Unveiling Outperformance: A Portfolio Analysis of Top AI-Related Stocks against IT Indices and Robotics ETFs

Abstract

1. Introduction

2. Methodological Issues

2.1. Return, Risk Premium, and Cumulative Return: Investment and Reinvestment

2.2. The Construction of Portfolios

Equally Weighted Portfolios and Buy-and-Hold Portfolios

3. Data Source and Description

3.1. Data Collection

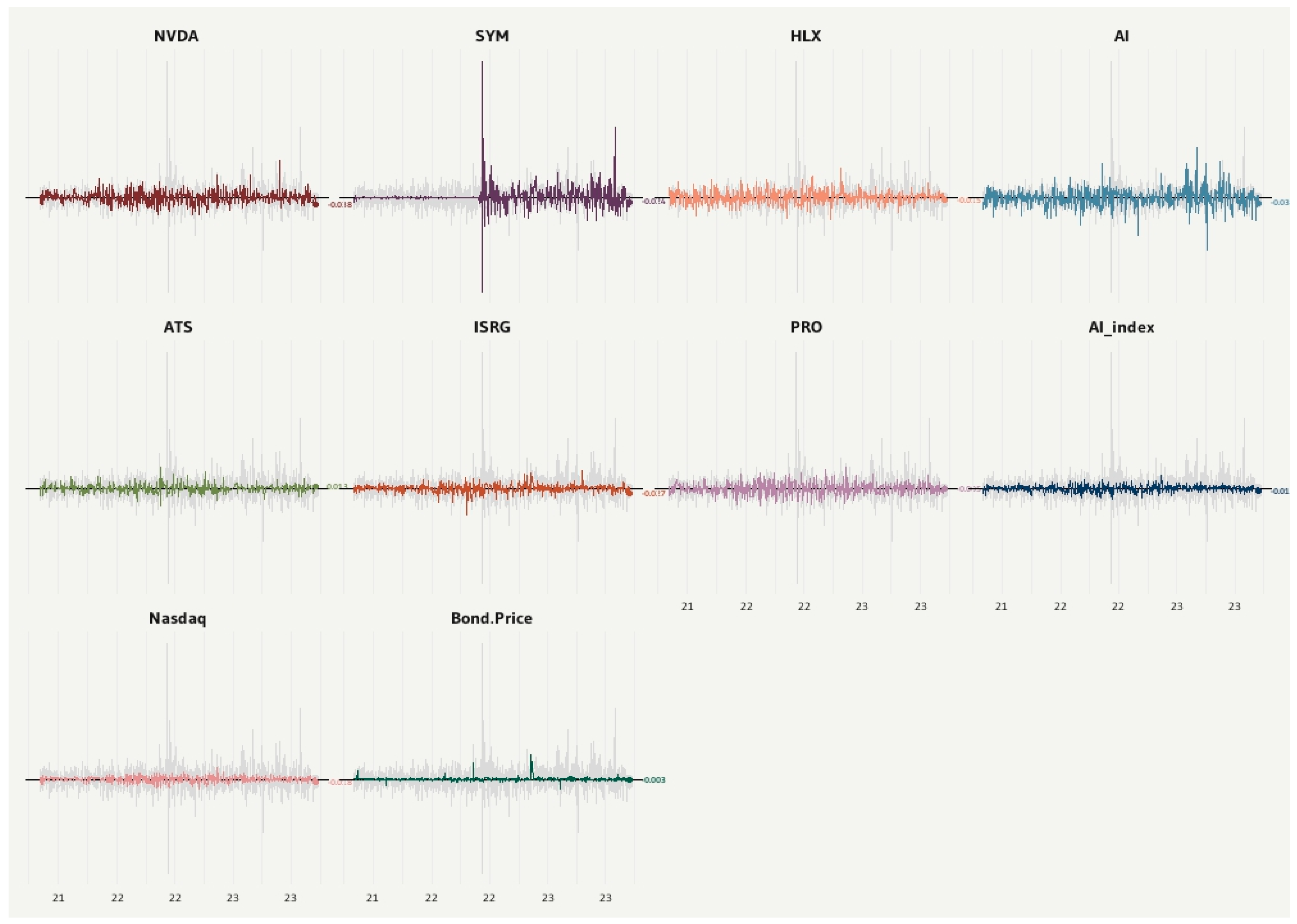

3.2. Descriptive Statistics

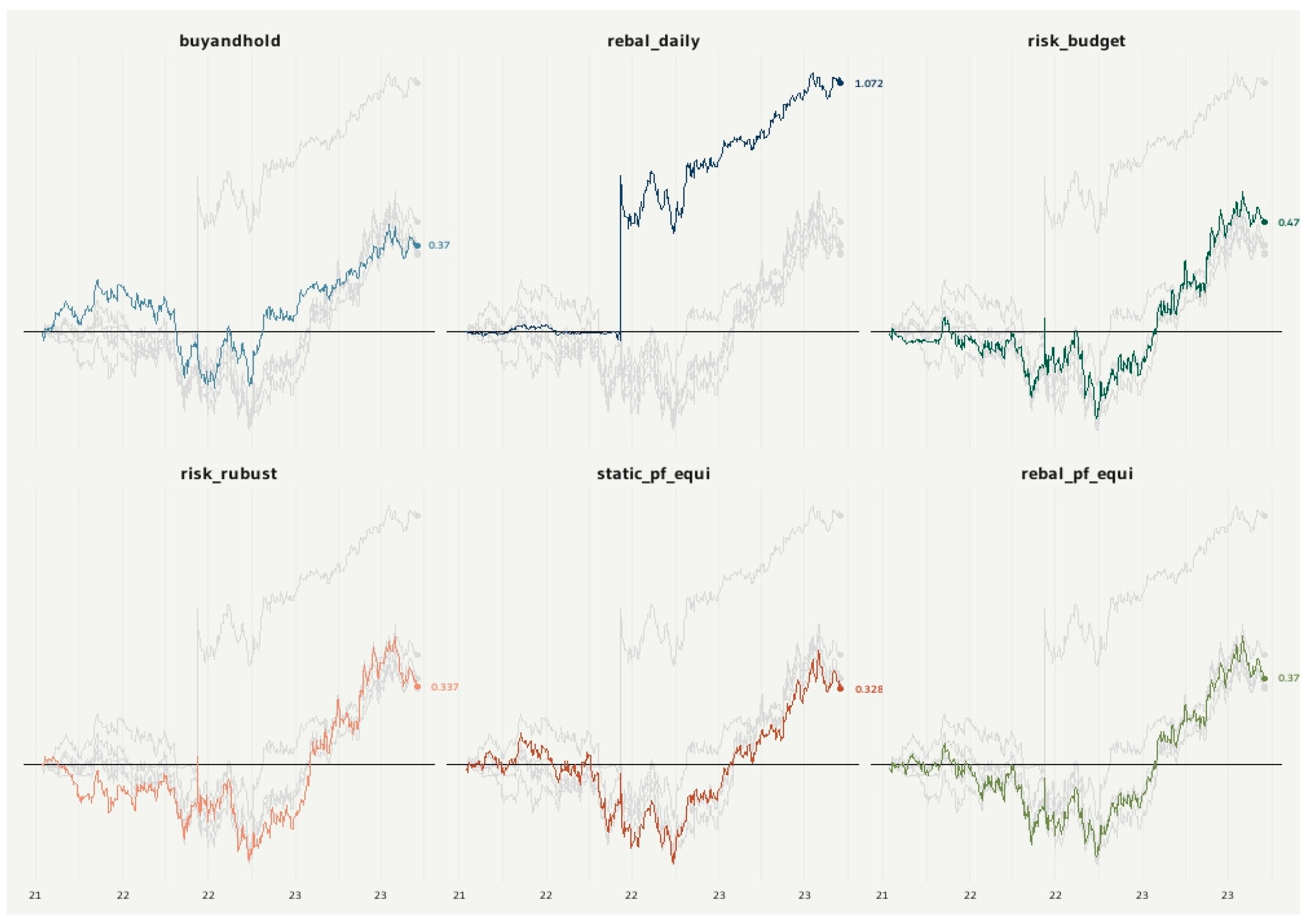

3.3. Descriptive Statistics: Portfolios of AI Stocks

4. Empirical Findings and Discussion

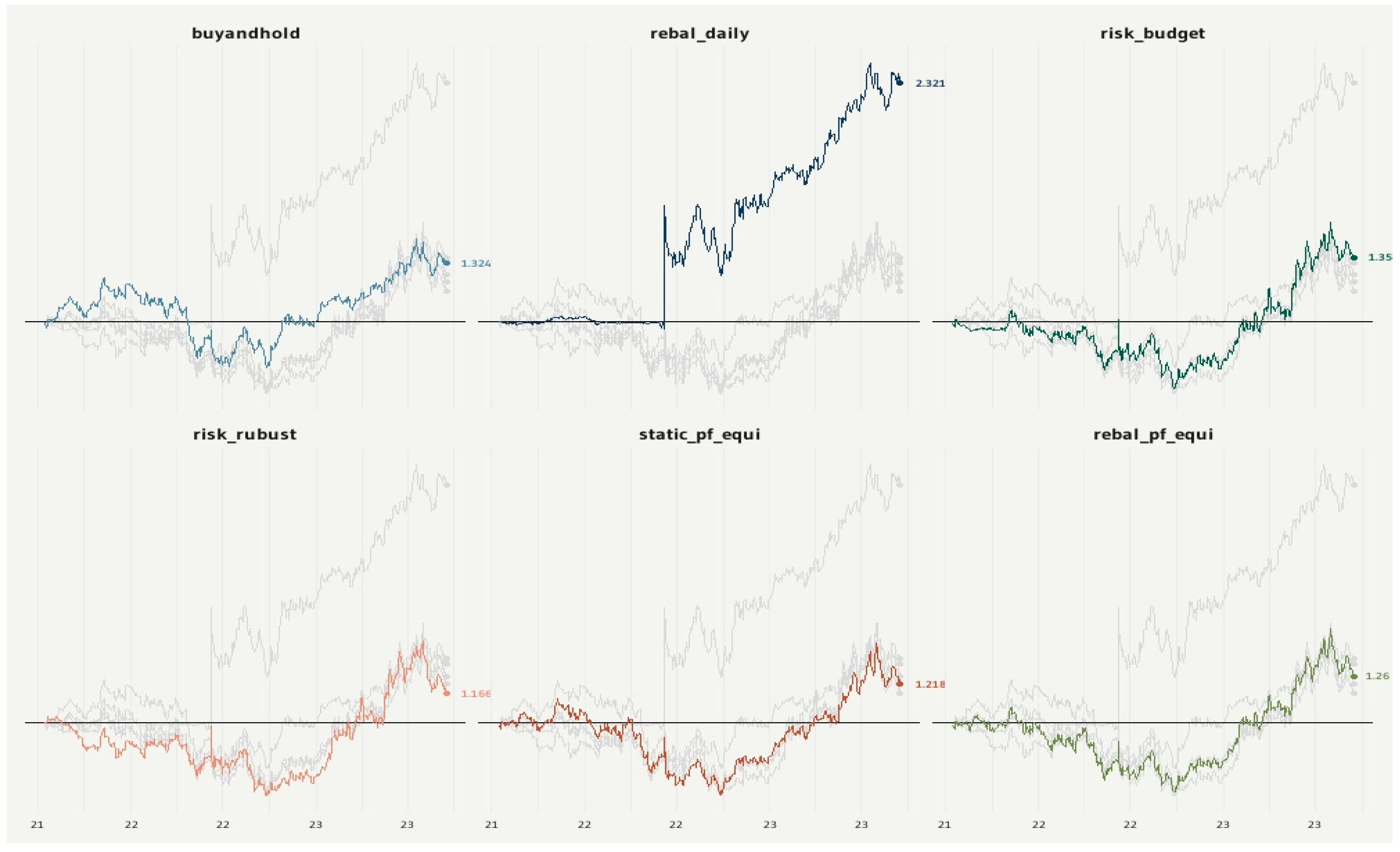

4.1. Cumulative Return: AI Portfolios

4.2. Portfolios Performance

4.2.1. The Downside Risk and Upside Potential

4.2.2. Portfolio Performance Regarding Market Risk- and Risk-Free Rate

4.3. Discussion: Relation of Most Related Chips Stocks to Global Performance

4.3.1. Portfolios Relation to Other Market Benchmarks: Systemic Risk

4.3.2. Performance in Terms of Market Benchmarks

5. Conclusions and Perspectives

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | https://www-formal.stanford.edu/jmc/whatisai.pdf (accessed on 12 December 2023). |

| 2 | https://edition.cnn.com/2023/07/26/investing/premarket-stocks-trading/index.html (accessed on 26 July 2023). |

| 3 | https://www.theverge.com/23610427/chatbots-chatgpt-new-bing-google-bard-conversational-ai^ (accessed on 12 December 2023). |

| 4 | https://edition.cnn.com/2023/05/30/investing/nvidia-1-trillion/index.html (accessed on 31 May 2023). |

| 5 | https://www.nerdwallet.com/article/investing/ai-stocks-invest-in-artificial-intelligence (accessed on 6 January 2024). |

References

- Abakah, Emmanuel Joel Aikins, Aviral Kumar Tiwari, Chi-Chuan Lee, and Matthew Ntow-Gyamfi. 2023a. Quantile price convergence and spillover effects among Bitcoin, Fintech, and artificial intelligence stocks. International Review of Finance 23: 187–205. [Google Scholar] [CrossRef]

- Abakah, Emmanuel Joel Aikins, Aviral Kumar Tiwari, Sudeshna Ghosh, and Buhari Doğan. 2023b. Dynamic effect of Bitcoin, fintech and artificial intelligence stocks on eco-friendly assets, Islamic stocks and conventional financial markets: Another look using quantile-based approaches. Technological Forecasting and Social Change 192: 122566. [Google Scholar] [CrossRef]

- Acemoglu, Daron, and Pascual Restrepo. 2018. The race between man and machine: Implications of technology for growth, factor shares, and employment. American Economic Review 108: 1488–542. [Google Scholar] [CrossRef]

- Acemoglu, Daron, and Pascual Restrepo. 2020. The wrong kind of AI? Artificial intelligence and the future of labour demand. Cambridge Journal of Regions, Economy and Society 13: 25–35. [Google Scholar] [CrossRef]

- Bahrammirzaee, Arash. 2010. A comparative survey of artificial intelligence applications in finance: Artificial neural networks, expert system and hybrid intelligent systems. Neural Computing and Applications 19: 1165–95. [Google Scholar] [CrossRef]

- Bannerjee, Gouravmoy, Uditendu Sarkar, Swarup Das, and Indrajit Ghosh. 2018. Artificial intelligence in agriculture: A literature survey. International Journal of Scientific Research in Computer Science Applications and Management Studies 7: 1–6. [Google Scholar]

- Baur, Dirk G., and Kristoffer J. Glover. 2012. The Destruction of a Safe Haven Asset? Available online: https://ssrn.com/abstract=2142283 (accessed on 31 August 2012).

- Bhatnagar, Mukul, Ercan Özen, Sanjay Taneja, Simon Grima, and Ramona Rupeika-Apoga. 2022. The Dynamic Connectedness between Risk and Return in the Fintech Market of India: Evidence Using the GARCH-M Approach. Risks 10: 209. [Google Scholar] [CrossRef]

- Booth, David G., and Eugene F. Fama. 1992. Diversification returns and asset contributions. Financial Analysts Journal 48: 26–32. [Google Scholar] [CrossRef]

- Brynjolfsson, Erik, Daniel Rock, and Chad Syverson. 2018. Artificial intelligence and the modern productivity paradox: A clash of expectations and statistics. In The economics of Artificial Intelligence: An Agenda. Chicago: University of Chicago Press, pp. 23–57. [Google Scholar]

- Bughin, Jacques, Eric Hazan, Sree Ramaswamy, Michael Chui, Tera Allas, Peter Dahlström, Nicolaus Henke, and Monica Trench. 2017. Artificial Intelligence the Next Digital Frontier. Chicago: McKinsey & Company. [Google Scholar]

- Chen, An-Sing, and James Wuh Lin. 2014. The relation between gold and stocks: An analysis of severe bear markets. Applied Economics Letters 21: 158–70. [Google Scholar] [CrossRef]

- Chrisley, Ronald, and Sander Begeer, eds. 2000. Artificial Intelligence: Critical Concepts. Abingdon-on-Thames: Taylor & Francis, vol. 1. [Google Scholar]

- Dammak, Wael, Salah Ben Hamad, Christian de Peretti, and Hichem Eleuch. 2023. Pricing of European currency options considering the dynamic information costs. Global Finance Journal 58: 100897. [Google Scholar] [CrossRef]

- David, Dharish, Miyana Yoshino, and Joseph Pablo Varun. 2022. Developing FinTech Ecosystems for Voluntary Carbon Markets Through Nature-Based Solutions: Opportunities and Barriers in ASEAN. In Green Digital Finance and Sustainable Development Goals. Singapore: Springer Nature Singapore, pp. 111–42. [Google Scholar] [CrossRef]

- Destefanis, Giuseppe, Silvia Bartolucci, and Marco Ortu. 2023. A Preliminary Analysis on the Code Generation Capabilities of GPT-3.5 and Bard AI Models for Java Functions. arXiv arXiv:2305.09402. [Google Scholar]

- Dirican, Cüneyt. 2015. The impacts of robotics, artificial intelligence on business and economics. Procedia-Social and Behavioral Sciences 195: 564–73. [Google Scholar] [CrossRef]

- Došilović, Filip Karlo, Mario Brčić, and Nikica Hlupić. 2018. Explainable artificial intelligence: A survey. Paper presented at 2018 41st International Convention on Information and Communication Technology, Electronics and Microelectronics (MIPRO), Opatija, Croatia, May 21–25; Piscataway: IEEE, pp. 0210–0215. [Google Scholar] [CrossRef]

- Dowling, Michael, and Brian Lucey. 2023. ChatGPT for (finance) research: The Bananarama conjecture. Finance Research Letters 53: 103662. [Google Scholar] [CrossRef]

- Dranev, Yury, Ksenia Frolova, and Elena Ochirova. 2019. The impact of fintech M&A on stock returns. Research in International Business and Finance 48: 353–64. [Google Scholar] [CrossRef]

- Dwivedi, Yogesh K., Nir Kshetri, Laurie Hughes, Emma Louise Slade, Anand Jeyaraj, Arpan Kumar Kar, Abdullah M. Baabdullah, Alex Koohang, Vishnupriya Raghavan, Manju Ahuja, and et al. 2023. “So what if ChatGPT wrote it?” Multidisciplinary perspectives on opportunities, challenges and implications of generative conversational AI for research, practice and policy. International Journal of Information Management 71: 102642. [Google Scholar] [CrossRef]

- Felten, Edward W., Manav Raj, and Robert Seamans. 2018. A method to link advances in artificial intelligence to occupational abilities. In AEA Papers and Proceedings. Nashville: American Economic Association, vol. 108, pp. 54–57. [Google Scholar] [CrossRef]

- Feyen, Erik, Jon Frost, Leonardo Gambacorta, Harish Natarajan, and Matthew Saal. 2021. Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. BIS Papers, Bank for International Settlements, Number 117. Available online: https://www.bis.org/publ/bppdf/bispap117.pdf (accessed on 12 December 2023).

- Furman, Jason, and Robert Seamans. 2019. AI and the Economy. Innovation Policy and the Economy 19: 161–91. [Google Scholar] [CrossRef]

- Graetz, Georg, and Guy Michaels. 2018. Robots at work. Review of Economics and Statistics 100: 753–68. [Google Scholar] [CrossRef]

- Hanicova, D., and R. Vojtko. 2021. Rebalancing Premium in Cryptocurrencies. Available online: https://ssrn.com/abstract=3982120 (accessed on 12 December 2023).

- Holzinger, Andreas, Georg Langs, Helmut Denk, Kurt Zatloukal, and Heimo Müller. 2019. Causability and explainability of artificial intelligence in medicine. Wiley Interdisciplinary Reviews: Data Mining and Knowledge Discovery 9: e1312. [Google Scholar] [CrossRef] [PubMed]

- Horn, Matthias, Andreas Oehler, and Stefan Wendt. 2020. FinTech for consumers and retail investors: Opportunities and risks of digital payment and investment services. In Ecological, Societal, and Technological Risks and the Financial Sector. Berlin/Heidelberg: Springer, pp. 309–27. [Google Scholar] [CrossRef]

- Hu, Krystal. 2023. ChatGPT Sets Record for Fastest-Growing User Base. London: Reuters, vol. 12. [Google Scholar]

- Huynh, Toan Luu Duc, Erik Hille, and Muhammad Ali Nasir. 2020. Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies. Technological Forecasting and Social Change 159: 120188. [Google Scholar] [CrossRef]

- Jawadi, Fredj, Nabila Jawadi, Duc Khuong Nguyen, and Hassan Obeid. 2013. Information technology sector and equity markets: An empirical investigation. Applied Financial Economics 23: 729–37. [Google Scholar] [CrossRef]

- Jiang, Christine X., Jang-Chul Kim, and Robert A. Wood. 2011. A comparison of volatility and bid–ask spread for NASDAQ and NYSE after decimalization. Applied Economics 43: 1227–39. [Google Scholar] [CrossRef]

- Kamssu, Aurore J., Brian J. Reithel, and Jennifer L. Ziegelmayer. 2003. Information technology and financial performance: The impact of being an Internet-dependent firm on stock returns. Information Systems Frontiers 5: 279–88. [Google Scholar] [CrossRef]

- Katz, Daniel Martin, Michael James Bommarito, Shang Gao, and Pablo Arredondo. 2023. Gpt-4 Passes the Bar Exam. Available online: https://ssrn.com/abstract=4389233 (accessed on 12 December 2023).

- Königstorfer, Florian, and Stefan Thalmann. 2020. Applications of Artificial Intelligence in commercial banks—A research agenda for behavioral finance. Journal of Behavioral and Experimental Finance 27: 100352. [Google Scholar] [CrossRef]

- Li, Guozhong, Jian Sheng Dai, Eun-Mi Park, and Seong-Taek Park. 2017. A study on the service and trend of Fintech security based on text-mining: Focused on the data of Korean online news. Journal of Computer Virology and Hacking Techniques 13: 249–55. [Google Scholar] [CrossRef]

- Lopez-Lira, Alejandro, and Yuehua Tang. 2023. Can chatgpt forecast stock price movements? return predictability and large language models. arXiv arXiv:2304.07619. [Google Scholar]

- Ortas, Eduardo, and José M. Moneva. 2013. The Clean Techs equity indexes at stake: Risk and return dynamics analysis. Energy 57: 259–69. [Google Scholar] [CrossRef]

- Ozbay, Feyza Altunbey, and Bilal Alatas. 2020. Fake news detection within online social media using supervised artificial intelligence algorithms. Physica A: Statistical Mechanics and Its Applications 540: 123174. [Google Scholar] [CrossRef]

- Popova, Yelena. 2021. Economic basis of digital banking services produced by FinTech Company in Smart City. Journal of Tourism and Services 12: 86–104. [Google Scholar] [CrossRef]

- Rupeika-Apoga, Ramona, and Stefan Wendt. 2022. FinTech Development and Regulatory Scrutiny: A Contradiction? The Case of Latvia. Risks 10: 167. [Google Scholar] [CrossRef]

- Smales, Lee A. 2019. Bitcoin as a safe haven: Is it even worth considering? Finance Research Letters 30: 385–93. [Google Scholar] [CrossRef]

- Tong, Wang, Azhar Hussain, Wang Xi Bo, and Sabita Maharjan. 2019. Artificial intelligence for vehicle-to-everything: A survey. IEEE Access 7: 10823–43. [Google Scholar] [CrossRef]

- Vasenska, Ivanka, Preslav Dimitrov, Blagovesta Koyundzhiyska-Davidkova, Vladislav Krastev, Pavol Durana, and Ioulia Poulaki. 2021. Financial transactions using fintech during the COVID-19 crisis in Bulgaria. Risks 9: 48. [Google Scholar] [CrossRef]

- Vidal-Tomás, David, and Silvia Bartolucci. 2023. Artificial Intelligence and Digital Economy: Divergent Realities. Available online: https://ssrn.com/abstract=4589333 (accessed on 12 December 2023).

- Vrontis, Demetris, Michael Christofi, Vijay Pereira, Shlomo Tarba, Anna Makrides, and Eleni Trichina. 2022. Artificial intelligence, robotics, advanced technologies and human resource management: A systematic review. The International Journal of Human Resource Management 33: 1237–66. [Google Scholar] [CrossRef]

- Willenbrock, Scott. 2011. Diversification return, portfolio rebalancing, and the commodity return puzzle. Financial Analysts Journal 67: 42–49. [Google Scholar] [CrossRef]

- Wu, Philip Fei, Jessica Vitak, and Michael T. Zimmer. 2020. A contextual approach to information privacy research. Journal of the Association for Information Science and Technology 71: 485–90. [Google Scholar] [CrossRef]

- Xu, Zhong, and Chuanwei Zou. 2022. Fintech: Frontier and Beyond. London: Routledge. [Google Scholar] [CrossRef]

- Yu, Jing-Rung, and Wen-Yi Lee. 2011. Portfolio rebalancing model using multiple criteria. European Journal of Operational Research 209: 166–75. [Google Scholar] [CrossRef]

- Yu, Jing-Rung, Wan-Jiun Paul Chiou, Wen-Yi Lee, and Kai-Cheng Yu. 2017. Does entropy model with return forecasting enhance portfolio performance? Computers & Industrial Engineering 114: 175–82. [Google Scholar] [CrossRef]

| Names | n | Mean | Sd | Median | Trimmed | Mad | Min | Max | Range | Skew | Kurtosis | Se |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | 569 | 0.0019 [0.002] | 0.0349 [0.036] | 0.0023 [0.002] | 0.0012 [0.001] | 0.0290 [0.030] | −0.099 [−0.12] | 0.2180 [0.225] | 0.3176 [0.350] | 0.5431 [0.418] | 2.8945 [2.882] | 0.0014 [0.001] |

| SYM | 569 | 0.0024 [0.002] | 0.0621 [0.062] | 0 [0.0003] | 0.0008 [0.001] | 0.0116 [0.015] | −0.546 [−0.54] | 0.7909 [0.796] | 1.3374 [1.341] | 3.1823 [3.220] | 59.369 [59.386] | 0.0026 [0.003] |

| HLX | 569 | 0.0019 [0.002] | 0.0363 [0.038] | 0 [0.001] | 0.0010 [0.001] | 0.0302 [0.032] | −0.123 [−0.12] | 0.1732 [0.165] | 0.2966 [0.290] | 0.3318 [0.162] | 1.3405 [1.145] | 0.0015 [0.002] |

| AI | 569 | −0.0021 [−0.002] | 0.0546 [0.055] | −0.0008 [0.0008] | −0.0021 [−0.002] | 0.0423 [0.043] | −0.305 [−0.31] | 0.2900 [0.281] | 0.5956 [0.593] | 0.1144 [0.099] | 4.2432 [4.205] | 0.0022 [0.002] |

| ATS | 569 | 0.0009 [0.001] | 0.0230 [0.025] | 0.0009 [0.001] | 0.0002 [0.0005] | 0.0175 [0.018] | −0.098 [−0.13] | 0.1248 [0.122] | 0.2229 [0.258] | 0.5435 [0.003] | 3.2946 [4.143] | 0.0009 [0.001] |

| ISRG | 569 | 0.0002 [0.0001] | 0.0223 [0.023] | 0.0016 [0.001] | 0.0007 [0.001] | 0.0174 [0.017] | −0.154 [−0.15] | 0.1032 [0.105] | 0.2579 [0.261] | −0.4988 [−0.616] | 5.694 [5.554] | 0.0009 [0.001] |

| PRO | 569 | −0.0004 [−0.001] | 0.0338 [0.034] | −0.0008 [0.001] | −0.0005 [−0.0002] | 0.0298 [0.032] | −0.103 [−0.10] | 0.1204 [0.101] | 0.2237 [0.208] | 0.0708 [−0.068] | 0.5373 [0.259] | 0.0014 [0.001] |

| AI_index | 569 | −0.0004 [−0.001] | 0.0182 [0.019] | −0.0008 [0.0003] | −0.0004 [−0.0001] | 0.0175 [0.017] | −0.059 [−0.09] | 0.0767 [0.063] | 0.1358 [0.157] | −0.0022 [−0.333] | 0.6785 [1.022] | 0.0008 [0.001] |

| Nasdaq | 569 | 0.0003 [0.0002] | 0.0159 [0.018] | 0.0007 [0.002] | 0.0005 [0.001] | 0.0139 [0.014] | −0.057 [−0.09] | 0.0722 [0.046] | 0.1292 [0.145] | −0.1538 [−0.624] | 1.1400 [2.209] | 0.0007 [0.001] |

| Bond.Price | 569 | 0.0001 | 0.0100 | −0.0003 | −0.0003 | 0.0055 | −0.053 | 0.1423 | 0.1953 | 6.5383 | 86.4419 | 0.0004 |

| Names | N | Mean | Sd | Median | Trimmed | Mad | Min | Max | Range | Skew | Kurtosis | Se |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Buyandhold | 519 | 0.0007 | 0.0185 | 0.0001 | 0.0006 | 0.0164 | −0.093 | 0.0722 | 0.1657 | −0.104 | 2.0946 | 0.0008 |

| rebal_daily | 519 | 0.0020 | 0.0345 | 0.0001 | 0.0004 | 0.0067 | −0.073 | 0.7116 | 0.7852 | 16.772 | 341.9 | 0.0015 |

| risk_budget | 519 | 0.0009 | 0.0257 | 0.0001 | 0.0005 | 0.0188 | −0.119 | 0.1926 | 0.3120 | 0.7332 | 7.4636 | 0.0011 |

| risk_rubust | 519 | 0.0006 | 0.0267 | −3.8 × 10−5 | 0.0004 | 0.0197 | −0.168 | 0.1926 | 0.3608 | 0.3044 | 8.3203 | 0.001 |

| static_pf_equi | 519 | 0.0006 | 0.0223 | 0.0009 | 0.0006 | 0.0194 | −0.165 | 0.1114 | 0.2769 | −0.502 | 6.599 | 0.0009 |

| rebal_pf_equi | 519 | 0.0007 | 0.0234 | 0.0004 | 0.0007 | 0.0209 | −0.116 | 0.1125 | 0.2289 | 0.0223 | 2.1030 | 0.0010 |

| Portfolio | Annualized Downside Risk | Daily Downside Risk | Downside Potential | Omega | Omega–Sharpe Ratio | Sortino Ratio | Upside Potential | Upside Potential Ratio |

|---|---|---|---|---|---|---|---|---|

| Buyandhold | 0.2027 | 0.0128 | 0.0066 | 1.1081 | 0.1081 | 0.0559 | 0.0073 | 0.7847 |

| rebal_daily | 0.1525 | 0.0096 | 0.0042 | 1.4902 | 0.4902 | 0.215 | 0.0063 | 0.8852 |

| risk_budget | 0.2672 | 0.0168 | 0.0085 | 1.1076 | 0.1076 | 0.0541 | 0.0094 | 0.7626 |

| risk_rubust | 0.2877 | 0.0181 | 0.0089 | 1.0726 | 0.0726 | 0.0358 | 0.0096 | 0.7509 |

| static_pf_equi | 0.252 | 0.0159 | 0.008 | 1.0793 | 0.0793 | 0.0399 | 0.0086 | 0.7141 |

| rebal_pf_equi | 0.2566 | 0.0162 | 0.0085 | 1.0844 | 0.0844 | 0.0446 | 0.0093 | 0.7898 |

| Buy and Hold | Rebal_Daily | Risk_Budget | Risk_Rubust | Static_pf_Equi | Rebal_pf_Equi | Metric |

|---|---|---|---|---|---|---|

| 0.039936 | 0.060666 | 0.036493 | 0.025388 | 0.029483 | 0.031865 | StdDev Sharpe |

| 0.02509 | 0.023669 | 0.029487 | 0.018642 | 0.018203 | 0.020382 | VaR Sharpe |

| 0.016904 | 0.048532 | 0.029487 | 0.018543 | 0.009229 | 0.0142 | ES Sharpe |

| Portfolio | ESSharpe | StdDevSharpe | VaRSharpe | Treynor Ratio |

|---|---|---|---|---|

| Buy and hold | 0.016274 | 0.038448 | 0.024155 | 0.002 [0.002] |

| rebal_daily | 0.059866 | 1.023 [0.956] | ||

| risk_budget | 0.028619 | 0.035418 | 0.028619 | 0.170 [0.163] |

| risk_rubust | 0.017787 | 0.024352 | 0.017882 | 0.082 [0.079] |

| static_pf_equi | 0.008843 | 0.02825 | 0.017442 | 0.102 [0.099] |

| rebal_pf_equi | 0.013676 | 0.03069 | 0.01963 | 0.118 [0.114] |

| Portfolio | Beta Cokurtosis | Beta Coskewness | Beta Covariance | Cokurtosis | Coskewness |

|---|---|---|---|---|---|

| Buy and hold | 0.7042 [0.685] | −0.3429 [1.569] | 0.725 [0.711] | 0 [0] | 0 [0] |

| rebal_daily | 0.4769 [0.495] | 1.4967 [0.440] | 0.3878 [0.400] | 0 [0] | 0 [0] |

| risk_budget | 0.9677 [1.061] | 2.5442 [0.525] | 0.9619 [1.038] | 0 [0] | 0 [0] |

| risk_rubust | 0.9633 [1.050] | 2.1116 [0.558] | 0.9794 [1.050] | 0 [0] | 0 [0] |

| static_pf_equi | 0.8568 [0.890] | −0.7655 [1.574] | 0.9137 [0.954] | 0 [0] | 0 [0] |

| rebal_pf_equi | 0.9651 [1.011] | 1.4038 [0.945] | 1.0024 [1.059] | 0 [0] | 0 [0] |

| Portfolio | Active Premium | Alpha | Annualized Alpha | Beta | Beta− | Beta+ | Correlation | Corr p-Value | Information Ratio | R-Squared | Tracking Error | Treynor Ratio |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Buy and hold | 0.298 [0.133] | 0.001 [0.001] | 0.305 [0.157] | 0.725 [0.711] | 0.738 [0.839] | 0.721 [0.695] | 0.729 [0.628] | 0 [0] | 1.364 [0.550] | 0.531 [0.395] | 0.217 [0.241] | 0.202 [0.206] |

| Rebal daily | 0.656 [0.492] | 0.002 [0.001] | 0.762 [0.651] | 0.388 [0.400] | 0.446 [0.586] | 0.501 [0.527] | 0.210 [0.190] | 0 [0] | 1.159 [0.878] | 0.044 [0.036] | 0.565 [0.560] | 1.302 [1.264] |

| Risk budget | 0.309 [0.145] | 0.001 [0.001] | 0.410 [0.198] | 0.962 [1.038] | 0.962 [1.002] | 0.924 [1.053] | 0.698 [0.663] | 0 [0] | 1.058 [0.475] | 0.488 [0.440] | 0.292 [0.305] | 0.165 [0.153] |

| Risk rubust | 0.228 [0.064] | 0.001 [0.001] | 0.323 [0.121] | 0.979 [1.050] | 0.983 [0.984] | 0.888 [1.010] | 0.685 [0.646] | 0 [0] | 0.739 [0.198] | 0.469 [0.417] | 0.308 [0.323] | 0.079 [0.074] |

| static_pf equi | 0.251 [0.087] | 0.001 [0.001] | 0.308 [0.121] | 0.914 [0.954] | 0.927 [1.008] | 0.811 [0.863] | 0.761 [0.699] | 0 [0] | 1.083 [0.342] | 0.579 [0.489] | 0.232 [0.255] | 0.11 [0.105] |

| rebal_pf equi | 0.269 [0.105] | 0.001 [0.001] | 0.351 [0.141] | 1.002 [1.059] | 0.984 [1.032] | 0.921 [1.021] | 0.796 [0.740] | 0 [0] | 1.194 [0.420] | 0.634 [0.548] | 0.225 [0.251] | 0.118 [0.112] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trabelsi Karoui, A.; Sayari, S.; Dammak, W.; Jeribi, A. Unveiling Outperformance: A Portfolio Analysis of Top AI-Related Stocks against IT Indices and Robotics ETFs. Risks 2024, 12, 52. https://doi.org/10.3390/risks12030052

Trabelsi Karoui A, Sayari S, Dammak W, Jeribi A. Unveiling Outperformance: A Portfolio Analysis of Top AI-Related Stocks against IT Indices and Robotics ETFs. Risks. 2024; 12(3):52. https://doi.org/10.3390/risks12030052

Chicago/Turabian StyleTrabelsi Karoui, Ali, Sonia Sayari, Wael Dammak, and Ahmed Jeribi. 2024. "Unveiling Outperformance: A Portfolio Analysis of Top AI-Related Stocks against IT Indices and Robotics ETFs" Risks 12, no. 3: 52. https://doi.org/10.3390/risks12030052

APA StyleTrabelsi Karoui, A., Sayari, S., Dammak, W., & Jeribi, A. (2024). Unveiling Outperformance: A Portfolio Analysis of Top AI-Related Stocks against IT Indices and Robotics ETFs. Risks, 12(3), 52. https://doi.org/10.3390/risks12030052