Abstract

Following the introduction of EUR/USD futures and USD/JPY futures on 31 October 2022, Thailand Futures Exchange first entered the top 11 list of derivatives exchanges based on foreign exchange derivative volumes in 2022. This paper investigates the dynamics of foreign exchange futures trading volumes in Thailand through the VAR(2) model. Trading volumes of EUR/USD futures, USD/JPY futures, and USD/THB futures are considered over the sample period from 31 October 2022 to 12 January 2024. The empirical results provide no evidence that the trading volume of EUR/USD futures is dependent on the past trading volumes of USD/JPY futures and USD/THB futures. The Granger causality test results show the existence of bidirectional causality between the trading volumes of USD/JPY futures and USD/THB futures. The results of the impulse response function are consistent with the sign results of the VAR(2) model, showing that the USD/JPY futures trading volume has a negative impact on the USD/THB futures trading volume, and vice versa. The analysis of variance decomposition shows that the variability of the USD/JPY futures trading volume and USD/THB futures trading volume, apart from its own shock, is explained by other FX futures trading volume shocks. Therefore, traders should pay more attention to new FX futures trading activity due to its negative impact on the USD/THB futures trading volume and its contribution to the variance in the USD/THB futures trading volume. Understanding the futures trading volume relationship also helps Thailand Futures Exchange develop new products and services that can foster market liquidity and stability.

Keywords:

financial derivatives; dynamics; trading volume; VAR; Thailand; foreign exchange futures; causality 1. Introduction

The futures trading volume refers to the total number of contracts traded within a specific period. It is an important factor in determining market liquidity and helping any traders make informed investment decisions. A higher trading volume indicates a highly active market in which it is easy for buyers and sellers to execute transactions. It signals strong investor interest and participation in the market. On the other hand, when the market is less active, its trade volume is said to be low, suggesting a limited interest or a lack of market liquidity. Additionally, the previous literature considers trading volume as a proxy for speculative behavior. Rutledge (1979) focuses on the role of speculation in commodity markets by analyzing the relationship between commodity futures trading volumes as a measure of the volume of speculation and price variability. The empirical results provide evidence for the rejection of the hypothesis that speculative activity destabilizes price. Kumar (2009) investigates the relationship between Indian commodity futures trading activity and spot market volatility. The empirical evidence suggests the positive effect of speculative/day trading activity measured by trading volume on spot market volatility and the insignificant effect of hedging activity measured by open interest on spot market volatility. Malhotra and Sharma (2016) also examine the effect of commodity futures trading activity on the volatility of underlying spot markets in India. Considering either the futures trading volume (speculative activity) or open interest (hedging activity), the results show no evidence of a destabilizing impact of futures trading activity on the volatility of mustard seed prices. Therefore, understanding trading volume patterns and their implications can increase risk management effectiveness, enhance overall trading performance, and improve the odds of success in futures trading.

The foreign exchange (FX) futures market in Thailand has developed since 2012, but USD/THB futures were the first and only FX futures to be traded at Thailand Futures Exchange (TFEX) for the first 10 years. TFEX just added two new FX futures on the most actively traded major currency pairs, EUR/USD and USD/JPY, on 31 October 2022. In recent years, TFEX entered the top list of derivatives exchanges based on FX derivative volumes. Following the introduction of new FX futures and night session trading, TFEX improved its position in the global exchange-traded currency derivatives ranking by jumping 6 places from 17th in 2021 to 11th in 2022 (Table 1). FX futures reached a record high at TFEX in 2023, with a total yearly trading volume of 11,431,640 contracts. It rose by 12.19% from the previous year. For the first time, FX futures were one of the top three types of derivatives in TFEX trading, the other two being SET50 index futures and single stock futures.

Table 1.

Volumes of FX derivatives in 2021 and 2022 by top 10 exchanges and Thailand Futures Exchange.

Table 2 shows investor breakdown by total trading volume in 2023. Most trading of FX futures in TFEX was from local investors, accounting for 58% of the total FX futures trading volume, with 41% being carried out by local institutional investors, while only 1% was carried out by foreign investors. Local investors and foreign investors had a net sell while local institutional investors had a net buy.

Table 2.

FX futures trading in 2023 by investor types.

The question of what determines derivative volumes is an important question, especially when organized exchanges introduce new derivative contracts. Many new derivative contracts are unsuccessful due to insufficient trading volumes. Since TFEX, as one of the top derivatives exchanges based on FX derivative volumes, recently added two new FX futures, EUR/USD futures and USD/JPY futures, on 31 October 2022, the investigation of how the trading volume of the existing FX futures relates to that of the new ones is significant and provides the important implications for promoting the continuous growth of the Thai FX futures market.

The introduction of the new FX futures contracts has a large impact on the Thai FX futures market and may even alter the liquidity of the existing FX futures contracts significantly. The new FX futures contracts can have a negative impact on the liquidity of the existing FX futures contracts since traders can look at these new FX futures as trading alternatives. However, all three FX futures used together for the construction of a portfolio can lead to an increase in the liquidity of the existing FX futures contracts. Since volume and liquidity in futures trading are considered interrelated terms, a higher trading volume often equals more market liquidity. Therefore, the main purpose of this study is to conduct an analysis of the dynamic relationship of the trading volumes of three FX futures. These include two new FX futures, EUR/USD futures and USD/JPY futures, as well as USD/THB futures, which has been traded at TFEX over a decade.

By using the vector autoregressive approach, this study exhibits intriguing trading patterns among the three FX futures contracts. The findings show a negative and bidirectional relationship between the trading volumes of USD/JPY futures and USD/THB futures. The analysis of variance decomposition also shows that the variability of the USD/THB futures trading volume, apart from its own shock, is explained by new FX futures trading volume shocks. The EUR/USD futures contract is empirically found to be less popular and independent of past trading volumes of other FX futures. By spreading investments across different FX futures and focusing on futures contracts with a sufficient trading volume, traders can ensure a more stable and predictable trading environment and mitigate the risk associated with illiquid contracts. The findings help organized exchanges to better understand and effectively manage new futures contracts trading. Furthermore, this study contributes to the existing literature on the dynamic relationship of trading volumes in the context of Thai FX futures.

The rest of the paper is constructed as follows. Section 2 discusses previous studies in this area and develops hypotheses. The data and methodology adopted for modeling the trading volume relationships are presented in Section 3. Section 4 reports the empirical findings and provides some discussion. Finally, Section 5 concludes the paper.

2. Literature Review and Hypotheses

What determines the trading volume of the derivatives market is an important question that researchers analyze to help investors and organized derivatives exchanges to make more efficient and more effective decisions. Researchers study the determinants of derivative volume in different markets by using different variables and various econometric tools. One group of studies uses trading volume as a proxy for the success of derivatives contracts. Bekkerman and Tejeda (2017) review the literature and classify the factors affecting the success of agricultural futures markets into two groups. One is about the components of the underlying cash market, including cash price variability, size of the cash market, activeness of the cash market, product homogeneity and standardized product grading systems, degree of market vertical integration, and degree of market power concentration. Another is related to existing futures markets such as the ability to reduce risk through futures cross-hedging and the liquidity of cross-hedge futures contracts. They also extend the literature by investigating the roles of market participants and the significance of supporting futures markets in the demand for agricultural futures contracts. They employ a two-stage mixture model, in which the entry stage describes the impact of cash market characteristics and cross-hedge opportunities on the likelihood of having a futures market, and the second stage adds the roles of market participants in explaining a contract’s trade volume. The results show that cash market activeness, underlying cash market risk, product homogeneity, industry vertical integration, market power concentration, and the trade volume of a cross-hedge futures contract are relevant for predicting the commodities for which futures contracts are likely to exist. In addition, the type and relative balance of futures market participants help explain the variation in the futures contract trade volume. They also find that the types of participants and trade activity in one market affect the participation and trade volume in the related market. Other studies also find that the characteristics of both spot and futures markets have an impact on the agricultural futures volume. Brorsen and Fofana (2001) suggest that trading volume is positively affected by cash price volatility, cash market size, commodity homogeneity, and vertical integration, while it is negatively affected by the liquidity of the cross-hedge market and buyer concentration. Agrawal et al. (2019) used daily data for about five years on the trading of 22 agriculture futures contracts in India and confirmed the positive effect of spot market volatility on trading volume. However, they found a negative effect of vertical integration on trading volume. An increase in the success of the contract as measured by trading volume also depends on an increase in futures market volatility, competition, number of days of contract life, and tick size. Moreover, the results show a negative impact of international listing, the imposition of CTT, and the degree of geographical coverage on the likelihood of contract success. Sobti (2020) also uses panel data on trading of 30 agriculture futures contracts in India and shows the positive effects of spot price volatility, hedging effectiveness, and open interest and the negative effects of the size of the spot market, compulsory delivery settlement, and government intervention on trading volume. In addition, there are several studies focusing on equity derivative product success. For example, Ciner et al. (2006) estimate the structural model of trading volume, bid–ask spreads, and price volatility using the generalized method of moments estimation procedure for daily KOSP1200 index futures data and find that trading volume is negatively related to bid–ask spreads and positively related to price volatility. Hung et al. (2011) examine key factors that influence the success of ten major stock index futures listed on six Asian exchanges. The findings show that successful futures contracts gain from a large and volatile spot market as well as a smaller contract size. Specific institutional factors, such as trading platform type and exchange size, also affect futures contract success. Samarakoon et al. (2023) employ data on single stock futures and options and index futures and options to investigate the success of equity derivatives markets in three regions, including the Asia–Pacific region, America, Europe, Africa, and the Middle East. The results confirm the impact of both derivative market variables and underlying market variables on the derivatives markets’ success and highlight the crucial role of regulatory and political factors. On the other hand, a study by Ding and Lim (2024) emphasizes the demise of a Brent crude oil futures contract that was traded on the Singapore Stock Exchange. The findings show that trading volume and the number of trades decrease as a contract nears its demise.

Another group of studies considers trading volume as a proxy for liquidity. Jongadsayakul (2023) uses trading volume as a measure of market depth and applies a vector autoregressive (VAR) model to analyze the simultaneous relationships between five liquidity dimensions, namely tightness, immediacy, depth, breadth, and resiliency. The dummy variable for the effect of night session introduction on currency futures market liquidity is added into the VAR model. The results show that market depth and breadth are even stronger after a longer trading session. Dungore and Patel (2021) also consider two liquidity variables, namely trading volume and open interest, and apply a VAR model to understand the relationships between volume, open interest, and volatility for Nifty Index futures. The results of a Granger causality test show the absence of bidirectional causality in all cases and the existence of unidirectional causality for partnership firms from volume to open interest and for public and private firms from volatility to volume.

Many researchers focus on the causal relationship of futures trading activity with the spot market volatility. The study by Jochum and Kodres (1998) involves futures and spot market data on the Mexican peso, Brazilian real, and Hungarian forint. The Granger causality tests conducted for the Hungarian forint show that the futures trading volume is largely uninfluenced by spot market volatility. Jose et al. (2012) consider spot return, futures return, open interest, trade volume, futures return volatility, and turnover and analyze their relationships in the Indian futures market. For the whole study period, they find that Nifty spot and futures market returns, as well as open interest, are individually influencing the Nifty futures trading volume. Kumar (2009) uses the VAR model to investigate the interactions between spot volatility, futures trading volume, and open interest in the Indian commodity derivatives market. For maize, guar seed, aluminum, and crude oil, a bidirectional relationship exists between futures trading activity and spot price volatility. Malhotra and Sharma (2016) also conduct a dynamic analysis of the Indian commodity market. By focusing on the oil and oilseeds segment, there is a bidirectional causality between the futures trading volume and spot market volatility only with regard to Mentha oil.

However, only a few studies apply the VAR model to analyze the dynamic relationships between derivative trading volumes. Lee (2013) applies the VAR model to analyze the linear interdependencies between the KOSPI 200 futures trading volume, KOSPI 200 options trading volume, stock trading volume, and stock market volatility in Korea. There is an existence of a bidirectional relationship between the futures trading volume and options trading volume. Jongadsayakul (2022) focuses on the trading volume relationships between four types of gold derivatives traded in Thailand Futures Exchange. The results show evidence of a bidirectional relationship between 50 baht and 10 baht gold futures trading volumes. The 50 baht and 10 baht gold futures trading volumes are also statistically useful in forecasting the gold online futures trading volume.

Adding to the existing literature, this study aims to understand what determines FX futures trading volumes by conducting a dynamic analysis of three types of FX futures, namely EUR/USD futures, USD/JPY futures, and USD/THB futures. The following hypotheses are tested in this study:

H1.

There is a positive and bidirectional relationship between EUR/USD futures and USD/JPY futures.

H2.

There is a positive and bidirectional relationship between EUR/USD futures and USD/THB futures.

H3.

There is a positive and bidirectional relationship between USD/JPY futures and USD/THB futures.

3. Research Design

3.1. Data Collection

This paper uses the daily trading volumes of three FX futures listed on TFEX, including EUR/USD futures, USD/JPY futures, and USD/THB futures, from SETSMART for a period starting from 31 October 2022 to 12 January 2024. The sample period covers trading days when all three FX futures are traded on TFEX during the day session (9:45 a.m.–4:55 p.m.) and night session (6:50 p.m.–11:55 p.m.). This specific time period is chosen to avoid any possible effect of the extension of night session trading hours on trading volumes since TFEX extended night session trading hours to 3:00 a.m. on 15 January 2024, and the study by Jongadsayakul (2023) shows the positive effect of a longer trading session on the trading volume of USD/THB futures.

3.2. Data Analysis

Table 3 presents descriptive statistics for the daily trading volumes of EUR/USD futures, USD/JPY futures, and USD/THB futures. The daily trading volume series consists of 295 observations. An augmented Dickey–Fuller (ADF) test is also applied to test the null hypothesis of a unit root (H0: b = 0) against the alternative hypothesis of stationarity (Ha: b < 0). The zero lag with the minimum schwarz information criterion (SIC) value is chosen as the optimal lag length. This paper therefore uses the test equations of models with constant but no linear time trend and with both a constant and linear time trend, as shown in Equations (1) and (2), respectively.

Table 3.

Descriptive statistics and unit root test results.

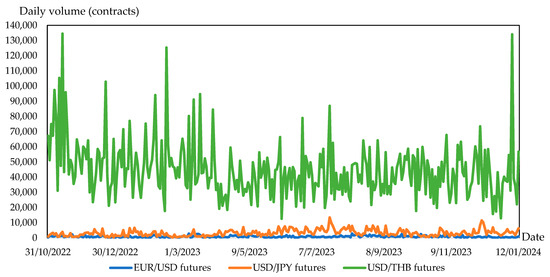

The ADF test results report test statistics less than critical values and their p-values of less than 0.01, when the 1% critical values are −3.45 for the test without a trend and −3.99 for the test with a trend. Therefore, all futures trading volume series are stationary at the 1% level of significance. Figure 1 shows the rise and fall of USD/THB futures trading volumes. However, the dispersion and average value of the daily trading volume remain consistent over time. Since USD/THB futures have been traded for more than 10 years, they are the most popular and largely traded among FX futures, with an average daily trading volume of 44,822 contracts. The maximum and minimum trading volumes for USD/THB futures are 134,560 contracts per day and 12,646 contracts per day, respectively. While both EUR/USD futures and USD/JPY futures have been traded since 31 October 2022, EUR/USD futures are less actively traded, with an average of 890 contracts traded per day. The mean USD/JPY futures trading volume is 3272 contracts per day, with a maximum daily trading volume of 13,476 contracts and a minimum daily trading volume of 177 contracts. The USD/THB futures volume dataset has the largest standard deviation of 18,356.65, indicating the greatest variability in the dataset.

Figure 1.

Daily trading volumes of EUR/USD futures, USD/JPY futures, and USD/THB futures from 31 October 2022 to 12 January 2024.

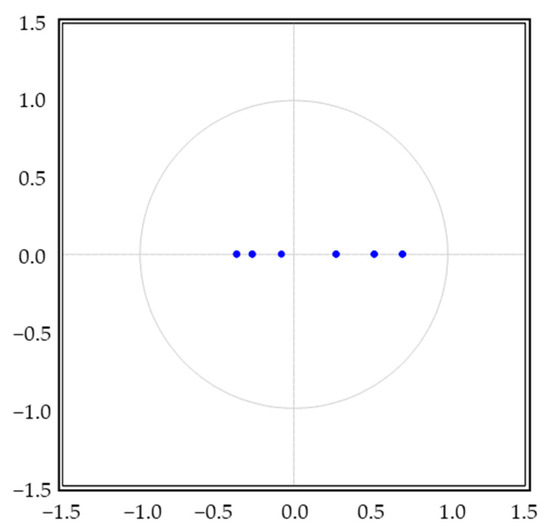

To examine the dynamic relationships between the trading volumes of EUR/USD futures, USD/JPY futures, and USD/THB futures, a vector autoregressive (VAR) model of order 2 is employed. Although the lag length of one generates the minimum Schwarz information criterion (SIC) and Hannan–Quinn (HQ) values, the optimal lag length of two is chosen. As illustrated in Table 4, the VAR(2) model provides the minimum Akaike information criterion (AIC) value, and its residuals pass the test for serial correlation. On the other hand, the results of the Lagrange multiplier (LM) test for autocorrelation in the residuals of the VAR(1) model show that the null hypothesis of no serial correlation at lag 1 can be rejected at a confidence interval of 90%. The VAR(2) model also satisfies the stability condition since the inverse roots of the model lie inside the unit circle (Figure 2).

Table 4.

Model selection results.

Figure 2.

Inverse roots of AR characteristic polynomial. Notes: Figure 2 shows the inverse roots of the VAR(2) model. All roots have a modulus less than one and lie inside the unit circle, meaning that the VAR(2) model is variance and covariance stationary.

The VAR(2) model can be expressed as the following equations:

where EUR is daily trading volume of EUR/USD futures, JPY is daily trading volume of USD/JPY futures, and USD is daily trading volume of USD/THB futures.

To analyze the dynamics of the trading volumes, the Granger causality test, variance decomposition, and impulse response function are also performed.

4. Results

This section presents a summary of the contract specifications, estimation results for the dynamic relationships between the three types of FX futures traded at TFEX, and variance decomposition analysis.

4.1. Contract Specifications

At present, there are three FX futures products, namely EUR/USD futures, USD/JPY futures, and USD/THB futures. FX futures trading in TFEX has developed steadily since its June 2012 introduction of USD/THB futures, with an increase in total trading volume from 396,138 contracts in 2012 to 3,449,751 contracts in 2021. To provide more variety of products and greater convenience, TFEX added two more FX futures, with EUR/USD and USD/JPY underlying them, on 31 October 2022 and extended trading hours until 3:00 a.m. on 15 January 2024. Table 5 summarizes the contract specifications of the three FX futures.

Table 5.

Summary of contract specifications.

As illustrated in Table 5, two new FX futures contracts are quoted and traded in foreign-denominated currencies but settled in Thai baht. The contract multipliers are equal to 30,000 for the EUR/USD futures contract and 300 for the USD/JPY futures contract. TFEX has set their settlement months to one nearest quarterly month, which is different from the settlement months of USD/THB futures. TFEX has set the expiry months of USD/THB futures to the three nearest consecutive months plus the next quarterly months. However, as discussed by Jongadsayakul (2023), the quarterly month contracts of USD/THB futures are the most actively traded delivery months due to the highest average daily trading volume and average daily number of transactions. In addition, the prices of EUR/USD futures contracts are quoted in terms of USD per EUR 1, while those of the USD/EUR futures and USD/THB futures are quoted in terms of JPY per USD 1 and THB per USD 1, respectively. The final settlement price is calculated from the exchange rate announced by Thomson Reuters at 11:00 hrs (BKK time) on the last trading day. All three FX futures can be traded every business day from 9:45 a.m. to 4:55 p.m. (day session) and from 6:50 p.m. to 3:00 a.m. of the next day (night session). They are all settled by cash.

4.2. Estimation Results

Table 6 states the estimation results of the VAR(2) model and the VAR Granger causality test results. It shows that the current trading volume of each FX futures contract is positively affected by its own lagged volumes. Additionally, the current trading volume of USD/JPY futures is negatively affected by one day of lagged trading volumes of both EUR/USD futures and USD/THB futures at the 5% significance level. The current trading volume of USD/THB futures is found to be negatively affected by a two-day lag of the USD/JPY futures trading volume at the 10% significance level. Regarding trading volume of EUR/USD futures, the empirical results provide no evidence that the trading volume of EUR/USD futures is dependent on past trading volumes of USD/JPY futures and USD/THB futures. The VAR Granger causality test results show the existence of a bidirectional relationship between the USD/JPY futures trading volume and the USD/THB futures trading volume in the Thai FX futures market.

Table 6.

Results of the VAR(2) model estimation and Granger causality test.

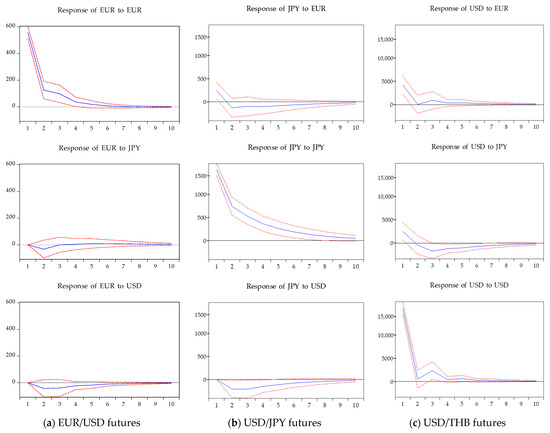

Next, the impulse response analysis is conducted to show the responses of the trading volumes of three types of FX futures, EUR/USD futures, USD/JPY futures, and USD/THB futures to a one-standard-deviation shock. As shown in Figure 3, for each case, the response to its own shock is positive and high on day 1. It diminishes quickly in the cases of EUR/USD futures and USD/THB futures trading volumes and reaches equilibrium within 6 days, while in the case of the USD/JPY futures trading volume, it exponentially decreases and reaches equilibrium after 10 days. The trading volumes of USD/JPY futures and USD/THB futures have no instantaneous impact on the EUR/USD futures trading volume. The negative response of the USD/JPY futures trading volume to the shock of the USD/THB futures trading volume can be detected within 2 days, and this effect disappears after day 10. The negative response of the USD/THB futures trading volume to the shock of the USD/JPY futures trading volume also vanishes after 10 days. Therefore, the results of the impulse response analysis match with the results of the Granger causality test and provide convincing evidence of the sign results of the VAR(2) model.

Figure 3.

Impulse response function results. Notes: Figure 3 shows the results of the response of trading volume of each FX futures contract, EUR/USD futures in panel (a), USD/JPY futures in panel (b), and USD/THB futures in panel (c) to a one-standard-deviation shock in its own innovation and to changes in trading volumes of other FX futures. The response of FX futures trading volume to its own shock is positive and high. The USD/JPY futures trading volume has a negative impact on USD/THB futures trading volume, and vice versa.

4.3. Variance Decomposition Analysis

This paper conducts variance decomposition analysis, as shown in Table 7, to explain how much of the variation in each FX futures trading volume is explained by its own innovation and exogeneous shocks to the trading volumes of other FX futures. As expected, the results show that the percentage of variation in each FX futures trading volume is mostly explained by its own innovation. However, shocks to the trading volumes of EUR/USD futures and USD/THB futures each account for 3% of the variation in the USD/JPY futures trading volume. The contributions of shocks in the trading volumes of EUR/USD futures and USD/JPY futures to the variation in the USD/THB futures trading volume are 6.5% and 4.5%, respectively. This finding suggests that the variation in the EUR/USD futures trading volume is mostly attributable to its own shock, but the variability of the USD/JPY futures trading volume and USD/THB futures trading volume, apart from its own shock, is explained by other FX futures trading volume shocks.

Table 7.

Results of variance decomposition.

Therefore, the analysis of the dynamic relationships between the three types of FX futures traded at TFEX shows that FX futures traders look at new FX futures as trading alternatives. The new FX futures trading activity, especially the USD/JPY futures trading volume, has a negative impact on the liquidity of the USD/THB futures. The analysis of variance decomposition in this paper also shows that around 11% of the variability of the USD/THB futures volume is explained by the innovative shocks in new FX futures trading volumes.

5. Conclusions

The VAR model of order 2 is employed to examine the dynamic relationships between the trading volumes of FX futures, namely EUR/USD futures, USD/JPY futures, and USD/THB futures. The empirical results provide no evidence that the trading volume of EUR/USD futures is dependent on the past trading volumes of USD/JPY futures and USD/THB futures. However, there is a decrease in the future trading volumes of USD/THB futures due to an increase in the current trading of USD/JPY futures as a substitute product. This empirical finding is different from what has been reported by Jongadsayakul (2022). In the case of gold futures trading in Thailand, the empirical results suggest that the new gold futures trading activity does not have an impact on 50 baht and 10 baht gold futures trading volumes. In addition, the three FX futures are considered as substitute products by USD/JPY futures investors. The Granger causality test results also show that there is a bidirectional causality between trading volumes of USD/JPY futures and USD/THB futures. These results are in line with the research on the KOSPI 200 equity derivatives market (see Lee 2013 for a bidirectional relationship between KOSPI 200 futures trading volume and KOSPI 200 options trading volume) and the gold futures market (see Jongadsayakul 2022 for a bidirectional relationship between 50 baht and 10 baht gold futures trading volumes). In addition, the impulse response analysis shows the negative response of the USD/JPY futures trading volume to the USD/THB futures trading volume, and vice versa. This effect disappears after day 10. The analysis of variance decomposition also shows that the variability of the USD/JPY futures trading volume and the USD/THB futures trading volume, apart from its own shock, is explained by other FX futures trading volume shocks.

An important implication can be derived from this study for market regulators and investors in the Thai FX futures market. Investors should pay more attention to the negative impact of new FX futures trading activity on the liquidity of the existing FX futures contracts. TFEX should focus on investor education by providing a complete guide to using FX futures bundle strategies. Bundling together multiple futures contracts to create a diversified portfolio can help investors mitigate FX risk and potentially enhance returns since investors currently trade FX futures as substitute products. Furthermore, special care should be taken when there is an exogeneous shock to either the EUR/USD futures trading volume or the USD/JPY futures trading volume due to its contribution to the variance in the USD/THB futures trading volume.

Although the number of observations is large enough to conduct statistical analysis, a larger sample size would strengthen the analysis. This study can also be extended by considering additional exogenous variables of the VAR regression, such as EUR/USD and USD/JPY trading volumes, on the US market, particularly on the Chicago Mercantile Exchange. In addition to the analysis of additional time periods and the model extension, further research can be conducted on whether a volatility clustering of FX futures trading activity is observed and how FX futures trading activity is related to FX futures and spot market volatility. This can improve the understanding of Thai FX futures trading activity and enrich the literature.

Funding

This research was funded by the Department of Economics, Faculty of Economics, Kasetsart University.

Data Availability Statement

The original data presented in the study are openly available in FigShare at https://doi.org/10.6084/m9.figshare.26484772 (accessed on 7 August 2024).

Conflicts of Interest

The author declares no conflicts of interest.

References

- Agrawal, Tarunika Jain, Sanjay Sehgal, and Rahul Agrawal. 2019. Determinants of Successful Agri—Futures Contracts in India. Asian Journal of Finance & Accounting 11: 120–47. [Google Scholar] [CrossRef]

- Bekkerman, Anton, and Hernan A. Tejeda. 2017. Revisiting the Determinants of Futures Contracts Success: The Role of Market Participants. Agricultural Economics 48: 175–85. [Google Scholar] [CrossRef]

- Brorsen, B. Wade, and N’Zue F. Fofana. 2001. Success and Failure of Agricultural Futures Contracts. Journal of Agribusiness 19: 129–45. [Google Scholar] [CrossRef]

- Ciner, Cetin, Ahmet K. Karagozoglu, and Wi Saeng Kim. 2006. What is So Special about KOSPI 200 Index Futures Contract? An Analysis of Trading Volume and Liquidity. Review of Futures Markets 14: 327–48. [Google Scholar]

- Ding, David K., and Wui Boon Lim. 2024. Lessons from the Demise of the Brent Crude Oil Futures Contract on the Singapore Exchange. Journal of Risk and Financial Management 17: 252. [Google Scholar] [CrossRef]

- Dungore, Parizad Phiroze, and Sarosh Hosi Patel. 2021. Analysis of Volatility Volume and Open Interest for Nifty Index Futures Using GARCH Analysis and VAR Model. International Journal of Financial Studies 9: 7. [Google Scholar] [CrossRef]

- Hung, Mao-Wei, Bing-Huei Lin, Yu-Chuan Huang, and Jian-Hsin Chou. 2011. Determinants of Futures Contract Success: Empirical Examinations for the Asian Futures Markets. International Review of Economics & Finance 20: 452–58. [Google Scholar] [CrossRef]

- Jochum, Christian, and Laura Kodres. 1998. Does the Introduction of Futures on Emerging Market Currencies Destabilize the Underlying Currencies? IMF Staff Papers 45: 486–521. Available online: https://www.imf.org/external/pubs/ft/wp/wp9813.pdf (accessed on 5 September 2024). [CrossRef][Green Version]

- Jongadsayakul, Woradee. 2022. Determinants of Gold Futures Trading Volume: A Study of Thailand Futures Exchange. Afro-Asian Journal of Finance and Accounting 12: 679–90. [Google Scholar] [CrossRef]

- Jongadsayakul, Woradee. 2023. The Launch of a Night Trading Session and Currency Futures Market Liquidity: Evidence from the Thailand Futures Exchange. Journal of Risk and Financial Management 16: 442. [Google Scholar] [CrossRef]

- Jose, Babu, Daniel Lazar, and K. C. Rao. 2012. Determinants of Futures Market in India. Paper presented at XI Capital Markets Conference, Mumbai, India, December 21–22. [Google Scholar]

- Kumar, Brajesh. 2009. Effect of Futures Trading on Spot Market Volatility: Evidence from Indian Commodity Derivatives Markets. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Lee, Hyo Seob. 2013. Determinants of the KOSPI 200 Futures and Options Markets Trading Volume. Capital Market Perspective 5: 29–44. Available online: https://www.kcmi.re.kr/common/downloadw.php?fid=16646&fgu=002001&fty=004003 (accessed on 17 July 2024).

- Malhotra, Meenakshi, and Dinesh K. Sharma. 2016. Volatility Dynamics in Oil and Oilseeds Spot and Futures Market in India. Vikalpa 41: 132–48. [Google Scholar] [CrossRef]

- Rutledge, D. J. S. 1979. Trading Volume and Price Variability: New Evidence on the Price Effects of Speculation. International Futures Trading Seminar 5: 160–74. Available online: https://scotthirwin.com/wp-content/uploads/2019/08/trading-volume-and-price-variability-new-evidence-on-the-price-effects-of-speculation-rutledge-1978-2.pdf (accessed on 5 September 2024).

- Samarakoon, S. M. R. K., Rudra P. Pradhan, Rana P. Maradana, and Premjit Sahoo. 2023. What Determines the Success of Equity Derivatives Markets? A Global Perspective. Borsa Istanbul Review. in press. [Google Scholar] [CrossRef]

- Sobti, Neharika. 2020. Determinants of a Successful Commodity Contract: Evidence from the Indian Agriculture Futures Market. IIMB Management Review 32: 376–88. [Google Scholar] [CrossRef]

- Thailand Futures Exchange. 2024. Currency Futures. Available online: https://www.tfex.co.th/th/education/knowledge/article/13-currency-futures (accessed on 4 August 2024).

- World Federation of Exchanges. 2024. Statistics Portal. Available online: https://statistics.world-exchanges.org/ (accessed on 4 September 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).