenario, the only difference being that now, at time

, the correlation matrix is a

matrix since

remains part of the banking system through time. A summary of the involved variables is reported in

Table 2.

We can calculate the total spread of each bank, at each discrete point in time

, by jointly computing the variables in

Table 2 according to Equation (

13). As in the liquidation scenario, the total spreads can be finally aggregated over time according to Equation (

14): the results consist of an overall total spread for each bank,

, where “overall” indicates the aggregation of the total spread over time and

b refers to the private intervention scenario. These outcomes can then be compared with

.

2.2.3. Scenario (c): Bail-In

As described in the introductory section, the bail-in tool considers the writing down and/or conversion of some liabilities according to a hierarchy structure strictly determined by the regulatory authority. According to the current regulation, in case of a distress event, the first action should consist of writing down a portion of going-concern capital, mainly expressed in terms of Common Equity Tier 1 (CET 1), to absorb losses: in line with the guiding principles of the BRRD and the SRMR, this response guarantees that shareholders bear the first burden. Since distressed banks have not only to cover all losses, but also to meet minimum regulatory requirements in order to avoid sanctions or restrictions, the second possible action, if needed, would consist of converting additional going-concern (Additional Tier 1) or gone-concern (Tier 2) capital into CET 1: this could serve both the loss-absorbing and the recapitalization functions. In case both gone-concern and going-concern capital are not sufficient to cover all losses while still ensuring regulatory requirements are not breached, and in case any other private action is excluded, the bail-in tool can be adopted, if and only if the SRB decides it is necessary in the public interest. Under this hypothesis, the competent or the resolution authorities would prescribe the reduction or conversion of senior debt (that we will call bail-in-able liabilities) into equity, with the objective to absorb potentially residual losses, to recapitalize the institution and reinstate market confidence. The current regulation also establishes the pari passu principle, according to which the bail-in should guarantee the equal treatment of creditors while still following the statutory rank of claims that would apply under the relevant insolvency law. On the other hand, the resolution authority has also the power to exclude some liabilities from bail-in for financial stability reasons.

Given the pari passu constraint and the fact that the possible exclusion of some liabilities from the bail-in process is ex-ante unknown, we ignore this latter opportunity, and we divide the banks’ balance-sheet on the funding side into three categories: regulatory capital, bail-in-able liabilities, and covered liabilities. In addition, we will not consider the possible intervention of the Single Resolution Fund, for two main reasons: first of all, because the SRF has not been fully built yet;

4 second, because the inclusion of the SRF intervention can imply the payment of ex-post contributions by the other banks in the system in order to replenish the SRF, thus creating further contagion effects that we are not able to model since we have no data on ex-ante and (consequently) ex-post contributions. We also remark that, according to the CRR, CRD, and the EBAGuidelines, the failing or likely-to-fail point can be reached if a bank infringes the requirements on its capital position, on its liquidity position, or any other requirements for continuing authorization. The capital position of a bank is determined by Pillar 1 and Pillar 2 requirements,

5 with the former one consisting of (a) a minimum requirement on CET 1 equal to 4.5%RWA (Risk Weighted Assets), (b) a minimum requirement on Tier 1 (T1) equal to 6%RWA, and (c) a minimum requirement on total capital (equal to T1 + AT2 (Additional Tier 2)) equal to 8%RWA. Given the fact that banks can convert T1 and AT2 into CET 1 while keeping the same level of total capital constant, we will focus only on the 8%RWA requirement on total capital.

Under the above-mentioned assumptions, we thus suppose that the liability side of banks’ balance-sheet is stressed by severe losses: the bail-in tool starts via the conversion of capital instruments into CET 1. If this is not enough to guarantee that all losses have been absorbed by banks without breaching the minimum requirements, we proceed with the conversion of bail-in-able liabilities, in the amount strictly necessary to meet the conditions on loss-absorbency and capital requirements. As previously underlined, beside market-driven contagion (through CDS price dynamics), the bail-in tool introduces a form of balance-sheet-driven contagion: a portion

k of the bailed-in liabilities, in fact, consists of cross-bank exposures.

6 This means that each bank

j in the system that is a creditor of the bailed-in bank

i would loose a portion

of the fraction

k of the bailed-in resources of bank

i. The balance-sheet-structure of the safe and bailed-in banks are specified in

Table 3, where we indicate with

the total balance-sheet of the distressed bank after it has been affected by losses.

We remark that, in this scenario, the total amount of assets (or liabilities) is not preserved over time, as a result of bailed-in instruments and cross-bank exposures. In particular, at time

, we obtain:

while, by aggregating the total balance-sheet of banks at time

, we can derive the following:

This result is substantially different from what has been modeled in the private intervention scenario: in this latter case, in fact, we model the precautionary recapitalization of the distressed bank, thus preventing (a) capital from shrinking and (b) bail-in from being triggered. As a consequence, the total balance-sheet of the distressed bank is not affected, and cross-bank exposures remain untouched, thus preventing also the balance-sheet of the other banks in the system from being reduced.