Abstract

This bibliometric study explores the cryptocurrency accounting (CA) literature and the connections between authors, institutions, and countries where cryptocurrency activity involves transactions that must be legally recognized in accounting, ensure accuracy and reliability for auditing, and adhere to tax compliance. The design involves the selection of data from Web of Science Core Collection (WoS) and Scopus, published between 2007 and 2023. The technique helps identify influential publications, collaboration networks, thematic clusters, and trends in research on CA using tools VOSviewer, Biblioshiny, and MS Excel. The originality of the study lies in its dual role as a support for accounting professionals and academics to develop innovative solutions for the challenges posed by crypto technology across core accounting areas: financial and managerial accounting, taxation, and auditing. The findings offer insights into the themes mentioned, and even if the collaboration between the authors is not very developed, the innovation and public recognition of the subject could raise researchers’ interest. The limitation of the dataset is that it does not cover all relevant publications in a different period from the one in which the data were retrieved, 9–11 May 2024. This review might need periodic updates because the CA landscape is constantly changing.

1. Introduction

As knowledge expands and new technologies emerge, this study explores the trends of research regarding the subject of cryptocurrency accounting (CA) (Beigman et al. 2023; Bellucci et al. 2022; Blahušiaková 2022; Derun and Mysaka 2022; Fomina et al. 2019; Huang et al. 2023; Hubbard 2023; Klopper and Brink 2023; Matusky 2017; Niftaliyev 2023; Procházka 2018; Smith et al. 2019; Vasicek et al. 2019) and the growing interest in specific concepts between researchers and professionals. The paper aims to evaluate scholarly scientific performance by measuring the keywords with the most significant impact in the field of research and grouping them under specific themes. Since bibliometric indicators provide quantitative information, they assess the impact and productivity of different entities or categories.

Factually, this bibliometric analysis identifies collaboration patterns between authors, organizations, or countries and research themes. It also evaluates the authors’ productivity and highlights the period when the research for cryptocurrency accounting started being of interest to researchers. Based on the recent trend of analysis, the authors can also predict future exploration areas.

Therefore, the bibliometric analysis of cryptocurrency accounting consists of identifying and analyzing academic research articles, papers, and other scholarly publications that explore the intersection of cryptocurrency and accounting. The dataset for this study was obtained by combining the Web of Science Core Collection (WoS) database with the Scopus database. WoS is a precious tool allowing researchers, scientists, and scholars to search for literature, analyze citations, and monitor research impact. Scopus is an extensive, multidisciplinary database of abstracts and citations launched by Elsevier. Moreover, a combination of software tools was employed: VOSviewer 1.6.20 (van Eck and Waltman 2023) for visualization and network analysis, together with Biblioshiny (Bibliometrix) (Aria and Cuccurullo 2017) from RStudio for data manipulation and exploration, and Microsoft (MS) Excel for basic graphs and world maps. VOSviewer generates three distinct kinds of bibliometric maps, which include cluster visualization, “overlay visualization”, and “density visualization” (van Eck and Waltman 2023). Biblioshiny is an instrument that uses data from bibliographic databases to perform bibliometric analysis or portray dynamic maps and graphs. Nonetheless, with MS Excel, we studied the most relevant sources and generated different figures and maps.

To conduct this study, the authors investigate the answers to the potential research questions for the bibliometric analysis: 1. What is the current state of collaboration between countries, organizations, and authors? 2. Which themes are of interest among the researchers?

In addition, the study incorporates a thematic review of academic studies to analyze trends, identify research gaps, and evaluate the impact and influence of different publications in the field.

The intersection of cryptocurrencies and accounting is a nascent area of study that necessitates a thorough understanding of both the technological underpinnings of digital currencies and the traditional principles of accounting. As cryptocurrencies continue to gain mainstream acceptance, they pose unique challenges and opportunities for the accounting profession, particularly in the areas of recognition, measurement, and reporting (Tiron-Tudor et al. 2024; Vigna and Casey 2015).

CA is a concept studied by various research areas such as business finance, economics, management, mathematics, interdisciplinary applications, social sciences, mathematical methods, sociology, accounting, auditing, and more. This interdisciplinary nature introduces an element of novelty, prompting critical thinking and new perspectives among professional accountants, auditors, economists, and researchers (Harrast et al. 2022; Smith et al. 2019; Yatsyk and Shvets 2020).

The rise of cryptocurrencies, built on blockchain technology (Bunget and Lungu 2023; Church et al. 2021; Dai and Vasarhelyi 2017; Fuller and Markelevich 2020; Gomaa et al. 2019; Lombardi et al. 2022; Smith 2018; Yu et al. 2018), has led to discussions about their financial and accounting implications (Angeline et al. 2021; Bunget and Trifa 2023; Luo and Yu 2022; Morozova et al. 2020; Procházka 2018; Ram et al. 2016; Smith 2021a, 2021b; Sokolenko et al. 2019), including recognition, disclosure, auditing, and taxation.

In theory, financial accounting (Angeline et al. 2021; Coyne and McMickle 2017; Luo and Yu 2022; Yu et al. 2018) and managerial accounting (Procházka 2018; Vodáková and Foltyn 2020b; Volosovych and Baraniuk 2018; Zadorozhnyi et al. 2022) are vital subjects in the reporting and decision-making infrastructure, each serving specific purposes and addressing different audiences. If financial accounting’s primary interest lies in external reporting according to specific standards (e.g., IFRS, International Financial Reporting Standards; GAAP, Generally Accepted Accounting Principles) and providing transparency and trust (Pflueger et al. 2022), managerial accounting’s task is to offer internal reporting focusing on costs and strategic planning (Zadorozhnyi et al. 2018).

The diverse range of topics related to CA includes challenges in accounting for cryptocurrencies under existing financial standards (Pelucio-Grecco et al. 2020; Smith et al. 2019; Vasicek et al. 2019), recognition and disclosure of cryptocurrencies (Bourveau et al. 2022; Fomina et al. 2019; Hubbard 2023; Jayasuriya and Sims 2023), characteristics and taxonomy of cryptocurrencies (Derun and Mysaka 2022; Yatsyk and Shvets 2020), costs of production (Barros et al. 2023; Kolková 2018; Zadorozhnyi et al. 2018), and valuation (Beigman et al. 2023; Blahušiaková 2022; Jackson and Luu 2023; Morozova et al. 2020; Niftaliyev 2023; Procházka 2018).

Cryptocurrencies further complicate tax compliance due to anonymity and lack of a central jurisdiction. This raises concerns about the possible uses of cryptocurrencies for tax evasion or money laundering (DeVries 2016). Accountants must be vigilant and implement robust AML (Anti-Money Laundering) and KYC (Know Your Customer) systems to comply with international regulations.

Described as decentralized (Alsalmi et al. 2023; Makurin et al. 2023; Yu et al. 2018), not regulated, anonymous, quite volatile, and secure, cryptocurrencies pose unique challenges for financial and managerial accounting due to the lack of a unified regulatory approach (Angeline et al. 2021; Jackson and Luu 2023; Pimentel and Boulianne 2020; Smith et al. 2019).

Current accounting standards are often ill-equipped to address the volatile and decentralized nature of cryptocurrencies. These assets do not fit comfortably into the traditional classifications of financial assets (Baur et al. 2018). Cryptocurrencies require an accounting framework that better reflects their economic realities, including specific methods for periodic valuation and reporting (Tapscott and Tapscott 2016).

These assets do not have a predictable income stream and are subject to high price fluctuations in exchange markets. Therefore, accountants must apply valuation methods that reflect both the current market price and the associated risk. In addition, the absence of a specific regular framework in international standards, such as IFRS or GAAP, for reporting these types of assets further complicates the situation (Cyrus 2023; Pieters and Vivanco 2017).

However, in this context, many scholars suggest treating cryptocurrencies as intangible assets, financial investments, stocks, or monetary means (Fomina et al. 2019; Hubbard 2023; Jackson and Luu 2023; Morozova et al. 2020; Procházka 2018).

The acquisition of cryptocurrency through initial coin offerings (ICO) or mining is a laborious and costly process that affects accounting practices (Barros et al. 2023; Harrast et al. 2022; Makurin 2023; Luo and Yu 2022; Zadorozhnyi et al. 2018). Additionally, crypto mining (Corbet et al. 2020; Makurin et al. 2023) and taxation (Bellucci et al. 2022; Pelucio-Grecco et al. 2020; Volosovych and Baraniuk 2018) are highlighted as significant areas in accounting for digital assets (Angeline et al. 2021).

Ozeran and Gura (2020) have also explored auditing aspects. They believe that auditors lack experience with crypto assets, which poses challenges for auditing practices (Dai and Vasarhelyi 2017; Dyball and Seethamraju 2022; Fuller and Markelevich 2020).

Blockchain technology offers revolutionary possibilities for financial auditing by increasing transparency and reducing fraud risks. This technology enables real-time transaction verification, which can fundamentally transform internal and external audits (Casey and Vigna 2018; Peters et al. 2015).

The paper is structured in five parts: (1) the first part creates the introduction to the scientific research; (2) the second part presents the research methods followed; (3) the third part shapes the descriptive bibliometric analysis of the manuscripts from the combined database; (4) the fourth part designs the bibliometric analyses of the main topics researched and offers insights in a thematic analysis, results, and discussion; (5) the conclusion part reveals the findings and offers other exploration suggestions.

2. Research Method

2.1. Keywords and Data Selection

The authors developed a search plan for this analysis to identify the relevant literature in WoS and Scopus databases using specific key terms. In the academic context, the use of the Web of Science (WoS) and Scopus databases is essential for researchers for multiple reasons that support the efficiency, quality, and breadth of research activities. These platforms not only facilitate access to a vast range of scientific literature but also ensure the rigor and relevance of consulted materials, a crucial fact in undertaking any serious academic research.

The selection criteria were customized to WoS and Scopus database, using the string (“crypto*” OR “cryptocurrenc*” OR “virtual currenc*” OR “digital currenc*” OR “initial coin offering” OR “bitcoin”) AND (“account*”) to search based on the topic in WoS and by article title, abstract, and keywords in Scopus. Within the string, we can find the essential keywords related to the research: “crypto*”, “cryptocurrenc*”, “virtual currenc*”, “digital currenc*”, “initial coin offering*”, and “bitcoin”. For a focused approach to the accounting issues, we added the word “account*”.

The selected timeframe encompassed a significant period of development in the field. Articles published between 2007 and 2023 were included in the WoS and Scopus databases. We chose 2023 as the final year because we wanted to analyze complete years and have a fixed database.

The sources include journal articles, review articles, early access articles, proceeding papers, and book chapters. To ensure accessibility and consistency, only English-language published content was included in the search. We extracted the data from Scopus on 11 May 2024, and WoS on 9 May 2024.

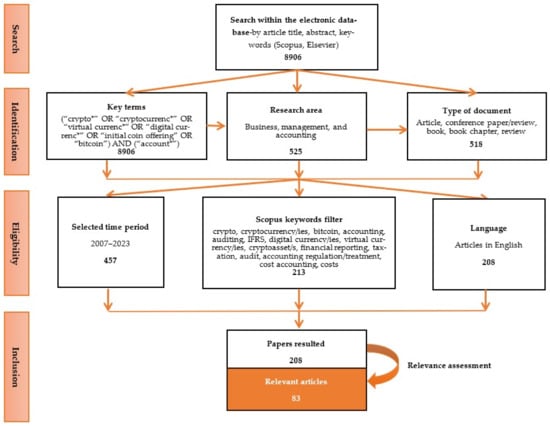

Firstly, in Scopus (Figure 1), the authors employed the search within the business, management, and accounting research areas across different countries worldwide. This targeted approach yielded an initial set of 525 scientific papers. However, following a rigorous screening process outlined in Figure 1, 317 were deemed irrelevant and excluded. This left a refined collection of 208 suitable research papers based on the inclusion criteria.

Figure 1.

Flow diagram of systematic selection of studies on cryptocurrency accounting (CA) from Scopus. Source: data processed by authors.

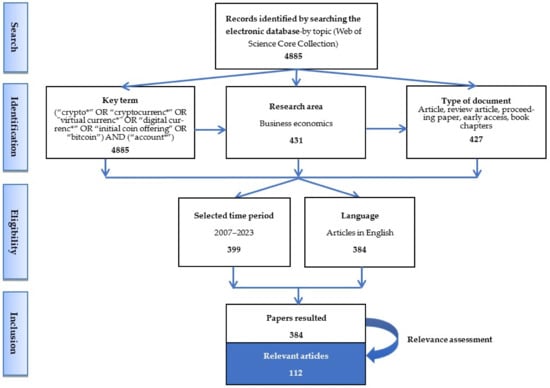

Secondly, in WoS (Figure 2), the search filters for this study were meticulously designed to target the available literature on cryptocurrency accounting within the business economics research area from different countries worldwide. As a result, out of 431 scientific papers, 47 were considered irrelevant and excluded according to the eligibility steps described in Figure 2. The scheme shows the selection of studies and the inclusion or exclusion criteria of papers at every stage. Therefore, based on the inclusion standards, the database included 384 suitable research papers.

Figure 2.

Flow diagram of systematic selection of studies on cryptocurrency accounting (CA) from WoS. Source: data processed by authors.

2.2. Method of Data Refining and Data Analysis

Following the initial screening, the authors assessed the relevance of the papers included. This multiple-step process ensured the accuracy of the data used for analysis.

Firstly, the abstracts and the contents of the papers were analyzed to ensure the relevance of academic literature included in the process. An abstract is a concise summary that highlights the main points of the research article. By carefully reading the abstracts and the contents, the authors were able to obtain a quick overview of the paper’s topic. After this step, documents lacking the key terms, documents using the key terms in unrelated contexts, and thematically irrelevant documents were excluded. This procedure was performed because not all the articles contained pertinent keywords central to the research, or even if these terms appeared, the manuscripts did not pertain to the study, as the term “accounting” did not refer to “bookkeeping” or financial aspects regarding cryptocurrencies. For example, articles that included the term “account*” in forms such as “taking into account”, “account/ing for”, “unit of account”, “personal/social media account”, “accountable”, and “accountability” would likely be excluded because they do not discuss accounting practices in the cryptocurrency industry. This screening process is significant for ensuring the quality and relevance of the research. By carefully selecting articles that directly address the research question and avoid irrelevant tangents, authors can build a foundation for their research.

Next, we combined the two databases in RStudio using a specific code. The database combination resulted in 195 papers, including duplicate files (from both WoS and Scopus). To maintain the database’s accuracy, duplicates were removed, leaving only 157 manuscripts.

Consequently, in the combined and refined database, we standardized the keywords. This involved merging, in the Excel database, plural and singular forms of terms like “crypto/s”, “cryptocurrency/ies”, “crypto asset/s”, “digital currency/ies”, “virtual currency/ies”, “smart contract/s”, “intangible asset/s”, “financial asset/s”, “digital asset/s”, as well as unifying variations such as “decentralized finance/defi”, “triple-entry accounting/triple entry”, “fair value/fair value measurement”, and “audit/auditing”.

After this laborious process, the analysis involved the descriptive bibliometric analysis and the analyses of the topics researched (including keyword co-occurrence analysis and thematic analysis).

3. Descriptive Bibliometric Analysis

3.1. Annual Scientific Production and Citations

The authors consider it relevant for this study to observe the annual scientific production of documents on CA. The evidence from Figure 3 suggests that the number of publications is continually growing due to the rising interest in this subject.

Figure 3.

Annual scientific production and average citation of articles on CA. Source: data processed by authors from WoS and Scopus.

From 2015, the production of articles evolved until 2020, when 29 scholarly publications were recorded. Despite the low number of publications in 2022 (22 articles), in 2022 and 2023 the production per year grew to 29–35 publications, an increase compared to the previous period. The growing trend might appear due to the intensification of online transactions and the development of blockchain technologies and therefore the necessity to study and legally recognize cryptocurrency transactions.

Considering the citations for the 157 articles, the trend, graphically represented in Figure 3 by the orange line, seems opposite to annual scientific productions, with 952 citations in 2018 but recording a continual decrease until 2023, when the total number of citations per year was 141 citations. According to the growth of publications, we expect the trend of citations to grow because publications released in recent years will be cited. This citation delay is especially found in rapidly evolving fields, such as technology, where newer research may supersede older more quickly.

3.2. Publications’ Sources

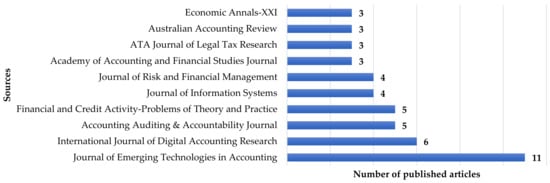

At the micro level, Figure 4 illustrates the top 10 of the most relevant sources where articles about CA were published.

Figure 4.

Top 10 most relevant sources for CA. Source: data processed by authors from Biblioshiny.

The sources are presented in increasing order: “Economic Annals-XXI”, “Australian Accounting Review”, “ATA Journal of Legal Tax Research”, and “Academy of Accounting and Financial Studies Journal” published three articles. Four papers were released through the “Journal of Risk and Financial Management”, and the “Journal of Information Systems”. Also, there are two journals with five articles published: “Financial and Credit Activity—Problems of Theory and Practice” and the “Accounting Auditing & Accountability Journal”. The “International Journal of Digital Accounting Research” published six articles, and the most significant source, with 11 publications, is the “Journal of Emerging Technologies in Accounting”.

3.3. Countries’ Scientific Production and Citation Analysis

The production and citation analyses show the impact of the bibliography and the most relevant documents that study CA, which is reflected in the total number of citations of a scientific work. Analyzing the production and citation patterns by country reveals the most frequent collaborations between countries and offers valuable quantitative insights into the research output of these states. Therefore, this study specifies the number of times authors, institutions, or countries are cited. This technique helps identify the most influential organizations and sheds light on potential collaboration networks between authors across different countries.

At the macro level, regarding the country’s scientific production of articles, the authors projected Figure 5 from Biblioshiny, which illustrates that the USA is the world leader in the research regarding CA, with 44 documents released, followed by Ukraine with 14 articles. With 13 manuscripts in the United Kingdom and 11 articles in Australia, a growing interest in CA is indicated. China and South Africa released seven research papers. Italy released eight documents; the Czech Republic recorded six articles; Canada has five articles; and Spain, Malaysia, and Indonesia have four manuscripts on CA. Finally, there are countries with fewer articles published: Turkey, Russia, New Zealand, Japan, Ireland, India, France, and Switzerland (three articles).

Figure 5.

Country scientific production of articles on CA. Source: own projection from Biblioshiny.

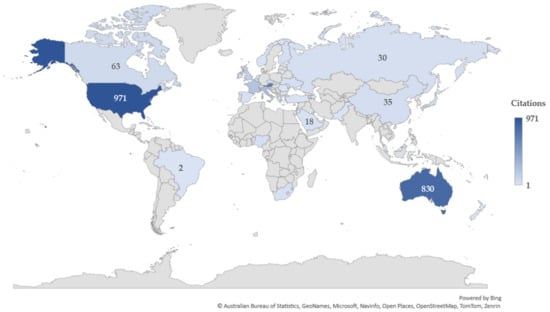

Observing Figure 6 and Table 1, it can be easily seen that the USA is paramount when exploring CA, with 971 citations of scientific scripts. The following countries are Australia, with 830 citations, and Austria with 696 citations. Italy and France rank highly in the top five, with 269 and 219 citations, respectively. The authors generated a Miller map projection within MS Excel to visualize these findings, with data retrieved from Biblioshiny. This map presents the most cited countries in CA (Figure 6).

Figure 6.

Country citation map for CA. Source: authors’ projection using MS Excel with data from Biblioshiny.

Table 1.

Distribution of citations of countries for CA.

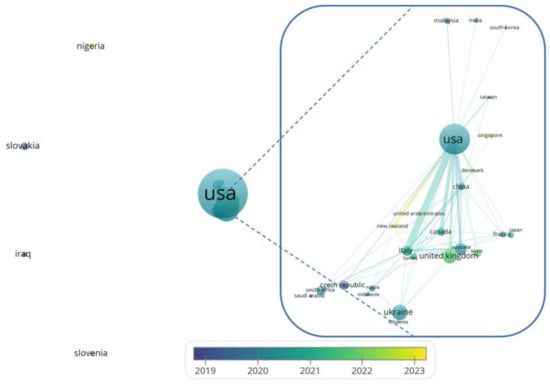

As Figure 6 graphically represents the number of citations by country, the visualizations from Figure 7 reveal seven clusters, regarding the country citation network:

Figure 7.

Country citation network for CA. Source: authors’ projection with VOSviewer.

- The first cluster contains the Czech Republic (six articles, 5 total link power), Indonesia (two articles, 2 total link power), Italy (seven documents, 54 total link power), Russia (three documents, 7 total link power), and South Africa (six articles, 8 total link power), which added their contribution to the research topic between 2019 and 2020.

- The second network is formed by a central node, the USA (41 documents, 91 total link power), indicating a significant role in international research; India (2 articles, 1 total link power); Malaysia (3 articles, 2 total link power); and South Korea (1 article, 1 total link power), with articles released around 2020.

- The third cluster shows the interconnection between China (four manuscripts, 34 total link power), Singapore (one document, 2 total link power), and Taiwan (one item, 4 total link power), and it added its contribution recently, between 2021 and 2023.

- The fourth network contains the United Kingdom as a central node because it released 12 documents, with a total link strength of 18. It is followed by Australia (nine articles, 31 total link power) and Spain (four documents, 7 total link power), which contributed between 2021 and 2022.

- The fifth interconnection was created between the United Arab Emirates (UAE) (one article released, 5 total link strength), Canada (five documents, 22 total link power), and Turkey (three documents, 13 total link power), and it added its contribution around the year 2022.

- France (three articles, seven total link power) and Japan (three documents, three total link power) form the sixth couple, being active between 2020 and 2021.

- In the seventh cluster, we note Ukraine (14 articles, seven total link power) and Lithuania (1 article, one total link power), with published articles between 2021 and 2022.

To further explore international collaboration patterns, the authors generated a network visualization using VOSviewer (Figure 7). This map highlights research areas where different countries contribute the most and unveils their collaboration networks. Academic institutions and policymakers can gain valuable insights by comparing these visualizations with citation data. The analysis incorporated a threshold of at least one published and three citations of a document per country. As a result, of the 62 explored countries, 29 met the limit, and 25 of the states were connected. When analyzing an emerging subject, such as CA, we consider employing lower thresholds a well-suited approach because crucial research areas might still be forming. Additionally, standard limits might exclude relevant studies due to their lower citation counts in a new field. Conversely, lower thresholds can provide a more inclusive view of the research landscape, potentially uncovering hidden connections. Consequently, in Figure 7, the nodes represent the countries, and the lines indicate the relations. The thickness of the lines reflects the frequency of citations.

3.4. Author Network and Productivity

Author citation analysis involves identifying how often each author’s work has been cited by counting the references for each document in the dataset and analyzing how frequently different pairs of authors are mentioned together. The study exposes the total link strength attributed to a specific author. Therefore, it can help identify highly cited, influential scientists and their interconnections within the research or their most significant contributions. Additionally, VOSviewer generates maps illustrating collaborations between authors by visualizing their network in a graphical format. These maps also indicate the density and centrality of specific researchers within a particular research area.

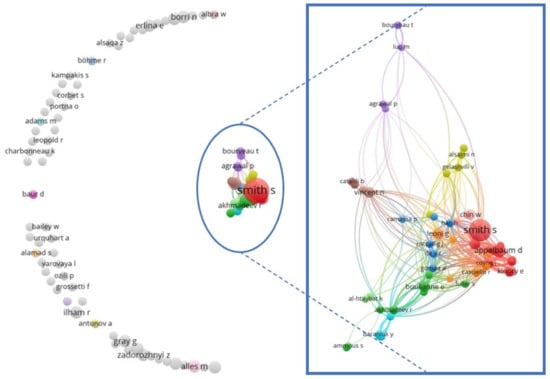

The analysis employs a normalization technique known as the strength association method and a threshold of three citations for an author’s work as a minimum requirement for inclusion in the research. This approach acknowledges that new ideas may take time to gain recognition, particularly in a rapidly evolving field like CA. While a higher threshold might prioritize established scholars, a lower limit provides a more comprehensive picture of the research community, including those making initial contributions. Therefore, out of 359 authors from the database, 227 authors met the limit. VOSviewer calculates the total link power of citations between all authors and identifies the ones with the highest power (van Eck and Waltman 2023). Even if so, only 143 authors are connected. This means that the items that are not linked are not cited among the others from their cluster.

As a result, in Figure 8, the 227 items representing the authors from the database were grouped in 76 clusters, with 1016 links between them and a total link power of citations of 1075. Moreover, Table 2 shows six clusters formed by authors who collaborated and were interested in CA. Even if the collaboration between the authors is not very developed at this point, it is essential to consider the novelty and notoriety of the subject.

Figure 8.

Author citation network for CA. Source: authors’ projection with VOSviewer.

Table 2.

Authors interested in CA, clusters 1–6.

As evidenced by Table 3, Böhme et al. (2015) were co-authors and were granted the most citations (696 citations), with a total link power of two, for one document published. Their article was published in the “Journal of Economic Perspectives”, indexed in SSCI—Business, Finance, which has the “American Economic Association” as its publisher.

Table 3.

Top 10 globally cited authors and publications.

In second place are three co-authors, Baur et al. (2018), who published an article in the “Journal of International Financial Markets, Institutions and Money” that received 604 citations and a total link power of two. The journal is indexed in SSCI in the Business, Finance category, with Elsevier as the publisher.

Besides the listed journals, a notable journal is the “Accounting Auditing & Accountability Journal”, indexed in SSCI in the Business, Finance category, with the publisher “Emerald Group Publishing”, in which the following authors chose to make public their research: Ramassa and Leoni (2022) (11 citations), Lombardi et al. (2022) (30 citations), and Dyball and Seethamraju (2022) (12 citations).

Ergo, the clusters from the citation of the authors’ network are more dispersed, which indicates that the connections between the study authors are not very tight, but the collaborations are promising.

3.5. Citations at Institutions Level

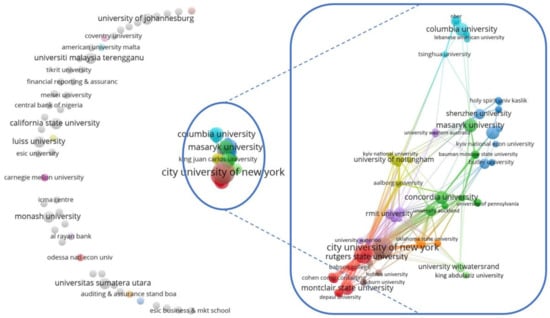

Building upon the author citation analysis, the study utilizes VOSviewer to conduct a similar analysis for organizations/institutions. The analysis plan involves identifying the impact and influence of academic institutions and research organizations and the frequency of their collaboration. Therefore, the most active organizations in terms of research partnership will be visually evidenced.

Figure 9 illustrates the distribution of the 240 organizations that released at least one article. The figure utilizes a network visualization approach, where nodes represent organizations and lines represent relationships between them. The map also indicates the density and the centrality of specific institutions within the research field. One noteworthy observation is the relatively low level of collaboration between institutions. As can be seen, only 164 out of 240 organizations meet the threshold, suggesting limited interconnectedness. Linked with Figure 9, Table 4 records the institutions that released at least two documents on CA. These findings may reflect the nascent stage of CA research, where institutions are still establishing their research agendas.

Figure 9.

Institution citation network for CA. Source: authors’ projection with VOSviewer.

Table 4.

Institutions that released at least two documents on CA.

4. Bibliometric Analyses of the Topics Researched

The empirical results of the bibliometric study are based on the outputs of VOSviewer, Biblioshiny, and Microsoft Excel. The graphics from Section 4.1 were employed to identify and illustrate the co-occurrence of the authors’ keywords in their publications. Grouping the keywords into clusters results in four core accounting-focused areas: financial, managerial, tax, and auditing. Therefore, starting from Section 4.2, the thematic analysis, based on the mentioned areas, reveals the geographical regions of the research setting, providing a detailed summary of the present state of understanding of CA. Finally, Section 4.3 provides key discussions and diverse perspectives on the researched subject.

4.1. Keyword Co-Occurrence Analysis

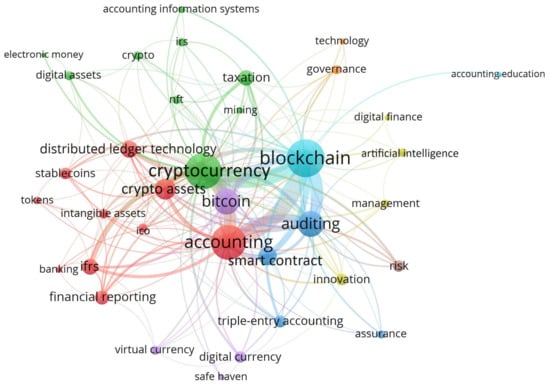

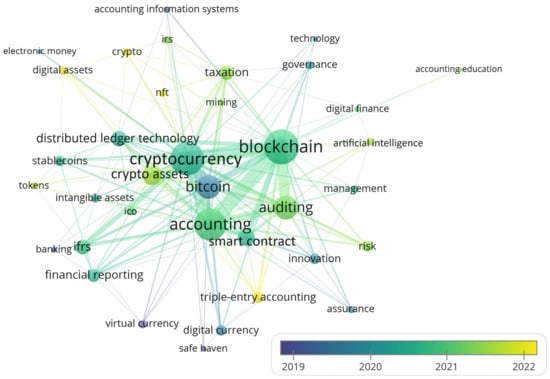

Keyword analysis is the process used to identify the key terms and words relevant to this topic. This way, the most important keywords are highlighted, and the researchers become aware of their importance. The threshold set for the analysis is three keywords because of the low number of studies on this subject. As a result, after the database was processed in VOSviewer, out of the total of 328 keywords, only 36 met the limit. Thereby, for all the 36 keywords included, the strength of the links between co-occurring keywords was computed. Notably, just one link can appear with different thicknesses between two words.

Figure 10 reveals the most important keywords, according to the selections made, reflected by the nodes. The size of the vertex shows how frequently the keywords appear. The edges illustrate the relationship between the terms. The stronger the relationship, the thicker and the shorter the line between the words. The edge weight indicates the number of articles in which two items occur together. Therefore, a network, or a cluster, is constructed by a set of nodes of the same color with links between them. VOSviewer 1.6.20 Manual explains that each cluster has a specific color and number that can be easily identified (van Eck and Waltman 2023).

Figure 10.

Co-occurrence cluster visualization of author keywords for CA studies. Source: authors’ projection with VOSviewer.

Evaluating the distance between the green cluster, where the principal word is “cryptocurrency”, and the red cluster, which comprises the second term of the analysis, “accounting”, it can be remarked that the two clusters are positioned next to each other. The thickness of the edge bordering “cryptocurrency”, which is directly connected to “accounting”, explains the necessity of this analysis.

For a more detailed explanation, Table 5 presents the most relevant key terms in the network visualization figure. Four important words can be identified in the most prominent nodes (green, red, turquoise, blue, and purple): “cryptocurrency”, “accounting”, “blockchain”, “auditing”, and “bitcoin”.

Table 5.

Keyword clusters with more than 1 item for CA in VOSviewer.

Consequently, these vertices form clusters with other keywords of the same color, meaning they are more likely to co-occur in the same scientific paper and cover a specific topic together.

The co-occurrence overlay visualization map (Figure 11) depicts the critical terms according to the period in which they were most used. Therefore, as can be seen, terms such as “crypto”, “digital assets”, and “triple-entry accounting”, colored with yellow, were used in recent publications around 2022. Next on the timescale, with light green shades, in the period from 2020 to the end of 2021, we can notice that the most frequent words were: “auditing”, “crypto assets”, “taxation”, “risk”, “accounting”, “cryptocurrency”, and “IFRS”. This suggests that discussions and research on the accounting and reporting of cryptocurrency as an intangible asset were prevalent during this period. Before 2020, keywords such as “bitcoin”, “virtual currency”, “digital currency”, and “innovation”, highlighted with darker blue, were frequently used. Hence, it is likely that these words will be interrelated to subjects on the impact of cryptocurrencies on specialized markets and the emergence of new regulations.

Figure 11.

Co-occurrence overlay visualization of author keywords for CA. Source: authors’ projection with VOSviewer.

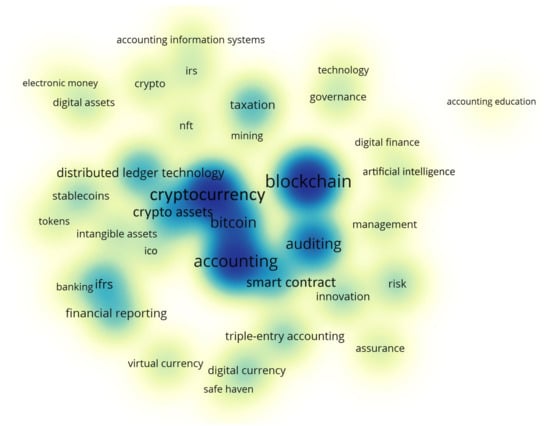

Moreover, the co-occurrence density visualization map (Figure 12) exhibits the most concentrated areas regarding using the key terms. The standard color gradient varies from blue to green shades, ending with yellow. When an item has a higher density and its weight increases, the color is dark blue; when the density is lower, the shade is light yellow. Thus, the densest zones, with dark blue shades, are the ones around the terms: “cryptocurrency” with 84 occurrences, “blockchain” with 80 occurrences, “accounting” which appears 58 times, “bitcoin” with 43 occurrences, and “auditing” which appears 31 times. Near the paramount zone, in light blue shades, but also important, are displayed connected items: “crypto assets” with 20 occurrences, “taxation” with 16 occurrences, and “IFRS” which appears 15 times. From this illustration, it can be observed that “cryptocurrency” and “accounting” are neighboring items, emphasizing that accounting practices need to evolve to ensure accurate and transparent reporting for cryptocurrency activities.

Figure 12.

Co-occurrence density visualization of author keywords for CA. Source: authors’ projection with VOSviewer.

It can be concluded that the relationship between the two topics continues to be of great importance and relevance, as the accounting and auditing of digital assets is in the phase of development and discovery.

4.2. Thematic Analysis

Nonetheless, the literature can be analyzed from the thematical point of view to consolidate the prevalent discussions and to understand the different perspectives on CA. In addition, the originality of this study results from examining and categorizing the articles from the database and starting from the main topics from Table 5 in four pivotal research themes related to accounting: financial accounting, managerial accounting, taxation accounting, and auditing. Thus, each article was assessed by reading and searching for explicit key terms, such as “accounting”, “financial”, “financial accounting”, “management accounting”, “managerial accounting”, “fair value”, “cost(s)”, “production”, “tax”, “taxation”, “tax accounting”, “taxation accounting”, “audit”, “auditing”, “internal auditing”, and “external auditing”.

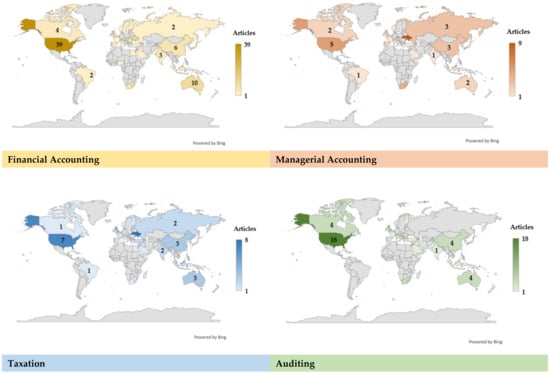

The findings of this exploration are materialized in Table 6, which presents the authors who delved into the mentioned themes and the geographical regions of the research setting. Thus, the distribution of the four themes suggested is as follows: “financial accounting” theme is represented in 87% of the articles, meaning all 138 items in yellow shades; the “managerial accounting” theme appears in 32% of the papers, represented by 51 orange items; 28% of the manuscripts write about “taxation” (44 articles in blue color); and 34% of the studies discuss “auditing” (53 of the articles in green shades from the table).

Table 6.

Research themes according to accounting categories by relevant authors and countries.

From the results of Figure 13, most of the studies on financial accounting (39 articles) and auditing (18 articles) are from the USA. Also, Ukraine manifested a high interest in financial accounting (12 articles), managerial accounting research (9 articles), and taxation matters (8 articles). The information was attentively inserted and processed into tables in MS Excel, following the plotting of the maps, with the software’s ability to generate and insert this type of graphics.

Figure 13.

Geographical location of the articles by research themes. Source: authors’ projection with MS Excel.

This study’s contribution is reflected in providing a detailed summary of the present state of understanding of CA, consolidating the previous discussions in Table 6. This table points to the key insights from the literature regarding the accounting and auditing categories (Rana et al. 2023).

4.3. Results and Discussion

The results and discussion section offers insights into the thematic framework, which serves as a powerful lens for analyzing the existing literature. Thematic research is a qualitative data analysis used to identify, analyze, and interpret patterns of meaning. Within each of the core accounting areas, the research delves into the key discussions and diverse perspectives presented by the authors of the analyzed papers. This comprehensive analysis provides a detailed summary of the current state of understanding in CA. It sheds light on the various approaches, challenges, and potential solutions that different researchers have proposed. Moreover, by examining the discussions within each theme, the research fosters a deeper understanding of the multifaceted nature of cryptocurrency accounting and the diverse perspectives at play.

Therefore, once the data were collected, each article was read to gain a comprehensive understanding of the content and identify potential themes. The next step involved categorizing each article according to the themes we searched for and found: financial accounting, managerial accounting, taxation, and auditing. The articles that comprised multiple themes were noted down in each category alongside their respective citations. After each theme was clearly defined, it was given descriptive subheadings to help communicate and group the findings of the research concisely into sub-themes.

4.3.1. Insights into Financial Accounting Regarding Cryptocurrencies

The issue of disconnection between legal and accounting treatment for cryptocurrencies (Huang et al. 2023; Kolková 2018; Matusky 2017) manifests in two areas: the general absence of legal frameworks governing cryptocurrencies (Pantielieieva et al. 2019) and the absence of established accounting standards for how companies should handle them in their financial statements. While law classifies them as property, accounting standards like IFRS offer options like inventories (IFRS IAS 2 2024), intangible assets (IFRS IAS 38 2024) (Huang et al. 2023), or long-term investments (IFRS IAS 32 2024) (Zadorozhnyi et al. 2022) according to the intended use (Zadorozhnyi et al. 2018). This is because “current legal and financial structures are not designed with a technology like this in mind” (DeVries 2016).

Kolková (2018) emphasizes the interplay of legal and accounting structures in the Czech system and states that cryptocurrencies should be treated as long-term intangible assets because Czech law does not recognize them as money or investments. Virtual currencies used for payments and trading currently exist in a regulatory gray area (Matusky 2017).

The emergence of cryptocurrencies has exposed limitations in the current accounting framework. A significant concern (Vodáková and Foltyn 2020b) is the lack of explicit guidance on how to account for crypto assets and cryptocurrencies in financial statements (Angeline et al. 2021; Alsalmi et al. 2023; Alhasana and Alrowwad 2022; Chou et al. 2022; Dyball and Seethamraju 2022; Morozova et al. 2020; Niftaliyev 2023; Zadorozhnyi et al. 2022; Zelic and Baros 2018). Due to the absence of a standardized approach regarding their valuation (Smith et al. 2019), different authors propose various valuation models (Alsalmi et al. 2023; Blahušiaková 2022; Fomina et al. 2019; Huang et al. 2023; Hubbard 2023; Procházka 2018; Yatsyk and Shvets 2020).

Current standards allow the classification of cryptocurrencies as intangible assets or inventory (Ramassa and Leoni 2022), with deficiencies that call for robust legal frameworks, economical identification methods for crypto transactions (Fomina et al. 2019), and the associated risks (Al-Wreikat et al. 2023). The guidelines should faithfully represent the financial position and relevant information for users (Yee et al. 2020). This is crucial for ensuring reliable accounting assessment, transparency, and consistency in financial reporting.

In unison with the other studies, Jackson and Luu (2023) tackle the issue regarding the need for amendments or new standards specifically for digital assets (Yan et al. 2022; Luo and Yu 2022; Morozova et al. 2020; Pimentel and Boulianne 2020; Zadorozhnyi et al. 2022). They expose the current accounting treatment of cryptos under GAAP as intangibles, inventory, or financial instruments.

Jayasuriya and Sims (2023) observe there is no single, universally accepted method for CA under IFRS standards, but they could be categorized as intangible assets (IFRS IAS 38 2024) because cryptocurrencies held by businesses meet three criteria for being classified as mentioned (Vincent and Davenport 2022). These criteria include being acquired through exchange, used for debt repayment, and potentially distributed to owners.

Makurin (2023) highlights the challenges in Ukraine due to cryptocurrency accounting ambiguity and the absence of an appropriate framework for domestic and international transactions.

Luo and Yu (2022) delve into the complexities of accounting treatment of cryptocurrency holdings under both GAAP and IFRS standards across five activities: (1) buying and investing; (2) mining cryptocurrencies; (3) using crypto as payment; (4) trading and participating in early-stage investments (ICOs); (5) other activities involving crypto.

The classification of cryptocurrencies in financial statements remains a debated topic. Primarily designed for transactional purposes (Nakamoto 2009) with the possibility of replacing fiat money (Lazea et al. 2023; Ammous 2018; Jumde and Cho 2020), they are also proposed to be recognized as inventory, financial instruments, intangible assets, or more (Angeline et al. 2021; Alsalmi et al. 2023; Munteanu et al. 2023).

Traditional accounting models for long-term assets, based on depreciation due to extensive utilization, may not be suitable for digital assets because they might not accurately reflect their value. Therefore, for digital assets with an indefinite lifespan, a method similar to land valuation reflects their ongoing value without depreciation charges. On the other hand, when valuing cryptocurrencies acquired via business activities, a precise fair value method is essential to account for fluctuations and enable potential revaluations, ensuring a precise reflection of their value (Derun and Mysaka 2022).

According to Ram et al. (2016) there are two models for valuing bitcoins: cost (grounded in stewardship) and fair value (grounded in neoliberalism). Using the cost model for intangible assets might not reflect the actual economic value of cryptocurrencies, especially during periods of rapid price increases (Alsalmi et al. 2023; Blahušiaková 2022; Huang et al. 2023; Pimentel and Boulianne 2020; Parrondo 2023; Ram et al. 2016; Zadorozhnyi et al. 2018), because it is used for less active markets. In the presence of an active market, applying the fair value model when each reporting period ends (as outlined in IFRS 13 (2024)) is a more suitable accounting practice because of the cryptocurrencies’ high volatility (Angeline et al. 2021; Beigman et al. 2023; Blahušiaková 2022; Fomina et al. 2019; Huang et al. 2023; Morozova et al. 2020; Pimentel and Boulianne 2020; Yan et al. 2022; Pandey and Gilmour 2024; Parrondo 2023). This approach ensures that the financial statements accurately record gains or losses from cryptocurrency value fluctuations. This volatility is emphasized by Volosovych and Baraniuk (2018), who argue that high price fluctuations and mining costs necessitate frequent revaluations of cryptocurrency holdings. These models are influenced by the authors’ professional reasoning and their need to comply with accounting standards in specific jurisdictions (e.g., IFRS, GAAP).

A key distinction emerges when examining how US and international companies account for cryptocurrencies. According to Luo and Yu (2022), US companies typically rely on the cost method for cryptocurrencies categorized as intangible assets. This approach reflects any decrease in value as impairment losses. In contrast, international companies following IFRS often utilize the fair value method, as evidenced by Morozova et al. (2020) and Niftaliyev (2023). This method emphasizes the current market value of the cryptocurrency, providing a more dynamic picture. However, Vasicek et al. (2019) identify a fundamental mismatch between cryptocurrencies and current IFRS accounting regulations. While fair value through profit or loss (FVTPL) might appear to be a logical valuation approach, it is not permitted under IFRS (Ramassa and Leoni 2022; Vasicek et al. 2019). IFRS (2019) offers some guidance, recommending classification as either inventory or long-term intangible asset, but the initial valuation is based on the acquisition cost. This approach may not reflect the nature of cryptocurrency prices (Vodáková and Foltyn 2020b).

Raiborn and Sivitanides (2015) delve into the debate over valuation methods, proposing two main options: fair value accounting, potentially applicable for short-term and long-term investments in cryptocurrencies, or the historical cost for long-term investments.

Derun and Mysaka (2022) delve deeper into valuation models for long-term digital assets, favoring an approach without amortization. They propose three models: (1) historical value (based on the acquisition cost), (2) current value (fair value), and (3) mixed model (a combination of the two models). Historical value reflects past expenses, while fair value reflects market expectations for future benefits. The mixed model values the crypto assets at the lowest possible price (between cost or fair value).

Several authors support classifying cryptocurrencies as intangible assets measured at fair value (IFRS IAS 38 2024; Angeline et al. 2021; Alsalmi et al. 2023; Klopper and Brink 2023; Yatsyk and Shvets 2020), inventory recorded at cost under IFRS IAS 2 (2024), or both (Bellucci et al. 2022; Blahušiaková 2022; Fomina et al. 2019; Jayasuriya and Sims 2023; Jackson and Luu 2023; Klopper and Brink 2023; Niftaliyev 2023; Makurin et al. 2023; Morozova et al. 2020; Păunescu 2018; Pimentel and Boulianne 2020; Procházka 2018; Ramassa and Leoni 2022).

Jayasuriya and Sims (2023) offer a broader perspective, considering alternative classifications under IFRS standards such as cash (IFRS IAS 7 2024); financial instruments (IFRS IAS 39 2024); investment properties (IFRS IAS 40 2024); or property, plant, and equipment (IFRS IAS 16 2024). Despite these options, they conclude that crypto assets should be classified as intangible assets under IFRS IAS 38 (2024), using cost or revaluation models for valuation (Jayasuriya and Sims 2023) to ensure proper accounting (Hampl and Gyönyörová 2021). Ram et al. (2016) propose that bitcoins should be recognized as inventory (IFRS IAS 2 2024), intangible assets (IFRS IAS 38 2024), or plant and equipment (IFRS IAS 16 2024).

Furthermore, the AASB (Australian Accounting Standards Board) argues that IFRS IAS 38 (2024) might not be suitable because it restricts “fair value measurement through profit or loss (FVTPL)” (Ramassa and Leoni 2022).

Beigman et al. (2023) advocate for fair value using the market approach (IFRS 13 2024) to value cryptocurrencies. Unlike investments, this conforms with their function as exchange-traded assets. Identifying the principal trading market is crucial for accurate valuation, which aligns with crypto’s primary use of exchange.

To add another layer of importance, the IRS (Internal Revenue Service—the US agency responsible for tax collecting and law enforcement) classifies cryptocurrencies as property (Terando et al. 2017).

Between all these opinions, Hubbard (2023) advocates for their recognition as a separate asset class requiring distinct accounting treatment. However, he reflects on three accounting treatment options: treating crypto as cash or cash equivalents, recording it as an investment at fair value (reflecting its market fluctuations), or maintaining its current classification as an intangible asset with a revaluation model. This approach balances fair value measurement with minimizing immediate impact on reported earnings.

Morozova et al. (2020) notice an absence of clear guidance on recognizing cryptocurrencies as cash equivalents. Hampl and Gyönyörová (2021) suggest reporting fiat-backed stablecoins (Kochergin 2020) as cash equivalents, even though they are not technically financial assets, because of their similarity to cash in terms of holding value.

The ideal classification and treatment for crypto-related activities like mining and ICOs (Gan et al. 2021) remain debated topics (Jayasuriya and Sims 2023; Luo and Yu 2022). While mining is one way to acquire cryptocurrency, Makurin (2023) also acknowledges the option of purchasing it on exchanges, which, with price stability, could become a payment option, moving beyond speculation.

Gomaa et al. (2019) examine a scenario where an accounting consulting service is paid for using cryptocurrency, understanding it as a legitimate form of payment. Rella (2020) would recognize cryptocurrencies as money, “turning them into monetary commodities”. Yee et al. (2020) emphasize the potential of fair value measurement when cryptocurrencies are received as payment.

Another interesting article is the one of Pelucio-Grecco et al. (2020), who make a classification of bitcoins and suggest assessing them as foreign currency for accounting purposes (Procházka 2019).

Yan et al. (2022) delve into the treatment of cryptocurrencies as investments, as intangible assets, or as inventories. The manuscript covers the idea of cryptocurrencies being classified as cash (IFRS IAS 7 2024) and accepted as payment by economic partners. It is not surprising that Makurin et al. (2023) study the potential implications of appreciating them as official means of payment (Yee et al. 2020).

Bellucci et al. (2022) propose a nuanced approach to cryptocurrency classification and valuation, considering the company’s purpose for holding them. Firstly, they suggest classifying them as financial instruments measured at fair value (under IFRS 9 2024) if the company considers them long-term investments. Alternatively, if the company actively trades cryptocurrencies (falling under IFRS IAS 2 2024), they recommend valuing them at fair value less cost to sell (supported by Păunescu 2018; Procházka 2018; Morozova et al. 2020). Thirdly, they acknowledge the possibility of classifying cryptocurrencies as intangible assets (IFRS IAS 38 2024), impaired, and valued at fair value (Procházka 2018; Morozova et al. 2020). Finally, they recognize the debate upon classifying cryptocurrencies as foreign currency (IFRS IAS 21 2024), but this definition is not widely accepted (Hampl and Gyönyörová 2021).

Procházka (2018, 2019) argues for fair value accounting for crypto investments and highlights scenarios where cryptocurrencies can be treated as cash or foreign currency (even if not legal tender), imagining scenarios like receiving crypto as payment (Rella 2020). He also explores how crypto might be used for hedging or derivative contracts under IFRS 9 (2024) and suggests treating it as a non-financial investment.

Parrondo (2023) proposes a classification based on the properties and rights associated with crypto tokens. This framework categorizes tokens into payment tokens (cryptocurrencies/stablecoins), utility tokens, and security tokens. The core of this classification is based on four key factors that Parrondo (2023) identifies: (1) the existence of a legal right; (2) the degree of token value stability; (3) the presence of intrinsic value of the token; and (4) the level of investment risk associated with the token.

Raiborn and Sivitanides (2015) focus on specific accounting issues related to cryptocurrencies, including asset classification (Yatsyk and Shvets 2020), bitcoin holdings for investment purposes, mining activity, bitcoin exchanges (Baur et al. 2018; Böhme et al. 2015), and transactions. The manuscript concludes that a reasonable classification for bitcoins would be as investments (long or short-term) (Beigman et al. 2023).

Table 7 summarizes the valuation approaches for cryptocurrencies proposed by various authors in our reviewed literature, all contributing valuable insights into managerial accounting practices. A clear trend emerges: fair value treatment is the most prominently discussed method in 31 articles. This suggests a preference for reflecting the current market value of cryptocurrencies in financial statements. Cost treatment remains a relevant option, supported by 18 studies.

Table 7.

Valuation treatment for cryptocurrencies.

A key challenge is the difficulty of establishing active markets for all cryptocurrencies, which complicates the application of fair value treatment. This uncertainty might lead accountants to favor the more conservative approach of historical cost valuation.

Regardless of the chosen standard, Niftaliyev (2023) emphasizes the importance of businesses maintaining proper accounting records for their cryptocurrency transactions. Therefore, legalizing cryptocurrencies and adopting modern blockchain-based accounting methods will contribute to a more robust and competitive landscape (Shvayko and Grebeniuk 2020). More than that, legislation is beneficial for both protecting the country’s economy and safeguarding the interests of its citizens (Salawu and Moloi 2018).

In conclusion, the ideal approach for valuation treatment for cryptocurrencies depends on a company’s specific cryptocurrency use case. Careful consideration of this factor and a commitment to transparency and consistency in financial reporting are crucial for companies navigating this evolving landscape.

The uncertainty and evolving nature of accounting treatments for cryptocurrencies (Smith et al. 2019) might be a reason behind the slow adoption of digital currencies by businesses and accounting firms (Appelbaum et al. 2022) and high volatility in stock markets (Soepriyanto et al. 2023; Borri 2019). Moreover, Smith (2018) highlights the need for accounting professionals to adapt to the emerging trends in blockchain technology (Alles and Gray 2020, 2023; Ntanos et al. 2020).

Pimentel and Boulianne (2020) explore the implications of blockchain technology on financial reporting. Similarly, Bonyuet (2020) talks about Big Four accounting firms actively advising on and developing blockchain solutions for financial accounting (Kokina et al. 2017) and reporting on cryptocurrencies. More than that, the paper of Barros et al. (2023) discusses decentralized accounting management regarding cryptocurrencies, highlighting the importance of coordination in updating accounting records.

Abdennadher et al. (2022) argue that blockchain technology presents a double win for the accounting profession (Atik and Kelten 2021; Pflueger et al. 2022). On the one hand, it has the potential to automate many routine accounting tasks, facilitate processes, enhance efficiency (Alhasana and Alrowwad 2022; Caliskan 2020), and support sustainable development (Al-Htaybat et al. 2019; ALSaqa et al. 2019). On the other hand, blockchain’s inherent security strengthens record-keeping, significantly reducing the risk of fraudulent transactions (Dai and Vasarhelyi 2017; Appelbaum and Nehmer 2020; Maffei et al. 2021). This frees up valuable time for accountants and auditors to shift their focus toward providing advisory services and leveraging their expertise (Garanina et al. 2022). Bonyuet (2020) emphasizes that proper accounting treatment for transactions requires significant accounting knowledge and experience (Schmitz and Leoni 2019).

Makurin et al. (2023) explore blockchain technology’s impact on accounting using a triple-entry system instead of the traditional double-entry (Adelowotan and Coetsee 2021; Han et al. 2023; Maffei et al. 2021; Mosteanu and Faccia 2020). This additional layer adds a cryptographic stamp for each transaction (Buhussain and Hamdan 2023), ensuring identical copies for all stakeholders (accountant, client, tax authorities, and auditor).

Incorporating blockchain technology into accounting education and practice is challenging due to its multidisciplinary nature (Desai 2023; Kaden et al. 2021; Stern and Reinstein 2021).

Recognizing the need for accurate record-keeping and understanding the financial transactions of cryptocurrencies, Stratopoulos’s (2020) work centers around creating an interactive learning activity for accounting students. This activity explores Bitcoin blockchains to equip students with a strong foundation on this subject. Specifically, it aims to cultivate a conceptual understanding of blockchain technology and its functions.

4.3.2. Insights into Managerial Accounting Regarding Cryptocurrencies

Management accounting involves the recognition and valuation of cryptocurrencies as elements of cost, with different accounting treatments leading to inconsistencies and potential distortions in assessing a company’s performance (Luo and Yu 2022). Fuller and Markelevich (2020) believe that accountants prioritize high-reliability information, ideally achieved at a reasonable cost. This suggests a balancing act between accuracy and efficiency in financial reporting.

Păunescu (2018) considers two phases in the creation of crypto assets: the research phase, during which any expenses incurred cannot be recognized as assets, and the development phase, during which associated costs can be capitalized as intangible assets.

In their research, Barros et al. (2023) delve into the production costs (Yang and Hamori 2021) of cryptocurrency, specifically mining costs (Proelss et al. 2023) related to energy consumption and computational capacity. These costs highlight how frequently the blockchain grows with new blocks. The frequency with which new blocks are added directly impacts several factors. Firstly, it establishes the update time for the ledger. Secondly, it influences the mining rewards, incentivizing miners to secure the network. Finally, it affects mining costs, which include IT equipment and software, electricity consumption, and personnel wages needed to operate the system (Kolková 2018; Zadorozhnyi et al. 2018; Zianko et al. 2022). Makurin (2023) breaks down the specific costs of mining one bitcoin, highlighting factors such as equipment depreciation and maintenance (Peters et al. 2015), high-speed internet access, software, and electricity costs. Considering these ongoing aspects, Makurin et al. (2023) advocate for revaluing cryptocurrencies on the balance sheet to reflect their current market value.

The cost of mining depends heavily on the approach taken by the miner (Makurin et al. 2023). If the miner develops a new technology, the development costs become part of the initial value of the mined coins. If existing technology is used, the initial value is simply the direct cost of mining. In both cases, mining costs and the desired profit margin for miners ultimately influence the cryptocurrency’s exchange rate (Volosovych and Baraniuk 2018).

Corbet et al. (2020) highlight a critical cost variable in cryptocurrency valuation: the amount of electricity consumed during mining. They emphasize that energy consumption has a dual impact, influencing the cryptocurrency’s fair value and the potential investment returns for miners.

In this context, Smith et al. (2019) differentiate between externally acquired and internally created crypto assets. Externally acquired assets are recorded at their initial purchase cost, while internally created crypto assets (e.g., through mining) have all associated creation costs expensed as incurred.

An interesting idea is offered by Altukhov et al. (2020). They suggest that for some enterprises, creating and utilizing their own cryptocurrency could be beneficial for predicting the flow of information within the management accounting system. We believe these internal cryptocurrencies could function only as a closed-loop system within a company.

Derun and Mysaka (2022) highlight an additional cost consideration: transaction fees. Users may incur high commissions to expedite transaction confirmations, adding to the overall cost of managing digital assets (Borri and Shakhnov 2022).

Therefore, when appraising this type of asset, the preferred valuation method is the fair value treatment (Makurin et al. 2023; Smith et al. 2019; Alsalmi et al. 2023; Angeline et al. 2021; Beigman et al. 2023; Bellucci et al. 2022; Corbet et al. 2020; Hubbard 2023; Morozova et al. 2020; Niftaliyev 2023; Ramassa and Leoni 2022) which offers two approaches. Firstly, the market approach involves comparing the cryptocurrency with similar assets based on the same technology in an active market (Luo and Yu 2022). The comparison can be influenced by inputs such as the current market price (the value of one unit of cryptocurrency) (Derun and Mysaka 2022; Procházka 2018; Proelss et al. 2023; Zadorozhnyi et al. 2018), market capitalization (the overall value of the market) (Yang and Hamori 2021; Proelss et al. 2023; Zianko et al. 2022; Peters et al. 2015), trading volume (the total volume of cryptocurrencies traded in a specific period) (Yang and Hamori 2021; Zianko et al. 2022; Peters et al. 2015), or regulatory landscape (compliance and clarity of regulations) (Derun and Mysaka 2022; Yang and Hamori 2021; Proelss et al. 2023; Zianko et al. 2022; Makurin et al. 2023; Peters et al. 2015). The reliability of the information is influenced by the volatility of the cryptocurrency market (Luo and Yu 2022; Proelss et al. 2023; Makurin 2023; Makurin et al. 2023), leading to uncertainty when making comparisons between different markets (Zianko et al. 2022; Makurin et al. 2023). Secondly, the income approach is typically used for traditional assets. Therefore, this method is less applicable to cryptocurrencies because they often lack inherent cash flow (Proelss et al. 2023). If this approach were applied, the transaction fees (Derun and Mysaka 2022; Peters et al. 2015) would be a notable input.

4.3.3. Insights into Taxation of Cryptocurrencies

The emergence of cryptocurrencies has introduced a novel asset class with unique accounting and taxation considerations (Bozdoğanoğlu 2022; Cassidy et al. 2020; Cong et al. 2023; Obu and Ukpere 2022). Governments are still grappling with establishing clear rules for taxing cryptocurrency transactions, creating uncertainty for both governments and taxpayers (Pimentel and Boulianne 2020; Vumazonke and Parsons 2023). Tax authorities must explore the underlying principles of taxing cryptocurrency transactions to increase tax revenue potentially (Angeline et al. 2021).

A crucial aspect regarding the taxation of crypto assets lies in identifying ownership. The pseudonymous nature of cryptocurrency transactions (Pimentel and Boulianne 2020; Caliskan 2020) makes it challenging to track the true owner of these assets. This lack of transparency also makes it difficult to determine who is liable for taxes on income generated from cryptocurrency transactions.

In the situation of holding cryptocurrencies, different authors choose to consider that cryptocurrencies should be taxed similarly to properties or commodities (Alsalmi et al. 2023; Jayasuriya and Sims 2023; Smith et al. 2019; Terando et al. 2017; Cong et al. 2023). Offering a simple tax framework could potentially encourage taxpayers to comply with regulations. However, Angeline et al. (2021) draw attention to how companies must navigate accounting standards (e.g., IFRS IAS 38 2024; IFRS IAS 2 2024) and relevant tax regulations to determine their tax liabilities for cryptocurrencies accurately (Davenport and Usrey 2023).

Huang et al. (2023) explain the specific tax implications for cryptocurrency activities in Hong Kong. Profits earned from trading cryptocurrencies held as inventory and staking rewards received during the holding period are likely subject to profits tax. In contrast, cryptocurrencies sold after being classified as intangible assets fall outside the scope of Hong Kong profits tax. However, it is essential to note that other jurisdictions might have capital gains taxes (profits taxes) on such transactions, which differ from income tax. The profits tax is a percentage applied to the profit, which is the positive difference between revenue and expenses. The income tax represents a percentage applied to the income.

Smith et al. (2019) also consider holding periods. If a taxpayer holds cryptocurrency for more than one year before selling it, any profits are generally regarded as long-term capital gains. This distinction is significant because long-term capital gains are often taxed lower than ordinary income.

Donating cryptocurrency to charity offers an additional tax benefit in South Africa: exemption from capital gains tax. This means the fair market value of the donated cryptocurrency is not counted as income, a capital gain, or a loss for tax purposes (Vumazonke and Parsons 2023). This exemption can incentivize charitable giving using cryptocurrency.

The taxation of cryptocurrency mining activity sparks debate among scholars. Bellucci et al. (2022) suggest treating mining as a business activity subject to “general taxes” like other production activities. In their view, taxation should occur at the time of production, capturing the value generated during mining.

Conversely, Pelucio-Grecco et al. (2020) consider a different approach, aligning with Volosovych and Baraniuk (2018). They argue that mined cryptocurrencies should be taxed upon sale, not at the time of mining. This approach may be preferable due to the inherent volatility of cryptocurrency prices. We consider that taxing at the point of sale offers a more stable tax base.

The tax treatment of cryptocurrency exchanges also presents challenges (Cong et al. 2023; Nylen and Huels 2022). Several authors, including Bellucci et al. (2022) and Volosovych and Baraniuk (2018), recommend treating these exchanges similarly to foreign currency transactions. This analogy suggests that profits generated from cryptocurrency exchanges might be subject to capital gains taxes. Essentially, the argument is for taxing cryptocurrency exchanges like foreign currency trades. Furthermore, Kolková (2018) proposes that cryptocurrency conversions to fiat currency with a profit due to exchange rate fluctuations may be subject to income tax (Pelucio-Grecco et al. 2020). However, only the profit, not the entire amount converted, should be considered taxable income.

The taxation of cryptocurrency transactions extends beyond capital gains. Huang et al. (2023) suppose cryptocurrency transactions might be subject to transaction taxes depending on the jurisdiction.

Kolková (2018) emphasizes the importance of deductible expenses related to acquiring or managing the cryptocurrencies (e.g., exchange fees, training courses, hardware wallet) that can be diminished from the profit before calculating the final tax amount. This approach ensures a more accurate reflection of taxable income.

When a business accepts cryptocurrency as payment for goods or services, the tax treatment becomes similar to traditional currency sales. Income or sales tax applies in Brazil, as suggested by Pelucio-Grecco et al. (2020). However, these authors also highlight a debate surrounding Brazil’s tax on the circulation of goods and services (ICMS). One view suggests it might apply when buying crypto from a third party, while another proposes its application upon exchanging crypto for traditional money. Pimentel and Boulianne (2020) offer an alternative perspective, suggesting that cryptocurrency purchases for goods or services be treated as “barter transactions” for tax purposes.

Bellucci et al. (2022) believe that cryptocurrency activities should be exempted from Value Added Tax (VAT) in Italy. They draw a parallel to currency trading activities, which are typically exempt from VAT (Kolková 2018). This reasoning aligns with the approach taken in Ukraine, which follows the EU recommendations by not applying VAT to cryptocurrency transactions (Volosovych and Baraniuk 2018).

In conclusion, a critical link exists between the accounting treatment of cryptocurrencies in financial statements and their subsequent taxation (Makurin et al. 2023; Niftaliyev 2023). The absence of clear and consistent regulations creates an unpredictable and unstable environment for businesses operating in this space (Sokolenko et al. 2019; Ilham et al. 2019a, 2019b). Establishing well-defined rules would enhance transparency and comparability in financial reporting and stabilize businesses dealing with cryptocurrencies.

4.3.4. Insights into Auditing of Cryptocurrencies

The integration of blockchain technology into the auditing profession (Lombardi et al. 2022) holds the potential to revolutionize audit processes, making them more transparent and clear (Abdennadher et al. 2022; Bonyuet 2020; Dai and Vasarhelyi 2017; Dyball and Seethamraju 2022), including the verification of cryptocurrency transactions, recognition, and disclosure. These advancements could fundamentally reshape the way audits are conducted because transactions can be recorded when they happen, data are secure and cannot be altered once recorded, and every transaction has a verifiable time stamp (Buhussain and Hamdan 2023), while information is private on the blockchain (Pan et al. 2023). Even if blockchain technology can bring significant changes, it will not replace auditors themselves or their professional rationale (Coyne and McMickle 2017).

As cryptocurrency investments gain adoption within businesses, the demand for auditing and advisory services tailored to these assets is expected to rise (Klopper and Brink 2023; Ozeran and Gura 2020; Smith 2023). Auditors can leverage existing accounting guidance to assess how companies account for their cryptocurrency holdings to ensure proper financial reporting and adherence to relevant regulations (Klopper and Brink 2023).

However, the relatively nascent cryptocurrency market presents challenges for auditors. Ozeran and Gura (2020) noticed the lack of extensive experience with cryptocurrency among many auditors. This can make it difficult to decide whether to accept or continue auditing a company with significant crypto activity. Compounding this challenge is the absence of clear, consistent regulatory guidelines for crypto assets.

One of the primary challenges auditors face in the realm of cryptocurrency is the inherent volatility of the price (Angeline et al. 2021). This price fluctuation makes accurate valuation difficult, demanding heightened caution from both internal and external auditors when they estimate cryptocurrency values, review transactions (Gomaa et al. 2019), and consider factors like dates, estimations used, and assumptions made. Auditors must be careful in identifying and assessing the risks of errors in financial statements due to crypto transactions (Ozeran and Gura 2020). To achieve this, auditors can employ a set of risk assessment procedures tailored explicitly to crypto assets: (1) verification of cryptocurrency wallets and trading balances; (2) confirmation of ownership through third-party verification; (3) examination of whitepapers and trading agreements; (4) evaluation of internal controls for securing cryptocurrencies (Ozeran and Gura 2020).

Beyond the valuation challenges, auditors must consider inherent risks and control risks associated with cryptocurrencies (Angeline et al. 2021; Dunn et al. 2021; Tzagkarakis and Maurer 2023; Sheldon 2023). Inherent risks are those likely to occur due to the very nature of cryptocurrencies. A prime example is the valuation difficulty when holding cryptocurrencies over time, as highlighted by Smith et al. (2019). Another significant, both inherent and control, risk involves unauthorized access to private keys used to secure cryptocurrency holdings (Harrast et al. 2022; Gurdgiev and Fleming 2021), potentially leading to substantial misstatements in financial reporting. Control risks are those that an entity’s internal controls (Smith and Castonguay 2020) over financial reporting are ineffective in preventing or detecting.

Furthermore, the pseudonymous nature of cryptocurrency transactions presents unique auditing challenges for accountants in accurately recording and reporting financial transactions (Harrast et al. 2022). Bellucci et al. (2022) point out that auditors must rely heavily on a company’s internal controls for auditing (Dyball and Seethamraju 2022; Bauer et al. 2023). This underscores the critical role of robust internal controls for ensuring reliable data, a cornerstone for auditors to assess a company’s financial health properly (Fuller and Markelevich 2020).

In conclusion, auditing cryptocurrencies presents a complex challenge due to inherent risks, control risks, and the evolving nature of the technology. Further research on these challenges and developing a robust framework for auditing crypto assets remains pivotal for ensuring the accuracy and reliability of financial reporting in this dynamic space.

5. Conclusions

The analysis reveals several key insights in pursuit of an answer to the first research question, “What is the current state of collaboration between countries, organizations, and authors?” While collaboration between authors is still developing, the novelty and notoriety of the subject could raise the interest of other scientists. The network visualization suggests a gradual spread of connections between authors.

Similar trends are observed in the country and organization citation networks. Collaboration appears to be in its early stages, with the most involved countries being the USA, Australia, Austria, Italy, France, the United Kingdom, Ireland, Canada, Lebanon, the Czech Republic, China, and Ukraine. This geographical spread reflects potential factors influencing research activity in cryptocurrency accounting. Therefore, countries with a higher rate of cryptocurrency adoption among their citizens or with well-developed financial markets would accelerate research to address practical accounting challenges. Examples include the USA and Ukraine, which have a significant cryptocurrency user base, and China, a central financial hub. Moreover, countries with established or evolving regulatory frameworks for cryptocurrencies might be more inclined to invest in research. The USA, with its division between the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission), and the United Kingdom, where the FCA (Financial Conduct Authority) is taking the lead, are first examples of this, as both nations are actively developing frameworks to oversee cryptocurrency activities and address potential risks.

Regarding the institutions involved in the publishing process, we highlight the connected ones from the most significant cluster: Rutgers State University, Masaryk University Brno, City University of New York, Columbia University, Kyiv National University, Auckland University, and Concordia University. Universities in certain countries might have a focus on innovation and emerging technologies (Masaryk University Brno), financial and regulatory implications (Rutgers State University, Concordia University), crypto challenges in adoption countries (Kyiv National University), or impact on international standards (University of Auckland), leading to a natural extension of research into cryptocurrency accounting.

Investigating the second research question, “Which themes are of interest among the researchers?”, the authors reveal the distribution research across four key themes based on the network visualizations and the extracted citation data. The “financial accounting” theme forms the core subject matter, appearing in most of the articles. The “managerial accounting” and “auditing” themes are the next in the hierarchy, highlighting their relevance to the field. The impact of cryptocurrencies on “taxation” is addressed in fewer studies, but the interest will increase significantly as governments worldwide seek to regulate the growing cryptocurrency market.

Thematic analysis and discussions of the reviewed literature fill the gap by unveiling the valuation approaches most prominently discussed by authors for cryptocurrencies. The fair value treatment approach emerges as the most favored method. This finding suggests a preference for reflecting the current market value of cryptocurrencies within financial statements, potentially to provide a more accurate representation of their worth.