Abstract

As a crucial modeling tool for stochastic financial markets, the Lévy risk model effectively characterizes the evolution of risks during enterprise operations. Through dynamic evaluation and quantitative analysis of risk indicators under specific dividend- distribution strategies, this model can provide theoretical foundations for optimizing corporate capital allocation. Addressing the inadequate adaptability of traditional single-period threshold strategies in time-varying market environments, this paper proposes a dividend strategy based on multiperiod dynamic threshold adjustments. By implementing periodic modifications of threshold parameters, this strategy enhances the risk model’s dynamic responsiveness to market fluctuations and temporal variations. Within the framework of the spectrally negative Lévy risk model, this paper constructs a stochastic control model for multiperiod threshold dividend strategies. We derive the integro-differential equations for the expected present value of aggregate dividend payments before ruin and the Gerber–Shiu function, respectively. Combining the methodologies of the discounted increment density, the operator introduced by Dickson and Hipp, and the inverse Laplace transforms, we derive the explicit solutions to these integro-differential equations. Finally, numerical simulations of the related results are conducted using given examples, thereby demonstrating the feasibility of the analytical method proposed in this paper.

1. Introduction

In the highly uncertain and dynamically evolving environment of modern financial markets, stochastic risk modeling has emerged as a critical tool for addressing asset price volatility, interest rate fluctuations, and sudden shocks. While conventional stochastic models can characterize the continuous evolution of risk factors, they face significant limitations in capturing variation features such as jump diffusion and asymmetric heavy tails. Lévy processes, as a subclass of stochastic processes with stationary and independent increments, are widely used in financial and insurance modeling to capture random fluctuations such as asset price jumps or claim arrivals and provide a comprehensive modeling perspective for financial risk analysis via their triplet representation: drift rate per unit time, diffusion coefficient, and jump magnitude. Lévy processes can not only effectively characterize sharp fluctuations in asset prices and extreme market events, but also demonstrate significant advantages in risk management and financial asset pricing: in insurance actuarial science, they provide a powerful analytical tool for modeling claim risks; in financial engineering, they play crucial roles in both early-stage default pricing for credit risk and tail risk management for market risk. Kyprianou (2014) elaborated on the relevant theories and applications of the Lévy processes and added content on subjects such as scale function and fluctuation theory and their application in ruin theory.

Albrecher et al. (2016) derived mathematical expressions for exit problems under different conditions by using the scale function and fluctuation theory of the Lévy processes. Morozova and Panov (2023) applied jump-type Lévy processes to model Bitcoin prices and media-attention dynamics, revealing significant non-Gaussian behavior and jump-clustering effects that traditional models failed to capture. For more references on the Lévy processes, see Ken-Iti (1999), Kuznetsov et al. (2012), Pérez and Yamazaki (2018), Yoon et al. (2023), Mohammad et al. (2024), Lv et al. (2024), Shirvani et al. (2024), etc.

Within the conceptual framework of Lévy processes, spectrally negative Lévy processes have emerged as a critical research subject due to their distinctive path properties. These processes are restricted to jumps occurring only in the negative direction (Bertoin 1996). The characteristic of allowing only unilateral jumps endows them with unique advantages in applications in financial engineering and actuarial modeling. In recent years, related research has mainly focused on the following directions: (1) the application of spectrally negative Lévy processes in finance and insurance (e.g., Albrecher and Thonhauser 2008; Landriault and Lkabous 2021; Song and Sun 2023, etc); (2) risk-measurement methods based on spectrally negative Lévy processes, such as VaR (Value at Risk) or CVaR (Conditional Value at Risk) (e.g., Emmer and Klüppelberg 2004; Landriault et al. 2011; Wang et al. 2020, etc); (3) the application of spectrally negative Lévy processes in option pricing, portfolio optimization, and risk-capital allocation (e.g., Schoutens 2003; Cont and Tankov 2003; Aguilar and Kirkby 2023, etc). For recent research on the spectrally negative Lévy risk model, see Renaud (2019), Noba (2021), Avanzi et al. (2021), Zhang (2022), Irie and Shimizu (2024), etc.

Among the indicators that characterize risk, dividends and ruin are the indicators that researchers pay the most attention to. At the beginning of the 20th century, actuaries focused on studying the possibility of ruin and using it to assess the risks a company faced. During the Fifteenth Annual Symposium of the New York Society of Actuaries, De Finetti (1957) introduced the optimal dividend problem (that is, the problem of seeking to maximize the expected present value of aggregate dividend payments before ruin) into risk theory for the first time. These two fundamental questions, namely what dividend strategy to adopt and the amount of dividends, have gradually become important research topics in insurance-risk theory (Avanzi 2009).

As dividend strategies are a core tool for enterprises aiming to balance risk reserves and shareholder returns, their design needs to take into account the uncertainty of market fluctuations and the efficiency of capital operations. multi-periodic dividend constraints are particularly relevant in regulated financial sectors, such as banking under the Basel III framework, where institutions must maintain capital adequacy while optimizing dividend payouts. In insurance, firms face similar pressures to balance policyholder obligations with shareholder returns. Especially in asymmetric financial markets where jump risks exist, the question of how to maximize long-term returns by dynamically adjusting dividend strategies has become a core issue in both theoretical research and practical application. In recent years, many researchers have introduced different types of dividend strategies and explored several issues related to specific risk models under these strategies. Jeanblanc-Picqué and Shiryaev (1995) and Asmussen and Taksar (1997) introduced a threshold-based dividend strategy with a limited payout rate. Under this approach, dividends are distributed at a fixed rate only when the corporation’s capital surplus (after accounting for dividends) exceeds a predetermined threshold level . Conversely, no dividends are paid if the capital surplus falls below this threshold. Many researchers have discussed several issues related to insurance risk models under threshold strategies. For relevant papers, see Lin and Pavlova (2006), Ng (2009), Shen et al. (2013), Yu et al. (2018), Yang et al. (2020), Gao et al. (2022), etc.

In addition, based on the reality of regular dividend payments, Albrecher et al. (2011) first introduced the concept of a periodic dividend strategy based on the Cramér–Lundberg model. This dividend strategy allows dividends to be distributed only at certain fixed time points (discrete time points that meet certain conditions); that is, if the capital surplus observed at those time points is greater than a given level , the excess is paid to shareholders as a one-time dividend; otherwise, no dividend is paid. In practice, the periodic dividend strategy is an important tool in the capital management of financial institutions. Its core feature is to implement fixed profit distribution at a preset fixed interval (such as quarterly or annual). This strategy achieves a reasonable return on shareholder value while ensuring institutional capital adequacy by establishing an institutionalized dividend schedule and a scientific distribution mechanism. For more information on the periodic dividend strategy, see Avanzi et al. (2014), Zhong et al. (2021), Xie and Zhang (2021), Mata et al. (2023), etc.

Combining the advantages of periodic dividend strategies and threshold dividend strategies, Cheung and Zhang (2019) introduced a dividend strategy with both periodic and threshold constraints: given a series of discrete observation time points, whenever the corporation’s capital surplus at these observation time points exceeds the threshold level , a fixed proportion of the excess is paid out as dividends; otherwise, no dividends are paid. Using the discounted increment density method, they systematically studied the Poisson risk model under this strategy, not only deriving the analytical solution for the expected discounted dividends before ruin but also rigorously proving that when the observation time interval approaches zero, this strategy converges to the traditional continuous threshold strategy. It should be noted that the periodic threshold dividend strategy proposed by Cheung and Zhang (2019) has certain limitations: its static decision framework does not consider the cross-period transmission effects of risk factors and cannot dynamically adjust the dividend rate based on the capital surplus at a given observation time point, making it difficult for users of this strategy to adapt to the complexity of the actual financial environment. To overcome the above limitations, a better strategy would move from a static framework to dynamic adjustment; that is, it would implement differentiated dividend rules based on risk exposure and capital levels at different stages. For example, in the insurance industry, companies must periodically assess their capital surplus and distribute dividends to shareholders when it exceeds a predefined threshold. The multiperiod threshold strategy enables firms to dynamically adjust dividend payments based on capital surplus at varying observation points, thereby enhancing their flexibility in response to market shifts. During periods of high volatility, insurers can choose to conserve capital to mitigate risk, while in stable conditions, they can maximize shareholder returns; this represents a significant practical advantage over static models like that of Cheung and Zhang (2019). Therefore, it is necessary to construct a multiperiod threshold strategy with time-varying adaptability that can not only capture the dynamic capital surplus at different observation points but also enhance risk-response flexibility through a period-specific dividend mechanism. To this end, we propose a multiperiod threshold dividend strategy based on two core elements: (1) preset heterogeneous observation intervals (such as key financial nodes like the end of a quarter or half-year); (2) a dynamic threshold linked to financial health (usually based on surplus capital or retained surplus). When the capital surplus at the -th-type observation point exceeds , the excess part is paid out as dividends at a preset rate ; otherwise, no dividends are paid. From the perspective of dividend strategy in the actuarial field, this dynamic dividend strategy enables insurers to balance regulatory compliance and shareholder returns by adjusting payouts based on surplus assessments. It allows firms to increase dividends in stable times and conserve capital during periods of volatility, enhancing competitive positioning and long-term resilience. The approach supports sustainable growth while maintaining compliance in fluctuating markets. Building upon the aforementioned analytical foundation, this paper innovatively constructs a multiperiod threshold dividend decision model with time-varying characteristics under the framework of the spectrally negative Lévy process. In the proposed discounted increment density method, we simultaneously examine the two key objective functions of dividend and ruin. This study aims to investigate multi-periodic threshold dividend strategies under the spectrally negative Lévy risk model. Traditional dividend strategies often rely on single-period or continuous observations, whereas in real-world financial markets, dividend decisions are typically reviewed at fixed periodic intervals. Therefore, exploring multi-periodic threshold strategies is of significant theoretical and practical importance for corporate capital allocation and risk management. This study achieves breakthroughs in both theoretical and methodological dimensions through synergistic modeling of spectrally negative Lévy processes and multiperiod threshold dividend strategies. Theoretically, the proposed multiperiod threshold dividend strategy expands the research boundaries of insurance risk theory. Methodologically, the integration of discounted increment density, Dickson–Hipp operators, and Laplace transform techniques establishes a novel analytical framework for addressing complex financial insurance problems.

The rest of this paper is organized as follows. In Section 2, the spectrally negative Lévy risk model based on the multiperiod threshold dividend strategy is systematically constructed. In Section 3, we introduce the concept of the “discounted increment density”, which is a key tool for studying the main target variables of this paper, and present some important results related to it. In Section 4, we derive the integro-differential equation governing the expected present value of aggregate dividend payments and give its explicit solution using a combination of the operator introduced by Dickson and Hipp and the inverse Laplace transform. In Section 5, we derive the explicit solution of the Gerber–Shiu function using a method similar to that provided in Section 4. In Section 6, we verify the effectiveness and practicality of our method based on numerical solutions of some specific examples. The last section summarizes this paper.

2. Model Formulation

In this paper, the underlying process of the operation of an insurance company (before dividends) is modeled by a spectrally negative Lévy process described as follows (see Kyprianou 2014). For , let represent the conditional probability measure under the initial condition and let denote its corresponding conditional expectation. To simplify notation, we define and . The process can be uniquely characterized by the Laplace exponent

where , is the indicator function and is a non-negative measure centered on that satisfies the usual condition . Under the assumption , the process is guaranteed to have a finite first moment. Moreover, we assume that the constant satisfies the positive security loading requirement , precluding scenarios where exhibits monotonic trajectories (e.g., where is a subordinator; see Section 2.6 of Kyprianou (2014)).

Under conventional threshold dividend strategies (e.g., Lin and Pavlova 2006), continuous dividend payments are triggered by surplus levels surpassing a critical value , with dividends calculated as a fixed proportion of premium income. Albrecher et al. (2011, 2013) modified this threshold dividend strategy through the inclusion of regular monitoring time points. Our work revises the current periodic dividend strategy via the incorporation of different types of time points for periodic observation and implementing the allocation of different proportions of lump-sum dividends at these time points. As in Cheung and Zhang (2019) and Peng et al. (2020), we assume the surplus process is examined periodically by the insurance company at stochastic observation times with . These observation times include different types of points, ; ; until . The observations are used to decide whether or not to pay dividends according to the following multi-periodic dividend strategy.

- For each a dividend is paid at the observation time if the surplus at this time (before any dividend payouts) exceeds the surplus at the previous observation time (after dividend payouts) and if the surplus level is greater than the threshold level ;

- At the -th-type of observation time point () where a dividend is payable, the dividend amount is calculated as the proportion () of the greater value between the net surplus at the previous time point (after deducting dividends) and the threshold level .

Based on the above modified multi-periodic threshold dividend strategy, we introduce the surplus process as , which can be mathematically described as follows. Denote by () the sequence of surplus values recorded at the epochs directly preceding any dividend disbursement. Subsequently, the process and are jointly characterized through the following equations:

and

where max and where for , represents the set of -th-type periodic observation times.

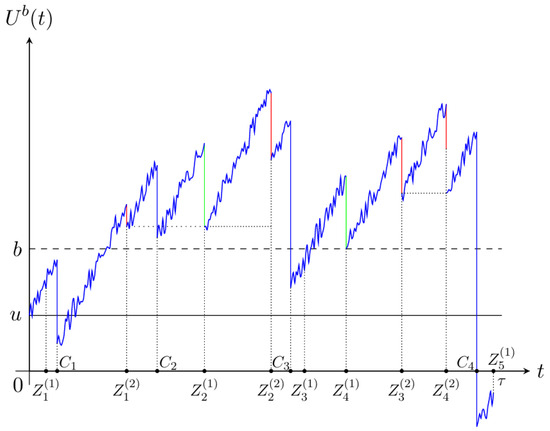

To better illustrate the spectrally negative Lévy process , we plot a possible sample path for the process in Figure 1. The path in Figure 1 begins with an initial surplus and shows the dynamic characteristics of the spectrally negative Lévy process between two observation periods, namely, random fluctuations with upward drift and no positive jumps. Figure 1 also labels several discrete observation time points of different types (e.g., etc.). When the profit level of the process at a given observation point (such as the moments corresponding to and ) exceeds the preset dividend threshold , the company will distribute a dividend, causing the profit to drop vertically instantly. The size of the dividend is calculated as a preset fraction of the excess; at some observation points (such as ), despite monitoring, no dividend is paid because the surplus does not reach the threshold and the process continues to evolve; the end of the path shows a ruin event, which occurs at time ; at that time, the value of the surplus process falls below zero.

Figure 1.

A sample path for the spectrally negative Lévy process .

For , and let be the -th-type interobservation times. Throughout the paper, we assume that the inter-observation times are independent and exponential distributions with the same parameter ; that is, the probability density function is

Moreover, for let be the inter-observation times. Since contains all the possible types of observation time points, it is easy to get that , so the inter-observation times constitute a sequence of independent and identically distributed (i.i.d.) random variables characterized by an exponential density function

In insurance and financial practice, dividend payments are typically reviewed at fixed intervals, such as quarterly or annually. However, real-world operations often face uncertainties—market volatility, fluctuating company finances, or regulatory changes—that disrupt these fixed schedules. The assumption of exponentially distributed inter-observation times allows our model to capture this uncertainty, offering a more realistic simulation of irregular review timings compared to static periodic models. This flexibility is particularly valuable in dynamic financial environments where adaptability to unpredictable conditions is crucial.

In this paper, we assume that the solvency can be monitored at the discrete time points and the ruin time is formally defined as , where represents the number of observations before ruin. One quantity of interest is the expected present value of aggregate dividend payments until ruin, given by

where is the force of interest. Moreover, we are also interested in studying the Gerber–Shiu expected discounted penalty function, which is defined as follows:

where is the nonnegative measurable function of the surplus before ruin and the deficit at ruin . In the limiting case where the barrier parameter , dividend payments are entirely suspended and the adjusted risk model collapses to the classical spectrally negative Lévy framework with no mechanism for dividend distribution. In this model, the ruin time is given by , where , and if for all . Then, in the case that , the corresponding Gerber–Shiu expected discounted penalty function is defined as follows:

3. The Discounted Increment Between Observations

In this section, we first introduce the discounted increment density of the continuous observed surplus level, which is proposed by Albrecher et al. (2013) and plays an important role in analyzing the target variables and . For a sequence of independent and identically distributed two-dimensional random vectors , let , , be the discounted density of the increment discounted at rate , so that it satisfies

is a bilateral discounted increment density that admits a decomposition into two components, as follows:

where the density functions and characterize the net profit and deficit of within the time frame , respectively. By (9) and (10), it is easy to get that

Because follows an exponential distribution with parameter , we derive the following result:

where serves as the -potential density associated with defined by

The explicit expression of can be presented through the -scale function introduced by Kyprianou (2014). Kyprianou’s foundational work (Theorem 8.1(i)) establishes the -scale function for all . This function vanishes identically on the negative real axis (that is, ), and, for , it is uniquely characterized by its Laplace transform

where is the supremum of all satisfying , serving as the inverse of the Laplace exponent on the right half-line. Following Corollary 8.9 in Kyprianou (2014), one can get

Furthermore, the identity implies, through differentiation with respect to , the derivative relationship . Therefore, by replacing with , (15) can be rewritten as

By substituting (16) into (12) and comparing its result with (9), we can get that

where From (17) and (11), we have

and

Remark 1.

The upper bound for can be derived by applying the discounted increment density. According to the definition of in (6), one can get

Next, we introduce some auxiliary mathematical symbols and operators that will be used to more clearly demonstrate the solution of the main objective variables. Let denote the Laplace transform of the function , defined over the domain , and denote by the operator of the inverse Laplace transform with argument . Moreover, we introduce the operator first introduced by Dickson and Hipp, , which is defined as follows: for any integrable function on and any complex number with ,

More properties of the operator introduced by Dickson and Hipp are described in Li and Garrido (2004).

4. The Expected Present Value of Aggregate Dividend Payments Until Ruin

This section focuses on analyzing the expected present value of aggregate dividend payments until ruin, denoted by . We initiate our analysis by deriving the governing integro-differential equations for and subsequently employ the Laplace transform with the operator introduced by Dickson and Hipp’s methodology to resolve these equations. For clarity of exposition, we write as

We now proceed to establish the system of integral equations satisfied by . For , by using the discounted increment density , and considering the increment of surplus process from time to , while taking into account -types of observation times, we can obtain that

For , by using arguments similar to those used above, we can obtain that

We now begin to solve the integral Equations (23) and (24). For convenience, we denote the constant as . By substituting (19) into (23) and making some changes to variables, (23) can be rewritten as

Applying the operator to both sides of (25), we can obtain that, for ,

Let denote a solution to (26)

with an initial condition . It is easy to get that

where is an undetermined constant. Applying the inverse Laplace transform to Equation (27) in its entirety yields

Using the inverse Laplace transform to (29), we can get

where the expression of can be given through the -scale function. Specifically, by (18) we have, for ,

Then, (29) can be rewritten as

Further, using the inverse Laplace transform in (32), for , one can get

On the other hand, for , by integral transforms on (24) and some careful mathematical calculations, we can obtain

where . For , applying a multiplicative weighting of to both sides of (34) and performing integration over the interval yields

Note that and the integral expression on the right-hand side of (35) can be respectively calculated as

and

To analytically determine the constant , we consider the root of the following equation:

Let , since

and

We conclude that the function possesses a unique positive root within the interval . By leveraging the upper-bound constraint on established in (20), for , we can get

and

Therefore, can be represented as

5. The Gerber–Shiu Expected Discounted Penalty Function

In this section, we shall study the Gerber–Shiu expected discounted penalty function at the time of ruin (denoted as ). In a structure similar to that of the previous section, we begin by formulating the integro-differential equations obeyed by , then employ the Laplace transform and the operator introduced by Dickson and Hipp to solve these integro-differential equations. For convenience, can be written as

We now proceed to establish the system of integral equations associated with . For , by using an analysis similar to that used in the previous section, one can obtain that

For , by using arguments similar to those used above, we can obtain that

By substituting Equations (19) into Equation (52) and making some changes to variables, (52) can be rewritten as

where . Then, applying the operator to both sides of (54), one can get that, for ,

On the other hand, by using arguments similar to those used above, one can find that satisfies an integro-differential equation of identical structural form to (55); that is, for ,

Then, combining (55) and (56), we have that

where represents an undetermined coefficient whose value will be explicitly resolved through subsequent analysis.

Next, we solve and the constant to determine the expressions for and . Applying the Laplace transforms on (56) for both sides, one can get that

i.e.,

Given that is continuous and given the intermediate value theorem, we can conclude that has a positive root in and set it as . Note that when , . Then, for any with , we have under the integrability assumption of the Gerber–Shiu function, which means that is also a root of the numerator in (59). Thus, we can get

Then, substituting (63) into (59) yields

and together with the inverse Laplace transform, this gives

On the other hand, for , by integral transforms on (53) and some careful mathematical calculations, we can obtain

where . We now solve the integral Equation (66) to obtain the expression of . For , a multiplicative weighting of to both sides of (66) and integration over the interval yields

which can yield that

Since is bounded for and is a root of the denominator in (68), must be a root of the numerator in (68). Thus, we can easily get

Therefore, can be expressed as

6. Numerical Illustrations

In this section, we use a perturbed compound Poisson risk model, which is a special case of the spectrally negative Lévy process, to provide numerical examples for and , as analyzed in Section 4 and Section 5. The proposed risk process before dividends are deducted is expressed as

where is the initial surplus, is the premium rate per unit time, the claim process is a Poisson counting process with intensity , is an i.i.d. sequence of positive random variables with a probability density function for , is a disturbance coefficient, and denotes a Wiener process initialized at . Additionally, mutual independence holds among . By (1), we have that is uniquely determined by the Laplace exponent

where . For convenience, we presume that is a rational function and is given by

where and are polynomials in with degrees and (). Furthermore, we assume that and do not have a common zero point and that the coefficient of in is . Under the previous assumption, has exactly roots. We postulate that these roots are distinct, with mathematical certainty establishing precisely one positive solution , while the remaining roots rigorously satisfy the negativity criterion for .

We now begin to investigate the numerical solutions for and . To obtain specific numerical solutions, we must first derive explicit expressions for the key functional components: , , , , and , as defined in (50) and (74).

First, we derive the explicit expression for . The analytical foundation for this numerical computation requires resolving the explicit formulation of the discounted density function through the Laplace transform. For , it is a scale function whose Laplace transform can be written as

where and . Then, through the application of the inverse Laplace transform to (78), we can get

Then, the Laplace transform of (80) (i.e. ) can be given by

Substituting (81) into (29) yields

where are different roots of the equation , and . From the analysis of in Section 5, we have that one of the roots of is equal to . Taking the inverse Laplace transform of (82), one can obtain

Next, we derive the explicit expressions for and . By (46) and (81), the Laplace transform of can be expressed as

where are all negative roots of the equation and . After applying the inverse Laplace transform to , we can obtain that

Applying the operator introduced by Dickson and Hipp to (80), we can get

Therefore, by (47) and (87), the Laplace transform of can be expressed as

where is a polynomial of degree , and . Then, by performing the inverse Laplace transform on (88), one can get

Finally, we derive the explicit expressions for and . Assume that the penalty function is always equal to 1 (i.e. ). By (54), we can get that

and find its Laplace transform, as follows:

Substituting (91) into (64) gives that

where , and . Therefore, the inverse Laplace transform of can be written as

By (86) and (93), we can get that

Then, by (72) and (94), the Laplace transform of can be expressed as

where and . Then, applying the inverse Laplace transform to (95), one can get that

Based on the explicit expressions for , , , , and provided respectively in (83), (85), (89), (93), and (96), we can now present values of and across varying values of , systematically investigating their dependence with different combinations of the parameters , , , and .

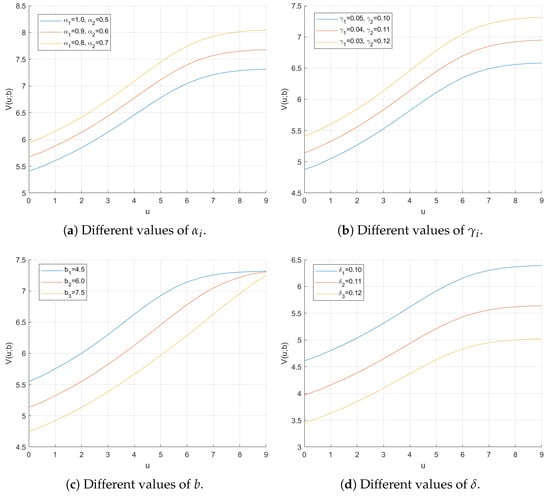

In Table 1, Table 2, Table 3 and Table 4, we systematically present the numerical computation results of the function under different combinations of parameters , , , and . Through these four comparative tables, we present quantitative data that analyze the effects of these parameters on . To further uncover the patterns in the variation of the function, Figure 2a–d depict the corresponding curves of using visualization methods, intuitively demonstrating its dynamic characteristics as it evolves with the independent variable . Through a systematic analysis of the data in Table 1, Table 2, Table 3 and Table 4 and the observations given in Figure 2a–d, we have identified a significant common trend: within the studied parameter ranges, the value function increases strictly with each of the parameters , , , and . This result unequivocally demonstrates the systematic regulatory effects of these parameters on , where an increase in any individual parameter directly leads to the enhancement of the value function. Figure 2a reveals a crucial detail about the strategy. When the company reduces the dividend payout ratio for the first type of observation (less frequent, ), it simultaneously increases the payout ratio for the second type of observation (more frequent, ). Since the second type of event occurs twice as frequently as the first, the positive contribution of the increased payout ratio to total expected dividends outweighs the negative impact of the reduced payout ratio for the first type. Therefore, the net effect of the strategy is an increase in expected shareholder returns. This demonstrates that combining a higher dividend payout ratio with more frequent observations is an effective way to maximize shareholder value when designing a multiperiod dividend strategy. For Figure 2b, which suggests that increasing the value of allows the company to more promptly capture surplus exceeding the threshold and pay dividends, thereby increasing . Furthermore, it further suggests that, given limited resources, prioritizing increasing the frequency of observation types associated with higher dividend payout ratios is a more effective way to maximize shareholder value. Figure 2c shows that a higher threshold implies that the company is employing a more conservative capital strategy, requiring the retention of more surplus as a safety buffer. This reduces risk but also delays and reduces dividend payments, thereby lowering . Conversely, a lower threshold represents a more aggressive strategy, making it more likely that dividend payments will be triggered and thereby maximizing short-term cash returns to shareholders, but it may also make the company more vulnerable to future negative shocks. Figure 2d illustrates the application of standard financial valuation principles. The discount rate represents the time value of money. Since dividends are a series of cash flows paid at different points in the future, a higher discount rate means that future dividends are worth less today. This emphasizes the importance of the macro interest-rate environment in assessing the value of a company’s dividend strategy.

Table 1.

For the main parameters , , , , , , where , and , the specific computed results for under an exponential distribution.

Table 2.

For the main parameters , , , , , , where , and , the specific computed results for under an exponential distribution.

Table 3.

For the main parameters , , , , , , , and , the specific computed results for under an exponential distribution.

Table 4.

For the main parameters , , , , , , , and , the specific computed results for under an exponential distribution.

Figure 2.

Graphs of versus for varying parameter values.

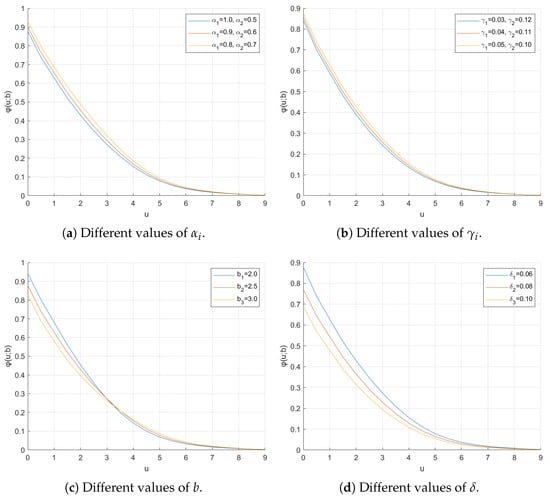

On the other hand, Table 5, Table 6, Table 7 and Table 8 present numerical results for the Gerber–Shiu function under various combinations of parameters , , , and . To further explore the function’s patterns in variation, Figure 3a–d illustrate its curves, highlighting how changes with the independent variable . This integration of tabular data and graphical representations provides dual validation of the function’s behavior through numerical and visual analysis. Analysis of the parameter combinations in Table 5, Table 6, Table 7 and Table 8 alongside trends in Figure 3a–d reveals a clear pattern: decreases with increases in each parameter , , , or . This finding confirms the parameters’ inhibitory effects on , offering quantitative insights into its sensitivity. Figure 3a further illustrates the risk–return trade-off. When companies increase their dividend payout ratios for the more frequent second-type events, the result is more frequent and larger capital outflows overall. This “more efficient” capital distribution, while increasing shareholders’ expected returns , also causes the company’s capital buffer to be depleted more quickly, increasing its ruin risk in the event of future adverse shocks. Figure 3b shows that more frequent surplus checks (i.e., increasing ), while they create more opportunities for increased dividend payments (as shown in Figure 2b), also lead to more frequent capital outflows. This continuous “capital depletion” weakens the company’s risk buffer, making it more vulnerable to future significant losses and increasing the likelihood of ruin. This further highlights the inherent contradiction between maximizing dividends and controlling risk. Figure 3c demonstrates that raising the dividend payout threshold (i.e., increasing ) is a conservative financial strategy. It forces companies to build a stronger capital base before distributing profits to shareholders. This larger capital buffer can more effectively withstand future adverse shocks, significantly reducing the company’s ruin risk, as reflected in the decline in . For Figure 3d, since measures the expected discounted value of future penalties incurred in the event of ruin, ruin is an event that may occur in the distant future. According to the time value principle, the later an event occurs, the lower its present value today. When the discount rate increases, future events are discounted more severely. Therefore, even if the actual probability of ruin remains unchanged, the discounted expected penalty value will decrease accordingly.

Table 5.

For the main parameters , , , , , , where , and , the specific computed results for under an exponential distribution.

Table 6.

For the main parameters , , , , , , where , and , the specific computed results for under an exponential distribution.

Table 7.

For the main parameters , , , , , , , and , the specific computed results for under an exponential distribution.

Table 8.

For the main parameters , , , , , , , and , the specific computed results for under an exponential distribution.

Figure 3.

Graphs of versus for varying parameter values.

In this study, we analyzed the multi-periodic threshold dividend strategy under the spectrally negative Lévy risk model, deriving explicit solutions for the expected present value of dividends and the Gerber–Shiu function. Numerical results suggest that the proposed multi-periodic strategy outperforms traditional single-period strategies under certain parameter settings. Theoretically, this research extends the application of Lévy risk models to dividends, particularly in the context of multi-periodic observations. It provides a novel perspective for future studies, such as those that may explore the impact of varying observation interval distributions on dividend strategies. Practically, the proposed strategy offers actionable insights for insurance companies’ dividend strategies, especially in scenarios requiring periodic policy reviews. By optimizing the timing and amount of dividend payments, firms can enhance risk management and improve capital efficiency.

7. Conclusions

This paper studies the spectrally negative Lévy risk model under a multithreshold strategy. The integro-differential equations for and are derived separately. Through the application of the discounted increment density, the operator introduced by Dickson and Hipp, and the inverse Laplace transform, we obtain explicit expressions for the integro-differential equations of two specified variables. Lastly, a range of numerical solutions is demonstrated to highlight the utility of this framework in studying the target function.

In addition, we can generalize the research content of this paper as follows: on the one hand, we can replace the target model with the framework of a spectrally positive Lévy risk model; on the other hand, when studying multitype period threshold strategies in this paper, the period time interval is assumed to be exponential, and we can extend this distribution to an Erlang(n) distribution or a mixed exponential distribution. We propose to retain these extensible research questions as open-ended issues to facilitate in-depth exploration by future researchers.

Author Contributions

Conceptualization, S.S. and Z.L.; methodology, Z.L.; software, S.S.; validation, S.S. and Z.L.; formal analysis, S.S. and Z.L.; investigation, S.S. and Z.Y.; resources, Z.L.; data curation, S.S.; writing—original draft preparation, S.S.; writing—review and editing, S.S. and Z.L.; visualization, S.S.; supervision, Z.L.; project administration, Z.L.; funding acquisition, Z.L. All authors have read and agreed to the published version of the manuscript.

Funding

The work was supported by: National Natural Science Foundation of China (No. 12361095) and National Natural Science of Jiangxi province (No. 20232BAB201028).

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Correction Statement

This article has been republished with a minor correction to the Data Availability Statement. This change does not affect the scientific content of the article.

References

- Aguilar, Jean-Philippe, and Justin Lars Kirkby. 2023. Closed-form option pricing for exponential Lévy models: A residue approach. Quantitative Finance 23: 251–78. [Google Scholar] [CrossRef]

- Albrecher, Hansjoerg, Eric C. K. Cheung, and Stefan Thonhauser. 2013. Randomized observation periods for the compound Poisson risk model: The discounted penalty function. Scandinavian Actuarial Journal 2013: 424–52. [Google Scholar] [CrossRef]

- Albrecher, Hansjörg, and Stefan Thonhauser. 2008. Optimal dividend strategies for a risk process under force of interest. Insurance: Mathematics and Economics 43: 134–49. [Google Scholar] [CrossRef]

- Albrecher, Hansjörg, Eric C. K. Cheung, and Stefan Thonhauser. 2011. Randomized observation periods for the compound Poisson risk model: Dividends. ASTIN Bulletin: The Journal of the IAA 41: 645–72. [Google Scholar]

- Albrecher, Hansjörg, Jevgenijs Ivanovs, and Xiaowen Zhou. 2016. Exit identities for Lévy processes observed at Poisson arrival times. Bernoulli 22: 1364–82. [Google Scholar] [CrossRef]

- Asmussen, Søren, and Michael Taksar. 1997. Controlled diffusion models for optimal dividend pay-out. Insurance: Mathematics and Economics 20: 1–15. [Google Scholar] [CrossRef]

- Avanzi, Benjamin. 2009. Strategies for dividend distribution: A review. North American Actuarial Journal 13: 217–51. [Google Scholar] [CrossRef]

- Avanzi, Benjamin, Hayden Lau, and Bernard Wong. 2021. Optimal periodic dividend strategies for spectrally negative Lévy processes with fixed transaction costs. Scandinavian Actuarial Journal 2021: 645–70. [Google Scholar] [CrossRef]

- Avanzi, Benjamin, Vincent Tu, and Bernard Wong. 2014. On optimal periodic dividend strategies in the dual model with diffusion. Insurance: Mathematics and Economics 55: 210–24. [Google Scholar] [CrossRef]

- Bertoin, Jean. 1996. Lévy Processes. Cambridge: Cambridge University Press, vol. 121. [Google Scholar]

- Cheung, Eric C. K., and Zhimin Zhang. 2019. Periodic threshold-type dividend strategy in the compound Poisson risk model. Scandinavian Actuarial Journal 2019: 1–31. [Google Scholar] [CrossRef]

- Cont, Rama, and Peter Tankov. 2003. Financial Modelling with Jump Processes. Boca Raton: Chapman and Hall/CRC. [Google Scholar]

- De Finetti, Bruno. 1957. Su un’impostazione alternativa della teoria collettiva del rischio. Paper presented at theTransactions of the XVth International Congress of Actuaries, New York, NY, USA, October 14–22, vol. 2, pp. 433–43. [Google Scholar]

- Emmer, Susanne, and Claudia Klüppelberg. 2004. Optimal portfolios when stock prices follow an exponential Lévy process. Finance and Stochastics 8: 17–44. [Google Scholar] [CrossRef]

- Gao, Zhongqin, Jingmin He, Zhifeng Zhao, and Bingbing Wang. 2022. Omega model for a jump-diffusion process with a two-step premium rate and a threshold dividend strategy. Methodology and Computing in Applied Probability 24: 233–58. [Google Scholar] [CrossRef]

- Irie, Haruka, and Yasutaka Shimizu. 2024. Approximation and estimation of scale functions for spectrally negative Lévy processes. arXiv arXiv:2402.13599. [Google Scholar]

- Jeanblanc-Picqué, Monique, and Albert N. Shiryaev. 1995. Optimization of the flow of dividends. Russian Mathematical Surveys 50: 257–78. [Google Scholar] [CrossRef]

- Ken-Iti, Sato. 1999. Lévy Processes and Infinitely Divisible Distributions. Cambridge: Cambridge University Press, vol. 68. [Google Scholar]

- Kuznetsov, Alexey, Andreas E. Kyprianou, and Victor Rivero. 2012. The Theory of Scale Functions for Spectrally Negative Lévy Processes. Lévy Matters II. Berlin/Heidelberg: Springer, pp. 97–186. [Google Scholar]

- Kyprianou, Andreas E. 2014. Fluctuations of Lévy Processes with Applications: Introductory Lectures. Berlin/Heidelberg: Springer Science & Business Media. [Google Scholar]

- Landriault, David, Bin Li, and Mohamed Amine Lkabous. 2021. On the analysis of deep drawdowns for the Lévy insurance risk model. Insurance: Mathematics and Economics 100: 147–55. [Google Scholar] [CrossRef]

- Landriault, David, Jean-François Renaud, and Xiaowen Zhou. 2011. Occupation times of spectrally negative Lévy processes with applications. Stochastic Processes and Their Applications 121: 2629–41. [Google Scholar] [CrossRef]

- Li, Shuanming, and José Garrido. 2004. On a class of renewal risk models with a constant dividend barrier. Insurance: Mathematics and Economics 35: 691–701. [Google Scholar] [CrossRef]

- Lin, X. Sheldon, and Kristina P. Pavlova. 2006. The compound Poisson risk model with a threshold dividend strategy. Insurance: Mathematics and Economics 38: 57–80. [Google Scholar] [CrossRef]

- Lv, Shuai, Shujie Liu, Hongkun Li, Yu Wang, Gengshuo Liu, and Wei Dai. 2024. A hybrid method combining Lévy process and neural network for predicting remaining useful life of rotating machinery. Advanced Engineering Informatics 61: 102490. [Google Scholar] [CrossRef]

- Mata, Dante, Harold A. Moreno-Franco, Kei Noba, and José-Luis Pérez. 2023. On the bailout dividend problem with periodic dividend payments for spectrally negative Markov additive processes. Nonlinear Analysis: Hybrid Systems 48: 101332. [Google Scholar] [CrossRef]

- Mohammad, Kazi Mehedi, Mayesha Sharmim Tisha, and Md Kamrujjaman. 2024. Wiener and Lévy processes to prevent disease outbreaks: Predictable vs. stochastic analysis. Partial Differential Equations in Applied Mathematics 10: 100712. [Google Scholar] [CrossRef]

- Morozova, Ekaterina, and Vladimir Panov. 2023. Modelling the Bitcoin prices and media attention to Bitcoin via the jump-type processes. Applied Stochastic Models in Business and Industry 39: 772–88. [Google Scholar] [CrossRef]

- Ng, Andrew CY. 2009. On a dual model with a dividend threshold. Insurance: Mathematics and Economics 44: 315–24. [Google Scholar] [CrossRef]

- Noba, Kei. 2021. On the optimality of double barrier strategies for Lévy processes. Stochastic Processes and Their Applications 131: 73–102. [Google Scholar] [CrossRef]

- Peng, Xuanhua, Wen Su, and Zhimin Zhang. 2020. On a perturbed compound Poisson risk model under a periodic threshold-type dividend strategy. Journal of Industrial & Management Optimization 16: 1967–86. [Google Scholar] [CrossRef]

- Pérez, José-Luis, and Kazutoshi Yamazaki. 2018. Mixed periodic-classical barrier strategies for Lévy risk processes. Risks 6: 33. [Google Scholar] [CrossRef]

- Renaud, Jean-François. 2019. De Finetti’s control problem with Parisian ruin for spectrally negative Lévy processes. Risks 7: 73. [Google Scholar] [CrossRef]

- Schoutens, Wim. 2003. Lévy Processes in Finance: Pricing Financial Derivatives. Chichester, West Sussex and New York: J. Wiley, pp. 1–180. [Google Scholar]

- Shen, Ying, Chuan-cun Yin, and Kam Chuen Yuen. 2013. Alternative approach to the optimality of the threshold strategy for spectrally negative Lévy processes. Acta Mathematicae Applicatae Sinica, English Series 29: 705–16. [Google Scholar] [CrossRef]

- Shirvani, Abootaleb, Stefan Mittnik, William Brent Lindquist, and Svetlozar Rachev. 2024. Bitcoin volatility and intrinsic time using double-subordinated lévy processes. Risks 12: 82. [Google Scholar] [CrossRef]

- Song, Zhan-Jie, and Fu-Yun Sun. 2023. The dual risk model under a mixed ratcheting and periodic dividend strategy. Communications in Statistics-Theory and Methods 52: 3526–40. [Google Scholar] [CrossRef]

- Wang, Wenyuan, Ping Chen, and Shuanming Li. 2020. Generalized expected discounted penalty function at general drawdown for Lévy risk processes. Insurance: Mathematics and Economics 91: 12–25. [Google Scholar] [CrossRef]

- Xie, Jiayi, and Zhimin Zhang. 2021. Finite-time dividend problems in a Lévy risk model under periodic observation. Applied Mathematics and Computation 398: 125981. [Google Scholar] [CrossRef]

- Yang, Chen, Kristina P. Sendova, and Zhong Li. 2020. Parisian ruin with a threshold dividend strategy under the dual Lévy risk model. Insurance: Mathematics and Economics 90: 135–50. [Google Scholar] [CrossRef]

- Yoon, Eun Bi, Keehun Park, Sungwoong Kim, and Sungbin Lim. 2023. Score-based generative models with Lévy processes. Advances in Neural Information Processing Systems 36: 40694–707. [Google Scholar]

- Yu, Wenguang, Yujuan Huang, and Chaoran Cui. 2018. The absolute ruin insurance risk model with a threshold dividend strategy. Symmetry 10: 377. [Google Scholar] [CrossRef]

- Zhang, Aili. 2022. Gerber–Shiu function at draw-down Parisian ruin time for the spectrally negative Lévy risk process. Bulletin of the Iranian Mathematical Society 48: 1895–917. [Google Scholar] [CrossRef]

- Zhong, Wei, Yongxia Zhao, and Ping Chen. 2021. Equilibrium periodic dividend strategies with non-exponential discounting for spectrally positive Lévy processes. Journal of Industrial and Management Optimization 17: 2639–67. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).