The Determinants of Reward-Based Crowdfunding Success in Africa

Abstract

1. Introduction

2. Literature Review

Theories Used in This Study and the Development of Research Hypotheses

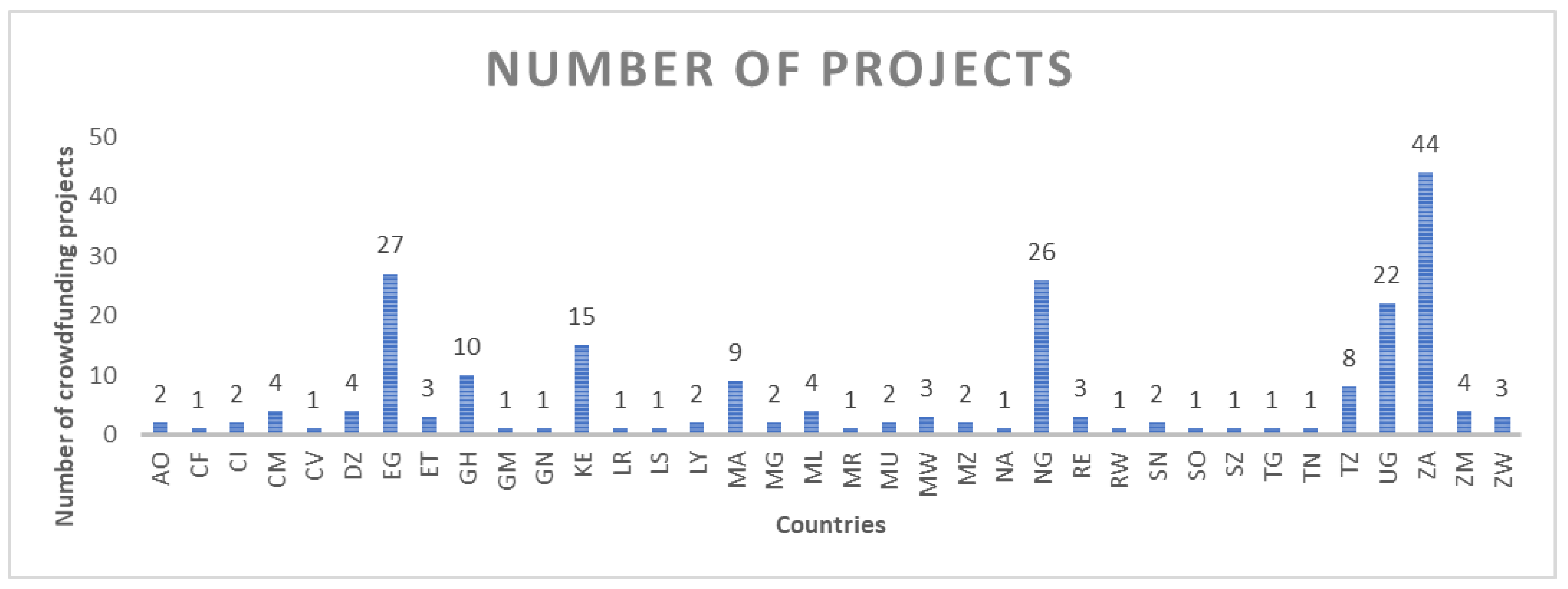

3. Research Method and Materials

Logistic Regression Model 1 of an Equation

4. Research Findings and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Dependent Variable: Success | ||||

|---|---|---|---|---|

| Method: ML—Binary Logit (Newton–Raphson/Marquardt Steps) | ||||

| Variable | Coefficient | Std. Error | z-Statistic | Prob. |

| SPR | −0.899021 | 0.922751 | −0.974283 | 0.3299 |

| DR | 0.555500 | 0.798641 | 0.695556 | 0.4867 |

| BCK | 0.086827 | 0.019250 | 4.510372 | 0.0000 |

| VD | 0.316703 | 0.824335 | 0.384192 | 0.7008 |

| IM | 1.320547 | 1.140280 | 1.158090 | 0.2468 |

| TA | −1.513360 | 0.399182 | −3.791155 | 0.0001 |

| C | 5.587175 | 3.315316 | 1.685262 | 0.0919 |

| McFadden R-squared | 0.674197 | Mean dependent var | 0.153488 | |

| S.D. dependent var | 0.361299 | S.E. of regression | 0.195133 | |

| Akaike info criterion | 0.344468 | Sum squared resid | 7.920018 | |

| Schwarz criterion | 0.454209 | Log likelihood | −30.03027 | |

| Hannan–Quinn criter. | 0.388808 | Deviance | 60.06054 | |

| Restr. deviance | 184.3464 | Restr. log likelihood | −92.17321 | |

| LR statistic | 124.2859 | Avg. log likelihood | −0.139676 | |

| Prob (LR statistic) | 0.000000 | |||

References

- Abdelfattah, Rana Maged Mahmoud. 2023. The Impact of Fintech on Financial Inclusion in Egypt. Available online: https://www.researchgate.net/profile/Rana-Maged/publication/371082526_The_Impact_of_Fintech_on_Financial_Inclusion_in_Egypt/links/647ddb17d702370600d69d74/The-Impact-of-Fintech-on-Financial-Inclusion-in-Egypt.pdf (accessed on 16 March 2024).

- Ackah, Betty. 2021. Blockchain and Gender Digital Inequalities in Africa: A Critical Afrocentric Analysis. Available online: https://summit.sfu.ca/_flysystem/fedora/2022-08/input_data/21996/etd21486.pdf (accessed on 16 September 2024).

- African Crowdfunding Association. 2022. Africa Crowdfunding Landscape Report 2022. Cape Town: African Crowdfunding Association. Available online: https://www.africancrowd.org (accessed on 5 May 2025).

- Agrawal, Ajay, Christian Catalini, and Avi Goldfarb. 2015. Crowdfunding: Geography, social networks, and the timing of investment decisions. Journal of Economics & Management Strategy 24: 253–74. [Google Scholar] [CrossRef]

- Ahmed, Shamira. 2021. A gender perspective on using artificial intelligence in the African fintech ecosystem: Case studies from South Africa, Kenya, Nigeria, and Ghana. Paper presented at 23rd Biennial Conference of the International Telecommunications Society (ITS), Gothenburg, Sweden, June 21–23; Available online: https://hdl.handle.net/10419/238002 (accessed on 15 November 2024).

- Aideyan, Sarah Nnenna. 2023. Reward-Based Crowdfunding in Nigeria: Exploring the Mechanism of Trust. Available online: https://pureportal.coventry.ac.uk/en/studentthesis/rewardbased-crowdfunding-in-nigeria-exploring-the-mechanism-of-trust(4d4f5041-90f7-439b-9633-2e07f16366c3).html (accessed on 16 September 2024).

- Arifin, Firmansyah, Marlina Widiyanti, and Isni Andriana. 2024. Crowdfunding Success Factors: Financial Information and Advertising Finance. KnE Social Sciences, 702–17. [Google Scholar] [CrossRef]

- Berndt, Adele. 2016. Crowdfunding in the African context: A new way to fund ventures. In Entrepreneurship and SME Management Across Africa: Context, Challenges, Cases. Edited by Leona Achtenhagen and Ethel Brundin. Singapore: Springer, pp. 31–49. [Google Scholar] [CrossRef]

- Blanchard, Simon J., Theodore J. Noseworthy, Ethan Pancer, and Maxwell Poole. 2023. Extraction of Visual Information to Predict Crowdfunding Success. arXiv arXiv:2203.14806. [Google Scholar] [CrossRef]

- Blaseg, Daniel, Douglas Cumming, and Michael Koetter. 2021. Equity crowdfunding: High-quality or low-quality entrepreneurs? Entrepreneurship Theory and Practice 45: 505–30. [Google Scholar] [CrossRef]

- Buttice, Vincenzo, and Paola Rovelli. 2020. “Fund me, I am fabulous!” Do narcissistic entrepreneurs succeed or fail in crowdfunding? Personality and Individual Differences 162: 1–7. [Google Scholar] [CrossRef]

- Butticè, Vincenzo, and Silvio Vismara. 2022. Inclusive digital finance: The industry of equity crowdfunding. The Journal of Technology Transfer 47: 1224–41. [Google Scholar] [CrossRef]

- Butticè, Vincenzo, and Douglas Noonan. 2020. Active backers, product commercialisation and product quality after a crowdfunding campaign: A comparison between first-time and repeated entrepreneurs. International Small Business Journal 38: 111–34. [Google Scholar] [CrossRef]

- Chan, CS Richard, Charuta Pethe, and Steven Skiena. 2021. Natural language processing versus rule-based text analysis: Comparing BERT score and readability indices to predict crowdfunding outcomes. Journal of Business Venturing Insights 16: 1–17. [Google Scholar] [CrossRef]

- Chao, Emmanuel James, Priscilla Serwaah, Prince Baah-Peprah, and Rotem Shneor. 2020. Crowdfunding in Africa: Opportunities and challenges. In Advances in Crowdfunding. Cham: Palgrave Macmillan, pp. 319–39. [Google Scholar] [CrossRef]

- Courtney, Christopher, Supradeep Dutta, and Yong Li. 2017. Resolving information asymmetry: Signaling, endorsement, and crowdfunding success. Entrepreneurship Theory and Practice 41: 265–90. [Google Scholar] [CrossRef]

- Cowling, Marc, Ross Brown, and Augusto Rocha. 2020. Did you save some cash for a rainy COVID-19 day? The crisis and SMEs. International Small Business Journal 38: 593–604. [Google Scholar] [CrossRef]

- Deng, Lingfei, Qiang Ye, DaPeng Xu, Wenjun Sun, and Guangxin Jiang. 2022. A literature review and integrated framework for the determinants of crowdfunding success. Financial Innovation 8: 1–70. [Google Scholar] [CrossRef]

- Djimesah, Isaac Edem, Hongjiang Zhao, Agnes Naa Dedei Okine, Elijah Duah, Kingsford Kissi Mireku, and Kenneth Wilson Adjei Budu. 2023. What factor is essential in successful crowdfunding: A MULTIMOORA-EDAS approach to explore factors that influence the success of crowdfunding campaigns. Kybernetes 54: 909–35. Available online: https://www.emerald.com/insight/0368-492X.htm (accessed on 16 October 2024). [CrossRef]

- Domencich, Thomas A., and Daniel McFadden. 1975. Urban Travel Demand Behavioural Analysis (No. Monograph). Available online: https://trid.trb.org/View/48594 (accessed on 19 September 2024).

- dos Santos Felipe, Israel José, Wesley Mendes-Da-Silva, Cristiana Cerqueira Leal, and Danilo Braun Santos. 2022. Reward crowdfunding campaigns: Time-to-success analysis. Journal of Business Research 138: 214–28. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M. 1989. Building theories from case study research. Academy of Management Review 14: 532–50. [Google Scholar] [CrossRef]

- Ge, Ruichen, Sha Zhang, and Hong Zhao. 2025. How do Timing and Narrative Tone Influence the Impact of Pro-environmental Orientation on Crowdfunding Performance? Finance Research Letters 75: 1–8. [Google Scholar] [CrossRef]

- Gujarati, Damodar. N., and Dawn. C. Porter. 2009. Basic Econometrics, 5th ed. New York: McGraw-Hill. [Google Scholar]

- Fang, Xue, Chaowu Xie, Jun Yu, Songshan Huang, and Jiangchi Zhang. 2023. How do short-form travel videos trigger travel inspiration? Identifying and validating the driving factors. Tourism Management Perspectives 47: 1–20. [Google Scholar] [CrossRef]

- Fourkan, Md. 2021. Crowdfunding: Antecedents of a number of backers and success of a project. International Journal of Small Business and Entrepreneurship Research 9: 1–13. Available online: https://ssrn.com/abstract=3865312 (accessed on 19 September 2024).

- Herd, Kelly B., Girish Mallapragada, and Vishal Narayan. 2022. Do backer affiliations help or hurt crowdfunding success? Journal of Marketing 86: 117–34. [Google Scholar] [CrossRef]

- Hellmann, Thomas, and Joseph Stiglitz. 2000. Credit and equity rationing in markets with adverse selection. European Economic Review 44: 281–304. [Google Scholar] [CrossRef]

- Ho, Han-Chiang, Candy Lim Chiu, Somkiat Mansumitrchai, Zhengqing Yuan, Nan Zhao, and Jiajie Zou. 2021. The influence of signals on donation crowdfunding campaign success during COVID-19 crisis. International Journal of Environmental Research and Public Health 18: 7715. [Google Scholar] [CrossRef] [PubMed]

- Hou, Jian-Ren, Jie Zhang, and Kunpeng Zhang. 2023. Pictures that are worth a thousand donations: How emotions in project images drive the success of online charity fundraising campaigns? An image design perspective. Management Information Systems Quarterly 47: 535–84. Available online: https://kpzhang.github.io/paper/MISQ-Web-Appendix.pdf (accessed on 20 August 2024). [CrossRef]

- Huang, Shuangfa, David Pickernell, Martina Battisti, and Thang Nguyen. 2022. Signalling entrepreneurs’ credibility and project quality for crowdfunding success: Cases from the Kickstarter and Indiegogo environments. Small Business Economics 58: 1801–21. [Google Scholar] [CrossRef]

- Huang, Yi, Marilyn A. Uy, Chang Liu, Maw-Der Foo, and Zhuyi Angelina Li. 2023. Visual totality of rewards-based crowdfunding pitch videos: Disentangling the impact of peak negative affective visual expression on funding outcomes. Journal of Business Venturing 38: 1–23. [Google Scholar] [CrossRef]

- Jung, Eunjun, Changjun Lee, and Junseok Hwang. 2022. Effective strategies to attract crowdfunding investment based on the novelty of business ideas. Technological Forecasting and Social Change 178: 1–16. [Google Scholar] [CrossRef]

- Kenworthy, Nora J. 2019. Crowdfunding and global health disparities: An exploratory conceptual and empirical analysis. Globalisation and Health 15: 1–13. [Google Scholar] [CrossRef]

- Kim, Jong Hae. 2019. Multicollinearity and misleading statistical results. Korean Journal of Anesthesiology 72: 558–69. [Google Scholar] [CrossRef]

- Kim, Keongtae, Jooyoung Park, Yang Pan, Kunpeng Zhang, and Xiaoquan Zhang. 2022. Risk disclosure in crowdfunding. Information Systems Research 33: 1023–41. [Google Scholar] [CrossRef]

- Kuma, Francis Kwaku, and Mohd. Effandi Bin Yusoff. 2021. Resolving information asymmetric and social network theories challenges in crowdfunding campaigns. Resolving Information Asymmetric and Social Network Theories Challenges in Crowdfunding Campaigns 1: 89–102. [Google Scholar] [CrossRef]

- Kuma, Francis Kwaku, Mohd Effandi Bin Yusoff, and Paul Kwasi Apreku-Djan. 2022. A Synthesis of Crowdfunding Concepts in the Ghanaian Context: Crowdfunding Information Challenges in Ghana. Journal of the Knowledge Economy 15: 435–60. [Google Scholar] [CrossRef]

- Lagazio, Corrado, and Francesca Querci. 2018. Exploring the multi-sided nature of crowdfunding campaign success. Journal of Business Research 90: 318–24. [Google Scholar] [CrossRef]

- Liu, Zhunzhun, Shenglin Ben, and Ruidong Zhang. 2023. Factors affecting crowdfunding success. Journal of Computer Information Systems 63: 241–56. [Google Scholar] [CrossRef]

- Li, Liangqiang, Liang Yang, Meng Zhao, Miyan Liao, and Yunzhong Cao. 2022. Exploring the success determinants of crowdfunding for cultural and creative projects: An empirical study based on signal theory. Technology in Society 70: 1–13. [Google Scholar] [CrossRef]

- Li, Yaokuang, and Junjuan Du. 2020. What drives the rapid achievement of a funding target in crowdfunding? Evidence from China. Agricultural Economics 66: 269–77. [Google Scholar] [CrossRef]

- Liang, Ting-Peng, Shelly Ping-Ju Wu, and Chih-chi Huang. 2019. Why funders invest in crowdfunding projects: Role of trust from the dual-process perspective. Information & Management 56: 70–84. [Google Scholar] [CrossRef]

- Ma, Zecong. 2023. Early backers’ social and geographic influences on the success of crowdfunding. Journal of Research in Interactive Marketing 17: 510–26. [Google Scholar] [CrossRef]

- Maiolini, Riccardo, Stefano Franco, Francesco Cappa, and Darren Hayes. 2023. Optimizing Reward-Based Crowdfunding. IEEE Engineering Management Review 51: 55–62. [Google Scholar] [CrossRef]

- Mamaro, Lenny Phulong, and Athenia Bongani Sibindi. 2023. The drivers of successful crowdfunding projects in Africa during the COVID-19 pandemic. Journal of Risk and Financial Management 16: 332. [Google Scholar]

- Maow, Bashir Ahmed. 2021. The impact of small and medium enterprises (SMEs) on economic growth and job creation in Somalia. Journal of Economic Policy Researches 8: 45–56. [Google Scholar] [CrossRef]

- McGuire, Erin. 2020. Can Equity Crowdfunding Mitigate the Gender Gap in Startup Finance? Briarcliff Manor: Academy of Management. [Google Scholar] [CrossRef]

- McFadden, Daniel. 1974. The measurement of urban travel demand. Journal of Public Economics 3: 303–28. [Google Scholar] [CrossRef]

- Miller, Tim. 2019. Explanation in artificial intelligence: Insights from the social sciences. Artificial Intelligence 267: 1–38. [Google Scholar] [CrossRef]

- Mochkabadi, Kazem, and Christine K. Volkmann. 2020. Equity crowdfunding: A systematic review of the literature. Small Business Economics 54: 75–118. [Google Scholar] [CrossRef]

- Molla, Alemayehu, and Ashenafi Biru. 2023. The evolution of the Fintech entrepreneurial ecosystem in Africa: An exploratory study and model for future development. Technological Forecasting and Social Change 186: 1–17. [Google Scholar] [CrossRef]

- Mollick, Ethan. 2014. The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing 29: 1–16. [Google Scholar] [CrossRef]

- Noor, A., Tanjela Hossain, and Hasan Shirazi. 2022. Crowdfunding: A New Approach to Entrepreneurship’s Startup Phase. ABC Journal of Advanced Research 11: 83–96. [Google Scholar] [CrossRef]

- Piening, Erk P., Ferdinand Thies, Michael Wessel, and Alexander Benlian. 2021. Searching for success—entrepreneurs’ responses to crowdfunding failure. Entrepreneurship Theory and Practice 45: 626–57. [Google Scholar] [CrossRef]

- Prasobpiboon, Somboon, Roongkiat Ratanabanchuen, Achara Chandrachai, and Sipat Triukose. 2021. Success factors in project fundraising under the reward-based crowdfunding platform. Academy of Entrepreneurship Journal 27: 1–20. Available online: https://www.proquest.com/info/openurldocerror?accountid=14648 (accessed on 15 September 2024).

- Rončević, Ante, and Petra Furdi Šafarić. 2023. Crowdfunding as a Financing Alternative for Entrepreneurial Ventures. Croatian Regional Development Journal 4: 34–55. [Google Scholar] [CrossRef]

- Salvi, Antonio, Nicola Raimo, Felice Petruzzella, and Filippo Vitolla. 2022. The role of communication in restaurant crowdfunding success. British Food Journal 124: 4323–38. [Google Scholar] [CrossRef]

- Sauermann, Henry, Chiara Franzoni, and Kourosh Shafi. 2019. Crowdfunding scientific research: Descriptive insights and correlates of funding success. PLoS ONE 14: e0208384. [Google Scholar] [CrossRef]

- Sendra-Pons, Pau, Dolores Garzón, and María-Ángeles Revilla-Camacho. 2024. Catalysing success in equity crowdfunding: Trust-building strategies through signalling. Review of Managerial Science 18: 2699–721. [Google Scholar] [CrossRef]

- Shneor, Rotem, Urszula Mrzygłód, Joanna Adamska-Mieruszewska, and Anna Fornalska-Skurczyńska. 2022. The role of social trust in reward crowdfunding campaigns’ design and success. Electronic Markets 32: 1–16. [Google Scholar] [CrossRef]

- Silva, Lafaiet, Nádia Félix Silva, and Thierson Rosa. 2020. Success prediction of crowdfunding campaigns: A two-phase modeling. International Journal of Web Information Systems 16: 387–412. [Google Scholar] [CrossRef]

- Spence, Michael. 1978. Job market signalling. In Uncertainty in Economics. Cambridge: Academic Press, pp. 281–306. [Google Scholar] [CrossRef]

- Strausz, Roland. 2017. A theory of crowdfunding: A mechanism design approach with demand uncertainty and moral hazard. American Economic Review 107: 1430–76. [Google Scholar] [CrossRef]

- Soltani Delgosha, Mohammad, Nastaran Hajiheydari, and Hossein Olya. 2024. A person-centred view of citizen participation in civic crowdfunding platforms: A mixed-methods study of civic backers. Information Systems Journal 34: 1626–63. [Google Scholar] [CrossRef]

- Spence, Michael. 2002. Signalling in retrospect and the informational structure of markets. American Economic Review 92: 434–59. [Google Scholar] [CrossRef]

- Troise, Ciro, and Mario Tani. 2020. Exploring entrepreneurial characteristics, motivations and behaviours in equity crowdfunding: Some evidence from Italy. Management Decision 59: 995–1024. [Google Scholar] [CrossRef]

- Ullah, Saif, and Yulin Zhou. 2020. Gender, anonymity and team: What determines crowdfunding success on Kickstarter. Journal of Risk and Financial Management 13: 80. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2016. Introductory Econometrics: A Modern Approach, 6th ed. Belmont: Cengage Learning. Available online: http://dspace.kottakkalfarookcollege.edu.in:8001/jspui/bitstream/123456789/3869/1/Introductory%20econometrics.%20A%20modern%20approach%20%28%20PDFDrive%20%29%20%281%29.pdf (accessed on 4 April 2025).

- World Bank. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19. Washington, DC: World Bank. Available online: https://www.worldbank.org/en/publication/globalfindex (accessed on 4 May 2025).

- Xu, Yan, and Jian Ni. 2022. Entrepreneurial learning and disincentives in crowdfunding markets. Management Science 68: 6819–64. [Google Scholar] [CrossRef]

- Zhang, Xinfang. 2022. The Role of Images in the Performance of Crowdfunding Projects. Paper presented at 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), Online, January 14–16; Paris: Atlantis Press. ISBN 978-94-6239-554-1. [Google Scholar]

- Zhang, Xupin, Xinqi Tao, Bingxiang Ji, Renwu Wang, and Silvia Sörensen. 2023. The success of cancer crowdfunding campaigns: Project and text analysis. Journal of Medical Internet Research 25: 1–22. [Google Scholar] [CrossRef]

- Zhu, Xun. 2022. Proximal language predicts crowdfunding success: Behavioral and experimental evidence. Computers in Human Behavior 131: 1–13. [Google Scholar] [CrossRef]

- Ziegler, Tania, Rotem Shneor, and Bryan Zheng Zhang. 2020. The global status of the crowdfunding industry. In Advances in Crowdfunding. Cham: Palgrave Macmillan, pp. 43–61. [Google Scholar] [CrossRef]

- Zhou, Mi, Baozhou Lu, Weiguo Fan, and G. Alan Wang. 2018. Project description and crowdfunding success: An exploratory study. Information Systems Frontiers 20: 259–74. [Google Scholar] [CrossRef]

| Crowdfunding success (SP) | Whether the targeted amount of the project/campaign was reached | The binary variable of 1 if the targeted amount was obtained and 0 otherwise |

| Duration (DR) | The number of days for the project/campaign to raise funds | Transformed as log |

| Spelling errors (SPR) | Grammatical mistakes detected by automated tools and manual verification; backers counted as unique contributors per project | The binary variable of 1 if there are spelling errors on the project page and 0 otherwise |

| Targeted amount (TA) | The amount requested by the fund seeker or entrepreneur | Transformed as log |

| Backers (BCK) | Backer counts and amounts of funding were log-transformed to correct for skewed distribution | Transformed as log |

| Videos (VD) | The presence of videos on the project/campaign website | Dummy variable of 1 if a video is available on the website and 0 otherwise |

| Images (IM) | The presence of images or visuals on the project/campaign website | Dummy variable of 1 if a video is available on the website and 0 otherwise |

| Variance Inflation Factors | |||

|---|---|---|---|

| Coefficient | Uncentred | Centred | |

| Variable | Variance | VIF | VIF |

| SPR | 0.003212 | 1.289353 | 1.055470 |

| DR | 0.001787 | 53.00989 | 1.153351 |

| BCK | 1.06 × 10−8 | 1.129699 | 1.084172 |

| VD | 0.002128 | 2.606337 | 1.163760 |

| IM | 0.002581 | 4.330006 | 1.047257 |

| TA | 0.000167 | 33.15755 | 1.189246 |

| C | 0.026961 | 59.65905 | NA |

| SP | SPR | DR | BCK | VD | IM | TA | |

|---|---|---|---|---|---|---|---|

| Mean | 0.1535 | 0.1814 | 3.6217 | 1.3932 | 0.5535 | 0.7581 | 9.2926 |

| Median | 0.0000 | 0.0000 | 3.7136 | 0.6931 | 1.0000 | 1.0000 | 9.2103 |

| Maximum | 1.0000 | 1.0000 | 4.2047 | 7.7989 | 1.0000 | 1.0000 | 15.944 |

| Minimum | 0.0000 | 0.0000 | 1.0986 | 0.0000 | 0.0000 | 0.0000 | 5.8861 |

| Std. Dev. | 0.3613 | 0.3862 | 0.5414 | 1.7754 | 0.4983 | 0.4292 | 1.7965 |

| Observations | 215 | 215 | 215 | 215 | 215 | 215 | 215 |

| CS | SPR | DR | VD | IM | TA | BCK | |

|---|---|---|---|---|---|---|---|

| CS | 1.000 | ||||||

| SPR | −0.066 | 1.0000 | |||||

| DR | −0.1324 ** | 0.0369 | 1.000 | ||||

| VD | 0.1488 ** | 0.180 *** | 0.0703 | 1.000 | |||

| IM | 0.1501 ** | 0.0685 | 0.1022 | 0.170 *** | 1.000 | ||

| TA | −0.188 *** | −0.0550 | 0.296 *** | 0.235 *** | 0.0054 | 1.000 | |

| BCK | 0.416 *** | −0.0666 | −0.157 ** | 0.1582 ** | −0.051503 | 0.1036 | 1.0000 |

| Variables | Regression Coefficient | Standard Errors | p Value |

|---|---|---|---|

| Constant | 5.5871 | 3.3153 | 0.091 * |

| SPR | −0.8990 | 0.9227 | 0.329 |

| DR | 0.5555 | 0.7986 | 0.486 |

| BCK | 0.0868 | 0.0192 | 0.000 *** |

| VD | 0.3167 | 0.8243 | 0.700 |

| IM | 1.3205 | 1.1402 | 0.246 |

| TA | −1.5133 | 0.3991 | 0.000 *** |

| McFadden R-squared | 0.6741 | ||

| LR statistic | 124.28 | ||

| Prob (LR statistic) | 0.0000 |

| Hypothesis | Result | ||

|---|---|---|---|

| Spelling error Hypothesis | The presence of spelling errors on a crowdfunding page decreases the probability of success of a crowdfunding campaign. | Supported | |

| Duration Length Hypothesis | A longer duration decreases the probability of success of a crowdfunding campaign. | Not supported | |

| Targeted amount Hypothesis | A larger targeted amount negatively influences the success of a crowdfunding campaign. | Supported | |

| Backers Hypothesis | A large number of backers increases the probability of success of a crowdfunding campaign. | Supported | |

| Videos Hypothesis | The availability of video is positively associated with the likelihood of success of a crowdfunding project. | Supported | |

| Image Hypothesis | The availability of images is positively associated with the likelihood of success of a crowdfunding project. | Supported | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mamaro, L.P.; Sibindi, A.B.; Godi, N.J. The Determinants of Reward-Based Crowdfunding Success in Africa. Risks 2025, 13, 94. https://doi.org/10.3390/risks13050094

Mamaro LP, Sibindi AB, Godi NJ. The Determinants of Reward-Based Crowdfunding Success in Africa. Risks. 2025; 13(5):94. https://doi.org/10.3390/risks13050094

Chicago/Turabian StyleMamaro, Lenny Phulong, Athenia Bongani Sibindi, and Ntwanano Jethro Godi. 2025. "The Determinants of Reward-Based Crowdfunding Success in Africa" Risks 13, no. 5: 94. https://doi.org/10.3390/risks13050094

APA StyleMamaro, L. P., Sibindi, A. B., & Godi, N. J. (2025). The Determinants of Reward-Based Crowdfunding Success in Africa. Risks, 13(5), 94. https://doi.org/10.3390/risks13050094