1. Introduction

We study the problem of optimal insurance design. This is a risk sharing problem between an insured financial agent and an insurer who typically holds a whole portfolio of similar insured risks. There is a vast literature on this optimal insurance design problem, see for instance Arrow [

1,

2], Raviv [

3], Gollier [

4] and Gollier-Schlesinger [

5]. Classical literature assumes that the preferences of both the insured and the insurer are modeled by the expected utility framework. Using this expected utility setting the Pareto optimal insurance design is determined. Usually, this results in choosing a deductible and co-insurance above this deductible. Raviv [

3] investigates necessary and sufficient conditions leading to deductibles and co-insurance, and the cost of insurance is identified to be the driving force behind deductibles.

As described in Yaari [

6] and Bernard

et al. [

7], this framework fails to explain various phenomena that are observed in practice, for instance, that financial agents prefer to purchase extended insurance cover for relatively small claims over buying protection against disastrous large claims. Bernard

et al. [

7] modify the original framework by introducing a probability distortion which tries to describe human behavior more appropriately. In particular, these probability distortions reflect that small and large claims are over-weighted by individuals which results in insurance covers different from deductibles.

In the present paper we choose a different approach for the modeling of the preferences of the insurer. In insurance practice, solvency of an insurance company is determined through a regulatory risk measure. This regulatory risk measure is the equity the insurance company needs to hold in order to run its business from a supervisory point of view. This risk measure is directly related to the insurance policies the company is selling and, henceforth, should directly reflect the quality of the insurance portfolio. The insurance company’s and the shareholders’ preferences, respectively, are then satisfied if the expected return on this regulatory risk measure, i.e., risk bearing equity, is sufficiently large.

In the present paper we model the regulatory risk measure with the expected shortfall risk measure (also called Tail-Value-at-Risk) as it is used in the Swiss Solvency Test [

8]. Assuming that this risk measure reflects the necessary equity that needs to be provided by shareholders, the premium risk loading is model by a cost-of-capital approach which is equivalent to the expected return on this shareholders’ equity. In this spirit we obtain a risk-adjusted premium calculation principle which is the essential difference to the constant risk premium case considered in the literature, see formula (3’) in Raviv [

3] or formula (2) in Bernard

et al. [

7]. As a result, the price of insurance will directly be related to the regulatory requirements and it will reflect the diversification within the insurance portfolio. The crucial result will be that insurance for small claims is comparatively cheap because it only marginally triggers the expected shortfall risk measure. This exactly explains that individuals purchase more insurance for small claims whereas insurance for large claims seems rather expensive in their judgment.

Organization of the paper. In the next section we introduce the insurance claim model which is based on a common risk factor that affects all claims simultaneously and idiosyncratic components that only influence individual claims. Based on this model we formulate the optimal insurance design problem from the viewpoint of the insured. In

Section 3 we introduce the regulatory risk measure and we describe the related risk-adjusted premium calculation principle. The crucial point will be that idiosyncratic risk is diversifiable which substantially simplifies the regulatory risk measure and the related risk-adjusted premium calculation. Based on this risk-adjusted premium we determine the optimal insurance design in

Section 4 and we conclude this section with various properties and examples of the optimal insurance design. All results and statements are proved in the appendix.

A. Proofs

Proof of Lemma 1. The function

is strictly increasing for all

. Since

is a non-decreasing function, also the function

is non-decreasing for all

. But then independence between

and Θ implies that also

is non-decreasing. Assume there exist

such that

Inequality

,

-a.s., and identity (25) then imply that we must have

,

-a.s. Because the support of

is

we must have that

I is constant on

, and from

we see that this constant is equal to zero. Therefore, Equation (25) cannot occur unless

. This proves the strict increasing property.

Next we prove Lipschitz continuity of

. From

non-decreasing it follows that for all

and for all

we obtain (

I is also non-decreasing)

This implies that for any

and, moreover, using independence between Θ and

and integrability of

,

Thus, the function

is Lipschitz continuous and strictly increasing. As a consequence the remaining properties follow from Proposition A.3 in McNeil

et al. [

11]. This proves Lemma 1. ☐

Proof of Theorem 1. The first two premium identities follow from Equation (6). Choose a measurable function

. We obtain

We calculate the last term, using the tower property for conditional expectations in the first step,

basically, this is simply the application of Bayes’ theorem. This implies that

and proves the last identity for the choice

.

Next we prove the premium inequality. Choose

. Observe that the function

is component-wise non-decreasing. Moreover, the function

is also non-decreasing. Since

and Θ are independent, the FKG inequality implies, see Fortuin

et al. [

13],

where in the second last step we have used that

φ is a density and, thus, normalized. This closes the proof of Theorem 1. ☐

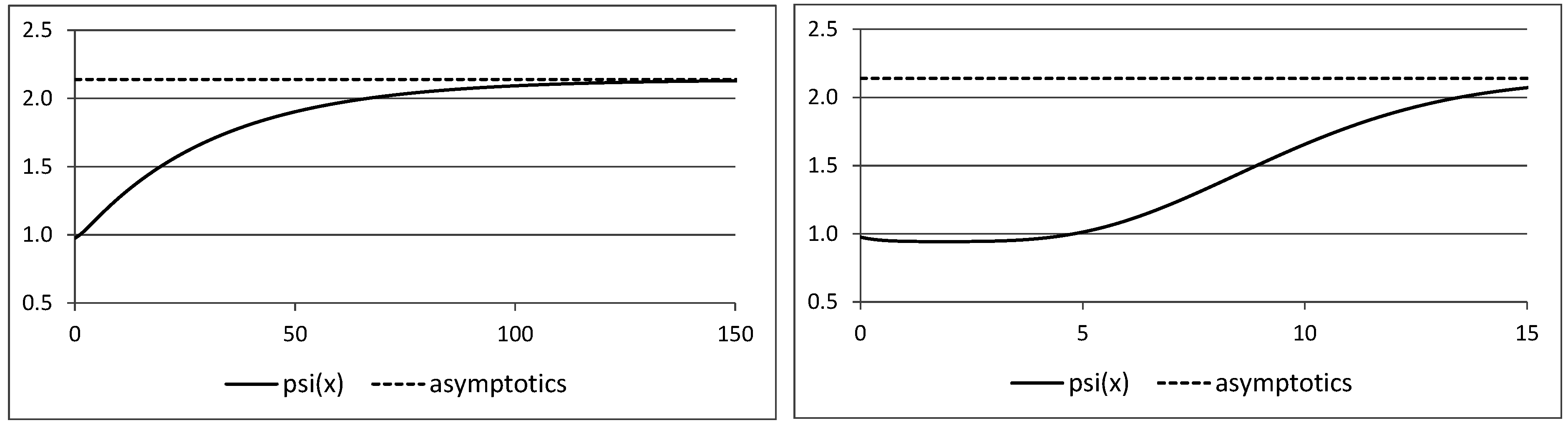

Proof of Theorem 2. For given

we recall Equation (7) which allows to rewrite

ψ as follows, set

,

Differentiability of

ψ follows from Leibniz’ integral rule. Moreover, we have

We define the new probability measure

by

This allows to rewrite

as follows: for

Observe that

and

are non-decreasing. FKG inequality [

13] then implies that

, which proves the claim. ☐

Proof of Lemma 2. The proof follows from Kamien-Schwartz [

14]. Note that the optimal control problem in Kamien-Schwartz [

14] is formulated on a finite interval

for

x. This can be achieved by a change of variables

in Equations (11)–(14) and then one checks that all the conditions are fulfilled. ☐

Proof of Lemma 3. Note that we need to distinguish the two cases

and

for the domain of

u. In the latter case we need

, due to

(Inada conditions). This implies that we need to have

and, thus,

Therefore, the initial wealth

should at least be able to finance the full insurance cover premium

if

u has support

. If the support of

u is

the wealth

is also allowed to become negative, and therefore no constraint is needed.

Proof of (i). Consider

given in Equation (16). Note that

is continuous and non-increasing in

λ. Therefore, we would like to consider the limits

and

of

. Note that

. This implies for

that

and, hence, for

we have

This means that for

we have

because we buy full insurance cover. On the other hand we have for any

i.e., we have point-wise (in

x) convergence to 0. Using that

provides an integrable upper bound, we can apply Lebesgue’s dominated convergence theorem to obtain

This immediately implies that there is

such that

. Moreover, for

the function

is non-increasing in

λ and on a set of positive Lebesgue measure it is strictly increasing, therefore

is strictly increasing in

λ and hence, there is a unique

with

. This proves (i).

Proof of (ii). We consider

The function

is non-decreasing in

x (note that we replace

by

if

u has support

). This implies that

is non-increasing in

x and, hence, the claim follows.

Proof of (iii). This is an immediate consequence of the increasing property of .

Proof of (iv). This is an immediate consequence of the boundedness of and the Inada condition at the left endpoint of u.

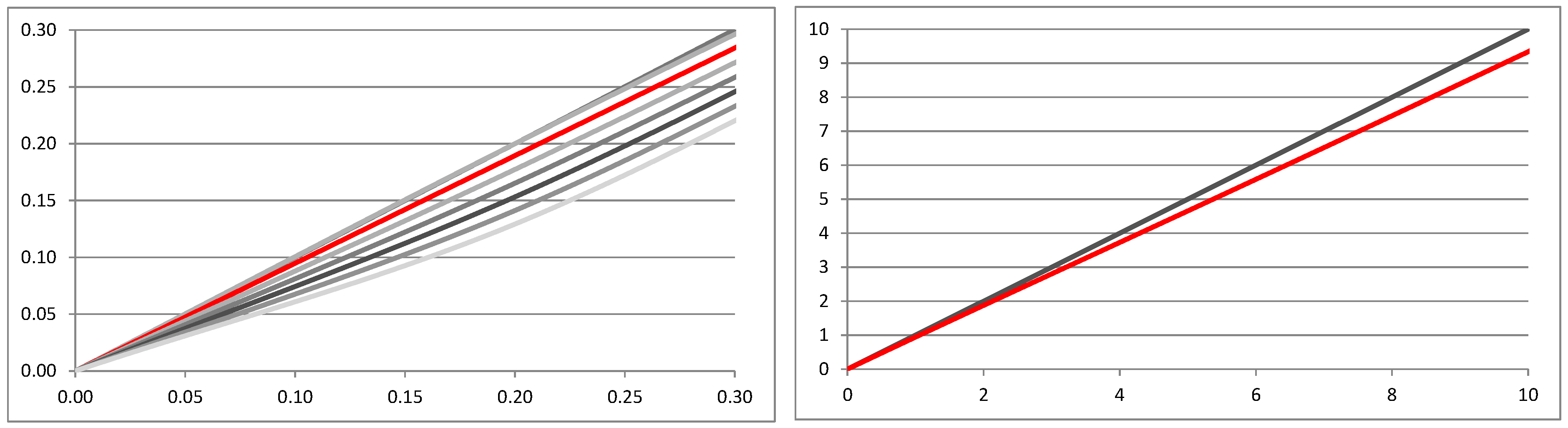

Proof of (v). From Equation (16) we get premium identity, see also Equation (21),

Note that the bracket

is decreasing in

. Therefore,

needs to be increasing for the premium identity to be fulfilled. Since this increasing property needs to be strict on a set of positive Lebesgue measure for

,

is strictly decreasing in

.

Observe from the premium identity

Therefore, lower bound

and upper bound

are strictly decreasing in

P. This implies that the term

needs to be increasing for the premium identity to be fulfilled. Since this increasing property needs to be strict on a set of positive Lebesgue measure we obtain that

is strictly decreasing in

P. ☐

Proof of Theorem 3. We start by calculating the derivative w.r.t.

P in Equation (21). Observe that the derivatives at the boundaries vanish and we obtain

From this we immediately conclude that

We now calculate the derivative of

U from Equation (20). This provides

Using Equation (27) for the middle term on the right-hand side of the above identity provides the claimed derivative of

U. The second derivative of

U is then given by (observe that the derivatives at the boundaries vanish)

Both

and

are decreasing which immediately implies that

and we have concavity. ☐

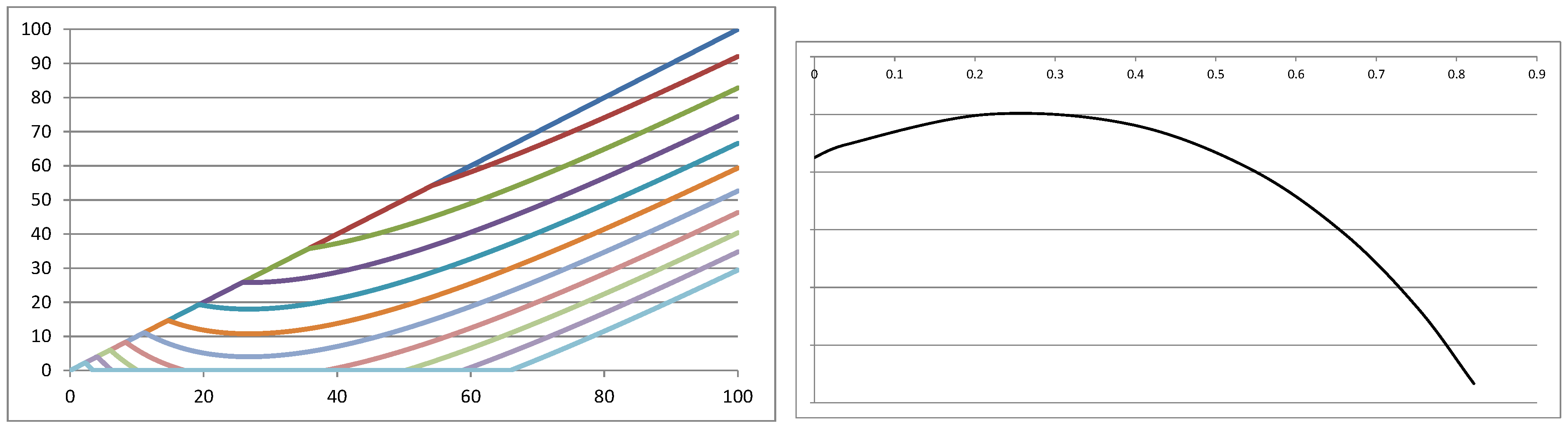

Proof of Theorem 4. Consider the function

The first derivative w.r.t.

P is given by

From Lemma 3 we know that

is decreasing in

P, this implies that

and, henceforth, insurance cover

are non-decreasing in

P for all

x.

Proof of (i). Full insurance cover means that

. Therefore, we need to have point-wise convergence

because otherwise we would get the following contradiction

This point-wise convergence requires for all

which implies

The latter implies that

as

. We prove this by contradiction: assume that

is bounded by

. Choose

. Continuity and strict monotonicity of all involved functions implies that there exists

P sufficiently close to

such that for all

This implies that

, which is a contradiction. Moreover, this also implies that

for all

P sufficiently large. Theorem 3 then reads as

Note that for any

we have

which implies that

for all

P sufficiently close to

. Therefore, full insurance cover is never optimal.

Proof of (ii). If

we need to have

which immediately provides the claim. Therefore, we can concentrate on

. No insurance means that

. In that case we need to have

as

. We prove this by contradiction. Assume that

. In that case we have

But this immediately implies that we buy insurance for all

x sufficiently large, and hence

P is bounded from below by a strictly positive constant. This contradicts

. Therefore, we have

This implies that for any

P sufficiently small we have

This implies that for all

P sufficiently small we have

. In view of Theorem 3 this implies that

for all

P sufficiently small because the first integral in Theorem 3 is equal to zero. Therefore, no insurance is never optimal. ☐

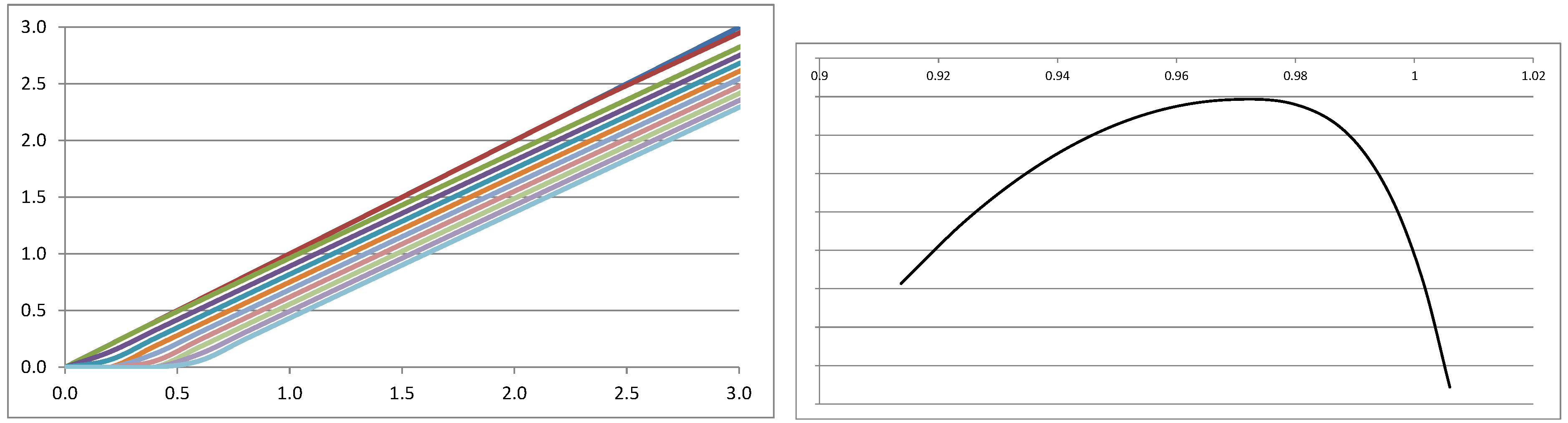

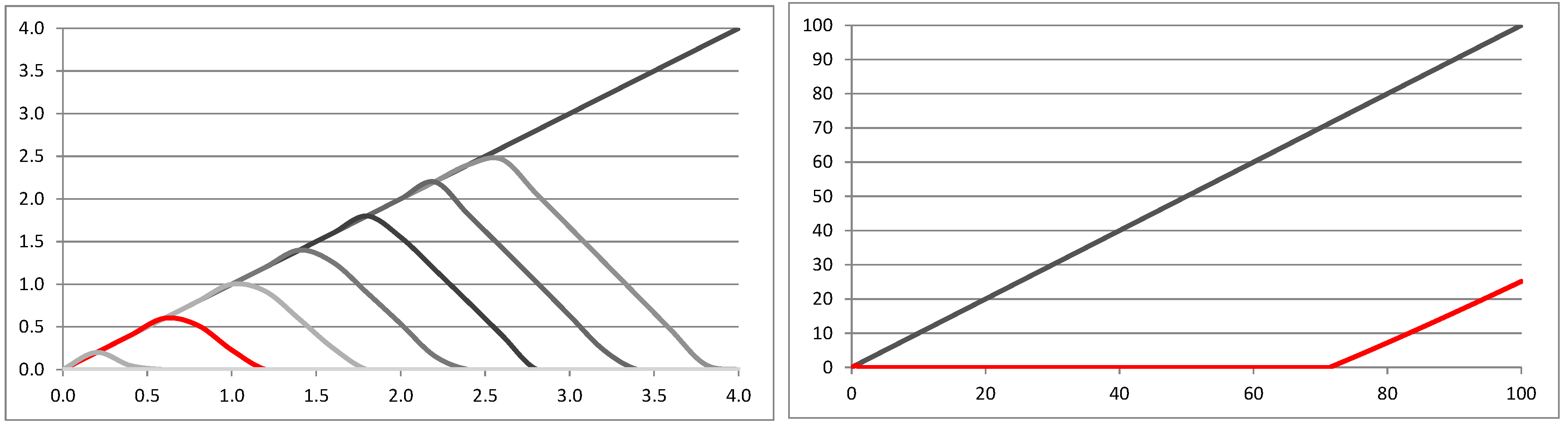

Proof of Proposition 1. (i) From Theorem 4 we know that we cannot have full insurance cover if is optimal. This implies that . Therefore, it is sufficient to consider . Condition (22) then implies that is non-decreasing in any x and for all . Therefore, for all , which implies that is of Type I.

(ii) Condition (23) implies that is strictly decreasing in 0, and henceforth, we have for all sufficiently close to 0. If then we have and for all x sufficiently close to 0, therefore . If then for all x sufficiently close to 0 and henceforth which implies that is of Type II if . ☐