The first objective of the model is to estimate various versions of the MGARCH framework, each incorporating a constant in the mean equation along with a GARCH (1,1) variance specification. Modifications include the addition of an AR(1) term in the mean equation and the exploration of different distributional assumptions. The model selection process indicates that the DCC specification with an AR(1) term in the mean equation provides the best fit. All GARCH model variants (DCC, ADCC, GO-GARCH) have been estimated with an AR(1) term included in the mean equation. To address the non-normality typically present in return distributions, both the DCC and ADCC models have been estimated, assuming that residuals follow a multivariate skewed t-student distribution. For the GO-GARCH model, where the multivariate t-distribution is not applicable, estimation was performed assuming a multivariate affine negative inverse Gaussian (MANIG) distribution.

5.1. Dynamic Conditional Correlation

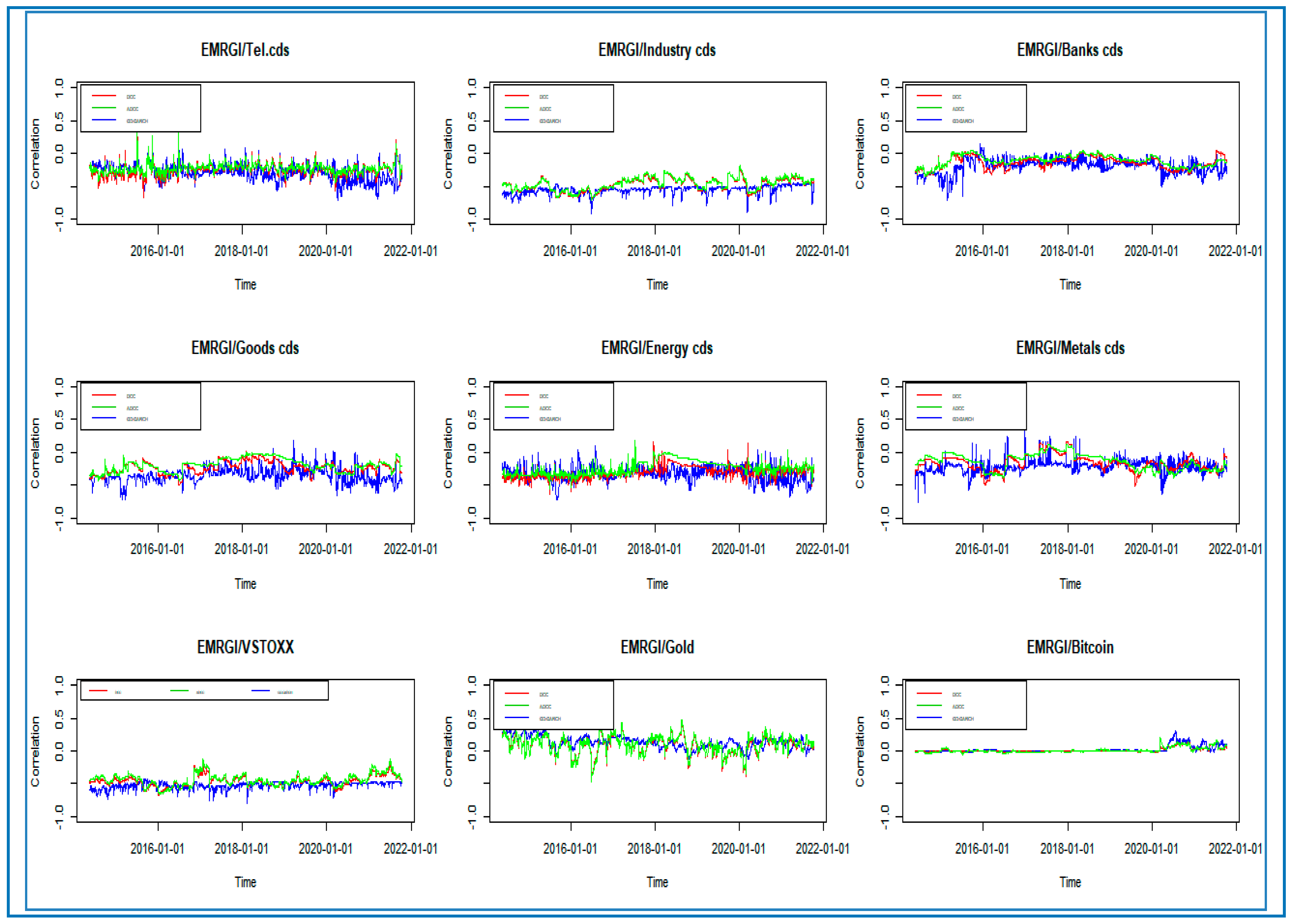

In this step, we use the rolling window analysis to construct one-step-ahead dynamic conditional correlations. The estimation window is set at 2929 observations, and a total number of 1000 one-step-ahead dynamic conditional correlations have been attained. We then refit each MGARCH model for every 20 and 60 daily observations. We aim to determine the conditional correlations and then time-varying optimal hedge ratios for different time horizons using three MGARCH versions (DCC, ADCC, and GO-GARCH). Therefore, the objective consists of distinguishing between the short- and long-run hedging effectiveness of sectoral CDSs, VSTOXX, gold, and Bitcoin to reduce the risk of both conventional and Islamic portfolios.

Figure 2 presents the rolling one-step-ahead conditional correlations between emerging stocks indices and each considered alternative assets using the three versions of the MGARCH models.

While the dynamic conditional correlations of the DCC and ADCC models exhibit nearly identical patterns, the GO-GARCH model yields conditional correlations that diverge significantly from both. Notably, despite a synchronized rise in correlation estimates across all three models in early 2020, the DCC model’s correlations gradually weakened thereafter. In contrast, the correlations derived from the GO-GARCH model remained robust and reliable, a finding consistent with prior studies by

Ahmad et al. (

2018),

Basher and Sadorsky (

2016),

Hachicha et al. (

2022), and

Zghal et al. (

2022). Overall, while the DCC and ADCC models produce similarly volatile correlation dynamics, the GO-GARCH model generates more stable linkages.

Touching upon the dynamic conditional correlations linking the conventional (EMERGC) and Islamic (EMERGI) stock indices and five sectoral CDSs (TEL, Banks, Goods, Energy Metals) and gold, they appear to fluctuate between negative and positive values. During 2020, however, the correlation increased remarkably in both the conventional and Islamic stock indices, and conditional correlations obtained from MGARCH models displayed significantly greater variability.

In addition, the conditional correlations for EMERGC/CDS-IND and EMERGC/VSTOXX, and EMERGI/CDS-IND and EMERGI/VSTOXX, are predominantly negative in terms of each estimation model. This empirical finding suggests that CDS IND and VSTOXX could be considered significant hedging instruments in both conventional and Islamic portfolios. Furthermore, the GO-GARCH model’s estimated correlation recorded the more negative values.

Moreover, the conditional correlation between Bitcoin and the two emerging stock indices is positive for each MGARCH model. However, Bitcoin can play the role of diversifier instrument in both conventional and Islamic indices.

Overall, the correlations estimated by the DCC and ADCC models show a high degree of similarity, whereas those from the GO-GARCH model exhibit a distinct pattern. Notably, all three MGARCH models demonstrated an upward trend in correlation levels throughout 2020, which was further amplified by the onset of the COVID-19 pandemic. However, while the DCC model correlations gradually weakened over time, the GO-GARCH model correlations remained relatively stable.

Table 2 presents the Pearson’s correlation coefficient between each pair of conditional correlation series obtained using the DCC, ADCC, and GOGARCH models.

For the conventional and Islamic equity indices, the dynamic conditional correlations modeled by the DCC show a strong alignment with those produced by the ADCC model. In contrast, the correlation pairs associated with the DCC and GO-GARCH models, as well as those between the ADCC and GO-GARCH models, tend to exhibit significantly weaker relationships for each individual pair.

5.2. Diversifier, Hedge, and Safe Haven Properties of Sectoral CDSs, VSTOXX, Gold, and Bitcoin

To examine CDSs’, VSTOXX’s, gold’s, and Bitcoin’s capabilities as a diversifier, hedge, and safe haven against movements in EMERGC and EMERGI equity markets, we follow the method used by

Baur and McDermott (

2010). A safe haven instrument is an asset that is expected to retain or increase in value during periods of market turmoil or economic uncertainty. It performs well during crises (e.g., recessions, geopolitical shocks). Following the ADCC-GARCH estimation, the pairwise dynamic conditional correlations between both the Dow Jones conventional and Islamic emerging market indices stock markets, and each of the alternative assets, are extracted from Equation (17) into separate time series.

are regressed on dummy variables (

D) as follows:

where

D represents the dummy variables used to take into account the extreme movements at the 10%, 5%, and 1% quantiles of the most negative stock returns.

In effect, the CDSs, VSTOXX, gold, and Bitcoin would act as a weak hedge if is zero and as a strong hedge in case proves to be negative, thus standing as significant for the individual sector. Still, CDSs, VSTOXX, gold, and Bitcoin turn out to be a weak safe haven once the , , or coefficients appear to be negative and non-significant, and a strong safe haven in case they prove to be negative and significant. Accordingly, CDSs, VSTOXX, gold, and Bitcoin should not represent a safe haven in case the , , or coefficients turn out to be positive.

Equations (18)–(20) show the theoretical model used to investigate the role of CDSs, VSTOXX, gold, and Bitcoin during the three periods.

Following the estimation of the ADCC model, dynamic conditional correlations are extracted from Equation (17) into separate time series and then used to assess the hedge and safe haven properties of sectoral CDSs, VSTOXX, gold, and Bitcoin for conventional and Islamic portfolios.

Table 3 and

Table 4 report the coefficient estimates from the regression models specified in Equations (18)–(20). The estimated results on the role of sectoral CDSs, VSTOXX, gold, and Bitcoin as a hedge and safe haven for EMERGC stock return are reported in

Table 3.

Table 3 highlights that the hedge parameter

is negative and statistically significant, which indicates that sectoral CDS spreads and VSTOXX can be considered as a strong hedge for EMERGC index in all periods. In contrast, the positive and significant parameter

indicates that gold and Bitcoin act only as an effective diversifier for the EMERGC index.

Concerning the safe haven capability, the sectoral CDS spread, except for the Banks and Goods sectors, can be regarded as a weak safe haven asset before bubble crypto currency. In contrast, it can be considered as a strong safe haven for the EMERGC before the COVID-19 period. Furthermore, CDS metals and VSTOXX were a strong safe haven for the EMERGC index during the COVID-19 pandemic.

Moreover, gold and Bitcoin serve neither as a strong hedge nor as a strong safe haven, which implies that sectoral CDSs and VSTOXX have more preferable characteristics for EMERGC investors. These results are of interest to investors in terms of portfolio diversification and hedging strategies during a crisis.

These results corroborate those of

Shahzad et al. (

2019) that compare the safe haven properties of Bitcoin and gold during extreme market conditions. They verify whether such properties are similar or different for the two assets. Furthermore, they conclude that both Bitcoin and gold can be regarded as weak safe haven assets in most cases.

Table 4 depicts the estimated results on the role of CDSs, VSTOXX, gold, and Bitcoin as a hedge and safe haven for EMERGI stock return.

As shown in

Table 4, the EMERGI index is found to be negatively and significantly correlated with the sectoral CDS indices and VSTOXX during the three periods under study. This result indicates that both assets are a strong hedge for the emerging Islamic financial index. As such, it could be beneficial for investors in emerging Islamic countries to include sectoral CDSs and VSTOXX in their equity portfolios for hedging purposes. However, gold and Bitcoin cannot be considered hedge alternatives, as all the coefficients (

) are positive and significant. This implies that gold and Bitcoin are only effective diversifiers for investors in the EMERGI market.

As for safe haven capability, we find evidence of Bitcoin being a strong safe haven for emerging Islamic financial indices, before bubble crypto currency, in the 5% quantile. These findings suggest that investors react to shocks in the emerging Islamic countries.

In addition, before the COVID-19 period, CDS spreads for banks, goods, metals, and other financial sectors and Bitcoin served as a strong safe haven for the EMERGI index. That is, in times of extreme market turmoil and uncertainty, investors with exposure to the EMERGI sell stocks and buy CDSs for the four sectors and Bitcoin. It is also worth noting that sectoral CDSs, VSTOXX, gold, and Bitcoin acted as a weak safe haven for the EMERGI during the COVID-19 period. Our results corroborate those of

Conlon and McGee (

2020), which considered Bitcoin to not act as a safe haven during times of crisis.

5.3. Optimal Hedge Ratio and Hedging Effectiveness

The conventional and Islamic stock index return hedged by CDSs, VSTOXX, gold, and Bitcoin can be reformulated as follows:

where

is the return on the hedged portfolio;

denotes the conventional or Islamic emerging stock index return;

represents the alternative asset returns (sectoral CDSs, VSTOXX, gold, and Bitcoin); and

is the hedge ratio. When an investor holds a long position in the stock index, the hedge ratio indicates the quantity of alternative asset indices to be sold. Consequently, the variance of the hedged portfolio, given the information available at time

, is expressed as

The optimal hedge ratios (OHRs), represented by

, are utilized to minimize the conditional variance of the hedged portfolio. The OHR, given the information set as

, is computed after taking the partial derivative of the variance of

with respect to the hedge ratio and equating it to zero, as proposed by

Baillie and Myers (

1991). The resulting expression is as follows:

The conditional volatility estimates from the GARCH models can be utilized to determine hedge ratios, as discussed by

Kroner and Sultan (

1993). In this approach, a long position in one asset (e.g., asset i) can be hedged by taking a short position in another asset (e.g., asset j). The optimal hedge ratio for mitigating stock market risk using alternative asset indices is calculated as follows:

Here,

refers to the conditional variance of returns for alternative assets, while

represents the conditional covariance between the conventional and Islamic stock market indices and other indices, including sectoral CDSs, VSTOXX, gold, and Bitcoin. The effectiveness of various optimal hedge ratios (OHRs), derived from different GARCH model specifications, can be assessed using the hedging effectiveness (HE) index, as outlined by

Chang et al. (

2011) and

Ku et al. (

2007).

In this context, refers to the variance of the unhedged portfolio, while indicates the variance of the optimally hedged portfolio. Hedging effectiveness is a measure of how well a hedging instrument reduces the risk exposure of a portfolio or position. It quantifies the reduction in volatility, variance, or downside risk achieved through hedging.

A higher HE index demonstrates greater hedging effectiveness. Additionally, out-of-sample hedge ratios are derived using a rolling window approach. At each time period t, one-step-ahead conditional volatilities are predicted, and these predictions are subsequently employed to calculate one-step-ahead hedge ratios. We fix the size of the rolling window at 1929 observations with the objective of obtaining 1000 one-step-ahead hedge ratios.

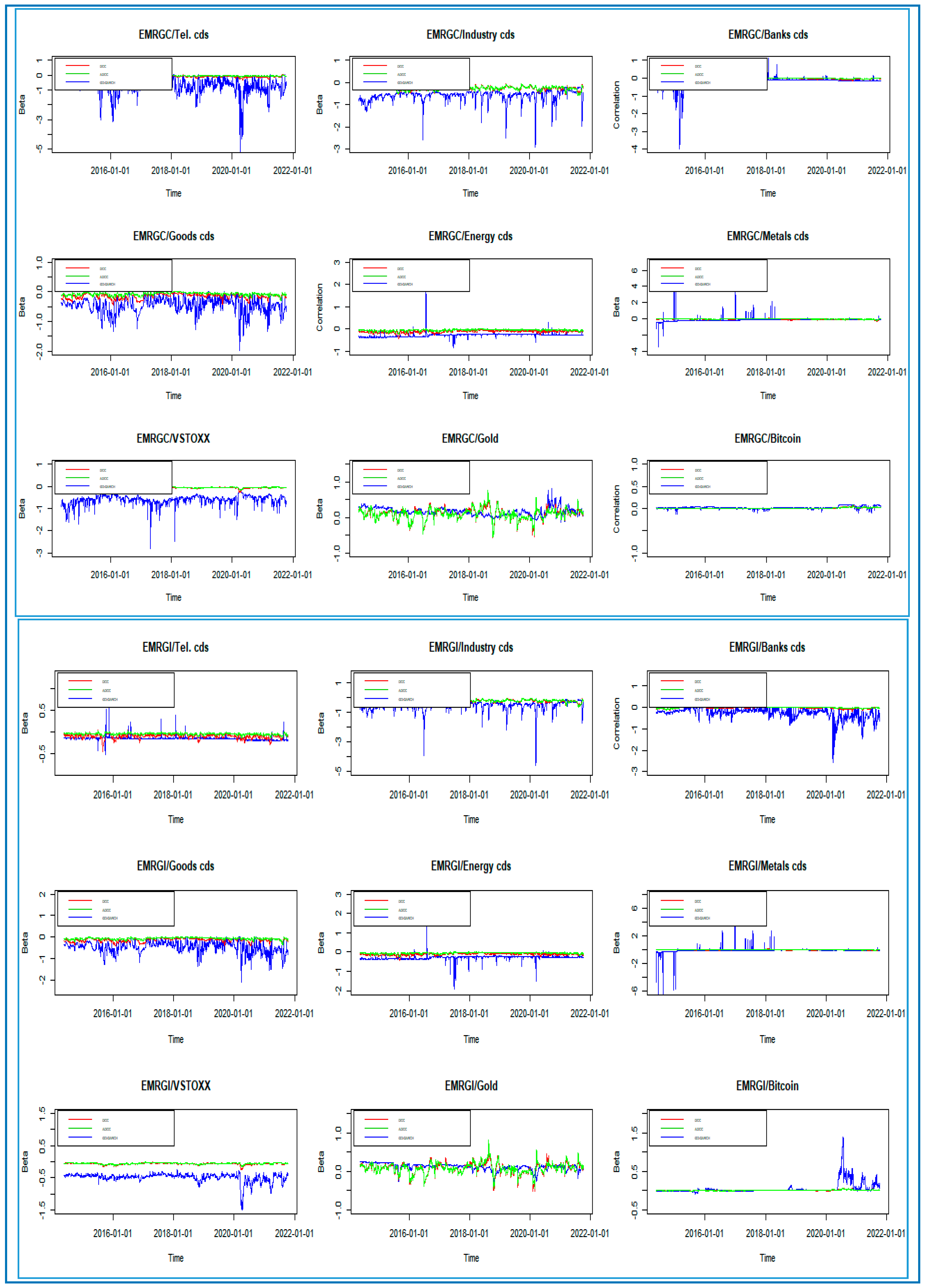

Figure 3 depicts the daily optimal hedge ratios between conventional and Islamic emerging stock indices and the sectoral CDSs, VSTOXX, gold, and Bitcoin based on the three MGARCH models (DCC, ADCC, and GO-GARCH).

Accordingly, we notice that the GO-GARCH hedge ratios mostly exhibit greater variations, but there are some exceptions as in the case of EMERGC/gold, EMERGC/Bitcoin, and EMERGI/gold. It is also worth noting that DCC hedge ratios are similar to the ADCC model’s hedge ratios. Similarly, we find that time-varying hedge ratios can capture significant events related to the global economic system viz., bubble crypto currency and the COVID-19 pandemic.

Table 5 displays the registered correlations between the inter-hedge ratios calculated from three versions of MGARCH models viz., DCC, ADCC, and GO-GARCH.

We find that the hedge ratios obtained from the DCC/ADCC models exhibit a high correlation, indicating that the two models captured the properties of the data similarly.

In addition, the DCC/GO-GARCH hedge ratio correlations, in the EMERGC index, are considerably lower than the ADCC and GO-GARCH for the CDS of IND, banks, goods, other fin., and VSTOXX hedge ratio binding correlations. Further, hedge ratios calculated from DCC/GO-GARCH, in the EMERGI, are significantly lower than ADCC and GO-GARCH for the CDS of TEL, IND, goods, energy, and other fin. sectors’ hedge ratio binding correlations.

Table 6,

Table 7 and

Table 8 report the summary statistics of the hedge ratios and hedging effectiveness between the two Dow Jones emerging market indices and hedging instruments obtained from the three variants of the MGARCH models. We discuss the sensitivity of the results to refit used (every 20 and 60 days) to compare the hedging effectiveness in the long and short term and the sensitivity to periods to analyze the effect of crises on hedging strategies.

Table 6 displays the hedge ratios and hedging effectiveness obtained by using the DCC model. A rolling estimation approach is employed to estimate these parameters, with two refit intervals (20 and 60 days) selected to evaluate the effectiveness of sectoral CDSs, VSTOXX, gold, and Bitcoin to hedge Islamic and conventional stock markets in short and long-run horizons during the three periods.

Our analysis reveals that hedge ratios and hedge effectiveness values remain consistent across both refits. Notably, negative mean hedge ratios characterize all alternative assets except gold and Bitcoin. This suggests that hedging benefits for EMERGC and EMERGI can be realized through either short or long positions in sectoral CDSs and VSTOXX—results consistent with those of

Basher and Sadorsky (

2016) and

Raza et al. (

2019).

However, positive mean hedge ratios emerge for EMERGC/gold, EMERGI/gold, EMERGC/Bitcoin, and EMERGI/Bitcoin across all three periods. This implies an optimal strategy of long positions on Islamic/conventional stocks paired with short positions on gold and Bitcoin. Specifically, gold’s hedge ratios average between 0.0812 and 0.1057 for EMERGC and between 0.0623 and 0.0944 for EMERGI. Practically, hedging a USD 1 long position in EMERGC and EMERGI indices during Period 3 requires an average short position of USD 0.1033 and USD 0.0944 in gold, respectively. Critically, hedging USD 1 in the conventional index proves more costly within the Islamic index framework, underscoring divergent risk mitigation dynamics between the two.

Therefore, according to the maximum HE criterion, the CDS IND sector yields the highest hedging effectiveness level (0.2827) for the EMERGC, followed by EMERGI (0.2625) during the first period under study and for the longest forecasts. The VSTOXX index ranks as the second instrument, providing the highest hedging effectiveness (0.2490) for EMERGC and (0.2312) for the EMERGI stock market.

In addition, for each period analyzed, we observe that the values of the hedge ratio and hedging effectiveness are quite consistent across the various model refits.

Such findings have important implications for investors seeking to reduce risk in their Islamic and conventional portfolios. In this context, our results corroborate those of

Hachicha et al. (

2022), considering that opting for the industrial sector CDS index implies a rather beneficial portfolio design objective.

Table 7 highlights the results of the hedge ratio and hedging effectiveness values estimated with the ADCC model. Compared to

Table 6, we find that the different hedging values achieved with the ADCC model are statistically similar to those calculated by the DCC model during the three periods. In fact, among the ten pairs, EMERGC/gold, EMERGI/gold, EMERGC/Bitcoin, and EMERGI/Bitcoin exhibit positive average hedge ratio values. For instance, the mean value of the hedge ratio of EMERGC/gold is 0.0777 (

Table 7, period 1, refit = 20). We interpret this value as a USD 1 long position in EMERGC, which can be hedged on average for 7.77 cents with a short position in gold.

Moreover, the different hedging effectiveness values for both Islamic and conventional stock market indices are very similar.

One could also conclude that both CDS-IND and VSTOXX keep the highest values during the first period. Hence, hedging using industrial CDSs and VSTOXX for both Islamic and conventional emerging indices can be highly effective and profitable for investors in the short and long term and during calm and volatile periods.

Furthermore, the different hedge ratios and HE values are very similar, regardless of which period is studied (Period 1, Period 2, and Period 3).

Table 8 depicts the results highlighting the optimal hedge ratios and the hedging effectiveness calculated from the estimates of GO-GARCH.

Generally, the GO-GARCH model records the highest values of the hedge ratios and hedging effectiveness regarding the different periods and refits used in this study. Indeed, all of the alternative assets have the same sign of the average mean hedge ratio values (positive values for gold and Bitcoin and negative values for all other indices).

However, both Islamic and conventional stock market indices differ with respect to the GO-GARCH model, in comparison to the DCC and ADCC models. For instance, the hedging values of the pair EMERGC/Bitcoin are 0.0204, 0.0199, and 0.2916, respectively, for the DCC, ADCC, and GO-GARCH models.

Additionally, based on the maximum HE criterion, the industrial CDS sector achieves the highest hedging effectiveness level (36.88%) for the shortest forecast horizon during the first period. As a result, the GO-GARCH model demonstrates relatively high hedging efficiency, particularly in the EMERGC/CDS-IND case.

In this context, our results corroborate those of

Zghal et al. (

2022), considering that selecting for the GO-GARCH model maximizes the efficiency of the various hedging measures.

The superiority of GOGARCH model can be explained by various factors.

If asset returns are driven by a small set of latent factors (e.g., macroeconomic or sector-specific drivers), GO-GARCH’s orthogonal decomposition better isolates these factors, leading to more accurate covariance estimates and more accurate factor identification that improves hedge ratio calculations (e.g., minimizing portfolio variance).

- -

With many assets, GO-GARCH’s parsimonious structure (via orthogonalization) avoids the “curse of dimensionality” that plagues ADCC, which requires estimating pairwise correlations.

- -

Orthogonal factors reduce multicollinearity, making the model less sensitive to noisy or redundant data.

- -

Correlation estimates in ADCC can become unstable if asset pairs exhibit erratic dependencies.

- -

GO-GARCH out-performs ADCC models when markets have clear factor structures (e.g., sector ETFs, commodities) or if they are stable correlation regimes (no abrupt asymmetry).

In addition, through the comparison of both of the econometric models, statistical evidence reveals that there is no significant differences between DCC and ADCC models in term of hedging effectiveness. Investors in the EMERGC and EMERGI stock market have the same opportunity to hedge their portfolios because of these models, by using sectoral CDS indices and VSTOXX. In contrast, GO-GARCH model provide optimal hedge ratio and effectiveness hedging significantly not the same than DCC and ADCC models which confirms empirical results founded in previous works.

Industrials (e.g., manufacturing, machinery, aerospace, and transportation firms) are highly cyclical, meaning their performance is closely tied to macroeconomic trends (GDP growth, industrial production, and commodity prices).

Stock markets often decline during economic downturns, which simultaneously increases the default risk for cyclical sectors like industrials. This dual sensitivity amplifies the correlation between industrial CDS spreads (cost of insuring against default) and equity market downturns.

In a recession, industrials face reduced demand, tighter margins, and higher default risk, causing their CDS spreads to widen sharply. This mirrors equity market declines, making industrial CDS a natural hedge.

During crises, industrial CDS spreads widen more dramatically than non-cyclical sectors, providing stronger offsetting gains when equities fall.

Industrial firms’ equity prices and CDS spreads are often strongly negatively correlated. When stock prices fall, CDS spreads rise (due to perceived higher default risk), creating a natural hedge. Empirical studies show that correlation is stronger for cyclicals like industrials than for sectors with stable cash flows (e.g., consumer staples). Industrials are exposed to risks that drive broad market selloffs, such as rising interest rates (increasing borrowing costs), supply chain disruptions (e.g., COVID-19, trade wars), and commodity price volatility. These factors simultaneously pressure industrial equities and widen CDS spreads, enhancing hedging effectiveness.

Finally, industrial CDSs are particularly effective for hedging stock market risk due to their cyclicality, liquidity, and strong correlation with systemic economic stressors. They act as a “macro hedge” during broad downturns, outperforming CDSs tied to less cyclical or defensive sectors. However, their effectiveness depends on the nature of the equity risk (systemic vs. sector-specific) and the economic context driving market movements. Thus, it is necessary to always validate these via historical stress-testing and correlation analysis.