Abstract

In the context of Japan’s rapidly aging population, people’s anxiety about life after 65, especially regarding financial sustainability, has become a growing concern. This study examines old age anxiety through the lens of digital financial literacy (DFL), which can significantly impact people’s retirement well-being and long-term financial security in today’s digital environment. Drawing on a large-scale dataset from the “Survey on Life and Money,” jointly conducted by Rakuten Securities and Hiroshima University, we analyze responses from 94,695 individuals aged 40 to 64 who are active bank account holders. Based on ordinal logistic regression, our findings reveal a negative association between DFL and old age anxiety. Further analysis of the five dimensions of DFL demonstrates that several practical components, such as digital financial know-how, decision-making abilities, and self-protection skills, are associated with alleviated old age anxiety. In contrast, a reliance on basic financial knowledge and general awareness alone may exacerbate anxiety. These findings underscore the need to move beyond basic digital awareness and focus on promoting practical skills in digital finance, ultimately supporting better financial decision-making and enhancing overall well-being in older age.

1. Introduction

The determinants of anxiety about life after age 65 are commonly associated with financial status, family circumstances, and health conditions. For instance, Kadoya and Khan (2017) and Kadoya et al. (2018) were among the first to demonstrate that higher levels of financial literacy are linked to diminished anxiety among older adults, highlighting the role of rational financial decision-making in improving psychological well-being. Subsequent studies (Lusardi and Streeter 2023; Lone and Bhat 2024; Niu et al. 2020) have expanded this evidence across various countries and socioeconomic settings.

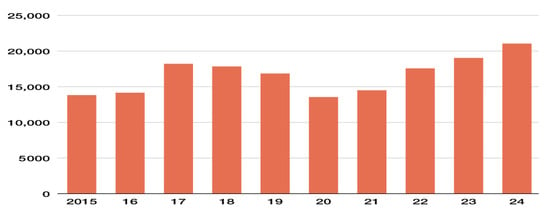

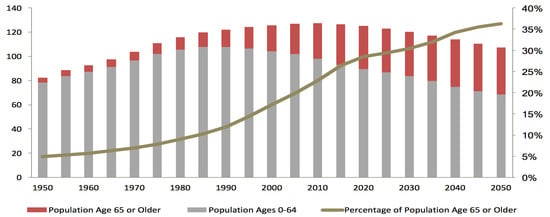

However, the financial environment has rapidly evolved in recent years, driven by the rise of artificial intelligence (AI), digital financial services (DFS), online trading, and the widespread adoption of smartphones. These developments have reshaped the way people interact with financial systems and introduced new layers of complexity, particularly for older adults, who often lack digital proficiency. Compounding these challenges, Japan has recently experienced a surge in digital fraud, including large-scale phishing attacks and the hacking of online brokerage accounts, with losses reportedly exceeding $700 million (Japan Times 2025; Japan Exchange Group (JPX) 2025; Bloomberg News 2025). Such incidents underscore the growing risks associated with digital finance and intensify anxiety among individuals who are not equipped to recognize or respond to these threats. Figure 1 depicts the increasing trend of financial loss from fraud cases in Japan, while Figure 2 shows the rapid aging of the population, together underscoring the urgent need for specialized knowledge to safeguard older adults from digital financial risks.

Figure 1.

Reported cases of specialized frauds in Japan. Source: Nippon.com (2025) based on data from Japan’s National Police Agency.

Figure 2.

Trend of aging population in Japan. (Source: AARP (2025) International).

In this evolving context, traditional financial literacy, while still relevant, appears insufficient for navigating the digital age. This study builds on the work of Kadoya and Khan (2017) by examining whether digital financial literacy (DFL)—a broader, more integrated concept—can help mitigate financial anxiety among the aging population. Japan, with its rapidly aging population and the accelerated pace of digitalization, offers a particularly compelling case for this investigation.

Against this backdrop, the financial system has experienced a profound transformation through rapid advancements in digital technologies such as mobile banking platforms, online investment tools, algorithmic trading, blockchain applications, and AI-powered financial advisory services (Baker 2024; Zhang and Zhang 2015; Soldatos and Kyriazis 2022). Although these innovations have introduced greater accessibility, speed, and convenience in financial transactions, they have also introduced new layers of complexity and vulnerability. Traditional methods of manual, in-person transactions such as visiting bank branches, conducting face-to-face investment consultations, or managing cash-based savings are rapidly becoming obsolete, replaced by technology-driven digital platforms that demand new forms of engagement and understanding (Morgan et al. 2019; Serrano 2020; Chavleishvili et al. 2024). Although digital finance broadens access, it imposes significant challenges, particularly for individuals unfamiliar with digital interfaces or cybersecurity practices. Participation in today’s financial environment requires a sound understanding of traditional financial principles such as saving, investing, and debt management. At the same time, individuals must be able to navigate digital platforms, authenticate secure transactions, critically assess algorithmic financial recommendations and protect against cyber risks (Lyons and Kass-Hanna 2021; OECD 2024).

Beyond systemic transformations, the aging population has historically exhibited considerable anxiety about life in old age (Kadoya 2016; Kadoya and Khan 2017; Lal et al. 2025). Previous research using Japanese national survey data revealed that individuals aged 40 and above reported significantly higher levels of anxiety, largely driven by uncertainties about income stability, deteriorating health, and family obligations (Kadoya 2016; Kadoya and Khan 2017). Factors such as inadequate retirement planning, low household assets, and limited social safety nets have long contributed to this persistent concern (Pinquart and Sörensen 2000; Kadoya and Khan 2017). In the contemporary era, however, these anxieties are further compounded by the increasing complexity of financial systems and the rapid digitization of essential services. Older adults often struggle to adapt to digital financial platforms, protect themselves from online fraud, and make informed financial decisions in volatile, technology-driven markets (OECD 2024; Lyons and Kass-Hanna 2021). Additionally, non-financial pressures such as declining physical and cognitive health, weakened family structures, and greater social isolation, amplified by technological divides, have intensified feelings of vulnerability among the elderly (Hofmann et al. 2010; Heinrichs et al. 2006). Unlike previous generations, today’s aging population must navigate both the traditional risks of aging and the demands of an increasingly uncertain and digital financial world. These challenges render comprehensive financial planning and DFL more critical than ever for mitigating anxiety and promoting the well-being of older adults.

DFL is conceptualized as a comprehensive, multidimensional construct that encompasses the knowledge, skills, and attitudes necessary to safely and effectively manage financial activities in an increasingly digitalized environment (Lyons and Kass-Hanna 2021; OECD 2024). DFL includes several core domains, such as basic financial knowledge, digital transaction proficiency, cybersecurity awareness, the ability to interpret algorithmic financial recommendations, and behavioral adaptability (Nguyen et al. 2024; Soldatos and Kyriazis 2022). These competencies are further elaborated into eight interconnected sub-dimensions that reflect the realities of modern financial engagement. Although financial knowledge remains essential, encompassing foundational areas such as budgeting, saving, investing, and debt management (Lusardi and Mitchell 2014), DFL extends to include the ability to navigate online banking platforms, using mobile financial applications, understanding blockchain technologies, and managing automated expense tracking tools (Amnas et al. 2024; Subburayan et al. 2024; Liu et al. 2021; Koskelainen et al. 2023). Equally important are critical digital competencies such as managing digital credentials, securely authenticating transactions, and protecting sensitive information (Nguyen et al. 2024; Ogunola et al. 2024). Furthermore, DFL entails behavioral adaptability, the capacity to adjust to evolving technologies and psychological resilience to manage risks, make sound decisions, and filter information in a digitally saturated financial world (Kumar et al. 2023; Mishra et al. 2024).

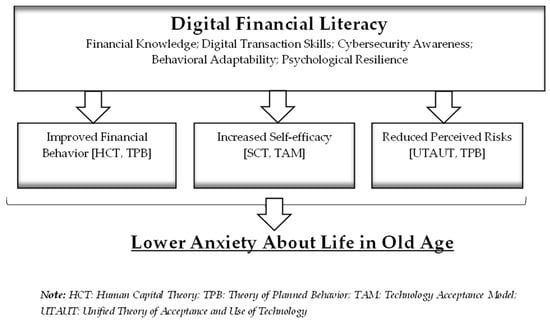

Several theoretical models explain how DFL may mitigate anxiety in later life. The Technology Acceptance Model (TAM) suggests that individuals are more likely to adopt and benefit from technology when they perceive it as useful and easy to use, perceptions that digital literacy directly strengthens (Davis and Granić 2024). The Unified Theory of Acceptance and Use of Technology (UTAUT) extends the TAM by incorporating social influence and facilitating conditions, thereby underscoring the importance of digital confidence and accessibility (Venkatesh et al. 2016). From an economic perspective, the Human Capital Theory (HCT) (Becker 1962) posits that investments in skills, such as financial and digital, enhance an individual’s ability to manage risk and secure future well-being. The Social Cognitive Theory (SCT) (Bandura 2023) further emphasizes the role of digital self-efficacy, or the belief in one’s ability to effectively manage digital tasks, as a crucial mechanism for overcoming anxiety-provoking barriers in financial contexts. Finally, the Theory of Planned Behavior (TPB) (Ajzen 1991) highlights how positive attitudes, perceived behavioral control, and supportive social norms contribute to proactive financial engagement—attributes strengthened through DFL. Cumulatively (as shown in Figure 3), these theoretical models suggest that DFL not only improves financial decision-making but also fosters psychological resilience, a sense of autonomy, and greater confidence in navigating increasingly complex digitalized financial environments.

Figure 3.

Theoretical framework.

Against this background, the objective of this study is to examine whether DFL can alleviate anxiety about life in old age in the context of Japan’s rapidly digitalizing financial environment. Building on previous research that established the role of traditional financial literacy in mitigating anxiety (Kadoya and Khan 2017; Kadoya et al. 2018), this study extends the analysis to a technology-driven financial landscape, where digital competencies have become equally essential. Grounded in the theoretical frameworks discussed, the central hypothesis of this study is that higher levels of DFL are associated with lower levels of anxiety regarding financial security and overall well-being in later life. Specifically, it is hypothesized that individuals with greater proficiency in digital financial management, cybersecurity awareness, and adaptive financial behaviors are better equipped to cope with uncertainty, thereby fostering greater confidence and mitigating psychological distress in later life.

This study makes several important contributions to the literature. First, it is among the first to explicitly link DFL with psychological outcomes, namely, anxiety about old age, thereby expanding the conceptual boundaries of financial literacy research. Second, it adapts and applies an integrated theoretical framework, drawing on the TAM, UTAUT, HCT, SCT, and TPB, to explain how DFL operates as a determinant of emotional well-being. Third, by focusing on Japan—a society experiencing rapid population aging and accelerated digitalization—the study provides timely insights for policymakers and financial educators seeking to design targeted interventions that enhance digital financial capabilities among the aging population and alleviate vulnerabilities in the emerging digital economy

2. Literature Gap and Novelty of the Study

Research on financial literacy and well-being has yielded important insights into the psychological challenges of aging. Previous studies show that financial literacy reduces anxiety in later life by enabling more effective retirement planning, savings, and asset accumulation (Kadoya and Khan 2017; Kadoya et al. 2018). This literature consistently demonstrates that financially literate individuals are better equipped to manage risks, plan for retirement, and make informed investment decisions, thereby lowering their anxiety about life after 65. Additional evidence highlights financial literacy’s role in ensuring financial well-being across diverse contexts (Lusardi and Streeter 2023; Lone and Bhat 2024; Niu et al. 2020). However, these studies conceptualize financial literacy in its conventional form, budgeting, saving, and investing in largely offline settings, without fully accounting for the digital transformation of finance.

A more recent body of work has turned to digital financial literacy (DFL), which extends traditional literacy into the digital domain by incorporating competencies, such as conducting online transactions, maintaining cybersecurity awareness, managing digital identity, and adopting to financial technologies (Lyons and Kass-Hanna 2021; OECD 2024). This stand of research has primarily examined the determinants of DFL acquisition. For example, Jose and Ghosh (2025) and OECD (2024) identify sociodemographic, psychological, and infrastructural factors that shape individuals’ ability to acquire digital financial skills. Other studies have highlighted DFL’s role in enabling participation in modern, technology-driven financial ecosystems; Nguyen et al. (2024) and Soldatos and Kyriazis (2022) show that DFL facilitates financial engagement in cyberspace, now the dominant platform for financial activity. Moreover, DFL encompasses practical skills such as navigating online banking platforms, using mobile applications, understanding blockchain technologies, and managing automated financial tools (Amnas et al. 2024; Subburayan et al. 2024; Liu et al. 2021; Koskelainen et al. 2023). While this research advances our understanding of DFL measurement, acquisition, and usage, it has yet to examine its broader psychological consequences.

Taken together, these two strands, traditional financial literacy’s link with anxiety and research on DFL acquisition, leave an important gap. We know that financial literacy reduces anxiety and that DFL is indispensable for navigating today’s financial systems, but we do not yet know whether DFL itself mitigates anxiety about life in old age. This question is particularly salient in Japan, where rapid population aging intersects with accelerated financial digitalization and a surge in online fraud and cybersecurity threats (Bloomberg News 2025; Japan Times 2025; Japan Exchange Group (JPX) 2025).

This study addresses that gap by explicitly linking DFL to psychological outcomes, with a focus on anxiety about life after 65 among Japanese investors. In doing so, it makes three key contributions. First, it extends the well-established financial literacy–anxiety relationship into the digital era, testing whether digital skills reduce retirement-related anxiety. Second, it complements the DFL acquisition literature by shifting the focus from who acquires DFL to what DFL achieves, specifically its consequences on psychological well-being. Third, it provides policy-relevant insights for regulators, financial institutions, and educators in Japan and beyond, demonstrating how strengthening DFL can reduce vulnerabilities and enhance confidence in a rapidly evolving digital economy.

3. Data and Methods

3.1. Data

This study utilized data from the 2025 wave of the “Survey on Life and Money”—an online survey jointly conducted by Rakuten Securities and Hiroshima University. The data were collected in January and February 2025, targeting active account holders of security companies aged 18 and older who had logged in to their accounts at least once in the preceding year. The questionnaire addressed a range of topics, including investment behavior, sociodemographic characteristics, economic status, and psychological preferences. As this is a panel dataset initially launched in 2022 and 2023, several variables, such as old age anxiety, educational attainment, financial literacy, and myopic view of the future, were extracted from these earlier waves. Moreover, we limited the sample to individuals aged 40 to 64, as the objective of this research is to investigate anticipatory anxiety about life after 65, and such anxiety is most commonly experienced during this age range (Weissman and Myers 1980; Jorm 2000; Kadoya et al. 2018). Individuals under 40 are generally less likely to form concrete expectations about post-retirement life, while those aged 65 or older report anxieties based on lived experiences rather than anticipatory concerns. To specify our data processing, we merged relevant variables from the 2022 and 2023 waves. We excluded observations with missing data on main sociodemographic and economic variables, resulting in a final sample size of 94,695 observations.

To ensure the rigor of the survey instrument, multiple steps were taken to establish both validity and reliability before full-scale distribution. Content validity was addressed by adapting items from established financial literacy and digital financial literacy surveys (e.g., Lyons and Kass-Hanna 2021; OECD 2024), followed by expert review from three academics specializing in finance, behavioral economics, and psychology to confirm the appropriateness and clarity of the measures. Construct validity was assessed through a pilot test, which allowed us to evaluate item wording, cultural appropriateness, and the dimensional structure of the scales. Feedback from the pilot study was used to refine and adjust survey items. Reliability was examined using Cronbach’s alpha for multi-item constructs, with all scales exceeding the commonly accepted threshold of 0.70, indicating acceptable internal consistency.

3.2. Variables

3.2.1. Dependent Variable

The dependent variable in this study is old age anxiety. We used the following statement to define five levels of a respondent’s future anxiety: “I have anxieties about my life after 65 years old.” Responses ranged from 1 to 5, following a reverse pattern: “apply,” “somewhat true,” “neither one nor the other,” “not very applicable,” and “not at all.” Thereafter, we recoded this as an ordinal variable, with values from 1 to 5 indicating higher levels of old age anxiety.

3.2.2. Independent Variables

We used DFL as the main independent variable in this study. This variable comprises five dimensions and eight sub-dimensions adapted from Lyons and Kass-Hanna (2021) study. The first dimension is basic knowledge and skills, which includes two sub-dimensions: digital knowledge and financial knowledge. The second dimension is awareness, with two sub-dimensions: awareness of available DFS and awareness of positive financial attitude and behaviors. Practical know-how is the third dimension and includes one sub-dimension: practical know-how of operating DFS applications. The fourth dimension is decision-making, which has two sub-dimensions: positive financial attitudes and positive financial behaviors through DFS. The fifth dimension, self-protection, comprises one sub-dimension: self-protection from online scams and frauds. Using these eight sub-dimensions, we calculated the DFL Index and an average index for each sub-dimension. The detailed calculation process is as follows.

As seven sub-dimensions, excluding financial knowledge, were measured using Likert-scale questions (1 = strongly disagree to 5 = strongly agree), the index scores given for each of these sub-dimensions were calculated by summing the total scores for all related questions and dividing by the number of questions. For financial knowledge index, we used three multiple-choice questions, with response scores ranging from 0 to 3. The financial knowledge score was calculated by averaging the number of correct answers, which is consistent with previous research on financial literacy (Kadoya and Khan 2020; Lal et al. 2022; Nguyen et al. 2022). Finally, the overall DFL index was computed as a composite score of the eight sub-dimensions indices. For broader comparisons across studies using different units or value ranges, we applied z-score normalization to the average score of each sub-dimension, before summing them to produce the final DFL score.

Before normalization, all sub-dimensions and the composite DFL score were on a different scale: the first seven sub-dimensions—basic digital knowledge, awareness of available DFS, awareness of positive financial attitudes and behaviors, practical know-how of operating DFS applications, positive financial attitudes, positive financial behaviors through DFS, and self-protection from online scams and frauds—were scored from 1 to 5; basic financial knowledge ranged from 0 to 1; and the composite DFL ranged from 7 to 36. This raises concerns about interpreting the results of a multidimensional index like the DFL, given the differing scales of its components. Therefore, as suggested by Lyons and Kass-Hanna (2021), to address the issue of lack of standardization, researchers should consider employing z-score normalization to standardize each sub-dimension index.

To illustrate the above formula, Zij denotes the z-score for the jth index for the ith participant. The symbols µ and σ stand for the average and the standard deviation of the jth index across the entire population, respectively. The z-scores in this context indicate the extent to which each participant’s literacy index deviates from the average score for that specific literacy index. This standardization approach adjusts each index by centering the mean at 0 and setting the standard deviation to 1, thereby aligning it with the characteristics of a standard normal distribution. Consequently, it produces standard scores that indicate how many standard deviations a value is from the mean, enabling researchers to examine and compare indices with varying units or value ranges. In addition to the DFL index as the main independent variable, our empirical specification includes several control variables. These consist of demographic factors, including sex, age, marital status, having children, university degree, employment status, socioeconomic factors), household income, and household asset, as well as psychological factors (risk aversion and myopic view of the future). Table 1 presents the definition of each variable.

Table 1.

Variable definitions.

3.3. Methods

As the dependent variable in this study is an ordinal discrete variable, we performed an ordered probit regression analysis to examine the relationship between old age anxiety and DFL, using the following equation. This approach is particularly suitable as it accounts for the ordinal nature of the anxiety measure without assuming that the differences between response categories are equal.

where is the measure of the dependent variable “old age anxiety”. is our main independent variable and is a vector of individual sociodemographic and economic characteristics. is the error term. The full specifications of Equation (1) are as follows:

Additionally, we conducted an ordered probit regression analysis by each DFL dimension to investigate the association between old age anxiety and each dimension.

4. Results

4.1. Descriptive Statistics

Table 2 presents the descriptive statistics of the variables. A total of 57.6% of the sample reported experiencing anxieties about life after 65. The mean score for old age anxiety is 3.5 (SD = 1.21) on scale of 1 to 5 (with 5 indicating the highest level of anxiety). The mean DFL score is 30.26 (SD = 4.37) on a scale of 7 to 36, suggesting a relatively high level of DFL among participants. Regarding sociodemographic characteristics, 70.2% of the respondents are male, with an average age of 50.78 years (SD= 6.75). Most participants are married (71.1%). A total of 66.5% have children, and 58.6% hold at least a bachelor’s degree. The average household income for 2024 is 8,230,242 Japanese yen, while the average household asset balance is 24,607,068 Japanese yen. Additionally, approximately 54% of the respondents reported being risk averse, and 14.2% perceived the future as uncertain, expressing skepticism about the benefits of future planning.

Table 2.

Descriptive statistics.

4.2. Empirical Results

Table 3 presents the results of the regression analyses that examine the association between old age anxiety and DFL. The estimates from the full model specification are shown in the final column. Across all four models, the DFL index demonstrated a statistically significant negative association with old age anxiety (at a 1% significance level). This suggests that higher DFL scores are associated with lower levels of anxiety about life after the age of 65.

Table 3.

Ordered probit estimation results.

To assess the robustness of these findings, we employed the add–drop variable approach across Models 2 through 4. Although the strength of the association slightly diminishes as additional control variables are introduced, the relationship remains robust. By sequentially including relevant control variables, we identified that the association between DFL and old age anxiety remained statistically significant across all models. This consistency reinforces the robustness and reliability of the observed relationship.

Regarding covariates, most sociodemographic variables are negatively associated with old age anxiety, including being male, attaining a university degree, being married, and having children. These results indicate that those who are male, have obtained higher education, are married, and have children tend to be less anxious about life after 65. Notably, while age is positively associated with old age anxiety, age squared is negatively associated, indicating an inverted U-shape relationship, where anxiety about later life increases with age up to a certain point, and thereafter, begins to decline with age. Moreover, it is noteworthy that unemployment appears to decrease the likelihood of experiencing old age anxiety, possibly because of diminished future expectations. In terms of psychological factors, while individuals who are more risk averse are more likely to worry about their life after retirement, people with a myopic view of the future are less likely to experience such anxiety.

Table 4 presents the results of the robustness check performed by using probit regression across all model specifications that examine the association between DFL and old age anxiety. Although the statistical significance of the relationship between DFL and anxiety about life after 65 slightly decreased after applying the add-drop method, the direction of the association remained consistently negative. This reinforces the finding that being equipped with DFL helps to alleviate old age anxiety. Furthermore, the effects of most explanatory variables on old age anxiety remain largely unchanged, suggesting no substantial variation in their influence across models. As an additional robustness check, we also estimated ordinary least squares (OLS) regressions, which produced results consistent in direction and significance with those from the probit model and ordered probit model. These consistent results support the robustness of our findings, regardless of the regression method applied for the outcome variable.

Table 4.

Probit estimation results.

Table 5 presents the estimation results for the association between each individual dimension of DFL and old age anxiety, providing nuanced insights into how specific aspects of DFL relate to anxiety about life after 65. Models 1 to 5 illustrate the independent influence of each DFL dimension, while Model 6 includes all dimensions, offering the most comprehensive estimate of their associations with old age anxiety. The results reveal that dimensions related to knowledge and awareness, such as digital knowledge, financial knowledge, awareness of available DFS, and awareness of positive financial attitudes and behaviors, are positively associated with old age anxiety. In contrast, dimensions reflecting practical usage, such as the practical know-how of operating DFS applications, the ability to make positive financial attitudes and behaviors through DFS, and self-protection from online scams and frauds, are statistically and negatively associated with old age anxiety. However, the negative association between the decision-making dimension and old age anxiety became insignificant and switched in sign, suggesting potential overlap or mediation effects with other dimensions. Overall, these findings indicate that having just digital financial knowledge and awareness may increase concerns about retirement after age 65, whereas having the practical skills to operate DFS and apply financial knowledge effectively can help alleviate such anxiety.

Table 5.

Ordered probit estimation results by dimensions.

5. Discussion

Our findings revealed a significant association between lower DFL and heightened anxiety about life after the age of 65. Retirement is one of the most crucial aspects of life in older age, and previous studies have consistently shown that individuals who are satisfied with their retirement planning tend to enjoy a more fulfilling and secure post-retirement life (Lusardi and Mitchelli 2007; Niu et al. 2020). Effective planning for life after 65 not only provides financial security but also decreases uncertainty about the future, which can help maintain psychological well-being in older adults (Solhi et al. 2022). Conversely, inadequate preparedness, particularly due to the inability to navigate digital tools, may contribute to the lack of confidence in one’s financial planning and preparedness, and hence, contribute to stress and diminish overall life satisfaction and quality of life (Choung et al. 2023).

Multiple pathways explain how low DFL undermines a sense of preparedness and aggravates anxiety about life after 65. First, individuals with low DFL are more likely to experience financial uncertainty, as they may lack the tools and practical knowledge required to assess, plan, and manage their retirement finances using digital platforms. This is crucial, given broader global trends. Bibliometric studies show that the link between financial literacy and retirement planning has acquired increasing attention since the 2008 financial crisis and continues to grow in relevance in the context of new global challenges such as the COVID-19 pandemic (Gallego-Losada et al. 2022). Recent bibliometric reviews focused specifically on DFL further underscore the expansion of this field. Yadav and Banerji (2023) provide a comprehensive mapping of the intellectual and social structure of DFL research, highlighting its connections to saving behavior and retirement planning. Similarly, Suganya and Nithya (2025) analyze global publication trends on DFL between 2000 and 2024, identifying key contributing regions, influential authors, and emerging thematic clusters that emphasize the role of DFL in supporting informed decision-making. As global uncertainty increases, individuals are increasingly recognizing the need to proactively plan for the future and adapt to changing financial systems and digital tools to ensure stability and well-being in later life.

Second, low DFL can hinder access to financial opportunities. As digital platforms increasingly become the primary channels for delivering financial services, such as investment tracking, insurance selection, and pension planning, those who struggle to navigate these tools may miss out on crucial benefits or make suboptimal financial choices. For example, a study of urban financial consumers in Indonesia identified that digital knowledge significantly improves financial behavior (Badrudin et al. 2025), suggesting that better digital skills enable individuals to make more informed and advantageous financial decisions. In contrast, those lacking such skills may feel excluded from or overwhelmed by the digitized financial ecosystem. This aligns with the TPB and the HCT, which posits that perceived behavioral control is crucial for translating financial intentions into actual behavior, and therefore, improved financial behavior is associated with enhancements in financial and economic outcomes.

Third, individuals with low digital financial skills are also more vulnerable to financial fraud and mismanagement, which raises their perceived financial risk and contributes to ongoing stress, especially in contexts where physical attacks or scams targeting older investors have been reported in Japan (Japan Times 2025; Japan Exchange Group (JPX) 2025; Bloomberg News 2025). In addition to the direct risk of fraud, ignorance about how to navigate new technologies can further reinforce this financial vulnerability (Wendy and Wong 2010), undermining older adults’ sense of autonomy and increasing fears of dependency or exploitation, especially as they face age-related challenges. This is consistent with the TAM and the UTAUT, which emphasize that individuals are more likely to adopt and effectively use digital tools when they perceive these tools as useful and easy to use. The development of practical digital skills can directly facilitate this ease of use and mitigate any feelings of helplessness or exclusion.

Fourth, even in cases where individuals have stable financial resources, the inability to understand or use digital tools can create a sense of helplessness and disempowerment. According to the SCT proposed by Bandura (1977), an individual’s belief in their capability to execute behaviors necessary to manage prospective situations significantly affects their motivation, performance, and emotional well-being. Applied to DFL, lacking practical skills can undermine one’s confidence and perceived control over financial management, thereby increasing anxiety and feelings of unpreparedness, even among those with some general financial knowledge or stable resources.

This elucidates how different components of DFL relate to anxiety about life after age 65. Our analysis revealed that certain practical skills within DFL can act as protective factors against retirement-related anxiety. Specifically, individuals who possess practical knowledge and the ability to use digital financial tools effectively tend to feel less anxious about their life after retirement. Notably, our results also show that knowledge and awareness alone—without the ability to apply this knowledge—can actually increase anxiety and uncertainty. This finding is consistent with those of previous studies in the financial literacy realm (Fernandes et al. 2014; Lusardi and Mitchelli 2007) that have shown that merely knowing about complex financial concepts without possessing the skills or confidence to act on that knowledge may not give “consumers the tools to change their behaviors,” and thus aggravate insecurity and worry. For example, in our study, general awareness of financial and digital services was positively associated with anxiety, whereas practical know-how and hands-on skills were negatively associated. This highlights the potential role of applicable skills in mitigating uncertainty and stress.

6. Limitations

This study has several limitations that should be considered when interpreting the results. First, sample is drawn exclusively from the users of a single online securities company who are likely to be more financially literate than the general population. This sampling bias may limit the generalizability of the findings to broader populations with more diverse financial backgrounds. Second, the cross-sectional design of our study restricts our ability to draw conclusions about causal relationships or track how DFL and retirement-related anxiety may evolve over time. Therefore, future research should use longitudinal data to better understand how changes in sociodemographic, economic, and psychological factors affect the acquisition and practical application of DFL. Third, our measurement of anxiety is based on self-reported subjective ratings, which may be affected by individual response style or biases. Finally, although our study provides novel insights into the role of DFL—particularly its practical dimensions—in mitigating anxiety related to life after 65, it is limited in explaining the mechanisms underlying the negative association between DFL and old age anxiety. Previous studies have suggested that DFL may reduce such anxiety by increasing retirement savings and asset accumulation, which enhance individuals’ sense of security and preparedness for the future (Kadoya and Khan 2017; Kadoya et al. 2018; Wang et al. 2022). However, since this is the first wave of our dataset to include DFL, subsequent waves in our longitudinal project will allow us to examine changes in asset accumulation and financial preparedness as potential mediators, thereby shedding light on the pathways through which DFL alleviates old age anxiety. Despite these limitations, this study provides novel insights into the role of DFL—particularly its practical dimensions—in mitigating anxiety related to life after 65.

7. Conclusions

This study highlights the pivotal role of DFL in mitigating anxiety about life after 65. Our findings indicate that individuals with higher DFL are significantly less likely to experience old age anxiety. This provides strong evidence to showcase DFL as a determinant of financial and psychological well-being, significantly enhancing financial stability post-retirement and alleviating anxiety about later life. Moreover, we explored the heterogeneity effects of the five dimensions of DFL on old age anxiety. We identified that the negative association between DFL and old age anxiety is primarily facilitated through practical know-how, decision-making skills of digital financial tools, and the capacity for self-protection against online scams or fraud. In addition, we found that established sociodemographic characteristics, such as being male, having higher education, being married, and having children, are associated with lower old age anxiety. These findings are consistent with prior evidence and highlight that both digital financial skills and traditional demographic factors jointly shape psychological well-being in later life.

To promote preparedness for later life, policymakers should prioritize integrating DFL into financial education, with a specific focus on the practical applications of digital financial skills in today’s digitalized world. In addition, academics can build on these findings to develop theory-driven models that further clarify the mechanisms through which DFL influences psychological well-being, while financial professionals can incorporate DFL training into advisory practices to better equip clients for digital-era risks. Such integration will equip individuals with the necessary skills to better understand and navigate the digital financial landscape, ultimately supporting better financial decision-making and enhancing overall well-being for older age.

Author Contributions

Conceptualization, T.X.T.N., Y.K. (Yu Kuramoto), M.S.R.K. and Y.K. (Yoshihiko Kadoya); methodology, J.A., T.X.T.N., Y.K. (Yu Kuramoto), M.S.R.K. and Y.K. (Yoshihiko Kadoya); formal analysis, J.A., T.X.T.N., Y.K. (Yu Kuramoto), M.S.R.K. and Y.K. (Yoshihiko Kadoya); writing—original draft, J.A., T.X.T.N. and Y.K. (Yu Kuramoto); writing—review and editing, J.A., T.X.T.N., M.S.R.K. and Y.K. (Yoshihiko Kadoya); investigation, J.A., T.X.T.N. and Y.K. (Yu Kuramoto); data curation, J.A., T.X.T.N., and Y.K. (Yu Kuramoto); software, J.A., T.X.T.N., and Y.K. (Yu Kuramoto); supervision, Y.K. (Yoshihiko Kadoya); project administration, Y.K. (Yoshihiko Kadoya). All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by Rakuten Securities (awarded to Yoshihiko Kadoya) and JSPS KAKENHI through grant numbers JP23K25534 and JP24K21417 (awarded to Yoshihiko Kadoya). Rakuten Securities (https://www.rakuten-sec.co.jp) (accessed on 28 May 2025) and JSPS KAKENHI (https://www.jsps.go.jp/english/e-grants/) (accessed on 28 May 2025) played no role in the study design, analysis, manuscript preparation, or publishing decision.

Institutional Review Board Statement

All procedures used in this research were approved by the Ethical Committee of Hiroshima University (Approval Number: HR-LPES-001872) on 3 July 2024.

Informed Consent Statement

Written informed consent was obtained from all participants in the questionnaire survey under the guidance of the institutional compliance team.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available upon acceptance of the manuscript.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| DFL | Digital Financial Literacy |

| AI | Artificial Intelligence |

| DFS | Digital Financial Services |

| TAM | Technology Acceptance Model |

| UTAUT | Unified Theory of Acceptance and Use of Technology |

| HCT | Human Capital Theory |

| SCT | Social Cognitive Theory |

| TPB | Theory of Planned Behavior |

References

- AARP. 2025. Aging Readiness and Competitiveness: Japan. Available online: https://www.aarpinternational.org/initiatives/aging-readiness-competitiveness-arc/japan (accessed on 23 August 2025).

- Ajzen, Icek. 1991. The Theory of Planned Behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Amnas, Muhammed Basid, Murugesan Selvam, and Satyanarayana Parayitam. 2024. FinTech and Financial Inclusion: Exploring the Mediating Role of Digital Financial Literacy and the Moderating Influence of Perceived Regulatory Support. Journal of Risk and Financial Management 17: 108. [Google Scholar] [CrossRef]

- Badrudin, Rudy, Mochammad Fahlevi, Sahara Putri Dahlan, Olivia Putri Dahlan, and Mochamad Dandi. 2025. Financial Stress and Its Determinants in Indonesia: Exploring the Moderating Effects of Digital Knowledge, Age, and Gender. Journal of Open Innovation: Technology, Market, and Complexity 11: 100528. [Google Scholar] [CrossRef]

- Baker, Paul. 2024. The Frontiers of Finance. University of Chicago Professional. Available online: https://professional.uchicago.edu/stories/strategic-financial-management/frontiers-finance?language_content_entity=en (accessed on 6 June 2025).

- Bandura, Albert. 1977. Self-Efficacy: Toward a Unifying Theory of Behavioral Change. Psychological Review 84: 191–215. [Google Scholar] [CrossRef]

- Bandura, Albert. 2023. Social Cognitive Theory—An Agentic Perspective on Human Nature. Hoboken: John Wiley and Sons, Inc. [Google Scholar] [CrossRef]

- Becker, Gary S. 1962. Investment in Human Capital: A Theoretical Analysis. Journal of Political Economy 70: 9–49. [Google Scholar] [CrossRef]

- Bloomberg News. 2025. Japan FSA Says Hacked Online Trading Reaches About $700 Million. Bloomberg. Available online: https://www.bloomberg.com/news/articles/2025-04-18/japan-fsa-says-hacked-online-trading-reaches-about-700-million (accessed on 18 April 2025).

- Chavleishvili, Sulkhan, Manfred Kremer, and Frederik Lund-Thomsen. 2024. Quantifying Financial Stability Risks for Monetary Policy. European Central Bank Research Bulletin. Available online: https://www.ecb.europa.eu/press/research-publications/resbull/2024/html/ecb.rb210129~d9b4085476.en.html (accessed on 5 June 2025).

- Choung, Youngjoo, Swarn Chatterjee, and Tae-Young Pak. 2023. Digital Financial Literacy and Financial Well-Being. Finance Research Letters 58: 104438. [Google Scholar] [CrossRef]

- Davis, Fred D., and Andrina Granić. 2024. The Technology Acceptance Model: 30 Years of TAM. Human-Computer Interaction Series; Berlin/Heidelberg: Springer International Publishing AG. [Google Scholar]

- Fernandes, Daniel, John G. Lynch, and Richard G. Netemeyer. 2014. Financial Literacy, Financial Education, and Downstream Financial Behaviors. Management Science 60: 1861–83. [Google Scholar] [CrossRef]

- Gallego-Losada, Rocío, Antonio Montero-Navarro, José-Luis Rodríguez-Sánchez, and Thais González-Torres. 2022. Retirement Planning and Financial Literacy, at the Crossroads: A Bibliometric Analysis. Finance Research Letters 44: 102109. [Google Scholar] [CrossRef]

- Heinrichs, Nina, Ronald M. Rapee, Lynn A. Alden, Susan Bögels, Stefan G. Hofmann, Kyung Ja Oh, and Yuji Sakano. 2006. Cultural Differences in Perceived Social Norms and Social Anxiety. Behaviour Research and Therapy 44: 1187–97. [Google Scholar] [CrossRef]

- Hofmann, Stefan G., M. A. Anu Asnaani, and Devon E. Hinton. 2010. Cultural Aspects in Social Anxiety and Social Anxiety Disorder. Depression and Anxiety 27: 1117–27. [Google Scholar] [CrossRef]

- Japan Exchange Group (JPX). 2025. Be Careful of Phishing Scams! (Warning). Japan Exchange Group. Available online: https://www.jpx.co.jp/english/corporate/news/news-releases/0060/20250404-01.html (accessed on 4 April 2025).

- Japan Times. 2025. Japanese Online Brokerage Accounts Hacked in Growing Scandal. The Japan Times, April 17. Available online: https://www.japantimes.co.jp/news/2025/04/17/japan/crime-legal/hacking-brokerage-accounts/ (accessed on 30 April 2025).

- Jorm, Anthony. 2000. Does Old Age Reduce the Risk of Anxiety and Depression? A Review of Epidemiological Studies across the Adult Life Span. Psychological Medicine 30: 11–22. [Google Scholar] [CrossRef]

- Jose, Jeswin, and Nabanita Ghosh. 2025. Digital Financial Literacy and Financial Inclusion in the Global South for a Sustainable Future: A Scoping Review. DECISION 52: 129–48. [Google Scholar] [CrossRef]

- Kadoya, Yoshihiko. 2016. What Makes People Anxious about Life after the Age of 65? Evidence from International Survey Research in Japan, the United States, China, and India. Review of Economics of the Household 14: 443–61. [Google Scholar] [CrossRef]

- Kadoya, Yoshihiko, and Mostafa Saidur Rahim Khan. 2017. Can Financial Literacy Reduce Anxiety about Life in Old Age? Journal of Risk Research 21: 1533–50. [Google Scholar] [CrossRef]

- Kadoya, Yoshihiko, Mostafa Saidur Rahim Khan, Tomomi Hamada, and Alvaro Dominguez. 2018. Financial Literacy and Anxiety about Life in Old Age: Evidence from the USA. Review of Economics of the Household 16: 859–78. [Google Scholar] [CrossRef]

- Kadoya, Yoshihiko, and Mostafa Saidur Rahim Khan. 2020. What Determines Financial Literacy in Japan? Journal of Pension Economics and Finance 19: 353–71. [Google Scholar] [CrossRef]

- Koskelainen, Tiina, Panu Kalmi, Eusebio Scornavacca, and Tero Vartiainen. 2023. Financial Literacy in the Digital Age—A Research Agenda. Journal of Consumer Affairs 57: 507–28. [Google Scholar] [CrossRef]

- Kumar, Parul, Md Aminul Islam, Rekha Pillai, and Taimur Sharif. 2023. Analysing the Behavioural, Psychological, and Demographic Determinants of Financial Decision Making of Household Investors. Heliyon 9: e13085. [Google Scholar] [CrossRef]

- Lal, Sumeet, Aliyu Ali Bawalle, Mostafa Saidur Rahim Khan, and Yoshihiko Kadoya. 2025. What Determines Digital Financial Literacy? Evidence from a Large-Scale Investor Study in Japan. Risks 13: 149. [Google Scholar] [CrossRef]

- Lal, Sumeet, Trinh Xuan Thi Nguyen, Abdul-Salam Sulemana, Mostafa Saidur Rahim Khan, and Yoshihiko Kadoya. 2022. Does Financial Literacy Influence Preventive Health Check-up Behavior in Japan? A Cross-Sectional Study. BMC Public Health 22: 1704. [Google Scholar] [CrossRef] [PubMed]

- Liu, Siming, Leifu Gao, Khalid Latif, Ayesha Anees Dar, Muhammad Zia-UR-Rehman, and Sajjad Ahmad Baig. 2021. The Behavioral Role of Digital Economy Adaptation in Sustainable Financial Literacy and Financial Inclusion. Frontiers in Psychology 12: 742118. [Google Scholar] [CrossRef]

- Lone, Umer Mushtaq, and Suhail Ahmad Bhat. 2024. Impact of Financial Literacy on Financial Well-Being: A Mediational Role of Financial Self-Efficacy. Journal of Financial Services Marketing 29: 122–37. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Jialu L. Streeter. 2023. Financial Literacy and Financial Well-Being: Evidence from the US. Journal of Financial Literacy and Wellbeing 1: 169–98. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2014. The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature 52: 5–44. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchelli. 2007. Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education. Business Economics 42: 35–44. [Google Scholar] [CrossRef]

- Lyons, Angela C., and Josephine Kass-Hanna. 2021. A Methodological Overview to Defining and Measuring ‘Digital’ Financial Literacy. Financial Planning Review 4: e1113. [Google Scholar] [CrossRef]

- Mishra, Deepak, Naveen Agarwal, Sanawi Sharahiley, and Vinay Kandpal. 2024. Digital Financial Literacy and Its Impact on Financial Decision-Making of Women: Evidence from India. Journal of Risk and Financial Management 17: 468. [Google Scholar] [CrossRef]

- Morgan, Peter J., Bihong Huang, and Long Q. Trinh. 2019. The Need to Promote Digital Financial Literacy for the Digital Age. In Realizing Education for All in the Digital Age. Edited by Peter J. Morgan and Naoyuki Yoshino. Tokyo: ADBI Press, pp. 40–46. Available online: https://www.adb.org/publications/realizing-education-all-digital-age (accessed on 30 May 2025).

- Nguyen, Thu Thuy, Thi Ngoc Hoai Tran, Thi Huyen My Do, Thi Khanh Linh Dinh, Thi Uyen Nhi Nguyen, and Tran Minh Khue Dang. 2024. Digital Literacy, Online Security Behaviors and E-Payment Intention. Journal of Open Innovation: Technology, Market, and Complexity 10: 100292. [Google Scholar] [CrossRef]

- Nguyen, Trinh Xuan Thi, Sumeet Lal, Sulemana Abdul-Salam, Mostafa Saidur Rahim Khan, and Yoshihiko Kadoya. 2022. Financial Literacy, Financial Education, and Cancer Screening Behavior: Evidence from Japan. International Journal of Environmental Research and Public Health 19: 4457. [Google Scholar] [CrossRef]

- Nippon.com. 2025. Financial Losses Soar as Cases of Scams Jump in Japan. Available online: https://www.nippon.com/en/japan-data/h02424/ (accessed on 24 August 2025).

- Niu, Geng, Yang Zhou, and Hongwu Gan. 2020. Financial Literacy and Retirement Preparation in China. Pacific-Basin Finance Journal 59: 101262. [Google Scholar] [CrossRef]

- OECD. 2024. OECD/INFE Survey Instrument to Measure Digital Financial Literacy. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Ogunola, Amos Abidemi, Tobi Sonubi, Rebecca Olubunmi Toromade, Oluwatosin Omotola Ajayi, and Amarachi Helen Maduakor. 2024. The Intersection of Digital Safety and Financial Literacy: Mitigating Financial Risks in the Digital Economy. International Journal of Science and Research Archive 13: 673–91. [Google Scholar] [CrossRef]

- Pinquart, Martin, and Silvia Sörensen. 2000. Influences of Socioeconomic Status, Social Network, and Competence on Subjective Well-Being in Later Life: A Meta-Analysis. Psychology and Aging 15: 187–224. [Google Scholar] [CrossRef]

- Serrano, Antonio Sánchez. 2020. High-Frequency Trading and Systemic Risk: A Structured Review of Findings and Policies. Review of Economics 71: 169–95. [Google Scholar] [CrossRef]

- Soldatos, John, and Dimosthenis Kyriazis, eds. 2022. Big Data and Artificial Intelligence in Digital Finance: Increasing Personalization and Trust in Digital Finance Using Big Data and AI. Berlin/Heidelberg: Springer Nature. [Google Scholar]

- Solhi, Mahnaz, Razieh Pirouzeh, Nasibeh Zanjari, and Leila Janani. 2022. Dimensions of Preparation for Aging: A Systematic Review. Medical Journal of the Islamic Republic of Iran 36: 81. [Google Scholar] [CrossRef]

- Subburayan, Baranidharan, Amirdha Vasani Sankarkumar, Rohit Singh, and Hellena Mohamedy Mushi. 2024. Transforming of the Financial Landscape from 4.0 to 5.0: Exploring the Integration of Blockchain, and Artificial Intelligence. In Applications of Block Chain Technology and Artificial Intelligence. Edited by Mohammad Irfan, Khan Muhammad, Nader Naifar and Muhammad Attique Khan. Financial Mathematics and Fintech. Berlin/Heidelberg: Springer International Publishing, p. 9. [Google Scholar] [CrossRef]

- Suganya, Ravi, and Gopalakrishnan Nithya. 2025. Mapping the Landscape of Digital Financial Literacy: A Bibliometric Study (2000–2024). European Economic Letters 15: 1347–62. [Google Scholar] [CrossRef]

- Venkatesh, Viswanath, James Thong, and Xin Xu. 2016. Unified Theory of Acceptance and Use of Technology: A Synthesis and the Road Ahead. Journal of the Association for Information Systems 17: 328–476. [Google Scholar] [CrossRef]

- Wang, Qing, Chengjun Liu, and Sai Lan. 2022. Digital Literacy and Financial Market Participation of Middle-Aged and Elderly Adults in China. Economic and Political Studies 11: 441–68. [Google Scholar] [CrossRef]

- Weissman, Myrna M., and Jerome K. Myers. 1980. Psychiatric Disorders in a U.S. Community: The Application of Research Diagnostic Criteria to A Resurveyed Community Sample. Acta Psychiatrica Scandinavica 62: 99–111. [Google Scholar] [CrossRef] [PubMed]

- Wendy, Way, and Nancy Wong. 2010. Harnessing the Power of Technology to Enhance Financial Literacy Education and Financial Well-Being: A Literature Review. Paper presented at Financial Literacy Research Consortium Conference, Washington, DC, USA, November 18. Available online: https://www.rand.org/content/dam/rand/pubs/conf_proceedings/2010/CF283/harnessing-power-technology-enhance-financial-literacy.pdf (accessed on 30 May 2025).

- Yadav, Mansi, and Priyanka Banerji. 2023. Digital Financial Literacy: A Bibliometric Review. Asian Journal of Business and Accounting 16: 183–212. [Google Scholar]

- Zhang, Xiaoquan, and Lihong Zhang. 2015. How Does the Internet Affect the Financial Market? An Equilibrium Model of Internet-Facilitated Feedback Trading. MIS Quarterly 39: 17–38. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).