1. Introduction

In the modern context of the Decade of Action, sustainability has become a new criterion for measuring the strategic market success of companies. The main threat to the sustainability of companies is risk. Sustainable development of companies—as a reflection of the level of their correspondence to the criterion of sustainability—is the efficiency of opposing risks. Growth of the level of risks to companies (increase in the level of threat of negative consequences of risks and growth of the probability of risk events) is a sign of instability for companies and slows down their development. Reduction of the level of companies’ risks means their sustainable development, and complete overcoming of risks means the absolute sustainability of companies.

The problem is that the sustainable development of companies requires the general reduction of their risk burden, i.e., the fight against risks of a different nature. Simultaneous management of risks of different natures is a complex task, the final solution to which has not yet been found by science. The essence of the problem posed is that in modern economic theory and practice, financial and social risks for companies are opposed to each other and are managed separately. This limits the capabilities and reduces the effectiveness of risk management for companies. The justification for this research is the need for a systemic view of financial and social risks for modern companies and the development of a unified set of tools for managing these risks.

In this paper, we analyzed variables that characterize financial risks for companies: investment risk (reduction of direct foreign investments), risk of market capitalization (reduction of the market capitalization of listed companies), and risk of the movement of shares (reduction of the movement of shares of listed companies in the stock market), as well as variables that characterize elements of the marketing mix in the 7P model: affordability of products for consumers (P1: Price), product quality (P2: Product), affordability of products for wide groups of consumers due to realization of products at online marketplaces (P3: Place), strength of global brands of companies (P4: Promotion), socially-oriented HRM from the positions of creation of knowledge-intensive jobs and corporate training (P5: People), automatization of business processes (P6: Process), and corporate environmental responsibility (P7: Physical evidence).

The challenges of risk management for modern companies are connected with the aggravation of financial risks against the background of the transformation of international economic relations and the global financial system, on the one hand, and an increase in the importance of social risk management for companies’ preserving market positions in a more progressive social environment with actively developing environmental communities, trade unions, and growing consumer awareness, on the other hand.

The key milestones of the central topic of this paper are as follows: the growth of the intensity and effectiveness of marketing contributes to the reduction of companies’ financial risks; marketing activities allow modern companies to better cope with financial risks; the effectiveness of marketing grows due to the integration of CSR elements into it; to determine the general risk burden on companies, it is important to take into account financial and social risks; comprehensive risk management is more effective than the management of each isolated risk or group of risks. Therefore, the central idea of this paper was to demonstrate the consequences of integrating CSR into each element of their marketing mix for modern companies’ financial risks.

The manifestation of corporate social responsibility (CSR) is one of the main tools for managing risks for modern companies to ensure their sustainable development in theory and practice. This tool is applied for managing social risks, which are especially high in the conditions of technological progress.

Under the influence of digitalization, employers’ requirements for the level of qualification and specialized professional competencies of employees grow. Under the influence of automatization, more and more personnel are dismissed in all sectors of the economy. Due to this, social risks to the activities of modern companies are connected with the threat of the loss of jobs by employees, the emergence and increase in gaps in their competencies, and the necessity of adapting to the change in organization and functional responsibilities of labor activities.

A separate issue is financial risks, which grew against the background of an increased cyclicity of the market economy at the world and national levels. The change in the model of globalization in the world economic system led to the reorientation of international financial flows. This increased the risk component of companies’ financial activities, raising the investment risk, the risk of market capitalization, and the risk of the movement of shares in the stock market. Financial risk management is conducted separately from social risk management, which reduces the effectiveness of modern companies’ risk management due to high expenditures and contradictory results.

In practice, there are frequent situations, when the application of generally accepted tools for financial risk management leads to an increase in social risks and vice versa. For example, in the conditions of economic crises, companies face a choice: either reduce expenditures for human resources (from the reduction of wages or personnel cuts to the growth of requirements for labor efficiency and an increase in working hours), which reduces financial risks but increases social risks, or preserve the status quo in the sphere of HRM, reducing social risks but facing the growth of financial risks.

The issues of the application of CSR in the marketing activities of companies have not been sufficiently studied in the existing literature. Existing publications note only the important role of CSR in HRM, but this is only one of many elements of the marketing mix. Moreover, this role is disclosed primarily from the position of reducing social risks, with the ambiguity of how this influences financial risks. Uncertainty about the consequences of modern companies’ manifesting CSR in different elements of the marketing mix for financial risks to companies is a gap in the literature, which this paper strives to fill.

The search for a solution to the set research problem in this paper was performed using the authors’ vision of the specifics of CSR. This vision involves distinguishing between internal CSR-responsibility companies to business owners, shareholders, and investors, which allows for reducing financial risks, and external CSR-responsibility companies to other interested parties, which are not direct business owners: employees, consumers, etc.

This paper’s research question is as follows: “How does the integration of CSR into the marketing mix in the 7P model influence the financial risks for modern companies?». The basic precondition of this research is the assumption that systemic integration of CSR into the marketing mix allows for the simultaneous reduction of social and financial risks for modern companies, comprehensively supporting their sustainable development. The originality of this research consists in the development of novel marketing tools for the systemic management of social and financial risks for companies with the help of CSR.

The goal of this paper is to establish the consequences of the integration of CSR into the marketing mix for financial risks in modern companies. The order of the achievement of this goal predetermined the logical structure of this paper. In the main part of the paper (the research section), we perform the following: (1) modeling the dependence of financial risks on the integration of CSR into their marketing mix; (2) determining the perspective of the sustainable development of Russian companies through a more complete integration of CSR into their marketing mix to reduce financial risks; and (3) developing a system approach to the management of companies’ sustainable development.

3. Materials and Methods

The methodology of this research is described in

Table 1.

For the measurement of variables in this paper, the following scale is used: low values (below 75% of the average value); at the level of average values (between 75% and 125% of the average value); high (more than 125% of the average and maximum values). The research has the following design. To achieve the set goal in this paper, we consistently solve the three following research tasks:

The first task is to compile a model of the dependence of financial risks on the integration of CSR into their marketing mix. This task is solved with the help of the regression analysis method. This method is utilized to find the regression dependence of the indicators of financial risks to companies on the indicators of the level of CSR’s integration into each element of their marketing mix. The indicators of companies’ financial risks are as follows (measured in % of GDP):

“Foreign direct investment, net inflows” (FR1) as the indicator of investment risk (

World Bank 2024b);

“Market capitalization of listed domestic companies” (FR2) as an indicator of the risk of market capitalization (

World Bank 2024d);

“Stocks traded, total value” (FR3) as an indicator of the risk of movement of shares (

World Bank 2024e).

The system of indicators for measuring the level of CSR’s integration into the marketing mix, which are factor variables, is given in

Table 2.

Indicators for measuring the integration of CSR into the element of 7P (

Table 2) are the correct indicators to present the “integration of CSR into each element of the marketing mix”, due to the following:

Inflation and consumer prices demonstrate the integration of CSR into P1 because it reflects the manufacturing company’s adopting responsibility for the stability of prices for manufactured and sold products in the market, which allows for reducing the risks of the reduction of the affordability of products for consumers (

Hemphill and Johnson 2020);

ISO 9001 quality demonstrates the integration of CSR into P2 because it reflects voluntary standardization of quality and increased control over quality in companies’ activities, which allows reducing the risks to product quality (

Koesworodjati et al. 2024);

E-participation demonstrates the integration of CSR into P3 because it reflects the establishment of agreements between companies and online marketplaces regarding convenient and profitable conditions for consumers purchasing their products, which allows for reducing the risks of reducing the affordability of products for wide groups of consumers (

Behera et al. 2024);

Global brand value demonstrates the integration of CSR into P4 because it reflects the sustainability of demand for their products from progressive and environmentally responsible consumers, which allows for reducing the risks of weakening companies’ global brands (

Enslin et al. 2023);

Knowledge workers demonstrate the integration of CSR into P5 because it reflects the creation of knowledge-intensive jobs by responsible employers, which allows for reducing the risks of reduction of knowledge-intensive employment (

Rubel et al. 2023);

The Frontier Technologies Readiness index demonstrates the integration of CSR into P6 because it reflects employers’ responsibility to employees (which ensures minimization of personnel dismissal) and employees’ loyalty to companies, which is manifested in the maximum return from automatization in the form of growth of labor efficiency, which allows reducing social risks of automatization of business processes in companies’ activities (

Biao et al. 2023);

The Green Growth Index demonstrates the integration of CSR into P7 because it reflects the implementation of green innovations and voluntary refusal of economic practices with low eco-friendliness, which allows reducing the environmental risks of companies’ activities (

Silva and Lopes 2015).

The control variable is the “Depth of credit information index (0 = low to 8 = high)” from the statistics by the

World Bank (

2024a) (F) as an indicator of the depth of credit information sharing by companies. For this research, we formed a sample of 69 countries, for which the full set of necessary statistical data is available. The research period is 2023 (data as of the beginning of the year as a result of 2022). The sample is presented in

Appendix A and

Appendix B. The research model has the following form:

Hypothesis H is deemed proven if, in the model (1), most of the coefficients bi at factor variables P1, P5–P7 take positive values, and most of the coefficients bi at factor variables P2 take negative values. We select factor variables for which regression coefficients took target values at least for one resulting variable.

Second task: reveal the perspective of the sustainable development of Russian companies through a more complete integration of CSR into their marketing mix to reduce financial risks. For this, we insert into the model (1) the maximum values from the sample of the selected factor variables. The method of trend analysis is used to measure the change in the values of all indicators from the perspective of the Decade of Action (until 2030).

Third task: develop a system approach to managing companies’ sustainable development. The authors’ approach is compiled based on the results of regression modeling. To substantiate the advantages of the new approach, we perform its comparative analysis with the existing approach to managing companies’ sustainable development.

4. Results

4.1. The Model of the Dependence of Companies’ Financial Risks on the Integration of CSR into Their Marketing Mix

To solve the first task and compile a model of the dependence of financial risks to companies on the integration of CSR into their marketing mix, we use the data from

Appendix A and

Appendix B to find the regression dependence of the indicators of financial risks to companies on the indicators of the level of CSR’s integration into each element of their marketing mix. The results obtained are shown in

Table 3,

Table 4 and

Table 5.

Results from

Table 3 showed that in 2023, the companies’ investment risk was 75.24% determined by applying risk management measures. The correctness and reliability of the regression analysis results are confirmed by the F-test, which was successfully passed at the level of significance of 0.01: F-observed is 9.7830, and significance F is 1.42 × 10

−8.

Results from

Table 4 showed that in 2023, the risk of the market capitalization of companies was 63.54% determined by the application of risk management measures. The correctness and reliability of the results of regression analysis are confirmed by the F-test, which was successfully passed at the level of significance of 0.01: F observed is 5.0772, and significance F is 17.63 × 10

−5.

Results from

Table 5 showed that in 2023, the risk of movement of companies’ shares was 77.78% determined by the application of risk management measures. The correctness and reliability of the results of regression analysis are confirmed by the F-test, which was successfully passed at the level of significance of 0.01: F observed is 11.4852, and significance F is 1.02 × 10

−9. As a result of the generalization of the results obtained in

Table 2,

Table 3 and

Table 4, the following model of the dependence of financial risks on the integration of CSR into their marketing mix was compiled:

According to model (2), the reduction of annual inflation by 1% leads to a decrease in investment risk of 0.02% of GDP, but an increase in the risk of market capitalization of 0.55% of GDP and the growth of the risk of movement of shares by 0.43% of GDP. An increase in the quality of products by 1 point leads to a reduction of investment risk by 0.71% of GDP, a reduction of the risk of market capitalization by 0.30% of GDP, and a reduction of the risk of the movement of shares by 0.08% of GDP.

Growth of the activity of sales at online marketplaces by 1 point leads to a reduction of investment risk by 0.25% of GDP and a reduction of the risk of movement of shares by 0.33% of GDP, but an increase in the risk of market capitalization of 0.58% of GDP. Strengthening global brands of companies by 1 point leads to a reduction of the risk of market capitalization by 2.88% of GDP and a reduction of the risk of movement of shares by 1.39% of GDP, but an increase in investment risk of 0.25% BBП.

Growth of the activity of implementing socially-oriented HRM by 1 point leads to a reduction of the risk of movement of shares by 0.51% of GDP, but an increase in investment risk of 0.63% of GDP and an increase in the risk of market capitalization of 0.61% of GDP. Growth of the activity of the use of leading technologies by 1 point leads to a reduction of investment risk by 4.06% of GDP and a reduction of the risk of market capitalization by 7.08% of GDP, but an increase in the risk of movement of shares by 1.07% of GDP.

Acceleration of the green growth of the economy by 1 point leads to an increase in investment risk of 0.14% of GDP, an increase in the risk of market capitalization of 2.07% of GDP, and a growth in the risk of movement of shares of 1.15% of GDP. An increase in the depth of credit information sharing of 1 leads to a reduction of investment risk by 26.50% of GDP, a reduction of the risk of market capitalization by 2.17% of GDP, and a reduction of the risk of the movement of shares by 5.71% of GDP.

Since in model (2), most of the coefficients b

i at factor variables P

1, P

5-, and P

7 took positive values and most of the coefficients bi at factor variables P2 took negative values, hypothesis H is deemed proven. The results of regression modeling, which were obtained in

Table 2,

Table 3 and

Table 4, also allowed selecting factor variables for which regression coefficients took target values at least for one resulting variable: these are variables P

1-P

6, i.e., all factor variables, except for P

7.

4.2. The Perspective of Sustainable Development of Russian Companies through Fuller Integration of CSR into Their Marketing Mix to Reduce Financial Risks

To solve the second task and determine the perspective of the sustainable development of Russian companies through fuller integration of CSR into their marketing mix to reduce financial risks, we inserted into the model (2) the maximum values from the sample of the selected factor variables (from

Appendix A and

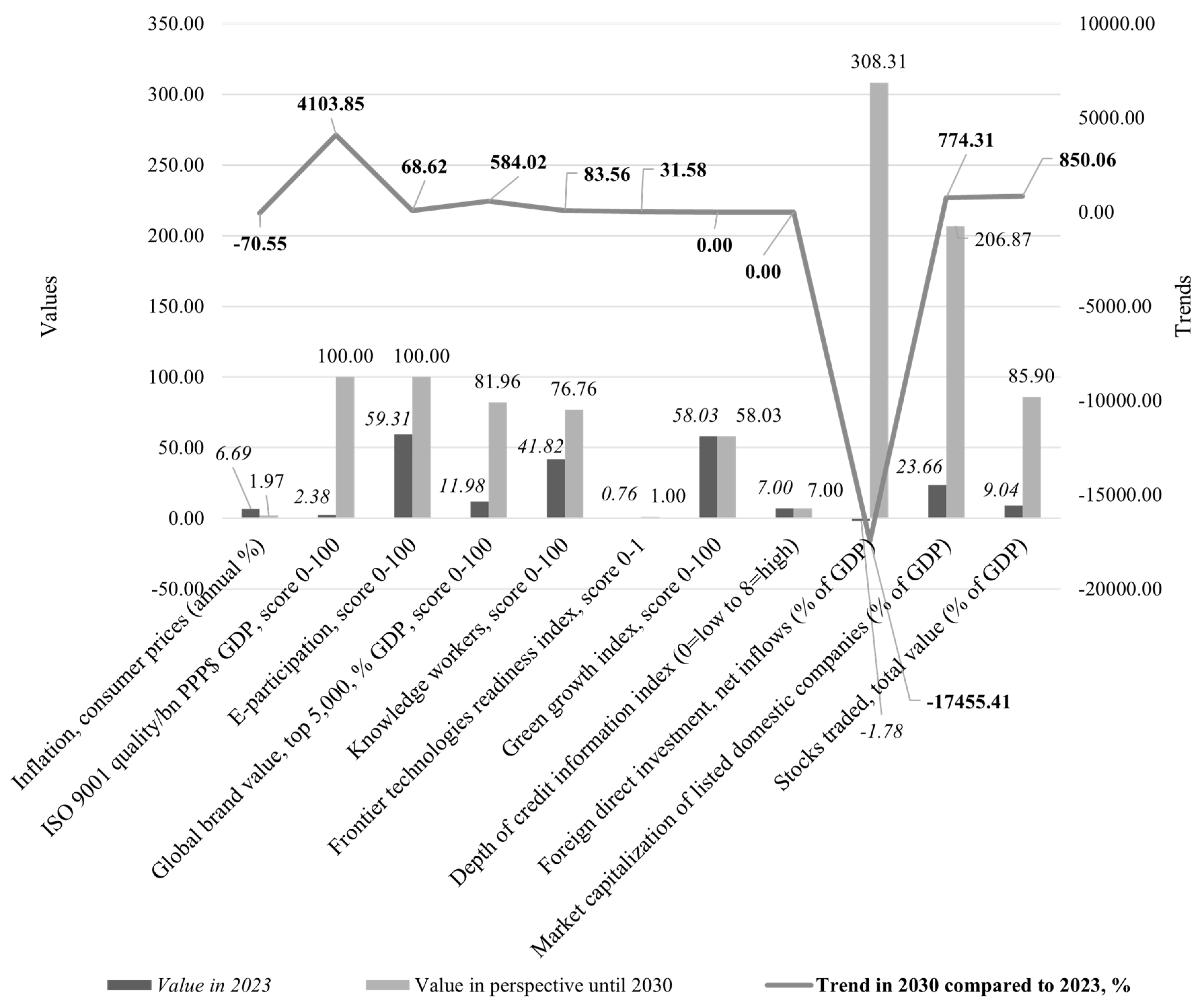

Appendix B). The method of trend analysis was used to find the change in the values of all indicators from the perspective of the Decade of Action (until 2030), as shown in

Figure 1.

As shown in

Figure 1, the perspective of the sustainable development of Russian companies through fuller integration of CSR into their marketing mix is connected with the following reduction of financial risks:

Investment risk—by 17,455.41%;

Risk of market capitalization—by 774.31%;

Risk of movement of shares—by 850.06%.

To reach the revealed perspective in practice, the following recommendations from the authors are offered:

Reduction of annual inflation by 70.55%;

Increase in the quality of products of 4103.85%;

Growth of the activity of sales at online marketplaces by 68.62%;

Strengthening of global brands of companies by 584.02%;

Growth of the activity of implementing socially-oriented HRM by 83.56%;

Growth of the activity of the use of leading technologies by 31.56%.

4.3. System Approach to the Management of Companies’ Sustainable Development

To solve the third task and develop a system approach to the management of companies’ sustainable development, we used the results of regression modeling. The proposed approach involves systemic integration of CSR into the marketing mix in the following order: First, in such an element of the marketing mix as P2: Product—through an increase in the quality of products, in particular, by bringing it by international quality standards, the main of which is ISO 9001.

Second, into such elements of the marketing mix as P3: Place—through an increase in product accessibility for wide groups of consumers by selling it at online marketplaces, P4: Promotion—through the strengthening of global brands of companies, and P6: Process—through automatization of business processes in companies’ activities. Third, into such elements of the marketing mix as P1: Price—through reduction of prices to raise affordability of products for consumers, and P5: People—through socially-oriented HRM, e.g., creation of knowledge-intensive jobs and corporate training. To prove the advantages of the new approach, we performed a comparative analysis with the existing approach to managing companies’ sustainable development.

As shown in

Table 6, unlike the existing approach, the new approach to the management of companies’ sustainable development suggests implementing not corporate but marketing management of this development. It is proposed to manage social and financial risks for companies not in isolation but jointly. The essence of risk management consists of integrating CSR into the marketing mix (except for P7: Physical Evidence). The target result of managing companies’ sustainable development in the new approach is the reduction of social and financial risks not separately but in a systemic manner.

5. Conclusions

This paper contributes to the concept of the sustainable development of companies (

Saleem et al. 2024;

Samieva et al. 2023) by clarifying the consequences of modern companies’ manifesting CSR for their financial risks. Due to this, the paper bridges the gap in the scientific view of managing financial and social risks. The results obtained are compared with the existing literature in

Table 7.

As shown in

Table 7, unlike

Bogoviz et al. (

2023) and

Ravichandran et al. (

2023), the integration of CSR into P7: Physical evidence does not facilitate the reduction of financial risks to companies. Confirming

Tao and Ji (

2024), integrating CSR into P2: Product ensures a simultaneous reduction of all three considered financial risks to companies.

Unlike

Mkrtchyan et al. (

2023), integrating CSR into P1: Price facilitates the reduction of only investment risk but not the risk of market capitalization or the risk of the movement of companies’ shares. Unlike

Zhang et al. (

2024), the integration of CSR into P3: Place facilitates the reduction of only investment risk and the risk of movement of shares, but not the risk of market capitalization of companies.

Unlike

Farmaki et al. (

2023), the integration of CSR into P4: Promotion leads to the reduction of only the risk of market capitalization and the risk of movement of shares, but not the investment risk of companies. Unlike

Binh et al. (

2023), the integration of CSR into P5: People stimulates the reduction of only the risk of movement of shares, but not the investment risk or the risk of market capitalization of companies.

Unlike

Petrenko et al. (

2019), the integration of CSR into the P6: Process leads to a reduction of only the investment risk and the risk of market capitalization, but not the risk of the movement of companies’ shares. Continuing the scientific discussion and confirming the works by

Oduro and Haylemariam (

2019),

Przhedetsky et al. (

2018), and

Yim et al. (

2019), this paper proves the hypothesis that integration of CSR into the marketing mix contributes to the reduction of financial risks for modern companies.x

The goal posed was achieved, and we specified the consequences of the integration of CSR into the marketing mix for financial risks to modern companies. In particular, we received the following scientific results:

- (1)

We compiled a model of the dependence of financial risks on the integration of CSR into their marketing mix. The model revealed that the complex reduction of all three considered financial risks is achieved in the case of CSR’s integration into P2: Product. Neither of the financial risks to companies decreased during CSR’s integration into P7: Physical Evidence. CSR’s integration into P1: Price, P3: Place, P4: Promotion, P5: People, and P6: Process ensures only a partial decrease in financial risks to companies;

- (2)

We determined the perspective of sustainable development for Russian companies through fuller integration of CSR into their marketing mix to reduce financial risks. In Russia, this perspective is connected with a decrease in investment risk of 17,455.41%, the risk of market capitalization of 774.31%, and the risk of movement of shares of 850.06%;

- (3)

We develop a new system approach to managing companies’ sustainable development. The features of the new approach are the transition from corporate to marketing management of companies’ sustainable development; the transition from isolated to systemic management of social and financial risks to companies; the implementation of risk management through the integration of CSR into the marketing mix (except for P7: Physical Evidence); establishing the target result of sustainable development management of companies as the reduction of social and financial risks not separately but systemically.

The main authors’ conclusion as a result of the conducted research is that sustainable development of companies in the Decade of Action (until 2030) requires the systemic integration of CSR into the marketing mix, for this will allow for a simultaneous decrease in social and financial risks. The theoretical importance of this conclusion consists in the disclosure of previously unknown cause-and-effect relationships between CSR and financial risks to companies, which are explained in the paper through the lens of the elements of the marketing mix in the 7P model.

The practical significance is because the proposed recommendations for fuller integration of CSR into their marketing mix will allow for reducing financial risks and ensuring the sustainable development of Russian companies in the Decade of Action (until 2030). The managerial significance is that the developed system approach to managing companies’ sustainable development will improve the practice of risk management in companies due to previously inaccessible joint management and a general reduction of social and financial risks.

The limitation of the results obtained is that they revealed a general necessity for the integration of CSR into the marketing mix of companies to reduce their financial risks, but the specific practice of this integration will be unique in each separate case. Each company requires its own applied solutions for systemic risk management based on marketing, given the specifics of its activities and the target market. That is why suggestions for future research are connected with case studies by the example of concrete companies and the development of highly detailed applied recommendations for the most optimal integration of CSR into the marketing mix of companies in the interests of the largest reduction of their financial risks.