2.1. Logistics Companies’ Importance and Evolution

A logistics company is a business that plans, coordinates, and oversees the supply chain of other businesses. A logistics company may function in the areas of order fulfilment, distribution, storage, transportation, and supplier procurement, contingent upon the terms of the parties’ commercial agreement. Logistics includes many important activities. While transport is often considered the most crucial logistics activity (

Tseng et al. 2005), logistics also involves other essential functions, such as warehousing, storage, cargo handling, and ancillary support activities related to land, air, and water transportation. Long before logistics gained global recognition as a concept, traders would store their goods in one location and then transport them to the market for sale. Over time, logistics has evolved into a multibillion-dollar sector that serves global trade. Nowadays, logistics continues to evolve and produce new opportunities. The evolution of logistics has significantly influenced the growth of the global economy (

Frikha and Hlali 2023).

Dablanc and Rakotonarivo (

2010) claim that the initial step in logistics begins with the warehouse. They discovered the importance of the spatial organisation of logistics facilities from a geographic perspective and found that the relocation of logistics facilities from the central urban areas of Paris to the suburbs had a more pronounced impact on geography compared to its effect on employment and households.

The changes in electronic commerce businesses that have taken place over the past four decades in industrialised countries have been mainly due to logistics. The gradual advancement and acceptance of remote methods of selling items represent one of the most significant changes in the logistics process (

Ilchenko and Freiuk 2020). In the past, logistical tasks such as order picking, break-bulk, freight consolidation, shipping, receiving, storing, and containerisation were commonplace.

In the present day, numerous distribution operations have been computerised, automated, and outfitted with cutting-edge material handling machinery and information systems, all owing to technological advancements (

Rimienė and Grundey 2007). These advancements have significantly enhanced the efficiency of logistics operations, facilitating the timely delivery of goods at a reduced cost (

UK Essay 2017).

Some significant aspects of logistics operations that play a vital role in the distribution process are the level of customer service, quality, efficiency, satisfaction, and transportation. Various economic trends focus on enhancing and optimising the volume of commodities moved and cutting down the time between production and receipt by the final consumer (

Tomasz 2013).

Pokrovskaya et al. (

2022) suggest that the COVID-19 pandemic has reshaped the rules of engagement for businesses. Those that have demonstrated the ability to swiftly adapt to rapid changes have emerged victorious. Logistics providers and their electronic platforms are changing and becoming more and more influential in setting the rules of the market. Globalisation is facilitating greater accessibility to commodities, services, and information worldwide. Consequently, the global freight volume has steadily risen alongside the deepening of economic globalisation, while urban logistics spaces are undergoing progressive transformations. Specifically, sustainable development plays a crucial role in redistributing social resources, enhancing urban ecology, and stabilising the urban economic system (

He et al. 2019). Furthermore, with the emergence of COVID-19, internet shopping became the predominant driving force in the logistics industry, as an increasing number of customers opted to order products online (

Stošić and Trajković 2020).

Many researchers agree that the effectiveness of supply chain management is the most important aspect of logistics activities. Supply chain management is a rapidly growing field that is transforming the ability of manufacturing and non-manufacturing businesses to satisfy their clients’ needs (

Almatarneh et al. 2022). As the geographical distances between the points of production and consumption expand, the importance of logistics grows. The rising global demand for a diverse array of products is prompting shifts in people’s expectations for each product (

Neeraja et al. 2014). It is necessary for companies to effectively manage logistics activities to enhance business competitiveness and ensure customer satisfaction. Therefore, selecting appropriate storage, warehouse, and transport management strategies is essential for companies to minimise their overall costs (

Ristovska et al. 2017). Logistics companies need to focus on organising the control of procurement, storage, transport, and information to enhance efficiency. An effective supply chain management strategy lowers expenses and increases a company’s ability to compete (

Kumar et al. 2006). Countries with emerging economies must pay particular attention to the logistics and supply chain management processes to maintain competitiveness. Modern technology enables these countries to capitalise on market opportunities to their fullest extent (

Kherbach and Mocan 2016). Suppliers, customers, and logistics service providers are the key players in the supply chain, and companies rely on their support to successfully execute supply chain management (

Larson and Halldorsson 2010).

Many researchers have focused on the financial aspect of logistics companies. It is a fact that capital structure negatively influences the profitability of logistics companies, specifically in terms of their return on assets (ROA). Unfortunately, there is no statistically significant evidence supporting the direct impact of capital structure on return on equity (ROE) (

Ngoc et al. 2021). Despite its negative impact on the financial aspect of the logistics sector, its economic significance is substantial, with its direct contributions and indirect effects collectively contributing to GDP and domestic employment (

De Doncker 2017). To reduce logistics costs relative to the gross domestic product, it is important to focus on the relationship between logistics costs and economic development. Developing appropriate logistics policies that accommodate economic growth needs is essential (

Liu 2016). Hence, investments in the logistics sector are essential to enhance trade outcomes and earn higher earnings, while also effectively meeting the changing demands of customers (

Al Jabri et al. 2021). Other researchers have revealed the negative effect on the financial performance of logistics companies during the COVID-19 pandemic, which lead to severe constraints on export activities and international transportation. As a result, there was a notable increase in the leverage ratio, accompanied by decreases in profitability and efficiency ratios among affected businesses (

Nguyen 2022). This downturn is evidenced by a decrease in overall revenue, profitability, and investment among companies operating in sectors including travel and tourism, transportation, the supply chain, sports, and other industries reliant on these sectors (

Atayah et al. 2021).

According to the literature review, most studies have primarily focused on several financial indicators or specific aspects of logistics, such as supply chain efficiency and transportation infrastructure. However, as the global demand for logistics services continues to surge, driven particularly by the expansion of international trade, there is a significant gap in the research. Specifically, there is a need for more comprehensive studies to understand the relationship between the overall economic and financial health of logistics companies. This literature gap highlights the necessity for an integrated approach that examines both the financial and economic performance metrics of logistics companies in a microeconomic context.

For further analysis, we have chosen Lithuanian logistic companies as a sample for several compelling reasons. First and foremost, they are a crucial pillar of Lithuania’s economy, significantly driving economic growth and development. Furthermore, logistic companies in Lithuania are known for generating substantial profits, which contribute to their growth and bolster the country’s overall financial health. Providing employment opportunities and fostering related industries can create a ripple effect that strengthens the broader Lithuanian economic landscape. While other sectors were not the primary focus of our analysis, this decision allowed us to concentrate specifically on the logistics sector and conduct a detailed examination.

2.2. Viability of Logistics Companies in Lithuania

The viability of logistics companies is based on a range of internal factors, such as social dynamics, human resources, and technology, as well as external factors such as economic conditions, political–legal frameworks, socio-cultural trends, ecological considerations, and the competitive environment. For a logistics company to achieve a high level of economic viability, it is necessary for it to apply new tools and methods. One of the key tools is a financial ratio analysis involving the following attributes: profitability, efficiency (asset management), solvency (liquidity), and capital markets (

Karpavičienė and Navickas 2020).

Lithuanian logistics companies primarily focus on offering transportation and warehousing logistics services, along with various additional services. Regrettably, it has been found that Lithuanian companies offering integrated logistics services are unable to provide comprehensive management of the entire business logistics process (

Meidutė et al. 2012). Transport and logistics services are vital activities in Lithuania. Companies in this sector fulfil the requirements and needs of various transport users across the EU market and CIS countries. Transportation is unrestricted across borders, with exceptions for quality and pollution standards. Additionally, drivers can be hired from any country within the EU or the CIS (

Sekliuckienė and Langvinienė 2013). The most challenging year for numerous transport sectors was the onset of the economic recession in 2007. During this period, transportation saw a decrease in demand, leading to businesses struggling to meet their needs. As a consequence, profitability experienced a significant decline (

Bazaras and Palšaitis 2012). However,

Raslavičius et al. (

2014) highlighted that Lithuanian transportation has played a pivotal role in fostering economic growth. The effect of this growth may have both a positive and negative impact on the environment and people’s quality of life, depending on the measures taken at all levels to promote sustainable development.

Juozapaitis and Palsaitis (

2017) argue that the effective viability of logistics companies in Lithuania requires the utilisation of transport cluster systems. This is further bolstered by the strategic significance of international logistics and transport hubs. Furthermore, it is advised that Lithuania develops sectoral models, contingent upon data availability, and ceases relying on foreign models to assess domestic enterprises (

Prusak 2017). Looking back at statistics data from 2020, it is evident that the primary logistics companies comprised road transport (65%), sea transport (6.1%), rail transport (5.3%), air transport (2.1%), postal and courier services (0.8%), and other services (20%) (

Enterprice Lithuania 2020). In Lithuania’s transport industry, the road freight transportation sector had the biggest turnover (EUR 6.7 billion of the total turnover generated), followed by the storage and support operations sector (EUR 3.8 billion of the total turnover generated). Together, these two sectors constituted 89% of the total turnover volume in the transport sector in 2020 (

Statista Research Department 2023).

Bazaras and Palšaitis (

2017) surveyed the logistics situation in Lithuania. Their findings revealed that the primary issue in the logistics industry is the high cost associated with modern software, which poses a challenge for small businesses. However, despite this challenge, most companies acknowledge that Lithuania offers them a favourable operational environment.

Vaičiūtė et al. (

2022) have highlighted that with the emergence of the COVID-19 pandemic, road transport logistics encountered new technological challenges. Therefore, there is a need to foster synergy between technological advancements in transport companies and collaborative logistics. Nowadays, green logistics has emerged as a focal point and is considered essential for transport and logistics service companies in Lithuania to adopt. This adoption can increase the domination of logistics companies in sustainable development efforts. The primary sustainability factors encompass environmental protection, business partner demands, corporate culture, and legal regulations and policies, among others (

Vienažindienė et al. 2021).

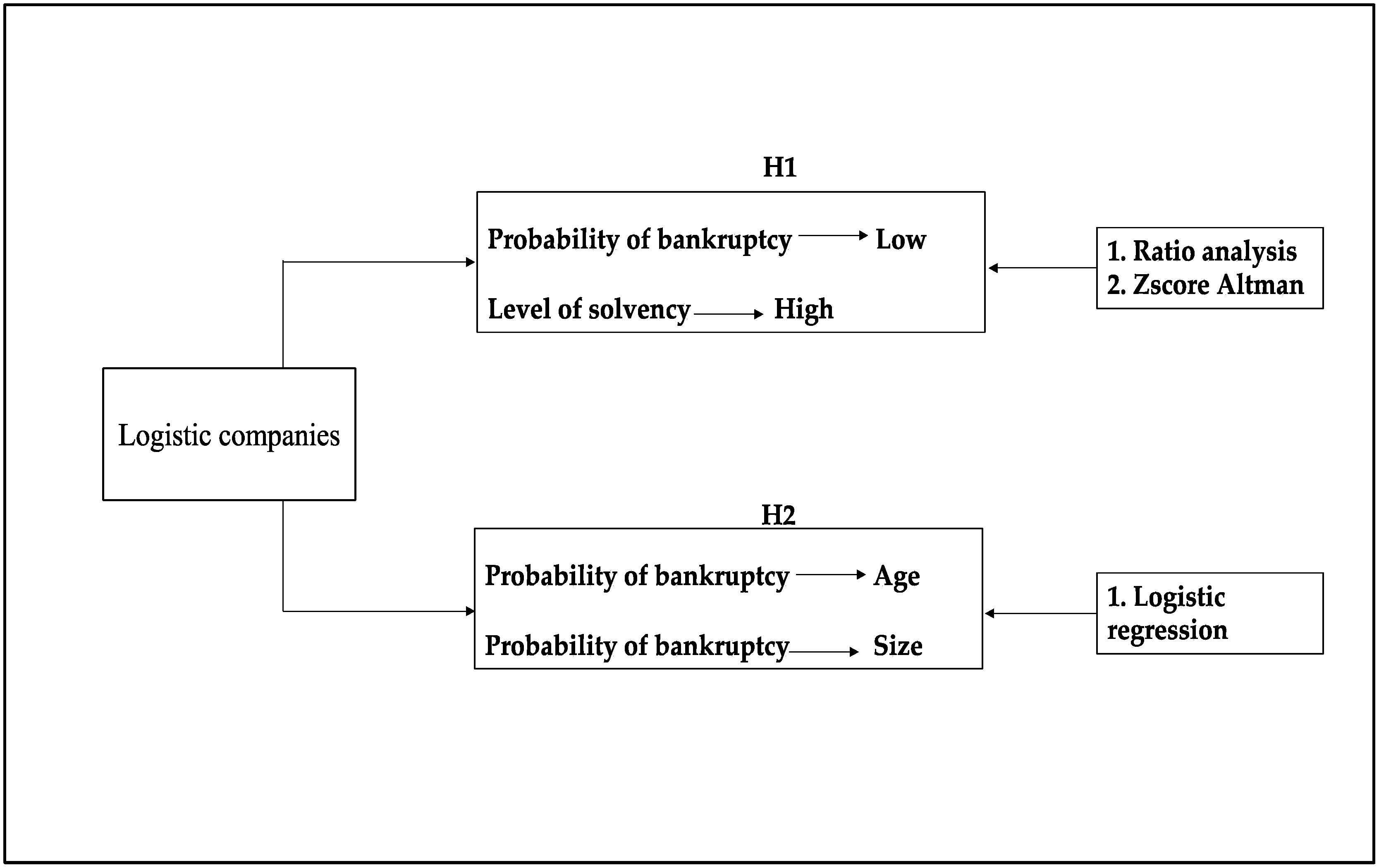

In the following section, we outline our hypotheses considering the circumstances around logistics operations in Lithuania.