Company Value with Ruin Constraint in a Discrete Model

Abstract

:1. Introduction

2. Methods

2.1. A Modified Bellman Equation

2.2. Iteration Method

2.3. Running Allowed Ruin Probabilities

2.4. The Barrier Method

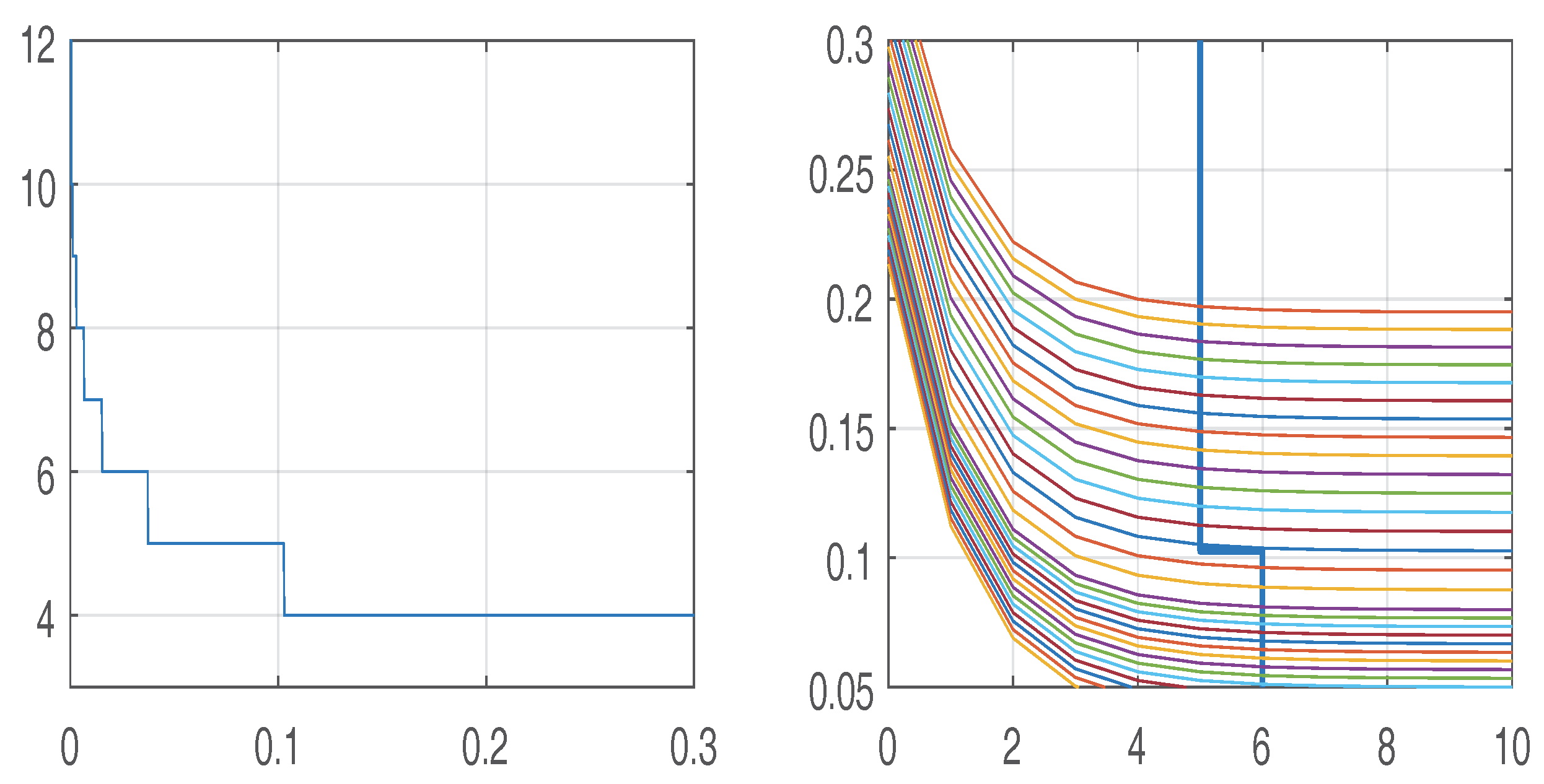

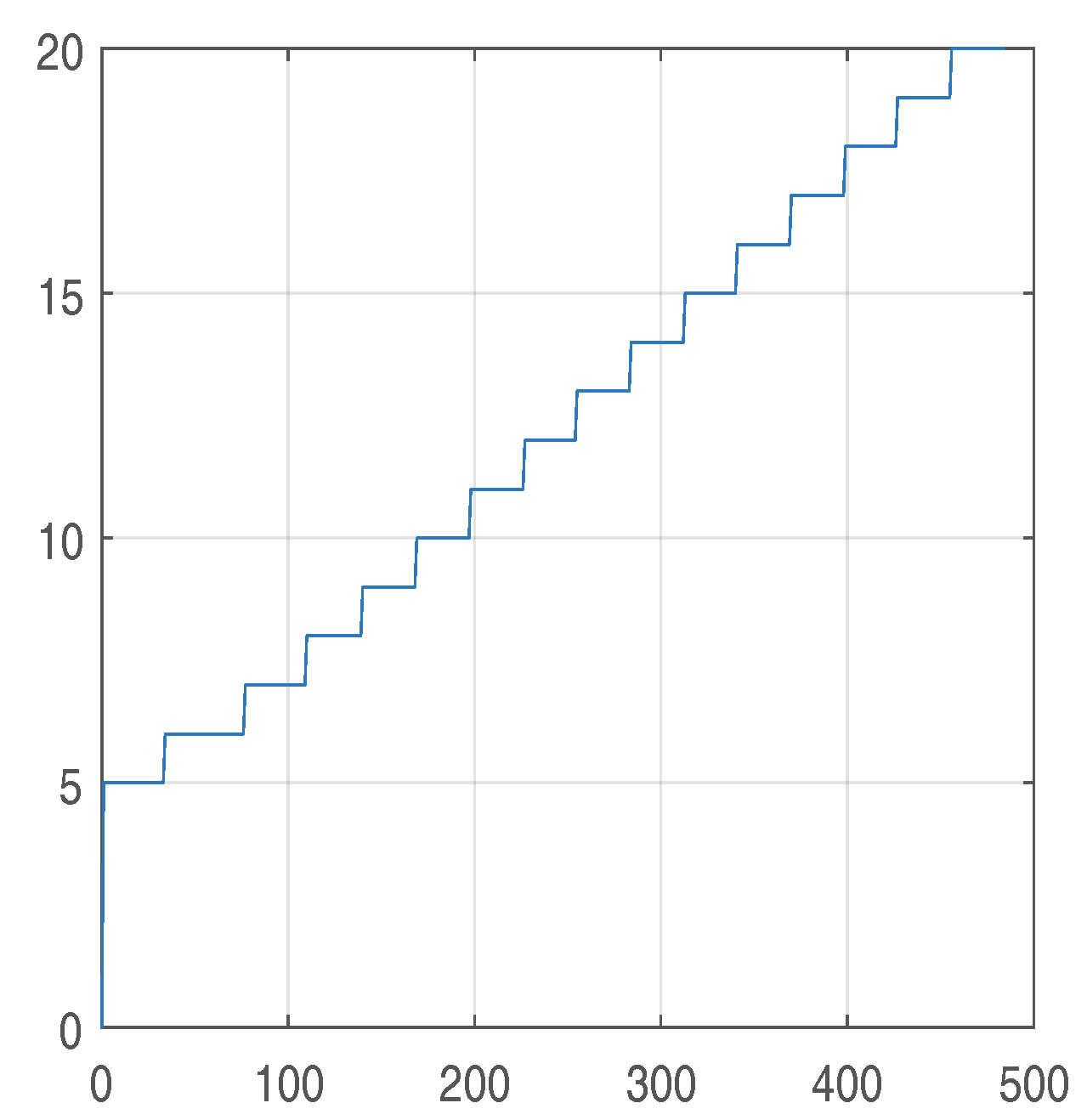

2.5. The Lagrange Multiplier Approach

3. Numerical Example

DeFinettiModel

ds=1;

S0=300; S=0:ds:S0; KS=length(S);

W=zeros(1,KS); V1=W; V2=W; V0=W;

p=0.7; q=1-p;

r=1/1.03;

a1=1.0714285;

a2=0.4;

b2=-.5957446812;

b1=1-b2;

for k=1:KS

W(k)=b1*a1^(k-1)+b2*a2^(k-1);

end

kk=6;

C=1/(W(kk)-W(kk-1));

for k=1:kk

V0(k)=W(k)*C;

end

g=(1-p)/p;

Psi=g.^(1:1:KS);

for i=(kk+1):KS

V0(i)=V0(i-1)+1;

end

Policy improvement with Bellman, with new

formulas for beta1 and beta2 and interpolation

DeFinettiModel;

da=1/100000;

Alpha=da:da:1; KA=length(Alpha);

V1=zeros(KS,KA); V2=V1;

for L=1:400

M=zeros(1,KA);

al0=ceil(Psi(1)/da);

for al=al0:KA

alpha=al*da;

y1=(alpha-q)/p/da;

u1=floor(y1);

z1=(y1-u1);

if u1==0

v1=z1*V1(2,u1+1);

else

v1=V1(2,u1)+z1*(V1(2,u1+1)-V1(2,u1));

end

V2(1,al)=r*p*v1;

end

for s=2:KS-1

for al=1:KA

alpha=al*da;

if Psi(s)>=alpha

V2(s,al)=0;

else

ga=(1-alpha)/(1-Psi(s));

y1=(1-ga+ga*Psi(s+1))/da;

y2=(1-ga+ga*Psi(s-1))/da;

u1=floor(y1);

u2=floor(y2);

z1=(y1-u1);

z2=(y2-u2);

if u1==0

v1=z1*V1(s+1,u1+1);

else

v1=V1(s+1,u1)+z1*(V1(s+1,u1+1)-V1(s+1,u1));

end

if u2==0

v2=z2*V1(s-1,u2+1);

else

v2=V1(s-1,u2)+z2*(V1(s-1,u2+1)-V1(s-1,u2));

end

x=r*p*v1+r*q*v2;

if Psi(s-1)<alpha & x<V2(s-1,al)+1

if M(al)==0

M(al)=s;

end

x=V2(s-1,al)+1;

end

V2(s,al)=max(V1(s,al),x);

end

end

end

V1=V2;

V1(:,KA)=V0;

[L V1(5,round(0.2/da)) V0(5)]’

end

Policy improvement without dynamic equation

clear;

DeFinettiModel;

da=1/100000; Alpha=da:da:1; KA=length(Alpha);

V1=zeros(KS,KA); V2=V1;

V1(:,KA)=V0;

M0=round(0.2/da);

for L=1:150

M=zeros(1,KA);

for s=1:KS

for al=max(round(Psi(s)/da),1):KA-1

Feld=zeros(1,KS);

alpha=al*da;

if M(al)>0 && s>M(al) && Psi(s-1)<al

V1(s,al)=V1(s-1,al)+1;

end

for B=s+1:KS

x1=(Psi(s)-Psi(B))/(1-Psi(B));

x2=1-x1;

y=(alpha-x1)/x2*KA;

aB=floor(y);

z=y-aB;

if aB==0

VF=z*V1(B,aB+1);

end

if aB>0

VF=V1(B,aB)+z*(V1(B,aB+1)-V1(aB));

end

Feld(B-s)=W(s)/W(B)*VF;

end

x=max(Feld);

if s>1

y=V2(s-1,al)+ds;

if (Psi(s-1)<al*da) & (x<y)

V2(s,al)=max(V1(s,al),y);

if M(al)==0

M(al)=s;

end

else

V2(s,al)=max(V1(s,al),x);

end;

end

end

V2(s,KA)=V0(s);

end

V1=V2;

end

Lagrange method

DeFinettiModel;

T0=2000; T=0:T0; KT=length(T);

V=zeros(KS,KT); W=V;

M=zeros(1,KT);

L=2.93;

s0=5; a0=0.2; p=0.7; r=1/1.03;

% computation of value function

V(:,T0)=-L*Psi;

for k=1:T0-1

t=T0-k;

rt=r^(t-1);

V(1,t)=p*V(2,t+1)-q*L;

for i=2:KS-1

V(i,t)=max(p*V(i+1,t+1)+q*V(i-1,t+1),V(i-1,t)+rt);

if p*V(i+1,t+1)+q*V(i-1,t+1)<V(i-1,t)+rt

if M(t+1)==0

M(t+1)=i-1;

end

end

end

end

% computation of corresponding ruin probability

W(:,T0)=Psi;

for k=1:T0-1

t=T0-k;

W(1,t)=p*W(2,t+1)+q;

for i=2:KS-1

W(i,t)=p*W(i+1,t+1)+q*W(i-1,t+1);

if i>M(t+1)

W(i,t)=W(M(t+1),t);

end

end

end

[V(5,1) W(5,1) V(5,1)+L*W(5,1)]’

And finally the MAPLE code for the barrier method:

Barrier.mw

restart; Digits := 25;

p := .7; q := 1-p; r := 1/1.03;

Ps := s->(q/p)^(s+1);

z := solve(r*(p*x^2+q) = x, x);

B0 := solve((1-B)*z[2]+B*z[1] = 0, B);

W := s->(1-B0)*z[1]^s+B0*z[2]^s;

s0 := 4; a0 := .2;

for i from 0 to 6 do B[i] := 4 end do;

for i from 7 to 14 do B[i] := 5 end do;

for i from 15 to 19 do B[i] := 8 end do;

for i from 20 to 30 do B[i] := 12 end do;

for i from 31 to 40 do B[i] := 15 end do;

for i from 41 to 50 do B[i] := 18 end do;

for i from 51 to 101 do B[i] := 24 end do;

g[0] := (1-a0)/(1-Ps(s0));

a[0] := 1-g[0]+g[0]*Ps(B[0]);

for i from 0 to 100 do a[i] := 1-g[i]+g[i]*Ps(B[i]);

g[i+1] := (1-a[i])/(1-Ps(B[i]-1)) end do;

g[100];

A1 := (103/33)*W(s0)/W(B[0]+1); C := 10/11;

U[1] := 1; for i from 2 to 100 do U[i] := U[i-1]*C*W(B[i-1]-1)/W(B[i]+1) end do;

F := evalf(A1*(sum(U[k], k = 1 .. 100)));

Conflicts of Interest

References

- Albrecher, Hansjörg, and Stefan Thonhauser. 2008. Optimal dividend strategies for a risk process under force of interest. Insurance: Mathematics and Economics 43: 134–49. [Google Scholar] [CrossRef]

- Avanzi, Benjamin. 2009. Strategies for dividend distribution: A review. North American Actuarial Journal 13: 217–51. [Google Scholar] [CrossRef]

- Borch, Karl. 1963. Payment of Dividends by Insurance Companies. Econometrics Research Program Research Memorandum 51: 1–17. Available online: www.princeton.edu/~erp/ERParchives/archivepdfs/M51.pdf (accessed on 5 January 2018).

- Choulli, Tahir, Michael Taksar, and Xun Yu Zhou. 2003. A diffusion model for optimal dividend distribution for a company with constraints on risk control. SIAM Journal on Control and Optimization 41: 1946–79. [Google Scholar] [CrossRef]

- De Finetti, Bruno. 1957. Su un’ impostazione alternativa della teoria collettiva del rischio. Transactions of the XVth International Congress of Actuaries 2: 433–43. [Google Scholar]

- Feng, Runhuan, Hans W. Volkmer, Shuaiqi Zhang, and Chao Zhu. 2015. Optimal dividend policies for piecewise-deterministic compound Poisson risk models. Scandinavian Actuarial Journal 5: 423–54. [Google Scholar] [CrossRef]

- Gerber, Hans-Ulrich. 1969. Entscheidungskriterien für den zusammengesetzten Poisson-Prozess. Schweiz Verein Versicherungsmath Mitt 69: 185–228. [Google Scholar] [CrossRef]

- Hipp, Christian. 2003. Optimal dividend payment under a ruin constraint: Discrete time and state space. Blätter der DGVFM 26: 255–64. [Google Scholar] [CrossRef]

- Hipp, Christian. 2016. Dividend payment with ruin constraint. In Risk and Stochastics: Ragnar Norberg at 70. Edited by Pauline Barrieu. Singapore: World Scientific, ISBN 978-1-7863-45. Available online: https://www.researchgate.net/publication/291339576_Dividend_payment_with_ruin_constraint (accessed on 5 January 2018).

- Hipp, Christian. 2017. Working Paper on Dividend Payment under a Ruin Constraint. Available online: https://www.researchgate.net/publication/318983299_Working_paper_on_dividend_payment_under_a_ruin_constraint (accessed on 5 January 2018).

- Loeffen, Ronnie L. 2008. On optimality of the barrier strategy in de Finetti’s dividend problem for spectrally negative Lévy processes. The Annals of Applied Probability 18: 1669–80. [Google Scholar] [CrossRef]

- Schmidli, Hanspeter. 2007. Stochastic Control in Insurance. Heidelberg, Germany: Springer, ISBN 978-1-84800-003-2. [Google Scholar]

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hipp, C. Company Value with Ruin Constraint in a Discrete Model. Risks 2018, 6, 1. https://doi.org/10.3390/risks6010001

Hipp C. Company Value with Ruin Constraint in a Discrete Model. Risks. 2018; 6(1):1. https://doi.org/10.3390/risks6010001

Chicago/Turabian StyleHipp, Christian. 2018. "Company Value with Ruin Constraint in a Discrete Model" Risks 6, no. 1: 1. https://doi.org/10.3390/risks6010001

APA StyleHipp, C. (2018). Company Value with Ruin Constraint in a Discrete Model. Risks, 6(1), 1. https://doi.org/10.3390/risks6010001