1. Introduction

The sustainability and sufficiency of retirement funding systems have emerged as crucial concerns for governments globally due to aging populations, longer life expectancies, declining birth rates, and rising healthcare expenses (

Barr and Diamond 2009;

Holzmann and Hinz 2005). Governments are increasingly under pressure to create viable solutions to support the elderly financially as they age with respect and comfort (

Timonen 2008). One promising approach gaining momentum involves using housing wealth to enhance retirement income. This strategy acknowledges that a considerable amount of personal wealth is typically tied to home equity, a trend especially prevalent among older individuals (

Skinner 1996;

Venti and Wise 2004).

Equity release products, like reverse mortgages (RMs) and home reversion (HR) schemes, have been created to enable homeowners to access the equity tied up in their properties without having to sell or move (

Mayer and Simons 1994). RMs have been widely researched and adopted in various countries such as the US (

Shan 2011), UK (

Sharma et al. 2022), Australia (

Ong 2009), South Korea (

Kim and Li 2016), Japan (

Mitchell and Piggott 2004), Spain (

Debon et al. 2013), and Hong Kong (

Kwong et al. 2021), among others. Studies have identified challenges with RMs, including high costs, intricate product designs, and risks linked to fluctuations in property values (

Shan 2011;

Nakajima and Telyukova 2017;

Davidoff and Welke 2007).

On the contrary, HR schemes are less prevalent forms of equity release products, primarily available in select countries like Australia (

Ong et al. 2013) and the UK (

Welch 2009), with limited market penetration reported by the Population Issues Working Group (

PIWG 2019).

Alai et al. (

2014) conducted a thorough analysis comparing the risks associated with RMs and HR using measures such as value-at-risk and conditional value-at-risk.

Xiao (

2011) delved into a contractual framework linking HR schemes with long-term care requirements, while

Hanewald et al. (

2016) examined the optimal timing for releasing equity through RMs and HR. Furthermore,

Kwong et al. (

2021) put forth a hybrid home equity release plan merging features of the Singapore Lease Buyback Scheme (LBS) into HR to enhance product versatility to meet a broader spectrum of retirement needs.

Jang et al. (

2022) develops a life-cycle optimal investment and consumption model that incorporates a range of financial instruments and decisions, including deferred annuities, housing, mortgages, and home reversion contracts. The problem is solved numerically using multi-stage stochastic programming, which is extended from the approach of

Konicz et al. (

2016). On the other hand,

Coulomb et al. (

2023) analyses annuitization preferences when retired individuals use their homes to extract cash through French

viager (home reversion) transactions. The research examines the relationships between annuitization, negotiation dynamics, cash extraction, and demographic factors like age, gender, and marital status.

Kwong et al. (

2024) recently developed an enhanced HR product featuring life annuity incomes and a guaranteed return of the principal invested. Building on their innovation, this paper tailors these concepts to Singapore’s public housing system. It highlights how the proposed product can offer significant benefits to both consumers and providers by introducing a transparent and equitable actuarial framework that justifies the costs associated with each product feature.

The Mercer CFA Institute Global Pension Index for 2024

1 assesses 48 retirement income systems using over 50 indicators focused on adequacy, sustainability, and integrity. In the 2024 report, Singapore ranks fifth, highlighting it as one of the top pension systems in Asia, with an overall index value of 78.7—an increase from 76.3 in 2023 and up from 57.0 in its first year in 2009. Singapore’s distinctive approach to retirement financing offers valuable insights for other governments aiming to enhance their pension systems. A key component of this approach is the Central Provident Fund (CPF), a mandatory defined contribution scheme that has greatly shaped the nation’s strategies for retirement savings, homeownership, and healthcare financing (

Asher 1999).

Each young CPF member manages three distinct accounts: the Ordinary Account (OA), Special Account (SA), and MediSave Account (MA), designed to accumulate savings with risk-free annual interest rates between 2.5% and 6%. The SA is intended for retirement savings, while the MA is dedicated to healthcare expenses. The OA primarily enables members to use their savings to purchase flats from the Housing and Development Board (HDB) or private properties. Singapore’s approach effectively connects savings with home ownership, promoting asset accumulation through mandatory contributions to the CPF. As a result, approximately 77.6% of residents lived in HDB flats in 2023, with over 91% of them being homeowners

2, fostering a culture of widespread property ownership. The Singaporean government has successfully developed a homeowner culture, in which properties function not only as living spaces in early life but also as potential financial resources for retirement through equity release products. A new Retirement Account (RA) is established for each CPF member upon reaching age 55, with funds transferred from the SA and OA to enhance retirement savings up to a certain amount. When members reach age 65, the accumulated RA balance will be used to cover premiums for the national longevity insurance annuity scheme, CPF Lifelong Income for the Elderly (CPF LIFE), which provides members with monthly payouts for life.

In 2009, the HDB launched the LBS, representing an innovative equity release strategy designed specifically for Singapore’s public housing residents. The LBS enables HDB flat owners aged 65 and over to sell the tail-end remaining lease of their flats back to HDB and use the sale proceeds to bolster their retirement incomes. These proceeds can be allocated as a lump sum payment and a mandatory top-up on their RA, which can generate monthly payouts for life through CPF LIFE

3. The LBS currently stands as the sole equity release option available to HDB flat owners in Singapore. Given there are more than 1.1 million HDB flats with 91.1% of these flats being owned, its adoption has been relatively low with an average take-up rate of 1680 households annually over the last five years.

The low take-up rate can be attributed to various HDB’s policies that make retaining ownership of HDB flats beneficial, even as the lease nears its end. For instance, the HDB’s Selective En Bloc Redevelopment Scheme provides incentives for homeowners to maintain ownership of their flats. Through this scheme, the government acquires flats in selected locations for redevelopment, compensating owners with a new flat of an equivalent size at a subsidized price, along with a fresh 99-year lease

4. This offers a significant financial advantage for homeowners who choose to retain ownership, allowing them to benefit from the appreciation of the new property’s value over time.

Additionally, the HDB’s Home Improvement Programme funds renovations for aging flats, enhancing living conditions and flat values for owners. The Neighbourhood Renewal Programme, introduced in August 2007, is fully funded by the government to facilitate on-block and precinct improvements. The Life Upgrading Programme upgrades lift services to provide direct access to every floor where feasible, thereby enhancing residents’ convenience and increasing flat values, with the government subsidizing a large portion of the costs. All these estate renewal programmes may further discourage homeowners from participating in the LBS, as it requires them to forfeit 100% ownership of the end-of-lease portion of their HDB flats.

Considering the low uptake of the LBS and recent development of HR products by

Kwong et al. (

2024), this paper proposes an alternative solution to fine tune and empower the LBS in Singapore. We present a new sell-type home reversion product that addresses the shortcomings of the LBS and enables elderly HDB flat owners to monetize their properties according to their housing needs, as well as enhancing their retirement incomes. Our proposed product features the CPF LIFE benefit and a guaranteed staying period, while also offering additional benefits, including the ability to age in place, flexibility in retaining a portion of the property’s value, provisions for bequests, and a guaranteed return of the principal amount. These improved features aim to enhance the attractiveness and demand for equity release products among the elderly population in Singapore.

The remainder of our paper is organized as follows:

Section 2 presents a review of the LBS along with its limitations. In

Section 3, we introduce our innovative sell-type home reversion product.

Section 4 discusses the actuarial framework of the new product from the perspectives of both homeowners and providers. In

Section 5, we examine the impact of the chosen parameters with various combinations of demographic and flat characteristics on the product’s benefits and costs.

Section 6 illustrates a case study of the pricing model and yield rate calculation, and

Section 7 sets out our conclusions.

2. Lease Buyback Scheme Review and Drawbacks

The Lease Buyback Scheme (LBS) helps elderly HDB flat owners unlock the value of their equity while allowing them to continue to live in their homes for a specified period. This scheme is the only equity release option available for HDB flat owners in Singapore. A detailed explanation of the LBS pricing model can be found in

Kwong et al. (

2021).

To qualify for the LBS, applicants must be Singaporean citizens aged 65 or older, with at least 20 years remaining on the lease they wish to sell back to the HDB

5. Under the LBS, homeowners can retain a portion of their HDB flat’s lease (the front-end lease) for a designated time while selling the back-end lease to the HDB. The proceeds from this sale must be used to top up the homeowners’ RA to meet the mandatory balance, which subsequently pays for the premium of their retirement income through CPF LIFE, an annuity scheme that provides lifelong monthly payouts. Once the RA is topped up, homeowners may keep any remaining proceeds in cash, up to SGD 100,000 per household. Any excess funds beyond this limit must also be used to further enhance the RA.

Here is a brief example to illustrate the cash flows of CPF LIFE: Suppose a single female homeowner who turns 65 years old in 2024 is required to keep a mandatory balance of SGD 205,800 in her RA after signing up for the LBS. After topping up her RA to this mandatory balance and enrolling the entire RA balance as a premium in the CPF LIFE Standard Plan in 2024, she will be entitled to a lifelong monthly payout of approximately SGD 1070

6, starting immediately. Additionally, if she were to pass away prematurely after receiving just the first ten monthly payments, the remaining CPF LIFE premium balance of SGD 195,100 (SGD

could be left as a bequest. As the mandatory balance is adjusted annually to align with inflation, future retirees will need to contribute more to their RA in order to receive higher monthly payouts.

As of June 2024, 12,656 households have joined the LBS since 2009, with about 6700 (53%) households living in three-room or smaller HDB flats, about 4200 (33%) in four-room HDB flats, and about 1800 (14%) in five-room or larger HDB flats

7. According to the HDB Key Statistics Annual Report 2022/2023, the number of three-room, four-room, and five-room HDB flats sold totaled 246,606, 443,285, and 251,762, respectively

8. Taken together, these statistics imply that the LBS’s take-up rate is relatively low.

While the LBS seeks to provide financial security for elderly homeowners, it has significant drawbacks that hinder its effectiveness and attractiveness. These challenges may be factors in the low adoption rate. We have pinpointed four key areas, each linked to a specific feature of the product, that highlight these main issues.

First, while the LBS offers homeowners a front-end lease for a guaranteed stay, this feature falls short of fully supporting the concept of aging in place. It provides residence for a predetermined period rather than ensuring housing for the homeowner’s lifetime. As the end of the front-end lease approaches, homeowners may experience significant anxiety about their future living arrangements, adding to their uncertainty at a vulnerable stage of their life. Moreover, the guaranteed stay might be unnecessary for most Singaporean families, given that Singaporeans are generally encouraged to own their HDB flats and are not allowed to stay in two different HDB flats simultaneously, which diminishes the need for this provision, especially if all family members own their HDB flats. Additionally, the cost of securing this guaranteed stay can be relatively high, especially for older homeowners. The scheme also lacks flexibility, with retained lease terms fixed at 15, 20, 25, 30, or 35 years, depending on the homeowner’s age.

Second, the ability for homeowners to sell the back-end lease to HDB presents several challenges. The lack of transparency in the valuation method for the back-end lease can make it difficult for homeowners to grasp the terms fully, potentially discouraging them from participating in the scheme. By opting to sell the back-end lease, homeowners relinquish any chance for future appreciation in their home’s value, which exposes them to inflation risk and could diminish the real value of their retirement funds over time. The loss of potential capital gains might also reduce homeowners’ motivation to maintain their flats, potentially impacting the overall quality of the housing stock. For those with four-room or five-room HDB flats, the lump sum cash payout after topping up their RA may surpass their immediate financial needs, leading to a lack of flexibility in accessing equity that aligns with their current financial situation. Furthermore, after completing the LBS transaction, homeowners are restricted from selling or renting out their flats, limiting their ability to adapt to changing personal circumstances. Consequently, many HDB flat owners transition from being asset-rich but cash-poor to becoming asset-poor but cash-rich retirees by opting for the LBS to realize their flat’s equity.

Third, bequest considerations present a notable drawback of the LBS. If homeowners keep the flat until the end of the front-end lease—or outlive the lease—there will be no remaining value in the flat to pass on to their heirs. This absence of residual value can significantly deter homeowners who want to leave an inheritance to their family, potentially diminishing their willingness to engage with the scheme.

Finally, the pricing structure of the LBS overlooks factors such as the number of owners, gender, and age-related considerations. Consequently, the scheme can be disproportionately costly for older homeowners, particularly when the family does not require a guaranteed stay period following the owner’s death. This one-size-fits-all pricing model does not consider the unique circumstances and needs of older individuals, making the scheme less attractive and potentially inequitable for this demographic.

Considering the various drawbacks of the LBS, there is a need for alternative solutions that better cater to the needs and circumstances of Singapore’s elderly homeowners. To address these challenges, we propose a new sell-type home reversion product aimed at overcoming the limitations of the LBS. In the upcoming section, we will introduce this innovative product and explain how it can provide elderly homeowners with a more effective way to unlock the value of their HDB flats, offering enhanced retirement financing options in Singapore.

3. New HDB Home Reversion Scheme

Given the LBS’s drawbacks and limitations outlined in the last section, there is a clear need for an alternative solution that more effectively meets the needs of Singapore’s elderly homeowners. Drawing on insights from new home reversion product concepts (

Kwong et al. 2024), we propose a novel sell-type home reversion product specifically designed for HDB homeowners, allowing them to better monetize their flats in conjunction with Singapore’s existing CPF LIFE.

Similar to the two primary features of the LBS, this innovative product incorporates the CPF LIFE benefit for lifetime monthly incomes and provides a guaranteed stay period. However, it also introduces several additional features, including the ability to age in place, the flexibility to retain a portion of the property’s value, a guaranteed return of the principal amount, and a fair pricing strategy based on homeowners’ demographic characteristics. These enhanced features are designed to make the product more attractive and accessible to elderly homeowners, thereby increasing the demand for equity release products.

3.1. Benefits of the New Scheme

Under the new scheme, homeowners make two critical decisions based on their individual circumstances and immediate financial needs to determine the proportion of their home’s value to sell. The first decision involves selecting the amount of the upfront payout (B1), which is subject to CPF LIFE funding restrictions like the LBS. The second decision entails choosing the guaranteed stay period (B2), enabling homeowners to select a duration that best meets their family’s housing needs, without any limitations of the flat’s remaining lease. Generally, opting for higher values for B1 and B2 results in a larger portion of the flat’s value being sold. The pricing model of this new product is designed so that the proceeds from the partial property sale fund these two benefits as well as the other two additional benefits.

Benefit B1 offers an upfront cash payout, providing homeowners with immediate access to the funds they need. This payout serves two primary purposes: it enables homeowners to top up their RA and address any immediate financial needs. By bolstering their RA to pay for the CPF LIFE premium, homeowners become eligible for a lifelong monthly income, securing long-term financial stability. This upfront cash payout offers flexibility and peace of mind, effectively addressing both short-term cash shortages and long-term financial needs.

Benefit B2 provides the flexibility of choosing a guaranteed stay period, allowing homeowners and their families the right to remain in their flat for a specified period, which can be customized to suit their needs. This feature is designed for families seeking housing stability for a defined period, whether due to personal, health, or familial reasons. By giving homeowners flexibility to choose the duration of the guaranteed stay period based on their circumstances, this benefit provides greater control over their living arrangements. It alleviates concerns about potential displacement during this period, ensuring that the family’s housing needs are met with certainty and providing peace of mind.

Benefit B3 allows homeowners to age in place by granting them the right to remain in their flat for life if they outlive the guaranteed period provided under B2. Unlike the fixed cost associated with B2, the cost of B3 is stochastic and should be calculated using an actuarial approach that accounts for the demographic characteristics of individual homeowners. This feature removes the stress of potential relocation in later years, allowing seniors to stay in the comfort of their own home and community. Aging in place has a profound positive impact on the emotional and psychological well-being of the elderly, as it helps them maintain established social connections and daily routines. By providing this privilege, the product supports a crucial aspect of quality of life for seniors, enabling them to live independently and age with dignity.

Benefit B4 is a term life insurance protection, adding an extra layer of financial security. In the event of the homeowner’s premature death, this benefit ensures that the unused principal amount of the investment is returned to their beneficiaries as an additional bequest. This product offers more than just the option to retain a portion of the unsold property’s value as a bequest; it also includes a potential death benefit through the term life insurance, offering further financial protection in case of an unexpected early death. This feature provides peace of mind by shielding against the financial consequences of a sudden loss and enhances the inheritance potential for heirs—a key consideration for homeowners who wish to leave a legacy. By incorporating this protection, the product not only secures the homeowner’s financial needs but also contributes to the long-term financial stability of their family.

3.2. Advantages of the New Scheme

The advantages of the new product can be summarized in four key areas, each directly addressing the four drawbacks of the LBS as outlined in

Section 2.

First, the new product retains all the key benefits of the LBS while offering greater flexibility to homeowners. It preserves features such as the guaranteed stay option and the requirement to top up the RA to pay for the CPF LIFE premium. A major advantage of the new product is that homeowners will no longer be required to sell their entire flat. Instead, it allows them to choose and sell only a portion of the flat to meet their immediate needs, providing greater control over their long-term fixed asset investment strategy. Unlike the LBS tail-end lease sale approach, the home reversion partial sale approach simplifies the product’s pricing structure in terms of the current market flat price, making it more transparent and easier to understand, which enhances its appeal to potential participants.

Second, unlike the LBS’s fixed stay period, the new product offers an age-in-place guarantee, allowing homeowners to continue living in their flats for life. It also provides greater flexibility by enabling homeowners to release equity based on their current financial needs without releasing all equity value under the LBS. Since homeowners retain partial ownership of their HDB flat, they have an incentive to maintain the property’s condition and benefit from any future appreciation in its value. Moreover, the unsold portion of the flat serves as a safety net against inflation and unforeseen financial challenges, as it can be leveraged or sold in the future if additional funds are needed. Additionally, the product ensures the return of the invested principal in the event of an unexpected early death, offering financial security to the homeowners and their beneficiaries.

Third, the new product boosts bequest potential by allowing homeowners to retain a portion of their flat’s value, which can be passed on to their heirs. This feature caters to most homeowners who wish to leave a legacy for their family. Additionally, the inclusion of a potential death benefit from term life insurance can further increase the total bequest, providing extra peace of mind that beneficiaries will receive substantial financial support if the homeowner dies prematurely.

Finally, the new product incorporates variables such as the number of owners, their gender, and their ages into its pricing structure. This personalized pricing strategy allows single male older homeowners to pay a significantly lower price for the same benefits, making the product more attractive and accessible to this demographic compared to the uniform pricing criteria of the LBS for all homeowners. By providing equitable and tailored pricing, the product encourages older homeowners to consider the new equity release option as a viable solution for retirement financing, effectively addressing one of the primary limitations of the existing LBS.

4. Actuarial Pricing Model

To determine the proportion of the flat value sold

, we must gather information regarding the homeowner’s parameter choices, demographic factors, and property status. As outlined in

Section 3.1, the higher the values selected for benefits B1 and B2 will lead to a larger proportion

in the pricing model. Additionally, the proportion

tends to be larger due to increased longevity risks faced by homeowners when there are two flat owners instead of one, when the homeowner is younger rather than older, and when the homeowner is female rather than male. Furthermore, a lower market flat value and a shorter remaining lease will contribute to a higher value for

for the same levels of benefits.

Next, we will explore the pricing model of the new home reversion product and examine how it determines the amount of partial flat value sold to finance the four benefits discussed in

Section 3.1, taking into account a given set of factors and chosen parameters from both the homeowners’ and providers’ perspectives.

4.1. Product Structure

Consider an HDB flat owner aged () joining the new scheme with a current market flat value and remaining lease of β years. After considering the top-up requirement to RA and their immediate financial needs, the owner is assumed to choose the upfront payout amount B1 to be and selects a guaranteed staying period of n months, where θ represents the proportion of the flat’s value to be paid in cash by product providers at the start of the transaction.

For simplicity, this paper uses months as the time unit rather than years. Let

represent the discount factor for one month, corresponding to the monthly interest rate

, such that

. The monthly interest rate

is assumed to be a constant, which can be determined based on the current monthly rental incomes from a similar HDB flat with the same remaining lease (

Kwong et al. 2021). Let

be the number of complete months of the curtate future lifetime of the flat owner (

) for

9.

The new home reversion plan is structured in such a way that the amount of partial property sold

is used to cover the cost of four benefits: the upfront cash payout to homeowner, the cost of

n months guaranteed stay, the cost of staying for life if the homeowner survives after

n months, and the cost of term life insurance. From the homeowner’s perspective, the present value of the future loss random variable

L issued to homeowner (

) is as follows:

where

is the monthly rental amount,

α (0 <

α < 1) is the tuning parameter dependent on the flat’s remaining lease

β, and the maturity of term insurance

is determined by the following:

with the restriction

where [

a] is the integer part of

a. When the chosen parameter

t, the homeowner will receive benefits during the guarantee period that exceed the invested principal amount, eliminating the need for term life insurance. The components

for

and

for

in the definition of

L represent the cost of staying in the flat until the homeowner’s death or the end of the guaranteed period of

n months, whichever is longer, while the components

for

and

for

serve as the cost of decreasing term insurance.

Note that the numerator of ratio represents the amount invested by the homeowner (or the difference in amount between the property value when sold and the upfront payment), while the denominator represents the amount of monthly survival rental benefits from staying in the flat. Thus, the ratio indicates the maximum number of complete months the invested principal amount can cover the rental benefits. If the homeowner lives for t months and beyond, the invested principal will be fully returned to the owner in the form of survival rental benefits, and the term insurance will not pay any death benefit as it expires in t months. On the other hand, if (<t) months, the death benefit is payable at the end of n months for or payable at the end of g + 1 months for . Consequently, the value of the potential death benefit combined with the survival rental benefit will be equal to or greater than the invested principal amount, regardless of when the homeowner passes away.

4.2. Cost of Features

After taking the expectation on random variable

L, we set the actuarial present value of cash inflows equal to the actuarial present value of cash outflows, or

E(

L) = 0, and obtain the following:

The proof of Equation (1) is presented in

Appendix A. According to (

), the sold property value

covers the expected costs of four benefits with the first two benefits determined by the homeowner’s parameter choices. The first benefit

is the amount of upfront payment to the owner. The second benefit

is the predetermined cost of staying in the flat for

n months. The third benefit

is the cost of aging in place after the first

n months. The fourth benefit

is the cost of the term life insurance. Note that if the homeowner chooses

n = 0, then Equation (1) will be reduced to the following:

In other words, the sold property value will cover only three benefits: , and . Since we are using the equivalence principle such that , the determined property value sold . can be considered as the net price of the product without incorporating the costs of business and the economic reality, such as operating expenditures, investment returns, taxes, etc.

4.3. Provider’s Yield Rate

From the product provider’s perspective, the present value of the future loss random variable

issued to homeowner (

) is as follows:

According to the equivalence principle, the difference between the provider’s acquired value of the flat and the present value of its future selling amount should equal the present value of the rental costs incurred by the homeowner for occupying the flat until their death or the end of the guaranteed period of n months, whichever is longer. Therefore, for and . It is now straightforward to show that , which are the same pricing model from two different perspectives.

If the provider outsources B4 to insurance companies by paying a single premium, the initial amount of cash outflow

I is the sum of B1 and B4 as follows:

while the future cash inflow is

.

In contrast to the homeowner’s perspective outlined in

Section 4.2, the provider’s perspective focuses on methods for forecasting the cash flows generated by each transaction. Utilizing cash flow projections offers greater flexibility in evaluating risks and returns, enabling a clear assessment of return on capital and an analysis of how cash flows may be affected by various adverse scenarios. For any given set of factors and the pricing model for determining

, the provider’s monthly yield rate

at time

can be determined by solving

or the following:

for

while the yield rate

at time

n is as follows:

. As a result, the yield rate depends on the survival model of

and property model of the future flat value

.

On the other hand, if the provider keeps the term insurance component in the portfolio, the provider’s monthly yield rate

at time

is calculated by the following:

or

, while the yield rate

at time

n is as follows:

. The determination of yield rate from the provider’s perspective offers a convenient and flexible way of analyzing the effects of

on

, when comparing it with the equivalence principle discussed in

Section 4.2.

5. Numerical Analysis

For illustrative purposes, let us assume the flats have market prices of SGD 450,000, SGD 600,000, and SGD 700,000, which generate rental yields of 7%, 6%, and 5%, respectively

10. The survival model is based on the 2020 Singapore Life Tables, with a maximum attainable age extending to 111 years, and it operates under the assumption of a uniform distribution of death between integer ages. The tuning parameter α based on flat’s remaining lease

β is assumed to be as follows:

11This means that if the remaining lease period is 65 years or more, the rental charges will receive a 20% discount. This discount decreases by 0.005 for each year less than 65 years until there is no more discount when the remaining lease is 25 years or less. This negative linear relationship between β and α indirectly reflects the higher proportion required in the pricing model for β values < 65 due to the lower projected property value for smaller β values.

We now examine how different combinations of selected parameters, alongside various homeowner demographic factors and flat characteristics, influence the costs and benefits of the new products.

5.1. Demographic Analysis

Consider flat owners who choose four combinations of parameters

, and

. Based on these given set of factors and chosen parameters, we analyze the pricing model of the proposed product to determine the proportion of the flat value sold, according to different demographic characteristics of homeowners: age, gender, and number of homeowners.

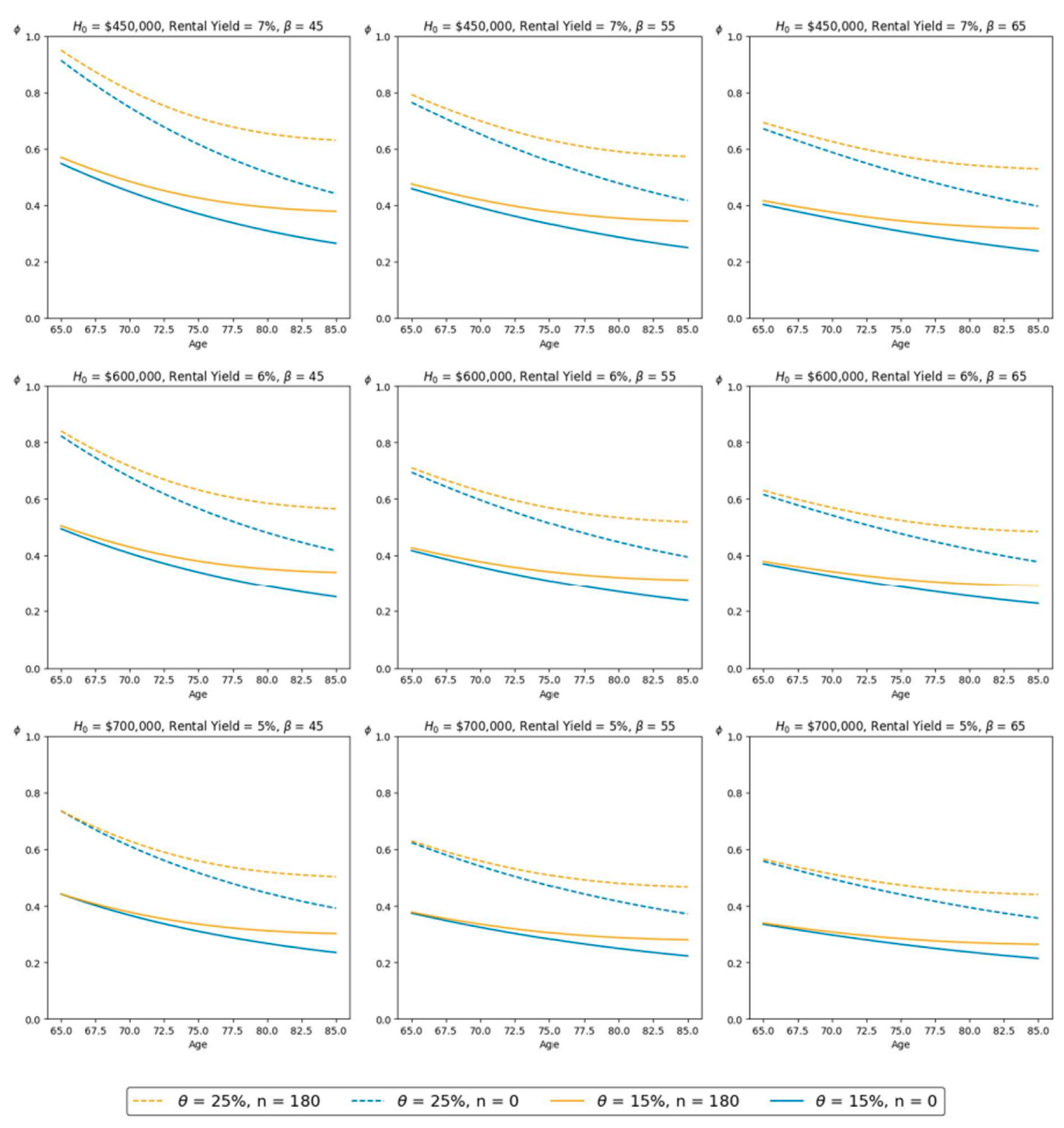

Figure 1 illustrates three demographic cases: a single male homeowner, a single female homeowner, and a married couple. The analysis considers homeowners’ age groups ranging from 65 to 85, with assumptions that both members of a couple are the same age and have independent survival rates. In

Figure 1, sub-graphs are organized into columns representing these three demographic cases and rows corresponding to different flat values.

In general, the higher the parameters

θ and

n, the higher proportion

will be required in all considered cases.

Figure 1 shows that a single male homeowner consistently needs to sell the smallest percentage of their flat’s value across all combinations of factors. In contrast, a single female homeowner must sell a larger portion, while a married couple is required to sell the largest percentage. For example, a single 65-year-old male homeowner with a flat valued at SGD 450,000 would need to sell around 60% of the flat’s value when

θ and

. In comparison, a single female homeowner would need to sell approximately 67%, and a married couple would need to sell about 75%. However, if homeowners are 85 years old, all three demographic cases have a similar proportion of the flat value sold at around 40%. A similar result is also observed for the cases with

. This suggests that younger homeowners have a greater longevity risk and face greater benefit costs when compared to older homeowners.

Moreover, lower flat values necessitate that homeowners sell a higher proportion of the flat values. However, the choice of n does not have too much impact on particularly when the homeowners are young. For example, a female owner aged 65 choosing θ needs to sell proportions of 40%, 38%, and 34% for flat values of SGD 450,000, SGD 600,000, and SGD 700,000, respectively, regardless of whether n is set at 0 or 180.

5.2. Remaining Lease Analysis

Consider the case of a single female homeowner with

. As seen in the first row of sub-graphs in

Figure 2, when

and

becomes smaller, younger homeowners need to sell a significantly higher proportion of their flat’s value, when compared to older homeowners. For example, a 65-year-old homeowner needs to sell 91%, 76%, and 67% for

θ and

when the remaining lease is 45, 55, and 65 years, respectively. But an 85-year-old homeowner choosing the same parameters only needs to sell approximately 44%, 42%, and 40% when the remaining lease is 45, 55, and 65 years, respectively. Similar results are observed for flats with larger values. In conclusion, the shorter period of the remaining lease has a limited impact on the proportion sold for older homeowners when compared to younger homeowners.

5.3. Benefit Proportion Analysis

Consider the scenario of a single female homeowner choosing the parameter combinations of

and

n = 0, 60, 120 with

and

.

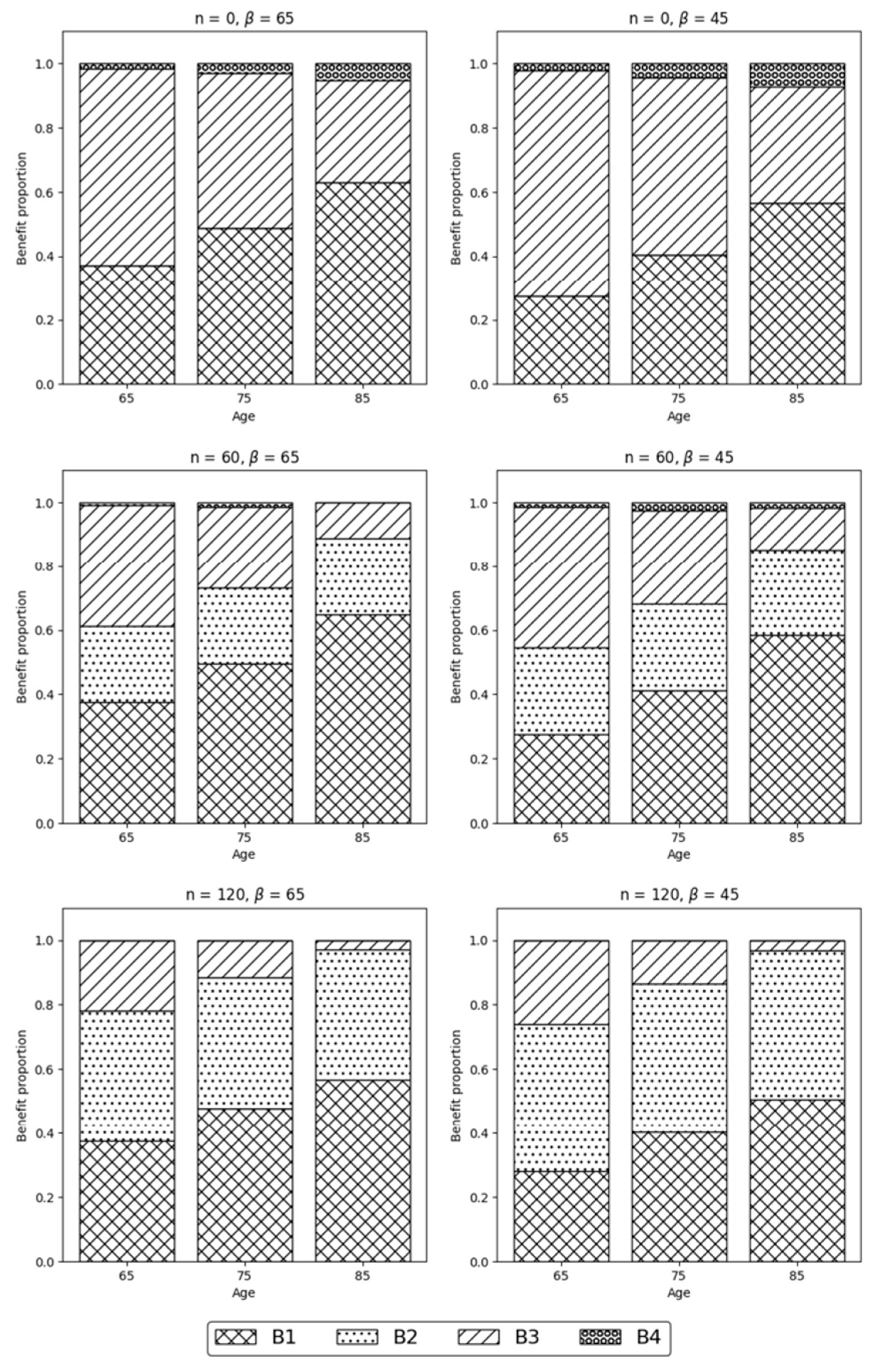

Figure 3 illustrates the various benefit proportions for homeowners of different ages (65, 75, and 85) associated with the different parameter combinations. The subgraphs are organized into columns that represent the remaining leasehold years on the flat and rows that represent the duration of the guaranteed stay period.

While older homeowners generally have a higher proportion of benefits allocated to B1, the proportion assigned to B3 is relatively smaller, particularly for cases with larger n values, regardless of the remaining lease period. This indicates a lower cost proportion of aging-in-place benefits for older homeowners who choose larger n values. A longer guaranteed stay period naturally implies a longer deferral for age-in-place benefits, leading to a decrease in B3 costs. Additionally, older homeowners selecting larger n values reflect the reduced longevity risk that they present to the provider, resulting in lower costs associated with supporting rent-related benefits. For instance, a homeowner aged 85 pays about 11% of the property’s sold value for B3 with , while a homeowner aged 65 must pay a significantly higher proportion of 38%.

Since the proportion of benefits allocated to B2 remains consistent across all age groups, the proportion allocation to B4 is notably smaller, particularly for higher values of n. The cost proportion of B4 benefit decreases as n increases because the death benefit amount associated with the term insurance is lower. When the selected guaranteed stay period surpasses the payback period of the invested principal, the allocation to B4 falls to zero, as the resident no longer carries any financial risk linked to premature death. For example, with n , the proportions allocated to B4 are about 1.5%, 3.1%, and 5.3% for homeowners aged 65, 75, and 85, respectively, while the proportions decrease to less than 1.5% for n for all considered ages and no proportions are allocated to B4 for n.

Figure 3 also illustrates that a flat with smaller

β values leads to higher proportions of benefits assigned to B2 and B3 across all combinations of ages and

n. With a smaller

β, the rental discount offered to homeowners decreases due to a larger

α and a larger proportion of the property sold. Consequently, the monthly rental charged is higher for flats with shorter remaining leases, which drives up the total cost of staying benefits B2 and B3. For instance, when

, the total proportion of B2 and B3 is 71%, 56%, and 40% for homeowners aged 65, 75, and 85, respectively. By contrast, when

the total proportion of B2 and B3 decreases to 62%, 49%, and 35% for the same age groups.

5.4. Benefit Value Analysis

Consider the scenario of a single female homeowner choosing parameter combinations of

and

with

and

.

Figure 4 illustrates the four benefit amounts and corresponding proportion of the flat value sold for homeowners aged 65, 75, and 85, based on the selected parameter combinations. Subgraphs are organized into columns representing the proportion of benefit B1 and rows representing the length of the guaranteed stay period.

As seen in

Figure 4, an older homeowner generally sells a lower proportion of their flat. However, for any age group, the proportion of the flat sold stays relatively stable as

increases. For example, a 65-year-old homeowner who chooses

is only required to sell about 40% of their house for

, 120. In contrast, a 75-year-old homeowner choosing

is required to sell about 31% for the considered

n while an 85-year-old homeowner would sell 23% for

and 26.5% for

. We conclude that the parameter

n is not a decisive factor determining the proportion of flat value sold when the homeowners are not so old.

Moreover, an older homeowner generally pays less for rental costs. For instance, an 85-year-old homeowner choosing and is required to pay SGD 56,000 for B3 while a 75-year-old and 65-year-old homeowner must pay SGD 110,000 and SGD 185,000, respectively.

6. A Case Study

Consider the case of a 70-year-old single female homeowner of a flat worth SGD 600,000 that has a remaining lease of 50 years and monthly rental income of SGD 3000. If she chooses the parameters

in the transaction, the flat value sold to the provider is SGD 300,712 (or

which pays for the benefits B1 = 120,000, B2 = 68,914, B3 = 105,417, and B4 = 6380, based on the pricing model discussed in

Section 5. As a result, the amount of principal invested by the homeowner is SGD 180,712, the monthly rental benefit is SGD 1503, and the decreasing term insurance matures in 120 months with the amount of death benefits

when

:

Therefore, the combined amount of the death benefit and rental benefit is always equal to or greater than the invested principal of SGD 180,712, regardless of when she passes away.

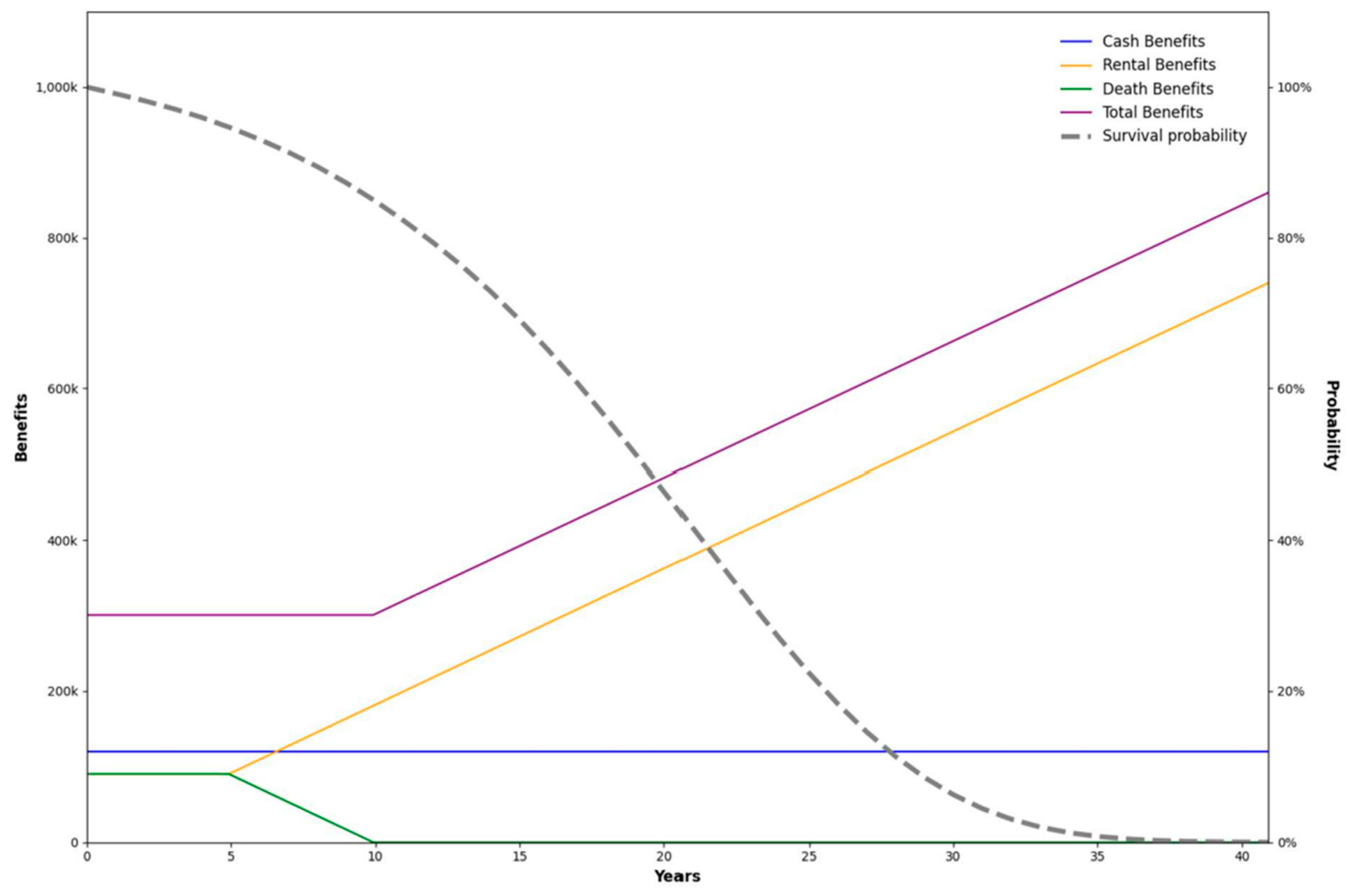

Figure 5 illustrates the survival probabilities and the total benefits she will receive at the time of her death, categorized by the three benefit components: cash, rental, and death benefits. The figure shows that the total benefit remains constant at SGD 300,712 for the first 10 years, after which it increases linearly each year. For example, there is a 22.4% chance that she will survive at age 95 and enjoy at least SGD 573,000 of total benefits as shown in

Figure 5.

From the provider’s perspective with the assumption that the benefit B4 can be outsourced to insurance companies, the provider’s initial cash outflow of SGD 126,380 is the sum of benefit B1 and the single premium of term life insurance B4 while the cash inflow is the future proceeds of selling the flat

which depends on the survival model and the stochastic property pricing model. To illustrate this, assume that the survival model is the same as the model discussed in

Section 5 and the property price

follows the lognormal distribution with the parameters of the expected property return per year

and the volatility of property price per year

, shown as follows:

After setting eight combinations of parameters with

and

, 9%, 10%

12 in this property model, we simulate 100,000 repetitions of the yield rate

on the provider’s capital investment, both with and without outsourcing the benefit B4 for each combination. The results are presented in

Table 1.

As shown in

Table 1, the simulated yield rates are consistently higher when the provider retains the B4 component in the portfolio compared to when B4 is outsourced. As the parameter

increases or

the percentile values of the simulated yield rates rise. For instance, when

is 10% and 7% with

the simulated 25th percentile yield rates are 4.57% and 5.15%, respectively.

7. Conclusions

In this paper, we present a novel sell-type home reversion product designed to monetize HDB flats in Singapore, offering a new alternative to the existing LBS, which typically provides rigid options regarding the guaranteed period of residence and monthly life annuity incomes under the CPF LIFE arrangement.

This new home reversion product aims to address the significant drawbacks of the LBS, which are believed to hinder the growth of the market in Singapore. The new product retains the guaranteed period of residence and life annuity features, while also enhancing capabilities to meet other specific homeowner needs, such as aging in place, flexibility in retaining part of the property, options for bequests, and guaranteed principal return. With these additional features tailored to a broader range of homeowner needs, the new product is expected to generate greater demand for monetizing HDB flats among asset-rich but cash-poor homeowners.

Taking demographic factors and flat characteristics into account, we have developed an actuarial pricing model that establishes a transparent and actuarially fair framework to justify the costs and benefits of the new product from the homeowners’ perspective. The pricing model provides a detailed breakdown of the cost of each feature, allowing homeowners to easily understand the impact of product parameters and make informed decisions based on their financial needs. Additionally, the paper examines the product’s cash flow analysis from the provider’s perspective. These projected financial results can serve as a comprehensive pricing model to determine the product’s price, incorporating associated expenses and required investment returns.